Insurance Agents in Indonesia in the Era of Industrial Revolution 4.0

Fia Fridayanti Adam

Vocational Education Program, Universitas Indonesia, Indonesia

Keywords: General insurance, distribution channel, insurance agents, competency

Abstract: In the current era of industrial revolution 4.0, insurance companies can sell insurance products by

combining their distribution channels. This distribution channel includes through the internet or website,

direct sales by companies, bank assurance, and sales through agents. For motor vehicle insurance, data in

2018 shows that only nine general insurance companies provide online applications to purchase motor

vehicle insurance products which indicate that the utilization of the company’s official website is not

optimal. In general, insurance companies still rely on agents as marketers of their products. To improve the

ability of agents, insurance agents must be competent. For this reason, insurance agents must take the

certification exam held by the Indonesian General Insurance Association (AAUI). This study aims to

provide an overview of general insurance agents in Indonesia that have been certified. Data sourced from

the Financial Services Authority (OJK) and AAUI shows that there are still many general insurance agents

that have not met these competencies. To make it easier for insurance agents to take a certification exam,

AAUI has issued an e-certificate.

1 INTRODUCTION

At present, the world is facing a 4.0 industrial

revolution. In this era, there was a massive change in

all fields. Changes that occur are not only digital

changes, but also there are developments in

innovations that are rapidly spreading and the

emergence of platforms that can unite several fields

at once as stated by Roblek et al., (2016) that the era

of industrial revolution 4.0 is characterized by the

process of digitization and automation, and the use

of electronic devices and information technology in

the process of making and servicing a product. The

world of insurance is also not spared from the 4.0

industrial revolution. Eling and Lehmann (2018)

analyzed what technologies affect the insurance

sector. While in Klapkiv and Kalpkiv (2017) stated

that the main factors that determine the emergence

of new technologies in the insurance sector are

asymmetry information, increasingly fierce

competition, changing generations and social norms,

growth of technology and computer capabilities,

economic crisis and reduced premiums insurance.

The insurance industry in Indonesia is growing

every year. In Rahim (2013), the results of the

analysis of various data and predictions of the

growth of the insurance industry explained that the

insurance industry in Indonesia is experiencing a

significant development from year to year. However,

the industry must be improved because the

penetration is still low. Given the size of Indonesia’s

population, the insurance market in Indonesia is still

quite large. So that many efforts have been made to

increase the number of insurance participants in

Indonesia.

In general, the efforts made by insurance

companies to increase the number of customers are

carried out through distribution channels. In Dumm,

R. E., & Hoyt, R. E. (2003) described a variety of

distribution channels commonly used to increase

insurance sales, namely distribution channels carried

out by companies themselves, agents, banks, and the

internet. In this industrial revolution era 4.0, the

distribution channel that is more widely used is the

internet. However, in the study of Adam and

Hikmah (2018), it was found that only nine general

insurance companies in Indonesia provided online

applications to purchase motor vehicle insurance

products. This condition shows that the utilization of

the company’s official website in Indonesia is not

optimal. Many general insurance companies choose

to use other distribution channels, especially using

insurance agents. Insurance agents can be called the

spearhead of insurance marketing. In deciding

Fridayanti Adam, F.

Insurance Agents in Indonesia in the Era of Industrial Revolution 4.0.

DOI: 10.5220/0010674100002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 277-282

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

277

insurance sales to prospective customers or their

customers representing insurance companies. Those

who know, serve, and master customer portfolios.

For example, insurance agents that insurance

products for the market motor vehicle. They must be

able to explain the definition of motor vehicle

insurance, the type of motor vehicle insurance

coverage, how benefits will be received, and others.

By definition, insurance agents are

entrepreneurs who carry out agency activities under

the agency contract stated by the insurance company

and included in the insurance agent list (Andrzej,

2015). Besides, insurance agents must be

professional. The study conducted by Tseng et al.,

(2016) states the extent to which the attitude of

insurance agents in recommending an inappropriate

insurance product can increase sales of insurance

products that do not meet customer needs.

