Should Telkom Do IPO for Telkomsel?

Eggi Ahmad Hidayat and Riko Hendrawan

Telkom University, Jalan Gegerkalong Hilir No.47, Bandung, Indonesia

Keywords: DDM, FCFF, IPO, Relative Valuation.

Abstract: The objective of this research is to estimate the fair value of Telkomsel share price in the initial public offering

plan using FCFF and DDM approach with the verification of the result by using Relative Valuation method

with the PBV approach and Price to Earnings Ratio. This research used three scenarios, namely the

pessimistic, the moderate, and the optimistic, with historical financial data from 2012-2017 used as the

baseline for projections for 2018 – 2022 conditions. Outcomes from this research show that by using the DCF-

FCFF method in every one of the three scenarios, Telkomsel’s value is in the range of 80% to 93% of

Telkom’s (TLKM.ID) Market Price. Comparison with DDM valuation shows the FCFF valuation range

extend in an acceptable range - on the other side, relative valuation method used is the PER and PBV

approach, where the calculation for Telkomsel PBV is above Telco Industry market range and Telkomsel

PER value is still within market range.

1 INTRODUCTION

Liberalization of the Indonesian telecommunication’s

industry began in 2000, with the enactment of Law

No. 36 of 1999 concerning Telecommunications.

Since then the Indonesian telecommunications

industry has become open to the private sector and

foreigners. Telkomsel, which is a subsidiary of

Telkom, is a State-Owned Enterprise with an

ownership structure of 65%, at that time the only

provider of cellular telecommunications services

owned by the government, had to compete freely with

new cellular telecommunications operators entering

the Indonesian cellular telecommunications industry,

and must continue to innovate and improve efficiency

so that they can compete with other operators or

providers of cellular telecommunications services.

Previously the Indonesian cellular

telecommunications market was dominated by three

companies that had operating licenses from the

government, namely Telkomsel, Indosat, and XL.

However, now, the operator numbers have grown to

become five cellular operators and three Fix Wireless

Access (FWA) mobile operators, with the number of

mobile cellular subscribers in Indonesia being 439

million customers (GSMA Global Report 2018)

which currently exceeds the population of Indonesia.

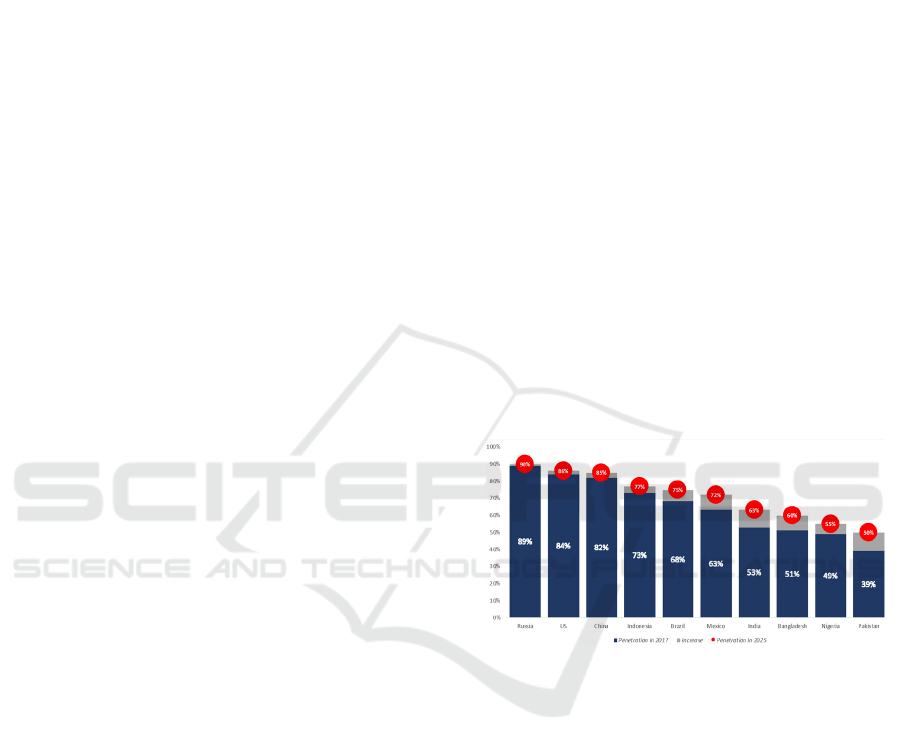

Figure 1: Countries with the unique penetration mobile subs

largest in the world.

Cellular phone customers in Indonesia have a

penetration rate above the population, GSMA in the

Global Report 2018 issue the results of the unique

calculation of subscribers in the country to be 73%.

The penetration of Indonesia's cellular customer has

the fourth position in the penetration of unique

cellular customers throughout the world, other

countries that have customer penetration above

Indonesia are Russia, the United States, and China.

Regarding unique customers growth, Indonesia still

has room to grow compared to the three countries,

where Indonesia still has 4% of space to grow while

Russia, the United States, and China only have 1%,

2%, and 3%. The numbers above can also be an

indicator that the telecommunications business still

has a strong foundation. Regarding customer

productivity, Indonesian cellular customers in the

Hidayat, E. and Hendrawan, R.

Should Telkom do IPO for Telkomsel ?.

