Stock Valuations in Cement Companies: Evidence from Indonesia

Stock Exchange

Riko Hendrawan, Rijikan

and Hiro Tugiman

Telkom University, Jalan Geger Kalong Hilir, Bandung, Indonesia

Keywords: Cement Companies, Discounted Cash Flow, Relative Valuation.

Abstract: This research aimed to assess the fair value of stock price at Cement Companies listed in Indonesia Stock

Exchange using Discounted Cash Flow (DCF) with Free Cash Flow to Firm (FCFF) approach to calculate the

value of a company and Relative Valuation methods with Price Earning to Ratio and Price Book to Value

approach to validate DCF result. The samples of this research are Indocement Tunggal Prakarsa (INTP),

Holcim Indonesia (SMCB) and Semen Baturaja (SMBR) which are the big three cement company. The

research data were derived from historical data 2013 – 2017 which considered as reference for projection

years 2018 – 2022 involving three scenarios namely pessimistic, moderate and optimistic scenario and the

value of the research compared within market price on January 2, 2018. Findings from this research showed

that using DCF FCFF fair value on INTP has overvalued in all scenarios, for SMCB and SMBR have

overvalued in the pessimistic scenario but undervalue in moderate and optimist scenarios. Furthermore, in

relative valuation method within PER and PBV, the research is within the industry range that means the result

of a calculation is proper. The conclusion of this research is to recommend selling INTP shares, buying SMCB

and SMBR shares.

1 INTRODUCTION

Along with the growth of the cement industry in

supporting development in the infrastructure sector in

Indonesia. A large number of investors and business

opportunities creates business competition in the

cement industry and the impact on fluctuations in

financial performance and share prices of each

company.

In the context of the phenomenon of stock price

fluctuations, many investors use it in the short term

by buying a lower stock price and selling it when the

stock price is high. The decision to buy shares based

on stock prices only can lead to a bad decision

because it does not value the company as a whole and

over a more extended period.

The fluctuations in stock price performance and

the return value of cement companies in Indonesia

stock exchange namely Indocement Tunggal

Prakarsa (INTP), Holcim Indonesia (SMCB) and

Semen Baturaja (SMBR) which are the determinants

in this study are as follows:

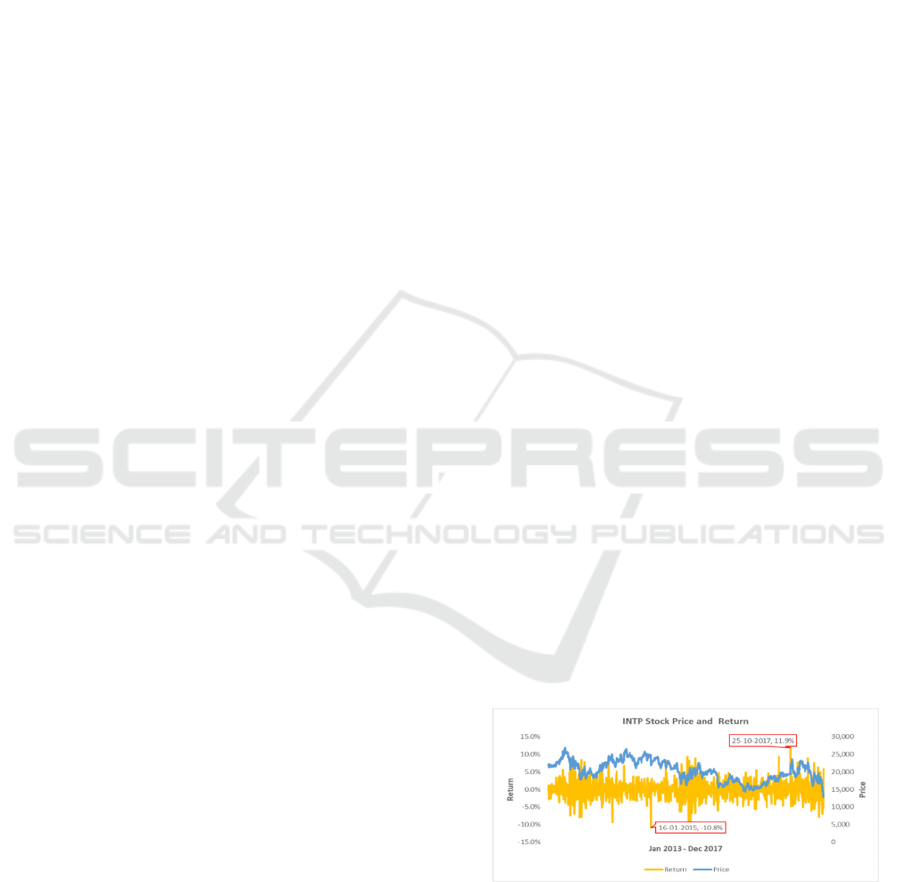

Based on Figure 1 the daily stock price of INTP

tends to fluctuate followed by fluctuations in the

return pattern. In a certain period, there is a significant

daily return rate, with the lowest occurring on January

16, 2015, amounting to -10.8% and the highest

occurring on October 25, 2017, at 11.9%. The

historical fluctuation value is an interesting thing to

see if the pattern can be used as a reference for

forecasting or making new assumptions and

normalizing existing patterns and then determining

the fair value of the company.

Figure 1: INTP Stock Price and rate return (Jan 2013-Dec

2018).

