The Impact of Power of Authority to Tax Compliance: A Case Study

on the Indonesian Banking Industry

Erwin Harinurdin

Financial and Banking Laboratory, Vocational Education Program, University of Indonesia, Depok, Indonesia

Keywords: Power authority, tax compliance

Abstract: Compliance with taxpayers can be measured using the perspective of the authority of the tax authority to

obtain more complete results. This study aims to analyze the effect of the influence of the tax authority on tax

compliance. The approach of this research is the mix methods approach, namely, quantitative and qualitative

methods. Qualitative is used to enrich the analysis of the results of quantitative data processing. This study

obtained results that the authority of the tax authority influences tax compliance. Taxpayer's trust in the

administration and power of the tax authority is essential. The results of this study will be able to extend the

theory to power authority and tax compliance. Tax authorities must control their influence and power. This

study only focuses on the perspective of taxpayer behaviour.

1 INTRODUCTION

This research is based on previous research conducted

by Harinurdin (2009). This study discusses the

behaviour of taxpayers and taxpayer's intentions on

compliance. The results of this study note that

taxpayer intentions and taxpayer behaviour affect

significantly on compliance. This research focuses on

the taxpayer's side. So in the current study,

researchers want to emphasize agreement from the

bottom of the taxation institution (Fiscus).

The increase in tax ratio can be increased through

increasing compliance. Taxpayer compliance is

closely related to the tax collection system adopted by

a country. Tax is forced, so the term "nothing is

certain except death and taxes" appears. But on the

other hand the word "no one likes to pay taxes"

appears. Actually, the problem of compliance is a

long-standing problem. This is similar to what was

stated by Amriani et al. (2014) that the issue of tax

compliance is a classic problem faced by all

countries. Research on this is also done by Mustika

(2007).

In the era of financial technology and electronic

commerce, the problem of non-compliance is

increasingly becoming and complex. Starting with the

term Base Erosion and Profit Shifting (BEPS), it is

known that this can erode the tax base of a country.

The problem that is always experienced by every

country related to this is the widespread practice of

tax avoidance and tax evasion. Despite the wide

acceptability of public goods, this study argues that

there is a relationship between government and

taxpayers. There is a need to understand how and why

citizens agree to pay taxes and how they abstain

(Nkundabanyanga et all, 2017)

According to Bird in Pantamee and Mansor

(2015), the weak tax revenue of developing countries

is the result of many things, one of which is tax

administration inefficiency due to corruption and

distrust of tax institutions and other inefficiencies that

can change the behaviour of taxpayers for their

compliance.

According to Bird (1992), to solve problems in

tax administration, quick fixes alone are not enough.

More sustainable and stable things are needed to

solve problems related to non-compliance. In the

matter of fulfilling the tax revenue target, tax officials

often have the wrong perception, namely prioritizing

state revenues without regard to problems related to

how to make the right collection. Because basically,

the method of selection will determine the

compliance of the taxpayers in the future. That is,

different ways will produce a separate agreement.

According to Silvani in Bird (1992), the primary

purpose of tax administration is to maintain voluntary

compliance. Imposing sanctions or penalties on tax

evaders is not the purpose of tax administration. It's

just that, if you want to succeed in improving

Harinurdin, E.

The Impact of Power of Authority to Tax Compliance: A Case Study on the Indonesian Banking Industry.

DOI: 10.5220/0010704900002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 559-566

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

559

voluntary compliance, it is better if the government

builds a strong view in the community that non-

compliance will result in them being found out and

punished. But if the power is too excessive, this is

feared to lead to the practice of tax evasion or tax

evasion.

According to Tyler (2006), the reality of the

authority of the tax authority has long been known,

including by Aristotle and Plato, that the influence

obtained from the power of the tax authority requires

high and inefficient costs.

Voluntary compliance is more needed than forced

agreement because it is expected that tax revenues

can increase and be more sustainable, have lower

compliance costs and can reduce the practice of tax

evasion and tax avoidance. This is a winning solution

for the government to increase the potential for tax

revenues.

Referring to a previous study conducted by

Mas'ud et al. (2014), obtained results that trust

taxpayers and the authority of the tax authority affect

taxpayer compliance. With the country's need to

increase tax revenues and the lowest tax ratio, the

government needs to find the right strategy to

overcome this problem. One way to increase the rate

of taxes and state revenues is by improving tax

compliance.

Today, the Indonesian government, especially the

Directorate General of Taxes, continues to strive to

increase voluntary compliance of taxpayers. This has

also been stated by Gunadi (2004) that voluntary

compliance is the backbone of the self-assessment

system adopted by Indonesia. This framework is also

in accordance with the structure built by Kaplanoglou

et all (2016). This framework assumes that tax

payments are influenced by the trust in government

and the power of tax authorities. People might pay

their taxes because they want to or because they are

forced to do so. Increasing confidence in government

boosts voluntary compliance while increasing the

power of increases in enforced conformity. This is the

topic of this research, namely how the authority of the

tax authority powers the compliance of banking

taxpayers and other financial companies. The purpose

of this study is in accordance with the research

objectives proposed by Gangl et al. (2015): the use of

the present paper is to conceptualize these dynamics

and to collaborate on how they might influence tax

compliance.

