The Effect of Self-Service Technology Service Quality and Customer

Satisfaction toward Loyalty and Behavioural Intentions on

E-banking Users

Hardika Widi Satria

1

and Darra Pradita Hidayat

2

1

Vocational Education Program of Universitas Indonesia, UI Campus Depok, Indonesia

2

Management Studies Program Faculty of Economics and Business, Perbanas Institute, Indonesia

Keywords: SST Service Quality, Customer Satisfaction, Customer Loyalty, Behavioural Intentions, E-banking,

Banking Industry

Abstract: Research aims: this study aims to examine the effect of self-service technology service quality and customer

satisfaction toward loyalty and behavioural intentions, particularly on e-banking users. Methodology: This

study uses a quantitative method based on a questionnaire. The research design used is hypothesis testing

that explains phenomena in the form of relationships between variables obtained based on data and facts.

This study is used to test hypotheses regarding the effect of SST Service Quality on Loyalty, Customer

Satisfaction and Behavioural Intentions, and the impact of Customer Satisfaction on Loyalty and

Behavioural Intentions. Practical Implications: This study gives an outlook of an effect between the

variable’s relationships toward the e-banking customer. It provides several suggestion and recommendations

for the industry of banking in Indonesia to maintain sustainable business toward industrial 4.0 era, which

rely heavily on the internet. This study can be an insightful lesson-learned that can be used to create another

better virtual banking experience services in Indonesia. Theoretical Implications: This study expands the

existing literature on self-service technology service quality, customer satisfaction, loyalty and behavioural

intentions by providing a theoretical support of e-banking services in the age of industrial revolution 4.0. It

illustrates how the theoretical approach could help the banking industry creating better service that tailored

to the customer needs and provide satisfaction to the customer.

1 INTRODUCTION

The Indonesian banking industry in the digital era

has experienced significant developments which can

lead to intense inter-bank competition. Therefore

each bank is expected to attract attention and interest

of the customer in various ways because the factors

that are used as a customer assessment in choosing a

bank is the reputation of the bank, friendliness of

staff, a reasonably close and convenient location,

Automatic Teller Machine (ATM) in an easily

accessible location and availability of parking space

(Aslam et al., 2011). A bank must be able to make

innovations from other banks to face intense

competition, where innovations made can be

adjusted to the expectations of customers so that

behavioural intentions and customers become loyal

(Loanata et al., 2015).

The banking industry will not succeed without

the existence of behavioural intentions and customer

loyalty. Therefore, with the development of

increasingly creative technological service

innovations, customers are expected to remain loyal

and even buy any service products provided by

banks (Azisyah, 2016). Lovelock (2012) states that

the service sector is an industry that must quickly

innovate; otherwise, it will sink in the banking

industry competition. The success of a bank to

maintain customers remain loyal is strongly

influenced by several marketing strategies such as

product innovation, the provision of cutting-edge

technology, the ease of the product and provide fast

self-service via e-banking (Azisyah, 2016). Various

facilities and strategies that are continually being

developed, especially self-service banking

technology, are expected to make customers have

behavioural intentions for a particular bank

(Azisyah, 2016).

304

Widi Satria, H. and Pradita Hidayat, D.

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking Users.

DOI: 10.5220/0010675400002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 304-318

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

This paper has formulated research problems in

detail to examine the effect of self-service

technology service quality on loyalty, behavioural

intentions, and customer satisfaction. Further, it will

also cover the effect of customer satisfaction on

loyalty and behavioural intentions.

The objective research of this paper is to find out

and analyse the effect of self-service technology

service quality on loyalty, behavioural intentions and

customer satisfaction. It will also expand to find out

and analyse the effect of customer satisfaction on

loyalty and behavioural intentions., the research will

be conducted in several limitations such as four

variables to make it clear and specific. The variables

are self-service technology service quality that

focuses on the outline, customer satisfaction, loyalty

and behavioural intentions. Research sampling is the

banking industry in general

2 LITERATURE REVIEW

2.1 Self Service Technology Service

Quality

Self-service technology is a technology intermediary

that occurs to customers, where customers do their

own services without assistance or dependence on

company employees (Rambat, 2013). Meuter (2000)

explained that self-service technology is a

technology that is made to make it easier for

customers to transact independently. Further, Hsiech

(2005) explains the factors that drive self-service

technology are product quality, services offered,

product costs, presentations and services, self-

service technology design, how companies manage

and prevent the failure of self-service technology

and the company’s ability to create self-innovation

service technology. According to Kasmir (2012) the

reason companies must use self-service technology

includes: (a) many services are carried out through

technology; (b) many companies have used self-

service technology; (c) can provide convenience and

comfort for customers.

2.2 Customer Satisfaction

Customer Satisfaction is a state of one’s feelings that

are obtained from the results of a comparison

between the assessment of final product

performance in relation to customer expectations

(Kotler & Keller, 2016). Tjiptono (2014) explains

that a customer will feel satisfaction or discomfort of

the response given to the evaluation that can be felt

between expectations and performance felt after use.

The purpose of measuring customer satisfaction is:

(a) to identify the needs of customers who are

considered necessary by the customer so that they

can influence whether satisfied or not; (b) to

determine the level of customer satisfaction on

company performance; (c) to compare customer

satisfaction with companies with customer

satisfaction with other companies; (d) to identify

priorities for improvement through analysing the

level of essential needs with satisfaction; (e) to

measure the customer satisfaction index which can

be used as an indicator that can be monitored the

progress of development from time to time.

According to Irawan (2009), some factors

influence customer satisfaction. Firstly, product

quality, customers will feel satisfied if the results of

the product quality assessment are to meet the

customers demand, adding value to customers’

satisfaction. Secondly, service quality, customers are

satisfied if the expected service is obtained, leading

to a good perception of the product or service.

Thirdly, emotional, satisfaction is obtained from

satisfying social values. Fourthly, price, products

with the relatively same quality and low price

provide more value for consumers. The more

expensive a product or service is, the higher

expectations expected by customers; (e) ease:

customers will be more satisfied if the products and

services obtained provide convenience and comfort.

2.3 Loyalty

Creating customer loyalty is needed to maintain the

success of a business because it can create

innovation in sales (Musfar and Vivi, 2012). Ishaq

(2014) mentions that loyalty is a process of customer

satisfaction which in the end will have an impact to

intentions. Customer loyalty is a commitment

obtained from customers experience buy or use a

product and service consistently by making repeated

purchases on the same brand even though the

customer gets influence from other competitors

(Oliver, 2015).

Olivier (2015) describes four stages regarding

loyalty, namely; (a) cognitive loyalty: the initial

stage where more emphasis on customer confidence

in a brand and is usually based on recent experience

so that this stage can also be called the lowest stage;

(b) affective loyalty: the second stage which is

assessed based on the accumulation of customers in

the use of the company’s products and at this stage

the customer is quite easy to move to another brand

or try products from other companies; (c) conative

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

305

loyalty: a stage of loyalty where the customer is

committed to buying back the product and at this

stage is usually influenced by positive experiences

that are repeatedly felt by the customer and usually

at this stage the customer is more committed to the

company; (d) action loyalty: the final stage of

loyalty and at this stage is more about performance

factors such as how a brand can be liked by

customers so that the customer has the intention and

act to buyback.

2.4 Behavioural Intentions

Behavioural intentions are a desire of the customer

to behave as having, using or disposing of the

product purchased so that the customer decides to

find out information or notify others of the

experience (Mowen, 2012). Schiffman and Kanuk

(2010) explain that behavioural intentions are an

indicator to assess whether customers will remain

loyal or will move to products and services from

other companies.

Zhillin et al. (2009) mention three dimensions of

behavioural intentions namely; (a) recommendation:

behavioural intentions at the recommendation stage

are more about encouraging surrounding relatives to

use goods or services from the company, in other

words, the customer has carried out indirectly

marketing activities and brought other customers to

the company; (b) repurchase intention: behavioural

intentions on this dimension are by using products

twice, or more on the same products and services;

(c) pay more: behavioural intentions that will occur

are a result of customer satisfaction on a product so

that even if there is a price change, the customer

willing to pay more for it.

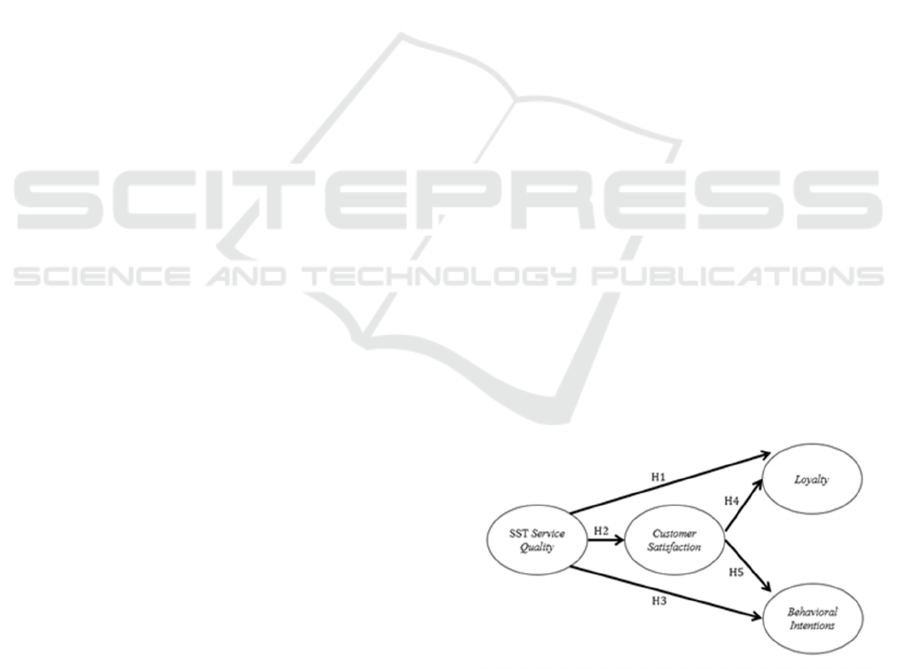

2.5 Hypothesis

H1: There is a positive influence between Self

Service Technology Service Quality on Loyalty.

