Business Valuation for Small Medium Enterprise in the Shoe

Industry

Alexius Reinaldo Hartadi Budiman, Raden Aswin Rahadi and Dwi Rahmawati

School of Business and Management, Institut Teknologi Bandung, Jl. Ganesha No.10, Bandung, Indonesia

Keywords: Adjusted Present Value, Business Valuation, Discounted Cash low, Shoes Industry, Small Medium

Enterprise.

Abstract: The footwear, leather product, and clothing industry contributed around IDR 35.14 trillion to the Indonesian

state revenue in 2016. One of the products produced by this industry is sneakers. NAH Project is one of the

local brand sneakers from Bandung has a desire to grow their business by opening a store, but to do it NAH

Project needs additional funds from an investor. This research aims to conduct a company valuation of NAH

Project and to find out whether customer preferences in buying sneakers affect the company valuation. There

are five scenarios are conducted that are used for company valuation. This research uses DCF and APV

methods in calculating company valuations and the questionnaire is used to find out the customer preferences

and the customer price expectations toward sneakers. The results of this research show that the most optimal

value for the company valuation is the first scenario that focuses on the official store with the value of IDR

6.4 billion. The customer's preference for sneakers and customer price expectations for sneakers affect the

company valuation on NAH Project where customer preferences and customer price expectations for sneakers

can affect the company's sales level, which will be a turmoil in the company's sales.

1 INTRODUCTION

NAH Project is one of the local brand sneakers from

Bandung. NAH Project was started by a small team

named N.A.H Indonesia which initially provided

products in the form of apparel & sneakers shoes.

NAH Project has an objective to change the stigma

that Indonesian sneakers had quality & competitive

designs and be able to compete in the way of branding

marketing through innovations. They also have the

purposes to presents sneakers made with research &

development that are relevant to the needs of the

Indonesian market with guaranteed quality. NAH

Project utilizes social media and E-Commerce as its

marketing media. By using this method, the NAH

Project already gained sales of IDR 831 million in

August 2018. Along with the development of the

footwear industry that supported by the government

and with the growth of the NAH Project, NAH

Project has the desire to grow their business by

opening a store. NAH Project considers that now they

only capture the online shoe market since all of the

sales is come from the online, so this makes the NAH

Project still has the opportunity to capture the market

from the offline stores. To capture the market, the

NAH Project has considered opening an offline

market such as a consignment or an official store.

This idea arises from 2 considerations - first, the

customer preferences when buying sneakers. The

“Need for Touch” is one of the factors that influences

the customers' decisions in buying sneakers. Some

customers feel that touching sneakers can increase

their chances of buying sneakers. They have the

opportunities to know more about the sneaker by

touching the sneakers, in terms of size, quality, and

the material used. This is important for the customers

since one of the most important things when buying

sneakers is a comfort. There are also customers who

just want to look fashionable, who sometimes

sacrifice comfort as long as they still look cool with

the latest model sneakers. For this type of customers,

the design of the sneakers is more important than the

comfort of the product. Second, the problems faced

by customers when buying products using online

methods. Through online methods, it is possible that

the products of sneakers that come are not according

to their expectations due to size, colour, material,

design, and more. Therefore, the product warranty is

needed when selling using online methods to provide

450

Budiman, A., Rahadi, R. and Rahmawati, D.

Business Valuation for Small Medium Enterprise in the Shoe Industry.

DOI: 10.5220/0008432404500459

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 450-459

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

security to the customer. But this will lead to

excessive costs for the company and the customer.

To capture this opportunity and to handle this

problem, NAH Project has considered opening an

offline market such as a consignment or an official

store. But to do that, the NAH Project needs

additional funds from the investor. The best way for

NAH to get additional funds is through external

funding from an investor. The frequent funding

sources used by many companies in the various size

of the business is the external funding. There are so

many types of external funding, but the type of

external funding that is most suitable for the NAH

Project is venture capital. Venture capital is one of the

more popular forms of equity financing used to

finance high-risk-high-business. Investors will

perform technical and fundamental analysis to

determine favourable investment opportunities, and

generally prefer to minimize risk while maximizing

returns, since the investors are the fund’s provider.

Investors expect profitable products and an attractive

income-to-equity-ratio which make the management

should manage sources of surplus successfully and

sustainably (Pohl, 2017). To help the investor, some

methods are needed to assess the value of the

company. The author will use two types of method to

assess the company's value, namely, Discounted Cash

Flow (DCF) and Adjusted Present Value (APV). The

Discounted Cash Flow (DCF) is a valuation method

used to estimate the value of the investment based on

its future cash flows, where the purpose is to estimate

the money an investor would receive from an

investment. The Adjusted Present Value (APV) is

similar to the DCF method, where the APV seeks the

value effects of the cost of equity and cost of debt. the

DCF-method and APV-method give proper insights

into the cash incomes and outcomes and how the

value is established (Beld, 2017).

2 METHOD

2.1 Conceptual Framework

This research starts from finding business issues as

explained in the sub introduction. Next is the

exploration of business issues by conducting market

research through interviews and questionnaires

regarding customer preferences for sneakers. The

results of the interview and questionnaire were then

analysed and used to create calculation scenarios.

