Significant Relationships In The Value Of Currency Exchange Rate

In Southeast Asia

Wuri Septi Handayani, Amir Indrabudiman, Amri Amrulloh, Ratih Puspaningtyas Faeni, Dewi

Puspaningtyas Faeni

Universitas Budi Luhur

Keywords: Multiple regression, Exchange rate, Southeast Asia, Significant

Abstract: This study aims to investigate significantly among the exchange rates of several countries in the Southeast

Asia region. The data in this study consisted of mature currency exchange rates from Malaysia, Philippines,

Thailand, and Indonesia, with standards converted into US dollars. This study uses a simple regression

analysis model to see the significant level that occurs by proposing four simple regression models. The

result of this study is that there is a significant relationship between the exchange rates of several countries

in the region of Southeast Asia with the proposed model in the study.

1 INTRODUCTION

The rupiah currency has been used for a long time

by Indonesia. The exchange rate against other

countries' currencies continues to decline from the

first time used. Formerly in the early days of

independence, Indonesia has not used the rupiah

currency but uses an official currency known as ORI

or Oeang Repoeblik Indonesia. ORI has a circulation

period in Indonesia for four years, ORI has been in

use since 1945-1949. However, the legitimate use of

ORI has only begun since the launching of this

currency by the government as the Indonesian

currency on October 30, 1946. In November 1949

recorded the exchange rate of the rupiah against an

American dollar worth Rp 3.80. In November 1965

or about 16 years later, the rupiah exchange rate

slumped to one US dollar worth Rp 4.995, or

dropped by 1314%. This slump was caused by

denomination as a policy of the Third Deputy Prime

Minister, Chairul Saleh, he replaces the old money

with new money with the exchange rate of Rp 1,000

old money to Rp 1 new money. This denomination

immediately led to inflation of up to 650%.

Years change, the rupiah continues to decrease in

value against the world's benchmark currency,

namely the US dollar. Until the peak occurred in

December 1997 - January 1998 from the exchange

rate of one US dollar worth Rp 5.915 to reach Rp

14,800. It was the impact of the monetary crisis that

swept across Southeast Asia. The government at that

time, kept trying to control it by continuing to flush

the rupiah to the market. Until February and April

1998 the rupiah exchange rate was Rp 7,400 and Rp

8,000. However, the monetary crisis was too strong

for Indonesia, until June 1998 the rupiah exchange

rate became Rp 16,800 against one US dollar, which

resulted in a rampant demo to the government and

ended with the fall of President Suharto. The

government changed, but the rupiah continued to

erode against the US dollar until it was recorded on

September 2015 one US dollar worth Rp 13,500. So

from the beginning of the use of rupiah has been

eroded Rp 3.80 to Rp 13,500 or 3,552%.

This study aims to see how significant the rupiah

currency, especially with some countries in

Southeast Asia region, such as Malaysia,

Philippines, and Thailand.

2 THE CURRENCY VALUE

THEORY

Can be defined as the exchange rate is the sum of

money from a particular currency that can be

exchanged with one unit of currency in another

country. The increase in the exchange rate of

domestic currency is called the appreciation of the

foreign currency. The decline in the domestic

currency exchange rate is called depreciation of the

foreign currency. Meanwhile, devaluation is a

government policy to reduce the rupiah exchange

Handayani, W., Indrabudiman, A., Amrullah, A., Faeni, R. and Faeni, D.

Significant Relationships in the Value of Currency Exchange Rate in Southeast Asia.

DOI: 10.5220/0008930701350139

In Proceedings of the 1st International Conference on IT, Communication and Technology for Better Life (ICT4BL 2019), pages 135-139

ISBN: 978-989-758-429-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

135

rate to foreign currency. Moreover, revaluation is a

government policy to increase the rupiah exchange

rate to foreign currency.

The exchange rate system is highly dependent on

a country's monetary policy. The shape of the

exchange rate system can be divided into two forms:

Karim, A. (2002)

a. Fixed Exchange Rate System

It is an exchange rate system in which the value

of a currency is maintained at a certain level against

a foreign currency. Moreover, if the exchange rate

moves too big, then the government intervenes to

return it. This system began to be applied in the

post-World War II marked by the convening of a

conference on exchange rate system held in Bretton

Woods, New Hampshire in 1944.

b. Floating Exchange Rate System

After the collapse of the Fixed Exchange Rate

System, a new concept of the Floating Exchange

Rate System emerged. In this concept, the exchange

rate is allowed to move freely. The exchange rate is

determined by the power of demand and supply of

the currency in the money market.

Facts that occur in many countries of the world

embrace the variance of the two central systems of

exchange rates above. According to Gilis (1996), in

Abimayu, there are six exchange rate systems based

on the magnitude of foreign exchange interventions

and views owned by a country's central bank, which

is used by many countries in the world, among

others, Abimanyu, Y. (2004).