Self-service technology can affect loyalty if

companies can improve service quality by creating

new and exciting things to create loyalty (Iqbal,

2017). Other research explains that with the self-

service technology innovation that is profitable for

customers, it will create loyal customers (Azisyah,

2016).

H2: There is a positive influence between Self

Service Technology Service Quality on Customer

Satisfaction.

Iqbal (2017) carried out a test to see whether

self-service quality influences customer satisfaction

and the results obtained is that it has a significant

impact because by increasing the convenience of

using self-service technology the customer will be

created satisfaction. Customer satisfaction comes

from customer expectations, by providing services

that meet customer expectations it will improve

customer satisfaction (Azisyah, 2016).

H3: There is a positive effect between Self Service

Quality on Behavioural Intentions.

Iqbal (2017) states that self-service quality has a

significant impact on behavioural intentions because

behavioural intentions can be created if the company

can provide quality self-service. While other studies

also explain the same thing where quality self-

service quality can create behavioural intentions

(Winata, 2015).

H4: There is a positive influence between Customer

Satisfaction on Loyalty.

Customer satisfaction is one of the essential

factors of loyalty because it will make the customer

loyal (Iqbal, 2017). Winata (2015) stated that

customer satisfaction has a significant influence on

loyalty, by increasing customer satisfaction, loyalty

will also increase.

H5: There is a positive influence between Customer

Satisfaction on Behavioural Intentions.

Loanata et al. (2015) explain that customer

satisfaction has a significant and significant effect on

behavioural intentions because it can encourage or

influence behavioural intentions themselves, the

higher customer satisfaction, the higher behavioural

intentions will be created. Other research also

confirms that customer satisfaction influences

behavioural intentions (Winata, 2015).

Figure 1: Conceptual Framework

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

306

3 METHODOLOGY

3.1 Research Approach and Design

This study refers to Iqbal et al. (2017). The research

design used is hypothesis testing, where this study

aims to test hypotheses and generally is a study that

explains phenomena in the form of relationships

between variables obtained based on data and facts.

This study is used to test hypotheses regarding the

effect of SST Service Quality on Loyalty, Customer

Satisfaction and Behavioural Intentions, and the

impact of Customer Satisfaction on Loyalty and

Behavioural Intentions. The unit of analysis used in

this study is that individuals who use e-banking will

be asked directly through a questionnaire.

3.2 Variables and Measurements

There are four variables to be measured in this

study, namely SST Service Quality, Customer

Satisfaction, Loyalty, and Behavioural Intentions.

SST Service Quality variables are measured using

several dimensions, including Functionality,

Enjoyment, Security, Design, Assurance,

Convenience and Customization. Functionality

dimensions are measured using five statement items.

Enjoyment dimensions are measured using four

statement items. The Security Dimension is

measured using two statement items. Design

dimensions are measured using two statement items.

The Assurance Dimension is measured using two

statement items. Convenience dimensions are

measured using three statement items.

Customisation dimensions are measured using three

statement items. Customer Satisfaction variable is

measured by using three statement items. Loyalty

variables are measured using five statement items.

Behavioural Intentions variable is measured by

using three statement items.

The items used were adapted from the research

developed by Lien and Hsieh (2011) to measure the

dimensions of the SST Service Quality variable. It

was adapted from the research of Fornell et al.,

(1996) to measure the Customer Satisfaction

variable. Items used were adapted from research

developed by Cronin (2000) to measure Loyalty and

Behavioural Intentions variables. Each item of the

variable measured uses a five-point Likert scale,

where “1” means “Strongly Disagree”, up to “5”

which means “Strongly Agree”.

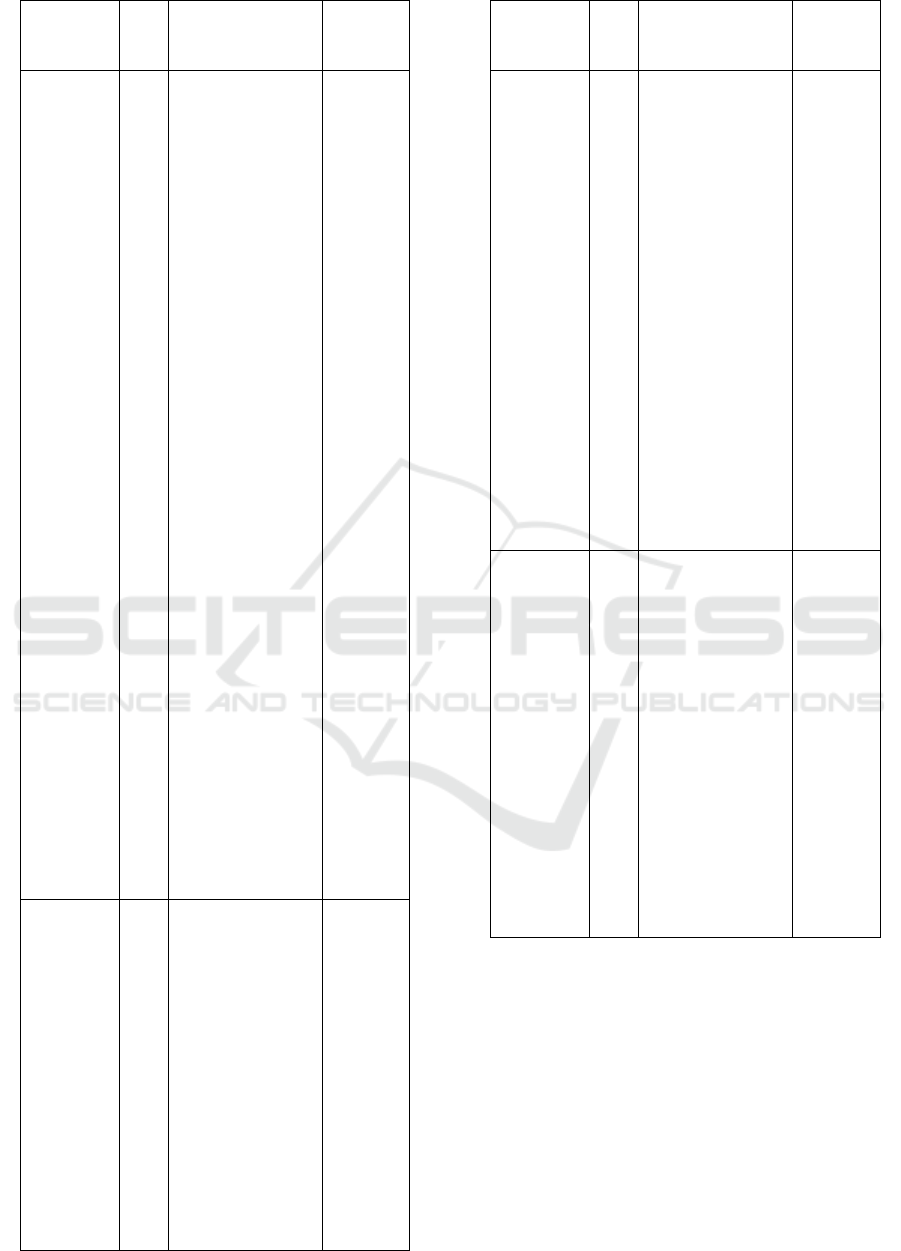

Table 1: Matrix Variables and Measurements

Variable Items Source

SST Service

Quality

Functionality:

1. I can do

financial needs

transactions

with a short

period through

e-banking SST.

2. The service

process of e-

banking SST is

transparent.

3. Using SST e-

banking

requires a little

effort.

4. I can do

financial

services

smoothly

through e-

banking SST.

5. Every service

function from

e-banking SST

is excellent

(free of errors).

Enjoyment:

1. Attractive e-

banking SST

operations.

2. I feel I can use

SST e-banking

well.

3. SST e-banking

has an

interesting

additional

function.

4. SST e-banking

provides all

information

that is relevant

to me.

Security:

1. I feel safe in

financial

transactions

through e-

banking SST.

2. The privacy

policy is clearly

stated when I

use e-banking

SST.

Design:

1. The layout of

the SST e-

banking is

aesthetically

attractive.

2. The bank

seems to use

Lehtinen,

1991; Lien

and Hsieh,

2011

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

307

Variable Items Source

the latest

technology for

e-banking SST

Assurance:

1. Bank X is a

well-known

SST e-banking

provider.

2. Bank X is a

company that

has an excellent

reputation for

e-banking SST

service

providers.

Convenience:

1. Operation of

SST e-banking

services from

Bank X is

convenient for

customers.

2. Bank X’s SST

e-banking is

not easily

erroneous when

used.

3. It is effortless

and convenient

to use Bank X

SST e-banking.

Customisation:

1. SST e-banking

Bank X

understands my

specific needs.

2. Bank X’s SST

e-banking

really attracted

me.

3. SST e-banking

Bank X has

features that

can be tailored

to my needs.

Customer

Satisfaction

1. 2. I am satisfied

with the

technology

services offered

by Bank X.

3. The self-

service

technology

offered by

Bank X

exceeded my

expectations.

4. The self-

service

technology

offered by

Bank X is very

close to my

idea.

