Fleet Planning Scenarios as an Impact of Changing the Export Policy

on Cost, Insurance and Freight: A Case Study of Indonesian Coal

Export

Firmanto Hadi

1,a

, Siti Dwi Lazuardi

b

, Irwan Tri Yunianto

c

, Dika Virginia

d

, and Dhany Herdiansyah

e

1

Department of Marine Transportation Engineering,

Institut Teknologi Sepuluh Nopember, Indonesia

e

dhanyherdiansyah7@gmail.com

Keywords: Coal Export, Cost Insurance and Freight, Fleet Planning, Free on Board, Shifting Term of Delivery.

Abstract: Indonesia is one of the world’s largest coal producers and exporters with total number of production and

export in 2017 are 271 million ton (rank-5) and 17,9 million ton (rank-2) respectively. However, Indonesian

coal export has been dominantly carried by foreign vessels, so that it effects on decreasing national fleets

usage in the export activities. In order to enhance the participation of national fleets on the export activities,

Indonesian government created a policy to change the terms of delivery on coal export from free on board

(FOB) to cost insurance and freight (CIF). Therefore, the coal export should be transported by national fleets.

The problem is total national fleets could merely control 3% of total coal export transportation. Hence, this

study aims to compare FOB and CIF term on Indonesian coal export and to determine the optimum fleet

planning required to support national fleets with three scenarios: (1) ship chartering, (2) second-hand ship

purchasing, and (3) new ship building. The method used for determining new ship building is optimization

by finding the optimum vessel size that produces the cheapest required freight rate (RFR). The analysis result

obtained that for the coal export from Muara Pantai to Port of Guangzhou with total demand of 9,360,000

tons per year, it required 6 bulk carriers of 67,452 DWT with the lowest RFR of $. 4.26 per ton.

1 INTRODUCTION

Indonesia is one of the world’s largest coal producers

and exporters with total number of production and

export to China, India and Japan in 2017 are 271

million ton (rank-5) and 17.9 million ton (rank-2)

respectively.

The government establishes regulations through

the Minister of Trade regarding the export and import

activities of certain commodities. Export activities are

listed in the Regulation of the Minister of Trade of the

Republic of Indonesia no. 82 of 2017 article 3

paragraph (1) which requires exporters of coal or

Crude Palm Oil (CPO) to use sea transportation

controlled by national sea transportation companies

and in article 4 paragraph (1), exporters in insuring

coal export commodities or CPO are obliged to use

insurance from a national insurance company

(Permendag, 2017). Sea transportation controlled by

a national sea transportation company is sea

transportation owned by a national shipping company

and has an Indonesian flag, not under a lease from a

foreign shipping company. This regulation was

enacted on 26 October 2017 and will be implemented

6 (six) months later, namely on 26 April 2018. If

exporters do not comply with these rules, they will be

subject to administrative sanctions in the form of

suspension of permits or revocation of permits. This

regulation is the government's effort to increase the

competitiveness of the national shipping industry in

the international world.

Responding to this, the Indonesian Coal Mining

Association (APBI) considers this regulation to be

burdensome for coal export activities. According to

Hendra Sinadia (Chairperson of APBI), the use of

national vessels can hamper coal exports because the

availability of export transportation is still limited and

coal companies use more foreign ships with a free on

board (FOB), accounting for 80% of Indonesia's coal

export activities (Benarto, 2016).

Currently, national shipping companies only

control 3% of coal export transportation (Yunianto,

Lazuardi, & Hadi, 2018). Due to the high number of

Indonesian coal exports, while the use of the national

Hadi, F., Lazuardi, S., Yunianto, I., Virginia, D. and Herdiansyah, D.

Fleet Planning Scenarios as an Impact of Changing the Export Policy on Cost, Insurance and Freight: A Case Study of Indonesian Coal Export.

DOI: 10.5220/0010854700003261

In Proceedings of the 4th International Conference on Marine Technology (senta 2019) - Transforming Maritime Technology for Fair and Sustainable Development in the Era of Industrial

Revolution 4.0, pages 63-70

ISBN: 978-989-758-557-9; ISSN: 2795-4579

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

63

fleet is still limited, it is necessary to plan a vessel so

that the national shipping company is able to meet the

demand of coal exports.

2 METHODOLOGY

The first analysis compares the existing FOB to the

projected CIF. Both apply the identical term, Free on

Board (FOB). There are four phases of analysis

1. Selecting the port of origin (Mara Pantai Port,

East Borneo) and the port of destination

(Guangzhou Port, China),

2. Comparing FOB to CIF that obtained through

required freight rate (FRF),

3. Obtaining RFR of FOB from the coal mining

company and RFR of CIF from the calculation,

4. Determining the total shipping cost of CIF on the

certain route. In fact, the total shipping cost of CIF

equals to FOB due to the similar shipping cost

components.

