The Importance of Innovative Logistics Service Capabilities for

Assets-based Logistics Service Providers

Darjat Sudrajat, Sevenpri Candra and Agustinus Dedy Handrimurtjahjo

BINUS Business School – Undergraduate Program, Bina Nusantara University, Jakarta, Indonesia

Keywords: Physical Assets Ownership (PAO), Innovative Logistics Service Capabilities (ILSC), Assets-based

Logistics Service Providers Performance (AB-LSP Performance), Assets-based Logistics Service Providers

(AB-LSP).

Abstract: The purpose of this study is to provide a model to improve the performance of asset-based logistics service

providers (AB-LSP) in Indonesia so that they can survive in increasingly fierce competition, especially from

foreign logistics service companies. The study used a quantitative approach with causal, verification, or

cross-sectional survey method by using SEM-PLS program in processing data. The sample size consisted of

83 asset-based logistics service providers (AB-LSP) in Jakarta area (Jabodetabek) and using probability

sampling technique. This study found that the innovative logistics services capabilities (ILSC) mediated in

full (indirect-only mediation) the effect of physical assets ownership (PAO) on AB-LSP performance.

Theoretically, the research implication confirmed that the dynamic capabilities (DC) theory in explaining

the research’s model, so that it more effective than the resources-based view (RBV) theory. Whereas

practically, the research implication showed that asset-based logistics service providers (AB-LSP) in

Indonesia should develop the innovative logistics services capabilities (ILSC) so that they were able to

reconfigure or transform their physical assets in order to in line with changes of the business environment

both external and internal.

1 INTRODUCTION

Logistics services are activities that provide logistics

services (transportation, warehousing, packaging,

customs, distribution, inventory management) both

partially and integratedly (Mangan and Lilwani,

2016). Meanwhile, based on Permenhub No. PM 74,

2015, logistics services are activities that intended to

represent the interests of cargo owners to handle all

activities needed for the delivery and receipt of

cargo through land transportation, railways, sea and

air, including shipping, receiving, loading and

unloading, storing, sorting, packing, marking,

measuring, weighing, handling document settlement,

issuing transportation documents, ordering transport

space, distributing cargo, calculating transportation

costs, insurance claims for shipping, bill settlement

and other costs needed and the provision of

information and communication systems and

logistics services. In the regulation, there are 23

types of services that can be run by logistics services

companies.

The logistics services market in Indonesia in

2020 is estimated at Rp.4,396 trillion, with an

average growth rate of 15.4% per year (Frost &

Sullivan, in Bisnis Indonesia, 29 August 2016).

However, this huge potential market cannot be

utilized by Indonesian logistics services companies,

even 90% of export-import logistics transportation is

still controlled by foreign logistics service

companies, thus increasing the deficit of service

transaction (Krisnamurthi, 2014). According to the

Indonesian Logistics and Forwarder Association

(ALFI), about 50% of their members are non-active

because of their poor performance and

competitiveness. The government tried to encourage

the companies' competitiveness through physical

assets ownership (trucks, forklifts and warehouses),

but it was refused by the Association (ALFI).

Finally, the government issued Permenhub No 74,

2015 to regulate the industry that requires a

minimum capital amount of Rp.25 billion (include

physical assets), whereas in the the previous

regulation it only Rp.200 million. Therefore, the

regulation brought out a problem for the companies.

The physical assets ownership in the logistics

234

Sudrajat, D., Candra, S. and Handrimurtjahjo, A.

The Importance of Innovative Logistics Service Capabilities for Assets-based Logistics Service Providers.

DOI: 10.5220/0008429702340239

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 234-239

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

services industry has certain characteristics for the

companies' status, especially in the customers' view.

The characteristics are distinguished by assets and

non-assets based logistics service companies

(Hofmann and Osterwalder, 2017; Skender,

Mirkovic and Prudky, 2017; Norall, 2013; Saglietto,

2013). An assets-based logistics service company

has many or all of the assets needed to run its

customer's supply chain. These assets include trucks,

warehouses, distribution centers and forklifts.

Conversely, a non-assets based logistics service

company does not have the assets needed to manage

and implement a supply chain. However, the

company offers its expertise in negotiating contracts

with shipping lines or airlines; maintain relationship

management programs with shipping lines or

airlines, warehouses, and distribution centers so that

they can manage their customers' supply chains at

the lowest possible costs (Norall, 2013).