DOI: 10.5220/0008431003370347

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 337-347

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

337

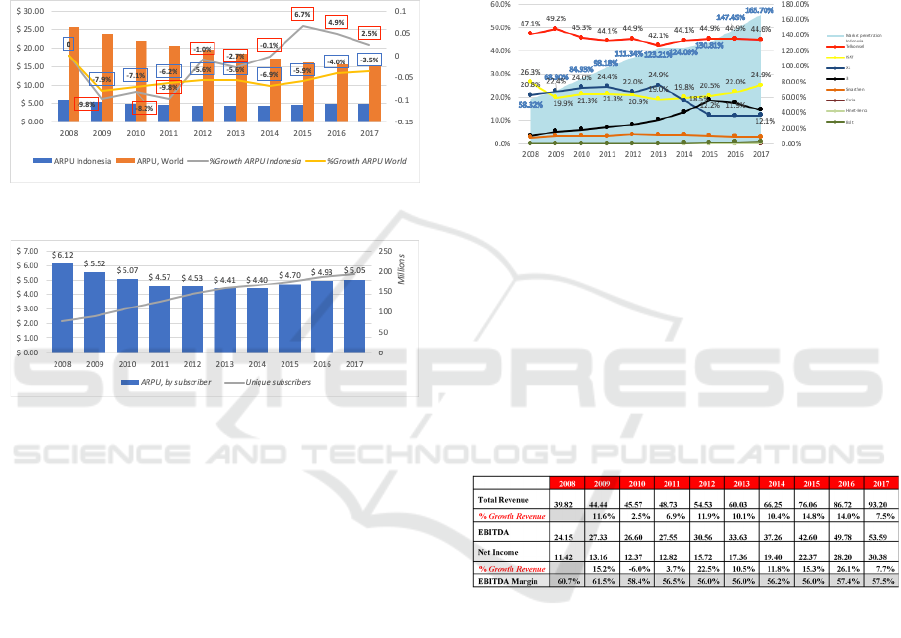

past three years still have a reasonably positive

customer productivity level compared to the average

growth rate of customers worldwide. Which is

presented in Figure 2, where % ARPU mobile subs

growth from 2009 still experiencing negative growth,

although in the past three years it has been able to

withstand or slow down the rate of decline in its

ARPU growth. Despite ARPU in Indonesia has

declined, its growth rate remains above the growth

rates of other operators in the World.

Figure 2: APRU Indonesia and World Growth 2008-2017.

Figure 3: Indonesia’s Cellular customers and APRU 2008-

2017.

Average Revenue Per User (ARPU) is an

expression of income produced by customers or

devices per unit of time in the telecommunications

network. Usually, telecommunications sector use

ARPU as a driver and to track the amount of revenue

generated per user and also to assist in estimating

future service revenues generated from the customer

base. The graphs of growth in customer numbers and

Indonesian ARPU directly show that there is still

potential for growth of cellular business in Indonesia.

This is evidently true if we go deeper into the

competitive conditions of the telecommunications

industry in Indonesia where the market penetration of

the cellular industry is growing from 58.3% from

2008 to 10 years later to 165.7%. Telkomsel had a

high level of superiority and was able to survive in

the competitive Indonesia's cellular market, owing

market share in the range of 42.1% to 49.2%, where

this is entirely different from other operators in the

competition, e.g., initially (2009) Indosat ranked

second only own 26.3% market share. The following

six years showed XL struggled hard to overtake

Indosat's position - XL, which previously in 2009 was

third (20.8%), continuously becoming the second

place in 2009-2013. The last three years (2015-2017)

the second position was returned to Indosat, and 3

(three) (Hutchinson) passed XL to be in third place.

Telkomsel's superiority with an average market share

gap of 20% above other cellular operators is quite an

exciting phenomenon to deepen, when the condition

of the mobile cellular industry in the world is not in a

very good growth condition, whereas Indonesia still

has momentum for stable growth.

Figure 4: Indonesia Cellular market penetration vs. operator

market share.

Looking at the condition of the comparison of the

growth of the world and domestic cellular industries

as described in the two figures above, if seen more

deeply in Figure 4, over time, Telkomsel has a

constant increase in the number of customers, and this

represents its superiority in Indonesia’s cellular

market share.

Table 1: Performance Revenue, Net Income Telkomsel and

EBITDA 2008-2017.

Based on the above conditions, which are shown

in Figure 1.5 and Table 1, the authors see it is possible

for Telkomsel to get higher enterprise value when

Telkomsel plan for an Initial Public Offering (IPO) in

the years to come, while also improving alternative

sources of funding and operational funding. The

initial price of Telkomsel's IPO shares will affect the

condition of secondary shares which will change

based on the law of supply and demand. So if

Telkomsel conducts an IPO, the condition of

Telkomsel as the market leader will have a significant

influence in gaining the trust of investors and

shareholders. Wahyudi & Surya (2013) asserted in

their 2012 research results that IPO benefits for

companies in the stock market with the aim of carved-

out, can significantly have higher incomes than the

industry average during the first three years after the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

338

IPO, and parent company also have a higher ROA in

the first year after releasing share ownership in their

subsidiary. With both the value of the shares of the

subsidiary and the parent company increasing, the

overall value of the company will rise, and

shareholder value will increase.

This Telkomsel valuation will produce intrinsic

value information which is then compared to the bid

price to determine the position of purchase or sale of

initial shares at the time of the IPO, one of which is

an investment guide, so investors need to carry out

fundamental analysis using financial data or valuing

intrinsic value of company shares.

2 LITERATURE REVIEW

2.1 Corporate Value Theory

Maximizing company value is one of the essential

things for the company, not only for the shareholders

but also for the other stakeholders. Company value

usually acts as an indicator of the performance of the

company in the long term, and it also can be

functioned as indicative measurement on company’s

health status, for example, companies that maximize

their value, will have more value in creating jobs,

treating their employees, and giving their customers

more satisfaction.

The value of a company that has gone public is

reflected in the market price of a company's stock,

while the selling price can measure the value of a

company that has not gone public if the company not

only reflects the value of the company's assets but

also covers the level of business risk, company

prospects, management, environment effort, and

other factors. With this condition, there are several

ways to determine the value of a company, because

the value of this company is one of the determining

factors for investors to invest their capital. It’s the

assessment can be categorized into 3 (three) methods,

namely:

1. The Economic Assessment Method.

The method comes from the idea that an asset can

be assessed from how the asset produces

economic value or benefits for the company in the

future, one approach that includes the Discounted

Cash Flow (DCF) and Economic Value Added

(EVA)

2. Relative or Market Assessment Method.

Which departs from the value of an asset depends

on the assessment of other components that make

up the asset, by comparing with similar assets or

similar transactions, for example, Price To Equity,

Price to Earning and EV / EBIT

3. Asset-based Method.

This method emphasizes the value of assets in

determining the fair value of a company,

particularly intangible assets, the commonly used

approach is the Liquidation Model.

2.2 Stock Valuation

Stock valuation is a process used to determine the fair

value of a stock. First, fundamental analysis is an

analysis that considers multiple good factors

concerning company performance, analysis of

business competition, industry analysis, and

economic analysis both macro and micro. The second

analysis is technical analysis. Which is a technique

that analyzes fluctuations in stock prices in a certain

period. The purpose of this analysis is to find out

whether a stock is in an overbought or oversold

condition.