There are five calculation scenarios performed in this

study to provide some values based on customer

preferences that have been obtained from market

surveys. All calculation scenarios use the DCF and

APV methods to find company value

2.2 Method of data Collection and

Analysis

In this research, two interviews were conducted

aimed at obtaining the information needed for this

research. The interview used in this research was a

semi-constructed interview. The semi-constructed

interview contains structured and unstructured

sections with standardized and open type questions,

by allowing for a discussion with the interviewee

rather than a straightforward question and answer

format. The first interview was conducted with three

shoe industry players. It aims to find out the opinions

of shoe industry players regarding the condition of the

shoe market in Indonesia. In addition, in this

interview also find out the factors that influence

customer preferences in decision making when

buying sneakers from the point of view of shoe

industry players and how shoe industry players think

about consignment and official stores. The factors

that want to be obtained in this interview are not only

focused on factors in general, this research also looks

at the factors that influence customer preference for

sneakers from the place variables. Furthermore, the

second interview focused more on sneakers users who

acted as the customers for sneakers product. The

interviews were conducted with 11 respondents

randomly, with the aim of getting more varied results.

The purpose of this second interview is to find out

whether the factors that influence customer

preferences for sneakers have been found by the

author and those that have been obtained from the

first interview are relevant to sneakers users when

they want to buy sneakers. In this research, the factor

that affects the customer preferences in buying

sneakers already collected from the author’s findings,

first interview, and second interview. These factors

will be used in building a questionnaire.

This research also conducted a market survey

using a questionnaire in order to find out the

customers’ preferences toward the sneakers. The

questionnaires are a particularly suitable tool for

gaining the quantitative data but can also be used for

qualitative data. The advantages of using a

questionnaire is allowing the author to organize the

questions and receive replies without actually having

to talk to every respondent, and also having a

structure format, is easy and convenient for

respondents, and is cheap and quick to administer to

a large number of cases covering large geographical

areas (Walliman, 2011). The questionnaire was

Business Valuation for Small Medium Enterprise in the Shoe Industry

451

conducted in December 2018, with a total of 177

respondents from various regions in Indonesia. Based

on the confidence level diagram and the precision

level provided by Israel (1992), it can be concluded

that the confidence level of this research is 95% with

10% sampling error. The questionnaire used

consisted of 48 questions divided into 6 sections. The

first section relates to the background and

demographics of the respondents and the rest are

related to the respondents’ tendency towards

sneakers, the expected price for sneakers and

respondent’s preferences in buying sneakers in

general and under the place variable. To process the

data collected from the questionnaire, descriptive

statistical analysis was used in this research.

According to Walliman (2011), descriptive analysis

is a method of quantifying the characteristics of

parametric numerical data such as where the centre is,

how wide they are scattered, central tendency points,

modes, medians and means. To be more specific,

descriptive statistical analysis used is mean analysis

and the mode analysis.

2.3 Company Valuation

Company valuation, or also called business valuation,

is the process of determining the economic value of a

business or company. The goal of company valuation

is to give the owners, potential buyers, and others

interested stakeholders an approximate value of what

a company is worth (Steiger, 2008). The valuation

process is a fundamental approach to support making

an investment decision. These methods can be

divided into the income approach, market approach,

and the asset approach. According to Damodaran

(2005) and Fernández (2013) on Beld (2017), there

are five approaches for valuation, namely:

1. Discounted cash flow (DCF) valuation

2. Liquidation and accounting valuation

3. Relative valuation

4. Contingent claim valuation (real options)

5. Goodwill valuation

2.4 Discounted Cash Flow

Discounted cash flow valuation estimates the value of

any ass`et by discounting the expected cash flow on

that asset at a rate that reflects their riskiness

(Damodaran, 2011). The DCF method is primarily

based on the fundamental principle, that the value of

an asset is the present value of its expected future cash

flow (Luehrman, 1997b). The DCF method values the

company on the basis of the net present value (NPV)

of its future free cash flows which are discounted by

an appropriate discount rate. The value of the

company is the result of the free cash flow discounted

by the cost of capital, in this case the WACC.

Where:

CF to Firm = expected cash flow to the firm in

period t WACC = Weighted Average Cost of Capital

According to the Brotherson et.al (2014), all of

the respondents from the survey conducted by them

which consisted of investment banks in the US used

DCF as the standard to valuate a company, even

though they think that this method is not usable in

every situation and according to the Koller, Goedhart,

Wessels (2005), the discounted cash flow analysis is

the most accurate and flexible method for valuing

project, divisions and companies. The DCF method

reflects the commonly-accepted principle of asset

valuation, the value of an asset is the total amount of

expected cash flows it can generate, discounted at a

rate which reflects the risks of the asset (Le, 2017).

2.5 Adjusted Present Value

The APV is another possibility to analyse a

company’s value using the discounted cash flows.

The APV is the net present value of the company’s

free cash flows assuming the pure equity financing

and adding the present value of any financing side

effect, like tax shield (Brealey, Myers, & Allen, 2006,

p. 993). The pure equity financing means that the

company is financed entirely by the equity

(Luehrman, 1997a). Since the company has no

leverage, the cash flows are discounted by the

unlevered cost of equity. After that, the next step is

adding the value of all financing side effects.

