Equity Valuation on Property and Real Estate Listed Companies in

2018: Evidence from Indonesia Stock Exchange

Riko Hendrawan, Palti M.T. Sitorus, and Ernest L.P. Siagian

Management of Business and Economics Faculty of Telkom University, Bojongsoang, Bandung, Indonesia

Keywords: Fair Value, Free Cash Flow to Firm, Market Price, Overvalued, Relative Valuation, Undervalued.

Abstract: Investment in the form of shares of stock valuation analysis is required to estimate the intrinsic value or a

reasonable price of the stocks based on fundamental data. The objective of this study was to valuate the

intrinsic value of stock price at Property and Real Estate Companies listed on IDX 2018. The valuation was

carried out comprehensively by using Discounted Cash Flow (DCF) method of Free Cash Flow to Firm

(FCFF) approach, and to validate the results this study used the Relative Valuation method with Price to

Earnings Ratio (PER) and Price to Book Value (PBV) approaches. The methods were applied in three

scenarios of pessimistic, moderate and optimistic with the historical data of the companies from 2013 to

2017 as the basis for the projections of the 2018-2022 period. By comparing the results of the fair value of

the stocks in the market on January 1, 2018, the DCF-FCFF method concluded that CTRA was undervalued

in all scenario, while LPKR and BSDE were overvalued in all scenario. The PER and PBV analysis found

that all evaluated stocks within the industry ranged. It means that the valuation results are correct.

Therefore, in conclusion, this study recommends to sell LPKR and BSDE shares and buy CTRA shares.

1 INTRODUCTION

To facilitate the investment activities, the

Government of the Republic of Indonesia on

December 1, 2017, merged two major Indonesian

capital markets of the Jakarta Stock Exchange (JSX)

and the Surabaya Stock Exchange (BES) into the

Indonesia Stock Exchange (IDX). One of the most

important things is that in addition to managing the

current stocks, the IDX also manages sharia stocks

as one of the investment tools. IDX provides a sharia

index that can be a reference in investing, which is

known as the Indonesia Sharia Stock Index (ISSI)

launched on May 12, 2011. Currently, according to

the IDX data, 366 of the 573 listed stocks are sharia

stocks. On April 2018, the number of sharia stocks

investors reached 29,670 investors or if it is

calculated from the end of 2013 to April 2018, the

number of sharia stock investors had increased by

3,594.89%.

The capital market of Indonesian sharia itself is

considered to be quite competitive. ISSI was

launched in 2011, and by April 2018 this index had

grown by 44%. Some of the business sectors listed

on the Indonesia Stock Exchange (IDX) and

included in the ISSI calculation are the sectors of

property, real estate, and building construction.

Following the IDX data of quarterly statistics, in the

1

st

quarter (IDX 2018), there were 41 companies

listed on the calculation of the Indonesia Sharia

Stock Index (ISSI). Up to the first quarter of 2018,

there were three property and real estate sector

companies having the most significant asset value.

The first was PT Lippo Karawaci Tbk. (LPKR)

whose value of its total asset was IDR 57.63 trillion.

The next was PT Bumi Serpong Damai Tbk.

(BSDE) with the total assets of IDR 48.58 trillion.

The third was PT Ciputra Development Tbk.

(CTRA) having its total asset of IDR 32.29 trillion.

The amount of profit and its multiplier effects

encourages many investors to choose the property

and real estate sector as one of their choices to

invest. However, up to now, there is still a rare study

of the valuation analysis of companies in

determining the fair value of stocks, especially in the

property and real estate sector which is included in

the calculation of the Indonesia Sharia Stock Index

(ISSI). Though, investors are very interested in this

sector.