1) Fixed-Rate (fixed exchange rate)

In this system, the monetary authority always

intervenes the market to maintain its currency

exchange rate against one particular foreign

currency. These interventions require relatively

sizeable foreign exchange reserves. Pressure on

foreign exchange rates, which usually originate from

trade balance deficits, tends to result in devaluation

policies.

2) Free Floating Rate System (free-floating

exchange rate)

This system is at the poles as opposed to fixed

systems. In this system, the monetary authority is

theoretically unnecessary to intervene in the market

so that the system does not require vast foreign

exchange reserves. This system is valid in Indonesia

today.

3) Wider Band System

In such systems, the exchange rate is allowed to

float or fluctuate between two points, highs, and

lows. If the state of the economy causes the

exchange rate to move beyond the upper and lower

limits, then the monetary authority will implement

intervention by buying or selling rupiah so that the

rupiah exchange rate is between the two points that

have been determined.

4) Controlled Floating System

In this system, the monetary authority does not

determine to maintain a particular exchange rate.

However, monetary authorities continually

implement interventions based on specific

considerations, such as depleting foreign exchange

reserves. The monetary authority will intervene in

order for the currency to strengthen to encourage

exports.

5) Peg System Crawling

The monetary authority in this system links the

domestic currency with several foreign currencies.

The exchange rate is periodically changed gradually

in small percentages. This system was used in

Indonesia in the period 1988-1995.

6) Adjustable Peg System

In this system, the monetary authority other than

committed to maintaining the exchange rate is also

entitled to change the exchange rate in the event of a

change in economic policy.

3 Factors Affecting the Exchange Rate

In a fixed exchange rate system, the local

currency is fixed steadily against foreign currencies.

While in a floating exchange rate system, the

exchange rate or exchange rate may vary at any

time, depending on the amount of supply and

demand of foreign currency relative to the domestic

currency. Any change in the supply and demand of a

currency will affect the exchange rate of the

currency concerned.

In the case of the demand for foreign currency

relative to the rising domestic currency, the value of

the domestic currency will decrease. Conversely, if

the demand for foreign exchange decreases, the

value of the domestic currency increases.

Meanwhile, if the foreign exchange offerings

increase relative to the domestic currency, then the

domestic currency exchange rate increases.

Conversely, if the supply decreases, the exchange

rate of the domestic currency decreases. Judging

from the factors that influence it, three main factors

affect the demand for foreign exchange, namely:

1) Import payment factor

The higher the import of goods and services, the

greater the demand for foreign exchange so that the

exchange rate will tend to weaken. Conversely, if

imports decline, then demand for foreign exchange

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

136

decreases to encourage the strengthening of the

exchange rate.

2) Outflow capital factor

The higher the capital out, the higher the demand for

foreign exchange and in the future will weaken the

exchange rate of money. Capital outflow involves

repayment of Indonesian (both private and

government) debt to foreigners and placement of

Indonesian citizens overseas.

3) Speculation activities

The more speculative foreign exchange activity

conducted by speculators, the higher the value of

demand for foreign exchange, thus weakening the

exchange rate of the local currency against foreign

currencies.

3 MAIN FACTOR INFLUENCE

FOREIGN EXCHANGE

OFFERING

Meanwhile, foreign exchange offerings are

influenced by two main factors, namely:

1) Factors of receipt of export proceeds

The higher the volume of export revenues of goods

and services, the higher the amount of foreign

exchange held by a country and in the future the

exchange rate against the foreign currency tends to

strengthen or appreciate. Conversely, if exports

decline, then the amount of foreign exchange owned

young decreased so that the exchange rate also tends

to depreciate.

2) Capital inflows factor

The higher the capital inflows, the exchange rate

will tend to strengthen. The capital inflows can be in

the form of foreign debt receivable, short-term fund

placement by outside party (Portfolio investment),

and foreign direct investment (foreign direct

investment).

The definition of exchange rate or exchange rate

(foreign exchange rate), among others, stated by

Abimanyu in his book 'Understanding foreign

exchange rates' is the price of a country's currency

relative to other currencies. Because this exchange

rate covers two currencies, then the balance point is

determined by the supply and demand side of both

currencies.

Exchange rates or more popularly known as

currency rates are the quotation of the market price

of a foreign currency in the domestic currency or its

reciprocal currency, the domestic currency price in

foreign currency. The exchange rate represents the

exchange rate of exchange from one currency to

another and is used in various transactions, including

international trade transactions, tourism,

international investment or short-term cash flow

between countries, which passes geographic

boundaries or boundaries law.

