High Risk High Return? Empirical Testing of Prospect Theory in

Indonesia

Rini Setyo Witiastuti, Kris Brantas Abiprayu, and Ascariena Rafinda

Department of Management, Universitas Negeri Semarang, Gedung L2 Fakultas Ekonomi UNNES, Gunungpati, Semarang

Keywords: Financial Behaviour, Prospect Theory, Risk-return

Abstract: The purpose of this research is to examine the prospect theory which show negative relation between risk and

return as opposed to conventional view of “high risk high return” belief. We are testing the firm’s behaviour

regarding their decision making under specific circumstances. We expect firm which underperform will show

risk seeking behaviour and vice versa, which will prove the prospect theory. Using the data form 2005-2012,

the samples in our research are all companies listed in Indonesian Stock Exchange. The result form our model

shows robust and consistent evidence that support the prospect theory. We find that firm that perform under

their competitor within industry (which shown by ROE/ROA lower than median industry) show a significant

negative risk and return relation. We also find that within industry regression, the negative relation between

risk and return still consistent with the base model. And lastly, in the annual regression, almost all period

shows negative significant relation between risk and return. All of the result strongly support premise that

argue most individuals are loss averse, then perform prospect theory behaviour.

1 INTRODUCTION

During its development, research in the field of

finance starting to give more contribution to the world

as it is. The current researches in academic finance

are usually referred to as traditional finance. The

foundation of traditional finance often associated

with Modern Portfolio Theory developed by

Markowitz (1952). Another backbone of standard

finance is known as the Efficient Market Hypothesis

and led the research in finance as we know nowadays.

Basically, the foundation of standard finance is under

the assumption that individual always making

rational decision making, which explained within the

frame of Expected Utility Theory. At some point,

Kahneman and Tversky (1979) emerge with this idea

called Prospect theory. The basic assumption of

Prospect Theory is that individual seldom rational, as

they have bounded rationality, a cognitive limitation

to absorb all necessary information available as

guidance when an attempt to make a decision. As this

happens, they will rely on their so-called “ruled of

thumb,” which allow them to decide faster although

it is often misleading.

We try to examine whether the relation between

risk and return will always be positively related as the

modern portfolio theory posit that high-risk always

result in high return. Under the prospect theory

presented by Kahneman and Tversky (1979), the

concept of high-risk, the high return will likely to be

violated since the theory state that the risk preference

in individual, will change relative to their current

position. Being in winning condition will be different

with if a person under losing condition, they likely to

be more risk seeker as they have more incentive to

avoid the loss.

Even though prospect theory was developed to

describe an individual to make a decision, it often to

predict the decision-making process within an

organization. And to make it clearer, Hambrick and

Finkelstein (1987) believe that, at some degree, the

performance of firm or organization in the long term,

will be determined by the decision made by an

individual running the firm so called manager. So, in

the end, the decision made by the manager will reflect

in their firm future performance.

Among many research in the earlier period is

Bowman (1980) posit an idea that the decision

makers in an organization, especially an organization

that their financial condition bad shape, have the

tendency to make a more risky decision under the

notion of that they have nothing to lose. Fiegenbaum

and Thomas (1988) study found evidence that

82

Witiastuti, R., Abiprayu, K. and Rafinda, A.

High Risk High Return? Empirical Testing of Prospect Theory in Indonesia.

DOI: 10.5220/0009199300820086

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 82-86

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

company with financial performance that lies below

the industry performance tend to be more aggressive

in risky condition. Beside those two, many have been

examined the firm decision making under irrational

behaviour as posited by Prospect Theory (Sinha

(1994), Lehner (2000), Chou et al (2009), Kliger and

Tsur (2011), Dominguez and Raïs (2012), Diez-

Esteban et al (2017), Gupta and Pathak (2018))

Most of the result from prior studies show some

consistencies. Which led to the conclusion of many of

the sample performing loss-aversion attitude.

