Alternative Strategy for Decreasing Non-performing Financing in

Commercial Unit PT. XXX KCS Bekasi using Analytic Network

Process (ANP)

Wahyu Nofiantoro, Nisa Ismundari Wildan

Finance and Banking-Vocational Education Program, Universitas Indonesia, Depok, Indonesia

Keywords: Analytic Network Process, Non-Performing Financing, Strategies, Decision

Abstract: PT XXX KCS Bekasi in 2018 has a poor financing performance, indicated by the value of Non-Performing

Financing of 9%. There are two main factors, namely, internal factors and external factors. Both of these

factors are interrelated and affect the causes of Non-Performing Financing at PT XXX KCS Bekasi to be very

complex and challenging to repair. This research is included in the type of applied research because it aims

to provide solutions to specific problems practically, namely identifying priority aspects of the problems that

affect the high NPF at PT XXX KCS Bekasi, as well as explaining the best alternative policies and strategies

in reducing NPF using the Analytic Network Process (ANP). The ANP method was chosen because of its

ability to make decisions in complex conditions. This method is a development of the previous method,

namely the Analytic Hierarchy Process (AHP). The result of this study is the selection of a short-term

alternative strategy to reduce NPF value is to conduct financing restructuring and increase financing

expansion to reduce the total NPF value. The alternative long-term policy taken to prevent the reoccurrence

of NPF is to develop an integrated information system and an early detection system of default by customers.

1 INTRODUCTION

The growth of the bank industry in Indonesia is

starting with dual banking system implementation.

This growth means that the Sharia Bank system and

conventional bank system are granted permission to

operate simultaneously (El Ayyubi, Anggraeni, &

Mahiswari, 2018). In 1992 the growth was

characterized by the establishment of Bank

Muammalat Indonesia, gradually sharia banks are

considered able to meet the needs 2 of people who

want banking services in accordance with the

principles of Sharia, especially those related to With

the practice of RIBA, speculative activities, and

distribution of financing on ethical and Sharia lawful

business activities (Ascarya & Yumanita, 2007).

There are fundamental differences in Sharia bank

business activities with conventional banks. The

difference lies in the operational principles used.

Bank Syariah applies the principle for the outcome,

whereas conventional banks still apply the principle

of interest. In the concept of Sharia banks, interest is

a clear practice of RIBA. In Sharia banking system

also does not know the term credit, known is

financing. The development of the new Sharia bank

has been felt since the government and Bank

Indonesia changed the banking LAW through LAW

No. 19 of 1998, and the provisions of Bank Indonesia

that permitted conventional banks to form a unit

Sharia enterprises (UUS).

Broadly, sharia banks have three operational

activities, namely gathering Fund (funding) that can

be taken in the mechanism of savings, Giro, and

deposits. Secondly, the distribution of funds (lending)

that can be reached by the mechanism of Murabahah,

Musyarakah, Ijawah, and Qardh. Third bank services

in the form of provision Bank guarantee (Kafalah),

Letter of Credit, Hiwalah, Wakalah, and buy and sell

foreign exchange (Barkatullah, 2014).

On 29 April 2015, the government proclaimed

the one million house Program through the Ministry

of Public Works and the People’s Housing (PUPR),

which is a joint movement by all stakeholders of the

government’s residential areas. Center, local

government, residential developers, banking, private

companies and communities to address the backlog of

housing in Indonesia.

48

Nofiantoro, W. and Wildan, N.

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process (ANP).

DOI: 10.5220/0010029500002967

In Proceedings of the 4th International Conference of Vocational Higher Education (ICVHE 2019) - Empowering Human Capital Towards Sustainable 4.0 Industry, pages 48-58

ISBN: 978-989-758-530-2; ISSN: 2184-9870

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Looking at a huge opportunity, in this case, PT

XXX as a company that already has experience in the

construction/property/residential sector is committed

to solidly strengthen the dominance of business in the

housing sector one of them by keeping moving

through The one million homes development

Program each year has increased. The government,

through the Ministry of Public Works and Housing

(PUPR), targeted the achievement of the one million

house Program in 2019 years higher than the previous

year. In 2015, the achievement of a one million house

program was 669,770 units. Whereas in the year

2016, there were as many as 805,169 units, and in the

year 2017, as many as 904,758 units. Lastly, in the

year 2018, there were as much as 1,132,621.

The one million home Program is a collaboration

with the developers of various associations, such as

Real estate Indonesia (REI) and the Indonesian

Housing and Settlement Development Association

(APERSI). The concept is collaborating on business

from both developers and banks. This community-

based housing Program will obtain a home loan

subsidy (KPR) in the form of a Housing financing

liquidity Facility (FLPP) and a cash advance subsidy

(SBUM) from Directorate General of Housing

Financing of the Ministry of PUPR. The company’s

credit and financing has been increased by 19.48% to

Rp 237.76 trillion, which is supported by the growing

housing credit.

According to the census of 2015, the percentage

of households occupying a self-owned home has

increased from 78% in 2010 to 82.63% in 2015. Thus,

there is still a residential backlog of 11.4 million units

waiting to be completed immediately. The

government’s commitment to settle the backlog of

housing is the company’s opportunity to expand the

housing business, especially in the subsidies and low-

income communities segment (MBRI). In addition to

committing, the company also saw the million house

Program can provide a multiplier effect up to 136

industry sectors that are expected to improve the

quality 3 of economic growth faster, as well as a

potential business, both from Terms of credit, funding

and source fee-based income.

Although the historical PT XXX has grasped its

own market and is thought to be able to participate in

the program directly, the risk of credit/financing

problem is still a problem that needs special attention

because the impact will affect both or poor bank

performance during that period. The bigger the

market is held, the higher the risk will occur in the

process of observation conducted by the author for

three months in PT. XXX KCS Bekasi found a

problem centred on the commercial Unit. The

problem occurs in the high value of NPF in 2018

(Non-Performing Financial) in the year, which is 9%

which is based on POJK No. 15/POJK. 03/2017 on

the determination of Status and follow-up of public

Bank supervision of a bank is not If the NPF value is

higher than 5%. Based on the results of interviews

with employees of PT. XXX KCS Bekasi The high

donor value of NPF PT. XXX KCS Bekasi in 2018 is

construction financing using a MUTANAQISAH

contract because construction financing has the most

substantial portion of financing Of 73% of the total

outstanding issued by the commercial unit. The

height of NPF PT. XXX KCS is influenced by several

aspects that are aspects of human resources, aspects

of information system development, business

processes aspects, Morale hazard aspects, and

economic aspects.

