Framing in Decision Making Investment at Indonesia Stock Exchange

M. F. Arrozi Adhikara

1

, Abdurrahman

1

, Sudarwan

1

and Erman Munzir

1

1

Faculty of Economics and Business, Esa Unggul University, Jakarta 11510,Indonesia

Keywords: framing, investment decision making

Abstract: Investment decision making is rational because investors want the prospect of return with risk preferences

through initial confidence determination by framing. The purpose of this study is to obtain empirical

evidence of investor's mental accounting behavior in investment decisions with the use of framing in the

Indonesia Stock Exchange (IDX). The research design is descriptive qualitative research. The information

given is the investor who invests in the Indonesia Stock Exchange. The unit of analysis is individual

investors and as members of the Indonesian Securities Investor Society (MISI). The units are

analyzedindividual investors. Analyze data using content analysis. The results show investor behavior in

investment allocation chooses neutral risk preference for utility maximization if described with a negative

frame.Conversely, investor behavior will be different if done with a positive frame.This study provides new

theoretical evidence into the behavior of investor decision making with a positive frame in Indonesia. The

findings of this research will be useful for public go companies in providing publication and dissemination

of information with good news signals in the Indonesian capital market.

1 INTRODUCTION

The capital market is defined as a market for various

long-term financial instruments or securities that can

be traded, either in the form of debt or equity,

whether issued by the government, public

authorities, or private companies (Hartono, 2015).

As the tool of financial sector outside banking,

capital market has some attractiveness for investors.

Firstly, thecapital market is expected to be an

alternative way to obtain rapid and inexpensive

funds from investors and creditors through

investments in financial assets (such as stocks,

bonds, warrants, options and

certificates).Secondly,the capital market allows

investors to obtain various investment options that

match their risk preferences. Therefore, investors

can diversify their investments and arrange a

portfolio based on the risk and the expected return.

When the capital market is efficient, there will be a

positive relationship between risk and return (East,

1993; Arroziet al., 2014; Arrozi,2016a; Arrozi,

2016b).Thirdly, the attractiveness of investing in

financial assets is emphasized on the liquidity,

which means the securities can be traded

immediately and investors can reposition their

securities at any time. For example, an investor

invests their securities in the field of food and

beverage today. On the next day, he can replace the

securities with investment in banking or tobacco

industry. He also can reposition his securities in any

different industries on the day after tomorrow, next

week, or next month.This shows that the capital

marketprovides more opportunities for investors to

diversify into the most feasible investment (Arrozi,

2016b; Hartono, 2015; Scott, 2015).

Indonesian capital market is included as an

emerging market, which is categorizedas a weak

capital market (Prabowo, 2000; Arrozi, 2010; Arrozi

et al., 2014;Arrozi, 2016a). The characteristics of

this market are: firstly, investors tend to react

naively and unsophisticatedly to information.

Investors have limited ability to interpret, analyze,

and interpret the information they receive.

Therefore, investors tend to use rumours,

speculative, and mass behaviour. Mass behaviour

will make investors lose their rationalities because

the determination of stock prices is a manifestation

of the psychological factors and emotions of

investors (Arrozi, 2016a). As a result, investors

often make the wrong decision. The securities are

assessedinappropriately,andthe market often seems

to be fooled by the information. Secondly, the

securities in the capital market belong to the risky

Arrozi Adhikara, M., Abdurrahman, ., Sudarwan, . and Munzir, E.

Framing in Decision Making Investment at Indonesia Stock Exchange.

DOI: 10.5220/0009953628492857

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 2849-2857

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2849

assets, which meansthe financial assets that hasa risk

and the expected result is uncertain. Investors can

only estimate how much profit is expected from

their investments, and how likely the actual outcome

will deviate from the expected results. As a result,

these assets generally give a higher return whether

the return is positive or negative. Therefore, it is

reasonable for investors to take protection from the

risk of loss.Thirdly, the role of financial statements

as a support tool for investment decision making has

not been optimally used,and the application is still

relatively small in Indonesian capital market

(Prabowo, 2000; Arrozi, 2016b). This situation

occurs because investors behave as stock fryers in

profit taking through technical analysis. It also

shows that investors tend to like short-term

investments, speculative behavior, and doing active

strategy by paying attention to macro factors such as

issues, rumors, politics, conspiracy, insider trading,

regulation, market anomalies, and others. As a

result, financial statements are not utilized

maximally. Fourthly, there is a shifting when

investors are motivated in looking for return

(Paimpo and Didi, 2000). This shifting is caused by

the experience of investing based on rumorswhich

causing loss.Meanwhile, investors can study all the

company’s fundamental aspects using fundamental

analysis. Such as corporate performance, financial

statements, future issuer prospects, corporate actions

ranging from business expansion plans, particularly

dividend payout plans (Arroziet al., 2014; JSX team,

2006).