Kahneman and Tversky (1979) explained that there

two decision factors when certain individual attempt

to make a decision, especially if the result from the

decision they made is a risky one. First, the deciding

factor of decision making isn’t the amount of utility

or benefit that an individual will acquire. Instead, they

will compare the results or output from their decision

to the target level that already been decided

beforehand. In other words, they already have a

certain level of expectancy over future results.

Second, people have a tendency to avoid loss. It is

better not to lose $1 that to get $1. The level of

satisfaction from losing $1 will be different, if not

worse, than to find $1. Those two conditions explain

why loss-aversion happened, and also shed some

answer on why companies that underperformed tend

to be bolder, in term of making risky decision.

In short, the Prospect Theory explained the

decision-making behaviour of the firm in regard to

their risk preference. The risk-return relation will be

varied depending on firm performance position or

condition. The condition that mentioned in Prospect

Theory is winning or losing condition. The line that

separates those two conditions is called a reference

point. This reference point is so important, yet

Kahneman and Tversky (1979) in their paper did not

mention how the reference point is conducted. Thus,

such fact will be one of the obstacles for the

researcher to examine or testing the Prospect Theory.

Even though they did mention that to determine the

reference point, we must find the line that separate

gains and losses which in the end affecting the

decision maker.

Most of the prior research which examined the

relation of risk and return under Prospect Theory

usually measured the reference point at the industrial

level by using the centre value of firm performance.

We try to find the evidence that decision maker

within the firm which performed below (lose) the

reference level would show some risk-seeking

attitude, which will be proven by the negative

association between risk and return. While the firm

that able to perform better than peer company within

the industry (above the reference point) will show

risk-averse attitude.

2 METHOD

The data used in this research are all of the public

companies (ousting the financial industry) in

Indonesia from 2005-2012 and acquired from

Bloomberg database. We use all of the data from

those periods without omitting the firm that delisting

or recently being public in order to avoid the

survivorship bias. The sequence that we do before

testing the regression model is: First, we have to

determine the reference point. Using the reference

point method from Kliger and Tsur (2011), we

measure the reference point as the median of firms’

industrial return from the previous year (lag one

year).

