Transportation Strategy in Optimization the Economic Value and

Operational Reliability (Case Study of PT Adaro MetCoal (AMC),

Subco from PT Adaro Energy Tbk)

Hadi Purnomo and Kin Tjendrasa

School of Business and Management, Institut Teknologi Bandung, Gd. Graha Irama 12th Floor,

Jl. H.R. Rasuna Said Kav. 1-2, Kuningan Timur Jakarta Selatan, 12950, Jakarta Campus, Indonesia

Keywords: Logistics & Coal Supply Chain, Barge to Barge Transfer in the River, Optimizing Logistics Cost Saving,

Logistics Improvement.

Abstract: PT Adaro MetCoal Companies (AMC) is one of the subsidiaries of PT Adaro Energy, Tbk, which in October

2016 was acquired 100% from BHP Billiton. AMC has assets consisting of seven Coal Contracts of Work

(CCoW). BHP Billiton initially explored the Maruwai Coal Basin, in which the seven CCOWs are located

and made a significant capital investment over a number of years for studying and defining the potential and

coal quality of the area. AMC requires more than 73 km to transport coal from the Pit (mining location) to

Stockpile by hauling trucks in the road and about 615 km from Stockpile to the Taboneo offshore port,

transported by tug and barge through the river. AMC faces difficulties in their existing coal supply chain.

There are three transportation options that required investment which can be carried out by Adaro Group as a

logistics solution for AMC, namely Optimizing existing operations, direct barging (upper and lower cycles)

and Transferring trough the river. The study was carried out by analyzing technical, operational, financial of

the three options, with the same indicators to get the through-put cost per ton. The results of the study show

that the third option provides sufficient investment returns and efficiency to AMC in their logistics costs.

1 INTRODUCTION

In the existing coal port to port logistics, AMC needs

more than 73 km to transport the coal from mining pit

to stockpile, which located near from River Port, by

hauling truck via road and 615 km from its stockpile

to the Taboneo Offshore Anchorage, in the mount of

Barito River, by tug & barge. AMC faced difficulties

in their existing coal supply chain. Total production

is 0.5 million ton in 2016 needs 125 shipments with

eight dedicated set of tug & barges employed. This

condition is still far from AMC target to produce and

sale with production volume target about 3 million

ton per annum (MTPA) started in the year of 2020.

The existing of AMC infrastructure in the entire

their coal supply chain was first designed with the

particular capacity to be used at a certain project time.

It is clear that to increase production in succeeding

years, and the infrastructure will finally reach its

limit. The maximum capacity was designed with

production volume 1 MTPA. This maximum capacity

is influenced not only by the infrastructure but also by

the natural condition, since the AMC operation

located in the Central of Kalimantan with several

difficulties supply chain due to port and river

condition at hulu barito, tug & barge size limitation,

and weather uncertainty which cause tidal river draft.

Below table describes the total existing through-

put logistics cost (TC) per ton that AMC pays to the

third party. With total volume 1 MTPA and total TC

about 16.67 per ton (rise and fall formula applied for

fuel price & exchange rate), AMC spent about 16.7

million USD per year.

The question that needs to be answered is

highlighted on the improvement and development in

current operation, which faced on the logistics port to

port coal supply chain from the Pit to the export point,

Taboneo Offshore Port;

“What is the efficient way to operate coal

transportation about 3 MTPA for Adaro

MetCoal (AMC) in Central Kalimantan trough

Barito River?”.

Purnomo, H. and Tjendrasa, K.

Transportation Strategy in Optimization the Economic Value and Operational Reliability.