2 LITERATURE REVIEW

2.1 Power of Authority

According to Raven (2008), social power is a

potential influence, namely the ability of a leader or

community leader to make changes through their

resources. Power is the ability to form gains and

losses for other parties through threats or coercion to

prevent undesirable behaviour or through rewarding

desired actions.

According to Kirchler et al. (2008), the authority

of the tax authority is a taxpayer's perception of the

ability of the tax authority to detect and punish tax

crimes. In the context of regulating citizen behaviour,

there are two theories of power approaches that are

widely known. The first, refer to Becker's (1968)

economic approach that strict supervision and

punishment affects a person's behaviour. Second,

referring to the proposal by Tyler (2006) that

legitimate power can change a person's behaviour

efficiently than through supervision and punishment

put forward by Becker.

According to Turner (2005) and Tyler (2006) in

Hofmann et al. (2014), in psychology, power quality

is divided into two, namely coercive Power and

legitimate Power. The difference in factors from this

power was identified by French and Raven (1959) as

harsh Power and Soft Power. Coercive power also

referred to as hash power, is shown in a way that is

seen as negative and positive, namely in the form of

sanctions and benefits. Negative ways that are usually

applied by the tax authorities can be in the form of

fines and gitjzeling.

According to Turner (2005) and Tyler (2006) in

Hofmann et al. (2013), coercive power is a power of

authority based on applying pressure through

supervision and punishment. Legitimate Power is

Power that is used through expertise, legitimacy and

gaining support. According to Hofmann et al. (2013),

the term coercive power proposed by Turner (2005)

is used instead of the harsh power term, which

consists of coercive control and reward power.

The term legitimate power refers to soft power

which consists of reasonable Power, expert Power,

referent power and information power. When

coercive power is used through negative and positive

ways such as imposing sanctions and giving gifts,

legitimate power is characterized by the legitimacy of

a strong position, knowledge and skills, authority

capacity as a public figure, and the desire to provide

relevant information. Legitimacy has the

characteristic that having legitimacy is like being

placed in a place that is seen as something that is right

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

560

and appropriate. The root of the modern approach to

legitimacy was first written by Weber (1968) who

stated that social values and norms become part of

one's internal motivation system and guide their

behaviour regardless of the influence of incentives

and sanctions.

According to Tyler (2006), legitimacy is an

additional form of power that allows authorities to

shape the behaviour of other parties who are different

from their control through incentives or sanctions.

This study shows that police and institutions are seen

as more legitimate, and decisions and regulations are

accepted when the authorities exercise their authority

through procedures deemed fair by the community.

This is also supported by studies in organizations that

powers who use influence reasonably will be seen as

legitimate and widely accepted.

According to Gangl et al. (2012), the concept of

legitimate power is based on someone who follows a

voluntary legal authority because it is based on the

reason that it is the right action. To integrate the view

of power and refer to a psychological perspective,

then Gangl et al. refer to the "bases of social power"

theory proposed by French and Raven (1959). This

theory was first conceptualized as a basis for

measuring relationships between individuals. The

concept of power is divided into six, namely coercive

power, reward power, legitimate power, expert

power, referent power, and information power.

All of this Power is integrated into two

dimensions of the structure by Raven et al. (1998)

into harsh and soft power forms. In order to be

consistent with the development of the slippery slope

framework model, Gangl et al. (2012) then use the

term coercive power to refer to harsh Power and

legitimate Power to apply to soft power. Coercive

power comes from pressure through punishment or

remuneration, and according to the concepts put

forward by French and Raven, it consists of coercive

control and reward power. Coercive power is based

on the taxpayer's expectations that non-cooperative

behaviour will be punished through penalties or

guzzling. Reward power is based on the hope that an

obedient taxpayer will be given an award or gratuity.

Here are five instruments in measuring the power

of the authorities as stated by French and Raven

(1959) in Raven et al. (1998):

1. Coercive power is a power that arises from a

threat to the applicable sentence.

2. Reward Power is a promise for compensation

given by the state to citizens if they obey.

3. Legitimate power is a power that comes from

the right of a person or a party to influence other

parties in a structural relationship.

4. Expert Power is a power that relies on superior

knowledge of a person or party so that citizens are

expected to believe that the state knows which is best.

According to Raven (1990), this power has more

advantages than coercive power and reward power

and can prevent problems that come from legitimate

authority when used effectively.

5. Referent Power is a power based on mutual

trust that citizens and state officials have the same

desire.

