Disruption of Financial Performance and Sustainability in Property

and Real Estate Companies in Indonesia for the 2009-2018 Period

Reinandus Aditya Gunawan

1

and Adler Haymans Manurung

2

1

Fakultas Ekonomi Dan Bisnis, Universitas Katolik Indonesia Atma Jaya, Jl.Jend. Sudirman No.51, Jakarta, Indonesia

2

Doctor of Research in Management, Binus Business School, Jakarta, Indonesia

Keywords: Sustainability, Financial Performance, Environment, Social, Governance.

Abstract: Sustainability means that companies must minimize environmental damage and ponder their long-term

sustainability. Sustainability generally includes the environment, societal aspects and governance.

Nowadays, Property and Real Estate industry sector is disrupted because there has been a shift in the pattern

of home purchases by the millennial generation that threatens the sustainability of these property and real

estate companies. This research attempts to find out about the way financial performance has influenced the

sustainability of property companies for the 2009-2018 period. The measurement of the latter’s financial

performance employs the financial ratios consisting of profitability, efficiency, liquidity, leverage and

market, as derived from financial performance and annual reports from 34 companies. Company

sustainability is measured using a scorecard by examining the website and annual report from each

company. This study uses the quantitative approach and employs financial data as stated in the financial

statements of property and real estate industry companies as secondary data. The statistical method for this

study is panel data regression. The novelty of this research can be found in the influence of financial

performance on the sustainability of property companies, a phenomenon that has never been studied. The

results show a concept of how financial performance affects the sustainability of property and real estate

companies in Indonesia.

1 INTRODUCTION

Observing the current conditions, the business world

in Indonesia is influenced by industrial

developments which are often referred to as the 4.0

Industrial Revolution. One of the factors that greatly

influence the sustainability of an industry is the

sustainability factor. Sustainability generally

includes the environment, societal aspects and

governance, often abbreviated as ESG. ESG is

important for investors, governments, regulators,

companies, non-government organizations and the

general public as a measure of whether a company

pays attention to environmental, social and

governance aspects. The ESG score of a company is

directly proportional to the benefits of the company

for the environment, societal aspects and governance

around it.

Sustainability means that companies must

minimize environmental damage, which is a serious

problem as the company develops. In general, the

cause of this damage is that the management of

resources is not carried out optimally but

predominantly focuses on economic purposes.

Environmental pollution will also have an impact on

social problems in the community. For example, the

Lapindo Mud case in Indonesia has caused

tremendous harm to the people around the company

that made the environmental and social impacts.

Sustainability is also related to current

phenomena, especially those observed among the

millennial generation, which will greatly affect the

development of the property industry. Millennials

tend not to be interested in buying property, as their

income is more used to support their lifestyle,

including buying the latest devices, or dine at a

luxurious place in prestigious malls. They do not

think about investing in property for the long term.

Millennials think it is better to use their money for a

vacation abroad than to save the money for a down

payment on a property. They are better off renting a

property than buying property, because if they are

bored somewhere they can easily rent a new place.

This millennial generation's behavior will certainly

Gunawan, R. and Manurung, A.

Disruption of Financial Performance and Sustainability in Property and Real Estate Companies in Indonesia for the 2009-2018 Period.

DOI: 10.5220/0008429602290233

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 229-233

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

229

affect the performance and sustainability of property

companies.

Property business (like any other business) has a

cycle of ups and downs. But the decline experienced

by the property industry in Indonesia is currently

fairly long. The decline in demand for the property

industry has been going on from 2014 until now and

has not shown signs of recovery. Many predict that

the property industry has been going on after the

2019 elections for which investors are currently

waiting There are many factors that affect the

current sluggishness of the property industry in

Indonesia, but perhaps the main problem is that there

has been a property price bubble that rose nearly 40-

50% in 2010-2013 so that fewer people can afford to

buy homes at increasingly high prices. As a result of

this lethargy it is often a question of how property

and real estate companies in Indonesia maintain their

sustainability.