Whereby the most common value of financing

side effects consists of tax shields, because interest

expenses are tax deductible

2.6 Terminal Value

The terminal value is the NPV of all future cash flows

that accrue after the time period that is covered by the

scenario analysis. According to Elsner & Krumholz

(2013) terminal value held a significant portion of the

firm value; hence exact and unbiased calculation of

terminal value is essential. Since it is very difficult to

estimate precise figures showing how a company will

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

452

develop over a long period of time, the terminal value

is based on average growth expectations, which are

easier to predict. On the DCF approaches, the

terminal value will be calculated using the Gordon

Growth Mode, the formula to calculate the terminal

value is shown below:

2.7 Analysis of Business Situation

The first interview was conducted with three shoe

industry players. It aims to find out the opinions of

shoe industry players regarding the condition of the

shoe market in Indonesia. In addition, in this

interview also find out the factors that influence

customer preferences in decision making when

buying sneakers from the point of view of shoe

industry players and how shoe industry players think

about consignment and official stores. The results of

the interview show that all respondents have a

different point of views regarding to the current

condition of the shoe market in Indonesia, where 2

out of 3 respondents feel the growth in the shoe

market in Indonesia. However, the measurement of

growth in the shoe market is only based on the

respondent level of sales, this cannot help in

describing the state of the shoe market in Indonesia.

This shows that there is still a lack of awareness from

industry players regarding to the current condition of

the shoe market in Indonesia. The competition in the

shoe market was also quite strict where the

respondents felt difficulty in marketing their products

because of many other brands including foreign

brands that sell similar products at lower prices. This

makes industry players have to make better strategies

in dealing with the global market. The respondents

also realized that there were several factors that

influenced customer preferences in buying sneakers,

including factors that influence customer preferences

from place variables. The respondents also agreed

that the absence of a store or consignment made them

unable to take the entire existing shoe market. In

addition, the presence of a store or consignment can

make it easier for customers to get the shoes they

want, because they can see products such as anything

and product variants that are directly related to

customer preferences to see and hold shoes directly

when buying shoes. The respondents also argued that

the presence of an official store or consignment could

make customers feel more confident or believe in

shoes sold by respondents. This can be relating to the

trustworthiness toward the brand and the product.

Furthermore, the second interview focused more

on sneakers users who acted as the customers for

sneakers product. The interviews were conducted

with 11 respondents randomly, with the aim of getting

more varied results with the purpose of this second

interview is to find out whether the factors that

influence customer preferences for sneakers have

been found by the author and those that have been

obtained from the first interview are relevant to

sneakers users when they want to buy sneakers. From

the interview results with the sneakers users show that

9 out of 11 respondents felt that place factors could

influence their decision to buy sneakers. But there are

2 respondents who feel that the place factor is not so

important because of the catalogue that explains the

products to be purchased and the opinions of other

buyers to see reviews of the same product, besides

that the items purchased can be deposited to people

who trusted by the respondents. From the factor of

holding or seeing the sneaker directly, there are 10 out

of 11 respondents who agree that holding and seeing

sneaker can directly influence their decision in buying

sneakers. There is 1 respondent who disagrees,

because there is a product warranty that offered when

buying the product through the online method. The

product warranty is a guarantee of exchanging

products if there is a mismatch. However, the overall

responses of respondents indicated that respondents

agreed that the factor of holding and seeing sneakers

directly influenced their decision in buying sneakers.

This research also conducted a market survey

using a questionnaire in order to find out the

customers’ preferences toward the sneakers. From the

questionnaire results of this research indicate that the

overall respondents are dominated by ages 15-25

years and students who are domiciled in Bandung.

For the factors that affects the customer preferences

in buying sneakers can be seen in Table 1. There are

6 factor that greatly influences the customer

preferences in buying sneakers, namely comfort and

support, product quality, product design, fit,

promotion, and price. From these results, it can be

concluded that customers are sensitive and aware of

the factors of comfort and support, product quality,

and product design, since sneakers can be categorized

into fashion products and these three factors are very

important in fashion products. The fit factor means

the compatibility felt by the customers of the products

they buy, for example, such as the size of sneakers.

This is different from the comfort and support factor,

which focuses on comfort and whether the product

helps and supports daily customer activities. The

promotion and fit also the factor that most influences

customer preferences on sneakers purchasing

decisions. Consumer buying behaviour and sales

promotion can be motivated through various types of

elements, one of which is the price discounts

Business Valuation for Small Medium Enterprise in the Shoe Industry

453

(Ghafran, M., 2014). In addition to promotion, prices

also influence consumer purchasing decisions. Prices

have a significant influence on communication

factors regarding the benefits of buying a product.

Prices accompanied by "discounts," can increase the

perceived value of the product for the buyer, so that it

can increase the percentage of consumer purchasing

decisions (Giuliani et al., 2012). But from the result

of the questionnaire also shows that there are 3 factors

that customers do not really consider, namely the

opinions of others, customer service and after-sales

services, and the advertisement. There are also two

more factors about the need to hold and see sneakers

directly that can be seen in Table 2. The result shows

that the factors of the need to hold and see sneakers

directly really affect the customer's decision in

purchasing. It can be concluded that the customers

feel more confident with the sneakers they will buy,

because they can see immediately and can try the

sneakers directly.

Next, the factors that influence customer

preferences in making decisions in buying sneakers

from the place variable. There are seven factors that

influence the customer preferences from the place

variable, namely convenience to the customer,

location of the store, employees, display, layout,

light, and music (see Table 3). The most influence

factors are the convenience to the customer, location

of the store, employees, and display. The convenience

to the customer factor is a combination of all the

factors that have been mentioned, but in this research

want to find out more in detail about what factors are

most influential to those that are not too influential.

