Application of a Fuzzy Set and Fuzzy Logic to Economic Problems:

Study Literature Review of Journal

Suripah, Zetriuslita

Department of Mathematics, Universitas Islam Riau, Pekanbaru, Indonesia

Keywords:

Fuzzy Set, Fuzzy Logic, Economic Problems

Abstract:

This article aims to describe the set of application and fuzzy logic on the economy. The problems still faced

over the years is still the presence of obstacles how to create a formula approach to economic modeling. But

with the development of increasingly sophisticated technology, it must be followed by the progress of the

method approach refers to the development of mathematics and computer technology. Based on a review,

several studies in the field of economics has been developed to address the existing problems. As one

alternative approaches to modelling and in providing system solutions in the real world, especially for the

complexity of the system that are not easy to approach through mathematical modelling, fuzzy logic method

can be used as an alternative to solve the economic problems.

1 INTRODUCTION

The problems that occurred during this are the

constraints related to the discovery of a method for

the formulation and economic modelling approach.

(Flood and Marion, 1998) to suggest that there

are still challenges to find new methods for the

formulation and estimation of economic modeling in

order to obtain a high flexibility in the formulation

of functional; parametric assumptions as little as

possible; a good look for a data bit or a lot; as well as

the possibility of computing to support large number

of variables.

A long with the development of increasingly

sophisticated technology, it must be followed by

the progress of the method approach refers to

the development of mathematics and computer

technology. In the development of the past, for

modeling a system used a statistical method based

on the theory of probability that represent uncertainty.

However, this model has not succeeded in providing

an accurate prediction for a few series for the linear

structure and a few otherlimitations (Lin et al., 2002).

Therefore, around 1965, Professor LA Zadeh of the

University of California at Berkeley introduced a

vague set theory. Indirectly, this theory suggests

that there is a theory that can be used to represent

uncertainty. That is, as one alternative is fuzzy logic.

Fuzzy logic as a main component builder,

softcomputing has been shown to have excellent

ability to overcome the problems of uncertainty.

The set and fuzzy logic increasingly attracted many

researchers to be used as an alternative to data

analysis in research. Fuzzy logic implementation is

already very extensive, both in the fields of education,

agriculture, health, engineering, psychology, no less

important social and economic field.

In economics, has had its own association which

is named SIGEF (The International Association for

Management and Economy Fuzzyset), which was

formed on November 30 through December 2, 2006,

and hold the 13th congress in Morocco (Muslim,

2007). The congress is a forum for associations

of academics, professionals and practitioners in

the field of economics, management, finance, and

organizations to exchange ideas and experiences in

research, based on fuzzy logic, ant system, neural

systems, genetic algorithms, the theory of uncertainty

, complexity theory and softcomputing.

2 DISCUSSION

The discussion of several journal. articles application

of research results fuzzy set and fuzzy logic in the

economic that has been conducted by researchers

between 1987 to 2007. The results of the application

of the model used and to look into further fields are

described as follows.

Suripah, . and Zetriuslita, .

Application of a Fuzzy Set and Fuzzy Logic to Economic Problems: Study Literature Review of Journal.

DOI: 10.5220/0009059900790087

In Proceedings of the Second International Conference on Social, Economy, Education and Humanity (ICoSEEH 2019) - Sustainable Development in Developing Country for Facing Industrial

Revolution 4.0, pages 79-87

ISBN: 978-989-758-464-0

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

79

2.1 Fuzzy Logic

Theory of probability during the period of this

century, plays an important role to explain the notion

of uncertainty. In 1965, Prof. Lotfi A. Zadeh of

the University of California at Berkeley introduced

the concept of fuzzy sets indirectly this theory states

that in addition to the probability approach, the

uncertainty can also be done with a different approach

in this case using the concept of fuzzy set.

Fuzzy set theory is a mathematical framework

used to represent uncertainty, vagueness, inaccuracy,

lack information and partial truth (Studer and Masulli,

1997). Basically, vague set is an extension of classical

set (crisp), the classical set A an element will have two

possibilities, namely membership A member denoted

by uA (x). In the classical set of two memberships are

uA (x) = 1 if x is a member of A and uA (x) = 0 when

x is not a member of A.

