Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT

Jasa Raharja Putra Insurance

Kuncoro Haryo Pribadi

Insurance and Actuarial Administration, Vocational Education Program University of Indonesia, Depok

Keywords: Insurance Product, Financial Protection and Investment.

Abstract: Many people realize the importance of knowing insurance products in a professional manner to minimize the

risks that will occur in the business. Products from insurance companies are now proliferating including

products for life insurance, health insurance products and insurance products loss. With so many alternative

choices of insurance products make us more literate and follow the development so that we can choose the

right insurance products that we need. Insurance companies must also be able to educate the community,

especially urban communities and rural communities, especially in rural areas of Kalimantan, Sulawesi,

Papua, which uses water transportation.

1 INTRODUCTION

2015 is the beginning of the free trade in the ASEAN

Free Trade Country. ASEAN is in the political and

economic organization of the countries in the region

of Southeast Asia within the State of Indonesia. The

purpose of ASEAN establishment is in addition to

political interests aimed at also to promote the

economic growth of social progress between the State

and the cultural development of its Member States.

ASEAN countries set up free trade areas in order to

enhance ASEAN’s regional economic

competitiveness and make ASEAN a world

production base and market the population to

ASEAN.

The existence of AFTA (ASEAN Free Trade

Area) in 2015 in ASEAN can have a positive and

negative impact for the State of Indonesia, because of

the readiness-free trade of all industry sectors in the

State of Indonesia and Human Resources must have

good quality. President Joko Widodo has a program

to face AFTA, one of the leading programs of the

president’s father is to strengthen the maritime sector.

The president intends to strengthen the maritime

sector because of the geographical location of the

State of Indonesia is very strategic, and 2/3 of

Indonesia is an ocean because it is the president’s

father built a toll booth. This sea toll road program is

the route for ships connecting major ports in

Indonesia. The purpose of the seafloor is that there is

no difference in the price of logistic goods and

necessities, which makes it a business opportunity for

general insurance companies that have marine-based

products.

The magnitude of business opportunities for

insurance companies makes insurance companies

should be more selective in taking risks. To avoid

risks that can occur due to marine hazard, general

insurance companies must carefully select risk

because the risks are significant and unpredictable.

To determine the amount of premium the insurance

company must determine the rate for the vessel order

insurance as well as to observe the condition of the

order of the vessel to be insured, while for the sea

freight insurance the insurance company should be

able to assess and select the risk level of the goods to

be insured. The need for marine insurance today is

needed because to distribute human needs evenly

throughout the territory of Indonesia.

1.1 Problems

1.1.1 Definition of Underwriting

The risk selection process by an Insurance Company

that decides whether to issue a policy requested by a

prospective customer (the insured) or not, where the

company will also decide what terms and conditions

apply, as well as the amount of the premium imposed,

and the party performing this process is the

underwriter. Providing consideration of whether or

Haryo Pribadi, K.

Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT Jasa Raharja Putra Insurance.

DOI: 10.5220/0010700100002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 483-491

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

483

not a life insurance request submitted by the insured

candidate and issued the policy.

1.1.2 Understanding Underwriting

Underwriting is also called risk selection which is the

determination of the level of risk that is on the object

to be insured, based on the level of risk. The insurance

application can be accepted, delayed or rejected.

Implementation or not of a very dependent on the

underwriting process that identifies the feasibility of

the insured candidate. An underwriter must

understand the concepts and procedures of

identifying risk well, precisely and accurately, the

primary responsibility of an underwriter is to ensure

that no risk will cause significant problems for the

company in the future, so the risk selection process

undertaken underwriter can create company goals

Achieved the maximization of profit.

1.1.3 Definition of Ship Insurance (Marine

Hull Insurance)

Insurance provides warranty or protection against

loss or damage or loss to the vessel’s framework

along with its propulsion machinery as a result of

risks guaranteed under the conditions of the policy.