The second analysis conducts a calculation on

fleet planning for coal export, as follows

1. Collecting the existing national ship data that

serve coal export activities,

2. Gathering the second-hand ship data, which serve

coal export activities,

3. Calculating the ship’s main size in order to obtain

the optimum RFR through optimization method,

4. Computing cost and RFR calculation for each

scenario,

5. Determining the number of ships where have the

lowest RFR,

6. Conducting the sensitivity analysis.

The scenario analysis conducted on the study

1st Scenario: Ship chartering

The number of national shipping as the main object is

20 units in various size. In this scenario, the RFR

calculation includes time charter hire (TCH), voyage

cost, and cargo handling cost. In addition, the charter

rate depends on the fixed costs; both capital and

operational cost (Lazuardi, 2017).

2nd Scenario: Second-hand ship purchasing

Purchasing 15 unit of ships in various size. The

capital cost is obtained through the price and their size

(Blank, 2008). Furthermore, the ship price is various

depended on their size and year of establishment.

3rd Scenario: New ship building

The total cost of new ship building consists of capital

cost, operational cost, voyage cost and cargo handling

cost (Stopford, 2009). Ship building calculation is

required when the capacity of existing ships unmet

the demand. The ship size: Length between

Perpendicular (Lpp) is optimized using the Nonlinear

Programming method (Santosa & Willy, 2011).

There are three main components in optimization

model, the objective function, constraints and

decision variables. Therefore, Solver in Microsoft

Excel is used to find the optimal solution.

Mathematical Model

With the development of formulations, the following

is a mathematical model that is created and must be

implemented in the software in the Microsoft Excel

called Solver. The equation used to determine the

total cost is as follow:

𝑇𝐶 𝐹𝐶 𝑉𝐶 𝑃𝐶

(1)

Objective Function

Min 𝑅𝐹𝑅

𝑇𝐶

𝐷

(2)

Where:

𝐹𝐶 𝑆

𝑃

(3)

𝑆𝑐

𝑃

𝑆𝑇

𝐿𝑃𝑃 𝐵 𝐷

𝐴

𝐶

𝑆𝑇

𝑈

𝐸

(4)

𝑃𝑐 𝐷

𝐶

𝑃𝑖

𝐶

𝐸𝑀

𝐶

𝑅

𝑒

𝑀

𝐶

Tax (5)

𝑉𝑐 𝑆

𝑜𝐶

𝑆

𝑣𝐶

𝑃

𝑜

(6)

𝑆

𝑛

𝑆

𝐸𝑀𝐶

𝑇𝐷𝐹𝑊

𝑐

(7)

𝑆

𝑀𝐸

𝑐

𝐴

𝐸

𝑐

(8)

𝑀𝐸

𝑛𝑀𝐶𝑅 𝑆𝐹𝑂𝐶 𝑡

𝑠

𝑃

𝑀𝐹𝑂

(9)

𝐴

𝐸

𝑛

𝑀𝐶𝑅

𝑆𝐹𝑂𝐶

𝑡𝑠

𝑡𝑝

𝑃𝐷𝑀𝑂

(10)

𝑃𝑂

𝑛

𝐴

𝐵𝑀

𝑐

(11)

Decision Variable

LPP (Length between Perpendicular)

Constraints

Operational efficiency and effectiveness of ports or

𝐿𝑃𝑃

> 0;

𝐿𝑃𝑃

𝜖

1, 2, 3 …

𝑥

𝑖𝑗

≥

𝐷

ℎ

𝑗

×(

𝑡

𝑠

+t

𝑝

)

𝑇𝑠 ≤ 𝐿𝑊𝑆

senta 2019 - The International Conference on Marine Technology (SENTA)

64

𝐿𝑃𝑃 ≥ 𝐿𝑃𝑃 𝑚𝑖𝑛

𝐿𝑃𝑃 ≤ 𝐿𝑃𝑃 𝑚𝑎𝑥

𝐷 ≤ 𝐾

𝑎

× 𝐹

𝑑

Descriptions:

RFR : Required Freight Rate

TC : Total cost in a year

D : Demand (ton/year)

T : Ship Draft (meter)

Tp : Port Draft (meter)

Ka : Cargo Handling Capacity (ton)

Fq : Frequency

3 GENERAL AND LITERATURE

REVIEW

3.1 Coal Mining Industries

Coal production in Indonesia is dominated by Low to

Medium Calories coal, such as bituminous, sub

bituminous, and briquettes. The tendency of coal

production is increasing during the past 10 years. The

highest amount of coal production was in 2013, 474

million ton. Most of the use of the coal was providing

the export demand. In 2017, the amount of coal

production reached 97 million ton, climbed 7.2% by

the previous year and surged to 364 million ton, 5%

increasing in 2016. The Indonesia's Ministry of

Energy and Mineral Resources said that the

production level in 2018 rocketed was caused by

many small-scale business licenses that have been in

the exploitation period.

