Debt, State-owned Enterprise, and Accounting Conservatism:

Indonesia Evidence

Dewi Kartika Sari

1

1

Accounting and Audit Laboratory, Vocational Education Program, Universitas Indonesia, Depok, Indonesia

Keywords: Conservatism, Debt, and SOE.

Abstract: This research aims to empirically examine the effects of public debt ownership and state ownership on the

level of corporate conservatism in Indonesia. More specifically, this study will examine whether: (1) the level

of conservatism of companies that have public debt will be higher than companies that only have private debt;

(2) conservatism of state-owned enterprise (SOE) will be lower than non-SOE companies, and (3)

conservatism of SOEs that have public debt will be higher than SOEs that do not have public debt. The

examination is done using two ways, market-price based and accrual-based. Both of these methods are used

to mitigate the bias of results due to the inefficient nature of the market. The test results show that accrual-

based measurements are better at explaining conservatism in an inefficient market such in Indonesia. Accrual-

based test results show that: (1) conservatism of companies that have public debt (bonds) is higher than

companies that only have private debt; (2) SOE conservatism is lower than non-SOE, and (3) conservatism

of SOE that have public debt is lower than SOEs that do not have public debt. The low level of SOE

conservatism is presumably due to the assumption that there is protection from the government, weak public

demand for SOE conservatism, and the absence of regulations that encourage the practice of high

conservatism in SOE.

1 INTRODUCTION

The predicted total bond issuance in Indonesia for

2017 is IDR.119.6 trillion (Gumelar, 2017). This

value is smaller than the corporate credit provided by

a state-owned bank in one quarter (BRI recorded that

it had disbursed credit of Rp. 182.1 trillion in the first

quarter of 2017 (Permana, 2017)). This shows that in

Indonesia, there are still very few companies that

issue bonds. According to IDX Book Fact 2016, there

are 104 companies that have issued bonds, and 62 of

them are public companies. Compared to the total

issuers listed on the Indonesia Stock Exchange, the

number of issuers issuing bonds is only 12% (62 out

of 533 issuers). So, it is interesting to examine

whether there are differences in characteristics

between companies that issue bonds and those that do

not issue bonds.

Bharath et al. (2008) have found evidence that

companies that have poor accounting quality tend to

prefer private debt (bank debt) over public debt

(bonds). This is consistent with the statement that

banks have superior information access and have the

ability to reduce adverse selection costs from

borrowers. In contrast to bonds, bondholders do not

have access to company internal information and also

do not have the ability to monitor and control the

company. So that bondholders need information on

timely loss recognition is higher than banks or other

private lenders (Nikolaev, 2010). Referring to Basu

(1997), the more time the company recognizes losses,

the more conservative the company is called. Because

corporate conservatism arises because of requests

from lenders, this conservatism is called conditional

conservatism.

In companies with state ownership, the

position of the manager or leader is often related to

politics or social reputation. To improve their social

and political reputation, managers will focus on short-

term performance (Cullinan et al., 2012). So it is

suspected that managers will tend to do aggressive

accounting practices, which are faster in recognizing

good news than bad (not conservative) news. Plus,

the research results of Faccio et al. (2006) found that

companies that have political relations are more often

saved when bankruptcy (bailed out) than companies

that do not have political relations. Then the

incentives of state-owned companies to engage in

Kartika Sari, D.

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence.

DOI: 10.5220/0010170800002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 153-167

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

153

conservative practices will be lower. This is

consistent with the results of the study of Chen et al.

(2010), who found that state-owned companies in

China had a lower level of conservatism than private

companies.

Based on the background above, this research

aims to empirically test whether there are differences

in conservatism between companies that have public

debt (bonds) and companies that only have private

debt (do not have bonds). This research is also wanted

to test the effect of the ownership of the state of the

accounting conservatism to see: (1) differences in

conservatism among state-owned enterprises (SOEs)

and non-state enterprises, and (2) differences in the

conservatism of SOEs that have bonds and those that

do not.

To the author's knowledge, there has been no

research comparing the conservatism of companies

that have public debt with those that only have private

debt. Previous studies have examined conservatism

and debt (Beatty et al. (2008), but have not considered

the difference in the level of conservatism of

companies that have public debt and only those with

private debt. In Indonesia, also no one has examined

the effect of state ownership on accounting

conservatism. Research on conservatism in Indonesia

has examined the relationship between conservatism

and conflict of bondholders-shareholders (Dahlia,

2004), corporate governance (Ward (2008), Weku

(2013), Hendro and Ward (2015), Kartika et al.

(2015)), quality of financial report (Fanani (2009),

Haniati and Fitriany (2010), Mutmainnah and

Wardhani (2013), and Irwanto (2015)), and corporate

social responsibility disclosure (Anis and Utama,

2016).

Previous conservatism research in Indonesia

measured conservatism only in terms of the

recognition of bad news (Weku, 2013), or of the total

value of conservatism. Both the total value of

accounting-based conservatism, namely the value of

accruals (Sari (2004), Haniati and Fitriany (2010),

Mutmainnah and Wardhani (2013), Irwanto (2015),

Kartika et al. (2015), Anis and Utama (2016)), as well

as market-based measures, namely the comparative

market value and a book value of the company

(Fanani, 2009), or both (Wardhani (2008), Hendro

and Wardhani (2015).

This research has three contributions. First, this

study seeks to provide evidence of differences in the

level of conservatism between companies that have

public debt (bonds), and companies that only have

private debt (banks). Second, this research is trying to

provide evidence of the influence of state ownership

over the different levels of conservatism companies.

Third, this research will measure conservatism both

from delaying the recognition of good news and from

the timeliness of recognition of bad news.

The first test of this study uses a conservatism

measure developed by Khan and Watts (2009). In the

operationalization of variables, conservatism Khan

and Watts (2009) use the value of return; this is done

with the assumption that the capital market in

Indonesia is efficient. To avoid the possibility of bias

in the result caused by inefficient capital markets in

Indonesia, this study also tested using an accrual-

based conservatism model developed by Ball and

Shivakumar (2005).

Furthermore, this study will describe the literature

review and hypothesis formulation, describe the data

sources and empirical models, and discuss the test

results using both the market price based model and

the accrual-based model. Finally, the conclusions and

implications of this study will be conveyed.

2 LITERATURE STUDY AND

HYPOTHESIS DEVELOPMENT

2.1 Efficient Contract Theory and

Conservatism

Efficient contract theory views the company as

organizing itself in the most efficient way, so as to

maximize the likelihood of the company to survive

(Scott, 2015). This theory studies the role of

accounting information in moderating information

asymmetry on contracting parties, resulting in

efficient contracts and stewardship.

Debt contracts are an essential source of funding

for companies. In a debt contract, there are two

aspects that must be considered. First, management

has more information about the company's condition.

Lenders are concerned about information asymmetry

because management does not share information with

them, and chooses accounting policies that can harm

the interests of lenders. So, lenders need protection

for the possibility of this happening.

Second, lenders face payoff asymmetry, where

lenders will suffer losses if the company's

performance is reduced. But unlike investors, profits

from lenders are limited to existing contracts. Thus,

lenders will better protect themselves from the

possibility of companies failing to pay.

Payoff asymmetry condition is generated

demands on conditional conservatism, where lenders

want more information on unrealized losses, rather

than information on unrealized gains because

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

154

information about unrealized losses will be more

useful in predicting defaults (Watts, 2003).

Conservatism in accounting is divided into two

(Scott, 2015), the conservatism that is unconditional

(unconditional conservatism) and conservatism that

is conditional (conditional conservatism). A

condition is considered unconditional conservatism if

the value of the asset at risk is recorded at a value

lower than the present value, even though economic

gains or losses have not yet occurred for the asset (for

example, recognition of R&D costs as an expense)

whereas conditional conservatism is a condition

where risky assets are recorded at a lower value if a

condition has occurred (for example, recording

inventories according to which value is lower

between acquisition costs and market values).

Because conservatism referred to in this study is

conservatism arising from requests for debt contracts,

what is meant by conservatism in this study is

conditional conservatism.

2.2 Debt and Conservatism

Companies can get funding from lenders in two ways,

namely through bank loans (private debt) and bonds

(public debt). Bharath et al. (2008) have examined

whether the quality of corporate accounting

influences the choice of companies in choosing

funding sources. Bharath et al. (2008) found that

companies with low accounting quality preferred

funding through private debt (bank debt). This is

because banks have more superior access to

information owned by the company, compared to the

public. Banks also have higher flexibility in

managing existing contracts (both in terms of price

(interest rate) and non-price (maturity and collateral).

So banks have the ability to reduce adverse selection

costs from borrowers.

The above advantages are not owned by

bondholders. Bondholders do not have access to

private information and also do not have the ability to

monitor and control the company. Bondholders can

only exercise control over prices (interest rates). For

this weakness, bondholders need information on

timely loss recognition (timely loss recognition) is

higher than banks or other private lenders (Nikolaev,

2010). Timely loss recognition can provide more

accurate ex-ante information to determine debt prices

and more quickly identify possible violations of debt

terms based on accounting ratios (Ball and

Shivakumar, 2005). The more timely the company

recognizes the loss, the company is said to be more

conservative (Basu, 1997). Upon this discussion, the

researchers suspect the level of conservatism of

companies that have bonds will be higher than

companies that only have private debt. We, therefore,

propose a hypothesis in an alternative form as

follows:

H

1

: Conservatism of companies that have public debt

(bonds) will be higher than the conservatism of

companies that only have private debt.