Not all of the company's resources have a

positive and significant effect on innovation

(Demirkan, 2018; Kim et. Al., 2017; Sivalogathasan,

2015). Tangible or physical resources has an

unsignificant effect on a company's performance

(Othman et al., 2015; Sudrajat, 2018). Physical

resources have an unsignificant effect on innovative

capability (Sudrajat, 2018). The innovative

capability has a positive and significant effect on

firm performance (Donkor et al., 2018;

Rajapathirana and Hui, 2017). Innovation mediated

the effect of resources on firm performance (Khin

and Ho, 2018). In connection with that, there were

the gaps, controversies and inconsistencies so it was

interesting to be researched and further verified.

2 LITERATURE REVIEW

Strategic management is art and science (David and

David, 2017), the process of analysis (Dess et al.,

2014; Rothaermel, 2017), decisions (Dess et. al.,

2014; Hitt, Ireland and Hoskisson, 2017; Wheelen et

al., 2018), actions (Dess et al., 2014; Hitt, Ireland,

and Hoskisson, 2017; Wheelen et. al., 2018); what

the company does to achieve its long-term

performance (Phillips and Moutinho, 2018; Hitt,

Ireland, and Hoskisson, 2017; Wheelen et. al.,

2018). Based on this literature, strategic

management is art and science in analyzing,

deciding, and executing the company's programs to

achieve its long-term performance.

The resource-based view (RBV) is a model or

theoretical perspective that sees certain types of

resources as key to superior firm performance

(Rothaermel, 2017; Wheelen et. al., 2018). Physical

assets are one of the company's tangible resources

(Grant and Jordan, 2015; Rothaermel, 2017).

Physical assets ownership in the logistics services

industry distinguishes between assets and non-assets

based logistics services companies (Norall, 2013;

Saglietto, 2013). The dimensions of assets can be

analyzed through intrinsic and extrinsic aspects. In

this study the ownership of physical assets is defined

as the ownership of trucks, warehouses, and forklifts

by logistics service providers that used to support

their operational activities.

Capabilities constitute company’s competencies,

skills, or capacities necessary to orchestrate a

diverse set of resources and to deploy them

strategically (Rothaermel, 2017; Dess et al., 2014;

Hitt, Ireland, and Hoskisson, 2017). Dynamic

capabilities is a model (Rothaermel, 2017) or

process (Inan and Bititci, 2015) in building,

integrating, and reconfiguring internal and external

competencies to deal with rapidly changing

environments through the processes of sensing,

seizing and transforming (Teece, 2017). It is not

only allow firms to adapt to changing market

conditions, but they also enable firms to create

market change that can strengthen their strategic

position (Rothaermel, 2017). According to Wang

and Ahmed (2007), dynamic capability can be

analyzed with three main elements encompasses

adaptive capability, absorptive capability, and

innovative capability

Innovation is one of the most important aspects

of developing business in the future (Schilling,

2017; Corsi and Neau, 2015; Trott, 2017; Andriole,

Cox, and Khin, 2018). Presently, the success of a

company to compete in the long run depends on its

ability to create innovative business models

(Ottosson, 2019). Innovation requires the allocation

of strategic resources to develop and utilize

productive resources (Lazonick, 2015). Innovative

capability is a comprehensive set of characteristics

of an organization that facilitates and supports

innovation strategies. Managing innovation is about

building a dynamic capability (Bessant and Tidd,

2015). Innovative capability is the ability to organize

and manage the search process (find opportunities

for innovation), choose (what will be done and

why), implement (how to make it happen), and

capture (how to get results).

Logistics service companies require innovative

capabilities in exploring business opportunities, for

example in exploring information from specific

target markets, customer's logistics activities

requirements, customer's product characteristics,

The Importance of Innovative Logistics Service Capabilities for Assets-based Logistics Service Providers

235

customer's logistics operations patterns, market

trends or regulation changes, competitors' logistics

innovation, and competencies of suppliers. In

addition, these companies also need capabilities for

products or services development. In this case, for

example, the ability to develop new creative ideas

include processes, technology and products.

Furthermore, another innovative capability is the

ability in the learning process. it includes the ability

to transfer new knowledge and experiences, create a

conducive work environment, understand the

company's strategic plan, develop effective team

work. In this study, innovative logistics service

capabilities are being defined as the ability of

logistics service providers to develop new logistics

service products or market innovatively.