3.2 Coal Importer Countries

The countries in Asia that yield the highest amount of

coal are China, Japan, India, Korea, and Taiwan. The

biggest importer is China that yielded 255 million

tonnage in 2016. In addition, the importers for

Indonesia are China, Japan, South Korea, and

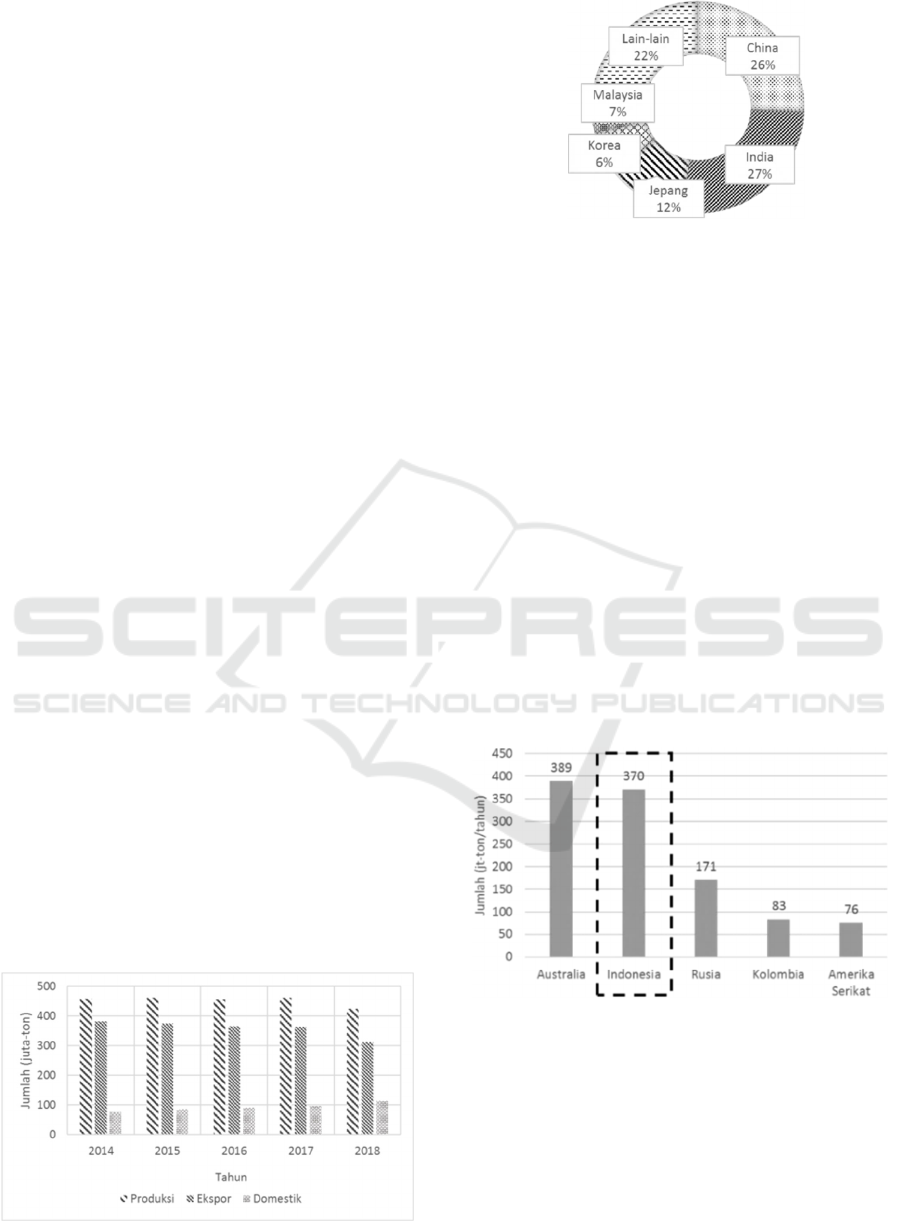

Figure 1: The amount of coal production in Indonesia.

Figure 2: Importer countries for Indonesia (tonnage per year).

Malaysia (International Trade Centre, 2015).

