Determinant of Quality Audit in Sustainable Development Goals

Almatius Setya Marsudi

The Professional Programme in Accounting (PPA), Atma Jaya Catholic University, Jakarta, Indonesia

Keywords: Work Experience, Audit Tenure, Auditor Ethics, Time Budget Pressure, Audit Quality.

Abstract: The inclusive role of the auditor towards Sustainable Development Goals, encouraging public accounting

offices to improve their audit performance by improving the quality of audits. This study is aimed at

explaining the determinant of audit quality in the Indonesian context. We hypothesize that the influence of

the work experience, auditor ethics, audit tenure, and time budget pressure impact to the audit quality

produced by auditors that work in the Public Accountant Firms. The research used questionnaires to collect

data with a total sample of 102 respondents. This study uses a quantitative approach and using multiple linear

regression analysis. The result of testing the hypothesis stated that work experience, auditor ethics, and audit

tenure variables partially influence the quality of the audit. Finally, our results contribute to the regulatory

agencies that must make strict rules to ensure auditor compliance on audit tenure, and code of ethics, so that

SNP Finance failures cases do not occur in Indonesia.

1 INTRODUCTION

The development of country's economic conditions

makes business complexity increase. The more

complex the business, encourage the quality financial

statement information needs. The auditor plays a role

in encouraging accountable transparent financial

management. United Nations Conference on Trade

and Development (UNCTAD) is the main organ of

the UN General Assembly in dealing with trade,

investment, and development issues, in 2017

UNTACD launched a sustainable development

agenda until 2030. The contribution of the private

sector in achieving the agenda will be very

significant, especially the contribution of auditors in

ensuring the reporting of sustainable accounting

(Pramono, 2018). The inclusive role of auditors in the

Sustainable Development Goals (SDGs) was

followed up by the International Organization of

Supreme Audit Institutions (INTOSAI) with a second

cross-field priority, namely to contribute to the

follow-up and review of the SDG in the context of

each country's specific sustainable development

efforts. One of the priority approaches is audit

performance assessment (Intosai, 2017). The Public

Accountant Office or Kantor Akuntan Publik (KAP)

must have good audit quality to produce financial

reports that can be trusted by users of financial

information. According to De Angelo (1981) and

Rizal, N. and Liyundra, F. S. (2016) revealed the

relationship between findings of fraud in the client's

accounting system with increasing audit quality.

There are many public doubts about the

profession of public accounting. One phenomenon

that can support this study is Bank Mandiri's Medium

Term Notes failure case of $ 98,000 in SNP Finance.

In the case of SNP Finance, it was called the KAP

under the entity of Deloitte - Indonesia was involved.

The Deloitte entity represented by Satrio Bing Eny &

Rekan (SBE) conducted an SNP financial statement

audit based on audit standards set by the Indonesian

Institute of Certified Public Accountants (IAPI).

Steve Aditya (Marketing & Communications Lead of

Deloitte - Indonesia) revealed BE was the last time to

publish an Independent auditor's report on the SNP

financial report for the 2016 financial year. The audit

was not related to the need for issuance of MTN

conducted by SNP in 2017 and 2018. SBE was also

never asked for approval or notified by SNP if the

audit report on SNP financial statements was used as

a reference in the issuance of Medium Term Notes

(MTN). Steve also insists Deloitte has a strict quality

control standard. Prior to the release of an

independent auditor's report shall be through the

review of strict internal quality control performed by

the colleague / partners and managers who are not

involved in the audit alliance. A different matter was

uttered by Langgeng Subur (Head of the Ministry of

Finance's Professional Development Center), the

584

Marsudi, A.

Determinant of Quality Audit in Sustainable Development Goals.

DOI: 10.5220/0008434005840589

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 584-589

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

state exchequer acknowledged that there were

indications of negligence by KAP in auditing

financial statements. "Because Public Accountants

has long been holding PT SNP as their client, then

there are things that the audit step must be deepened

are not done," said Langgeng (CNBC, 2018). Audit

quality in the case of Bank Mandiri MTN made the

audit quality of the Deloitte SBE Entity questionable

even though Deloitte itself is apart of the Big Four

KAPs in Indonesia. KAP SBE is considered to have

conducted low-quality audit activities, so the Ministry

of Finance imposed administrative sanctions on

Marlinna and Merliyana Syamsul Public Accountants

in the form of limiting the provision of audit services

to financial services entities for 12 months from

September 16, 2018 to by September 15, 2019. A

public accountant needs to improve audit quality to

be able to increase the level of reliability of financial

statements so that they can be trusted again by

interested parties.

