Factors Affecting Profitability of Retail Company in Indonesia with

DUPONT Model Approach

Bobby Chandra and Dadan Rahadian

Master of Management Students, Telkom University, Bandung, Indonesia

Keywords: DuPont, Return on Equity, Net Profit Margin, Total Asset Turn Over, Equity Multiplier.

Abstract: In the end of 2017 some retail’s outlet was closed to survive in the business competition. This research will

determine the factors that affect the profitability of the retail industry in Indonesia. DuPont model shows that

profitability (ROE) could be divided into three ratios, namely Net Profit Margin (NPM), Total Asset Turn

Over (TATO), and Equity Multiplier (EM). This study aimed to determine how significant the influence of

NPM, TATO and EM factors had on profitability (ROE). The method used in this study was quantitative. The

number of samples used was 21 companies with a population of all retail companies listed on the Stock

Exchange for the period of 2010-2017. The results of this study indicated that in part the independent variables

significantly influence the variable profitability (ROE).

1 INTRODUCTION

The development of retail business in Indonesia has

proceeded to impact on intense business competition.

Throughout 2017, there were quite surprising

phenomena in Indonesia’s retail industry, some

industries closed a number of outlets to survive the

business competition, and even some international

retail industries closed their businesses. Take Lotus

as an example. At the end of 2017, Lotus closed three

outlets in Thamrin, Cibubur, and Bekasi; besides that

Ramayana Supermarket closed eight outlets on

October 28, 2017. Not to mention that Matahari

Department store also closed its outlets in Pasaraya

Manggarai and Pasaraya Blok M in September 2017,

and in mid-November 2017, Matahari closed its

outlets in the Lombok city center and Taman Anggrek

mall. Even at the end of June 2017, PT. Modern

International, tbk closed all Seven Eleven outlets in

Indonesia. This, of course, will be one particular

concern to the stakeholders, especially investors,

because the steps taken by market participants are

expected to increase the company's profits once more.

With regard to generating profits, according to

Harahap (2006:300), the ability of a company to make

a profit through all capabilities and existing resources

is called profitability. Profitability can be a major

attraction for investors because profitability can be

considered as a result obtained through a management

effort on the invested funds.

Based on the mentioned phenomena, the authors

are interested in conducting research on the retail

sector, especially regarding the performance of retail

companies in Indonesia in relation to generating

profitability. ROE is a parameter which can be used

as a comparison between the net incomes of an issuer

with its own capital (Harahap 2007: 156). Regarding

profitability, the DuPont model can be utilized to

measure the variables affecting a company's

profitability through analyzing profitability ratios,

into more detailed elements, so factors which can

affect the profitability of the company can be

searched.

