The Role of Information Technology in Supporting Accountant

Profession in the Era of Industrial Revolution 4.0

Titis Wahyuni

Vocational Education Program, University of Indonesia, Depok, Indonesia

Keywords: Industri 4.0, Information Technology, Digital Technology, Digital economy, Big Data, Cloud Computing.

Abstract: The purpose of this study is to identify the role of information technology in supporting accountant

profession in the era of Industry 4.0. The method used in this study is a descriptive analysis. The results of

this study indicate that information technology through the application of digital data technologies such as

the Internet of Things, AI, Cyber-Physical Systems in the industry helps accountants in carrying out their

work in the Industrial 4.0 era. The study provides an understanding, advice and recommendations to the

accountant profession about how information technology in Industry 4.0 works, helps the tasks undertaken

by accountants and directs the capabilities that accountants should have in facing the Industry 4.0 era. The

research enhances the prior works in the area of accountant’s tasks, not a job by discussing ways of how the

information technology could support tasks of accountant in the era of industry 4.0. Since the world is

moving towards the industry revolution 4.0 (IR 4.0), many technological infrastructures have been

developed. Hence, a new study discussing these new states of the art is needed, to ensure the competence of

accountant’s to-do their jobs. This study is essential to satisfy the new needs of the industry due to the

emerging IR 4.0. this study only discusses the role of information technology as a supporting tool for the

accountant. Our next research will further discuss the role of the accountant in industry 4.0.

1 INTRODUCTION

The presence of the fourth Industrial Revolution

(often referred to as Industry 4.0) is predicted to be

the most powerful driver of innovation over the next

few decades, which triggers the next wave of

innovation. Various applied technologies in Industry

4.0 emerged, including advanced robotics, artificial

intelligence, internet of things, virtual and

augmented reality, cyber-physical systems, additive

manufacturing, and distributed manufacturing. The

use of this technology is changing business

processes and business models that are applied in

various industries (Dorleta, Jaione, and Ignacio,

2017).

The main concepts of Industry 4.0 are

digitalisation, optimisation and personalisation of

production, automation and adaptation, human-

machine interaction, value-added services and

automatic data exchange and communication. The

full integration of information, communication

technology and automation technology in future

factories in Industry 4.0 is implemented to increase

productivity, efficiency and effectiveness of

operations in each value chain and production

process. The concept of Industry 4.0 is an industrial

process for adding value and knowledge

management (Ślusarczyk, 2018). (Weyer, Schmitt,

Ohmer and Gorecky, 2015). (Paprocki, 2016).

In the Industrial 4.0 era, the development of

digital technology increased and penetrated various

fields of industry. This development provides

opportunities as well as challenges in the economic,

social, technical, environmental, political, and

regulatory fields (Hecklau, Galeitzkea, Flachsa, and

Kohl, 2016). The world economy has changed

because of the significant development and

application of this technology. The integration of

information and communication technology in this

era creates opportunities for the growth of the digital

economy how economic values are created changes

fundamentally in the digital economy. In the digital

economy, economic and business activities are

carried out digitally through the internet and web-

based markets (Zimmermann,2019). (Berisha-

Shaqiri and Berisha-Namani, 2015).

The Indonesian Ministry of Research,

Technology and Higher Education states that the 4.0

590

Wahyuni, T.

The Role of Information Technology in Supporting Accountant Profession in the Era of Industrial Revolution 4.0.

DOI: 10.5220/0010706400002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 590-596

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

industrial revolution brought changes to the

adjustment of work done by humans, machines,

technology and processes in various fields of the

profession including accountants. Gerd Leonhard, a

futurist, stated that the threat of the digital era is that

the globalisation era will eliminate around 1 - 1.5

billion jobs during 2015-2025. This loss of work is

due to the replacement of work that was initially

done by humans with automatic machines. Therefore

the way of working and accounting practices must

be changed in order to improve service quality and

global expansion through online communication and

the use of cloud computing. Cloud computing and

big data for accounting data are needed in the era of

the digital economy. In the era of the digital

economy, the volume of information will continue to

grow and require cloud computing as its

infrastructure (Fariantoi, 2019).

