The Policy of Regional Economic Development Acceleration on

Sulawesi Island

Nandang Najmulmunir

1

1

Faculty of Agriculture, “45” Islamic University (UNISMA)

Jl Cut Mutiah No. 83 Bekasi 17117, Bekasi, West Java

Keywords: Regional economic corridor, acceleration of regional growth, economic driver sectors

Abstract: Abundant of Natural resources, geographical position, number of population and infrastructure are the

important factors in comparative advantage, especially for supporting the acceleration of economic growth

policies that are focused in six regional economic corridors. Economics corridors approach is expected to

spill over impacts to encourage more rapid growth in surrounding areas and ensure the realization of

continuing development. The sectors that act as an economic driver need to be clearly identified for each

province in order to accelerate the development of Sulawesi. Model used to analyzed the regional data is

the analysis of Location Quotient (LQ), LQ Trend and Regional Concentration Coefficient. Each province

in Sulawesi Island has a regional economic driving sector according to its potential.

1 INTRODUCTION

1.1 Background

The Policy of Indonesian economic development

acceleration is called Master Plan of Acceleration

and Expansion of Indonesian Economic

Development (MPAIED) 2011-2025. It was

launched by President of Republic Indonesia On

May 27

th

2011. (Situmorang, 2011).

The Master plan includes 22 major Indonesian

economic activities and is an adaptation and

integration of National Long Term Development

Plan (LTDP) 2002-2025. It serves as the blue print

or framework to accelerate and expand the

economies, and reduce the rate of poverty in the

respective region. In this paper, the region that will

be analyzed further is the fourth economic

corridors,it was Sulawesi island.

(http://www.kemendag.go.id/files/pdf/2012/12/06/m

aster-plan-2011-2025-id0-1354731495.pdf.)

The master plan divide Indonesia into six

economic corridors namely 1) eastern of Sumatra

corridor , 2) Northern of West Java, the north coast

of Java, 3) Kalimantan, 4) Sulawesi, 5) Papua and 6)

Eastern of Java-Bali-Nusa Tenggara. Each corridor

will be connected by the transportation system,

logistics and economic development of region-based

(Situmorang, 2011)

Further Situmorang, (2011) stated that the

National Area Spatial Plan (NASP) has indicated

that six economic corridors were a region which has

advantages in terms of availability of infrastructure

is relatively good even very good, and the existence

of the economic process of commodities production/

superior sectors which high competitiveness.

Minister of Planning / Head of Bappenas has

described the preparation of the master plan strategy

which includes three main elements, namely: (a)

developing six Indonesia economic corridors

byconstruct growth centers in each corridor with

developing industrial clusters and special economic

zones superior resource-based (commodities), (b)

strengthen national connectivity, including intra

connectivity and inter growth center in economic

corridor, inter economic corridor (inter island), and

international (trade doors and tourists), (c) accelerate

the ability of national science and technology to

support the development of the main program.

(https://www.bappenas.go.id/files/rpjmn/RPJMN

202010-2014.pdf)

Kamarzuki, (2011) stated that the developing

economic corridor approach was expected to make

an impact spill over to drive the surrounding area

growth faster and ensure the existing of the

continuation development. One of the six corridors

is Sulawesi Island, which is expected to be the

forefront of the national economy of the East Asian

Najmulmunir, N.

The Policy of Regional Economic Development Acceleration on Sulawesi Island.

DOI: 10.5220/0009935417991808

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 1799-1808

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1799

market, Australia, Oceania and North and South

America.

1.2 The Purposes of Research

The Policy of Economic Development Corridor aims

to accelerate and expand economic development.

But the national economic face the problem

difference of area economic growth. Then the

problems in this study, is "what are the sectors that

acts as a prime mover of the economy in order to

accelerate the development of Sulawesi "?.

This study aims to 1) Identify the prime mover

sectors that act as the main mover to accelerate

regional economic development of Sulawesi Island

corridors, 2) To determine the development and

sustainability of the sector based 3) To be able to

determine the coefficient sectors concentration and

the excellence of areas and the base region.

2 THEORY

According to Hecksher and Ohlin there is a

difference in the opportunity cost of a country

depending on the difference in the number of

production factors it has (Nopirin, 1999).

Furthermore, it was stated that there were

differences in the proportion and intensity of factors

due to differences in gifts, in the form of differences

in the abundance of natural resources (endowment

factors). That difference encourages the exchange of

goods and services between countries.

In general, international trade arises mainly due

to relative price differences between countries. The

difference comes from production costs. While the

difference in production costs is caused by

differences in God's gift of production factors.

Besides that there are other differences, namely the

level of technology that determines the intensity of

production factors, differences in efficiency in using

factors of production, and foreign exchange rates

(Nopirin, 1999).

Abundant natural resources play an important

role in economic development, but to combine into

competitive goods and services and to transform the

economic structure is very dependent on human

capacity, in line with that Yameogo et al. (2014)

said that natural resource, especially oil endowment

may affect negatively the process of more complex

of countries productive structures. A huge

endowment of oil may negatively impact the

productive structure of a nation through its industry

and manufacturing.

Transformation of the economic structure is an

indicator of regional development and growth.

Economic transformation adopts Fisher and Clark's

theory which links with changes in three main

sectors, namely primary, secondary and tertiary. The

development is characterized by the use of resources

and its benefits, namely the decline in the proportion

of the primary sector, the increase in the proportion

in the secondary sector and the proportion of the

tertiary sector (Nugroho and Dahuri, 2004).

