Merger & Acquisition: A Comparative Integration Analysis of Third

World Country

Zaib Maroof and Muhammad Jawad

Department of Leadership & Management Studies, National Defence University Islamabad, Pakistan

Lahore Business School, University of Lahore Islamabad, Pakistan

muhammad.jawad@lbs.uol.edu.pk

Keywords: Merger & Acquisition, Horizontal Mergers, Vertical & Conglomerate Mergers, Financial Analysis.

Abstract: After globalization, an upsurge in Merger & Acquisition (M&A) activities has been observed all over the

globe especially in last decade, as same contributed towards the economic wellbeing of any country.

Companies adopted different Integration Strategies (Vertical, Horizontal & Conglomerate) to undergo the

merger deals and accordingly their post merger financial performance analysis was documented for future

reference. On the contrary, comparatively inadequate evidence is accessible to appreciate the outcome of

this activity in Pakistan, which cannot be taken as reference for future M&A deals. Therefore, the present

research investigate in a decent way the impact of various M&A Integration Strategies on the financial

performance of the merged firms in Pakistan, with an aim to identify the best suited M&A Integration

Strategy in own environment. Available data from pre and post merger financial Statements of 36 merger

events categorized broadly into three Integration Strategies (year 2000 to 2010) had been examined using

paired sample T-test for difference of means of ratio categorized on four basis i.e. Liquidity Ratio,

Profitability Ratio, Operating Expense Ratio & Financial Leverage Ratio. Plausible recommendations were

solicited for the benefit of the investors, financial analysts, advisory firms and investment banks.

1 INTRODUCTION

The advancement in the field of information

technology has transformed the business markets

and have increased competition to manifolds

Companies have expanded their operation across the

international boundaries and in order to achieve

growth and expansion of products and services,

businesses use diverse strategies depending on their

business environment and the degree of competition

prevailing in the markets. Literature narrated that in

order to meet competition different integration

strategies are used by firms all across the globe.

David (2000) discussed in his book “Strategic

Management concepts and cases” that different

Integration strategies were adopted by firms at

domestic and International level according to the

circumstances. Among all the integration strategies

the most widely used included vertical integration

strategies, diversification strategies and defensive

strategies however, the type and mean of adopting

and implementing a strategy depends on the

circumstances faced by the firms (David, 2000).

Literature infers that firms used different means for

growth and expansion of the businesses which

mainly included collaboration with the competitors,

joint ventures, Merger & Acquisition (M&A) and

Outsourcing, strategic alliances and internal

development etc. (Santos et al., 2011).

Literature evidenced that among all the means to

achieve expansion M&A activity is the most widely

used across the globe and has witnessed an upward

trend especially in developed countries due to their

contributing role in bringing structural economic

changes in any country (Santos et al., 2011).The

growth of M&A activity had made it an area of

interest for large group of investors which can be

witnessed with the approximate financial statistics of

M&A activities in USA, which is equal to US $ 2.1

trillion in the last one decade (Bashir et al., 201l).

Estimates have also showed that more than 1500

M&A cases have been reported in the USA markets

in last decade (Hoang et al., 2007). Researchers have

verified that generally the objective of the M&A

activity is to expand the customer base, risk

minimization, increased possession of distribution

78

Maroof, Z. and Jawad, M.

Merger Acquisition: A Comparative Integration Analysis of Third World Country.

DOI: 10.5220/0007761000780085

In International Conference on Finance, Economics, Management and IT Business (FEMIB 2019), pages 78-85

ISBN: 978-989-758-370-4

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

channels and to acquire the assets of the target

company which is sometime impossible to acquire

through other alternative strategy (Zappa, 2008).

Bashir et al., (201l) further argued that integration

of firms through M&A activity is backed by

different motives, of which the two most prominent

are value maximization and non value maximization.

M&A activity implied that on the basis of the

Integration Strategies there are three types of

mergers namely vertical mergers, Conglomerate

mergers (diversification) and horizontal mergers

(Robert et al., 2012). Vertical mergers have further

been categorized into two more types forward

(combination with distributors) and backward

integration (combination with supplier). However,

Horizontal mergers include incorporation of

organizations involved in similar business and

conglomerate mergers include incorporation of

organizations involved in dissimilar business

(Robert et al., 2012).

