Analysis of the Application of the Ease of Administration Principle in

the Property Tax Reduction Procedure in the Fourth Industrial

Revolution: Case Study Personal Tax Payer

Elsie Sylviana Kasim

Tax Administration, Vocational Education Program, University Indonesia

Keywords: Ease of administration, Property Tax Reduction Procedure, Case Study

Abstract: The purpose of this research is to analyse the application of the ease of administration principle in property

tax reduction procedure in the fourth industrial revolution – case study personal taxpayer. This research

approach is quantitative by conducting interviews with informants as well as other supporting data. The

results of the study indicate that the principle of ease of certainty has not been fully fulfilled. The ease of

efficiency is fully fulfilled. Moreover, the ease of simplicity is fully fulfilled. This research is expected to

provide input for the government, especially Regional Tax and Retribution Agency, South Jakarta

Administrative City and also for taxpayers, as study material related to the procedure for obtaining property

tax reduction. This research is expected to provide information and be a reference material in reviewing

procedures to obtain property tax reduction and provide an overview of the application of the principle of

ease of administration.

1 INTRODUCTION

There has been an increase in the property tax

reduction procedure. One factor is the massive

changes in housing prices that have occurred over

the past decade. The increase in house prices across

the country in the early 2000s caused many owners

to apply for a reduction to their property taxes

(Doerner and Ihlanfeldt, 2014). It is because their

values rose too quickly. Residents of DKI Jakarta

also complained about by the increase in the price of

the Sales Value of Taxable Object. According to the

Head of DKI Regional Tax and Retribution Agency,

Faisal Syafruddin, the Sales Value of Taxable

Object increase varies and adjusts market prices. In

DKI Jakarta, the Average Sales Value of Taxable

Object increase is 19.54% in the 2018 period. The

adjustment is regulated in Regulation of the

Governor of the provincial district exclusive Capital

Jakarta No. 24 in 2018 on the Determination of Sale

Value of Land and Rural and Urban Land Tax

Objects in 2018.

The property tax reduction procedure gives

owners who believe that their property is overvalued

to make adjustments to its assessed value. Because

the government’s valuation system inherently

introduces some randomness in the tax burden

(Doerner and Ihlanfeldt, 2014). One of the rights of

the taxpayer is to get a reduction in Rural and Urban

Land and Building Tax. A reduction in Rural and

Urban Land and Building Tax can be given when the

amount of tax received by the taxpayer on the object

of the tax is appropriate, but the taxpayer feels

unable to pay the tax debt. This condition means that

the land and building area and the Sales Value of

Taxable Object per m

2

of tax objects (land and

building classification) are in accordance with the

field conditions. However, for the amount of tax

stipulated by the tax authorities, taxpayers feel that

they cannot pay the amount of Rural and Urban

Land and Building Tax owed. For these conditions,

taxpayers can submit a reduction in the amount of

Rural and Urban Land and Building Tax owed.

Reductions can be given based on the taxpayer’s

request. Requests can be submitted individually or

collectively (collectively). The decision is to grant a

reduction in the authority of the tax authorities

(regional head). The amount of Rural and Urban

Land and Building Tax is given is determined based

on subjective considerations of the tax authorities by

paying attention to the state of the tax object that has

to do with the tax subject.

492

Sylviana Kasim, E.

Analysis of the Application of the Ease of Administration Principle in the Property Tax Reduction Procedure in the Fourth Industrial Revolution: Case Study Personal Tax Payer.

DOI: 10.5220/0010700200002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 492-500

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

The complexity of the tax reduction procedure

often makes representing oneself virtually

impossible. (Tomes and Dvorak, 2014). A personal

taxpayer, in this case, is Mr X, who is a resident of

Cilandak, Lebak Bulus. Since the construction of the

mass rapid transit (MRT) phase of Lebak Bulus –

Hotel Indonesia Roundabout residents can feel

The increase in land value. However, this resulted in

an increase in Rural and Urban Land and Building

Tax in this case Property Tax through Sales Value of

Taxable Object adjustments.

