Socially Responsible Investment (SRI) versus Islamic Portfolio: Case

in Indonesia Stock Market

Vindaniar Y. Putri

1

and Alifia C. Firnuansyah

2

1

Finance and Banking Administration Department, Vocational Education Program, Universitas Indonesia

2

Faculty of Economic and Business, Universitas Indonesia

Keywords: Socially Responsible Investment, Islamic Portfolio, Indonesia.

Abstract: This paper aims to evaluate the socially responsible investment portfolio in Indonesia as an alternative

investment for investors who concerned about ethical, ESG, and social environment. This study uses a

quantitative approach and portfolio performance model (Jensen measurement, Treynor Index, and Sharpe

Index) as performance indicators. The hypothesis of this study based on the current study is that SRI portfolio

has better performance than conventional performance. The result of this study may be an alternative for an

investor to construct their portfolio. This study expands the existing literature on portfolio management, also

the theory of SRI. It will illustrate how the portfolio performance approach could be integrated into our daily

needs in managing funds.

1 INTRODUCTION

Along with the increasing interest of the public in

investing in capital market instruments, the more

diverse the objectives of the community in investing.

The purpose of investment, in general, is to earn

income, so that the value of assets or the value of

wealth increases (Warsini, 2009). Furthermore,

various stock portfolios are available throughout the

world, consisting of various sectors, finance,

development, or property, for example. Everything

has its charm.

In Indonesia, the portfolio that is of interest to

investors is the LQ45 Index, which consists of

companies with an excellent stock performance that

offers competitive returns. However, it does not rule

out the possibility that as the times develop, investors'

objectives in investing will not only based on

expected returns, but also investment choices related

to ethical issues. The Socially Responsible Index is an

example of an investment that pays attention to

ethical issues, namely having an investment strategy

that considers financial and social benefits. Socially

responsible investors encourage corporate practices

that promote human rights, diversity, environmental

management, or consumer protection. In the UK, SRI

has reached £ 7.1 billion. In the United States, ethical

investment schemes reached US $ 153 billion by

2000 (Hindrayani, 2013). SRI itself was present for

potential reasons, in the background in 1970 where

there was a rigorous screening process for arms,

tobacco and the like.

In addition to SRI, the portfolio that investors

consider is the Islamic financial index, which is a

portfolio that uses Islamic law as its legal basis.

Investment in this portfolio has another name for

Islamic investment. The development of Islamic

financial index in the world is also significant,

especially in the United Kingdom, where it was the

first non-Muslim country to issue Sukuk or bonds

based on sharia principles. Also, Islamic financial

index has better performance than the conventional

index. It is interesting to note that due to the enormous

growth of Islamic funds, even conventional funds

have started offering similar customized financial

products to cater to the growing needs of all investors.

It might happen because regardless of the religious

influence on the characteristics of these funds, they

are equally desirable for both Muslim and non-

Muslim investors. It is essential to make a fair

comparison among Islamic, conventional and SRI

funds on neutral grounds in order to make the benefits

of one product over the other access to the broader

spectrum of investors, including Muslims and non-

Muslims (Kabir Hassan, Nahian Faisal Khan, &

Ngow, 2010; Reddy, Mirza, Naqvi, & Fu, 2017).

Y. Putri, V. and C. Firnuansyah, A.

Socially Responsible Investment (SRI) versus Islamic Portfolio: Case in Indonesia Stock Market.

DOI: 10.5220/0010675100002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 283-289

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

283

In Indonesia, the SRI portfolio and Islamic

financial investments are named SRI-KEHATI and

the Jakarta Islamic Index (JII). Both have relatively

significant growth. Based on data on the Indonesia

Stock Exchange, the SRI-KEHATI Index and JII as

of November 21, 2018, the SRI-KEHATI Index ranks

2.12 basis points and JII at 3.57 basis points.

