The Determinations of Return on Equity in the Food and Beverage

Industry in Indonesia Stock Exchange

Nurjannah Endah Rahayu

1

, Eva Cahaya Reski

2

,Sugiyanto

1

and Jatmiko

1

1

Lecturer of Department of Management Faculty of Economic and Business, Esa Unggul University

2

Student of Department of Management, Esa Unggul University, Kebon Jeruk, Jakarta, Indonesia

Keywords: Financial Leverage Multiplier (FLM), TotalAssetsTurnover (TATO), Operating Profit Margin (OPM),

Interest Burden (IB), Tax Burden (TB) and Return on Equity (ROE).

Abstract: This study aims to determine the influence of Financing Leverage Multiplier (FLM), Total Asset Turnover

(TATO), Operating Profit Margin (OPM), Interest Burden (IB), and Tax Burden (TB) toward Return on

Equity (ROE). The type of research is explanatory causality and using secondary data. This study set out five

years from 2011-2015. Purposive sampling technique used in the sampling and uses 18 companies from all

over the food and beverage companies in Indonesia. The 70 data obtained from financial statements at 18 the

food and beverage companies. Data analysis with multiple regression, hypotheses test used partial t – test and

F – test at the level of significance 5%. The results of this study indicate that: partially

(1)FinancialLeverageMultiplier (FLM) has significant positive influence toward Return on Equity (ROE), (2)

Total Assets Turnover (TATO) has positive significant influence toward Return on Equity (ROE), (3)

Operating Profit Margin (OPM) has significant positive influence toward Return on Equity (ROE), (4) Interest

Burden (IB) have significant positive influence toward Return on Equity (ROE), and (5) Tax Burden (TB)

have a negative influence and insignificant toward Return on Equity.

1 INTRODUCTION

Food and beverage industries are one of the

categories of industrial sectors in Indonesia Stock

Exchange which have the opportunity to grow and

develop. Food and beverage industry predicted will

improve its condition. It is seen growing food and

beverage industries mushrooming in the country. This

condition makes the competition getting tougher so

that the managers of the company looking for

investors to invest their funds in the food and

beverage companies.

Consumer goods became an important industry

for the economic development of the nation. This is

not apart from the companies that are engaged in the

industry of consumer goods in Indonesia. It cannot be

denied that in the process of production of consumer

goods it takes lots of resources including human

resources. Consumer goods industry has a role in

absorbing the labour and increase income in a

country. Food and beverage companies area company

engaged in the manufacture of the product later sold

for a huge profit. To achieve that goal required

management with a high level of effectiveness.

Measurement of the level of effectiveness of

management shown by the profit resulting from the

sale of investment income, and can be madeby

knowing how big the profitability ratios that are

owned (Weston and Brigham (2010) in Afrinda

(2013)).

Among of food and beverage companies that are

listed on the Indonesia Stock Exchange more than

other companies. Thismakes the author interested to

choose food and beverage companies as an object that

will be examined, food and beverage companies that

are listed on the Indonesia stock exchange which will

be presented in Table 1.

Table 1: List of the food and beverages companies on the

Indonesian Stock Exchange period 2011-2015

No. Code The name of the companies

1

ADES Akasha Wira International Co., Ltd.

2

AISA Tiga Pilar Sejahtera Food Co., Ltd.

3

CEKA Wilmar Cahaya Indonesia Co., Ltd.

4

DLTA Delta Jakarta Co., Ltd.

2778

Endah Rahayu, N., Cahaya Reski, E., Sugiyanto, . and Jatmiko, .

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange.

DOI: 10.5220/0009952627782787

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 2778-2787

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

No. Code The name of the companies

5

FAST Fast Food IndonesiaCo., Ltd.

6

ICBP

Indofood CBP Sukses Makmur Co.,

Ltd.

7

INDF Indofood Sukses Makmur Co., Ltd.

8

MLBI Multi Bintang Indonesia Co., Ltd.

9

MYOR Mayora Indah Co., Ltd.

10

PTSP

Pioneerindo Gourmet International

Co., Ltd.

11

ROTI

Nippon Indosari Corpindo Co.,

Ltd.

12

SIPD Sierad Produce Co., Ltd.

13

SKBM Sekar Bumi Co., Ltd.

14

SKLT Sekar Laut Co., Ltd.

15

SMAR

Sinar Mas Agro Resources and

Technology Co., Ltd.

16

STTP Sintar Top Co., Ltd.

17

ULTJ

Ultrajaya Milk Industry & Trading

Company Co., Ltd.

18

TBLA Tunas Baru Lampung Co., Ltd.

Source: Indonesia Stock Exchange, processed by the

author.