Damodaran (2012) says that fundamental analysis

is appropriate for valuation of stock prices because

fundamental analysis relates indicators related to the

characteristics and financial condition of the

company, both from the condition cash flow, risk

profile and even growth potential, due to the varying

focus areas of investors, where there are more

investors looking at the quality of assets, the

composition of capital and equity and even the future

potential of the company. Some approaches from the

stock valuation method according to Damodaran

(2012), can be categorized as follows: "There are

three approaches to valuation. The first, discounted

cash flow valuation, relates the value of assets to the

present value of the expected future cash flows on that

asset. The second, relative valuation, estimates the

value of assets relative to a common variable like

earnings, cash flows, book value, or sales. The third,

contingent claim valuation, uses option pricing

models to measure the characteristics of these assets.”

The three approaches described as follows:

1. Discounted Cash Flow (DCF).

Discounted Cash Flow is a valuation method for

determining the present value of an asset by

discounting cash flow in the future, where assets

are discounted based on the level of risk

associated with cash flow, whereas the discounted

cash flow method is a stock valuation method

based on the concept of the time value of money.

The Discounted Cash Flow method has three

types of calculation approaches that can be used

according to individual needs, namely Dividend

Should Telkom do IPO for Telkomsel ?

339

Discount Models, Free Cash Flow to Firm and

Free Cash Flow to Equity stated in Neaxie &

Hendrawan (2017).

2. Relative Valuation.

Relative valuation is one of the most commonly

used asset valuation methods by comparing the

same company. According to Damodaran (2012),

relative valuation is a company assessment

carried out by looking at how the market price of

similar assets. Investors often decide whether a

stock is cheap or expensive by comparing prices

with similar stocks (usually within the peer

group).

3. Contingent Claim Valuation.

Contingent claim valuation is the method of

valuation of assets rated if it is in a certain

condition, that is if the value of the underlying

asset exceeds the predetermined value for the call

option or less than the predetermined value for the

put option. At present, there has been much

development of this model option, and the pricing

model option has been used to assess all assets

that have the features mentioned above.

2.2.1 Discounted Cash Flow

Discounted Cash Flow approach can be described as

follows:

a. Dividend Discount Models.

DDM is a calculation model with discount

dividends which is then used to calculate the

intrinsic value of shares by discounting future

dividend flows to their present value. It can be

said that the value of a company (its share price)

is the accumulation of all money distributed to

shareholders in the form of dividends as long as

the company stands. This is then discounted at a

certain discount rate.

b. Free Cash Flow to Firm.

Neaxie & Hendrawan (2017) argues that FCFF

calculates the value of companies without debt,

where operating costs have been excluded from

tax and discounted using capital costs (WACC).

FCFF can assess the amount of accounting cash

flow after the company conducts operations and

investment activities.

c. Free Cash Flow to Equity.

FCFE is a value calculation model based on the

remainder of the cash flow after payment of

interest and principal loans, used for capital

expenditure both for current operations and for

future growth. FCFE which will be calculated

must be a value of cash flow remaining after

calculating the value of reinvestment and

additional working capital needed by the

company to create future growth and repayment

of debt installments.

Summarized by Neaxie & Hendrawan (2017)

suggesting the proper use of FCFF and FCFE

approaches, as will be presented in Table 2 below:

Table 2: FCFF Differences with FCFE.

FCFF FCFE

1. FCFF used to calculate

companies that have

not to go public.

2. For companies listed

public, according to the

shareholder who is less

interested in a stable

dividend.

3. The valuation results

are intended for large

investors or

shareholders majority

as funders.

4. FCFF according to

count companies with

debt levels or high

capital expenditure, as

an example in

company’s high tech

and

telecommunications.

1. The FCFF approach

is not recommended

use for calculating

values in companies

high tech.

2. FCFE is right for

calculating the cash

flow for minority

shareholders, where

they focus on a stable

flow of dividends.

3. FCFE is used to

calculate the value of

a company with the

purpose of

acquisition (taken

over).

4. FCFE is suitable for

calculating the value

of a company with a

possible level of debt.

2.2.2 Free Cash Flow to Firm

FCFF is the amount of cash flow available to all

investors in a company, including common

stockholders, bondholders, or preferred-stockholders,

it also can be calculating company value without debt,

where operating costs incurred from taxes and

discounted using capital costs (WACC), calculated

using the formula:

FCFF = (EBIT x (1-Tax)

+ Depreciation

– Capex

–

N

WC

(1)

And then the value of the company can be calculated

by:

Valueo

f

Firm

(2)

Whereas if there is some expected rate of return, the

researcher uses FCFF Two-Stage Model:

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

340

Valueo

f

thefirm

FCFF

1WACC

FCFF

/

WACC g

1WACC

(3)

2.2.3 Cost of Capital

The cost of capital is a cost that reflects all funding

sources used by the company, including from funding

sources that come from debt and equity, usually this

capital cost in general termed as weighted average

cost of capital (WACC), which can be defined as the

average cost after tax of each source of capital used

by companies to fund a project, where the weight of

each post reflects the proportion of the total funding

from each source. WACC is one of the main factors

in calculating DCF valuations, where there is a

change in the proportion of capital costs that can

significantly influence the measured value.

WACC can be calculated by the following

formula:

WACC

costo

f

equit

y

x

equit

y

debtequity

costo

f

debtx

debt

debt equit

y

x

1tax

(4)

2.2.4 Dividend Discount Model

DDM is the calculation model with discount

dividends which is then used to calculate the intrinsic

value of shares by discounting future dividend flows

to their present value. The Dividend Discount Model

can be formulated as follows:

ValuePerShareofStock

E

DPS

1k

(5)

The following formula use for the variable dividend

payout ratio, where the model is based on two stages

of growth.

P

∑

.

.

where

P

DPS

k

.

g

(6)

2.2.5 Relative Valuation

According to Damodaran (2012), relative valuation is

a company carried out by looking at how the market

price of similar assets. Investors often decide whether

a stock is cheap or expensive by comparing prices

with similar stocks (usually within the peer group).

a. The Price Earnings Ratio.

The estimating the intrinsic value of shares in

company analysis can be done by utilizing two

essential information components, namely

earnings per share and earnings multiplier. The

formula for determining the intrinsic value of

shares through the approach Price Earnings Ratio

(PER)is as follows:

PER

P

EP

S

(7)

If the intrinsic value of a stock has been estimated, the

next step is to compare the intrinsic value of the stock

with its market price.

b. Approach Price per Book Value (PBV).

