The Role of Islamic Corporate Governance in Preventing Fraud

Nunung Ghoniyah and Sri Hartono

Faculty of Economics, Universitas Islam Sultan Agung, Semarang, Indonesia

Keywords: Bank’s Health, Islamic Corporate Governance, Fraud, Moderating Regression Analysis.

Abstract: This research aims to examine the Sharia banks’ health, registered at Bank Indonesia, towards fraud through

the role of Islamic Corporate Governance. The independent variables were Non-Performance Financing

(NPF), Operational Efficiency Ratio (BOPO), and Capital Adequacy Ratio (CAR), with Islamic Corporate

Governance (ICG) as a moderating variable. The dependent variable in this research was fraud. The

population in this research were all Sharia Banks registered at Bank Indonesia year 2015 to 2018. The sample

was selected using purposive sampling method. The total sample used in this study were 60 Sharia Banks.

The analytical method of this research used moderation regression analysis. The results showed that, NPF has

a significant negative influence toward fraud, CAR has a significant positive influence toward fraud, while

BOPO has no influence toward fraud. Islamic Corporate Governance (ICG) played a role in strengthening the

influence of NPF and CAR toward fraud. However ICG was unable to strengthen the influence of BOPO

toward fraud in Sharia Banks registered at Bank Indonesia.

1 INTRODUCTION

Sharia banking in Indonesia has grown rapidly after

its legalization of law number 21 of 2008 about Sharia

banking (Falikhatun, 2012). The developments are

seen from the number of banks and offices of Shariah

General Bank (BUS), Sharia Business Unit (UUS),

and Sharia People's Financing Bank (BPRS). In this

development, sharia banks will face challenges, and

the biggest challenge is to maintain their image and

name, so that the customers remain confident and

loyal to the sharia bank.

Sharia bank is a bank that operates based on

Islamic principles, especially those involving

ordinances in muamalat (Dendawijaya, 2005).

However, the existence of sharia banks does not

necessarily guarantee the bank is free from fraud.

There is no guarantee that sharia-based financial

institutions are free from the possible tendency of

fraud behaviour (Sula et al., 2014). Although the bank

is known as a strict regulatory institution, but the bank

also becomes the target of fraud itself (Rahman and

Irda, 2014).

Fraud is an act of deviation or refraction that is

deliberately done to deceive or manipulate banks,

customers, or other parties, in the bank's environment

by using the means of banks. So that it makes the

banks, customers or other parties suffer losses and/or

perpetrators obtain financial benefit either directly or

indirectly (Albrech et al., 2012; Priantara, 2013; SE

BI No. 13/28/DPNP). The most widely fraudulent

cases are the assets misappropriations (85%),

corruption (13%) and the fewest number (5%) is

fraudulent statement (Koroy, 2008).

One of cheating that can happen in sharia banking

is the cheating on financial statements. Cheating in

financial statements causes the information in the

financial statements to be invalid and not in

accordance with the prescribed mechanisms.

Whereby an audit should convince the company that

the financial statements are free from misstatement

and also can convince about management

accountability of the company assets (Koroy, 2008).

Cheating in financial statements are a social and

economic problem. This will result in decreased

public reputation about the company, so that the

company can be directed to banckrupty.

One of fraud cases in sharia institutions is the case

in Shariah Mandiri Bank. It involved the internal

bank, a fictionalized credit distribution in Shariah

Mandiri Bank in Bogor, Indonesia around 102 billion

rupiah to 197 fictional customers. As the result, BSM

was potentially lose 59 billion rupiah. In addition

there is a case, where the customer reported BRI

Shariah Bank and Mega Syariah Bank, related to

shariah mortgage. The customer's lawsuit is caused

Ghoniyah, N. and Hartono, S.

The Role of Islamic Corporate Governance in Preventing Fraud.

DOI: 10.5220/0010115200830089

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 83-89

ISBN: 978-989-758-473-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

83

by they felt harmed related to the gold pledge in BRI

Sharia and Sharia Mega Bank (Djumena, 2014).