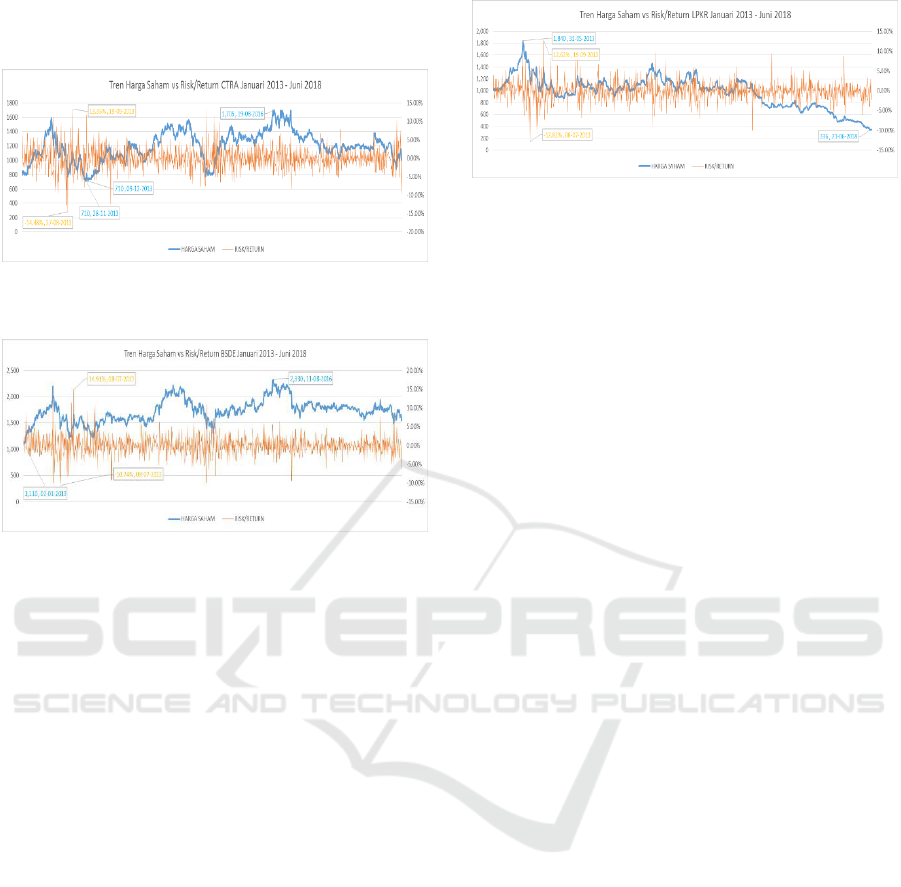

Based on Figure 1.1, it can be concluded that

there are fluctuations in the value of stock prices

and yields, both negative and positive. PT. Ciputra

Hendrawan, R., Sitorus, P. and Siagian, E.

Equity Valuation on Property and Real Estate Listed Companies in 2018: Evidence from Indonesia Stock Exchange.

DOI: 10.5220/0008427600650073

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 65-73

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

65

Development Tbk. (CTRA) Has the highest

share

Figure 1.1: Stock Price Trends vs. CTRA Risk / Return

January 2013 - June 2018.

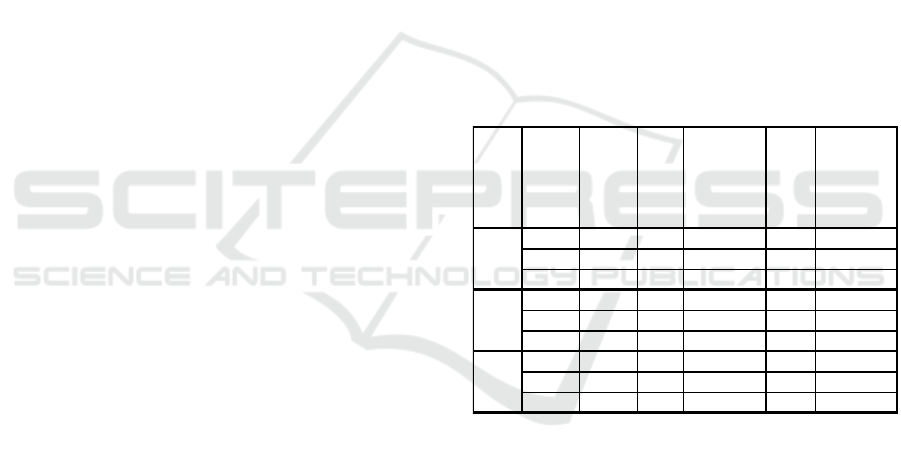

Figure 1.2: Stock Price Trends vs. BSDE Risk / Return

January 2013 - June 2018.

price value on August 19, 2016, with a value of

1,705 and found its lowest price on November 28,

2013, and December 9, 2013, with a value of 710.

As for the condition of risk and return from this

company also increased and decreased 13.35%

positive returns on September 19, 2013, and

experienced negative returns on August 27, 2013,

with a value of -14.48%.

Figure 1.2 shows that in the period of January

2013 to June 2018 there was an increase in the share

price of PT. Bumi Serpong Damai Tbk., On August

11, 2016, amounted to 2,330 and was at its lowest

point on January 2, 2013, and was at 1,110. For the

highest yield occurred on July 8, 2013, namely

getting a return of 14.91%, while the most

significant risk occurred on July 8, 2013, which was

equal to -10.74%.

Based on Figure 1.3, it can be seen that the same

thing happened with PT. Lippo Karawaci

Tbk.

Figure 1.3: Stock Price Trends vs. LPKR Risk / Return

January 2013 - June 2018.

(LPKR), this company had the highest share value

on May 31, 2013, with a value of 1,840, and had the

lowest share value on June 21, 2018, with a value of

336. Then for risk and return, the most significant

return occurred on September 19, 2013, with an

increase of 12.62% and the most significant risk

occurred on July 8, 2013, with a percentage of -

12.82%.

Damodaran (2006) suggested that the

requirement helping investors to make the right

decision in choosing an investment is to know the

value of assets that will be a kind of funds

investment object, which provides value to the asset.

