Bank Bankruptcy Prediction Model with Risk-Based Bank Rating

(RBBR): BUKU1 and BUKU2 Categories

Sintha Lis

Finance and Banking Program, Vocational Faculty, Universitas Kristen Indonesia, Indonesia

Keywords: Risk Profile, GCG, Earning, Capital

Abstract: This study aims to obtain empirical evidence that the risk approach through the Risk-Based Bank Rating

variables is an appropriate source to be used as a predictor of banks problem. The model formed is expected

to have the right model accuracy to be applied in Indonesia as one of the early warning tools. The research

variables are Risk Profile, GCG, Earning, and Capital by using risk ratios and financial ratios. The research

population is bank financial statements in the period from 2005 - 2014 with bank categories BUKU 1 and 2.

Econometric models with logistic regression analysis techniques to find the variables that influence bank

bankruptcy. The results of the study with logistic regression testing found that bank prediction models with

BUKU 1 and BUKU 2 categories partially and simultaneously showed that from all the research variable

indicators tested supported the hypothesis and had a significant effect on the 5% accurate level in predicting

the financial condition of a bank, this is evident from the 74.07% backtesting and Rsquare results.

1 INTRODUCTION

The phenomenon of bank bankruptcy in Indonesia

has been seen since the existence of banking

deregulation in 1983, where competition between

banks, whether it is the government, private, joint

venture and foreign banks was increasing. Banks

that have small capital and do not have a market

experience financial difficulties which are eventually

liquidated, frozen or taken over by the government.

With the liquidation, the level of public trust in the

banking sector has decreased, and people prefer to

invest their funds abroad so that banks can

experience a lack of funds. Therefore, an early

warning system is needed that can provide

information about problems that occur in the

banking industry (Suharman, 2007). With the early

detection of banking conditions, financial difficulties

can be anticipated before reaching a crisis. Financial

risk factors have an essential role in explaining the

phenomenon of the bankruptcy of the bank. With the

early detection of banking conditions, the bank can

take anticipatory steps to prevent the financial crisis

from being handled immediately. Previous

researchers also tried to overcome this problem by

making a model that was built from indicators of

financial ratios to predict the financial difficulties of

a bank. The model in question is a way of

representation of the condition of the bank that is

described by financial ratios into a particular bank

that is simple, where it is expected that the resulting

model can describe the financial condition of a bank

in an integrated manner. The existence of this model

is expected to help interested parties in the existence

of banks, especially banks with BUKU 1 and BUKU

2 categories, either directly or indirectly, to

participate in monitoring and overseeing the bank's

financial performance so that they can immediately

anticipate the possibility of deteriorating financial

conditions these banks in the future.

Based on the description of the importance of

market risk management, credit risk, liquidity risk,

good corporate governance, profitability and bank

capital adequacy, this study examines the effect of

these variables on the bank soundness rating in the

BUKU1 and BUKU2 categories in predicting bank

bankruptcy in Indonesia.

520

Lis, S.

Bank Bankruptcy Prediction Model with Risk-based Bank Rating (RBBR): BUKU1 and BUKU2 Categories.

DOI: 10.5220/0010700700002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 520-525

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

2.1 Bank Risk

Risk management is a risk management activity so

that risks can be minimized in the future by

supporting adequate infrastructures such as

organizations, guidelines, and information systems.

Such activities include the identification of risks,

measuring risk, controlling routinely, and

recommending policies (risk shifting/hedging,

absorbing risks by pricing, insurance, and increasing

capital).

W.Santoso and E. Pariantoro (2003) say that risk

is the possibility of banks experiencing losses as a

result of changes in conditions that affect the value

of the position of the bank.