Performance is the end result of activities. It

includes the actual outcomes of the strategic

management process (Wheelen, et. al., 2018).

Performance is the efficiency and / or effectiveness

of an action; efficiency is the number of resources

used to get results or output, whereas effectiveness is

the level at which the results of an action fulfill

specifications, requirements, and expectations that

have been set (Bititci, 2015). firm performance is a

measure that shows how well a company achieves

its goals (organizational and financial goals)

primarily is profitability and growth (Sam and

Hoshino, 2013). Whereas according to Wu (2009),

performance is a level of achievement towards the

targets set with the use of economic resources to

deal with the external or internal environment

(shareholders, competitors, communities). Company

performance can be both financial and non-financial,

the main financial performance includes profitability

and sales growth (Delen, Kuzey and Uyar, 2013;

Khan and Singhal, 2015). The profitability ratios

that are often used in financial analysis are mainly

gross profit margin and net profit margin (Delen,

Kuzey and Uyar, 2013; Gitman and Zutter, 2015).

3 RESEARCH METHOD

This research was a quantitative reasearch. Its unif

of analysis was the organization, whereas the unit of

observation was the company's leaders (managers or

directors). Data was collected using questionnaires

(Likert scale) and probability sampling (simple

random sampling). The sample size consisted of 83

asset-based logistics service providers or companies

that registered as members of Association (ILFA) in

the Jakarta (Jabodetabek) region. The data was

processed using the SEM-PLS program.

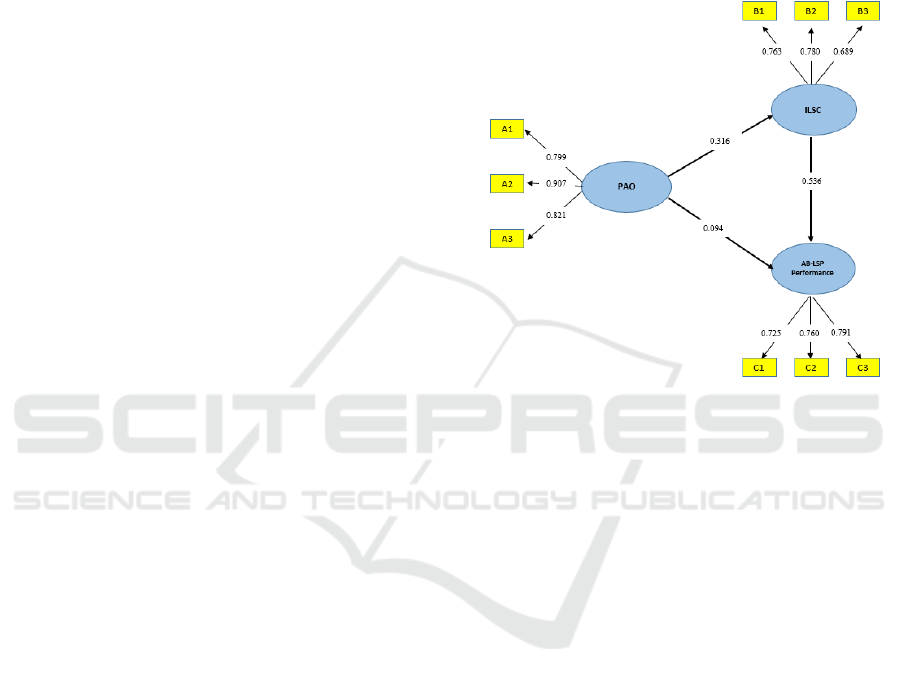

As in figure 1, the research consisted of three

latent variables: Physical Assets Ownership (PAO),

Innovative Logistics Services Capabilities (ILSC)

and Assets-based Logistics Service Provider

Performance (AB-LSP Performance). Physical

Assets Ownership (PAO) comprised three indicators

(number of trucks, number of forklifts and

warehouse area). Innovative Logistics Service

Capabilities (ILSC) consisted of three indicators

(ability in exploring logistics service business

opportunities, ability in developing new logistics

service, ability in learning). Assets-based Logistics

Service Provider Performance (AB-LSP

Performance) encompassed three indicators (gross

profit margin, net profit margin and revenue

growth). The research’s hypotheses consisted of:

H

1

: Physical Assets Ownership (PAO) has effect

on Assets-based Logistics Service Provider

Performance (AB-LSP Performance).