The valuation of an asset becomes very important in

the world of investment because errors in the

valuation of an asset will affect the return generated.

Such information can help investors in deciding their

investment on the company's stock, whether the

stocks are bought, held or sold. For the company

owners, the information is useful as a basis in

evaluating their company performance when their

company stocks are undervalued because their stock

value is lower than the intrinsic value or fair value,

and when the stocks are overvalued because in the

market the stock value is higher than the intrinsic

value or the fair value.

From the phenomena above, the aims of this

research is to assess the fair value (intrinsic value) of

the current property and real estate sub-sector

companies listed on the Indonesia Stock Exchange

(2013-2018) using the Discounted Cash Flow (DCF)

method with the Free Cash Flow to Firm (FCFF)

approach and the Relative Valuation method with

Price to Earning Ratio (PER) and Price Book Value

(PBV) approaches, in optimistic, moderate, and

pessimistic scenarios.

In terms of research contributions, the results of

the research are expected to provide many benefits

including for theoretically, the results are expected

to be used as a reference regarding the

implementation and the use of valuation theory,

especially the valuation of intrinsic stock value and

the projected value of shares, and illustration for

future research. Also practically benefits for

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

66

investors, this research is expected to provide

appropriate information for investors regarding the

fair price of shares and intrinsic value of shares

through the company's fundamental value that can

be used to support the decision to invest.

Furthermore practically benefits for the company,

this research is expected to provide input for

property and real estate companies in increasing the

value of the company through improving its

performance so that the value of shares in the market

can reflect its fair value.

2 LITERATURE REVIEW

Previous studies supporting this research are as

follows:

Zemba and Hendrawan (2018) discuss valuations

in the healthcare/health sector listed on the IDX

using DCF and Relative Evaluation methods, to find

out the fair value. Unfortunately, three out of four

issuers always suffer losses, let alone having the

remaining free cash flow, to finance operations in

the years that are running even though they rely on

debt. If this is the case, the DCF method is no longer

relevant because the equity value is negative, the

impact of the PER is also negative. This makes it

difficult to analyze because the stock price is the

slightest if the PER and FCFF are negative, the

valuation is overvalued. Only MIKA whose

financial performance can be processed according to

the rules of valuation theory. In the optimistic

scenario, moderate, pessimistic has been designed,

MIKA does not have a significant difference in

analysis results, all scenarios led to overvaluation

from the perspective of DCF and undervalued when

using Relative Valuation.

The research conducted by Neaxie and

Hendrawan (2017) studied the valuation of the stock

price of telecommunication industry listed on the

IDX using the FCFF, relative PER, PBV, and

Multiple EBITDA methods. It was concluded that

using the DCF method of the FCFF approach in an

optimistic scenario the fair value of TLKM was

undervalued, the fair value of ISAT was overvalued

and the fair value of EXCL was undervalued. Then

in the moderate scenario the fair value of TLKM

under undervalued conditions, the fair value of ISAT

is overvalued, and the fair value of EXCL is

overvalued. Furthermore, in the pessimistic scenario,

the fair value of TLKM is overvalued, the fair value

of ISAT is overvalued, and the fair value of EXCL is

overvalued. As for using relative valuation with the

PER approach, the fair value of TLKM is

undervalued, the fair value of ISAT is overvalued,

and the fair value of EXCL is undervalued. Then

with the PBV approach, the fair value of TLKM is

overvalued, the fair value of ISAT is in overvalued

conditions, and the fair value of EXCL is in an

undervalued condition. Furthermore, with the

multiple EBITDA approaches the fair value of

TLKM is overvalued, the fair value of ISAT is

undervalued, and the fair value of EXCL is

undervalued.

Gounder and Venkateshwarlu (2017) discuss the

Bank valuation model was designed based on the

objective to fit the most applicable valuation model

for banks to help in forecasting bank-specific

decision and also forecast the market value of the

share. The accuracy of the value estimates from the

residual income model compared to the estimates

from the relative valuation model for banks. The

results of the comparison suggest that value

estimates from the residual income model are even

more reliable for banks. There was a relationship

between the intrinsic value of bank share determined

by the RIV model and Market price of the share.

This study will be useful for forecasting the possible

changes in market price.

Ivanovska, Ivanovski, and Narasanov (2015)

examined the effectiveness of DDM model for the

valuation of stocks on the Macedonian Stock

Exchange (MSE), and it showed that DDM Model

was handy when it was used together with the

relative model. The results of the study show that the

value of shares that are calculated using the

Discounted Free Cash Flow Model results close to

the fundamental value or average market value.

The research conducted by Georgios and Chris

(2015) achieved to value each of the Greek Food and

Beverage Company that were selected. The result

seems to be fair for each company. When comparing

one another, it shows that the superiority of the

Public Company over the Private one, more specific

when comparing their P/E ratio. The Private

Company surpasses the Public one; the Private

Company anticipates higher future profits. As a

conclusion, the most appropriate valuation methods

for the Public Company, is the EVA and the 3st-

FCFE, and for the Private one are the Net Asset

Value and the Goodwill Valuation methods.