2 THEORETICAL FRAMEWORK

2.1 Sufficient Work Experience

This section must Auditors are required to have

sufficient work experience, understand the code of

ethics of the accounting profession, and consider the

factor of the length of the relationship between the

auditor and the client (audit tenure) and the time

budget pressure factor in auditing. The auditor's

experience factor in conducting audits is one of the

factors that influence audit quality. The auditor's

knowledge will develop as experience increases in

performing audit tasks. With the increasing

experience, the expertise possessed by auditors is also

growing. The impact of experience on every decision

taken in conducting an audit is expected to help make

the right decision. The longer the auditor's working

period is indicated, the better the audit quality

produced by the auditor.

2.2 Auditors' Ethical behavior

Auditors' ethical behavior is a factor that influences

audit quality. Auditors should be guided by the code

of ethics and auditing standards of relevant public

accountants in carrying out audits. Code of ethics is

very necessary because in the code of ethics regulates

the behavior of public accountants in carrying out

practices. According to Ardelean A. (2013) the idea

of ethics consists of the concepts of integrity, honesty,

and responsibility. Therefore, ethics is perceived by

the community as a set of moral principles and rules

of conduct that guide the audit profession. To

improve auditor performance, the auditor is required

to maintain ethical standards to produce quality

audits.

2.3 Audit Tenure

The length of the auditor's relationship with the client

is called audit tenure. Tenure is the period of

assignment of audits by certain KAP in client

companies that are in accordance with government

regulations. The longer the audit assignment can be

indicated to affect audit independence. (Yudi et al.

2013; Puspitasari and Nugrahanti, 2016). Another

factor that also determines audit quality is Time

budget pressure. The more efficient of the Auditor in

completing the case, the better the quality of the

auditor.

2.4 Time Budget Pressure

Time budget pressure can also cause deviant behavior

from an auditor because the auditor tends to be

depressed in carrying out his duties. The negative

impact caused by time budget pressure is that the

auditor intentionally removes several stages of the

audit for reasons of time constraints, thereby reducing

audit quality. Research on audit quality is important

for KAP so that they can find out the factors that

influence audit quality and can further improve audit

quality produced by auditors working in KAP

(Andreas, 2015).

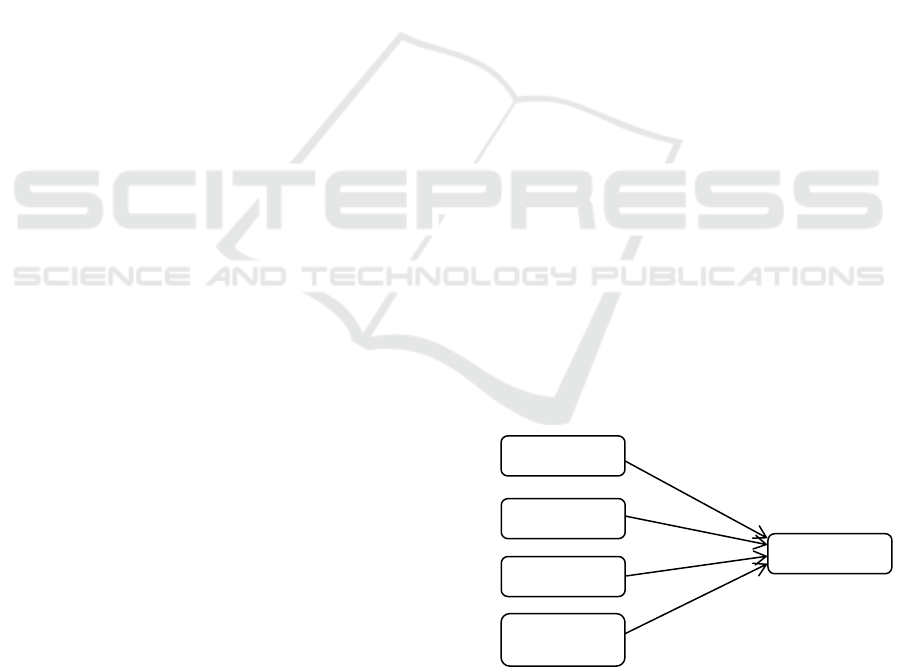

2.5 Conceptual Framework

The conceptual framework can be seen in figure 1.