H

2

: Physical Assets Ownership (PAO) has effect

on Innovative Logistics Services Capabilities

(ILSC)

H

3

: Innovative Logistics Service Capabilities

(ILSC) has effect on Assets-based Logistics

Service Provider Performance (AB-LSP

Performance)

H

4

: Physical Assets Ownership (PAO) has effect

on Assets-based Logistics Service Provider

Performance (AB-LSP Performance) pass

through Innovative Logistics Services

Capabilities (ILSC)

4 RESULTS AND DISCUSSION

Based on figure 1, the first hypothesis test showed

that Physical Assets Ownership (PAO) has an

unsignificant effect on Assets-based Logistics

Service Provider Performance (AB-LSP

Performance). The result emphasized that the

resource-based view (RBV) theory was not

effectively to explain the research's model. It

showed that not all of a firm's resources have the

potential to be the foundation for a competitive

advantage and good performance. It meant also that

the physical assets need other resources to shape a

unique bundle of resources so that have a significant

effect on firm performance. In addition, the result

comprehends with sharing economy principles that

have been running recently as a transformation from

owning the economy system, which is physical

assets ownership as a source of firm's competitive

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

236

advantage and superior performance was not

significant anymore.

The second test showed that Physical Assets

Ownership (PAO) has a positive and significant

effect on Innovative Logistics Services Capabilities

(ILSC). The result indicated that dynamic

capabilities (DC) theory were effective in explaining

the research's model. It was based on Wang and

Ahmed (2007) that innovative capability constitute

one of the elements of dynamic capabilities.

Resources should be changed or modified into

capabilites so that have a significant impact on firm

performance. Sustainable competitive advantage

only can be achieved if the firms were able to create

and develop dynamic capabilities. In this case,

logistics physical assets must be developed and

modified into dynamic capabilities so that the

logistics service providers will be able to explore

logistics service business opportunities, develop new

logistics service and share new logistics knowledge

and experiences.

The third test showed that Innovative Logistics

Service Capabilities (ILSC) has a positive and

significant effect on Assets-based Logistics Service

Provider Performance (AB-LSP Performance). The

result showed that Assets-based Logistics Service

Providers (AB-LSP) have to create and develop

especially innovative logistics service capabilities

and generally dynamic capabilites to enhance their

performance. In connection with that, in line with

Rothaermel (2017) that the firms (AB-LSP) must be

able to change its internal resource base as the

external environment changes. Indonesian assets-

based logistics service providers (AB-LSP) are

facing technological change, deregulation,

globalization, and demographic shifts, so that

dynamic markets today are the rule rather than the

exception. As a response, the firm (AB-LSP) may

create, deploy, modify, reconfigure, or upgrade

resources so as to provide value to customers and/or

lower costs in a dynamic environment. The essence

of this result is that competitive advantage is not

derived from static resource or market advantages,

but from a dynamic reconfiguration of an AB-LSP's

resource base.

The fourth test showed that Physical Assets

Ownership (PAO) has a positive and significant

effect on Assets-based Logistics Service Provider

Performance (AB-LSP Performance) pass through

Innovative Logistics Services Capabilities (ILSC). It

was also showed that Innovative Logistics Services

Capabilities (ILSC) mediated in full (indirect-only

mediation) the effect of physical assets ownership

(PAO) on AB-LSP performance. The result

indicated that Indonesian assets-based logistics

service providers (AB-LSP) must be able to change

and modify their logistics physical assets into

innovative logistics service capabilities (ILSC) so

that they can enhance their performance. It was

comprehended with Khin and Ho (2018) stated that

innovation mediated the effect of resources on firm

performance.

Figure 1: PLS Model (Algorithm).

5 CONCLUSIONS

Innovative Logistics Services Capabilities (ILSC)

was importance for Assets-based Logistics Service

Providers (AB-LSP) due to their physical assets

could not enhance their performance unless they

were able to develop or modify the assets into

Innovative Logistics Service Capabilities (ILSC)

first. Therefore, the physical assets ownership

(PAO) could encourage the Assets-based Logistics

Service Providers (AB-LSP) to explore logistics

service business opportunities, develop new logistics

services and share new logistics service knowledge

and experiences. In connection with that, the

dynamic capabilities (DC) theory was more effective

in explaining the research's model than the resource-

based view (RBV) theory. Theoretically, the

innovative logistics services capabilities (ILSC)

mediated in full (indirect-only mediation) the effect

of physical assets ownership (PAO) on assets-based

logistics service providers performance (AB-LSP

Performance).