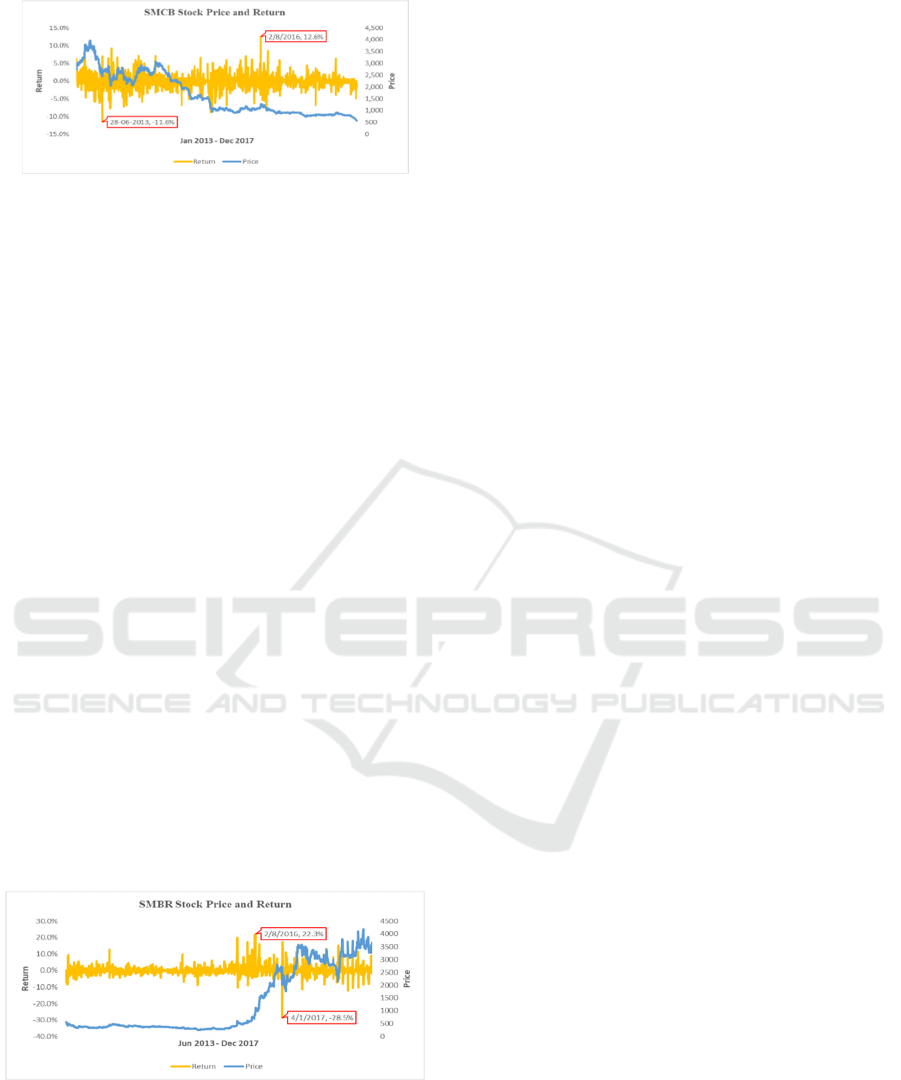

Based on Figure 2, it can be seen that the trend of

the decline in SMCB stock prices is not directly

proportional to the return pattern. The lowest growth

occurred on June 28, 2013, amounting to -11.6% and

the highest occurred on August 2, 2016, at 12.6%.

Hendrawan, R., Rijikan, . and Tugiman, H.

Stock Valuations in Cement Companies: Evidence from Indonesia Stock Exchange.

DOI: 10.5220/0008427400450054

In Proceedings of the 2nd International Conference on Inclusive Business in the Changing World (ICIB 2019), pages 45-54

ISBN: 978-989-758-408-4

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

45

Figure 2: SMCB Stock Price and rate return (Jan 2013-Dec

2018).

Based on Figure 3, the daily price of SMBR for

the period June 2013 to June 2018 tends to be

stagnant from the beginning of the IPO until the end

of 2015 and from the beginning of 2016, the pattern

of SMBR stock prices is followed by a pattern of

daily returns which looks stable because the flat

pattern of the chart will remain in a certain period

there is a daily return rate that is above average, the

highest return on August 2, 2016 is 22.3% and the

lowest is -28.5%. Occurred on January 4, 2017.

To calculate the value of shares, investors and

shareholders can use stock valuation models and

make decisions on stock trading accordingly, but in

the market stock price fluctuations triggered by

supply and demand of stock. If more people want to

buy a particular stock, it is market price will increase.

Conversely, if more people want to sell a stock, its

price will fall.

Stock prices in the market not necessarily reflect

the right price of the company, fundamental analysis

is needed to find out the value of the company

(Damodaran, 2012).

Zemba & Hendrawan (2017), stated that every

investor has different terms in stock valuation which

cause the stock price fluctuation. The difference

refers to some conditions namely optimistic,

moderate and pessimistic. An optimistic condition is

Figure 3: SMBR Stock Price and rate return (Jun 2013-Dec

2018).

a condition in which investors can sell stocks at the

highest potential price because of the performance of

a company higher than industry. The moderate

condition is a condition in which the desire of

investors to sell stocks following the wishes of other

investors (buyers). While the pessimistic condition is

a condition in which investors can buy stocks at the

least price as possible because of the performance of

the company lower than industry.

Valuation of an asset can be determined in three

ways. First, as the intrinsic value of the asset, based

on its capacity to generate cash flows in the future.

Second, as a relative value, by examining how the

market is pricing similar or comparable assets.

Finally, we can value assets with cash flows that are

contingent on the occurrence of a specific event as

options (Damodaran, 2012).

Based on the phenomenon as explained there is a

fluctuating stock price of cement companies in

Indonesia from year to year, and there is a significant

return value at a certain period and from the results of

previous studies which show that stock prices do not

reflect the actual value (intrinsic value), the

researcher intends to conduct research on the

valuation of fair prices of Indocement Tunggal

Prakarsa (INTP), Holcim Indonesia (SMCB) and

Semen Baturaja (SMBR) using Discounted Cash

Flow (DCF) method with Free Cash Flow to Firm

(FCFF) approach and Relative Valuation Method

with Price Earning to Ratio (PER) approach and Price

Book to Value (PBV).

The study result provides guidance to help

investors on corporate valuation that explains the

intrinsic value to make investment decisions.

2 REVIEW OF RELATED

LITERATURE

This study uses several theories as a reference to

determine the method of calculating corporate value

valuations and makes consideration in conducting

evaluations.

2.1 Firm Values

Knowing what an asset is worth and what determines

that value is a prerequisite for intelligent decision

making in choosing investments for a portfolio, in

deciding on the appropriate price to pay or receive in

a takeover, and in making an investment, financing,

and dividend choices when running a business

(Damodaran, 2012).

Damodaran's statement illustrates that in the

business world it is essential to know assets that

provide value for a company. The value of the

company is indeed very beneficial for internal

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

46

company, its shown the success in managing

company and also for external or investors, company

value can be useful as information in investment

decisions, good value will bring in more investors to

invest or buy the company's shares so that the

company's value is also related to the company's stock

price. Investors' requests and offers form the stock

price. High stock prices make the value of the

company high and can increase market confidence

not only in the company's current performance but

also infuture prospects.