The role of accountants in the era of the digital

economy will change. In the era of the digital

economy, the role of accountants has shifted from

recording transactions to financial analysis.

Accountants must be aware of the development of

emerging information technology and strive to

continue to improve capabilities in accordance with

the development of information technology and can

continue to survive in this digital economy era.

Accountants must be able to understand the support

of information technology in supporting their

profession in the digital age. This understanding will

direct accountants in learning the technology

needed.

Based on the aforementioned problems, the

researchers are interested in investigating the role of

information technology in supporting the accounting

profession in the industrial era 4.0. The discussion

about the role of information technology in

supporting the accounting profession in the

Industrial era 4.0 in this article formulates the

question: what is the influence of the industrial

revolution on the accounting profession? What is the

role of information technology in supporting the

accounting profession in the industrial era 4.0? What

skills should accountants learn about the support

provided by information technology in the industrial

era 4.0?

2 THEORETICAL REVIEW

2.1 Industrial Revolution 4.0

The Industrial Revolution 4.0 is a term that emerged

at the Hannover trade fair in Germany in 2011. This

term emerged as an initiative of the German

government to promote Germany as a global leader

in technological innovation. Subsequently, several

publications that defined Industry 4.0 emerged and

became popular. The concept of industry 4.0 in

several countries generally has the same goal, which

is to increase competitiveness in global markets due

to the development of digital technology in various

industrial fields Bartodziej, 2017).

The industrial revolution 4.0 was marked by the

emergence of five leading technologies to be

implemented as a new business model solution and

had a significant impact on the supply chain, namely

internet of things (IoT), artificial intelligence,

advanced robotics, enterprise wearables, and

additive manufacturing (Li, Hou, Yu, dan Yang,

2017).

2.2 Information Technology

Information technology is the hardware and software

needed to process data and other information.

Information technology includes all technologies

used to create, process, transmit, store, exchange and

use information in all forms. Accountants who have

different roles depending on the functions performed

must always be up to date with technological

changes and must comply with recognised

international standards (Zenuni, Begoli, and Ujkani,

2014).

2.3 Digital Economy

The term digital economy refers to various economic

activities that use digital information and knowledge

as the main factors of production. The internet,

cloud computing, big data, financial technology, and

other new digital technologies are used to collect,

store, analyse and share information digitally and to

change existing social interactions. Tapscott first

introduced the concept of the digital economy in

1998, which is a sociopolitical and economic system

that has the characteristics of an intellectual space,

including information, various information access

instruments, information capacity and information

processing. The components of the digital economy

that were identified for the first time were the ICT

industry, e-commerce activities, digital distribution

of goods and services.

2.4 Big Data

Gartner defines big data as data that has three

attributes, namely volume, variety, and velocity.

The Role of Information Technology in Supporting Accountant Profession in the Era of Industrial Revolution 4.0

591

Volume is related to the size by which data growth

reaches volumes of tens of terabytes to several

petabytes. Variety means the type or type of data,

which includes various types of data both data that

have been structured in a database or unorganised

data in a database such as text data on web pages,

voice data, video, click streams, log files, and

etcetera. Velocity is the speed at which data is

generated and how fast the data must be processed in

order to meet user requests.

2.5 Cloud Computing

Cloud Computing is a combination of the use of

computer technology and cloud-based Internet

Storage development. Cloud Storage is a metaphor

of the internet, as storage media are often depicted

on computer network diagrams. Cloud Computing

applies a computational method. Namely,

capabilities related to information technology are

presented as a service. Users can access cloud

computing via the internet without knowing what is

inside, expert with it, or have control over

technological infrastructure (Santiko, Irfan, Rosidi,

Wibawa, and Seta, 2017).