Churamati and Suraj (2014), compared various

models for bank stock price valuation of 14 banks

belonging to BSE bank of the Indian Stock

Exchange. The research resulted in the highest value

of Ohlson and PBV models compared to CAPM,

DDM, PER or Excess Return.

Antonios, Ioannis, and Panagiotis (2012) explore

the sensitivity of three multiples in terms of bias.

The three multiples under consideration are the

Price-To-Sales (P/S) multiple, the Price-To-Book

value of equity (P/B) multiple and the Price-To-

Equity Valuation on Property and Real Estate Listed Companies in 2018: Evidence from Indonesia Stock Exchange

67

Earnings (P/E) multiple using both current and one-

year-ahead earnings forecasts. This study offers a

better understanding of the valuation approach

through the use of multiples, in order analysts

assumption to be more carefully and correctly

chosen and their results to be more accurately

produced

Sehgal and Pandey (2010) examined the

important method for equity analysis and evaluation,

which is highly prevalent among market

practitioners was Relative Valuation. P/E, price to

book value, price to cash flow and price to sales are

the relative valuation toolbox. In this study, the

relative efficacy of these price multiples and their

combinations for equity valuation purposes were

tested. With sample data 145 Indian companies

belonging to 13 prominent sectors from 1990–2007,

generating price forecasts based on each multiple by

regressing the historical prices on relevant value

drivers. As recommendation result, historical P/E

(and hence EPS as a value driver) is the best

approach for equity valuation in the Indian context.

Also relevant for market players, such as equity

analysts, portfolio managers, and global fund

managers, who are continuously involved in equity

valuation including the use of relative valuation

criteria.

Gardner, McGowan, and Moeller (2009) who

combined the concept of equity valuation,

supernormal growth, equity returns are needed, and

sustainable growth is to determine the long-term

value of Coca Cola Corporation. The equity value of

a company is defined as the present value of all

future cash flow from the company to shareholders.

The company value is FCFE divided by the number

the rate of return needed for equity minus the rate of

growth of the company's income. Free Cash Flow to

Equity is defined as net income minus net capital

expenditures minus the change in net working

capital plus the net change in long-term debt

financing. The rate of return uses CAPM. The five-

year monthly return is relative to the S & P500

index. The extension of the DuPont Model

calculates sustainable growth for the supernormal

growth period. The long-term growth rate is

assumed to be the same as the level of economic

growth.

3 METHOD

The financial statement data in the period of 2013-

2017 was used as the basis of calculation in this

research. The underlying assumption of this research

employed three scenarios of pessimistic condition

(below the growth rate of the industry), optimistic

condition (above the growth rate of the industry),

and moderate condition. These conditions were then

calculated after looking at the data and information

from situational and environmental data from the

industry and businesses of property and real estate.

The calculation of valuation value was done using

the Discounted Cash Flow method with the Free

Cash Flow to Firm approach, which was previously

carried out by searching the value of Cost of Capital

(WACC) of each condition. This value was

calculated to get an equity value. In the end, a fair

value per stock would be obtained for each of these

conditions. In addition to the DCF method, the

method of relative valuation with the Price Earning

Ratio (PER) and Price to Book Value (PBV)

approaches were also used.

3.1 The Analysis of Free Cash Flow to

Firm (FCFF)

FCFF is the cash available for all company owners.

In other words, it is a net cash flow available to debt

holders, stockholders, and preferred stock. If the

FCFF is used in a calculation, the final result of the

calculation will be the enterprise value.

3.2 EBIT Analysis

EBIT is Earnings Before Interest Tax or pre-tax

operating profit.

EBIT Value = Profit (Loss)* + Financial Costs +

Income Tax Expense. (1)

3.3 Analysis of Depreciation and

Amortization

Depreciation is a reserve that will be used to buy

new assets to replace old assets that are no longer

productive. Amortization is a reduction in the value

of intangible assets, such as trademarks, copyrights,

etc., in stages within a certain period in each

accounting period. This assessment can be obtained

through:

The Depreciation formula = 100% / Life Time. (2)

3.4 Analysis of Capital Expenditures

Capital expenditure is a planned allocation (within

the budget) to make purchases/repairs/ replacements

for everything that is categorized as a company asset

in accounting. The assessment of Capital

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

68

expenditure can be obtained through the following

formula:

Capex = New PPE - Old PPE + (New Accumulated

Depreciation - Old Accumulated Depreciation). (3)

3.5 Analysis of Working Capital

Working Capital is a company's investment in the

short term that is attached to current assets such as

cash, marketable securities, accounts receivable and

inventories. The Working Capital assessment can be

obtained through the following formula:

The Working Capital = Current Assets - Current

Liabilities Formula. (4)

The FCFF results are then obtained through:

EBIT (1-Tax) + Depression - Capital Expenditure -

Change in Working Capital Formula. (5)

3.6 Analysis of Relative Valuation (RV)

Damodaran (2006) stated that relative valuation is a

company valuation made by looking at the market

price of similar assets. The tool used to do Relative

Valuation is multiples.