According to The Indonesia's Ministry of Energy and

Mineral Resources, in 2017, China, India, South

Korea and Malaysia imported 31.5 million tonnage,

40 million tonnage, 7.7 million tonnage and 7.8

million tonnage, respectively.

3.3 Coal Exporter Country

According to the International Energy Agency in

2017, Australia is the top country that yields 389

million-ton coals (26.5% out of world’s total coal

production). The second country is Indonesia, 370

million ton (24% out of world’s total coal

production). In the third place, Russia yields 171

million ton. Lastly, in 2016, the 10 biggest coal

exporters contribute 95% of coal production in the

World. The amount of coal export in Indonesia

increased by 0,9% in 2016, from 368 million ton to

365.7 million ton.

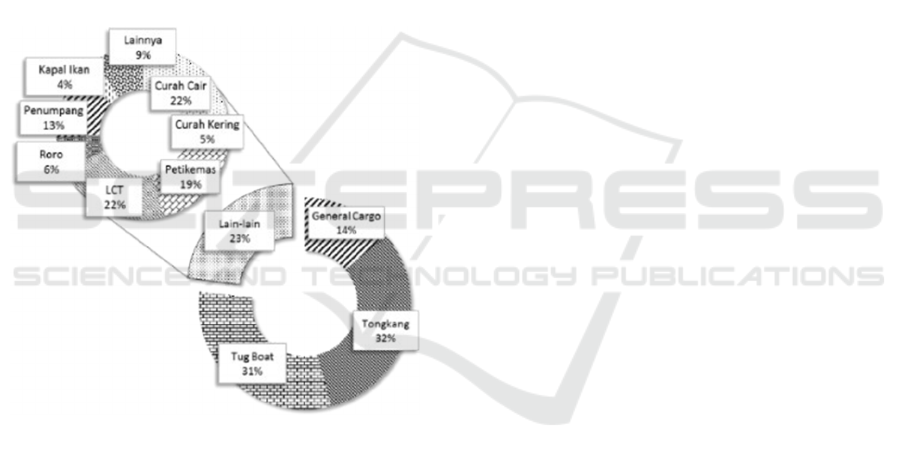

Figure 3: Coal exporter.

3.4 Coal Fleet by National Company

Currently, the number of carriers in Indonesia is 27,500

units according to the Ministry of Transportation. The

Indonesian ship such as dry bulk and barge have been

continuously operated to fulfil the domestic demands.

In consequence, Indonesian ship has the small

percentage of fulfilling the export demand, since there

Fleet Planning Scenarios as an Impact of Changing the Export Policy on Cost, Insurance and Freight: A Case Study of Indonesian Coal

Export

65

are few numbers of ships, 50 units. Recently, only 3%

of national fleet are operated for coal carrier while the

rest, 97%, managed by international ship (Yunianto,

Lazuardi, & Hadi, 2018).

3.5 The Port of Origin and Port of

Destination

The study case on this research is the export of coal

from Muara Pantai, East Borneo to Guangzhou port,

China. There are three mining areas, Sambarata, Lati,

and Binungan. From Lati, Coal are produced for

brand Agathis and Sungkai. The coal reserved in this

area is 465 million ton. Coal is excavated with a

hydraulic excavator and loaded on trucks. From this

mining area, the coal is transported to the installation,

11 km, through a well-established road on any

weather, then stocked in the stockpile before loaded

into the barge.

Figure 4: The percentage of Indonesian fleets.

The destination port in China, Guangzhou port

which established in 2004, has 14 coal terminals, with

the result that it could manage 60 million ton in a year.

In 2010, the port could handle 410 million ton of

cargo in which it was nominated as the 5th busiest

port for non-container handling and the 7th best port

for container handling (UNCTAD, 2015). Moreover,

one of terminal is Xinsha (14,4-meter depth) on the

fresh water. So that, the ship that aim to conduct

loading and discharging is restricted to the maximum

of 85,000 DWT.

4 ANALYSIS AND RESULTS

4.1 Introduction

The result of this research on the coal trade is the

optimum fleet planning in terms of cost analysis on

charter, ship building and second-hand ship through

national shipping company which fulfils the

international coal demand.

4.2 Existing Coal Export in Indonesia

In today’s world, 80% of shipping contract apply the

FOB as the term of delivery in where the exporter

pays the cost of marine freight, insurance, discharging

and transportation from the arrival port to the final

destination. Besides, the CIF term in export- import

increases the role of companies with Indonesian legal

status and assists increasing foreign exchange

through taxes.

Coal export in Indonesia is carried by bulk carrier

from Muara Pantai, East Borneo to Guangzhou port,

China for 1,424 nm. The loading-discharging

activities in Muara Pantai utilises the floating transfer

solution (speed 40,000 tonnage/day). In addition, dry

bulk carrier is operated to transport coal using the

FOB delivery term. The size of the dry bulk carrier is

65,000 DWT with RFR $4-$4.5 per tonnage.