In this era of globalization the business world

increasingly growing rapidly, there so many new

companies, thereby encouraging companies to be

more efficient and more selective in operation, so that

the objectives of the company in achieving high

profits, in the long run, could be realized.

The company must always be monitored, can be

done by analyzing the financial statements

themselves are generally made up of balance sheets

and reports income statement. The balance sheet

describes the State of the finances of a company at a

certain period, while the income statement shows the

results of the efforts and costs during the period of

accounting. The financial statements will be more

informative and useful, then the parties concerned

with financial information should analyze in advance.

Through the analysis of financial statements can

be known of the success of the firms that are indicated

by the financial report, which is the basis of the

assessment of the achievements ofthe company. One

of the basic considerations that serve as a referencefor

measuring the company's performance was a

financial report. The financial report is an important

source of information for the companies. The

financials have information describing the financial

condition of a company (Fahmi, 2012). The

measurement tool used to analyze financial

statements include ratio analysis, analysis of market

value added (MVA), the analysis of the economic

value added (EVA, the Balance Score Card (BSC),

Analysis of capital asset, management, equity, and

liquidity (CAMEL) and the du Pont system

(Warsono,2003).In this study were used to analyze

the financial statements is to use ratio analysis of

profitability regarding the return on equity (ROE).

Return on equity (ROE) was influenced by

financial leverage multiplier (FLM), total asset

turnover (TATO), and net profit income (NPM). Net

profit income can be broken down into

three,operating profit margins(OPM), interest burden

(IB), and tax burden (TB). Financial leverage

multiplier (FLM) used to measure the ability of

management to manage its assets, due to the costs that

incurred by the use of assets.Research conducted by

Animah et al. (2009), Kumalasari and Widyawati

(2016) shows the results that leverage multiplier

(LM) have a negative influence and significant

toward return on equity (ROE). This contrasts with

the results of research conducted by Hamid et al.

(2016) which suggests that leverage multiplier (LM)

insignificantly toward return on equity (ROE).

Based on the issues above, then the purpose of

this research is (1) Partially, to know the influence of

financial leverage multiplier (FLM), total asset

turnover(TATO), operating profit margins (OPM)

,interest burden (IB), tax burden (TB) toward Return

on Equity (ROE) on the food and beverage companies

in Indonesia, (2) Simultaneously, to know the

influence financial leverage multiplier (FLM), total

asset turnover(TATO), operating profit

margins(OPM), interest burden(IB), and tax

burden(TB) toward Return on Equity (ROE) on the

food and beverage companies in Indonesia

2 LITERATURE REVIEW

2.1 Financial Analysis

For the process of financial analysis is obtained from

a range of sources internally generated by the

company. These statements can be prepared

periodically, generally annually, but could also be

done quarterly or for biannual accounting periods.

The most basic and compact financial document

available to the general public is the financial

statements.

2.2 Return on Equity

Return on equity (ROE) shows how much profit is

generated from shareholders. ROE is calculated from

data in both the balance sheet and profit and loss

statement. Total Assets Turnover is the ratio that

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange

2779

indicates the level of efficient use of overall

company's assets in a certain volume of sales,

generates Syamsuddin (2007). Leverage is an

indication of the company uses outside party funds to

buy assets. Net Profit Margin is the ratio between the

net profit (net profit) that is reduced by having the

entire sales expenses including sales taxes,

Syamsuddin (2007). NPM can be broken down into

three namely Operating Profit Margins (OPM),

Interest Burden (IB), and Tax Burden (TB).

Operating Profit Margins (OPM) shows a trend

towards the increase or decrease in performance and

the influence of indirect cost against profits

generated. Interest Burden. The ratio indicates how

much of the resulting operating income to cover

interest expenses.Tax Burden (TB) is used to measure

the influence of taxes on Return on Equity (ROE),

which is the rest of the profit after the interest which

is used to pay tax.

2.3 Relationship among Variables

2.3.1 The Relationship between FLM

(Financial Leverage Multiplier) with

ROE

Financial Leverage Multiplier (FLM) used to

measure the part of the assets that funded by

shareholders. On a good economic condition or

stable, the use of Financial Leverage can provide a

positive influence in the form of an increase in ROE.

Thisis caused the rate of return more than the

company's operating profit. While the used of

Financial Leverage can make negative for ROE,

especially at the weak of economic conditions.

2.3.2 The Relationship between TATO

(Total Asset Turnover) with ROE

This ratio indicates the ability of the company's assets

in generating total net sales. The higher the ratio Total

Assets Turnover (TATO) shows, the more effective

the company uses its assets. Thus it is possible that

the relationship between Total Assets Turnover

(TATO) and Return on Equity (ROE) was positive.

