The Determinant Variables of Stock Prices in Jakarta Islamic Index

(JII) Stock Group

Suryo Budi Santoso and Herni Justiana Astuti

Magister Management, Universitas Muhammadiyah Purwokerto, Central Java, Indonesia

Keywords: Earnings per Share, Price Earnings Ratio, Dividend Pay-out Ratio, Interest Rate, Net Profit Margin, Stock

Prices

Abstract: The purpose of this study was to determine the effect of earnings per share (EPS), price earnings ratio

(PER), dividend pay-out ratio (DPR), interest rate (IR), and net profit margin on stock prices in the Jakarta

Islamic Index (JII) stock group. This study uses multiple regression analysis. The research data passed the

classic assumption test. The research model fulfills the Goodness of Fit criteria, with the variability of the

independent variable to the stock price of 76.3 percent. Based on multiple regression tests it was found that

EPS and DPR significantly influence on stock prices in the JII stock group, while the other factors have no

effect. Theory and previous research state that interest rates have a negative effect on stock prices. However,

this study found the opposite and not significant.

1 INTRODUCTION

Many factors influence stock prices on the stock

exchange. These factors can occur from internal

companies and external companies. External factors

are bank interest rates, inflation and oil prices.

Company performance, earnings per share, and

dividends are examples of causes from internal

companies (Kumar, 2017).

Up and down stock prices can indicate company

performance. If the stock price rises indicate good

company performance. Investors expect to be able to

get dividends, so they scramble to buy shares of

companies that are performing well. Conversely,

stock prices that tend to fall continuously indicate

that the company's performance is not good, such as

the example of BUMI's shares in Indonesia Stock

Exchange (Ariyanti and Sulasmiyati, 2016).

Smart investors analyse stocks before investing.

Fundamental analysis is an analysis of the

company's financial performance (Schlichting,

2013). Some of the company's financial performance

analysed in this study are earnings per share (EPS),

price earnings ratio (PER), dividend pay-out ratio

(DPR), and net profit margin (NPM).

Some previous researchers found that EPS has a

positive and significant effect on stock prices

(Ariyanti and Sulasmiyati, 2016); (Margareta and

Firzitya, 2015); (Kumar, 2017); (Bhattarai, 2014)

and (Viandita and Husaini, 2013). Previous

researchers on PER found that PER has a positive

and significant effect on stock prices (Suselo et al.,

2015); (Zuliarni, 2012) and (Viandita and Husaini,

2013). On the other hand, the negative influence of

the DPR on stock prices was found by several

researchers such as (Zuliarni, 2012) and (Hunjra et

al., 2014). The dividend pay-out ratio was tested in

mediating the relationship of debt to equity, total

asset turns over, and total assets to the stock price

not proven (Wijaya, 2017). Based on previous

research, inconsistencies in results between

researchers occurred. Therefore, this research is

important to do.

2 THEORICAL FRAMEWORK

2.1 The Previous Theory

The selection of stocks that are potentially profitable

for investors needs to use fundamental analysis.

Fundamental analysis based on company

Santoso, S. and Astuti, H.

The Determinant Variables of Stock Prices in Jakarta Islamic Index (JII) Stock Group.

DOI: 10.5220/0009511613011306

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1301-1306

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1301

performance. Source of fundamental analysis data

come from financial statements. A good company

will certainly be reflected in good financial

statements. Good financial reports show good

corporate performance. Good performance will

generate company profits that can also distribute

dividends to investors. The choice of a company that

performs well like this has the potential to produce

an attractive level of profit for investors (Budiman,

2018).

The Signalling Theory discovered by Spence in

1973 found that the equilibrium of several

companies to the market was different. Companies

can provide positive signals through good

performance from their financial statements, so the

market will respond well too. Conversely, poor

company performance will be responded to poorly

by the market (Spence, 1978). The good

performance of the company is usually called good

news by investors. This is because it will have a

positive effect on the company's stock price, and the

profits will usually be shared with shareholders in

the form of dividend distribution. Managers must

work well to produce optimal performance.

