Annual Report Preparation Process in PT Energi Mega Persada, Tbk

to Face Industrial Revolution 4.0: Spearman’s Correlation

Coefficient

Mohammad Ridha and Sherin Ratna Pradita

Office Administration Laboratory, Vocational Education Program, Universitas Indonesia

Keywords: Annual Report, Spearman, industrial industry 4.0, integrated reporting, oil and gas industry, shareholder.

Abstract: This study aims to determine the Spearman’s Correlation Coefficient in the process of preparing annual

reports at PT. Energi Mega Persada, Tbk. Researchers observe this annual report as very useful for

companies engaged in the oil and gas industry as a source of information about company performance and

prospects as a basis for consideration in making investment decisions. Annual reports contain information

relating to company activities in general, accurate, open and up-to-date. The annual report also helps

companies increase the credibility and trust of investors or shareholders. An annual report is also a

promotional tool posted on the company’s website. Regular annual reports develop into integrated reporting

that is needed by companies to face the era of the Industrial Revolution 4.0. Stakeholders tend to want

annual reports that are easy to understand and can be accessed digitally. The researchers lower the factors in

the process of preparing annual reports to be the appearance, completeness, timeliness, reliability and

response. The respondents of this study were employees from 8 internal divisions. The researcher suspects

the existence of stable relationships between variables that are expected to show characteristics in the

preparation of annual reports. The results of this study are expected to determine the stages of preparing a

concise, complete and exciting annual report. This research is the development of existing literature related

to annual reports and integrated reports.

1 INTRODUCTION

Over the last few decades, the corporate annual

report has, for many modern corporations, been

transformed from a rather dull financial document to

a colourful marketing and public relations document

in which the financial statements are relegated to a

technical ‘appendix’. This transformation, it appears,

is a result of the changing corporate reporting

environment, in terms of technological, legislative

and regulatory change, as well as changing business

management practices. (Beattie, Dhanani & Jones,

2008). The company’s annual report is an instrument

to present relevant information to stakeholders in

order to be able to find out the company’s

development and achievements. Company leaders

need annual reports as a basis for making decisions

and determining the direction of the company going

forward. The annual report of Open Limited

Liability Company can publicly be seen.

Annual reports aim to provide a fair review of

the development of a company’s business and its

position. Transparent presentation of information in

annual reports is especially important for listed

companies. The consensus among financial

economists is that a productive disclosure

environment and low information asymmetry have

many desirable consequences, such as efficient

allocation of resources, capital market development,

market liquidity, decreased cost of capital, lower

return volatility and high analyst forecast accuracy.

(Pivac, Vuko & Cular, 2017). Annual reports in the

industrial revolution era 4.0 show the development

of more exciting information presentation. Graphic

design, photographs and tables are presented in a

more simple, clear and complete format.

Communities in this disruptive era tend to want a

series of information that can be easily digested but

still be complete and can be taken immediately.

In this practice, companies include extensive

voluntary disclosures regarding financial and non-

financial results, well beyond required financial

Ridha, M. and Ratna Pradita, S.

Annual Report Preparation Process in PT Energi Mega Persada, Tbk to Face Industrial Revolution 4.0: Spearman’s Correlation Coefficient.

DOI: 10.5220/0010700600002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 511-519

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

511

disclosures. Voluntary disclosure includes, for

example, carefully designed financial and non-

financial charts and graphs, impressive pictures of

products and leadership, and bold, impressive words

in print, such as improved quality and growth.

(Zeller, Stanko & Jin, 2012). Financial reports

usually become the main report in the annual report

because they contain measurable data such as

company profits. It can be seen here that annual

reports are often used as instruments to measure

company achievements in various perspectives.

Inclusion of the company’s vision and mission is to

illustrate that the process of organising company

activities is not deviant. Company achievement is

obtained from the comparison of targets and outputs.

In an excellent annual report, there is also an

overview of the company and executive summary.

Stakeholders demand for more information,

especially in the non-financial section of corporate

reporting has increased after the financial crisis

(Velte & Stawinoga, 2016). In response to this call,

organisations have increasingly been involved in the

provision of voluntary non-financial information as

part of their corporate reporting. (Appiagyei,

Djajadikerta & Xiang, 2016). Many annual reports

show more about the company’s achievement in the

quantity of activities, even though stakeholders want

to know the quality of these achievements.

Stakeholders also want data accuracy and logical

explanation.

Market participants, practitioners and regulators

alike argue that there is an essential need for more

significant investigation and understanding of

Intellectual Capital (IC) disclosure (or reporting) as

the usefulness of financial information in explaining

firm profitability continues to deteriorate. Bukh

(2005) [2], for example, asserts that traditional

disclosure mechanisms are not able to cope

adequately with the disclosure requirements of new

economy firms. (Bhasin, 2011). In this disruptive

era, the factors that need to be presented in annual

reports are not only financial resources but also

intellectual capital in the form of the development of

the competencies of their employees. Human

resources have become a determining factor for the

success of a company, so it is no longer considered a

factor of production.