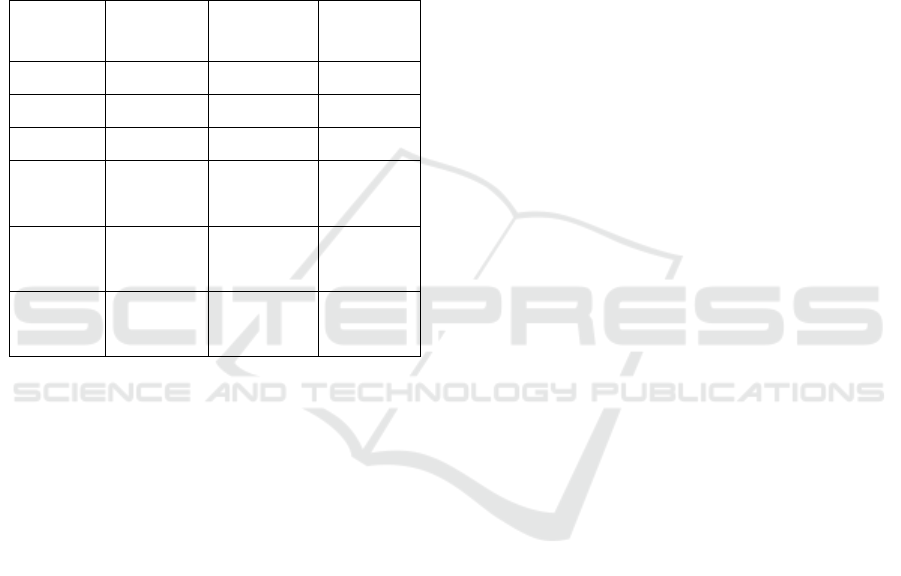

Table 1: Mr X’s Total Sales Value of Taxable Object

Yea

r

2016 2017 2018

(

R

p)

(

R

p)

(

R

p)

Lan

d

5.938.317.000

5.938.317.000

7.060.077.000

Buildin

g

2.371.500.000

2.371.500.000

2.371.500.000

Total Land

& Buildin

g

8.309.817.000

8.309.817.000

9.431.577.000

Acquisition

Value of

15.000.000

15.000.000

15.000.000

Non-Taxable

Ob

j

ect

Sales Value

of

8.294.817.000

8.294.817.000

9.416.577.000

Taxable

Ob

j

ect

Rural and

Urban Lan

d

16.589.634

16.589.634

18.833.154

and Building

Tax

Based on the table 1 above during 2016 and

2017, Mr X did not experience a rise in property tax.

However, in 2018 there was a 13.5% increase from

Rp16,589,634 to Rp18,833,154. Since 2016 Mr X

has proposed a reduction in property tax. However,

the reduction in property tax obtained by Mr X since

2016 is only 10%.

In this study, the goal is to analyse the

application of the ease of administration in Mr X

property tax reduction procedure as an input to

improve the reduction procedure system and to look

closely at the emerging technology that has enabled

online assessment appeal (OAA) systems (Brady

and Sanderson, 2017).

2 LITERATURE REVIEW

In the preparation of the study entitled “Analysis of

the Application of the Ease of Administration

Principle in Property Tax Reduction Procedure in

the Fourth Industrial Revolution - Case Study

Personal Tax Payer”, the researcher uses four other

research results that have relevance to the theme

raised by the researcher and at the same time

become a reference in the preparation of research.

The first research that became a reference is an

international journals title Munich Personal RePEc

Archive Paper year 2015 by William Doerner and

Keith Ihlanfeldt, title “An Empirical Analysis of the

Property Tax Appeals Process”. This paper

investigates the efficiency and equity of the property

tax appeals process. Regarding the efficiency of

correcting assessment error, reductions are granted

for a majority of appealing homeowners who are

overassessed but also for homeowners who are not

overassessed, leaving them under-assessed.

The secondary research that became a reference

is in an international journal entitled Munich

Personal RePEc Archive Paper year 2014 by

William Doerner and Keith Ihlanfeldt, title “ The

Role of Representative Agents in the Property Tax

Appeals Process”. This paper describes property tax

appeals to challenge their assessments and reduce

their property tax bill. Appeals are frequently filed

not by the homeowner but by a representative.

Appeals using representatives have a more

significant presence in higher-priced

neighbourhoods, which makes these homeowners

more likely to appeal than those in lower-priced

neighbourhoods.

The third research that became a reference is in

an international journal entitled Real Estate Finance

year 2014 by Johnathan P. Tomes and Richard D.

Dvorak, the title “Appeals Once and for All: In the

Matter of the Protest of Lyerla, Kathy L”. This paper

describes a recent Kansas tax case for property tax

appeals. The taxpayers believe that the assessment

on their commercial property is too high, so they

hire a tax consultant to represent them through the

property tax appeal process. The complexity of the

tax appeal process makes it virtually impossible to

represent oneself.

The fourth research that became a reference is

in an international journal entitled Journal of

property tax assessment & administration year 2017

by Michael Brady and Richard L. Sanderson, AAS,

title “The Current Environment of Online

Assessment Appeal Systems”. This paper describes

the current environment of online assessment appeal

(OAA) systems that identified as having been

implemented by assessment jurisdictions in the

United States or Canada for real property

assessments or in 2015 or earlier.

These papers offer insights on factors that effects

reduction adjustment. In the present study,

researchers tried to analyse the application of the

ease of administration principle and constraints of

Analysis of the Application of the Ease of Administration Principle in the Property Tax Reduction Procedure in the Fourth Industrial

Revolution: Case Study Personal Tax Payer

493

property tax reduction procedure in the fourth

industrial revolution - Case Study Personal Tax

Payer.