This study uses a quantitative approach and

portfolio performance models (Jensen measurement,

Treynor Index, and Sharpe Index) as performance

indicators, with the current portfolio hypothesis that

SRI portfolios have better performance than

conventional performance.

2 LITERATURE REVIEW

The ethical investment that develops in Indonesia is

sharia investment which aligned with ethical

investment because it develops values in investment

activities (Toni, 2004). Meanwhile, in the West,

ethical investment places more emphasis on

environmental and social issues, such as war,

environmental destruction, and the use of alternative

energy. At the same time, sharia emphasizes the

criteria of haram and halal such as alcohol, gambling,

usury practices and others.

Sjöström (2012), summarizes the findings of

studies that compare SRI with conventional funds

undertaken between 2008 to 2010 into four groups,

that are, (i) neutral performance ; (ii) positive

performance; negative performance; and (iv) mixed

performance. (Sjöström, 2012) also concludes that

there is no standard SRI concept, Spanish SRI fund is

defined differently to an Australian SRI fund, and a

Shariah fund may include different investment

criteria than an environmental and so on. His finding

is there's positive performance of SRI compared to

conventional investment. Although studies that have

reported negative results for SRI are in the minority,

those results are not disqualified.

The inherent differences between Islamic and SRI

funds regarding the restrictions applied to both funds

make it difficult to theorize which fund should

perform better or worse. Islamic funds are

characterized by strict limitations such as a

purification process and the exclusion of investment

in interest-bearing securities, which SRI funds are not

subjected. On the portfolio theory, it could be likely

that Islamic funds will underperform SRI and

conventional funds because fewer investment

alternatives exist (restricted diversification) for

Islamic funds and may also have an adverse selection

effect on the fund's financial performance.

Alternatively, Islamic funds could outperform SRI

and conventional funds because less diversification

exposes them to more systemic risk, or possibly that

fund managers have a small number of funds to

choose from and will be careful in selecting securities

(Alam, Tang, & Rajjaque, 2013).

The literature has previously compared SRI, and

conventional funds, Islamic and conventional funds,

and there exists sparse literature on the comparative

performance of SRI and Islamic funds with

Abdelsalam, Duygun, Matallín-Sáez, & Tortosa-

Ausina (2014) pointing out that no other research had

been carried out in that domain before their study.

They find that a difference in performance between

SRI and Islamic funds is only visible when funds are

divided into several quantiles classifying their

performance from best to worst. However, their

findings do not point to one conclusion and similar to

the debate regarding Islamic and conventional funds,

the comparative performance literature for Islamic

and SRI funds has no clear consensus (Boo, Ee, Li, &

Rashid, 2017; Reddy et al., 2017).

3 METHODOLOGY

This study refers to a performance approach with

comparative risk adjustment where the results show

that the SR portfolio based on current research is that

SRI portfolios have better performance than

conventional performance using quantitative

approaches and portfolio performance models of

Jensen measurement, Treynor Index and Sharpe

Index. The data used is the performance of SRI and

JII in 2015-2018 and uses the interest rate from Bank

Indonesia and monthly calculations.

3.1 Jensen Index

Portfolio performance measurement using the Jensen

method is based on the Capital Asset Pricing Model

(CAPM). (Hudori, 2015). The equation of measuring

the performance of the Treynor method measures the

differences from the average portfolio return with the

expected portfolio return value obtained from the

CAPM calculation results (Sutawisena, 2011;

Hudori, 2015). Treynor, what is considered as

fundamental risk-adjusted is systematic risk, by

modifying it to reflect the superiority or priority of

investment managers in forecasting security prices.

Jensen believes that good portfolio performance is a

portfolio that has a portfolio performance that

exceeds market performance following its systematic

risk. The first risk-adjusted model of equilibrium used

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

284

(2)

(3)

in regression analysis is Jensen alpha. It is calculated

based on the Capital Assets Pricing Model (CAPM)

as follows: (Bodie, Kane, & Marcus, 2011)

𝑅

𝑅

∝

𝛽

𝑅

𝑅

𝜀

(1)

Where,

∝

model constant;

𝑅

𝑅

Excess return of portfolio over the

risk-free rate at time-t;

𝑅

𝑅

Market risk premium over risk free

rate for time-t;

𝛽

Beta for portfolio p, and represents its

systematic risk;

𝜀

zero mean, error term.