Based on the explanation above, it is clear that

the investment process depends on mass psychology

and tends to use rumours to act speculatively. The

indication ofthis condition is shown by the

unsophisticated and naive investors (Prabowo, 2000;

Hartono, 2015; Arrozi, 2016a). Investors are less

likely to have an understanding of financial

knowledge about corporate information disclosure

signals because of their limited cognitive ability to

interpret the information. As a result, it will cause

some negative consequences. Firstly, it

misleadsinvestors to revise the initial belief about

the expected values that have been determined by

the interpretation of accounting

information.Secondly, it gives investor behavior to

become impatience, loss control, and more

impulsive attitude because it has misinterpreted

perceptions on the interpreted object. Therefore, the

investment decisions will experience many high

risks.Thirdly, there is a probability of making a

mistake in predicting the subjectivity of return and

risk. Fourthly,it misleads investors in making

rational decisions because the relevant securities are

assessed inappropriately. The investment decision-

making process in the capital market for investors is

sophisticated and rational, which means investors

will choose the investment opportunity that provides

the highest utility maximization and welfare (Scott,

2015). Utility maximization indicates the level of

expected return subjectivity based on the investment

opportunity in an individual stock or stock portfolio.

Then, it also depends on the cognitive capacity of

each securities analyst according to investor

preference. The sophisticated investors must have

the ability to think, consider, imagine, and have the

skills in processing information, applying

investment knowledge, and making changes in

investment preferences. This process is a cognitive

process which is done by securities analysts through

memory, attention, perception, action, problem-

solving, mental imagery, human information

processing, and strong belief in the investment.

The application of explanation above is

necessary because it is important for investors to

allocate funds into each of the selected securities in

their investments. The objective is to estimate the

return and risk of each investment securities. Each

security is compared with the return and risk value,

then the value of return and risk are sorted from the

highest to the lowest (Markowitz, 1952; Nofsinger,

2005). This method is used by securities analysts to

establish initial beliefs of selected securities in

making investment portfolios based on return and

risk preferences. This process is called mental

accounting. The implementation of mental

accountinguses anchoring or narrow framing, which

is the disclosure of the fact in investment about the

return(gain) and risk (losses) (Kahneman and

Tversky, 1981; Thaler, 1985; Barberis and Huang,

2001). This indicates the investor preference

onreturn and risk of the securities.

Barberis and Huang (2001) considered the form

of mental accounting, which means investors pay

attention about return and risk in their individual

stocks. Moreover, investors are also concerned about

return and risk of their portfolios. Those investment

behaviors show that investors have two possible

attitudes, firstly, a tendency to accept the risk (risk

seeker), avoid risk (risk averter), or having a neutral

attitude.Secondly, the investors preference to receive

a return in the form of capital gains, dividends, or

both capital gains and dividends (Djunaidi, 1990;

Nofsinger, 2005; Arrozi, 2010; Arrozi, 2016a;

Arrozi, 2016b). In order to find out the behavior of

securities analysts as the representation of investors

in addressing the return and risk, framing is used to

ICRI 2018 - International Conference Recent Innovation

2850

explain investor preferences. Therefore, this causes

an attitude for investors which tend to accept gains

in a positive frame or accept losses in a negative

frame, or even respond equally to both of them.

However, when the decisionmaking in the capital

market is under uncertainty condition, investors

usually will hold an irrational attitude because there

is a possibility of investor will get an abnormal

return.Some studies have found that investors often

violate the assumption of rationality. This occurs

because the decision framing which is adopted by

the decision maker depends on the formulation of

the problem, cognitive aspects, norms, habits, and

characteristics of the decision maker. The adopted

frame depends on the cognitive phenomenon of

investors in determining and influencing their

decisions (Kahneman and Tversky, 1981) which is

caused by the available information and how the

information is interpreted.

This research has some motivations. Firstly, this

issue has not been studied empirically in the field of

capital market. In the accounting environment,

mental accounting has been applied in taxation

(White et al., 1993), money markets (Harvey, 1996),

and auditing (Karim et al., 1995), however, it has not

been applied in the study of the capital market.

Indonesian Stock Exchange (IDX) is an emerging

market, which means the decision making of

investment is speculative,and it is still influenced by

opinion and mass psychology. Meanwhile,

accounting and financial decision-making focus on

the utilization, processing, and evaluation of

information from financial statements, particularly

in securities investment decisions. Secondly, mental

accounting provides an alternative explanation for

decision making which is beneficial under

uncertainty condition. This concept determines the

preferences of securities analysts in dealing with

securities investment as a form of decision framing

based on the preference of return or risk.It makes

easier to identify investor behavior that tends to

make investment decisions with framing to bear the

risk or avoid the risk.Thirdly, the preference about

investment prospect is dichotomous and confusing.