The bank’s financial performance level can affect

public’s trust toward the bank. Basically, the society

judgement is seen from implied measures such as

facilities, services and profit levels. Therefore, as an

institution that in its activities using the society’s

funds, the bank is required to maintain and improve

its performance (Najib, 2016). The Financial Services

Authority, as an institution that regulate and supervise

the Sharia banks in Indonesia, publishes regulations

related with the health procedures of banks. The

regulation is reflected on Financial Services

Authority number 8/POJK. 03/2014 about the health

level assessment of sharia banks and sharia business

units. Banks are required to conduct bank health

assessments either individually or in consolidation

with the scope of assessments towards the factors of

risk profile, good corporate governance, earnings, and

capital. In other words, it uses Risk-based Bank

Rating (RBBR) concept. RBBR concept requires

banks to maintain and improve the bank’s health level

by applying the principles of prudence and risk

management in conducting the business activities

(Setiawan, 2009; Widyaningrum et al., 2014;

Yacheva et al., 2016).

Based on the above background, this research

attempts to analyze and empirically test the

relationship between non-performing financing,

operational efficiency ratio, and capital adequacy

ratio on fraud. This research also placed the Islamic

corporate governance, as a control mechanism, which

is expected to suppress the fraud of sharia bank in

Indonesia.

2 LITERATURE REVIEW

2.1 Background Theory and Previous

Studies

2.1.1 Non-performing Financing and Fraud

Non-Performing Financing (NPF) is a financial ratio

that is associated with credit risk. It indicates the

Bank's management capabilities in managing the

problematic financing provided by the Bank. The

higher the ratio, the worse credit quality of the bank.

Credit in this case is credit given to the third party not

included credit to other banks. The problematic

credits are credit with less fluent quality, doubtful,

and stuck (Kasmir, 2011).

As an entity that has special character, the

management of sharia finance business has a high

risk, so it takes the prudence principle of the

perpetrators. The type of fraud that often occurs in

sharia banks is credit card fraud (Rahman and Irda,

2014). If the bank has a lot of problematic credit then

the possibility of fraud is greater.

Setiawan (2009) stated that sharia banks can still

operate properly if the average NPF is under the

maximum limit of Bank Indonesia's regulations

without disrupting the level of return received.

Triwahyuningtyas and Ismail (2014) showed that

sharia banks in Indonesia has healthy conditions with

the NPF under 6%.

H1: Non-Performing Financing has positive

influence toward fraud

2.1.2 Operational Efficiency Ratio and

Fraud

Operational efficiency ratio (BOPO) is the company's

ability to get revenue based on the operational funds.

This ratio is used to measure the level of efficiency

and ability of the bank to perform its operations

(Dendawijaya, 2005). The small BOPO indicates that

the bank's operating costs are smaller than their

operating income, so it shows that bank management

is very efficient in carrying out the operational

activities (Habbe et al., 2012). The lower operational

efficiency ratio, indicating that the financial

performance of sharia banks is getting better, thus it

is expected that there is no fraud.

Kusumo (2008) stated that decreasing operational

efficiency ratio indicates a better level of efficiency

and the bank’s ability to run out the operations. This

is because the costs incurred by the bank are able to

earn more income. The bank is at a safe position if the

operational efficiency ratio is at a position of less than

95%. The management of the company will strive to

maximize revenues or minimize costs in order to

provide and report good performance to the

shareholder (Anugerah, 2014).

