Analysis Performance of Stock Price of Spin Off Companies on the

Indonesian Stock Exchange

Muhammad Ananda Fakhri

1

, Isfenti Sadalia

1

Amlys Syahputra Silalahi

2

1,2

Department of Magister Management, Universitas Sumatera Utara, Jl. Sivitas Akademika Kampus USU, Medan, Indonesia

1

Department of Management, Universitas Sumatera Utara, Jl. Prof. T.M Hanafiah, SH, Kampus USU, Medan, Indonesia

Keywords: Spin-off, Abnormal Return, Return on Assets, Buy and Hold Abnormal Return and Market-to-Buy Ratio

Abstract: The purpose of this study is to look at significant abnormal returns, buy and hold abnormal returns, return on

assets, market-to-book ratios of parent companies and spin-off companies on the Indonesia Stock Exchange.

This research is a research program using the type of data that is quantitative data taken from the Indonesia

Stock Exchange database in 2009 - 2018. The population in this study are 8 companies in which there are 4

companies in the construction sector, 1 company in the retail sector, 1 companies in the consumption sector

and 2 companies in the banking sector.

1 INTRODUCTION

A spin-off company is a subsidiary that is split from

a parent company which then becomes an

independent company. Spin-off decisions are made to

restrict the focus of a particular business and leave

other businesses that are relatively irrelevant or to get

rid of businesses with low profit margins. Joel

Greenblatt in his book entitled "You can be a stock

market genius: uncover the secret hiding places of

stock market profits" says that buying shares of spin-

of companies can produce extraordinary returns

because proven historically spin-off company stock

consistently outperformed the market and parent

company averages. The same thing was expressed by

Peter Lynch in his book "One Up On Wall Street"

saying that underneath one of the characteristics of

The Perfect Stock is spin-off company shares. The

profits of the parent company that do spin-offs can

increase the efficiency of the parent company and

reduce risk by reducing losses from non-strategic

business units that lead to higher growth and

performance of the parent company, which is able to

make the share price rise.

Figure 1.1.

In Figure 1.1 the company's stock returns PT. housing

construction. TB 14 days before and 14 days after the

spin-off where on the day the spin-off takes place (H-

0) the share price drops by 2.87%. This reaction can

be used by using returns as price changes or by using

abnormal returns (Jogiyanto, 2013). Then the ROA

ratio is used to see whether the assets that have been

burdening the company after being allocated to the

subsidiary through a spin-off that generates a return

on assets.

Figure 1.2.

0,00

5,00

‐4 ‐3 ‐2 ‐1 0 1 2 3 4

DalamPersen

TRIWULAN

ROA 1 TAHUN SEBELUM DAN SESUDAH

DILAKUKANNYA SPIN-OFF

Fakhri, M., Sadalia, I. and Silalahi, A.

Analysis Performance of Stock Price of Spin Off Companies on the Indonesian Stock Exchange.

DOI: 10.5220/0009199100690073

In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019) - Economics and Business in Industrial Revolution 4.0, pages 69-73

ISBN: 978-989-758-498-5

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

69

In Figure 1.2 seen when the spin-off (Quarter 0) ROA

has increased but in Quarter 3 has decreased sharply.

Thus the allocation of assets by the parent company

does not make the return on assets increase

continuously. McConnel (2004) in his research found

that Spin-off company stock prices outperformed

index prices and holding companies, because spinoff

companies have high valuations because the

resources that were once owned by the parent

company belonged to spin off companies.