The preference indicates investment risk; however,

on the other hand, it implies utility maximization on

return. Meanwhile, both of them have very close

relevance,and they are not mutually exclusive.

This research is a replication study from

Kahneman and Tversky (1981). This research will

provide empirical evidence about investment

decision making in Indonesia can be which

explained by the theory of prospect. This research

does not propose any hypothesis because it is

exploratory research. Moreover, this research is

expected to give important contribution inbehavioral

accounting and behavioral finance whereas the

decision making and information processing are the

main activity factors.

2 LITERATURE REVIEW

The concept of mental accounting refers to the way

investors frame their financial decisions and

evaluate their investment decisions (Thaler, 1985),

and it refers to the way individuals decide current

and future assets to be separate, non-transferable

parts (Nofsinger, 2005). This concept provides a

broad description through a cognitive process when

people feel, categorize, evaluate, and engage in

financial activities. Mental accounting has an

individual content item that determines the different

utility levels in each asset group which affects their

consumption decisions and other behaviors.This

concept provides descriptions through the cognitive

processes in which individuals perceive, categorize,

evaluate, and engage in financial activities with a

form of mental accounting. The manifestations are

individuals classifying expenditures in budgets (e.g.

food, housing), welfare distribution in accounts (e.g.

pensions, insurance), and dividing income sources

into categories (eg.. regular income, winning money

from the lottery, savings, investment). The

accounting process of mental accounting provides

important goals, such as facilitating decisions that

use our funds, and the function of self-control

through spending rules into the placement of funds

in the threshold of accounts.

The mental accounting of investor pays attention

to gains and losses (Barberis and Huang, 2001). The

implementation of mental accounting is by using

narrow framing, which means investors frame their

financial decisions by expressing their attention to

gains/returns or losses/risks and evaluating their

investment decisions. Therefore, investors frame a

transaction subjectively in their minds to determine

the utility that they accept.This reflects the non-

consumption resources of utility when the

experience of nature exceeds narrow framed gains

and losses. Furthermore, investors consider two

forms of mental accounting. Firstly, investors are

concerned about gains and losses in the value of

individual stocks (individual stock accounting);

secondly, investors care about gains and losses in the

value of the entire portfolio and shows that the

mental accounting affects the price of assets in a

significant way.The investment behavior shows that

Framing in Decision Making Investment at Indonesia Stock Exchange

2851

investors have two possible attitudes, firstly, a risk

seeker preference, risk averter, or neutral attitude.

Secondly, abehavior to receive a return in the form

of capital gains, dividends, or both of capital gains

and dividends (Djunaidi, 1990).Framing is used to

explain the preferences of securities analysts to show

the behavior of securities analysts as the

representation of investorsin addressing the return

and risk. This causes an attitude that tends to accept

gains/returns in a positive frame and accept

losses/risk in a negative frame, or respond equally to

both attitudes.

The assumption model of investor preferences

(Markowitz, 1952) is based on expected returns and

risk from portfolios that implicitly assume investors

have the same utility function. However, each

investor has a different utility function (Hartono,

2015). If investor preferences on the

portfolioaredifferent because investors have

different utility functions, the optimal portfolio for

each investor will also be different. The Markowitz

model does not consider this, because the focus lies

on the value of the portfolio with the smallest risk

for a given expected return. However, there are

some vary investor preferences. A risk-averse

investor will choose according to Markowitz's model

response. Meanwhile a risk seeker investor will

choose a high risk with the high returns implication.

The selection of portfolio is based on investor

preferences is an efficient portfolio, which is still in

the efficient set. The chosen portfolio depends on the

function of each utility. The optimal portfolio for

each investor lies at the point of intersection

between the utility function of the investor and the

efficient set.

Investors use some axioms in the investment

decision-making process based on the expected

utility model (Scott, 2015; Schoemaker, 1982). This

is the underlying model of investment selection in

the portfolio in the context of the mean-variance

model. The expected utility model historically

provides normative and descriptive models for risk-

making decisions. This theory assumes that the

decision maker is a rational investor. The decision

makers are considered to be capable of processing

information perfectly in determining the best option.

The assumption of rationality also requires

consistency and coherence in decisions making. The

axioms of investment decision making are stated

below:

a. Investors can choose some alternatives by

arranging the ranking from various alternatives

to make decisions.

b. Each rank of these alternatives is transitive. This

means if investment A is preferred over B, and

B is preferred over C, then A will be certainly

preferred over C.

c. Investors will consider alternative risks they and

do not pay attention into of these alternative

characteristics. For example, investors will not

consider whether an investment opportunity is

more capital intensive or more labour-intensive.

d. Investors can determine the certainty equivalent

of any uncertain investment. The certainty

equivalent of investment indicates a certain

value that is equivalent to the expected value of

the investment.