The development of human resources capacity is

part of the responsibility of the regional government,

including having an important role in economic

development, through four important roles of local

government, namely 1) as an entrepreneur, the

regional government can develop its own business

through the utilization of its assets to economically

benefit, 2) as coordinator the regional government

can play a role in the establishment of policies and

strategic planning for regional development, 3) as

facilitators, the regional government can play a role

in accelerating regional development through

improving the attitudinal environment (behavior and

culture) in the region and 4) as a stimulator, it plays

a role to stimulate business creation and

development through specific actions that affect

companies entering to the area concerned (Arsyad,

1999).

According to Hoover and Giarratani (1985) the

development of a region can be seen in the following

parameters: 1) Growth in population, 2) Increased

income per capita and 3) Changes in economic

structure. While according to Nasution (1990)

measures the development of a region can be seen

from the following benchmarks: 1) economic

growth, 2) income distribution, 3) poverty, 4)

unemployment, 5) environmental quality and natural

resource productivity. Trade in the form of exports

will have an impact on regional development. Base

economic theory states that the main determinants of

economic growth in a region are directly related to

the demand for goods and services from outside the

region (Arsyad, 1999). The policy related to this

theory is the reduction of barriers to export-oriented

companies. The income is in line with Hoover and

Giarratani (1985) the development of a region will

be influenced by external factors, namely 1) the

demand for regional output from outside the region,

and 2) Decision making related to the location of the

supply of inputs for production activities in the

region, and 3) trade between regions.

Economic development of the region is divided

directly related to locational factors and not directly

related to non locational factors. The location factor

ICRI 2018 - International Conference Recent Innovation

1800

has a direct effect on the aspect of inertia and is

related to the minimization of transport costs

(Nugroho, and Dahuri, 2004).

Companies tend to minimize costs by choosing a

location that maximizes their opportunities to

approach the market. The model of ancient industrial

development states that a good location is the

cheapest cost between raw materials and markets

(Arsyad, 1999).

The choice of location selection was carried out

by the company as an effort to minimize costs

carried out through agglomeration, carried out

through internal agglomeration, inter-industry

linkages, localization economies, urbanization

economies (Nugroho and Dahuri, 2004). Even

though agglomeration economies can be classified in

several ways, typically three major categories are

distinguished: (1) benefits of localization economies

(Marshall - Arrow - Romer externalities) are derived

from the agglomeration of specialized firms.

The choice of location selection was carried out

by the company as an effort to minimize costs

carried out through agglomeration, carried out

through internal agglomeration, inter-industry

linkages, localization economies, urbanization

economies (Nugroho and Dahuri, 2004). Even

though agglomeration economies can be classified in

several ways, typically the three major categories are

distinguished: (1) benefits of localization economies

(Marshall - Arrow - Romer externalities) are derived

from the agglomeration of specialized firms across

the same industrial sector, (2) urbanization

economies (Jacobs' externalities) across different

industries, and (3) internal economies of scale

results in significant returns because of the size of

the firms (Parr 2002; McCann 2013 ).

Location Quotient (LQ) is a method for

determining to measure the degree of specialization

of an industry owned by an area, while measuring

the export capacity of the regional economy and the

independence of a sector. Based on the LQ analysis,

the economy is divided into two parts, namely

economic basis, namely economic activities to

produce goods and services for markets in the region

and outside the relevant region and non-base

economy is an activity to produce goods and

services for needs within the region (Widodo , 2006;

Nugroho and Dahuri, 2004).

3 METHODOLOGY

This study used the quantitative approach on

regional economic secondary data based, especially

Gross Regional Domestic Product (GRDP) in all

Provinces on Sulawesi Island.

The model used to analyze regional data is the

analysis of Location Quotient (LQ) (Blair 1991), LQ

Trend (Canon and Uton, 2007) and the Regional

Concentration Coefficient (Blair 1991 and Warpani,

1984).

4 RESULT AND DISCUSSION

4.1 Economic Based

Sulawesi Island as the fourth corridor has a several

sectors of the economy in the region which

distributed to several Provincial. Potential

development of the sector is reflected by LQ value.

If LQ > 1 then called economic sector based, that is,

a region growing or developing as a result of

specialization in exports, with export incomes will

be obtained, it can increase the wealth and the ability

of a region to carry out the construction and pay the

price of goods imported from outside the region.

This analysis basically uses the theory of

international trade is applied to the boundary of an

area. (Adisasmita, 2008). LQ values are in all

provinces on Sulawesi Island was presented in Table

1.

Sulawesi Island is expected to contribute to

national economic growth. The development is

highly dependent on the performance of the engines

of economic development regions. Economic growth

in the region is strongly influenced by the stability

of regulation in each regions, if the regulation is not

steady will have an impact on the economy and

income distribution(Jaya,2004). Among these are the

elements of security policy which of these factors is

a key element in determining investment

decisions(Ulum, 2006), besides that there are factors

levies, licensing procedures, services, local

economic regulation (Usman, 2002).

Sulawesi Island as seen in Table 1, has potential

natural resource, if managed properly then it will act

as a driver of regional economic sector, because the

sector is a double impact on the sector either directly

or indirectly that may eventually lead to the growth

of the region.