Based on the above aspects, the commercial Unit

should prevent the NPF from increasing among others

by restructuring, the division of the number of

customer accounts to be monitored as much as the

number OF SDI in the commercial Unit, expenditure

of the call letter or SOMASI. However, newly

implemented solutions merely solve financing

problems in the short term only. It takes a long-term

Strategy II so that PT. XXX KCS Bekasi does not

experience the same problems later on.

In this case, the authors use the Analytic

Network Process because ANP is a qualitative

method approach which is the development of the

previous method of Analytic Hierarchy Process

(AHP). ANP can assist decision-makers in measuring

and synthesizing several factors in a hierarchy or

network. In addition, ANP has a simple methodology

that is easy to apply for qualitative studies such as

decision making, planning or forecasting, evaluation,

mapping, strategizing, and allocation of resources

(Aminudin, 2010).

2 LITERATURE REVIEW

2.1 Financing Monitoring

Financing monitoring or commonly referred to as

financing monitoring is the most crucial part in Sharia

bank business activities because the bank still has to

be informed that the funds have been given to assist

the customer’s business process thoroughly and can

be returned within the agreed period (Sumar’in,

2012).

Financing monitoring is done through some of the

activity of the:

1. Implementation of financing

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process

(ANP)

49

2. Completeness of documents and administration

of financing

3. Business Development

4. Use of financing

5. Payment History

6. Financial performance

7. Warranties consist of warranty, the value of

guarantee, warranty perfection.

According to the financing monitoring process can be

done :

1. On Desk

a. Verify customer financing documents in

case there is no delay on eligibility;

b. Research and verification of deficiencies

found;

c. Identification of potential problems in the

procurement of cash;

d. Detection of the worsening tendency of

customer’s financial condition;

e. Assess customer’s intention in fulfilling its

obligations.

2. On-site

a. Visits of physical locations, the company

will schedule physical monitoring and send

its employees to view the condition of the

field in the form of business activities,

guarantee the progress of the project, detect

customer problems, customer business

management, and others;

b. Trade checking, view the business

conditions of the financing customer by

utilizing information derived from suppliers,

distributors, competitors, industry

associations, or other business partners;

c. Credit checking, to monitor financing by

utilizing information relating to the smooth

debt of receivables, both for facilities

provided by the correspondent banks and

other banks. 3. Early Detection Early

detection is an early monitoring action by

the bank for smooth financing and

individual attention in order not to enter the

phase of less fluid, doubtful or even stuck.

Indications of problematic financing,

according to (Ibrahim & Rahmati, 2017) :

1) Account behaviour, account behaviour

to be an indication of early business

customers experiencing problems for

example account balances often

experience overdraft;

2) Financial statement behaviour, the

symptoms of problematic financing can

be decreased liquidity, decreased

financing capital turnover, increased

receivables;

3) Customer behaviour, symptoms of

problematic financing such as poor

customer health, household disputes,

banks often do not answer;

4) Business conduct, in this category, the

symptoms of problematic financing are

characterized by the relationship with

the customer deteriorating, low selling

price, loss of significant customers,

reluctant to visit, and labour strikes.

2.2 Collectibility Financing

Collectibility is the rate of return or repayment of

financing by the customer. This level of payment is

the determining quality of financing. Quality

financing can also be seen from the business

prospects and the business performance from the

concerned financing customers.

The collectibility of financing aims to know the

quality of financing so that banks can calculate and

anticipate early financing risks. The setting of

collectibility is also used to determine the reserve

level of financing loss potential.

Collectibility financing is set to be smooth, in

particular attention, less fluency, doubtful and

jammed:

a. Seamless (collectibility 1), i.e. if there are no

delays in principal payments, margins,

investment results/for ahcils, and/or returns

(Ujrah) or there are delays in principal payments,

margins, investment returns/outcomes, and/or

returns Services (Ujrah) up to 30 calendar days;

b. In special attention (collectibility 2), i.e. the

delay of principal payment, margin, investment

result/profit share, and/or the Return of Service

(Ujrah) that has exceeded 30 calendar days up to

90 calendar days;

c. Less smoothly (collectibility 3) namely if there is

a delay in principal payment, margin, investment

result/profit share, and/or the return of services

(Ujrah) that has exceeded 90 calendar days up to

120 calendar days;

d. Doubtful (collectability 4) is if there is a delay in

principal payment, margin, investment

result/profit share, and/or the return of services

(Ujrah) that has exceeded 120 calendar days, up

to 180 calendar days. Stalled (collectibility 5)

namely is if there is a delay in principal payment,

margin, investment result/profit share, and/or the

return of services (Ujrah) that has exceeded 180

calendar days.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

50

2.3 Non-performing Financing

According to the copy of regulation of the Financial

Services Authority No. 15/POJK. 03/2017

concerning the determination of Status and follow-up

of public Bank supervision that in order to support the

creation of financial system stability, a healthy

banking system is required. Healthy banking is

banking that has a problematic “credit” (NPL/Non-

Performing Loan) or problem financing (NPF/Non-

Performing Financing) less than 5%.

Called the NPL or NPF is a credit or financing that

has a quality less fluent, doubtful, or stuck as referred

to in the provisions of the legislation on the

assessment of the quality of public bank assets and

provisions of OJK ( Financial Services Authority) on

the assessment of asset quality of Sharia and sharia

business units (Otoritas Jasa Keuangan, 2017b).