Bank Indonesia classifies risks into 8 (eight)

types of risk, which are generally divided into 2

(two) risk categories, namely those that can be

measured (quantitatively) and those that are difficult

to measure (qualitative) as follows:

1. Risks that can be measured (quantitatively)

include:

a. Credit Risk

Credit risk is a risk due to the failure of

the debtor and/or other parties to fulfil

obligations to the bank. Credit risk can be

sourced from various bank business

activities.

b. Market Risk (Market Risk)

Market risk is risk in the balance sheet

and administrative account positions,

including derivative transactions, due to

overall changes in market conditions,

including the risk of changes in option

prices. Market risk includes, among

others, interest rate risk, exchange rate

risk, equity risk, and commodity risk.

c. Liquidity Risk (Liquidity Risk)

Liquidity risk is a risk due to the inability

of banks to fulfil maturing obligations

from cash flow funding sources and /or

from high-quality liquid assets that can be

pledged, without disrupting the activities

and financial condition of the bank.

d. Operational Risk

Operational risk is a risk due to

insufficiency and /or non-functioning of

internal processes, human errors, system

failures, and /or the presence of external

events that affect the bank's operations.

Operational risk can be sourced from,

among others, Human Resources (HR),

internal processes, systems and

infrastructure, and external events.

2. Risks that are difficult to measure, namely

a. Legal Risk

Legal risk is the risk due to lawsuits and

/or weaknesses in juridical aspects. Legal

risk can be sourced from, among other

things, weaknesses in the juridical aspects

caused by the weakness of the

engagement made by the bank.

b. Reputation Risk (Reputation Risk)

Reputational risk is a risk due to a

decrease in the level of trust of

stakeholders (stakeholders) originating

from negative perceptions of the bank.

c. Strategic Risk (Strategy Risk)

Strategic risk is a risk due to inaccuracy in

making and /or implementing a strategic

decision and failure to anticipate changes

in the business environment.

d. Compliance Risk

Compliance risk is a risk due to banks not

complying with and /or not implementing

the applicable laws and regulations.

2.2 Concepts and Methods of

Risk-Based Bank Rating (RBBR)

Bank Indonesia issued a new regulation regarding

guidelines for rating bank soundness, namely Bank

Indonesia Regulation (PBI) No.13 / 1 / PBI / 2011

concerning Soundness Rating for Commercial

Banks, which requires Commercial Banks to

conduct self-assessments on Bank Soundness by

using the Risk approach (Risk-based Bank Rating /

RBBR) both individually and on a consolidated

basis.

Guided by Basel II from the Bank for

International Settlements (BIS) there are 8 (eight)

types of risks inherent in the banking industry, but

from experience shows that there are significant

risks that often arise and are the cause of a bank

facing various complicated problems. These risks

are grouped into 4 (four) main groups, namely risks

related to Credit Risk, Market Risk, Liquidity Risk

and Operational Risk.

The criteria used are the Risk-Based Bank

Rating (RBBR) method approach, namely: (1) Risk

Profile; (2) Good Corporate Governance; (3)

Earning; and (4) Capital.

Risk Profile. Assessment of risk profile factors

is an assessment of inherent risk and the quality of

risk management implementation in bank

Bank Bankruptcy Prediction Model with Risk-based Bank Rating (RBBR): BUKU1 and BUKU2 Categories

521

operations, namely credit risk, market risk, liquidity

risk, strategic risk. Each of these types of risks refers

to the general principles of assessing the soundness

of commercial banks. The minimum

parameters/indicators that must be used as a

reference by banks in assessing Risk Profiles are

credit risk, market risk, liquidity risk and bank

operational risk.

Good Corporate Governance (GCG). As a

financial institution that plays a vital role in

supporting the economy in Indonesia, banks face

increasingly complex risks and challenges.

Corporate governance is a concept to improve

company performance through supervising or

monitoring management performance and ensuring

management accountability to stakeholders by

basing it on the regulatory framework (M. Nasution

and D. Setiawan (2007).

Profitability (Earnings. Earnings are one

indicator to see banking performance. According to

Joen and Miller, therefore, earnings performance is

represented by ROE. ROE shows the rate of return

given by the bank to the shareholders. The higher

the ROE, the better the state of the bank. However,

the lower the ROE, the worse the bank concerned.