Managers, owners, and investors who have

"Contracting Relationships" examined by Jensen and

Mekling (1976) find a pattern of relations between

agents (managers) and principals (owners) known as

the Theory of the firm (Jensen and Meckling, 1976).

2.2 Measurement and Analysis of Financial

Performance

The company is successful if the company has

achieved a certain predetermined performance.

Financial performance measurement is carried out

simultaneously with the analysis process of financial

performance assessment critically, which includes a

review of financial data, calculation, measurement,

interpretation, and providing solutions to the

company's financial problems in a certain period

(Hery, 2016). One of the financial performance

analysis techniques is financial ratio analysis.

According to Hery, financial ratio analysis is an

analytical technique used to determine the

relationship between certain posts in the balance

sheet and profit loss.

The company conducts financial ratio analysis every

year, it can be studied the composition of changes

and can determine whether there is an increase or

decrease in the financial condition and performance

of the company during that time. Broadly speaking

there are five types of financial ratios (Hery, 2016).

namely liquidity ratios, solvability ratios, activity

ratios, profitability ratios, and valuation ratios or

market size ratios. One type of profitability ratio is

the ratio of operating performance. This ratio is used

to evaluate profit margins from sales operations

activities. This study uses a net profit margin ratio in

measuring operating performance. Whereas the

valuation ratio uses earnings per share, price

earnings ratio, and dividend payout ratio.

2.3 Stock Prices

Stock prices can be influenced by the strength of

demand and supply on the stock market. Stock

prices can be influenced by the strength of demand

and supply on the stock market. In addition, stock

prices are also influenced by many factors. Some

previous researchers have found many antecedents

that influence stock prices. When viewed outline,

these factors are divided into internal and external

factors of the company. Internal factors are much

influenced by the company's financial performance,

while external factors are influenced by the macro

conditions of a country.

2.4 Earnings per Share (EPS)

EPS is a ratio to measure the success of a company's

management in providing benefits to ordinary

shareholders. This ratio shows the relationship

between the amount of net income and the share

ownership in the investee company (Hery, 2016).

Previous research has found that earnings per share

had an effect on the closing price of the price of

stock companies (Margaretha, 2015). The higher

EPS will attract investors' attention in investing,

because high EPS is one indicator of the success of

a company, so that more investors who are

interested in buying shares will have an impact on

rising stock prices (Fahmi, 2012).

Based on forgoing, the following hypothesis was

proposed:

H1: Earning per Share and Stock Prices are

significantly positively influenced.

2.5 Price Earnings Ratio (PER)

PER is a ratio that shows the results of a comparison

between market prices per share with earnings per

share. In other words, the stock price of an issuer is

compared to the net profit generated by the issuer in

one year (Hery, 2016). Information on the amount of

PER, this tells whether the stock price of a company

is quite valued, undervalued, or too high and this can

have an impact on stock prices (Kumar, 2017).

Based on forgoing, the following hypothesis was

proposed:

H2: Price Earnings Ratio and Stock Prices are

significantly negatively influenced.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1302

2.6 Dividend Payout Ratio (DPR)

DPR is a ratio that shows the results of a

comparison between cash dividends per share with

earnings per share. This ratio describes the amount

of profit from each share allocated in the form of

dividends (Hery, 2016). Memon et al found that

DPR had significant impact on stock prices (Memon

et al., 2017).

Based on forgoing, the following hypothesis was

proposed:

H3:

Dividend Payout Ratio and Stock Prices are

significantly positively influenced

2.7 Interst Rate

Rakhimsyah and Gunawan found that interest rates

did not affect stock prices (Rakhimsyah and

Gunawan, 2011). (Subing and Kusumah, 2018);

(Purnamawati and Werastuti, 2013) found that

interest rate did not impact the stock price of the

company.

Based on forgoing, the following hypothesis was

proposed:

H4:

Interst Rate and Stock Prices are not influenced

2.8 Net Profit Margin (NPM)

(Roesminiyati et al., 2018) found that NPM have a

positive significant effect on stock price in

automotive sector in Indonesia Stock Exchange.

(Dita and Saifi, 2017) also found that NPM have a

positive significant effect on stock price in

companies at Utility, Infrastructure, and

Transportation sector.