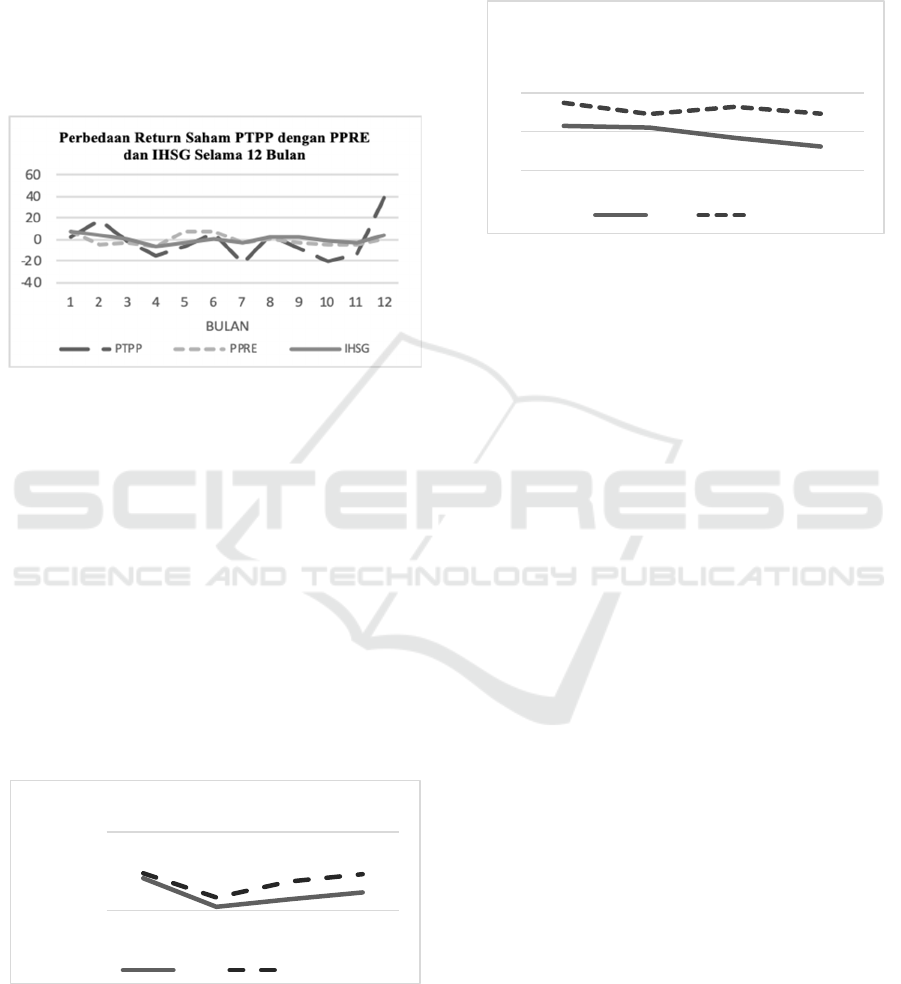

Figure 1.3.

In Figure 1.3 the spin off company return, namely

PPRE (PT. PP Precision. Tbk) is only 3 times the

share price outperforming the market and the parent

company, PTPP (PT. Perumahan Perumahan. Tbk)

Returns from long-term investments from companies

that have completed an event ( event) and sold after

the length of time a person holds a predetermined

hiolding period is a buy and hold abnormal return

(BHAR). The ROA of the parent company and the

spin-off company are compared to see who is the

most superior in generating return on assets, whether

the parent company separates the business divisions

that have been less profitable or the spin off

companies that receive assets from the parent

company and become their own.

Figure 1.4.

In Figure 1.4 ROA spin-off companies are higher than

the parent company. In this case the spin-off company

is able to generate maximum return on assets than the

parent company. Market-to-book ratio is a ratio that

shows the extent to which investors are optimistics by

comparing stock prices with book values, the higher

this ratio indicates investors are more optimistic about

the prospects and performance of the company in the

future

Figure 1.5.

In Figure 1.5, investors tend to be more optimistic

about the performance and prospects of the spin-off

company, namely PPRE (PT. PP Presisi .Tbk)

2 LITERATURE REVIEW

2.1 Stock

Stock can be defined as a sign of ownership or

ownership of an individual investor or institutional

investor or trader of their investment or the amount of

funds invested in a company. Share characteristics

include obtaining dividends, having voting rights at

the GMS, it is possible to have Pre-emptive Rights or

Right Issues, and there are potential capital gains or

capital losses (Azis, 2015).