Capital. The provisions of bank capital in the

Basel Accord 1 of 1988, have been shown to

increase bank capital in Europe (Fiordelisi et.all,

2010). The capital provisions issued by the

International Settlement Bank (BIS) were adopted

by Bank Indonesia in regulating bank capital in

Indonesia in requiring that the amount of bank

capital be at least 8% of the risky total assets of the

bank called RWA (Risk-Weighted Assets). If bank

capital is sufficient to cover the level of asset risk,

the bank's performance will improve. This condition

is due to an increase in the level of trust of

depositors to deposit their funds even though the

interest rates of third party funds are deficient. In

terms of assets, a high level of capital adequacy will

provide an opportunity for asset diversification for

banks and can expand so that it can improve the

ability of bank profitability or bank financial

performance, Rose (2002). Fiordelisi et al. (2011)

examined the relationship between capital and risk,

indicating that banks with high income resulted in

increased bank risk and bank capital could increase.

Banks with high capital levels have a positive

impact on supervisory institutions to achieve long-

term benefits so that financial stability is maintained.

Based on bank classification based on the core

capital owned by the Bank (Bank Indonesia

Regulation Number 14/26 / PBI / 2012) grouped into

four business groups (Business Banks - BUKU) as

follows: (a) BUKU 1, Banks with core capital less

than Rp1 Trillion; (b) BUKU 2, Banks with core

capital of Rp1 Trillion up to less than Rp 5 Trillion;

(c) BUKU 3, Banks with core capital of IDR 5

Trillion up to less than IDR 30 Trillion; and (d)

BUKU 4, Banks with core capital above Rp30

Trillion.

Bank classification based on Core Capital in

2005 - 2014, can be seen in Table 1 below that

banks with small and medium-sized core capital are

more dominant than banks with large amounts of

core capital.

Table 1: Bank Classification Based on Core Capital 2005-

2014.

Core Capital Total

Ban

k

BUKU 1 < 1 Trillion 51

BUKU 2 1< Core Capital < 5 Trillion 44

BUKU 3 5 < Core Capital < 30 Trillion 21

BUKU 4 >30 Trillion 4

2.3 Indicators Research

Captions should be typed in 9-point Times. They

should be centred above the tables and flush left

beneath the figures. This research is conducted on

financial statements periodically (quarterly) in the

form of annual bank reports and bank financial

statements published from all banks (populations),

namely bankrupt and non-bankrupt banks operating

in Indonesia during the period 2005 to 2014.

Financial ratios selected because financial ratios are

representations of management's performance in

carrying out its business. With financial ratios can be

seen the position and financial condition of a bank in

a certain period (Cole, 1972; Foster, 1986; Frase,

1995); because financial ratios can be the primary

indicator for predicting bankruptcy of a bank, it can

also be used as a precautionary step before

bankruptcy occurs (Hempel, 1994). From this signal,

it can be seen whether the bank can be predicted to

experience bankruptcy problems or even vice versa

the signal is not able to provide accurate information

on the future of the bank's condition.

The Observation Unit in this study is all Banks

in Indonesia listed in the Indonesian Banking

Directory Book, namely State Banks, Foreign

Exchange National Private Banks, Non-Foreign

Exchange National Private Banks, Regional

Development Banks (BPD), Mixed Banks and

Foreign Banks with the total bank as shown in Table

2.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

522

Table 2: Number of Observation Bank Populations 2005 –

2014.

Source: Direktori Perbankan Indonesia 2005 - 2014

Some causes of the decrease in the number of banks

were because the bank was revoked. The business

license was liquidated, acquired by another bank.

Later, it will merge with a bank or self-liquidation.

3 RESEARCH METHODS

The study was conducted using a quantitative

approach with a level of descriptive and verification

achievement. In the level of description, an overview

of the state of the research variables is presented:

Risk Profile, GCG, Earning and Capital studied.

Furthermore, from the population carried out by

purposive sampling based on the criteria available

for complete financial report data for 2005 and 2014

obtained a sample of 74 banks for 2005 - 2014

consisting of 12 troubled/bankrupt banks and 62

non-bankrupt banks. This research utilizes a panel

data state to predict the occurrence of a bank

quarterly before the occurrence of a troubled bank.

