Contract, Scheme, and Underlying Asset Awqaf-based Suku

k

: Study

Case in Malaysia, Singapore and Indonesia

Indah Yuliana

1

and Rossy Anggraini

1

1

Faculty of Economy,Maulana Malik Ibrahim Islamic State University of Malang, Malang, East Java

Keywords: Sukuk-Waqf Based, Contract, Scheme, Underlying Asset

Abstract: Sukuk is an element of Islamic Finance Instrument which increased rapidly by over the years. Nowadays, in

another country is doing something to made inovation with sukuk instrument by get benefit of capital or

fundraising for development fund of non-financial institutions such as waqf asset.Hence, this paper attempts

to Introduce,Understand, and Purpose the Contract, Scheme and Underlying Asset Sukuk-Awqaf Based in

Malaysia, Singapore and Indonesia.The results of this research showed that schemes and contracts in

Malaysia, Singapore and Indonesiais varied according to the governance system in each different

country.Underlying Asset on tosukuk-waqf based in each country is a waqf asset with different type of waqf

and management according to government authority in developing waqf asset.

1 INTRODUCTION

Sukuk in this milenial Era is working out

became fundrising which the good selection to

empower waqf asset. The reason is lack of funding

sources for waqf management is inversely

propotional to the waqf asset itself. The advantages

of waqf-based sukuk are associated with project-

based sukuk. It’s mean thatsukuk issuance is

intended for the real economy of sector

development. Waqf assets appropriated topurpose

for any productive in the communitywith Islamic

principles

A waqf maybe structured on real underlying

asset which have productive use (for e.g. office

complexes, residential buildings) or may even

bestructured as a cash waqf where financial assets

are utilised to generate returns (e.g. investments in

Islamic securities, sukuk) and achieve the

waqf’spurpose. As such waqf institutions

criticallyachieve four major economic and social

objectives: Generating growth, Incomestream

inperpetuity, Social redistributive attributes,and

provision of public services. (MIFC Report, 2014)

Indonesia in mid-2016 issued sukuk as a waqf

funds in collaboration with Bank Indonesia, Badan

Wakaf Indonesia (BWI), and the Ministry of

Finance to issue waqf-based sukuk instruments into

absolute legitimacy undercover for sukuk products.

In the Badan Wakaf Indonesia News (2016) are the

mechanism of sukuk in Indonesia is done by leasing

waqf assets to sukukissue.The issuer will be

issuingsukuk to investors. After that, the issuer will

corporate the contractor to build assets on the waqf

assets.

By mean of Qardhulhasan or Musyarakah /

mudharabah contracts should be alleviate poverty

for some country. Mubarok (2014: 12) showed how

Singapore in 2002 had used waqf-based sukuk for

building mosques which included waqf assets and

other development program for other waqf assets.

Majelis Ugama Islam Singapura (MUIS) has issued

contemporary financing in form sukuk of about S $

35 million. In that contract, profits are divided

according to the proportion of capital invested.

Investors with corporateBaitulmal get profit income

based on the agreed rental income which is 3.03%.

The guardian of the waqf (or the self-waqf land) gets

a new mosque with an increase in Jemaah capacity

and 4 floors of commercial property that is used as

income for the mosque as an operational and

maintenance fund. The proceeds from the

management of waqf property can generate a surplus

of up to SGD 3 million or around Rp 21 billion.

About 60 percent of this surplus is distributed to

maintain 69 mosques in Singapore. Singapore issues

Sukuk as an asset management fund mixing new

waqf (mosque management, hospital management,

commercial complex land, and science

endowments). Whereas New Zealand has succeeded

in issuing sukuk by collaborating with endowments

Yuliana, I. and Anggraini, R.

Contract, Scheme, and Underlying Asset Awqaf-based Sukuk: Study Case in Malaysia, Singapore and Indonesia.

DOI: 10.5220/0009924611811188

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 1181-1188

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1181

which can help increase the credibility of the New

Zealand endowments globally, encourage innovation

in non-bank Islamic financial institutions and can

open up the potential of Muslim minority

communities in developing Islamic economics

(Hasan, et al: 2017). Sairally et al. (2017) revealed

that sukuk issuance can finance the renewal of waqf

assets. Saudi Arabia issued sukuk al-Intifa 'in 2003

used as a waqf asset management, Zam-Zam Tower,

Malaysia issued Sukuk Sustainable and Responsible

Investment (SRI) as a source of waqf funds (Hasan

et al., 2017), Research Results from Musari (2016 )

shows that sukuk has the potential to become an

Islamic nanofinance instrument where sukuk

collaboration with waqf with underlying assets can

be a low source of funding for micro-society

financing that avoids interest rates. Waqf-based

sukuk can be integrated into the nanofinance

program to be effective. The purpose of this research

is to describe the sukuk contract and scheme as well

as waqf-based sukuk underlying assets in Malaysia,

Singapore and Indonesia.

2 THEORITICAL REVIEW

2.1 Waqf-based Sukuk

The construction ofwaqf assets Financing made

it commercial withsukuk instruments. Sukuk

instruments are the one of the other way to obtain

funds for carrying out a large-scale project (Omar,

2015: 96). Sukuk is a certificate of ownership for a

real asset in accordance with the basis of Islamic

economics,sukuk may be an instrument for equal

distribution and distribution of wealth. Being a big

challenge for sukuk at this time to be able to connect

the financial sector with the real sector, especially

utilizing more economies.Sukuk as a ownership

certificate for real assets, namely waqf assets

included in the real asset category.