According to research conducted by Mohan (2014),

customers who prefer location and convenience

usually buy shoes more often. The more customers

feel comfortable in the store, the more influential it

will be on customer preferences in buying sneakers.

An easy-to-reach location will help improve customer

decisions in purchasing sneakers. On the employee

factors, the speed of employees in welcoming

customers, the accuracy of employees in serving

customers, and employee politeness will also

influence customer decisions in purchasing. Next is

the display factor. Display represents the appearance

of stores such as themes, shelves, paint colors, etc.

The more attractive the display from the store will

attract the attention of customers to visit the store.

The remaining three factors are the factors that less

influence customer preferences in making decisions

when buying sneakers, namely layout, light, and

music. The factor of layout which is the management

in terms of determining the location and shop

facilities that aim to make use of the store space as

effectively as possible. Location in this case is the

position placement for each product or facility that

supports store activities. Examples included in layout

factors are traffic flow (store traffic flow) and

division between employee space and customer

space. The simpler the layout of the store will make it

easier for customers to find or find sneakers they

want. This makes the layout factor less influential.

The factor of light is related to lighting that is used to

highlight the products that are sold to make them look

clearer and better. Consumers will tend to touch and

assess the quality of the product when the lighting

provided uses good colour. This shows that lighting

only affects touching interest and assesses the quality

of sneakers on display. The last factor is the music.

According to Smith and Curnow (1966), customers

will spend less time in stores when music is played

harder than softly played music. This shows that

music is not too influential on customer preferences,

because music will only affect the duration of people

in the store.

From the questionnaire results also find out that

most respondents use social media as one of their

sources of information to obtain information about

the sneakers trends which are then followed by

information or recommendations obtained from their

family, friends, or colleagues. Furthermore, from the

questionnaire results also find out that the most. In

addition, the questionnaire also obtained results

regarding the method most used by respondents to

buy sneakers. 88.70% of the total respondents

preferred to buy sneakers in the store rather than

online.

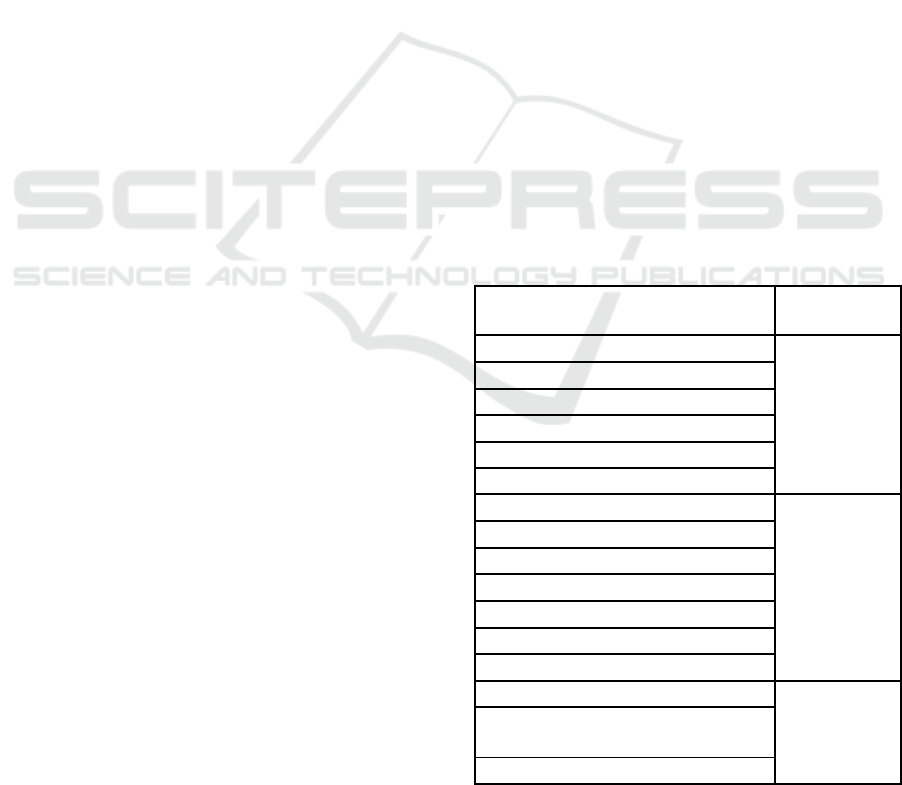

Table 1: Customer Preferences toward Sneakers Product.

Factor Affect Customer

Preferences

Effect Levels

Comfort and Support

Product Quality

Product Design

Very

Affecting

Fit

Promotion

Price

Ease of Ordering

Product Knowledge

Ease of Payments

Affecting

Brand Image

Variety of Product

Location

Product Warranty

Opinions of Others

Customer Service & After-Sales

Less

Service

Affecting

Advertisement

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

454

Table 2: Customer Preferences from The Factors of

Holding and Seeing the Product.

Factor Affect Customer

Effect

Levels

Preferences

Seeing

Very

Affecting

Touching

Table 3: Customer Preferences toward Sneakers Product

from Place Variable.