Studies have investigated the M&A activity from

different perspective including strategic, financial,

accounting, marketing and management. Despite this

fact that M&A activity has increased considerably

across the globe very little evidence have been found

about the M&A activity in Pakistan. Numerous

studies have been conducted across the globe that

investigated the post merger financial performance

and the impact of merger deals on the share holder’s

wealth patterns. Despite this fact, in Pakistan almost

negligible researches have been reported in this area

and a very few studies have been found on the

subject under study (Bashir et al., 201l). Apropos in

view, a need is identified to carry out an in-depth

comprehensive analysis of the impact of M&A on

the financial performance of the merged firms in

Pakistan with an aim to analyze the pre merger &

post merger financial statements of all the merged

firms in all sector from time period 2000 to 2010

and then identify whether mergers in Pakistan are

contributing significantly to financial growth of the

companies or not. This study adopted a different

methodology to investigate the issue. The review of

the literature has evidenced that not a single study

has been conducted in Pakistan that investigate the

financial performance of the merged companies

from the strategic perspective. All the companies

that merged during time period 2000 to 2010

adopted certain integration strategy for merging with

the target company. Some of the companies merge

through vertical integration, some adopt horizontal

integration strategy and some merged through

conglomerate integration strategy. The current study

investigates this issue and analyzed 3 to 5 yrs

premerger and post merger financial performance of

the companies merged through vertical, horizontal

and conglomerate integration strategies separately,

with an aim to examine and compare the financial

performance of different types of merger deals held

in Pakistan and suggesting the way forward to the

advisory firms and investment banks.

1.1 Study Objectives

Does adopting Horizontal, Vertical and

Conglomerate integration strategies have any

effect on the financial performance of merged

companies in Pakistan or not?

Does financial performance of the Horizontally,

Vertically and Conglomerate merged enhanced

in Pakistan from the time period 2000 to 2010

as per 3 to 5 yrs premerger and post merger

financial data or not?

2 LITERATURE REVIEW

Fan and Goyal (2002) revealed that vertical mergers

contributes positively towards the wealth creation of

the merged companies and significantly impact the

performance of the company. Coontz (2004)

discovered significant role of mergers in reducing

systematic risk of the companies while horizontal

and conglomerate mergers does not. Chang and

Thomas (1989) concluded that risk and return of the

merged firms is more closely associated with the

structural factors related to markets and business

than with the diversification strategy used for the

mergers. Hitt et al., (1990) revealed that Merger and

Acquisition activity is positively related to the

managerial commitment and innovation. Sinha et al.,

(2010) investigated the impact of merger and

acquisition on the financial efficiency of the

financial institutions in India and showed that M&A

activity significantly improved the financial

performance of financial institutions in India (Sinha

et al., 2010). Selcuk and Kiymaz (2013)

demonstrated that the returns of the acquiring firms

decreased as a result of the merger and further the

smaller firms reported more abnormal returns as

compared to the larger firms. Ramswamy (1997)

concluded that the banks merged through horizontal

integration strategy showed an improved financial

performance after the merger as compared to those

merging with the strategically dissimilar banks.

Studies further measured the impact of strategic

similarities between the bidder and the target firms

Merger Acquisition: A Comparative Integration Analysis of Third World Country

79

on the financial performance of the merged banks in

European Union. The results revealed that the

financial performance of the merged banks has

improved as a result of the Merger and Acquisition

activity (Altunba and Ibanez, 2004). Coontz (2004);

Kashiramka and Rao (2013); Natarajan and

Kalaichelvan (2011) explored the shareholders

wealth effects of mergers & acquisitions and

reported the gains of shareholder of the target as

well as acquirer firms irrespective of the deal

announcement period. Liargovas and Repousis

(2011) further examined the impact of the merger

and acquisition on the performance of the Greek

Banking Sector. Event study methodology was used

to analyze the data and overall results indicated that

Mergers and acquisitions held in Greek banking

sector have no impact on their financial performance

and also do not create shareholders wealth

(Liargovas and Repousis, 2011).