Aspects that need in underwriting marine process is:

1. Data Object to be Insured

a. Ship Type

b. Weight of Ship (GRT)

c. Lost Record

d. Year of the Ship

2. Legality

Entered into the Indonesian Bureau of

Classification (BKI)

The risk guaranteed by the clause on Ship

Insurance for marine underwriter vessel

insurance shall request data such as

shipbuilding year, ship weight (GRT),

entered in the Indonesian Bureau of

Classification (BKI), and the last lost record

of the vessel. This condition is useful for a

marine underwriter in determining the

amount of risk that will be borne by general

insurance companies. However, not all

underwriting process runs smoothly, in

practice, still insurance companies get the

data provided by the prospective insured

does not match the reality. Therefore a

marine underwriter should be able to select

well items that will be insured.

2 RESEARCH METHODS

Research Methods used by the authors using the

method of qualitative research with approaches

conducted by the authors, among others, by field

survey methods and interviews conducted by the

author to related parties such as Insurance

Companies, Ship Owners, OJK Provisions,

Provisions Minister of Finance (KMK) By using the

help of data that exist in a computer.

2.1 Results and Discussions

General Insurance Business is a risk-based insurance

business that provides reimbursement to the insured

or the policyholder due to loss, damage, expense, loss

of profit, or legal liability to third parties which may

be suffered by the insured or the policyholder due to

the occurrence of an uncertain event.

2.2 Principles of Insurance

1. Very Good Items (Utmost Good Faith)

An action expresses wholly and accurately,

all material facts about something to be

insured whether requested or not.

2. Insured Interest (Insurable Interest)

The right to insure, arising from a financial

relationship, between the insured and the

insured and recognized by the law and this

principle means that if a person has entered

into coverage when the insured has no

interest in the insured goods, the insurer not

required to provide compensation, insurable

interest may arise due to several things

including:

A. Because of the employment

relationship, i.e. the employer with his

employees or because of the employee

agreement.

B. The relationship of marriage or blood

relationship is essential because of the

marital relationship that occurs from

marriage.

C. Debt indebtedness relationship that is

because the lending party (the creditor)

will suffer losses of debt that have not

been repaid by the borrower (the debtor)

if the debtor is dead.

D. Because of the agreement, a person or

entity may be authorized/appointed by

another person to represent closing the

insurance.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

484

E. The obligation provides compensation

to a third party due to the ownership or

use of any property. This condition

causes losses to third parties, such as the

use of motor vehicles.

F. Other reasons is because of the

provisions of the legislation.

G. Because of ownership, that is because

ownership is the most crucial cause, it is

familiar and known by society in

general. Ownership may occur due to

purchases, grants, and inheritance.

3. Cause (Proximate Cause)

An actual cause provides a chain of events

that can cause a result without any

intervention starting and activating from a

new and independent source.

4. Indemnity (Indemnity)

Indemnity principle is that the insured in

principle only entitled to receive

compensation from the insurer of losses

suffered. The loss is as high as losses

suffered. This means, if the insured goods

suffered losses, the insured would receive

compensation amount of the sum insured

with the understanding does not exceed the

value/price of the real goods. The insured

must not enrich themselves or profit from it.

Article 253 of the Criminal Code states that

if the insured closes the sum insured for an

item greater than the value or price of the

real goods, then the insured will only receive

the replacement of the loss he suffered. In

addition, in Article 352 of the Criminal Code

it is stated that the insured shall not hold a

second coverage for the time and against the

same dangers of objects already insured for

full prices, with the threat of cancellation of

the second insured. This principle of

indemnity applies only to insurance losses

and does not apply to life insurance.

5. Subrogation (Subrogation)

In article 284 KUHD it is said that the

insurer who has paid the loss of an insured

object gets all the rights that existed on the

insured against the third party causing the

loss. This is called subrogation. The

necessity of this subrogation is by itself

because of the Act. Insurers who have paid

their responsibilities to the insured, then the

insured must not claim compensation to a

third party and vice versa.

6. Contribution (Contribution)

The right of the insurer to invite other

insurers who both bear, but not necessarily

the same obligation to the insured to

participate give indemnity.

Table 1: The risks covered (covered under the Policy

Clause).