For this reason, this study uses a logit model because

it will form a model that is expected to answer the

probability of bankruptcy

4 RESULTS AND DISCUSSION

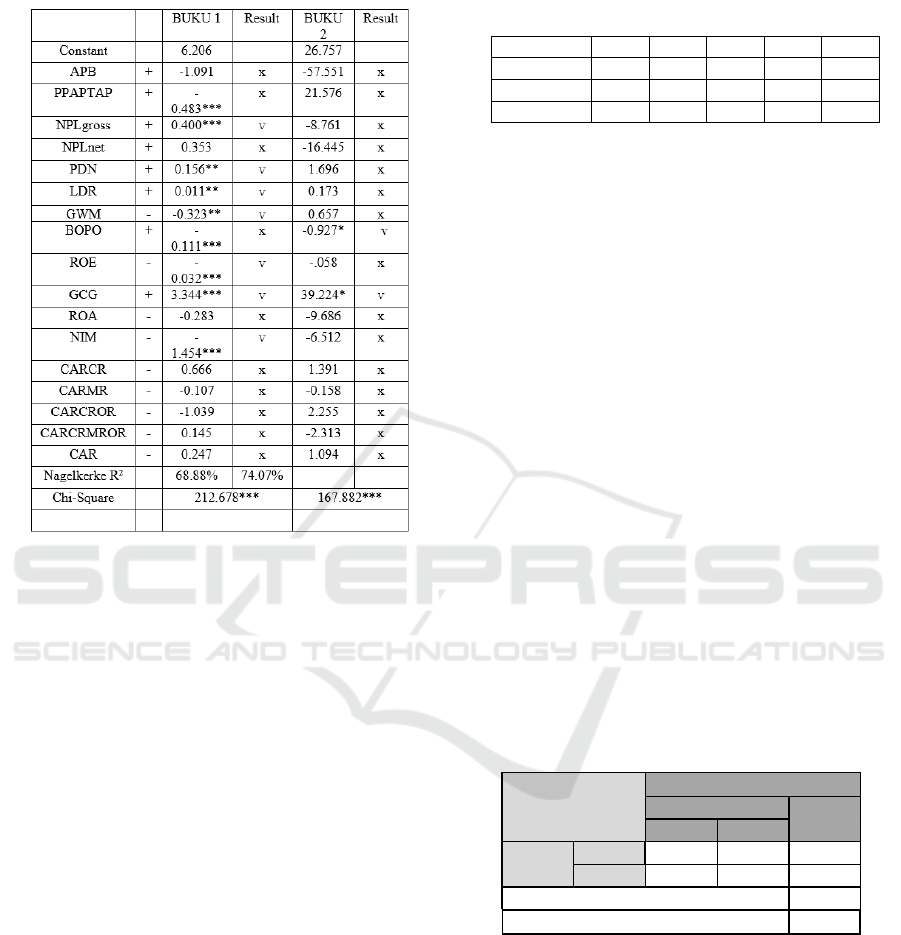

Table 3: Model Testing Results.

Yea

r

2005 2006 2007 2008 2009

Po

p

ulation 131 130 130 124 121

Yea

r

2010 2011 2012 2013 2014

Po

p

ulation 122 120 120 120 119

Source: Data processed, *** Supported statistically at alpha

1%, ** at alpha 5%, and * at alpha 10%

Regression of bank partially showed that the

prediction models with core capital are less than 1

trillion (BUKU 1). The variable risk profile is the

only variable of PPAPTAP, NPLgros PDN, LDR

and ROE. It supported the hypothesis and have a

significant effect on the level of 5%. The rating of

Good Corporate Governance has a significant

positive effect on the level of 1%. In the earnings

variable, only the NIM is significant while the

variable capital has no significant indicator. The

regression test results of bankruptcy prediction

models with core capital <1 trillion (BUKU 1)

simultaneously show that the variable Risk Profile,

GCG, Earning and Capital have a significant effect

in predicting bankruptcy of banks at a significance

level of 1%. The ability of bank bankruptcy

prediction model can be seen from the value of

Negelkerke R-squared 68.88%, meaning that

68.88% of the variables in the model are able to

predict bankruptcy in the BUKU 1 category. In

comparison, the remaining 31.12% is the magnitude

of other factors beyond predicting Bank bankruptcy

in the BUKU 1 category.