The Policy of Regional Economic Development Acceleration on Sulawesi Island

1801

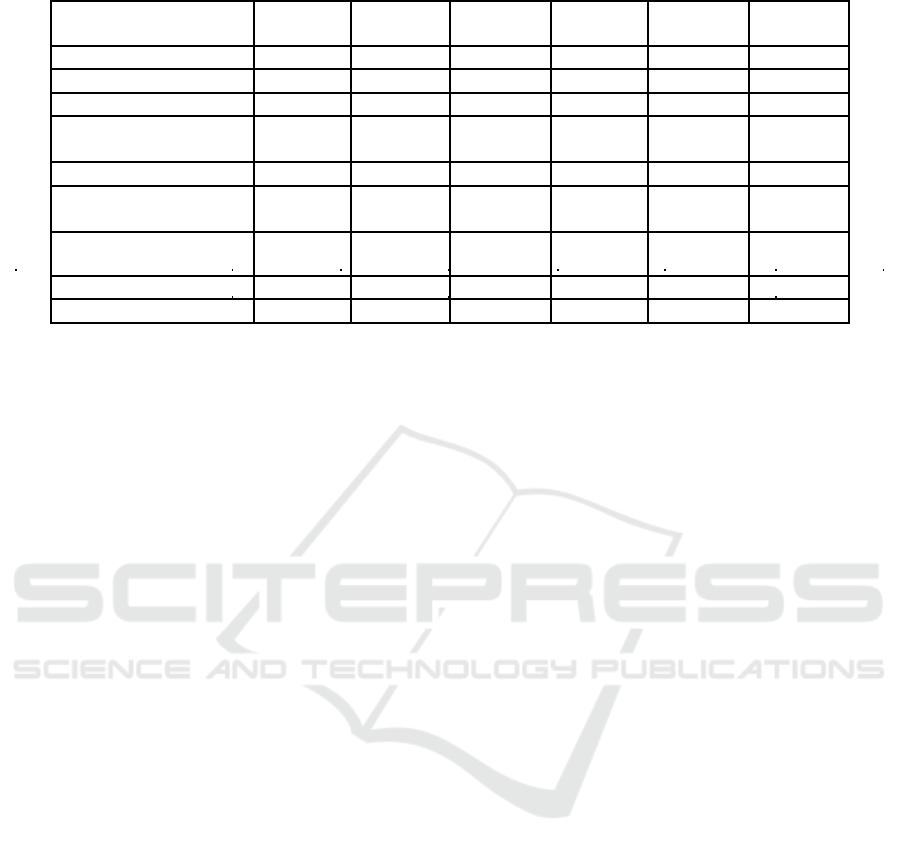

Table 1. Location Quotient Values in the Province of Sulawesi Island in 2006

North Central

South

Southeast West

Sector

Sulawesi Sulawesi Sulawesi Sulawesi

Gorontalo

Sulawesi

Agriculture

0.839

1.74

1.18

1.41 1.20 2.11

Mining

0.701

0.34

1.33

0.67 0.13 0.07

Industry

0.771

0.65

1.41

0.8751 0.83 0.75

Electricity, Gas and

Water Supply

1.075

1.10

1.35

1.00 0.83 0.48

Construction

2.555

1.07

0.75

1.27 1.25 0.50

Trade, Hotel and

Restaurant

1.101

0.95

1.10

1.12 1.03 0.98

Transportationand

Communications

1.661

0.96

1.08

1.08 1.47 0.38

Financial Services

1.292

0.88

1.18

1.08 1.66 0.89

Services

1.366

1.37

1.04

1.20 1.72 1.28

Source: Results of Analysis

These include the potential for widespread

agricultural sector, particularly farming, fishing and

mining, and the results of the processing industry can

be a major driver of development. The potency when

accompanied by the smooth connectivity through the

infrastructure network, it can stream the supply to

meet demand across the province, in Sulawesi island

and inter-island and international. Beside that, labor

costs of this export activity if it is spent in the region

will cause demand goods and services, so it can

encourage economic growth in the next.

According to the theory of the export base, an

area grown or developed as a result of specialization

in export activities, with export income will be

obtained, this can increase the wealth and the ability

of an area to carry out the construction and pay the

price of goods imported from outside the area. This

analysis basically uses the theory of international

trade which is applied to boundary of an area.

(Adisasmita, 2008).

Table 1 shows a sector basis in some provinces

on Sulawesi Island. If all of these facilitated, it will

have an impact in growth acceleration. Each

province has a different driving sector growth,

which is as follows:.

a. Agriculture emerged as a driver of the economy

in all regions except North Sulawesi province,

but has a tendency to increase.

b. Mining and industry sector only in the province

of South Sulawesi which became sector basis

c. Electricity, gas and water supply in the entire

province became a sector basis except in the

province of Gorontalo.

d. The building sector became basis sector in all

regions except in the province of West and

South Sulawesi

d. Trade, Hotel and Restaurantbecame a basis

sector in all regions except in the province of

Central and West Sulawesi

e. Transport and Communications sector and also

financial services sector became basis sector in

all provinces, except the Western and Central

Sulawesi

f. While the service sector into a sector basis

throughout the province.