The risks covered

(covered under the

Polic

y

Clause

)

280 284 289

1. Danger of the sea

such as bad

weather,

collision,

drowning, etc.

YES YES YES

2. Fire, explosion YES YES YES

3. Theft by force by

an outside party

YES YES YES

4. Disposal of goods

to the sea

YES YES YES

5. Piracy YES YES YES

6. Accidents on

nuclear

installations or

reactors

YES YES YES

7. Fall of aircraft or

other celestial

bodies, land

vehicles, docks,

port equipment,

etc.

YES YES YES

8. Earthquakes,

volcanic

eruptions, and

lightning strikes

YES YES YES

9. Accident due to

loading -

unloading cargo

or fuel

YES YES YES

10. The boiler

blast on the boat

YES YES YES

11. Negligence on

the captain

YES YES YES

12. Negligence in

repair

YES YES YES

Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT Jasa Raharja Putra Insurance

485

13. Rebellion or

forced taking by

the captain or

crew

YES YES YES

14. Measures by

authorities to

reduce pollution

levels

YES YES YES

15. Legal liability

due to ship

collision

YES YES NO

16. The general

contribution

YES YES NO

17. Contributions

salvage and

salvage charges

YES YES YES

18. Rescue Costs YES YES YES

2.3 Duties and Roles of Underwriters

Underwriting task is to process the completion and

grouping of risks to be borne by the company,

because the purpose of the underwriting process for

the company is to bring profit through the distribution

of risk, the underwriting process must be efficient so

that the marketed product can compete with the

products from other companies. In practice to attract

customers there must be the same proportion between

good risk and unfavorable risk.

a. The role of underwriters in insurance companies,

among others

1. Consider the risks posed

2. Determine terms and conditions

3. Decides to accept, refuse or postpone the

proposed risk

4. Wearing extra premium (if needed)

b. Underwriting Objectives

1. Maintain policy persistence;

2. Establish reasonable and fair underwriting

conditions;

3. Maintaining the stability of funds collected for

the company to grow

c. Underwriter’s authority is to approve and issue a

policy, the issued policy must meet 3 criteria:

1. Fair for the Customer (Equitable to the client)

One of the grounds that the insured must pay

a premium according to the assumed level of

risk, if the insurance application is accepted

then the insurance company delaku the

insurer must determine the amount of

reasonable premium and in accordance with

the level of risk.

2. Delivered Through Agent (Delivery by the

agent)

The prospective insured person or customer

makes a final decision on whether the

insurance policy can be accepted or not when

the agent attempts to submit the policy, if the

insured candidate decides not to accept the

policy, the undeliverable policy can not be

submitted or not taken.

3. Profitable to the company (Profitable to the

company)

An underwriter must take a decision that will

benefit the company therefore the insurance

company requires a healthy underwriter to

ensure profits for the company, then the main

purpose of underwriting is to protect the

company by conducting risk selection.

In order for the policy can be received prospective

insured, there are 3 basic requirements that must

be met:

1 The premium rate should be competitive.

2 The policy must provide benefits that

suit your needs.

3 Policy costs for coverage provided must

be in accordance with the consumer.

2.4 Problems and Solutions in

Underwriting Process

The problem that is often faced by a marine

underwriter lies the delivery of information provided

by the ship owner to an underwriter as well as

counterfeit letters, is intended to speed up the risk

selection process by underwriters. Information

required by marine underwriting in shipboard

acceptance (marine hull insurance). Generally, a

marine underwriter before accepting a cover in the

form of a vessel requests only minimal information,

ie ship type, shipbuilding year, ship weight (GRT)

Bureau of Classification of Indonesia (BKI) or not,

and the last lost record. It is certainly very less and

dangerous. A marine underwriter is required to know

many things about the characteristics of the vessel

before it is to accept a request for the closure of vessel

insurance. Information concerning psysical hazard

and moral hazard should be known in full. Such

information among other things:

Ship type

Year of shipbuilding (seen from IMO number

- Inter Maritime Organization)

Ship size

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

486

Status of ship (owner / operator / chartered)

Classification of ships

Maintenance of the vessel

Use of ships

Trading area of ship

These are often forged by the shipowner for the

purpose of reducing the premium costs incurred by

the insurance company and / or for the ship to pass a

risk selection test conducted by an underwriter.