2.2 Valuation Theory

According to Damodaran (2012), states that in

general there are three approaches to valuing an asset,

namely: (1) Discounted Cash Flow Valuation; (2)

Relative Valuation; and (3) Contingent Claim

Valuation.

2.3 Discounted Cash Flow Valuation

Discounted Cash Flow Valuation is the value of an

asset that is calculated based on the present value of

the cash flow generated in the future (expected future

cash flow) of an asset discounted using a specific

discount rate. The approach used in DCF consists of

Dividend Discounted Model (DDM), Free Cash Flow

to Equity (FCFE) and Free Cash Flow to Firm

(FCFF).

2.3.1 Dividend Discount Model

Damodaran (2012), Dividend Discounted Model

(DDM) is the most extended model used in the

Discounted Cash Flow (DCF) model, the principle

that underlies this DDM Model is when investors buy

shares in public companies (IPOs), they generally

expect two benefits: first profit from dividend during

the holding period and profit from the increase in the

share price itself at the end of the holding period.

Because the price of a stock that is expected to be

determined by a future dividend, the value of a share

can be reflected as the present value of dividends

forever.

The following formula can be used to calculate the

intrinsic value of shares (Damodaran, 2012):

P₀ =

+

+

+……..+

(1)

2.3.2 Free Cash Flow to Equity

Free Cash Flow to Equity (FCFE) is cash flow

available to shareholders after the company takes into

account capital expenditure, working capital and

corporate debt (Damodaran, 2012).

The equation is presented as follow:

FCFE = Net Income

- Capital Expenditures

- Depreciation

- Change non-cash working

capital

+ New debt issued

- Debt repayment (2)

2.3.3 Free Cash Flow to Firm

Free Cash Flow to Firm (FCFF) represents the

amount of cash flow from operations available for

distribution after depreciation expenses, taxes,

working capital, and investment are paid

(Damodaran, 2012).

The equation is presented as follow:

FCFF = (EBIT*(1-Tax)) + Depreciation

- Change noncash working capital (3)

FCFF calculates the intrinsic value of a company

by discounting cash flow to the firm with a weighted

average cost of capital (WACC). By using the WACC

formula to discount the FCFF value, the company

value will be obtained with the following formula

(Damodaran, 2012):

Value of Firm =

∑

.

(4)

2.4 Cost of Capital

Generally, sources of corporate funding can be

obtained through shareholder's equity and from

creditors in the form of debt. Cost of Capital is the

rate of return desired by providers of corporate funds,

namely a combination of equity, debt and hybrid

securities which is proxied as a weighted average cost

of capital (WACC).

WACC is one of the critical factors in the

calculation using the DCF model. Minor changes in

WACC will result in significant changes in company

value. The WACC is calculated by weighting the

source of capital according to the company's financial

structure and then multiplying them at their expense.

The equation is presented as follow:

WACC = (Composition of equity * rate of equity)

+ ((composition of debt * rate of debt)

Stock Valuations in Cement Companies: Evidence from Indonesia Stock Exchange

47

*(1-tax)) (5)

In the WACC calculation there are several factors

which will be explained as follows:

a.

Cost of equity

Definition of cost of equity (R

e

) is the rate

of return expected by the shareholder (equity)

on his investment in a company. The formula to

calculate the cost of equity (R

e

) is as follows

(Damodaran, 2012):

ERi R

f

β

ERm R

f

(6)

If the company distributes dividends

regularly, an alternative formula that can be

used to calculate R

e

is as follows (Kenton,

2018):

R

e

=

/

(7)

b. Cost of debt

Cost of debt (Cod) is the interest rate that

must be paid by the company for its debt or

external capital (Damodaran, 2012).

2.5 Terminal Value

Terminal value is the present value of all future cash

flows obtained after a period determined by scenario

analysis. The thinking behind terminal values is to

assume a constant growth rate for the time after the

period analyzed, where the constant growth rate is

symbolized by g then WACC is symbolized by r as

the discount rate used.

Terminal Value is calculated using the constant

growth model as follows (Damodaran 2012):

TV=

(8)

2.6 Enterprise Value

Enterprise Value is an economic measure that reflects

the market value of a business. Enterprise Value is

used as one of the benchmarks in business, financial,

accounting, portfolio analysis, and risk analysis. In

simple terms, the Enterprise Value formula (EV) is

the market cap value plus debt minus cash.

The equation is presented as follow:

EV = Market value of equity + debt – cash (9)

2.7 Relative Valuation

Relative Valuation is one of the most commonly used

valuation methods by comparing companies that are

similar or with the industries in which the company is

located. Market prices are obtained by relative

valuation, as a result of using real data during the

analysis. The tool used to do Relative Valuation is

multiples.

One form of multiples is price multiples, where

the main component of price multiple is the market

price. Some examples of price multiples include Price

Earning to Ratio (PER), Price Book to Value (PBV).

The advantages of the Relative Valuation model

are also weaknesses. First, ease in Relative Valuation

can be put together, pulling together with several

groups of similar companies, can also produce

estimates of values that are not consistent where key

variables such as risk, growth, or potential cash flows

are ignored. Second, the fact that multiples reflect the

market atmosphere also illustrates that using the

Relative Valuation method to value an asset can

produce a value that is too high when the market

overestimates similar companies or vice versa is too

low when the market underestimates similar

companies. Third, there is room for bias in all

valuation methods, the lack of transparency regarding

the underlying assumptions in the relative valuation

method makes it vulnerable.

2.7.1 Price Earning Ratio

Another alternative in conducting valuations to

calculate the intrinsic value of a stock or fundamental

value is to use the value of profit from the company.

Estimates of the intrinsic value of shares in a

company's analysis can be done using two important

information components of the company, namely

earnings per share and earnings multiplier,

(Damodaran, 2012).

The equation of PER is presented as follow

(Damodaran, 2012):

P₀= Estimasi EPS x PER (10)

2.7.2 Price Book to Value

One alternative approach to determining the value of

a stock with the Relative Valuation method is to use

the relationship between stock market prices and

book value per share (Damodaran, 2012).

Theoretically, the market value of stock must

describe the book value.