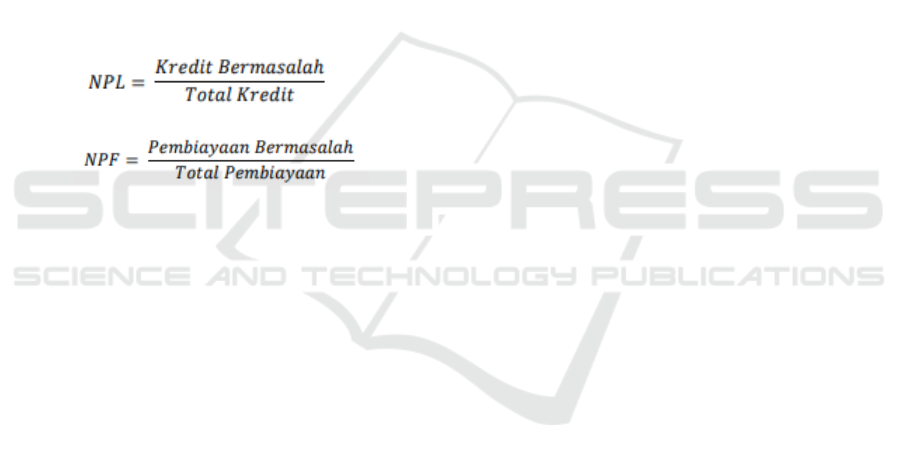

A net (NPL Net) Credit ratio calculation Formula

is problematic:

A net (NPF Net) financing ratio calculation

Formula :

The higher the NPL or NPF of a bank is, the worse

the health quality of the bank. Conversely, the smaller

the NPL or the NPF bank, the better the health quality

of the bank.

3 METHODOLOGY

In this research, the prosecution used is a qualitative

approach using the method of Analytic Network

Process (ANP). According to (Saaty, 2001) Analytic

Network Process or ANP is a new approach to

qualitative methods created by Thomas L. Saaty, a

research expert from Pittsburgh University. ANP is a

development of the previous method of Analytic

Hierarchy Process (AHP). ANP can assist decision-

makers in measuring and synthesizing several factors

in a hierarchy or network. In addition, ANP has a

simple methodology that is easy to apply for

qualitative studies such as decision making, planning

or forecasting, evaluation, mapping, strategizing,

resource allocation, and so forth.

In general, research with a qualitative approach

only describes the results of the invention in the field

without doing more in-depth synthesis. In this case,

ANP has more advantages over AHP, such as a

comparison of more objective, more accurate

predictive capabilities, and more stable results. ANP

is more general than AHP used in multi-criteria

decision analysis. AHP’s structure is a decision

problem in the form of a hierarchy, while ANP uses a

network approach without having to set the level of

the same hierarchy used in AHP.

ANP is used to solve problems that rely on the

alternative-alternatives and the existing criteria. In

terms of its analytical techniques, ANP uses pairing

comparisons to the alternatives and criteria of the

project. In AHP network There is goal level, critical,

subcriterion, and alternative, where each level has an

element. The Level in AHP is called a Cluster on an

ANP network that can have both criteria and

alternatives in it, which are called vertices.

4 RESULT

4.1 Description of Research

4.1.1 Framework

The method of Analytic Network Process has three

phases, i.e. the first decomposition or analyst to

structure the complexity of the problem, both the

comparison (pairwise comparisons) assessment for

measurements into the ratio scale and the third is the

composition for The synthesis is to reunite all the

parts that have been degradable and measured into

one unit.

The first stage of decomposition, this stage is

carried out through in-depth interviews with

employees who have duties and responsibilities in the

commercial unit of PT. XXX KCS Bekasi. The

decomposition stage consists of four phases, namely:

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process

(ANP)