The additional advantage of the multi-index

model is that it controls for investment style bias and

different risk exposures (Kabir Hassan et al., 2010;

Binmahfouz & Kabir Hassan, 2013), and it has also

empirically proven to be a superior model to the

single CAPM. The model is determined as follows:

𝑅

𝑅

∝

𝛽

𝑅

𝑅

𝛽

𝑆𝑀𝐵

𝛽

𝐻𝑀𝐿

𝜀

Where,

∝

model constant;

𝑅

𝑅

Excess return of portfolio over the

risk-free rate at time-t;

𝑅

𝑅

Market risk premium over risk free

rate for time-t;

β

i

= Beta for portfolio p;

𝐻𝑀𝐿

= Difference in return between a cyclical stock

portfolio and growth stock portfolio at time t;

𝜀

Zero mean, error term.

Jensen takes measurements by assessing the

performance of investment managers based on how

much the investment manager can provide

performance above-market performance according to

the risk he has. Therefore, the higher the yield of αp,

the better the performance of the portfolio measured

(Sutawisena, 2011).

3.2 Jensen Index - Capital Asset

Pricing Model

Capital Asset Pricing Model (CAPM) is a model for

determining the level of return on assets required or

expected. It assumes that investors are planners in a

single period that have the same perception of market

conditions and look for the mean-variance of an

optimal portfolio. The Capital Asset Pricing Model

also assumes that the ideal stock market is a massive

stock market and investors are price-takers, there are

no taxes or transaction costs, all assets can be traded

in general, and investors can borrow an unlimited

amount at a fixed risk-free rate. With this assumption,

all investors have portfolios with identical risks. The

Capital Asset Pricing Model (CAPM) states that in

equilibrium, the market portfolio is tangential to the

average portfolio variance. The Capital Asset Pricing

Model (CAPM) implies that the risk premium of any

individual asset or portfolio is the product of the risk

premium in the market portfolio and the beta

coefficient (Bodie et al., 2011)

CAPM takes into account only the systematic or

market risk or not the company only inherent or

systemic risk. This factor eliminates the vagueness

associated with an individual company risk, and only

the general market risk, which has a degree of

certainty becomes the primary factor. The model

assumes that the investor holds a diversified portfolio,

and hence the unsystematic risk is eliminated between

the stock holdings.

It is widely used in the finance industry for

calculating the cost of equity and ultimately for

calculating the weighted average cost of capital which

is used extensively to check the cost of financing from

various sources. It is seen as a much better model to

calculate the cost of equity than the other present

models like the Dividend growth model (DGM). It is

universal and easy to use the model. Given the

extensive presence of this model, this can efficiently

be utilized for comparisons between stocks of various

countries.

3.3 Treynor Measure

The size of the Treynor index is also called the

reward-to-volatility ratio (RVOL). This model was

developed by Jack Treynor (1965). Not much

different from the Sharpe index, the Treynor index

also links portfolio returns to the risks. The difference

is that the risk used in the calculation is not a total risk

but systematic risk. In its calculation, the Treynor

index assumes that non-systematic risk can be

eliminated through a portfolio diversification process

so that the risk does not need to be considered in

measuring portfolio performance.

The Treynor ratio is equal to the portfolio excess

return per unit of systematic risk (beta) and is

determined as follows:

𝑇

𝑅

𝑅

𝛽

Where,

Socially Responsible Investment (SRI) versus Islamic Portfolio: Case in Indonesia Stock Market

285

(4)

𝑇

= Treynor ratio of the portfolio;

𝛽

= Portfolio Beta.