The equation is presented as follow:

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

48

PBV =

₀

(11)

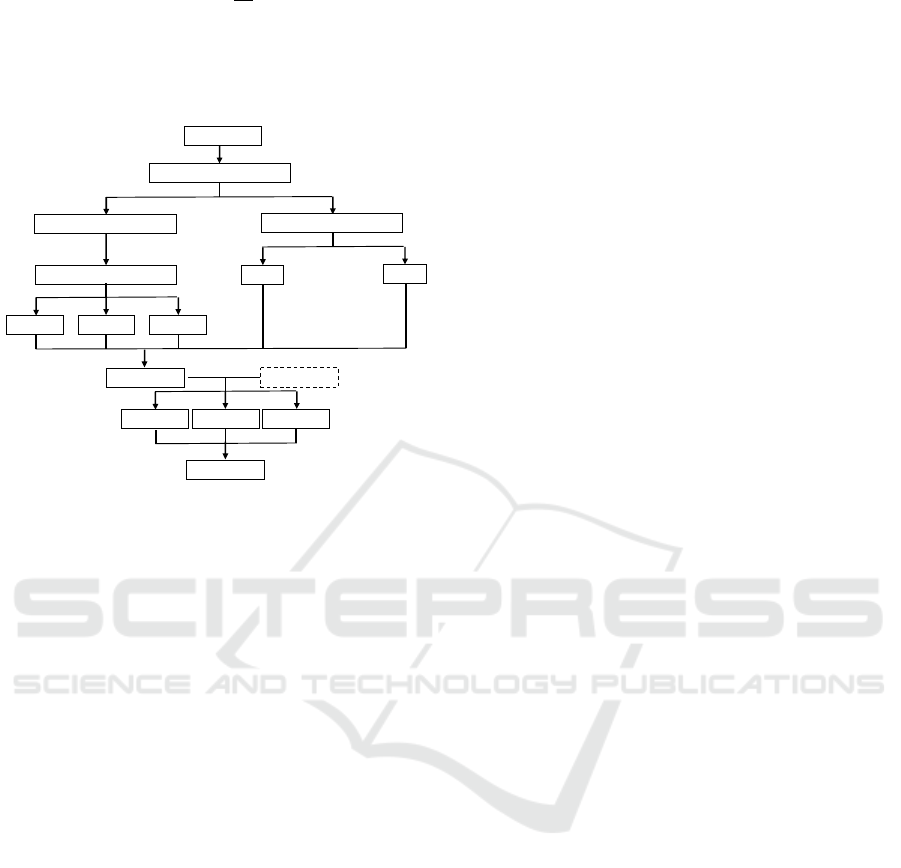

2.8 Research Framework

The research framework is presented as follow:

Figure 4: Research Frameworks.

With the stock price fluctuations that occur in

cement industry companies, to obtain fair company

fair value, fundamental analysis of the intrinsic value

stock prices is needed so that stock price valuation

needs to be done based on the chosen method namely

Discounted Cash Flow (DCF) method with Free Cash

Flow to Firm (FCFF) approach and Relative

Valuation (RV) with Price Earning to Ratio (PER)

approach and Price Book to Value (PBV) approach

using three scenarios, namely scenario optimistic,

moderate and pessimistic.

In order to conduct the fair value of stock prices,

projections of company performance are needed by

using historical data on company performance. To

map the performance of companies in an industry,

scenarios are made, namely optimistic scenarios

(company performance above industry), moderate

scenarios (company performance in the industry

range) and pessimistic scenarios (company

performance under industry). Scenarios can be

determined and viewed based on information on

environmental data and facts (Neaxie and

Hendrawan, 2017).

The results of valuation calculations based on the

DCF method and relative valuation will be compared

with market price, and the results can be known

whether the market price is overvalued, fair valued or

undervalued. If the result is overvalued, the investor

is recommended to sell the shares, if fair value is the

stock can still be maintained and if it is undervalued,

investors are recommended to buy the stock.

2.9 Previous Research

Khatik & Patil (2018), stated that to know the value

of a company, analysts, investors, researchers not

only understand the value of the company but must

know where the value of the company originates,

valuation of company value is done by estimating the

value of the company based on cash flow calculations

in the future or with comparing it with the value of its

assets.

Neaxie & Hendrawan (2017) using the DCF

method and Relative Valuation to evaluate the shares

of Telecommunications companies listed on the

Indonesia Stock Exchange, the use of both methods is

considered reliable because the results are still in the

industry range.

Trinh

& Thao (2017), the corporate valuation

model approaches discounted cash flow (DCF) and

capital asset pricing model (CAPM) for strategic

financial decisions of investment appraisal and

capital structure, the study provides an effective tool

in corporation valuation and value-based

management.

Jamshidi, Akbari, Asgari, & Renani (2015), the

necessity of considering the economic valuation of

the arts and culture comes from the competition

between different public and merit goods which seek

government.

D’Amato & Anghel (2013), in conducting

valuations using the DCF method, the critical thing

that needs to be taken into account is the discount rate,

where the discount rate range used between risk-free

and a risk premium.

Fairchild (2010), in his research, provides an

overview of the importance of corporate managerial

communication in corporate dividend distribution

decisions, small or down dividends are often

connoted as corporate values that are down again,

affecting investors' valuation of the company and vice

versa large dividends will have good corporate value

image, but information regarding this dividend

distribution if it is not managed correctly it will be

counterproductive because the company also needs to

reinvest in continuity and business development, the

indicator used to determine the dividend value is

knowing Net Present Value (NPV). Dividends can be

reduced for investments in NPV projects that are

negative until they get benefits.

Yoo (2006), this research using a combination of

simple valuation techniques where the data used to

make estimates also come from historical multiples

Value o

f

Firm

Valuation o

f

Intrinsic Values

D

iscounted Cash Flow Mode

l

R

elative Valuation Mode

l

PBV

PER

F

ree Cash Flow to Firm

Pesimi

s

tic

Moderate O

p

timistic

Tar

g

et Price

Price

p

er Share

Compare

Undervalued

F

airvalued Overvalued

B

u

y

/Hold/Sell

Stock Valuations in Cement Companies: Evidence from Indonesia Stock Exchange

49

combinations where the more relevant information is

to improve the valuation accuracy.

Another tool to validate the result of valuation is

relative valuation method, this method making the

comparison of the intrinsic value of the company, as

long as a result is within industrial range, the result of

DCF calculation is reliable and proper (Neaxie &

Hendrawan, 2017).