The advantages of waqf-based sukuk are aimed

at productive goals in the community in accordance

with sharia principles. Endowments are structured

based on real basic assets which have productive

uses (eg office complexes, residential buildings) or

can even be prepared as cash waqf where financial

assets are used to generate returns (for example

investments in sharia securities, sukuk) and achieve

waqf goals.

The waqf system from the position of Islamic

finance was built to serve all segments of the

community consisting of Islamic banking, capital

markets and takafulto increase the full income of the

commercial community through financial products

and services. The funds used are channeled for

various purposes around production and

consumption activities as well as Government

infrastructure development, in turn, funds can also

be used through tax collection and also government

sukuk issuance to finance expenditures (general

costs and infrastructure development). In the Islamic

social sector consisting of zakat and waqf appears to

serve low-income communities through the

provision of economic programs for those who are

classified as poor. Programs can include basic

consumption, business incubation programs, health

services, program education, and so on. (Ismail:

2015).

2.2 Underlying Asset

In the Islamic perspective,sukuk of its essence is

a representation of the legal ownership rights that

are transferred by the sukuk issuer (issuer) to the

sukuk holder through intermediation called Special

Purpose Vehicle (SPV). Therefore, sukuk holders

have full rights (milkiyyah kamilah) on the

commercial sale value or profit on the asset, and if

there is a loss on the underlying assets experienced

by the sukukissuer, the sukuk holder must be willing

to bear the risk of the loss. This is based on the

Sharia legal maxims which says that al-ghorm bi al-

ghonm (there is no riskless advantage) and al-kharaj

bi al-dhaman (liability that determines profit).

(Wafa: 2010).

Sukuk transactions aren’t receivables but

investments, because debt securities create an

impression that interest is not lawful according to

sharia so it cannot be issued. Six characteristics of

sukuk that differ from conventional bonds are;

Require underlying assets, is proof of ownership of a

tangible asset or benefit rights (beneficial title),

income in the form of rewards (coupons, margins

and profit sharing, according to the type of aqad

used), free from elements (riba, gharar and maysir),

issuance through Special Purpose Vehicle, The use

of proceeds from the sukuk issuance must be in

accordance with sharia principles. In the issuance of

sukuk, it must be accompanied by an underlying

asset or asset participation that functions as an object

of agreement or contract. In this case the sale of

assets does not mean the sale of physical benefits

(benefical title) while the ownership rights (legal

title) remain with the issuer (DepKeu: 2010). Assets

are generally in the form of Tangible assets and

financial assets which are the Beneficiary Right for

the originator. The originator may act freely in

ICRI 2018 - International Conference Recent Innovation

1182

exploiting assets to gain profits, can sell (bay '), rent

(ijarah), or make the assets as collateral for debt

(rahn). In connection with the sukuk contract, the

originator can use his assets (Tangible assets) in the

form of direct sales (bay'mutlakah), rent (ijarah), or

make it as a guarantee for obtaining capital increase.

Sales, leasing of assets, or making it a guarantee of a

contract, are not intended to release assets

absolutely, but only make the assets as collateral so

that assets that are less salable are sold. By making

the assets as collateral, the originator will be able to

obtain cash capital that will be used to finance the

project. (Wahid, 2010: 152)

Underlying Assets are not in the form of tangible

assets, but in the form of benefits for those assets.

Al-intifa'a in question means "taking advantage",

namely the benefits of assets that are used as

Underlying Assets on the sale of sukuk. So the

sukuk investor or holder has the right to use the

sukuk issuer's assets, but does not have the right to

own the asset. Underlying Assets to be used are

derived from waqf assets. (Syairozi: 2016)

3 METHOD

This type of research is descriptive with a

qualitative approach. The sampling technique uses

purposive sampling and is based on the criteria that

have been set in each country. The type of data in

this study is in the form of secondary data, data

collection is done by documentation.

This research was conducted in 3 countries,

namely Indonesia, Singapore and Malaysia. Waqf-

based sukuk studied are waqf-based sukuk

incorporated in the Indonesia Sukuk Index (ISI),

Sukuk registered at Singapore Government

Securities (SGS), and Sukuk in the Bloomberg

Malaysian Sukuk Bond Index (BMSBI). This

research is also limited to products and contracts that

are only used for developing Waqf.

Data analysis in this study uses qualitative

methods. The data obtained are classified and

thematically processed and descriptive-analytic

studies are carried out by examining

multidisciplinary concepts of science.

Table 1. Samples

I

ssuance

Year

Name of

Sukuk

Issuer

Due

Sukuk

S

tructure

Due

Date

2002

First

Resourc

es

Singapor

e

Al-

Musharaka

h

Al-Ijarah

2017

2017

2015

National

treasury

Berhad

Malaysia Wakalah

bil

Istithmar

2022

2016

Govern

ment of

Indonesi

a

Indonesi

a

Al-Ijarah 2017

4 FINDING AND DISCUSSION

4.1 Contracts and Schemes as Well as

Waqf-based Sukuk Underlying

Assets in Malaysia

In the Malaysian state, the sukuk instrument in

an effort to build waqf assets using the Ijarah

contract and the Al-wakalah agreement with the

name of the SRI (Sustainable and Resposing

Investment) sukuk. In financing using the ijarah

contract has four phases, namely in the first phase,

the State Islamic Religion Council (MAIN) makes a

special company, the Al-Wakalah Company. Al-

Wakalah company, a subsidiary of MAIN. The Al-

Wakalah company collaborates with the Malaysian

Waqaf Foundation (YWM) with the mudhorobah

mutlaqah agreement in the making of waqf land

belonging to MAIN. Second, Syarikat Al-Wakalah

by using the services of SPV, SPV issues sukuk

ijarah to investors aiming to get a number of funds

for the construction of assets on waqf land. Third,

the process of payment of profits for ijarah sukuk

issuance on an annual basis to the issuer and to

MAIN and YWM.Fourth, the process of redeeming

sukuk ijarah and taking over all shares issued to

YWM wa'ad. (Omar, 2015: 124)