Factor from Place Variable

Effect

Levels

Convenience to the Customer

Location of the Store

Very Affecting

Employees

Display

Layout

Less Affecting

Light

Music

Based on the results of business situation analysis,

it was found that NAH Project's desire to scale up

their business by opening stores was in line with the

findings that had been obtained. First is from the

interviews with shoe industry players saying that

without a store, the company has not been able to

fully capture the overall shoe market. In addition,

from the sneakers user point of view, they prefer to

buy sneakers at the store rather than using online

methods. Furthermore, the factors that greatly

influence customer preferences in buying sneakers

are comfort and support, product quality, product

design, fit, promotion, and price. Comfort and support

and fit factors can be obtained in a way where

customers must be able to hold, see, and try sneakers

directly. Since sneakers can be categorized into

fashion products, so the factors of comfort and

support, product quality, and product design are very

important in fashion products.

3 RESULTS AND DISCUSSION

3.1 Alternative of Business Solution

Company valuation or often referred to as business

valuation is a process to determine the economic

value of a business or company on the investor's side.

Company valuation is also often used to provide an

assessment of the strategy and the company's ability

to generate value to maximize investor wealth.

According to research conducted by Beld (2017), the

methods used for company valuation can be divided

into income approaches, market approaches, and

asset approaches. But according to de Souza et.al

(2017), there are two extreme perspectives on

company valuation. The first point of view says that

there are people who believe as an exact science

which if done correctly, will only give a little chance

for human error. The second point of view is that

company valuation is an art in which analysts can

manipulate numbers to get the desired results for

investors and management. In this research, several

scenarios were prepared to conduct a company

valuation of NAH Project. The scenarios used in this

research are built on assumptions that have been used

by the author whose purpose is to examine the effect

of changes in the underlying assumptions. These

assumptions are based on the results of the

questionnaire findings that have been done

previously. The price of sneakers for consignment

and official store determined by the market survey.

The number of sales of sneakers obtained from the

previous data and the sales forecasted to be increased

for the next four years using the value of growth by

5% from the company.

The number of sneakers sold on consignments and

official stores determined based on the findings of the

questionnaire about the average number of sneakers

purchased by customers each year in consignment

and official stores. The average number of purchases

of sneakers used is one time each year.

The number of sneakers stock provided for

consignment and official stores. The amount of stock

used is divided into five parts, where each part has a

maximum amount of 100% for consignment and

official store.

All these assumptions are used for company

valuation which will be divided into five scenarios.

The aim is to obtain the most optimal value based on

customer preferences that have been obtained from

the market survey by comparing the five scenarios.

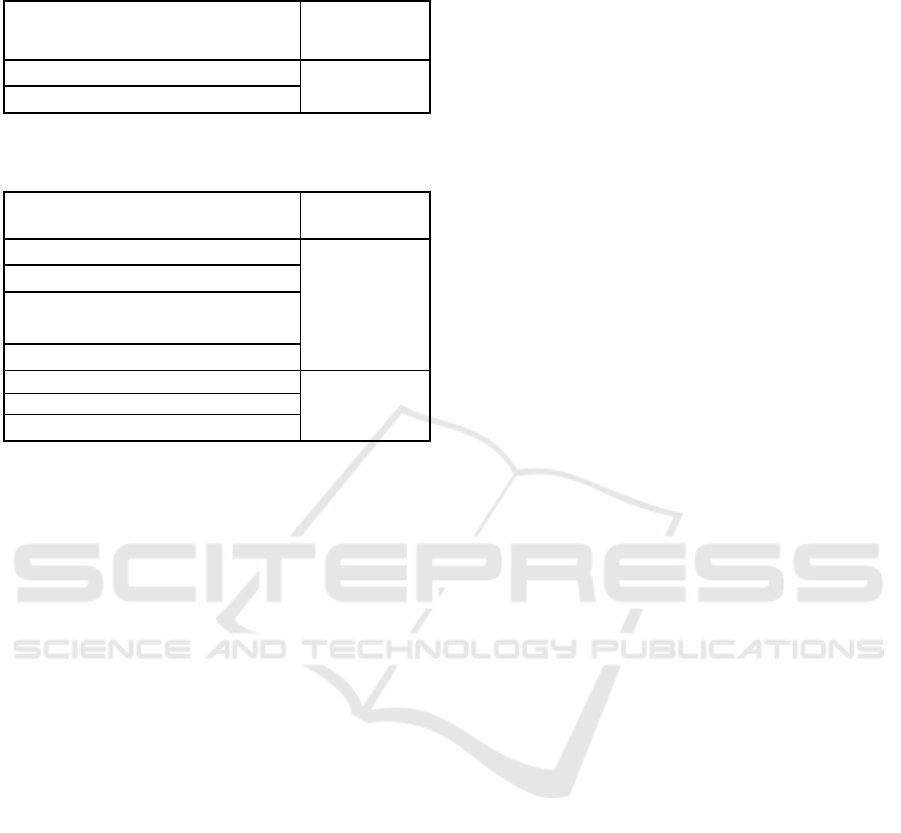

The five scenarios can be seen in Table 5. Each

scenario is distinguished by the amount of stock

provided for consignment and official store and the

price set for consignment and official store, which are

both based on the findings of the questionnaire that

has been done previously. In addition, the annual

inflation each year equals to 3.5%. However, in

calculating the company valuation of NAH Project,

an additional number are still needed. In this case, the

fee required for consignment is 30% obtained from

the interview with the shoe industry players. Whereas

for the official store based on the results of the

interview, itshows that the fee needed is 5%, but in

this calculation the fee is increased to 10% due to

costs added for the rental costs.

Business Valuation for Small Medium Enterprise in the Shoe Industry

455

Table 4: All of the Scenarios used in this Research.