Solutions performed by an underwriter are:

1. An underwriter must be fully aware of the ship

data provided by the insured candidate to the

insurance company, whether the ship is registered

or registered in the Bureau of Classification

Indonesi (BKI) so that no information and data

that are not in accordance with the vessel Which

will be in charge.

2. Surveying the existence of the vessel, an

underwriter is entitled to survey the vessel to be

responsible or otherwise, the insurance company

may hire surveyor services to see the condition of

the vessel and later adjusted to the data provided

by the prospective insured.

3. Provide a rate rate for the vessel to be insured in

accordance with the type and degree of risk

possessed by the vessel. The rate given is the rate

fixed by the OJK (Financial Services Authority).

A marine underwriter must be able to know the

possibility of any possibility that may cause peril

and what may cause hazard,

• Peril is an event that may cause harm, if within any

marine hull insurance that constitutes a peril:

A. Collision with another ship

B. Explosion of the machine

C. Tear off the hull, etc.

• Hazard is a factor that can affect the frequency and

severity of peril, there are two factors that can

affect hazard,

A.

Physical hazard

Physical hazard is a hazard contained in its

physical karate, for marine hullphysical

hazard insurance such as a ship that does not

have a fire completeness, so that when a fire

on the ship is not immediately extinguished.

B.

Moral hazard

Moral hazard is a hazard arising from the

prospective insured, for marine hull moral

hazard insurance to see the track record of the

ship or boat captain, because when the ship

has a bad record makes the risk becomes high

and can happen rejection in the insurance

application

.

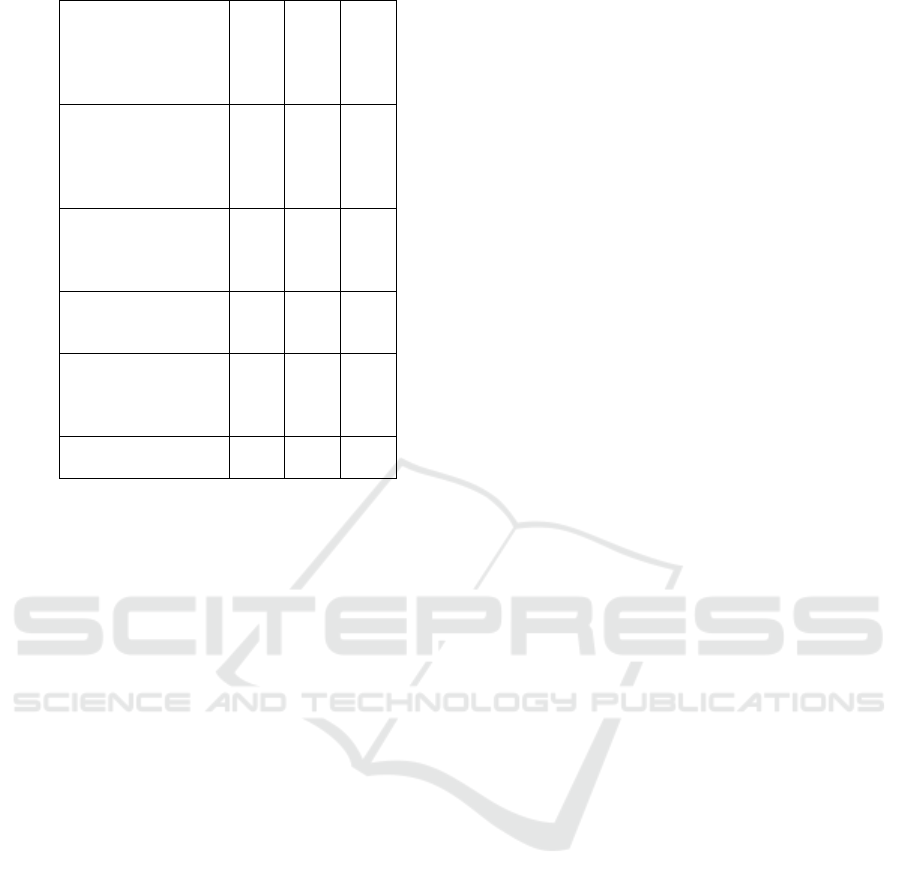

Figure 1: Flow from The Underwriter Process of Ship

Insurance.