2.3 State Ownership and Conservatism

In companies with state ownership, there are two

issues that arise (Cullinan et al., 2012). First, the

ultimate owner of the company is the people as

taxpayers; this causes the ownership of the company

to be very scattered so that the control ability is

deficient. Second, managers or company leaders are

often appointed directly by the government, not

through a recruitment mechanism. Manager positions

are often related to politics or social reputation. To

improve his social and political reputation, managers

will focus on short-term performance. So it is

suspected that managers will tend to do aggressive

accounting practices, which are faster in recognizing

good news than bad (not conservative) news.

When studying lenders' demand for conservatism

in China, Chen et al. (2010) found that state-owned

companies in China had a lower level of conservatism

than private companies. They argue that this

happened because lenders were not too worried about

the possibility of a decrease in default risk of the state-

owned company. This is in accordance with the

findings of Faccio et al. (2006), who found that

companies that have political relations are more often

saved when bankruptcy (bailed out) than companies

that do not have political relations. We, therefore,

propose a hypothesis in an alternative form as

follows:

H

2a

: Conservatism of state-owned companies is lower

than the conservatism of private

companies.

If hypothesis one and hypothesis two are proven,

then we suspect that the level of conservatism of

state-owned companies that issue bonds will be

higher than state-owned companies that do not issue

bonds. This is due to the great demand for timely loss

recognition from bondholders. We, therefore,

propose a hypothesis three in an alternative form as

follows:

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

155

H

2b

: The conservatism of state-owned companies that

issue bonds are higher than the conservatism of

state-owned companies that do not issue bonds.

3 RESEARCH METHODS

3.1 Sample

The sample used in this study were all non-financial

companies on the Indonesia Stock Exchange (IDX) in

2012-2015. 2012 was chosen as the initial period of

observation because Indonesia won an investment

grade category from Fitch Ratings on 15 December

2011 and from Moody's Investor Services on 18

January 2012 (Rachman and Pamungkas, 2012).

Observation is limited until 2015 because for the

measurement of the tested variables, t-1, and t + 1

data are needed. Therefore, to meet the required data,

the companies included in the sample are companies

listed on the Indonesia Stock Exchange from 2011-

2016.

3.2 Market Price Testing (Khan and

Watts, 2009)

3.2.1 Variable Measurement

Accounting Conservatism. The conservatism in this

study is defined as how much more time the company

recognizes economic losses (lousy news) compared

to the recognition of economic benefits (good news).

To measure conservatism, this study uses a measure

developed by Khan and Watts (2009), which is the

total timeliness of news recognition (called CONS)

which is the sum of the timeliness of the recognition

of good news (called G_Score) and an increase in the

timeliness of recognition of bad news (called

C_Score).

The measure developed by Khan and Watts

(2009) was chosen as a measure of conservatism

because it can reflect the time of change in the level

of conservatism and variations in conservatism

between companies. This consideration is relevant to

the conditions in Indonesia, because the time period

since Indonesia was ranked as worthy of investment

until this research was made relatively short (six

years), and the first year the company issued bonds

also varied. The use of this measure is done with the

assumption that the capital market in Indonesia is

efficient.

Following Khan and Watts (2009), to estimate the

timeliness of acknowledging good news and

conservatism at the company-year level, we specify

G_Score each year and C_Score each year as a linear

function of the specific characteristics of the company

each year:

G_Score = 𝜇

𝜇

𝑆𝑖𝑧𝑒

𝜇

𝑀/𝐵

𝜇

𝐿𝑒𝑣

(1)

C_Score = 𝜆

𝜆

𝑆𝑖𝑧𝑒

𝜆

𝑀/𝐵

𝜆

𝐿𝑒𝑣

(2)

Where size is the natural logarithm of the market

value of equity, M / B is the market-to-book ratio, and

Lev is leverage (the amount of long-term debt and

short-term debt, divided by the market value of

equity). The estimator 𝜇

and 𝜆

, i = 1-4 are constant

for the whole company but are different for each time

because this value comes from the annual cross-

sectional regression estimation.

Whereas the annual cross-sectional regression

model used to estimate C_Score and G_Score is as

follows:

𝑋

= 𝛽

𝛽

𝐷

𝑅

𝜇

𝜇

𝑆𝑖𝑧𝑒

𝜇

𝑀/𝐵

𝜇

𝐿𝑒𝑣

𝐷

𝑅

𝜆

𝜆

𝑆𝑖𝑧𝑒

𝜆

𝑀/𝐵

𝜆

𝐿𝑒𝑣

𝛿

𝑆𝑖𝑧𝑒

𝛿

𝑀/𝐵

𝛿

𝐿𝑒𝑣

𝛿

𝐷

𝑆𝑖𝑧𝑒

𝛿

𝐷

𝑀/𝐵

𝛿

𝐷

𝐿𝑒𝑣

ɛ

(3)

Where i is the index for the company, X is the

value of earnings (net income divided by the value of

the market value of equity period t-1), R is returned

(annual returns are calculated starting from the 4th

month after the fiscal year ends), D is a dummy

variable where is one of the values of R<0 and 0 if

otherwise, and

ɛ is an error.

Company Characteristics. This study will look at

the characteristics of the company based on the type

of debt and type of company. Related to the type of

debt, it will be tested whether the company has public

debt (bonds) or not. Give a value of 1 if the company

has a Bond, and 0 if not. Regarding the type of

company, if the company is an SOE, then the SOE

variable will be given a value of 1 and given a value

of 0 if otherwise.

Control Variable. We were referring to Khan and

Watts (2009) this research also controls the age of the

company (Age), the company's uncertainty factor

(Volatility), and the company's investment cycle

(InvestCycle). The company's age (Age) believed to

affect the level of conservatism companies because

the younger company, it tends to have more choice of

asset placement, rather than the older companies.

Information asymmetry between managers and

investors will increase in accordance with the

company's growth, and future cash flow increases

tend to be difficult to verify. This can increase agency

costs, so we need a conservatism to reduce agency

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

156

problems. The older age of the company is thought to

reduce the level of conservatism.

The company's uncertainty factor (Volatility) and

the company's investment cycle (InvestCycle) are

expected to be positively related to conservatism.

This is because these two factors can cause agency

costs to increase. The higher the volatility of stock

returns and the longer the investment cycle,

increasing the difficulty in forecasting the number of

future cash flows. It also increases the likelihood of

shareholders experiencing losses, and increases the

likelihood of experiencing litigation, thereby

increasing the demand for conservatism. Volatility is

measured using standard deviations from monthly

stock returns. And InvestCycle is measured by

dividing the value of depreciation expense by the

value of lagged assets (the smaller the value of

InvestCycle indicates the longer investment cycle).

3.2.2 Research Model

To test Hypothesis 1 and Hypothesis 2a proposed, this

study uses the following research model equations:

𝐶𝑂𝑁𝑆

𝛽

𝛽

𝐵𝑜𝑛𝑑

𝛽

𝑆𝑂𝐸

𝛽

𝐴𝑔𝑒

𝛽

𝑉𝑜𝑙𝑎𝑡𝑖𝑙𝑖𝑡𝑦

𝛽

𝐼𝑛𝑣𝑒𝑠𝑡𝐶𝑦𝑐𝑙𝑒

𝜀

(

4

)

Where:

CONS = addition of G_Score and C_Score values.

Bond = dummy variable, given a value of 1 if the

company has bonds, and 0 otherwise.

SOE = dummy variable, given a value of 1 if it is an

SOE company, and 0 otherwise.

Age = company age .

Volatility = standard deviation of monthly stock

returns.

InvestCycle = depreciation expense value divided by

the value of lagged assets.

If hypothesis 1 and hypothesis 2a are proven, this

research expects 𝛽

positive and negative values for

𝛽

.

Specifically, for hypothesis 2b, regression testing

uses model (5) and only uses SOE companies as

samples.

𝐶𝑂𝑁𝑆

𝛽

𝛽

𝐵𝑜𝑛𝑑

𝛽

𝐴𝑔𝑒

𝛽

𝑉𝑜𝑙𝑎𝑡𝑖𝑙𝑖𝑡𝑦

𝛽

𝐼𝑛𝑣𝑒𝑠𝑡𝐶𝑦𝑐𝑙𝑒

𝜀

(

5

)

The description of the variable has been explained in

the explanation of the model (4). If hypothesis 2b is

proven, this research expects a 𝛽

positive value.

3.3 Accrual based Testing (Ball and

Shivakumar, 2005)

Ball and Shivakumar (2005), based on a model

developed by Basu (1997), developed a model that

can measure the level of conservatism of private

companies. The Ball and Shivakumar (2005) model

would be suitable if the research assumes that the

capital market in Indonesia is not an efficient market

so that not all gains and losses experienced by a

company are reflected in the value of the company's

stock market price. The Ball and Shivakumar (2005)

models referred to are as follows:

𝐴𝐶𝐶

𝛽

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂

𝛽

𝐶𝐹𝑂

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

(6)

Where ACC

it

is the current period's accrual value

divided by the market value of the company at the

beginning of the period ( initial market value of equity

- MVE

t-1

), CFO

it

is cash flow from operational

activities divided by MVE

t-1

, and NEGCFO

it

is

dummy variable, which is worth one if the value of

the CFO

it

is less than zero.

Ball and Shivakumar (2005) argue that if the

influence of cash flows on persistent current news,

timely recognition will be the cause of a positive

relationship between accruals and current period cash

flows. The difference in recognition time between

losses and profits caused by conservatism applied by

the company, causing a positive relationship between

cash flow and accruals, will be more substantial for

the recognition of losses rather than profits. In

accordance with the hypothesis, Ball and Shivakumar

(2005) found a negative correlation between accruals

and operating cash flow, current cash flow is negative

(β

3

> 0). While the coefficient β

3

indicates the

timeliness of the company recognizing bad news

(losses), the coefficient β

2

indicates the timeliness of

the company recognizing good news (profit).