6. Furthermore, in Raven (1990), there are six power

bases by adding informational power based on

information or a logical argument that officers who

have influence can bring change to citizens.

2.2 Tax Compliance

Compliance is a strong trigger for individuals.

Compliance is an essential element that is important

for the formation of an orderly and orderly social life.

To improve voluntary compliance, according to

Silvano (1992), justice and openness are needed in the

application, tax procedures, simplicity of regulations

and good and fast service to taxpayers. From the

definition above, it can be said that tax compliance is

the implementation of the obligation to register,

deposit and report tax payable in accordance with tax

regulations (self-assessment). The expected

compliance in the self-assessment system is voluntary

compliance rather than compliance that is

implemented.

According to Nashuca (2004), tax compliance can

be seen from three aspects, namely:

a). Juridical aspects, namely tax compliance, is seen

from compliance with existing tax administration

procedures. This aspect includes reports on the

progress of SPT submission, reports on the

progress of SPT submission in the percentage of

correctly and incorrectly filled in, and reports on

the growth of the instalment submission based on

the development of the SPT period.

b). Psychological aspects, namely taxpayer

compliance seen from the taxpayer's perception

of counselling, service and tax audit.

c). Sociological perspectives, namely taxpayer

compliance seen from the social aspects of the

taxation system, including the policy of

discipline, fiscal policy, taxation policy and tax

administration.

Taxpayer compliance is an embodiment of the

taxpayer's discipline of rights and obligations in

paying and reporting the amount of tax owed in

accordance with tax regulations. Taxpayer

compliance can be motivated by the existence of

The Impact of Power of Authority to Tax Compliance: A Case Study on the Indonesian Banking Industry

561

formal binding tax policy, in the sense that it can

encourage taxpayers' behaviour to be obedient, and

there must be compelling legal sanctions in the form

of taxation policies that contain legal penalties for

those who do not comply compliance requirements.

These legal sanctions must be given to each taxpayer

who is not eligible and does not meet. Because

basically, every policy as a licensed product in the

field of taxation will not be meaningful if it is not

implemented in a certain way (sandy: 2001).

Tax compliance is enhanced by external

incentives, predominantly by audits and fines. The

second path stresses taxpayers' and the authorities'

interaction style, mutual trust, and commitment to the

society in which they live. Trust is defined as a

relational variable providing the base for voluntary

cooperation. If confidence is high, taxpayers perceive

a duty in fulfilling societal needs (Kastlunger et all,

2013)

Tax compliance is defined as the ideal condition

of taxpayers who fulfil tax regulations and report their

income regularly and honestly. From these perfect

conditions, tax compliance is defined as a state of

taxpayers who meet all tax obligations and carry out

their taxation rights in the form of formal and material

respect. The concept of tax compliance above is in

accordance with the opinion of Yoingco (1997) which

states the level of voluntary tax compliance has three

aspects, namely: formal, material (honesty) and

reporting (reporting).

According to Toshiyuki in Nasucha (2004), a

description to measure taxpayer compliance can be

done based on an approach to economic rationality,

psychology, and sociology. The compliance

dimension consists of conditions including essential

compliance, requirements for tax reporting,

conditions for paying taxes, taxpayer responses to

checks and billing, terms of financial management,

terms of business workers, conditions of non-

governmental organizations, and understanding of

people other than taxpayers regarding taxation.

According to Jimenez and Iyer (2016) that the

dominant theory in tax compliance literature is that

the perception of fairness in the tax system increases

the individual's trust in government and

consequently, has a positive influence on compliance.

In accordance with the classification in social

psychology, there are three types of justice used in the

study of Kogler et al. (2015), namely procedural truth,

distributive justice, and retributive justice. Procedural

justice is justice for the process of distribution of

resources and tax decisions made by the tax authority.

According to Tyler and Lind (1992), Murphy in

Kogler et al. (2015), an essential component of

procedural justice is the neutrality of procedures, trust

in the tax authority, and respectful treatment of

taxpayers.

According to Kirchler et al. (2008), when

taxpayers are asked about the tax system; in general,

they pay more attention to the issue of justice.

According to Wenzel in Kirchler et al. (2008) state

that the conceptual framework for justice is divided

into three according to social psychology, namely

distributive justice, procedural justice, and retributive

justice. Distributive justice refers to the exchange of

resources, namely benefits and costs. Procedural

justice refers to the process of distributing these

resources. Retributive justice refers to perceptions of

eligibility for sanctions if violations occur.