Kotler,

2016

Variable Items Source

Loyalty 1. 2. I will continue

to use SST e-

banking

services from

Bank X.

3. I will

recommend

SST e-banking

Bank X to my

friends.

4. If I need

independent

financial

services, then I

will use SST e-

banking from

Bank X.

5. I will comment

positively

about SST e-

banking from

Bank X to

others.

6. SST e-banking

from Bank X is

my first choice.

Griffin,

2013

Behavioural

Intentions

1. 2. My chances of

using

independent

technology

from Bank X

will be high.

3. The possibility

of me to

recommend

SST e-banking

from Bank X to

friends will be

high.

4. If I must

choose in the

use of e-

banking SST,

then I will

choose SST e-

banking from

Bank X.

Schiffman

and

Kanuk,

2012

3.3 Research Population

The sampling method in this study is non-probability

sampling which is a technique that does not provide

equal opportunities and opportunities for each

element or member of the population to be sampled.

The sampling technique using purposive sampling

technique is a technique for determining samples

with specific considerations, where consideration is

based on certain characteristics that are considered

to have a close relationship with the characteristics

of a population that has been previously known

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

308

(Sekaran, 2012). In other words, the sample units

contacted are adjusted to specific criteria applied

based on the research objectives. The characteristics

of respondents needed in this study are customers

who use e-banking at least three times a month in

one year.

The data used in this study is primary data,

namely, data collected directly by researchers who

are given directly to the selected sample to answer

the problem or purpose of the study. In this study

carried out through distributing questionnaires to

160 respondents (Sekaran, 2012). After being

collected, 160 respondents who were valid to be

processed were explained as follows:

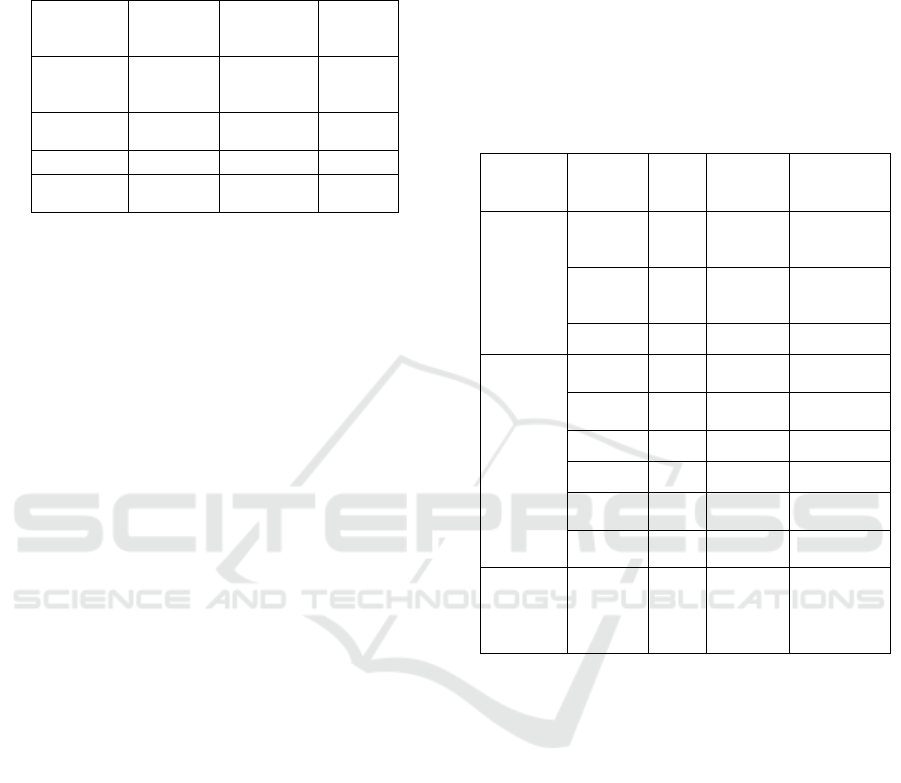

Table 2: Respondent Gender

Gender Total Respondent Percentage (%)

Male 89 55,6

Female 71 44,4

Total 160 100

Table 3: Respondent Age

Age Total Respondent Percentage (%)

< 20 years old 13 8,1

21 – 25 years old 36 22,5

25 – 30 years old 50 31,3

30 – 35 years old 38 23,8

> 35 years old 23 14,4

Total 160 100

Table 4: Respondent Education Background

Educational Background Total Respondent Percentage (%)

Senior High School 24 15

Vocational Higher Education 28 17,5

Bachelor Degree 90 56,3

Post Graduate Degree 18 11,3

Total 160 100

Table 5: Respondent Profession Background

Profession Total Respondent

Percentage

(%)

Student 24 15

Private Employees 96 60

Civil Servant 21 13,1

State-owned

Enterprises

Employees

10 8

Entrepreneur 9 5,6

Total 160 100

Table 6: Respondent Monthly Income Background

Monthly Income Total Respondent Percentage (%)

< Rp 3.000.000 23 14,4

Rp 3.000.000 – Rp

4.999.000

33 20,6

Rp 5.000.000 – Rp

6.999.000

49 30,6

Rp 7.000.000 – Rp

8.999.000

29 18,1

> Rp 9.000.000 26 16,3

Total 160 100

Table 7: Respondent Monthly E-banking Use Background

Monthly

E-banking Use

Total Respondent Percentage (%)

3 – 4 times 102 63,8

5 – 7 times 35 21,9

8 – 10 times 14 8,8

> 10 times 29 18,1

Total 160 100

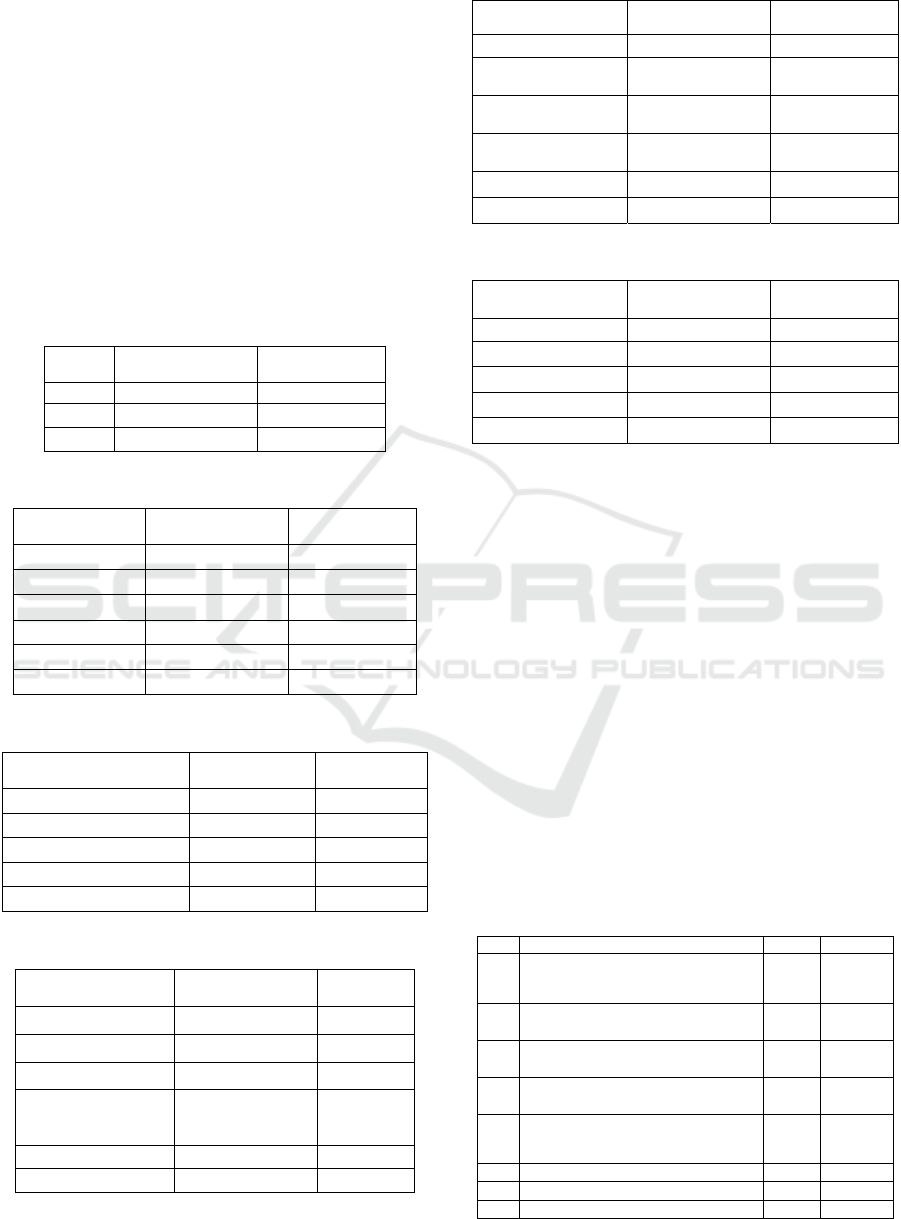

3.4 Validity Test

Validity test is a test in the valid or valid measure of

a questionnaire. A questionnaire is valid only if the

question in the questionnaire can reveal something

that will be measured by the questionnaire (Ghozali,

2013). The analytical tool for testing the validity of

this study is factor analysis using the Kaiser-Meyer-

Olkin (KMO) value approach. Fundamental testing

decision making on the validity of factor analysis,

namely:

If the value of ¬KMO> α (0.05) à, then

the item statement is valid.

If the value of ¬KMO <α (0.05) à, then

the item statement is invalid.