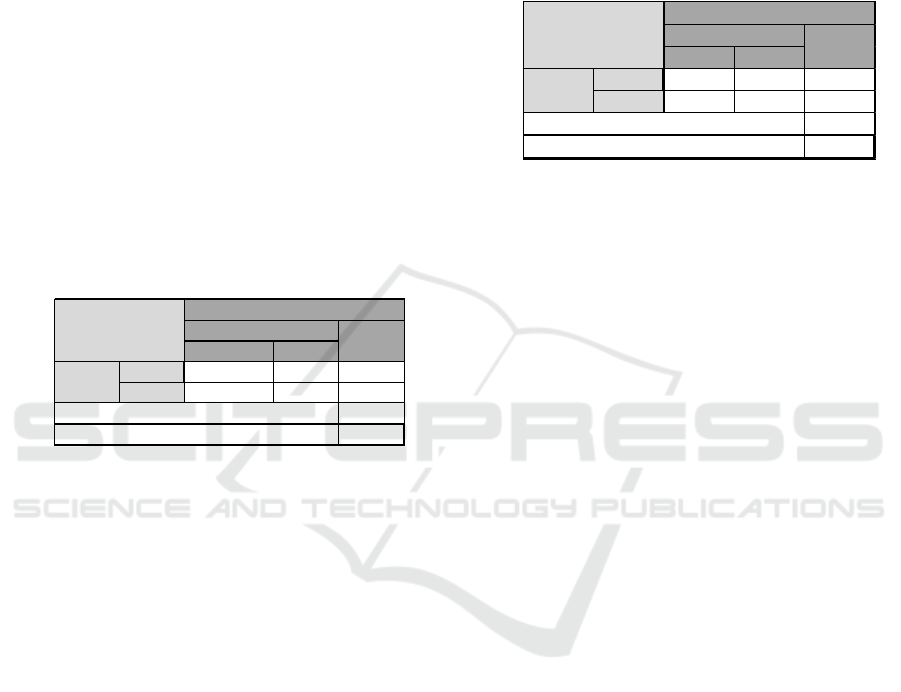

Table 4: Backtest and Rsquare of BUKU 1.

Source: Data processed

With a high total accuracy level of 97.17%, it

can be said that the logistic regression model of the

BUKU 1 category is formed accurately in predicting

the financial condition of a bank, this is evident from

proper backtesting and Rsquare results. Based on the

results of the accuracy of the classification above,

the logit model for bankruptcy has quite good

robustness because it has an accuracy of above 80%

for the non-bankrupt, bankrupt and total groups

(Greene, 2010).

Non Pailit Pailit

Non Pailit 765

17

97.83%

Pailit

625

80.65%

97.17%

68.88%

Y

Overall Percentage

Rsquare

Prediks i

Aktu a l

Y

Percentag

e Correct

Bank Bankruptcy Prediction Model with Risk-based Bank Rating (RBBR): BUKU1 and BUKU2 Categories

523

The regression test results of bank prediction

models with core capital are less than 1 trillion

(BUKU 2). It partially showed that all tested

research indicators support the hypothesis and have

a significant effect on the 5% level only NPLgross,

CARMR, CARCROR and CARCRMROR. While

PPAPTAP has a significant influence on the level of

10%, the regression test results of predictive bank

models with core capital of 1-5 trillion (BUKU 2),

simultaneously showing that the variable Risk

Profile, GCG, Earning and Capital have a significant

effect in predicting bankruptcy of banks at a

significance level of 1%. The ability of bank

bankruptcy prediction models can be seen from the

value of Negelker to R-squared of 74.07%, which

means 74.07% of the variables in the model can

predict bankruptcy in the BUKU 2 group, while the

remainder of 25.93% is the magnitude of other

factors predict bank bankruptcy in the BUKU group.

Table 5: Backtest and Rsquare of BUKU 2.

Source: Data processed

With a high level of total accuracy of 98.35%, it

can be said that the logit regression model of Bank

BUKU 2 category is formed accurately in predicting

the financial condition of a bank, this is supported

by proper backtesting and Rsquare results. Based on

the results of the classification above, the logit

model For bankruptcy, it has reasonably good

robustness because it has an accuracy of above 80%

for non-bankrupt, bankrupt and total categories.