Bashir et al., (2007) investigated the performance

record of forty five Mergers and acquisitions (M&A)

that took place during 2004 to 2010 in various

sectors of Pakistan and proved that the M&A

activity has no influence on the wealth

maximization of the merged companies in Pakistan,

contradictory to the literature and finding of the

global researches. Kemal (2011) further analyzed the

four years financial statements (2006-2009) of the

Royal Bank of Scotland (RBS) to measure its Post-

Merger Profitability. The results revealed that the

profitability, cash flows, liquidity, leverage and

assets management of the RBS has been relatively

reasonable previous to the merger agreement but

after the merger the financial performance of RBS

decreased so the deal failed to improve the

profitability of RBS. Arshad (2012) analyzed the

post merger performance of Standard Chartered

bank Pakistan. Results revealed that the financial

performance of the Standard Charter bank also

decreased after the merger. Usman et al., (2008)

investigated the Operating and financial

Performance of Merged Companies in Textile Sector

of Pakistan from time period 2001 to 2005. The

results revealed that the post merger operating

performance of the firms in textile sectors also

decreased as compared to the pre merger financial

performance. Afza and Yusuf (2011) examined the

impact of mergers on efficiency of conventional

banks in Pakistan. The results revealed that the

mergers held in banking sector reported

improvement in the cost efficiency of in Pakistan

from 93.83% to 94.15%. Kouser and Saba (2011)

examined the impact of M&A activity on the

profitability of the merged banks in Pakistan. The

six financial ratios i.e. profitability ratio, return to

net worth ratio, invested capital ratio and debt to

equity ratio were analyzed using paired sample t-test

and the findings evidenced decreased financial

performance of commercial banks after the mergers

(Kouser and Saba, 2011).

Ramaswamy (1997) investigated efficiency gains

from Banks in Pakistan. Findings revealed that

efficiency effect is marginal and pre merger

efficiency of acquirer didn’t contribute anything in

efficiency gains (Ramaswamy, 1997). Usman et al.,

(2010) investigated the impact of Scale Efficiency in

Banking Sector of Pakistan. For analytical purpose

banks were divided into three categories: domestic

private banks, state owned Banks, and foreign

owned banks. Foreign owned banks reported more

efficiency, followed by state owned banks and

domestic private banks (Usman et al., 2010).

Kayani et al.,(2013) examined the impact of merger

and acquisition on operating performance and

shareholder wealth in Pakistan banking sector and

showed that the operating performance &

shareholder wealth of the banks decreased after the

merger (Kayani et al., 2013).Hence, from the

extensive review of the literature we can conclude

that the researchers across the globe have studied the

M&A activity from different perspectives and

investigated the diversified issues encountered by

the merged firms concerning the HR, Marketing and

finance. Some studies investigated the

organizational differences among the acquired and

target firms and further investigated the cross

country determinants, HR Practices and

organizational structure of merged firms around the

globe. Researchers also examined the impact of

Merger and Acquisition on the post merger financial

performance, Share holder wealth maximization,

Operating financial performance and profitability of

the merged firms in different countries by adopting

different methodologies i.e. event study

methodology, financial ratio analysis technique etc.

Apropos in view, no study have been found in the

literature that investigates the impact of mergers and

acquisition on the financial output of all the merged

companies in Pakistan from the time span 2000 to

2010. The contribution of the current research is that

it investigates the influence of different integration

strategies (Vertical, Horizontal & Conglomerate)

upon financial output of the merged companies. It

distinguish the Merger deals held from 2000 to 2010

on the basis of Integration strategies (Vertical,

Horizontal & Conglomerate) and then evaluates

financial output through financial ratio system by

using their yearly financial declaration with an idea

FEMIB 2019 - International Conference on Finance, Economics, Management and IT Business

80

to categorize that whether implementing diverse

integration strategies have some influence on the

financial output of the merged companies or not.

Further it also categorize and advocate the best

integration strategy to Investors, MNCs, advisory

firms and Investment Banks for the future merger

deals in Pakistan.

2.1 Horizontal/ Vertical/ Conglomerate

Mergers

There is a significant difference between the Pre-

Merger and Post-Merger means of

H1:H8:H15 Current Ratio of Horizontal,

Vertical and Conglomerate Mergers.

H2:H9:H16 Sales Growth Ratio of Horizontal,

Vertical and Conglomerate Mergers.

H

3

:H

10

:H17

NPM of Horizontal, Vertical and

Conglomerate Mergers.