3 METHODOLOGY

The research design used in this study is a

descriptive analysis method. The descriptive

analysis describes the world or phenomenon.

Descriptive analysis is used to answer questions

about who, what, where, when and to what extent.

The purpose of descriptive analysis is to identify and

describe trends and variations in populations, make

new measurements of crucial phenomena, or

describe samples in studies aimed at identifying

causal effects. Descriptions play an essential role in

the scientific process in general and educational

research in particular.

Questionnaires are used to collect formal data

from accountants via Google form. Samples were

chosen based on purposive sampling with the criteria

graduated from Accounting major and works as

educator accountants, internal accountants, public

accountants, government accountants/auditors,

management accountants, business analysts,

entrepreneurs and corporate finance. Data collected

from the final survey was analysed.

4 RESULT AND DISCUSSION

4.1 Result

Respondents are accountants who work as educator

accountants, internal accountants, public

accountants, government accountants/auditors,

management accountants, business analysts,

entrepreneurs and corporate finance. Questionnaires

were sent to more than 5 Whats Up Accountant

Groups. The number of accountants who became

respondents was as many as 286 people.

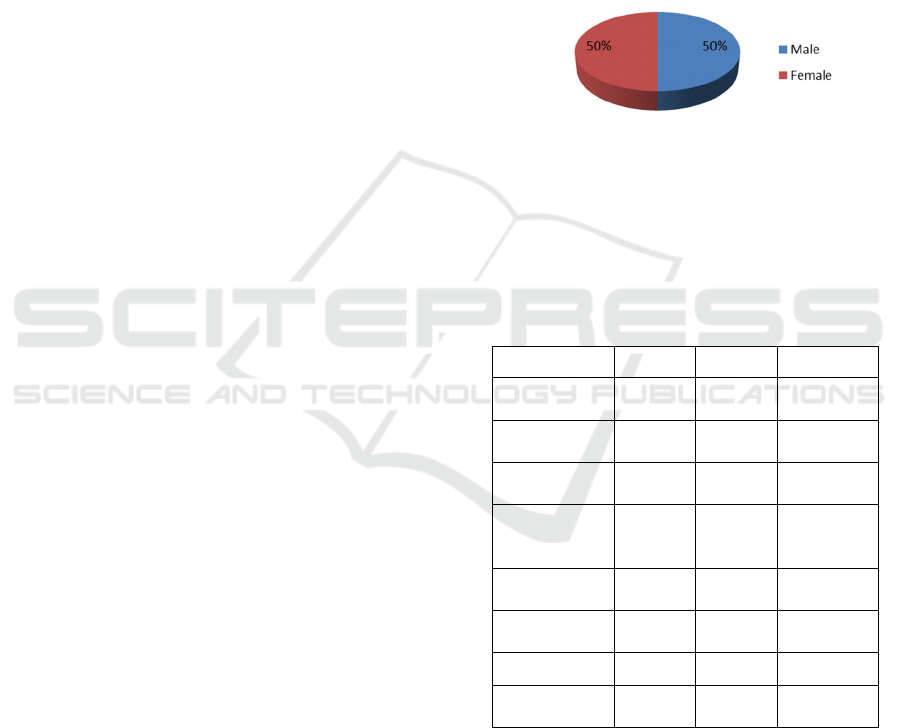

Figure 1: Sex of Respondents

Figure 2 shows that of 286 accountants invited to

participate, 78 submitted surveys for a response rate

of 27,

2

7%. Of the 78 respondents, 39 (50%)

reported their gender as female and 39 (50%) as

males.

Table 1: Gender and Type of Accountant.

Profesi % Total % Male % Female

Educator

Accountant

50% 35% 15%

Internal

Accountant

4% 3% 1%

Public

Accountant

10% 6% 4%

Government

Accountants /

Auditors

15% 14% 1%

Management

Accountant

0% 0% 0%

Business

Analyst

4% 3% 1%

Entreprneurs 4% 4% 0%

Corporate

Finance

13% 5% 8%

Table 1 shows that the majority of respondents

in this study were accountant educators consisting of

35% men and 15% women. The least respondents

were business analysts and internal accountants.