4.3 FOB and CIF Comparation

Calculation model used in this research can be

utilized to calculate freight on other routes on

domestic coal demand. The freight excludes the profit

margin, called require freight rate (RFR).

Ship operations determine the cost required in the

transportation process. There are 2 (two) types of

time, when ship is berthing and sailing. The vessels

time conducting activities in the port is called port

time, whereas the time spent vessel on the sea (origin

to destination) is called sea time. Port time includes

waiting time, approaching time, and berthing time.

Sea time calculation is obtained from the division

between the distance travelled (s) with the speed of

the vessel (v). Meanwhile, the speed of the ship is

determined by laden and ballast condition. Port time

distance travelled (S) and sea time (s) are the time are

required to export the coal in one roundtrip.

senta 2019 - The International Conference on Marine Technology (SENTA)

66

Table 1:Roundtrip time.

Sea time

(

roundtri

p)

219.08 Hours

10.00 Days

Port time

Origin

38.71 Hours

2.00 Days

Destination

57.71 Hours

3.00 Days

Roundtrip

315.5 Hours

14.00 Days

The demand (D) of coal in China is 9,360,000 ton

per year and the payload is 64,519 ton. Therefore, the

trip frequency (Fd) can be counted by 146 times

(divided payload by demand) and the operation days

(Ho) in a year is 330 days, 1 ship is required (RTD)

14 days in one roundtrip. So that, the frequency (Fa)

of the ship obtained by divide Ho by RTD is 24 times.

Besides, to count the number of ships required, 7

unites with the size of 65,000 DWT; 80% of

utilization, can be counted by divide Fa by Fd in a

year.

Furthermore, charter rate can be found through

some calculations: capital cost, operational cost and

freight. Time charter charged the charterer in the time

charter scheme during certain period, 1 (one) year in

this study. The total of capital and operational cost is

$ 157,224,261. The total cost is charged in each year

and is added by the profit of time charter hire, $

19,291,286 in a year.

The shipping cost is the component that take into

account when RFR is calculated. The amount of the

shipping cost depends on the distance and the type of

the ship. As well as the bunkers and port charges.

Through the considered routes from Muara Pantai to

the Guangzhou Port, the Fa can be counted by

determined the number of roundtrips. The bunker cost

is divided by two types, the fuel for main engine, $

14,847,480 per year and the fuel for auxiliary engine

$ 3,704,362 per year. In addition, the port charge is

divided into 4 parts: anchorage, berthing, pilot service

and tug assistance cost, $ 2,841,124 per year.

Moreover, the cargo handling cost using the CIF term

where the exporter is responsible to the cargo loading

cost in the origin port. There are 9,360,000 tonnage

cargo carried that cost $ 742,543 per year.

The freight in which the analysis that applied CIF

terms is the RFR excluded the profit. RFR can be

counted by divide the number of Demand in a year

(D) to Total Cost (TC). The total cost includes Time

charter hire, shipping, and cargo handling cost. Then,

the total cost of coal export to China is $ 41,426,796

per year. At last, after knowing all the total cost, RFR

can be calculated by divide demand (D) to total cost,

$ 4.43 per tonnage.

Table 2: Existing cost.

Tittle Amount ($) Unit

Time Charte

r

Hire 19,291,286 /yea

r

Shi

pp

in

g

Cost 21,392,967 /

y

ea

r

Cargo Handling Cost 742,543 /yea

r

Total Cost 41,426,796 /

y

ea

r

RFR 4.43 /ton

In summary, the minimum RFR is using the FOB

term, $ 4.0 per tonnage which is $ 0,43 per tonnage

lower.

4.4 The First Scenario: Ship Charter

Bulk carriers owned by shipping company are in the

limited numbers. According to INSA, their national

vessels are able to satisfy only 3% of the total amount

of coal export in Indonesia, 370 million tonnage per

year. In terms of national charterer, there are 20

alternative vessels that could be operated.

The model used to calculate the charter vessel is

MV Victory Union 65,000 DWT, its payload is

64,509 ton, so that, in order to meet the demand from

China, 146 frequencies (Fd) are required. The

operation days (Ho) in a year is 330 days, 1 ship is

required (RTD) 14 days in one roundtrip. So that, the

frequency (Fa) of the ship obtained by divide Ho by

RTD is 24 times. Thus, 7 ships, 87% of utilization,

can be counted by divide Fa by Fd in a year.

Table 3: Existing charter cost.