Damayanti et all (2015) stated that psychological

contracts require a balanced relationship between

taxpayers and tax officials. In addition, tax success

depends on how many taxpayers and tax officials

have mutual trust and adhere to the commitments in

this psychological contract. According to Braithwaite

(2003), there are two fundamental dimensions of

community responsiveness, namely attitude and

conception in general, and the second is specific

actions. This model adopts the concept of

motivational postures. Attitudes toward

responsiveness are measured through motivational

positions. Motivational postures describe the

approach of taxpayers who must be managed when

the tax authority tries to change or requires an

explanation of the behaviour of taxpayers in paying

taxes. Taxpayer behaviour responses that are

considered by the tax authorities are illegal behaviour

or minimize taxes aggressively. To be able to

distinguish between attitudes and actions

consistently, specific approaches need to be paired

with particular activities, as well as between general

positions and general operations. Braithwaite argues

that motivational postures evaluate the tax authority.

The difference between voluntary compliance

and coercion is reflected in the motivation to obey. In

a study conducted by Wahl et al. (2010), commitment

and resistance in motivational postures are used as

indicators of voluntary compliance and compulsion

compliance. In engagement, taxpayers feel a moral

obligation to contribute to the state by paying taxes.

In resistance, taxpayers do not believe that the tax

authorities have good intentions and are cooperative

with them. Brow and Mazur (2003) define tax

compliance according to IRS tax compliance which

consists of 3 variables, namely: filing compliance,

payment compliance and reporting compliance.

The research hypothesis proposed is:

H1: Power Authority influences Tax Compliance.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

562

2.3 Operationalization Concept

In this study, researchers used an independent

variable in the form of trust in taxpayers and the

authority of the tax authority. These dimensions and

indicators are used as part of the renewal of research

from previous studies.

The authority variables of the authority of the tax

authority are revealed to be dimensions and indicators

that refer to Tyler (2006), Raven (2008), and Raven

et al. (1998). The concept of the authority of the tax

authority is taken from Tyler (2006), which consists

of legitimate and coercive power. While the

dimensions of the body of the tax authority are taken

from Raven et al. (1998) which includes harsh Power

and Soft Power. The authority indicator of the body

of the tax authority is taken from Raven (2008) and

Raven et al. (1998).

The dependent variable of this study is taxpayer

compliance (tax compliance), referring to Yoingco

(1997), Braithwaite (2003), Brow & Mazur (2003),

Wahl et al. (2010), Kirchler et al. (2008), Damayanti

et al. (2015) and Kogler et al. (2015) in reducing the

dimensions and indicators. Referring to Kirchler et al.

(2008), the taxpayer compliance dimension consists

of voluntary tax compliance and enforced tax

compliance. This issue is also a research topic from

Hofmann (2013).

Below is table 1. on the operationalization of

research concepts consisting of concepts, variables,

dimensions, indicators and scales:

Table 1: Operationalization Concept.

Concepts Dimensions Indicato

r

s Scale

(

Power Of

Authority)

(Tyler, 2006)

(Raven, 2008)

(Gangl et al.

2012)

Soft Power

Legitimate

Powe

r

Interval

Expert

Powe

r

Information

al Powe

r

Referent

Powe

r

Harsh Power

Coercive

Powe

r

Interval

Reward

Powe

r

(Tax

Compliance)

(Yoingco, 1997)

(Brown &

Mazur,2003)

(Harinurdin,

2009)

(Damayanti et al.

2015)

(Kogler et al.

2015)

Voluntary

Tax

Compliance

Filing

compliance

Interval

Payment

compliance

Reporting

compliance

Enforced

Tax

Compliance

Audi

t

Interval

Law

enforcement

3 RESEARCH METHODS

Based on the thought and review of the literature and

previous studies, this study aims to test the hypothesis

of the influence of the power authority on tax

compliance. The model built in this study involves an

independent variable, namely power authority which

consists of 2 dimensions and six indicators and one

dependent variable, tax compliance.

This study will test the hypothesis of the influence

of the power authority on tax compliance. This study

is an empirical study using the analysis to get an

overview of the importance of the power authority on

tax compliance. Testing is done using linear

regression.