The concern that traditional financial reports do

not adequately represent the multiple dimensions of

corporate value today has resulted in a search for

new financial metrics (Rappaport, 1998; Steward,

1999), and/or additional non-financial performance

measures (Kaplan and Norton, 1992 and 1996;

Sveiby, 1997). Associated with these developments

has

been a growing tendency for companies to

voluntarily disclose financial and non-financial

performance measures in their annual reports.

However, it is unclear whether this information

helps firms to gain competitive advantage and

improve company performance. (Braam &

Borghans, 2010). Decision-makers have considered

Non-financial reports. Its achievements can be

measured in terms of frequency of activities, the

number of participants, percentage increase

compared to last year. The financial statements

remain the primary exposure supported by

explanations from supporting resources.

Annual reports are undergoing a profound

transformation on the Web. The boundaries of Web-

based annual reports are dynamic and becoming less

distinct, giving the user many viewing options and

formats. The transformation is a result of companies

increasingly serving the business needs of virtual

global communities. (Haasbroek & Toit, 2003). In

the era of industrial revolution 4.0, digitalisation

played an important role. All activities cannot be

separated from the internet. Business processes,

human relations and business control can be done

online. The distance and time dimensions are no

longer the reason if there are obstacles. The process

of monitoring evaluation can also be done using

information and technology management systems.

Annual reports should be easily accessible to

stakeholders and other communities. The most

effective way to present annual reports to the entire

world is through the company’s website. The public

can easily access and upload the company’s limited

company annual reports open to the interests of

share purchase decisions and to science.

The call by stakeholders of firms for enhanced

reporting of corporate responsibility and other

information that impact business performance has

gained pace worldwide due to several impromptu

corporate collapses and financial crises. The

business environment has drastically changed and

has become complex whereby information spreads

through social media and internet networks as it

happens. (Juma, Orobia & Tumwebare, 2018).

Developments in the disruptive era require a

company to change according to the wishes of

society. Many new companies become competitors

and have a business process acceleration strategy. In

the end, there are winners in similar businesses. In

anticipation of intense competition, companies need

to convince stakeholders, especially shareholders.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

512

The annual report is the main instrument to

showcase the overall success of the company.

The existence of new information, in addition to

the financial statements, will form new confidence

among investors. Companies that have revealed

more information is needed the investor will earn the

trust of the community. Increased public confidence

in the companies that have done the disclosure is

expected to drive the increase in stock price and

sales volume. (Gunawan & Lina, 2015). The

indicator of the company’s success is rising stock

prices and being able to face the economic crisis. Of

course, behind the rising stock prices, there are

planned business processes, measured and supported

by capital resources, facilities and human resources.

All series of company successes must be displayed

in full.

The concept of “integrated reporting” has been

gaining prominence during the last few years. In its

purest form, integrated reporting can be understood

as the convergence of the sustainability report and

the financial report into a single “narrative”—a

communication intended mainly for investors in

which top management provides its views on how

sustainability issues and initiatives are expected to

contribute to the long-term growth strategy of the

business. (Churret & Eccles, 2014). In its

development, annual reports become integrated

reports that are equipped with narratives to explain

quantitative data. The addition of graphics and

images is not just accessories, but rather to

strengthen the explanation.

The adoption of an integrated reporting

approach, overcoming the boundaries and

limitations of traditional information systems, is

expected to enhance the effectiveness of internal

control systems and to support the achievement of

financial, environmental and social results; in other

words, the sustainability of the overall performance,

thus boosting the value creation of the

organisation.Furthermore, such an approach is

expected to improve the value relevance of

traditional accounting information. (Loprevite &

Ricca, 2018). The researcher limits this research to

the preparation process for preparing the annual

report of PT. Energi Mega Persada, Tbk which is

engaged in oil and gas energy. After successfully

passing various economic conditions in Indonesia,

PT. Energi Mega Persada, Tbk is still a leading

company. There are still vast opportunities for

companies in the oil and gas energy sector to expand

overseas. Oil and gas energy is still the mainstay of

the Indonesian economy, both as a foreign exchange

producer and supplier of domestic energy needs. The

development of infrastructure and industry is

actively carried out in Indonesia, making the growth

in energy consumption an average of 7% in the last

ten years. (http://www.academia.edu, February 19,

2016). Nowadays, corporate annual reports (CARs)

are mostly used channels to disclose information to

stakeholders and are treated as a promotional tool

for the company. CARs involve many variables such

as stock exchanges and company industries. (Wang

& Li, 2012).

2 LITERATUR REVIEW

2.1 Administration

Preparations are required by the company’s internal

team and the Vendors on the stages of making the

Annual Report. This process takes about 3-4 months.

The administration is an activity business with the

implementation of wisdom to achieve a goal as

understanding in the book (“Modern Office

Administration” Drs. The Liang Genie (1995: 13)

Administration is a whole series of structuring

activities on work carried out by a group of people

in cooperation to achieve these objectives.