DOI: 10.5220/0008430903290336

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 329-336

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

329

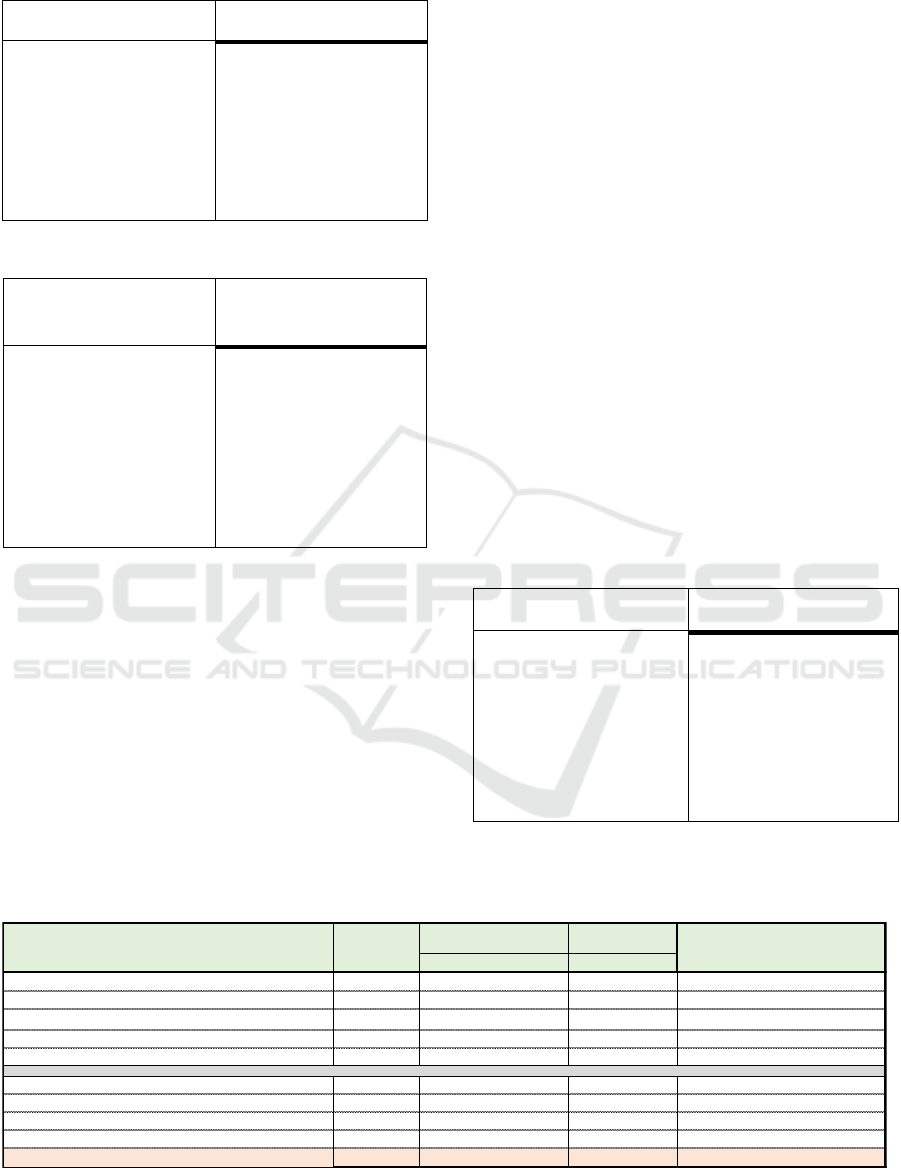

Table 1: AMC Existing Logistics Capacity & existing through-put logistics cost (TC) per ton.

Service

Product/Service Description

Maximum

volume

handled

The dedicated capacity provided

Unit Cost

(USD/mt)