Based on forgoing, the following hypothesis was

proposed:

H5:

Dividend Payout Ratio and Stock Prices are

significantly positively influenced

3 RESEARCH METHOD

3.1 Population and Sample

Population is the whole element that you want to

predict its characteristics. Not all elements or

subjects to be examined can be observed properly,

this is because of limitations, therefore a study needs

to be taken from the population sampling. While the

sample is part of the population to be tested for its

characteristics (Suliyanto, 2018). The population

used in this study is as many as 30 companies whose

shares have been included in the Jakarta Islamic

Index for the 2014-2017 period. Samples taken from

the population using a non-probability sampling

technique with a purposive sampling approach. This

approach is a method of selecting samples based on

certain criteria (Suliyanto, 2018). The criteria that

form the basis of sample selection are:

1. Companies listed in the Jakarta Islamic Index

on the Indonesia Stock Exchange,

2. Shares traded during the 2014-2017

observation period for the most active

companies.

3. Data needed is available on the website

www.idx.co.id.

Based on the criteria specified above, a sample

of 17 companies was obtained for the 2014-2017

observation period, then 10 (ten) large capitalized

companies were taken.

3.2 The Data Analysis Method

3.2.1 Regression Analysis

This study uses a multiple regression analysis

method. The regression equation used in this study

is:

Y = α +

β

1

x

1

+

β

2

x

2

+

β

3

x

3

+ β

4

x

4

+

β

5

x

5

+ ε

Remaks:

Y = Stock Price

α

= intercept/Constanta

β

1,

β

2,

β

3,

β

4,

β

5

= partial regression coefficients of

the dependent variable

x

1

= Earnings per Share (EPS)

x

2

= Price Earnings Ratio (PER)

x

3

= Dividend Payout Ratio (DER)

x

4

= Interst Rate

x

5

= Net Profit Margin (NPM)

ε = error for the i-observation

3.2.2 Classic Assumption Test

Multiple linear regression models can be called a

good model if the model meets the classical

assumptions (Sujarweni, 2016). The classic

assumption test used are (Ghozali, 2016):

1. Normality test aims to test whether in the

regression model of the confounding or residual

variables have a normal distribution.

2. Multicollinearity test aims to test whether in the

regression model used there is a correlation

between independent variables.

3. Heteroscedasticity test aims to test whether in

the regression model variance from residual

inequality occurs one observation to another

observation.

4. Autocorrelation test aims to test whether in the

linear regression model there is a correlation

between the confounding errors in period t with

the interfering error in period t-1 (before).

The Determinant Variables of Stock Prices in Jakarta Islamic Index (JII) Stock Group

1303

3.2.3 Goodness of Fit

1) Coefficient of Determination

This test aims to measure how far the model's

ability to explain the variation of the

dependent variable. The small value of R

2

means that the ability of independent

variables to explain the dependent variable is

very limited. Conversely, if the value of R

2

is

close to one, it means that the independent

variables provide almost all the information

needed to predict the dependent variable

.

2) Simultaneous Significance Test (F Test)

The F statistical test basically shows whether all

the independent or free variables included in the

model have a joint effect on the dependent

variable.

H0: b1 = b2 = ... = bk = 0, meaning whether all

independent variables are not significant

explanations of the dependent variable.

HA: b1 ≠ b2 ≠ ... ≠ bk ≠ 0, meaning that all

independent variables simultaneously are

significant explanations of the dependent

variable.

d. Significant Individual Parameter Test (t Test)

The t statistical test basically shows how far the

influence of one independent variable /

explanatory individually in explaining the

variation of the dependent variable.

H0: bi = 0, meaning whether an independent

variable is not a significant explanation of the

dependent variable.

HA: bi ≠ 0, meaning that the variable is a

significant explanation of the dependent

variable.

4 ANALYSIS AND RESULTS

Based on the results of the classic assumption test,

the following results are obtained:

1. One-Sample Kolmogorov-Smirnov Test

Normality Test obtained the Sig. (2-tailed) of

0.200 > 0.05. This means that standardized

residual values are declared to spread normally.