Meanwhile, the era of the industrial revolution

4.0 despite having many opportunities, also further

complicates the problem of competition. This fact is

because organizations no longer compete with local

brands; instead, they compete with brands from all

over the world. This situation means that every

organization must be prepared, not only to build its

business with global standards but also to try to

outperform the global competition. To be able to

achieve success, the industry focuses on people who

have a higher level of individual competence

(Amodu et al., 2017). Similarly, the insurance agent

profession, in addition to being a professional, the

insurance agent must also be competent or certified.

Like the insurance industry, insurance agents are

also divided into general insurance agents and life

insurance agents.

OJK Regulation Number 69 / POJK.05 / 2016 /

states that insurance agents must be registered with

OJK and have agency certificates following their

business fields. While based on Law No. 40 of 2014

concerning insurance states that OJK gives authority

to associations to certify agency, AAUI as the

association that oversees general insurance in

Indonesia, has taken several steps to improve the

competence of general insurance agents in

Indonesia. This study will provide an overview, the

extent to which general insurance agents fulfil these

requirements and what efforts are made by AAUI to

increase the number of certified general insurance

agents.

2 LITERATURE STUDY

2.1 Definition of Insurance

Based on Law No. 40 of 2014 concerning Insurance,

insurance is an agreement between two parties,

namely an insurance company and policyholder,

which is the basis for receiving premiums by

insurance companies in return for:

a. Provide replacement to the insured or

policyholder due to losses, damages, costs incurred,

loss of profits, or legal liability to third parties. They

may be suffered by the insured or policyholder due

to an uncertain event, or provide payments based on

the death of the insured or payment. Based on the

life of the insured, the benefit of the amount

determined and /or based on the results of the

management of funds.

The above definition implies that there are two types

of insurance, namely life insurance and general

insurance. Life Insurance Business is a business that

carries out risk management services that provide

payments to policyholders, insured, or other parties

who are entitled in the event the insured dies or

remains alive, or other payments to policyholders,

insured, or other parties entitled at certain times

regulated in the agreement, the amount of which has

been determined and/or based on the results of the

management of funds. While the General Insurance

Business is a risk insurance service business that

provides compensation to the insured or

policyholder due to losses, damages, costs incurred,

loss of profits, or legal responsibility to third parties

that may be suffered by the insured or policyholder

due to an uncertain event. Ayat (2012) states that in

general insurance there are 13 types of insurance

products commonly marketed, namely insurance

transportation, ship frame insurance, shipbuilding

insurance, property insurance, motor vehicle

insurance, guarantee insurance, various insurance,

engineering insurance, satellite insurance, aviation

insurance, energy insurance, credit insurance, and

liability insurance.

2.2 Definition of Insurance Agents

All types of general insurance products require a

marketing process to reach consumers. In marketing

terms, it is known as a distribution channel, which is

a path that must be traversed by the flow of goods

from producers to agents or intermediaries or large

traders to users, in this case consumers. Distribution

channels can be also defined as marketing channels

or market channels. A distribution channel is a group

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

278

of dependent on each other organization units, which

are taking part in process of flow of products or

services form producers to buyers (Szopa and

Pękała, 2012).

In Dumm, R. E., & Hoyt, R. E. (2003)

described a variety of distribution channels

commonly used to increase insurance sales, namely

distribution channels carried out by companies

themselves, agents, banks, and the internet. If

marketing is carried out by the insurance company

itself, whether through company sales staff, home

service agents, or the internet, the sales are

categorized as direct marketing channels.

Conversely, if marketing is done by agents, brokers,

or banks, it is called an indirect marketing channel.

From various known distribution channels,

insurance agents play an essential role in insurance

sales. According to Law No. 40 of 2014, insurance

agents are people who work alone or work for a

business entity, who act for and on behalf of an

Insurance Company or Sharia Insurance Company

and fulfill the requirements to represent an Insurance

Company or Sharia Insurance Company to market

insurance products or products sharia insurance.