The relationship between stock market prices and

book value per share can be used as an approach

to determine a share value. Theoretically, the

market value of stock must reflect the value of the

book. PBV can be calculated using the following

formula:

P/B

V

P

B

V

ROExPayoutratiox

1g

k

g

(8)

2.2.6 Previous Research

Based on previous research on related subjects and

methods, we can see some previous studies that deal

with the valuation of company values and valuation

of stock prices for companies engaged in or related to

telecommunication value chains. The similarities of

some previous studies with this research is to analyze

the intrinsic value of stock prices with fundamental

analysis with the Discounted Cash Flow approach,

while other methods used in previous studies include

Relative Valuation, EBITDA Multiple, and Residual

Income.

Zemba & Hendrawan (2018) states that on

company valuation can using two approaches, the

DCF method relies on the assumption that is built to

perform projection or estimate of the future. Just like

a forecast in common, the results can exceed or less

than actual, and Relative Valuation that has three

approaches of calculation, Price to Earnings Ratio,

Price to Book Value, and Enterprise Multiple. The

valuation will be compared in three comparison

scenarios, in order to have view if it is growing much

better than that it has been estimated or otherwise

even worse than that. The Scenario can be stated as

the optimistic scenario that obtained from the

predicted growth of the industry, plus the difference

between a history of the company's growth and

history of industrial growth, plus half of the

difference in the history of industrial growth and

predicted growth of the industry, taken in half

Should Telkom do IPO for Telkomsel ?

341

because it is considered the probability of growth of

the industry is not all affect the full at any one

company, but there contributed to the growth of other

companies in the same industry. Moderate scenario

obtained from industrial growth predictions, plus the

excess of the company's growth history and history of

industrial growth. Pessimistic scenario obtained only

from industrial growth projections, without

considering factors that historical growth of the

company which is usually always higher than the

industry growth.

Research conducted by Saplista & Iryna (2008),

has a foreign telecommunications companies as the

object of research, while other studies have domestic

companies as the object of research. There is a

research that discusses stock valuation which aims to

provide information about the intrinsic value of

shares which is then compared with market prices to

determine investment decisions. The research that

discusses the comparison between intrinsic value and

market value which then produces three stock

conditions, namely undervalued, overvalued and fair

valued conducted by Neaxie & Hendrawan (2017),

show that in previous years the valuation research of

Telecommunications sector companies was oriented

as a comparison of company performance and

company growth.

Valuation is crucial for investment decision

making process. Investors and analysts can use

different models and tools in order to determine stock

intrinsic value, the research find that stock values

calculated with DCF model are very close to average

market prices which suggest that market prices

oscillate near stock values, which follows to

conclusion that DCF models are reliable tools for

calculation of companies’ enterprise values on long

term. Analysis by using this model can get long-term

picture for real stock value as well as enterprise value,

which is solid base for investment decision-making.

Chirputkar, Kulkarni, Vadgama & Prabhu (2016)

state on their research that valuation on

telecommunication company can be using Market

Capitalization and Enterprise Value Method, where

the market capitalization method can be relevant to

most of the operators are not listed in open market,

meanwhile the enterprise valuation method is often

used for operator’s valuation due to debt component

and its capital structures. Using Discounted Cash

flow approach is most suitable to operators since it is

based on cash flows of the company. Here the value

of the firm is present value of cash flow during

explicit forecast period, however in a DCF method,

for discounting purpose, we need to calculate

discounting rate which is based upon weighted cost

of capital from all sources.

The research conducted by Glaum and Friedrich

(2006) stated that for telecommunications companies

that tend to be oriented to cash flow, one of them is

because telecommunications companies as service

companies but also have the nature as infrastructure

companies, so it is said that the most frequently used

company valuation methods are DCF, while Relative

Valuation is usually just a comparison. This is also

stated by Wahyudi and Surya (2013), where there is a

significant gap between DCF valuation and relative

valuation. Both of these studies are studies that aim to

assess the intrinsic value of shares with the same goal

as this research, namely to determine the condition of

the intrinsic value of shares or actual value through

assumptions based on company fundamentals and can

be considered suitable for use by telecommunications

companies. The researcher uses the DCF valuation

method, which uses Free Cash Flow to Firm and

Dividend Discount Model and Relative Valuation.

Based on the information and research, the

valuation will produce intrinsic value information

which is then compared to the share price to

determine the position of purchase or sale of initial

shares at the time of the IPO, one of which is an

investment guide, so investors need to carry out

fundamental analysis using financial data or valuing

intrinsic value of shares company. The purpose of this

research is to estimate the fair value of Telkomsel

share price in the initial public offering plan.

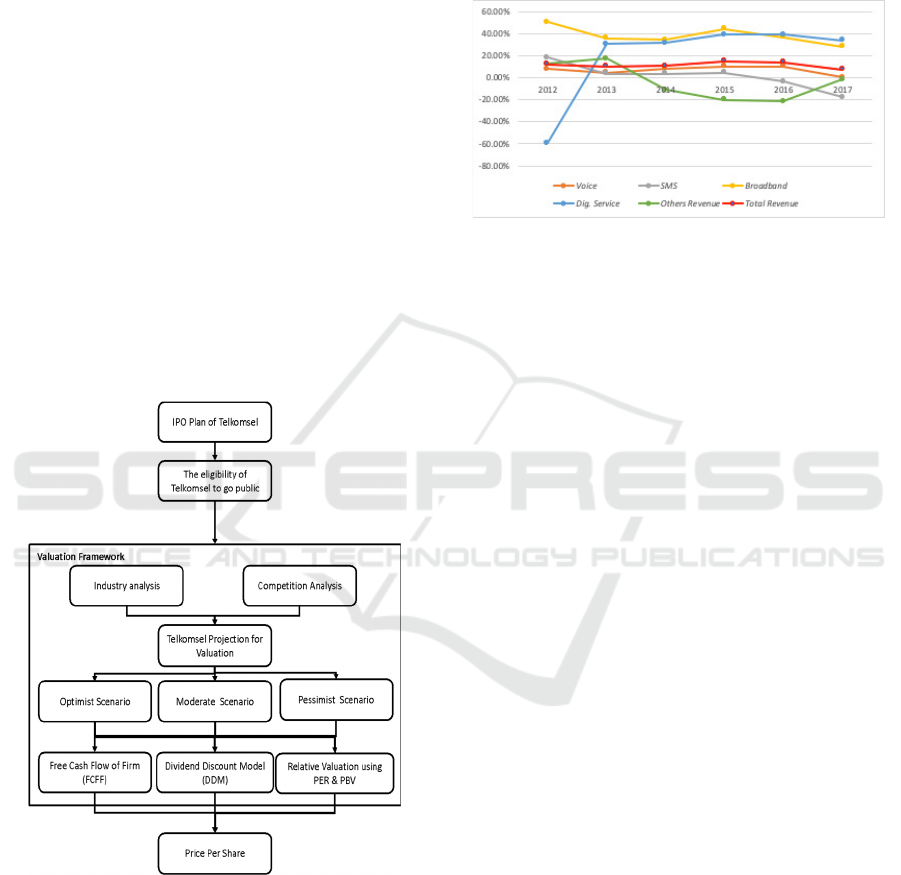

2.3 Thinking Framework

Fundamental Valuation of company value is based on

assumptions and projections of the condition of the

company, where in this study the historical data used

is historical data from 2012 - 2017 as the basis for

calculation, and then projections are made to

determine future cash flow and its present value.