3.3.1 Research Model

To test Hypothesis 1 and Hypothesis 2a, using

accrual-based conservatism models (Ball and

Shivakumar, 2005), the research models tested are as

follows:

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

157

𝐴𝐶𝐶

𝛽

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂

𝛽

𝐶𝐹𝑂

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

𝛽

𝐵𝑂𝑁𝐷

𝛽

𝑆𝑂𝐸

𝛽

𝑆𝐼𝑍𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐵𝑂𝑁𝐷

𝛽

𝐶𝐹𝑂 ∗ 𝐵𝑂𝑁𝐷

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

∗ 𝐵𝑂𝑁𝐷

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝑆𝑂𝐸

𝛽

𝐶𝐹𝑂 ∗ 𝑆𝑂𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

∗𝑆𝑂𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝑆𝐼𝑍𝐸

𝛽

𝐶𝐹𝑂 ∗ 𝑆𝐼𝑍𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

∗𝑆𝐼𝑍𝐸

𝜀

(7)

Where:

ACC = current period accrual value.

CFO = cash flow from operational activities.

NEGCFO = dummy variable, which is worth one if

the value of the CFO

is less than zero.

BOND = dummy variable, given a value of 1 if the

company issued BOND, and 0 if otherwise.

SOE = dummy variable, given a value of 1 if it is an

SOE company, and 0 if otherwise.

SIZE = company size.

If the hypothesis is proven, then this research expects

𝛽

positive and 𝛽

negative values.

Specifically, for hypothesis 2b, regression testing

uses model (8) and only uses SOE companies as

samples.

𝐴𝐶𝐶

𝛽

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂

𝛽

𝐶𝐹𝑂

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

𝛽

𝐵𝑂𝑁𝐷

𝛽

𝑆𝐼𝑍𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐵𝑂𝑁𝐷

𝛽

𝐶𝐹𝑂 ∗ 𝐵𝑂𝑁𝐷

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

∗ 𝐵𝑂𝑁𝐷

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝑆𝐼𝑍𝐸

𝛽

𝐶𝐹𝑂 ∗ 𝑆𝐼𝑍𝐸

𝛽

𝑁𝐸𝐺𝐶𝐹𝑂 ∗ 𝐶𝐹𝑂

∗𝑆𝐼𝑍𝐸

𝜀

(

8

)

The variable description has been explained in the

explanation of the model (7). If the hypothesis is

proven, then this research expects a 𝛽

positive value.

In accordance with Ball and Shivakumar (2005),

this study also exerted control over company size

(SIZE). The larger size of the company is expected to

report losses faster than smaller companies. This is

because there is a higher risk of litigation, or because

of different types of agency fees. SIZE value is

obtained from the logarithm of the market value of

the company's equity.

3.4 Data Processing

This study uses a balanced panel data structure,

where the sample is selected based on the

completeness of the data and also the sample

selection criteria that refer to previous research. The

use of a balanced panel data structure allows this

study to use the FGLS panel data estimator. As for the

structure of the model, this research can use the

structure of the collective effect/pooled model, fixed

effects, or random effects. The choice of model to use

depends on the best test results.

Because this study uses the FGLS data estimator,

it is no longer relevant to meet classical assumptions

(Ekananda, 2016). The FGLS estimation process,

although not the minimum value of the variance (not

the best - best), is still linear and has an unbiased

parameter estimator (linear unbiased estimator).

4 RESEARCH RESULTS AND

ANALYSIS

4.1 Sample Selection Results

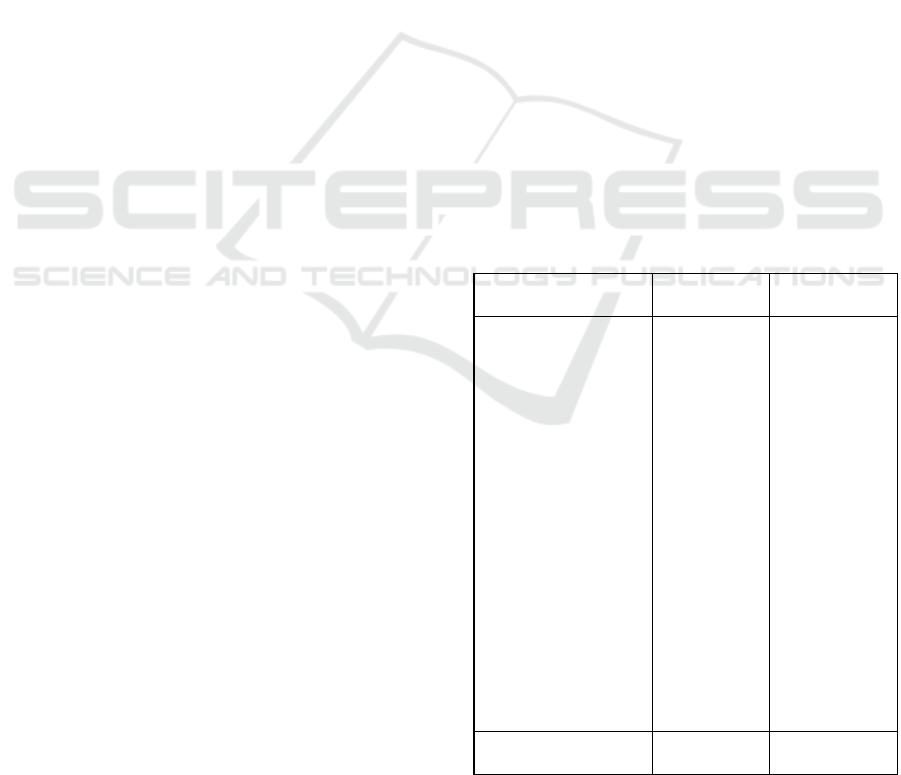

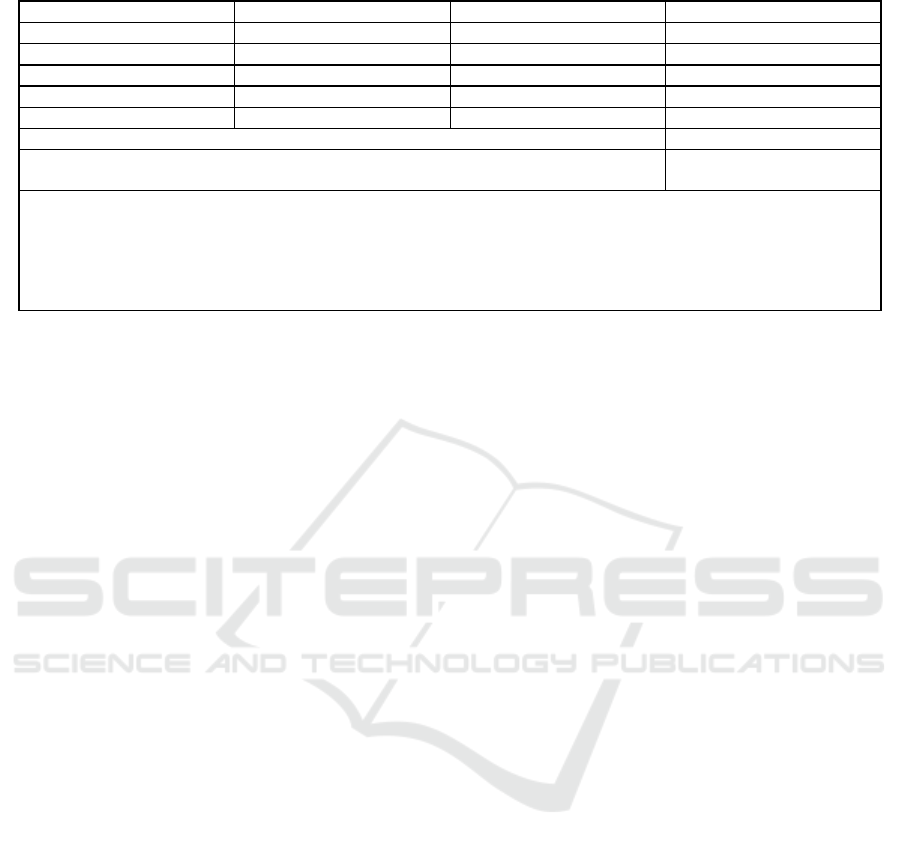

Table 1: Sample Selection Procedure

Sample Criteria Number of

Companies

Number of

observations

Registered on the

Indonesian Stock

Exchange in 2012 -

2015

Reduced by:

Data incomplete

Included in the

financial

industry

Has no private

and/or public

debt

Has a non-

December

reporting period

end

Has a negative

asset or negative

book value of

e

q

uit

y

549

(124)

(70)

(130)

(5)

(8)

2,196

(496)

(280)

(520)

(20)

(32)

The number of final

observations

212 848

Source: processed data

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

158

The sample criteria used in this study are as

follows: (1) companies listed on the Indonesia Stock

Exchange in 2011-2016; (2) has complete data

needed; (3) does not include the financial industry;

(4) has private and/or public debt; (5) has a book year

ending in December; and (6) has no negative asset

value or equity book value.

The financial industry is excluded from the

sample because of the nature of the composition of

financial statements that is different from other

industries, so it cannot be compared. A summary of

sample selection can be seen in Table 1.

4.2 Descriptive Statistics and

Correlation Test

The descriptive statistical analysis aims to provide a

simple description of the data and the results of the

research conducted. Table 2 panel A shows

descriptive statistics for the variables tested using

market-based testing. Table 2 panel A shows that the

average level of firm conservatism is negative. This

is because many sample companies experience

negative returns. So as an initial guess, the sample

company is suspected of having admitted bad news

(losses ) in a timely manner.

Table 2 panel A also shows that 17% of the

sample companies have public debt (bonds), and 5%

of the sample companies are state-owned companies.