2 LITERATURE REVIEW

2.1 Profitability and DuPont Model

According to Burja & Mǎrginean (2014), the name of

the DuPont model came from the name of the

company which began to introduce the formula in

1920, and was also known as the "Strategic Profit

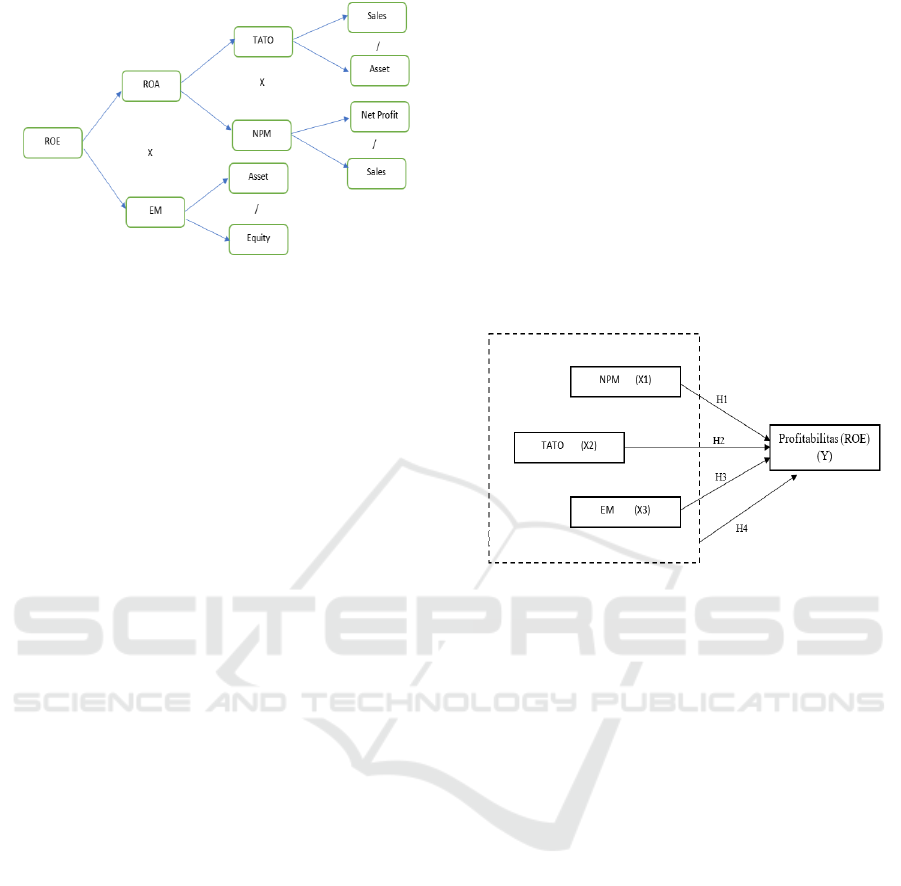

Model". In the DuPont model, profitability based on

the ROE variable can be illustrated in the following

diagram:

136

Chandra, B. and Rahadian, D.

Factors Affecting Profitability of Retail Company in Indonesia with DUPONT Model Approach.

DOI: 10.5220/0008428401360142

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 136-142

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Figure 1: ROE Profitability of DuPont Model.

From the description of the DuPont model above, the

main ratio components can be described as follows:

2.1.1 Net Profit Margin (NPM)

Net Profit Margin is a profitability ratio which

describes the number of profits generated from sales

(Anarfi & Danquah, 2017). This means that the size

of the sales value will affect the ratio of the net profit

margin. Based on the DuPont model in figure 1, the

Net Profit Margin ratio can be formulated as follows:

NPM = Net Profit / Sales

2.1.2 Total Asset Turn Over (TATO)

Total Asset Turn Over is a ratio which describes the

company’s efficiency to generate sales (Anarfi &

Danquah, 2017). This is related to the efficiency in the

company, where the more efficient the company uses

its assets, the higher the sales. The Total Asset Turn

Over ratio can be formulated as follows:

TATO = Sales / Asset

2.1.3 Equity Multiplier (EM)

Equity Multiplier is a ratio which can depict the

percentage of financed/owned assets by shareholders

(Anarfi & Danquah, 2017). Equity Multiplier ratios

are often known as Financial Leverage. Financial

Leverage is determined by debt policy, dividend

policy and financial risk factors in the business. Based

on the DuPont model in figure 2-1, the ratio of Total

Asset Turn Over can be formulated as follows:

EM = Asset/ Equity

2.1.4 Return on Equity (ROE)

According to Harahap (2007: 156), ROE is a

comparison between the net incomes of an issuer with

its own capital. High ROE reflects that the company

managed to generate profits from its own capital. In

this study, the ROE variable will be used as a

measurement of profitability. The reason for choosing

this variable is because ROE can provide a level of

profit for capital invested by investors. The increase

in ROE will also boost the book value of the company

which impacts on the value of investment. The ROE

ratio can be calculated using the following formula:

ROE=Net Profit/Equity

ROE = NPM X TATO X EM

ROE = Net Profit/Sales X Sales/Asset X Asset/Equity

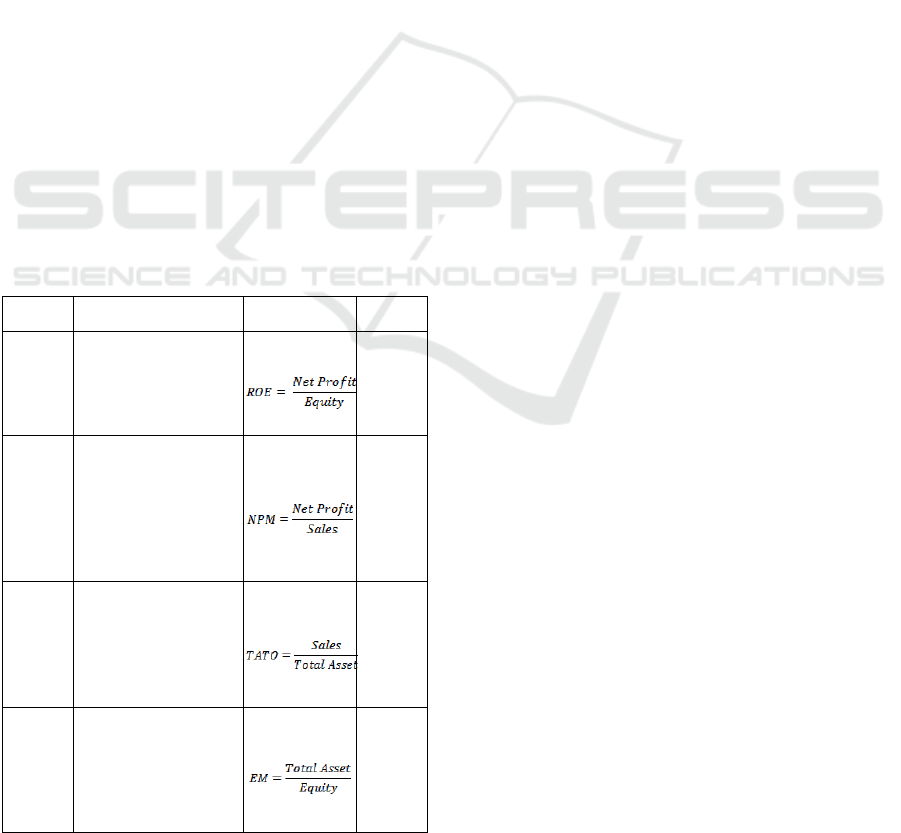

2.2 Research Model

Figure 2: Research Model.

Based on the research model in Figure 2, the

hypothesis which will be proposed in this study are:

H1: Net Profit Margin (NPM) variable has a

positive and significant effect on profitability

H2: Total Asset Turnover (TATO) variable has a

positive and significant effect on profitability

H3: Equity Multiplier (EM) variable has a positive

and significant effect on profitability

H4: Net Profit Margin (NPM), Total Asset Turn

Over (TATO) & Equity Multiplier (EM) have

a positive and significant effect on

profitability

3 RESEARCH METHOD

3.1 Research Types

The research type used in this study was associative

causal, based on the purpose of this study which is to

prove the causal relationship of several independent

variables on the dependent variable according to

established theories/models.

Factors Affecting Profitability of Retail Company in Indonesia with DUPONT Model Approach

137

3.2 Sample and Population

The population is 25 retail companies which have

been marketed on the IDX stock market for the period

2010-2017. The sampling technique in this study used

purposive sampling, namely:

• The retail companies are listed on the IDX and

have complete financial statements for the period of

2010-2017

• The retail companies which have complete

financial statements for the period of 2010-2017

• The Retail companies whose financial statements

do not have total equity, total assets and total sales

equal to 0 (zero), because it will result in failure at the

time of calculation

3.3 Data Collection

This study used secondary data collection methods,

namely data obtained from financial statements in the

period of 2010-2017. The data source used in this

study was the company's financial statements for the

period of 2010-2017 which can be obtained from the

company's official website.