Determination of future cash flow from this

projection is carried out based on a choice of certain

assumptions and scenarios, with underlying

assumptions made that have different conditions

where later alternative decisions and projections will

be obtained stated by Ivanoska, Ivanovski, &

Narasanov (2014).

These underlying assumptions use three scenarios

of conditions, namely pessimistic conditions (below

the industry growth rate), optimistic conditions

(above industry growth rates) and moderate

conditions. These conditions calculated after looking

at data and information from situational and

environmental data from the telecommunications

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

342

industry and business and moderate conditions are

possible conditions to occur from the principal

figures of the company. Pessimistic conditions are a

condition in which the company is assumed to grow

below the industry figure, which means it is a

condition that is considered as the worst condition

reference, while optimistic conditions are conditions

in which the company's growth is above the industry

figure.

The next process is the determination of valuation

based on the Discounted Cash Flow method with the

Free Cash Flow to Firm approach where previously

the value will be searched for from Cost of Capital

(WACC) of each condition, which is then calculated

to obtain the equity value or called the intrinsic value

of the company. Finally, a fair price per share for each

of these conditions can be obtained. Another process

in valuing this company is to perform the calculation

of Discount Model Dividend as the second reference

of the company's intrinsic value, which determines

the level of dividend growth in each scenario with the

same data used by FCFF and determines the expected

dividend rate in the future.

Figure 5: Thinking Framework.

As described earlier, the research framework can

be presented as shown in Figure 5.

3 RESULTS AND DISCUSSION

3.1 Historical Performance Analysis

3.1.1 Growth Revenue per Service

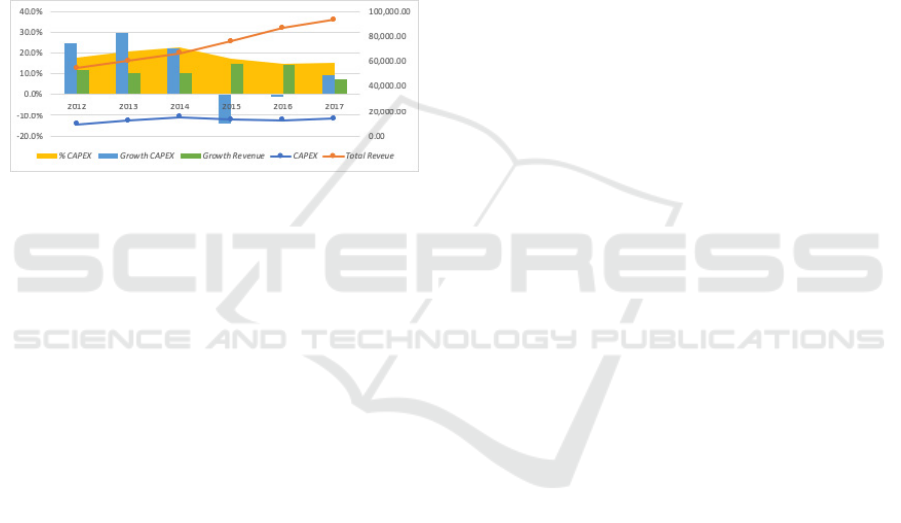

Figure 6: Growth Revenue per Service 2012-2017.

Figure 6 shows that the total revenue growth of

Telkomsel has increased by trend successively each

year enabling Telkomsel to experience significant

growth amounting to 11.90% in 2012, 10.09% in

2013, and 10.36% in 2014, 14.80% in 2015, and

14.03% in 2016. However, later in 2017 Telkomsel

experienced decreased growth in total revenue to

7.49%. Based on service to revenue contribution, the

increase in Telkomsel's revenue growth essentially

still supported by Voice service revenue, as

evidenced in the year of 2012 when Telkomsel Voice

service posted a revenue of 53.7% from total revenue

and up until the year of 2017, the service still

increasing plainly.

The most influential service in the changing of

revenue growth in Figure 6 above is shown by the

growth of Voice service in 2012 when the service had

a growth rate of 7.86%, which then declined in 2013

to 4.51%. After that Voice service revenue increased

again to 7.83% in 2014, 10.09% in 2015 and 10.06%

in the following year, but in 2017, even though it still

had positive growth it experienced a significant

decline in growth at a rate of 0.21%, whereas in other

services such as SMS, despite the steady growth rate

in the period from 2013 to 2015, it experienced

negative growth in 2016 amounted to -3.38% which

was then in 2017 decreased by -17.82%. Other

services which have a relatively high average growth

in the period 2013 to 2017 are broadband services (at

a growth rate of 35.7%) and digital services (at a

growth rate of 34.7%).

3.1.2 Capital Expenses per Revenue

Based on Figure 7, there is a downward trend for

CAPEX per revenue for the last three years. Where in

Should Telkom do IPO for Telkomsel ?

343

the year 2012, CAPEX per revenue was at 17.6%,

growing at 24.7% from the previous year compared

to revenue growth of 11.9%, in 2013 CAPEX per

revenue grew to 20.7% where in that year the number

of CAPEX issued by Telkomsel grew by 29.4%

compared to revenue growth of 10.1%. In 2014

CAPEX per revenue experienced a re-growth to

22.9% with CAPEX growth of 22.3% from the

previous year (the figure dropped by 7.1%),

compared to revenue growth of 10.4%. Then in 2015,

there was a decrease in Telkomsel CAPEX per

revenue to 17.2%, this was due to the negative growth

of CAPEX issued from the previous year by -13.9%

even though the growth of revenue have increased to

14.8%.

Figure 7: CAPEX per Revenue.

In 2016, CAPEX per revenue began to decline,

where in that year, Telkomsel recorded CAPEX per

revenue of 14.9% accompanied by a decrease in the

number of CAPEX issued by -1.2% from the previous

year, compared to Telkomsel revenue growth at 14%.