The Importance of Innovative Logistics Service Capabilities for Assets-based Logistics Service Providers

237

REFERENCES

Andriole, S. J., Cox, T., Khin, K. M., 2018. The

Innovator’s Imperative: Rapid Technology for Digital

Transformation. CRC Press. USA

Bessant, J., Tidd, J., 2015. Innovation and

Entrepreneurship. John Wiley & Sons Ltd. New York,

Third Edition

Bititci, U. S., 2015. Managing Business Performance: The

Science and the Art. John Wiley & Sons, Ltd., West

Sussex

Corsi, P., Neau, E., 2015. Innovation Capability Maturity

Model. John Wiley & Sons, Inc. New Jersey

David, F. R., David, F. R., 2017. Strategic Management: A

Competitive Advantage Approach, Concepts and

Cases. Pearson Education Limited, Harlow, Sixteenth

Edition

Delen, D., Kuzey, C., Uyar, A., 2013. Measuring Firm

Performance Using Financial Ratios: A Decision Tree

Approach. Expert Systems with Applications. Vol. 40

(2013) 3970-3983

Demirkan, I., 2018. The Impact of Firm Resources on

Innovation. European Journal of Innovation

Management. EMERALD.

Dess, G. G., Lumpkin, G.T., Eisner, A.B., McNamara, G.,

2014. Strategic Management: Text and Cases.

McGraw-Hill/Irwin. New York, Seventh Edition

Donkor, J., Donkor, G.N.A., Kankam-Kwarteng, C.,

Aidoo, E., 2018. Innovative Capability, Strategic

Goals and Financial Performance of SMEs in Ghana,

Asia Pacific Journal of Innovation and

Entrepreneurship, Emerald Publishing Limited, 2398-

7812. EMERALD.

Frost & Sullivan., 2016. Industri Logistik Indonesia

Diprediksi Mencapai Rp 4.396 Triliun Tahun 2020.

Available from: http://industri. bisnis.com/

read/20160303/ 98/524625/industri-logistik-indonesia-

diprediksi-mencapai-rp4.396-triliun-tahun-2020

Gitman, L. J., Zutter, C. J., 2015. Principles of Managerial

Finance. Prentice Hall. USA, 14

th

Edition.

Grant, R. M., Jordan, J., 2015. Foundations of Strategy.

John Wiley & Sons, Ltd. West Sussex-UK, Second

Edition.

Hitt, M. A., Ireland, R. D., Hoskisson, R. E., 2017.

Strategic Management: Concepts: Competitiveness &

Globalization. South-Western-Cengage Learning.

USA, 12

th

Edition.

Hoffmann, E., Osterwalder, F., 2017. Third-Party

Logistics Providers in the Digital Age: Towards a

New Competitive Arena?, Logistics 2017, 1,9.

Inan, G. G., Bititci, U. S., 2015. Understanding

Organizational capabilities and Dynamic Capabilities

in the Context of Micro Enterprises: A Research

Agenda. Procedia-Social and Behavioral Sciences.

Vol. 210. pp. 310-319. ELSEVIER.

Khan, A., Singhal, J., 2015. Growth and Profitability

Analysis of Selected IT Companies. International

Journal of Commerce, Business and Management

(IJCBM). Vol. 4, No. 3

Kim, B. N., Lee, N. S, Wi, J. H., Lee, J. K., 2017. The

Effects of Slack Resources on Firm Performance and

Innovation in the Korean Pharmaceutical Industry.

Asian Journal of Technology Innovation. Vol. 25, No.

3, p.p. 387-406. EMERALD.

Khin, S., Ho, T. C. F., 2018. Digital Technology, Digital

Capability and Organizational Performance: A

Mediating Role of Digital Innovation, International

Journal of Innovation Science, Emerald Publishing

Limited, 1757-2223.EMERALD.