H4:H11:H18 ROE of Horizontal, Vertical and

Conglomerate Mergers

H5:H12:H19 Interest coverage Ratio of

Horizontal, Vertical and

Conglomerate Mergers

H6:H13:H20 Operating Expense Ratio of

Horizontal, Vertical and

Conglomerate Mergers

H7:H14:H21 Debt to Equity Ratio of Horizontal,

Vertical and Conglomerate Mergers

U

1

≠U

2

H

0

: There is no significant difference between the

Pre Merger and Post Merger means Current

Ratio, Sales Growth Ratio, NPM, ROE,

Interest Coverage Ratio, Operating Expense

Ratio and Debt to Equity Ratio Horizontal,

Vertical and Conglomerate Mergers

U1=U2

3 METHODOLOGY: STUDY

VARIABLES

Liquidity situation of the company is calculated

through Current ratio, Profitability of the firms is

calculated through Net Profit Margin & Return on

Equity, Operating expense ratio is used to measure

Operating efficiency of the company and Debt to

equity & Interest coverage ratio is used to measure

financial Leverage of the firms.

3.1 Population/Sample Size

For the purpose of current study initially 60 Merger

events were observed from the time period 2000 to

2010 based on three Integration Strategies i.e.

Horizontal, Vertical and Conglomerate mergers.

However 24 merger deals were excluded later on the

basis of non accessibility of the financial statistics.

Therefore, final sample comprises of 36 merger

deals which were analyzed separately after

distinguishing them on the basis of three integration

strategy. Almost 17 of the total merger

transactions/deals were integrated through vertical

strategy about 9 were merged through horizontal

strategy and 10 were merged through Conglomerate

strategy.

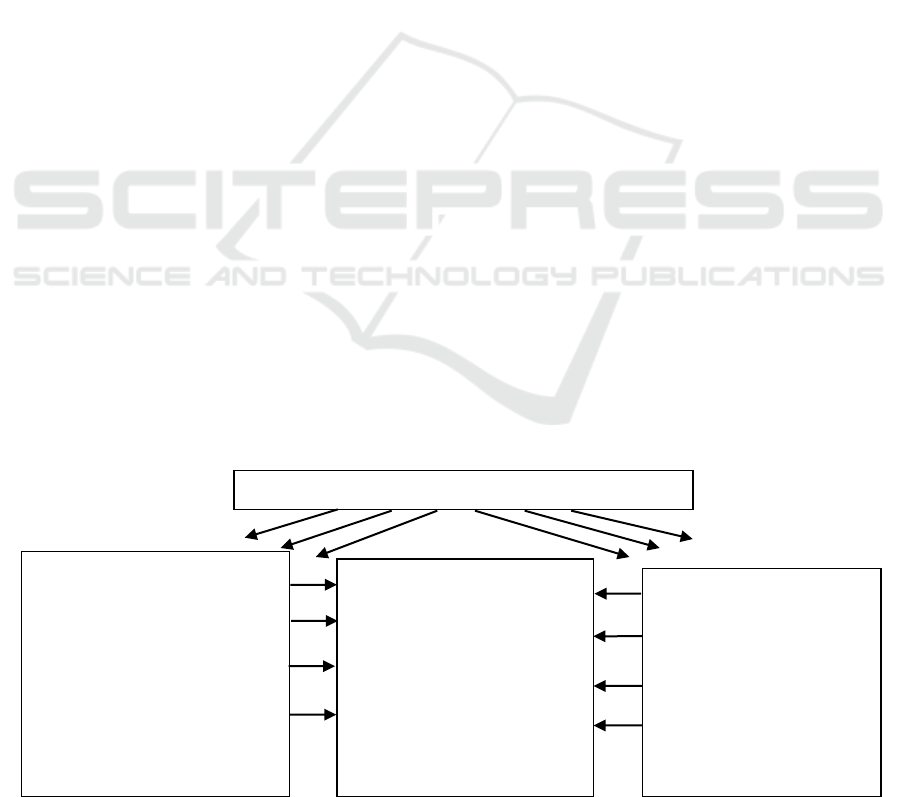

Theoretical Framework of the Study

Figure 1: Schematic diagram of the study.