ICRI 2018 - International Conference Recent Innovation

1802

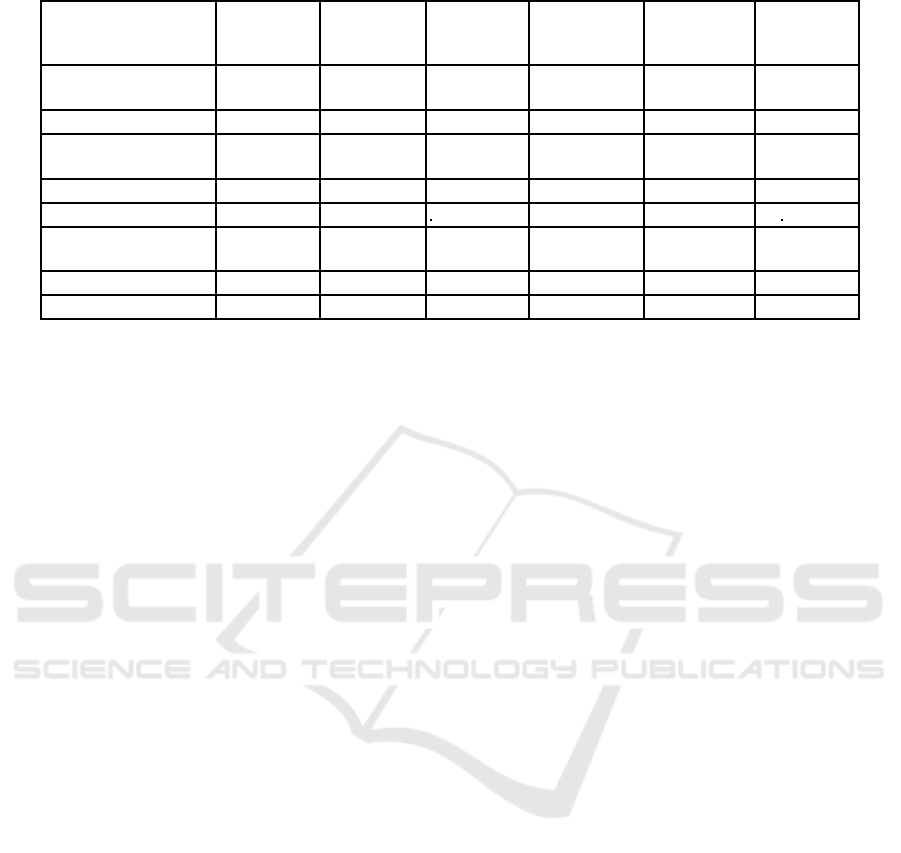

Table 2: Based Sector Development in Sulawesi Provinces between Year 2000 to the Year 2006

North Middle

South

Southeast West

Sector/ Province

Sulawesi Sulawesi Sulawesi Sulawesi

Gorontalo

Sulawesi

Agriculture

Up Up

Down Up

up

Up

Mining an

d

Quarrying

Down Up Up

Up

up

Up

Industry

Down Down Up

down

down Up

Electricity, Gas an

d

Water Supply

Up Up Up

Up

down Up

Building

Up Down Up

Down

down Up

Trade. Hotel& Rest.

Up Down Up

Down

down

Down

Transport

&

Communications

Down Down Up

Up

down

Down

Financial Services

Down Down Up

Up

down Up

Services

Up Down Up

Down

up

Up

Source: Results of Analysis

The economic potential of the region most

associated with national policies among other

policies Integrated Economic Development Zone or

KAPET (Kuncoro, 2004) and policy of

Development Economic Corridor (Situmorang,

2011). Economic Corridor development is realized

through 8 main programs, namely agriculture,

mining, energy, industrial, marine, tourism,

telecommunications and the development of

strategic areas, and 22 main economic activity.

Selection of the main economic activity for each of

the corridors is based on the consideration of the

strategic view of economic activity and conditions

or interests of current economic activity as well as

the potential winning in each economic corridor. All

22 main economic activity is food and beverage

industry, agro-food, copper, nickel, coal, rubber,

palm oil, fisheries, animal husbandry, tourism, oil

and gas, textiles, shipbuilding, steel, transport

equipment, defense equipment, timber, cocoa and

bauxite, also national strategic area (KSN) of Sunda

Strait and Jabodetabek. (Bappenas go id). According

to Hoover and Giarratani (1985) stated that the

development of an area will be affected by internal

and external factors. These factors are 1) the demand

for the output region from outside the region, 2)

inputs supply for production activities in the region,

and 3) inter-regional trade.

4.2 Economic Based Developments

Regional economic development do not merely

pursue the growth, but must be accompanied by an

increase in the quality of human resources and

institutional capacity of the economy and leaving the

old paradigm where the economy is exploitative,

contrary to the new paradigm in the autonomous

region towards economic development in order to

improve the welfare and distributive justice (Haris ,

2001). This is consistent with the results of the study

by Mopangga (2011) stated that Gorontalo Province

Development has shown inequalities caused by

economic growth that required quality growth and

lead to equitable development and social welfare,

which can be done through increase per capita

income followed by increasing the quality of human

resources and ease of access the infrastructure.

Development and reliability of sector base is

proved by it’s development from time to time in the

province. This development can be approached from

LQshift-share, which the results are presented in

Table 2. LQ shift-share describes the development

status of the sector, in a certain period, if the

development above the provincial average in the

whole island in a certain period means showing up

development. If development below the provincial

average, its mean decline development. Ups and

down of the developments is indicating the

dynamics power. Subsequently Table 2 shows the

development of economic base status.The

developments are part of the region economic

dynamics; most sectors moved up and partially

decreased.

Primary sectors namely agriculture experienced

positive development in the period 2000-2006 but

suffered a setback in South Sulawesi. While the

mining sector increased all regions except in the

province of North Sulawesi. Industrial sector

increased only in the province of South Sulawesi

and West Sulawesi.

Electricity, gas and water supply in almost all

provinces has positive developments, except in the

The Policy of Regional Economic Development Acceleration on Sulawesi Island

1803

province of Gorontalo. Meanwhile, electricity, gas

and water increased except in Gorontalo. The

building sector is largely increased, except in

Central Sulawesi, Southeast Sulawesi and

Gorontalo. Trade, Hotel and Restaurant sector only

increased in North and South Sulawesi.