Those axioms can be used to construct utility

functions from investors as a basis for an investor’s

attitude model against risk. The objective is

maximizing the expected utility index of income

(discounted interest rate). The utility functions are

used to select investments that have an element of

uncertainty. Investors will choose investments based

on expected returns at a maximum or high level.

Investors may have different utility functions.

Therefore, they may choose the different investment

or equal investment opportunities. The utility

function can be different between one investor and

another investor. The differences in functioning

investor utilities can be illustrated by indifference

curves, which means investors will not feel different

as long as investors are on the curve. The utility rate

of investors will differ from each other at the same

level of risk, but investors will prefer to choose

utility rates at higher returns. Thisshows a risk

preference for investors (Scott, 2015; Arrozi et al.,

2014; Arrozi et al., 2016a).

The concept of mental accounting is similar to

the prospect theory (Kahneman and Tversky, 1979).

Mental accounting adopts many of the prospect

theory structure as a value function in the analysis.

The prospect theory describes how investors frame

and assess a decision in uncertainty condition.First,

the investor frames the option regarding potential

profit and loss relative to a specific referent point.

Second, investors assess the advantages or

disadvantages which are related to S-shape function.

This is useful as an alternative explanation in

decision making. The main element of the prospect

theory is the value function in the form of concave

(risk averse) in the profit domain,and a convex in the

loss domain, both of them measures the relative to a

neutral referent point with a value of 0. Mental

accounting provides basic thinking for decision-

makers in designing referent points on the accounts

which determine profits and losses. The decision

ICRI 2018 - International Conference Recent Innovation

2852

makers tend to separate the different types from

speculation into separate accounts, and then they use

the prospect theory on each account by ignoring

possible interactions.

3 RESEARCH METHOD

3.1 Type of Research

This research is descriptive research which is

developed from Kahneman and Tversky (1981).

This study uses the methodology of the survey,

which means the data is collected by using a

questionnaire instrument.

3.2 Source of Data

This research uses questionnaires which are filled by

respondents. Therefore, the data is the primary data.

The object research is an individual of investors.

3.3 Criteria for Determination of

Population, Sample, and

Respondent

The population of this study is investors who invest

in capital markets and members of the Indonesian

Securities Investor Society (MISI). The sample

includes individual investors using investment

strategies.

3.4 Method of Collecting Data

Data were collected using a questionnaire survey

method. The questionnaire was provided with a

personal interview. The purposive sampling and

snowball method are used to handle the data

collected from investors.

4 RESULTS AND DISCUSSION

The data were collected through a survey with 150

sheets of questionnaires. However, only 110

questionnaires are returned from the respondents.

Therefore, the response rate of the questionnaire is

73.3%. The questionnaire tabulation is shown in

Table 1.

Table 1:Return Questionnaires

Information

Total

Questionnaires sent

150 copies

The questionnaires are invalid because the address is unknown

0 copies

Total questionnaires sent

150 copies

The returned questionnaires

110 copies

Percentage returns

73,3 %

A usable questionnaires

110 copies

The percentage which can be used

73,3 %

4.1 Demographics of Respondents

The analysis is based on the answers of 110

respondents. The male respondents amount to 78

people (70.9%),and female respondents amount to

32 people (29.1%). The respondents who worked

between 1 to 5 years amount to 19 people (17.3%),

respondents who worked for 6 - 10 years amount to

38 people (34.5%), and respondents who worked

more than 10 years amount to 53 people (48, 2%).

Table 2 shows the demographic data of respondents:

Framing in Decision Making Investment at Indonesia Stock Exchange

2853

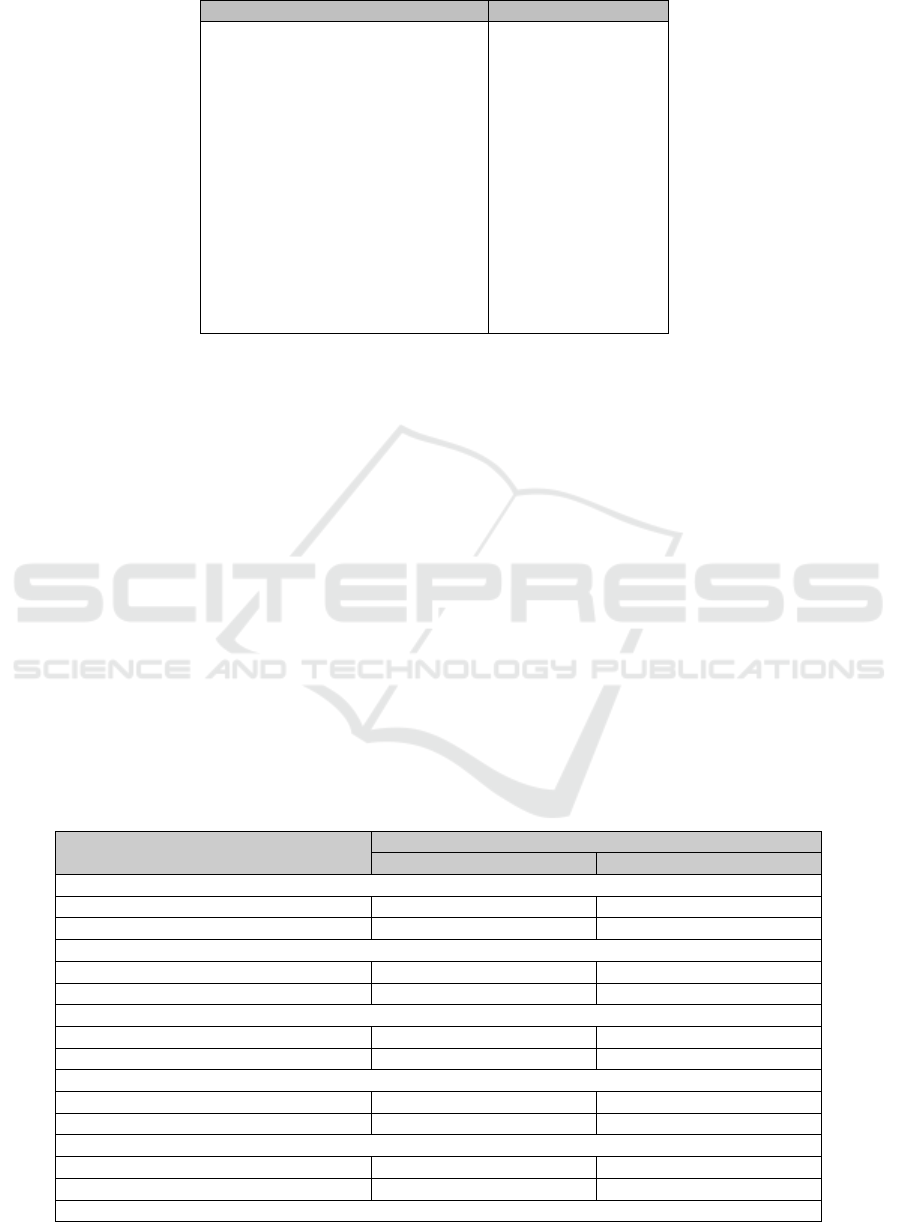

Table 2:Demographics of Respondents

Information

Total

Gender

Male

78

Female

32

Total

110

Experience

1 – 5 years

19

6 -10 years

38

> 10 years

53

Total

110

Education

<Bachelor

87

>Master or post-graduate

23

Total

110

4.2 Discussion

The results of respondents answers are

summarized in Table 3. This table shows a summary

of the comparison between research results with

Kahneman and Tversky (1981).

4.2.1 Case Analysis 1

Case 1: Imagine that the Government of

Indonesia is preparing a business to eradicate highly

dangerous speculators who will attack the issuers on

Indonesia Stock Exchange. The speculators attempt

to destroy 600 emitters. The Financial Authority

Service has two choices of programs to eradicate it,

each of them has the following effects:

If program A is selected, 200 issuers will be

saved. (59%).

If program B is selected, the probability of 600

issuers will be savedis1/3, whereas the probability

that the issuer cannotbe saved is 2/3 (41%).

This problem is shown by using positive

framing, which means it emphasizeson the problem

that can be saved. Based on the expected utility

theory, program A and program B will have the

same expected utility value (A: 100% x 200 = 200 |

B: 1/3 x 600 + 2 / 3 x 0 = 200). In case 1, the

positive framing indicates that many respondents

choose program A compared to program B, even

though the difference is not big. This shows that

investors perceive an investment based on the profit-

is-proportional-to-the-loss. The higher the desired

return will also make the higher risk probability of

the investment. Based on the positive framing,

investors in Indonesian Stock Exchange shows a

neutral attitude in choosing an alternative.