Activities: notes, correspondence, bookkeeping

light, type typing, agenda, which is clerical work.

Thus administration is a small part of the activities

of the administration.

Drs Soewarno Hardayaningrat quoted in his

book entitled “Introduction to the Study of

Administrative Sciences and Management” (1996:

2). The administration is the activity of note-taking,

letter-lettering, light bookkeeping, typing, and so on

that are technical (clerical work) according to the

process of making annual reports that require daily

administration to be summarised and made into an

annual report resulting from production,

information, financial data and reports, companies

obtained during the year all use administrative

activities.

2.2 Administrative Function in Making

Annual Reports

Compilation of annual reports uses administrative

functions as a guideline to carry out all activities for

preparing the Annual Report. “The functions of

Administration and management according to Luther

M. Gullick” are planning (planning), organising

(organising), staffing (procurement of labour),

directing (giving guidance), coordinating

Annual Report Preparation Process in PT Energi Mega Persada, Tbk to Face Industrial Revolution 4.0: Spearman’s Correlation Coefficient

513

(coordinating), reporting (reporting), budgeting

(budgeting ) The explanation is as follows:

1. Planning (planning), Namely in administrative

or administrative activities, definitely requires

proper and mature planning. For example data

collection, preparation of planning, data processing,

wherein these activities administration is needed.

2. Organising (organising)

Likewise with organising, where every activity

of the organisation must be in desperate need of

administration as an example in the determination of

officers or workers.

3. Staffing (procurement of labour)

It is the practice of finding, evaluating,

evaluating and establishing work relationships with

employees or labour and dismissing them if they are

no longer needed so that the workforce or employees

are determined according to their fields of expertise.

4. Directing (giving guidance)

Functions that relate to the effort in guiding,

giving suggestions, input to improve an activity that

is being carried out so that the task can be carried

out as much as possible, with satisfactory results.

5. Coordinating (coordination) That is a

coordinating process where all the interests and

objectives of the organisation implemented can be

united and can be synchronised with the place and

time.

6. Reporting (reporting) Namely how to inform

what has been done in all activities as one of the

responsibilities.

7. Budgeting (budgeting) That is how to plan

finances, how much budget is needed, where the

financing is, calculation of incoming and outgoing

money, and supervision carried out.

2.3 Understanding the Annual Report

The annual report is an achievement and

development of a company that is achieved within a

year. The annual report contains data and complete

information about the company consistently,

transparently and accurately. According to

(“Brigham Houston (2001: 38)”) the understanding

of the Annual Report (annual report) is the following

report published annually by the company to the

shareholders. This report contains necessary

financial reports and management opinions on the

company’s operations over the past year and the

company’s prospects in the future.

Whereas according to Government regulations,

namely OJK Regulations (“Financial Services

Authority Regulation Number /POJK.04/20 ..

Regarding the Annual Report of Issuers or Public

Companies”)

a. That the annual report of the Issuer or Public

Company is an essential source of information for

shareholders and the public in making investment

decisions

b. In order to improve the quality of information

disclosure on annual reports of Issuers or Public,

Companies to shareholders and the public;

c. Whereas based on the considerations as

referred to in letters a and b, it is necessary to issue a

Financial Services Authority Regulation concerning

the Annual Report of Issuers or Public Companies;

This annual report will be used at the General

Meeting of Shareholders (GMS) as consideration for

shareholders to assess the condition of the company

and also determine whether the shareholders buy or

sell their shares and provide company information

within a year (historical). In detail, the relationship

between the company’s social activities and the

community and the environment is conveyed to

external companies such as stakeholders, investors,

creditors and other parties in making economic

decisions.

2.4 Types of Annual Report

Information Disclosures

The annual report has several types of information

disclosures in the Annual Report. An annual report

containing real and mandatory information must be

available in the annual report and also exciting

things for shareholders to know more about

company information through this annual report.

According to (“Cahyani Nuswandari (2009: pp

48-57”) suggests two types of disclosures related to

annual reports, namely as follows:

“1. Mandatory Disclosure

2. Voluntary Disclosure

From the above quotation, two compulsory and

voluntary disclosures can be explained as follows:

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

514

1. Mandatory disclosure

Every issuer or public company registered on the

stock exchange must submit annual reports regularly

and other material information to Bapepam and the

public. Provisions concerning Obligations for

Submitting Annual Reports to Issuers and Public

Companies are regulated in rule number X.K.6

2. Voluntary Disclosure

Voluntary disclosure is the delivery of

information provided voluntarily by companies other

than mandatory disclosures. Voluntary disclosure is

information disclosure that exceeds the minimum

requirements of applicable capital market

regulations. Companies have the freedom to carry

out voluntary disclosures in annual reports, giving

rise to a variety of wide variety of voluntary

disclosures between companies.