The Treynor Index will provide results as good as

the Sharpe index when the investment portfolio can

be ascertained to be well-diversified so that non-

systemic risk does not need to be considered in

evaluating portfolio performance. Sharpe and

Treynor indices are very likely to produce the same

mutual fund ranking even though the value produced

is different (Siagian, 2012). Different values occur

because Sharpe and Treynor index uses different

denominator variables, namely cumulative risk and

systematic risk. The higher the difference in Sharpe

and Treynor index values, it will show that the

portfolio is not well diversified. A well-diversified

portfolio will produce Sharpe and Treynor index

values that are not much different. According to

Reilly and Brown (2003), these two measurement

methods produce different but complementary

measures of investment management performance.

3.4 Sharpe Index

The sharper index is a measure of portfolio

performance developed by William Sharpe in 1966.

The measurement using the Sharpe method focuses

on Risk Premium, which is the difference between the

average performance produced by the portfolio and

the average risk-free investment performance free

asset) (Sharpe, 1994). Investment without risk is

assumed to be the average interest rate of a Bank

Indonesia Certificate (SBI). Risk-free assets in this

study are assumed to be SBI (Hudori, 2015). Sharpe

measurement is formulated as a ratio of risk premium

to its standard deviation. The standard deviation is the

total risk of the portfolio concerned.

Pratomo and Nugraha (2009) in the research of

Ratnawati and Khairani (2012) explained that Sharpe

measures risk premium through the method of

dividing risk premium by the resulting standard

deviation per unit of risk taken.

It is determined as follows:

𝑆

𝑅

𝑅

𝜎

Where,

𝑆

= Sharpe ratio;

𝑅

= the return on UK interbank daily

interest rate during t period (the risk-free

rate);

𝜎

= the standard deviation of portfolio.

This is based on the fact that the measured

portfolio risk has risks, whereas risk-free assets such

as SBI have no risk(Sutawisena, 2011). Therefore, the

higher the Sharpe ratio value, the better the

performance of the portfolio.

4 RESULTS

Using a quantitative approach and a portfolio

performance model measuring Jensen, Treynor Index

and Sharpe Index, the SRI and JII performance data

for the 2015-2018 period are calculated monthly and

using the interest rate from Central Bank of

Indonesia.

4.1 The Difference in Returns from

SRI and JII in 2015 – 2018

Based on the analysis, the average return on the

Composite Stock Price Index is 0.37% with a daily

average of 0.55%. JII got the highest return in March

2017, which was 5.43% and the lowest return was -

4.13% in June 2015. Besides, the SRI-KEHATI index

had the highest return of 9.38% in July 2016, and the

lowest return was -10.88% in May 2018. Meanwhile,

the average JII was 0.82%, and the SRI portfolio was

0.38%.