Tittle Amount ($) Unit

TCH 20,768,631 /

y

ea

r

Shipping Cost 21,109,806 /yea

r

Car

g

o Handlin

g

Cost 742,614 /

y

ea

r

Total Cost 42,621,051 /yea

r

RFR 4.55

/

ton

Furthermore, time charter hire can be found

through some calculations: capital cost, operational

cost and freight. Time charter charged the charterer in

the time charter scheme during certain period, 1 (one)

year in this study. The total of capital and operational

cost is $ 157,224,261. The total cost is charged in

each year and is added by the profit of time charter

hire, $ 19,291,286 in a year.

Time charter hire is obtained by calculating the

capital and operational cost, $ 108,882,197 and

$40,923,057 respectively. Thus, TCH is $ 20,768,631

per year. The shipping cost consists of fuel and port

cost, $ 18,263,645 per year and $ 2,846,161 per year

respectively. Whereas the cargo handling cost is $

742,614 per year.

Fleet Planning Scenarios as an Impact of Changing the Export Policy on Cost, Insurance and Freight: A Case Study of Indonesian Coal

Export

67

In summary, the total time charter hire on MV.

Victory Union is $ 42.621.051 per year, so that the

RFR is $ 4,55 per ton

4.5 The Second Scenario: Buy Bulk

Carrier

As mentioned previously, the number of bulk carriers

owned by National shipping company is limited. So

that, the alternative offered is buy the bulk carriers. In

this research, there are 15 bulk carriers with various

DWT. The existing method to calculate the RFR is

applied to the MV. Hanton Trader II with 63,800

DWT. The payload is 63.321 ton, so that in order to

meet the China’s demand (D), 9,360,000 ton per year,

148 frequencies (Fd) are required. The operation days

(Ho) in a year is 330 days, 1 ship is required (RTD)

14 days in one roundtrip. So that, the frequency (Fa)

of the ship obtained by divide Ho by RTD is 24 times.

Thus, 7 ships, 87% of utilization, can be counted by

divide Fa by Fd in a year.

The market price for the ship is $ 15,300,000. The

capital cost that should be paid is $ 107,100,000. This

cost is charged in each year with the value of

weighted average cost of capital (WACC), 12%, thus

the capital cost is $ 13,655,247 per year.

Table 4: Recapitulation of ship purchase cost.

Tittle Amount ($) Unit

Capital Cost 13,655,247 /Yea

r

O

p

erational Cost 6,581,359 /Yea

r

Shipping Cost 20,905,138 /Yea

r

Car

g

o Handlin

g

Cost 738,019 /Yea

r

Total Cost 41,879,762 /Yea

r

Unit Cost 4.47 /ton

The operational cost consists of the salary of

crews, maintenance cost, consumable cost, insurance,

lubricant, and fresh water. Thus, the total operational

cost of Mv. Harton Trader II is $ 5,361,560 per year.

The shipping cost consists of bunker and port cost.

The fuel of main engine and auxiliary engine are $

14,385,621 per year and $ 3,663,732 per year,

respectively. In addition, the port cost is $ 2,855,785

per year.

In summary, the total cost for purchasing the MV.

Hanton Trader II is $ 41,879,762 per year. The RFR

on this scenario is $ 4,47 per ton in which it is 11%

higher than the existing FOB term.

4.6 The Third Scenario: Building New

Ship

The main size of the ship is obtained by conducting

the optimization method. Since there are 9.360.000

ton per year demand (D) and the speed required is 15

knot, ship planning calculation is assigned. The

calculation includes the displacement and ship

tonnage. The optimization method is used to find the

minimum value of RFR.

Table 5: Optimized vessel specifications.

Tittle Amount Units

LOA 226.78 m

LWL 218.38 m

LPP 209.98 m

B 31.91 m

H 18.77 m

T 13.12 m

DWT 67,452 ton

LWT 11,133 ton

GT 36,978

NT 22,731

Main Engine Powe

r

12,270 hp

Auxiliar

y

En

g

ine Powe

r

650 h

p

The ship’s payload is 66,995 ton that gained by

reducing the DWT in consumable and crew weight.

The frequency required, since the demand (D) is

9,360,000 ton and the payload is 66,955, is 140 times.

The operation days (Ho) in a year is 330 days, 1 ship

is required (RTD) 14 days in one roundtrip. So that,

the frequency (Fa) of the ship obtained by divide Ho

by RTD is 24 times. Thus, 6 ships, 97% of utilization,

can be counted by divide Fa to Fd in a year.

The total cost is obtained by multiplying steel,

machinery, equipment, and tools to the existing price

of the steel. The ship building cost is $ 12,537,930.