Category

Scenario

1

st

2

nd

3

rd

4

th

5

th

Stock for

Consignment

0%

25%

50%

75%

100%

Stock for

Official Store

100%

75%

50%

25%

0%

Price for

Consignment

(IDR 000)

-

300

400

400

500

Price for

Official Store

(IDR 000)

500

400

400

300

-

Table 5: The Company Valuation Results based on All

Scenarios (in IDR).

Method

DCF

APV

1st Scenario

6,381,291,885.41

6,381,291,885.41

2nd Scenario

5,253,537,731.03

5,253,537,731.03

3rd Scenario

5,170,236,437.73

5,170,236,437.73

4th Scenario

4,755,734,711.08

4,755,734,711.08

5th Scenario

5,276,078,097.99

5,276,078,097.99

3.2 Analysis of Business Solution

The results of the NAH Project company valuation

can be seen in Table 6. From the result, the value of

DCF and APV is the same due to NAH Project has no

debt, so the most optimal value obtained is 1st

Scenario, where the DCF and APV method produces

a value of Rp. 6,381,291,885.41. 1st Scenario is made

based on the amount of stock provided only for

official stores. By utilizing these results, it can be said

that the NAH Project only needs to consider opening

an official store, so that the choice for consignment

can be removed.

The price set for the official store in the first

scenario is the price most chosen by the respondent.

Therefore, the customer's preference for sneakers and

customer price expectations for sneakers affect the

company valution on NAH Project where customer

preferences and customer price expectations for

sneakers can affect the company's sales level, which

will be a turmoil in the company's sales. According to

Rahmawati (2019), the assessment of companies

using DCF and APV can provide insight into cash

flows, income or results, and how these values are

determined and how much the company values

investment funding from future investors. Sales and

cash flow projections can be used as a standard for

managing funds provided by investors in developing

products and services performed by the company. By

utilizing the findings of the questionnaire that has

been conducted and the results of interviews with

industry players and sneakers users, NAH Project can

find out about customer preferences and information

about market conditions that can be used to develop

the strategies needed by NAH Project. In addition,

NAH Project can determine the exact proportion of

the ownership of future investors.

4 CONCLUSION

This research shows that customer preferences in

buying sneakers including customer preferences from

place variables can influence company valuation. The

company's valuation of the NAH Project was carried

out on 5 scenarios, which obtained that the first

scenario could provide the most optimal value. The

first scenario produces a DCF and APV value of Rp.

6,381,291,885.41. 1st Scenario is made based on the

amount of stock provided only for official stores. By

being able to open its own official store, the NAH

Project can increase the level of customer trust in the

brand and products produced by NAH Project.

Another advantage obtained from the official store is

the NAH Project can interact directly with their

customers to get feedback that can be used for their

product development. Furthermore, the assessment of

companies using DCF and APV can provide insight

into cash flows, income or results, and how these

values are determined and how much the company

values investment funding from future investors.

Sales and cash flow projections can be used as a

standard for managing funds provided by investors in

developing products and services performed by the

company. In addition, these funds can also be used for

NAH Project in developing their products so they can

continue to innovate and can continue to compete in

the shoe market. By innovating, NAH Project can

develop their products so they can meet customer

preferences for sneakers, which are comfort and

support, product quality, and product design. that the

factors that influence customer preferences in making

decisions when buying sneakers from place variables

are a convenience to the customer, location of the

store, employees, and display. While the factors that

less influence the customer preferences from place

variables are layout, light, and music.

5 IMPLICATION

5.1 Theoretical Implication

The factors that influence customer preferences in

making decisions when buying sneakers have been

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

456

analysed in this research. These factors are price,

promotion, brand image, product quality, customer

service and after-sale service, product design,

location, comfort and support, opinions of others, fit,

ease of payment, ease of ordering, variety of products,

advertisement, product warranty, and product

knowledge. The results of this research indicate that

comfort and support factors, product quality, product

design, fit, promotion, and price are very affecting the

customer preferences in making decisions when

buying sneakers. Furthermore, the ease of ordering

factors, product knowledge, ease of payments, brand

image, variety of products, location, and product

warranty is also affecting the customer preferences in

making decisions to buy sneakers. The latter are

factors that are not taken into consideration by

customers when buying sneakers, namely opinions of

others, customer service and after-sales service, and

advertisement. In addition to these factors, this

research also analysed two factors related to the need

to hold and see the product directly. The results show

that the need to hold and see sneakers directly are very

affecting the customers' decisions in purchasing. It

can be concluded that the customers feel more

confident with the sneakers they will buy, because

they can see immediately and can try the sneakers

directly.