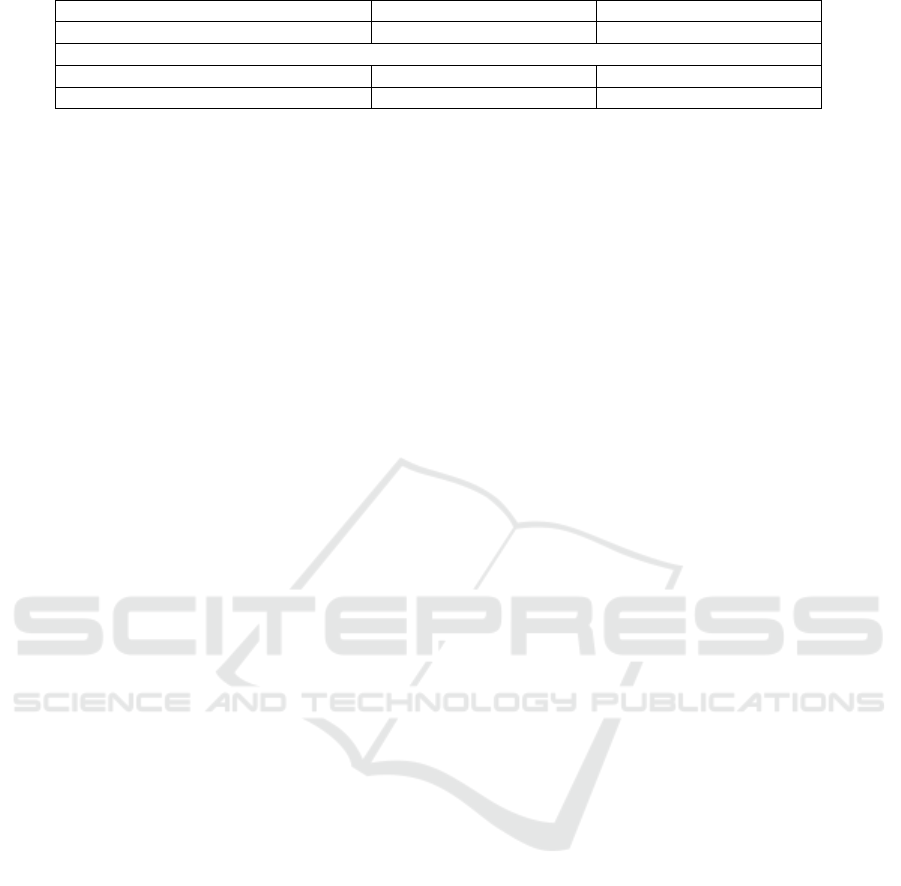

Table 3: The Comparison Between Research Result and Tversky dan Kahneman (TK)’s Result

Case Number

Percentage Result

Research Result (%)

TK’s Result (%)

Case 1

Alternative A

59

72

Alternative B

41

28

Case 2

Alternative A

32

22

Alternative B

68

78

Case 3 – Part 1

Alternative A

37

84

Alternative B

63

16

Case 3 – Part 2

Alternative A

28

13

Alternative B

72

87

Case 4

Alternative A

20

0

Alternative B

80

100

Case 5

ICRI 2018 - International Conference Recent Innovation

2854

Alternative A

58

88

Alternative B

42

12

Case 6

Alternative A

56

46

Alternative B

44

54

4.2.2 Case Analysis 2

Case 2: Imagine that the Government of

Indonesia is preparing a business to eradicate highly

dangerous speculators who will attack the issuers on

Indonesia Stock Exchange. The speculators attempt

to destroy 600 emitters. The Financial Authority

Service has two choices of programs to eradicate it,

each of them has the following effects:

If program A is selected, 400 issuers will be

liquidated (32%). If program B is selected, the

issuer's probability of not being liquidated is 1/3,

meanwhile the probability of issuer’s profit is 2/3.

(68%).This problem is shown by using negative

framing, which means it emphasizes the problem

that the issuerwhich is going to be liquidated. Based

on the expected utility theory, program A and

program B will have the same expected utility value

(A: 100% x 400 = 400| B: 1/3 x 0 + 2 / 3 x 600 =

400). ). In the case of negative framing, respondents

chose program B compared to program A. This

shows that investors are more daring to take the risk,

which means that investors prefer to choose B that

have 2/3 chance of liquidity instead of choosing A

with a chance only 400 issuers liquidity. This proxy

provides an understanding that investors preferences

for investment regarding expected returns and risk

are not singular,butthey have different preferences.

4.2.3 Case Analysis 3

Case 3: Imagine that you are facing two alternative

sets of decisions. Learn each alternative carefully,

then choose which one you like

Decision 1. Choose one according to your

preference:

A. The certain profit of Rp. 240.000, - (37%)

B.The profit probability of Rp. 1,000,000 is 25%

The profit probability Rp. 0 is 75%. (63%)

If you are asked to decide, which alternatives do you

like?

