The Effect of Regional Government Expenditure on Economic

Growth: Case Study of Sumatera Island - Dynamic Panel Approach

Agus Tri Basuki

1

, Yunastiti Purwaningsih

2

, A. M. Soesilo

2

and Mulyanto

2

1

Economy Faculty and Business Universitas Muhammadiyah Yogyakarta

2

Economy Faculty and Business Universitas Sebelas Maret Surakarta-Indonesia.

Keywords: Government Expenditure, Economic Growth, General Allocation Funds, Fiscal Policy

Abstract: The purpose of this study is to see the effect of fiscal variables that affect the economic growth of several

provinces in Sumatra. The model used in seeing the effect of government spending on GRDP growth is the

dynamic panel model. Based on data from 7 provinces of 10 provinces on the island of Sumatra and using

data from 2008 to 2017, in the short term BPK's opinion on regional financial statements has a negative

relationship, meaning that if opinion is good or there are no findings of poor performance on regional

financial statements it will reduce economic growth. In the long run, few case findings in financial reporting

will encourage economic growth. Local government spending on education both in the long term and in the

short term affects economic growth. While spending on health, maritime and agriculture in the short term

has not been able to encourage economic growth. Whereas in the long run, health and marine expenditures

encourage economic growth. While general allocation funds in the short term affect economic growth, but

in the long run it does not affect economic growth.

1 INTRODUCTION

Economic growth is one indicator in looking at a

country's economic development. Although

economic growth has limitations, until now

economic growth is still very important because: (1)

growth does not always reduce poverty, but without

economic growth it is very difficult to make

meaningful and sustainable reductions in poverty,

especially in developing the economy; (2) economic

growth is always measured by increasing output,

with increasing output expected to increase

employment, so that with the growth of the economy

of an area it is expected to reduce unemployment;

(3) the economic recession that occurs in many

countries has caused a significant increase in the

budget deficit, so that economic growth is one of the

important alternatives to overcome the government

budget deficit; (4) economic growth enables

increased resources for public services such as

education and health, so that economic growth

enables increased social spending without increasing

tax rates (Todaro, 1999).

Figure 1: Sumatra Island by Province

Sumatra Island is one of the islands in Indonesia

which is located in the west, Sumatra Island has 10

provinces out of 34 provinces in Indonesia. The

figure 1 describes the location of 10 provinces on the

island of Sumatra. Of the 10 provinces in Indonesia

7 provinces were used as samples of research from

650

Basuki, A., Purwaningsih, Y., Soesilo, A. and Mulyanto, .

The Effect of Regional Government Expenditure on Economic Growth: Case Study of Sumatera Island - Dynamic Panel Approach.

DOI: 10.5220/0009511106500657

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 650-657

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2008 to 2017. The reasons for using 7 provinces in

Sumatra Island were because they had complete

data.

Source : Central Bureau of Statistics (Province in

Figures 2008-2018)