51

(1) Logging the issue

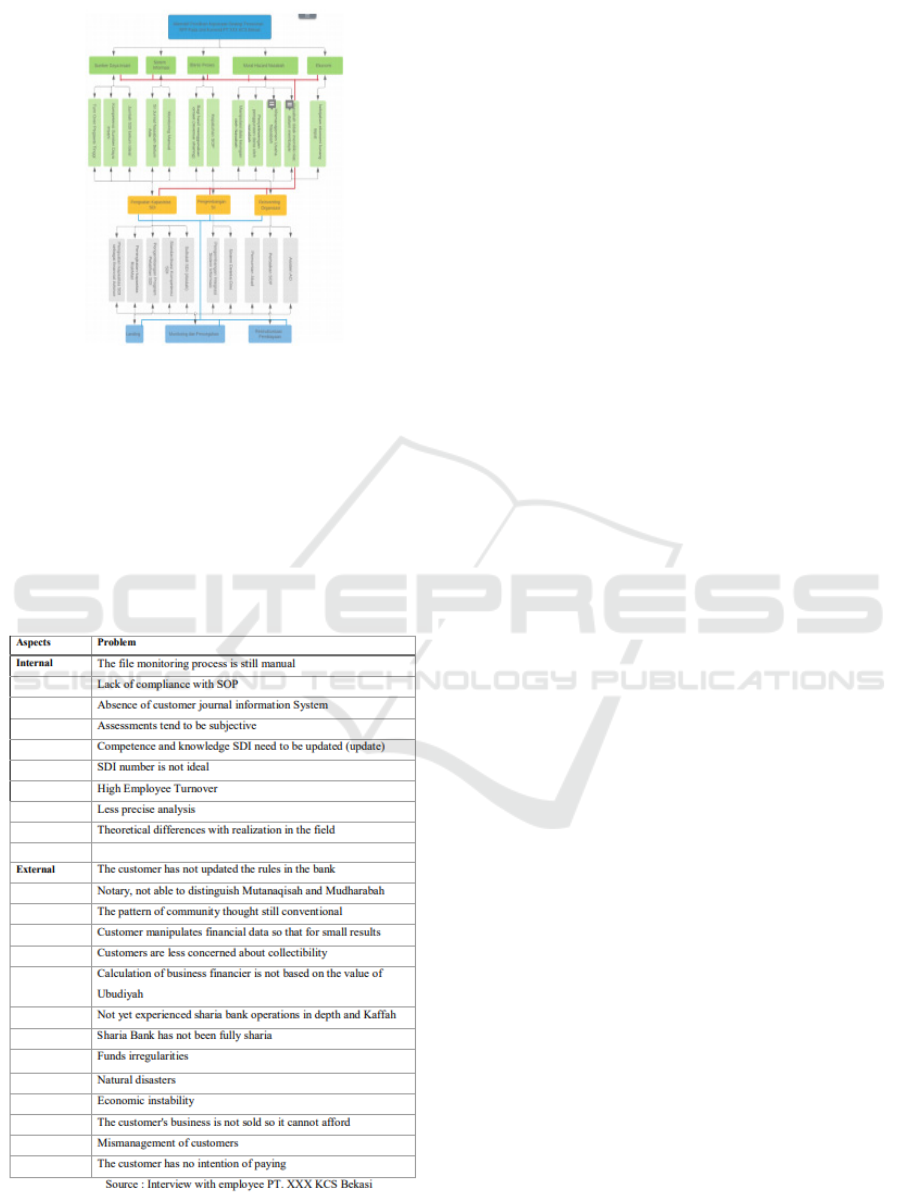

Figure 4.1: Confirmed Framework (Source: Agrregated

interview results with respondents that have been validated

by exp)

In the first phase, there are 23 aspects of the problem

that successfully identified from three respondents,

namely Desy Rifqya, Fuad Rajab Nugroho, and

Muhammad Iqbal Komaruddin. After re-examined,

the aspect of the problem can be classified into two

parts: internal problems and external problems.

Table 4.1 Aspects of the problem

4.1.2 Framework ANP

After confirmation by all respondents, the final form

of the framework has been determined as in Figure

4.1. There are 4 (four) main clusters, namely goals or

goals, financing problems at PT. XXX KCS Bekasi,

short-term strategy, and long-term strategy. In the

central cluster of problems, five aspects become the

criteria of the problem, namely human resources,

information systems, business processes, customer

hazard Morale, and the last is the economy.

At first, the final form of the model after

confirmation by all respondents there are internal

aspects and external aspects after the cluster main

goal (goal). To facilitate the processing of data and

inputs given by experts, the aspect of the problem

does not need to be grouped into internal and external

problems, because each other is a linkage. Grouping

aspects of internal and external problems is only a

tool at the start of the framework

Then in the long term Cluster strategy, there are

three strategies that are identified based on literature

review and deep interviews with respondents and

experts, all strategies are grouped based on

similarities in nature.

1) Cluster of destinations

The destination Cluster is the top level of a structured

framework that contains the main objectives of the

research, which is an alternative to the selection of

NPF reduction strategies on commercial units of PT.

XXX KCS Bekasi. In this cluster, there is a right

direction to the aspects of the problem of causes NPF

in Sharia banking, or it can be said that alternative

decision-making of NPF reduction strategy in

commercial units covered five aspects of the issue

The primary criteria for alternative selection of

solutions.

2) Cluster problem

Cluster problem causes NPF in PT. XXX KCS Bekasi

consists of aspects of SDI that has three subclusters,

namely high employee turnover, SDI competence,

and the amount of SDI is not yet ideal.

Next is the aspect of an information system, which

until now no monitoring mechanism can take a

personal approach to the customer and the absence of

the information system of customer journal.

Currently, the bank is only waiting for information

from the customer regarding the profit/loss of

business or its project, which is very vulnerable to

change by the customer.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

52

Further aspects of the business process, there is a

problem with SOP compliance. In certain conditions,

some situations can not if only fixed in the SOP alone,

in such conditions should be observed and tightened

mechanism of deviation or waiver mechanism. In

Sharia banks, there is a financing committee that acts

as an approver if there is a licensing deviation, in this

case, the role of risk management should also give

consideration through the bank’s risk acceptance

criteria.

Furthermore, the aspect of the customer’s moral

hazard is a deviation or non-compliance by the

customer who directly affects the financing process

that has been agreed from the beginning with the

bank, causing Non-yielding business processes.

Last is the economic aspect when talking about

the environment of economic conditions is a result of

the policy decided by the government. If the policy is

taken inappropriately, it will produce a bad economic

condition, because banking regulation does not affect

a lot of financing, which affects the length of

financing is the policy that causes The purchasing

power of the public. The interview with experts also

resulted in an alternative strategy solution that is

divided into a long-term strategy and short-term

strategy To tackle the five aspects of the problem

above.

3) The long term alternative Cluster strategy

The alternative cluster of long-term strategies

consists of three main clusters, namely the

strengthening of SDI capacity, SI development, and

reinventing the organization. Although each solution

comes from grouping the problem at the level above

the connectedness of the solution is possible against

problems beyond the directly related problems.

First, on the SDI aspect of Pemguatan, it is hoped

that SDI Bank can direct, give input and determine

the contract in accordance with the project/client’s

business.

Second in the aspect of increased risk

management capacity, to take an unregulated decision

in the SOP, then the role of risk management Divison

becomes crucial to weigh the risks that may occur.

Third, on the development aspect of the SDI

training program, there is a gap analysis that is

measuring personnel capacity to the problems

handled. After that, there will be a further stage that

is training need analysis, at this stage will be known

training needed to develop the competence of SDI to

handle the problem at hand.

Fourth on the aspect of SDI competence,

standardization of competency of SDI is necessary to

prevent the performance of a unit in this case of a

commercial unit in case of employee turnover. In

addition, the creation of carrier paths is also important

so that each SDI is able to know the next working

period and employment.

Five Softskill SDI (Akidah), often training

organized by banking in this case sharia is more

focused on the development of Hard skills, but on the

other hand, there is sense or ability of soft skills that

also need to hone, because One’s success is the

manifestation of his relationship with God. It is

obligatory to be owned by any banking student

because by the existence of an Insani banking is

willing to run Sharia, when an Insani willing to run

Sharia, there will be an Akhlakul karimah (good

moral). If born well, then the process of giving

financing to customers will be based on the blessing

to help others, not just make a profit.