Ref

i, j, t

= Med

j, t-1

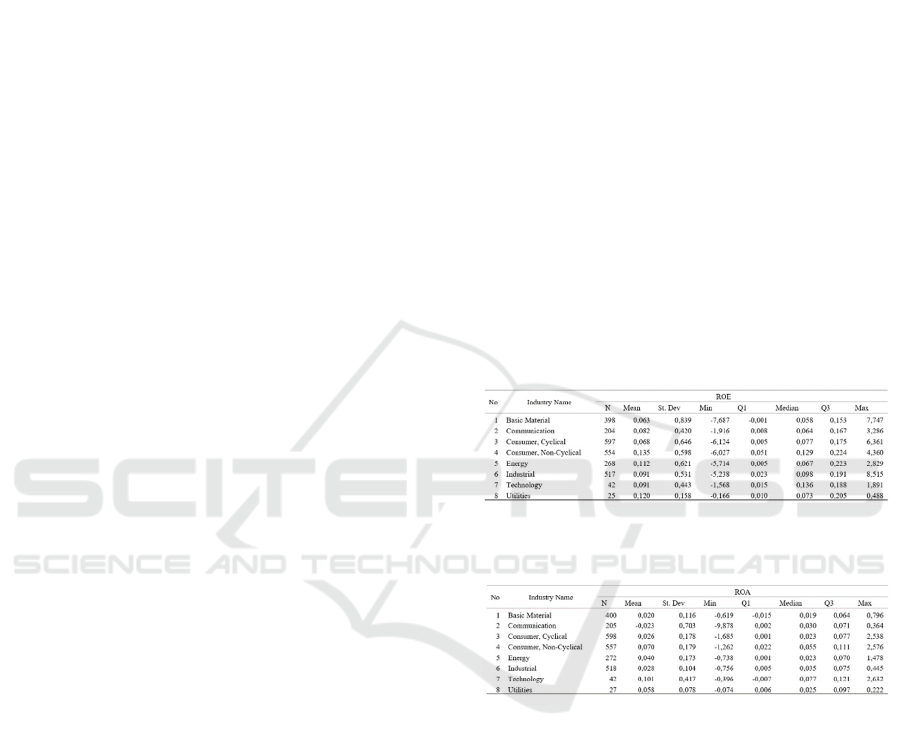

Table 1: Descriptive statistics by Industry

Table 2: Descriptive Statistics for ROA as Alternative

Proxy by Industry

Ref

i, j, t

is the reference point within the industry

that calculated each year, and Med

j, t-1

median ROE

of industry j at year t-1. So even though we used the

data from 2004-2012, we only managed to get an

eight-year span of data. In order to find the reference

point, firstly, we separate our sample into industrial

subsample data. Then, we find the median ROE of the

previous year.

To test our hypothesis, we used a model that

shows the relationship between risk and return. The

basic model is in the following equation:

Risk

i, j, t

= α + β Dumwin

I, j, t

+ ε

i, t

Risk

i, j, t

= ROE

i, j, t

- Med

j, t

Where Risk

i, j, t

is calculated by finding the

difference between ROE

i, j, t

(ROE is calculated from

firm net income divided with total equity) and

High Risk High Return? Empirical Testing of Prospect Theory in Indonesia

83

Median ROE industry in the same year. While

Dumwin

I, j, t

is dummy variable with the value of 1 if

the ROE

I, j, t

above the Ref

i, j, t

which indicate that firm

in winning condition relative to their industrial peer

.

The expected value of β in the base model is negative,

which will support the hypothesis in this paper.

The base model will be examined using several

adjustments. First is we use the complete sample to

test our hypothesis. Second, we separate our full

sample into industrial sub-sample and then test the

model using that sub-sample in each industry. Third,

we will conduct the annual cross-sectional regression

for each year in our sample from 2005-2012. The

configurations that we create is in an attempt to

eliminate the time- and industry-specific effects.

Lastly, we will conduct the three previous

configurations using the ROA performance indicator.

We hoped that using the different proxy of firm

performance, we would find a robust model.

3 RESULTS AND DISCUSSION

3.1 Descriptive Analysis

We present the descriptive statistics by industry and

by year to show the idiosyncratic effect of industry

and year to the data tested. Table 1 and table 2 show

the descriptive statistics by industry, and as we can

see there isn’t any significance difference between

ROE and ROA. The data present already winsorized

to avoid outliers within the observation. The highest

mean ROE comes from Consumer, Non-Cyclical

industry with mean 0.135 and the lowest is Basic

Material with ROE 0.063. While from ROA, we can

see that the highest mean comes from Technology

with 0.101 and the lowest one is Communication with

-0.023.