Transportation sector also increased in South and

Southeast Sulawesi. Financial sector has increased

only in South, Southeast and West Sulawesi. The

service sector has increased except Central and

Southeast Sulawesi.

4.3 Sector Concentration and Superior

Region

Each province has agglomeration of economic

activity; if these sectors are collected and

accumulated it will be advantage for the area

because it can contribute the economic growth in the

region accumulatively which called Regional

Concentration Coefficient (RCC)

Developing the region's economy can be

classified based on the region itself, namely: (1) core

region which grow rapidly as result of economies

agglomeration (core region), 2) the transition region

that grow rapidly because closeness to the central

economies agglomeration (upward transition areas),

transition region whose economy is declining or

stagnant (down ward transitional areas), 4)

undeveloped area but have a primary agricultural

resources or primary activities (resource frontier

regions) and 5) areas that facing special problems

because ofoutlying or isolated condition or its

potential resources inadequate (special problem

region)(Kadin, 2009)

Seppo Laakso and Eeva Kostiainen, (2010) states

that the concentration of activity in a place indicates

that, first, the activity that creative and intensive in

science tends to concentrate in one location.Second,

creative business activities tend to congregate in the

center of the old city. This trend was also found in

several other countries.This is caused by the primary

key is the ease of communication between business

workerand they partners. Besides, with the

concentration can lead positive externalities from

science to creative business community.

Concentration in a few sectors of the region is an

advantage for the province to other provinces. The

Regional Concentration Coefficient (RCC) was

derived from sector concentration index; a positive

concentration index showed concentrations above

the

sector’s average, if negative means was below

the sector’s average.

Positive summation index is a number RCC

(Blair, 1991). A region if it has RCC highest score

mean most superior region, because it has role in the

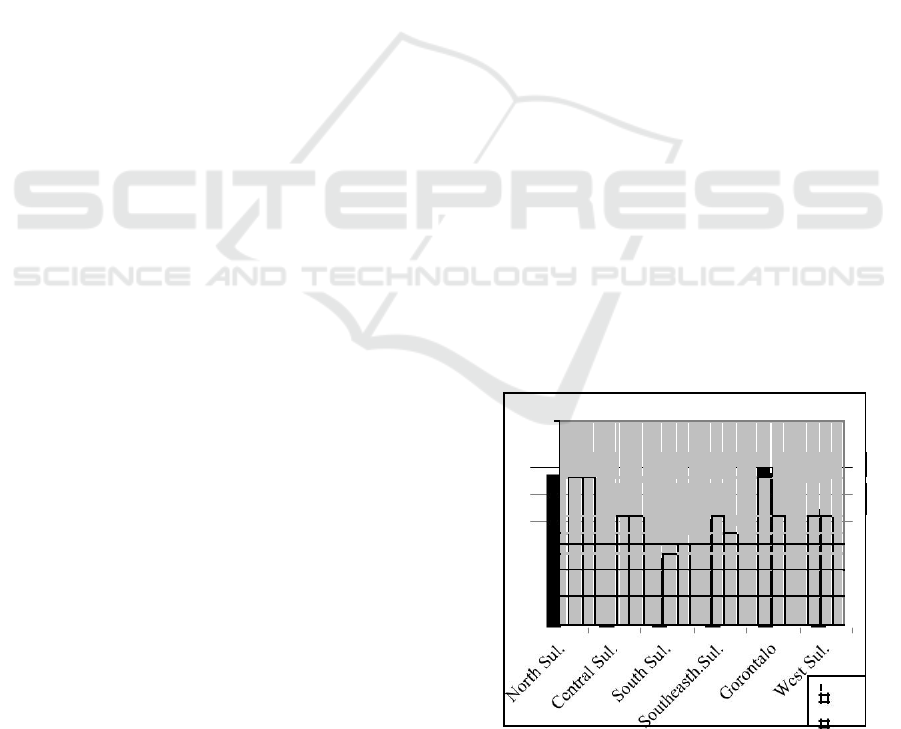

accumulation of sector excellences. Based on the

GRDP in 2000 until 2006 in 2000 constant prices, it

was found that the value of RCC all provinces in

Sulawesi Island are presented in Figure 1, which

illustrates that South Sulawesi Province has the

smallest RCC value for Sulawesi Island compared to

other provinces. North Sulawesi province in 2000

had the highest value of the RCC that is 0.29, after 6

years this province is still relatively high sectorial

performance, despite a slight decline.

Likewise with Gorontalo province of the result

of expansion from North Sulawesi has a similarity

RCC index with his parent province, but after 6

years experienced a little decline superiority. Figure

1 illustrates the excellence of all provinces on

Sulawesi Island. In a period of 6 years then there are

several regions which the excellence was increase,

that is North, Central and West Sulawesi. North

Sulawesi has an advantage relative to other

provinces caused by a number of sectors and

sectorial activity levels high above the provincial

average on the island of Sulawesi. Besides, the

province that formed relatively recently in the early

period shows positive developments, because the

policy is progressive as Gorontalo and West

Sulawesi, but the next period Gorontalo decrease

with policy dynamics.

Excellence remains the South and Southeast

Sulawesi, and Gorontalo Province was decrease.