Service

provider

Upper Cycle

route

Freight Services

1 Mtpa coal

12 set dedicated small Tug &

Barges 230ft employed

7.56

Third party

Intermediate

stockpile

Coal Handling –

Discharging/Stockpiling/Loading

1 Mtpa coal

Total Installed Capacity is

1,312,000 mt, while dedicated to

AMC is 150.000 mt

4.2

Third party

Lower Cycle

route

Freight Service

Transshipment service

1 Mtpa coal

3 set dedicated a large size of Tug

& Barges 300-330ft employed

1 unit Floating Crane

3.4

1.5

Third party

Source: Company Data

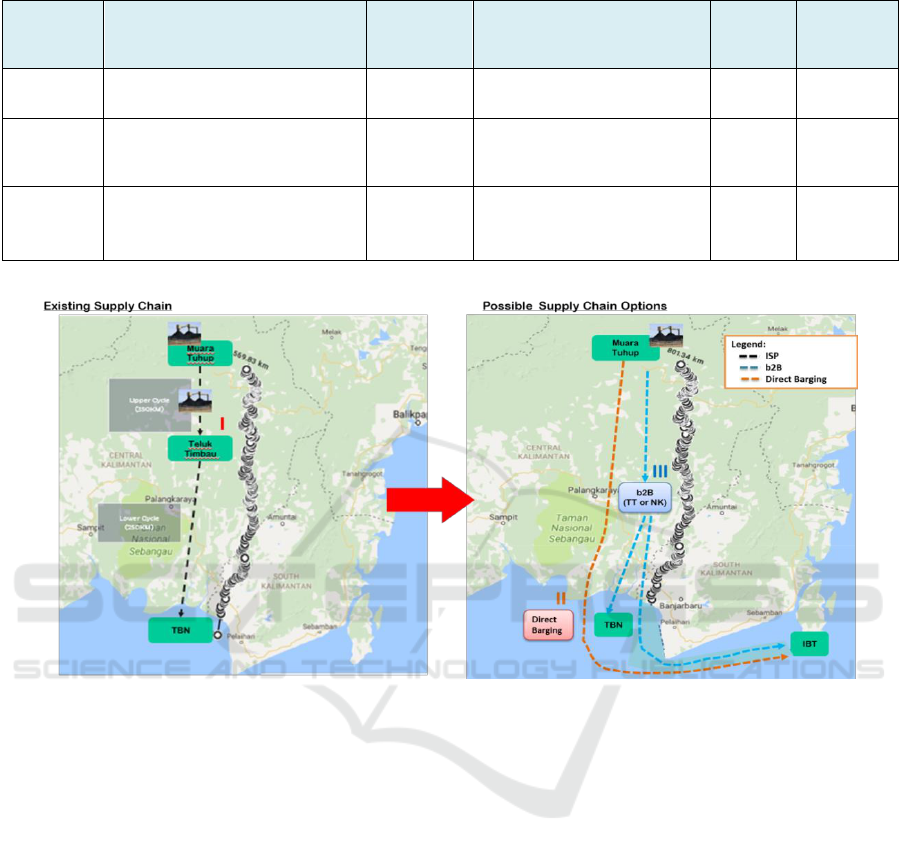

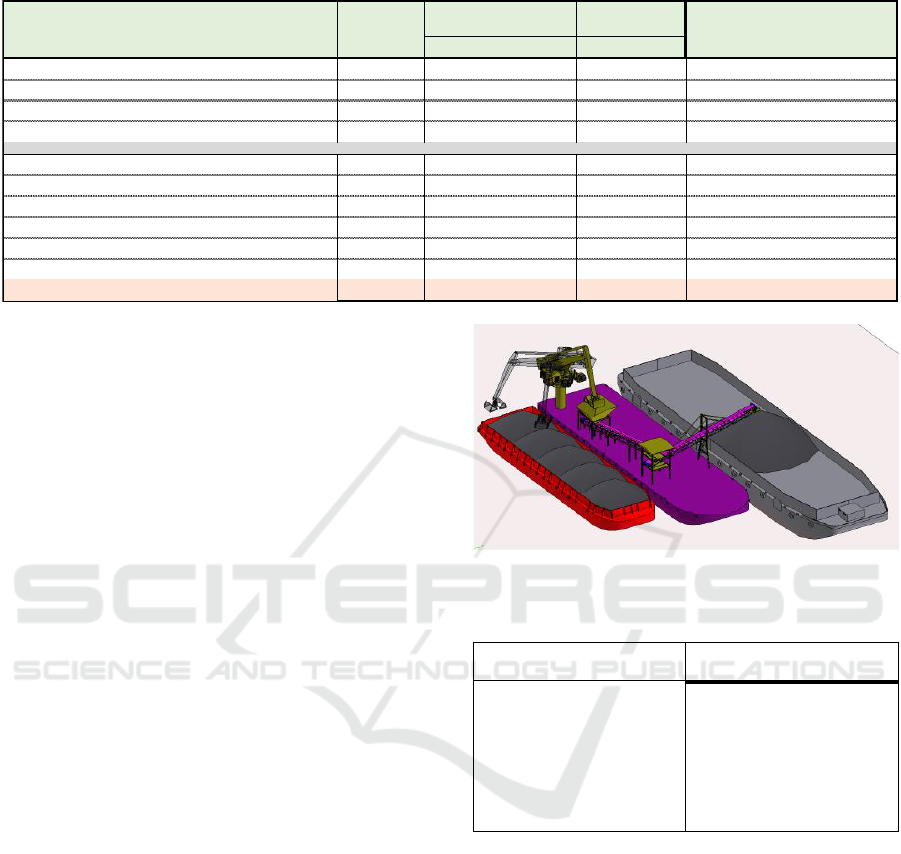

Figure 1: Identifying Options along Barito River (Source: Company Data).

Hence, the objective is to seek the best alternative

on the port to port supply chain model to transport

coal with production volume plan 3 MTPA for AMC

in Central Kalimantan trough Barito River without

sacrifice safety and coal security.

2 IDENTIFYING OPTIONS

To be able to transport 3 MTPA efficiently, herewith

the three options to be compared from this paper:

1. Optimizing existing operation with additional

investment in current facilities and equipment.

2. Direct barging method to transport coal directly

from Muara Tuhup to IBT Onshore Terminal in

Pulau Laut as a hub for export shipment.

3. Conducting river barge to Barge transfer (b2B) to

transport coal from Muara Tuhup using a small

barge to be transferred to a large barge then head

to Taboneo Offshore anchorage for export

shipment.

The map can be seen in figure 1.

3 METHOD AND DATA

COLLECTION

The analysis will be done through both quantitative

and qualitative assessment. Quantitative will focus on

financial matters (investment indicators) while

qualitative will focus on the comparison of several

factors, which covers technical, operational, safety

and other important components.

The quantitative assessment is carried out by

comparing existing TC with the new TC obtained

from the investment calculation of each option, with

an economic variable defined as a company standard.

Data Collected consist of primary data and secondary

data, however mostly secondary data from the

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

330

Company's Internal Database, Consultants, Annual

Report, Conferences and Investor Presentations, as

well as from the internal study of the relevant

literature.

4 RESULT AND DISCUSSION

4.1 Coal Overview

4.1.1 Global Coal Overview

Coal price in Indonesia highly depends on the global

situation. China and India are key players in the coal

markets, both as producer and consumer. They give

import a balancing role to fulfill the portion that

cannot be covered by domestic supply, so due to the

large scale of these countries, fluctuations in their

imports can influence the global market. China

currently operates approximately 920 gigawatts

(GW) of coal-fired power plants, with more than 140

GW additional capacities expected to commence

operations in the next three years. In the long run,

China's plan to continue relying on coal as the main

fuel for power generation will keep it the most

dominant consumer in the global coal market.