2.2 Stock Price

The stock price is a reflection of the sale and purchase

transactions carried out between sellers and buyers in

hoping that they will get benefit in the future

(Suryawan, 2017). Stock prices are formed due to

demand and supply from investors in the capital

market

2.3 Stock Valuation

The reason for valuing a stock is to predict the future

price of the stock or the potential movement of the

stock in the market to determine the exact time when

the stock is sold or bought. According to Tandelilin

(2010) in valuing stock prices there are 3 valuations,

namely: book value, market value and intrinsic value.

0,00

10,00

1234

PERSEN(%)

TRIWULAN

ROAPERUSAHAANINDUKVSSPIN‐OFF

PTPP PPRE

0

1

2

1234

MARKETTOBOOKRATIO

PERUSAHAANINDUKDANSPIN‐OFF

PTPP PPRE

EBIC 2019 - Economics and Business International Conference 2019

70

2.4 Nilai Buku

According to Marks et al (2012) book value is a

concept on accounting that simply refers to the value

of assets reflected in the company's financial

statements. Sometimes book value is used as a

benchmark in shareholders to buy or sell the

company's shares

2.5 Return on Asset

Return on assets (ROA) is an indicator to determine

the extent to which a company's ability to profit from

its assets. One of the advantages of profitability ratios

such as ROA is that this ratio not only measures

profitability in terms of revenue or profit, but also

refers to the capital needed (Gal, 2013).

2.6 Nilai Pasar

Market value is the value determined as the price at

which buyers and sellers are willing to make the

transaction (Vanderhoof, et al 1998). Market value is

determined by supply and demand between sellers

and buyers in the capital market. According to Marks

et al (2012) market value can be considered as the

highest value of business interest in the open market

and market value is usually considered as the highest

value for business.

2.7 Book-to-Market Ratio

According to Heal (2008) book-to-market ratio is the

market value divided by the book value of its assets,

which must represent the acquisition costs of these

assets today. If the book-to-market ratio is more than

2, it means that the company's manager has made the

value of the asset far higher than the value paid to

obtain the asset and add value to the company.

2.8 Stock Price Performance

According to Best (2013) the performance of stock

prices is an assessment of the number of transactions

and share growth in a company. Stock price

performance is considered important from the

company's point of view because if the trend of stock

price performance decreases, then the company's

performance in the eyes of investors is bad. The

weakening of the company's stock price performance

is the advantage of the company's competitors.

2.9 Stock Return

Stock return is income that is stated in percentage of

initial investment capital. Investment income in these

shares is the profit gained from buying and selling

shares, where if to be called capital gains and if losses

are called capital losses (Samsul, 2006).

2.10 Abnormal Return

In finance, an abnormal return is the difference

between an expected return of security and an actual

return. Abnormal returns are sometimes triggered by

"events”. For example includes mergers, dividend

announcements, productive company

announcements, increased interest rates, lawsuits, etc.

all of which can contribute to abnormal returns

(Aggarwal, 1993).

2.11 Buy and Hold Abnormal Return

According to Mitchell (200) the buy and hold

abnormal return is the return on the average long-term

investment of a company that has completed an event

and is sold after a predetermined hiolding period.

2.12 Corporate Action

Corporate action is an event that is approved by the

board of directors and authorized by shareholders

(Brose, 2014). In corporate action, every change in

the company will affect the stock price and dividend

flow. Reporting and taking timely corporate action is

very important to assess risk and to determine the

value of each share held (Kanna, 2010).

2.13 Divestment

There are three types of divestments. First, sales of

operating units to other companies. Secondly, the sale

of operating units to management is now through a

Leveraged Buyout (LBO). Third, the separation of

certain operating units to be independent from the

company, while the shares are then shared pro-rata

with the parent company. The third way is called a

spin-off (Mardiyanto, 2008).

2.14 Spin-off

Spin-offs are divisions or business units that are

separated from the parent company so as to create a

new and independent business entity where usually

the majority shareholder is the parent company

(Uddin: 2010).