After the flow goes smoothly in the 5th year the

yield is ready to be given to the manager. As many

as 10% of tenants will be granted to the company al-

wakalah. The granting of these grants can be used as

an initiative to the al-wakalah company in an effort

to promote the premise contained in rented assets.

Contract, Scheme, and Underlying Asset Awqaf-based Sukuk: Study Case in Malaysia, Singapore and Indonesia

1183

Table 2: Distribution of Nisbah to Sukuk Issuance Parties

Investo

rs and

Other

Parties

Amou

nt of

Payme

nt

Total

Amou

nt

Notes

Syarikat Al-

Wakalah

(MAIN

subsidiary)

90% 1 The funds are collected to

make par value payment to

investors and the initial

purchase of YWM assets.

It is also used a

mudharabahmutlaqahpartn

ership fund to other parties

(YWM and MAIN)

Sukuk

Investor

10%

1

The level of profit gained

by investors

YWM and

MAIN

These two parties will get a sharewith the profits

obtained by the company with a 90:5:5 ratio after

a deduction from the provision of shares to

investors.

Source: data processed by the author.

While 90% will be used as contingent money

(Omar, 2015: 130). At the end of the fifth year, the

results of the rental obtained will be billed by the

company al-wakalah to investors and those who

collaborate. Between MAIN and YWM will get the

division ratio from Syarikat Al-Wakalah 90: 5: 5

(90% of the land of waqf building, 5: 5 for both

parties).

Table 3: Distribution of Nisbah After the 25th Year (the

end of the yield)

Stakehol

ders

Total

Ratio

of

Rental

Results

Numb

er of

years

Note

Syarikat

Al-

Wakala

h

(MAIN's

subsidia

ry

compan

y

60

%

1 Put in the Waqf

Tube Fund

supervised by the

company it self.

Re-divided into

several parts:

Rizab's special

needs, liquidity

needs and new

publishing needs

State

Islamic

Religion

Majlis

(MAIN

40

%

1 Distribution of

funds to

mauquf'alayh and

groups in need

Source: Financing the Construction of Waqf Assets

Using Sukuk Books, Universiti Malaya.

After division between high-ranking parties,

where in the 26th year, the company al-wakalah

received as much as 60%, the MAIN received 40%

of the total number of rented (benefits) of the

successful building. Thus MAIN will obtain

sustainable funding sources and the distribution of

the benefits of waqf assets to Mauquf'alayh. The

results of Omar's (2013) research suggest that

contracts suitable for waqf-based sukuk issuance in

Malaysia use musyarakahsukuk that has been

implemented by the Saudi Arabian country with

Singapore. However, in practice, the contract

applied and used in the Malaysian state waqf-based

Sukuk issuance, namely Khazanah SRI (Sustainable

and Responsible Investment) uses the Al-Wakalah

contract published on May 18, 2015 amounting to

RM 100 million to fund waqf assets namely the

foundation AMIR Trust School. SRI Sukuk is part of

the government's ongoing efforts to optimize waqf

assets.

Khazanah Nasional Berhad aims to encourage

the innovation of Islamic finance, to support

Malaysia's position as a global Islamic financial

center. Sukuk contracts with SRI use the Wakalah bi

Al-Istithmar contract where the certificate represents

or represents a project that is managed based on

Investment Agency by giving the agent the freedom

to manage operations as a Certificate Holder. In this

transaction the publisher is an agency of investment

and the Investor is the main actor as a source of

operational funds. Thus the certificate holder has

assets represented by the existence of a certificate

with a value of benefits and has the right to obtain a

ratio if there is a benefit in the issuance. (IIFM

Glossary 4th Edition, 2014)

Through the success of Waqf-based Sukuk

issuance carried out in 2015 and able to improve

educational accessibility, the second phase was

relaunched. The second phase of the SRI worth Rp.

100 million sukuk includes retail proportions to

enable Malaysian individuals to participate in

supporting the further implementation of the Trust

Schools Program. The contract using Al-Wakalah

Al-Istithmar contract, Wakeel namely IhsanBerhad,

Trustee or supervisory board is CIMB Islamic

Trustee Berhad and Khasanah is as Sub-wakeel from

Sukuk issuance. Schemes and contracts make it

easier for investors to understand more clearly where

the funds are directed without other parties making

the process of channeling funds too long. The

purpose of Sukuk SRI (Sustainability and

Responsibility Investment) as a continuous action

for resposibiliti in providing social funds including

waqf assets. Providing returns to investors if the

project is successful and giving investors the choice

to change their investment into donations.