Decision 2. Choose one according to your

preference:

C.The certain loss of Rp. 750.000, - (28%)

D. The loss probability of Rp. 1,000,000 is 25%

The loss probability of Rp. 0 is 25%. (72%)

If you are asked to decide, which alternatives do you

like?

In this case, there is the difference between decision

1 and decision 2 in framing financial decision.

Investors have the opportunity to see each type of

decision case.

The decision 1 shows that the investors prefer

alternative B with the big difference(36%) compared

to investors who choose alternative A. The results of

this study is different from Kahneman and Tversky

(1981) because the positive framing is clearly

different from the results of Kahneman and Tversky

(1981). The investors in Indonesian Stock Exchange

is neutral for choosing alternatives in positive

framing.

In decision 2, many investors choose alternative

D. This shows that investors act as a risk taker,

which means investors prefer to choose risk

alternatives than the alternative without risk. The

participants can make a combination of alternative

options to maximize their utility because the

exposure of decisions 1 and 2 in case 3 is displayed

simultaneously. The alternative combination of

options can be done according to investor

preferences, which are AC, AD, BC, and BD. The

results show that the investor choosing combination

B and D is consistent with investor preference.

4.2.4 Case Analysis 4

Case 4: Choose one of the alternatives that you like:

Alternative 1:

A and D: The profit probability of Rp. 240.000 is

25%, - andnThe loss probability at Rp. 760.000 is

75% - (20%)

Alternative 2:

B and C:The profit probability of Rp. 250.000 is

25%, - andThe loss probability at Rp.750.000 is 75%

- (80%)

If you are asked to decide which alternatives do

youlike?

Many investors choose alternative 2 (B and C

shows). This result shows a different decision

making with the case 3. It also indicates that

investors may not have the ability to combine

discrete information about the financial investment

and financial fundamentals of the issuer to make

Framing in Decision Making Investment at Indonesia Stock Exchange

2855

optimal choices in the decision making of securities

investment.

This questionnaire answer shows that investors

in decision-making process, especially in selecting

individual securities, ranking expected returns and

risk of individual securities, and compiling a

portfolio of individual securities will be able to

reverse 360 degrees in a securities analysis if the

investors can combine facts to be analyzed when the

investment is not mutually exclusive.

4.2.5 Case Analysis 5 and 6

Case 5: Imagine the situation where you intend to

attend a Financial Investment seminar where the

ticket price/seminar fee is Rp. 20.000. When you

arrive at the seminar building, yourealize that you

lost Rp. 20.000 from your wallet.

Are you still willing to spend Rp. 20,000, - to attend

the Financial Investment seminar?

ANSWER: YES (58%) NO (42%)

Case 6: Imagine that you have purchased a ticket for

Rp. 20,000.0 to attend Financial Investment seminar.

When you enter the seminar building,you suddenly

realize that the ticket is missing. Therefore, you are

not allowed to enter the building.

Are you still willing to spend Rp. 20,000 to

attend the Financial Investment seminar?

ANSWER: YES (56%) NO (44%)

These cases are used to perform an analysis in a

situation when an action may alter the balance which

is previously created by the action. This shows a

change in the balance due to the result of the new

decision. Case 5 and case 6 are the influence of

sunk-cost effects which arise from an action that has

been done before; the evaluation uses a negative

referent point that appears as a failure of the last

decision. That means that the investors who already

have risk taker preferences will bear all the risks

from investment activities and the investment

planning. The investments that have been issued will

be able to provide the maximum expected return or

zero return. Investors will subjectively make

assessment and decisions from the referent point (the

value function of prospect theory). Therefore, the

investor will feel as if the value of a certain amount

of money in investment will be greater than the

winning the similar amount of money. In a loss

situation, the investor will tend to act recklessly at

risk, since further losses will result in lower

subjective value than profit. The result of case 5 and

case 6 indicates that a loss of money is not

specifically related to the purchase of a ticket. The

implications of the investor will be indifference to

the fair incident.

5 CONCLUSIONS

This study provides evidenceof mental accounting

investor regarding the preferences of financial

investments. This evidence can be used to explain

the phenomenon of investor investment decision

making in the Indonesian Stock Exchange. The

research result is different with Kahneman and

Tversky (1981), particularly for case 2, cases 3 part

1, case 4, case 5, and case 6. They specifically

indicate that investmentdecision-making cases are

described by negative framing (case 2 and 4) and

positive framing (case 3 part 1).This shows that

investors in Indonesian Stock Exchange tend to be

risk neutral in maximizing their utility. It also

providesevidence that investors ten to be

indifference in fair investment. Also, case 5 and case

6 indicate that Indonesian investors' decisions tend

to be consistent in valuing Rp. 20,000,which means

they do not considerwhether it is money or ticket.