3 PROBLEM DEFINITION

Based on the introduction, the problems in this study

is stock prices fluctuations, and stock prices in the

market have not become certainty for investors to be

used as a basis for investment decisions, it is

necessary to do a valuation of the intrinsic value of

stock prices, for which research objectives are made

that will help these problems, as follows:

a. To analyze the intrinsic value of stock price in

cement companies in Indonesia Stock Exchange

using Discounted Cash Flow (DCF) method with

Free Cash Flow to Firm (FCFF) approach and

Relative Valuation method with Price Earning to

Ratio (PER) and Price Book to Value (PBV) on

an optimistic scenario in 2018.

b. To analyze the intrinsic value of stock price in

cement companies in Indonesia Stock Exchange

using Discounted Cash Flow (DCF) method with

Free Cash Flow to Firm (FCFF) approach and

Relative Valuation method with Price Earning to

Ratio (PER) and Price Book to Value (PBV) on a

moderate scenario in 2018.

c. To analyze the intrinsic value of stock price in

cement companies in Indonesia Stock Exchange

using Discounted Cash Flow (DCF) method with

Free Cash Flow to Firm (FCFF) approach and

Relative Valuation method with Price Earning to

Ratio (PER) and Price Book to Value (PBV) on a

pessimistic scenario in 2018.

4 METHODOLOGY / APPROACH

This research uses quantitative research method that

is a research method by calculating with a specific

method to get the desired result, in this case, is to get

fair value of stock prices used Discounted Cash Flow

(DCF) with Free Cash Flow to Firm (FCFF) approach

and Relative Valuation method with Price Earning to

Ratio (PER) and Price Book to Value (PBV)

approach as calculation tools referring to previous

research (Neaxie and Hendrawan, 2017).

In this study, researchers will use sampling

techniques with purposive sampling techniques. The

purposive sampling technique is getting samples by

setting specific characteristics that are suitable for the

objectives of the study.

The stages of selecting samples according to the

purposive sampling criteria that have been

determined are as follows:

a. Cement companies listed on the Indonesia

Stock Exchange in 2018 is presented as follows

follow:

1. Indocement Tunggal Prakarsa (INTP)

2. Semen Indonesia (SMGR)

3. Holcim Indonesia (SMCB)

4. Semen Baturaja (SMBR)

5. Wijaya Karya Beton (WTON)

6. Waskita Beton Precast (WSBP)

b. Cement companies that have the last five years

of financial statements (2013-2017) are

presented as follows:

1. Indocement Tunggal Prakarsa (INTP)

2. Holcim Indonesia (SMCB)

3. Semen Baturaja (SMBR)

Based on the criteria of the purposive sampling

determined, the sample of this study is Indocement

Tunggal Prakarsa (INTP), Holcim Indonesia

(SMCB) and Semen Baturaja (SMBR).

5 RESULT AND DISCUSSION

In this section of the discussion we will explain the

result of the calculation using the Discounted Cash

Flow method with Free Cash Flow to Firm (FCFF)

approach and by using Relative Valuation method

with the Price Earning to Ratio (PER) and Price Book

to Value (PBV) approach using three scenarios,

namely pessimistic, moderate, and optimistic.

5.1 The Intrinsic Value by Discounted

Cash Flow

Historical data from financial statements are needed

over the past five years (2013-2017) to conduct stock

price valuations using the Discounted Cash Flow

(DCF) method with Free Cash Flow to Firm (FCFF)

approach and Relative Valuation method with Price

Earning to Ratio (PER) and Price Book to Value

(PBV) approach.

Based on historical data the financial ratios are

calculated such as EBIT, EBITDA, Net Income,

Enterprise Value, Value Terminals. Where the ratio

will be used to calculate the fair value of the stock

price.

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

50

Furthermore, based on historical data and its ratio,

the growth projection is made up to the next five years

with three scenarios namely pessimistic, moderate

and optimistic.

An essential thing in projecting is to make sales

growth projections because all ratios are very

dependent on the growth of sales.

To make the Revenue Projection, it must first be

known (Neaxie and Hendrawan, 2017):

a. Historical average industrial sales growth

b. Historical average sales growth of the company

c. Spread (delta between historical average

industrial sales growth with average sales

growth of company)

d. Industrial sales projection

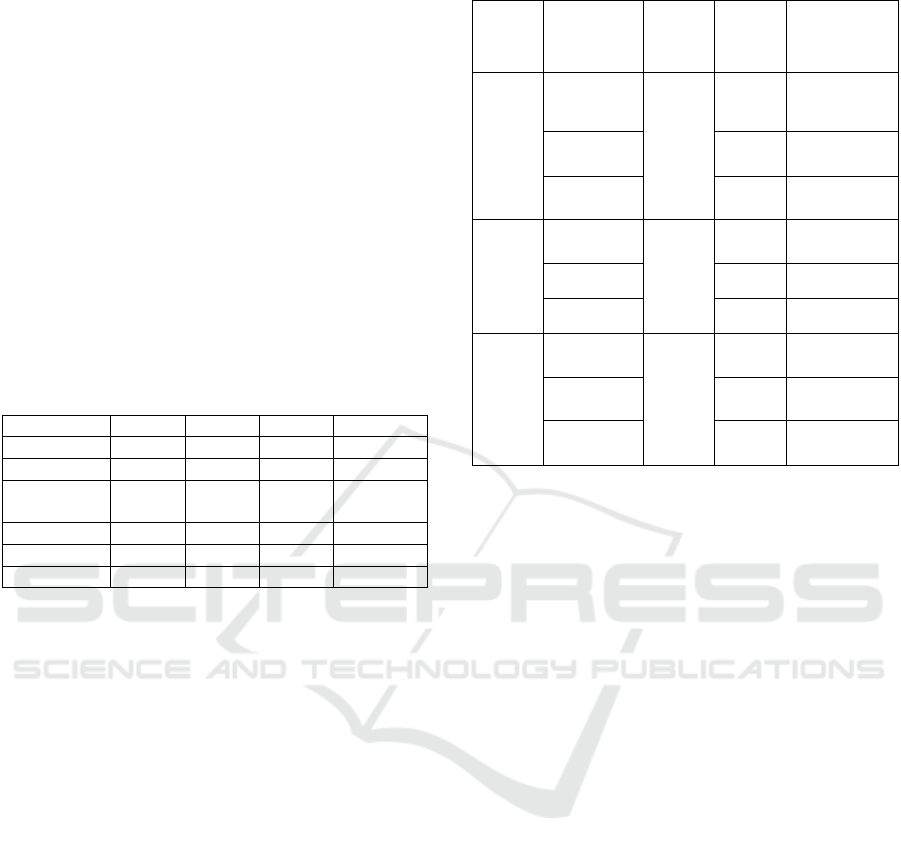

The summary of sales projection using those

assumptions is presented as follows:

Table 1: Revenue projection growth.