In contrast to the classical set of fuzzy sets treating

elements in the degree of membership. For example

if the price of rice Rp 5,500 relatively expensive or

mediocrity? In the concept of fuzzy sets and in the

real world ”both statements are true” and perhaps as

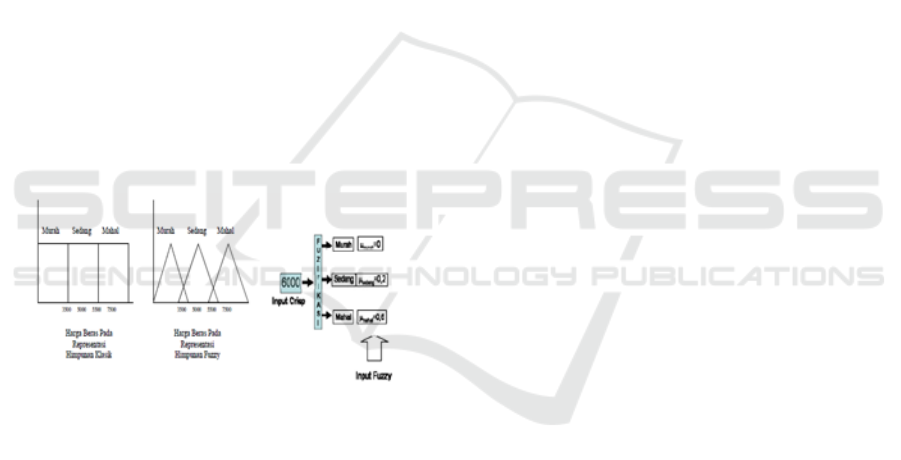

an answer. The figure below shows the representation

of the price of rice in conventional sets and fuzzy sets.

Figure 1: Representation of the Association and Fuzzyfikasi

Value Crisp. Source: Adapted from Muslim (2017)

In classical logic truth values of right and wrong

is only worth it in the fuzzy logic truth values are

in the interval [0,1] which can be determined by

its membership function (Kaneko, 1996). Fuzzy

logic is an appropriate way to map an input space

into an output space based on the concept of fuzzy

sets (Velasco, 1987). As a general overview say

we have grouped the data into the data input and

output data of other groups is, between the input and

output are mapping process called black box, black

box where it describes a process that is not known.

To analyze the contents of the black box, there are

several approaches that can be used such as: linear

systems approach, econometrics, interpolation, expert

systems, fuzzy logic, etc. However, as disclosed Lotfi

Zadeh: ”In almost every case, fuzzy way faster and

cheaper”(Muslim, 2017).

2.2 Fuzzy Logic Applications on

Economic Affairs

Use of Fuzzy Logic for Research in Economics

Compared to conventional methods, for example

OLS, the application of fuzzy logic approach on

research in economics is still not a done deal.

However, this method can be used as an alternative

to modeling economic behavior. Economic modeling

is a form of abstraction of economic behavior in the

real world, in order to obtain a picture that is simpler

and easier to understand by humans. The modeling

used for ”real world” is too complex to be described

in detail. Although the details are not described by the

model, but a good model should be able to represent

anything that you want to know from the real world,

and also can predict the conditions that occur in the

real world. The following is some research in the field

of economics that uses fuzzy logic.

(Flood and Marion, 1998) in the “Output

convergence and International Trade: Time Series and

Fuzzy Clustering Evidence for New Zealand and Her

Trading Partners” introduces a new way to measure

the convergence in the form of time series data,

using the fuzzy c-means application in the clustering

algorithm. Fuzzy Grouping provide a clearer

picture of that difference in output will converge in

groups. In the same year, Giles on ”Econometric

Modeling based on Pattern Recognition via the Fuzzy

C-Means Clustering Encryption” using fuzzy logic

in particular grouping of fuzzy c-means in economic

modeling as a model of money demand with annual

data 1960-1983 American trade department, models

Kuznets’ U-Curve ”with a Gini coefficient data and

US real GDP from 1947 to 1991 and the results

show that the approach is better than the OLS and

non-parametric models.