Merger Types: Horizontal, Vertical and Conglomerate

Pre-Merger

Liquidity ratio

Current Ratio

Profitability Ratio

NPM

ROE/SG

Efficiency Ratio

Operating Expense

Interest Coverage

Leverage Ratio

Debt/Equity Ratio

Difference of Mean-

Application of Paired Sample

T –test

Pre-Merger

Liquidity ratio

Current Ratio

Profitability Ratio

NPM

ROE/SG

Efficiency Ratio

Operating Expense

Interest Coverage

Leverage Ratio

Debt/Equity Ratio

Merger Acquisition: A Comparative Integration Analysis of Third World Country

81

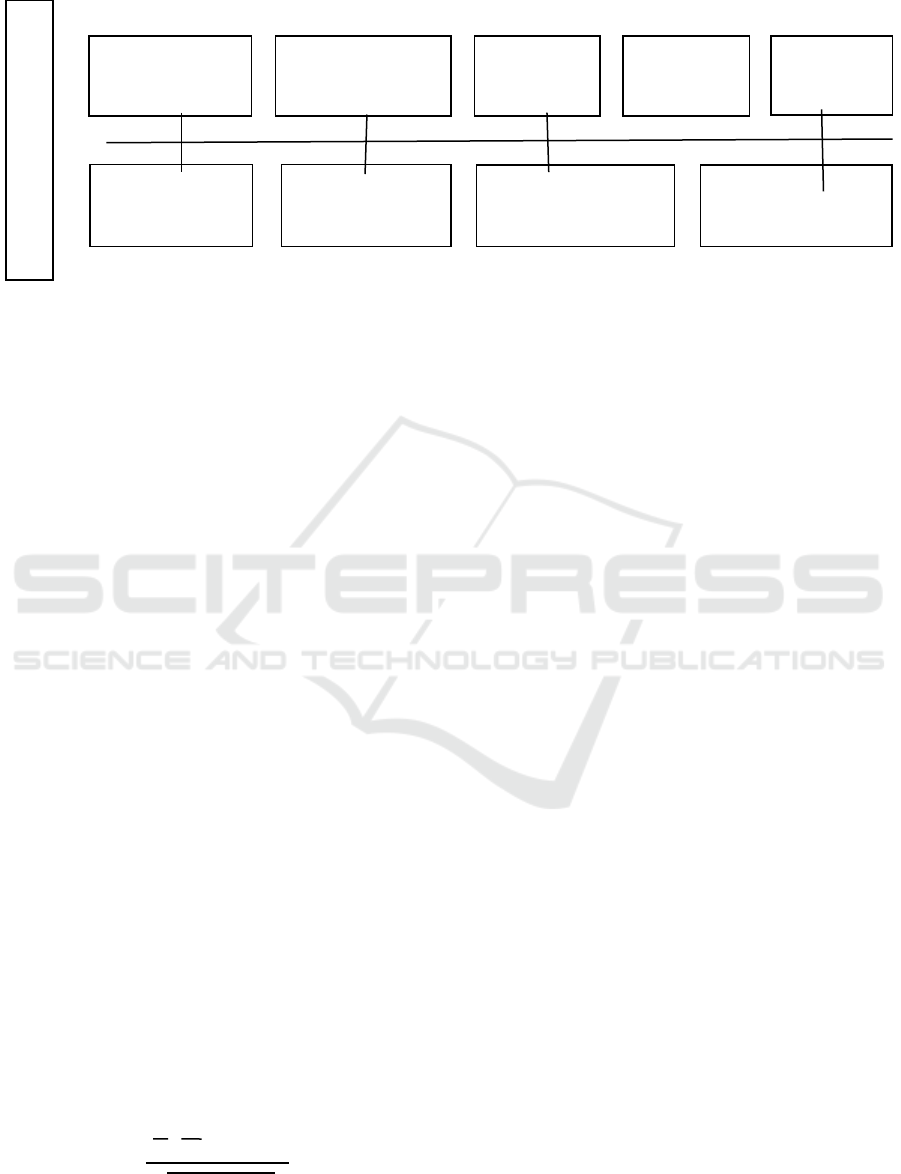

Research Design

Figure 2: Diagrammatic representation of study research design.

3.2 Statistical Analysis

The financial declaration of every merger events are

subsequently evaluated by financial ratio

examination. Entire seven ratios used in the study

included Current Ratio, Sales Growth ratio, Net

profit margin ratio, Return on equity, Operating

expense ratio, Interest coverage ratio and Debt to

equity ratio to measure the Liquidity, Profitability,

Operating Efficiency and financial Leverage of the

merged firms.

3.3 Financial Ratio Examination

A technique employed to examine the current,

previous and predictable financial output of the

companies (Tugas and CPA, 2012). Firstly, for pre-

merger period, each variable i.e. Current Ratio, Sales

Growth Ratio, NPM Ratio, ROE, Operating

efficiency Ratio, Interest coverage Ratio and Debt to

Equity Ratio is calculated for each of the three to

five years (-5,-4-3,-2,-1) independently for mutually

the acquirers’ and the target companies in the

sample. Likewise, the variables under study are then

evaluated for the acquiring companies merely for

three to five years post merger era (+1, +2, +3, +4,

+5). A combined mean for three years pre and

combined mean for three years post-merger period is

then computed. The difference between the mean

output measure of the pre and post-merger years is

then studies. To verify the outcome and significant

differences in the output during the pre and post

merger era Paired sample t-test was used in the

current study.