H2: Operational efficiency ratio has positive

influence toward fraud

2.1.3 Capital Adequacy Ratio and Fraud

Capital Adequacy Ratio is the ratio to measure the

level of capital adequacy, which shows how far all

assets contain risk (financing, inclusion, marketable

securities, other bank bills) are financed from the

bank's capital funds, besides obtaining funds outside

of the bank, such as community funds, loans (debts)

and others (Dendawijaya, 2005). Sharia banks that

have a high CAR ratio lead to better capital positions,

a good capital will increase the public's trust towards

banks, and large capital allows the bank to create

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

84

greater financing. so that it will increase profits

(Kusumo, 2008; Setiawan, 2009 Laela, 2012). The

results showed that CAR has a positive impact toward

the bank's performance, so that the fraud is smaller.

Archer and Rifaat (2009) found that lack of capital

adequacy management caused Islamic banks in Qatar,

Jordan, Malaysia and UK place the investment share

as capital so that the bank's liquidity is problematic.

Therefore, the bank must have sufficient capital,

maintain the quality of its assets, manage and operate

based on the prudence principle in order to perform

its functions properly. Najib (2016) added that the

level of financial performance of a bank can affect

public’s trust toward bank. So as an institution in its

activities using the funds from the community, the

bank is required to maintain and improve its

performance.

H3: Capital Adequacy Ratio has negative

influence toward fraud

2.1.4 Islamic Corporate Governance and

Fraud

The operation of sharia banks is not separated with

the demands of good corporate governance based on

sharia principles called Islamic corporate governance.

The governance implementation of of sharia banks is

reflected through the existence of sharia supervisory

board (SE BI number 12/13/DPbS in 2010). It is

stated that the more meetings of sharia supervisory

board, the more obedient the bank with on sharia

principles in conducting all transactions. This is

because sharia supervisory board performs

supervision and monitoring functions (Maradita,

2012).

Bhatti and Bhatti (2010); Faozan (2013) stated

that Islamic corporate governance (the existence of

sharia supervisory boards) in a company could reduce

the action of fraud. Cheating will appear when the

company is in an unhealthy, but it can happen when

companies have high excess funds. The existence of

audit committee and sharia supervisory board as an

extension of the commissioner is the corporate

governance element that may prevent fraud (grace,

2014). Asrori (2014) also shows that Islamic

corporate governance positively affects the sharia

banks performance. El Junusi (2012), stated that the

implementation of sharia governance positively

affects the reputation and customers’ trust. Ponduri

and Syeda (2014) stated that = organization could

control fraud through internal audit and internal

control. Sherif and Khaled (2016) found that sharia

supervisory board is able to minimize fraudulent

actions. The better implementation of corporate

governance, is expected to strengthen the bank's

health in suppressing fraud behavior.

H 4.a Islamic Corporate Governance strengthen

the influence of Non-Performing Finance in

suppressing fraud

H 4.b Islamic Corporate Governance strengthen

the influence of Capital Adequacy Ratio dalam in

suppressing fraud

H 4.c Islamic Corporate Governance strengthen

the influence of operational efficiency ratio in

suppressing fraud

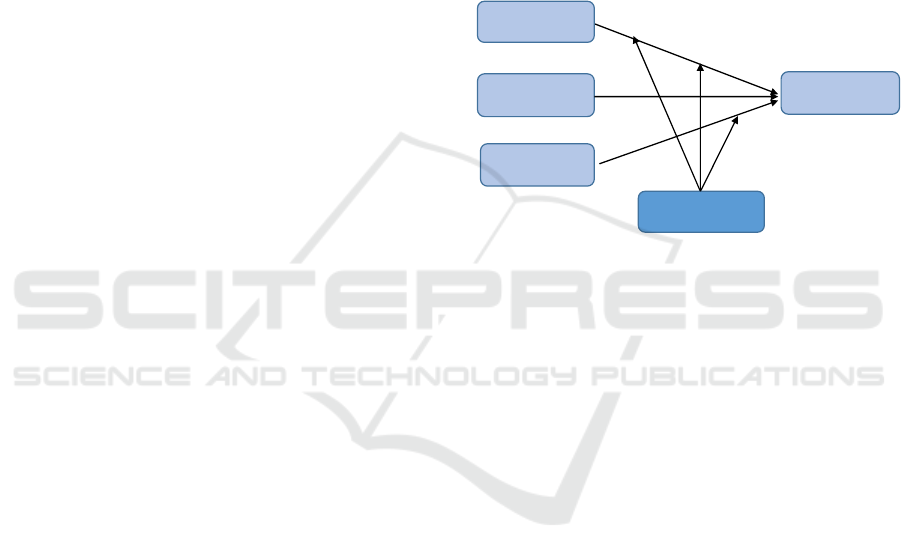

2.2 Conceptual Framework

Figure 1: Research Model.