In the central cluster of information systems, there

are two alternative long-term strategies for

developing information systems integration and early

detection systems. Referring to the problem should be

the software that connects the customer with the bank

so that every transaction movement that is in the

customer can be monitored directly by the bank.

Because according to experts, customers tend not to

want to the business institution conditions/projects to

the bank.

From the banking side, the software is beneficial

to determine the object for the ideal outcome and

monitor the movement of the project/business, so that

the bank has a control mechanism for the customer’s

business/project. With the system, the risks that may

occur can be detected early so that the loss impact is

not too significant.

On the primary cluster reinventing the

organization, this aspect has three alternative policies,

namely purification of the Akad, repair of SOP, and

the assistant AO. The bank, as a significant financial

institution should implement the refreshment or

revitalizing role per section to create an increase in

effectiveness, efficiency and Insani ability to innovate

so as not to make The same error repeatedly.

4) The short term Cluster strategy

Cluster Short-term strategy to downgrade the NPF.

First, refer to the NPF calculation formula where

Rumunsya is the number of doubtful accounts (Col.

3, 4, 5) divided by the total financing given. The logic,

the larger the number of dividers the result is

deficient. In this case, more and more financing is

given then the smaller its NPF value.

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process

(ANP)

53

Secondly, the monitoring effort in a way is made

by PT. XXX KCS Bekasi who currently is a visitation

to the customer’s project/business in order to see the

suitability development of the customer’s business

between reports with its realization.

Thirdly, financing restructuring is a bank’s effort

in collecting problematic financing. It is usually done

by sending a letter of warning 1 when the rider’s

detection of instalment payment is when entering the

Collectibility 2, which the customer delinquent more

than 90 days. If after 7 – 14 working days There is no

good i’tikad from the customer to pay or just respond

to a letter from the bank, then the warning letter is

appointed as a warning letter 2, warning letter 3, to

SOMASI. SOMASI is a call letter with a strike to the

customer regarding the loan arrears. The customer is

asked to come to the office and discuss with the

commercial unit before being taken follow-up

financing his problem. If after the discussion also did

not find the bright point, then the next step is to find

investors to take over the project or direct execution

of collateral.

4.1.3 Profile Respondents

According to Ascarya (2006:34), there are no

requirements for the number of respondents used for

validation. Terms of valid respondents are those who

are experts in their field. Therefore, the respondents

chosen in this research are sharia banking

practitioners who are every day engaged in the sharia

banking world. There are two respondents as

representatives of the sharia banking industry, and

one respondent represents the academic world. In

order to obtain the primary data on the sharia banking

world of experts and practitioners against problems

affecting the Non-Performing Financing of the sharia

bank, the “pairwise comparisons” questionnaire was

modified into a questionnaire Make it easier for

respondents to fill in questionnaires. Once the rating

questionnaire is filled, subsequent questionnaires are

converted into pairwise form comparisons when

entering data into software Superdecisions 2.10.

4.1.4 Data Processing

Data processing is done using software

Superdecisionss 2.10, which can be downloaded free

from the website www.superdecisions.com. In this

website, two versions can be downloaded namely V

2.10 and V 3.2 which can both be installed on MAC

and Windows PC platforms with low resolution or

high resolution (HD Resolution) depending on the PC

used.

In data processing, some stages are performed to

synthesize results. The first stage is the creation of the

framework. The second stage is the creation of the

Pairwise Comparisons questionnaire. Next, the third

stage is to test the consistency and Synthesizing

results. Finally, the last step is to determine the

priority aspect of the problem, long-term strategy and

short-term strategy option conducted by PT. XXX

KCS Bekasi.

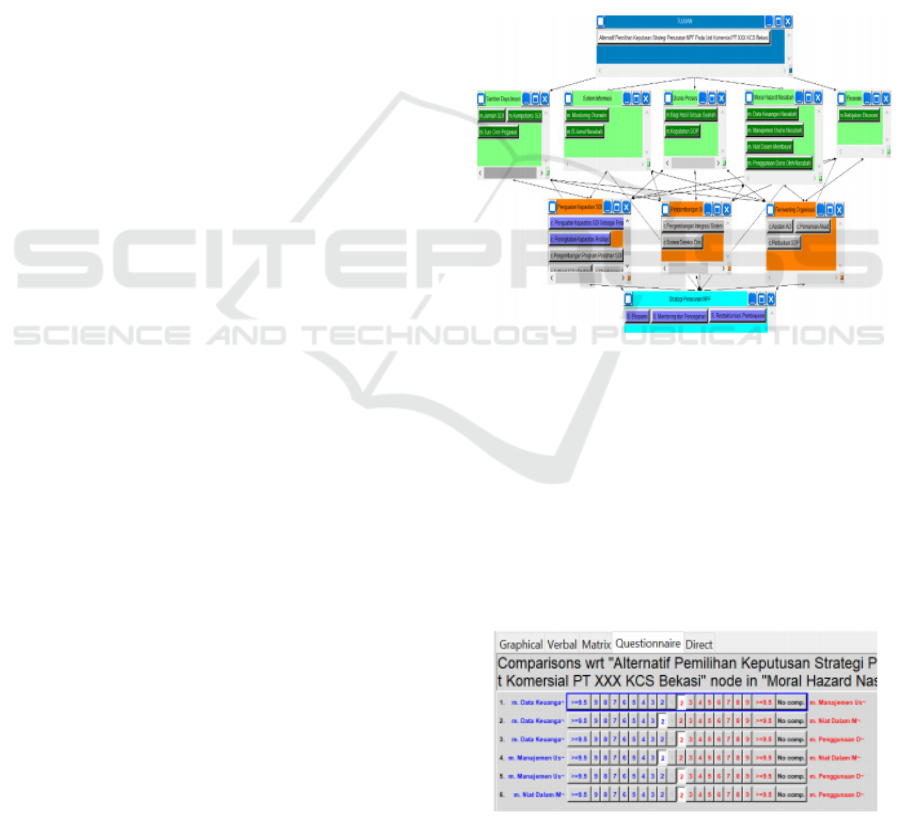

(1) Framework Making

The previously compiled Design framework was

moved into a research model conducted using

Superdecisions software. In Figure 4.2, it presented

the form of a Framework that has been formed based

on the form of framework confirmed by respondents.