In this research also analysed the factors that

influence customer preferences in decision making

when buying sneakers from a place variable. These

factors are a convenience to the customer, location of

the store, employees, display, layout, light, and

music. From the results of this research it was found

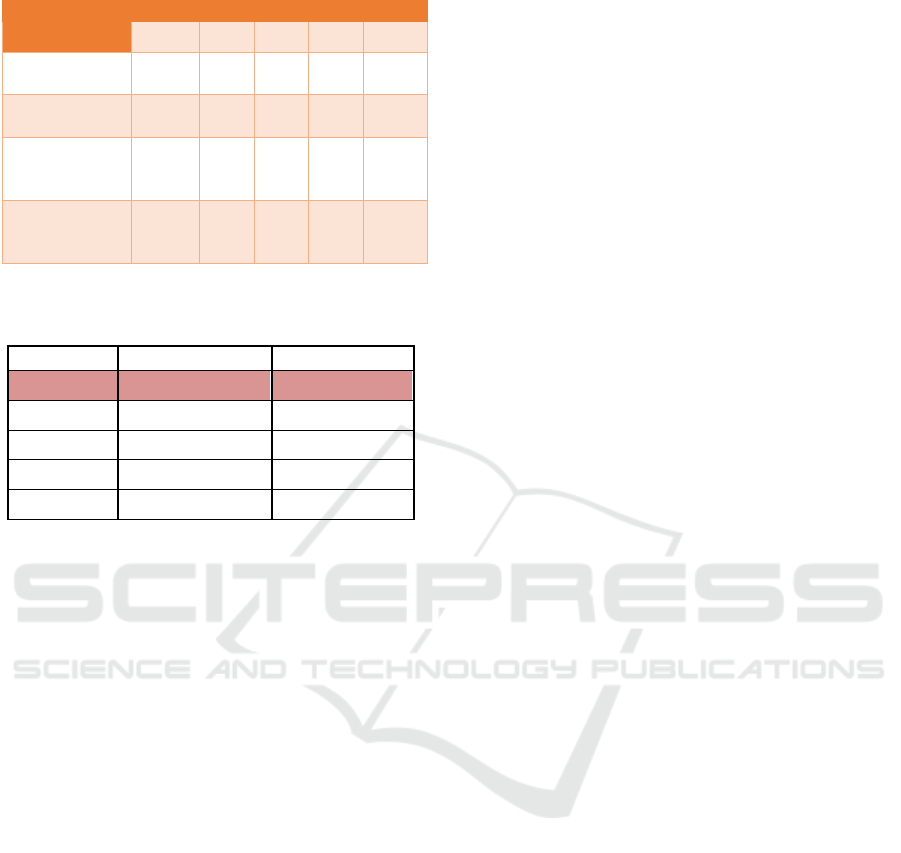

5.2 Practical Implication

The five scenarios have been conducted in order to

determine the company valuations for NAH Projects.

From the five scenarios, it can be concluded that the

first scenario is the best scenario with the most

optimal value compared to the other four scenarios

(see Table 6). This first scenario focuses on the

overall stock given to the official store with the

number of sales projected to grow by 5% over the

next four years, where the price set for the official

store is obtained from the price most chosen by the

respondents. Using these findings, NAH Project can

determine the strategies they can use to develop their

income.

All the funds obtained by NAH Projects will be

focused on developing official stores and also

marketing their sneakers. The results obtained

indicate that the NAH Project's should focus on

developing their official stores is in line with the

results of interviews that have been conducted with

industry players. The interview results show that the

industry players prefer to open the official store rather

than do a consignment. This is because the fees

needed for consignment are very large. By

Table 6: The Company Valuation Results based on All

Scenarios (in IDR).

Method

DCF

APV

1st Scenario

6,381,291,885.41

6,381,291,885.41

2nd Scenario

5,253,537,731.03

5,253,537,731.03

3rd Scenario

5,170,236,437.73

5,170,236,437.73

4th Scenario

4,755,734,711.08

4,755,734,711.08

5th Scenario

5,276,078,097.99

5,276,078,097.99

being able to open its own official store, the NAH

Project can increase the level of customer trust in the

brand and products produced by NAH Project.

Another advantage obtained from the official store is

the NAH.

The project can interact directly with their

customers to get feedback that can be used for their

product development.

With the official store, NAH Project can take on

the entire shoe market and can take opportunities

related to customer preferences that influence the

decision making in buying sneakers. The customer's

preference is the need for touch and sees the product.

This is related to the results of the questionnaire

which shows that these factors greatly influence

customer preferences in buying sneakers. It can be

concluded that touching and seeing products can

increase customers' trust and desire to buy sneakers.

In addition, majority of the respondents prefer to buy

sneakers through the "In Store" method rather than

using the "Online" method. This is in line with NAH

Project's desire to open an official store which is then

supported by the preference of customers who need

to directly touch and see products in buying sneakers.

Furthermore, in the research conducted by Razdan

(2004) said that the Indonesians have started to trust

Indonesian companies, have pride in using local

brands, and have confidence that local companies

really understand the preferences of Indonesian

consumers. This can be an opportunity for NAH

Project which is one of the local brands that focuses

on sneakers in Bandung. But there are several things

that must still be considered by NAH Project, where

the customers consider that local fashion brands are

only superior in terms of price. Local fashion brands

are considered to only have more affordable prices

compared to foreign fashion brands, so it can be

concluded that customers choose local fashion brands

simply because they offer better value for money than

the foreign fashion brands. While in terms of design

and quality, local fashion brands are still under the

foreign fashion brand. In order to overcome this

Business Valuation for Small Medium Enterprise in the Shoe Industry

457

situation, NAH Project must continue to innovate in

order to develop products with better designs and

quality than foreign fashion brands. This will be in

line with the vision of NAH Project who wants to

make NAH Project become the "Indonesian cultist

sneakers who dominate sneakers market through

innovation and breakthrough", where NAH Project

wants to change the stigma that Indonesian sneakers

have competitive quality & design and can be

competed in the way of branding & marketing. By

utilizing this, it can help improve the ability of the

NAH to not only compete with foreign brands but

also with other local brands.