The more effectively a company uses its assets to

generate net sales shows the company achieves better

performance.ROE increased because affected by

Total Assets Turnover (TATO) (Brigham and

Houston, 2001).

2.3.3 The Relationship between OPM

(Operating Profit Margin) with ROE

Operating Profit Margins (OPM) is used to measure

the influence the profitability of the operations toward

Return on Equity (ROE). Also, Operating Profit

Margin (OPM) is used to find out the trend towards

increased or decreased performance and influence of

indirect cost toward profits generated by the firms.

The larger the OPM, then the greater the ROE

generated, meaning that the company's performance

is the better (Kharatyan, 2016).

2.3.4 The Relationship between IB (Interest

Burden) with ROE

Interest Burden (IB) is used to measure the

influence of interest toward Return on Equity (ROE).

This ratio is used to find out how much of the

operating income to cover interest expenses. The

higher the ratio of Interest Burden (IB) means the

greater operating profit (Kharatyan, 2016).

2.3.5 The Relationship between TB (Tax

Burden) with ROE

Tax Burden (TB) is used to measure the influence of

taxes on Return on Equity (ROE), the rest of the

profit after the interest which are used to pay taxes

This TB will measure how much profit before

corporate taxes The higher the Tax Burden ratio (TB)

means,thegreater the operating profit can pay the tax

burden (Kharatyan, 2016).

3 HYPOTHESIS

The hypothesis of this research are:

H1: Financial leverage multiplier (FLM), have

significant positive influence toward return on

equity (ROE).

H2: Total asset turnover (TATO), have significant

positive influence toward return on equity

(ROE).

H3: Operating profit margins (OPM), have

significant positive influence toward return on

equity (ROE).

H4: Interest burden (IB), have significant positive

influence toward return on equity (ROE).

H5: Tax burden (TB), have positive significant

influence toward return on equity (ROE).

H6: Financial leverage multiplier (FLM), Total

asset turnover (TATO), Operating

profitmargins (OPM), Interest burden (IB),

ICRI 2018 - International Conference Recent Innovation

2780

Tax burden (TB), significant simultaneous

influence toward return on equity (ROE).

4 RESEARCH METHOD

4.1 Population, Sample, and Sampling

Techniques

The population in this study are the whole of the food

and beverage companies that are listed on the

Indonesia stock exchange period 2011-2015. All

companies listed in the food and beverage industry

that is sampled so that the sampling technique uses

census methods. The data used in this study is the

financial statements of the food and beverage

companies that are listed on the Indonesia stock

exchange period 2011-2015, there are 70

observations from 18 companies.

4.2 Data Analysis Techniques

4.2.1 Classic Assumption Test

Classical assumptions in the study include the

normality test, Heteroscedasticity test,

multicollinearity test and autocorrelation test.

a. Normality test aims to test all of the variables

have a normal distribution of data

b. Heteroscedasticity is to know the differential

among data variable. It is better if there are no

Heteroscedasticity in data.

c. Autocorrelation Test, This analysis is to know

whether there are any disturbances in analysis or

not. The analysis tool is Durbin Watson and the

best data if there is no correlation among variable.

To calculate DW dU < d<(4 – dU).

d. Multicollinear defined as the extent to which

variables in multiple regression analysis are

related to each other (Zikmund et al., 2013).

4.2.2 Statistic Descriptive

Descriptive statistics were used to provide an

overview or description of a data seen from the

average value (mean), standard deviation, variance,

maximum, minimum, sum, range, kurtosis and

Skewness distribution.

Descriptive statistics were used to provide an

overview or description of a data seen from the

average value (mean), standard deviation, variance,

maximum, minimum, sum, range, kurtosis and

Skewness (skewness distribution).

4.3 Data Analysis (Multiple Regression

Analysis

)

Y= ɑ + β1 X1+ β2 X2+ β3 X3+ β4 X4+ β5 X5 +e

Where:

Y = Return on equity,

X1 = Financial Leverage Multiplier,

X2 = Total Assets Turnover,

X3 = Operating Profit Margin,

X4 = Interest Burden,

X5 = Tax Burden,

e = error,

β = coefficient beta.

a. Return On Equity (ROE)

ROE=

(1)

b. Financial Leverage Multiplier (FLM)

FLM=

(2)

c. Total Asset Turnover (TATO)

TATO=

(3)

d. Operating Profit Margin (OPM)

OPM=

(4)

e. Interest Burden

IB=

(5)

f. Tax Burden (TB)

TB=

(6)

5 RESULTS

5.1 The Result of Classic Assumption

Test

From the KolmogorovSmirnov test data analysis (see

appendix) all of the variables are normally distributed

because all of the variables have sig value more than

0,05. The results of the data analysis show that there

is no interdependence relationship between the

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange

2781

independent variables. This can be seen from the VIF

value for all independent variables less than 5 (see

appendix).