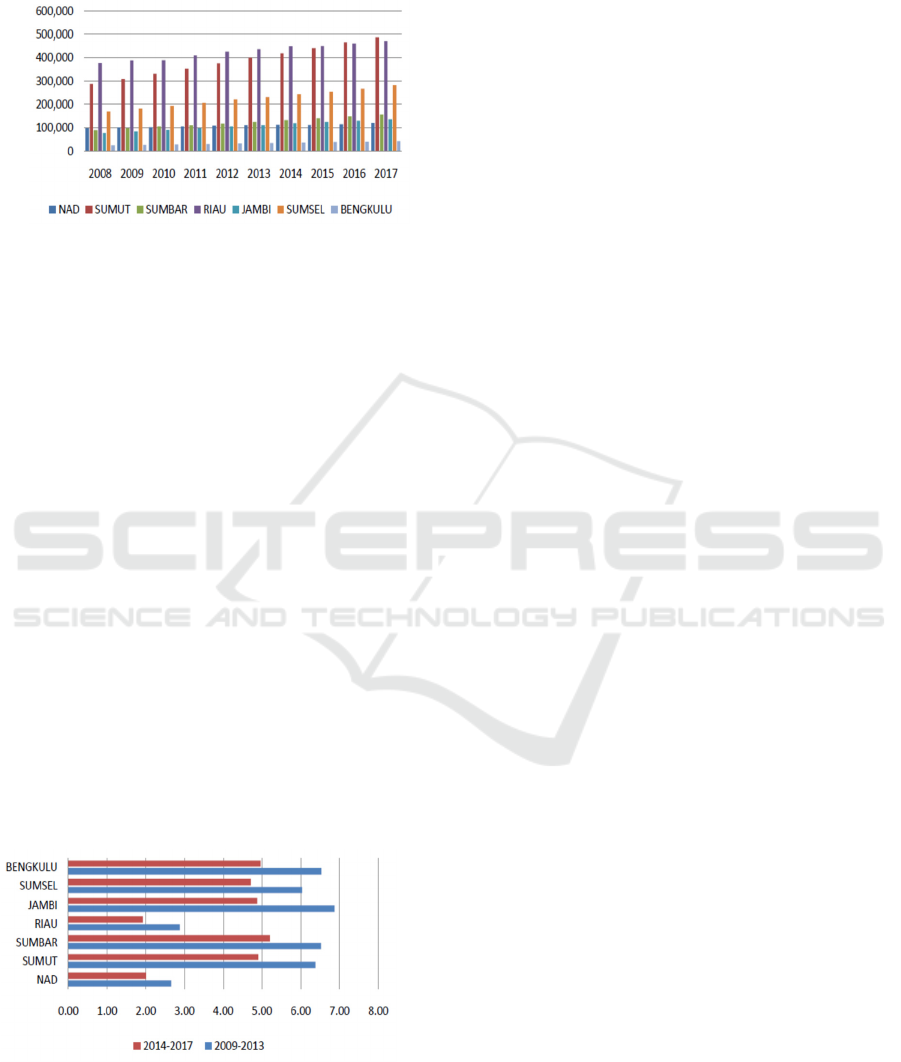

Figure 2: Gross Regional Domestic Product in Some

Province in Sumatra Island

Figure 2 shows the highest Gross Regional

Domestic Product (GRDP) on Sumatra Island in

2008-2015, which was occupied by Riau Province,

followed by North Sumatra and South Sumatra

Provinces, and in 2016-2017 the highest GRDP was

occupied by North Sumatra Province, Riau Province

and South Sumatra Province . While the lowest

GRDP is occupied by Bengkulu Province, Jambi

Province and West Sumatra Province.