4.2 JII and SRI Performance based on

Jensen Index in 2015 – 2018

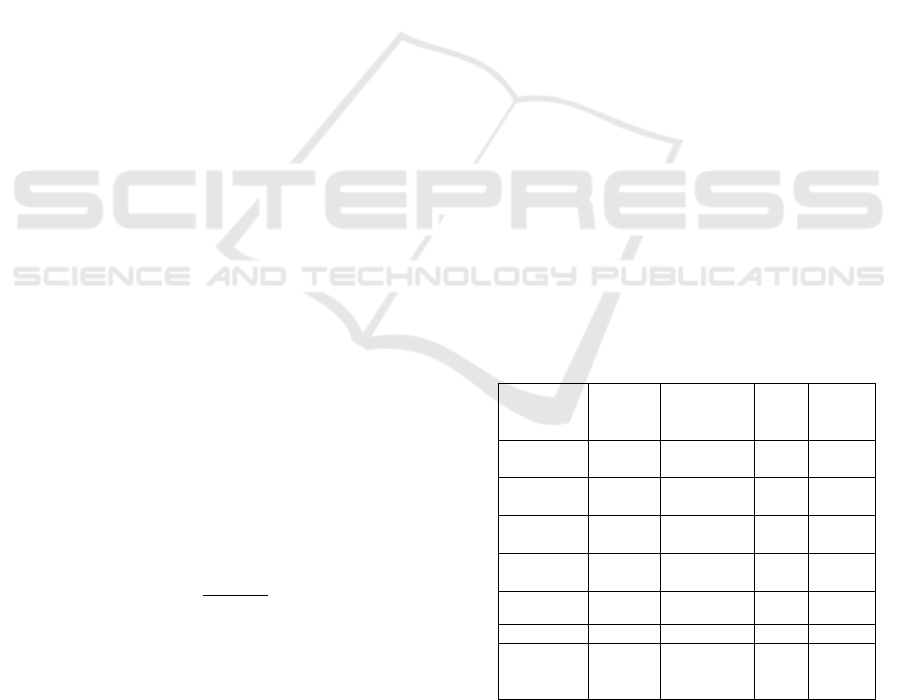

Table 1: Jensen return analysis to JII and SRI-KEHATI

portfolio from 2015 2018.

Return

Marke

t

Daily

Interest

Rate

JII

SRI-

KEH

ATI

Average 0,37% 0,55%

0,82

%

0,38%

Standar

Deviation

3,47% 0,06%

2,23

%

4,45%

Variance 0,12% 0,00%

0,05

%

0,20%

Covarianc

e

0,05

%

0,11%

Beta 0,44 0,88

0,4 1,26

Jensen

Index

0,00

351

-

0,0000

7

Based on the results of JII and SRI in the 2015-

2018 period using the Jensen Index, JII has a Jensen

Index of 0.00351 and SRI-KEHATI, has a value of -

0.00007. JII has relatively higher performance

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

286

compared to SRI-KEHATI. It is concluded that the

ability of investors to predict market movements and

respond to changes in the market is high. So that, the

position of the performance of each portfolio is the

above-market following its risks.