Krisnamurthi, B., 2014. Angkutan Logistik Ekspor

Dikuasai Asing. Kompas. Edisi Cetak: 22 April 2014

Lazonick, W., 2015. The Theory of Innovative Enterprise:

A Foundation of Economic Analysis. AIR Working

Paper #13-0201. Massachusetts: TheAIRnet

Mangan, J., Lalwani, C., 2016. Global Logistics and

Supply Chain Management. John Wiley & Sons Ltd.,

UK

Menteri Perhubungan, 2015. Peraturan Menteri

Perhubungan Republik Indonesia PM 74 Tahun 2015

tentang Penyelenggaraan dan Pengusahaan Jasa

Pengurusan Transportasi

Norall, S., 2013. Non-Asset Based Logistics vs. Asset

Based Logistics: What’s the Difference? Available

from: http://cerasis.com/2013/08/21/ non-asset-based-

logistics/

Othman, R., Arshad, R., Aris, N. A., Arif, S. M. M., 2015.

Organizational Resources and Sustained Competitive

Advantage of Cooperative Organizations in Malaysia.

Procedia-Social and Behavioral Sciences, volume 170

pp. 120-127. ELSEVIER.

Ottosson, S., 2019. Developing and Managing Innovation

in a Fast Changing and Complex World: Benefiting

from Dynamic Principles. Switzerland: Springer

International Publishing AG

Phillips, P., Moutinho, L., 2018. Contemporary Issues in

Strategic Management, Routledge, New York.

Rajapathirana, R.P.J., Hui, Y., 2017. Relationship between

Innovation Capability, Innovation Type, and Firm

Performance. Journal of Innovation & Knowledge,

Vol 3, p.p. 44-55. EMERALD.

Rothaermel, F. T., 2017. Strategic Management.

McGraw-Hill/Irwin. New York, Third Edition

Saglietto, L., 2013. Towards a Classification of Fourth

Party Logistics (4PL). Universal Journal of Industrial

and Business Management. 1(3): 104-116

Sam, M. F. M., Hoshino, Y., 2013. Sales Growth,

Profitability and Performance: Empirical Study of

Japanese ICT Industries with Three ASEAN

Countries. Interdisciplinary Journal of Contemporary

Research in Business. Vol. 4. No. 11

Schilling, M. A., 2017. Strategic Management of

Technological Innovation. McGraw-Hill Education.

New York, Fifth Edition.

Sivalogathasan, V. X., 2015. Intangible Assets, Innovation

Capability and Performance, the Comparative

Analysis in the Textile and Apparel Industry of Sri

Lanka, Journal of Humanities & Social Sciences.

Volume 9. EMERALD.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

238

Skender, H. P., Mirkovic, P. A., Prudky, I., 2017. The

Role of the 4PL Model in a Contemporary Supply

Chain. Scientific Journal of Maritime Research, Vol.

31 (2017), p.p. 96-101. EMERALD.

Sudrajat, D., 2018. Upaya Peningkatan Kinerja

Perusahaan-Perusahaan Jasa Logistik Indonesia

Melalui Peningkatan Kapabilitas Jasa Logistik

Inovatif. Disertasi. Program DRM-BINUS University

Teece, D. J., 2017. Towards A Capability Theory of

(Innovating) Firms: Implications for Management and

Policy. Cambridge Journal of Economics, Vol. 41,

p.p. 693-720

Trott, P., 2017. Innovation Management and New Product

Development. Pearson Education Limited. Harlow,

Sixth Edition

Wang, C. L., Ahmed, P. K., 2007. Dynamic Capabilities:

A Review and Research Agenda. The International

Journal of Management Reviews. 9(1): 31-51.

Available from: https://repository.royalholloway.

ac.uk/file/591eb589-5df7-45b1-89e0-6ed34222d85d/

1/Wang%20 C%20IJMR%20final.pdf

Wheelen, T. L., Hunger, J. D., Hoffman, A.N. and

Bamford, C.E., 2018. Strategic Management and

Business Policy: Globalization, Innovation and

Sustainability. Pearson Education Inc. New York, 15

th

Edition

Wu, X., Sivalogathasan, V., 2013. Intellectual Capital for

Innovation Capability: A Conceptual Model for

Innovation. International Journal of Trade, Economics

and Finance. Vol. 4. No. 3. Available from:

https://pdfs.semanticscholar .org/5b41/6a2d4501aff53

b53f673717d117739d 583b7.pdf

The Importance of Innovative Logistics Service Capabilities for Assets-based Logistics Service Providers

239