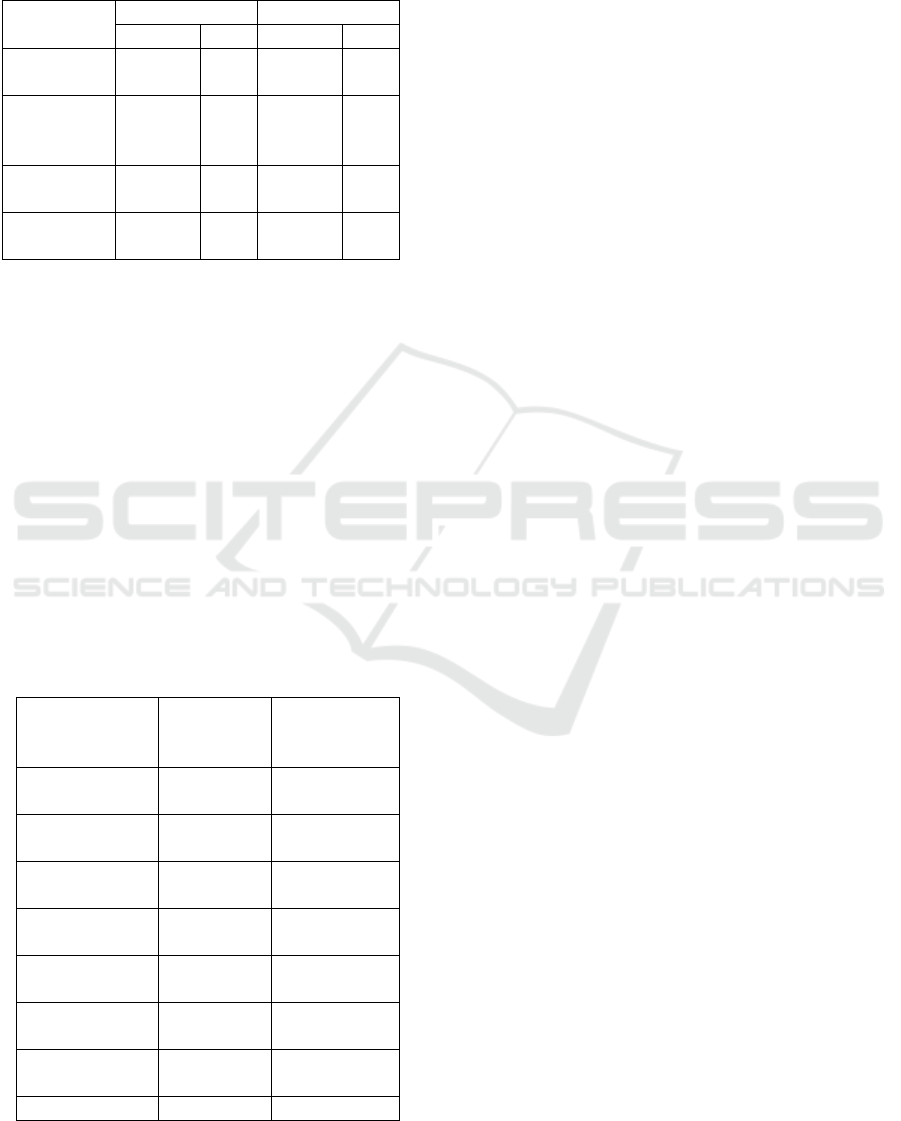

Figure 3 shows that the highest economic growth

in 2009-2013 was occupied by Jambi Province,

Bengkulu Province and West Sumatra Province and

the lowest was NAD Province, Riau Province and

South Sumatra Province. While the economic

growth in 2013-2017 the highest economic growth

was occupied by West Sumatra, Bengkulu Province

and Jambi Province and the lowest was occupied by

Riau Province, NAD Province and South Sumatra

Province. Based on figures 2 and 3, the highest

GRDP can be predicted, not necessarily the

economic growth achieved will be high too, whereas

the low GRDP is not necessarily the economic

growth achieved will be low.

Source : Central Bureau of Statistics (Province in

Figures 2008-2018)

Figure 3: Economic Growth in several Province in

Sumatra Island period 2009-2013 until 2014-2017

Factors that can influence economic growth are

fiscal policy. Fiscal policy is an economic policy

carried out by the government in the management of

state finances (through government expenditures

such as government spending on education, health,

agriculture and maritime affairs) with the aim of

directing economic conditions for the better. The

fiscal policy commonly used by regional

governments is the preparation of the Regional

Budget (APBD). APBD is the annual financial plan

of the regional government approved by the

Regional People's Representative Concil (Law No.

17, 2003). The Regional Revenue and Expenditure

Budget (APBD) is prepared in accordance with the

needs of government administration and regional

income capabilities. The preparation of this Regional

Budget is guided by the Regional Government Work

Plan (RKPD) in order to realize services to the

community to achieve the goal of the state. APBD

has the function of authorization, planning,

supervision, allocation, distribution, and stabilization

(Bastian, 2006). The authorization function means

that the regional budget becomes the basis for

implementing income and expenditure in the year

concerned. The planning function means that the

regional budget becomes a guideline for regional

management in planning activities in the year

concerned. The supervisory function means that the

regional budget is a guideline to assess whether the

activities of the local government organizers are in

accordance with the provisions of the applicable

law. The allocation function means that regional

budgets must be directed at creating employment

and waste of resources, as well as increasing

efficiency, and the effectiveness of the economy.

The distribution function means that the regional

budget functions in order to improve income

distribution, so that it will avoid gaps. The

stabilization function means that the regional

government budget is a tool to maintain and strive to

balance the fundamentals of the regional economy.

Fiscal policy occupies a strategic position in

macroeconomic policy. fiscal policy through

government expenditure can influence the rate of

economic growth (Basri, 1995). The purpose of this

study is to look at the role of local governments in

playing the role of fiscal policy in influencing

economic growth in several provinces of Sumatra.

2 LITERATURE REVIEW

Research conducted by Dada (2013), Idrees and

Siddiqi (2013) concluded that government spending

The Effect of Regional Government Expenditure on Economic Growth: Case Study of Sumatera Island - Dynamic Panel Approach

651

on education has a positive influence on economic

growth. Grabova's (2014) study concluded that

government spending on education had a negative

influence on economic growth, while Gisore,

Kiprop, Kalio, Ochieng and Kibet (2014) and Al-

Shatti's (2014) study concluded that government

spending on education had no influence on

economic growth.