4.3 JII and SRI Performance based on

CAPM in 2015 – 2018

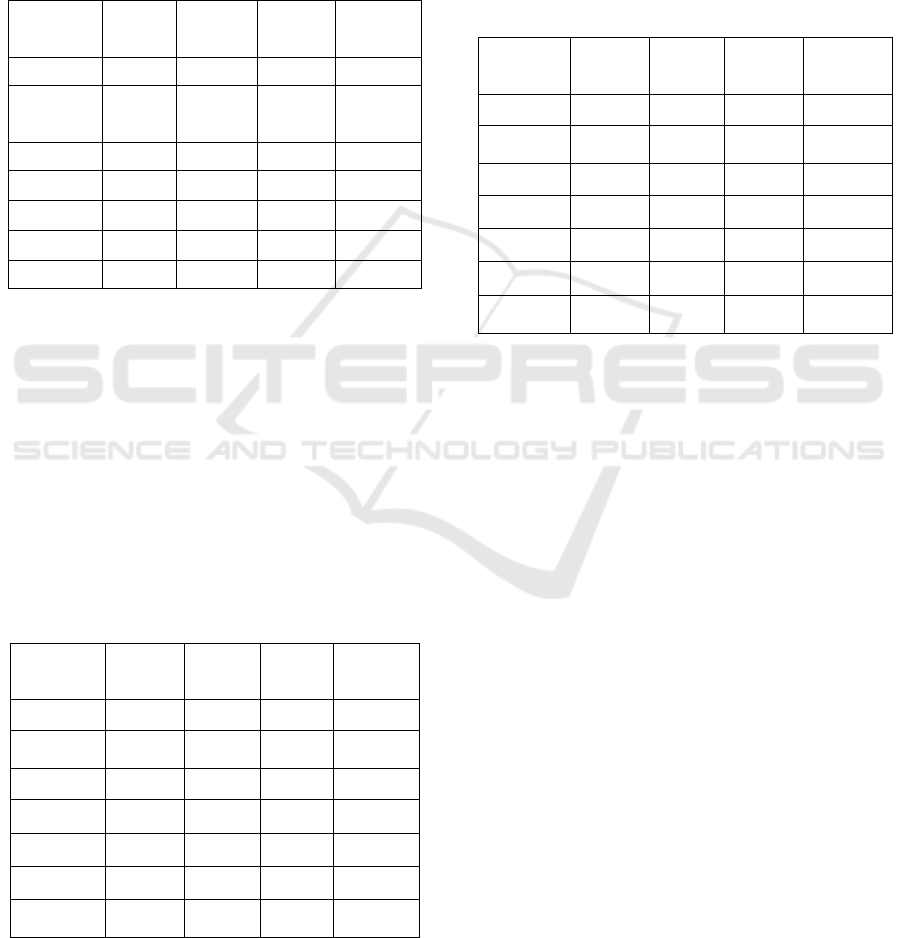

Table 2: CAPM return analysis to JII and SRI-KEHATI

portfolio in 2015 2018.

Return

Market

Daily

Interest

Rate

JII

SRI-

KEHATI

Average 0,37% 0,55% 0,82% 0,38%

Standar

Deviation

3,47% 0,06% 2,23% 4,45%

Variance 0,12% 0,00% 0,05% 0,20%

Covariance

0,05% 0,11%

Beta

0,44 0,88

0,4 1,26

CAPM 0,00469 0,00389

The results indicate that JII and SRI portfolio

return using the CAPM model was lower than the

market rate of return. The portfolio return of JII Index

was 0.00469, while SRI-KEHATI was 0.00389. Both

of them still have a beta less than 1, so the return of

each portfolio fluctuates less than the fluctuation of

market returns. Thus, the required rate of return is

lower than the rate of return on the market.

4.4 JII and SRI Performance based on

Treynor Index in 2015 – 2018

Table 3: Treynor return analysis to JII and SRI-KEHATI

portfolio in 2015 – 2018.

Return

Market

Daily

Interest

Rate

JII

SRI-

KEHATI

Average 0,37% 0,55% 0,82% 0,38%

Standar

Deviation

3,47% 0,06% 2,23% 4,45%

Variance 0,12% 0,00% 0,05% 0,20%

Covariance

0,05% 0,11%

Beta

0,44 0,88

0,4 1,26

Treynor

Index

0,00617 -0,00187

Table 3 shows JII and SRI-KEHATI portfolio

performances using the Treynor Index. JII in the

2015-2018 period has a Treynor value of 0.00617 and

an SRI-KEHATI portfolio of -0.00187. It is suggested

that the SRI portfolio is relatively lower based on the

additional investment obtained for each unit of total

systematic risk that arises when compared to another

index in the study.

4.5 JII and SRI Performance based on

Treynor Index in 2015 – 2018

Table 4: Jensen return analysis to JII and SRI-KEHATI

portfolio in 2015 – 2018.

Return

Market

Daily

Interest

Rate

JII

SRI-

KEHATI

Average 0,37% 0,55% 0,82% 0,38%

Standar

Deviation

3,47% 0,06% 2,23% 4,45%

Variance 0,12% 0,00% 0,05% 0,20%

Covariance 0,05% 0,11%

Beta 0,44 0,88

0,4 1,26

Sharpe

Index

0,12199 -0,0371

The results of table 4 show that the JII in the 2015-

2018 period has a Sharpe value of 0.12199 and SRI-

KEHATI of -0.0371. It is implied that JII has a

relatively higher performance based on the additional

investment generated for each unit of total risk

arising.

JII and SRI-KEHATI have the average portfolio

return 0.82% and 0.38% for four years. Even though

it is above the average of the IHSG portfolio (at

0.37%), the two portfolios return are still below one.