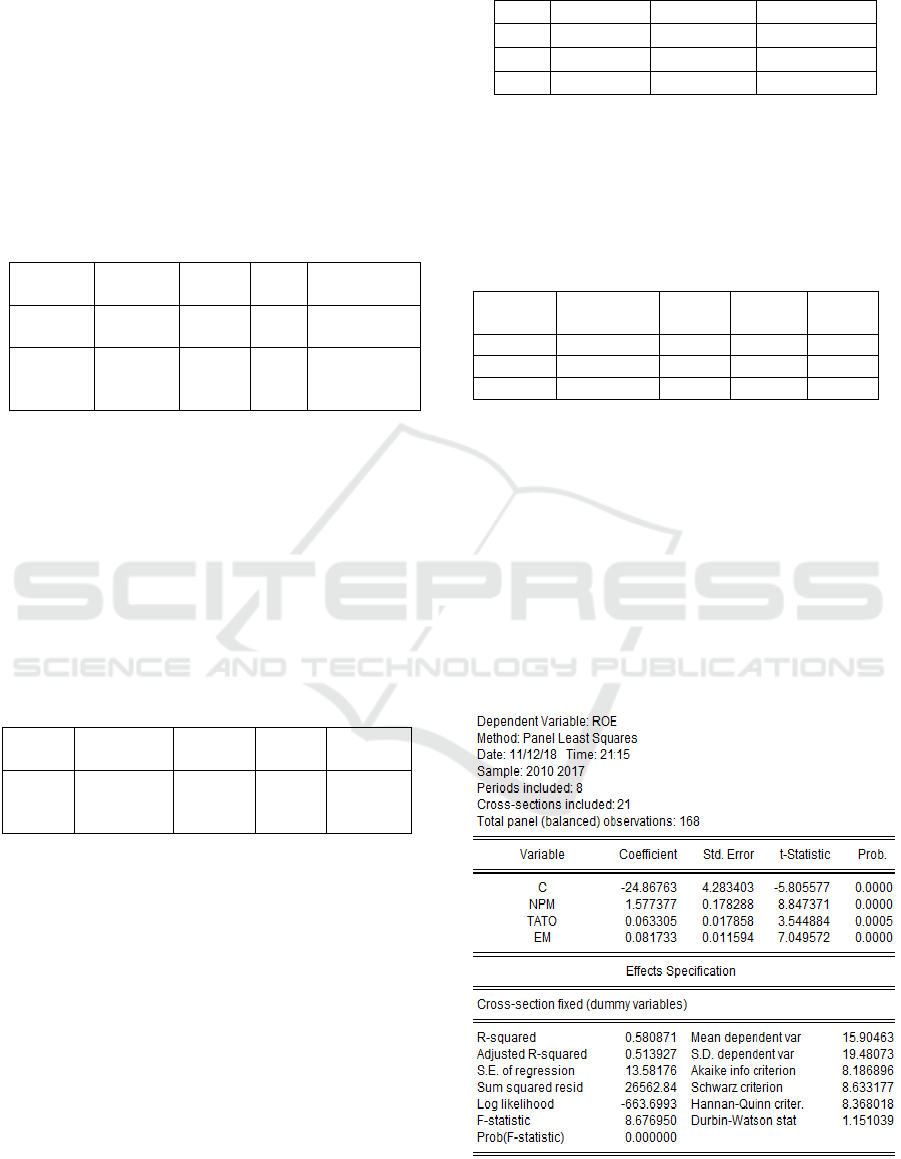

3.4 Research Operational Variables

In detail, the variables used in this study are as

follows:

Table 1: Research Operational Variables.

Variable

Definition

Formula

Scale

ROE

Return on Equity is a

comparison on the net

profit of an issuer with

its own capital

(Harahap 2007:156).

Ratio

NPM

Net Profit Margin is a

profitability ratio

which deptict how

significant the profit

produced from sales is

(Anarfi & Danquah,

2017).