3.7 Analysis of Price Earning Ratio

Price Earning Ratio (PER) is one of the most basic

measures of fundamental stock analysis. Easily, PER

is a comparison between stock price and a net profit

of a company. It occurs when the stock price of an

issuer is compared to the net profit generated by the

issuer in a year. PER valuation can be obtained

through the following formula:

P/E Ratio = Stock Price / Earning Per Stock. (6)

3.8 Analysis of Price Book Value

Price Book Value (PBV) focuses on the company's

equity value. PBV according to its meaning is

explained as 'the stock price that is compared to the

value of equity per stock.' It was calculated by

dividing the stock price by its Book Value (BV).

The BV is generated from equity divided by the

average number of circulating stocks. The PBV

assessment can be obtained through the following

formula:

Price Ratio to Book Value = Price per Stock Sheet /

Book Value per Stock. (7)

4 DISCUSSION

4.1 Discounted Cash Flow - Free Cash

Flow to Firm

The results of the calculation, processing, and

analysis of overall stock valuation data using the

Discounted Cash Flow method are as shown in

Table 1.

In the pessimistic scenario, the intrinsic value

of LPKR stocks is IDR 126, whereas, on January 1,

2018, the price of LPKR stocks was IDR 448.

Therefore, when it is compared to its intrinsic value,

the LPKR stock price is in an overvalued condition.

On December 31, 2018, the price of LPKR stocks

was IDR 254. As a result, the price of LPKR's stocks

is overvalued compared to its intrinsic value. BSDE

has

Table 1: Intrinsic Value of Stocks.

Source: Author’s own computations

Information:

PMT:

Pessimistic

; MDT: Moderate; OPT: Optimistic

an intrinsic value of IDR 791, and on January 1,

2018, BSDE stock price was IDR 1,700. It can be

said that the stock price of BSDE is overvalued

when it is compared to its intrinsic value. On

December 31, 2018, the price of BSDE stocks was

IDR 1,255, so that it can be said that the stock price

of BSDE is overvalued. Furthermore, CTRA has the

intrinsic value of IDR 1,610, while, on January 1,

2018, the price of CTRA's stocks was IDR 1,185.

When it is compared to its intrinsic value, the stock

price of CTRA is undervalued. On December 31,

2018, the price of CTRA's stocks was IDR 1,010.

Therefore, it can be said that the stock price of

Scenario

Intrinsic

Value

Stock

Price

on Jan

1st

2018

Condition

Stock

Price

on Des

31st

2018

Condition

PMT 126 488 Overvalued 254 Overvalued

MDT 356 488 Overvalued 254 Undervalued

OPT 431 488 Overvalued 254 Undervalued

PMT 791 1700 Overvalued 1255 Overvalued

MDT 1256 1700 Overvalued 1255 Fairvalued

OPT 1047 1700 Overvalued 1255 Overvalued

PMT 1610 1185 Undervalued 1010 Undervalued

MDT 2274 1185 Undervalued 1010 Undervalued

OPT 2599 1185 Undervalued 1010 Undervalued

LPKR

BSDE

CTRA

Equity Valuation on Property and Real Estate Listed Companies in 2018: Evidence from Indonesia Stock Exchange

69

CTRA is undervalued when it is compared to its

intrinsic value.

In this pessimistic scenario, investors are

recommended to sell LPKR and BSDE stocks

because the price of the stocks in the market is

overvalued, and purchase the stocks of CTRA due to

its undervalued stock price. In the market,

companies are to keep their stock prices near their

intrinsic value. They need to improve their

performance of the companies by increasing the

revenue and the growing revenue as well as

efficiency on all types of company expenses and

costs both OPEX and CAPEX.

In a moderate scenario, the intrinsic value of

LPKR stocks is IDR 356, whereas, on January 1,

2018, the price of LPKR stocks was IDR 448. It

means that the stock price of LPKR is overvalued

compared to its intrinsic value. On December 31,

2018, the price of LPKR stocks was IDR 254. It is

smaller than its intrinsic value. Therefore, the stock

price of LPKR is undervalued. The intrinsic value of

BSDE is IDR 1,256, while on January 1, 2018, it's

stock price was IDR 1,700. Compared to its intrinsic

value, it could be said that BSDE's stock price was

overvalued. On December 31, 2018, BSDE's stock

price was IDR 1,255. When it is compared to its

intrinsic value, it could be said that the price of

BSDE's stocks is fair-priced. Meanwhile, the

intrinsic value of CTRA is IDR 2,274. On January 1,

2018, the stock price of CTRA was IDR 1,185.