So, the required rate of return is almost the same as

the fluctuations in the market. Furthermore, several

models used to measure the performance of JII and

SRI-KEHATI for the 2015-2018 period also showed

that most were still in the lower position. When

viewed from each portfolio's performance, JII still has

more leadership than SRI-HAYATI, this indicates

that the management of funds in JII is acknowledged

to be relatively close to the rate of return required by

conditions in the market. Also, the result shows that

the JII performance has a positive and significant

effect on the market.

Socially Responsible Investment (SRI) versus Islamic Portfolio: Case in Indonesia Stock Market

287

Table 5: Jensen return analysis to JII and SRI-KEHATI

portfolio from 2015 2018.

JII SRI-KEHATI

Jensen

Measurement

0,00351 -0,00007

Jensen Index -

CAPM

0,00469 0,00389

Tre

y

nor Index 0,00617 -0,00187

Shar

p

e Index 0,12199 -0,0371

Jensen takes measurements by assessing the

performance of investment managers based on how

much the investment manager can provide a higher

return than market return according to its risk.

Therefore, the higher the yield of αp, the better the

performance of the portfolio is measured. JII has a

Jensen Index of 0.00351 and SRI-KEHATI has a

value of -0.00007. JII has relatively higher

performance compared to SRI-KEHATI.

The Capital Asset Pricing Model assumes that the

ideal stock market is a massive stock market and

investors are price-takers, there are no taxes or

transaction costs, all assets can be traded in general,

and investors can borrow an unlimited amount at the

level a risk-free fixed rate. The results of the

measurement using CAPM, JII has a return of

0.00469 and SRI-KEHATI has a return of 0.00389.

Both of them still have a beta less than 1, so the return

of each portfolio fluctuates less than the fluctuation

of market returns.

The Treynor Index will provide results as good as

the Sharpe index when the investment portfolio can

be ascertained to be well-diversified so that non-

systemic risk does not need to be considered in

evaluating portfolio performance. JII in the 2015-

2018 period had a Treynor value of 0.00617 and an

SRI portfolio of -0.00187. It proves that the SRI

portfolio is relatively lower based on the additional

investment obtained for each unit of total systematic

risk that arises when compared to other mutual fund

products in the study sample.

The sharper index is a measure of portfolio

performance developed by William Sharpe in 1966.

The measurement using the Sharpe method focuses

on Risk Premium which is the difference between the

average performance produced by mutual funds and

the average investment performance that is risk-free

(risk-free assets, JII and SSRI using the Sharpe Index

show that JII in the 2015-2018 period has a Sharpe

value of 0.12199 and SRI-KEHATI of -0.0371. It

shows that JII has a relatively higher performance

based on additional investment generated for each

unit of total risk that arises.

Besides SRI, the portfolio that is considered by

investors is the Islamic financial index. The

development of Islamic financial index in the world

is also significant, especially in the United Kingdom,

where it was the first non-Muslim country to issue

Sukuk or bonds based on sharia principles. Besides,

Islamic financial index has better performance than

conventional index. In Indonesia, the SRI portfolio

and Islamic financial investments are named SRI-

KEHATI and the Jakarta Islamic Index (JII). Both

have adequately significant growth. Based on data on

the Indonesia Stock Exchange, the SRI-KEHATI

Index and JII as of November 21, 2018, the SRI-

KEHATI Index ranks 2.12 basis points and JII at 3.57

basis points.

This study refers to a performance approach with

comparative risk adjustment where the results show

that the SR portfolio based on current research is that

the SRI portfolio has a better performance than

conventional performance using a quantitative

approach and a portfolio performance model

measuring Jensen, Treynor Index and Sharpe Index.

The data used is the performance of SRI and JII in

2015-2018 and uses the interest rate from Bank

Indonesia and monthly calculations. Based on the

above analysis, the average return on the Composite

Stock Price Index is 0.37% with a daily average of

0.55%. JII got the highest return in March 2017,

which was 5.43% and the lowest return was -4.13%

in June 2015. Other than that, the SRI-KEHATI index

had the highest return of 9.38%, namely in July 2016

and the lowest return was -10.88% in May 2018.