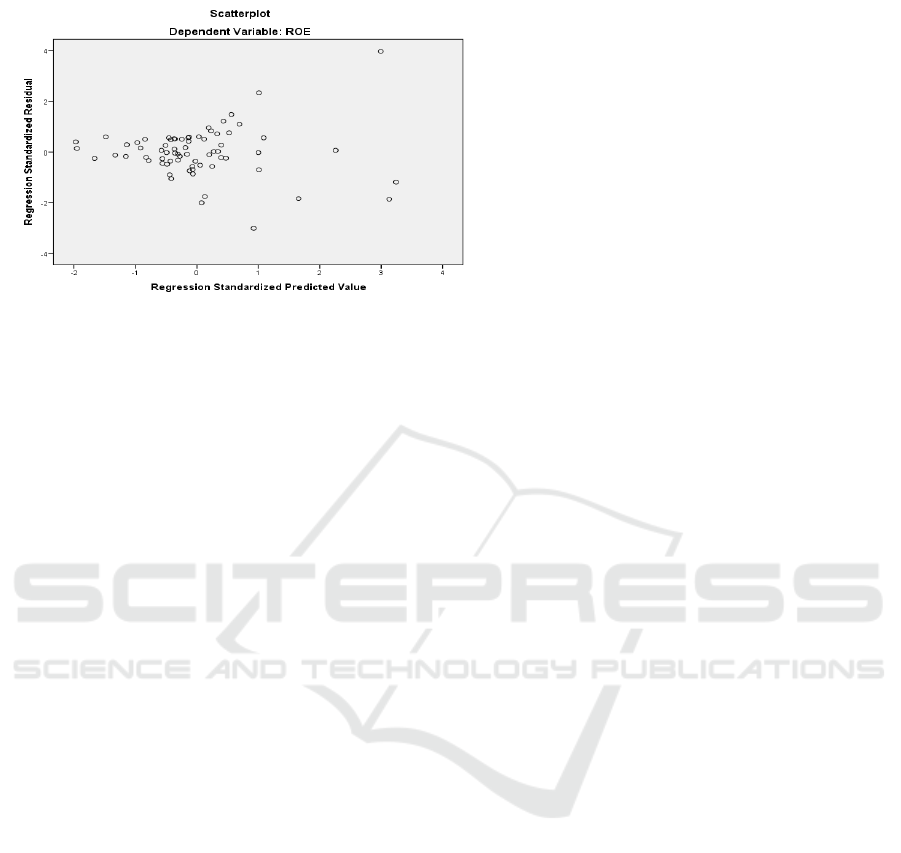

The results of autocorealysis analysis show that

the data is free from autocorrelation, this can be seen

from the value of DurbinWatson of 1.793 more than

the minimum value of Du of 1.7683. The results of

heteroscedasticity analysis show that the data is free

from heteroscedasticity, it can be seen that the scatter

plot spreads across the four quadrants (see appendix).

5.2 The Result of Statistics Descriptive

There are 70 observations in total from 18 companies

during five years.This below are the result of analysis

data Return on Equity (ROE), Financial Leverage

Multiplier (FLM), Total Assets Turnover (TATO)

,Operating Profit Margin (OPM), Interest Burden

(IB) , and Tax Burden (TB) on company that are listed

in Indonesia Stock Exchange period 2011-2015 can

be observed as in Table 2.