0.3500

0.285

7

0.3000

0.2719

0.2892

0.2415

0.2500

0.2262

0.2208

0.213

0

0.2033

0.211

7

0.2000

0.1529

0.1693

0.1500

0.1297

0.1000

0.0500

0.0000

T-2000

T-2006

Source: Results of analysis

Figure 1. RCC value of Provinces on 2000 and 2006 on

Sulawesi Island, based on constant prices on 2000.

ICRI 2018 - International Conference Recent Innovation

1804

Regional economic dynamics are characterized

by the dynamics of LQ and RCC changes from time

to time, then the excellence regions and sectors can

be changed according to the dynamics of regional

economic development.

This dynamics is strongly influenced by the

policies of both policies at the district level and

provincial-level policies (Jaya, 2004). Sector is a

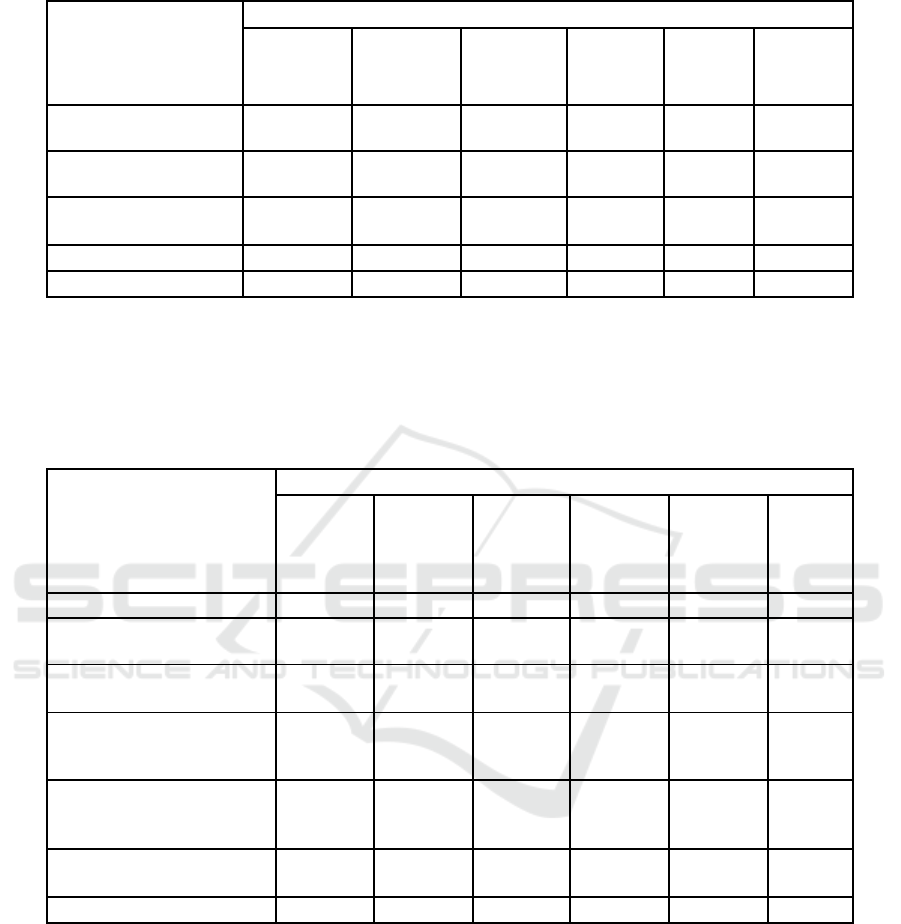

major driver for the primary sectors, namely

agriculture, growth centers can be seen in Table 3.

This table explains that the sectors driving growth

of the agricultural sector and food crops expected to

grow much from West Sulawesi. Southast Sulawesi,

Central Sulawesi and West Sulawesi.

Plantation sector is expected to grow from

Southeast Sulawesi, West Sulawesi and Central

Sulawesi. The forestry sector is expected to grow

from almost all provinces, except the province of

South and North Sulawesi. The livestock sector is

expected to grow into a center of excellence in the

Southeast and Central Sulawesi.

The fisheries sector is expected to grow rapidly

and become a center of excellence in the South and

Southeast Sulawesi Province. However, the growth

of agricultural sector cannot be accelerated as the

industrial sector, because of constraints related to

natural factors such as climate factors, biological

potency, also natural conditions from the factors

that cannot be fully controlled Industry excellence

concentrated in the following Provinces:industrial

sector concentrated in South Sulawesi Province

which has a diversity of industries, with this it can

be seen that South Sulawesi has shown a variety of

industrial centers. Gorontalo province seen as the

concentration of the forestry industry and the food

industry. West Sulawesi province only has a

concentration in the food industry. North province

region has a concentration in the food industry and

wood processing and forest products. While other

provinces have the power in each timber and forest

products also the industry of cement and minerals

the industry, respectively for the province of Central

Sulawesi and Southeast Sulawesi. More results are

presented in Table 4.

Other economic prime movers are classified as

tertiary sector is strongly linked with the main

sectors, namely agriculture and industry, yet still

provide a real sense of the region's economic

growth. That economic development as well as

actual and potential, are also strongly associated

with the policies of the provinces and regencies /

cities in each region.

Dynamics of regional economic development that

has been widely driven by domestic consumption

should also be driven by investment and exports. It

is necessary for a conducive investment climate

(Kuncoro, 2004). According to Tambunan (2006)

conducive investment climate is a climate that

encourages a person to invest with the lowest

possible cost and risk, and generate long-term

highbenefits. There are a number of factors that

affect the investment climate, the political and

social stability, the condition of basic infrastructure,

financial sector, labor market, regulation, taxation,

bureaucracy, corruption, consistency and certainty

of policy.