The building cost is added by 20% profit, 5%

inflation, 10% taxes, hence the ship price is $

19,926,206. The number of units required is 6, thus

the total cost is $ 101,557,236. That capital cost is

equally split through 30 years of ship’s economically

age and the WACC is 12%. Accordingly, the cost is

$ 12,607,687 per year.

The operational cost consists of the salary of

crews, maintenance cost, consumable cost, insurance,

lubricant, and fresh water. Consequently, the total

operational cost is $ 4,852,608 per year. The shipping

cost consists of bunker and port cost. The fuel cost for

both main engine and auxiliary engine depend on

engine power, voyage duration, and the cost of the

fuel in the market. The fuel of main engine and

auxiliary engine for the new ship are $ 17,790,105 per

year and $ 3,663,732 per year, respectively. In

senta 2019 - The International Conference on Marine Technology (SENTA)

68

addition, the port cost is $ 2,757,594 per year. The

cargo handling cost is calculated when the ship in is

in the origin. Hence, the cargo handling cost is

$739,095 per year.

Table 6: Recapitulation of ship building cost.

Tittle Amount ($) Units

Ca

p

ital Cost 12,607,687 /

y

ea

r

Operational Cost 6,071,169 /yea

r

Shi

pp

in

g

Cost 20,547,699 /

y

ea

r

Cargo Handling Cost 739,095 /yea

r

Total Cost 39,965,650 /

y

ea

r

RFR 4.26 /ton

In summary, the total cost for building the new

ships is $ 39,965,650 per year. Therefore, the RFR is

$ 4.27 per ton which is 6% higher than using the FOB

term.

4.7 The Comparison of RFR

The alternative term (CIF) for coal export is by

chartering the national ship, or by building the new

ships which can be the demand. The price reference

of RFR in FOB for shipping from Muara Pantai to

Guangzhou port (1,424 nm) is $ 4 - $ 4.5 per ton.

Table 7: Scenario comparison.

Charte

r

Buy Buil

d

DWT (ton) 65,000 63,800 67,452

Shi

p

(

unit

)

7 7 6

Annual Total Cost

(

Thousand $

)

42,621 41,879 39,909

RFR ($/ton) 4.55 4.47 4.26

As shown in the table above, the amount of RFR

in three scenarios are $ 4.55, $ 4.47, $ 4.26 which are

allocated for charter, buy, and build the ship,

respectively. Moreover, the time charter hire for

65,000 DWT requires 7 units of ship, buying ship on

63,800 DWT requires 7 units, and building ship on

67,425 DWT requires 6 units. To sum up, according

to the result of the analysis, the scenario chosen is

building 6 units of ship which have RFR $ 4.26 ton.

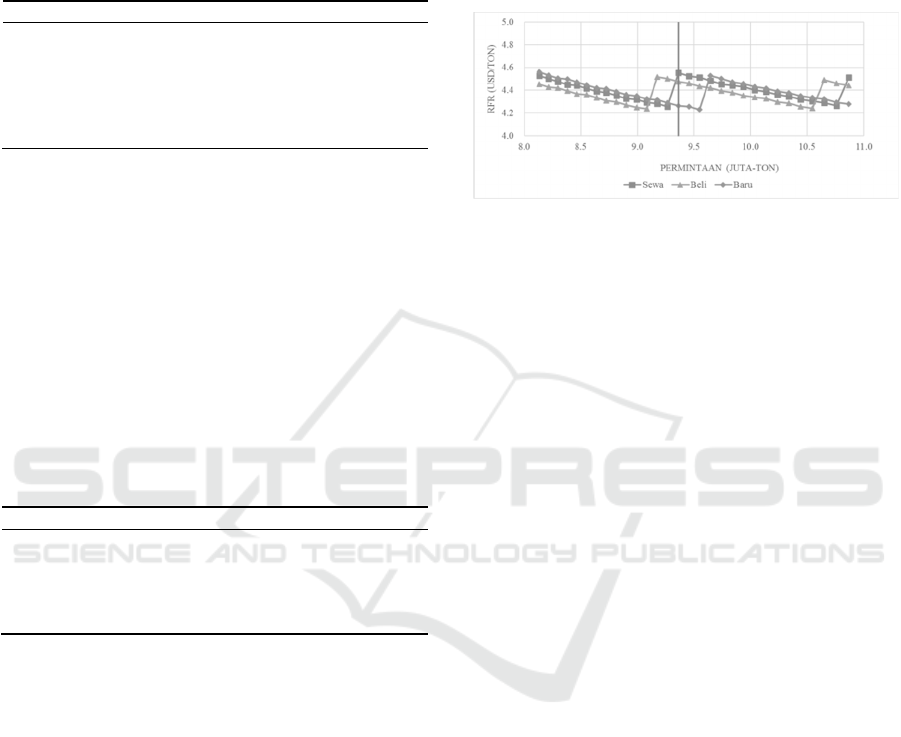

4.7 Sensitivity Analysis

Sensitivity Analysis provides the information in

which variables affected by the chosen scenario.