Regression of bank prediction models with core

capital is less than1 trillion (BUKU 1). It partially

shows that the variable risk profile is only variable

PPAPTAP, NPLgros PDN, LDR and ROE that

support the hypothesis and have a significant effect

on the level of 5%. The rating of Good Corporate

Governance has a significant positive effect on the

level of 1%. In the earnings variable, only the NIM

is significant while in the capital variable, there is no

significant indicator. The regression test results of

bank bankruptcy prediction models with core capital

<1 trillion (BUKU 1) simultaneously indicate that

the variable Risk Profile, GCG, Earning and Capital

have a significant effect in predicting bankruptcy of

banks at a significance level of 1%. The ability of

bank bankruptcy prediction model can be seen from

the value of Negelkerke R-squared 68.88% meaning

that 68.88% of the variables in the model can predict

bankruptcy in the BUKU 1 group, while the

remaining 31.12% is the magnitude of other factors

beyond predicting Bank bankruptcy in the BUKU

group 1.

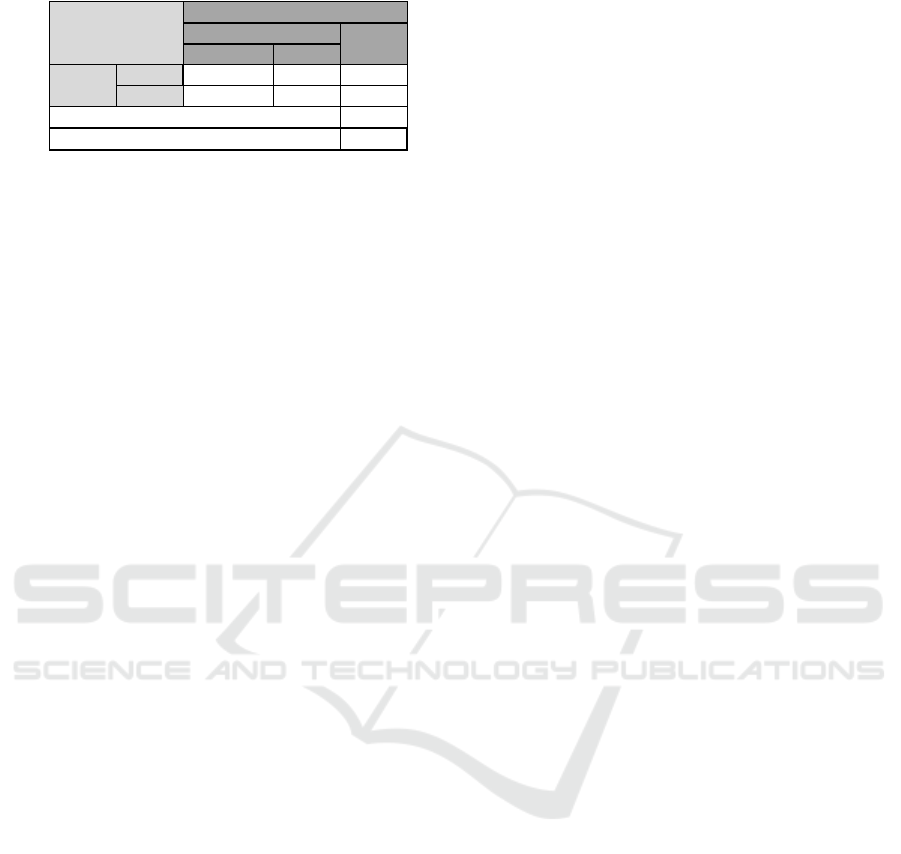

Table 6: Backtest and Rsquare of BUKU 1.

Source: Data processed

With a high total accuracy level of 97.17%, it

can be said that the logistic regression model of

BUKU 1 category is formed accurately in predicting

the financial condition of a bank, this is evident from

proper backtesting and Rsquare results. Based on the

results of the accuracy of the classification above,

the logit model for bankruptcy has quite good

robustness because it has an accuracy of above 80%

for the non-bankrupt, bankrupt and total groups

(Greene, 2010).