2. The results of the calculation of Tolerance value

indicate that there is no independent variable

that has a Tolerance value of less than 0.10 and

the value of Variance Inflation Factor (VIF) has

a VIF value of more than 10. So, it can be

concluded that there is no multicollinearity

between independent variables in the regression

model.

3. Based on the Heteroscedasticity test with the

Glejser method it is known that the regression

model does not occur symptoms of

heteroscedasticity. This is because of the Sig.

independent variables on residual absolute >

0.05.

4. Autocorrelation test results using the Durbin

Watson method, obtained a DW value of 2.073

Because the DW value is 2.073 located between

dU and 4-dU, it can be concluded that the

regression equation model does not contain

autocorrelation problems.

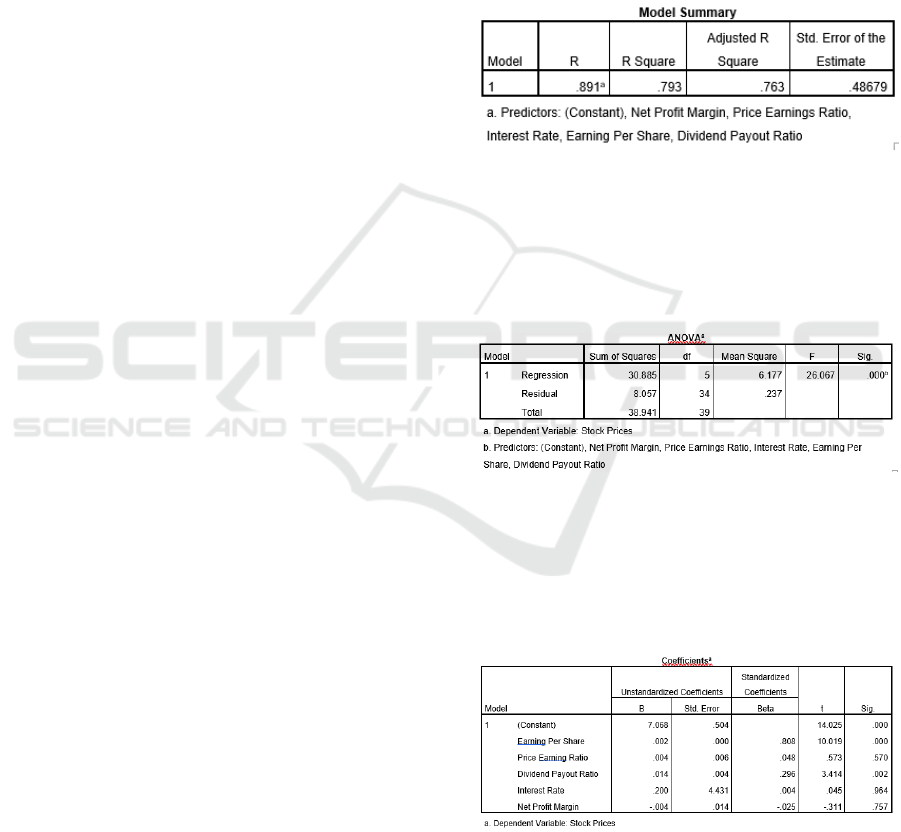

Table 1: Determination Coefficient Results

Based on Table 1 we see the Adjusted R-Squere

value is 0.763. This means that 76.3% of the stock

price variable can be explained by variations in the

five independent variables, namely EPS, PER, DPR,

interest rates and NPM. While the remaining 23.7%

is explained by other reasons outside the model.

Table 2: F Test Results

Based on the ANOVA test results in Table 2, the

calculated F value is 26.067 with a significance

value of <0.05, then the regression model can be

used to predict that EPS, PER, DPR, interest rates

and NPM. together influence stock prices.

Table 3: The Results of t Test

In Table 3, it can be seen that of the five

independent variables, the EPS and DPR variables

show a sig value of < 0.05, it can be concluded that

EPS and DPR variables have a significant effect on

stock prices. While the significantly of PER, Interest

Rate, and NPM variables are > 0.05, it can be

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1304

concluded that the effect of the PER, Interest Rate,

and NPM variables on the Stock Price is not

significant.