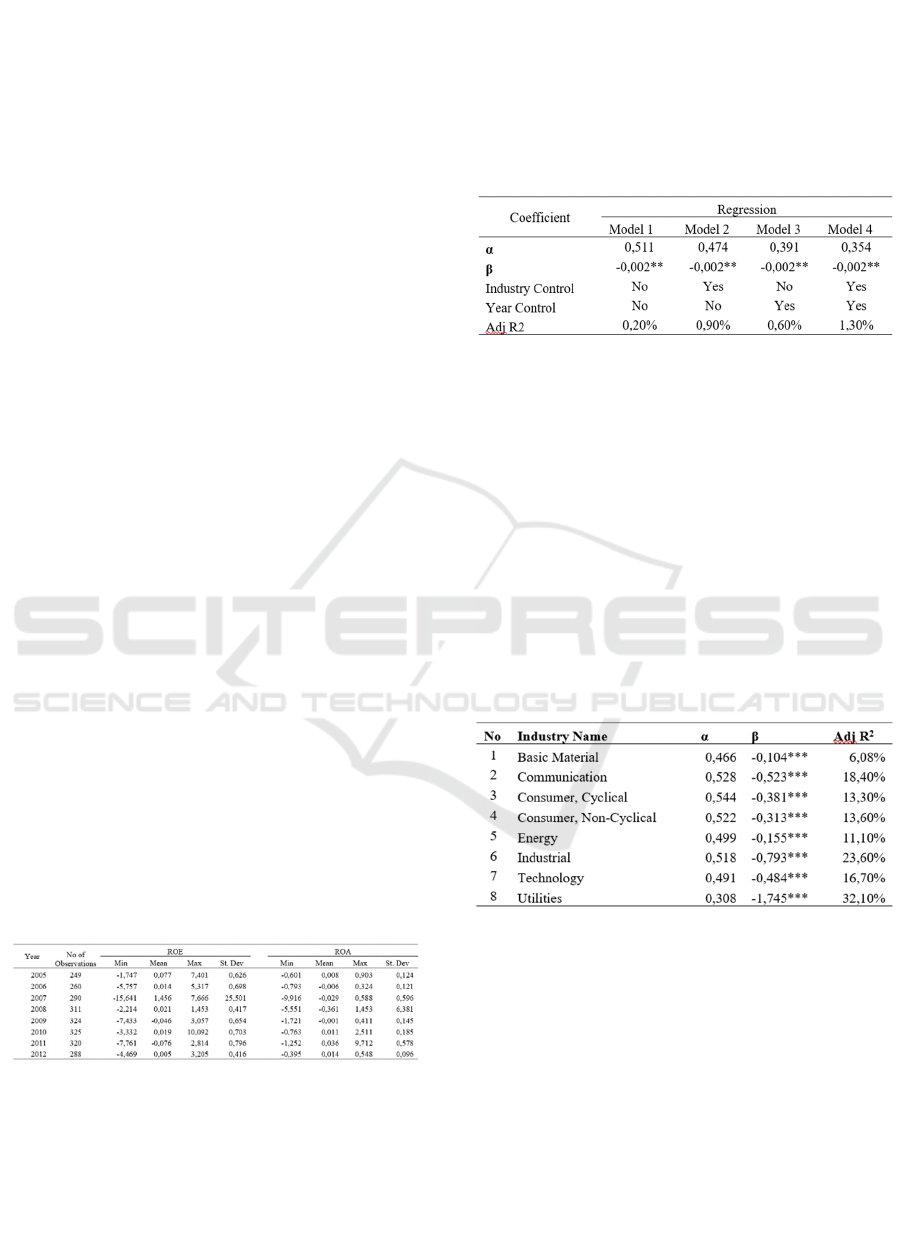

Table 3: Descriptive Statistics by Year.

Table 3 present the descriptive statistics by year

for ROE and ROA. The lowest of ROE come from

year 2011 with -0.076 and the highest is 1.456 in

2007. While, the highest mean ROA is 0.036 from

2011 and th e lowest is -0.361 in 2008.

To examine the main hypothesis, we formulated

the empirical model to capture the relationship

between firm’s risk and the return. We separate the

model into three models, first is the base model, we

examine all of the data to prove whether the

hypothesis is true or not. Second, we construct the

model according by industry, to capture the industry

effect and the last model is formulated by year to

control the year effect.

Table 4: Base model of risk and return.

Table 4 present the result from the base model

using combination of control variables. In model 1 we

test the risk-return association without controlling

industry and year, the result shows the negative effect

of risk on return. Model 2 we include industry control

and the result still show negative relation between

risk and return. Model 3 include year control and still

show negative relation between risk and return. The

last model, we control the industry and year and the

result still show negative significant association

between risk and return. The results from all four

models corroborate the main hypothesis that firms

with return above the reference point (gain) take less

risk (risk-averse).

Table 5: Risk-Return Industry Analysis.

In the second examination, we estimate the risk-

return association within each industry observed as

presented in table 5. The result show that all of the

industries observed in this research show consistent

result. The negative β all similar in all industries,

which show the negative relation between risk and

return.