The awareness of the millennials aged 27-37 to

fulfill basic needs in the form of housing is still low,

even though they form a fairly large part of the

workforce in Indonesia, which is estimated to reach

23 million. In addition, residential prices are

increasing from year to year, making it impossible

for them to buy a property. They are only able to

rent because property prices prices do not match

their income. This condition will certainly be

detrimental to them, because renting alone means

they spend money as a cost, while by deciding to

buy property, they will obtain more benefits in the

shape of assets, which at the same time become a

form of investment. In addition, technological

developments support this trend, that is to say people

can easily rent a house, among others, through the

Air BnB application and Airy Rooms. This factor in

technological development has made it easier for the

millennial generation to rent than to buy an asset in

the form of a property at a relatively high price level,

which requires them to take credit to a bank or other

financial institution. Millennials who are also very

familiar with the internet certainly expect that

Information and Communication Technologies

(ICT) must also be well implemented by property

companies. ICT that is not implemented properly

will create inefficiencies in the market, leading to

high transaction costs.

This phenomenon will directly or indirectly

affect the performance of companies in the property

and real estate sector in Indonesia, especially their

financial performance, due to a decrease in the

number of purchases of property and real estate. By

the same token, financial performance will affect the

sustainability of the company. Sustainability is

generally interpreted as a goal or target that covers

the long-lasting balance between the economy,

environment and society. Sustainability is an

ongoing process that is directed towards achieving

this goal. (Lorenz & Lützkendorf, 2008).

Sustainability of the Property and Real Estate

industry is measured using the ESG Score. ESG

stands for Environment, Societal Aspects and

Government. These three variables are measurement

variables from the ESG Score used to measure the

sustainability of a company. This sustainability is a

measurement for the continuity of the company's

long-term existence.

The problem that arises in this study is that there

is some inconsistency in the results of previous

studies where there are certain studies that claim

financial performance affects sustainability while

others say there is no effect at all. A study conducted

by Halbritter & Dorfleitner (2015) concludes that the

stock portfolio using ESG does not produce

abnormal returns, both for companies with high ESG

and with low ESG ratings. This is in line with

research conducted by Lee, Faff, & Rekker (2013)

which says that there is no significant difference in

return between companies that have high and low

corporate social portfolio values. Likewise in the

study of Bauer, Guenster & Otten (2004), stating

that governance does not affect the performance of

the company and Bello (2005) where social

performance does not affect the performance of the

company.

Company performance is generally measured by

its financial performance through stock prices.

Companies with good performance usually have

high stock prices and vice versa. In a study from

Waddock & Graves (1997) social performance and

financial performance showed a positive and

significant relationship whereas in the study of

Gompers & Metrick (2003) it is said that governance

is very influential on company stock returns. Al-

Tuwaijri, Christensen, & Hughes (2004) conclude

that enviromental performance has a significant

influence on financial performance. Likewise in the

study of Friede & Bassen (2015) it is found that

ESG has a positive correlation with financial

performance. Companies that report ESG to to have

low stock volatility and high returns (Ashwin et.al.,

2016).

There are two perceptions, namely whether

sustainability affects financial performance or

financial performance affects sustainability. Since

there are still several differences in various previous

studies, this study seeks to find out what the

conceptual effect is of the financial performance of

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

230

property companies on sustainability. According to

Razali & Adnan (2015), the novelty of this research

study lies in the fact that sustainability in property

companies has been studied but the influence of

financial performance on the sustainability of

property companies has never been subjected to any

academic research study.

2 LITERATURE REVIEW

The basis of sustainability theory is the theory of the

triple bottom line as developed by Elkington (1998),

who said that the measure of a company's success is

whether it can balance three aspects, namely People,

Planet and Profit. These three aspects are measured

by societal, environmental and economic aspects.

This theory was developed when companies were

simply operated to make a profit.

Donaldson & Preston (1995) state that

companies in carrying out company operations are

not solely doing this for the sake of the company,

but must also be responsible to stakeholders of the

company, consisting of shareholders, creditors,

consumers, suppliers, government, and society.