Voluntary disclosure is one way to increase the

credibility of corporate financial reporting and to

help investors understand the company’s business

strategy (“Healy, Palepu 1993 in Sotomo, 2004”). In

the context of voluntary disclosure management

companies are free to choose to provide other

accounting information that is considered relevant in

supporting decision making by users of annual

reports (“Meek, Gary K, Clare B. Robert and Sidney

J. Gray, 1995 in Sutomo, 2004”).

2.5 Purpose of the Annual Report

According to (“Dewi (2010: 21”) the objectives of

the annual report are as follows:

1. Providing useful information for people who

understand business and economic activities in

making investment and credit decisions.

2. Providing information that is useful for

investors, creditors and other users in predicting

future cash flows.

3. Providing information about asset claims

against assets (liability and equity) and their

changes.

Investors or potential shareholders use the

Annual Report more often, while individual

investors more often use financial business

information. Annual report disclosures are related to

financial statements.

2.6 Annual Report Standards and

Regulations

Regulations in making Annual Reports are very

much needed because they are directly regulated by

the relevant institutions OJK, that made a

regulation regarding the obligation to

Chairperson of the Capital Market and Financial

Institution Supervisory Agency Number: Kep-134 /

BL / 2006 concerning Obligation to Submit Annual

Reports to Issuers and Public Companies by

stipulating Decision of the Chairperson of the new

Capital Market and Financial Institution Supervisory

Agency. For the standard content of the Annual

Report, there is a regulation Number X.K.6, number

2.

3 RESEARCH MODEL

The research model used is derived from the

Analysis of Factors in the Process of Preparing the

Annual Report at PT Energi Mega Persada Tbk.

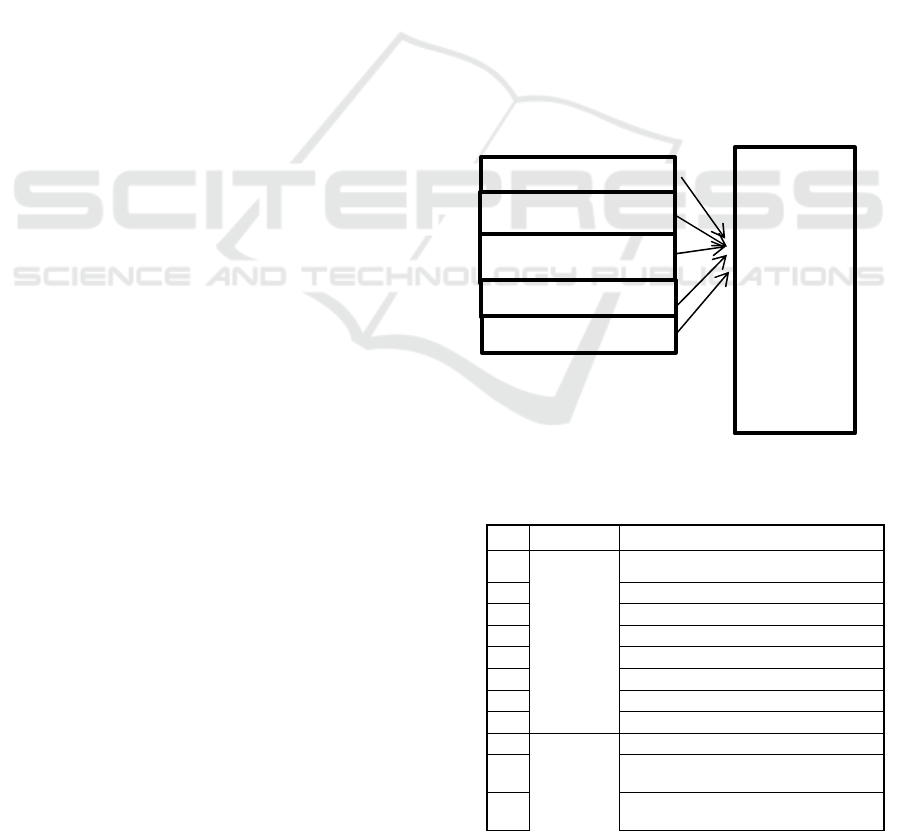

Figure 1. Reserarch Model

Table 1 Attributes asked in the questionnaire.

No. Attribute

1

Appearan

ce

Good Indonesian and English

2 Printed with good quality

3 Font type and size are easy to read

4 State the company identity

5 Equipped with photos and tables

6 Report theme

7 The number of pages of the book

8 Linkages between images and writing

9 Equipped with statistical data

10

Complete-

ness

Compliance with Financial Services

Authority (OJK) regulations

11

Completeness of information

availability

APPEARANCE

TIMELINESS

RELIABILITY

COMPLETENES

RE

S

P

O

N

S

E

Service

Quality in

the

Process of

Preparing

the

Annual

Report at

PT Energi

Mega

Persada

Tbk

.