On the other side, the projected industrial growth

of India is expected to push the country to require

more coal. India currently has approximately 70 GW

of coal-fired capacity under construction, and another

130 GW under the proposal. To support their

electrification, the Indian government has

implemented aggressive plans to increase domestic

coal production from Coal India. Regardless of the

efforts, the higher ash content and impurities of

Indian coal requires the country to continue importing

coal of lower pollutant content in order to balance its

domestic coal. India is estimated to be one of the key

drivers in the seaborne thermal coal markets along

with the Southeast Asian countries.

Southeast Asia (SEA), currently the 3rd largest

economic region in Asia and the 7th largest globally,

is a major driver of Asia's economic growth. The

region's rapidly growing economy and population

have increased demand for electricity by an average

rate of 6% per annum since 2000. Wood Mackenzie

predicts that the demand will keep growing at a rate

of 4.6% per annum until 2035. As of 2016, the region

had approximately 240 GW installed power

generation capacity, and an addition of 111 GW is

expected by 2025.

4.1.2 Indonesia Coal Overview

Indonesia, currently expected its 35,000 MW

electrification program, is spearheading the growth of

coal-fired power plants in Southeast Asia. The

program expects to add approximately 20,000 MW of

coal fired capacity, which translates to an addition of

70 Mt to 80 Mt of coal demand on top of the current

level as in table 2. For Indonesia, coal is not only the

most consumed fuel for the electrification program

but also a significant contributor to the country's

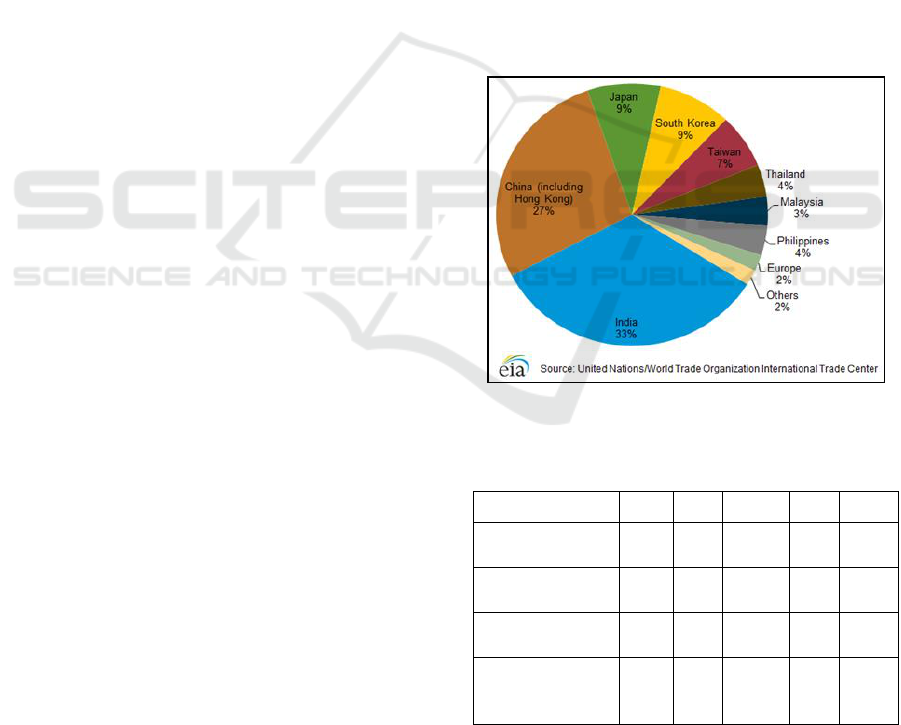

foreign reserves and non-tax revenues. As in figure 2,

96% of Indonesia coal export focuses on the region of

Asia with India and China.

It is projected that domestic coal consumption will

increase significantly due to the government policy

for electricity using coal power plant. Rupiah per

kWh for coal is the lowest price compared to other

sources of energy. In 2017, the using of coal as a

source of energy valued Rp. 859 per kWh, meanwhile

fuel valued Rp. 6.691 per kWh.

Figure 2: Indonesia Coal Export by Destination.

Table 2: Coal Production Data during Period of 2013 –

2017.

Description

2013

2014

2015

2016

2017

Total Production

(Millon Tons)

474

458

461

463

476

Export

(Millon Tons)

402

382

375

372

369

Domestic (Millon

Tons)

72

76

86

91

107

Domestic to

Total Coal

Production

15%

17%

19%

20%

22%

Source: Ditjen Minerba 2017

Transportation Strategy in Optimization the Economic Value and Operational Reliability

331

4.2 Industry Analysis

Coal remains as the fuel of choice for developing

economies in Southeast Asia, Affordable and

abundant. For Indonesia, it will need to constantly

balance its export and domestic market, especially in

the near term when exports remain high. Exports are

expected to remain strong in the near term, staying

around 350-360 Mt until 2020.

Applying the result of the analysis through

Porter's 5 Forces Model to the Indonesia coal

industry, the result emerges as in table 3.

Table 3: Porter’s 5 Forces Model to the Indonesia coal industry.