The results of testing the validity of the SST

Service Quality variables performed are as follows:

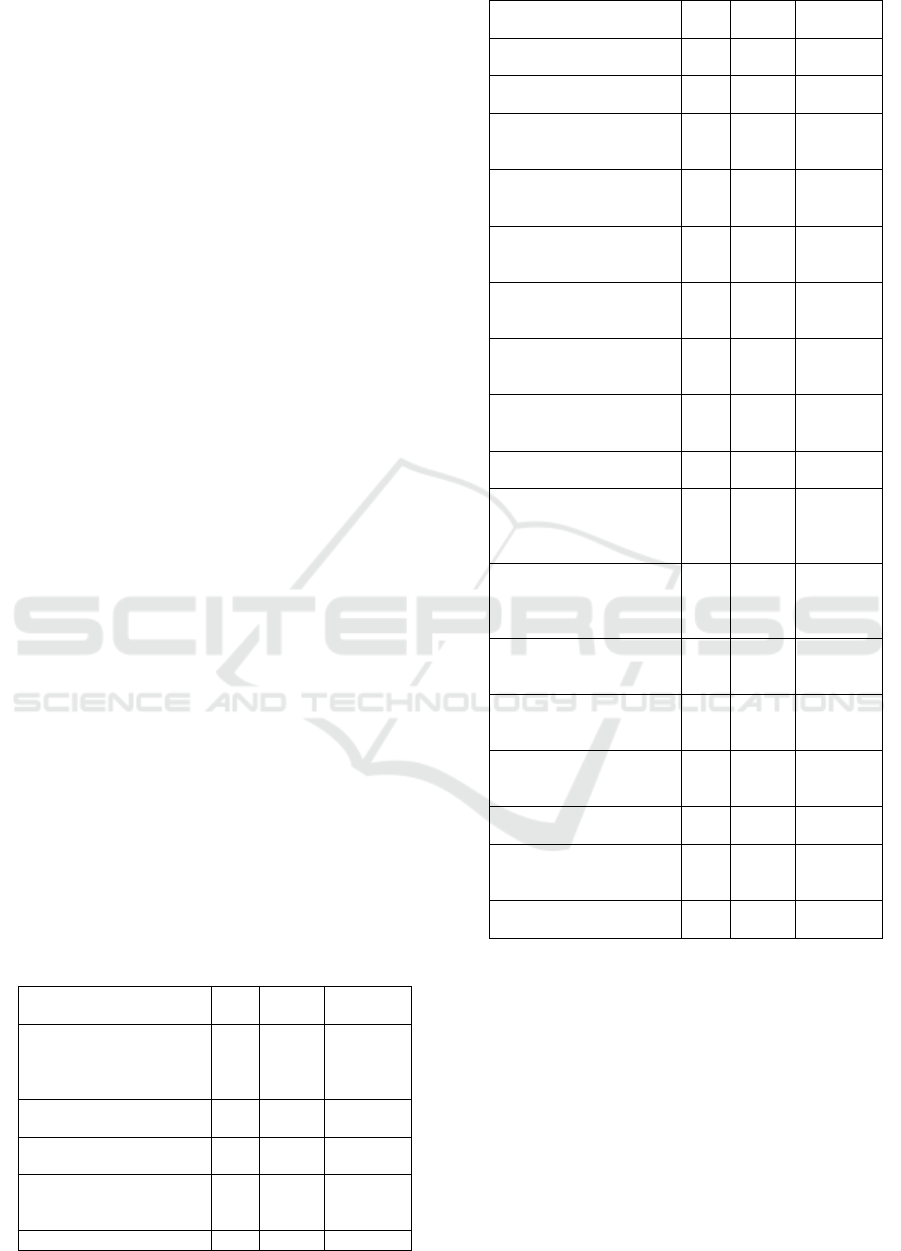

Table 8: Validity Test Results for Construct Quality

Services for SST

No. Statement item KMO Decision

1.

I can do financial needs transactions

with a short period through e-banking

SST.

0,778 Valid

2. The service process of e-banking is

transparent.

0,850 Valid

3. Using SST e-banking requires a little

effort.

0,886 Valid

4. I can do financial services smoothly

through e-banking SST.

0,910 Valid

5.

Each service function of the SST-

banking SST is excellent (free of

errors

)

.

0,817 Valid

6. Attractive e-banking SST operations.

0,854 Valid

7. I feel I can use SST e-banking well.

0,781 Valid

8. SST e-banking has interesting

0,731 Valid

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

309

additional functions.

9. E-banking SST provides all

information that is relevant to me.

0,929 Valid

10. I feel safe in financial transactions

throu

g

h e-

b

ankin

g

SST.

0,904 Valid

11. The privacy policy is clearly stated

when I use e-

b

ankin

g

SST.

0,904 Valid

12. The layout of the SST e-banking is

esthetically attractive.

0,912 Valid

13. Bank X seems to use the latest

technolo

gy

for e-

b

ankin

g

SST.

0,879 Valid

14. Bank X is a well-known SST e-

b

ankin

g

p

rovider.

0,732 Valid

15. Bank X is a company that has an

excellent reputation for e-banking

SST service

p

roviders.

0,533 Valid

16. Operation of SST e-banking services

from Bank X is convenient for

customers.

0,926 Valid

17. Bank X SST e-banking is not easily

erro

r

ed when used.

0,834 Valid

18. It is effortless and convenient to use

Bank X e-

b

ankin

g

SST.

0,844 Valid

19. Bank X e-banking SST understands

m

y

s

p

ecific needs.

0,786 Valid

20. Bank X banking system attracts me.

0,860 Valid

21. Bank X e-banking SST has features

that can be tailored to m

y

needs.

0,836 Valid

From the table above, each KMO value on the

statement item SST Service Quality variable has a

value of more than 0.5, which means that each item

statement is valid. This value means that all

statement items are suitable for measuring SST

Service Quality variables.

Table 9: Validity Test Results for Customer Satisfaction

Constructions

No. Statement item KMO Decision

1.

I am satisfied with the

independent technology

services offered by Bank X.

0,681 Valid

2.

The self-service technology

offered by Bank X exceeded

my expectations.

0,697 Valid

3.

The self-service technology

offered by Bank X is very

close to my idea.

0,667 Valid

From the table above, each KMO value on the

variable item statement of Customer Satisfaction has

a value of more than 0.5, which means that each

item statement is valid. This value means that all

statement items are suitable for measuring Customer

Satisfaction variables

Table 10: Validity Test Results for Loyalty Constructions

No. Statement item KMO Decision

1.

I will continue to use SST e-

banking services from Bank

X

0,822 Valid

2.

I will recommend Bank X e-

b

anking SST to my friends.

0,763 Valid

3.

If I need independent

financial services, then I will

0,716 Valid

use SST e-banking from

Bank X

4.

I will comment positively

about SST e-banking from

Bank X to others.

0,667 Valid

5.

SST e-banking from Bank X

is my first choice.

0,736 Valid

From the table above, each KMO value on the

item statement Loyalty variable has a value of more

than 0.5, which means that each item statement is

valid. This value means that all statement items are

appropriate for measuring Loyalty variables

Table 11: Validity Test Results for Constructs of

Behavioural Intentions

No. Statement item KMO Decision

1.

I will continue to use SST e-

banking services from Bank

X

0,822 Valid

2.

I will recommend Bank X e-

b

anking SST to my friends.

0,763 Valid

3.

If I need independent

financial services, then I will

use SST e-banking from

Bank X

0,716 Valid

4.

I will comment positively

about SST e-banking from

Bank X

0,667 Valid

5.

SST e-banking from Bank X

is my first choice.

0,736 Valid

From the table above, each KMO value in the

item statement of Behavioural Intentions variable

has a value of more than 0.5, which means that each

item statement is valid. This value means that all

statement items are appropriate for measuring

Behavioural Intentions variables.

3.5 Reliability Test

Reliability test is a test to measure a questionnaire

which is an indicator of a construct. A questionnaire

is said to be reliable if someone’s answer to the

statement is consistent or stable over time (Ghozali,

2013). The reliability test of each construct can be

seen from the value of Cronbach’s Alpha, as the

coefficient of the reliability test. An indicator is

considered reliable if it has Cronbach’s Alpha of 0.6

or more (Hair, 2013). Fundamental decision-making

reliability is as follows:

If the Cronbach’s Alpha value is 60

(0.60), then the statement in the

questionnaire is appropriate to use.