Annual Report Preparation Process in PT Energi Mega Persada, Tbk to Face Industrial Revolution 4.0: Spearman’s Correlation Coefficient

515

12 Completeness of company identity

13

Timelines

s

Accuracy of preparation schedule

14 Timeliness of data collection

15 Reliability

Presentation adjusted to the

transaction

16

Disclosure according to economic

reality

17

Information about financial

statements can be understoo

d

8

Response

The author’s willingness to show the

manufacturing procedure

9

The author’s willingness to respond

to the problem

2

0

Responses and willingness of the

writer in collecting data from each

division

4 ANALYSIS AND DISCUSSION

4.1 Testing of Research Hypotheses

4.1.1 Test Validity and Reliability

a. Validity test

A research instrument is said to be valid or valid

when it has high validity, and is able to be a measure

of what is desired and can reveal data from each

variable that is examined appropriately. In this study

to find out the results of the data validity test can be

seen in the Item-Total Statistics table in the

Corrected item-total Correlation column. To see the

value of r with a significance of 0.05 for the two-

tailed test and N = 29, df = (N-2), df = 29-2 = 27,

then obtained value (0.05; 27) = 0.3673, A items are

said to be valid if r count> r table.

The results of the validity test for each variable

can be seen in the following table:

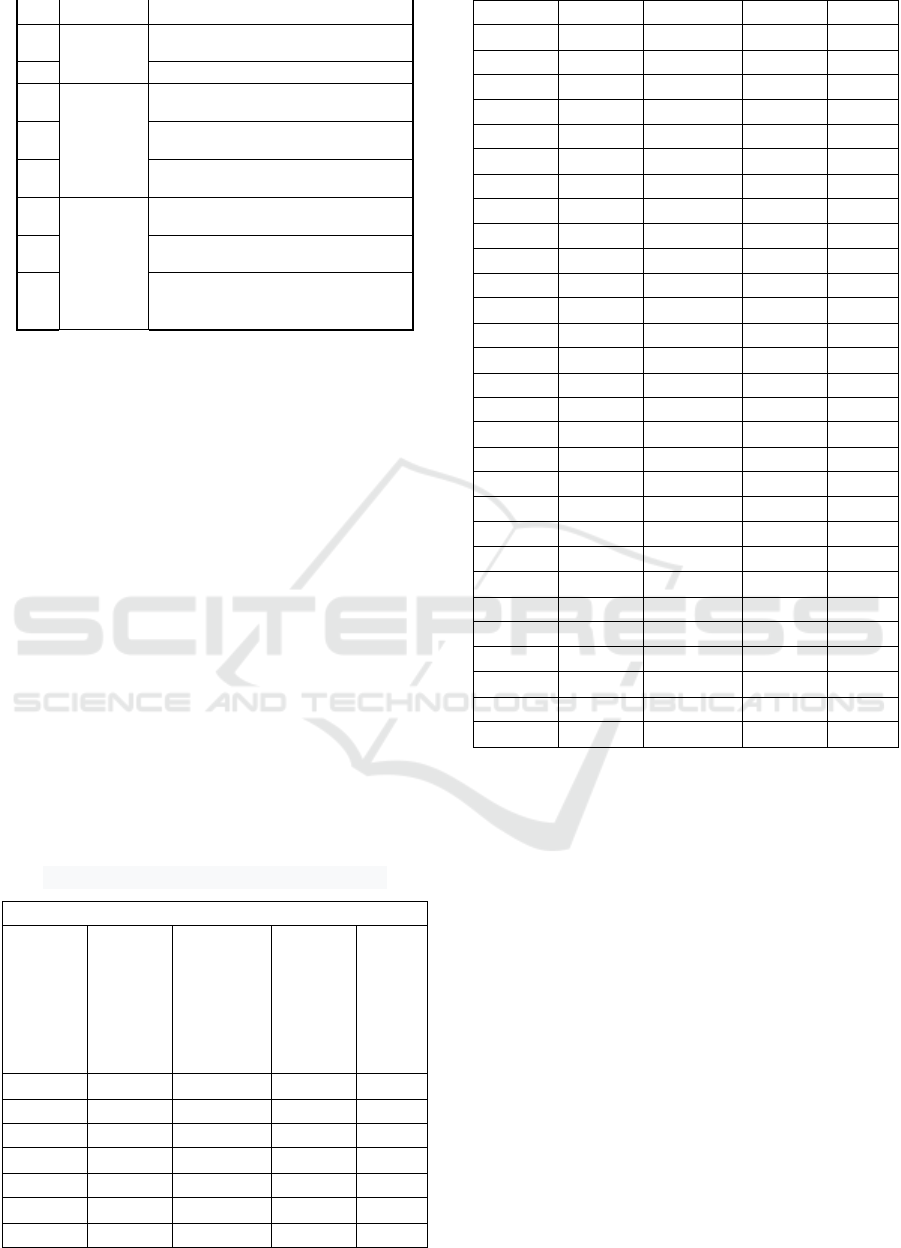

Table 2: Test validity Item-Total Statistics.