Figure 4.2: Framework on Superdecisions (Source:

Processed Data using Superdecisions)

Kueisoner is done automatically through software

super decisions 2.10 in its implementation, the

“pairwise comparisons” questionnaire was modified

using a rating card system to shorten the number of

questions produced of the model formed. The

interview is done to the respondents using rating

system cards. After the result is obtained, the data is

entered into the software Superdecisionss 2.10 as

presented in Figure 4.3

Figure 4.3: Kuesioner Pairwise Comparisions (Source:

Processed Data using Superdecisions)

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

54

According to Thomas L. Saaty must be ensured

the level of inconsistency should be below 10% or 0.1

when the respondent’s response level is above 10%,

it can be said that the expert answers are not valid due

to various matters. The value of inconsistency index

through SUPERDECISIONSS software can directly

be known when entering data as presented in Figure

4.4 below, in the table below the inconsistency value

of 0.043, which means less than 0.1 (10%) Which

means that the respondent’s answer is consistent or

valid.

Figure 4.4: Inconsistency Index’s Value (Source: Processed

Data using Superdecisions)

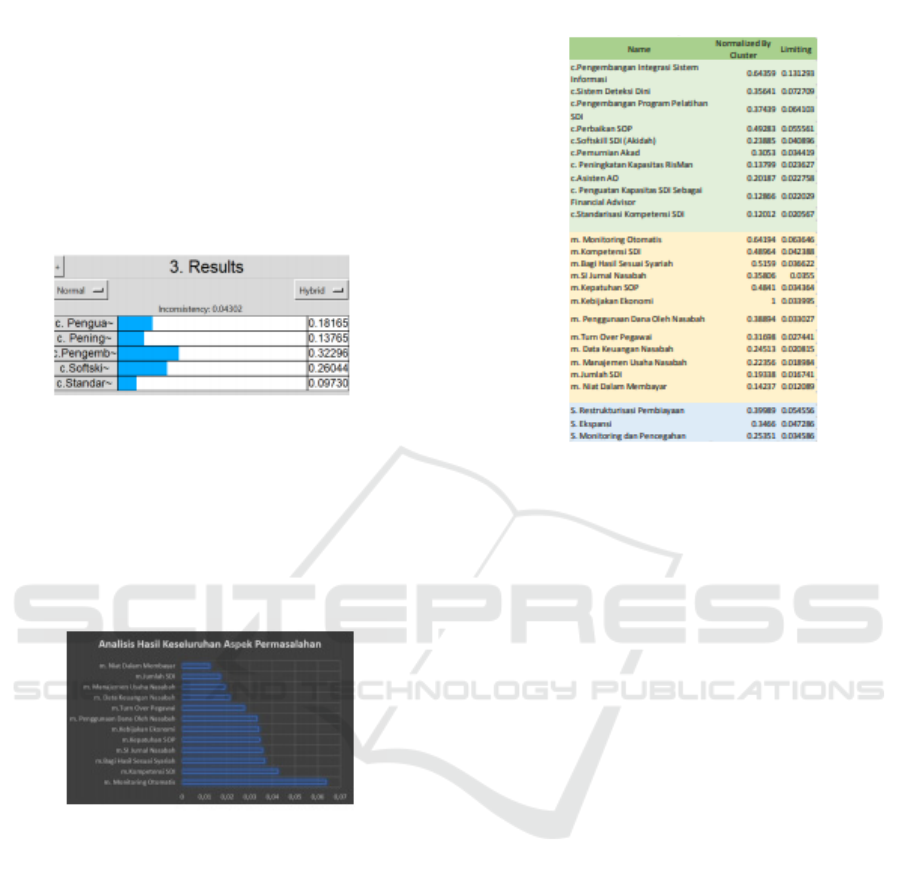

(2) Syntheses Results

After all the numbers entered, it can be drawn the

synthesis of the result so that it will produce a

sequence of priorities of the essential aspects of NPF

problems, the priority of alternative strategies to

reduce NPF PT. XXX KCS Bekasi.

Chart 4.1: Analysis of overall aspects (Source: Processed

Data using Superdecisions)

Table 4.3: Syntheses Results

The Limiting value is a priority value on any

single Cluster that is worth one or one hundred

percent if it counts in a single Cluster, while the

Normalized by Cluster value is the priority value of

all priority issues and alternatives Cluster policies. In

this study used the Normalized by Cluster value

because essentially the order of precedence over

alternative options on a single Cluster would result in

the same order either using Normalized by Cluster

values or by using the value of the limiting

4.2 Combined Research

4.2.1 Aspects of the Problem

All aspects are combined into one without being

grouped into each cluster. Based on the priority score

is known that the aspect of the problem that is the

leading cause of BPF PT. XXX KCS Bekasi is

automatic monitoring, competency of SDI, Shariah-

compliant outcomes and customer journal

information System. Of the four main priorities, there

are two aspects related to information system, namely

automation system and customer journal information

System. Once converted into chart form can be seen

based on Chart 4.1. The automatic aspect of the

system has a high priority value of 0.06 while the

second priority of SDI competence has a priority

value of 0.04.

The billing process as a financing monitoring

issue is constrained because of the still manual

monitoring system, the use of MS Excel is not yet

able to assist the billing process, based on the paper

Creation warning letter published by PT. XXX KCS

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process

(ANP)

55

Bekasi in 2018. Twenty-nine warning letters

accumulated on one date. It shows less effective

monitoring process. Based on the results of FGD, the

automatic monitoring and early detection system are

required by the commercial unit concerning the NPF

reduction strategy at PT. XXX KCS Bekasi. The

absence of a reliable monitoring system, according to

the speakers and in the discussion above can be

categorized as a moral hazard conducted from the

banking side, because it allows the customer to make

delays in payment or even Other acts that harm the

bank itself.