Each consists of only 7% of men and 0 women.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

592

Table 2: Gender and Age of Respondent.

Age of

Responden

% Total % Male % Female

20 - 30 tahun 24% 9% 15%

31 - 40 tahun 26% 10% 15%

41 - 50 tahun 41% 24% 17%

51 - 60 tahun 9% 6% 3%

> 60 tahun 0% 0% 0%

Table 2 shows that most respondents in this

study were in the age 41-51 years old of 24% men

and 17% women. The fewest respondents were in

the age 51-60 years old. It consists of 6% of men

and 3% women.

4.1.1 The Effects of the Industrial

Revolution on Accountants

Based on the data obtained from the questionnaires,

the outline can be presented major findings obtained

are:

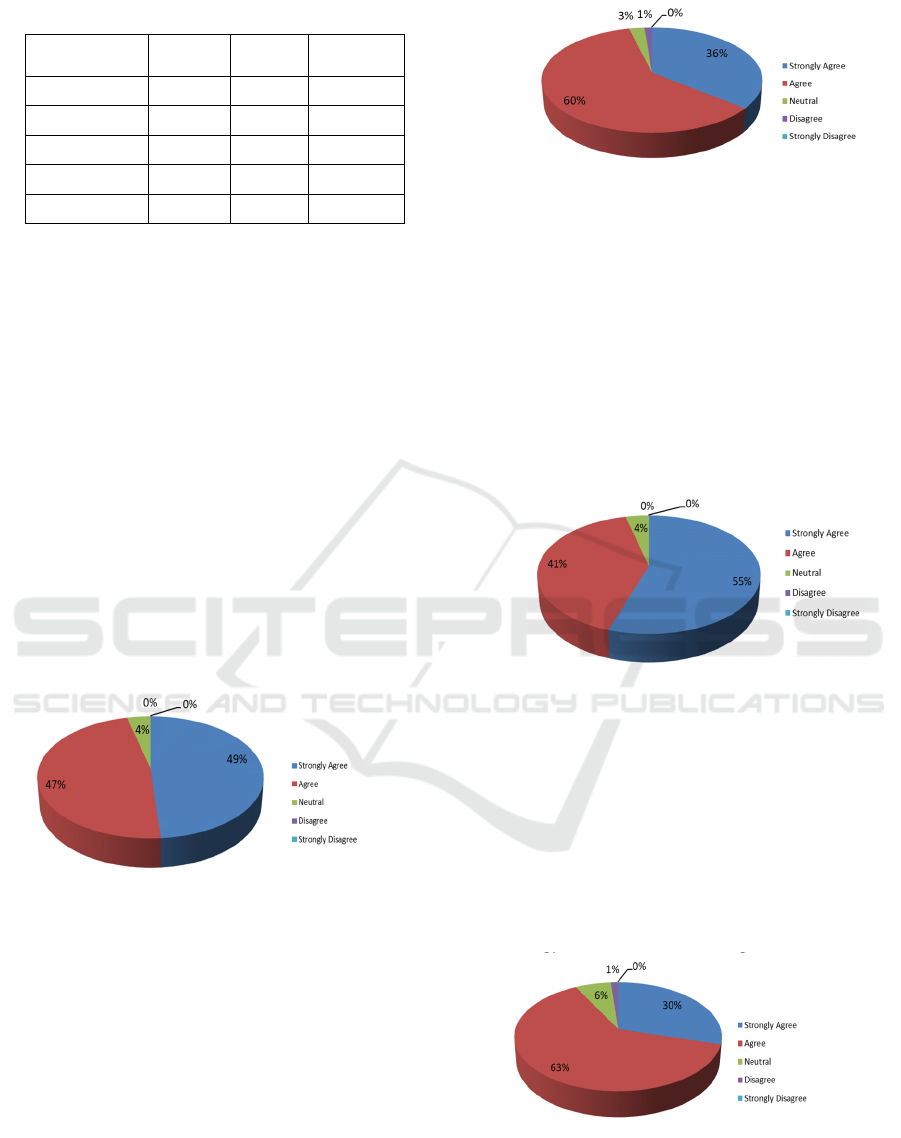

Approximately 47% and 49% of respondents

agreed and strongly agreed respectively due to the

emergence of the industrial revolution 4.0, the

workings and practices of accountants need to be

changed to improve service quality and global

expansion through online communication and the

use of cloud computing (Figure 2).

Figure 2: Changes in Accountants’ Work Methods and

Practices

Figure 2 also shows that 4% of respondents were

neutral that the workings and practices of

accountants need to be changed to improve service

quality and global expansion through online

communication and the use of cloud computing.

Approximately 60% and 36% of respondents

agreed and strongly agreed respectively that in the

Industrial 4.0 era, information technology which was

defined as hardware and software now turned into

digital data technology (Figure 3).

Figure 3 Changes in information technology from

hardware and software to digital data technology.

Figure 3 also shows that 3% of respondents were

neutral with the statement that information

technology has changed from hardware and software

to digital data technology and the other 1% of

respondents disagree.

Approximately 41% and 55% of respondents

agreed and strongly agreed that in the Industrial 4.0

era, accountants should have the ability in terms of

data analysis, information technology development,

and leadership skills. (Figure 4).

Figure 4: Accountant’s ability in data analysis, data

analysis, IT development, and leadership skills.

Figure 4 also shows that 43% of respondents

were neutral that the accountants should have the

ability to data analysis, information technology

development, and leadership skills.

Approximately 63% and 30% of respondents

agreed and strongly agreed that the Industrial

Revolution 4.0 resulted in the full integration of

information, communication and automation

technology in future factories (Figure 5).

Figure 5: Industry 4.0 led to full integration of IT,

communication and automation in the future factory.

The Role of Information Technology in Supporting Accountant Profession in the Era of Industrial Revolution 4.0

593

Figure 5 also shows that 6% of respondents were

neutral and 1% disagreed that Industry 4.0 is causing

full integration of information, communication and

automation technology in future factories.