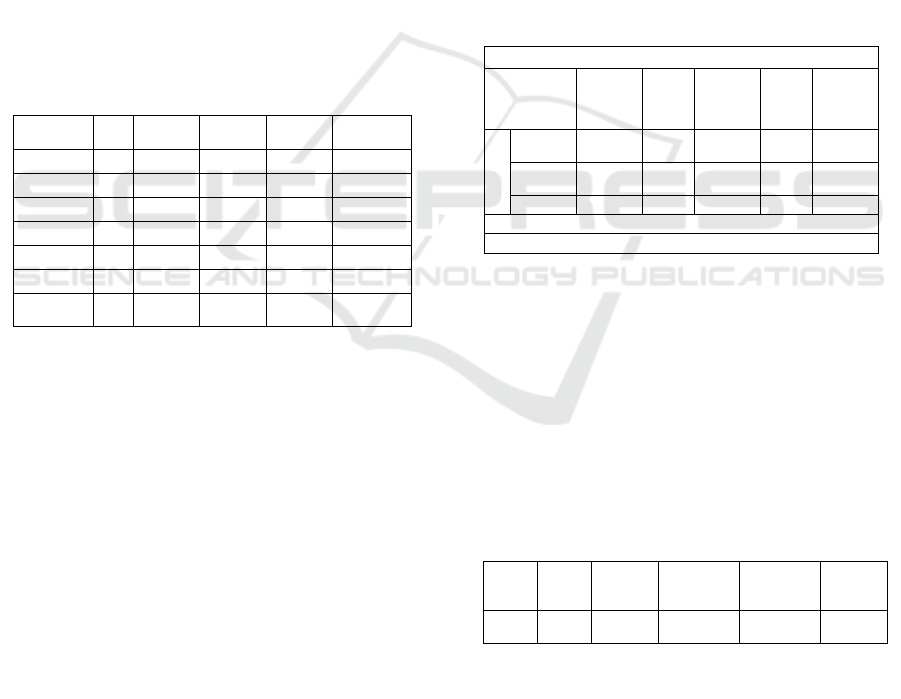

Table 2: Descriptive Statistic

N Min Max Mean Std. Dev.

OPM 70 0,0144 0,3918 0,113 0,075347

ROE 70 0,0065 0,648 0,173 0,102521

IB 70 0,0793 1,529 0,880 0,23308

TB 70 0,646 0,87 0,751 0,0336

TATO 70 0,4477 2,8827 1,39 0,5318

FLM 70 1 2,8344 1,9956 0,41377

Valid N

(listwise)

70

Sources: analytical data, processed by the author.

The lowest Operating Profit Margin from 70 data

is about 0,01448 it is Sekar Bumi Company on 2011,

and the highest lowest Operating Profit Margin is

0,39181 it is Delta Jakarta company on 2012,the

standard deviation is 0,07534752. The lowest amount

of ROE is about 0.00652 presented by Sierad Produce

Company on 2013,andthe highest amount of ROE is

0.64830 by Multibintang Indonesia Company on

2015 with standard deviation is 0,10252169. The

minimum value of Interest Burden is 0,07935 by

Sierad Produce Company in 2013,and the maximum

value is Delta Jakarta company on 2012 about

1,52983with standard deviation is 0,23308550. The

minimum value of Tax Burden is 0,64612 by

Ultrajaya Milk Industry & Trading Company on

2011,and the maximum value is Akasha Wira

International Company on 2011 about 0,87312 with

standard deviation is 0,05997220. The minimum

value of Total Assets Turnover (TATO) is 0,44771

Tiga Pilar Sejahtera Food Company on 2011,and the

maximum value is Ultrajaya Milk Industry & Trading

Company on 2011 about 2,88274 Wilmar Cahaya

Indonesia company with standard deviation is

0,03366913. The minimum value of Financial

Leverage Multiplier is 1,00000 by Nippon Indosari

Corpindo Company on 2011,and the maximum value

is Tunas Baru Lampung Company on 2013 about

2,83445 Sinar Mas Agro Resources and Technology

company with standard deviation is 0,41377998.

Study Result and discussion.

5.3 The Result of F Test

This analysis is to know there are any causal relations

between independent variable towards dependent

variable. If the value of significant simultaneously is

smaller than 0.05, it hasa relation.Table 3 shows the

result of f-test.

Table 3: F-test

ANOVA

a

Model Sum of

Square

s

Df Mean

Square

F Sig.

1

Regres

sion

0,552 5 0,110 40,6

94

0,000

b

Residu

al

0,174 64 0,003

Total

0,725 69

a. Dependent Variable: ROE

b. Predictors: (Constant), TB, FLM, TATO, IB, OPM

Sources: analytical data SPSS, processed by the author.

From the data above shown us the value of sig.

0.000<0.05 so it is mean that independent variable

simultaneously has significant influence toward

Return on Equity. So Hypothesis 6 is accepted there

are significant simultaneous influences of Financial

leverage multiplier (FLM), Total asset turnover

(TATO), Operating profit margins (OPM), Interest

burden (IB), Tax burden (TB), toward return on

equity (ROE).

Table 4: Coefficient of Determination

Mod

el

R R

Square

Adjusted

R Square

Std. Error

of the

Estimate

Durbin-

Watson

1

0,87

2

a

0,761 0,742 ,052071

7

1,793

a. Predictors: (Constant), TB, FLM, TATO, IB, OPM

b. Dependent Variable: ROE

R

2

= r

2

x 100%

= 0.742x 100%

= 74,2%

ICRI 2018 - International Conference Recent Innovation

2782

Based on Table 4, this means that Financial

Leverage Multiplier (FLM), Total Asset Turnover

(TATO), Operating Profit Margin (OPM), Interest

Burden (IB), and Tax Burden (TB) are

simultaneously influence toward return on equity

about 74,2% while 25,8% return on equity is

influenced by another variable that excludes or not

mentioned in this study.