Figure 1: Conceptual Framework.

2.6 Hypothesis

H1 : work experience has a positive effect on audit

Work Experience

Audit Tenure

Auditor Ethics

Time Budget

Pressure

Audit Quality

H1

H2

H3

H4

Determinant of Quality Audit in Sustainable Development Goals

585

quality

H2 : audit tenure has a positive effect on audit

quality

H3 : auditor ethics has a positive effect on audit

quality

H4 : time budget Pressure has a positive effect on

audit quality

3 RESEARCH METHODOLOGY

3.1 Population and Sample

In this study, we use auditor at KAP in Jakarta as a

sample and population. There are 102 auditors from

18 KAP in Jakarta. The IAPI database which consists

of all Indonesian accountants list is used in this study

to determine the research sample.

The questioner is sent to the auditor to obtain

auditor perceptions of the variables used in this study.

Non-probability sampling was used in this research.

This study used some The criteria of sample : (1) the

auditor has worked in KAP for at least 1 year, and (2)

the auditor has audited at least 3 years.

3.2 Operational Definition

3.2.1 Audit Quality

Audit quality indicates how appropriate the audit

results are to the established standards (Watkins et al.,

2004). The indicators used to measure audit quality

consist of (1) the quality of the audit report, (2)

compliance with audit standards and (3) the process

of finding and reporting evidence.

3.2.2 Work Experience

The indicators used for Work Experience: the

duration of working as an auditor and the number of

tasks (Setiawan's, 2017).

3.2.3 Audit Tenure

Audit Tenure was measured using indicators: (1)

good relationship with clients, and (2) the length of

time the relationship with the client.

3.2.4 Auditor Ethics

Auditor ethics was measured using indicators: (1)

Auditor Professional Responsibility, (2) Integrity, (3)

Objectivity.

3.2.5 Time Budget Pressure

Time Budget Pressure was measured using

indicators: (1) time limitations in assignments, (2)

completion of work with a specified time, (3) fulfillment of

target time during the assignment, (4) focus on tasks with

limited time, and (4) time budget communication.