2.3 Methodology

The population in this research were all sharia banks

registered in Bank Indonesia year 2013-2018. The

sample selection method used purposive sampling

method, with the criteria: (1) Sharia Bank registered

in Bank Indonesia consecutively for the year of 2013-

2018; (2) Sharia Bank that published the annual

financial statements and the Good Corporate

Governance implementation reports on the official

website during the observation period; and (3) Sharia

Bank which disclosed the complete data related with

the research variables. According to the criteria

above, the total samples used in this study were 10

sharia banks, 60 observations.

The fraud variable in this research was measured

by seeing at the amount of internal fraud in Sharia

banks, as stated in the annual report. NPF is a ratio of

problematic financing to total financing used to

measure the level of financing problems faced by

sharia banks. The operational efficiency ratio is a

ratio of comparison between operational costs and

operating income. CAR is a ratio of comparison

between bank capital and total risk weighted assets.

Meanwhile, Islamic corporate governance is

measured from the meeting frequency of sharia

supervisory board.

NonPerforming

Financing

OperationalActivities

EfficientionRatio

CapitalAdequacy

Ratio

IslamicCorporate

Governance

Fraud

The Role of Islamic Corporate Governance in Preventing Fraud

85

3 DISCUSSION

The result of multiple linear regression test can be

seen in table 1 below:

Table 1: The Result of Multiple Linear Regression Test.

Source: ㅤProcessed secondary data, ㅤ2019

Table 1 shows that NPF and CAR variables have

significant influence on fraud, while BOPO is not

influenced by fraud. Islamic corporate governance

can strengthen the influence of NPF and CAR to

suppress fraud. However, the ICG is not able to

strengthen BOPO on fraud. So it can be concluded,

from the six independent variables in the regression

model of this research, there are 2 independent

variables and two moderation variables which give

significant influence toward fraud as the dependent

variable. Meanwhile, BOPO variable and BOPO

interaction with ICG are not significant

3.1 Non-performing Financing and

Fraud

Non-Performing Financing (NPF) has a significant

negative influence toward fraud. In other words, the

higher problematic credit, the higher the amount of

fraud. The credit quality of the bank on this research

suggests that most of bank credits have a value under

5% (2.84%). This means that NPF in a secure

condition is potentially encouraging the moral hazard

behavior as shown by the amount of fraud. From this

it can be understood that, the increase of NPF sharia

banks that are still in healthy category, potentially

increase the number of fraudulent behavior in the

bank itself, because in fact fraud will still happen in

the healthy NPF conditions.

This result in contrast with the research results of

Kusumo (2008) which found that NPF does not

influence the sharia bank performance. Sharia bank

performance with NPF value below the maximum can

show that this sharia entity have the potential to

commit fraud.

3.2 Operational Efficiency Ratio and

Fraud

The operational efficiency ratio influences positive

insignificant towards fraud in sharia banks. The

assessment towards efficiency and ability level of the

bank in conducting its operations in this research,

show that banks are dominated by poor efficiency

level. The proportion of average operational cost in

this ratio is 98.37 %. However, the presence of less

efficient operational costs does not improve the

potential of behavior. This means that cheating

behavior is not driven based on the efficiency of

sharia bank operations. It is contrary to the COSO

Research (2010) found that the most common fraud

techniques is the improper revenue confession.