3 RESEARCH QUESTION

To determine the application of the ease of

administration in the application of property tax

reduction procedure in the fourth industrial

revolution case study personal taxpayer as stipulated

in Law No. 28 in 2009 on local tax and regional

retribution and regulation of the governor of the

provincial district exclusive Capital Jakarta No. 211

in 2012 on land tax rural and urban building

reduction.

4 RESEARCH DESIGN

4.1 Research Approaches

The author chose a quantitative approach in

analysing the implementation of the ease of

administration in the application of the property tax

reduction procedure in the fourth industrial

revolution. The research subject is the ease of

administration in the Indonesian taxation system.

While the object of research is the reduction of the

property tax as stipulated in the Law No. 28 in 2009

on local tax and regional retribution and regulation

of the governor of the provincial district exclusive

Capital Jakarta No. 211 in 2012 on land tax rural and

urban building reduction.

4.2 Types of Research

Types of research are differentiated by purpose, time

dimensions, benefits and data collection techniques.

1. Types of research by purpose

This research is descriptive research. The purpose of

using descriptive research is to describe the extent to

which the ease of administration is implemented in

the application for property tax reduction procedure

as set forth in the Law No. 28 in 2009 on local tax

and regional retribution and regulation of the

governor of the provincial district exclusive Capital

Jakarta No. 211 in 2012 on land tax rural and urban

building reduction. This research is classified as case

studies. Researchers analysed the underlying

implementation of the ease of administration of Mr

X’s property tax reduction.

2. Types of research based on the time dimension

This research included cross-sectional research

because it was implemented at a specific time from

2016 to 2018 and not carried out subsequent studies

to be compared.

3. Types of research-based benefits

The research is based on its benefits belonging to the

pure research category.

4. Types of research based on Data collection

techniques

Based on data collection techniques, this study uses

qualitative data collection techniques. Researchers

use literature studies and in-depth interviews in

conducting research.

4.3 Data Analysis Techniques

The data analysis technique used by the authors in

this research is a qualitative data analysis technique.

The authors will conduct data analysis of the

interviews and search for related data in the field to

analyse the implementation of the ease of

administration in the application of the property tax

reduction procedure.

4.4 Speaker/Informant

Mr X filed a property tax reduction from 2016 to

2018 in the Regional Tax and Retribution Agency of

South Jakarta regional administration.

4.5 Site Research

Research Site in South Jakarta Regional Tax and

Retribution Agency.

4.6 Research Constraints1

This research saw only the fulfilment of the ease of

administration elements in the application of

property tax reduction procedure Mr X from 2016 to

2018 in South Jakarta central city area.

5 RESULTS

5.1 Description of Topic

The property tax reduction can be given to taxpayers

because of certain tax object conditions that have to

do with the subject of tax and/or due to specific

other causes; and/or the condition of the tax object is

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

494

exposed to natural disasters or other extraordinary

causes.

Certain tax object conditions that have to do with

the subject tax and/or due to specific other causes

are given a reduction to the individual taxpayers,

among others:

1. The object of tax that is an individual taxpayer of

veteran independence fighters, veterans defenders of

Independence, the recipient of the mark of the

service of guerrilla stars, or his widow/widower;

2. The object of tax that is an individual taxpayer of

the former president and the vice president and

former governor and deputy governor or his

widow/widower;

3. The object of tax that is an individual taxpayer of

private persons whose income is solely from retirees

so that the obligations of property tax are difficult to

fulfil;

4. The object of tax that is an individual taxpayer

who is low-income so that the property tax is

difficult to fulfil; or

5. The object of tax that is an individual taxpayer

who is low-income Sales Value of Taxable Object is

increased due to environmental change and positive

impact of development.

The property tax reduction is given to corporate

taxpayer who suffered liquidity losses and

difficulties in the previous tax year so that they

could not fulfil routine obligations. Natural disasters

are natural disasters resulting from events or a series

of events caused by nature, such as earthquakes,

tsunamis, volcanic eruptions, floods, droughts,

cyclone angina and/or landslides. Other remarkable

reasons include fire, crop outbreak and/or crop pests.

The property tax reduction can be given based on

the notification of tax due and/or the property tax

listed in the tax underpayment assessment letter.

Reductions can be administered at the highest of

50% (fifty) percent of the property tax owed.

Reductions can be provided on a taxpayer’s request

and may be individually or collectively filed.