Waqf assets are used as underlying assets in the

form of educational foundations. With the issuance

of waqf-based sukuk with the concept of Sustainable

ICRI 2018 - International Conference Recent Innovation

1184

and Resposible Investment (SRI) through the

Wakalah agreement bi Al-Istithmar proceeds from

the sukuk issuance will be distributed to the Amir

Foundation (YA) which is a waqf asset, the

Foundation is a non-profit organization initiated by

Khazanah in 2010 From distribution to the Amir

Foundation, it is used to fund the Trust Schools

Program education. (Fasha, 2017)

4.2 Contracts and Schemes and

Underlying Waqf-based Waqf

Assets in Singapore

Waqf-based sukuk issued by the state of

Singapore is a successful sukuk pilot conducted by

MUIS as the holder of waqf-based Sukuk issuance.

The use of waqf development financing using sukuk

instruments involves in Singapore using two main

concepts, namely in the implementation of sukuk

using the musharaka contract and the creation of

new asset values that are higher in value by using

old assets using the ijarah contract.

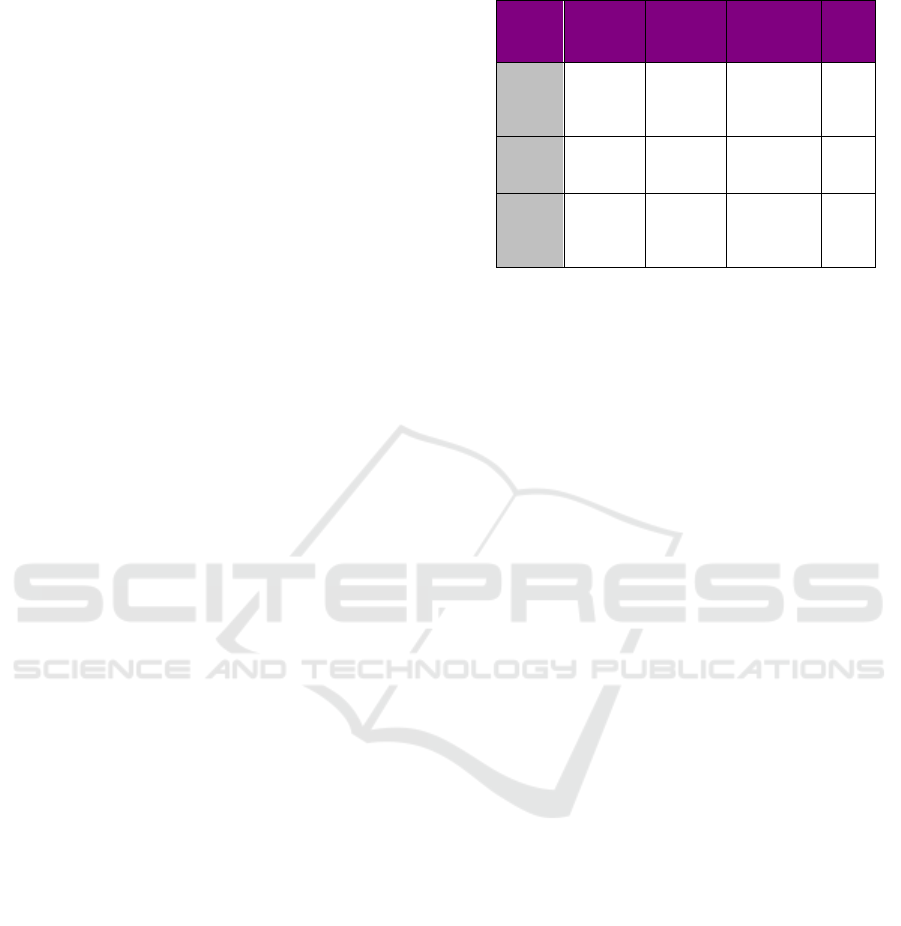

Figure 1. Singapore Waqf Scheme (musyarakah

agreement)

Source :Financing the construction of waqf assets

using sukuk books, Universiti Malaya is

processed by the author

The implementation of the first sukuk involves

three parties, namely; Baitul maal (MUIS / Majelis

Ugama Islam Singapore), Warees Investment Pte.

Ltd, Tube of waqf funds (MUIS). The use of the

Musharaka contract has a maturity of 5 years. The

establishment of the Singapore Islamic Assembly

(MUIS) as Baitul Maal for the management of waqf

that has been stipulated in the Administration of

Muslim Law Act (AMLA) in Chapter 3 Article 2

concerning the Islamic Ugama Majlis and Article 4

concerning FinancialProvisions (Financial

Provisions). , 2017) Then the creation of new asset

values that are higher in value by using old assets

using the ijarah contract. Following is the cash flow

movement scheme using the ijarah contract:

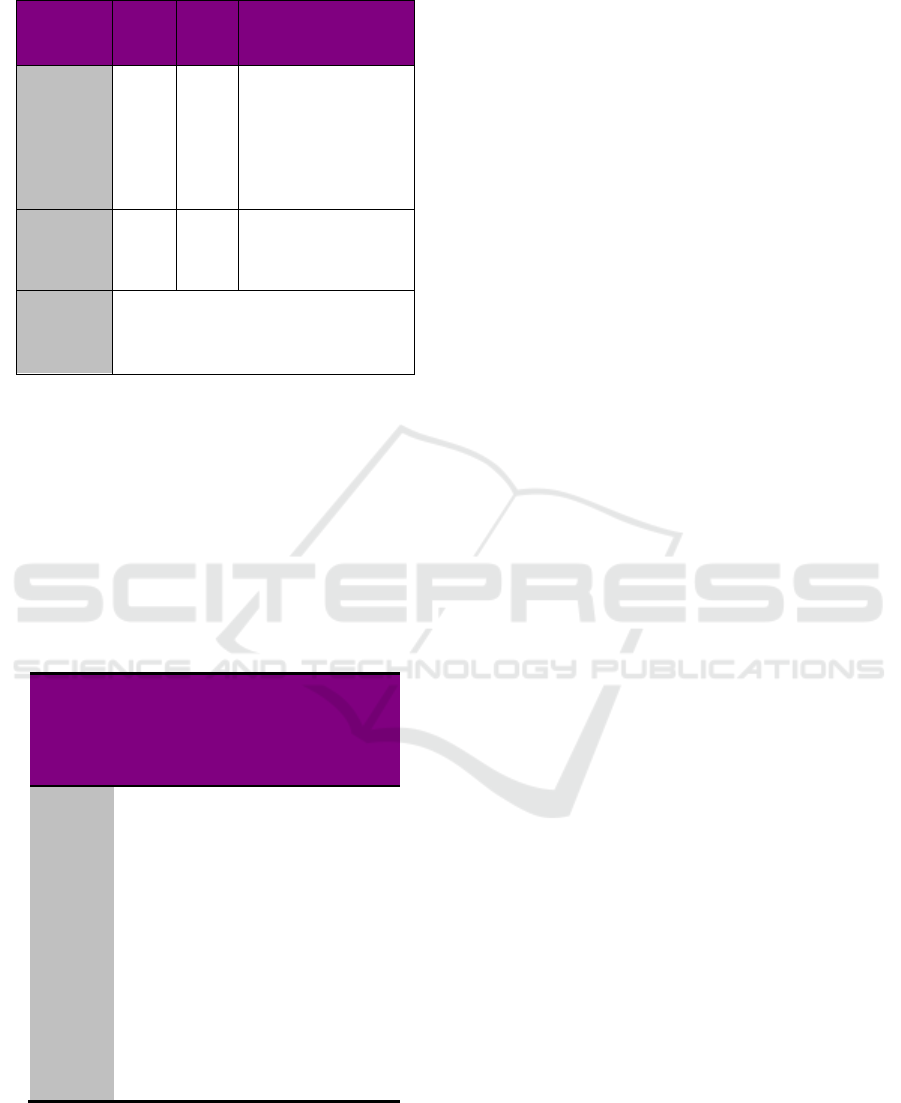

Figure 2. Scheme of Singapore waqf-based

sukuk movement (ijarahcontract)

Source :Financing the contruction of waqf assets

using sukuk books, Universiti Malaya. (Processed

by the author )

Waqf assets are located in Bencoolen Singapore

in the form of fostering mosques, commercial

complexes and 103 apartment rooms (including the

first waqf assets used in the issuance of sukuk). The

three parties initiated the capital amounting to SD35

billion where the Waqf Fund Tube (MUIS) was in

the form of endowments with SD 4.2 billion and

cash in the amount of SD 519,000 as well as the

BaitulMaal (MUIS) as the parent financier and

investment warehouse in the form of expertise and

providing little capital . In the second contract, ijarah

has an expected yield of 3.5 percent with a maturity

of 10 years where there is an agreement on ijarah

contract made by SPV with the Ascott international

Pte.Ltd (developed progress). In the process of

issuing sukuk with this model, it does not run in two

contracts simultaneously. When the maturity date of

the Musharaka agreement is 5 years, the Ijarah

contract only runs in the 6th year from the due date.

In this practice the MUIS as a legitimator allows the

terms of the ijarah contract value to equal the value

of the first contract with the value of the next

contract. In the process BaitulMaal (MUIS) is

entitled to building rental assets for 99 years. (Omar,

2015: 99). The concept of waqf-based Sukuk in

Singapore is more internal in nature where MUIS

(Assembly of the Islamic Ummah of Singapore)

holds full assets of waqf and acts as BaitulMaal.

Then Warees Investment as a direct subsidiary of

MUIS acts as a capital provider or Sukuk Issuer.

Very progressive regulations that allow waqf

properties to be rented for up to 99 years without

transferring ownership to tenants; and allow to sell

waqf properties completely and replace them with

new and higher loan-free property (istibdal).

Because of this flexibility, MUIS can issue sukuk

called sukukMusharakah to finance the development

of fair assets on a large enough scale. The results of

Omar's (2013) study show that waqf-based Sukuk in

Singapore use Musyarakah contracts. Singapore

Contract, Scheme, and Underlying Asset Awqaf-based Sukuk: Study Case in Malaysia, Singapore and Indonesia

1185

wants waqf assets to be more productive by

adjusting sharia principles or principles with caution

and detail where waqf assets are not assets with

private ownership or a group but assets that have

been represented for mutual benefit. Waqf assets are

used as underlying assets in the form of property

assets. The Singapore Islamic Assembly (MUIS)

makes a special section on the management of waqf

property in Singapore. Processing of waqf assets

under the specialization of the unit of strategy of

zakat and waqf (zakat and waqaf strategic

unit).Waqf assets that will be used as Underlying

Assets located in Bencoolen Singapore are the first

waqf assets carried out by MUIS by using

musyārakahsukuk as a development financing

contract. The waqf assets are used for the

management of the mosque, a commercial complex

and maintenance costs for 103 rooms in apartments

where the waqf is underground.