Sustainability disclosures issued in the sustainability

report are generally a form of corporate

responsibility towards stakeholders.

Sustainability of property companies is also

related to the sustainability of the earth as a whole

(Lorenz & Lützkendorf, 2008). The issue of

sustainability develops from environmental

problems, namely in the form of concerns about

pollution and damage to the earth (Razali & Mohd

Adnan, 2015). One measurement of financial

performance on this sustainability property is to use

the returns from companies that measured

sustainability (Halbritter & Dorfleitner, 2015).

The government as the party that oversees the

environment, social and corporate governance

(especially of incorporated companies) is actually

also very concerned about social and environmental

responsibility. This is evidenced by the issuance of

Law No. 40 of 2007 concerning the Limited

Liability Company of the Republic of Indonesia, as

in Article 74 it is stated that the company that carries

out its business activities in the field of natural

resources must carry out social and environmental

responsibilities in which the obligation is budgeted

and calculated as the company's costs, paying

attention to propriety and fairness.

3 HYPHOTHESIS

There are 8 hypotheses that have been used in this

study, namely:

H1: Company liquidity affects the financial

performance of property companies in Indonesia;

H2: The size of the company influences the financial

performance of property companies in Indonesia;

H3: Firm leverage affects the financial performance

of property companies in Indonesia;

H4: Company efficiency affects the financial

performance of property companies in Indonesia;

H5: Financial performance affects the sustainability

of property companies in Indonesia;

H6: The environment affects the sustainability of

property companies in Indonesia;

H7: Societal aspects affect the sustainability of

property companies in Indonesia;

H8: Governance affects the sustainability of

property companies in Indonesia.