Accurate prediction of stock market indices is

very important for certain reasons. Chief among the

needs of investors is the potential to hedge against

market risks, opportunities for market speculators and

to make profit by trading indices. Estimating the stock

market index accurately has profound and important

implications for researchers and practitioners.

The most commonly used technique for predicting

stock prices are the regression method and ARIMA

models (Box et al., 1970). Various models

and methods have been used extensively in the

past. However, they failed to provide accurate

prediction for several other limitations. Although

there are models of ARCH / GARCH Eichengreen,

(Eichengreen et al., 1995); (Bollerslev, 1986) models

to overcome non-linear variance, there are still some

series cannot be predicted satisfactorily. Recent

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

80

Table 1: Part 1. Selected literature on predictive economics problem mapping.

Study Modelling

Method

Variables Fields Goals attained

Achsani, NA.

2003

Auto

Regressive

Conditional

Heteroskedastic

(ARCH)

Y: national product at

1993 prices

R: interest rate

(long-term)

M: Money stock.

P: Consumer price index.

Mr: logarithmic real

balances.

Finance If the µ coefficient increases,

the interest rate elasticity

decreaces after the Asian

crisis

Agenor, PR, JS

Bhandari, and RP

Flood. 1992

Linear

regression

Payments Crises and

financial aspects

Finance There is a relationship

between payments crises and

financial aspects

Al-Shammari, M.

and Shaout, A.

1998

Fuzzy

personnel

performance

model

Teaching and instruction,

research and scholarly,

activities, service to the

department, output from

the fuzzy relations, merit

increase, promotions, and

tenure.

Organisation

/managerial

The modified model offers a

better evaluation performance

system since it allows

for dynamic changes in

the strength effect of the

input variables on output

performance.

Bollerslev, T.

1986.

ARCH,

Regression

models

Autoregressive

conditional

heteroskedasticity

General

economics

Empirical example relating to

the uncertainty of the inflation

rate is represented

Box, G. and

Jenkins, G. 1970.

ARIMA Busines

Buyukozkan. G.,

&Feyzioglu. O.

2004

Membership

function

New product development Manajemen

product

An increase in accuracy of

decision-making in NPD

underuncertainty

Chowdhry, B.,

Goyal, A. 2000

Survey Exploring the financial

crisis in Asia

Finance Represent the introduction

Dash, P. K., Liew,

A. C., Rahman,

S., & Dash, S.

1995

Fuzzy expert

system and a

hybrid neural

network-fuzzy

expert system

Load Forecasting General

field

Represent the introduction

Draeseke, R &

Giles, D.E. 2002

Multiple

indicators,

multiple causes

(MIMIC)

Tax rate and an index of

the degree of regulation.

Economic Relatively achieved

Eichengreen, B.,

AK Rose, and C.

Wyplosz. 1996

ARCH/GARCH The causes and

consequences.

Busines Answer the problem

statement

Application of a Fuzzy Set and Fuzzy Logic to Economic Problems: Study Literature Review of Journal

81

Table 2: Part 2. Selected literature on predictive economics problem mapping.

Study Modelling

Method

Variables Fields Goals attained

Engle, RF. 1982 ARCH,

Regression

models

United kingdom

inflation

Finance ARCH effects is found

to be significant and the

estimated variances increase

substantially during the

chaotic seventies.

Flood, R. and N.

Marion. 1998

Fuzzy c-Means

Clustering

Perspectives on

the recent currency

crisis

Finance Represent the introduction

Giles, DEA. 2005 Both bivariate

and multivariate

time-series

Time-series data

and fuzzy clustering

evidence for New

Zealand and trading

partners

Busines Time-series methods are able

to predict existing problems.