If the Cronbach’s Alpha value is <0.60,

the statement in the questionnaire is not

suitable to use.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

310

The reliability test results for each construct are

shown in the following table:

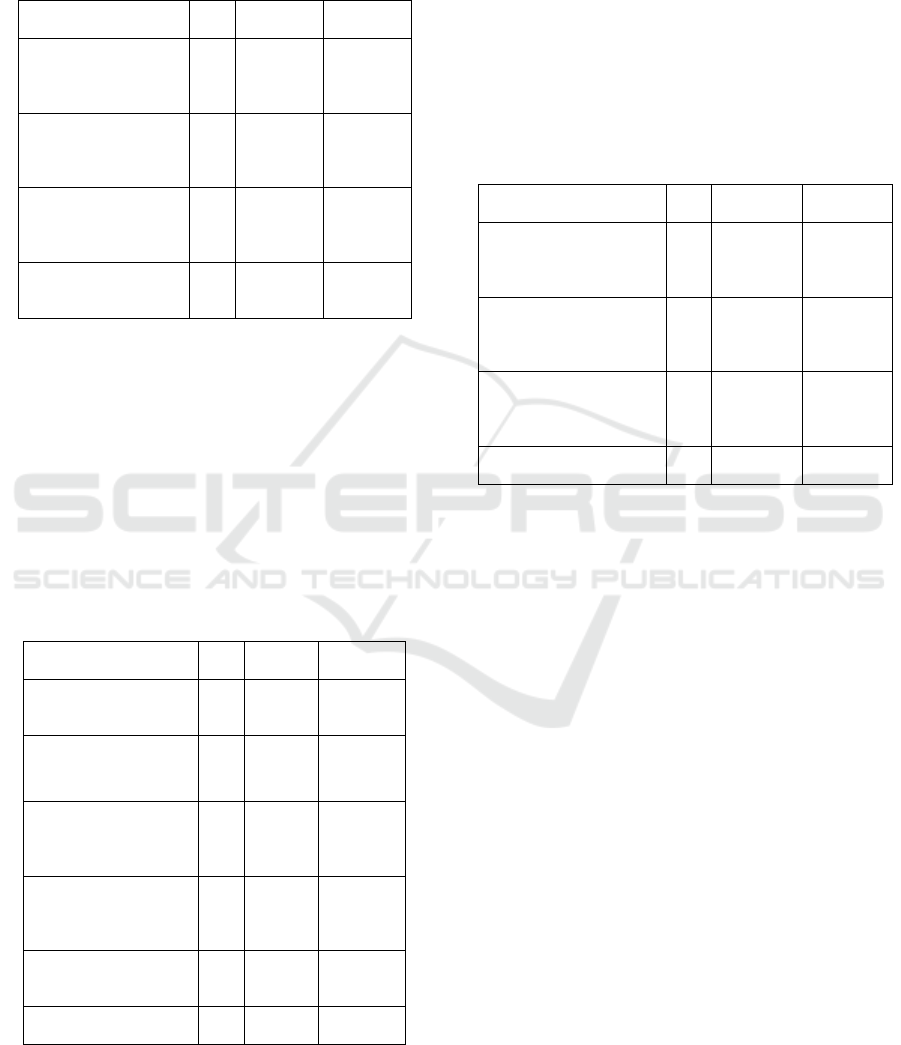

Table 12: Reliability Test Results

Construct

Number

of Items

Statement

Cronbach’s

Coefficient

Alpha

Decision

SST

Service

Quality

21 0,881 Reliable

Customer

Satisfaction

3 0,722 Reliable

Loyalty 5 0,750 Reliable

Behavioral

I

ntentions

3 0,704 Reliable

Based on the table above, Cronbach’s

Coefficient Alpha in the construct used in the study

has met the criteria of reliability. Thus, if all

constructs in the study have a Cronbach’s

Coefficient Alpha of at least 0.60 or more, then the

respondent’s answer to the statements used to

measure each construct is consistent, and the

construct is reliable.

3.6 Data Analysis Method

The analytical method used in this study is the

Structural Equation Model (SEM). Structural

Equation Model (SEM) is a statistical tool used to

complete multilevel models simultaneously which

cannot be solved by linear regression equations.

SEM can also be considered as a combination of

regression analysis and factor analysis (Ghozali,

2013). In SEM analysis techniques, the program can

use the AMOS program version 24.

Before analysing the hypothesis proposed, the

model conformity test is first carried out. Model

suitability testing is done by looking at the

measurement criteria, namely (Hair, 2013):

1. Absolute Fit Measure used to measure the

overall fit model. The criteria are to look

at the Chi-square value, Significant

Probability and Root Mean Square Error

of Approximation (RMSEA).

2. Incremental Fit Measure is a measure

used to compare models proposed with

other models specified by researchers.

The criteria are by looking at the

Goodness-of-fit Index (GFI), Normed Fit

Index (NFI), Turker-Lewis Index (TLI),

Relative Fit Index (RFI), Comparative Fit

Index (CFI), and Incremental Fit Index

(IFI).

3. Parsimonious Fit Measure is an

adjustment to the measurement of fit to be

compared between models with a

different number of coefficients. The

criteria are to see the value of Normed

Chi-square (CMIN).

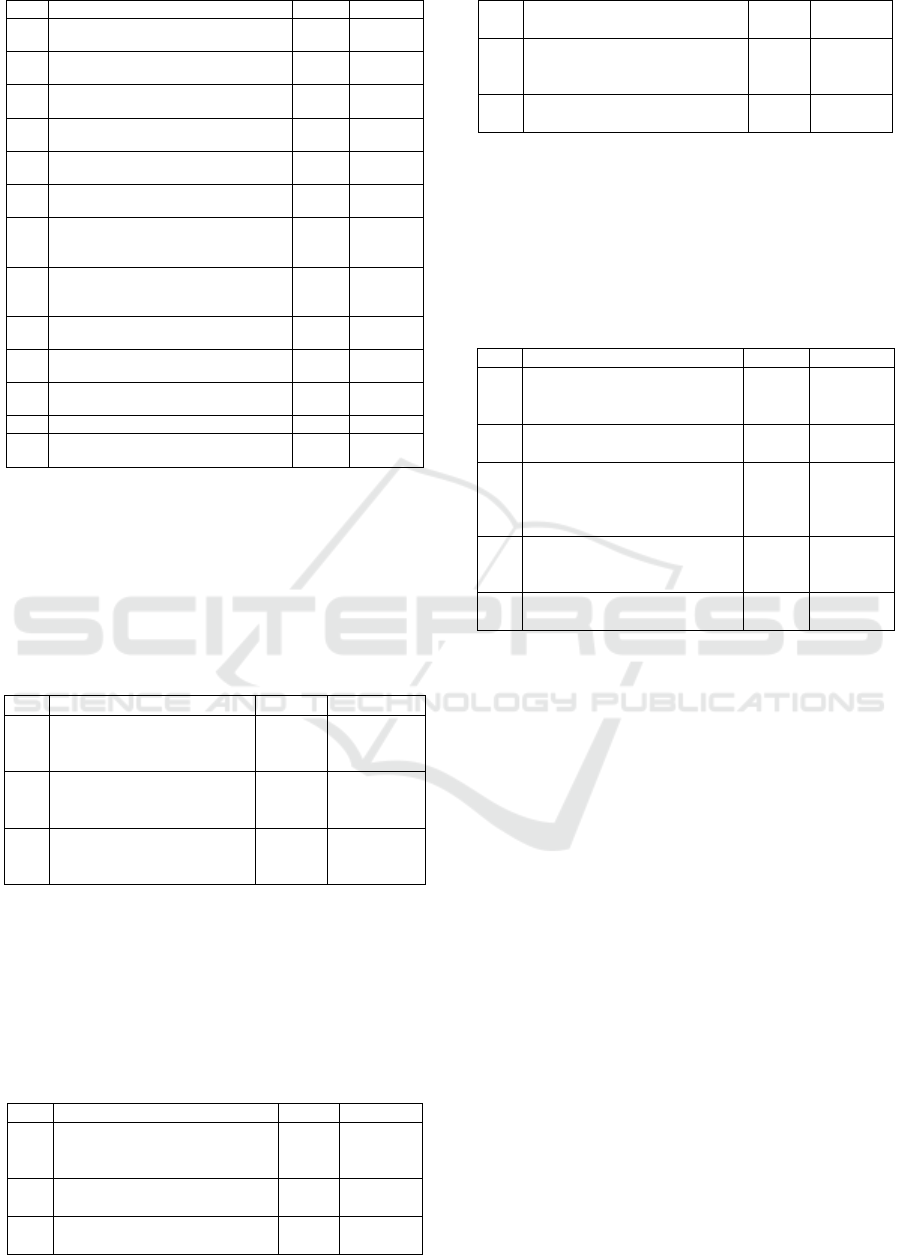

The results of the Goodness of Fit Model

measurement results are shown in the table below:

Table 13: Goodness of Fit Model

Type of

measure

ment

Measur

ement

Valu

e

Expecte

d value

Conclusion

Absolute

Fit

Measures

Chi-

Square

313,2

91

Expected

to be

small

Poor fit

Sig.

Probabil

ity

0,000

≥ 0,05 Poor Fit

RMSEA 0,148

≤ 0,10 Poor Fit

Incremen

tal Fit

Measures

GFI 0,852

≥ 0,90

Marginal

F

i

t

NFI 0,853 ≥ 0,90

Marginal

F

i

t

TLI 0,742 ≥ 0,90 Poor Fit

RFI 0,761 ≥ 0,90 Poor Fit

CFI 0,921 ≥ 0,90

Goodness of

F

i

t

IFI 0,932 ≥ 0,90

Goodness of

F

i

t

Parsimon

ious Fit

Measure

Normed

Chi-

Square

3,601

Lower

limit 1,

upper

limit 5

Goodness of

Fit

The test results of model suitability (goodness of

fit) show the Chi-Square value of 313,291. It can be

concluded that the value of Chi-Square is a poor fit.

Significance Probability of 0,000 so that it can be

concluded that poor fit. The RMSEA value is 0.148,

which means that poor fit is due to the expected cut-

off limit of ≤ 0.10. The testing of the goodness of fit

for an incremental fit measure is done by looking at

the values of GFI, NFI, TLI, RFI, CFI and IFI with

cut-off values that have the criteria ≥ 0.90. The value

obtained from processing SEM data on GFI and NFI

is 0.852 and 0.853, which means marginal fit

because the cut off value approaches the criteria

value. For TLI and CFI, it is 0.742 and 0.761, which

means that the weak fit data. The value of CFI and

IFI has a value of 0.921 and 0.932. It means the

goodness of fit because the value exceeds the cut-

off.