The result of this study is also different from the

research by Anugerah (2014); Setiawan (2009);

Kusumo (2008), stated that the BOPO positively

impacts the financial performance, thus it opens

opportunities for fraud. Similarly, the opinion that

sharia bank is healthy in the aspect of operational

efficiency can reduce the occurrence of fraud in the

banking operations itself (Habbe et al., 2012). In line

with the reseatch by Najib (2016), which stated that

the income has been made in accordance with sharia

provisions is not able to contribute greatly in reducing

or increasing the amount of fraud in sharia banks.

3.3 Capital Adequacy Ratio and Fraud

Capital Adequacy Ratio has a significant positive

impact toward fraud in sharia banks. It can be

interpreted that the higher the Capital Adequacy

Ratio, the amount of fraud will be high as well. It

means that the better level of the bank’s capital

adequacy could potentially create fraud. CAR

becomes a measurement of risk assets (financing,

inclusion, marketable securities, bills on other banks

financed) from capital funds can describe the health

bank performance. The average of CAR sharia bank

is currently at 22.23%. This indicates a high level of

health, because it is far above 8% (the minimum

standard of Bank Indonesia). This means that with a

high level of health, it raises the potential for

cheating.

These findings are in contrast to the research of

Setiawan (2009); Kusumo (2008) which stated that

the CAR ratio negatively influences the problematic

condition. In other words, the lower the CAR ratio,

the problem of bank will be higher. It is also stated by

Najib (2016), when the CAR Sharia Bank is good, the

financial performance of the bank is in good

condition as well. This indicates that sharia banks

Model

Dependent

Variable

Independent

Variable

Β

Standardized

T Sig

Model 1

FRAUD

NPF

-1.143 -2.581 .013

BOPO

-.312 -1.035 .305

CAR

1.036 3.308 .002

NPF*ICG

1.364 2.260 .028

BOPO*ICG

.001 .004 .997

CAR*ICG

-1.580 -3.446 .001

F 3.409 .006

Adj. Rsquare .197

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

86

with CAR value are increasingly influence the low

fraud in the bank.

3.4 Islamic Corporate Governance,

Bank’s Health and Fraud

Islamic Corporate Governance can suppress the

behavior of moral hazard in banks that have a healthy

non-performing finance. This means that. an increase

of NPF in a healthy bank can be suppressed by the

support of Islamic Corporate governance.

Employees or managers have an opportunity to do

fraud. Sula et al., (2014); Triwahyuningtyas and

Ismail (2014) demonstrated good bank’s financial

performance cannot guarantee that the bank is free

from fraud. However, with the Islamic corporate

governance in form of meeting frequency of sharia

supervisory board can significantly suppress fraud in

Sharia banks.

The result of this research support the research

conducted by Bhatti and Bhatti (2010); Faozan

(2013); Anugerah (2014); Ponduri and Syeda (2014);

Rahman and Irda (2014); Sherif and Khaled (2016)

stated that corporate governance can reduce fraud

level. Asrori (2014) added that Islamic corporate

governance positively affects the performance of

Sharia banks. El Junusi (2012) also showed that the

implementation of Sharia governance positively

affects the reputation and customer’s trust. However,

this is not in line with the research of In'airat (2015)

which stated that the existence and implementation of

corporate governance is insufficient to reduce the

level of fraud.

Islamic corporate governance cannot support the

operational efficiency in suppressing fraud. The

efficiency of shariah bank is not the stimulant of

cheating behavior, so the existence of Islamic

corporate governance also does not strengthen or

weaken the relationship between Islamic corporate

governance and fraud. It means that the existence of

Islamic corporate governance in form of supervisor’s

meeting frequency is ineffective control mechanism

to operational efficiency. This is different from the

opinion that, the corporate governance

implementation is a must for an institution including

sharia banks, it becomes the public’s responsibility

regarding the bank's operations which are expected to

comply with the outlined regulations (Maradita,

2014).

