Comparison the Unit Cost of Hemodialysis Service with Dialysis

Service’s Tariff in INA CBGs Universal Health Coverage Programe

(JKN): Case Study Hemodialysis Clinic in Depok

Supriadi

Vocational Education Programme, Universitas Indonesia, Hospital Administration Department,

Keywords: Activity-based Costing, INA Cbgs, Hemodialysis.

Abstract: Comparing the hemodialysis service unit costs calculated by activity-based costing method with INA CBG

tariff for dialysis service in the National Health Insurance Program (JKN). Data was taken from a

hemodialysis clinic that was the provider of the JKN program in the Depok area. Calculation of the unit cost

of hemodialysis services uses the activity-based costing method. This method was started by tracking all

hemodialysis service activities. T The direct and indirect costs of each service activity were traced. The data

used are primary data obtained from interviews with leaders and clinical finance officers, and secondary data

obtained from clinical, operational records, both financial and non-financial records. The results of unit cost

calculations will be compared with the tariff dialysis service in INA CBGs. The results showed that the unit

cost of hemodialysis services using the activity-based costing method was lower than the tariff of dialysis

service in INA CBGs. The results of this study it is used to trace costs and make efficiency in order to reduce

service costs so that real profits can be increased from hemodialysis services

1 INTRODUCTION

The Universal Health Coverage Programme (JKN)

organised by the Health Insurance Administration

Agency (BPJS) began to be implemented on January

1, 2014. The goal of the JKN program is to fulfil the

proper public health needs and are given to everyone

who is registered and has paid contribution, or the

contributions are paid by the government (PMKRI

28, 2014; Noviatri LW, 2016).

In the JKN Program, BPJS Kesehatan

collaborates with first-rate and advanced health

services both government and private. Payment

system for JKN organisers’ health services using two

ways; by capitation and INA CBGs. Capitation

payment is for the primary health services, while

payment by INA CBGs is for the advanced health

services (PMRK 28, 2014).

NA CBGs is a system for determining health care

rates that use the case-mix system is a grouping of

diagnoses and procedures by referring to

similar/similar clinical features and similar/similar

use of resources/ maintenance costs. The grouping is

done using grouper software. The amount of INA

CBG tariff is influenced by the class of hospital or

health service and regionalisation, which is where the

location of the health service is located (PMKRI 27,

2014).

The problem that arises is that INA CBG tariff is

sometimes not in accordance with the real costs

incurred in the services provided. This happens a lot

in hospital services such as in surgical and non-

surgical cases, besides that it is also influenced by the

use of drugs, consumables and medical equipment as

well as treatment classes (Sari RP, 2014;

RayahuningrumIO, Tantomo D, Suryono A 2016).

Hemodialysis services are health services

included in the payment system using INA CBGs.

This service can be done in a hospital and at a special

hemodialysis clinic. Febriani (2016) in his study

found that the real costs incurred for hemodialysis

services at the Medika Stania Hospital in Bangka

were higher than the rates of INA CBGs paid. This is

mainly because the overhead costs are still high and

there are not enough hemodialysis patients (Febriani,

2016).

Hemodialysis services not only in hospitals, there

are now many hemodialysis clinics that serve JKN

patients with the INA CBGs payment system. To find

out the ratio of costs incurred with the INA CBGs

130

Supriadi, .

Comparison the Unit Cost of Hemodialysis Service with Dialysis Service’s Tariff in INA CBGs Universal Health Coverage Programe (JKN): Case Study Hemodialysis Clinic in Depok.

DOI: 10.5220/0010168900002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 130-134

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

tariff for hemodialysis services in the clinic, so the

real unit cost calculation is carried out with the tariff

of INA CBGs in a hemodialysis (HD) clinic in the

Depok area. Real unit cost calculation uses the

Activity Based Costing (ABC) method, where this

method is an ABC cost calculation focusing on

activities carried out to produce a product or service.

The ABC method provides information about the

activities and resources needed to carry out these

activities (Rumumpuk MS, 2013). The ABC method

was developed to accommodate various

shortcomings of traditional calculation methods,

where the ABC method can be to allocate a suitable

cost driver for any activity, and to calculate the cost

price according to the activity (Javid M, Hadian M,

Ghaderi H, Gaffari S, Salehi M

, 2106). This method

will get a summary of the costs of the organisation of

activities by providing more detailed cost information

about health service activities so that it is seen which

activities require large costs and are considered for

efficiency measures (Kazemi Z, Zadeh AH, 2015).

2 METHOD

This research is a descriptive study in which the cost

calculation uses the Activity Based Costing method.