Research on the relationship between

government spending on health and economic

growth is carried out by Al-Shatti (2014) and Dada

(2013). The study concluded that government

spending on health had a positive influence on

economic growth in several countries.

Research on the relationship between

government spending on agriculture on economic

growth was carried out by Oyinbo, Zakari and

Rekwot (2013). The results of the study concluded

that spending on agriculture had no effect on

economic growth. Furthermore, the results of the

research by Shuaib, Igbinosun and Ahmed (2015)

and Mursidah, Effendi and Zaini (2017) concluded

that government spending on agriculture promoted

economic growth.

Research on the relationship between

government spending on fisheries and maritime

affairs on economic growth was carried out by

Huda, Purnamadewi and Firdaus (2015), Novianti,

Rifin, Panjaitan and Sri (2014), and Agustine

(2014). The results of the study concluded that

government expenditures for fisheries and maritime

affairs could encourage economic growth.

Research on the relationship between the General

Allocation Fund (DAU) on economic growth was

carried out by Manik and Hidayat (2010), Ahmad

(2011), Tajuddin, Hasanuddin and Rahmatia

(2014).The results of the study concluded that the

General Allocation Fund can encourage economic

growth. Furthermore, the research of Muti'ah (2017)

concluded that balancing funds in the form of

General Allocation Funds had no influence on

economic growth.

Mauro's (1995) study concluded that the practice

of corruption (measured through an index of

corruption), in the form of giving money to speed up

matters that allow economic actors to avoid delays

in their affairs, can support growth if the country's

bureaucratic rules are very bad. The results of the

study of Nawatmi (2014), Gyimah-Brempong

(2002), and Mo (2001) concluded that the corruption

index slows or decreases economic growth, while

also causing inequality and disparity in people's

income.

3 RESEARCH METHODOLOGY

3.1 Data

The data used for the study are secondary data taken

from the Regional Statistics Agency, Ministry of

Finance of the Republic of Indonesia and the

Supreme Audit Agency's Opinion on Regional

Government Financial Reports of various

publications from 2008 to 2017.

Government expenditures for the allocation of

education, health, agriculture and maritime affairs

are obtained from the APBD based on the

government expenditure function for the education

sector allocation, expressed in rupiah and taken from

the Data on Regional Expenditures published by the

Ministry of Finance.

General allocation funds are funds whose amount

is determined based on a presidential decree,

expressed in rupiah and taken from a Presidential

Decree concerning the Provincial General Allocation

Fund.

The Supreme Audit Board's opinion on the

Regional Financial Accountability Report is an

opinion on the fairness of the financial information

presented in the financial statements, expressed in

scale and taken from an overview of the results of

the first semester of the Supreme Audit Board. Fair

Without Exception (WTP) (5), Fair Without

Exception With Explanatory Paragraphs (WTP-

DPP) (4), Fair With Exceptions (WDP) (3),

Unqualified (TW) (2), and Not Giving Opinion

(TMP ) (1).

3.2 Estimation Procedure

The model used is the Dynamic Panel Method

(Panel Error Correction Model). Before estimating

the ECM Panel, it is necessary to take steps such as

data stationary test, cointegration degree test and

then use ECM for short-term analysis. The steps in

formulating the ECM model are as follows:

Conduct expected relationship specifications in the

model under study.

PDRB

t

=

0

+

1

Educ

t

+

2

Health

t

+

3

Agric

t

+

4

Marine

t

+

5

DAU

t

+ u

t

………........ (1)

Information:

PDRBt: Gross Regional Domestic Product per year

in period t

Educt : Expenditures for education period t

Healtht : Expenditures for health period t

Agrict : Expenditures for agriculture period t

Marinet: Expenditures for maritime period t

DAUt : Funds for general allocation period t

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

652

α : Long-term coefficient

t : Time

I : Province

While short-term relationships are expressed as

follows:

DLnPDRBit = α

0

+

1

DlnEducit +

2

LnHealthit +

3

DLnAgricit +

4

DLnMarinei

t

+

5

DLnMarinei

t +

6

(LnPDRB

t-1

– b

1

LnEduc

t-1

+ b

2

LnHealth

t-1

+

b

3

LnAgric

t-1

+ b

4

LnMarine

t-1

+ b

5

LnDAU

t-1

)

+ u

t

........................................................ (2)

From the results of parameterization of short-term

equations can produce new equations, the equation

is developed from the previous equation to measure

long-term parameters using econometric regression

using the ECM model (Domowitz and Elbadawi,

1987) :