Item-Total Statistics

Scale

Mean if

Item

Deleted

Scale

Variance

if Item

Deleted

Correct

ed

Item-

Total

Correla

tion

Cron

bach’

s

Alph

a if

Item

Delet

ed

App1 147.10 300.953 .633 .968

App2 147.14 301.337 .675 .968

App3 147.17 298.933 .732 .968

App4 147.07 301.924 .695 .968

App5 147.21 300.599 .731 .968

App6 147.34 304.734 .507 .969

App7 147.28 301.707 .604 .968

App8 147.31 303.507 .590 .968

App9 147.41 301.966 .667 .968

App10 147.52 301.473 .536 .969

App11 147.52 303.044 .644 .968

Com1 147.52 303.901 .604 .968

Com2 147.55 309.042 .387 .969

Com3 147.31 301.865 .818 .968

Com4 147.34 303.448 .766 .968

Com5 147.31 303.150 .666 .968

Com6 147.21 297.670 .865 .967

Com7 147.41 299.180 .794 .967

Com8 147.45 301.470 .718 .968

Com9 147.07 299.281 .751 .968

Com10 147.34 301.520 .643 .968

Com11 147.34 300.520 .637 .968

Com12 147.17 301.005 .700 .968

Com13 147.28 305.707 .479 .969

Com14 147.34 301.234 .655 .968

Com15 147.41 300.894 .659 .968

Com16 147.24 300.547 .688 .968

Com17 147.38 301.530 .572 .969

Com18 147.38 300.672 .648 .968

Time1 148.00 297.143 .621 .968

Time2 147.97 292.606 .738 .968

Rel1 147.62 302.458 .560 .969

Rel2 147.62 298.244 .728 .968

Rel3 147.38 295.887 .790 .967

Res1 147.66 299.805 .697 .968

Res2 147.55 296.042 .806 .967

Res3 147.45 294.756 .827 .967

Source: SPSS Data version 25.0 (2019)

From the results of the statistical validity test

data above, it can be seen that none of the statement

items is ruled out because the result r value> r Table

is thus the whole item of the Brand Image variable

statement is valid.

b. Reliability Test

Reliability test is a measure that shows stability

in measuring. Stability here means that the

questionnaire is consistent if it is used to measure

concepts or constructs from one condition to

another. In this technique measurement is done only

at one time, then compare with other questions or by

measuring the correlation between answers. In the

SPSS program, this method is carried out by the

Cronbach Alpha method, where a questionnaire is

said to be reliable if the Cronbach Alpha value is

more significant than 0.60.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

516

Table 3: Reliability Test

Reliability Statistics

Cronbach’s

Alpha

Cronbach’s Alpha

Based on Standardised

Items

N

of

Items

.969 .970 37

Source: SPSS Data version 25.0 (2019)

From the results of the reliability test statistical data

shows that the Cronbach’s alpha value is reliable,

because the Cronbach’s alpha value is above the

minimum limit of 0.60, so it can be concluded that

the measurement scale for service quality variables

has excellent reliability.