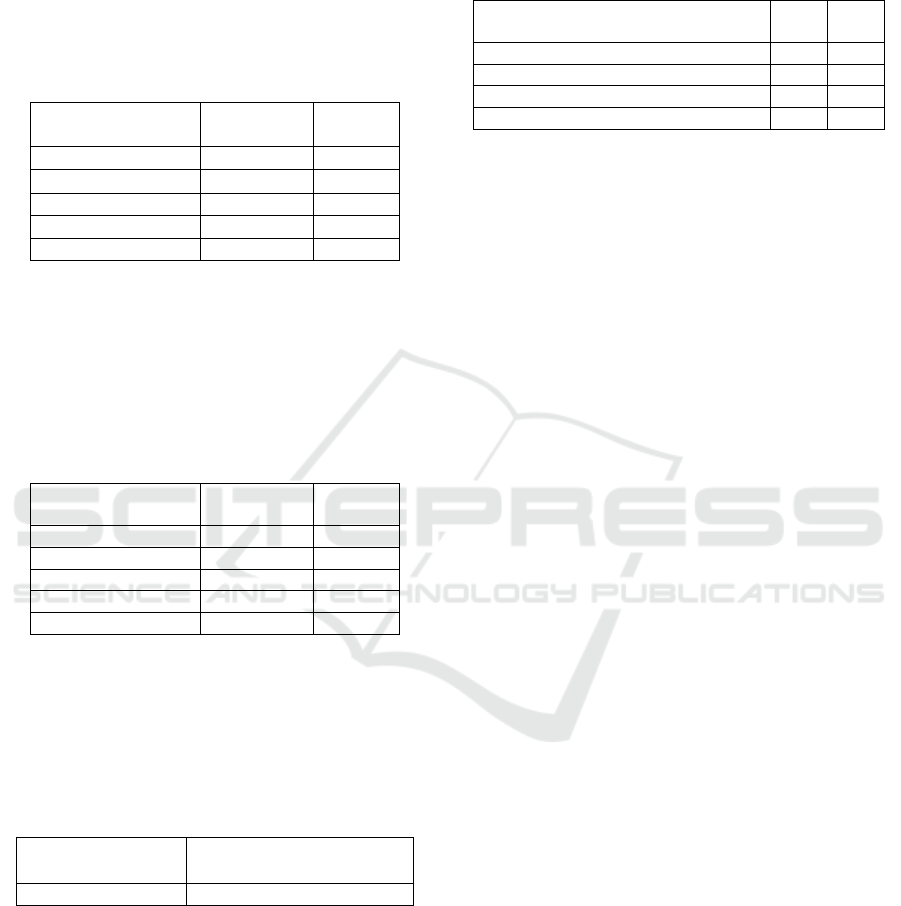

Table 1: Operational Definition.

Variables

Indicators

Work

Experience

The duration of working as an auditor

The number of tasks

Audit Tenure

Good relationship with clients

The length of time the relationship with

the client

Auditor Ethics

Auditor Professional Responsibility

Integrity

Objectivity

Time Budget

Pressure

Time limitations in assignments

Completion of work with a specified time

Fulfillment of target time during

assignment

Focus on tasks with limited time

Time budget communication

Audit Quality

Compliance with audit standards

Quality of audit report

Finding and reporting evidence

3.3 Analysis Method

Multiple regression analysis was used in this study. In

addition, researchers used the SPSS tool to analyze

the research model, the research formula was as

follows:

AQ = a + b

1

WE + b

2

AT + b

3

AE + b

4

TBP + e (1)

Formula remarks:

AQ = Audit Quality

a = Constanta

b

1

– b

4

= The regression coefficient

WE = Work Experience

AT = Audit Tenure

AE = Auditor Ethics

TBP = Time Budget Pressure

e = error

The t-test is used as a basis for determining whether

the hypothesis is accepted or rejected. If the P-value

is <0.05; Ha is accepted = there is a significant effect

between the independent variables on the dependent

variable. If the P-value> 0.05; Ha is rejected = there

is no significant influence between the independent

variable and the dependent variable.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

586

4 RESULTS AND DISCUSSION

4.1 Results of the Outer Model

Measurement

4.1.1 Result of the Validity Test

Table 2: Results of the Discriminant Validity Measurement.

Variables

Original

Sampling (O)

P-values

Work Experience

0.524

0.000

Audit Tenure

0.513

0.000

Auditor Ethics

0.538

0.000

Time Budget Pressure

0.812

0.000

Audit Quality

0.543

0.000

All variables have discriminant validity values in

the column of original sampling (o) > 0.30 and a p-

value < significance level. It can be concluded that all

the variables are valid.

4.1.2 Result of the Reliability Test

Table 3: Results of the Composite Reliability Measurement.

Variables

Original

Sampling (O)

P-values

Work Experience

0.892

0.000

Audit Tenure

0.875

0.000

Auditor Ethics

0.818

0.000

Time Budget Pressure

0.975

0.000

Audit Quality

0.807

0.000

All variables have composite values > 0.70. It can

be concluded that all variables are reliable.

4.2 Results of the Inner Model

Measurement

Table 4: Value of the Adjusted R-square (Adjusted R2).

Dependent Variable

Value of Adjusted R-square

(R

2

)

Audit Quality

24.67%

The value means that 37.30% of audit quality can

be explained by the independent variables in this

research.

4.3 Results of the Hypothesis Test and

Discussion

Table 5: Relationship between the Variables.

Relationship between the

Variables

β

P-

values

Work Experience → Audit Quality

0.198

0.047

Audit Tenure → Audit Quality

0.181

0.042

Auditor Ethics → Audit Quality

0.345

0.012

Time Budget Pressure → Audit Quality

0.043

0.587

The more experienced an auditor, the more audit

quality increases, which is statistically significant at

the 0.047. The result is consistent with research

conducted by Wang et al. (2015), Wang found: there

is perceive that auditor to be more credible when the

underlying companies are audited by more

experienced partners. There is perceive that auditor to

be more credible when the underlying companies are

audited by more experienced partners. Audit Tenure

has a positive effect on audit quality, which is

statistically significant at the P-values 0.042. Auditor

ethics has a positive effect on audit quality, which is

statistically significant at P-values 0.012. The result

is consistent with research conducted by Jackson et

al. (2007) which state that the audit tenure can

provide auditor a better understanding of his clients,

thus increasing audit quality. Time budget pressure

has a positive effect on audit quality, which is

statistically not significant at P-values 0.587. The

result is consistent with research conducted by Gaol

et al. (2017).