Based on the success of some countries in

implementing Economic Corridor system, it was

concluded that the successful implementation of the

Economic Corridor Development approach in

supporting the rapid economic development of a

country is determined by the following factors:

1. The existence of political and good will of the

Government and all stakeholders in the

consistency of its implementation, starting at

central, provincial to local government

2. Supported by the availability of adequate

infrastructure hardware.

3. Ease of information to support business

competitiveness

4. Ease licensing procedures and guarantees in

business development.

5. Access or ease the movement of goods and

people.

6. Good and strong governance. (Kamarzuki ,

2011)

The Policy of Regional Economic Development Acceleration on Sulawesi Island

1805

Table 3. Concentration Coefficient Agricultural Sector in Sulawesi Island

Agricultural Sector

Province

Gorontalo

West

South

Southeas

t

North

Central

Sulawesi

1

Sulawesi

2

Sulawesi

2

Sulawesi

1

Sulawesi

1

Province

3

Crop *

0.019

9

Plantation

0.160

6

0.0272

0.0712

Forestry *

0.003

0

0.001

5

0.0046

0.0328

Pasture *

0.0078

0.0046

Fisheries *

0.0096 0.0355

Source: Results of analysis

* Associated with the main policy MPAIED

Informatio

n

1) the tendency is up;2) the tendency is constant;3)

the tendency is down

Table 4. Concentration Coefficients of Non Agricultural Sector on Sulawesi Island

Sectors

Province

Goronta

lo

West

South Southeast

North

Central

3

Sulawesi

1

Sulawesi

2

Sulawesi

2

Sulawesi

1

Sulawesi

1

Non-oil and gas industry

0.0437

* Food and Beverage

0.0054

0.0011

0.0036

Industry

0.0113

Wood and Forest Products

*

0.0013

0.0042

0.0007

12:03

Fertilizer Industry,

Rubbe

r

0.0001

and Chemicals

Cement, metals and

materials

0.0302 0.0451

Quarrying Products *

Machinery and Equipment

*

0.0015

Other industries

0.0010

0.0011

Source: Results of analysis

* Associated with the main policy MPAIED

Informatio

n

1) the tendency is up; 2) the tendency is constant; 3) the

tendency is down

The factors above are the domain of local

government and should be commitments in the

implementation of MPAIED policy, so that become

the power of local government to be considered by

investors through the power investment climate that

created, not just rely on the power of government

facilities. Samosir study results and Wibowo (2004)

reveals that, existence of KAPET Pare-Pare has not

significantly able to drive the region's economy as

well as fiscal facilities have not effectively utilized

by investors.

Principal strategies that can contribute to the

economic development of the region, namely 1)

increased productivity of human resources, labor

quality, and the ability to mastering the technology:

ICRI 2018 - International Conference Recent Innovation

1806

2) development and management of utilization

natural resource (marine biodiversity, minerals and

energy) and land development; 3) economic

institutional development which support increased

production, the economic empowerment of the

people, and the competitiveness of the regional

economy; 4) increased interregional infrastructure

(road networks, marine transportation, air and

railroad) and regional infrastructure (roads, water

supply, dams, irrigation, sanitation, drainage, waste

management, electricity, and communications), 5)

the increase of economic integration in interregional

through strengthening the interregional economic

network (Kamarzuki, 2011) and 6) increasing the

climate of conducive investment (Tambunan, 2006:

Kuncoro, 2004)

Economic potential on Sulawesi Island, as

described above provide very important information

for the investment to be a commitment between the

Government, State Owned Enterprises (SOEs), local

government and the business world. The investment

opportunity consists of regional development

investment or business activities and infrastructure

investment. Besides, it is also necessary the

connectivity infrastructure development, human

resource and institutional also the progress of

science and technology (Science and Technology

).

Planning and National Development Agency is

responsible for the synergy Acceleration Master plan

and Expansion of Indonesian Economic

Development (MPAIED) with other government

programs. This was stated by Minister for Planning

and National Development / Chief of National

Planning Board (Kompas.com.). This synergy is

very important to combine the function of economic

growth and the distribution at the local community

level. Besides, not all sectors are the main target of

the MPAIED policy but there are other sectors that

can drive the region's economy and become the

vocation for the local community.

5 CONCLUSION

Acceleration Master Plan and Expansion of

Indonesian Economic Development (MPAIED)

based on the Framework of Regional Economic

Corridors. Furthermore Corridor Economic Region

is strongly associated with the sectors of the

economy, reliability in the development and

commitment of the local government.

Based on the results above, it can be concluded

that Sulawesi Island can accelerate its development,

through the sectors with the performance as driver of

regional economic, has dimensions of sustainability

and focus on specific areas as the central

agglomeration. The third dimension is expected to

act as a growth locomotive which sustainable in

order to accelerate Sulawesi Regional Economic

Growth Corridor, and also distribute benefits for the

Sulawesi people which more equitable.

Sectors that have been identified as a driver of

economic regions or prime mover sector on

Sulawesi Island will give the meaning in economic

regional development if supported and responded by

the local government in the form of 1)lack of

political will and good will from the central

government and local governments and the whole

stakeholders in the implementation consistency, 2)

support the availability of adequate infrastructure, 3)

ease of information to support business

competitiveness, 4) ease of licensing procedures and

guarantees in business development, 5) access or

ease the movement of goods and people, 6) Good

and strong governance 7) comfort guarantee and

safety on the sustainability of business activities.