Ratio

TATO

Total Asset Turn Over

is a ratio which depicts

company’s efficiency

in producing sales

(Anarfi & Danquah,

2017)

Ratio

EM

Equity Multiplier is a

ratio which can show

the financed/owned

asset percentage of the

stakeholder (Anarfi &

Danquah, 2017).

Ratio

3.5 Descriptive Statistic Analysis

Descriptive analysis refers to the statistical values of

the data which have been collected, such as: mean

value, standard deviation, maximum value, minimum

value of all variables in the study, namely:

profitability (ROE), net profit margin (NPM), total

asset turn over (TATO), and equity multiplier (EM).

3.6 Estimation Selection of Common

Effect Model and Fixed Effect

Model

To determine the model used in the regression

between the Common Effect Model and the Fixed

Effect Model, the F Statistic Test (Chow) is

performed. The hypotheses used in the F Test (Chow)

are as follows:

H0: Model Common Effect

H1: Model Fixed Effect

H0 is accepted if the P-value is greater than the

value of α, whereas if the P-value is smaller than the

value of α, then H0 is rejected, and H1 will be

accepted.

3.7 Estimation Selection of Fixed Effect

Model and Random Effect Model

If the result of the F Test (Chow) shows that the P-

value is smaller than the value of α or the fixed effect

model is used more significantly than the common

effect model, further testing is needed to determine

whether to use the fixed effect model or random effect

model.

3.8 Estimation Selection of Common

Effect Model and Random Effect

Model

If the result of the F test (Chow) shows that the P-

value is greater than the value of α, or the common

effect model is used more significantly than the fixed

effect model, further testing is needed to determine

whether the common effect model will still be

selected or the random effect model. To determine

whether to choose the common effect model or

random effect model, the Lagrange Multiplier (LM)

test is used.

3.9 Classic Assumption Test

To find out whether the regression model that we used

in the study fulfilled the BLUE criteria, then a

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

138

multiple linear regression prerequisite test was

conducted, namely the Classic Assumption test.

According to Gujarati (2015), only multicollinearity

and heteroscedasticity tests are needed in panel data

regression for classical assumption tests.

3.9.1 Multicollinearity Test

According to Ghozali (2005), Multicollinearity Test

aims to detect whether the independent variables in

the regression model are correlated. If there is a

correlation between the independent variables, then

the variable can be said to be not orthogonal. To

measure the occurrence of multicollinearity in the

regression model, it can be seen from the correlation

coefficient between each independent variable. If the

coefficient is> 0.80, multicollinearity occurs in the

regression model.

3.9.2 Heteroscedasticity Test

According to Ghozali (2013:139), Heteroscedasticity

test aims to detect whether inequality of variance

between a variable to another variable in the

regression model happened. If the residual variance

between one variable and another variable was

constant then it is called homoscedasticity, otherwise

it is called heteroscedasticity. A good regression

model is a model without heteroscedasticity.

Heteroscedasticity test can be done by the following

Glesjer test:

¦e

i

¦ = β

1

X

i

+ V

t

note:

β = absolute value, residual value of the

estimated equation

X

i

= explanatory variable

V

t

= interference element

3.10 Regression Equation Analysis

The data analysis technique used is multiple

regression analysis. Its function is to predict the value

of the dependent variable (Y) if the independent

variable (X) is two or more (Abdurahman & Muhidin,

2007: 198). In this study, the variables measured are

the effects of Net Profit Margin, Total Asset Turn

Over and Equity Multiplier as the variables on

profitability by using the following equation:

Y

i,t

= a + b

1

X

1

+ b

2

X

2

+ b

3

X

3

+ μ

i,t

Note:

Y : dependent variable, namely

retail company’s profitability

X

1

: Net Profit Margin

X

2

: Total Asset Turn Over

X

3

: Equity Multiplier

a : variable/constant number

b

1

, b

2

, b

3

: regression equation

μ

i,t

: residual variable, the i

entity, t

period

3.11 F Test

The purpose of this test is to find out whether the

independent variables simultaneously or as a whole

have a significant effect on the dependent variable.