Giles, DEA and

R. Draeseke.

2017

Fuzzy c-mean

Encryption,

Econometric

modelling

recognition via

pattern

Economic Represent the introduction

Kahraman, C,

Tolga, E, and

Ulukan, Z. 2000

Fuzzy benefit

/cost ratio

analysis

Justification of

manufacturing

technologies

Manufacturing The method of operating cost

ratio (B/C) fuzzy logic is

used to justify the making

technology

Kaneko,

Takaomi. 199

Fuzzy Logic

and Fuzzy

Logic

Production

System

(FLOPS)

Financial diagnosis Finance FLOPS is recommended as a

function of financial diagnosis

Karsak, E. E., &

Tolga, E. 2001.

Fuzzy Multiple

Criteria

Decision

Making

(MCDM)

Evaluating

advanced

manufacturing

system investments.

Manufacturing The fuzzy decision-making

approach appears

as a consistent and

computational-efficient

alternative to existing

methods.

Lie, TT and

Sharaf, AM. 1995

Neuro-fuzzy

short-term load

forecasting

(STLF)

Self-correcting

online electric load

forecasting model

Economic Vector input affects the

estimated the short-term

forecast load.

Lin, CS et al.

2006

Neuro-fuzzy Currency crises Finance The neuro-fuzzy approach

produces better predictions

significantly.

Lin, CS; Khan,

HA & Huang,

CC. 2002

Neuro-fuzzy Stock indexes Busines Neuro fuzzy models predict

stock indexes better than its

rivals, neuro fuzzy consistent

over time.

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

82

Table 3: Part 3. Selected literature on predictive economics problem mapping.

Study Modelling

Method

Variables Fields Goals attained

Munakata,

Toshinori, and

Jani, Yashvant.

1994

Fuzzy system

include fuzzy

sets, logic,

algorithms, and

control

- An

overview

Fuzzy system are most

suitable for uncertain or

approximate reasoning,

particularly systems with

a algorithm model that is

difficult to be controlled.

Muslim, Aziz.

2017

Fuzzy logic Fuzzy logic in economics Economic In almost every case, fuzzy

way faster and cheaper

Obstfeld, M. 1994 Linear example Balance-of payments

crisis and Devaluation

Finance Thre are effects of the

influence of the balance of

payments crisis

Okada, H.,

Watanabe, N.,

Kawamura, A.,

and Azakawa, K.

1992

Artificial

Neural Network

(ANN)

combination of fuzzy

logic and ANN to

describe the input

An

overview

The system produces bond

ratings that are very suitable

for human experts, and are

able to generalize better than

a simple three-layer neural

network.

Ozkan, FG and A.

Sutherland. 1995

Fuzzy system

modelling,

type-I, FCM

Currency crises Finance The predictive power of

RBFSM is very encouraging.

Padmakumari,

K. Mohandas,

KP, and

Thiruvengadam,

S. 1999

ANN

Neuro-Fuzzy,

Radial Basis

Function

Network

(RBFN),

Land use based load

forecasting

Busines The RBFN is found to be

more suitable for long-term

prediction.

Studer, L. and

Masulli, F. 1997

Neuro-Fuzzy

system (NFS)

mackey Glass

time series

Layer of singleton inputs,

a hidden layer of Gaussian

membership functions

and one output unit

Organisation The use of a Neuro-Fuzzy

system for forecasting time is

promising

Velasco, A. 1987. Linear

regression

Bank crisis and payments

crisis

Finance There is a relationship

between bank crisis and

payments crisis

Zavadskas, E. K

and Turskis, Z.

2011

Fuzzy Multiple

Criteria

Decision

Making

(MCDM)

Multiple Criteria Decision

Making in Economics

Economic MCDM is effective for

supporting decisions in

several conditions.

Application of a Fuzzy Set and Fuzzy Logic to Economic Problems: Study Literature Review of Journal

83

research in neural network engineering has shown

that neural networks have the properties needed for

relevant applications, such as nonlinearity and fine

interpolation, the ability to learn nonlinear complex

mapping, and self-adaptation for different statistical

distributions.