The exchange rate of a currency can be

determined by the government (monetary authority),

as in countries using fixed exchange rates system or

is determined by a combination of interacting market

forces as well as government policies such as those

in the regime system 'flexible exchange rates.

Since each country has a relationship in

investment and trade with another country, no

exchange rate can adequately measure the

purchasing power of the domestic currency over

foreign currencies in general. Therefore, several

concepts of effective exchange rate have been

developed to measure the weighted average of

foreign currency prices in domestic currency Karim

A. (2004).

4 RESEARCH METHODS

This research was conducted in June 2017 using

variable data from currency exchange rates of

several countries in Asia such as Indonesia,

Thailand, Philippines, and Malaysia. The analysis in

this study using the proposed model as follows:

1. IDRit = α0 + b1 MR it + b2PPit + b3TBit + εit (1)

2. IDR (-1) it = α0 + b1 MR (-1) it + b2PP (-1) it +

b3TB (-1) it + εit (2)

3. D(IDR)it = α0 + b1 D(MR) it + b2D(PP)it +

b3D(TB)it + εit (3)

4. D(D(IDR)) it = α0 + b1 D(D(MR)) it +

b2D(D(PP)) it + b3D(D(TB)) it + εit (4)

IDR it is Indonesian rupiah, MR it is a Malaysian

ringgit, PP it is Philipina Peso, TB it is Thailand

bath. D is different first, DD is twice different. (-1)

Is a derivative first year.

5 RESEARCH RESULT

In this study, proposed four models of multiple

regression analysis that aims to answer the problem,

whether among the exchange rates of several

Significant Relationships in the Value of Currency Exchange Rate in Southeast Asia

137

countries in the Southeast Asia region is

significantly related.

Model 1

Model 1 proposed, and has the following results:

Table 1: Result for regression model 1

Model 2

Model 2 proposed, and has the following results:

Table 2: Result for regression model 2

Dependent Variable: IND_RUPIAH(-1)

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

5.135080

0.058044

88.46886

0.0000

MALAY_RINGGIT(-1)

1.452388

0.079123

18.35602

0.0000

PHIL__PESO(-1)

-0.667129

0.051797

-12.87975

0.0000

THAI_BAHT(-1)

-0.525341

0.069305

-7.580171

0.0000

R-squared

0.140556

Mean dependent var

3.984184

Adjusted R-squared

0.139595

S.D. dependent var

0.042372

S.E. of regression

0.039303

Akaike info crit.

-3.633528

Sum squared resid

4.144566

Schwarz criterion

-3.624751

Log likelihood

4885.645

Hannan-Quinn crit.

-3.630353

F-statistic

146.2616

Durbin-Watson stat

0.017317

Prob(F-statistic)