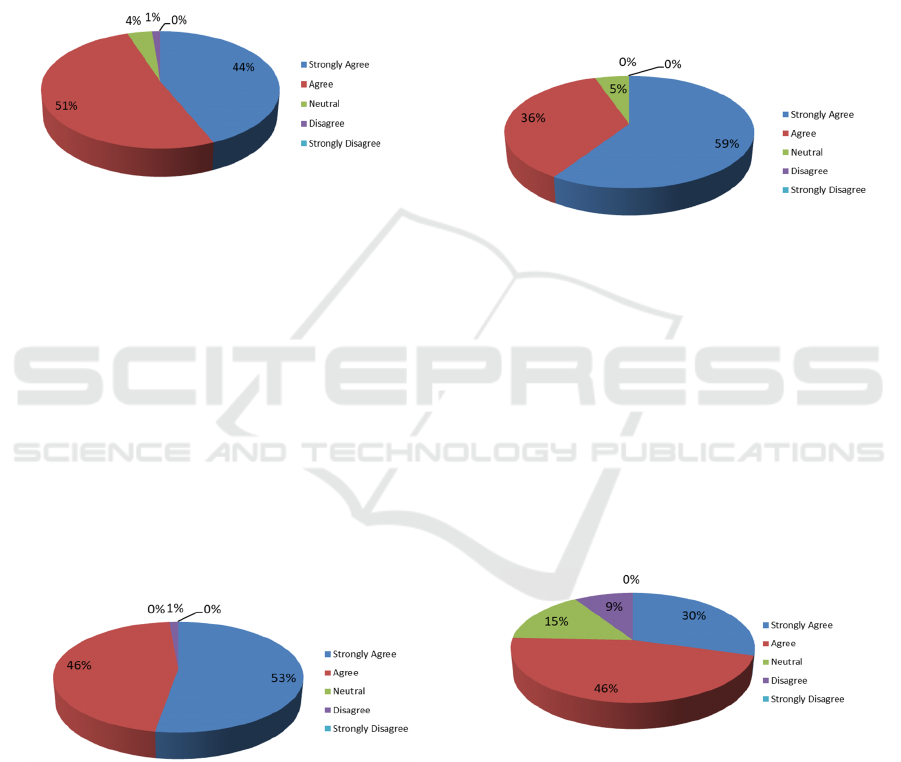

Approximately 51% and 44% of respondents

agreed and strongly agreed that as technology

became more sophisticated and present in all aspects

of the business, the role of accountants shifted

towards a more strategic and analytical role (Figure

6).

Figure 6: The role of accountants shifted towards a more

strategic and analytical role

Figure 6 also shows that 4% and 1% of

respondents were neutral and disagreed that the role

of accountants shifted towards a more strategic and

analytical role, and the other 2% of respondents

disagree.

Approximately 46% and 53% of respondents

agreed and strongly agreed that accountants must

have the expertise needed in the industrial era 4.0

such as the use of AI-based and Big Data

technology, the ability to analyse data,

understanding of customer needs, the ability to use

data forms, interpret data to produce information

which is more meaningful for decision making

(Figure 7).

Figure 7: Accountants must have the expertise needed in

the industrial era 4.0

Figure 7 also shows that 1% of respondents

disagree that accountants must have the expertise

needed in the industrial era 4.0.

4.1.2 the Role of Information Technology in

Accounting Profession in the

Industrial Age 4.0

Approximately 36% and 59% of respondents agreed

and strongly agreed that the Industrial Revolution

4.0 was the convergence of information technology

into the industrial world. Through the Internet of

Things (IoT) and Big Data, technology can be used

to collect and process data used by accountants in

their function as financial information provider

experts (Figure 8).

Figure 8: Industrial Revolution 4.0 was the convergence of

IT into the industrial world

Figure 8 also shows that 5% of respondents were

neutral that the Industrial Revolution 4.0 was the

convergence of information technology into the

industrial world.

Approximately 46% and 30% of respondents

agreed and strongly agreed that the use of Robotics

and data analytics (big data) takes over the necessary

work done by accountants (records transactions,

processes transactions, sorts transactions). This use

increases the efficiency and effectiveness of work

(Figure 9).

Figure 9: the use of Robotics and data analytics (big data)

increase the efficiency and effectiveness of work

Figure 9 also shows that 15% and 9% of

respondents were neutral and disagreed that the use

of Robotics and data analytics (big data) increase the

efficiency and effectiveness of works while 10% of

respondents disagree.