In the term of sneakers user, most of the

respondents are the young-age (15 – 25 years), so the

respondents can be categorized into generation Z or

formerly known as the Post-Millennials generation

and Millennials generation, also known as generation

Y. According to Dimock, M. (2019), the generation Z

category is people aged between 7 - 22 years, while

the Millennials generation category is people aged

between 23 - 38 years. Millennials generation can be

chosen because of their high population and their

potential purchasing power; besides that, they have

become the decision makers in large companies that

allow them to control their purse that affecting the

success or the failure of the market (Solomon, 2016).

Based on this information, the NAH Project can make

the millennials generation become their target market

and NAH Project should prepare the strategy that can

be used to capture the target market.

The brand has also become the power for the

NAH Project. This is due to the role of the President

of the Republic of Indonesia Joko Widodo who uses

NAH Project sneakers at the Asian Games event.

NAH Project used the event to produce special

edition sneakers for the Asian Games event. In

addition, the strategy used by NAH Project by

collaborating with one of the influencers in Indonesia.

An influencer who collaborate with NAH Project is

Yoga Arizona, which is also one of the right strategies

to market their products. The strategy that has been

implemented by NAH Project by producing special

edition sneakers and collaborating with influencers is

the right thing to do.

NAH Project uses Instagram social media as one

of the medias to market their sneakers, this is in line

with the results of the questionnaire where all

respondents use the social media as the media to find

information about sneakers trends. NAH Project must

also continue to maintain relationships with their

customers. In addition, NAH Project needs to

consider doing the market research with the aim of

knowing who their customers are, the trends in

sneakers both in terms of design and colour, as well

as customer opinions about NAH Project sneakers

and feedback that can be used for improvements and

development of NAH Project.

REFERENCES

Beld, B. G. 2017. Business Valuation for Small and

Medium-Sized Enterprise. Master thesis. Business

Administration. University of Twente

Brealey, R. A., Myers, S. C., & Allen, F. (2006). Principles

of Corporate Finance (8th Edition ed.). McGraw-Hill.

Brotherson, W. T., Eades, K. M., Harris, R. S., & Higgins,

R. C. (2014). Company Valuation In Mergers And

Acquisitions: How Is Discounted Cash Flow Applied

By Leading Practitioners?. Journal of Applied Finance,

24(2), 43-51.

Damodaran, A. (2005). Valuation approaches and metrics:

a survey of the theory and evidence. Delft: now

Publishers Inc.

Damodaran. 2011. Applied Corporate Finance: 3

rd

Edition.

United States: Wiley.

de Souza, R. F., Messias, D., Denis Dall’ Asta, & Johann,

J. A. (2017). Biased Companies Valuations: An

Analysis Based On Reports Of Public Offer Of Shares.

Revista De Gestão, Finanças e Contabilidade, 7(2), 65-

78.

Dimock, M. 2019. Defining generation: Where Millennials

end and Generation Z begins. http://www.

pewresearch.org/fact-tank/2019/01/17/where-mille

nnials-end-and-generation-z-begins/ . 20 January 2019

Elsner, S., & Krumholz, H. (2013). Corporate Valuation

Using Imprecise Cost of Capital. Zeitschrift Für

Betriebswirtschaft, 83(9), 985-1014.

Fernández, P. (2013). Company valuation methods.IESE

Business School.

Ghafran, M. 2014. The promotional tools and situational

factors’ impact on consumer buying behaviour and

sales promotion. Journal of Public Administration and

Governance 4(2).

Giuliana, I., Alexandre, I., Pozzani, VC., Murillo BPG.

2012. Influence of Discount Price Announcements on

Consumer’s Behavior, Evaluated in double blind

review.

Koller, T., Goedhart, M., & Wessels, D. (2005). Measuring

and managing the value of companies. John Wiles &

Sons, Inc.

Le, A. 2017. Equity Valuation Using Discounted Cash

Flows Method – A Case Study: Viking Line Ltd.

Arcada. University of Applied Sciences. Finland.

Luehrman, T. A. (1997a). Using APV: A better tool for

valuing operations. Harvard Business Review.

Luehrman, T. A. (1997b). What's it worth? Harvard

Business Review.

Mohan, R. 2014. Influence of Product and Place Factor on

Consumer Buying Behavior in Formal Footwear

Sector. International Journal of Management and Social

Science Research Review. Vol. 1 pp 63 – 71.

Pohl, P. (2017). Valuation of a Company Using Time Series

Analysis. Journal of Business Valuation and Economic

Loss Analysis, 12(1), 1-39.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

458

Rahmawati, D. 2019. Business Valuation for Small

Medium Enterprise (Case Study: Piksel Indonesia).

Master thesis. School of Business and Management.

Institut Teknologi Bandung. Razdan, R. et al. 2004.

The evolving Indonesian consumer.

https://www.mckinsey.com/business-

functions/marketing-and-sales/our-insights/the-

evolving-indonesian-consumer. 17 January 2019.

Smith, P. C., & Curnow, R. (1966). “Arousal hypothesis”

and the effect of music on Purchasing Behaviour.

Journal of Applied Psychology, 50, 255-256.

http://dx.doi.org/10.1037/h0023326

Steiger, F. 2018. The Validity of Company Valuation Using

Discounted Cash Flow Methods. European Business

School.

Walliman, Nicholas. (2011). Research Methods: TheBasic.

Oxon: Routledge

Business Valuation for Small Medium Enterprise in the Shoe Industry

459