Analysis Performance of Stock Price of Spin Off Companies on the Indonesian Stock Exchange

71

2.15 Research Purpose

Referring to the research problem formulation that

has been described, the purpose of this study is:

1. Analyze whether there is a significant difference

Abnormal Return of the parent company's stock

before and after the spinoff

2. Analyzing whether there is a significant

difference Return on assets of the parent company

before and after the spinoff

3. Analyzing whether there is a significant

difference between Buy and Hold Abnormal

Return on the parent company and the spin-off

company after the spin-off process

4. Analyzing whether there is a significant

difference Return on assets in the parent company

and the spin-off company after the spin-off

process

5. Analyzing whether there is a significant

difference Market-to-buy ratio in the parent

company and the spin-off company after the spin-

off process.

2.16 Benefit on Research

The benefits of this research include the following:

1. For investors. Useful to increase investor

understanding of the performance of the

company's stock price spin-off and be taken into

consideration when investing in shares of

companies that have already made a spin-off

2. For companies. As a basis and consideration for

companies that intend to make a spin-off. The

company can analyze the potential profits and

losses that will arise before making a spin-off so

that the company can formulate the right steps that

can be taken to increase its share price.

3. For Academics. Useful as an additional reference

that can be used as an alternative source or

concept

4. For researchers. Useful for giving in formulating

policies in order to provide the knowledge gained

5. For the Capital Market. As a basis for controlling

or supervising issuers that carry out spin-offs.

Thus the spinoff is expected to provide benefits to

all parties.

3 METHOD

This research is an event study is a study that studies

the market reaction to an event whose information is

published as an announcement. The type of data used

in this study is quantitative. Quantitative data is data

in the form of numbers or qualitative data that are

considered / scoring (Sugiyono, 2017). The data

source used is secondary data. Secondary data is data

that is already available by other parties so there is no

need to be extracted directly from the source by

researchers (Sinulingga, 2017). Data obtained from

the database of the Indonesian branch office of the

Indonesian branch of the Medan city. The sample in

this study uses the Purposive Sampling method, in

which the sample selected by the criteria of the

holding company and spin-offs listed on the

Indonesia Stock Exchange for the period 2009 - 2018,

so that there are 8 sample companies that will be

examined.

4 RESULT AND DISCUSSION

Based on the results of the analysis and discussion,

the following conclusions can be drawn:

1. Based on the results of different tests on the

variable abnormal return for 14 days before to 14

days after the event period, it was found that AR

was significantly different or not significantly

dependent on the time span of the comparison.

Most abnormal returns after the spin-off showed a

decrease but not significant. Thus, corporate

actions carried out by the parent company by

separating its business units through spinoffs are

not used as information that attracts investors to

buy shares that make spinoffs, where it is

indicated by the existence of negative abnormal

returns around the spinoff date, not yet fully

proven and applies to all conditions.

2. Based on the results of different tests of return on

assets during the event period, which is 4 quarters

before up to 4 days after, it was found that ROA

is significantly different or not significant

depending on the time span of the comparison.

Most ROA after the spin-off showed a decrease.

This result does not match the efficiency of the

assets.

3. Based on the results of different buy and hold

abnormal return tests between the parent company

and the spin-off company, it was found that the

parent company and the spin-off company did not

outperform the JCI for 12 months and did not

differ significantly, but the parent company's

stock price growth was superior to that of the

parent company spin-off company. The parent

company's stock return is superior to the spin-off

company, indicating that investors prefer to invest

in the parent company because it is considered

more mature and more convincing performance in

EBIC 2019 - Economics and Business International Conference 2019

72

the future by separating divisions that have been

burdening the parent company's performance.

4. Based on the results of different return on asset

tests between the parent company and the spinoff,

it was found that ROA was not significantly

different. The majority of the parent company's

ROA and spinoff has decreased this indicates that

the efficiency of the assets of the parent company

and the receipt of valuable assets from the parent

company belonging to the spin-off company does

not make the company's net profit on assets

increase.