Islamic Corporate Governance can strengthen the

impact of CAR to suppress the number of frauds.

CAR without supported by the existence of Islamic

corporate governance is potential to improve fraud. It

means that the existence of Islamic corporate

governance can suppress fraud behavior in a good

CAR condition.

This finding can also be used as a signal that

Islamic corporate governance supports the healthy

capital adequacy in suppressing fraud. This finding is

in accordance with the opinion which stated that the

implementation of company's governance, including

considering all principles and functions itself and the

role of the audit Committee, will be able to prevent or

reduce fraud (Anugerah, 2014). This shows that, the

healthy CAR is not enough to be a good signal, when

the Islamic corporate governance is not supported by

the meeting frequency of the sharia supervisory

board. The frequency of the sharia supervisory board

can be used as a signal that fraud will not happen.

4 CONCLUSION

Non-performing financing has influence toward

fraud. The influence will be better when supported by

Islamic corporate governance. Meanwhile, Capital

Adequacy Ratio can potentially increase fraud, but

CAR which is supported by an adequate Islamic

corporate governance will suppress fraud.

The operational efficiency ratio has no influence

toward fraud in sharia banks, so the existence of

Islamic corporate governance is also unable to

support the operational efficiency to suppress fraud.

Thus, the level of operational efficiency cannot be

used as a signal for fraud. The limitation of this

research is the ability of independent variables to

explain the dependent variables is only 19.7%.

Further research is recommended to add the

population by using other types of sharia financial

institutions such as Sharia Business Unit (UUS),

Sharia People's Financing Bank (BPRS) or Sharia

insurance, using sharia banks outside Indonesia such

as Malaysia, Saudi Arabia and others. It also needs to

add other variables that may have an influence toward

fraud in sharia banks, such as Sharia compliance.

REFERENCES

Albrecht, W. Steve, Chad O. Albrecht, Conan C. Albecht,

Mark F. Zimbelman. 2012. “Fraud Examination fourth

edition”, USA: South-Western Cengage Learning.

https://mnasran.files. wordpress.com/2015/05/fraud-

examination-4th-edition.pdf.

Anugerah, Rita. 2014. Peranan Good Corporate

Governance dalam Pencegahan Fraud”, Jurnal

Akuntansi. Universitas Riau, Volume 3 Nomor 1,

Oktober.

The Role of Islamic Corporate Governance in Preventing Fraud

87

Archer, Simon dan Rifaat Ahmed A.K. 2009. Profit-

Sharing Investment Accounts in Islamic Bank:

Regulatory Problem and Possible Solutions, Journal of

Banking Regulation, Vol.10, No. 4, hal 300-306.

Asrori. 2014. Implementasi Islamic Corporate Governance

dan Implikasinya Terhadap Kinerja Bank Syariah”,

Jurnal Dinamika Akuntansi, Volume 6 Nomor 1,

Maret.

Bank Indonesia. Peraturan Bank Indonesia No

11/33/PBI/2009 tentang Pelaksanaan Good Corporate

Governance bagi Bank Umum Syariah dan Unit Usaha

Syariah. Lembar Negara RI Tahun 2009, No. 175

DPbS.

Bank Indonesia. Peraturan Bank Indonesia No

13/2/PBI/2011 tentang Pelaksanaan Fungsi Kepatuhan

Bank Umum. Lembar Negara RI Tahun 2011, No. 6

DPNP.

Bank Indonesia. Surat Edaran Bank Indonesia Nomor

12/13/DPbS Tahun 2010 Tentang Pelaksanaan Good

Corporate Governance bagi Bank Umum Syariah dan

Unit Usaha Syariah. Jakarta. 2010.

Bank Indonesia. Surat Edaran Bank Indonesia Nomor

13/28/DPNP Tahun 2011 Tentang Penerapan Strategi

Anti Fraud bagi Bank Umum. Jakarta. 2011.