In addition, an insurance agent is an agent

engaged for an insurance company based on the

requirements specified by the insurance company

where the insurance agent works. Furthermore, it

can be found in the Financial Services Authority

Regulation Number 23 / POJK.05 / 2015 concerning

Insurance Products and Insurance Product Marketing

Article 45 said that “Insurance companies can only

market insurance products through marketing

channels, one of which is mentioned by insurance

agents, which meet the provisions statutory

regulations regarding insurance agents “. Along with

the task of the agent as a liaison between the insured

and the insurer, then in this case the agent is also

required to recognize an insurance company where

the insurance agent works which aims to provide

information to the insurer that will be obtained from

having an insurance product based on the premium

amount paid by the insured. Insurance agents can

also be intermediaries between the insured party and

the insurer to make insurance premium payments

and also the process of filing claims against

insurance customers who experience a loss as stated

in the insurance policy. To become an insurance

agent who carries out work as a liaison between the

insured party and the guarantor, it must go through

procedures that have been determined by the

insurance company.

According to the Financial Services Authority

Regulation Number 69 / POJK.05 / 2016, individual

insurance agents and Legal Entity insurance agents

can conduct agency cooperation with 1 (one)

General Insurance Company, 1 (one) Islamic

General Insurance Company, 1 (one) Insurance

Company Life and 1 (one) Sharia Life Insurance

Company. Thus, Insurance Agents are prohibited

from conducting agency cooperation with more than

similar Insurance Companies. To be able to carry out

consultancy activities on insurance needs and / or

mediation of insurance closure to prospective

policyholders and to be able to place insurance with

insurance companies according to the needs of

prospective policyholders, a Legal Insurance agent

can apply for a business license as an Insurance

Brokerage Company.

Every insurance agent must be registered with

the Financial Services Authority (OJK) and must

have sufficient knowledge and ability and have a

good reputation. According to Article 31 of Law No.

40 of 2014 Insurance Agents, Insurance Brokers,

Reinsurance Brokers, and Insurance Companies are

required to apply all their expertise, attention, and

accuracy in serving or transacting with

Policyholders, Insured, or Participants. In other

words, an insurance agent must have good

competence in carrying out their work or in other

words, a right insurance agent is a certified agent.

2.3 Definition of AAUI

AAUI or the Indonesian General Insurance

Association is a forum where general insurance

companies work together in the same vision and

mission, with one of its functions being a forum for

unity and deliberation for the benefit of the general

insurance industry. In article 68 of Law No. 40 of

2014, each insurance company is required to become

a member of one of the insurance business

associations in accordance with the type of business.

For general insurance companies, the association in

question is AAUI.

As seen on its website, www.aaui.or.id, AAUI

currently has 84 members, consisting of general

insurance / loss companies and reinsurance

companies (78 Insurance Companies & 6 reinsurance

companies), and 27 branches spread throughout the

region. in Indonesia. AAUI is an organization that

runs all of its business in a non-profit nature and by

always adhering to all applicable legal provisions.

AAUI’s financial resources originate from

membership fees consisting of base fees for new

members and annual contributions consisting of basic

contributions and tiered contributions from AAUI

members whose amount is stipulated in the general

Insurance Agents in Indonesia in the Era of Industrial Revolution 4.0

279

meeting of members, other legitimate businesses and

receipts that are not contrary to the intent and the

purpose of AAUI.

3 DATA AND METHODS

This research is a descriptive study that provides an

overview of how many general insurance agents

meet the competency standards set by AAUI.

Secondary data is obtained from OJK through

www.ojk.go.id , from AAUI at www.aaui.or.id, and

the results of written interviews with AAUI

administrators. The object of research is the number

of general insurance agents working to market

general insurance products in all conventional

general insurance companies registered with the

OJK until 2019. The steps taken are:

1. Check the number of insurance companies in

Indonesia.

2. Check the number of general insurance agents in

Indonesia.

3. Check the number of certified general insurance

agents in Indonesia.

4. Explain the AAUI E-certification.

4 RESULT AND DISCUSSION

As explained earlier, AAUI has 84 members,

consisting of 78 insurance companies and six

reinsurance companies. However, OJK data per May

2019 only has 75 general insurance companies and

six reinsurance companies registered. In general,

there are a total of 151 insurance companies,

including well-known insurance companies and

sharia. Table 1 below explains the number of

insurance firms in Indonesia based on data from the

Financial Services Authority of May 2019. Table 1

shows that insurance companies are divided into life

insurance companies, general insurance, reinsurance

companies, mandatory insurance, and social.