Bargaining Power of Suppliers (low to medium)

• Coal is a commodity product

• Suppliers are concentrated, especially coal mining

contractors

• Limited or no potential of forwarding integration by

suppliers

• The industry association is important for players,

especially in influencing government policy

• High switching cost for players

Bargaining Power of Buyers/Customer (low to medium)

• Contract sales consist of a direct order from buyer, trader, and spot

sales from small companies. Mostly dominated by trader with a

long term contract

• Coal price easily benchmarked among suppliers

• Limited or no potential of backward integration by customers

• Limited type of product (coal). Easily compared with the

competitors

• Type of product (coal) affects customer’s overall production costs

• High switching cost for customers (to switch the sources of

product)

Competitive Rivalry within the Industry (low to medium)

• Only a few companies operate on a larger scale

• Industry growth is relatively directly correlated to (global) economic growth

• The industry has a high fixed cost

• This industry characterized high exit barriers

• Competitors approach customers in relatively the same way/style

The threat of substitute (low to medium)

• Few substitutes exist for coal, which are Oil, LNG, and

Renewable Energy. Their switching or application

requires adjustments in technology and equipment)

• Growth of the energy sector outpaces the rate of growth

of emergence and development of the substitute for

coal

• Regulation is critical to the success of development and

application of new substitute

The threat of New Entrants (low to medium)

• High capital requirement (to develop coal concession area, to

acquire heavy equipment, or to employ a massive work force)

• Regulation intensive (a company must obtain permits and license

to operate in this sector)

• Limited availability of coal concession areas for new players

• Economy of scale (on supply-side) is important to achieve

operational cost-efficiency

• Network effect (on demand-side) exists, especially in gaining

long-term sales contract

• High advantages for incumbents, especially in access to raw

materials, locations, government relations, and international

market

Table 4: Adaro Group SWOT Analysis.

Strengths:

• Diversified mining operations with several types of

calorie product

• Qualified operation & technical team

• Robust financial performance

• Awards and recognition

• Integrated Port to port operational within one holding

group company

• Strong Shareholder support for Management

Weaknesses:

• For certain mining concession is far from the

export point, impacting on the high logistics cost

Opportunities:

• Increasing coal demand, both of Domestics and

Export.

• Robust of government expenditure in

Infrastructure development, particularly for

domestic Coal Fire Power Plant (CFPP)

Threats:

• Government intervention on the concession given

• Operational hazards

• Adverse weather conditions

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

332

4.3 Internal Analysis

The SWOT Analysis of PT. Adaro Energy, Tbk

(Adaro Group) based on the history, current

achievement, and future opportunity are detailed as in

table 4.

4.4 Supply Chain Management

Concept

According to Hui Jiang (2006), et al. through their

research on "The study on characteristics of Coal

Supply Chain", the development of coal supply chain

should be designed based on characteristics of R, S,

C, T, which described in the following quote.

“The manufacturing industry emphasizes the Q

(quality), C (Cost), S (service), V (Velocity),

emphasize the quick in action and logistics service,

after-sales service. This is different from the

situation of coal products. Coal is a consumptive

energy product, and the consumer needs change

slightly, just some changes in ash, moisture, sulfur

or size, and others. So, coal supply chain

management should emphasize the stability and

price, and the content of stability includes two

aspects, the stable quantity, and stable quality. The

stability of supply is influenced by distance and

transport conditions. Therefore, the core of the

coal supply chain management is R (resources), S

(stability: including Q (quality) and Q (quantity)),

C (cost), T (Transport)".

The transportation method will be a leading indicator

to generate the level of trough-put cost (TC) expected.