DLnPDRB

it

= β

0

+ β

1

DlnEduc

it

+β

2

LnHealth

it

+ β

3

DLnAgricit + β

4

DLnMarine

it

+ β

5

DLnMarine

it +

ECT(-1) +

t

………………………………………… (3)

ECT(-1) = LnPDRB

t-1

– b

1

LnEduc

t-1

+ b

2

LnHealth

t-1

+ b

3

LnAgric

t-1

+ b

4

LnMarine

t-1

+ b

5

LnDAU

t-1

……………........................................... (4)

Information:

DLnPDRBt is a period t Gross Regional Domestic

Product, DLnEduct is government expenditure for

education period t, DLnHealtht is government

expenditure for health period t, DLnAgrict is

Government Expenditures for Agriculture period t,

DLnMarinet is Government Expenditures for Marine

period t, DLnDAU is General Alignment Fund , µt

is Residual, D is Change, t is Time period, i is

Province and ECT is Error Correction Term.

4 FINDINGS AND DISCUSSION

4.1 Data Stationarity Test Results

Before conducting a regression with the ECM test, it

is first tested whether the variable used is stationary

or not. If the data is not stationary then a spurious

regression will be obtained, an autocorrelation

phenomenon arises and also cannot generalize the

regression results for different times. In addition, if

the data to be used is stationary, OLS regression can

be used, but if it is not stationary, the data needs to

be seen as stationary through the degree of

integration test. And furthermore, data that is not

stationary at the level level has the possibility of

being cointegrated so that cointegration tests are

needed. Then if the data has been cointegrated, ECM

testing can be done.

Table 1: Unit Root Test Result

Source: Data processed

The results of the unit root test all the variables

passed in the 1st Difference test, this can be seen

from the probability of Levin, Lin & Chu * which is

less than 0.01 and the probability of ADF being less

than 0.05 (except DAU).

4.2 Cointegration Test

After knowing that the data is stationary at 1st

Difference, then the next step is to identify whether

the data is cointegrated. For that we need a

cointegration test. Cointegration test is used to give

an initial indication that the model used has a

cointegration relation.

The cointegration test results obtained by forming

residuals are obtained by expressing the independent

variable on the dependent variable in OLS. The

residual must be stationary at the level to be said to

have cointegration.

Table 2: Result of Long Run Coefficient

Dependent Variable

:LOG(PDRB)

Model 1 Model 2

LOG(EDUC) 0.0328**

(0.0130)

0.0333***

(0.0124

)

LOG(HEALTH)

0.0687*

(0.0385)

0.0733*

(0.0366)

LOG(MARINE)

0.1377**

*

(0.0281)

0.1410***

(0.0273)

LOG(AGRIC)

0.0064

(0.0300)

0.0073

(0.0300)

LOG(DAU)

0.0142

(0.0316)

OPINI

0.0272**

(0.0130)

0.0283**

0.0127

R-square

d

0.9952 0.9952

Source: Data processed

The Effect of Regional Government Expenditure on Economic Growth: Case Study of Sumatera Island - Dynamic Panel Approach

653

(***), (**) and (*) indicate significant at 1%, 5%

and 10% significance level respectively. Numbers in

parentheses are standart errors

Table 3: Cointegration Test Results

Method

Model 1 Model 2

Statistic Prob. Statistic Prob.

Levin, Lin &

Chu t* -5.026*** 0.000 -5.064*** 0.00

Im, Pesaran

and Shin W-

sta

t

-2.428*** 0.007 -1.639* 0.05

ADF - Fishe

r

Chi-square 28.85** 0.010 26.81** 0.02

PP - Fishe

r

Chi-square 32.18*** 0.003 22.57* 0.06

Source: Data processed

(***), (**) and (*) indicate significant at 1%, 5%

and 10% significance level respectively. Numbers in

parentheses are standart errors

After testing Levin, Lin & Chu *, Im, Pesaran and

Shin W-stat, ADF and PP to test the resulting

residuals, it was found that the stationary residuals in

the data level were seen from the t-statistic value

which was significant at the critical value of 5% .

Thus it can be said that the data is cointegrated

(Engle & Granger, 1987).

4.3 Short -Term Test

The regression produced through the ECM Panel

equation is a short-term regression result. The results

of the short-term regression equation can be seen in

table 4.