The regression test results of bank prediction

models with core capital are less than 1 trillion

(BUKU 2). It partially indicates that all tested

research indicators supported the hypothesis and

have a significant effect on the 5% level only

NPLgross, CARMR, CARCROR and

CARCRMROR. While PPAPTAP has a significant

influence on the level of 10%, the regression test

results of bankruptcy prediction models with core

capital of 1-5 trillion (BUKU 2), simultaneously

showing that the variable Risk Profile, GCG,

Earning and Capital have a significant effect in

predicting bankruptcy of banks at a significance

level of 1%. The ability of bank bankruptcy

prediction models can be seen from the value of

Negelker to R-squared of 74.07%, which means

74.07% of the variables in the model can predict

bankruptcy in the BUKU 2 category, while the

remaining 25.93% is the magnitude of other factors

predict bank bankruptcy in the BUKU 2 category.

Non Pailit Pailit

Non Pailit 695

8

98.86%

Pailit

42

0

83.33%

98.35%

74.07%

Prediksi

Rsquare

Aktu a l

Y

Percentag

e Correct

Y

Overall Percentage

Non Pailit Pailit

Non Pailit 765

17

97.83%

Pailit

625

80.65%

97.17%

68.88%

Y

Overall Percentage

Rsquare

Prediksi

Aktual

Y

Percentag

e Correct

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

524

Table 7: Backtest and Rsquare of BUKU2.

Source: Data processed

With a high level of total accuracy that is equal

to 98.35%, it can be said that the logit regression

model of BUKU 2 Bank category is formed

accurately in predicting the financial condition of a

bank, this is supported by proper backtesting and

Rsquare results. Based on the results of the accuracy

of the classification above, the logit model for

bankruptcy has reasonably good robustness because

it has an accuracy of above 80% for the non-

bankrupt, bankrupt and total categories with a bank

or self-liquidation.

5 CONCLUSION

The study was conducted using a quantitative

approach with a level of descriptive and the right

model used to predict bankruptcy in Indonesia is the

Risk-Based Bank Rating (RBBR) model. As a

predictive model, the findings of this model are

expected to contribute to banks, namely by utilizing

it as an early warning system for bank management.

The application of this model can be known as the

probability of bankruptcy as early as possible before

the bank is declared legal bankruptcy. The findings

of this model can also be used as alternative tools in

carrying out bank supervision functions. As a

prediction model for bankruptcy of commercial

banks built on capital and financial risk factors, the

findings of this model can be a complementary

reference for depositors, investors, creditors, and the

roader community in evaluating commercial banks

operating to protect their interests.

REFERENCES

Bank Indonesia Regulation Number 14/26 / PBI / 2012

Basel Committee on Banking Supervision. 1988.

International Convergence of Capital Measurement

and Capital Standards , Basel: Bank for International

Settlements.

Fraser, P & Tayor.MP., Modelling Risk In The Interwar

foreign Exchange Market., Scottish Journal of

Political Economy., Volume 36, Issue 3, Page 241-

257, August 1990

Gunsel, N. 2007. Financial ratios and the probabilistic

prediction of bank failure in North Cyprus. Eur. J. Sci.

Res., 18(2): 191-200

Nasution, M & Setiawan, D. 2007. Pengaruh Corporate

GovernanceTerhadap Manaemen Laba Di Industri

Perbankan Indonesia. Prosiding, Simposium Nasional

Peraturan Bank Indonesia Nomor 13/1/PBI/2011 tentang

Penilaian Tingkat Kesehatan Bank Umum

Santoso, W., & Hariantoro, E. 2003. Market Risk

ssessment Di Perbankan Nasional, Buletin Ekonomi

11Moneter dan Perbankan, Maret 2003

Scott, JH, Jr. 1981. The probability of bankruptcy: A

comparison of empirical predictions and theoretical

models, Journal of Banking and Finance 5, 317-344

Suharman, H. “Analisis Risiko Keuangan untuk

Memprediksi Tingkat Kegagalan Usaha Bank.” Jurnal

Imiah ASET Pusat Penelitian dan Pengabdian

Masyarakat School of Economics , Vol. 9, No. 1

Februari 2007.

Non Pailit Pailit

Non Pailit 695

8

98.86%

Pailit

4

20

83.33%

98.35%

74.07%

Prediksi

Rsquare

Aktual

Y

Percentag

e Correct

Y

Overall Percentage

Bank Bankruptcy Prediction Model with Risk-based Bank Rating (RBBR): BUKU1 and BUKU2 Categories

525