4.3 Contracts and Schemes as Well as

Underlying Waqf based Assets in

Indonesia

Waqf-based sukuk in Indonesia for contracts and

schemes use the concept of ijarah. Waqf-based

sukuk was introduced in mid-2016. The government

seeks to optimize waqf. At the Sharia Economic

Festival in August 2016, Bank Indonesia revealed

various efforts in encouraging waqf optimization,

one of which is the waqf-linked Sukuk model as an

alternative source of financing. Waqf-based sukuk

financing is more focused on infrastructure

development using the ijarah contract. Transaction

structure on waqf-based sukuk issuance in Indonesia

(1) Construction of infrastructure assets on waqf

land, (b) Nadzir issues sukuk, (2) Proceed sukuk is

used to build infrastructure by using contractor

services, (3) Financing is carried out in stages until

infrastructure assets are completed, (4) Contractors

have finished building infrastructure, (5)

Infrastructure assets are managed by nadzir

(shohibulmaal) with management company

(mudharib), (6) Rental income obtained from

tenants, (7) Rental income is divided into profits

from nadzir and sukuk investors

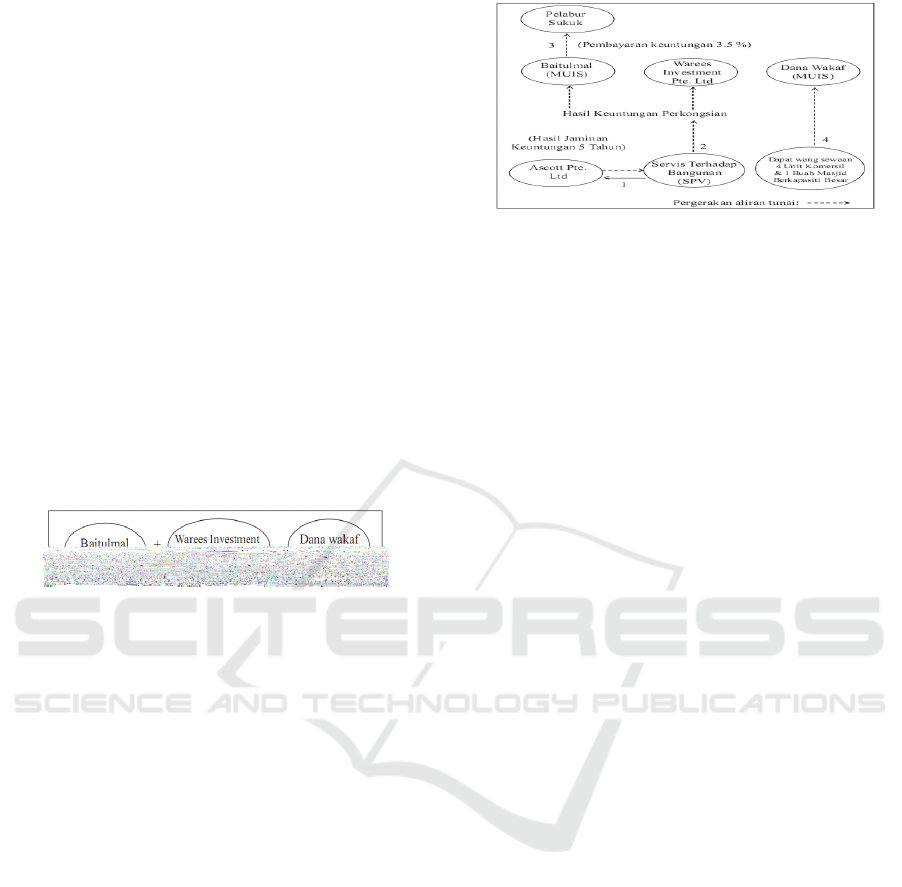

Figure 3. Indonesian waqf-based sukuk scheme (ijarah

contract ) Source :Sharia Economic

Festival(www.bi.go.id)

The results of Ismail's research (2015) show

that contracts and schemes use the ijarah structure.

However, the results of the success of waqf-based

sukuk in Indonesia are still unknown, this is due to

the fact that there is still a need for processes and

tangible results. Waqf-based sukuk in Indonesia

needs to be widely and more intensely introduced to

domestic and foreign investors where the potential

assets of waqf in Indonesia need to be produced.

Waqf assets that are used as underlying are assets

using infrastructure. The Indonesian Waqf Board

(BWI) initiated a productive waqf project with the

cooperation of NazhirWaqf of the

RaudatulMuta'alamin Foundation with PT. Provera

Development for the development of productive

waqf, namely Tower Office Building in the South

Jakarta area. The total project was around USD 20

million (12-year tenor) with funding contributions

from IDB amounting to USD 15.5 million. (BI,

2016)

5 CONCLUSION

Waqf-based contracts and sukuk schemes in

Malaysia, Singapore, Indonesia have different

concepts and contracts. Every contract and scheme

applied by each country has its own strengths and

weaknesses. Malaysia, which has rapid growth in the

capital market, makes waqf-based sukuk issuance in

great demand by investors. This is evidenced by its

success in issuing waqf-based sukuk until the second

stage in 2017. While in Singapore, Singapore is the

first initiator in waqf-based sukuk issuance and

emphasizes originality by adjusting the contract in

accordance with sharia principles and the

management is more internal because of the main

control in carrying out waqf-based Sukuk issuance

under the control of the Singapore Islamic Assembly

(MUIS). In Indonesia, waqf-based sukuk is a sharia

financial product that is still newly published in its

country. The success of waqf-based sukuk in

ICRI 2018 - International Conference Recent Innovation

1186

Indonesia is still unknown, this is because there is

still a need for a process and tangible results. The

knowledge of the people in Indonesia is not yet

widely known about waqf-based sukuk.