Based on the table above the multiple linear

regression equation is made as follows

Y= 7.068 + 0.002X

1

+ 0,004X

2

+ 0.014X

3

+ 0.200X

4

– 0.004X

5

+ ε

5 DISCUSSION

1. The results of this study are specifically about

EPS and DPR variables. This study found that

the two variables had a significant positive

effect on stock prices. This is in line with the

findings from (Ariyanti and Sulasmiyati, 2016);

(Margareta and Firzitya, 2015); (Bhattarai,

2014); (Wijaya, 2017); and (Viandita and

Husaini, 2013). This is also support with the

previous theory about signalling theory. If EPS

and DPR is a good performance than previous

year (good news) the investor will buy this

stock. This activity makes the demand of buyer

increase and the consequence is the price of

stock will also increase. This increase in stock

prices is due to a signal of good corporate

performance (good news).

2. PER, Interest Rate, and NPM theoretically

influence stock prices. In this study it was found

instead. PER, Interest Rate and NPM have no

effect. PER is the price ratio compared to

earnings. This means that the greater the PER of

a stock means the share price is getting more

expensive. This is useful to compare the price

level of the stock is expensive or cheap.

3. Interest Rate has a negative effect on stock

prices. The findings in this study are just the

opposite that Interest Rate has no effect. The

rising Interest Rate will have an impact on the

increase in operating costs for the company.

The company's operating costs rise, it will

reduce the company's profits. Then the effect of

the IR increase on the stock price will turn

around or reduce the stock price. This can be

attributed to the research area are stocks in

sharia groups, especially in the JII group

(Jakarta Islamic Index). The criteria for stocks

that are categorized as sharia include not

developing their business with interest, because

interest declared by the Indonesian Ulema

Council is prohibited.

4. NPM affects stock prices. The higher the NPM

value, the stock price will also increase. This is

related to the company's performance as seen

from the numbers at NPM. The company's

profit rises high, so investors will scramble to

hunt for shares because of the high performance

and profit potential that can be obtained through

dividends or price changes due to the very high

demand from investors for this stock. This

research shows the opposite direction. The

negative NPM relationship with stock prices,

although not significant. This finding needs to

be reviewed for the next study considering the

relationship opposite to stock prices.

CONCLUSIONS

The test results with multiple linear regression

analysis can be concluded as follows:

1. EPS and DPR variables had a significant

positive effect on stock prices.

2. PER, Interest Rate and NPM have no effect on

stock prices.

Limitation of this research

This research used five variables such as EPS, DRP,

PER, Interest Rate and NPM. The other variables

are potential to do the research for examples Return

on Asset (ROA), Return on Equity, and inflation.

REFERENCES

Ariyanti, S. & Sulasmiyati, S. (2016). The Effect Of

Profitability and Leverage On Stock Prices (Study of

Construction and Building Companies Listed on the

Indonesia Stock Exchange Period 2011-2014). Jurnal

Administrasi Bisnis, 35, 181-188.

Bhattarai, Y. R. (2014). Determinants of share price of

Nepalese commercial banks. Economic Journal of

Development Issues, 17, 187-198.

Budiman, R. (2018). Rahasia Analisis Fundamental

Saham, Elex media komputindo.

Dita, N. C. & Saifi, M. (2017). Pengaruh Economic Value

Added (Eva), Net Profit Margin (Npm), Return on

Equity (Roe), Dan Return on Investment (Roi)

Terhadap Harga Saham (Studi Pada Perusahaan Jasa

Sektor Infrastruktur, Utilitas, Dan Transportasi Yang

Terdaftar Di Bei Tahun 2013-2015). Jurnal

Administrasi Bisnis, 46, 140-146.

Fahmi, I. (2012). Teori Portofolio dan Analisis Investasi,

Bandung, Alfabeta.

Ghozali, I. (2016). Aplikasi Analisis Multivariete dengan

Program IBM SPSS 23, Semarang, Badan Penerbit

Universitas Diponegoro.

Hery (2016). Finacial Ratio for Business: Analisis

Keuangan untuk Menilai Kondisi Finansial dan

Kinerja Perusahaan, Jakarta, Grasindo.