The potential benefits of the region do not give

real meaning if there is no consistency of policy at

both the provincial government and policy at district

and city level and does not provide space on the

participation of local communities to improve their

welfare.

REFERENCES

Adisasmita, R. , 2008. Area Development, Concepts

and Theories. Housekeeping Science, Yogyakarta.

Arsyad, Lincolin. 1999. Pengantar Perencanaan dan

Pembangunan Ekonomi Daerah. BPFE. Yogyakarta.

Blair, J. P., 1991. Urban and Regional Economics. Irwin.

Boston. Bank Indonesia. 2007. Indonesian Economic

Report of 2007. Bank Indonesia.

Canon, RustanUtonSyarwani and Aaron. 2007. Derivation

of Share Lq, Lq and Lq Trend shift. The First

International Institute Bandung.

Hoover, E. M and F. Giarratani. , 1985. An Introduction to

Regional Economics. Third Edition. Alfred A Knopf.

New York.

Haris, Shamsuddin. , 2001. New Paradigm Relations-

Regional Center for Direction Format. Autonomous

Regions of the Future. News Science and Technology.

Year 42. No.. 3. Indonesian Institute of Sciences.

(Accessed on 12 September 2011)

Jaya KiranaWihana. , 2004. New Institutional Economics

of the State: An Alternative Approach to Regional

Autonomy in Indonesia. Indonesian Journal of

Economics and Business. Vol 19 # 4 things: 327-339.

UniversitasGadjahMada.

The Policy of Regional Economic Development Acceleration on Sulawesi Island

1807

Kamarzuki , 2011. Economic Corridors Development in

Regional Development. http:On-line bulletin. Spatial

ISSN: 1978-1571. March-April edition 2011.

(Accessed on June 28, 2011).

Chamber of Commerce. 2009. Roadmap Development

Economy Indonesia 2009-2014. www//Kadin

Indonesia. (Accessed on June 28, 2011).

Kuncoro, M., 2004. Autonomy and Regional Development,

Reform, Planning and Opportunities. Publisher

Erlangga, Jakarta.

Kuncoro, M. , 2005. Waiting for business investment

climate reform in Indonesia. Http / /

www.mudrajad.com (Accessed on June 28, 2011).

Situmorang, Budi. , 2011. Indonesian Economic

Development in Perspective An arrangement of space.

Http:On-line bulletin. Spatial ISSN: 1978-1571.

March-April edition 2011. (Accessed on June 28,

2011).

Mopangga, Herwin. , 2011. Inequality Analysis of

Development and Economic Growth in Gorontalo

province. Trikonomika, Volume 10 # 1 thing 40-51

ISSN 1411-514X.

SeppoLaakso & EevaKostiainen. 2010. Design in the local

economy: Location factors and Eketernalities of

design. On-line journal: www / / Springer Science and

Business Media BV. (Accessed on 12 September

2011).

Nopirin. 1999. Ekonomi Internasional. Edisi 3.BPFE.

Yogyakarta..

Nugroho, I dan Dahuri, R. 2004. Pembangunan Wilayah

Perspektif Ekonomi, Sosial da Lingkungan. Penerbit

Pustaka LP3ES, Jakarta.

Naidoo, P Collateral and Tri Wibowo. , 2004.

Effectiveness Analysis of Fiscal Incentives in Eastern

Indonesia (KTI), Case Study Kapet Pare-Pare. Studies

Economics and Finance. Vol.1 March 2004. Fiscal

Analysis Agency. Ministry of Finance.

Spinola, N D, Spinola, C. A and Pereira, A,.S.

2015.Business location: strategic factor for the

development of regions? An approach on industrial

location policy of Bahia. 55th Congress of the

European Regional Science Association: "World

Renaissance: Changing roles for people and places",

25-28 August 2015, Lisbon, Portugal. European

Regional Science Association (ERSA)

Tambunan, Sincere. 2006. I nvestment climate in

Indonesia: issues, challenges and potential. Kadin

Indonesia. Www / / kadin indonesia.or.id. (Accessed

on 12 September 2011).

Ulum, Ihya.2006. Analysis of Investment Attractiveness

Rating Relationships with Revenue District / town in

Indonesia. Journal of Accounting and Public Sector

Finance (JAKSP) Volume 7 # 1. ISSN 1411-5921.

Usman, Syaikhu et al. , 2002. Regional Autonomy and the

Business Climate: The Case of the Three Districts in

West Java. Institute Research Institute..

Warpani, S., 1984. Analysis of Cities and Regions.

Publisher ITB, Bandung.

Widodo, Tri. 2006. Perencanaan Pembangunan: Aplikasi

Komputer Era Otonomi Daerah. UP STIM YKPN

Yogyakarta.

Yameogo, N.D., Tiguene Nabassaga, Abebe Shimeles and

Mthuli Ncu. 2014. Diversification and Sophistication

as drivers of structural transformation for Africa: The

Economic Complexity Index of African Countries.

Journal of African Development Fall 2014 | Volume

16 #2.

World Development Indicators (2017). Indonesia

Database for Policy and Economic Research,

Washington, US: World Bank,

https://www.bappenas.go.id/files/rpjmn/RPJMN%202

010-2014.pdf downloaded 1-10-2018.

http://www.kemendag.go.id/files/pdf/2012/12/06/mast

er-plan-2011-2025-id0-1354731495.pdf.. downloaded

1-10-2018

ICRI 2018 - International Conference Recent Innovation

1808