Table 1: Number of the insurance company in Indonesia.

Component May 2019 Total

Conventional

Sharia*

Insurance

139

13

151

Life Insurance

53

7

60

General

Insurance

75

5

80

Reinsurance

6

1

7

Mandatory

Insurance

3

-

3

Social

Insurance

(

BPJS

)

2

-

2

From Table 1, there are quite a several

insurance companies in Indonesia, so that the need

for insurance marketers or insurance agents,

including general insurance agents is still

substantial. Table 2 explains the number of general

insurance agents in Indonesia from 2013 to 2018

sourced from www.ojk.go.id.

Table 2: Number of Indonesian general insurance agents.

Year National

Compan

y

Joint

Venture

Total

2013 8131 11074 19205

2014 7016 17288 24304

2015 9336 6402 15738

2016 8874 7757 16631

2017 12011 6060 18071

2018 13435 5904 18529

From Table 2, it can be seen that the number of

general insurance agents in Indonesia fluctuated

from year to year, with a tendency to increase the

number of general insurance agents in Indonesia.

However, it is not seen whether the number of

agents mentioned is already certified or not. OJK

Regulation Number 69 / POJK.05 / 2016 / states that

insurance agents must be registered with OJK and

have agency certificates in accordance with their

business fields. While according to Law Number 40

of 2014 concerning Insurance states that OJK grants

authority to associations to carry out agency

certification, in this case the general insurance

agency certificate is issued by AAUI.

To get agency certification, AAUI holds

special exams for general insurance agents. Initially,

AAUI developed a certification system with a half-

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

280

day workshop model with two main topics. The

prospective insurance market agents are crammed

with topics about insurance sales salesmanship and

the concept of risk management which covers the

principles of insurance. After the workshop, a

written test in the form of multiple-choice was held

with 100 questions in 60 minutes. The certification

is held once a month. More detailed information

about the number of insurance agents that have been

certified through the exam can be seen in the

following Table 3:

Table 3: Certified Agent.

Year Agent

2013 2351

2014 4900

2015 3556

2106 2396

2017 5948

2018 6838

When compared with the number of agents, as

shown in Table 2, until 2016, the number of certified

agents is still very small. In 2016, for example, only

around 12.5% of the agents had competency

certificates issued by AAUI. This shows that the

number of insurance agents who have the

certification is still lacking. But along with the

issuance of OJK Regulation Number 69 / POJK.05 /

2016 / which states that insurance agents must be

registered with the OJK and have an agency

certificate in accordance with their line of business,

in 2017 the number of certified agents becomes

5958 people, increasing by 3552 people. However,

when compared to the number of agents, only about

33% of agents are certified. To increase this number,

the AAUI issued a new strategy by utilizing

information technology.

In May 2018, AAUI issued a new scheme,

namely an E-certification or electronic-based

certification. Android-based E-certification platform

that can be downloaded at Google Playstore, so that

it can help agents to be able to carry out exams

anytime and anywhere as long as there is internet

access, the E-certification has also been equipped

with standardized material with the aim of insurance

agents being able to explain products that are offered

and understood general insurance principles and

products. In addition, this application is also

equipped with an exercise program so that agents

can carry out exam exercises before carrying out the

exam itself.