The last examination in table 6 show the annual

regression analysis from all the year of observed in

this research. The value of coefficient beta show

negative significant which in particular similar with

the beta estimated in base model and in industry-

based model. Only one from eight year of observation

which not significant. The result overall

EBIC 2019 - Economics and Business International Conference 2019

84

strengthening the negative relationship between

firm’s risk level and return.

Table 6: Risk-Return Annual Analysis.

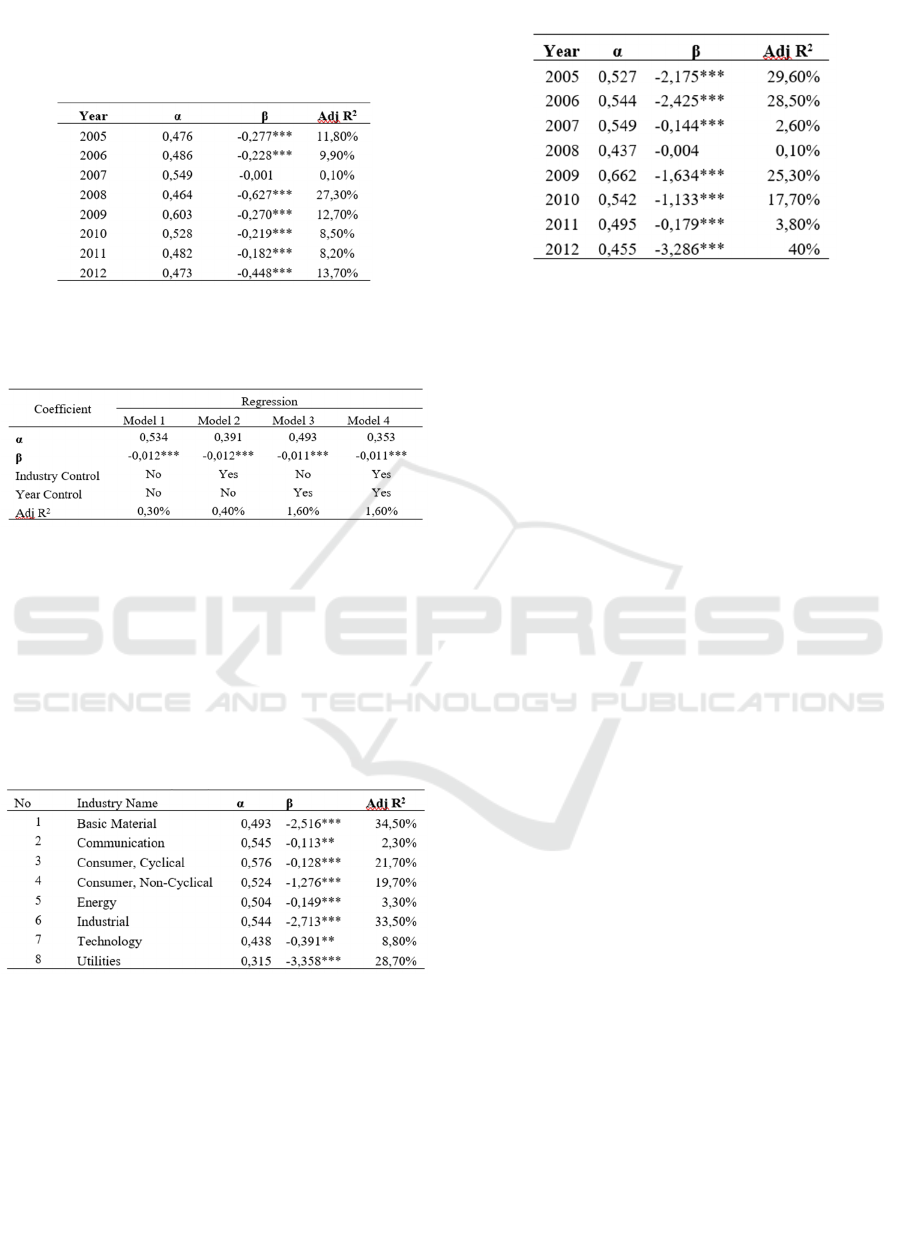

Robustness Analysis

Table 7: Base model of risk and return.