Regarding the age of the company, it can be seen that

the age of the sample companies varies significantly

from the youngest age of 3 years to the oldest 198

years (Kimia Farma Tbk. Company has been

established since the Dutch colonial era) while the

value of volatility shows that the average monthly

return of the sample company is worth 0.12. The

Investment Cycle value of the sample companies also

looks very varied, ranging from 0.00 to 10.35, with

an average value of 5%.

Whereas for accrual-based testing variables can

be seen in Table 2 panel B. The table shows that the

average value of the sample company accruals is

negative 0.07.

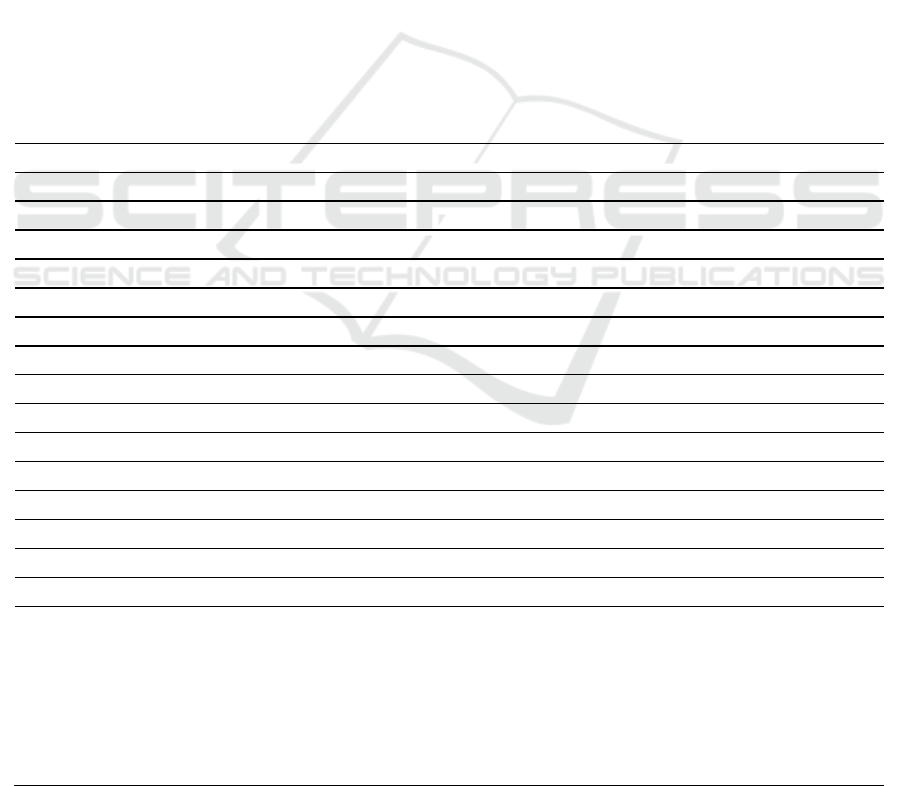

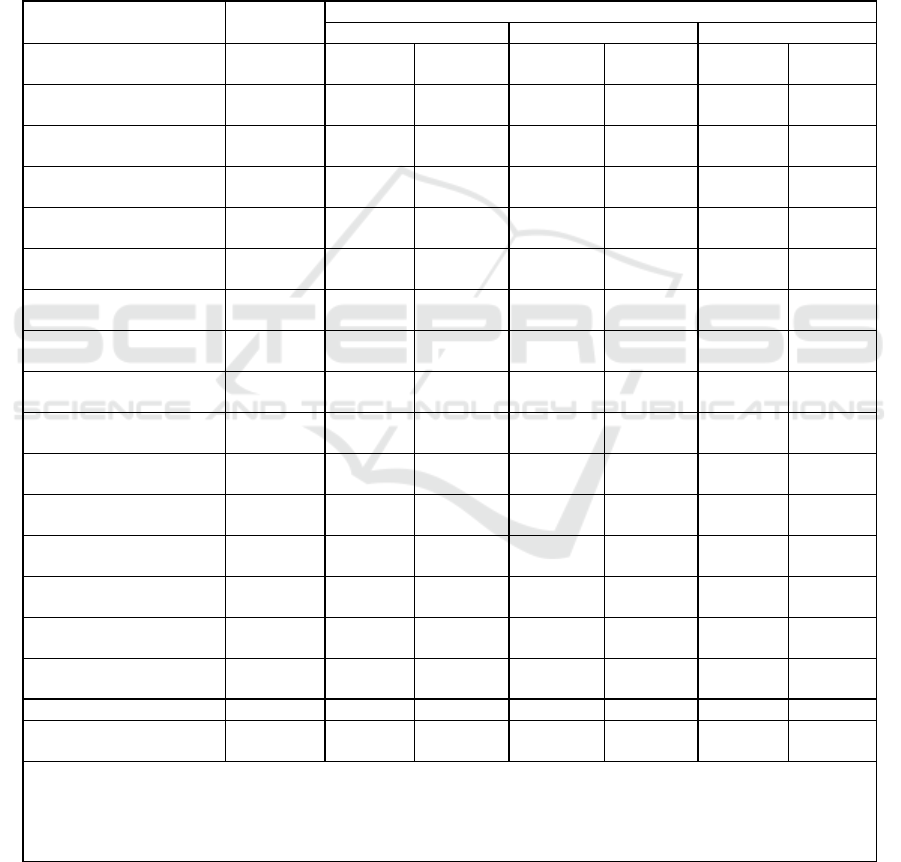

Table 2: Descriptive Statistics for Variables Tested During the Observation Period

Panel A: Marke

t

-

b

ased testing

Variable The mean Media

n

Maximum Minimu

m

Std. Dev

CONS -0.77 -0.20 10,43 -12.03 2.46

BOND .17 0.00 1,00 0.00 0.38

SOE 0.05 0.00 1,00 0.00 0.23

AGE 31.54 29.00 198.00 3.00 19.96

VOLATILITY 0.12 .10 .84 0.00 0.08

INVESTCYCLE 0.05 0.03 10,35 0.00 .36

Panel B: Accrual-

b

ased testing

Variable The mean Media

n

Maximum Minimu

m

Std. Dev

ACC -0.07 -0.02 6.14 -4.81 0.56

NEGCFO 0.22 0.00 1.00 0.00 0.41

CFO 0.13 0.06 6.87 -4.89 0.53

BOND 0.16 0.00 1.00 0.00 0.37

SOE 0.05 0.00 1.00 0.00 0.23

SIZE 28.0 9 27.99 33.37 23.66 1.97

N = 848 observations

CONS = company conservatism level, is the sum of the values of G_Score and C_Score; BOND = 1 if the company has

public debt, and zero if otherwise; SOE = value 1 if the company is a state-owned company (SOE), and zero if otherwise:

Age = age of the company; VOLATILITY = the level of volatility of the company, is the standard deviation of the monthly

stock return ; INVESTCYCLE = the company's investment cycle, calculated from the value of depreciation expense divided

by the value of lagged assets.

ACC = current accrual value ; NEGCFO = value 1 if the value of CFO is less than zero, and zero if otherwise, CFO = cash

flow from operational activities; BOND = value 1 if the value of the company issues bonds, zero if otherwise; SOE = 1 value

if the company is a SOE company. SIZE = firm size control variable.

Source: processed data

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

159

As many as 22% of the sample had a CFO that the

company is negative, 16.5% of companies sampled

had a bond (bond), and the number of state-owned

enterprises only 5.6% of the total sample. SIZE data

also shows that company size is relatively

homogeneous, that is, large companies.

Correlation test results between independent

variables based on market price testing can be seen in

Table 3. In the table, it appears that each variable

tested has a correlation with other tested variables

with an average value below 0.5. This indicates that

the independent variables tested were free from

colinearity problems. For the results of the correlation

test, independent variables used in accrual-based

testing can be seen in the Appendix.

4.3 Hypothesis Testing

4.3.1 Market-based Testing (Khan and

Watts, 2009)

Hypothesis Testing 1 (H

1

). The results of the

empirical regression model to test whether the

conservatism of companies that have public debt

(bonds) is higher than the conservatism of companies

that only have private debt can be seen in Table 4

section A. The table shows that the value of the F-

statistic equation has a Prob. (F-statistic) which is

significant, i.e., 0,000. This shows that the

independent variables tested together significantly (α

= 1%) affect the dependent variable (CONS).

Adjusted R-squared of 14,4% means that the number

of CONS can be explained by the independent

variables tested by 14,4%, while the remaining 84.6%

is explained by other variables not discussed in this

study.

Table 4 section A also shows that companies that

issue bonds (have public debt) have lower

conservatism than companies that only have private

debt. Conservatism is shown by the timely

recognition of losses. This can be seen from the value

of the BOND coefficient, which shows a negative

direction with a level of confidence (α = 1%). Despite

having significant value, but the test results did not

show support for the proposed hypothesis 1 (H

1

rejected).

The Volatility and InvestCycle coefficients also

have a negative and significant direction (as opposed

to the prediction direction). This shows that the higher

the uncertainty factor and the company's investment

cycle was not responded to by the high conservatism

practices of the company.

The results that are contrary to the hypotheses and

prediction of the proposed direction may occur for

several reasons. First, banks or lenders of private debt

are more stringent in overseeing financial reporting,

so companies that only have private debt will be more

conservative. Second, there is no demand for

conservatism from the public. Referring to the results

of Bushman and Piotroski's research (2006), the

demand for conservatism is influenced by hereditary

and political-economic factors in a country. Bushman

and Piotroski's (2006) research using data from La

Porta (1999) and La Porta (2003) shows that the legal

system and law enforcement in Indonesia tend to

below. This has led to low public demand for

conservatism in Indonesia. Low demand causes

companies to tend to be not conservative.