Therefore, when it is compared to its intrinsic value,

it can be said that the price of CTRA's stocks is

undervalued. The price of CTRA's stocks on

December 31, 2018, was IDR 1,010. It can be said

that the price of CTRA's stock is undervalued when

it is compared to its intrinsic value.

In this moderate scenario, investors are

suggested to sell LPKR and BSDE stocks or not to

purchase the stocks of LPKR and BSDE, because in

the market their stock prices are overvalued.

Besides, investors had better buy the stocks of

CTRA due to its undervalued stock prices. Except,

when the prices of LPKR, BSDE, and CTRA stocks

were fair valued and undervalued as occurred on

December 31, 2018, under these conditions,

investors are encouraged to buy those stocks. To

maintain the companies’ stock prices in the market

to be near their intrinsic value, the companies need

to improve their company performance by

increasing their revenue and growth revenue as well

as efficiency on all types of company expenses and

costs both OPEX and CAPEX.

In an optimistic scenario, the intrinsic value of

LPKR stocks is IDR 431. However, on January 1,

2018, the price of LPKR stocks was IDR 488. When

it is compared to its intrinsic value, it can be said

that the LPKR stock price is overvalued. The price

of LPKR stocks on December 31, 2018, was IDR

254. It is smaller than its intrinsic value, so it means

that the LPKR stock price is undervalued. The

intrinsic value of BSDE is IDR 1,047. On January 1,

2018, the price of BSDE's stock was IDR 1,700.

When it is compared to its intrinsic value, the price

of BSDE's stock is overvalued. On December 31,

2018, the price of BSDE's stock was IDR 1,255. It is

bigger than its intrinsic value. It means that the price

of BSDE's stock is overvalued. The intrinsic value of

CTRA is IDR 2,599. The price of CTRA's stocks

was IDR 1,185 on January 1, 2018. Therefore, the

price of CTRA's stocks is undervalued. On

December 31, 2018, the price of CTRA's stock was

IDR 1,010. Similarly, when it is compared to its

intrinsic value, it shows that the price of CTRA's

stock was undervalued.

In this optimistic scenario, investors are

suggested to sell LPKR and BSDE stocks or not to

purchase the stocks of LPKR and BSDE, because in

the market their stock prices are overvalued. Also,

investors had better buy the stocks of CTRA due to

its undervalued stock prices. Except, when the prices

of LPKR, BSDE, and CTRA stocks were

undervalued as occurred on December 31, 2018,

under these conditions, investors are encouraged to

buy those stocks. To maintain the companies' stock

prices in the market to be near their intrinsic value,

the companies need to improve their company

performance by increasing their revenue and growth

revenue as well as efficiency on all types of

company expenses and costs both OPEX and

CAPEX.

4.2 Relative Valuation - PER and PBV

In addition to using the Discounted Cash Flow

method with the Free Cash Flow to Firm (FCFF)

approach, the valuation calculation was also done by

using the Relative Valuation method with the PER

and PBV approaches. The results of the calculation,

processing and analyzing of overall data of stock

valuation using the Relative Valuation method with

the PER and PBV approaches can be seen in Table

2.

The table describes that in the pessimistic

scenario the LPKR PER value is 1.32 times, the

BSDE PER value is 3.54 times, and CTRA is 17.52

times. The quarterly IDX data (Q1 2018) shows that

the average PER value of property and real estate

companies is 15.09. The lowest PER value of -

267.65 times was gained by PT Nirvana

Development Tbk., whereas PT Sitara Propertindo

Tbk obtained the highest PER value of 22,071.60

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

70

times. It indicates that the results of research

calculations are in the PER range of the market.

Furthermore, the study in the pessimistic

scenario had found the value of LPKR PBV of 0.10

times, the BSDE PBV value of 0.52 times, and the

CTRA PBV value of 1.93 times. According to the

quarterly IDX data (Q1 2018), the average PBV

value of property and real estate companies is 1.47

times with PT Hanson International Tbk. I am

having the lowest PBV value of 0.00814 times and

PT Sitara Propertindo Tbk and having the highest

PBV value of 7.84 times. This condition indicates

that the results of the research calculations are in the

PBV range of the market.

Based on the results of the valuation calculation

in the pessimistic scenario using the Relative

Valuation method of the PER approach, it is

found

Table 2: Relative Valuation - PER & PBV.

Source: Author’s own computations

Information:

PMT:

Pessimistic

; MDT: Moderate; OPT: Optimistic

that the price of LPKR stocks is lower than BSDE

and CTRA. The value of LPKR PER is smaller than

BSDE and CTRA, with the LPKR PER value of

1.32 times. It indicates that when investors buy the

LPKR stocks, the capital turnover time (BEP) is

around one year and three months. The time is faster

than BSDE and CTRA. Therefore, investors should

prefer LPKR stocks to BSDE and CTRA stocks. As

for suggestions for companies, if they want to have a

low PER value, the company needs to increase the

earnings per stock from its stocks. When using the

PBV approach, the price of LPKR stock is also

lower than BSDE and CTRA, and the value of

LPKR PBV is smaller than BSDE and CTRA, which

is equal to 0.10 times. It means that the price of

LPKR stocks is valued at 0.10 time compared to its

intrinsic value.