The results of the t-statistic test reveal that the

audit tenure, work experience, and audit ethics has a

significant positive effect on audit quality. This is in

line with the studies conducted by, Kuntari et al.

(2017), and Habiburrochman & Manifesti J. (2018).

5 CONCLUSIONS

Auditor work experience has a positive effect on audit

quality. This means that working experience is able to

improve audit quality. The more complex the

company will improve the work experience of public

accountants because the complexity of the company

is reflected in the increasing number of transactions

that can be processed and this will expand the audit

object. In the study of ALim et al. (2007) revealed that

the more experienced an auditor would improve audit

quality.

Audit Tenure has a positive effect on audit

quality. This means that audit tenure can improve

Determinant of Quality Audit in Sustainable Development Goals

587

audit quality. These results are supported by Geiger

and Raghunandan (2002), they found that the

perceived audit quality increased with increasing

perceived audit tenure. The results related to the

audit partner's working period are consistent with

conclusions about the tenure of the audit company.

The influence of Auditor ethics on audit quality.

Auditors ethics can produce audit quality. This

result supports the theory which states that

professional auditors will act in accordance with the

code of ethics and standards. Therefore the role of

auditor behavior to increase the reputation and

credibility of the company is very large (Ardelean &

Alexandra, 2013).

An understanding of the factors that can

significantly influence audit quality, and strict

compliance with the rules governing these factors,

will improve audit quality. And finally, it will

increase the trust of users of financial statements.

This study recommends that audit tenure,

understanding of audit ethics, and work experience

must be maintained and improved. Regulatory

agencies must make strict rules to ensure cases of

SNP Finance failures in Indonesia do not occur.

REFERENCES

Alia, A. (2015). Laporan Keuangan Bermasalah, Inovasi

Ganti Auditor. Detik Finance, January 5, 2018

http://finance.detik.com/read/2015/05/25/131118/2924

038/6/laporan-keuangan-bermasalah-inovisi-ganti-

auditor

Alim, M.N., Hapsari, T., and Purwanti, L. (2007). Pengaruh

Kompetensi dan Independensi terhadap Kualitas Audit

dengan Etika Auditor sebagai Variabel Moderasi .

Proceedings SNA X Makasar.

Andreas. (2015). Interaction Between Time Budget

Pressure and Professional Commitment towards

Underreporting of Time behavior. Procedia-Social and

Behavioral Sciences 219. (2016) p.91-98.

Ardelean Alexandra (2013). Auditors’Ethics and their

Impact on Public Trust. p.55-60. Lumen International

Conference Logos Universality Mentality Education

Novelty (LUMEN 2013)

Ardikawan, D. (2012). Pengaruh Independensi,

Pengetahuan, Pengalaman, Audit Tenure, dan Peer

Review terhadap Kualitas Audit pada Kantor Akuntan

Publik Berafiliasi. Skripsi. Fakultas Ekonomi dan

Komunikasi. Jakarta

Ayuningtyas, H. Y. (2012). Pengaruh Pengalaman Kerja,

Independensi, Obyektifitas, Integritas Dan Kompetensi

terhadap Kualitas Hasil Audit (Studi Kasus pada

Auditor Inspektorat Kota/Kabupaten di Jawa Tengah).

Doctoral dissertation, Fakultas Ekonomika dan Bisnis.

Semarang.

Dewi, A., C. (2016). Pengaruh Pengalaman Kerja,

Kompetensi, dan Independensi Terhadap Kualitas

Audit dengan Etika Auditor Sebagai Variabel

Moderasi. Skripsi. Fakultas Ekonomi. Yogyakarta.

Muhsyi, A. (2013). Pengaruh Time Budget Pressure, Risiko

Kesalahan dan Kompleksitas terhadap Kualitas Audit.