Hence, to be considered on the parameter, those three

options will definitely impact on the total TC paid by

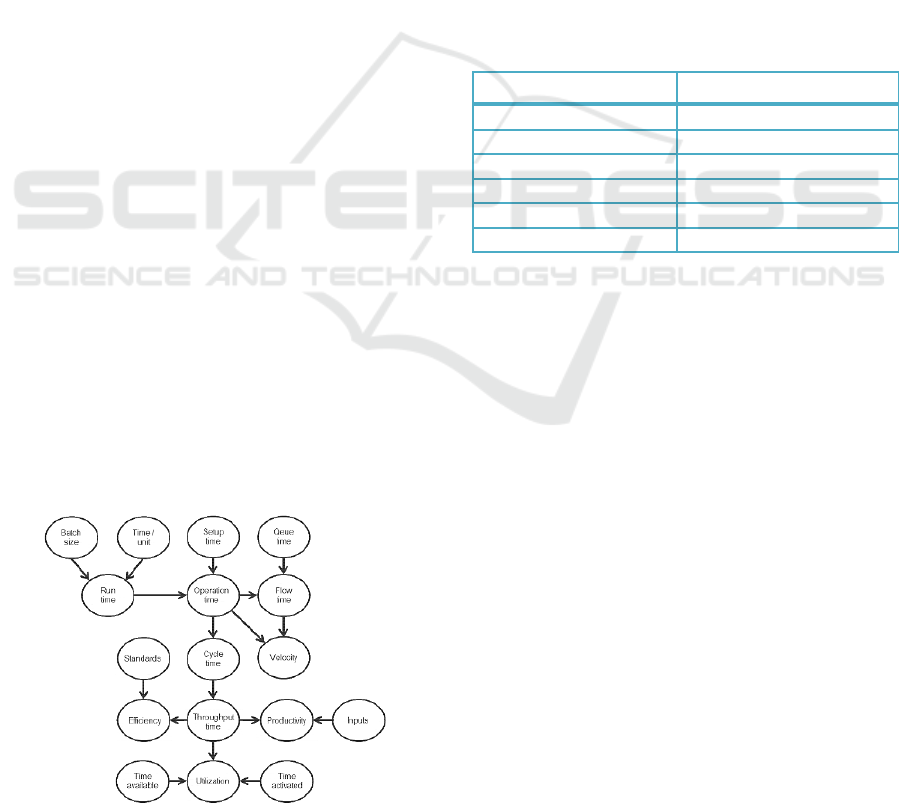

AMC To support the quantitative analysis, Chase and

Jacobs (2011) explained the relation of several

important factors through Process Performance

Matrices, as in figure 3.

Figure 3: Process Performance Matrices.

Above figure is explained as follows:

Operation time = Setup time + Run time

Flow time = Average time for a unit to move

though the system

Velocity = Flow time/Value-added time

Cycle time = Average time between

completion of units

Throughput rate = 1 / cycle time

Efficiency = actual output /standard output

Productivity = Output/Input

Utilization = Time activated / Time available

5 RESEARCH RESULT

To obtain total through-put cost is required to run a

financial model with basis variable economic from

Adaro Group Standard as in table 5.

Table 5: Variable economic used.

Parameters

Variable Economic

WACC

12.5%

Projection period

15 years

Tonnage volume

3 MTPA

Talk time

2000 TPH

Fuel Price

USD 1.06 per litre

Exchange rate

Rp 15.178 per USD

Source: Company Data

5.1 Option 1, Optimizing Existing

Operation with Additional

Investment in Current Facilities

and Equipment

There are two cycles in the existing operation to

transport the coal using Tug & Barges from Stockpile

Port to Taboneo Offshore Anchorage. The first cycle

is called Upper Cycle, which is the cycle transporting

the coal from Stockpile Port in Muara Tuhup (mining

site) to Intermediate Stockpile (ISP) in Teluk Timbau.

In this cycle, due to port and river condition at Hulu

Barito, Tug & Barge size limitation, coal only can be

carried out by small Tug & Barges with capacity 4000

DWT or 230-250 feet.

The second cycle is called lower cycle, that is the

cycle transporting the coal from ISP Teluk Timbau to

Taboneo Offshore Terminal for conduction ship to

ship transfer to Mother Vessel (Bulk Carrier) for

export shipment.

The financial result is described in table 6 and

table 7.

Transportation Strategy in Optimization the Economic Value and Operational Reliability

333

Table 6: Upper Cycle Barging Investment Result.

Financial Summary: upper

cycle barging investment

Annual figure (USD)

Revenue

30.275.783

EBITDA

13.774.729

EBITDA Margin

45%

Net Profit

10.128.896

Net Profit Margin

33%

Capex Investment

72.916.667

Fleet Requirement

29 set Tug &Barge

Payback Period

Six years

Throughput-Fee (TF)

10.09 per tonne

Table 7: Lower Cycle Barging Investment Result.

Financial Summary:

Lower cycle barging

investment

Annual figure (USD)

Revenue

11.235.585

EBITDA

4.303.310

EBITDA Margin

38%

Net Profit

1.783.310

Net Profit Margin

16%

Capex Investment

25.200.000

Fleet Requirement

7 set Tug & Barge

Payback Period

7 years

Throughput-Fee (TF)

3.75 per tonne

Based on financial analysis on the new investment

in sets of tug and barges in this option, the comparison

between the actual costs which AMC pays to the third

party as table 1 and new TC obtained from the

investment financial modelling particularly from new

tug and barge in the upper and lower cycle are

described in table 8.

According to table 8, total saving obtained from

the optimizing existing operation with additional

investment in current facilities and equipment,

particularly tug & barge in the upper and lower cycle

is 48 cent per ton which is equivalent to USD

1.440.000 per year.

5.2 Option 2, a Direct Barging Method

to Transport Coal Directly from

Muara Tuhup to IBT Onshore

Terminal in Pulau Laut as a Hub

for Export Shipment

The second option is to use a direct barging method

which there will be no separation in the shipment

cycle, either the upper cycle or lower cycle. The coal

will be transported directly from Muara Tuhup to IBT

using small size tug and barges, with size 4000 DWT.

IBT, Indonesia Bulk Terminal, is a subsidiary

company from Adaro Logistics, Subholding

Company of Adaro Energy which located in Pulau

Laut, South Kalimantan. The total distance from

Muara Tuhup Port to the IBT is 799 km, through river

and sea. The allowable speed for tug & barge depends

on the weather and crowd along Barito River. The

range of allowable speed for tug & barge is 3.5 – 6

knot, hence one round trip for that vessel from Muara

Tuhup to IBT and back to the Muara Tuhup is 18.5

days.

The financial result is described in the following

table 9.

Table 9: Direct Barging Investment Result.

Financial Summary:

direct barging investment

Annual figure (USD)

Revenue

57.271.445

EBITDA

21.740.573

EBITDA Margin

38%

Net Profit

15.490.573

Net Profit Margin

33%

Capex Investment

125.000.000

Fleet Requirement

50 set Tug &Barge

Payback Period

7 years

Throughput-Fee (TF)

18.94 per tonne

Table 8: Option 1 Result.