Figure2: Stages in the Underwriting Process in a branch

office and head office.

The underwriting process is valid when the sum

insured of 1.5 billion, the branch office can directly

perform underwriting at the branch office without

having to request the process of underwrite from the

head office

1. The first stage is the insured submitted an

Insurance Closing Application Form (SPPA) or

placing slip (for submission from the broker).

SPPA contains about the data of the vessel to be

insured, namely:

• Applicant data

Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT Jasa Raharja Putra Insurance

487

Contains the applicant’s name, the

applicant’s address and the telephone

number. This applicant’s data aims to be

recorded in the company as a responsible or

shipowner.

• Description of the insured vessel

Including ship name, shipbuilding year,

dead weight, ship weight, IMO number, ship

construction, ship class, ship type, flag,

waters area, shipbuilding, ship market price

and desired insurance coverage.

• Type of use

What is meant by the type of use is the ship

is privately owned, or the vessel is leased for

other needs.

Previous experience

Previous loss experience

Warranty desired

Placing slip is an insurance application letter filed by

the broker, this letter is not much different from

SPPA, in placing slip there is a commission element

from the broker.

2. Phase of data processing from SPPA

After SPPA comes in, the next step is to process data

from SPPA or from placing slip.

3. The third stage is the survey stage,

The survey stage is conducted by the internal

company if the price of the vessel to be insured is not

more than 2.5 billion, if the ship price is above 2.5

billion then the company or the insured can appoint

an external party that there is no bond between both

parties. The results of the survey are absolute and

when one party has appointed an external surveyor,

one party should not appoint another surveyor,

because there is a fear of dissent. An insured person

or insurer may request a survey if approved by both

parties.

4. The next stage is the stage of determining the

decision

After SPPA or placing slip in study and survey stage

have got the result then a marine underwriter must

decide whether the business is acceptable or rejected.

A marine underwriter must be able to give a wise

decision, if the business is unacceptable then a marine

underwriter should be able to refuse the business and

if the business is acceptable then a marine underwriter

should be able to provide conditions to the insured

and responsible with the decision taken. An

underwriter must be able to maintain the balance of

the company from risk management.

5.

After the business received by the company the

next stage is the printing of the policy. The printed

policy must be in accordance with the needs and

abilities of the insured, if the policy issued is not

in accordance with the insured then there is a

grace period for the insured to change the policy

sehinhgga the policy

can be beneficial to the

insured is not a negative impact on the insured.