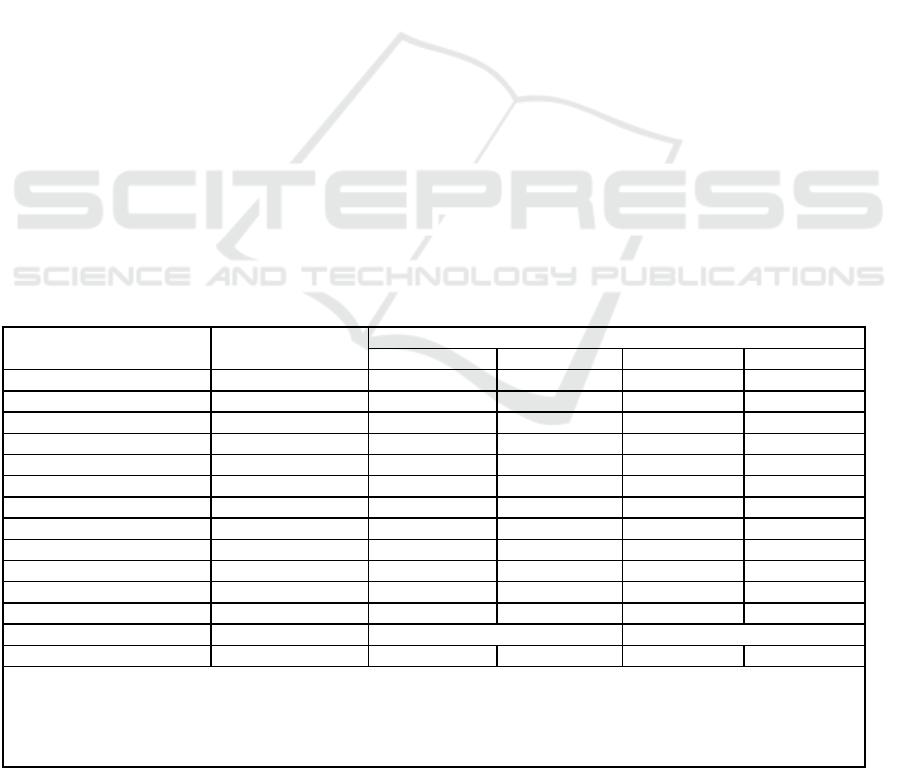

Table 3: Correlation Test for Variables Tested During the Observation Period (Market-Based Testing)

CONS BOND SOE AGE VOLATILITY INVESTCYCLE

CONS 1.00

BOND -0.11 1.00

SOE -0.11 0.22 1.00

AGE -0.05 0.11 0.43 1.00

VOLATILITY -0.01 -0.06 -0.03 -0.05 1.00

INVESTCYCLE -0.08 -0.01 -0.01 -0.04 0.07 1.00

N = 848 observations

CONS = company conservatism level, is the sum of the values of G_Score and C_Score; BOND = 1 if the company has public

debt, and zero if otherwise; SOE = value 1 if the company is a state-owned enterprise (SOE), and zero if otherwise; Age =

company age; VOLATILITY = the level of volatility of the company, is the standard deviation of the monthly stock return ;

INVESTCYCLE = the company's investment cycle, calculated from the value of depreciation expense divided by the value

of lagged assets.

Source:

p

rocessed data

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

160

Third, the use of return value in conservatism

measurement (CONS) is done with the assumption

that the capital market in Indonesia is efficient, where

changes in the company's stock market price will

reflect all losses and profits experienced by the

company. However, if the capital market in Indonesia

is not efficient, then this measurement will lead to

bias in the test results. To overcome this problem, an

alternative conservatism measurement technique will

be tested using an accrual-based conservatism

measure developed by Ball and Shivakumar (2005).

Hypothesis Testing 2a (H

2a

). The results of the

empirical regression model to test the differences in

conservatism between SOE and non-SOE companies

can be seen in Table 4 section B. The table shows that

the F-statistic test results have a significant Prob. (F-

statistic), which is 0,000. This shows that the

independent variables tested together significantly (α

= 1%) affect the dependent variable (CONS). The

adjusted R-squared value of 14,4% indicates that the

CONS amount can be explained by the independent

variables tested by 14.4%, while the remaining 85.6%

is explained by other variables that are not addressed

in this study.

Table 4 section B also shows that SOE companies

have lower conservatism than private companies.

Conservatism is shown by the timely recognition of

losses. This can be seen from the value of the

coefficient of SOE, which shows a negative direction

with a level of confidence (α = 5%). The results show

support for the proposed hypothesis 2a (H

2a

received).

Table 4 section C shows the results of regression

testing if the characteristics of companies that have

bonds and state-owned companies are tested together.

The results of joint testing show that the results of

testing hypotheses one and 2a are consistent; this can

be seen from the value of the BOND coefficient

(SOE), which has a negative direction (positive) and

remains significant with a confidence level of 1%

(5%).

Hypothesis Testing 2b (H

2b

). Hypothesis 2b wants

to test whether SOE companies that have bonds will

have a higher level of conservatism than SOE

companies that do not have public debt (bonds) and

only have private debt. The test results can be seen in

Table 5.

The test results in Table 5 show that the value of

the F-statistic equation has a Prob. (F-statistic) of

0.478. This shows that the model being tested is not a

good model. The adjusted R-squared also shows the

value of -0.0095, meaning that the amount of CONS

cannot be explained by the independent variables

tested. There may be other variables that affect the

CONS value but have not been considered in this

study.

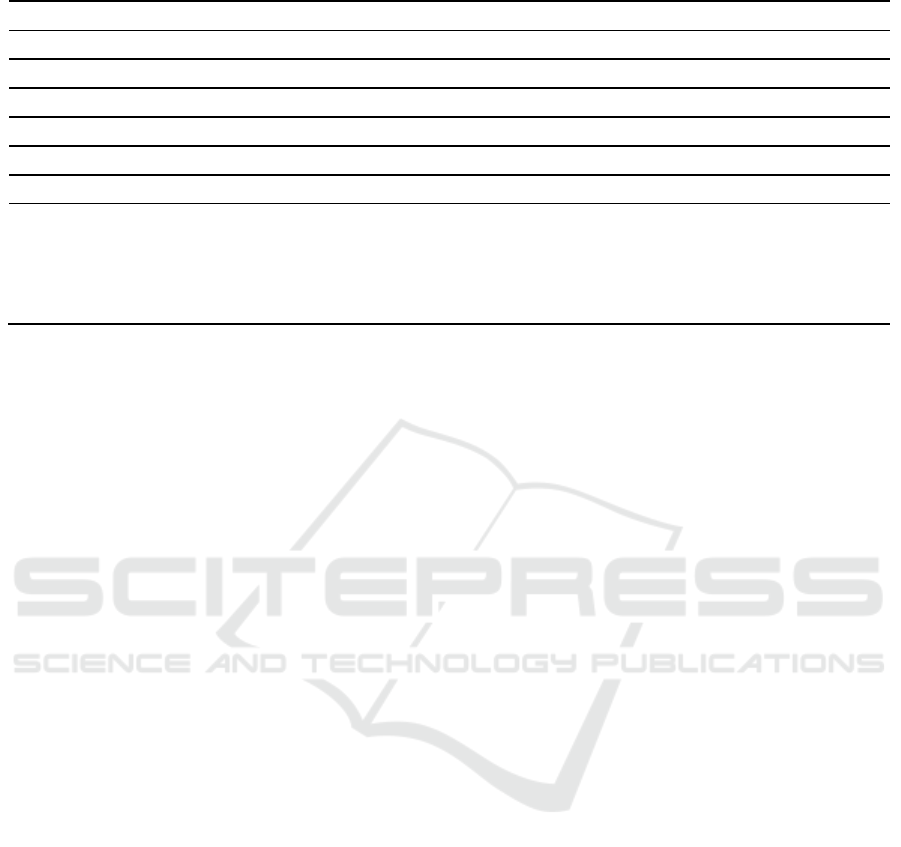

Table 4: Empirical Model Regression Results Testing Hypothesis 1 and Hypothesis 2a (Market-Based Testing)

Variable Prediction CONS

AB C

Coefficien

t

Prob. Coefficient Prob. Coefficien

t

Prob.

C ? -0.086 (0.4830) -0,225 (0.0807) -0,159 (0.2088)

BOND (+) -0.658 ( 0.0002)

a

-0,581 (0, 0008)

a

SOE

(

-

)

-0,937

(

0, 0138

)

b

-0,818

(

0, 0365

)

b

AGE (+) -0.003 (0.2911) -0,001 (0.7051) -0,000 (0.8472)

VOLATILITY (+) -0,937 ( 0.0649)

c

-0,749 (0.1491) -0,871 (0, 0858)

C

INVESTCYCLE (+) -0,576 ( 0.0000)

a

-0,570 (0, 0000)

a

-0,573 (0, 0000)

a

Ad

j

.R

2

.144 .144 .150

F-Stat

Prob.

(

F-Stat

)

36,639

(

0.0000

)

36,639

(

0.0000

)

38,439

(

0.0000

)

N = 848 observations

CONS = company conservatism level, is the sum of the values of G_Score and C_Score; BOND = 1 if the company has public

debt, and zero if otherwise; SOE = value 1 if the company is a state-owned enterprise (SOE), and zero if otherwise; Age =

company age; VOLATILITY = the level of volatility of the company, is the standard deviation of the monthly stock return;

INVESTCYCLE = the company's investment cycle, calculated from the value of depreciation expense divided by the value

of lagged assets.