The Normed Chi-Square value of the criteria is

the lower limit of 1 or the upper limit of 5, and the

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

311

indicator value is 3.601, so it can be concluded that

the model is the goodness of fit. That is, with

various approaches used to produce conclusions the

model produced in the goodness of fit. From the

measurements for the model of suitability (goodness

of fit), it can be concluded that the testing model is

feasible because some items achieve marginal fit

criteria and even meet the criteria of goodness of fit.

Therefore, further hypothesis testing can be

continued.

4 RESULT AND DISCUSSION

4.1 Descriptive Statistics

In this study, the first analysis carried out was the

descriptive statistical analysis. Descriptive statistics

aim to provide a description or description of data in

terms of minimum values, maximum values, mean

values and standard deviation (Hair, 2013). In the

descriptive analysis of the data described as follows,

the mean value is the average value of all

respondents to the variables under study, while the

standard deviation that shows the variation of

respondents’ answers. There is no limit on the

standard deviation value, but the standard value of

deviation that keeps away from zeros indicates that

the spread of data (respondent’s answer) is varied,

whereas if the standard deviation value is given

close to zero, then the respondent’s answers do not

vary. The minimum value is the lowest answer

(scale) chosen by the respondent, and the maximum

value is the highest answer (scale) chosen by the

respondent. In this study, the descriptive statistics

used are the mean and standard deviation. The

results of the descriptive statistics calculation of the

independent and bound variables are seen in the

table below:

Table 14: Descriptive Statistics Variable SST Service

Quality

Statement Item N Mean

Standard

Deviation

I can do financial needs

transactions with a short

period through e-banking

SST.

160 3,700 0,690

The service process of e-

b

anking is transparen

t

.

160 3,350 0,841

Using SST e-banking

requires a little effort.

160 3,513 0,824

I can do financial services

smoothly through e-

b

anking SST.

160 3,269 0,895

Every service function of 160 3,706 0,813

SST-banking is excellent

(erro

r

-free).

Attractive e-banking SST

operations.

160 3,619 0,776

I feel that I can use SST e-

b

anking well.

160 4,306 0,604

SST e-banking has

additional attractive

functions.

160 4,281 0,646

E-banking SST provides

all information that is

relevant to me.

160 3,531 0,854

I feel safe in financial

transactions through e-

b

anking SST.

160 3,313 0,877

The privacy policy is

clearly stated when I use

e-

b

anking SST.

160 3,456 0,882

The layout of the SST e-

banking is esthetically

attractive.

160 3,306 0,869

Bank X seems to use the

latest technology for e-

b

anking SST.

160 4,038 0,751

Bank X is a well-known

SST e-

b

anking provider.

160 4,088 0,730

Bank X is a company that

has an excellent reputation

for e-banking SST service

providers.

160 3,338 1,312

Operation of SST e-

banking services from

Bank X is convenient for

customers.

160 3,481 0,883

Bank X’s SST e-banking

is not easily erroneous

when used.

160 3,806 0,781

It’s easy and convenient

to use Bank X’s SST e-

b

anking.

160 3,631 0,829

Bank X’s SST e-banking

understands my specific

needs.

160 3,331 0,923

Bank X’s SST banking

attracted me.

160 2,969 0,914

Bank X’s SST e-banking

has features that can be

tailored to my needs.

160 2,881 0,980

Total Average SST

Service Quality

160 3,567 0,464

The magnitude of the mean or average value and

standard deviation is for the SST Service Quality

variable. Service Quality variable shows an average

of 3.567. Based on the average value, it can be

interpreted that the respondent can conduct financial

needs transactions with a short period through e-

banking SST and free from errors. In addition, the

use of SST e-banking is easy to use and has a variety

of new services. Bank X is a company that is well-

known and has a good reputation chosen by

customers because it has the latest technology for

the improvement of maximum service quality. The

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

312

standard deviation value of 0.464 shows the spread

of varied data.

Table 15: Descriptive Statistics of Customer Satisfaction

Variables

Statement Item N Mean

Standard

Deviation

I am satisfied with the

standalone technology

services offered by

Bank X as a whole.

160 3,194 1,073

The self-service

technology offered by

Bank X exceeded my

expectations.

160 3,663 0,958

The self-service

technology offered by

Bank X is very close

to my idea.

160 3,369 0,956

Total Average

Customer

Satisfaction

150 3,408 0,799

The magnitude of the mean or average value and

standard deviation is for the Customer Satisfaction

variable measured in this study. The Customer

Satisfaction variable shows an average of 3.408.

Based on the average value, it can be interpreted that

overall the customer is entirely satisfied with the

new technology offered by Bank X, in line with

expectations and the self-service technology offered

in accordance with the ideas and thoughts of the

customers as customers. The standard deviation

value of 0.799 shows the spread of varied data.

Table 16: Descriptive Statistics of Loyalty Variables

Statement Item N Mean

Standard

Deviation

I will continue to use

SST e-banking services

from Bank X.

160 3,481 0,883

I will recommend SST

e-banking Bank X to

my friends.

160 3,806 0,781

If I need independent

financial services, then

I will use SST e-

b

anking from Bank X.

160 3,631 0,829

I will comment

positively about SST e-

banking from Bank X

to others.

160 3,331 0,923

SST e-banking from

Bank X is my first

choice.

160 2,969 0,914

Total Average

Loyalty

160 3,444 0,614

The magnitude of the mean or average value and

standard deviation is for the Loyalty variables

measured in this study. Loyalty variables show an

average of 3.444. Based on the average value, it can

be interpreted that respondents will recommend the

use of e-banking-based independent financial

services to friends, customers will also continue to

use e-banking in the future because it makes it very

easy for customers to transact wherever and

whenever. So, e-banking services have become the

primary choice for them. The standard deviation

value of 0.614 shows the spread of varied data.

Table 17: Descriptive Statistics Behavioral Intentions

Variables

Statement Item N Mean

Standard

Deviation

My chances of using

technology

independently from Bank

X will be high.

160 2,881 0,980

My chances of

recommending SST e-

banking from Bank X to

my friends will be high.

160 3,194 1,073

If I have to choose in

using SST e-banking,

then I will choose SST e-

b

anking from Bank X.

160 3,663 0,958

Total Average

Behavioral Intentions

160 3,246 0,796

The magnitude of the mean or average value, and

the standard deviation is for the Behavioural

Intentions variable measured in this study. The

Behavioural Intentions variable shows an average of

3.246. Based on the average value, it can be

interpreted that the possibility to continue using e-

banking remains high, besides that it is possible to

invite friends to use e-banking and confidence in

choosing e-banking, namely by choosing the best

Bank X as e-banking. The standard deviation value

of 0.796 shows the spread of varied data.

4.2 Hypothesis Testing

After testing the suitability of the model, hypothesis

testing is done using a structural equation model

analysis (SEM). The primary decision-making

hypothesis is as follows:

If p-value <0.05, Ho is rejected

If p-value> 0.05 then Ho fails to be rejected

(Ho accepted)

The primary decision-making hypothesis test is

to compare the magnitude of the p-value with a

significant level of 5% (alpha 0.05). If the p-value is

more than alpha 0.05, the null hypothesis (Ho) fails

to be rejected which means there is no significant

relationship between the two variables and vice

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

313

versa if the p-value is lower than alpha 0.05, the null

hypothesis (Ho) is rejected.

Hypothesis 1

The null hypothesis (Ho) and the alternative

hypothesis (Ha) are as follows:

Ho1: There is no positive influence on the Self-

Service Technology Service Quality on

Loyalty.

Ha1: There is a positive influence on the Self-

Service Technology Service Quality on

Loyalty.

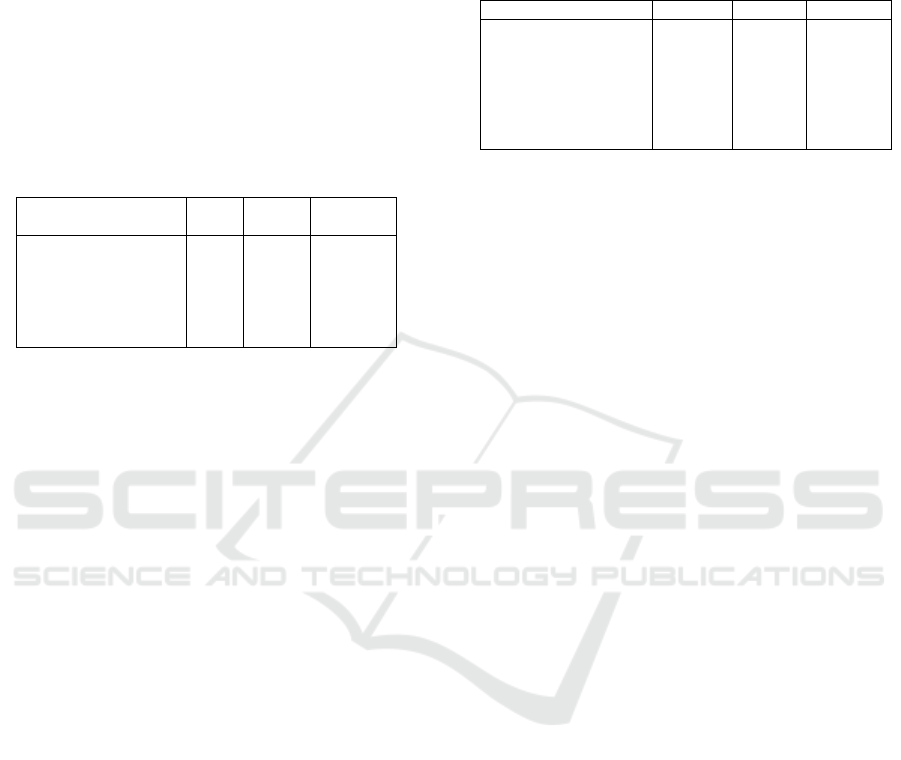

Table 18: Hypothesis 1 Testing Results

Hypothesis Esti

mate

p-

value

Decision

H1: There is a positive

influence on the

Self Service

Technology

Service Quality on

Loyalty

0,89

7

0,000 Ha1

supported

Based on the results of statistical tests, the p-

value is 0,000 <0,05, so Ho1 is not supported, and

Ha1 is supported. This means that there is a

significant influence of the Self-Service Technology

Service Quality on Loyalty. Regression coefficient

value of 0.897 indicates that the influence between

Self Service Technological Service Quality on

Loyalty is positive, which means that the higher the

level of Self-Service Technology Service Quality,

the loyalty will also increase.