Skripsi. Fakultas Ekonomi dan Bisnis. Jakarta.

Gaol, M. B. L., Ghozali, I. and Fuad (2017) ‘Time budget

pressure, auditor locus of control and reduced audit

quality behavior’, International Journal of Civil

Engineering and Technology, 8(12), pp. 268–277.

Geiger, M., & Raghunandan, K. (2002). Auditor tenure and

audit reporting failures. Auditing: A Journal of Practice

and Theory 21(1), 67-78.

Habiburrochman & Manifesti J. (2018). Factors Affecting

Audit Quality in Indonesia: A Meta-Analysis.

Proceeding Confrence JCAE, 536-546.

Hasanah, A. N., & Putri, M. S. (2018). Pengaruh Ukuran

Perusahaan, Audit Tenure terhadap Kualitas Audit.

Jurnal Akuntansi: Kajian Ilmiah Akuntansi (JAK), 5(1),

11-21.

Intosai (2017). Strategic Plan of INTOSAI 2017-2022.

http://www.intosai.org/about-us/strategic-plan-of-

intosai.html.

Jackson, A. B., Moldrich, M., & Roebuck, P. (2008).

Mandatory audit firm rotation and audit quality.

Managerial Auditing Journal, 420-437.

Kuntari Y., Chariri A., Nurdhiana. (2017), The Effect of

Auditor Ethics, Auditor Experience, Audit Fees and

Auditor Motivation on Audit Quality, SIJDEB, Vol

1(2). P.203-2018.

Kurnia, Khomsiyah dan Sofie. (2014), Pengaruh

Kompetensi, Independensi, Tekanan Waktu Dan Etika

Auditor Terhadap Kualitas Audit. Journal Akuntansi

Fakultas Ekonomi Universitas Trisakti, Vol. 1 No 2.

Pramono, A. J. (2018). Peran Inklusif AKuntan Menuju

SDG’s 2030. Seminar Nasional IAI Indonesia.

Purnomo H. (2018). Ada Apa dengan Deloitte dan SNP

Finance? Ini Penjelasannya. 02 August 2018. https://w

ww.cnbcindonesia.com/market/20180802101243-17-2

6563/ada-apa-dengan-deloitte-dan-snp-finance-ini-pen

jelasannya

Puspitasari, A., & Nugrahanti, Y. W. (2017). Pengaruh

Hubungan Politik, Ukuran KAP, dan Audit Tenure

Terhadap Manajemen Laba Riil. Jurnal Akuntansi dan

Keuangan, 18(1), 27-43.

Rizal, N., dan Liyundira, F. S. (2016). Pengaruh Tekanan

Waktu dan Independensi Terhadap Kualitas Audit.

Jurnal Penelitian Ilmu Ekonomi Wiga. 6(1). 45-52.

Setiawan, R. (2017). Pengaruh Pengalaman Kerja,

Independensi, Objektivitas, Integritas, Kompetensi, dan

Etika Terhadap Kualitas Audit pada Kantor Akuntan

Publik di Jakarta. Fakultas Ekonomi dan Komunikasi.

Jakarta

Wang, X. et al. (2015). Engagement audit partner

experience and audit quality, China Journal of

Accounting Studies. 3(1), 1-24

Yudi Irmawan, Mohammad Hudaib, Roszaini Haniffa,

(2013) "Exploring the perceptions of auditor

independence in Indonesia", Journal of Islamic

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

588

Accounting and Business Research, Vol. 4 Issue: 2,

pp.173-202

Zam, D. R. P., & Rahayu, S. (2015). Pengaruh Tekanan

Anggaran Waktu (Time Budget Pressure), Fee Audit,

Dan Independensi Auditor Terhadap Kualitas Audit

(studi Kasus Pada Kantor Akuntan Publik Di Wilayah

Bandung). eProceedings of Management, 2(2).

______, (2018). Kasus SNP Finance, Dua Kantor Akuntan

Publik Diduga Bersalah. 26/09/2018. https://www.

cnnindonesia.com/ekonomi/20180926072123-78-3332

48/kasus-snp-finance-dua-kantor-akuntan-publik-

diduga.

Determinant of Quality Audit in Sustainable Development Goals

589