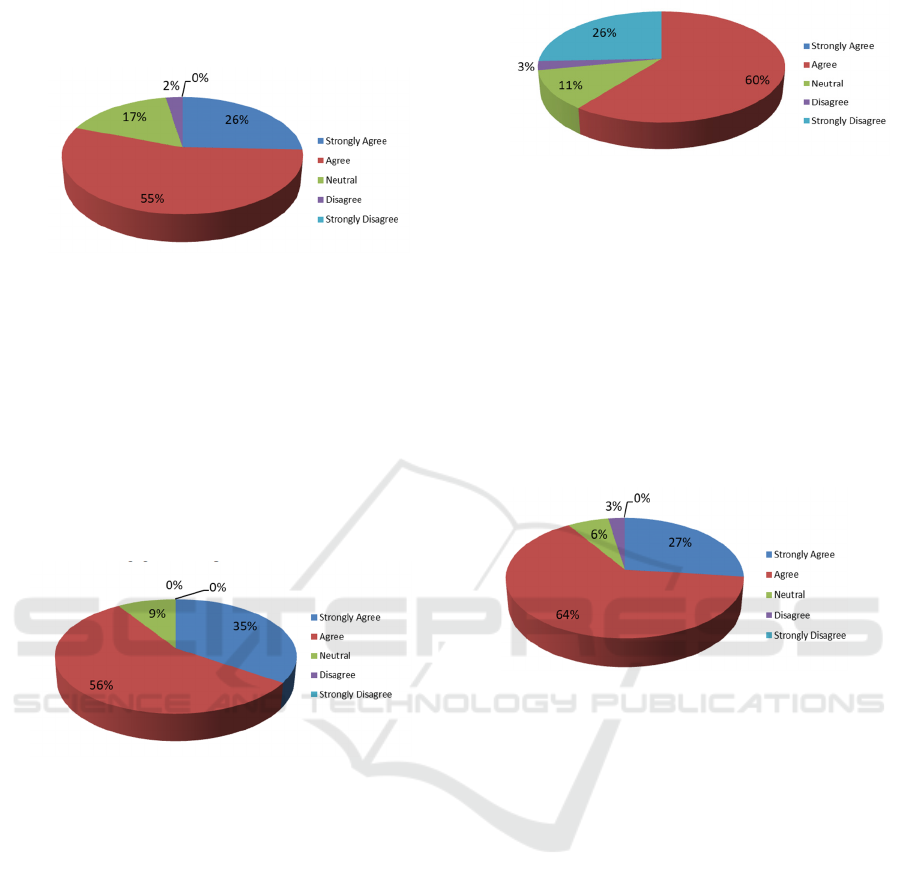

Approximately 55% and 26% of respondents

agreed and strongly agreed that technology in

Industry 4.0 allows accountants to obtain data that

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

594

previously could not be obtained in real-time,

through embedded sensors (Figure 10).

Figure 10: Technology in Industry 4.0

Figure 10 also shows that 17% and 2% of

respondents were neutral and disagreed that the use

of Robotics and data analytics (big data) increase the

efficiency and effectiveness of work while 3% of

respondents disagree.

Approximately 56% and 35% of respondents

agreed and strongly agreed that Technology in

Industry 4.0 improves data quality, namely through

better timeliness and accuracy and greater detail to

improve efficiency, the certainty of data and other

decision-making goals (Figure 11).

Figure 11: Technology in Industry 4.0 improves data

quality

Figure 11 also shows that 9% of respondents

were neutral that the use of Robotics and data

analytics (big data) increase the efficiency and

effectiveness of work.

11. Approximately 60% and 26% of

respondents agreed and strongly agreed that the use

of information technology (IT) in the audit is getting

wider, namely with general audit software that is

increasingly being used by public accounting firms

to increase productivity in carrying out audit work

(Figure 12).

Figure 12: The use of IT in the audit

Figure 12 also shows that 11% and 3% of

respondents were neutral and disagreed that the use

of information technology (IT) in the audit is getting

wider.

12. Approximately 64% and 27% of

respondents agreed and strongly agreed that non-

financial data that can be used to assist specific

decisions and provide the big data analytics could

provide new sources of assessment and hard

evidence needed by management accountants in

carrying out their work (Figure 13)

Figure 13: Non-financial data that can be used to assist

specific decisions and provide big data analytics

Figure 13 also shows that 6% of respondents

were neutral that non-financial data that can be used

to assist specific decisions and provide big data

analytics, while 3% of respondents disagreed.

4.2 Discussion

Based on data obtained from the result section

shows that industrial revolution 4.0 is the

convergence of information technology to the

industrial world. The industrial 4.0 era produced

developments in digital technology such as the

Internet of Things, Cyber-Physical Systems,

Artificial Intelligence, Cloud Computing, and Big

Data. Industry 4.0 produces full integration of

information and communication technology,

resulting in automation technology in future

factories. Smart robots and Artificial Intelligence

will largely replace personal work. All business

transactions will be carried out automatically and

produce a substantial volume of transaction data that

grows at high speed (big data). Big data requires

The Role of Information Technology in Supporting Accountant Profession in the Era of Industrial Revolution 4.0

595

cloud computing as an infrastructure to support it.