The Determinant Variables of Stock Prices in Jakarta Islamic Index (JII) Stock Group

1305

Hunjra, A. I., Ijaz, M. S., Chani, M. I. & Mustafa, U.(

2014). Impact of Dividend Policy, Earning per Share,

Return on Equity, Profit after Tax on Stock Prices.

Jensen, M. C. & Meckling, W. H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of financial economics,

3, 305-360.

Kumar, P. (2017). Impact of Earning Per Share and Price

Earnings Ratio on Market Price of Share: A Study on

Auto Sector in India. International Journal of

Research - GRANTHAALAYAH 5, 113-118.

Margareta, F. & Firzitya (2015). The Effect of Cash

Dividend, Retained Earnings, and Stock Price of

Manufacturing Company Listed In Indonesia Stock

Exchange. . Journal The Winner 16, 36-43.

Margaretha, F. (2015). The Effect of Cash Dividend,

Retained Earnings, and Stock Price of Manufacturing

Company Listed In Indonesia Stock Exchange. The

Winners, 16, 36-43.

Memon, N. A., Channa, N. & Khoso, I. (2017). Impact of

Dividend Policy on Market Prices of Shares: Evidence

from Pakistan. Journal of Business Strategies, 11, 57-

72.

Purnamawati, I. G. A. & Werastuti, D. N. S. (2013).

Faktor Fundamental Ekonomi Makro Terhadap Harga

Saham LQ45. Jurnal Keuangan dan Perbankan, 17,

211? 219.

Rakhimsyah, L. A. & Gunawan, B. (2011). Pengaruh

Keputusan Investasi, Keputusan Pendanaan, Kebijakan

Dividen dan Tingkat Suku Bunga Terhadap Nilai

Perusahaan. InFestasi, 7, 31-45.

Roesminiyati, R., Salim, A. & Paramita, R. W. D. (2018).

Pengaruh Earning Per Share (EPS), Return On Equity

(ROE), dan Net Profit Margin (NPM) Terhadap Harga

Saham Pada Perusahaan Otomotif yangTerdaftar Di

Bursa Efek Indonesia. Proceedings Progress

Conference, 2018. 861-869.

Schlichting, T.( 2013). Fundamental Analysis, Behavioral

Finance and Technical Analysis on the Stock Market. .

GRIN Verlag.

Spence, M. (1978). Job market signaling. Uncertainty in

Economics. Elsevier.

Subing, H. J. T. & Kusumah, R. W. R. (2018). An

Empirical Analysis of Internal and External Factors of

Stock Pricing: Evidence from Indonesia. Management

(open-access), 15, 178-187.

Sujarweni, V. W. (2016). Kupas Tuntas Penelitian

Akuntansi dengan SPSS, Yogyakarta, Pustaka Baru

Press.

Suliyanto (2018). Metode Penelitian Bisnis, Yogyakarta,

Andi Offset.

Suselo, D., Djazuli, A. & Indrawati, N. K. (2015).

Pengaruh Variabel Fundamental dan Makro Ekonomi

terhadap Harga Saham (Studi pada Perusahaan yang

Masuk dalam Indeks LQ45). Jurnal Aplikasi

Manajemen, 13, 104-116.

Viandita, T. O. & Husaini, A. (2013). Pengaruh Debt

Ratio (Dr), Price to Earning Ratio (Per), Earning Per

Share (Eps), Dan Size Terhadap Harga Saham (Studi

Pada Perusahaan Industri Yang Terdaftar Di Bursa

Efek Indonesia). Jurnal Administrasi Bisnis, 1, 113-

121.

Wijaya, R. (2017). Kinerja keuangan dan ukuran

perusahaan terhadap harga saham dengan kebijakan

dividen sebagai variabel intervening. Jurnal Keuangan

dan Perbankan, 21.

Zuliarni, S. (2012). Pengaruh Kinerja Keuangan Terhadap

Harga Saham Pada Perusahaan Mining and Mining

Service yang Terdaftar di Bursa Efek Indonesia

Periode 2008-2010. Jurnal Aplikasi Bisnis, 3.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1306