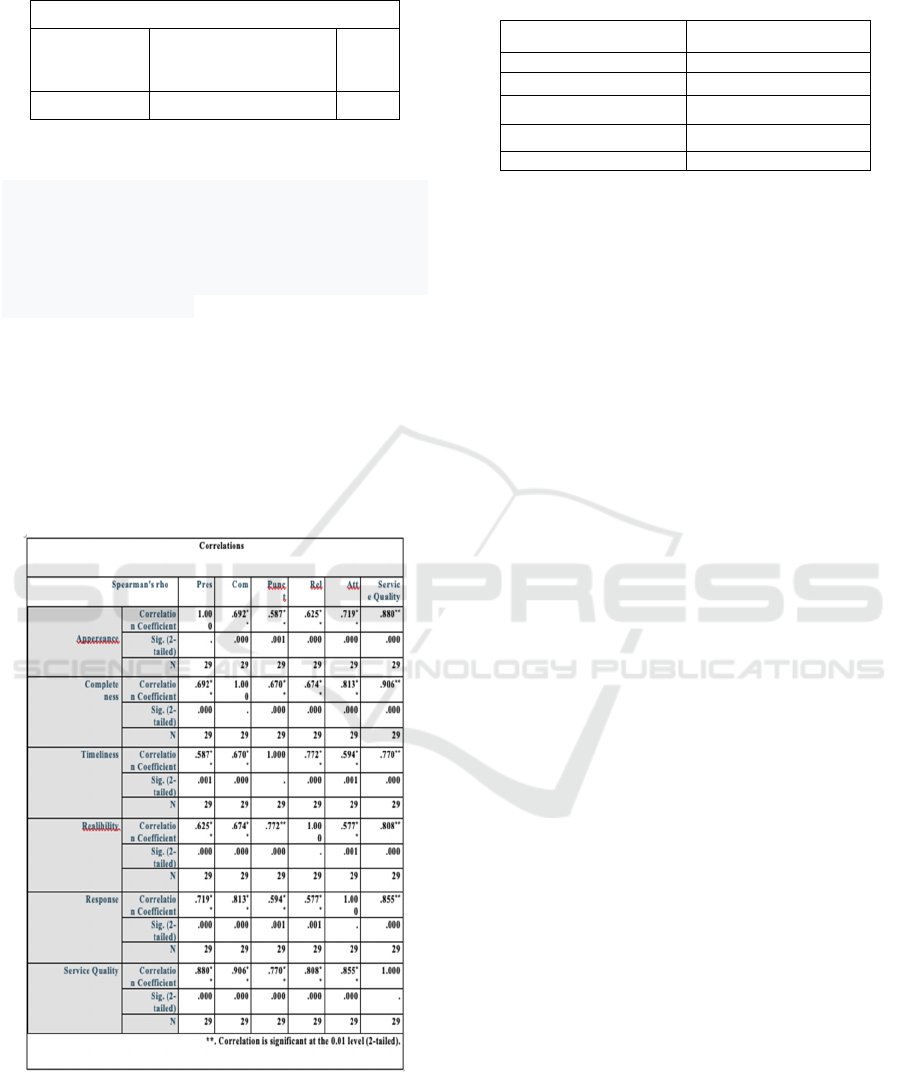

2. Partial Correlation Test (Spearman Correlation)

The data analysis technique used in this study is the

Spearman correlation test to test the relationship

between the variables studied. To find out the level

or degree of closeness of the relationship between

the variables studied, used a table of guideline

criteria for correlation coefficients, among others:

Table 4: Spearman Correlation Test

Table 5: Guidelines for Providing Interpretations of

Correlation Coefficients

Coefficient Interval Relationship Level

0,00 - 0,199 Very low

0,20 - 0,399 Low

0,40 - 0,599 Medium

0,60 - 0,799 Strong

0,80 - 1,000 Very strong

Source: Sugiyono (2012)

With the hypothesis H0: ρ = 0 (there is no

correlation between the two variables) VS H1: ρ ≠ 0

(there is a correlation between the two variables) the

following results are obtained:

1. From the data above, it can be seen that the

Spearman correlation value between

Presentation / Display and Service Quality

is = 0.880 because p-value = 0.000 is

smaller than α = 0.05, then H1 is accepted.

Conclusion there is a relationship Factor

appearance with service quality, where both

have a level of relationship “Very Strong”.

2. From the data above, it can be seen that the

Spearman correlation value between Completeness

and Service Quality is = 0.906 because p-value =

0.000 is smaller than α = 0.05, then H1 is accepted.

To conclude, there is a relationship between the

complete factor and the quality of service. Both of

which have a strong level of relationship.

3. From the data above, it can be seen that the

Spearman correlation value between Timeliness and

Service Quality is = 0.770 because p-value = 0.000

is smaller than α = 0.05, then H1 is accepted. The

conclusion is that there is a relationship between the

factor of timeliness and service quality, where both

have a level of “strong” relationship.

4. From the data above, it can be seen that the

Spearman correlation value between Reliability and

Service Quality is = 0.805 because p-value = 0.000

is smaller than α = 0.05, then H1 is accepted.

Conclusions there is a correlation between

Reliability Factors and Service Quality, where both

have a level of “Very Strong” relationship.

5. From the data above, it can be seen that the

Spearman correlation value between Attitudes /

Responses and Service Quality is = 0.855 because p-

value = 0.000 is smaller than α = 0.05, then H1 is

Annual Report Preparation Process in PT Energi Mega Persada, Tbk to Face Industrial Revolution 4.0: Spearman’s Correlation Coefficient

517

accepted. Conclusion there is a relationship between

Attitude / Response Factors and Service Quality,

where both have a level of “Very Strong”

relationship.

The researcher noticed that all factors had a

strong to a solid level of relationship to Service

Quality. However, the most substantial relationship

is the completeness factor in the annual report.

Stakeholders are very concerned about

comprehensive presentation, including executive

summary, development of each field, and future

company plans. The drafting team can be

categorised as having excellent performance if it has

completed all relevant quantitative, qualitative,

diagram and photo data. An essential aspect of the

annual report is displaying the latest data.

Completeness in preparing the annual report also

includes the ability of the drafting team to prepare

the template and be able to socialise it well. The

ability of social interaction is also needed in data

collection so that processing raw data into

interesting information can be carried out optimally.

Factors that have a relationship whose strength is

below other factors are timeliness. Stakeholders

assume that the period of annual report preparation

can be tolerated if the completion exceeds the

specified target. The withdrawal of the finalisation

of the annual report can be caused by the collection

of essential data which often needs to be reprocessed

and obtain the approval of the company leadership.

Data collection from branch offices in the regions

can also cause delays in the printing of annual

reports. The period of preparation can be arranged

more flexibly for the realisation of an annual report

that can display all activities and achievements in

full. But even though it is flexible, the company

must provide a final deadline, so that the annual

report can be used optimally for decision making, as

well as monitoring and evaluation material.