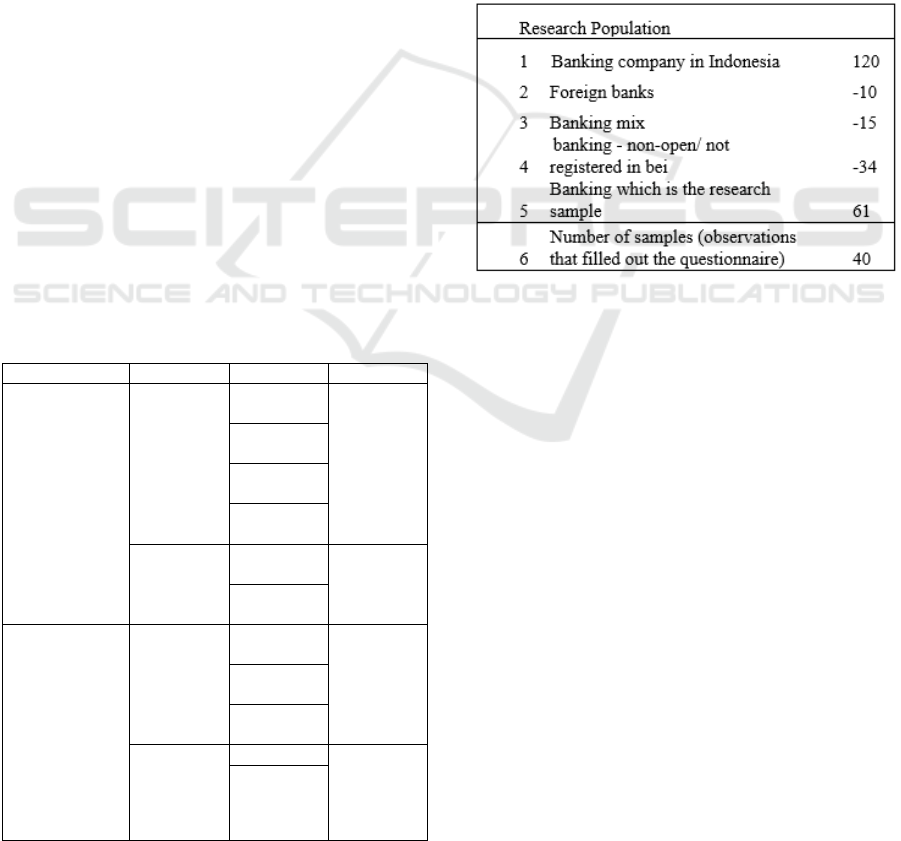

Table 2: Sample Selection Criteria.

The population of this study is a banking company

that is already open (listed in IDX) because in general

public companies have a formal accounting

information system (Bouwens and Abernethy, 2000;

Siahaan, 2005) allowing tax professionals to compile

their corporate tax reporting. The research location is

the stock exchange tax office that applies modern tax

administration based on information technology

systems to improve service, compliance and state

revenue. The population data from the study and

sample selection criteria can be seen in table 2. below.

The data obtained from field surveys were

analyzed using a linear regression model. Therefore,

the sample size is suitable if using the Maximum

Likelihood Estimation

technique in this modelling between 30-150

samples (Ferdinand, 2002). The sampling technique

is done by stratified random sampling, namely,

sampling of open banking companies. The population

is all other banking and corporate financial taxpayers

registered in the Tax Service Office (TSO) of the

Stock Exchange Taxpayers. Questionnaires are sent

to the company through an Account Representative

found in the TSO and then sent to the taxpayer.

The Impact of Power of Authority to Tax Compliance: A Case Study on the Indonesian Banking Industry

563

In this study, each question in the questionnaire

represents an observed variable. All answers to items

will be measured in a 7-point Likert scale. The use of

the 7-point Likert range has been used by Siahaan

(2005) and Mustika (2007). Data collected through a

list of questionnaires that have been filled in by

respondents were analyzed using linear regression

analysis.

The model to be analyzed by linear regression

analysis must have a theoretical framework that

supports it, namely the theory of tax compliance with

the approach of individual behaviour theory and

organizational behaviour theory. Correlation between

variables is the primary measuring tool by using the

main factors of measurement scale type: the

homogeneous range of values, imbalance or kurtosis,

linear, sufficient number of samples (representative

and appropriate), significant, and influential

(Schumacker and Lomax, 1996).

The measurement scale used can use a nominal,

ordinal, interval, or ratio scale, but it is not

recommended to use a different level in the

correlation matrix. Pearson product-moment

correlation is used as a basis for regression analysis,

path analysis, factor analysis, and structural equation

modelling. Measuring variable values is used

numerical scale (1-7 or 1-9) so that it gets

measurements of intervals or ratios. The same

measurement scale will be beneficial and facilitate the

interpretation of results and comparison of variables.

The theoretical framework used is decisive in

interpreting correlations between variables. You can

get a correlation between variables that are strong, but

the relationship between these variables is not

meaningful at all. The relationship between variables

used as the basis of a model comes from a clear and

plausible theoretical framework and has become an

agreement among experts in these disciplines. The

model to be tested in this study is the influence of the

power authority on tax compliance. Model testing

uses linear regression analysis which will estimate the

model of the relationship between the independent

variables on the dependent variable.

4 FINDINGS AND DISCUSSION

4.1 Validity and Reliability Test

In this section, data analysis will be conducted to test

the hypotheses that were carried out previously. The

steps of data analysis begin with testing validity and

reliability and ending with linear regression analysis.

Validity and reliability testing is done to measure

whether the questions used to measure the indicators

in the questionnaire have met the requirements

statistically or not. If all variables have met these

requirements, the next step is to do a regression

analysis accompanied by its interpretation.