The hypothesis used in this test is:

H0: The independent variables as a whole have a

significant effect on the dependent variable

H1: The independent variables as a whole have no

significant effect on the dependent variable. This test

is conducted by comparing F

count

with F

table

.

3.12 T-Test

The T-test is a test conducted to find out whether the

independent variable has a single influence on the

dependent variable by comparing the value of t

count

in

each independent variable with the value of t

table

. The

hypotheses that can be used in this test are:

H0: singly independent variable (X) has a

significant effect on the dependent variable (Y)

H1: singly independent variable (X) does not have

a significant effect on the dependent variable (Y)

4 ANALYSIS AND DISCUSSION

4.1 Descriptive Statistic Analysis

Table 2: Descriptive Statistic Analysis.

ROE

NPM

TATO

EM

Mean

15.90

5.52

190.13

245.11

Median

12.66

3.23

190.34

220.11

Maximum

160.99

68.10

717.94

873.47

Minimum

-39.91

-13.46

6.40

-151.68

Std. Dev.

19.48

7.72

104.87

138.38

Skewness

3.60

3.67

1.43

1.01

Kurtosis

24.38

27.67

7.88

5.64

Observations

168

168

168

168

Based on descriptive statistical analysis in table 2, the

maximum value of profitability is 160.99, and the

average value is 15.90.

Factors Affecting Profitability of Retail Company in Indonesia with DUPONT Model Approach

139

4.2 Estimation Selection of Common

Effect Model and Fixed Effect

Model

To determine the most suitable approach, Chow Test

is used. The hypothesis used is as follows:

H0: Value of F

count

> F

table

(0.05), then Common

Effect Model is chosen

H1: Value of F

count

< F

table

(0.05), then Fixed

Effect Model is chosen

Table 3. Chow Test Result.

Effect

Test

Statistic

d.f

Prob

Result

Cross-

section F

2.741470

(20.144)

0.0003

H0 is rejected,

H1 is accepted

Cross-

Section

Chi Square

54.202488

20

0.0001

4.3 Estimation Selection of Fixed Effect

Model and Random Effect Model

To determine the approach chosen between Fixed

Effect and Random Effect, the Hausman method is

used.

H0: Value of F

count

> F

table

(0.05),

then Random Effect Model is chosen

H1: Value of F

count

< F

table

(0.05),

then Fixed Effect Model is chosen

Table 4: Haussman Test Result.

Effect

Test

Ch-Sq.

Statistic

Chi-Sq. df

Prob.

Result

Cross-

section

random

8.392824

3

0.0386

H1 is

accepted

4.4 Estimation Selection of Common

Effect Model and Random Effect

Model

Lagrange Multiplier (LM) tests to choose between the

Common Effect Model and Random Effect Model do

not need to be conducted. This is because from the

results of the F (Chow Test) and Haussman tests, the

most effective model is the Fixed Effect Model.

4.5 Multicollinearity Test

Table 5 illustrates the results of the Multicollinearity

test. From the results of these tests, it can be seen that

Table 5: Multicollinearity Test Results.

NPM

TATO

EM

NPM

1.000000

-0.008336

0.096208

TATO

-0.008336

1.000000

0.434725

EM

0.096208

0.434725

1.000000

there is no correlation coefficient value above 0.8,

this proves that the data do not occur

multicollinearity.

4.6 Heteroscedasticity Test

Table 6. Heteroscedasticity Test Results.

Variable

Coefficient

Std.

Error

t-

statistic

Prob.

NPM

0,0187

0,0137

1,3592

0,1762

TATO

0,0017

0,0013

1,2945

0,1975

EM

0,0012

0,0008

1,3421

0,1817

From the results of the Heteroscedasticity test in

Table 6, it is seen that the probability value of each

variable is above 0.05 so that the data does not have

heteroscedasticity towards the variables.