3 RESULT

3.1 Sample Case

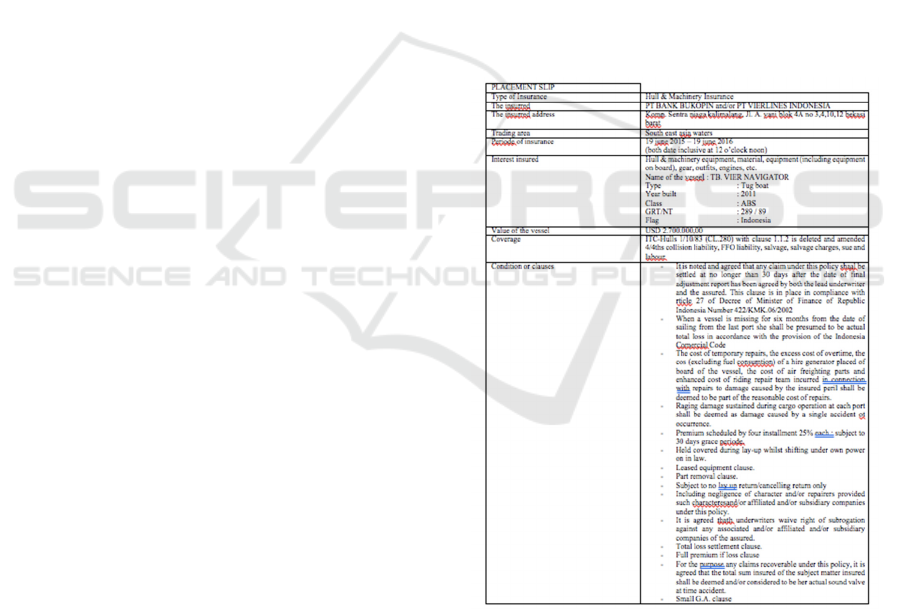

3.1.1 The First Case

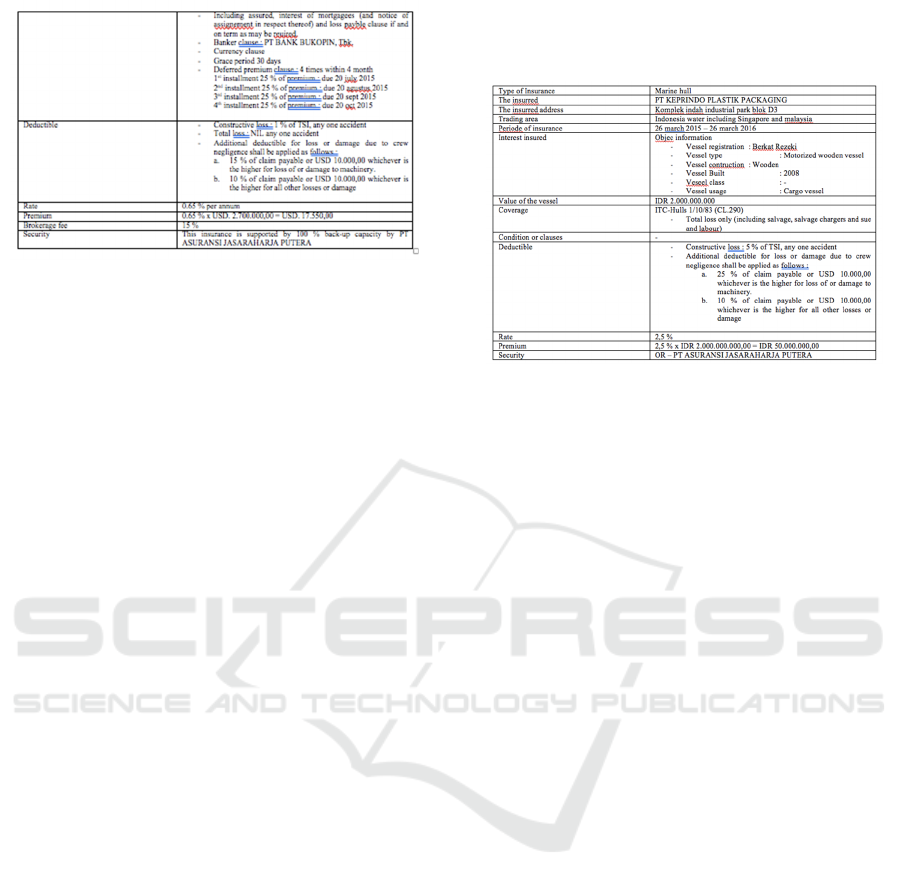

Table 2: Description of First Case.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

488

A marine underwriter can easily conclude the

business proposed by the broker is not accepted.

There are several things that make this business

rejected by PT JASARAHARJA PUTERA:

1. The broker does not provide clear information of

the vessel to be insured.

To accept the risk, a marineunderwriter must obtain

information in the clearest way that there is nothing

covered by the insured in accordance with the

principle of utmost good faith. It takes clear data to

assess the risks of the vessel to be borne, since the

duties of a underwriter are fair to the company and to

the insured.

2. The payment stated in the agreement is repaid four

times but in four months.

Payments made by installment quarterly have a high

risk because there is a possibility that the vessel is

exposed to the risk but the premium payment has not

been paid in full. PT Jasaraharja Putera still provides

waivers for premium payments in installment should

not be more than 4 months after the agreement.