Validity and Reliability Testing is done to

measure whether the questions used to measure

indicators in the questionnaire have met the

requirements statistically or not. To see the test results

The reliability of the questionnaire data for each

symbol can be seen in table 3. below this.

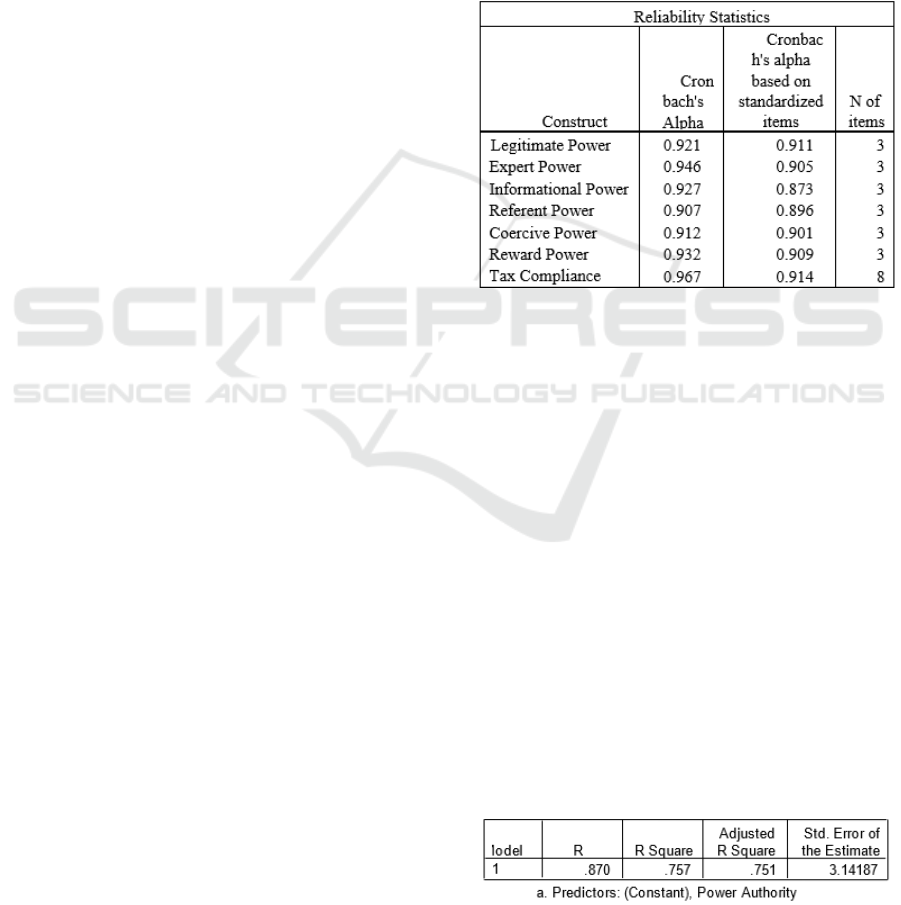

Table 3: Reliability of Questionnaire Data Test Results

Based on table 4.1. it can be seen that overall the

observed variables or questions in the questionnaire

have the above Cronbach's alpha of 0.896, which

indicates that these results have quite good reliability.

This is in line with Sakaran (2003), which states

Cronbach's alpha as a coefficient that shows how well

the correlation and consistency between items. The

Cronbach's alpha value gets better if it approaches 1.

4.2 Regression Analysis Results

Regression analysis used in this study aims to

determine the effect of the Power Authority on

Taxpayer Compliance. To find out the pattern of the

relationship between Power Authority (X) and Tax

Compliance (Y), expressed by a simple linear

regression model: 𝑌𝑎𝑏𝑋

The results of the regression analysis using SPSS

version 11.5 software in table 4 are as follows

Table 4: Model Summary.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

564

Based on the table above, it can be seen that there

is a relationship between the Power Authority and

Tax Compliance which is equal to 0.870 while the

influence of the Power Authority on Tax Compliance

is 0.757 or 75.7%. This shows that the Power

Authority can contribute 75.7% to Tax Compliance,

while the remaining 24.3% is the influence of other

factors. This result is in accordance with the results of

a study that refers to Kirchler et al. (2008), in the

slippery slope framework there are two dimensions of

determining taxpayer compliance, namely the trust of

taxpayers and the authority of the tax authority. To

assess the significance of the influence of the Power

Authority on Tax Compliance.

Based on the result, it can be seen that the F

statistic value obtained is 118,653 with a significance

value of 0,000. The significance value obtained is

much smaller than the specified α value, which is

equal to 0.05 (5%), which means that H0 is rejected.

Thus it can be concluded that the linear model used is

correct. This shows that the model can be used to

explain or explain the relationship and influence of

the Power Authority on Tax Compliance.

Because the linear regression model used is right

based on Anova testing, then it is followed by a t-test

to get the regression coefficient and test its

significance.