Waqf assets are used as Underlying Assets in

sukuk issuance. Waqf assets have commercial value

and are able to generate income. Asset

Characteristics according to IFSB-7 there are 3

types, namely Assets Bassed, Asset Backed, and

Pay-through Structure. The Malaysian state uses the

Al-Wakalah contract within the scope of the Backed

Asset which has a risk at the time of failure when the

sukuk is running, Singapore uses Al-Ijarah namely

Asset Based which has a guarantor if there is a risk

to return investor capital, Indonesia uses the Al-

ijarah contract, namely Asset Based .

REFERENCES

AAOIFI, Accounting ang Auditing Organization for

Islamic Financial Institutions, Shari’ah Standards n.17

Investment Sukuk.

AMLA. 2017. The Statutes of the Republic of Singapore:

Administration of Muslim Law Act (AMLA) chapter 3

Revision Edition. Informal Consolidation-version in

force from 1/10/2017 Singapura : The Law Revision

Commission Under The Authority of The Revised

Edition of The Lawa Act.

Al-Amine, Muhammad Al-Bashir Muhammad. 2012.

Global Sukuk and Islamic Securitization Market.

English : Koninklijke Brill NV.

Adam, Nathif J. Dan Abdulkader Thomas. 2004. Islamic

Bonds, Your Guide to Issuing, Structuring and

Investing in Sukuk. London :Euromoney Books.

Ahmed, Salahuddin. 2006. Islamic Banking Finance and

Insurance a Global Overview. Malaysia: AS Noordeen

Amrial. 2017. Sukuk Linked Wakaf: Optimalisasi Aset

Wakaf Melalui Penerbitan Sukuk. Yayasan Keluarga

Muslim FEUI(YKM FEUI)

Ariff, Mohamed,dkk. 2012. The Islamic Debt Market for

Sukuk Securities: The Theory and Practice of Profit

Sharing Investment.UK : Edward Elgar Publishing

Limited.

BI. 2016. Mendorong Pengembangan Islamic Social

Finance dalam Rangka Mewujudkan Masyarakat

Sejahtera. Slide presentasi Bank Indonesia. Sumber

:bi.go.id Diakses tanggal 20 juli 2017

BWI Newsletter, BadanWakaf Indonesia 2016 diakses

bwi.or.id Tanggal 06 januari 2017

Datuk, Bahril. 2014. Sukuk, Dimensi Baru Pembiayaan

Pemerintah untuk Pertumbuhan Ekonomi, Jurnal Riset

Akuntansi dan Bisnis, Vol 14 No.1, Maret 2014.

Depkeu, 2010.DepartemenKeuangan, Mengenal Sukuk:

Instrumen dan Pembiayaan Berbasis

Syariah, www.dmo.or.id ., akses 17 Mei 2010.

Fahruroji. 2015. Pengembangan HartaWakaf di Singapura.

Jurnal Equilibrium, Vol.3, No.1, Juni 2015

Fasha, Siti Nur Sathirah, Omiama Eltahir Babikir

Mohamed. 2017. The Development of Waqf via

Sukuk Financing : the Case of SRI Sukuk by

Khazanah Nasional Berhad. JurnalJawhar 2017

Fatah, D.Abdul. 2011. Perkembangan ObligasiSyariah

(Sukuk) di Indonesia: Analisis Peluang dan

Tantangan. Jurnal AL-ADALAH Vol. X, No. 1 Januari

2011.

Fatwa DSN no : 32/DSN-MUI/IX/2002.

Hamidi, M. Lutfi. 2003. Jejak-Jejak Ekonomi Syariah.

Jakarta : Senayang Abadi Publishing.

HarianSingapura, 2006. Pertama di Dunia Manfaat Sukuk

: Anugerah Iktiraf Sumbangan Inovatif MUIS sebagai

Badan Berkenun. Singapura :Berita Dalam Negeri. (25

Maret 2006)

Hasan, Sabana M, dkk. 2017. A waqaf New Zealand(NZ):

Developing The World’s First Socially Responsible A

waqaf Sukuk. International Shari’ah Research

Academy for Islamic Finance (ISRA) –Thomson

Reuters, Vol 5 No.1 Hal. 92.

ICLR. 2017.

Islamic Commercial Law Report 2017: An

Annual Publication Assessing the Key Issues and

Global Trends in Islamic Capital Markets. ISRA &

Thomson Reuters.

ICM. 2015.Islamic Capital Market Capacity Building

Programme: Workshop Report and

Recommendations.Malaysia : Securities Commission

Malaysia

IIFM. 2017. SukukReport : a Comprehensive Study of the

Global Sukuk Market, 6

th

Edition, July 2017.

____. 2016. SukukReport : a Comprehensive Study of the

Global Sukuk Market, 5

th

Edition, March 2016.

____. 2014. SukukReport : a Comprehensive Study of the

Global Sukuk Market, glossary 4

th

Edition, November

2014.