The request for a reduction submitted

individually must meet the formal requirements:

1. 1 (one) application for 1 (one) notification of tax

due or tax underpayment assessment letter;

2. Submitted in writing in Bahasa Indonesia, stating

the magnitude of the percentage of reduction

requested by the apparent reason;

3. Submitted to the head of Regional Tax and

Retribution Agency;

4. Photocopy of notification of tax due or tax

underpayment assessment letter for reduction;

5. The taxpayer signs the application letter, and in

case the application letter signed by non-taxpayer

shall be attached with a unique authorisation letter;

6. Filed within the timeframe:

a. 3 (three) months from the date of

receipt of notification of tax due;

b. 1 (one) months is not counted as from

the date of receipt of the tax

underpayment assessment letter;

c. 1 (one) month from the date of receipt

of the objection decision letter;

d. 3 (three) months from the date of the

occurrence of natural disasters; or

e. 3 (three) months after the date of the

occurrence extraordinary cause, except

where the taxpayer may indicate that

within that period cannot be fulfilled

due to circumstances beyond its

control.

7. Have not had the arrears of the property tax year

earlier over the object of tax that is subject to

reductions, except if tax objects are exposed to

natural disasters or other extraordinary causes; or

8. For notification of tax due or tax underpayment

assessment letter the petitioned reduction has not

filed an objection, or in the event filed objection has

been issued the decision letter objection and upon

the decision, letter objection has not filed an appeal.

A reduction request that does not meet the formal

requirements is considered not an application so that

it cannot be considered. If a reduction request cannot

be considered, the head of Regional Tax and

Retribution Agency within 10 (ten) working days

from the date of the application is received, shall

provide an answer in writing by notifying the

deficiency of the terms and the underlying reasons.

Taxpayers can still apply for a reduction in return

throughout meeting requirements.

The property tax individual reduction application

in addition to fulfilling the formal requirements also

meets the following requirements:

Application for individual reductions:

1. Taxpayer independence fighter veteran,

independence defender veteran, recipient of the

service mark of the guerrilla star or his

widow/state, former president and vice

president and former governor and deputy

governor or his widow/widower:

a. Photocopy of identification card

number;

Analysis of the Application of the Ease of Administration Principle in the Property Tax Reduction Procedure in the Fourth Industrial

Revolution: Case Study Personal Tax Payer

495

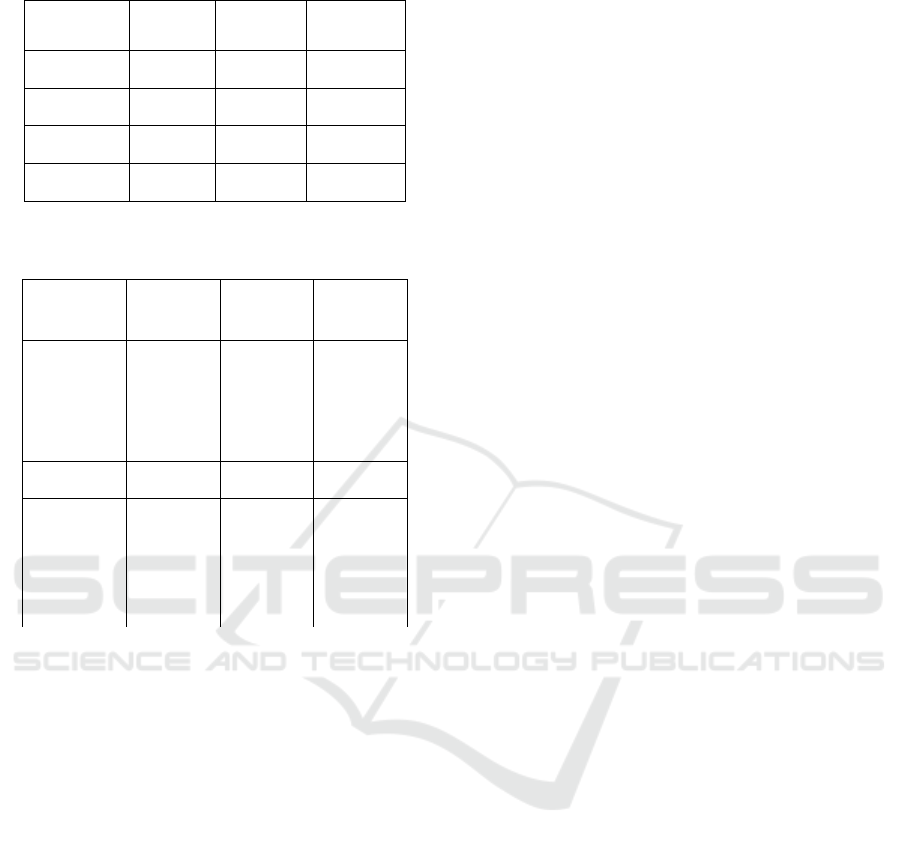

Table 2: Mr. X’s Notice of Land and Building Tax

Payable.