Existing cost (TF) OPTION I

based on Formula

Fuel Price USD/Ltr 1.06 1.06

FX IDR/USD 15,179 15,179

Projection year year 15 years

Annual Throughput volume MT/ yr 1 MTPA 3 MTPA

Lower cycle barge capacity DWT 10,000 10,000

Upper Cycle (4000 dwt) USD/ ton 10.18 10.09 Option 1: new investment

Current ISP cost USD/ ton 4.20 4.20 third party income

Lower cycle USD/ ton 4.14 3.75 Option 1: new investment

Transshipment at Taboneo (Gearless) USD/ ton 1.94 1.94 adaro group income

TOTAL COST USD/ ton 20.46 19.98 saving: 48 cent usd

Description

UOM

Remarks

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

334

Table 10: Option 2 Result.

Based on financial analysis on the new investment

in sets of tug and barges in this option, the comparison

between the actual costs which AMC pays to the third

party and new TC obtained from the investment

financial modeling particularly from new tug and

barge in direct barging method are described in the

table 10.

The option 2, direct barging method, is more

expensive than total existing TC, where instead it

contributes negatively by USD 2.940.000 per year.

5.3 Option 3, Conducting River Barge

to Barge Transfer (b2B) to

Transport Coal from Muara Tuhup

using a small barge to be

Transferred to a Large Barge then

head to Taboneo Offshore Port for

export Shipment

As in figure 1, the b2B transfer method is the new

method replacing ISP requirement, which it is used to

transfer coal directly from small barge to the large

barge in the river without unloading the coal to the

onshore facility (ISP). There will be still required two

cycles for barging activity, upper and lower cycle.

The export point stills same to be located at Taboneo

offshore port.

The financial result is described in the following

table 11.

Based on financial analysis on the new investment

in sets of tug and barges and b2B transfer facility in

this option, the comparison between the actual costs

which AMC pays to a third party and new TC

obtained from the investment financial modeling are

described in table 12.

Figure 4: Process Performance Matrices.

Table 11: b2B Transfer Facility Investment Result.

Financial Summary: direct

barging investment

Annual figure (USD)

Revenue

12.061.790

EBITDA

6.128.782

EBITDA Margin

51%

Net Profit

1.229.259

Net Profit Margin

10%

Capex Investment

38.483.744

Payback Period

6 years

Throughput-Fee (TF)

4.02 per tonne

The total saving obtained from conducting river

barge to Barge transfer (b2B) to transport coal from

Muara Tuhup using a small barge to be transferred to

large barge in the river then head to Taboneo Offshore

Anchorage is 66 cent per ton which is equivalent to

USD 1.980.000 per year.

5.4 Qualitative Assessment

Qualitative assessment will focus on the comparison

of several factors, which covers technical,

operational, safety and other important components

which explained in table 13.

Existing cost (TF) OPTION II

based on Formula

Fuel Price USD/Ltr 1.06 1.06

FX IDR/USD 15,179 15,179

Projection year year 15 years

Annual Throughput volume MT/ yr 1 MTPA 3 MTPA

Upper Cycle (4000 dwt) USD/ ton 10.18

Direct Barging (4000 dwt) USD/ ton 18.94 Option 2: New Investment

Current ISP cost USD/ ton 4.20

Lower cycle USD/ ton 4.14

Transshipment at Taboneo (Gearless) USD/ ton 1.94

IBT Handling Fee USD/ ton 2.50 Adaro Group Income

TOTAL COST USD/ ton 20.46 21.44 loss: 98 cent usd

Description

UOM

Remarks

Transportation Strategy in Optimization the Economic Value and Operational Reliability