It can be seen that the t-calculated value obtained

for the Power Authority regression coefficient is

10,893 with a significance value (sig) of 0,000. The

significance value obtained is much smaller than the

specified α value, which is equal to 0.05. With this

result, the decision taken is to reject H0, which means

that there is a significant influence from the Power

Authority on Tax Compliance. Based on the table

above, the linear regression equation obtained is:

ˆ

3,587 0,606YX

The equation can be interpreted as follows:

• The constant on the model is -3.587 giving the

meaning that when there is no Power Authority, the

average value of Tax Compliance is -3.587.

• The regression coefficient of 0.606 gives the sense

that the Power Authority has a positive influence on

Tax Compliance. This value also means that the

Power Authority increases by one unit, then the Tax

Compliance will increase by 0.606 units. These

results are in accordance with the opinion of

Gobena and Djike (2016) and (2017), namely, we

argue that the relationship between procedural

justice and voluntary tax compliance is the most

pronounced among citizens with low (vs high) tax

authorities who at the same time weakly (vs

strongly) identify with their nation.

5 CONCLUSIONS

The coefficient of determination (R

2

) or Adjusted R

2

is 0,757 means that 75.7% of the ability of the

independent variable is the power authority capable of

explaining the independent variable tax compliance in

an open banking company (listed on the IDX).

The advice that can be given to the government is

to pay attention to the elements of trust that can

influence the increase in tax compliance so that it can

be used as a consideration in decision making. Further

researchers are advised to add other variables such as

economic conditions or conditions of company

performance.

ACKNOWLEDGEMENTS

This study is based on three previous research results

namely Damayanti et al. (2015), Harinurdin (2009)

and Gangl et al. (2012) (2018SJZD06) from

Commerce Economy Association of Zhejiang

REFERENCES

Bird, R. M., and Jantscher, M. C. d. (1992). Improving Tax

Administration in Developing Countries. Washington,

DC: International Monetary Fund.

Ferdinand August. (2002). Structural Equation Modeling in

Management Research, Semarang: Diponegoro

University Publisher Agency.

Gunadi (2004). Tax Administration Reform in the Context

of Towards Good Governance. Speech of Inauguration

of Extraordinary Professor of Taxation at the University

of Indonesia. Jakarta: University of Indonesia.

Nasucha, Chaizi. (2004). Public Administration Reform:

Theory and Practice. Jakarta: PT. Grasindo.

Suandy Erly (2001). Tax Planning. Salemba Empat

Publisher. Jakarta.

Amriani, O., Herawati, and Darmayanti, Y. Effects of Trust

and Power in Government Authority on Tax

Compliance. Journal of Accounting, Bung Hatta

University.

Braithwaite, V. (2003). Dancing with tax authorities:

Motivational Postures And Non- Compliant Actions.

Dalam V. Braithwaite (Ed.), Taxing democracy (15–

39).

Brown, Robert.E dan Mazur, M. J. 2003. IRS's

Comprehensive Approach to Compliance

Measurement. National Tax Journal.

Bouwens, Jan dan Margaret A. Abernethy. 2000. The

Consequences of Customization on Management

Accounting System Design, Accounting Organization

and Society, pp.221-241.

The Impact of Power of Authority to Tax Compliance: A Case Study on the Indonesian Banking Industry

565

Damayanti, T. W., T, Sutrisno., Subekti, I., dan Baridwan,

Z. (2015). The Role of Taxpayer's Perception of the

Government and Society to Improve Tax Compliance.

Journal of Accounting and Finance Research, 4.

French, John Jr. dan Bertram Raven, The Bases of Social

Power, dalam Dorwin Cartwright, ed., Studies in Social

Power, The University of Michigan, Michigan, 1959.

Gangl, K., Hofmann, E., dan Kirchler, E. (2015). Tax

authorities' interaction with taxpayers: A conception of

compliance in social dilemmas by power and trust. New

Ideas in Psychology, 37, 13-23.

Gangl, K., Hofmann, E., Pollai, M., dan Kirchler, E. (2012).

The Dynamics of Power and Trust in the "Slippery

Slope Framework" and its Impact on the Tax Climate.

Gangl, K., Pfabigan, D. M., Lamm, C., Kirchler, E., dan

Hofmann, E. (2017). Coercive and legitimate authority

impact tax honesty: evidence from behavioural and

ERP experiments. Journal of Social Cognitive and

Affective Neuroscience, 1108–1117.

Gobena, L. B., dan Dijke, M. V. (2016). Power, justice, and

trust: A moderated mediation analysis of tax

compliance among Ethiopian business owners. Journal

of Economic Psychology, 52, 24–37.

Gobena, L. B., dan Dijke, M. v. (2017). Fear and caring:

Procedural justice, trust, and collective identification as

antecedents of voluntary tax compliance. Journal of

Economic Psychology, 62, 1–16.