5. Based on the results of the market-to-book

difference test between the parent company and

spin-off, it was found that the parent company

MtB and spin-off decreased and were not

significantly different. The decrease in MtB that

occurred at the parent company and spinoffs

indicated that market optimism towards the parent

company and spinoffs decreased which resulted in

the company's market value falling against the

book value

Based on the conclusions above, some

suggestions can be given, namely:

1. Based on the results of this study, investors who

want to buy and sell shares in companies that do

business units (spin-offs) should not make this

information the only benchmark in investment

decision making, but also need to consider factors

other factors such as the financial performance or

fundamentals of the company concerned

2. The results of this study are useful for the

Indonesia Stock Exchange to control and

supervise for companies that will or have already

conducted spinoffs. BEI can create a special index

of spin-off companies for spin-off companies, to

be able to monitor historically and make it easier

for investors to see stock price movements and the

fundamental performance of spin-off companies

3. The results of this study can also be considered by

companies listed on the Indonesia Stock

Exchange who want to do spin-offs to better plan

for more mature business and need to seriously

calculate the initial investment that will be

prepared for spin-offs. So that the spin-off process

conducted by the company becomes attractive for

investors who want to invest in the parent

company and the spin-off company itself

REFERENCES

Aggarwal, R, Leal, R dan Hurnandez, L. 1993. the After

Market Performance of Initial Public Offering in Latin

America. 22: 42 – 53.

Azis, Musdalifah., Mintarti, Sri dan Nadir, Maryam. 2015.

Manajemen Investasi Fundamental,Teknikal, Perilaku

Investor dan Return Saham. Deepublish. Yogyakarta.

Best, Roger J. 2013. Market-based Management, Strategies

for Growing Customer value and Profitability. Edisi ke-

6. Pearson Education Inc. New jersey.

Brose, Margarita S., Foold, Mark D., Krishno, Dilip dan

Nichols, Bill. 2014. Handbook of Financial Data and

Risk Information. Cambridge University Press.

Cambridge.

Gal, Peter. 2013. Measuring Total Factory at the Firm Level

Using OECD-ORBIS”, Economics Department

Working Papers No. 1049, ECO/WKP(2013)41.

Heal, Geoffrey. 2008. When Principles Pay: Corporate

Social Responsibility and the Bottom Line. Columbia

University Press. New York.

Kanna, Ayesha. 2010. Straight Through Processing for

Financial Services: The Complete Guide. Academic

Press. Cambridge.

Mardiyanto, Handono. 2008. Inti Sari Manajemen

Keuangan. PT. Gramedia Widisarana Indonesia,

Jakarta

Marks, Kenneth H, Robert T. Slee, Christian W. Blees dan

Michael R. Nall. 2012. Middle Market M&A:

Handbook for Investment Banking and Business

Consulting. John Willey & Sons. New Jersey.

Mitchell, M dan E. Stafford. 2000. Managerial decisions

and long-term stock price performance. 73: 287 – 329.

Samsul, Mohammad. 2006. Pasar Modal dan Manajemen

portofolio. Erlangga. Surabaya.

Sinulingga, Sukaria. 2017. Metode Penelitian. USU Press.

Medan

Suryawan, I Dewa Gede dan Wirajaya, I Gde Ary. 2017.

Pengaruh Current Ratio, Debt to Equity Ratio dan

Return On Assets pada harga saham”. ISSN: 2302-

8556.

Sugiyono. 2017. Metode Penelitian Kuantitatif Kualitatif

dan R&D. CV. Alfabeta. Bandung

Tandelilis, Eduardus. 2010. Portofolio dan Investasi; Teori

dan Aplikasi. Kansisu. Yogyakarta.

Uddin, M.D Hamid. 2010. Corporate Spin-offs and

Shareholders’ Value: Evidence from Singapore 4: 45 –

46.

Vanderhoof, Irwin T. 1998. The Fair Value of Insurance

Liabilities. Springer Science & Business Media. Great

Britrain.

Analysis Performance of Stock Price of Spin Off Companies on the Indonesian Stock Exchange

73