(x

1

– x

2

) – (µ

1

-µ

2

)

√s

2

1/

n

1 +

s

2

2 /

n

2

Where; X1=Target firm, X2=Acquirer firm,

μ1=Population of Target firm, μ2=Population of

Acquirer firm, S1=variance of target firm,

S2=Variance of acquirer firm, n1=Sample of target

firm, n2=Sample of Acquirer firm.

4 RESULTS AND ANALYSIS

o Horizontal Mergers

The findings of horizontal mergers evidenced that

the liquidity position, Sales Growth and profitability

of the horizontally merged firms deteriorated after

the merger while the Operating efficiency increased,

interest coverage Ratio declined and financial

leverage/Risk of the horizontally merged firms

decreased after the mergers.

o Conglomerate Mergers

The comprehensive analysis of the data revealed that

the liquidity position and the sales growth of the

firms merged through conglomerate integration

strategy decreased after the merger while the

profitability in some cases improved and in some

cases deteriorated after the mergers. The findings

further evidence that the operating efficiency

improved after the merger while leverage ratio

remained insignificant during post merger period.

o Vertical Mergers

Comprehensively, we can conclude that the liquidity

position, Sales growth, profitability and Operating

efficiency of the vertically merged firms increased

after the merger while the risk/leverage of the

vertically merged firms decreased during the post

merger period.

Data collection

Secondary

Secondary

Sampling design

Convenient sampling

Time Horizon

Longitudinal

Unit of Analysis

Organization

Purpose of Study

Hypothses testing

Type of investigation

Differentials

Researchers

Interferences

Minimal

Study setting

Non-contrived

Measurement

Financial Ratio

P

R

O

B

L

E

M

S

T

M

E

N

T

FEMIB 2019 - International Conference on Finance, Economics, Management and IT Business

82

5 DISCUSSION

Financial and economic state of Pakistan has

encountered numerous challenges among which the

predominant is to generate prospects for the

investment in Pakistan. Furthermore, from the

literature safely accomplished that M&A is

considered as an important means to enhance the

economic expansion of any country and are

frequently performed with an aim to progress the

financial output of any industry. On the contrary, in

case of Pakistan, same has been proved otherwise.

So the current study investigated the issue in

Pakistan and explores the impact of different

integration strategies (Horizontal, Vertical &

Conglomerate) on the financial output of the merged

companies in Pakistan. The study differentiated the

Merger deals held from 2000 to 2010 on the basis of

Integration strategies (Vertical, Horizontal &

Conglomerate) and then measured their financial

performance through financial ratio technique and

OLS Regression. The results of the financial ratio

analysis demonstrated that vertical integration

strategy is the most effective among the three

Integration strategies adopted by the firms for

conducting merger deals in Pakistan from time

period 2000 to 2010. The findings further revealed

that the firms that adopted vertical integration

strategy for merging reported improvement in

liquidity position, profitability, Operating efficiency

and improved financial leverage during the post

merger period and hence is identified as a most

effective integration strategy among the three under

study.