Harinurdin, Erwin.2009. Corporate Taxpayer Compliance

Behavior. Journal of Administrative and Organizational

Sciences, Vol. 16 No 2:96.

Hofmann, E., Gangl, K., Kirchler, E., Dan Stark, J. (2014).

Enhancing Tax Compliance Through Coercive And

Legitimate Power Of Tax Authorities By Concurrently

Diminishing Or Facilitating Trust In Tax Authorities.

Journal of Law & Policy, 36.

Hofmann, E., Gangl, K., Kirchler, E., Stark, J. (2013).

Enhancing Tax Compliance Through Coercive And

Legitimate Power Of Authorities. WU International

Taxation Research Paper Series Number 2013 – 01.

Jimenez, P., dan Iyer, G. S. (2016). Tax compliance in a

social setting: The influence of social norms, trust in

government, and perceived fairness on taxpayer

compliance. Advances in Accounting, incorporating

Advances in International Accounting, 34,17–26.

Kaplanoglou, G., Rapanos, V. T., dan Daskalakis, N.

(2016). Tax compliance behaviour during the crisis: the

case of Greek SMEs. Eur J Law Econ, 42, 405– 444.

Kastlunger, B., Lozza, E., Kirchler, E., dan Schabmann, A.

(2013). Great Authorities and Trusting Citizens: The

Slippery Slope Framework and Tax Compliance in

Italy. Journal of Economic Psychology, 34, 36–45.

Kirchler, E., Hoelzl, E., dan Wahl, I. (2008). Enforced

versus voluntary tax compliance: The "slippery slope"

framework. Journal of Economic Psychology, 29, 210-

225.

Kirchler, E., Muehlbacher, S., Kastlunger, B., dan Wahl, I.

(2007). Why Pay Taxes? A Review of Tax Compliance

Decisions. International Studies Program Working

Paper, 7(30).

Kogler, C., Muehlbacher, S., dan Kirchler, E. (2015).

Testing the "slippery slope framework" among self-

employed taxpayers. Econ Gov, 16, 125–142.

Mas'ud, A., Manaf, N. A. A., dan Saad, N. (2014). Do trust

and power moderate each other in relation to tax

compliance? Procedia - Social and Behavioral

Sciences, 164, 49-54.

Mustika Elia. (2007). Empirical Study of Compliance with

Corporate Taxpayers in Manufacturing Industry

Companies in Surabaya. National Symposium on

Accounting X. Unhas Makasar.

Nkundabanyanga, S. K., Mvura, P., Nyamuyonjo, D.,

Opiso, J., dan Nakabuye, Z. (2017) "Tax compliance in

a developing country: Understanding taxpayers'

compliance decision by their perceptions". Journal of

Economic Studies, 44(6), 931-957.

Raven, B. H. (1990). Political Applications of the

Psychology of Interpersonal Influence and Social

Power. Journal of Political Psychology, 11, 493-520.

Raven, B. H. (2008). The Bases of Power and the

Power/Interaction Model of Interpersonal Influence.

Analyses of Social Issues and Public Policy, 8, 1-22.

Raven, B. H., Schwarzwald, J., Dan Koslowsky, M. (1998).

Conceptualizing And Measuring A Powerllnteraction

Model Of Interpersonal Influence. Journal Of Applied

Social Psychology, 28, 307-332.

Siahaan, Fadjar O.P (2005). Factors that influence Tax

Professional Compliance Behavior in reporting

Corporate Taxes on Manufacturing Industry

Companies in Surabaya. Airlangga University

Postgraduate Program Dissertation. Not

publishedBrown,

Sekaran Uma (2003). Research Methods For Business.

New York: John Wiley and Sons. Inc.

Shumaker, Randall E and Ricard G Lomax, (1996). A

Beginner's Guide to Structural Equation Modeling.

(Lawrence Erlbaum Associates, New Jersey)

Silvani Carlos (1992). The economic of tax compliance:

facts and fantasy. National Tax Journal.

Turner, J. C. (2005). Explaining The Nature of Power: A

Three-Process Theory. European Journal of Social

Psychology, 35,1–22.

Tyler, T. R. (2006). Psychological Perspectives On

Legitimacy And Legitimation. Annu. Rev. Psychol., 57,

375–400.

Tyler, T. R., & Lind, E. A. (1992). A relational model of

authority in groups. Advances in Experimental Social

Psychology, Vol. 25, pp. 115-191.

Wahl, I., Kastlunger, B., dan Kirchler, E. (2010). Trust in

Authorities and Power To Enforce Tax Compliance: an

Empirical Analysis of The "Slippery Slope

Framework".

Yoingco, Angel Q (1977) taxation in Asia Pacific Region:

A Salute to the years of Regional Cooperation in Tax

Administration and research. Dalam studi Group in

Asian Tax Administration & Research Manila.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

566