H1: There is a positive influence on the Self-Service

Technology Service Quality on Loyalty.

Based on the testing of the first hypothesis, it can

be concluded that “There is a positive influence on

the Self-Service Technology Service Quality on

Loyalty” can be supported. The test results show that

the Self-Service Technology Service Quality has a

positive influence on loyalty. Self-service

technology can affect loyalty if the company can

improve service quality by creating new and exciting

things to create customer loyalty (Iqbal, 2017). With

the innovation of self-service technology that is

profitable for customers, the loyalty that customers

will give will also increase because the use of self-

service technology is effortless, it can be used

anywhere, and the level of error in usage is also

reduced due to the privacy policies provided by the

company - each user (Azisyah, 2016).

Hypothesis 2

Ho2: There is no positive influence on the Self-

Service Technology Service Quality on

Customer Satisfaction.

Ha2: There is a positive influence on the Self-

Service Technology Service Quality on

Customer Satisfaction.

Table 19: Hypothesis 2 Testing Results

Hypothesis Estimate p-value Decision

H2: There is a positive

influence on the

Self Service

Technology

Service Quality on

Customer

Satisfaction.

0,740 0,000 Ha2

supported

Based on the results of statistical tests, the p-

value is 0,000 <0,05, so Ho2 is not supported, and

Ha2 is supported. This value means that there is a

significant influence between the Self-Service

Technology Service Quality on Customer

Satisfaction. The regression coefficient value of

0.740 indicates that the influence between Self

Service Technology Service Quality on Customer

Satisfaction is positive, which means that the higher

the level of Self-Service Technology Service

Quality, the Customer Satisfaction will also

increase.

H2: There is a positive influence on the Self Service

Technology Service Quality on Customer

Satisfaction.

Based on the testing of the second hypothesis, it

can be concluded that H2, which reads “There is a

positive influence on the Self Service Technology

Service Quality on Customer Satisfaction.” Can be

supported. The test results show that the Self Service

Technology Service Quality has a positive influence

on Customer Satisfaction. This result shows that

there is a significant influence between the Self

Service Technology Service Quality on Customer

Satisfaction. Customer satisfaction comes from

customer expectations by providing appropriate

services will improve customer satisfaction

(Azisyah, 2016). All financial needs carried out by

the customer, if it is in accordance with the needs

and desires of the customer itself, it will have an

impact on satisfaction. When customers feel that the

operation of self-service technology runs smoothly

and attractively in terms of aesthetics, customers feel

made happy by the service provider. Feelings of

pleasure arising from customers will create

satisfaction for customers. Self-service quality that

affects customer satisfaction and has a significant

impact because, by increasing comfort in the use of

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

314

self-service technology, customer satisfaction will

be created (Iqbal, 2017).

Hypothesis 3

Ho3: There is no positive effect of the Self-

Service Technology Service Quality on

Behavioural Intentions.

Ha3: There is a positive influence on the Self-

Service Technology Service Quality on

Behavioural Intentions

Table 20: Hypothesis 3 Testing Results

Hypothesis Estimate p-value Decision

H3: There is a positive

influence on the

Self Service

Technology

Service Quality on

Behavioral

Intentions.

0,448 0,016 Ha3

supported

Based on the results of statistical tests, the p-

value 0.016 <0.05 means that Ho3 is not supported

and Ha3 is supported. This value means that there is

a significant influence between the Self-Service

Technology Service Quality on Behavioural

Intentions. The regression coefficient value of 0.448

shows that the effect of Self-Service Technician

Service Quality on Behavioural Intentions is

positive, which means that the higher the level of

Self-Service Technology Service Quality, the

Behavioural Intentions will also increase.

H3: There is a positive effect of Self-Service

Technic Service Quality on Behavioural

Intentions.

Based on the testing of the third hypothesis, it

can be concluded that H3, which reads “There is a

positive influence on the Self-Service Technology

Service Quality on Behavioural Intentions” can be

supported. The test results show that Self Service

Technology Service Quality has a positive influence

on Behavioural Intentions. Self-service quality has a

significant impact on behavioural intentions because

behavioural intentions can be created if the company

can provide quality self-service (Iqbal, 2017). Self-

service technology is basically to make it easier for

customers to transact. Convenience in the operation

of self-service technology is the basis for making

someone have positive behavioural intentions.

Quality self-service quality can create behavioural

intentions (Nelwan, 2014).

Hypothesis 4

Ho4: There is no positive influence on customer

Satisfaction on Loyalty.

Ha4: There is a positive influence on customer

Satisfaction on Loyalty.

Table 21: Hypothesis 4 Testing Results

Hypothesis Estimate p-value Decision

H4: There is a

positive influence

on Customer

Satisfaction on

Loyalty.

0,683 0,000 Ha4

supported

Based on the results of statistical tests, the p-

value is 0,000 <0,05, so Ho4 is not supported, and

Ha4 is supported. This value means that there is a

significant influence between Customer Satisfaction

on Loyalty. The regression coefficient of 0.683

shows that the effect of Customer Satisfaction on

Loyalty is positive, which means that the higher the

level of Customer Satisfaction, the loyalty will also

increase.

H4: There is a positive influence on customer

Satisfaction on Loyalty.

Based on the testing of the fourth hypothesis, it

can be concluded that H4, which reads “There is a

positive influence on Customer Satisfaction on

Loyalty” can be supported. The test results show that

Customer Satisfaction has a positive effect on

loyalty. Customer satisfaction is one of the most

critical factors of loyalty because of increasing

satisfaction. It will make the customer loyal and

loyal to his choice (Iqbal, 2017). Satisfaction arises

when the desire offered by the service provider is

given as a whole and in accordance with the wishes

of the customers. Customer satisfaction has a

significant influence on loyalty, namely by

improving the quality of service, loyalty in the form

of a product/service will also increase (Winata,

2015).

Hypothesis 5

Ho5: There is no positive effect of Perceived Value

on Brand Loyalty.

Ha5: There is a positive effect of Perceived Value on

Brand Loyalty.

Table 22: Hypothesis 5 Testing Results

Hypothesis Estimate p-value Decision

H5: There is a

positive

effect of

Perceived

Value on Brand

Loyalty

0,975 0,000 Ha5

supported

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

315

Based on the results of statistical tests, the p-

value is 0,000 <0,05, so Ho5 is not supported, and

Ha5 is supported. This value means that there is a

significant influence between Customer Satisfaction

on Behavioural Intentions. The regression

coefficient of 0.975 shows that the effect of

Customer Satisfaction on Behavioural Intentions is

positive, which means that the higher the level of

Customer Satisfaction, the Behavioural Intentions

will also increase.

H5: There is a positive influence on customer

Satisfaction on Behavioral Intentions.

Based on the testing of the fifth hypothesis, it can

be concluded that H5, which reads “There is a

positive influence on Customer Satisfaction on

Behavioral Intentions” can be supported. The test

results show that Customer Satisfaction against

Behavioral Intentions. Customer satisfaction can be

formed by paying attention to the behaviour of

prospective buyers. When someone feels satisfied

with what has been obtained, then the intention of

customers to be able to use products/services in the

future will increase (Loana et al., 2015). The

possibility of continuing to use products/services

that have been chosen will be more substantial when

the service provider gives what the customer wants

according to their needs. Lin and Hsieh (2006)

determined that satisfaction and intention behaviour

had a positive effect. Collier and Sherrell (2010)

empirically prove that the form of customer

satisfaction positive intention to experience using

self-service technology regarding future use will

increase.

5 CONCLUSIONS

Based on the results of the study, it can be concluded

that:

1. There is a positive effect of Self-Service

Technology Service Quality on Loyalty. This

effect shows that the higher the Self-Service

Technology Service Quality, the loyalty will

also increase. The innovation of self-service

technology that benefits the customer, the

loyalty that customers will give will also

increase because the use of self-service

technology is effortless, can be used

anywhere. The usage level of error is reduced

due to the privacy policies provided by the

company for each user.

2. There is a positive effect of Self-Service

Technology Service Quality on Customer

Satisfaction. All financial needs carried out

by the customer, if it is in accordance with

the needs and desires of the customer itself, it

will have an impact on satisfaction. When

customers feel that the operation of self-

service technology runs smoothly and

attractively in terms of aesthetics, customers

feel made happy by the service provider.

Feelings of pleasure arising from customers

will create satisfaction for customers.

3. There is a positive effect of Self-Service

Technology Service Quality on Behavioural

Intentions. Self-service technology is

basically to make it easier for customers to

transact. Convenience in the operation of

self-service technology is the basis for

making someone have positive behavioural

intentions. Quality self-service quality can

create behavioural intentions.

4. There is a positive influence on Customer

Satisfaction on Loyalty. Satisfaction arises

when the desire offered by the service

provider is given and in accordance with the

wishes of the customers. Customer

satisfaction has a significant influence on

loyalty, namely by improving the quality of

service so that loyal feedback on a

product/service will also increase.