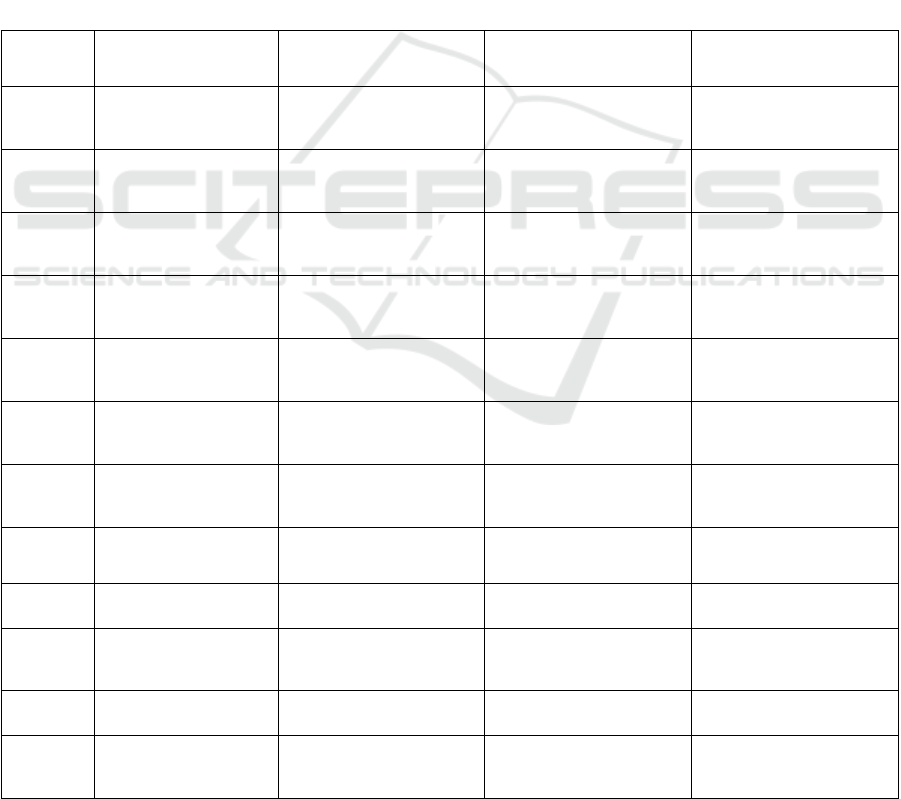

Table 1: Comparative Analysis of Financial Ratio.

Ser no.

Ratio

Horizontal Merger

Vertical Merger

Conglomerate Merger

1

Current Ratio

Deteriorated

(Accepted H1)

Improved

(Accepted H8)

Deteriorated

(Accepted H15)

2

Sales Growth Ratio

Deteriorated

(Accepted H2)

Improved

(Accepted H9)

Deteriorated

(Accepted H16)

3

NPM

Deteriorated

(Accepted H3)

Improved

(Accepted H10)

Improved

(Accepted H17)

4

ROE

Deteriorated

(Accepted H4)

Improved

(Accepted H11)

Deteriorated

(Accepted H18)

5

Operating Expense

Ratio

Deteriorated

(Accepted H5)

Deteriorated

(Accepted H12)

Deteriorated

(Accepted H19)

6

Interest Coverage

Ratio

Deteriorated

(Accepted H6)

Improved

(Accepted H13)

Improved

(Accepted H20)

7

Debt to Equity

Deteriorated

(Accepted H7)

Deteriorated

(Accepted H14)

Insignificant

(Accepted H0)

Ser no.

Ratio

Horizontal Merger

Vertical Merger

Conglomerate Merger

1

Liquidity position

Declined

Improved

Declined

2

Profitability

Declined

Improved

In some cases improved

/Declined /insig

3

Operating Efficiency

Improved

Improved

Improved

4

Financial Leverage

Declined

Declined

Insignificant neither

Improved/ Declined

Note: Comparative analysis of Vertical, Horizontal and Conglomerate Mergers (FY2000-FY2010).

Merger Acquisition: A Comparative Integration Analysis of Third World Country

83

Lastly, the results verified that the adopting different

integration strategies for conducting merger deals

have significant impact on the Liquidity position,

Profitability, Operating Efficiency and Financial

Leverage of the merged firms and suggests that

Vertical Integration strategy is the most favorable

among the three in Pakistani environment and hence

recommends Investors, MNCs, advisory firms, and

Investment Banks to adopt vertical integration

strategy for conducting future merger deals in

Pakistan and suggest the best M&A value chain

strategy to their clients in merger deals. Further the

study recommends that the Planning commission of

Pakistan should formulate a proper mechanism for

selecting a suitable integration strategy after proper

analyzing the previous trends and financial facts in

the industry. Lastly the study wills also assists policy

making organizations in increasing the volume of

merger activity in Pakistan by uprooting the factors

responsible for failure of mergers in Pakistan and

formulating a strategy that can increase the success

ratio of merger activity in term of financial

performance as it can contribute significantly in

improving the economic well of Pakistan.

Moreover, other developing and developed

economies should also consider the importance of

supply chain strategies i.e. Horizontal, Vertical and

Conglomerate strategies before making the merger

deals to maximize the shareholder’s wealth. The

adoption of appropriate strategy of supply chain

would also facilitate economies to expand their

customer base, minimize risk, increase possession of

distribution channels and acquire the assets of the

target company which is sometime impossible to

acquire through other alternative collaborating

strategies like joint venture or franchises etc

REFERENCES

David, F. R., 1999. Strategic Management Concepts Cases

Set. Prentice Hall.