However, neural networks cannot be used to

explain the causal relationship between input and

output variables. This is because the black box is

like the natural of most neural network algorithms.

Neural networks cannot be named with the underlying

knowledge. Networks must learn from the beginning,

while the learning process itself does not guarantee

success.

On the other hand, the expert system’s fuzzy

approach has been applied to the forecasting

of different problem (Bolloju, 1996), (Kaneko,

1996), (Shaout and Al-Shammari, 1998), where the

operator’s knoeledge to predict results. Although

forecasting is based on Fuzzy logic, the results

show that the process for constructing fuzzy- logic

system is subjective and depends on the heuristic

process. The choice of membership function and

basic rules must be developed heuristically for each

case. Rules in this way do not always produce

the best predictions, and the choice of membership

function still depends on trial and error. The

strengths and weaknesses of Neuro-fuzzy and fuzzy

logic, have combined the ability to learn from neural

networks and the functions of fuzzy expert systems.

Application can be found in (Dash et al., 1995),

(Studer and Masulli, 1997), and (Padmakumari et al.,

1999). For example the hybrid model is expected to

provide understanding to humans about the meaning

of ’Fuzzy’ through the various advantages can be

used as a concept of knowledge by studying neural

networks.

Some researchers such as (Jacobs and Levy,

1989), have claimed that the stock market is not a

system that can be explained by simple rules, nor

is it a random system that is impossible to predict.

In fact, they claim that the market is a complex

system, where the behaviour of the system can be

only be explained and predicted by a complex set of

relationships between variables.

Recognizing the complex characteristics of the

stock market to invites the researchers to further

investigate whether index variations can be improved

to predict nonlinear models using the neuro-fuzzy

approach. (Lin et al., 2002) in the ”Can the

neuro-fuzzy models predict stock indexes better than

its rivals?” Develop a model based on a trading

system by using a neuro fuzzy model to predict

stock indexes better. Thirty well-known stock indexes

were analyzed with the help of the developed model.

Empirically shows the corresponding non-linear

results in stock indexes using the KD technical index.

Analysis of trading points and analysis of trade costs

indicate endurance and opportunities for profit, it is

recommended to use nonlinear neuro fuzzy systems.

The analysis also shows that the recommended neuro

fuzzy is consistent over time.

In 2003, (

¨

Ozkan et al., 2004) in the ”Currency

Crises Analyzed By Type-I Fuzzy System

Modelling”, implementing softcomputing in the

analysis of a currency crisis, with test data time series

of data is the currency of Turkey. The method used

is the approach of macroeconomic time series data,

the Rule-based Fuzzy System Modelling (RBFSM)

become the focus of research and compared to

GARCH /ARMAX and ANFIS. The results show

that the GARCH approach / ARMAX and ANFIS no

better than predicted RBFSM.

Achsani, (2003) using a fuzzy cluster algorithm

to model the demand for Indonesia with the data in

1993: 4 to 2002: 3 even though the results are not

as good as the econometric model approach because

it does not consider the effect of autocorrelation and

seasonality of data, however, can explain in more

detail the grouping of economic periods. In the

same year, Achsani, (2003) back to do research using

Fuzzy-Clustering in data ASEAN + 3 as the ratio of

debt / GDP, exchange rate stability, inflation rate, and

the long term interest rate to determine the relative

position of Indonesia in the constellation of Asian

economies East.

In previous years some researchers report that

their concern for the problems of economic crisis.

They are concerned about theadverse consequences

of the policies needed to maintain economic variables

(Agenor et al., 1992; Flood and Marion, 1998;

Flood and Marion, 1998). While the traditional

approach emphasizes the role played by a decline in

foreign reserves in triggering the collapse of the fixed

exchange rate, some of the latest models suggest that

the decision to abandon the parity may occur based

on concerns about the evolution of the economic

authorities. On the other hand, variables indicate that

groups of other variables can be useful for predicting

the currency crisis (Ozkan and Sutherland, 1995) and

(Velasco, 1987). In addition, the latest model also

suggested that the crisis can develop in the absence

of fundamental changes in the real economy. This

model emphasizes that the nature of the contingency

of economic policy may pose some equlibria and

produce that meets its own crisis (Obstfeld, 1983).