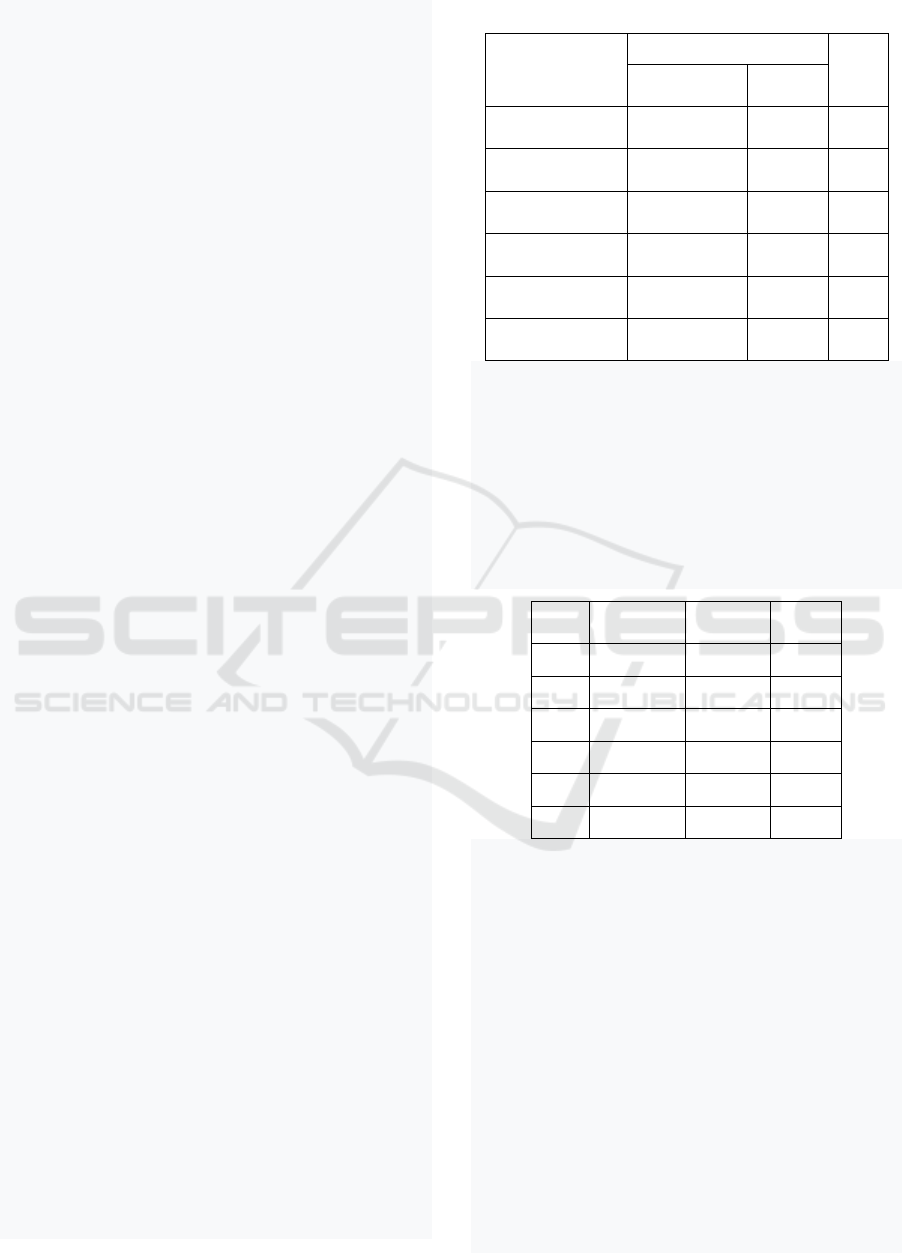

Figure 1: E-certification AAUI.

In Figure 1, you can see an e-certification

screenshot that includes test material and practice.

Materials include insurance law, insurance products,

risk recognition and insurance principles.

Prospective examinees can do the exercises before

taking the exam. Thus E certification is carried out

very effectively and efficiently without reducing the

quality of the agent.