Table 4:Result of Short Run Panel ECM Model

Dependent

Variable :

D(LOG(PDRB))

Model 1 Model 2

D(LOG(EDUC))

0.0041**

(0.0015)

0.0031**

(0.0015)

D(LOG(HEALT

H))

-0.0016

(0.0035)

-0.0011

(0.0038)

D(LOG(MARIN

E))

-0.0008

(0.0041)

0.0050

(0.0036)

D(LOG(AGRIC)

)

0.0036

(0.0033)

0.0011

(0.0042)

D(LOG(DAU))

0.0183***

(0.0034)

OPINI

-0.0081***

(0.0012)

-0.0058***

(0.0013)

ECT(-1)

-0.0645***

(0.0170)

-0.0750***

(0.0186)

R-square

d

0.860118 0.768501

Source: Data processed

(***), (**) and (*) indicate significant at 1%, 5%

and 10% significance level respectively. Numbers in

parentheses are standart errors

Results Table 4 shows that the ECT coefficient

value in the model is significant and is negative for

estimating economic growth (LOG (GRDP)). The

ECM panel estimation results above show that in the

short and long term the variables used in this study

significantly influence economic growth. R2 Model

1 value is around 0.86 or 86%. It can be said that the

types of independent variables included in the model

are very good, because only about 14% of the

diversity of dependent variables is influenced by

independent variables outside the model. While the

value of R2 Model 2 is around 0.768 or 76.8% it can

be said that the types of independent variables

included in the model are very good, because only

about 23.2% of the diversity of the dependent

variable is influenced by the independent variables

outside the model

The estimation results of Model 1 illustrate that

in the short term changes in the education budget

and the General Allocation Fund have a positive

influence on economic growth, ceteris paribus.

While the opinion of the Supreme Audit Board on

the Local Government Financial Statements has a

significant and negative influence on economic

growth. And Model 2 estimates illustrate that in the

short term changes in the education budget have a

positive influence on economic growth, ceteris

paribus. While the opinion of the Supreme Audit

Board on the Local Government Financial

Statements has a significant and negative influence

on economic growth.

Based on these short-term equations using the

ECM panel method produces the ECT coefficient.

This coefficient measures the response rate of each

period which deviates from balance. According to

Widarjono (2007) the ECT imbalance correction

coefficient model 1 in the form of absolute values

explains how fast time is needed to get a balance

value. The ECT coefficient value of 0.0645 means

that the difference between economic growth and its

equilibrium value is 6.45 percent which will be

adjusted within 1 year. While the ECT coefficient

value of 0.075 means that the difference between

economic growth with a balance of 7.5 percent will

be adjusted within 1 year. ECT shows how quickly

equilibrium is reached back into long-term balance.

which shows a long-term and short-term adjustment

to return to the equilibrium position has a slow rate

of speed because the ECT coefficient is negative.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

654

The ECM Panel model for model 1 and model 2

needs to be tested for classical assumptions, namely:

normality test, heteroscedasticity test and

multicollinearity test.

This normality test is used to determine whether

the residual is normally distributed or not. To test

whether the data distribution is normal or not can be

done by using the Jarque-Berra test (J-B test).

Table 5: Normality Test Results

Model 1 Model 2

Jarque-Bera 1.715439 2.4854

Prob. 0.424125 0.2886

Source: Data processed

(***), (**) and (*) indicate significant at 1%, 5%

and 10% significance level respectively.

Based on the normality test it can be seen that the

ρ-value Model 1 is 0.424> α = 5% and the Model 2-

value Model 1 is 0.2886> α = 5%. So, it can be

concluded that the data used in the ECM panel

model 1 and model 2 are normally distributed.

Heteroscedasticity is a regression problem in

which the interference factor does not have the same

variance or the variance is not constant. This will

give rise to various problems, namely OLS

estimators that are biased, variants of OLS

coefficients will be wrong. In this study we will use

the method with the Breusch-Pagan test to detect the

presence or absence of heteroscedasticity in the

regression model.