Where:

a

si

g

nificant 1%;

b

si

g

nificant 5%;

c

si

g

nificant 10%

Source: processed data

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

161

4.3.2 Accrual based Testing (Ball and

Shivakumar, 2005)

Hypothesis Testing 1 (H

1

). The results of the

empirical model regression equation (7) to test the

effect of bond issuance on the level of corporate

conservatism can be seen in Table 6 section A. In the

table it appears that the amount of adjusted R-squared

between models that include control variables, with

those that do not include control variables shows that

the adjusted R-squared value is higher for models that

include control variables. This model also has an

adjusted R-squared is much higher than the

hypothesis test 1 that using the model equation (4).

Tests that include control variables show an

adjusted R-squared value of 80.8%. This means that

the amount of ACC can be explained by the

independent variables tested by 80.8%, while the

remaining 19.2% is explained by other variables not

discussed in this study.

Table 6 section A also shows that companies that

issue bonds (have public debt) have higher

conservatism than companies that only have private

debt. Conservatism is shown by the timely

recognition of losses. This can be seen from the

coefficient of NEGCFO*CFO*BOND, which shows

a positive direction with a level of confidence (α =

5%), and when entering the control variable, the level

of confidence increases to (α = 1%). The results show

support for the proposed hypothesis (H

1

). The results

of this test are the opposite of the results of hypothesis

1, which were tested using equation (4). With a higher

adjusted R-squared value, it is assumed that the

equation model (7) is better in explaining

conservatism in Indonesia.

Although not presented in a hypothesis, the test

results in Table 6 section A also show that in addition

to the timely recognition of losses, the conservatism

of companies that have public debt is also done

through delaying the recognition of good news

(profits). This can be seen from the coefficient of the

variable CFO*BOND, which has a negative direction

with a significant level of confidence (α = 1%).

Hypothesis Testing 2a (H

2a

). The results of the

empirical regression model to test the differences in

conservatism between SOE and non- SOE companies

can be seen in Table 6 section B. The table shows that

the F-statistic test results have a significant Prob. (F-

statistic), which is 0,000. This shows that the

independent variables tested together significantly (α

= 1%) affect the dependent variable (ACC). Same

with the H

1

test results, the adjusted R-squared

quantity for the model that includes the control

variable shows the adjusted R-squared value is higher

than the model that does not enter the control

variable. The adjusted R-squared model value of

equation (7) is also higher than the equation model

(4).

The test that included the control variable showed

an adjusted R-squared value of 81.1%. This means

that the amount of ACC can be explained by the

independent variables tested by 81.1%, while the

remaining 18.9% is explained by other variables not

discussed in this study.

Table 6, part B, also shows that SOE companies

have lower conservatism than private companies.

Conservatism is shown by the timely recognition of

losses. This can be seen from the coefficient of

NEGCFO*CFO*SOE that shows a negative direction

with a level of confidence (α = 5%). But when

entering the control variable, this value becomes

insignificant. The results showed moderate support

for the hypothesis (H

2a

).

Table 5: Results of Regression Empirical Model Hypothesis Testing 2b (Market-Based Testing)

Variable Predictio

n

Coefficien

t

Prob.

C ? -0 , 874 0 , 5379

BOND (+) 0 , 161 0 , 8196

AGE

(

+

)

0 , 004 0 , 4995

VOLATILITY (+) -1 , 804 0 , 8435

INVESTCYCLE (+) -29 , 34 0 , 1076

Ad

j

. R-s

q

uare

d

-0.0095

F-Stat.

Prob. (F-Stat.)

0.8898

(0.478)

N = 48 observations

CONS = company conservatism level, is the sum of the values of G_Score and C_Score; BOND = 1 if the company has

public debt, and zero if otherwise; Age = company age; VOLATILITY = the level of volatility of the company, is the

standard deviation of the monthly stock return ; INVESTCYCLE = the company's investment cycle, calculated from the

value of depreciation expense divided by the value of lagged assets.

Where:

a

si

g

nificant 1%;

b

si

g

nificant 5%;

c

si

g

nificant 10%

Source: processed data

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

162

Regarding the recognition of good news (profits),

Table 6, section B shows that SOE companies also

recognize profits more slowly than private

companies. This can be seen from the coefficient of

the CFO*BOND variable, which has a negative

direction with a significance level of confidence (α =

5%) and increases to (α = 1%) when it has entered the

control variable.

Table 6 section C shows the results of regression

testing if the characteristics of companies that have

bonds and state-owned companies are tested together.

The results of the joint test show that the results of

hypothesis 1 testing are consistent because the value

of the NEGCFO*CFO*BOND coefficient is positive

and remains significant with a confidence level of 5%

and 1% (if entering control variables). Likewise, with

the results of hypothesis 2a, it still looks consistent.

Namely, the conservatism value of SOE companies is

moderately lower than that of private companies.

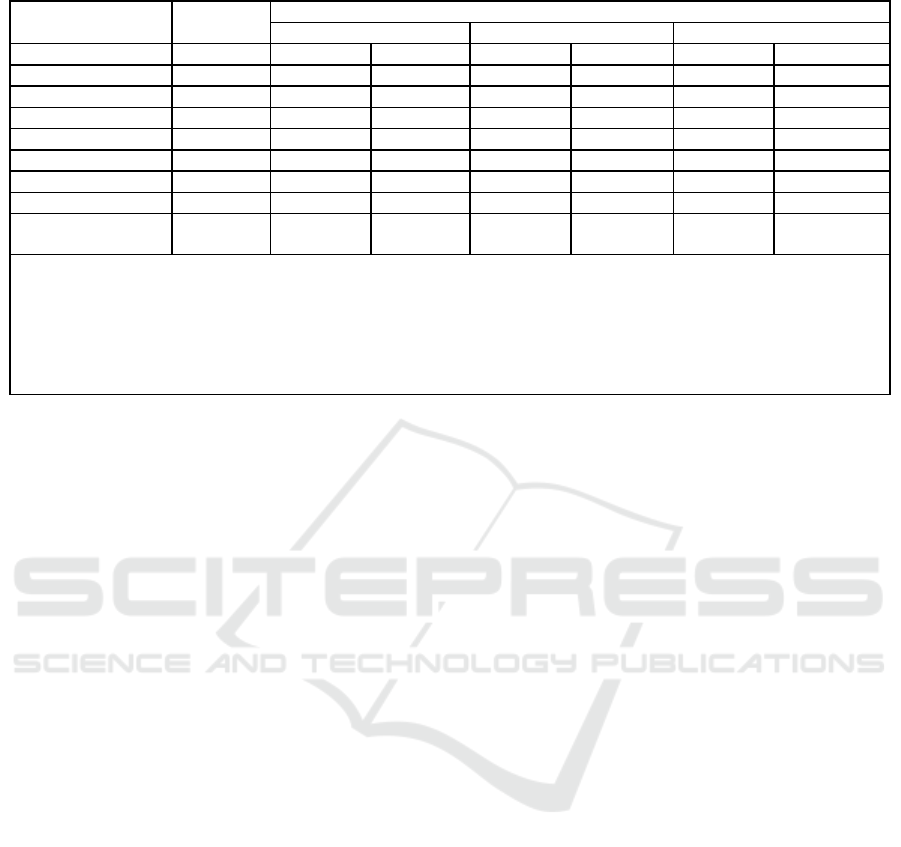

Table 6: Empirical Model Regression Results Testing Hypothesis 1 and Hypothesis 2a (Accrual Based Testing)

Variable Prediction ACC

ABC

C ? 0,002

(0,501)

0,195

(0,000)

a

0,005

(0,104)

0,152

(0,004)

a

0,001

(0 ,632)

0,194

(0,000)

NEGCFO ? 0,003

(0,655)

-0,067

(0,660)

0,004

(0,468)

-0,377

(0,003)

a

0,005

(0 ,501)

-0,079

(0, 606)

CFO (-) -0,686

(0,000)

a

-4,520

(0 ,000)

a

-0,684

(0,000)

a

-4,462

(0,000)

a

-0,686

(0,000)

a

-4 , 496

(0,000)

a

NEGCFO*CFO (+) -0,400

(0,000)

a

5,067

(0,000)

a

-0,379

(0,000)

a

2,637

(0,003)

a

-0,399

(0,000)

a

4 , 978

(0,000)

c

BOND ? 0,039

(0,000)

a

0,041

(0,000)

a

0,036

(0,000)

a

0,035

(0,000)

a

NEGCFO*BOND ? 0,033

(0,118)

0,045

(0,123)

0,036

(0,090)

c

0,050

(0,086)

c

CFO*BOND (-) -0,130

(0,001)

a

-0,383

(0,000)

a

-0,115

(0,015)

-0,338

(0,000)

a

NEGCFO*CFO*BOND (+) 0,521

(0,040)

b

0,979

(0,000)

a

0,612

(0,026)

b

1,026

(0,000)

a

SOE ? 0,029

(0,000)

a

0,029

(0,005)

a

0,028

(0,044)

b

0 ,035

(0,029)

b

NEGCFO*SOE ? -0,216

(

0,001

)

a

-0,230

(

0,000

)

a

-0,215

(

0,006

)

c

-0 ,205

(

0,008

)

a

CFO*SOE (+) -0,086

(0,067)

c

-0,292

(0,020)

b

-0,120

(0,240)

-0,245

(0 ,161)

NEGCFO*CFO*SOE (-) -0,678

(

0,018

)

b

-0,540

(

0,167

)

-0,917

(

0,038

)

b

-0 ,715

(

0,172

)

SIZE ? -0,007

(

0,000

)

-0,005

(

0,003

)

a

-0,007

(

0,002

)

a

NEGCFO * SIZE ? 0,002

(

0,637

)

0,014

(

0,002

)

a

0,003

(

0,577

)

CFO * SIZE ? 0,144

(0,000)

0,141

(0,000)

a

0,143

(0,000)

a

NEGCFO * CFO * SIZE ? -0,206

(

0,000

)

-0,112

(

0,001

)

a

-0,203

(

0,000

)

a

Adj.R

2

0,796 0,808 0 ,794 0,811 0,796 0,807

F-Stat

Prob. (F-Stat)

474,899

(0,000)

325,997

(0,000)

467,145

(0,000)

332,226

(0 ,000)

303,051

(0,000)

236,546

(0,000)

N = 848 observations

ACC = current accrual value ; NEGCFO = value 1 if the value of CFO is less than zero, and zero if otherwise, CFO =

cash flow from operational activities; BOND = value 1 if the value of the company issues bonds, zero if otherwise; SOE

= 1 value if the company is a SOE company. SIZE = firm size control variable.