Yea

r

2016 2017 2018

(Rp) (Rp) (Rp)

Due of

Notice

11 Jan

2016

9 Jan

2017

4 April

2018

Due Date

31 Aug

2016

31 Aug

2017

14 Sept

2018

Application

Date

March

2016

23 March

2017

24 May

2018

Date of

Decision

14 Juni

2016

7 Aug

2017

4 Sept

2018

Table 3: The Amount of Land and Building Tax Payable

after Reduction.

Yea

r

2016 2017 2018

(Rp) (Rp) (Rp)

Rural and

Urban Land

and

Building

Tax

16.589.634 16.589.634 18.833.154

Amount of

reduction

1.658.963 1.658.963 1.883.315

Rural and

Urban Land

and

Building

Tax

after

reduction

14.930.671 14.930.671 16.949.839

b. Photocopy of a veteran member card;

c. Photocopy of a decree on the

acknowledgement, endorsement and

award of Honorary degree of a

competent officer;

d. Photocopy of Decree of appointment or

termination as President and vice

president, Governor and Deputy

governor;

e. Photocopy of the death certificate; and

f. Photocopy of property tax settlement

of the previous year.

2. Individual taxpayers whose income is solely

from retirees so that the property tax obligations

are difficult to fulfil:

a. Photocopy of identification card

number;

b. Photocopy of the family card;

c. Photocopy of pension decree;

d. Photocopy of pension slip or other

similar documents;

e. Photocopy of electricity bills, water

and/or telephone; and

f. Photocopy of property tax payment of

the previous tax year.

3. Individual taxpayers who are low-income so

that the obligations of property tax are difficult

to fulfil :

a. Photocopy of identification card

number;

b. Photocopy of the family card;

c. A taxpayer’s statement letter stating

that the taxpayer’s income is low from

the place of work, if the taxpayer is not

equipped with statement letter, a

certificate of RT/RW and known to the

local Lurah; and

d. Photocopy of property tax payment of

the previous tax year.

4. The taxpayer of a low-income personal person

whose Sales Value of Taxable Object per meter

increases due to environmental changes and the

positive impact of development:

a. Photocopy of identification card

number;

b. Photocopy of the family card;

c. A taxpayer’s statement letter stating

that the taxpayer’s income is low from

the place of work;

d. Photocopy notification of tax due the

year before;

e. Photocopy of property tax payment

previous tax year;

f. Photocopy of electricity bills, water

and/or telephone accounts; and

g. Letter from Lurah that explains the

existence of physical development by

the government of the central/regional

or commercial development that has an

impact on environmental change and

the positive impact of development.

In case the taxpayer does not attach the

document, the taxpayer’s application remains

processed as long as the formal requirements are

met.

Based on the application equipped with the

requirements, the head of Regional Tax and

Retribution Agency conducts administrative

research and if necessary, can be continued with

field research. The head of Regional Tax and

Retribution Agency within the term 6 (six) months

from the date of receipt of the reduction request,

shall give a decision on the application of reduction.

If the term has been exceeded and the decision has

not been issued, the reduction application shall be

deemed granted and further issued the decision in

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

496

accordance with the taxpayer application in at least 1

(one) month since the term expires.

Discussion

Mr X applied for a reduction of property tax

from 2016 until 2018. Mr X submitted his own

application without the help of a tax consultant. Mr

X applied individually for a reason for a personal

taxpayer whose income was solely from retirees so

that the property tax obligations are difficult to fulfil.

In connection with the property tax reduction

application conducted by Mr X from 2016 to 2018,

there are 3 (three) main factors used to measure the

ease of administration, namely certainty (certainty)

in terms of the law, the efficiency of the time and

cost, and the simplicity of the taxation system and

the tax laws concerned.

1. Legal certainty

According to Mansury (2000, 12), The principle of

legal certainty is associated with 3 (three) tax

questions. It should be confident, who should be

taxed, what is the basis for taxing the tax subject,

and how much to pay based on the provisions on the

tax rate.

a. Who should be taxed

The certainty in determining who has the right to

apply for property tax reduction will affect justice.

Details on the subject refer to the section on the

application of property tax reduction, namely article

2 paragraph (1) of the Regulation of the Governor of

the provincial district exclusive Capital Jakarta No.