This calculation begins by tracing the activities that

occur in hemodilysis services from start to finish.

After the activity is obtained, the time for each

activity is calculated. Percentage of time each of these

activities will be the cost driver of overhead costs or

indirect costs. For direct costs traced directly for each

time service hemodialysis.

This study use data from January to December

2018 including financial data and non-financial

transactions. Direct cost data is the cost of medicines

and consumables used for each hemodialysis

procedure and doctor’s fee for each patient

consultation. While indirect costs are overhead costs,

including investment depreciation costs, employee

salaries, consumables, utilisation costs, maintenance

costs and others. Charging depreciation of the

building for 5 years, while electronic equipment and

furniture are depreciated for 5 years. Calculation of

depreciation costs using the straight-line method.

The total clinical overhead costs for a year will be

charged to each activity using the percentage cost

driver for each activity. Then the activity costs will be

divided by the number of hemodialysis actions

carried out during 2018 so the overhead or indirect

costs of activity is measured. Finally, this cost is

added to the direct cost of hemodialysis measures,

such as the cost of drugs and medical supplies and the

of a doctor’s services fee. This sum of indirect costs

and direct costs results in unit costs for hemodialysis

services.

Interviews were conducted with clinic managers

to find out operational policies at this clinic, such as

investment depreciation policies, provisions on the

use of hemodialysis tools and others.

3 RESULT AND DISCUSSION

3.1 The Activity of Hemodialysis (HD)

Based on interviews with managers of clinic HD and

observations of HD service actions starting from the

beginning to completion there are several activities

and the time needed for each activity as follows:

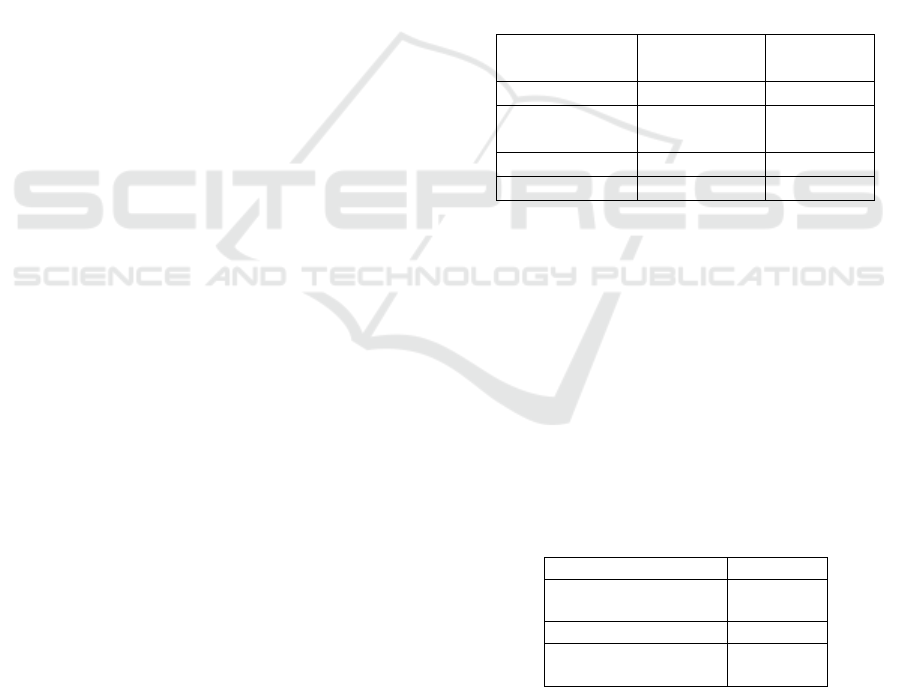

Table 1: HD Service Activity in 2018.

HD Activity Time Percentage

Re

g

istration 5 minutes 2 %

Doctor

Anamnesa

5 minutes 2 %

HD service 240 minutes 96%

Total 250 minute 100%

The percentage of HD service time that will be used

as a cost driver to share indirect cost of the HD

service.

3.2 Direct Cost of HD Services

Direct costs are costs incurred due to the occurrence

of the service, otherwise if there is no service, then

these costs do not arise. In the case of HD service, for

1 time HD service uses a fixed amount of a package

of drugs and medical supplies. In addition, there is a

fee for the doctor who performs the examination and

supervision during HD service. The direct costs are:

Table 2: Direct Cost for Each HD Service in 2018.