And then the following year CAPEX per revenue was

15.1% with a CAPEX growth percentage of 9.5%

compared to revenue growth of 7.5%.

Telkomsel CAPEX per revenue in 2012 to 2017

has an average of 18% with the most substantial value

in 2015 of IDR 15.16 trillion (proportion of 22.9%)

and second in 2017 with a nominal IDR 14.12 trillion

(proportion of 15.1%). The average annual CAPEX

growth in the 2012-2017 period is in the range of

11.8% with the condition of achieving revenue

growth averaging 11.4%.

3.2 Revenue Projection

The projection scenario used for Telkomsel growth

scenario for the next 5 years starting from 2018 to

2012, where in the preparation of the projection,

growth assumptions are made using the necessary

conditions in historical growth in each service along

with its projection and then reduced or added by the

average growth of service related in the

telecommunications industry.

3.2.1 Pessimistic Scenario Projection

The revenue growth projection in the pessimistic

scenario is obtained, for Voice service with a decrease

in 2018 of -7.22% with nominal revenue of IDR 37.2

trillion, then the consecutive decrease in service to

IDR 36.12 trillion in 2019, IDR 34.97 trillion in 2020,

IDR 33.43 trillion in 2021 and IDR 31.85 trillion in

2022, which means a negative growth of -4.71% from

the previous year. As for SMS service, the condition

of decline in 2018 was -8.01% with nominal revenue

service of IDR 9.97 trillion, then the progressive

decrease in the service to IDR 8.19 trillion in 2019,

IDR 6.4 trillion in 2020, IDR 4.55 trillion in 2021 and

IDR 2.7 trillion in 2022, which means a negative

growth of -40.63% from the previous year.

For Broadband services with revenue growth

which increased in 2018 by 0.23% with nominal

revenue of IDR 35.6 trillion, will provide additional

revenue growth to IDR 39.66 trillion in 2019, IDR

43.80 trillion in 2020, IDR 47.57 trillion in 2021 and

IDR 51.37 trillion in 2022, which means there is a

growth of 7.98% from the previous year. In the

Digital services, Telkomsel is projected to have

service revenue growth in 2018 amounted to 2.27%

with a nominal value of IDR 4.03 trillion, which in

the following year added additional service revenue

growth to IDR 4.57 trillion in 2019, IDR 5.14 trillion

in 2020, IDR 5.67 trillion in 2021 and IDR 6.21

trillion in 2022, which means there is a growth of

9.54% from the previous year. The average EBIT

from Telkomsel if calculated by this method will be

IDR 38.44 trillion in 2018, IDR 39.21 trillion in 2019,

IDR 39.99 trillion in 2020, IDR 40.39 trillion in 2021,

and IDR 40.8 trillion in 2022.

3.2.2 Moderate Scenario Projection

The growth projection is obtained with the projection

scenario used for the next five years starting from

2018 until 2022, where in the preparation of these

projections, growth assumptions for Telkomsel are

made using the necessary conditions in historical

growth in each service. Voice service with a decrease

in 2018 of -7.22% with nominal revenue of IDR 37.2

trillion, then the sequential decrease in service to IDR

36.48 trillion in 2019, IDR 35.66 trillion in 2020, IDR

34.43 trillion in 2021 and IDR 33.13 trillion in 2022,

which means a negative growth of -3.77% from the

previous year. As for SMS service, the condition of

decline in 2018 was -8.01% with a nominal service of

IDR 9.97 trillion, then the progressive decrease in the

service to IDR 8.27 trillion in 2019, to IDR 6.53

trillion in 2020, IDR 4.68 trillion in 2021 and IDR

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

344

2.81 trillion in 2022, which means a negative growth

of -40.04% from the previous year.

For Broadband service with growth in service

revenue which increased in 2018 by 0.23% with

nominal revenue of IDR 35.6 trillion, in the following

year will provide additional service revenue growth

to IDR 40.05 trillion in 2019, IDR 44.67 trillion in

2020, IDR 48.99 trillion in 2021 and IDR 53.42

trillion in 2022, which means there is a growth of

9.05% from the previous year. Telkomsel’s digital

service revenue is projected to have growth in 2018

service revenue amounted to 2.27% with a nominal

value of IDR 4.03 trillion, which in the following year

provided additional service revenue growth of IDR

4.62 trillion in 2019, IDR 5.24 trillion in 2020, IDR

5.84 trillion in 2021 and IDR 6.46 trillion in 2022,

which means there is a growth of 10.63% from the

previous year. The average EBIT from Telkomsel if

calculated by this method will be IDR 38.44 trillion

in 2018, IDR 39.59 trillion in 2019, IDR 40.78 trillion

in 2020, IDR 41.6 trillion in 2021, and IDR 42.43

trillion in 2022.

3.2.3 Optimistic Scenario Projection

The growth projection is obtained by revenue

projections in an optimistic scenario used for the next

5 years starting from 2018 to 2012, where the growth

assumptions are made using the necessary conditions

of historical growth in each service was then added to

the average growth of service in the

telecommunications industry. Voice service with a

decrease in 2018 of -7.22% with nominal revenue of

IDR 37.2 trillion, then the consecutive decrease in

service to IDR 36.83 trillion in 2019, IDR 36.36

trillion in 2020, IDR 35.27 trillion in 2021 and IDR

34.11 trillion in 2022, which means a negative growth

of -3.3% from the previous year. As for SMS service,

the condition of decline in 2018 was -8.01% with a

nominal service of IDR 9.97 trillion, then the

progressive decrease in the service to IDR 8.35

trillion in 2019, becoming IDR 6.66 trillion in 2020,

IDR 4.8 trillion in 2021 and IDR 2.89 trillion in 2022,

which means a negative growth of -39.75% from the

previous year.

Broadband service with growth in service revenue

which increased in 2018 by 0.23% with nominal

revenue of IDR 35.6 trillion will provide additional

service revenue growth of IDR 40.44 trillion in 2019,

IDR 45.54 trillion in 2020, IDR 50.19 trillion in 2021

and IDR 55 trillion in 2022, which means there is a

growth of 10.21% from the previous year. The Digital

service is projected to have growth in 2018 service

revenue amounted to 2.27% with a nominal value of

IDR 4.03 trillion, which in the following year

provided additional service revenue growth to IDR

4.66 trillion in 2019, IDR 5.34 trillion in 2020, IDR

5.98 trillion in 2021 and IDR 6.58 trillion in 2022,

which means there is a growth of 10.97% from the

previous year. The average EBIT from Telkomsel if

calculated by this method will be IDR 38.44 trillion

in 2018, IDR 39.81 trillion in 2019, IDR 41.58 trillion

in 2020, IDR 42.62 trillion in 2021, and IDR 43.68

trillion in 2022.