211 in 2012. Where in this article described the

subject that is entitled to apply for property tax

reduction is taxpayers due to certain conditions of

tax objects that have to do with the subject of tax

and/or due to specific other causes; and/or the

condition of the tax object is exposed to natural

disasters or other extraordinary causes. In article 2

paragraph (2), paragraph (3) and paragraph (4) of the

Regulation of the Governor of the provincial district

particular Capital Jakarta No. 211 in 2012 describe

what is meant by the condition of particular tax

objects that have to do with the subject of tax,

natural disasters and other remarkable reasons.

b. What is the basis for taxing the tax subject

The certainty in the essential determination to apply

for a property tax reduction refers to article 3 of the

Regulation of the Governor of the provincial district

exclusive Capital Jakarta No. 211 in 2012. Where in

this article is described the reduction awarded on the

property tax listed in the notification of tax due?

c. How much to pay based on the provisions on

the tax rate

The certainty in the determination of the number of

reductions in property tax refers to article 4

Regulation of the Governor of the provincial district

special Capital Jakarta No. 211 in 2012. Where in

this article explained reductions could be given as

large as 50% (fifty percent) of the property tax being

owed. However, for the property tax reduction

governments do not provide a specific benchmark

regarding the taxpayer’s criteria worthy of obtaining

a property tax reduction.

Here is an overview of fulfilling the fundamental

fulfilment certainty of each indicator and sub-

indicators:

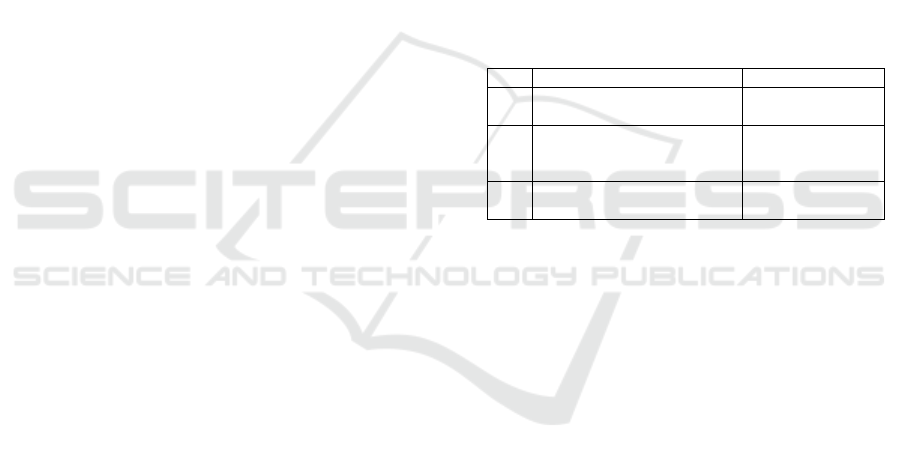

Table 4: Basic Fulfillment of Certainty.

No. Indicato

r

Fulfilment Status

1 Certainty in determining

who should be taxed

Have been

fulfilled

2 Certainty in determining

what is the basis for taxing

the tax subjec

t

Have been

fulfilled

3 Certainty in determining

how much to pay

Not been fulfilled

2. Efficiency in time and cost

In connection with the property tax reduction

application, the implementation of the principle of

efficiency will determine how much it should be

incurred by the applicant’s taxpayer to obtain a

reduction for property tax. According to Rosdiana

(2012, 177), measurement of efficiency in taxation

administration can be seen from fiscal cost and time

cost. The fiscal cost, associated with the property tax

deductible application, is a cost that can be measured

by monetary value or nominal rupiah which must be

issued by the applicant taxpayer at the start of the

property tax reduction application, which can be

grouped as follows:

a. Consulting services that are hired taxpayers

who conduct assistance in managing the

property tax reduction application.

b. The transportation cost of application

management. Of property tax reduction

c. The printing fees and reproduction of

application form for property tax reduction.

As for time cost, which is the cost of intangible,

which can be the following:

Analysis of the Application of the Ease of Administration Principle in the Property Tax Reduction Procedure in the Fourth Industrial

Revolution: Case Study Personal Tax Payer

497

a. The time required to fill in the application

forms for property tax reduction.

b. The time required to discuss the tax

management and tax exposure with the tax

consultant related to property tax reduction

application.

c. The time required to wait for a decision

regarding property tax reduction application.

Here is an in-depth interview was done to Mr X for

fiscal cost and time cost.

Fiscal Cost

The fiscal fee issued by the applicant’s taxpayer has

fulfilled the efficiency.

a. A taxpayer hired tax consulting services to

conduct assistance in managing the property

tax reduction application. The cost required to

take care of property tax reduction applications

has been efficient because taxpayer applicants

do not use consulting services in managing the

property tax reduction application. It happened

because Mr X felt that the property tax

reduction application could still be handled by

himself.

b. The transportation cost of application

management of property tax reduction was

discussed. In the early stages of application of

the property tax reduction taxpayer submits the

application to Regional Tax and Retribution

Agency Cilandak office. Property tax reduction

in application management transportation costs

has been efficient due to the distance of Mr X’s

house with Cilandak Office only about 1 (one)

km.

c. Printing fees and reproduction of application

forms for property tax reduction were

determined. Referring to the regulation of the

governor of the provincial district exclusive

Capital Jakarta number 211 in 2012, eight

documents must be attached by the applicant’s

taxpayer so that the application document for

property tax reduction can be categorised as

complete. The attached documents are:

a. Photocopy of notification of tax due

b. Photocopy of identification card number;

c. Photocopy of the family card;

d. Photocopy of pension decree;

e. Photocopy of pension slip or other similar

documents;

f. Photocopy of electricity bills, water

and/or telephone accounts; and

g. Photocopy of property tax payment of the

previous tax year.