0.000000

Source : Proceed by author with software

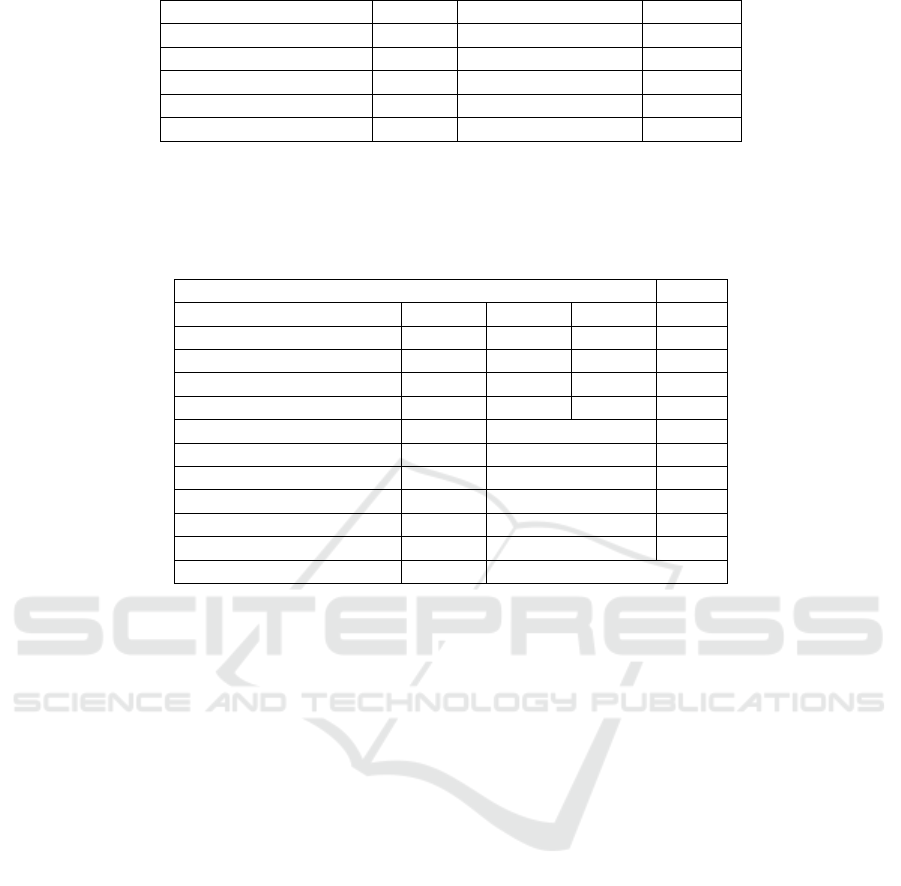

Model 3

Model 3 proposed, and has the following results:

Table 3: Result for regression model 3

Dependent Variable: D(IND_RUPIAH)

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

-6.74E-05

4.97E-05

-1.3559

0.1753

D(MALAY_RINGGIT)

0.241796

0.020966

11.5327

0.0000

D(PHIL__PESO)

0.066097

0.011073

5.9693

0.0000

D(THAI_BAHT)

0.050366

0.012412

4.0578

0.0001

R-squared

0.074862

Mean dependent var

-6.02E-05

Dependent Variable: IND_RUPIAH

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

5.1360

0.0580

88.5001

0.0000

MALAY_RINGGIT

1.4524

0.0791

18.3560

0.0000

PHIL__PESO

-0.6684

0.0518

-12.9084

0.0000

THAI_BAHT

-0.5246

0.0693

-7.5700

0.0000

R-squared

0.1407

Mean dependent var

3.9842

Adjusted R-squared

0.1398

S.D. dependent var

0.0424

S.E. of regression

0.0393

Akaike info criterion

-3.6336

Sum squared resid

4.1459

Schwarz criterion

-3.6248

Log likelihood

4887.5190

Hannan-Quinn criter.

-3.6304

F-statistic

146.5332

Durbin-Watson stat

0.0174

Prob(F-statistic)

0.0000

Source : Proceed by author with software

ICT4BL 2019 - International Conference on IT, Communication and Technology for Better Life

138

Adjusted R-squared

0.073828

S.D. dependent var

0.002678

S.E. of regression

0.002577

Akaike info crit.

-9.083038

Sum squared resid

0.017815

Schwarz criterion

-9.074260

Log likelihood

12207.06

Hannan-Quinn crit.

-9.079863

F-statistic

72.36940

Durbin-Watson stat

2.198009

Prob(F-statistic)

0.000000

Source : Proceed by author with software

Model 4

Model 4 proposed, and has the following results:

Table 4: Result for regression model 4

Dependent Variable: D(D(IND_RUPIAH))

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

2.30E-06

7.36E-05

0.031200

0.9751

D(D(MALAY_RINGGIT))

0.195998

0.019394

10.10623

0.0000

D(D(PHIL__PESO))

0.060425

0.010880

5.553943

0.0000

D(D(THAI_BAHT))

0.038948

0.010857

3.587254

0.0003

R-squared

0.057388

Mean dependent var

2.33

Adjusted R-squared

0.056333

S.D. dependent var

0.0039

S.E. of regression

0.003816

Akaike info criterion

-8.2980

Sum squared resid

0.039047

Schwarz criterion

-8.2892

Log likelihood

11148.15

Hannan-Quinn crit.

-8.2948

F-statistic

54.42807

Durbin-Watson stat

3.0488

Prob(F-statistic)

0.000000

Source : Proceed by author with software

The results presented in Table 1, 2, 3 and 4 for the

simple regression of the proposed model, almost all

of the variables for currency exchange rates in some

countries in Southeast Asia are significantly related,

as seen from the probability value generated are all

significant for models 1, 2, 3 and 4. Thus there is a

significant relationship between the exchange rates

of Thailland, Malaysia, Philippines, and Indonesia.

6 CONCLUSION

From the research that has been done, it can be

explained that the exchange rate of some countries

in Southeast Asia, including Indonesia, Malaysia,

Thailand, and the Philippines has a significant

relationship by using the model of simple regression

which is made in analysis tool basic research.

REFERENCES

Abimanyu, Y. (2004), Memahami Kurs Valuta

Asing, Jakarta: FE-UI.

Karim, A., (2002), Ekonomi Islam: Suatu Kajian

Ekonomi Makro, Jakarta: IIIT Indonesia.

Karim, A.(2004), Admin pembelajar EKIS, Teori

Nilai Tukar Dalam Islam in

http://pembelajarekis.blogspot.com/2011/06/teori

-nilai-tukar-dalam-islam.html (19 October 2017)

Significant Relationships in the Value of Currency Exchange Rate in Southeast Asia

139