3.3 Relative Valuation

Table 3: Relative Valuation.

Projections PBV PER

Pessimist 5.09 9.56

Moderate 5.53 10.38

Optimist 5.83 10.94

Based on Table 3 it can be seen Relative Valuation

with the approach of PER and PBV values in the

Pessimistic, Moderate and Optimistic Scenario. With

the pessimistic scenario, Telkomsel has a PBV value

of 5.09 times and a PER of 9.56 times, while the

moderate scenario of Telkomsel has a PBV value of

5.53 times and PER of 10.38 times. Then in the

optimistic scenario, Telkomsel has PBV value of 5.83

times and PER of 10.94 times.

3.4 Discussion

3.4.1 Free Cash Flow to Firm

Based on Table 4, it is explained that Telkom’s

Consolidate Revenue, compared to Telkomsel

revenue is in range of 68.4% to 74.5% from year 2012

to 2017, where if we go to Net Income comparison,

we will see that the Telkom’s Net Income is more

dependent to Telkomsel's performance where is

recorded from 44.1% going exponentially increasing

to 98.5% in the year 2017.

Table 4: Telkom and Telkomsel Comparison.

Should Telkom do IPO for Telkomsel ?

345

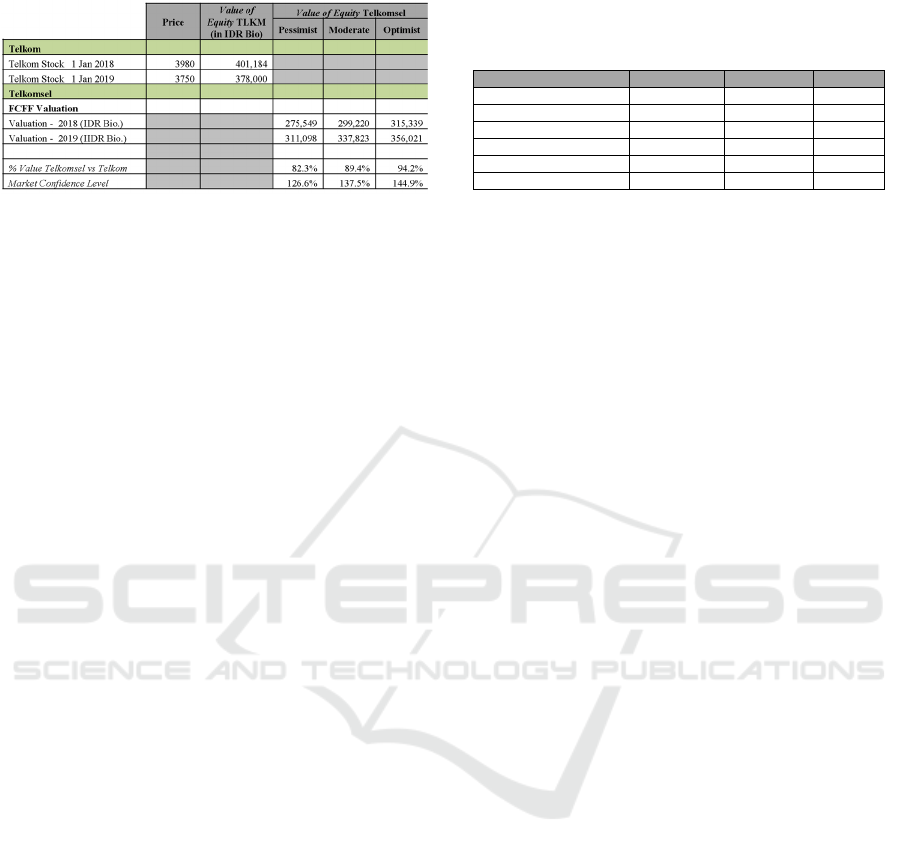

Table 5: Comparison of Telkomsel Valuation.

Based on Table 5 above, it is explained that

Telkom's share price at the opening of the beginning

of 2018 is at the price of IDR 3980, whereas Value of

Equity based on market price is IDR 401.18 trillion,

and at the beginning of the following year, namely

2019, the opening price of the beginning of 2019 fell

to IDR 3750 and Value of Equity of IDR 378 trillion,

this shows a decrease in Telkom's share price in the

market of IDR 230 within one year.

For comparison with the results of the previous

Telkomsel valuation where fair value was obtained in

2018, the calculation is done by involving the

calculation of WACC, so that the figure value of

Equity for the pessimistic scenario for 2019 is IDR

311.09 trillion, then for the moderate scenario the

calculation of Value of Equity becomes IDR 337.82

trillion, and for the optimistic scenario to be IDR

356.02. If a comparison of carried Value of Equity is

out by the two companies, where Telkom as a

Telkomsel shareholder with a 65% share, then the

market confidence level is 126.6% for the pessimistic

scenario, 137.5% for the moderate scenario and 144.9

% for optimistic scenarios.

3.4.2 Dividend Discount Model

Based on Table 6, it can be seen that the intrinsic

value of Telkomsel shares in the Pessimistic scenario

with the FCFF method is IDR 1509.28 while the

DDM method is IDR 1402.68 with a value difference

of 7.6%. For the Moderate scenario, the intrinsic

value of Telkomsel's shares with the FCFF method is

IDR 1638.93 while the DDM method is IDR 1515.01

with a value difference of 8.2%. For Optimistic

scenario, the intrinsic value of Telkomsel's shares

with the FCFF method is IDR 1727.22 while the

DDM method is IDR 1519.19 with a difference in the

value of 8.5%. In Value of Equity Pessimistic

scenario, the value obtained by the FCFF method is

IDR 275.58 trillion while the DDM method is IDR

256.08 trillion. In the moderate scenario, Value of

Equity Telkomsel's with the FCFF method is IDR

299.22 trillion while the DDM method is IDR 276.59

trillion. On the optimistic scenario Value of Equity

using the FCFF method is IDR 315.33 trillion while

the DDM method is IDR 290.5 trillion.

Table 6: Comparison of FCFF vs. DDM.