Direct Cost Rp

Package of drugs &

medical supplies

335,828,-

Doctor fee 55,000,-

Total Cost 390,828,-

Based on the table above, direct costs for 1 time

HD action amounting to Rp 390,828, - which consists

of the cost of the package of drugs and medical

supplies . The size of the drug package and the cost

of consumables are greatly affected by the number of

times the dialyser is reused. The more frequently used

Comparison the Unit Cost of Hemodialysis Service with Dialysis Service’s Tariff in INA CBGs Universal Health Coverage Programe

(JKN): Case Study Hemodialysis Clinic in Depok

131

again, the smaller direct costs will be. In medical

supplies there is a disposible tool called a dialyser.

This tool can be reused several times. The more

frequently used again, the lower the cost of medical

supplies. For the amount of drug packages and

medical supplies above is for the use of dialysers 5

times.

3.3 Indirect Cost of HD Services

According to the manager of clinic HD that the

building used is not its own, but is rented for 5 years

and will be extended after 5 years. Thera are 7 units

Hemodialysis instrument in this clinic and all of them

is loaned with an Operational Cooperation

Agreement (OCA), while other equipment such as

medical equipment, furniture and electronics are

investment.

In addition to investment depreciation costs, costs

which are indirect costs are electronic depreciation

costs, medical device depreciation and 5-year,

depreciation of the meubeler, employee salary costs,

utilisation costs, maintenance costs and other

consumable costs. All costs calculated are

transactions that occurred in 2018. Details of indirect

costs can be seen in the following table:

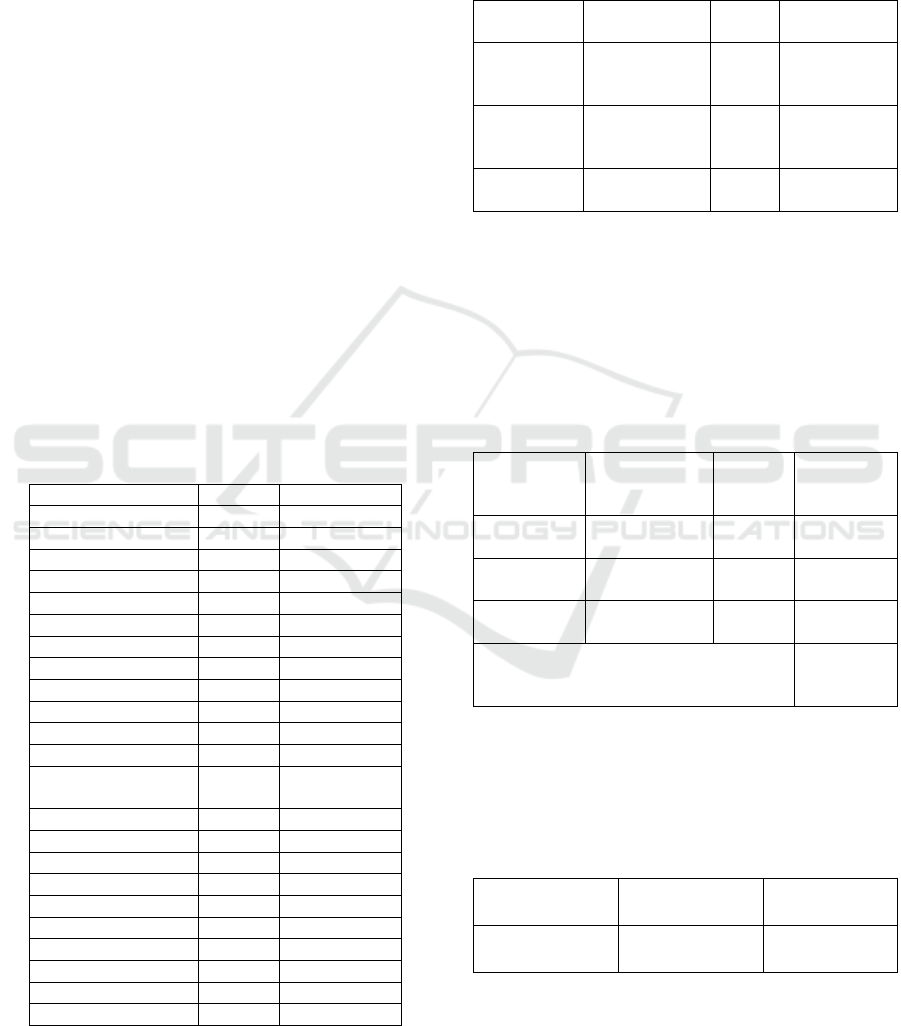

Table 3: Indirect Cost for HD Service in 2018.