335

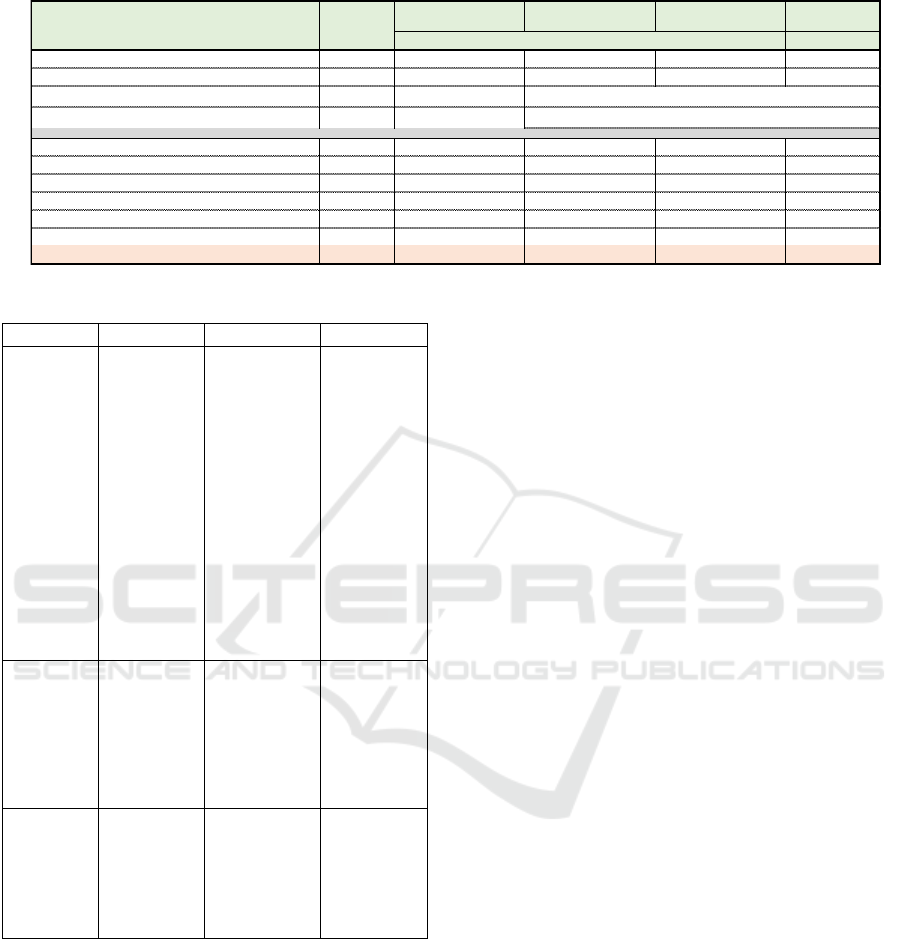

Table 12: End to End Total Cost Summary Result.

Table 13: Qualitative assessment.

Option 1

Option 2

Option 3

Technical

analysis

Option 1 is

less risk

compared to

the other

option since

it is only

improved

from the

existing

method with

increase the

capacity of

tug & barge.

Technically

direct barging

method is

feasible to be

done for 799

km distance,

from Muara

Tuhup to IBT.

The small tug

& barge will

be used along

the way for

18.5 days

cycle time.

Option 3 is

more

complicated

compared

the other

since it needs

to develop a

new system,

b2B transfer

in the river.

New

expertise,

System, and

operation

schedule

must be

prepared.

Operational

analysis

Option 1

operationally

feasible to be

carried out.

Direct barging

will cause a

heavy

operation

since there is a

lot of tug *

barge

employed.

Option 3

operationally

feasible to be

carried out

with a new

system and

procedure.

Safety &

other

No issue in

the safety

Big issue in

the safety that

needs to

mitigate

The new

system and

procedure

must in-line

with new risk

mitigation on

the safety.

6 CONCLUSION

Coal logistics is the second biggest cost in coal

mining activity after fuel cost. Hence to survive and

efficient in the operation, AMC needs to move and

manage the cost of their logistics. Until now, the coal

logistic activity causes huge inefficiency even less

that cost goes to the third party. Those three options

that have been analyzed can be used to optimize the

production of about 3 MTPA. Operationally and

technically doable to be conducted in Barito River

with the certain risk that to be mitigated, however,

according to table 13 options 1 and 3 are less risk

compared the option2. Hence, the main parameter to

be compared to justify decision making is the

financial result of the new additional investment.

Based on table 12, End to End Total Cost

Summary Result, the most efficient option to be

proposed to AMC is option 3. The efficiency from the

total throughput is about USD 66 cent per ton or

equivalent with USD 1.98 million per year with

production volume 3 MTPA.

REFERENCES

Adaro Energi. (2018, June 1). Adaro Energy Annual Report

of 2017. Retrieved from http://www.adaro.com

Alan Smyth. (2014). Barito River Logistics Coal

Transportation. BHP Billiton Report.

Allen, Glenn, et al. 1993. Improving throughput of a coal

transport system with the aid of three simple models.

The Institute of Management sciences

Jian, Hui, et al., 2006, The Study on Structure and

Characteristics of Coal Supply Chain, School of

Management, Xuzhou China

Fine, Lawrence G. (2009). The SWOT Analysis. North

Charleston, SC: Createspace

Franco Modigliani and Merton H. Miller, “The Cost of

Capital, Corporate Finance and Theory of Investment”,

The American Economic Review, Vol. 48, No. 3(Jun,

1958), pp.261-297

Rothaermel, Frank T. (2015). Strategic Management 2nd

Edition, New York: McGraw-Hill.

Existing cost (TF) OPTION I OPTION II OPTION III

based on Formula

Fuel Price USD/Ltr 1.06 1.06 1.06 1.06

FX IDR/USD 15,179 15,179 15,179 15,179

Projection year year

Annual Throughput volume MT/ yr 1 MTPA

Upper Cycle (4000 dwt) USD/ ton 10.18 10.09 10.09

Direct Barging USD/ ton - - 18.94 -

ISP / b2B USD/ ton 4.20 4.20 4.02

Lower Cycle USD/ ton 4.14 3.75 3.75

Transshipment at Taboneo (Gearless) USD/ ton 1.94 1.94 1.94

IBT Handling Fee USD/ ton - 2.50 -

TOTAL COST USD/ ton 20.46 19.98 21.44 19.80

15 years

3 MTPA

Description

UOM

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

336