6 DISCUSSION

From the results of the data analysis, it can be seen

that a variable of Financial Leverage Multiplier (IT),

Total Asset Turnover (TATO), Operating Profit

Margins (OPM), Interest Burden (IB), Tax Burden

(TB), simultaneously have significant influence

toward Return on Equity. Whereas, in a partially,

variable of Financial Leverage Multiplier (IT), Total

Asset Turnover (TATO), Operating Profit Margins

(OPM), Interest Burden (IB) have significant positive

influence toward Return on Equity. Whereas, the

variable tax Burden (TB) have a negative influence

and insignificant toward Return on Equity. The

determination coefficient 74.2% this means 33.06%

dependent variable is Return on Equity (ROE) could

be explained by the independent variable,i.e. IT,

TATO, OPM, IB, TB. While the rest of 25.8%.

Explained by other variables outside of the model that

are not described in this study.

6.1 The Influence of Financial

Leverage Multiplier's Variable

toward Return on Equity

Based on the results of the research that has been

done. The calculation of multiple regression equation,

the results of the test t (partial test) explained that

Financial Leverage Multiplier have significant

positiveinfluence toward Return On Equity. It shows

the H1 stating of the influence of the Financial

Leverage Multiplier toward Return On Equity on the

company's food and Beverage Industry, that is listed

on the Indonesian Stock Exchange Period 2011 -

2015. On a good or stable of the economic condition,

the use of Financial Leverage can provide a positive

influence in the form of an increase in ROE. It

Causesby the rate of return toward the company's

operating profit greater than the burden of the

program. The results of this research are consistent

with research conducted byKharatyan (2016) that

FLM hassignificant positive influence toward ROE.

6.2 The Influence of Total Asset

Turnover’s Variable toward

Return on Equity

Based on the results of the research that has been

done. The calculation of the multiple regression

equation, the results of the test t (partial test)

explained that Total Aset Turnover have positive

significant / influence toward Return On Equity. It

shows the H2 stating the existence of the influence of

the Total Aset Turnover toward Return On Equity on

the company's food and Beverage Industry that is

listed on the Indonesian Stock Exchange Period 2011

-2015 is accepted.

Profits owned by the company, influenced by

TATO of the company. As more and more companies

use its assets, suggesting that asset management

companies are increasingly effective and by itself will

be followed by a rise in profit of the company. The

value of the TATO which has increased during the

years 2011-2015 indicates the company is quite

effective in using funds that invested in assets to

generate revenue. The results of this research are

consistent with research conducted by Animah et al.

(2009) that TATO hassignificant positive influence.

6.3 The Influence of Operating Profit

Margin’s Variable toward Return

on Equity

Based on the results of the research that has been

done. The calculation of multiple regression equation,

the results of the test t (partial test) explained that

Operating Profit Margin positive significant effect/

influence toward Return On Equity. It shows the H3

stating the existence of the influence of the Operating

Profit Magin toward Return On Equity on the

company's food and Beverage Industry that is listed

on the Indonesian Stock Exchange Period 2011 -2015

is accepted.

The results of this study demonstrated the

effectiveness of the cost is getting a good deal.

Operating Profit Margins (OPM) is used to measure

the impact the profitability of the operations toward

the Return on Equity (ROE). Also, Operating Profit

Margin (OPM) used to see an increase or decrease in

performance and the influence of indirect cost against

profits generated. The decreasein cost then operating

profit will be higher which will increase the ROE. So,

the larger the OPM, then the greater the ROE

generated, meaning that the company's performance

isbetter. This is the one that makes a positive

significant influence OPM toward ROE.The results of

this research are consistent with research conducted

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange

2783

by Thomas J Liesz and Steven J Maranville.

6.4 The Influence of Interest Burden’s

Variable toward Return on Equity

Based on the results of the research that has been

done. The calculation of multiple regression equation,

the results of the test t (partial test) explained that

Interest Burden’s positive significant effect/

influence toward Return On Equity. It shows the H4

stating the existence of the influence of the Interest

Burden’s toward Return On Equity on the company's

food and Beverage Industry, that is listed on the

Indonesian Stock Exchange Periode 2011 -2015 is

accepted.

In financial management perspective, the Interest

Burden (IB) is another Income divide by Other

Expense (OI/OE). It is measure how much of the

operating income can cover the interest expenses. The

IB is also an EBTdivide by OP. The higher of the

EBT/OP is means,thegreater operating profit because

of other income greater than the burden of others.The

results of this research are consistent with research

conducted by Kusi et al. (2015).