REFERENCES

Bananuka Juma, Laura Orobia, Zainab Tumwebare, The

Adoption of Integrated Reporting: A Developing

Country Perspective, Journal of Financial Reporting

and Accounting, 2018,

https://www.researchgate.net/publication/325789760

Beattie, V. and Dhanani, A. and Jones, M. (2008)

Investigating presentational change in UK annual

reports: a longitudinal perspective. Journal of Business

Communication 45(2):pp. 181-222., University of

Glasgow

Brigham, Eugene F. dan Houston, Joel F. 2001.

Fundamentals of Financial Management. Jakarta:

Salemba Empat

Cecille Churet, RobeccoSAM, Robert G. Eccles,

Integrated Reporting, Quality of Management, and

Financial Performance, Journal of Applied Corporate

Finance • Volume 26 Number 1, 2014

Creswell, John. 2015. Education Research Ed 5 : Planning,

Implementation. Jakarta: Penerbit Pustaka Pelajar

Decision of the Chairman of the Capital Market and

Financial Institution Supervisory Agency Number:

Kep-134 / BL / 2006 concerning the Obligation to

Submit Annual Reports for Issuers and Public

Companies.

Decision of the Chairman of the Capital Market and

Financial Institution Supervisory Agency Number

KEP-431 / BL / 2012 concerning Submission of the

Annual Report of Issuers or Public Companies

Financial Services Authority Regulation Number /

POJK.04/20 .. Regarding the Annual Report of Issuers

or Public Companies

F. Haasbroek, A.S.A. du Toit, Importance of digital annual

reports, South African Journal of Information

Management, Vol. 5 (1) March 2003

Geert Braam, Lex Borghans Board and auditor interlocks

and voluntary disclosure in annual reports, NiCE

Working Paper 10-111, December 2010, Nijmegen

Center for Economics (NiCE) Institute for

Management Research Radboud University Nijmegen

Gulick, Luther. 1937. Notes on the Theory of

Organization, dalam Shafritz, Jay M dan J. Steven

Ott. 1987. Classics of Organization Theory,

Brooks/Cole Publishing Company Pacific Grove,

California.

Handayaningrat, Soewarno. 1996. Introduction to

Administrative Studies and Management Studies.

Jakarta : Hj Masagung.

Hendra Gunawan, Evelyn Octa Lina, Mandatory and

Voluntary Disclosure of Annual Report on Investor

Reaction, International Journal of Economics and

Financial Issues, 2015, 5(Special Issue) 311-314., 2nd

AFAP INTERNATIONAL CONFERENCE ON

ENTREPRENEURSHIP AND BUSINESS

MANAGEMENT (AICEBM 2015),10-11 January

2015, Universiti Teknologi Malaysia, Kuala Lumpur,

Malaysia.

Huili Wang, Lixin Li, LEXICAL FEATURES IN

CORPORATE ANNUAL REPORTS: A CORPUS-

BASED STUDY European Journal of Business and

Social Sciences, Vol. 1, No. 9, pp 55-71, December

2012. URL: http://www.ejbss.com/recent.aspx ISSN:

2235 -767X )

K. Appiagyei, H. Djajadikerta and E. Xiang, 2016,

Integrated Reporting and Firm Performance : A

Research Framework, Conference Paper, School of

Business and Law, Edith Cowan University, 270

Joondalup Drive, Joondalup, Western Australia, 6027 ,

https://www.researchgate.net/publication/320163713

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

518

Madan Lal Bhasin Disclosure of Intellectual Capital in

Annual Reports: An Empirical Study of the Indian IT

Corporations Modern Economy, 2011, 2, 455-467

doi:10.4236/me.2011.24051 Published Online

September 2011 (http://www.SciRP.org/journal/me)

Copyright

Nuswandari, Cahyani. 2009. Financial Report Disclosures

in the Signaling Theory Perspective. Accounting

Study. Vol. 1, No.1. Hal 48- 57.

The Liang Gie, (1995) Modern Office Administration,

Yogyakarta: Libety Publishers and the Science and

Technology Study Foundation.

Snjezana Pivac, Tina Vuko, Marko Cular, Analysis of

annual report disclosure quality for listed companies in

transition countries Economic Research-Ekonomska

Istraživanja, 2017 VOL.30, NO.1, 721–731

https://doi.org/10.1080/1331677X.2017.1311231)

Salvatore Loprevite, Bruno Ricca, Daniela Rupo,

Performance Sustainability and Integrated Reporting:

Empirical Evidence from Mandatory and Voluntary

Adoption Contexts, Sustainability 2018, 10, 1351;

doi:10.3390/su10051351

Thomas Zeller, Brian Stanko, Han Jin, INVESTIGATING

PRESENTATIONAL CHANGE IN COMPANY

ANNUAL REPORTS: AN EXTENSION, Academy

of Accounting and Financial Studies Journal, Volume

16, Number 3, 2012, Loyola University Chicago

Annual Report Preparation Process in PT Energi Mega Persada, Tbk to Face Industrial Revolution 4.0: Spearman’s Correlation Coefficient

519