Meanwhile, the price of BSDE's stock is 0.52

times compared to its intrinsic value, and the price

CTRA's stock is valued at 1.93 times compared to its

intrinsic value. Therefore, investors are

recommended to choose LPKR stocks than BSDE

and CTRA stocks. As for the companies, it is

recommended to increase the book value of the

company by increasing the amount of equity, so that

the value of the PBV will decrease.

In a moderate scenario, the results of the study

show that LPKR PER value is 3.74 times, BSDE

PER value is 5.62 times, and CTRA is 24.75 times.

The quarterly data of IDX (Q1 2018) indicates the

average PER value of property and real estate

companies of 15.09 times, in which PT Nirvana

Development Tbk. has the lowest PER value of -

267.65 times and PT Sitara Propertindo Tbk. has the

highest PER value of 22,071.60 times. It means that

the values are in the PER range of the market.

Furthermore, the results of the research in moderate

scenarios show that the value of LPKR PBV is 0.28

times, BSDE PBV value is 0.83 times, and CTRA

PBV value is 2.73 times. The quarterly data of IDX

(Q1 2018) displays the average PBV value of

property and real estate companies as much as 1.47

times. PT Hanson International Tbk gains the lowest

PBV value of 0.00814 times. The highest PBV value

of 7.84 times is obtained by PT. Sitara Propertindo

Tbk. The results of research calculations indicate

that the values are in the PBV range of the market.

By the results of the valuation calculation in a

moderate scenario using the Relative Valuation

method with the PER approach, it is found that the

price of LPKR stocks is lower than BSDE and

CTRA. Furthermore, the value of LPKR PER is

smaller than BSDE and CTRA. With the PER value

of 3.74 times, it means that when investing in LPKR

stocks, it takes three years seven months to return

the capital (BEP), which is faster than BSDE and

CTRA. Therefore, suggestions for investors should

prefer LPKR stocks compared to BSDE and CTRA

stocks. The suggestion for companies if they want to

have a low PER value is that the companies need to

increase the earnings per stock from their stocks. By

using the PBV approach, the price of LPKR stock is

lower than BSDE and CTRA, and the value of

LPKR PBV is smaller than BSDE and CTRA, which

is equal to 0.28 times. It means that the LPKR stock

price is valued at 0.28 times compared to its intrinsic

value. The BSDE stock price was valued at 0.83

times compared to its intrinsic value, and CTRA's

stock price was valued at 2.73 times compared to its

intrinsic value. Hence, it is better for investors to

purchase LPKR stocks than BSDE and CTRA

stocks. For the companies, it is recommended to

increase their book value by increasing the amount

of equity so that their PBV value decreases.

In an optimistic scenario, the results of the study

show that LPKR PER value is 4.53 times, BSDE

PER value is 4.68 times, and CTRA is 28.28 times.

According to the IDX quarterly data (Q1 2018), the

average PER value of property and real estate

companies is 15.09 times, with the lowest PER value

PER PBV PER PBV PER PBV

LPKR 1.32 0.10 3.74 0.28 4.53 0.33

BSDE 3.54 0.52 5.62 0.83 4.68 0.69

CTRA 17.52 1.93 24.75 2.73 28.28 3.12

PMT

Scenario

MDT

Scenario

OPT

Scenario

Relative

Valuation

Equity Valuation on Property and Real Estate Listed Companies in 2018: Evidence from Indonesia Stock Exchange

71

of -PT Nirvana Development Tbk gains 267.65

times. Moreover, the highest PER value of

22,071.60 times is obtained by PT Sitara Propertindo

Tbk. This shows that the results of research

calculations are in the PER range of the market.

According to the results of the research in an

optimistic scenario, the PBV values of LPKR,

BSDE, and CTRA are respectively 0.33 times, 0.69

times, and 3.12 times. The average PBV value of

property and real estate companies shown in the

IDX quarterly data (Q1 2018) is 1.47 times. PT

Hanson International Tbk. Got the lowest PBV value

of 0.00814 times, and PT. Sitara Propertindo Tbk.

Got the highest PBV value of 7.84 times. It indicates

that the results of research calculations are in the

PBV range of the market.