4.7 Panel Data Regression

Table 7 illustrates Panel Data Regression result, it is

seen the correlation between the independent variable

and dependent variable.

Table 7. Panel Data Regression Result.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

140

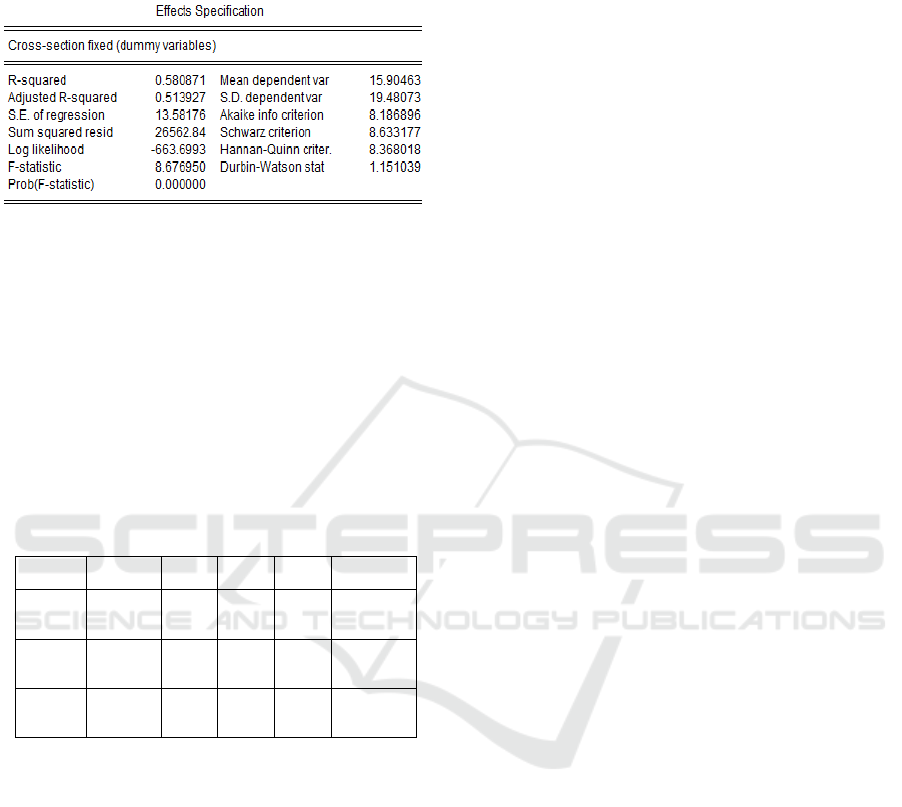

4.8 F Test

Table 8: F Test Result.

From the results of the data processing above, the F

value is 8.68, while the F table value is 2.66, so the

calculated F value is greater than F table. Besides that

the value is seen from P-value, the value is 0.0000,

which is smaller than 0.05. From these results, it can

be concluded that simultaneously and as a whole, net

profit margin, the total asset turn over and equity

multiplier as the independent variables significantly

influence the variable profitability (ROE).

4.9 t-Test

Table 9. t Test Result.

Variable

Coefficient

Std.

Error

t.

statistic

Prob

Result

NPM

1.577377

0.178288

8.847371

0.0000

Influenced

positively and

significantly

TATO

0.063305

0.017858

3.544884

0.0005

Influenced

positively and

significantly

EM

0.081733

0.011594

7.049572

0.0000

Influenced

positively and

significantly

Based on the table 9, all variables partially influence

profitability, where t statistic> t table (1.654).