Since the launch of the E-certification, the

number of certified agents in 2018 is 6,838, or there

has been an increase of 14.9%. In general, the

development of the number of certified general

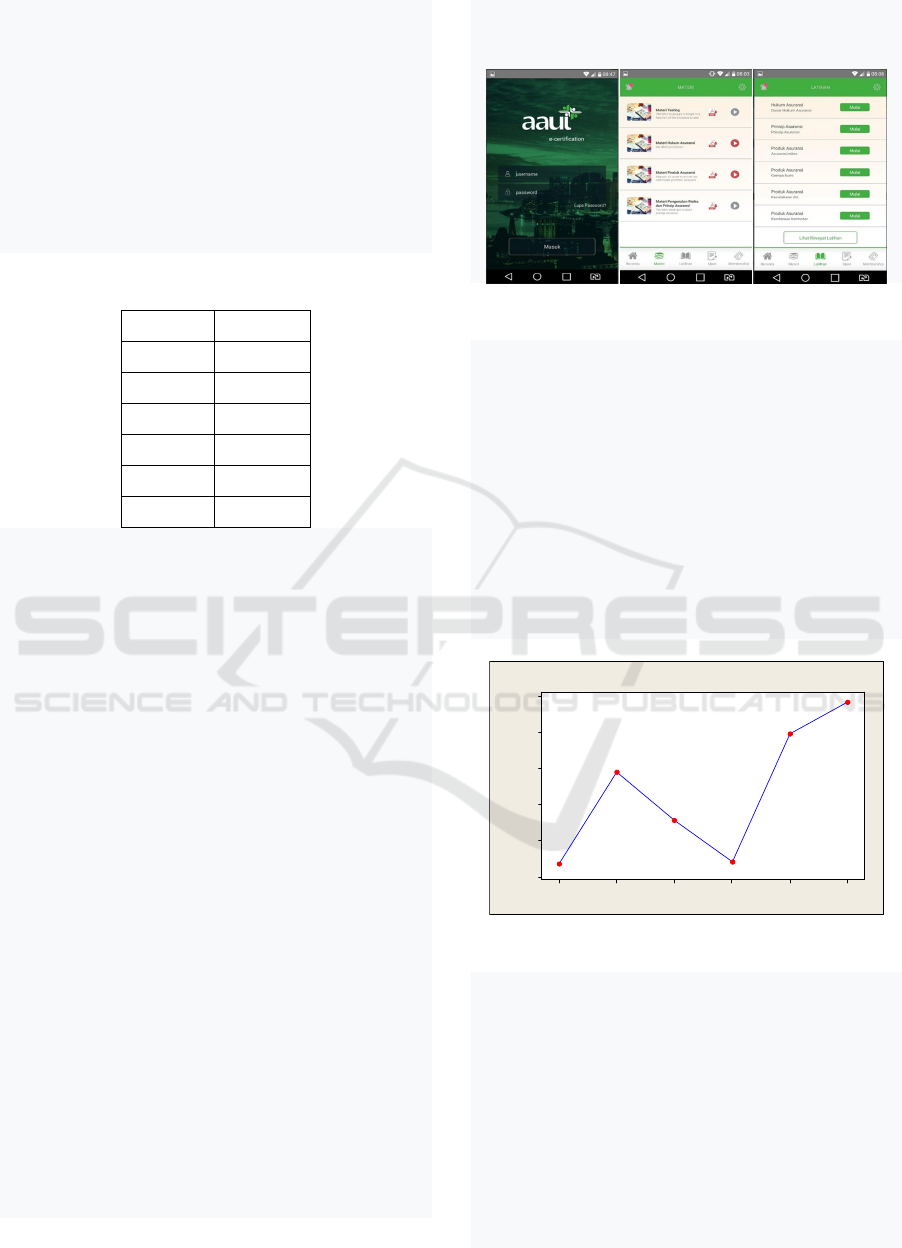

insurance agents can be seen in Figure 2 below:

201820172016201520142013

7000

6000

5000

4000

3000

2000

Year

Agent

The Development of Agent

Figure 2: The Development of Certified Agent.

From Figure 2, it can be seen that in 2016 there

was a decrease in the number of certified agents, but

since 2017 there has been an increase in the number

of certified agents in line with the FSA regulation

No. 69 / pojk.05 / 2016. Then it will increase in

2018 along with the E-certification, although the

increase is still 14.9%. This relatively small increase

shows that AAUI has not carried out effective

socialization. The socialization carried out by AAUI

has actually arrived at the process and practice of

implementing the exam by using an E-certification

to all AAUI Members represented by the agency

Insurance Agents in Indonesia in the Era of Industrial Revolution 4.0

281

coordinators of each company on the 26th February

2018 at the AAUI secretariat in Jakarta with the

hope that the agent coordinator will notify the

insurance agent in the area about this E-certification.