IFSB. 2009. Islamic Financial Services Board:Capital

Adequacy Requirements for Sukuk Securitisations and

Real Estate Investment-Standart7.

ISFR. 2014. Islamic Social Finance Report 2014 :Zawya

Islamic.IRTI & Thomson Reuters.

Islamic Finance News,

http://www.islamicfinancenews.com/listing_article_ID

.asp?nm_id=7919

Ismail, Rifki. 2015. Awqaf Linked Sukuk to Support the

Economic Development. Occasional Paper, Bank

Indonesia OP/1/2015.

Kholid, Muhamad, dkk. 2013. Waqf Through Sukuk Al-

Intifa’a : A Proposed Generic Model.

Margono, Suyud, dkk. (ed.), Kompilasi Hukum Ekonomi

Syariah, Jakarta :Novindo Pustaka Mandiri, 2004

MICM. 2014.Positioning Malaysia as an Islamic Wealth

Management Marketplace – A Regulator’s

Perspective.Bi-annual Bulettin on the Malaysian

Islamic Capital Market by the Securities Commission

Malaysia. January-June 2014 Vol 9 No 1

______. 2017. Second Tranche Of Khazanah SRI

Sukuk.Bi-annual Bulettin on the Malaysian Islamic

Capital Market by the Securities Commission

Malaysia. January-June 2017 Vol 12 No 1

Contract, Scheme, and Underlying Asset Awqaf-based Sukuk: Study Case in Malaysia, Singapore and Indonesia

1187

MIFC Report. 2014. A waqaf, Powerful Socio-Economic

Vehicles: MIFC Insight Report. Malaysia : M-MIFC.

Diakses pada www.mifc.com, tanggal 12 desember

2017

Mubarok, Zaki Halim. 2014. Peranan Wakaf dalam

Membangun Identitas Muslim Singapura.

Musari, Khairunnisa. 2016. Economic Sustainability for

Islamic Nano finance Through Waqf-Sukuk Linkpage

Program (Case Study in Indonesia), International

Journal of Islamic Economics and Finance Studies, e-

ISSN Vol. 2 Issue 3 November 2016.

Musari, Khairunnisa. 2016. Waqf-Sukuk, Enhancing the

Islamic Finance for Economic Sustainability in Higher

Education Institutions, World Islamic Countries

University Leader Summit(WICULS)2016.

Ngadimon, MdNurdin. 2016. Pembangunan Wakaf:

PendanaanMelaluiSukukSustainable and Responsible

Investment(SRI).

Obaidullah, Mohammed. 2016. A Framework for Analysis

of Islamic Endowment (Waqf) Laws. International

Jurnal of Not-for-Profit Law /vol. 18, no. 1, February

2016 / 54

Omar, Hydzulkifli Hashim, Asmak Ab Rahman. 2013.

Aplikasi Sukuk dalam Usaha Melestarikan Aset

Wakaf :Pengalaman Pemegang Amanah Wakaf

Terpilih. Shariah Journal, Vol. 21, No.2 (2013)89-

116.

Omar, Hydzulkifli Hashim, Asmak Ab Rahman. 2015.

Pembiayaan Pembangunan Harta Wakaf

Menggunakan Sukuk. Malaysia : Universiti Malaya.

Rahardjo, Sapto. 2003. Panduan Investasi Obligasi,

Jakarta : Gramedia Pustaka Utama.

Rosly, SaifulAzhar. 1997. Islamic Convertible bonds, An

Alternative to Bay al-Inah and Discounted Bay al-

Dayn Islamic Bonds for the Global Islamic Capital

Market. Kuala Lumpur :Departement of Economic

IIUM.

Sairally, Beebee S, dkk. 2017. Third-Party Guarantee in

Equity-Based Sukuk. International Shari’ah Research

Academy for Islamic Finance (ISRA-Thomson

Reuters), Vol 4 No.1 Hal. 62.

SC Blueprint,2017. Suruhanjaya Sekuriti: Securities

Commission Malaysia Islamic Fund And Wealth

Management Blueprint. Malaysia:Securities

Commission Malaysia.

Sugiyono. 2010. Metode Kuantitatif kualitatif & RND.

Bandung :Alfabeta.

Sukandarumidi. 2006. Metode Penelitian, Petunjuk

Praktisuntuk Peneliti Pemula. Yogyakarta :

Gajahmada University Press.

Sutedi, Andrian. 2009. Aspek Hukum Obligasi & Sukuk.

Jakarta: Sinar Grafika.

Syairozi, M Imam, Septyan B Cahya. 2016. Sukuk Al-

Intifa’a :Integrasi Sukuk dan Wakaf dalam

Meningkatkan Produktifitas Sektor Wakaf Pendorong

Investasi pada Pasar Modal Syariah. ISSN : 2502-

3780. Volume 11 No. 2, Juni 2016.

UU, Republik Indonesia Nomor 19 Tahun 2008

tentangSuratBerhargaSyariah Negara.

Wahid, Nazaruddin Abdul. 2010. Sukuk : Memahami &

Membedah Obligasi pada PerbankanSyariah : Seri

Disertasi. Yogyakarta :Ar-Ruz Media.

Wafa, Mohammad Agus Khoirul. 2010. AnalisaFaktor-

Faktor yang Mempengaruhi Tingkat Permintaan

SukukRitel, La_Riba JurnalEkonomi Islam Vol.IV No.

2,Desember 2010.

ICRI 2018 - International Conference Recent Innovation

1188