Seen from the size of customers who entered the

category in the problem financing from 137 accounts

there are 49 accounts or there are 35% problem

financing, the amount of accounts that are included in

the problem financing category is one of the factors

The NPF’s high value. According to the FGD, the

high number of problem financing showed that the

implementation of the eligibility assessment system

for debtor does not go well, it indicates the need for

increased competency From the commercial unit in

determining the prospective debtor, especially in the

application of prudence principles, the accuracy of

the capacity of prospective debtors and competencies

in determining the proper agreement for the financing

process

4.2.2 Alternative Aspects of a Long-term

Strategy

Based on the value of the priorities that have been

changed into chart form, the long-term alternative is

the most priority and influential in reducing the long-

term NPF value is to develop information system

integration, visible from the value. The highest

priority is 0.13, while the other policy is still related

to the information system of an early detection system

of 0.07 and followed by a policy of the development

of the SDI training program of 0064.

Chart 4.2: Analysis of long-term strategy priorities (Source:

Processed Data using Superdecisions)

The policy of development of information system

integration has a very high value of 0.13; this in

accordance with the main aspects of the problem is

the absence of the monitoring system. Experts in this

study believed the integrated information system is a

strategy that needs to be taken, especially with the

growing use of information technology in various

fields at this time. With the advancement of

technology, especially the use of big data, will help

the commercial unit effectively in conducting the

feasibility assessment of potential debtors,

monitoring and evaluation of financing and

integration of other operations will reduce the Morale

hazard (either due to weakness Not good) from the

customer’s side. Then the second policy is the

preparation and implementation of the early detection

system of the problematic financing, can be generated

from the data generated by the integrated information

system.

The next long-term strategy is the development of

an Insani resource training program, the growth of

information systems in terms of hardware, namely the

use of mobile devices to the application of IoT

(Internet of Things), then accompanied by Integrated

software creation that is able to process big data into

a piece of information, will be wasted if not

accompanied by the readiness of the brain are of its

insanitation. The improvement of competence related

to the presence of the 4.0 industrial Revolution,

especially the use of big data in the decision-making

process of prospective customers, will change the

technique and way of determination of prospective

customers to be more productive and efficient, all

new techniques and methods, become the new

competence that must be owned by the human

resource PT. XXX KCS Bekasi, this is the basis that

the SDI training program should be developed in

accordance with the development of technology and

the system Integrated.

Changes in methods and techniques complete the

process of financing realization because the

implementation of integrated systems will

implication on the inception of work procedures and

instructions so that the SOP repair will be essential

and become a fourth alternative strategy To be

considered by PT. XXX KCS Bekasi.

Then the fifth alternative policy is not less

important is the improvement of the employee

Softskill especially in the field of creed, because PT

XXX is the banking that implements the sharia

system in its operational, then the implementation of

Sharia started from Spirit Ubudiyah or worship, the

main principle of Sharia not only seeks only profit but

also worship especially the application of Tabaru

principles or please help.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

56

4.2.3 Alternative Aspects of Short-term

Strategy

In the alternative selection of short-term strategies for

decreasing NPF at PT. XXX KCS Bekasi, it was seen

on Chart 4..3 that the restructuring strategy of

financing became the main choice followed by the

financing expansion strategy. Chart 4.3

Chart 4.3: Analysis of short-term strategy priorities

(Source: Processed Data using Superdecisions)

The aspect of the financing restructuring in the

short-term strategy of decreasing NPF value in the

ANP framework has the highest priority value of

0.054, indicating that PT. XXX KCS Bekasi has an

emphasis on the rescue efforts through restructuring

Financing compared to other strategies. This effort is

in accordance with the principle of credit completion

in Sharia review, where the sharia principle further

emphasizes the problem of settlement of problematic

financing with deliberation first through financing

restructuring efforts. In general, efforts to address

problematic financing can be made with preventive

(preventive) and curative (treatment) efforts.

PT. XXX KCS Bekasi in handling the problem

has two main approaches: Stay strategy and exit

strategy. The Stay strategy is the primary strategy

undertaken by PT. XXX KCS Bekasi is a strategy

whereby banks still want to maintain business

relationships with customers in the context of long-

term time. This strategy is commonly referred to as a

cooperative strategy. The efforts associated with the

implementation of this strategy begin with the

process, reconditioning and restructuring.

The second strategy used by PT XX KCS Bekasi

is the exit strategy, which is a strategy where the bank

does not want to continue the business relationship

with the customer, in a long time unless other factors

strongly support the possibility of improvement of

customer condition. This strategy is done through

write off action, such as the auction through bank

management (IPIH Fitriani, 2018). Based on

interviews conducted with the speakers, the option of

write off action is the last option of handling

problematic financing in PT. XXX KCS Bekasi.

Curative or rescue stage and the completion of the

problem financing, in PT. XXX KCS Bekasi has the

same SOP with other branch offices because the

general SOP is compiled by PT XXX Center, with

attention to Compliance risk related to financing.

Identify the problem financing that occurred in PT.

XXX KCS Bekasi seen from customers who are late

making payment. The effort then is to contact the

customer by phone to remind the payment process, or

to make direct billing to the customer’s place.

However, in reality, this effort is hard to do because

the number of accounts on the commercial unit is too

much not comparable to the amount of its resource

insanitation.

The process of handling problematic financing, in

PT XXX KCS Bekasi, is preferable to use a stay

strategy or cooperative strategy, if in the billing

period, the customer has a good faith to settle the

obligations then the execution of the collateral is not

Will do. In this case, the party of PT. XXX KCS

Bekasi will make a restructuring effort. If in the last

day of the opportunity of repayment of obligations,

the customer pays off all Kewajiabannya PT XXX

KCS Bekasi will issue a settlement letter of all

liabilities (PSK), so the execution of collateral will

not be done.

The effort to rescue the problem financing

through a restructuring effort in PT. XXX KCS

Bekasi, allowing the customer to make repayment.