5 CONCLUSION & SUGGESTION

5.1 Conclusion

5.1.1 Net Profit Margin’s (NPM) Influence

toward Profitability

The hypothesis one proposed in this study is the

variable of Net Profit Margin (NPM), which has a

positive and significant effect on profitability. Based

on the results of data processing, it can be seen that

the variable of Net Profit Margin (NPM) affects

profitability by having the highest coefficient of 1.58

on profitability. In addition, the value of t

count

is 8.85>

t

table

(1.654), and the significance value is 0.00 <0.05.

Thus, it can be concluded that H1 in this study was

accepted.

5.1.2 Total Asset Turn Over’s (TATO)

Influence toward Profitability

The second hypothesis proposed in this study is that

the Total Asset Turn Over (TATO) variable has a

positive and significant effect on profitability. Based

on the results of data processing, it can be seen that

the Total Asset Turn Over (TATO) variable has an

effect on profitability by having a coefficient that is

0.06 on company profitability. In addition, the value

of t

count

is 3.54> t

table

(1.654), and the significance

value is 0.00 <0.05. Thus, it can be concluded that H2

in this study was accepted.

5.1.3 Equity Multiplier (EM) Influence

toward Profitability

The third hypothesis proposed in this study is that the

Equity Multiplier (EM) variable has a positive and

significant effect on profitability. Based on the results

of data processing, it can be seen that the Equity

Multiplier (EM) variable affects profitability by

having a coefficient that is 0.08 on the retail

company’s profitability. In addition, the value of t

count

is 7.05> t

table

(1.654), and the significance value is

0.00 <0.05. Thus, it can be concluded that H3 in this

study was accepted.

5.2 Suggestion

- Based on the conducted calculations, the results

show that all variables have a positive and

significant influence on the retail company’s

profitability. However, the Net Profit Margin

variable has the highest coefficient, which needs

to be considered for retail market players. The one

way that can be done to increase the ratio of Net

Profit Margin is to reduce the operating costs, so

it can increase its net profit.

- It is recommended to add variables that affect the

retail company’s profitability in Indonesia in

order to find other factors as the profitability

determinants of retail companies.

- In this study, the obtained results showed the

highest coefficient in generating the profitability

of a retail company is from Net Profit Margin.

Therefore, further research can continue to

analyze the factors which affect the Net Profit

Margin variable.

Factors Affecting Profitability of Retail Company in Indonesia with DUPONT Model Approach

141

- It is recommended that further research can add a

wider scope such as ASEAN or other countries, so

it can be a study for retail companies in various

countries.

REFERENCES

Abdurahman, M. & Muhidin, S. A. (2007). Correlation,

Regression, and Path Analysis in Research. Bandung:

Badan Penerbit Pustaka Setia

Anarfi, D. & Danquah, K. A. B. (2017). Determinants of

Return on Equity in the Czech Agric and Forest

Industry. Journal of Innovative Research in Business &

Economics - ISSN - 2456-7868 Vol. 1, Issue 1, Page

01-49, April 2017

Burja, V. & Mărginean, R. (2014). The study of factors that

may influence the performance by the Dupont analysis

in the furniture industry, 21st International Economic

Conference 2014, IECS 2014, 16-17 May 2014, Sibiu,

Romania

Ghozali, I. (2005). Multivariate Analysis Aplication using

SPSS. Semarang. Indonesia: UNDIP.

Ghozali, I. (2013). Multivariate Analysis Aplication using

SPSS, 7

th

Edition (pp.139). Semarang. Indonesia:

UNDIP.

Gujarati N. Damodaran, Dawn C. P. (2015). Basic

Econometrics. Fourteenth Edition.

Halomoney. (2017). Retrieve from: https://

www.halomoney.co.id/

Harahap, S. S. (2006). Critical Analysis of the Financial

Report (pp.300). Jakarta. Indonesia: Raja Grafindo

Perkasa Ltd.

Harahap, S. S. (2007). Critical Analysis of the Financial

Report, 1

st

Edition (pp.156). Jakarta. Indonesia: Raja

Grafindo Persada Ltd.

IDNFinancial. (2018). Retrieve from: https://

www.idnfinancials.com/

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

142