Taxpayers acknowledge that to fulfil and

complement the above data has been

streamlined because Regional Tax and

Retribution Agency only requires 1 (one)

Single document of attachment.

Time Cost

The time charge issued by the applicant taxpayer has

been efficient.

a. The time required to fill in the application

forms for property tax reduction has been

streamlined due to the application form

consisting of only 1 (one) sheet.

b. The time required to discuss tax management

and tax exposure with the tax consultant has

been efficient because the applicant’s taxpayer

does not use the tax consulting services in

managing the property tax reduction request. It

happened because Mr X felt that the property

tax subtraction application could still be

handled by himself.

c. The time required to wait for a decision

regarding property tax reduction request has

been efficient due to the application year 2016

is 106 days, in 2017 in 160 days and 2018 is

104 days. It is decided within less than 6 (six)

months from the date of receipt of the property

tax reduction.

Here is a summary of the essential fulfilment

efficiency of each indicator and sub-indicators:

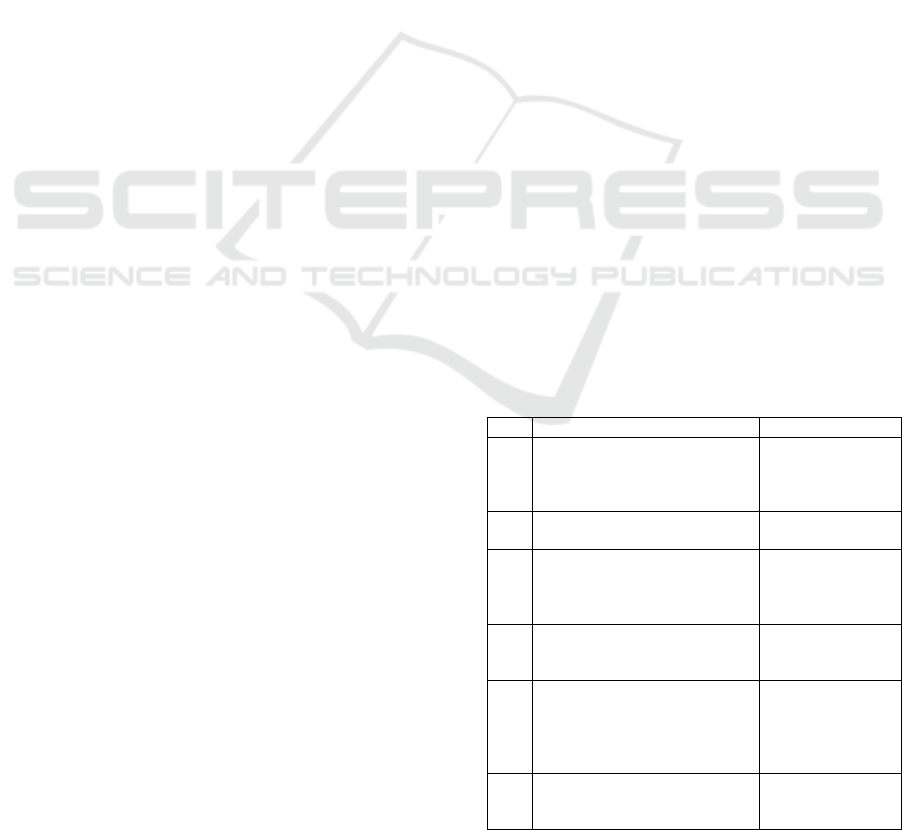

Table 5: Basic Fulfillment of Efficiency

No. Indicato

r

Fulfilment Status

1 A taxpayer hired tax consulting

service to conducts assistance

in managing the property tax

reduction application

Have been

fulfilled

2 Application management for

property tax reduction fee

Have been

fulfilled

3 The cost of printing and

reproduction of application

forms for property tax

reduction

Have been

fulfilled

4 The time required to fill in the

application forms for property

tax reduction

Have been

fulfilled

5 The time to discuss tax

management and tax exposure

with tax consultants relating to

property tax reduction

applications

Have been

fulfilled

6 The time required to wait for a

decision regarding property tax

reduction application

Have been

fulfilled

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

498

2. The simplicity of the taxation system

The vital issue in the arrangement of taxation

regulations and legislation is simplicity. Mansury

(2000, 23) argues that the simplicity in the

arrangement of regulation will facilitate the

understanding of the regulation and give rise to

alignment and not deviate with higher regulations.

a. The simplicity of the Regulation of the

Governor of the provincial district exclusive

Capital Jakarta No. 211 in 2012 provides an

easy understanding of the regulations.