3. The proposed rate is very low compared to the rate

limit which became the standard in PT Jasaraharja

Putera.

The rate determined must be in accordance with the

standards of PT Jasaraharja Putera, this is done so that

the stability of the company can be maintained and

the risks borne by the company is not large.

4. The broker wants PT Jasaraharja Putera to bear all

the retention of the vessel.

The broker who applied for the business wanted the

full cover ole PT Jasaraharja Putera, if the total cost

to be borne by the company is about 33.75 millira

rupiah, this is a huge risk if the company has to bear

all those risks.

3.1.2 The Second Case

Table 3: Description of Second Case.

For the second case, PT Jasaraharja Putera accepts the

risk. There are some things of concern from a marine

underwriter, namely:

1. The vessel is made of wood.

2. The ship has not been registered by BKI

3. The ship sailed throughout Indonesian waters

including Singapore and Malaysia

The reason for PT Jasaraharja Putera is to accept,

because the insured is subject to an unusual rate of

2.5% very far for the standard rate owned by PT

Jasaraharja Putera which is 0.75% for cargo. Marine

underwriter ships set the rate for the insured because

the risk of the vessel is so high that it must In

accordance with the burden of risk borne by the

company, because the insured approves the amount

of the rate then PT Jasaraharja Putera accept the

business.

4 CONCLUSION

The discussion on “underwriting process of ship order

insurance in PT Jasaraharja Putera” can be concluded:

1. Underwrite process for vessel order

insurance is very important; sailing vessels

have a substantial risk level and different

from each type of ship.

2. Proper and precise underwrite processes can

have a good effect on the company as well

as for the prospective insured. If the

insurance company bears the burden of the

vessel to be insured the risk estimate is lower

than the reality, it will harm the insurance

company but if the risk estimates provided

by an Underwriter is more significant than it

should then be detrimental from the insured

party.

Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT Jasa Raharja Putra Insurance

489

3. The role of an underwriter must be fair and

honest in assessing risks, other than that a

marine underwriter in deciding whether the

company will refuse the risk, or accept the

risk unconditionally and or accept the risk

with additional terms and conditions for

specific reasons.

4. A marine underwriter must completely

control the ins and outs of each type of

vessel and may read the agreement

submitted by the insured or the broker as

well as the completeness of the vessel letters

relating to transport or shipping permits.

5. If a marine underwriter has no knowledge of

the ship’s vessel and can not read the

agreement, then the company and

prospective insured will experience losses,

namely:

1. It will benefit one party

2. Can not provide a suitable rate for an

insured vessel

3. Does not provide the potential of a

reasonable premium for the company or

prospective insured

4. If there is loss, then the financial health

of the company will shake

5. Can cause companies to go bankrupt

5 SUGGESTION

Based on the observations of the authors, the authors

have some suggestions on the underwriting process of

ship order insurance, namely:

6. A marine underwriter must be well informed

about the ins and outs of the ship type

7. Completeness of the ship’s mail must be

fulfilled

8. Marine underwriters should be able to read the

agreement well

9. Human Resources for a marine underwriter in

multiply

10. Actuaries are required to determine the amount

of rate for vessel order insurance

11. The rate should be adjusted to the risk borne

12. Risk assessment should be done well and

thoroughly

13. There is always a re-risk assessment for the

vessel to be insured again

14. The alacrity in the business process given to the

company should be accelerated

REFERENCES

Caballero, G., & Soto-Oñate, D. (2017). Environmental

Crime And Judicial Rectification Of The Prestige Oil

Spill: The Polluter Pays. Marine Policy, 84, 213–219.

Https://Doi.Org/10.1016/J.Marpol.2017.07.012

Camillo, M. (2017). Cyber Risk And The Changing Role

Of Insurance. Journal Of Cyber Policy, 2(1), 53–63.

Https://Doi.Org/10.1080/23738871.2017.1296878

Cecep Aminudin, S.H., M. S. (2016). Perkembangan

Pengaturan Kualitas Udara Di Indonesia: Dari

Pendekatan Tradisional Atur Dan Awasi Kearah

Bauran Kebijakan. Jurnal Lingkungan Hidup

Indonesia, 1(Juli), 1.