Bhatti, Maria dan Bhatti, M. Ishaq. 2010. Toward

Understanding Islamic Corporate Governance Issues in

Islamic Finance. Asian Politics and Policy. Volume 2,

Nomor 2.

Committee of Sponsoring Organization of the Treadway

Commission (COSO, Fraudulent Financial Reporting,

2010.

Dendawijaya, Lukman. 2005. Manajemen Perbankan.

Bogor: Ghalia Indonesia.

Djumena, Erlangga. “Bank Mega Syariah Terseret Kasus

Investasi Emas?”,

http://bisniskeuangan.kompas.com/89read/2014/05/08/

0821423/Bank.Mega.Syariah.Terseret.Kasus.Investasi.

Emas.

El Junusi, Rahman. 2012. Implementasi Shariah

Governance serta Implikasinya terhadap Reputasi dan

Kepercayaan Syariah di Bank Syariah. Al-Tahrir,

Volume 12 Nomor 1, Mei.

Falikhatun dan Yasmin Umar Assegaf. 2012. Bank Syariah

di Indonesia: Ketaatan Pada Prinsip-Prinsip Syariah

dan Kesehatan Finansial”.Proseding CBAM-FE

UNISSULA, Volume 2 Nomor 1, Desember.

Faozan, Akhmad. 2013. Implementasi Good Corporate

Governance dan Peran Dewan Pengawas Syariah di

Bank Syariah, Jurnal La Riba, Vol. 7, No. 1, Juli.

Faradila, Astri. 2013. Analisis Manajemen Laba pada

Perbankan Syariah. JRAK, Vol. 4, No. 1, Februari.

Ghozali, Imam. 2016. Aplikasi Analisis Multivariate

dengan Program IBM SPSS. Semarang: Badan

Penerbitan Universitas Diponegoro.

Habbe, Abd. Hamid, Muhammad Ali, dan Muhammad

Sabir. 2012. Pengaruh Rasio Kesehatan Bank terhadap

Kinerja Keuangan Bank Umum Syariah dan Bank

Konvensional di Indonesia. Jurnal Analisis, Volume 1

Nomor 1, Juni.

In’airat, Mohammad. 2015. The Role of Corporate

Governance in Fraud Reduction – A Preception in the

Saudi Arabia Business Environment, Journal of

Accounting and Finance, Vol 15(2).

Jensen, M. C., and W. Meckling. 1976. Theory of the Firm:

Managerial Behavior, Agency Costs, and Ownership

Structure. Journal of Financial Economic3, 305-360.

Kasmir. 2011. Bank dan Lembaga Keuangan lainnya”.

Jakarta: Rajawali Press.

Komite Nasional Kebijakan Governance. 2012. Prinsip

Dasar dan Pedoman Pelaksanaan Good Corporate

Governance Perbankan Indonesia.

Koroy, Tri R. 2008. Pendeteksian Kecurangan (Fraud)

Laporan Keuangan oleh Auditor Eksternal. Jurnal

Akuntansi dan Keuangan. Vol. 10 No. 1.

Kusumo, Yunanto Adi. 2008. Analisis Kinerja Keuangan

Bank Syariah Mandiri periode 2002–2007 (dengan

Pendekatan PBI No. 9/1/PBI/2007). La_Riba, Jurnal

Ekonomi Islam, Universitas Islam Indonesia.

Laela, Sugiyarti Fatma. 2012. Kualitas Laba dan Corporate

Governance: Benarkah Kualitas Laba Bank Syariah

Lebih Rendah dari Bank Konvensional?. Jurnal

Akuntansi dan Keuangan Indonesia, Volume 9 Nomor

1, Juni.

Maradita, Aldira. 2012. Karakteristik Good Corporate

Governance Pada Bank Syariah dan Bank

Konvensional, Yuridika, Volume 29 Nomor 2, 2012.

Najib, Haifa dan Rini. 2016. Pengaruh Sharia Compliance

dan Islamic Corporate Governance terhadap Fraud pada

Bank Syariah. Simposium Nasional Akuntansi XIX,

Lampung, 2016.