The formulation of the Regulation of the Governor

of the provincial district exclusive Capital Jakarta

No. 211 in 2012 has given the ease of understanding

for taxpayer applicant to apply for property tax

reduction. This rule explains clearly the condition of

the object that can be granted property tax reduction.

So taxpayers can know if it can or cannot apply for a

property tax reduction. The regulation also explains

the formal requirements and materials that must be

met in filing a property tax reduction petition. With

the fulfilment of formal requirements and materials

explained in the regulation that the head of Regional

Tax and Retribution Agency within a period of 6

(six) months must give a decision to petition the

property tax reduction.

b. Position of Regulation of the Governor of the

provincial district exclusive Capital Jakarta No.

211 in 2012 against higher regulation.

When viewing from a hierarchy of regulations

governing property tax reduction, Law No. 28 on

local tax and regional retribution, Local Regulation

No. 6 in 2010 on general regional tax provisions and

Local Regulations No. 16 in 2011 on land tax on the

rural and urban building is a legal umbrella of the

Regulation of the Governor of the provincial district

exclusive Capital Jakarta No. 211 in 2012 on land

tax rural and urban building reduction. However, as

these regulations only govern widely and publicly

regarding the reduction of tax-deductible taxes, the

government publishes lower rules in its hierarchical

structure. However, it regulates more detail and

clarity on the provision of property tax reduction

such as Regulation of the Governor of the provincial

district exclusive Capital Jakarta No. 211 in 2012.

Here is a summary of the essential fulfilment

simplicity of each indicator and sub-indicators:

Table 6: Basic Fulfillment of Simplicity

No. Indicator Fulfilment

Status

1 The simplicity of the regulation

of the governor of the

provincial district exclusive

Capital Jakarta number 211 in

2012 in providing ease in

understanding the regulation

Have been

fulfilled

2 The position of regulation of

the governor of the provincial

district exclusive Capital

Jakarta number 211 in 2012 in

higher regulation

Have been

fulfilled

6 CONCLUSIONS

Based on the research that has been conducted, the

conclusion that the researcher obtained, among

others: The applying principle of certainty legally in

the application of the property tax reduction

procedure has not been fully fulfilled. This is due to

the certainty in determining how much to pay has

not been fulfilled. The applying principle of

efficiency is fully fulfilled by both fiscal and cost

time. Moreover, the applying principle of simplicity

has been fully fulfilled in terms of simplicity of

regulation and position of Regulation of the

Governor of the provincial district exclusive Capital

Jakarta No. 211 in 2012.

7 ADVICE

Here are some of the things that governments can do

to address the obstacles that the application of

property tax reduction face:

To provide standardisation regarding taxpayer

criteria for the application of property tax reduction

and to apply Online Assessment Appeal Systems

(OAA) to facilitate the application of property tax

reduction.

REFERENCES

Doerner, W., & Ihlanfeldt, K. 2014. An empirical analysis

of the property tax appeals process. Retrieved from

https://mpra.ub.uni-muenchen.de/61035

Doerner, W., & Ihlanfeldt, K. 2014. The role of

representative agents in the property tax appeals

process. Retrieved from https://mpra.ub.uni-

muenchen.de/id/eprint/61019

Analysis of the Application of the Ease of Administration Principle in the Property Tax Reduction Procedure in the Fourth Industrial

Revolution: Case Study Personal Tax Payer

499

Johanthan P. Tomes and Richard D. Dvorak. 2014.

Appeals Once and for All: In the Matter of the Protest

of Lyerla, Kathy L

Law No. 28 on local tax and regional retribution

Local Regulations No. 6 year 2010 on general regional tax

provisions

Local Regulations No. 16 year 2011 on land tax on rural

and urban building

Michael Brady and Richard L. Sanderson. (2017). The

Current Environment of Online Assessment Appeal

Systems. Retrieved from

https://researchexchange.iaao.org/jptaa/vol14/iss2/2/

Mansury, R. 2000. Kebijakan Perpajakan. Jakarta:

Yayasan Pengembangan dan Penyebaran Pengetahuan

Regulation of the Governor of the provincial district

special Capital Jakarta No. 211 year 2012 on land tax

and urban building reduction

Regulation of the Governor of the provincial district

special Capital Jakarta No. 24 year 2018 on the

Determination of Sale Value of Land and Rural and

Urban Land Tax Objects in 201

Rosdiana, Haula dan Edi Slamet Irianto. 2012. Pengantar

Ilmu Pajak: Kebijakan dan Implementasi di Indonesia

(Edisi Pertama). Jakarta: Rajawali Pers

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

500