The role of accountants will shift from a bookkeeper

to an expert provider of financial data or as a data

analyst. Accountants must be able to analyse

customer needs, financial data, and interpret data to

be more meaningful for decision making.

Accountants must be able to understand technology

in order to carry out future tasks.

The result section also shows some capabilities

that accountants should have in this industrial era

include data science, data analysis,

coding/programming, real-time accounting, and

understanding the Artificial Intelligence model in

order to adapt with technology applied in the digital

era. In addition, accountants must also have the right

attitude and mentality and be critical of

technological developments. Accountants should try

to learn new technology, attend training to obtain the

required competencies and certifications to be able

to survive in this industrial era.

5 CONCLUSIONS

All business transactions will be carried out

automatically and produce a substantial volume of

transaction data that grows at high speed (big data)

and requires cloud computing as infrastructure to

support it.

The role of accountants will shift from a

bookkeeper to an expert provider of financial data or

as a data analyst. Accountants must be able to

analyse customer needs, financial data, and interpret

data to be more meaningful for decision making.

Accountants must be able to understand technology

in order to carry out future tasks.

Some capabilities that accountants should have

in this industrial era include data science, data

analysis, coding/programming, real-time accounting,

and understanding the Artificial Intelligence model.

ACKNOWLEDGEMENTS

The authors would like to thank the Vocational

Education Program University of Indonesia, Depok,

Indonesia, for supporting the study.

REFERENCES

Ibarra, D., Ganzarain, J., & Igartua, J. I. (2018). Business

model innovation through Industry 4.0: A

review. Procedia Manufacturing, 22, 4-10.

Ślusarczyk, B. (2018). Industry 4.0: Are we ready?. Polish

Journal of Management Studies, 17.

Weyer, S., Schmitt, M., Ohmer, M., & Gorecky, D.

(2015). Towards industry 4.0-standardization as the

crucial challenge for highly modular, multi-vendor

production systems. IFAC-PapersOnLine 48 (3): 579–

584.

Paprocki, W. (2016). Industry 4.0 Concept and Its

Application in the Conditions of the Digital Economy.

In Digitization of the Economy and Society.

Opportunities and Challenges for Infrastructure

Sectors. Gdansk: European Financial Congress (pp.

39-57).

Hecklau, F., Galeitzke, M., Flachs, S., & Kohl, H. (2016).

Holistic approach for human resource management in

Industry 4.0. Procedia Cirp, 54, 1-6.

Zimmerman, H. D. (2000). Understanding the digital

economy: Challengers for new business

models. AMCIS 2000 Proceedings, 402.

Berisha-Shaqiri, A., & Berisha-Namani, M. (2015).

Information technology and the digital

economy. Mediterranean Journal of Social

Sciences, 6(6), 78.

Farianto, D. (2015). Fenomena Big Data dan Komputasi

Awan (Cloud Computing). PUSINFOLAHTA TNI.

https://pusinfolahtatni.mil.id/wp-

content/uploads/2015/07/Artikel-I-FENOMENA-BIG-

DATA-dan-KOMPUTASI-AWAN.pdf [Accessed 4

August 2019].

Jan, B. C. (2016). The Concept Industry 4.0: An Empirical

Analysis of Technologies and Applications in

Production Logistics.

Li, B. H., Hou, B. C., Yu, W. T., Lu, X. B., & Yang, C.

W. (2017). Applications of artificial intelligence in

intelligent manufacturing: a review. Frontiers of

Information Technology & Electronic

Engineering, 18(1), 86-96.

Zenuni, M. B., Begolli, M. T., & Ujkani, M. (2014).

Impact of information technology in the accounting

profession. In Conference Paper, ResearchGate.

Computing. Jurnal Teknik Informatika, 10(2), 137–146.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

596