Otoritas Jasa keuangan. Peraturan Otoritas Jasa Keuangan

Nomor 8/POJK.03/2014 tentang Penilaian Tingkat

Kesehatan Bank Umum Syariah dan Unit Usaha

Syariah. Jakarta. 2014.

Ponduri, Sailajan dan Syeda Amina Begum. 2014.

“Corporate Governance-Emerging Economies Fraud

and Fraud Prevention”, IOSR Journal of Business and

Management, Volume 16 Issue 3, Februari

Prabowo, Dani.”Kredit Fiktif BSM Terendus Sejak 2012, 3

Pegawai Sudah Dipecat”.

http://megapolitan.kompas.com/read/2013/10/24/2349

078/Kredit.Fiktif.BSM.

Priantara, Diaz. 2013. Fraud Auditing & Investigation.

Jakarta: Mitra Wacana Media.

Rahman, Rashidah Abdul dan Irda Syahira Khair Anwar.

2014. Types of Fraud among Islamic Banks in

Malaysia”, International Journal of Trade, Economics

and Finance, Volume 5 Nomor 2, April.

Republik Indonesia. Undang-Undang Nomor 21 Tahun

2008 tentang Perbankan Syariah. Lembar Negara RI

Tahun 2008, No. 94. Sekertariat Negara. Jakarta. 2008.

Setiawan, Azis Budi. 2009. Kesehatan Finansial dan

Kinerja Sosial Bank Umum Syariah di Indonesia.

Seminar Ilmiah: Kerjasama Magister Sains Keuangan.

Universitas Paramadhina, Ikatan Ahli Ekonomi Islam

(IAEI) Pusat, dan Masyarakat Ekonomi Syariah (MES).

2009.

Sherif El-Halaby, Khaled Hussainey, (2016), Determinants

of Compliance with AAOIFI Standards by Islamic

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

88

Banks, International Journal of Islamic and Middle

Eastern Finance and Management, Vol. 9 Issue: 1,

pp.143-168, https://doi.org/10.1108/IMEFM-06-2015-

0074.

Sula, Atik Emilia, Moh. Nizarul Alim dan Prasetyo. 2014.

Pengawasan, Strategi Anti Fraud, dan Audit Kepatuhan

Syariah sebagai Upaya Fraud Preventive pada Lembaga

Keuangan Syariah”, JAFFA, Volume 02 Nomor 2,

Oktober.

Triwahyuningtyas, Endah dan Ismail. 2014. Analisis

Kinerja Keuangan Bank Umum Syariah dan Faktor-

Faktor yang Mempengaruhinya”, e-Jurnal Manajemen

Kinerja.

Widyaningrum, Asih Hening, Suhadak, dan Tpowijono.

2014. Analisis Tingkat Kesehatan Bank dengan

Menggunakan Metode Riskbased Bank Rating (RBBR)

(Studi pada Bank yang Terdaftar di Bursa Efek

Indonesia dalam IHSG Sub Sektor Perbankan Tahun

2012). Jurnal Administrasi Bisnis. Volume 9, Nomor 2,

April.

Wijaya, Angga Sukma. “Kasus Gadai Emas Perburuk Citra

Produk Syariah”.

https://m.tempo.co/read/news/2012/10/04/087433724/

kasus-gadai-emasperburuk-citra-produk-syariah .

Yacheva, Nora, Muhammad Saifi, dan Zahroh Z.A. 2016.

Analisis Tingkat Kesehatan Bank dengan Metode

RBBR (Risk-Based Bank Rating) (Studi pada Bank

Umum Swasta Nasional Devisa yang Terdaftar di Bursa

Efek Indonesia Periode 2012-2014). Jurnal

Administrasi Bisnis. Volume 37, Nomor 1, Agustus.

The Role of Islamic Corporate Governance in Preventing Fraud

89