Cost Numbe

r

Rp

Depresiasi Inv.

- Clinic Buildin

g

1 unit 25,704,500,-

- AC S

p

lit 5 unit 1,070,000,-

-Medical Instrument total 9,534,000,-

- Meubele

r

total 2,587,600,-

- Computer+Printe

r

3 set 2,480,000,-

- LCD TV 50” 1 unit 1,960,000,-

Salaries

- Manage

r

1 prs 79,625,000,-

- Nurse 4 prs 213,200,000,-

- Marketing Office

r

1 prs 46,150,000,-

- Registration

Office

r

1 prs 37,050,000,-

- Nurse Ai

d

1 prs 27,300,000,-

- Cleaning Service 1 prs 20,410,000,-

Other Cost

Electricit

y

45,102,864,-

- Internet 6,000,000

- Consumables 4,476,000,-

- Food and Beverage 6,300,000,-

- Office Stationer

y

3,042,000,-

- Maintenance 4,227,720,-

Total Cost 561,219,684,-

The indirect costs incurred by HD clinics during

2018 are Rp. 561,219,684. This cost will be allocated

to each HD service activity using the percentage of

time for each activity. The total indirect costs for each

activity for a year are as follows:

Table 3: Indirect Cost Allocated to HD Activity.

HD

Activit

y

Indirect Cost Cost

Drive

r

Cost/year

Registration Rp

561,219,684,-

2 % Rp

11,224,394

Doctor

Anamnesa

Rp

561,219,684,-

2 % Rp

11,224,394

HD Service Rp

561,219,684,-

96% Rp

538,770,896

Table 4 shows the amount of indirect cost for each

activity during 2018. To get the indirect cost of one

time the HD service, must be divided by the number

of HD service in 2018. Based on HD service records

in 2018, the number of HD service are 2,072 services,

so that the indirect cost for one time HD service is as

follows:

Table 5: Indirect Cost Allocated to Each HD Activity.

HD Activity Indirect Cost HD

Service

in 2018

Indirect

Cost/ Serv

Registration Rp

11,224,394

2,072 Rp 5,417,-

Doctor

Anamnesa

Rp

11,224,394

2,072 Rp 5,417,-

HD

Service

Rp

538,770,896

2,072 Rp

260,025,-

Total Indirect Cost Each HD Service Rp

270,859,-

The unit cost calculation of HD services using the

ABC method is to add up the direct costs incurred in

the activities and indirect costs for one HD action as

obtained above. The HD services unit costs can be

seen in the following table:

Table 6: Unit Cost HD Service with ABC Method.

Direct Cost + Indirect

Cos

t

= Unit Cost

Rp 390,828,- + Rp

270,859,-

= Rp

661,687,-

Table 6 shows that for 1 time the HD service

requires direct costs and indirect costs of Rp. 661,687.

Based on interviews with HD clinic managers that the

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

132

HD clinics are in the category of primary referral

clinics at the level of type D hospitals and are in

regional 1 according to Permenkes RI RI no 64 2016.

For this reason, payments received by these HD

clinics use INA CBGs tariff code is N-3.15.0

(Dialysis Procedure) and the tariff is Rp. 737,700, -

for 1 time HD service (PMKRI 64, 2016).

Compared to the unit cost calculated using the

ABC method on HD services at the HD clinic, it was

obtained at Rp 661,687, with the INA CBGs rate

applicable to this clinic at Rp 737,700, - The profit of

Rp 76,013 was still obtained for each time HD.

Whereas the profit during 2018 was 2,072 HD

services multiplied by Rp 76,013, - equal to Rp

157,498,936.

There are the differ results from Febriani (2016)

for hemodialysis services in the Medika Stania

Hospital in Bangka where real costs were higher than

the INA CBGs tariff paid. This is mainly because

overhead costs are still high and the number of

hemodialysis patients has not been large (Febriani,

2016). Kalhor et al (2016) find that unit costs

calculated using the ABC method in the radiology

department at a hospital in Iran are higher than the

rates determined by the ministry of health11. Noer

(2016) in his research at Charitas Hospital Palembang

found that cost inefficiencies occur in employee

salary costs and maintenance costs. This causes the

high cost of HD services at the hospital (Rusli NT).