Some recent research has focused on the effects of the

balance of payments crisis (Eichengreen et al., 1995).

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

84

All these models recommend possible variables as the

main indicators of crisis. However, some new works

are opposing, for example (Chowdhry and Goyal,

2000), the results of the sample data forecasting

beyond a theoretical model for the case of the Asian

financial crisis is largely disappointing.

(Lin et al., 2002) in ”A New Approach to

Modeling Early Warning Systems for Currency

Crises: can a machine-learning fuzzy expert system

predict the currency crises Effectively?”. Back

conduct research using Neuro-Fuzzy approach to

predict the crisis in Indonesia, Philifina, Thailand,

and Malaysia. This model integrates the learning

ability with fuzzy logic inference. The empirical

it shows that the neuro-fuzzy approach produces

significantly better predictions. Compared to

traditional approaches such as logit techniques.

In 2007, (Muslim, 2007) in the ”Implementation

Algorithms and Neuro Fuzzy Fuzzy Cluster Case

Studies Indonesia’s exports to Japan” provide

an alternative modeling especially data modeling

Indonesian exports to Japan by applying algorithms

and Neuro Fuzzy Fuzzy Cluster. MAPE size and

Theils Inequality shows that both methods have

a good performance to estimate export. When

compared to conventional methods OLS-AR fuzzy

method provides better results. Prediction of the

input-output relationship on Fuzzy Cluster Algorithm

can predict their objective structural break in 1993:

Q2 and 1997: Q4 and evidenced by subjective

methods chow-test. Modeling indicates that there is

a conditional relationship in the model of Indonesian

exports to Japan, in the context of these relationships

are fuzzy low, medium, high, while in the context of

time is pre Japanese Slump, after the Japanese Slump,

post-crisis Indonesia.

2.3 Fuzzy Logic Applications in the

Field of Business

Use information technology becomes an important

part in business management in the 21st century

now. Today information technology were mostly

used to process data and efficient support effective

communication in business management. Predictions

of the future of information technology will be used

as a decision-making tool automatically, have the

intelligence capability to analyze and be able to do

the learning to make optimal decisions. For that

we need a system that is able to behave like a

human being in terms of thinking and make decisions

rationally. Fuzzy logic is a concept that can be used

to meet the demands of the system. In the business

world has made several application programs based

on fuzzy logic are: (Munakata and Jani, 1994), early

application in the trading world using fuzzy approach.

The system handles 65 industrial stocks in the Dow

and the Nikkei 800 rule prescribed by the experts and

if necessary repaired by senior business analyst. This

system has been tested for 2 years and performance

by using Nikkei Average showed an increase of over

20%. When tested this system recommends ”sell”

18 days before the ”Black Monday” in 1987. The

system is operated commercially in 1988. Most

financial analysts, agree to say that the ”rule” for the

trade was ”fuzzy”. Convertible Bond Rating, Nikko

Securities, has been using ANN to raise the rating

convertible bond since twenty seven years ago (Okada

et al., 1992). This system of learning from expert

instruction reaction rating, which change according to

economic circumstances. The system will analyze the

results, and using the results to advise. The system

consists of a combination of fuzzy logic and ANN to

describe the input. Ratio of the correct answer is 96%.

In (2000) (Kahraman et al., 2000) in the

”Justification of manufacturing technologies using

fuzzy benefit or cost ratio analysis”. The application

of fuzzy logic is used for the application of cash

discount techniques to justify the manufacturing

technologies studied many documents. The net value

of the country’s stock and stochastic value now are

two examples of this application. This application

is based on data that is outside the range. If we

have the faint of data such as interest rates and cash

applying the techniques of cash discounts, fuzzy set

theory can be used to resolve this uncertainty. Fuzzy

set theory has the ability to represent data and the

vague and allows the operator to apply mathematical

programming fuzzy domain. This theory is primarily

concerned with measuring uncertainty in the mind

and human perception. On paper, with the assumption

that we have data that is not clear, the method of

operating cost ratio (B/C) fuzzy logic is used to justify

the making technology. After calculating the B/C

ratio based on annual values, it turns out that the two

manufacturing systems have different cycles.