3.4.3 Relative Valuation - PER and PBV

Based on the results of the calculation, we then

process and analyze overall data of Telkomsel's stock

valuation using the Relative method Valuation

attached in the previous Table 4.14 using the

pessimistic, moderate and optimistic scenario. The

results showed that the PBV value in the pessimistic

scenario was 4.97 times, the moderate scenario was

5.44 times, and the optimistic scenario was 5.75

times.

If we make a comparison with quarterly IDX

statistical data (Q1 2018), it shows that the average

value of PBVs in telecommunications companies is

1.33 times, with the lowest value in PBV, namely the

value of PT. Bakrie Telecom Tbk. (BTEL) at -0.13

times and the highest PBV in PT. Telekomunikasi

Indonesia (Persero) Tbk. (TLKM) at 3.24 times. This

shows that the results of the research calculations are

above the PBV range that is in the market at this time.

For the calculation of the Telkomsel PER, the

results showed that the PER value in the pessimistic

scenario was 7.0 times, the moderate scenario was

7.66 times, and the optimistic scenario was 8.1 times.

If we make a comparison with quarterly IDX data (Q1

2018) which shows that the average PER value of

telecommunications companies is 21.55 times, with

the lowest value PER, namely PT. Smartfren

Telecom Tbk. (FREN) at -1.72 times and the highest

PER value in PT. XL Axiata Tbk. (EXCL) at 71.78

times. This shows that the results of research

calculations are within the range of PER in the market

at this time.

4 CONCLUSIONS

The study described how we calculate the fair value

of the company and the stock price of Telkomsel

using Free Cash Flow to Firm, Discount Model

Dividend, and Relative Valuation methods. We

calculated the fair value of the company and the

intrinsic value of Telkomsel shares by using the Free

Sce n a r i os P e ssi m i st M o d er a t e O p t i m i st

EV (IDR Bio) 275,548.76 299,220.11 315,338.78

Intrinsic Value of Shares (IDR) 1509.28 1638.93 1727.22

DDM Valuation

EV (IDR Bio) 256,087.51 276,595.26 290,503.46

Intrinsic Value of Shares (IDR) 1402.68 1515.01 1591.19

Shar e Pr ice D i f f . 7.6% 8.2% 8.5%

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

346

Cash Flow to Firm method in a pessimistic scenario,

the moderate scenario and the optimistic scenario. If

compared with the condition of the market value of

PT. Telkom (TLKM) as the holding company at the

beginning of 2019, the fair value of the Telkomsel is

still in a favorable condition, where the confidence

level of the Value of Equity TLKM is 126.6% for the

pessimistic scenario, 137.5 % for moderate scenarios

and 144.9% for optimistic scenarios.

Using the Dividend Discount Model method in a

pessimistic scenario resulted in 5.2% difference

compared to FCFF valuation, and for the moderate

scenario resulted in 6.5% difference, while in the

optimistic scenario resulted in 7.3% difference in

intrinsic stock value from the FCFF valuation. The

Relative Valuation method used is the PER (approach

Price Earnings Ratio) and PBV (Price Book Value),

to evaluate the fair value of the company and the

intrinsic value of Telkomsel shares, which in the

pessimistic scenario gives the PBV value of 4.97

times and PER of 7 times, while the moderate

scenario of Telkomsel has PBV value of 5.44 times

and PER of 7.66 times, then in the optimistic scenario

Telkomsel has PBV value of 5.75 times and PER of

8.1 times. The calculation results, when compared

with the market conditions in the IDX (statistical data

for financial, quarterly) during Q1 2018 period in the

telecommunications industry, will give the PBV

above the market range, while the PER value is still

within the range currently in the market.

Based on the results of the conclusions above, the

authors can make several suggestions that can be

taken into consideration in further writing. For

companies, to develop and increase the value of

shares in the market, especially for companies that

have not made an initial offer (IPO), in addition to

improving company performance with revenue and

Net Income, the company should also consider

alternatives to model the mapping of cost and expense

of the companies for both OPEX and CAPEX in this

company, of which this research shows the change in

the proportion of expenses, which can indicate

patterns of expenditure that are not effective.

For the next study, in order to gain significant

result whether the valuation theory can be applied in

any different context in Indonesia and

telecommunication industry, the researcher should be

able to describe the conditional assumption in the

industry environments, not only counting the forecast

based on historical financial numbers. This is critical

because valuation is very dependent on the

assumptions used so that the valuation between

researchers might yield different results.

For investors, in addition to paying attention to the

target stock price and enterprise value, we should

consider the fundamental conditions and company

performance outside the financial statement

information, such as competitor condition and market

awareness in other industry, as a comparison in

decision making. Theoretically, in decision making,

it is usually recommended to buy shares under the

intrinsic value, but it must be noted that other

conditions can support the sustainability of the

company's business as well.

REFERENCES

Chirputkar, A., Kulkarni, P., Vadgama, C., Prabhu, S.,

2016. Valuation Techniques in Telecommunication

Industry – An Alternative Approach based on

Operating Cash Flow and Number of Subscribers,

Telecom Business Review, SITM Journal Volume 9.

Damodaran, A., 2012. Investment Philosophies: Successful

Strategies and the Investors Who Made Them Work

Investment Philosophies, John Wiley & Sons Inc,

United States of America.

Glaum, M., Friedrich, N., 2006, After the ‘‘Bubble’’:

Valuation of Telecommunications Companies by

Financial Analysts, Journal of International Financial

Management and Accounting 17:2, 160-174.

Ivanovska, N., Ivanovski,Z., Narasanov. X., 2014.

Fundamental Analysis and Discounted Free Cash Flow

Valuation of Stocks at Macedonian Stock Exchange.

UTMS Journal of Economics 5 (1): 11–24.

Neaxie, LV., Hendrawan,R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange, Journal of Economic & Management

Perspectives 11 (3), 455-455.

Saplitsa, Iryna, 2008. Business Analysis and Valuation of

Vodafone Group. Economics and Business

Administration program, NORGES

HANDELSHØYSKOLE.

Wahyudi, A., Surya, B., 2013. Company Valuation

Analysis On PT Dayamitra Telekomunikasi in

Preparation of IPO, The Indonesian Journal Of

Business Administration Vol. 2.

Zemba, S. Hendrawan, R., 2018. Does Rapidly Growing

Revenues Always Produce An Excellent Company’s

Value? DCF & P/E Valuation Assessment on Hospital

Industry. Proceeding of Management: Vol.5.

Should Telkom do IPO for Telkomsel ?

347