5. There is a positive influence on Customer

Satisfaction on Behavioural Intentions.

Customer satisfaction can be formed by

paying attention to the behaviour of

prospective buyers. When someone is

satisfied with what has been obtained, then

the intention of customers to be able to use

products or services in the future will

increase. The possibility of continuing to use

products or services that have been chosen

will be more substantial when the service

provider gives what the customer wants

according to their needs.

5.1 Managerial Implication

The results show that the higher the Self-Service

Technology Service Quality, the loyalty will also

increase. Therefore, managers of SST e-banking

service companies must be able to use SST e-

banking properly. This result aims to anticipate if

there are customers who want to use e-banking but

cannot operate it, then the service provider must be

able to explain how to use SST-banking well and

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

316

correctly. In addition, there is an increase in features

that can be tailored to customer needs in order to

improve service quality by adding services such as

transfers to other banks or between banks using

foreign currencies.

The results showed that the higher the Self-

Service Technology Service Quality, Customer

Satisfaction will also increase. Therefore, managers

need to add additional e-banking functions that are

attractive such as trading services for

businesspeople, goods auction services (houses,

cars, land). In addition, managers must also promote

SST e-banking services to the fullest, hold promos

and prizes to attract customers to use e-banking SST.

This value aims to increase customer satisfaction.

The results showed that the higher the Self-

Service Technology Service Quality, the higher the

Behavioural Intentions. Therefore, managers need to

convince customers that the e-banking SST that has

been chosen as the best SST, because it is easy to

use, product and service offerings are also complete

and in accordance with the wishes of the customers.

Managers must also ensure that customers continue

to use SST-banking by communicating with

customers. Asking whether there are complaints or

suggestions in supporting the improvement of

service quality is one way to find out whether the

customer has the intention to continue using the

SST-banking service or not.

The results show that the higher the Customer

Satisfaction, the loyalty will also increase. Self-

service technology provided by the service provider

company is in line with customer expectations, it is

expected that managers can maintain the quality of

service so that customers are more loyal to the

service provider company. In addition, managers

need to improve overall independent technology

services. One way is to check the system regularly

and provide monthly reports to oversee the system

from e-banking.

The results showed that the higher the Customer

Satisfaction, the Behavioural Intentions would also

increase. Managers need to listen to the ideas of

customers in order to improve self-service

technology. This condition is so that the intention or

behaviour of customers becomes positive and

customers feel heard about the ideas given for the

development of e-banking SST. In addition,

managers must give a positive impression to

customers, so that customers can provide

recommendations to friends, family and relatives to

participate in using services from SST e-banking.

REFERENCES

Alrubaiee, L., & Alnazer, N. (2010). Investigate the

Impact of Relationship Marketing Orientation on

Customer Loyalty: The Customer’s Perspective.

International Journal of Marketing Studies, 2, 155-

174.

Azisyah, D., A. (2016). Pengaruh Self Service

Technology, Kualitas Layanan, Hubungan Pemasaran

Terhadap Kepuasan dan Loyalitas Nasabah pada Bank

BNI di Surabaya. Jurnal Manajemen Sekolah Tinggi

Ilmu Ekonomi Surabaya.

Cronin, J. J., Brady, M. K., & Hult, G. T. M. (2000).

Assessing the effects of quality, value, and

customer satisfaction on consumer behavioural

intentions in service environments. Journal of

Retailing, 76(2), 193–218.

Engel, et al., (2000). Perilaku Konsumen. Edisi Keenam.

Jilid I. Jakarta: Binarupa Aksara.

Fitzsimmons, J., F., M. (2008). Service Management. New

York: McGraw-Hill. Inc.

Fornell, C., Johnson, M. D., Anderson, E. W., Cha, J., &

Bryant, B. E. (1996). The American customer

satisfaction index: nature, purpose, and findings.

Journal of Marketing, 60(4), 7–18.

Ghozali, Imam. (2013). Aplikasi Analisis Multivariate

dengan Program SPSS Edisi Ketujuh. Semarang:

Badan Penerbit Universitas Diponegoro.

Griffin, R. W., & Moorehead, G. (2013). Organisational

Behavior: Managing People and Organisations,

Eleventh Edition. USA: South-Western, Cengage

Learning.

Hair, J.F., Anderson, R.E., Tatham, R.L. & Black, W.C.

(2013). Multivariate Data Analysis, 10th ed. Prentice-

Hall Publisher, Upper Saddle River, New Jersey.

Hsieh, H., F. dan Shannon, S., E. (2005). Three

Approaches to Qualitative Content Analysis.

Qualitative Health Research, 15 (2).

http://infobanknews.com/empat-tahun-pengguna-e-

banking-meningkat-270/. Diakses Bulan April 2018.

https://Sharingvision.com/pertumbuhan-internet-banking-

di-indonesia/. Diakses bulan April 2018.

Iqbal, M. S., Hassan, M. U., Sharif, S., & Habibah, U.

(2017). Interrelationship among corporate image,

service quality, customer satisfaction, and customer

loyalty: Testing the moderating impact of complaint

handling. International Journal of Academic

Research in Business and Social Sciences, 7(11),

667–688.

Iqbal, M., M. (2017). Minat untuk Menggunakan Go-Pay

pada Layanan Go-Ride. Jurnal Manajemen dan Bisnis.

Semarang.

Irawan, B., S. (2012). Manajemen Pemasaran Modern.

Edisi ke 2. Yogyakarta: Liberty Offset.

Ishaq, M. I. (2014). Perceived Value, Service Quality,

Corporate Image and Customer Loyalty: Empirical

Assessment from Pakistan. Serbian Journal of

Management, Vol. 7. No. 1.

Kasmir. (2012). Manajemen Perbankan Jakarta: Raja

Grafindo Persada.

The Effect of Self-service Technology Service Quality and Customer Satisfaction toward Loyalty and Behavioural Intentions on E-banking

Users

317

Kotler, Philip and Kevin Lane Keller. (2016). Marketing

Management 15th Edition, Pearson Education, Inc.

Lehtinen, U., & Lehtinen, J. R. (1991). Two approaches to

service quality dimensions. Service Industries

Journal, 11(3), 287–303.

Liestyana, Y. (2009). Persepsi Nasabah Tentang Layanan

Perbankan: Pengaruh Service Failure dan Service

Recovery Terhadap Behavioral Intention. Jurnal

Keuangan dan Perbankan. Vol. 13, hal. 165-175.

Lin, J.-S. C., & Hsieh, P.-L. (2011). Assessing the self-

service technology encounters:Development and

validation of SSTQUAL scale. Journal of Retailing,

87(2), 194–206.

Loanata, I., A., dan Dasmasela, K., N. (2015). Analisa

Pengaruh Service Quality Terhadap Behavioral

Intentions Dengan Customer Satisfaction Sebagai

Variabel Intervening di Amaris Hotel Surabaya.

Journal Universitas Kristen Petra: Surabaya.

Lovelock, C. dan Wright, H., L., K. (2011). Manajemen

Pemasaran Jasa. Jakarta: PT. Indeks

Gramedia Group.

Meuter, L., M., et al., (2000). Self Service Technology:

Understanding Customer Satisfaction with

Technology Based Service Encounter. Journal of

Marketing. Vol 64 (No.3).

Mowen, J., C. (2012). Perilaku Konsumen Erlangga.

Jakarta.

Musanto, T. (2004). Faktor-Faktor Kepuasaan Pelanggan

dan Loyalitas Pelanggan: Studi Kasus pada CV.

Sarana Media Advertising Surabaya. Jurnal

Manajemen & Kewirausahaan. Vol. 6, No. 2.

September 2004.

Musfar, T. F. dan Novia, V. (2012). Pengaruh Experiential

Marketing Terhadap Customer Loyalty Pada

Pelanggan Restoran Koki Sunda di Pekanbaru. Jurnal

Ekonomi. Vol. 20 (4).

Mohsan, F., Nawaz, M. M., Khan, M. S., Shaukat, Z., dan

Aslam, N., (2011) Impact of Customer Satisfaction on

Customer Loyalty and Intention to Switch: Evidence

from Banking Sector of Pakistan, International Journal

of Business and Social Science, Vol. 2 (16).

Oliver, R. L. (2015). Whence Consumer Loyalty? Journal

of Marketing. 63 (4).

Rambat. L. (2013). Manajemen Pemasaran Jasa. Salemba

Empat: Jakarta.

Schiffman, L., G. dan Kanuk, L., L. (2010). Consumer

Behaviour. 10th Edition. Pearson Education.

Schiffman, L.G., & Kanuk, Lesley L. (2012). Consumer

Behavior. New Jersey: Pearson Prentince Hall.

Sekaran, Uma (2012). Research Method for Business: A

Skill Building Approach.New York: John Wiley &

Sons.

Tjiptono, F. (2014). Pemasaran Jasa – Prinsip, Penerapan

dan Penelitian: Yogyakarta.

Winata, L., H. (2015). Pengaruh Customer Satisfaction

Terhadap Customer Loyalty dan Intention To Switch

Nasabah BCA Cabang Darmo Surabaya. Jurnal Ilmiah

Mahasiswa Universitas Surabaya. Vol. 4, No. 2:

Surabaya.

Zeithaml, V. A. dan Bitner, M. J. (2013). Service

Marketing, Fifth Edition, USA: McGraw Hill Co. Inc.

Zeng, F., Zuohao, H. dan Zhilin. R., C. (2009).

Determinants of Online Service Satisfaction and Their

Impact on Behavioral Intentions. Total Quality

Management, Vol. 20. No. 9.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

318