INTP SMCB SMBR Industry

Historical -3.1% 0.9% 7.4% 4.7%

S

p

rea

d

-7.8% -3.8% 2.7%

Sales

Pro

j

ection

6.6%

O

p

timistic 6.6% 6.6% 10.6%

Moderate -1.2% 2.8% 9.3%

Pessimistic -5.1% 0.9% 6.6%

Source: Author's computations

By using calculated sales growth, the other

parameter or financial ratios needed such as Ebitda,

Depreciation and amortization, Capex, Ebit and so on

will follow the historical trend and some of them

managed to go down like capex which could be

reduced because investment in the previous period

was already substantial to go down for example capex

reduce like capex. Furthermore, the projection value

is used to calculate the intrinsic value of the company

following the formula previously explained, namely

the formula for calculating DCF-FCFF and Relative

Valuation.

After calculating the sales growth and financial

ratios associated with stock price valuations are

made, the fair value of each company can be seen and

can be compared with market prices on January, 2

nd

2018.

The summary of valuation result by DCF-FCFF is

presented as follow:

Table 2: The valuation result by DCF

Stock

Code

Scenario

Po

(IDR)

Target

Price

(IDR)

Result

INTP

Pessimistic

23,000

6,828 Overvalued

Moderate 8,181 Overvalued

Optimistic 15,119 Overvalued

SMCB

Pessimistic

825

637 Overvalued

Moderate 882 Undervalued

Optimistic 1,829 Undervalued

SMBR

Pessimistic

3,690

921 Overvalued

Moderate 1,888 Overvalued

Optimistic 3,837 Undervalued

Source: Author's computations

Based on Table 2, it can be seen that in the

pessimistic scenario the fair value of INTP, SMCB

and SMBR shares using Discounted Cash Flow

(DCF) method with Free Cash Flow to Firm (FCFF)

approach is overvalued. With this result, investors are

recommended to sell their shares and companies,

must increase sales productivity and optimize the

costs of both expense and Capital Expenditures.

Results of intrinsic value calculation on the

pessimistic scenario are still far below the market

price value. This occurs because the projection of

revenue of each company is still low such as INTP

which is predicted to be negative growth was 5.1%,

SMCB has growth projection 0.9%, and SMBR

growth was 6.6 %, which means lower than average

of the 2013-2017 period was 7.4%.

Based on the results of intrinsic value calculations

in a moderate scenario where the results of INTP and

SMBR share price was overvalued. This result in line

with revenue growth all of them is below in which

INTP has growth negative 1.23%, and the market

price of SMBR was influenced by previous period

performance expectations which had good historical

average growth around 7.4% and a large capex value

in the 2016 and 2017 periods. Whereas SMCB has

intrinsic value that is in an undervalued condition, it

means the investors recommended to buy SMCB

shares. SMCB's performance is in line with market

expectations with a positive growth was 2.8%, up

from the 2013-2017 historical average growth only

0.9%.

Stock Valuations in Cement Companies: Evidence from Indonesia Stock Exchange

51

Based on the calculation of the intrinsic value in

the optimistic scenario, it can be seen that INTP is still

overvalued, this happened because as overall

performance INTP has lower in sales growth while

expense ratio is managed equally according to

historical trends and capex is also lower than the

historical average, but the results are still below

market expectations. In while SMCB and SMBR was

undervalued, this is in line with the excellent

performance where SMCB's sales growth has been

above the historical average sales growth, while

SMBR besides its sales growth is above the historical

average sales growth and also above the industry

sales growth where both of them also manage opex

according to historical trends and CapEx is planned

to be lower than historical average.

5.2 The Intrinsic Value by Relative

Valuation

To validate the calculation of intrinsic value using

DCF-FCFF, other valuation tools are needed, namely

Relative Valuation, where from relative valuation

based on Price Earning to Ratio (PER) and Price

Book Value (PBV) approach, the results can be seen

whether the value is still within the industry range in

the Indonesia stock exchange (IDX) data or outside

the industry range, if in the range, it means that the

DCF-FCFF calculation results are considered reliable

or proper and vice versa if it is still outside the range,

it can be seen the assumptions used in calculating the

valuation. In this case, the comparative data is IDX

data as of the 1

st

quarter, 2018.

The summary calculation of intrinsic value that

uses relative valuation method with PER and PBV

approach is presented as follow:

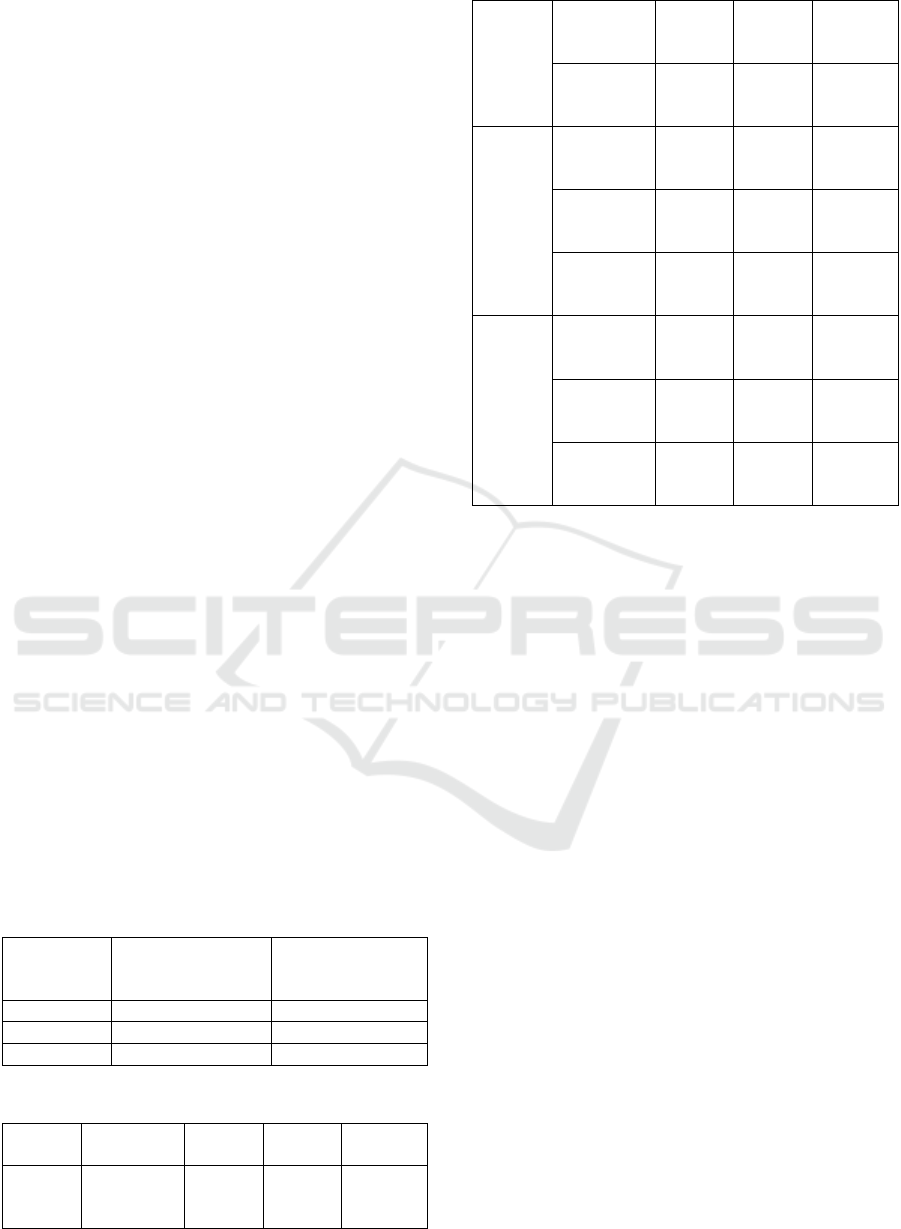

Table 3: Industry Range of PER & PBV.

PER of Industry

(IDX 1

st

Quarter

2018)

PBV of Industry

(IDX 1

st

Quarter

2018)

Min. -7.10 1.02

Avera

g

e 15.86 1.23

Max. 277.89 2.27

Table 4: The Valuation result by relative valuation.

Stock

Code

Scenario

PER

(

Times

)

PBV

(

Times

)

Result

INTP

Pessimistic

9.58 1.02

In

industry

range

Moderate

11.03 1.23

In

industry

range

Optimistic 18.88 2.27

In

industry

range

SMCB

Pessimistic 7.60 0.63

In

industry

range

Moderate 10.33 0.88

Out of

Industry

ran

g

e

Optimistic 20.65 1.82

In

industry

ran

g

e

SMBR

Pessimistic 35.09 2.68

In

industry

range

Moderate 70.19 5.49

In

industry

range

Optimistic 140.89 11.16

In

industry

ran

g

e

Source: Author's computations

The results of PER calculation in the pessimistic

scenario, INTP is 9.58 times, SMCB is 7.60 times,

and SMBR is 35.09 times. While on IDX data as of

1

st

quarter, 2018 shows that average PER value of

cement companies is 15.86 times, with the lowest

PER value in Holcim Indonesia (SMCB) Is -7.10

times and the highest PER value for Semen Barturaja

(SMBR) is 277.49 times. This shows that the results

of research calculations are in the range of PER in the

market.

Furthermore, the PBV calculation results on the

pessimistic scenario show that INTP is 1.02 times,

SMCB is 0.63 times, and SMBR is 2.68 times. While

on IDX data as of 1

st

quarter, 2018 shows that the

average PBV value of cement companies is 3.38

times, with the lowest of PBV in Holcim Indonesia

(SMCB) Are 0.83 times and the highest PBV value in

Semen Baturaja (SMBR) is 11.92 times. This shows

that the results of research calculations are in the PBV

range in the market except for SMCB slightly below

industry range.

Based on the results of the valuation calculation in

the pessimistic scenario using Relative Valuation

method with PER approach, it is found that the

SMCB stock price is lower compared to INTP and

SMBR, where the PER value of SMCB is smaller

than INTP and SMBR, with PER value of 7.60 times.

Which means that if we invest in SMCB shares, the

return on investment is around seven years six

months, faster than INTP and SMBR. So suggestions

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

52

for investors should prefer SMCB shares compared to

INTP and SMBR shares. While suggestions for

companies if they want a low PER value, the

company needs to increase earnings per share from its

shares. Whereas if using the PBV approach, then the

SMCB stock price is cheaper compared to INTP and

SMBR, where the value of SMCB PBV is smaller

than INTP and SMBR, which is equal to 0.63 times,

which means that the stock price of SMCB is valued

at 0, 63 times when compared to its intrinsic value.

While INTP's stock price is valued at 1.02 times when

compared to its intrinsic value, and the stock price of

SMBR is valued at 2.68 times compared to its

intrinsic value.

Based on PER calculation results on a moderate

scenario, INTP is 11.03 times, SMCB is 10.33 times,

and SMBR is 70.19 times. While on IDX data as of

1

st

quarter, 2018 shows that the average PER of

cement companies is 15.86 times, with the lowest

PER value in Holcim Indonesia (SMCB) Is -7.10

times and the highest PER value for Semen Barturaja

(SMBR) is 277.49 times. This shows that the results

of research calculations are in the range of PER in the

market.

Furthermore, the PBV calculation results on

moderate scenarios show that the INTP is 1.23 times,

SMCB is 0.88 times, and SMBR is 5.49 times. While

on IDX data as of 1

st

quarter 2018 shows that the

average PBV value of cement companies is 3.38

times, with the lowest PBV value on Holcim Tbk

(SMCB) is 0.83 times and the highest PBV value in

Semen Baturaja Tbk (SMBR) is 11.92 times. This

shows that the results of research calculations are in

the PBV range in the market.

Based on results of valuation calculation in

moderate scenario using the Relative Valuation

method with PER approach, it is found that the

SMCB share price is cheaper compared to INTP and

SMBR, where the PER value of SMCB is smaller

than INTP and SMBR, with a PER value of 10.33

times, which means that if we invest in SMCB shares,

the return on investment is 10 years and 3.3 months,

faster than INTP and SMBR. So investors should

prefer to choose SMCB shares when compared to

INTP and SMBR shares. While suggestions for

companies if they want a low PER value, the

company needs to increase earnings per share from its

shares.