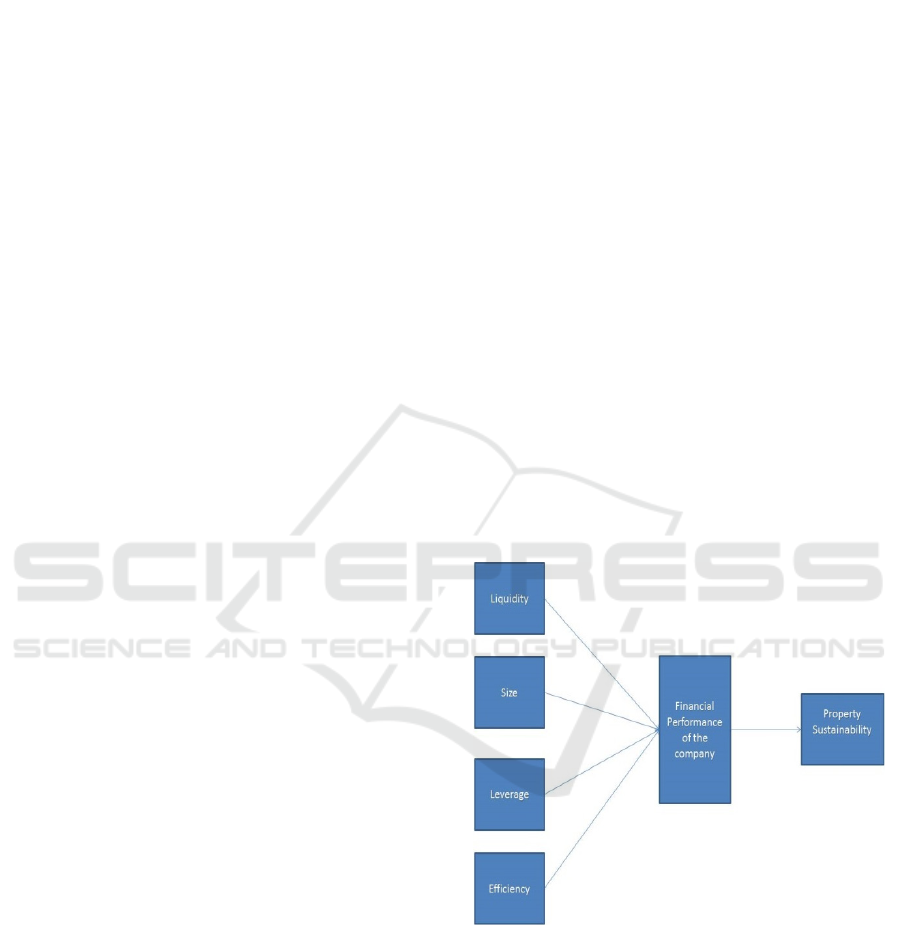

4 RESEARCH MODEL

Figure 1 below depicts the research model used in

this study:

Figure 1: Research Model.

5 RESEARCH METHOD

The approach used is a quantitative approach, so that

this study predominantly uses financial data,

specifically the financial statements of incorporated

(Tbk.) companies in the property and real estate

industry sector as secondary data for the 2009-2018

period. The data to be used is obtained from the

Disruption of Financial Performance and Sustainability in Property and Real Estate Companies in Indonesia for the 2009-2018 Period

231

financial statements of these incorporated companies

which is secondary data, collected by techniques

downloaded from the page www.idx.co.id. and

www.yahoofinance.com The sustainability data

consisting of Environment, Social and Governance

(ESG) scores are obtained from the company's

annual report using the content analysis method

(using scoring). (Razali, Yunus, Zainudin, & Lee

Yim Mei, 2017)

The sampling technique used in this study

consists of purposive sampling with the following

criteria:

1. Samples are taken from Property and Real Estate

companies that have been listed on the Indonesia

Stock Exchange from 2009 – 2018;

2. The sample measuring their financial

performance and sustainability was measured

using 16 measurement attributes.

The financial performance of a property company is

measured by efficiency ratios, liquidity ratios and

leverage ratios (Chan & Aziz, 2016), while size is

measured using market capitalization.

In this study there are 16 sustainability attributes,

namely the sustainable concept mentioned, the

sustainability in corporate social responsibility

statement in organisation, the environmental issues

statement, the special section on sustainability, the

policy on sustainability, the sustainability award

recognition, the green/ environmentally projects, the

social sustainability, the status of environmental

management system, the environmental system audit

programme in organisation, the conformance with

environmental, the code standards, the objectives or

targets relating to priority environmental issues in

the organisation, the initiatives on sustainability

practices, the awareness programmes, the

sustainable strategies, and the financial report with

integrated sustainability information. (Razali,

Yunus, Zainudin, & Lee Yim Mei, 2017)

.

Meanwhile in the measurement of financial

performance the ratio used is profitability ratios

which consists of net profit margins, return on

average assets, and return on average equity;

efficiency ratios consisting of sales to assets ratio

and sales to net working capital, liquidity ratios

consisting of current ratio and quick ratio (Chan &

Aziz, 2016), where the formula of the financial

ratios above as in figure 2.

Figure 2: Financial Ratios.

The statistical method used for this study is panel

data regression. Panel data is a combination of time

series data and cross section data. Panel data consists

of two types, namely balanced panel data if in each

period the same amount of data is found, and

unbalanced panel data if in each period the data is

not the same amount. If the panel data has a number

of periods greater than the number of individuals, a

fixed effect is used, but if the period is smaller,

random effects are to be used.

6 RESULT & DISCUSSION

After all financial ratios are calculated and all

companies have been ranked based on sustainability

attributes from the largest to the smallest, regression

statistical analysis is performed using panel data. In

the regression with the next panel data, it is first seen

whether the data obtained is balanced or unbalanced.

Next by using Eviews 10 software, the Chi-square

test and Lagrange multiplier test were conducted to

determine whether the panel data test in this study

used the common effect, fixed effect, or random

effect method. If the chi-square result is greater than

0.05, the common effect is chosen compared to the

fixed effect. In the Lagrange multiplier test, it will

be seen whether the p value of greater than 0.05 then

the common effect is chosen compared to the

random effect.