But it seems that it is not as effective as socializing

With the rapid development of information

technology in the current era of the industrial

revolution 4.0 it is hoped that socialization can be

intensively carried out so that more and more

general insurance agents can reach E-certification

and insurance agents in remote areas can reach E-

certification.

5 CONCLUSION

The insurance agent becomes an intermediary

between the insured party and the guarantor to pay

insurance premiums and also the process of filing

claims against insurance customers who experience

a loss as stated in the insurance policy. OJK

Regulation Number 69 / POJK.05 / 2016 / states that

insurance agents must be registered with OJK and

have an agency certificate in accordance with their

line of business. In other words, insurance agents

must be professional and competent. To achieve this

competency, OJK gives authority to associations to

carry out agency certification, in this case the

general insurance agency certificate issued by

AAUI. To get agency certification, AAUI holds

special examinations for general insurance agents.

Manual exams only produced 5958 certified agents

in 2017. Since the launch of E-certification in 2018,

the number of certified agents in 2018 was 6,838

people or an increase of 14.9% compared to 2017.

With the rapid development of information

technology in the era of the industrial revolution 4.0

is expected that more general insurance agents can

reach E-certification and insurance agents in remote

areas can reach E-certification.

REFERENCES

Adam FF, Hikmah Y. 2018. Analysis Web Site Utilization

of General Insurance Company in Selling Motor

Vehicle Insurance. Proceeding of the 3th ICVHE;

Batam, 2-4 August 2018. ISBN No 9786925252402.

Amodu, L., Alege, P., Oluwatobi, S., & Ekanem, T.

(2017). The Effect of Human Capital Development on

Employees ’ Attitude to Work in Insurance Industry in

Nigeria, 2017. https://doi.org/10.5171/2017.

Andrzej, J. 2015. The future of insurance agent as a

partner in a company’s operating

Activity. Scientific Journal (ScienceRise) No 2/3 (7). DOI:

10.15587/2313- 8416.2015.36928

Ayat S. Pengantar Asuransi. STMA Trisakti. Jakarta.

2012

Dumm, R. E., & Hoyt, R. E. (2003). Insurance distribution

channels: Markets in transition. Journal of Insurance

Regulation, 22(1), 27–47.

Eling, M., & Lehmann, M. (2018). The Impact of

Digitalization on the Insurance Value Chain and the

Insurability of Risks. The Geneva Papers on Risk and

Insurance - Issues and Practice, 43(3), 359–396.

https://doi.org/10.1057/s41288-017-0073-0

Klapkiv L., & Kalpkiv J. 2017. Technological innovations

in the insurance industry. Journal of Insurance,

Financial Markets and Consumer Protection 26: 67-

78.

Law No. 40 of 2014 concerning Insurance.

OJK Regulation Number 23 / POJK.05 / 2015 concerning

Insurance Products and I nsurance Product

Marketing

OJK Regulation Number 69 / POJK.05 / 2016 /

concerning the Operation of Insurance Companies,

Sharia Insurance Companies, Reinsurance Companies,

and Sharia Reinsurance Companies

Rahim, H. (2013). Optimisme Pertumbuhan Asuransi

Indonesia : Proyeksi Perkembangan Lima Tahun

(2014-2018). Jurnal Asuransi dan Manajemen Risiko

Vol 1 No. 2.

Roblek, V., Meško, M., & Krapež, A. (2016). A Complex

View of Industry 4.0. SAGE Open, 6(2).

https://doi.org/10.1177/2158244016653987

Szopa P., & Pekala W. 2012. Distribution channels and

their roles In the enterprise. Polish journal of

management studies.

Tseng, L. M., Kang, Y. M., & Chung, C. E. (2016). The

insurance agents’ intention to make inappropriate

product recommendations: Some observations from

Taiwan life insurance industry. Journal of Financial

Regulation and Compliance, 24(3), 230–247.

https://doi.org/10.1108/JFRC-03-2015-0014.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

282