6.5 The Influence of Tax Burden's

Variable toward Return on Equity

Based on the results of the data analysis has been

done. The calculation of multiple regression equation,

the results of the test t (partial test) explained that tax

Burden’s have a negative influence and insignificant

toward Return on Equity. It shows the H5 was

rejected. This study the ratio of the tax burden has no

significant effect on ROE, this is because the

company has short-term corporate debt that is used

for the cost of raw materials and so on. The increase

in interest costs paid by the company will reduce the

amount of tax paid to the government, but the tax

expense paid by the company is insignificant.

7 CONCLUSIONS

The conclusion of this research, as follows: (1)

Partially, Financial Leverage Multiplier toward

Return On Equity on the food and beverage

companies have significant positive influence, (2)

Partially, Total Asset Turnover toward Return On

Equity on the food and beverage companies have

significant positive influence. (3) Partially, Operating

Profit Margin toward Return On Equity on the food

and beverage companies have significant positive

influence.(4) Partially, Interest toward Return On

Equity on the food and beverage companies have

significant positive influence. (5) Partially, the Tax

burden toward Return On Equity on the food and

beverage companies have a negative influence and

insignificant. (6) Simultaneously, Financial Leverage

Multiplier (FLM), Total Asset Turnover (TATO),

Operating Profit Margin (OPM), Interest Burden

(IB), and Tax Burden (TB) toward Return On Equity

on the food and beverage companies have significant

influence.

The suggestions for this research, as follow (1)

For the next researcher is expected to use more

samples of this research so that research results will

be better. (2) For the next researcher is expected to

add to the independent variable. Because there are

still many factors that could affect the dependent

variable, like size (3) For the next researcher not only

on a registered company in Indonesia but also to

compare with other companies in the other country.

(4) In cooperation with subsidiaries to save costs of

raw materials the company so that it can increase

revenue, it also can revive the company with a

consistent price. Based on the results of the research,

conclusions and suggestions that have been presented

before, This research resulted in the conclusions on

the importance of analyzing the financial statements

to assess the financial performance of a company and

where the funds to finance the operational activities

of a company are acquired.

REFERENCES

Afrinda, N. (2013). Analisis Pengaruh Likuiditas dan

Solvabilitas terhadap profitabilitas pada perusahaan

makanan dan minuman yang terdaftar di Bursa Efek

Indonesia (BEI). Palembang. Fakultas Ekonomi

Universitas Sriwijaya.

Animah, A., Sasanti, E. E., and Karina, N. (2009). Pengaruh

Profit Margin, Investment Turnover, Equity Multiplier

terhadap Return on Equity. Jurnal Telaah dan Riset

Akuntansi, 2(2): 165-182.

Brigham, E. F., and Houston, J. F. (2001). Manajemen

Keuangan, 8

th

edition. Jakarta: Erlangga.

Fahmi, I. 2012. Analisis Laporan keuangan. First edition.

Bandung: Alfabeta.

Hamid, A., Kusrina, B. L., and Wardoyo, W. (2016).

Pengaruh Financial Leverage Terhadapreturn On

Equity (ROE) dan Earning Per Share (EPS) Pada Sektor

Industri Dasar Dan Kimia Yang Terdaftar Di Bursa

Efek Indonesia. Benefit: Jurnal Manajemen dan Bisnis,

1(1): 53-63.

Kusi, B. A., Ansah-Adu, K., and Agyei, A. (2015).

Evaluating banking profit performance in Ghana during

ICRI 2018 - International Conference Recent Innovation

2784

and post profit decline: A five step Du-Pont approach.

EMAJ: Emerging Markets Journal, 5(2): 29-40.

Kharatyan, D. (2016). Ratios and indicators that determine

return on equity (Doctoral dissertation). Available at:

https://bibliotecadigital.ipb.pt/bitstream/10198/13313/

1/David%20Kharatyan%20Master%20thesis%20REV

IEWED.pdf

Kumalasari, R., and Widyawati, N. (2016). Pengaruh

Operating Leverage dan Financial Leverage terhadap

Profitabilitas pada Perusahaan Telekomunikasi. Jurnal

Ilmu & Riset Manajemen, 5(5).

Syamsuddin, L. (2007). Manajemen Keuangan

Perusahaan: Konsep Aplikasi dalam Perencanaan,

Pengawasan, dan Pengambilan Keputusan. Jakarta: PT

Raja Grafindo Persada.

Warsono. 2003. Managemen Keuangan Perusahaan, 3rd

edition. Jakarta: Bayu Media.

Zikmund, W. G., Babin, B. J., Carr, J. C., and Griffin, M.

(2013). Business research methods. Cengage Learning.