According to Febriani (2016) that in addition to

fairly high employee costs, the thing that causes unit

costs to be high is the selection of Operational

Cooperation for HD devices with certain more

expensive brands. This is because the obligation to

purchase medical consumables used in HD services

has been determined by the Operational Cooperation

Agreement (OCA). The use of disposable dialysers is

also the factor that causes the high cost of HD services

in Medika Stania Hospital, Bangka. The results of

interviews with HD clinic managers that OCA is done

not with expensive companies brand, so that the cost

of medical supplies is not too high. On the other hand

the use of dialysers 5 times is also enough to reduce

the cost of HD services at the clinic, so the unit costs

are lower than the INA CBGs tariff for HD services.

4 CONCLUSION

Calculation of HD service unit costs in HD clinics in

Depok area using the ABC method found that the unit

cost was Rp. 661,687, -. This result is lower than the

INA CBGs tariff for HD services received by the

clinic of Rp. 737,700. When compared to other

services which turned out to be a higher unit cost than

JKN tariffs, this was due to, among other things,

Operational Cooperation Agreement with not an

ordinary brand companies so the price of consumable

medical materials that had a lower price compared to

xpensive brands. The use of dialysers 5 times can

reduce costs so that the direct costs are lower than the

INA CBG rates for HD services.

REFERENCES

Febriani, Analisis Perhitungan Unit Cost Pelayanan

Hemodialisi Terhadap Penetapan Tarif INA-CBGs dan

Tarif Rumah Sakit Medika Stannia Kabupaten Bangka.

Tesis. Program Studi Manajemen Rumah Sakit

Program Pascasarjana Universitas Muhammadiyah

Yogyakarta; 2016.

Javid M, Hadian M, Ghaderi H, Gaffari S, Salehi M.

Application of the Activity-Based Costing Method for

Unit-Cost Calculation in a Hospital. Global Journal of

Health Science; Vol. 8, No. 1.;2016.

Kalhor R, Amini S, Majid E, Etall. Comparison of the

Ministry of Health’s tariffs with the cost of radiology

services using the activity-based costing method.

Electronic Physician, Volume, 8;February 2016.

Kazemi Z, Zadeh AH . Activity based Costing: A Practical

Model for Cost Price Calculation in Hospitals. Indian

Journal of Science and Technology, Volume 27; 2015.

Noviatri LW. Sugeng; Analisis Faktor Penyebab

Keterlambatan Penyerahan Klaim BPJS di RS Panti

Nugroho, Jurnal Kesehatan Vokasional, Volume 1,

Nomor 1 ;Oktober 2016.

Peraturan Menteri Kesehatan Republik Indonesia (PMKRI)

no 27 Tahun 2014 Tentang Petunjuk Teknis Sistem

Indonesian Case Base Groups (INA-CBGs)

Peraturan Menteri Kesehatan Republik Indonesia (PMKRI)

no 28 Tahun 2014 Tentang Pedoman Pelaksanaan

Program Jaminan Kesehatan Nasional.

Peraturan Menteri Kesehatan Republik Indonesia (PMKRI)

no 64 Tahun 2016 Tentang Perubahan Atas Peraturan

Menteri Kesehatan Nomor 52 Tahun 2016 Tentang

Standar Tarif Pelayanan Kesehatan Dalam

Penyelenggaraan Program Jaminan Kesehatan.

Rahayuningrum IO, Tantomo D, Suryono A; Comparison

Between Hospital Inpatient Cost and INA-CBGs Tariff

of Inpatient Care in the National Health Insurance

Scheme in Solo, Boyolali and Karanganyar Districts,

Central Java. Journal of Health Policy and Management

1;2016.

Rumampuk MS, Perbandingan Perhitungan Harga Pokok

Produk Menggunakan Metode Activity Based Costing

dan Metode Konvensional Pada Usaha Peternakan

Ayam CV. Kharis di Kota Bitung, Jurnal EMBA 637

Vol.1 No.4; 2013.

Rusli NT, Analisis Biaya dan Faktor-Faktor Penentu

Inefisiensi Layanan Hemodialisis pada Pasien Gagal

Comparison the Unit Cost of Hemodialysis Service with Dialysis Service’s Tariff in INA CBGs Universal Health Coverage Programe

(JKN): Case Study Hemodialysis Clinic in Depok

133

Ginjal Kronik Rumah Sakit Rk Charitas Palembang

Tahun 2016. Jurnal ARSI;Juni 2017.

Sari RP, Perbandingan Biaya Riil dengan Tarif Paket INA-

CBGs dan Analisis Faktor yang Mempengaruhi Biaya

Rill pada Pasien Diabetes Melitus Rawat Inap

Jamkesmas di RSUP Dr Sardjito Yogyakarta, Jurnal

SPREAD, Volume 4 Nomor 1;April 2014.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

134