The sample in robustness analysis is same with the

earlier examination, but instead of using ROE, we

change it to ROA as alternative proxy of risk and

return. In this section, we will examine the negative

relation between firm’s risk and return using ROA.

Table 7 show the base model examination of risk and

return regression using ROA. All four models show

negative significant result that support the result in

table 4 and the hypothesis tested in this research.

Table 8: Risk-Return Industry Analysis.

The industrial regression analysis in table 8 also

show similar result that all of industries show

negative association between risk and return. The last

model is annual regression in table 9, the result show

almost all observation in all year show negative beta

except 2008.

Table 9: Risk-Return Annual Analysis.

4 CONCLUSIONS

Prospect theory by Kahneman and Tversky (1979)

addressed an important issue in behavioural finance.

In short, prospect theory built upon economic and

psychological-experimentation foundation. It shows

that individual cling on loss more heavily than gain

and evaluate the expected loss and gain relative to

their predetermined expectation. Our research model

aims to strengthening the results from prior research.

The result form our model shows robust and

consistent evidence that support the prospect theory.

We find that firm that perform under their competitor

within industry (which shown by ROE/ROA lower

than median industry) show a significant negative risk

and return relation. We also find that within industry

regression, the negative relation between risk and

return still consistent with the base model. And lastly,

in the annual regression, almost all period shows

negative significant relation between risk and return.

All of the result strongly support premise that argue

most individuals are loss averse, then perform

prospect theory behaviour.

REFERENCES

Bowman, E. H. (1980). A Risk/Return Paradox for

Strategic Management. Sloan Management Review

(pre-1986), 21(3), 17.

Chou, P. H., Chou, R. K., & Ko, K. C. (2009). Prospect

theory and the risk-return paradox: some recent

evidence. Review of Quantitative Finance and

Accounting, 33(3), 193-208.

Das Gupta, R., & Pathak, R. (2018). Firm’s Risk-Return

Association Facets and Prospect Theory

Findings—An Emerging versus Developed

Country Context. Risks, 6(4), 143.

Díez-Esteban, J. M., García-Gómez, C. D., López-Iturriaga,

F. J., & Santamaría-Mariscal, M. (2017). Corporate

risk-taking, returns and the nature of major

shareholders: Evidence from prospect theory.

High Risk High Return? Empirical Testing of Prospect Theory in Indonesia

85

Research in International Business and Finance, 42,

900-911.

Dominguez, N., & Raïs, M. (2012, September). Risk-

seeking behaviours in growth strategies of SMEs:

targeting unstable environments. In 15th McGill

International Entrepreneurship Conference (p. 21).

Fiegenbaum, A., & Thomas, H. (1988). Attitudes toward

Risk and the Risk-Return Paradox: Prospect Theory

Explanations. The Academy of Management

Journal, 31(1), 85-106.

Hambrick, D & Finkelstein, S. 1987. Managerial

Discretion: A Bridge between Polar Views of

Organizational Outcomes. Research in

Organizational behaviour. 9: 369-406.

Kahneman, D, & Tversky, A. (1979). Prospect theory: An

analysis of decisions under risk. Econometrica, 47,

278.

Kliger, D., & Tsur, I. (2011). Prospect theory and risk-

seeking behavior by troubled firms. Journal of

Behavioral Finance, 12(1), 29-40.

Markowitz, H. (1952). Portfolio selection. The journal of

finance, 7(1), 77-91.

Sinha, T. (1994). Prospect theory and the risk return

association: another look. Journal of Economic

Behavior & Organization, 24(2), 225-231

.

EBIC 2019 - Economics and Business International Conference 2019

86