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange

2785

APPENDIX

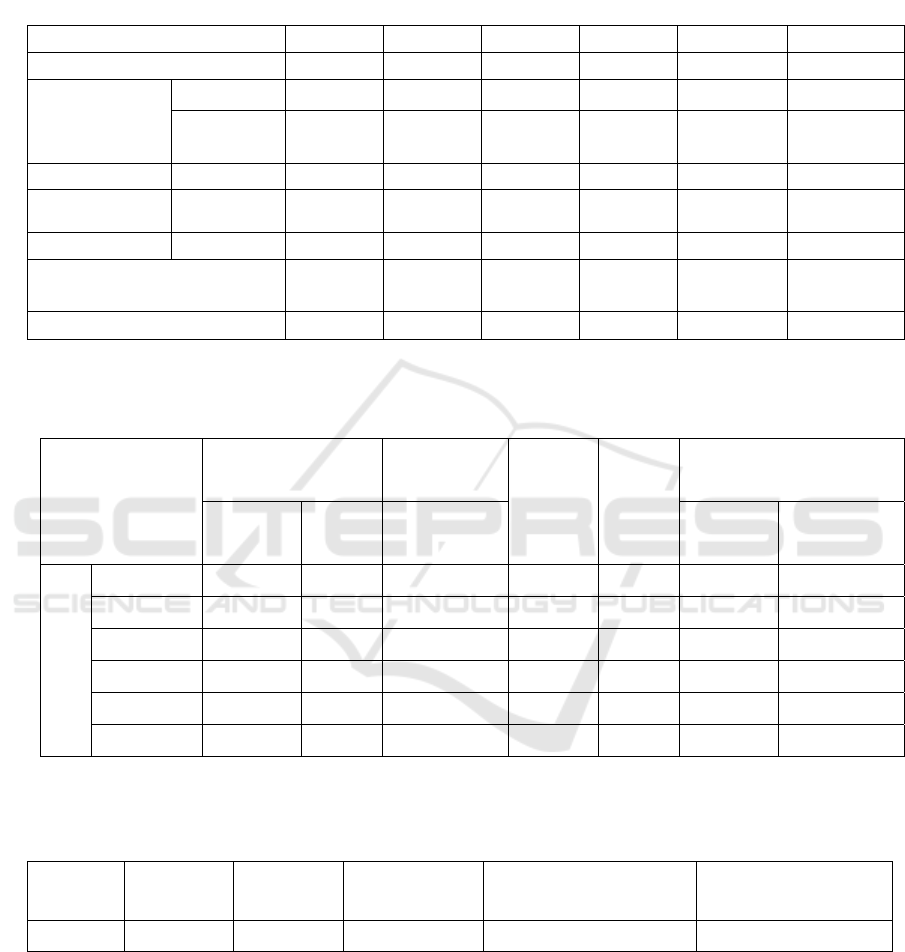

1. Normality Test

One-Sample Kolmogorov-Smirnov Test

ROE FLM TATO OPM IB TB

N

70 70 70 70 70 70

Normal

Parameters

a,b

Mean

0,17384 1,9956 1,37329 0,11329 0,88104 0,7519707

Std.

Deviation

0,10252 0,41378 0,53181 0,07535 0,23309 0,336691

Most Absolute

0,121 0,052 0,152 0,136 0,15 0,134

Extreme

Differences Positive

0,121 0,037 0,152 0,136 0,136 0,108

Negative

-0,089 -0,052 -0,08 -0,11 -0,15 -0134

Kolmogorov-Smirnov Z

1,011 0,434 1,271 1,139 1,259 1,119

Asymp. Sig. (2-tailed)

0,258 0,992 0,079 0,149 0,084 0,163

Test distribution is Normal.

2. Multicollinearity test

Coefficients

a

Model

Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

Collinearity Statistics

B

Std.

Error

Beta Tolerance VIF

1

(Constant) -0,526 0,147 -3,587 0,001

FLM 0,092 0,019 0,370 4,926 0,000 0,664 1,507

TATO 0,085 0,015 0,443 5,629 0,000 0,604 1,656

OPM 1,320 0,113 0,970 11,699 0,000 0,544 1,839

IB 0,126 0,033 0,287 3,792 0,000 0,652 1,534

TB 0,184 0,195 0,060 0,943 0,349 0,910 1,098

Dependent Variable: ROE

Sources: analytical data, processed by the author.

Model Summary

3. Autocorellation test

Model R R Square Adjusted R

Square

Std. Error of the Estimate Durbin-Watson

1

0,872

a

0,761 0,742 0,05207174 1,793

ICRI 2018 - International Conference Recent Innovation

2786

4. Heteroscedasticity Test

The Determinations of Return on Equity in the Food and Beverage Industry in Indonesia Stock Exchange

2787