After determining which panel data regression

test is used between the common effects, fixed

effects, or random effects, the next step is

conducting test panel data regression using Eviews

software. For each independent variable tested,

namely liquidity, size, leverage and efficiency, see

which p value is lower than 0.05. If the p value on

the independent variable is lower than 0.05, it means

that the independent variable has a significant effect

on the dependent variable, namely sustainability of

the company. Besides that, what needs to be seen

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

232

from the regression results is the r square value,

where if the r square value is greater than 0.05, then

the four independent variables, namely liquidity,

size, leverage, efficiency are considered

simultaneously to affect the dependent variable.

The results of this research form a concept of

how financial performance affects the sustainability

of incorporated companies, especially property and

real estate companies in Indonesia.

7 CONCLUSIONS

This research study provides a concept of the way

financial performance affects the sustainability of

incorporated companies, especially property and real

estate companies in Indonesia. The 8 hypotheses

mentioned above should be proven based on data

collected from www.idx.co.id. and

www.yahoofinance.com.

This research still needs to be tested empirically

by testing how the regression of financial

performance influences the sustainability of

incorporated companies, especially in property and

real estate companies in Indonesia. The results of

this study will demonstrate a concept of how

financial performance affects the sustainability of

incorporated companies, especially property and real

estate companies in Indonesia.

REFERENCES

Ashwin Kumar, N.C., Smith, C., Badis, L., Wang, N.,

Ambrosy, P. and Tavares, R., 2016. ESG factors and

risk-adjusted performance: a new quantitative model.

Journal of Sustainable Finance & Investment, 6(4),

pp.292-300.

Bauer, R., Guenster, N. and Otten, R., 2004. Empirical

evidence on corporate governance in Europe: The

effect on stock returns, firm value and performance.

Journal of Asset management, 5(2), pp.91-104.

Bello, Z.Y., 2005. Socially responsible investing and

portfolio diversification. Journal of Financial

Research, 28(1), pp.41-57.

Donaldson, T. and Preston, L.E., 1995. The stakeholder

theory of the corporation: Concepts, evidence, and

implications. Academy of management Review, 20(1),

pp.65-91.

Elkington, J., 1998. Partnerships from cannibals with

forks: The triple bottom line of 21st‐century business.

Environmental quality management, 8(1), pp.37-51.

Friede, G., Busch, T. and Bassen, A., 2015. ESG and

financial performance: aggregated evidence from more

than 2000 empirical studies. Journal of Sustainable

Finance & Investment, 5(4), pp.210-233.

Gompers, P., Ishii, J. and Metrick, A., 2003. Corporate

governance and equity prices. The quarterly journal of

economics, 118(1), pp.107-156.

Halbritter, G. and Dorfleitner, G., 2015. The wages of

social responsibility—where are they? A critical

review of ESG investing. Review of Financial

Economics, 26, pp.25-35.

Lee, D.D., Faff, R.W. and Rekker, S.A., 2013. Do high

and low-ranked sustainability stocks perform

differently?. International Journal of Accounting &

Information Management, 21(2), pp.116-132.

Lorenz, D. and Lützkendorf, T., 2008. Sustainability in

property valuation: theory and practice. Journal of

Property Investment & Finance, 26(6), pp.482-521.

Razali, M.N. and Mohd Adnan, Y., 2015. Sustainable

property development by Malaysian property

companies. Property Management, 33(5), pp.451-477.

Razali, M.N., Md. Yunus, N., Zainudin, A.Z. and Lee Yim

Mei, J., 2017. Sustainable property development by

Southeast Asian property companies. Property

Management, 35(1), pp.109-126.

Waddock, S.A. and Graves, S.B., 1997. The corporate

social performance–financial performance link.

Strategic Management Journal, 18(4), pp.303-319.

Disruption of Financial Performance and Sustainability in Property and Real Estate Companies in Indonesia for the 2009-2018 Period

233