Meanwhile, the average JII was 0.82%, and the

average SRI portfolio was 0.38%.

5 CONCLUSIONS

Along with the increasing interest of the public in

investing in capital market instruments, there are also

increasingly diverse objectives of the community in

investing that is not only based on expected returns,

but also investment choices related to ethical issues.

The Socially Responsible Index (SRI) is an example

of an investment that pays attention to ethical issues,

namely having an investment strategy that considers

financial and social benefits. SRI itself was present

for potential reasons, in the background in 1970

where there was a strict screening process for

weapons, tobacco and the like.

JII and SRI-KEHATI have the average portfolio

return 0.82% and 0.38% for four years. Even though

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

288

it is above the average of the IHSG portfolio (at

0.37%), the two portfolios return are still below the

market overall. So, the required rate of return is

almost the same as the fluctuations in the market.

Furthermore, several models used to measure the

performance of JII and SRI-KEHATI for the 2015-

2018 period also showed that most were still in the

lower position. When viewed from each portfolio's

performance, JII still has more leadership than SRI-

HAYATI, this indicates that the management of

funds in JII is acknowledged to be relatively close to

the rate of return required by conditions in the market.

Also, the result shows that the JII performance has a

positive and significant effect on the market.

REFERENCES

Ismail, Hadi. 2015. Pengaruh Kinerja Indeks Harga Saham

Gabungan dan Jakarta Islamic Index terhadap Kinerja

dan Aliran Dana Reksa Dana Saham Syariah Periode

Januari 2009 – September 2014.

Elvira, Nasika., dkk. 2012. Analisis Menggunakan Capital

Asset Pricing Model untuk Penetapan Kelompok

Saham-Saham Efisien

Reddy, Khrisna, dkk. Comparative Risk Adjusted

Performance of Islamic, Socially Responsbe and

Conventional Funds: Evidence from United Kingdom.

2017

Kurniawan. Analisis kinerja Portofolio Saham: Studi

Komparatif Kinerja 3 Indeks Saham Bursa Efek

Indonesia. 2013

Hudori, Khamim. Perbedaan Kinerja Reksa Dana

Konvensional dan Syariah Pendekatan Indeks Sharpe,

Treynor, Jensen, Appraisal Ratio, M2 Measure dan T2

Measure. 2015

Gumati, Tatang Ary (2011) Manajemen Investasi Konsep

Teori dan Aplikasi. Jakarta : Mitra Wacana Media

Bodie, dkk (2005). Investment. Edisi Bahasa Indonesia.

Jakarta : Salemba Empat

Ahmad, Kamarudin (2004) Dasar-Dasar Manajemen

Investasi dan Portofolio. Cetakan II . Jakarta : Rineka

Cipta

Jayaprana, Ogi (2014). Perbandingan Return Saham Lq45

Di Bursa Efek Indonesia Dengan Menggunakan Capital

Asset Pricing Model (CAPM) Dan Arbitrage Pricing

Theory (APT). [Online] tersedia di :

respository.upi.edu , diakses tanggal : 27 Oktober 2017

Novendra, Rehan. Analisis Pengaruh Reputasi Perusahaan

Keberlanjutan Terhadap Return Saham dan Kinerja

Keuangan Perusahaan: Bukti Empiris dari SRI-

KEHATI

Siagian, Naomi A. Perbandingan Kinerja Reksa Dana

Syariah selama Periode Krisis (Tahun 2008) dan

Periode Setelah Krisis (Tahun 2009) dengan

Menggunakan Indeks Sharpe dan Indeks Treynor. 2012

Bauer Rob, dkk. The Ethical Mutual Fund Performance

Debate: New Evidence From Canada. 2006

Hussein, Khalid A. Islamic Investment: Evidence from

Dow Jones and FTSE Indices

Socially Responsible Investment (SRI) versus Islamic Portfolio: Case in Indonesia Stock Market

289