Using PBV approach, SMCB stock price is lower

compared to INTP and SMBR, which is where the

PBV value of SMCB is 0.88 times, smaller than INTP

and SMBR, which means that the price of SMCB

shares is valued at 0.88 times when compared to its

intrinsic value. While INTP's stock price is valued at

1.23 times compared to its intrinsic value, and

SMBR's share price is valued at 5.49 times when

compared to its intrinsic value, as recommendation

investors to prefer SMCB shares compared to INTP

and SMBR shares. Whereas for companies it is

recommended to increase the book value of the

company by increasing the amount of equity in order

value of the PBV go down.

In the optimistic scenario, calculation results show

that INTP PER value is 18.88 times, SMCB PER

value is 20.65 times, and SMBR is 140.89 times.

While on IDX data as of 1

st

quarter, 2018 shows that

average PER value of cement companies is 15.86

times, with the lowest PER value in Holcim Indonesia

(SMCB) Is -7.10 times and the highest PER value for

Semen Baturaja (SMBR) is 277.49 times. This shows

that the results of research calculations are in the

range of PER in the market.

Overall, SMBR has a very high PER value or far

above the average where the pessimistic scenario is

35.09 times, moderate scenario is 70.19 times, and

optimistic scenario is 140.89 times while PER of

industry average is 15.86 times even though still

within the industry range, this is caused by market

expectations of historical performance of SMBR

which have high revenue growth while opex and

capex are also significant, so the result makes small

earnings.

Based on the results of PBV calculation on

optimistic scenarios, INTP is 2.27 times, PBV is 1.82

times, and SMBR is 11.16 times. While on IDX data

as of 1

st

quarter, 2018 shows that the average PBV

value of cement companies is 3.38 times, with the

lowest PBV value of Holcim (SMCB) is 0.83 times

and the highest PBV value in Semen Baturaja

(SMBR) is 11.92 times. This shows that the results of

research calculations are in the PBV range in the

market.

PER calculation results in optimistic scenario

using the Relative Valuation PER approach shows

INTP stock prices are cheaper compared to SMCB

and SMBR, where the INTP PER value is smaller

compared to SMCB and SMBR, with a PER value of

18.88 times, which means that if we invest in INTP,

the return on investment (BEP) for 18 years is 8.8

months, faster than SMCB and SMBR. So

suggestions for investors should prefer INTP shares

when compared to SMCB and SMBR shares. While

suggestions for companies if they want a low PER

value, the company needs to increase earnings per

share.

Whereas if using PBV approach, SMCB stock

price is lower compared to INTP and SMBR, which

is the PBV value of the SMCB is 1.82 times or smaller

Stock Valuations in Cement Companies: Evidence from Indonesia Stock Exchange

53

than INTP and SMBR, which means that the price of

SMCB shares is valued at 1.82 times intrinsic value.

Whereas INTP's share price is valued at 2.27 times

compared to its intrinsic value, and the stock price of

SMBR is valued at 11.16 times compared to its

intrinsic value, The recommendations are investors

prefer SMCB shares compared to INTP and SMBR

shares and companies recommended to increase the

book value of the company by increasing the amount

of equity, so that the value of the PBV will be down.

6 CONCLUSIONS

This research produces different valuation values

assuming different growth, in the pessimistic scenario

by DCF-FCFF calculation show that INTP, SMCB,

and SMBR are overvalued. Then in the moderate

scenario that INTP and SMBR in Overvalued and

SMCB conditions are undervalued, whereas in the

optimistic scenario the results of DCF-FCFF

calculations show that INTP is in overvalued

condition while SMCB and SMBR are undervalued.

From the Relative valuation calculation, all scenarios

show that the results of INTP, SMCB, and SMBR are

in the industry range, which means that DCF-FCFF

calculations are reliable and proper. The conclusions

of this research is to recommend selling INTP shares

and buying SMCB and SMBR shares.

This study illustrates that the method used to

evaluate the intrinsic value of stock prices is

Discounted Cash Flow (DCF) with the Free Cash

Flow to Firm (FCFF) approach and the Relative

Valuation method with the Price Earning to Ratio and

Price Book to Value (PBV) approach on Previous

research (Neaxie & Hendrawan, 2017) is still valid

and relevant where the results can be a reference for

investment decisions.

REFERENCES

Damodaran, A., 2012. Damodaran on Valuation second

edition. United States of America: John Wiley & Sons

Inc.

D’Amato, M., Anghel, I., 2013. Regressed DCF, Real

Estate Value, Discount Rate, and Risk Premium

Estimation. A case in Bucharest. ResearchGate

Fairchild, R., 2010. Dividend Policy, Signalling, and Free

Cash Flow: An Integrated Approach, Managerial

Finance, Vol. 36 Iss 5 pp. 394 – 413

Jamshidi, H. M., Akbari, N., Asgari, A. & Renani, M.,

2015. Economic Valuation of Cultural Goods (Case

Study: Isfahan City of Arts). International Journal of

Business and Development Studies Vol. 7, No. 1

Khatik,S.K., Patil, M., 2018. Company Valuation using

Free Cash Flow Technique: A case study of National

Thermal Power Corporation Limited. Journal of

Advanced Management Research. Vol.06 Issue-03

Neaxie, L.V., Hendrawan, R., 2017. Valuation

Telecommunications Firms: Evidence from Indonesia

Stock Exchange, Journal of Economic and

Management Perspectives, Volume 11, Issue 3.

Trinh, T.H., Thao, L.T.N., 2017. Corporate Valuation

Modeling for Strategic Financial Decisions. Asian

Economic and Financial Review. Vol. 7, No. 12, 1153-

1166

Yoo, Y.K. 2006. The valuation accuracy of equity valuation

using a combination of multiples, Review of

Accounting and Finance, Vol. 5 Iss 2 pp. 108 - 123

Zemba, S., Hendrawan, R., 2018. Does Rapidly Growing

Revenues Always Produce An Excellent Company’s

Value? DCF & P/E Valuation Assessment on Hospital

Industry. e-Proceeding of Management: Vol.5, No.2

ICIB 2019 - The 2nd International Conference on Inclusive Business in the Changing World

54