Where:

a

significant 1%;

b

significant 5%;

c

significant 10%

Source:

p

rocessed data

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

163

Hypothesis Testing 2b (H

2b

).Hypothesis 2b wants to

test whether SEO companies that have bonds will

have a higher level of conservatism than SOE

companies that do not have public debt (bonds) and

only have private debt. The test results can be seen in

Table 7.

The test results in Table 7 show that the value of

the F-statistic equation has a significant Prob. (F-

statistic), which is 0,000. This shows that the

independent variables tested together significantly (α

= 1%) affect the dependent variable (ACC). However,

the amount of adjusted R-squared between models

that include a control variable, and those that do not

include a control variable indicates that the adjusted

R-squared value is higher for models that do not

include a control variable. Tests that did not include a

control variable showed an adjusted R-squared value

of 46.4%. This means that the amount of ACC can be

explained by the independent variables tested by

46.4%, while the remaining 53.6% is explained by

other variables not discussed in this study.

Table 7 also shows that SOE companies that issue

bonds have a lower level of conservatism than SOE

companies that do not have public debt and only have

private debt. This can be seen from the coefficient of

the NEGCFO*CFO*BOND variable, which is

harmful and significant, with a level of confidence (α

= 1%). Therefore, hypothesis 2b is rejected.

The higher level of conservatism of state-owned

companies issuing public debt compared to only

having private debt, allegedly due to weak demand

for conservatism in Indonesia. In accordance with the

results of Bushman and Piotroski's research (2006),

the demand for conservatism is influenced by

hereditary and political-economic factors in a

country. The research of Bushman and Piotroski

(2006) states that the legal system (civil law) and the

level of law enforcement in Indonesia are weak.

Therefore the demand for conservatism in Indonesia

is also weak.

Considering the results of the study of Chen et al.

(2010) where state-owned companies will have deep

conservatism due to government guarantees, and the

results of Bushman and Piotroski's research (2006)

which show that demand for conservatism in

Indonesia is low, then the low level of conservatism

offered by state-owned companies that have public

debt will be included reason. The public prefers high

returns from SOE companies, so SOE companies do

not need to be conservative.

SOE Minister's Decree No. KEP-100/MBU/2002,

regarding the assessment of the health rate of SOE,

also shows that there are no indicators for evaluating

the health rate of SOE for financial aspects that

consider the company's ability to pay its debts. The

highest weighting indicator for the financial aspect is

the return to shareholders/Return on Equity (ROE),

followed by the return on investment (ROI). This

further weakens management's incentives to conduct

conservative financial reporting practices,

Table 7: Results of Regression Empirical Model Hypothesis Testing 2b (Accrual Based Testing)

Variable Prediction ACC

Coef. Prob. Coef. Prob.

C ? 0,061 0,179 -0,413 0,644

NEGCFO ? -0,072 0,496 6,240 0,160

CFO

(

-

)

-1,152 0,003 2,770 0,643

NEGCFO*CFO (+) 1,166 0,254 33,550 0,363

BOND ? -0,040 0,499 -0,054 0,392

NEGCFO*BOND ? -0,457 0,010 -0,332 0,087

CFO*BOND (-) 0,538 0,252 0,757 0,195

NEGCFO*CFO*BOND (+) -3,304 0,006

a

-3,642 0,009

a

SIZE 0,016 0,590

NEGCFO*SIZE -0,213 0,156

CFO*SIZE -0,135 0,509

NEGCFO*CFO*SIZE -1,080 0,390

Ad

j

.R

2

0,464 0,457

F-Stat 6,832 (0,000) 4,602 (0,000)

N = 48 observations

ACC = current accrual value ; NEGCFO = value 1 if the value of CFO is less than zero, and zero if other, CFO = cash

flow from operational activities; BOND = value 1 if the value of the company issues bonds, zero if other; SIZE = firm

size control variable.

Where:

a

significant 1%;

b

significant 5%;

c

significant 10%

Source:

p

rocessed data

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

164

And can encourage aggressive financial reporting

practices.

5 CONCLUSIONS

This research aims to empirically test whether there

are differences in conservatism between companies

that have public debt (bonds) and companies that only

have private debt (do not have bonds). This study also

wants to examine the effect of state ownership on

accounting conservatism by looking at: (1)

differences in conservatism between state-owned

(SOE) and non-SOE companies, and (2) differences

in SOE conservatism with bonds and non-bonds.

This research has three contributions. First, this

study seeks to provide evidence of differences in the

level of conservatism between companies that have

public debt (bonds), and companies that only have

private debt (banks). Second, this study seeks to

provide evidence of the influence of state ownership

on differences in the level of corporate conservatism.

Third, this research will measure conservatism both

from delaying the recognition of good news and from

the timeliness of recognition of bad news.

In testing, this study uses two ways, namely

market-based testing (Khan and Watts, 2009) and

accrual-based testing (Ball and Shivakumar, 2005).

Two methods are used because of concerns the capital

market in Indonesia is not efficient.

The results of the two types of tests above give

inconclusive results. The results of accrual-based

testing (Ball and Shivakumar, 2005) show that the

adjusted R-squared value is much higher than the

results of market-based testing. This shows that the

variables tested in the accrual-based model can

explain conservatism in Indonesia better than the use

of market-based models. Henceforth the conclusions

of this study will be submitted based on the results of

accrual-based testing.

The test results show that hypothesis 1 is accepted

(conservatism of companies that have public debt is

higher than companies that only have private debt).

Hypothesis 2a is accepted moderately (because when

entering the control variable, the coefficient value

tested becomes insignificant). And hypothesis 2b is

rejected (conservatism of SOEs that issue public debt,

lower than SOE companies that do not have public

debt).

The moderate acceptance of hypothesis 2a and the

rejection of hypothesis 2b allegedly because the

public strongly believes that the government will

guarantee or provide support to SOEs so that SOE

companies do not really need conservatism.

The implication of the research shows that the

existence of bonds shows that the company will be

more conservative, but if the issuing of bonds is an

SOE company, the issue of conservatism is not so

important. This is due to the possibility of guaranteed

survival from the government and also regulations

that do not encourage the implementation of

conservatism.

The limitation of this research is that there has not

been a stability test or model selection. Future studies

should conduct this test in order to get the best testing

model. This study also has not analyzed the behavior

of conservatism based on G_Score and C_Score

components. Future studies should do this in order to

get a more comprehensive understanding.

ACKNOWLEDGMENTS

I would like to thank Prof. Sidharta Utama and Dr.

Sylvia Veronica N.P.S. for their valuable input and

also for the Accounting and Audit Laboratory of

Vocational Education Program Universitas

Indonesia, which enabled this research to be

conducted.

REFERENCES

Anis, I., Utama, S., 2016. The effect of conditional

conservatism on the cost of debt and mediation role of

CSR disclosure: Empirical evidence from IDX. OIDA

International Journal of Sustainable Development.

09:09.

Ball, R., Shivakumar, L., 2005. Earnings quality in UK

private firms: comparative loss recognition timeliness.

Journal of Accounting and Economics. 39, 83-128.

Basu, S., 1997. The conservatism principle and the

asymmetric timeliness of earnings. Journal of

Accounting and Economics. 25 (1), 1-34.

Beatty, A., Weber, J., Jiewei, J., 2008. Conservatism and

Debt. Journal of Accounting and Economics, Vol. 45,

pp. 154–174.

https://doi.org/10.1016/j.jacceco.2008.04.005

Bharath, S.T, Sunder, J., Sunder, S.V., 2008. Accounting

Quality and Debt Contracting. The Accounting Review.

Vol. 83, No. 1 (Jan. 2008), pp. 1-28.

Bushman, Piotroski, 2006. Financial Reporting Incentives

for Conservative Accounting: The Influence of Legal

and Political Institutions. Journal of Accounting and

Economics. 107-148.

Chen, H., J.Z. Chen, G.J. Lobo, Y. Wang., 2010.

Association between borrower and lender state

ownership and accounting conservatism. Journal of

Accounting Research. Pp. 973-1014.

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

165

Cullinan, C. P., Wang, F., Wang, P., Zhang, J., 2012.

Ownership Structure and Accounting Conservatism in

China. Journal of International Accounting, Auditing,

and Taxation. 1-16.

Ekananda, M., 2016. Analisis Data Panel untuk Penelitian

Ekonomi dan Bisnis. Mitra Wacana Media: Jakarta.

Faccio, M., Masulis, R.W., McConnell, J.T., 2006. Political

Connections and Corporate Bailouts. The Journal of

Finance. Vol. 61, No. 6, pp. 2597-2635.

Fanani, Z., 2009. Kualitas Pelaporan Keuangan: Berbagai

Faktor Penentu dan Konsekuensi Ekonomis. Jurnal

Akuntansi dan Keuangan Indonesia. Vol. 6, No. 1, pp.

20-45.