However, this study also shows similarities with

Kahneman and Tversky’s research (1981). This

similarity can be seen in case 3 part 2, which is the

case using negative framing. This indicates that the

negative framing of both Indonesian investors and

U.S. investors (Kahneman and Tversky’s research,

1981) are a risk taker.

5.1 Limitations and Direction for

Future Research

This research concludes that the positive framing

of Indonesian behavior may differ from foreigners.

This condition occurs because of several factors. For

example, the cultural differences that cause

differences in attitude in making investment

decisions. Then, the behaviorof Indonesian people in

receiving information with a positive framing can

affect the personality, behavior, and perceptions of a

person

This study was conducted on investorswho have

different investment strategies, which area

speculative investment strategy, aggressive

investment strategy, and core investment strategy.

The results indicate a generalization of investor

preference attitude to investment. The future

ICRI 2018 - International Conference Recent Innovation

2856

researchare expected to create clusters for each

strategy. Therefore, there will be investor

preferences in groups.

REFERENCES

Arrozi, M. F.(2010).Revisi Keyakinan Atas Sinyal

Informasi Akuntansi (Beliefs Revision on Accounting

Information Signals).Jurnal Akuntansi dan Auditing

Indonesia, 14(2): 165 – 184.

Arrozi, M. F., Maslichah, and Diana, N.(2014).Qualitative

characteristics of accounting information in the belief

revision of the users for the securities prospects in

Indonesia Stock Exchange (IDX).Journal of

Economics, Business, and Accountancy Ventura,

17(1): 91 – 104.

Arrozi, M. F.(2016a). Mimetic Action Performed By

Individual Inventors at Indonesia Stock Exchange

(IDX).International Journal of Applied Business and

Economic Research, 14(6): 3909-3927.

Arrozi, M. F.(2016b).Behaviour of Risk Neutral

Individual Investors In The Indonesian Stock

Exchange, International Conference of Economic

Business and SocialScience, IFMA-Unisma,

Desember, Malang.

Barberis, N., and Huang, M.(2001). Mental Accounting,

Loss Aversion, and Individual Stock Returns.The

Journal of Finance, LVI(4).

Djunaidi, A. (1990). Investasi Melalui Instrumen Pasar

Modal: Mengapa Dividen Lebih Penting, Info Pasar

Modal, Juni, Jakarta.

East, R.(1993). Investment Decision and the Theory of

Planned Behaviour.Journal of Economic Psychology,

14: 337-375.

Hartono, M. J.(2015).Teori Portofolio dan Analisis

Investasi, Edisi Sepuluh, BPFE Yogyakarta.

Harvey, J.T.(1996).Long Term Exchange Rate

Movements: The Role of The Fundamentals In

Neoclasical Models of Exchange Rates.Journal of

Economics Issue, 30(2): 509-516.

JSX Team.(2006).Berburu Dividen, Lihat Dulu Jadwalnya

- Ada faktor psikologis, menjelang pembagian dividen

harga saham akan naik, Republika, April 17.

Kahneman, D. and Tversky, A.(1979). Prospect Theory:

An Analysis of Decision under Risk, Econometrica,

March: 263-291.

Kahneman, D., and Tversky, A. (1981).The Framing of

Decisions and The Psychology of Choice.Science,

211(30): pp 453 – 458.

Karim, J., Johnson, P. E., and Berryman, R. E.(1995).

Detecting Framing Effects in Financial

Statements.Contemporary Accounting Research,

12(1): 85-105.

Markowitz, H.M.(1952).Portofolio Selection.Journal of

Finance (March 1952): 77-91.

Nofsinger, J. R. (2005).The Psychology of Investing,

Pearson Education, Second Ed., Upper Saddle River,

New Jersey.

Paimpo and Didi.(2000).Bukan waktunya lagi

mengandalkan rumor.Media Akuntansi, (10): 16 – 17.

Prabowo, T.(2000).Dissemination of Information di Pasar

Modal, Media Akuntansi, No. 10, VII, June, Jakarta.

Schoemaker, P.(1982). The Expected Utility Model: Its

Variance, purposes, evidence and limitations.Journal

of Economic Literature,20: 529 – 563.

Scott, W. R.(2015).Financial Accounting Theory,

6edition, Pearson Education Canada Inc., Toronto.

Thaler, R. H.(1985). Mental Accounting and Consumer

Choice.Marketing Science, 4: 199-214.

White, R.A., Harrison, P. D., and Harrell, A.(1993). The

Impact of Income Tax Witholding on Taxpayer

Compliance: Further Empirical Evidence.The Journal

of the American Taxation Association, (3): 63-78.

Framing in Decision Making Investment at Indonesia Stock Exchange

2857