Carvalho Santos, J., Ferreira, M. P., Reis, N. R. and Serra,

F., 2010. Mergers & acquisitions research: a

bibliometric study of top strategy journals, 2000-2009.

Bashir, A., Sajid, M. R. and Sheikh, S., 2011. The impact

of mergers and acquisitions on shareholders wealth:

evidence from Pakistan. Journal of Scientific

Research, 8(1), pp.261-264.

Hoang, T. V. N. and Lapumnuaypon, K., 2008. Critical

success factors in merger & acquisition projects: A

study from the perspectives of advisory firms.

Zappa, M., 2008. The Fundamentals of Strategic Logic

and Integration for Merger and Acquisition Projects.

Management, Economics and Technology, pp.42-61.

Roberts, A., Wallace, W. and Moles, P., 2012. Mergers

and Acquisitions, United Kingdom, Edinburg Business

School. Retrieved on, 10.

Chang, Y. and Thomas, H., 1989. The impact of

diversification strategy on risk‐ return performance.

Strategic Management Journal, 10(3), pp.271-284.

Fan, J. P. and Goyal, V. K., 2006. On the patterns and

wealth effects of vertical mergers. The Journal of

Business, 79(2), pp.877-902.

Hitt, M. A., Hoskisson, R. E. and Ireland, R. D., 1990.

Mergers and acquisitions and managerial commitment

to innovation in M-form firms. Strategic Management

Journal, pp.29-47.

Sinha, N., Kaushik, K. P. and Chaudhary, T., 2010.

Measuring post merger and acquisition performance:

An investigation of select financial sector

organizations in India. International Journal of

Economics and Finance, 2(4), pp.190-200.

Selcuk, E.A. and Kiymaz, H., 2013. The impact of

diversifying acquisitions on shareholders' wealth.

Ramaswamy, K., 1997. The performance impact of

strategic similarity in horizontal mergers: Evidence

from the US banking industry. Academy of

Management Journal, 40(3), pp.697-715.

Coontz, G., 2004. Economic impact of corporate mergers

and acquisitions on acquiring firm shareholder wealth.

The Park Place Economist, 12(1), pp.62-70.

Altunbaş, Y. and Marqués, D., 2008. Mergers and

acquisitions and bank performance in Europe: The role

of strategic similarities. Journal of economics and

business, 60(3), pp.204-222.

Kashiramka, S. and Rao, N.M., 2013. Shareholders wealth

effects of mergers & acquisitions in different deal

activity periods in India. European Journal of

Business and Management, 5(4), pp.116-129.

Natarajan. P. and Kalaichelvan., 2011. Stock Price

Reaction of The Merged Banks-An Event Study

Approach. International Journal of Research in

Commerce & Management, 2(4).

Liargovas, P. and Repousis, S., 2011. The impact of

mergers and acquisitions on the performance of the

Greek banking sector: An event study approach.

International Journal of Economics and Finance, 3(2),

pp.89-100.

Kemal, M. U., 2011. Post-merger profitability: A case of

Royal Bank of Scotland (RBS). International Journal

of Business and Social Science, 2(5), pp.157-162.

Afza, T. and Yusuf, M.U., 2012. The impact of mergers

on efficiency of banks in Pakistan. Elixir International

Journal: Finance Management, 48, pp.9158-9163.

Kouser, R. and Saba, I., 2011. Effects Of business

combination on financial performance: Evidence from

Pakistan's banking sector. Australian Journal of

Business and Management Research, 1(8), p.54.

Usman, A., Khan, M.K., Wajid, A. and Malik, M.I., 2012.

Investigating the operating performance of merged

companies in textile sector of Pakistan. Asian Journal

of Business and Management Sciences, 1(10), pp.11-

16.

FEMIB 2019 - International Conference on Finance, Economics, Management and IT Business

84

Kayani, A. J., Javed, B., Majeed, A. and Shaukat, A.,

2013. Impact of merger and acquisition on operating

performance and shareholder wealth in Pakistan

banking sector. Interdisciplinary Journal of

Contemporary Research In Business, 5(6), pp.385-

391.

Tugas, F. C., 2012. A Comparative Analysis of the

Financial Ratios of Listed Firms Belonging to the

Education Subsector in the Philippines for the Years

2009-2011. International Journal of Business and

Social Science, 3(21).

Merger Acquisition: A Comparative Integration Analysis of Third World Country

85