(Draeseke and Giles, 2002) in the ”A fuzzy logic

approach to modeling the New Zealand underground

economy”. Implementing fuzzy logic to analyze the

importance of the availability of data on the size

of the economy ”under” (EU) for macroeconomic

policy. They use fuzzy set theory and fuzzy logic

to draw up an annual time series for New Zealand

unobserved EU during the twenty six year. Two

input variables used in effective tax rate and the

index of the level of regulation (REG). The result

of time series UE compared to the previously built.

Second, the authors use the model of ”multiple

Application of a Fuzzy Set and Fuzzy Logic to Economic Problems: Study Literature Review of Journal

85

indicators, multiple cause” (MIMIC) structural. Both

approaches produce each UE Photo New Zealand

sensible but somewhat different during this period.

The fuzzy logic approach to this problem involves

several subjective considerations, but the results are

quite satisfactory.

Research activities in the economic field during

the last five years it has increased significantly.

(Zavadskas and Turskis, 2011; B

¨

uy

¨

uk

¨

ozkan

and Feyzıoglu, 2004; Karsak and Tolga, 2001).

Conducting research in the ”Multiple Criteria

Decision Making (MCDM) Methods In Economics:

An Overview”. Suggests that the main research

field is the study of operations and sustainable

development. That philosophy of decision-making

in the economic field is to assess and choose the

most recommended solution, apply it and to get the

greatest benefits. Alternatives methods applied in

problematic conditions both in the decision-making

process of individuals or organizations. Several of

effective decision making methods support decisions

in conditions where several criteria have emerged

in the last decade. The Paper’s presents methods

of decision-making in the field of economics and a

summary of results and important applications over

the last five years. The paper considers the decision

making considering the development of some of

the latest methods of decision-making criteria (for

the classic method is discussed in many previous

publications). Researchers here using a different

approach, pioneering studies and papers presented

briefly.

The comparative analysis results of the reviewed

article are presented in the following table:

3 CONCLUSIONS

The rapid development of technology and computers

to follow the development of economic modeling

representative. As one alternative approaches to

modeling and in providing system solutions in the real

world, especially for the complexity of the system

that are not easy to approach through mathematical

modeling, can be used as an alternative method of

fuzzy logic to solve problems. As for some reason

it is advisable to use fuzzy logic is:

• Conceptually easy to use because it is based on a

simple mathematical concept.

• Their tolerance to uncertainty data;

• Program to model the system that is not linear and

complex;

• Working system is based on everyday human

communication.

ACKNOWLEDGEMENTS

The researchers express special thanks to Universitas

Islam Riau which has facilitated this study.

REFERENCES

Agenor, P.-R., Bhandari, J. S., and Flood, R. P.

(1992). Speculative attacks and models of balance of

payments crises. Staff Papers, 39(2):357–394.

Bollerslev, T. (1986). Generalized autoregressive

conditional heteroskedasticity. Journal of

econometrics, 31(3):307–327.

Bolloju, N. (1996). Formulation of qualitative models

using fuzzy logic. Decision support systems,

17(4):275–298.

Box, G. E., Jenkins, G. M., and Reinsel, G. (1970). Time

series analysis: forecasting and control holden-day

san francisco. BoxTime Series Analysis: Forecasting

and Control Holden Day1970.

B

¨

uy

¨

uk

¨

ozkan, G. and Feyzıoglu, O. (2004). A

fuzzy-logic-based decision-making approach for new

product development. International journal of

production economics, 90(1):27–45.

Chowdhry, B. and Goyal, A. (2000). Understanding the

financial crisis in asia. Pacific-Basin Finance Journal,

8(2):135–152.