The higher number of demands, the lower amount

of RFR. There is a significant rise of the RFR in

which it shows that there should be addition on the

number of ship when the demand rise. At the

9,360,000 ton per year demand, building the ship

gives impacts in a lower amount of RFR since the

utility of the ship is 97%, meanwhile, the utility of

time charter hire and buying ship is 87% and 88%,

respectively. In the case of increasing the number of

demands by 2%, the amount of RFR will decrease by

0.87%.

Figure 5: Sensitivity analysis on demands and RFR.

The sensitivity analysis is applied on other

variables, such as speed, loading and discharge rate,

load factor, distance, and currency. In this sensitivity

analysis, for each variable is increased by 2%. This

variation influenced the amount of SFR in which it is

increasing by 0.53% (speed), decreasing by 0.08%

(loading and discharge rate), decreasing by 1,1%

(load factor), increasing by 0.93% (distance), and

decreasing by 0.8% (currency).

5 CONCLUSIONS

According to the analysis and the result, there are

summary need to be considered:

1. Indonesia is one of the biggest coal exporters in

the world that export 364 million ton per year. The

importer countries for Indonesia are China (22%),

India (24%), Japan (11%), South Korea (6%) and

Malaysia (6%). Terms of delivery (ToD) Free on

Board (FOB) is massively used, 80%, in

Indonesia where Indonesia as the exporter

responsible to ship the coal to the origin port.

2. The amount of RFR and FOB on 65,000 DWT to

export coal from Muara Pantai to Guangzhou Port

(1.424 nm) in which demands 9.360.000 ton per

year is $4-$4.5, while using the CIF term, the

amount of RFR is $4.48 per ton, 11% higher than

FOB term.

3. Fleet planning has been conducted in three

scenarios, (1) time charter hire; (2) buying ship;

and (3) building new ship.

a. Time charter hire for 65,000 DWT requires 7

units of ship, the RFR amount is $ 4.55 per ton.

b. Buying ship on 63,800 DWT requires 7

units, the RFR amount is $4.47 per ton, and

Fleet Planning Scenarios as an Impact of Changing the Export Policy on Cost, Insurance and Freight: A Case Study of Indonesian Coal

Export

69

c. Building ship on 67,425 DWT requires 6

units, the RFR amount is $ 4.25 per ton

Thus, according to the result of the analysis, the

scenario chosen is building 6 units of ship which

have RFR $ 4,26 per ton.

4. Therefore, sensitivity analysis is conducted to

determine the most sensitive variables; the

sensitivity orders are: load factor (the most

sensitive), distance, demands, currency, speed and

loading and discharge rate (the least sensitive).

REFERENCES

Benarto, R. A. (2016). Analisis Penerapan Cost Insurance

and Freight (CIF) pada Komoditi Ekspor Indonesia:

Studi Kasus Komoditi Crude Palm Oil (CPO).

Surabaya: ITS.

Blank, L. &. (2008). Basic of Engineering Economy (Vol.

I). New York: McGraw-Hill.

International Trade Centre. (2015). Market Analysis and

Research. Switzerland: International Trade Centre.

Lazuardi, S. D., van Riessen, B., Achmadi, T., Hadi, I., &

Mustakim, A. (2017). Analyzing the National Logistics

System through Integrated and Efficient Logistics

Networks: A Case Study of Container Shipping

Connectivity in Indonesia. Applied Mechanics and

Materials, 862, 238–243.

https://doi.org/10.4028/www.scientific.net/amm.862.2

38.

Permendag. (2017). Peraturan Menteri Perdagangan

Republik Indonesia Nomor 82 Tahun 2017. Jakarta:

Kementerian Perdagangan RI.

Santosa, B., & Willy, P. (2011). Metode Metaheuristik,

Konsep, dan Implementasi. Surabaya: Guna Widya.

Stopford, M. (2009). Maritime Economics 3rd Edition.

Abingdon, Oxon: Routledge.

UNCTAD. (2015). Review of Maritime Transport 2015.

United Nations Conference on Trade and Development.

Yunianto, I. T., Lazuardi, S. D., & Hadi, F. (2018). Freight

calculation model: a case study of coal distribution. IOP

Conference Series: Earth and Environmental Science

Vol. 135 (p. 012-013). IOP Publishing.

senta 2019 - The International Conference on Marine Technology (SENTA)

70