Devault, D. A., Beilvert, B., & Winterton, P. (2017). Ship

Breaking Or Scuttling? A Review Of Environmental,

Economic And Forensic Issues For Decision Support.

Environmental Science And Pollution Research,

24(33), 25741–25774.

Https://Doi.Org/10.1007/S11356-016-6925-5

Dewi, A. N., Saptono, H., & Njatriani, R. (2017).

Pertanggungjawaban Ekspedisi Muatan Kapal Laut

(Emkl) Dalam Hal Ganti Kerugian Atas Kerusakan

Atau Kehilangan Barang Kiriman Melalui Laut (Pt.

Danatrans Service Logistics Semarang). Diponegoro

Law Journal, 6(2), 1–13.

Https://Doi.Org/10.1186/S12879-016-1413-6

Faure, M., & Wang, H. (2015). Compensating Victims Of

A European Deepwater Horizon Accident: Opol

Revisited. Marine Policy, 62, 25–36.

Https://Doi.Org/10.1016/J.Marpol.2015.08.017

Horton, J. B., Parker, A., Keith, D., & Keith, D. (2015).

Liability For Solar Geoengineering: Historical

Precedents, Contemporary Innovations, And

Governance Possibilities, (2/25/2015), 225. Retrieved

From

Https://Keith.Seas.Harvard.Edu/Files/Tkg/Files/176.H

orton.Keith_.Liabilityforsolargeoengineering.Pdf

Jing, L., Faure, M., Wang, And, & H. (2014).

Compensating For Natural Resource Damage, 29, 123.

Retrieved From Http://Www.Epa.Gov/Osweroe1

Kern, J. M. (2016). Wreck Removal And The Nairobi

Convention—A Movement Toward A Unified

Framework? Frontiers In Marine Science, 3.

Https://Doi.Org/10.3389/Fmars.2016.00011

Marchand, P. (2017). The International Law Regarding

Ship-Source Pollution Liability And Compensation:

Evolution And Current Challenges. Oil Spill

Conference, 1–18. Retrieved From

Https://Www.Itopf.Org/Fileadmin/Data/Documents/Pa

pers/Iosc17_Marchand.Pdf

N, M. N. F., Njatrijani, R., & Aminah. (2016). Tanggung

Jawab Penanggung Terhadap Klaim Tertanggung

Dalam Pelaksanaan Asuransi Marine Hull And

Machinery. Diponegoro Law, 5(Diponegoro Law

Review), 1–15.

Pessl, E., Sorko, S. R., Mayer, B., Mayer, B., & Roadmap,

B. M. (2017). Roadmap Industry 4.0-Implementation

Guideline For Enterprises. International Journal Of

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

490

Science, 5(6), 193–202.

Https://Doi.Org/10.11648/J.Ijsts.20170506.14

Purwedah, E. K. (2016). Penerapan Regime Tanggung

Jawab Dan Kompensasi Ganti Rugi Pencemaran

Minyak Oleh Kapal Tanker Di Indonesia. Jurnal

Komunikasi Hukum, 2(Agustus), 127.

Rani, M. (2016). Asuransi Tanggung Gugat Kapal

Terhadap Risiko Dan Evenemen Dalam Kegiatan

Pelayaran Perdagangan Melalui Jalur Laut. Jurnal

Selat, 3(2), 425–440.

Rosyid, M. (2015). Manajemen Berbasis Poros Maritim

Kabinet Kerja Pemerintahan Jokowi-Jusuf Kalla.

Bisnis, 3(1), 29.

Shamim, S., Cang, S., Yu, H., Li, Y., Yu, H., & Li, Y.

(2017). Examining The Feasibilities Of Industry 4.0 For

The Hospitality Sector With The Lens Of Management

Practice. Energies, 1, 1.

Https://Doi.Org/10.3390/En10040499

Underwriting Process (Risk Selection) Marine Hull: A Case Study at PT Jasa Raharja Putra Insurance

491