Dash, P., Liew, A., Rahman, S., and Dash, S. (1995). Fuzzy

and neuro-fuzzy computing models for electric load

forecasting. Engineering Applications of Artificial

Intelligence, 8(4):423–433.

Draeseke, R. and Giles, D. E. (2002). A fuzzy logic

approach to modelling the new zealand underground

economy. Mathematics and computers in simulation,

59(1-3):115–123.

Eichengreen, B., Rose, A. K., and Wyplosz, C. (1995).

Exchange market mayhem: the antecedents and

aftermath of speculative attacks. Economic policy,

10(21):249–312.

Flood, R. and Marion, N. (1998). 0perspectives on the

recent currency crisis literature. 1 national bureau of

economic research workm ing paper no. 6380.

Jacobs, B. I. and Levy, K. N. (1989). The complexity of

the stock market. Journal of Portfolio Management,

16(1):19.

Kahraman, C., Tolga, E., and Ulukan, Z. (2000).

Justification of manufacturing technologies using

fuzzy benefit/cost ratio analysis. International

Journal of Production Economics, 66(1):45–52.

Kaneko, T. (1996). Building a financial diagnosis system

based on fuzzy logic production system. Computers

& industrial engineering, 31(3-4):743–746.

ICoSEEH 2019 - The Second International Conference on Social, Economy, Education, and Humanity

86

Karsak, E. E. and Tolga, E. (2001). Fuzzy multi-criteria

decision-making procedure for evaluating advanced

manufacturing system investments. International

journal of production economics, 69(1):49–64.

Lin, C.-S., Khan, H. A., Huang, C.-C., et al. (2002). Can the

neuro fuzzy model predict stock indexes better than

its rivals? Discussion Papers of University of Tokyo

CIRJE-F-165.

Munakata, T. and Jani, Y. (1994). Fuzzy systems: an

overview. Communications of the ACM, 37(3):69–77.

Muslim, A. (2007). 2007. Cluster Algorithm

Implementation of Fuzzy and Neuro Fuzzy Model

Case Studies Indonesia’s exports to Japan.

Muslim, A. (2017). 2017. The use of fuzzy logic in

economics. (2017). Retrieved on December, 28.

Obstfeld, M. (1983). Balance-of-payments crises and

devaluation.

Okada, H., Watanabe, N., Kawamura, A., Asakawa, K.,

Taira, T., Ishida, K., Kaji, T., and Narita, M. (1992).

Initializing multilayer neural networks with fuzzy

logic. In [Proceedings 1992] IJCNN International

Joint Conference on Neural Networks, volume 1,

pages 239–244. IEEE.

Ozkan, F. G. and Sutherland, A. (1995). Policy measures

to avoid a currency crisis. The Economic Journal,

105(429):510–519.

¨

Ozkan, I., T

¨

urksen, I., and Aktan, O. (2004). Currency

crises analyzed by type-i fuzzy system modelling.

Fuzzy Economic Review, 9(1):35.

Padmakumari, K., Mohandas, K., and Thiruvengadam, S.

(1999). Long term distribution demand forecasting

using neuro fuzzy computations. International

Journal of Electrical Power & Energy Systems,

21(5):315–322.

Shaout, A. and Al-Shammari, M. (1998). Fuzzy logic

modeling for performance appraisal systems: a

framework for empirical evaluation. Expert systems

with Applications, 14(3):323–328.

Studer, L. and Masulli, F. (1997). Building a

neuro-fuzzy system to efficiently forecast chaotic

time series. Nuclear Instruments and Methods

in Physics Research Section A: Accelerators,

Spectrometers, Detectors and Associated Equipment,

389(1-2):264–267.

Velasco, A. (1987). Financial crises and balance of

payments crises: a simple model of the southern

cone experience. Journal of development Economics,

27(1-2):263–283.

Zavadskas, E. K. and Turskis, Z. (2011). Multiple criteria

decision making (mcdm) methods in economics: an

overview. Technological and economic development

of economy, 17(2):397–427.

Application of a Fuzzy Set and Fuzzy Logic to Economic Problems: Study Literature Review of Journal

87