Based on the valuation calculation results in an

optimistic scenario using the Relative Valuation

method with the PER approach, it is found that the

price of LPKR stocks is lower than BSDE and

CTRA. The value of LPKR PER of 4.53 times is

smaller than BSDE and CTRA. It means that if we

purchase the LPKR stocks, the return on investment

(BEP) time is four years five months that is faster

than BSDE and CTRA. Investors should prefer

LPKR stocks to BSDE and CTRA stocks. There is a

suggestion for companies that want to have a low

PER value. The companies need to increase their

earnings per stock from their stocks. When the PBV

approach is applied, the LPKR stock price is lower

than BSDE and CTRA, and the value of LPKR PBV

is smaller than BSDE and CTRA, which is equal to

0.33 times. It is concluded that the price of LPKR

stocks is 0.33 times when it is compared to its

intrinsic value. The price of BSDE stock is valued at

0.69 times compared to its intrinsic value, and

CTRA's stock price is valued at 3.12 times compared

to its intrinsic value. Therefore, investors are

recommended to purchase LPKR stocks than BSDE

and CTRA stocks. The companies are suggested to

increase their book value by increasing the amount

of equity so that the value of the PBV decreases.

Based on the previous explanation presented in

the three scenarios of pessimistic, moderate and

optimistic, investors are recommended to buy LPKR

stocks due to its lower price when it is compared to

BSDE and CTRA (if using calculations with the

Relative Valuation method with the PER and PBV

approach).

5 CONCLUSIONS

The results of the study show that by using the DCF

method in the pessimistic scenario, the fair values of

CTRA, BSDE, and LPKR are undervalued,

overvalued, and overvalued respectively. In a

moderate scenario, the fair values of CTRA, BSDE,

and LPKR are undervalued, overvalued, and

overvalued. Furthermore, in an optimistic scenario,

the fair values of CTRA, BSDE, and LPKR are

undervalued, overvalued, and overvalued.

The results of Relative Valuation method

application using the Price to Earnings Ratio (PER)

in pessimistic scenario describe that CTRA has the

value of 17.52 times, BSDE has a value of 3.54

times, and LPKR has a value of 1.32 times. In a

moderate scenario, a similar method resulted in the

values of CTRA of 24.75 times, BSDE of 5.62

times, and LPKR of 3.74 times. Furthermore, the

values of CTRA, BSDE, and LPKR obtained

through the method of the Relative Valuation using

the PER in the optimistic scenario are respectively

28.28 times, 4.68 times, and 4.53 times.

Meanwhile, by using a similar method with the

Price Book Value (PBV) in the pessimistic scenario

the values of CTRA, BSDE, LPKR are 1.93 times,

0.52 times, and 0.10 times respectively. Then, in the

moderate scenario the values of CTRA, BSDE, and

LPKR resulted by the Relative Valuation method

with the PBV approach are 2.73 times, 0.83 times,

0.28 times. Furthermore, the results of the Relative

Valuation method with PBV approach in optimistic

scenario show that CTRA has a value of 3.12 times,

while BSDE has a value of 0.69 times, and LPKR

has a value of 0.33 times.

REFERENCES

Antonios, S., Ioannis, S., Panagiotis, A., 2012. Equity

Valuation with the Use of Multiples. American

Journal of Applied Sciences 9 (1): 60-65.

Charumathi & Suraj, 2014, The Reliability Of Dividend

Discount Model In Valuation Of Bank Stocks At The

Bombay Stock Exchange. International Journal of

Accounting and Taxation 2:2, 111-127

Damodaran, A., 2006. Damodaran on Valuation second

edition, United States of America: John Wiley & Sons

Inc.

Gardner, J.C., McGowan, C.B., Moeller, S.E., 2009.

Applying the Free Cash Flow to Equity Valuation

Model to Coca-Cola. Proceedings of the Academy of

Accounting and Financial Studies, Volume 14,

Number 1.

Georgios, P.N., Chris, G., 2015. Employing Valuation

Tools for Public and Private Companies. The Food

Sector in Greece. Procedia Economics and Finance 33

( 2015 ) 491 – 505

Gounder, C. G., Venkateshwarlu, M., 2017. Bank

Valuation Models - A Comparatives Analysis.

Accounting and Finance Research Vol. 6, No. 3.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

72

SCIEDUPRESS.

Ivanovska, N., Ivanovski, Z., Nasaronov, Z., 2014.

Fundamental Analysis and Discounted Free Cash

Flow Valuation of Stock at MSE. UTMS Journal of

Economics 5:1, 11-24.

Neaxie, L.V., Hendrawan, R., 2017. Stock Valuations in

Telecommunication Firms: Evidence from Indonesia

Stock Exchange, Journal of Economic and

Management Perspectives, Volume 11, Issue 3.

Sehgal, S., Pandey, A., 2010. Equity Valuation Using

Price Multiples Evidence From India. AAMJAF, Vol.

6, No. 1, 89–108, 2010.

Zemba, S., Hendrawan, R., 2018. Does Rapidly Growing

Revenues Always Produces an Excellent Company's

Values? DCF & P/E Valuation Assessment on

Hospital Industry. ISCLO, Volume 6

th

.

Equity Valuation on Property and Real Estate Listed Companies in 2018: Evidence from Indonesia Stock Exchange

73