This effort will give the customer waivers to pay their

grants. The number of instalments each month will be

smaller when compared to the number of instalments

before restructuring attempts. It is hoped that the

customer can pay smoothly back its loan until the end

of the financing period.

PT will take effort. XXX KCS Bekasi in

conducting the first analysis of financing. Based on

customer’s business prospects and ability to pay

according to the projected cash flow, With a detailed

explanation of the cause of arrears, their ability to

repay after restructuring, the management efficiency

review can determine to restructure the need in the

organization. Company, repayment schedule after

revised, which has been adjusted to the ability to pay

customers, details of completeness of documents

restructuring. In suppressing the financing process as

well, the aspect of the breeding expansion is the

second strategy agreed upon by the resource as a

proper strategy in reducing the NPF in the short term.

According to the resource, by increasing the amount

of financing, a realization will be a factor for the NPF

value divider.

This strategy is in accordance with the research

conducted by Riyadi (Riyadi, Iqbal, & Lauren, 2015)

Alternative Strategy for Decreasing Non-performing Financing in Commercial Unit PT. XXX KCS Bekasi using Analytic Network Process

(ANP)

57

stating that the amount of credit transmitted

negatively affects the bad credit. The higher the credit

channelled it will drive the NPL reduction. The

results of the study were reinforced by subsequent

studies that said LDR had a negative influence on the

NPL. Each 1% LDR increase will lower the NPL by

0.0122%. Startegi improves LDR, of course, by

encouraging credit distribution. Adding credit

distribution lowers the lousy credit and opens

opportunities to increase the percentage of credit

quality delivered (Soebagio, 2005).

5 CONCLUSION

Based on the discussion of research results can be

concluded several things as follows:

1. Three aspects of the problem that affects the

height of NPF in PT. XXX KCS Bekasi based on

analysis using ANP method is automatic

monitoring, competency of human resources,

and for sharia yield;

2. PT XXX KCS Bekasi can do the long term

alternative strategy to lower the NPF value is to

develop information system integration, early

detection system and development of human

resources training program;

3. Alternative short-term strategy to reduce the

value of NPF PT. XXX KCS Bekasi is to conduct

financing restructuring and expand the financing

expansion to reduce the total NPF.

There are several solutions to the problem that causes

NPF PT. XXX KCS Bekasi High, namely:

1. The highest aspect of the problem with the NPF

is the automatic monitoring, to solve this

problem of strategies that are used in the long-

term strategy of creating information systems

integration that takes a long time In the process

of creating the system, to minimize PT completes

the monitoring of problematic financing before

the integration of information systems. XXX,

commercial units can use cloud-based Office

applications such as SharePoint on Office365;

2. On the task of this final work alternative, long-

term decline strategy only formulated together

with one expert of academics and officials PT.

XXX KCS Bekasi Related, then to produce a

better formulation need to be formulated with

more mature with Involve more than one expert

in academics and industry experts;

3. In PT. XXX KCS Bekasi’s decision making, it

will be analyzed in advance to the financing to be

restructured, then there should be a raw SOP in

the assessment of problematic financing or the

provision of competence Specific to the human

resources in dealing with problematic financing

that will be restructured.

REFERENCES

Aminudin. (2010). Penetapan Standar Kriteria Dan

Pemilihan Fabrikor Untuk Pengerjaan Piping Dan Skid

Dengan Metode Analytical Networl Process. Retrieved

From File:///C:/Users/Lab Perpajakan

1/Downloads/Bahan Tka/20250308-S52051-

Aminudin.Pdf

Ascarya, A., & Yumanita, D. (2007). Mencari Solusi

Rendahnya Pembiayaan Bagi Hasil Di Perbankan

Syariah Indonesia. Buletin Ekonomi Moneter Dan

Perbankan, 8(1), 7–43.

Https://Doi.Org/10.21098/Bemp.V8i1.127

Barkatullah, A. H. (N.D.). Problem Eksistensi Dan

Operasional Perbankan Syari’ah Indonesia.

AnNahdhah.

El Ayyubi, S., Anggraeni, L., & Mahiswari, A. D. (2018).

Pengaruh Bank Syariah Terhadap Pertumbuhan

Ekonomi Di Indonesia. Al-Muzara’ah, 5(2), 88–106.

Https://Doi.Org/10.29244/Jam.5.2.88-106

Ibrahim, A. (Fakultas E. Dan B. I. U. A.-R. B. A., &

Rahmati, A. (Fakultas E. Dan B. I. U. A.-R. B. A.

(2017). Analisis Solutif Penyelesaian Pembiayaan

Bermasalah Di Bank Syariah : Kajian Pada Produk

Murabahah Di Bank Muamalat. Iqtishadia.

Https://Doi.Org/Http://Dx.Doi.Org/10.21043/Iqtishadi

a.V10i1.2319

Otoritas Jasa Keuangan. (2017). Salinan Peraturan Otoritas

Jasa Keuangan No. 15/Pojk.03/2017 Tentang

Penetapan Status Dan Tindak Lanjut Pengawasan Bank

Umum.

Riyadi, S., Iqbal, M., & Lauren, N. (2015). Strategi

Pengelolaan Non Performing Loan (Npl) Bank Umum

Yang Go Public. Jurnal Dinamika Manajemen.

Https://Doi.Org/10.15294/Jdm.V6i1.4299

Saaty, T. L. (2001). Decision Making With Dependence

And Feedback : The Analytic Network Process (2nd

Ed.). Pittburgh: Rws Publication.

Soebagio, H. (2005). Analisis Faktor-Faktor Yang

Mempengaruhi Terjadinya Non-Performing Loan (Npl)

Pada Bank Umum Konvensional. Universitas

Diponegoro Semarang.

Sumar’in. (2012). Konsep Kelembagaan Bank Syari’ah.

Yogyakarta: Graha Ilmu.

ICVHE 2019 - The International Conference of Vocational Higher Education (ICVHE) “Empowering Human Capital Towards Sustainable

4.0 Industry”

58