Gumelar, 2017. Semester II, korporasi diramal marak

terbitkan surat utang.

https://www.cnnindonesia.com/ekonomi/20170724134

505-78-229921/semester-ii-korporasi-diramal-marak-

terbitkan-surat-utang/

Haniati, S., Fitriany, 2010. Pengaruh Konservatisme

Terhadap Asimetri Informasi Dengan Menggunakan

Beberapa Model Pengukuran Konservatisme. Presented

in Simposium Nasional Akuntansi XIII Purwokerto.

Hendro, Wardhani, R., 2013. Analisis Pengaruh Agency

Cost Of Free Cash Flow terhadap Tingkat

Konservatisme dan Pengujian Efek Moderasi dari

Kebijakan Hutang, Pendistribusian Kas, Persistensi

Kas, dan Tata Kelola Perusahaan. Presented in

Simposium Nasional Akuntansi XVI Manado.

IDX Fact Book 2016, 2016. PT Bursa Efek Indonesia.

Jakarta.

Irwanto, A., Airlangga, U., 2015. Peranan Konservatisme

Akuntansi dan Faktor Risiko Makro dalam Model Laba

Residual: Sebuah Studi di Bursa Efek Indonesia. Jurnal

Akuntansi dan Keuangan.Vol. 17, No. 1, 1–11.

Kartika, I.Y., Subroto, B., Prihatiningtyas, Y.W., 2015.

Analisa Kepemilikan Terkonsentrasi dan Asimetri

Informasi terhadap Konservatisme Akuntansi. Jurnal

Akuntansi Multiparadigma. Vol. 6, No. 3, pp. 341-511.

Khan, M., Watts, R.L., 2009. Estimation and empirical

properties of a firm-year measure of accounting

conservatism. Journal of Accounting and Economics.

48. 132-150.

Mutmainnah, N., Wardhani, R., 2013. Analisis Dampak

Kualitas Komite Audit Terhadap Kualitas Laporan

Keuangan Perusahaan Dengan Kualitas Audit Sebagai

Variabel Moderasi. Jurnal Akuntansi dan Keuangan

Indonesia. Vol. 10, No. 2, pp. 147-170.

Nikolaev, VV, 2010. Debt Covenants and Accounting

Conservatism. Journal of Accounting Research. Vol. 48

No. 1.

Permana, 2017. Bank papan atas genjot kredit korporasi.

http://keuangan.kontan.co.id/news/bank-papan-atas-

genjot-kredit-korporasi.

Rachman, Pamungkas, 2012. Pasar Obligasi 2012 akan

atraktif. http://www.cimb-principal.co.id/News-@-

Pasar_Obligasi_2012_Akan_Atraktif.aspx

Sapienza, P., 2004. The Effects of Government Ownership

on Bank Lending. Journal of Financial Economics, 72:

357-384

Sari, D., 2004. Hubungan Antara Konservatisme Akuntansi

Dengan Konflik Bondholders-Shareholders Seputar

Kebijakan Dividen dan Peringkat Obligasi. Jurnal

Akuntansi dan Keuangan Indonesia. Vol. 1, No. 2, pp.

63-88.

Scott, W.R., 2015. Financial Accounting Theory.

Pearson.

Toronto.

Wardhani, R., 2008. Tingkat Konservatisme Akuntansi di

Indonesia dan Hubungannya Dengan Karakteristik

Dewan Sebagai Salah Satu Mekanisme Corporate

Governance. Presented in Simposium Nasional

Akuntansi XI Pontianak.

Watts, R.L., 2003. Conservatism in Accounting Part II:

Evidence and Research Opportunities. Accounting

Horizons. Pp. 287-301.

Weku, P., 2013. Efektifitas Dewan Komisaris, Efektifitas

Komite Audit, Kepemilikan Keluarga dan Penerapan

Konservatisme Akuntansi di Indonesia. Presented in

Simposium Nasional Akuntansi XVI Manado.

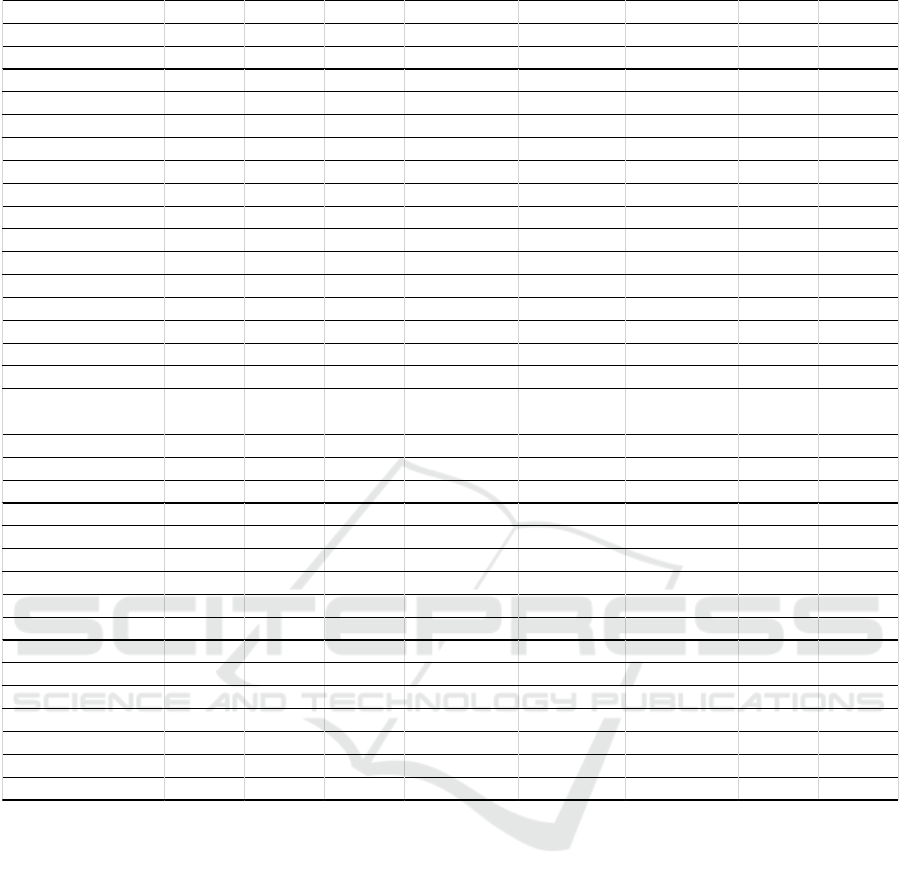

APPENDIX

Correlation Matrix (Accrual Based Testing)

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

166

Source: processed data

Variabel ACC BOND BUMN CFO CFO_BOND CFO_BUMN CFO_SIZE NEGCFO

ACC 1

BOND 0.035668 1

BUMN 0.013668 0.22096 1

CFO ‐0.50257 ‐0.04786 ‐0.02899 1

CFO_BOND ‐0.03322 0.346924 0.094053 0.116481 1

CFO_BUMN ‐0.01965 0.151113 0.499855 0.030816 0.23859 1

CFO_SIZE ‐0.47199 ‐0.0449 ‐0.0267 0.998149 0.127947 0.036865 1

NEGCFO 0.2327 ‐0.03733 ‐0.03182 ‐0.331212 ‐0.220514 ‐0.150508 ‐0.33444 1

NEGCFO_BOND 0.053633 0.399948 0.015638 ‐0.094662 ‐0.36042 ‐0.11127 ‐0.10053 0.334373

NEGCFO_BUMN 0.013825 0.022318 0.39841 ‐0.046417 ‐0.078769 ‐0.378146 ‐0.04928 0.183479

NEGCFO_CFO ‐0.45122 0.02963 0.024445 0.508359 0.156749 0.052761 0.496958 ‐0.34639

NEGCFO_CFO_BOND ‐0.00079 ‐0.2105 ‐0.02053 0.116904 0.633088 0.110852 0.125592 ‐0.17598

NEGCFO_CFO_BUMN ‐0.02957 ‐0.05474 ‐0.30643 0.047335 0.140823 0.483471 0.050696 ‐0.14112

NEGCFO_CFO_SIZE ‐0.45015 0.025252 0.02287 0.509257 0.172036 0.05693 0.498419 ‐0.35301

NEGCFO_SIZE 0.22643 ‐0.02371 ‐0.02546 ‐0.323866 ‐0.227818 ‐0.155311 ‐0.32782 0.997434

SIZE 0.08105 0.369698 0.255496 ‐0.041674 0.134961 0.157053 ‐0.02667 ‐0.20387

Variabel

NEGCFO_

BOND

NEGCFO_

BUMN

NEGCFO_

CFO

NEGCFO_CFO_

BOND

NEGCFO_CFO

_BUMN

NEGCFO_CFO_

SIZE

NEGCFO_

SIZE SIZE

ACC

BOND

BUMN

CFO

CFO_BOND

CFO_BUMN

CFO_SIZE

NEGCFO

NEGCFO_BOND 1

NEGCFO_BUMN 0.124164 1

NEGCFO_CFO ‐0.07986 ‐0.03147 1

NEGCFO_CFO_BOND ‐0.52631 ‐0.09476 0.192003 1

NEGCFO_CFO_BUMN ‐0.17641 ‐0.76914 0.050211 0.203718 1

NEGCFO_CFO_SIZE ‐0.09204 ‐0.03695 0.999398 0.215713 0.057872 1

NEGCFO_SIZE 0.362647 0.198001 ‐0.33098 ‐0.188364 ‐0.151761 ‐0.338834 1

SIZE 0.099469 0.048874 0.154187 ‐0.037959 ‐0.034548 0.148345 ‐0.17385 1

Debt, State-owned Enterprise, and Accounting Conservatism: Indonesia Evidence

167