Table 6: Heteroscedasticity Test Results

Variable

LOG(Residual

2

)

Model 1 Model 2

LOG(EDUC)

0.000144

(0.000757)

-0.002263

(0.001695)

LOG(HEALTH)

0.002456

(0.001787)

0.001571

(0.003357)

LOG(MARINE)

0.000715

(0.001910)

-0.003321

(0.002653)

LOG(AGRIC)

-0.003072

(0.001675)

-0.004008

(0.003415)

LOG(DAU)

0.001377

(0.002146)

OPINI

7.45E-05

(0.000615)

-0.000192

(0.000952)

Source: Data processed

(***), (**) and (*) indicate significant at 1%, 5%

and 10% significance level respectively. Numbers in

parentheses are standart errors

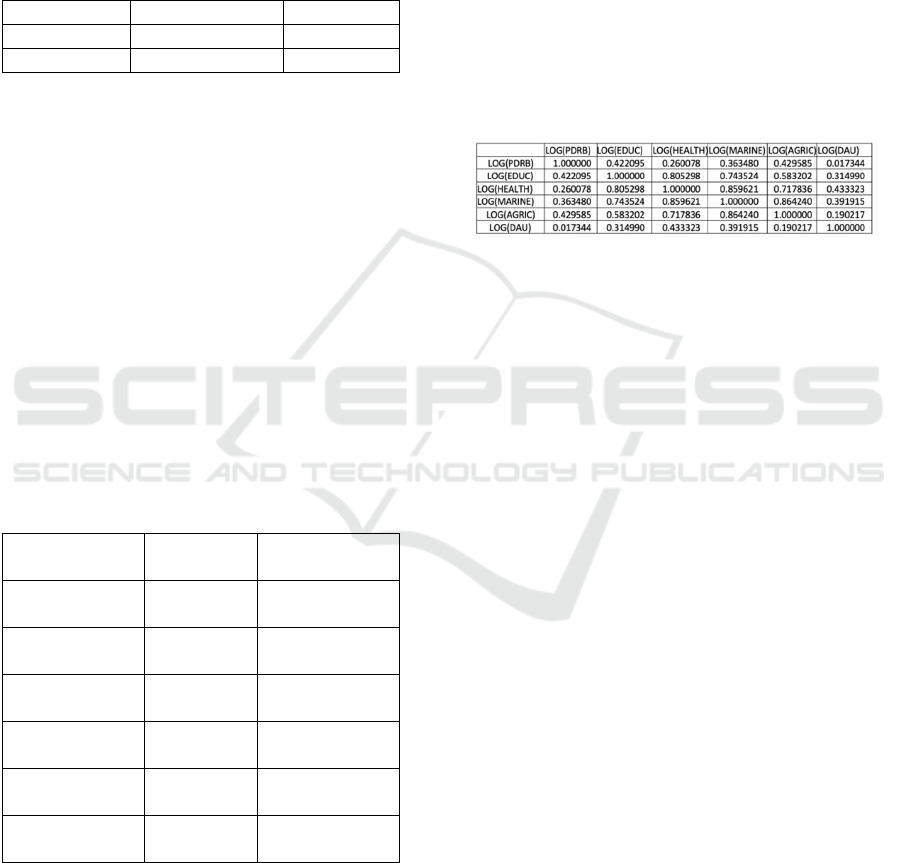

Multicollinearity is the existence of a linear

relationship between the independent variables in

the regression model. To test the presence or

absence of multicollinearity in the model,

researchers used a partial method between

independent variables. The rule of thumb of this

method is if the correlation coefficient is high

enough above 0.85 then there is multicollinearity in

the model. Conversely, if the correlation coefficient

is relatively low, the model does not contain

elements of multicollinearity (Gujarati, 2003).

Based on testing with the partial correlation

method between independent variables, it was found

that there was no multicollinearity problem in the

model. That is because the correlation matrix value

is less than 0.85.

Table 7: Serial Correlation Results

Source: Data processed

5 CONCLUSIONS

Local government spending on education both in the

long term and in the short term affects economic

growth. Education occupies an important role in

increasing GRDP. Improving education both in the

short term and in the long term will encourage

increased productivity and competitiveness of

regions in Sumatra. Local governments must

implement the National Education System Law No.

20 of 2003 in a democratic and non-discriminatory

manner by developing students creatively and

encouraging a culture of reading and writing.

Expenditures for health, marine and agriculture

in the short term have not been able to encourage

economic growth. Whereas in the long run, health

and marine expenditures encourage economic

growth. Health is an indirect investment, and

increased expenditure on marine infrastructure is

direct investment (Todaro and Smith, 2012; 151) so

that health requires a very large investment and can

be achieved in the long term. Increased government

spending on health will increase the health of the

people and increase worker productivity. While the

potential of the waters around the island of Sumatra

requires a very large budget and will only be

achieved in the long term.

Agricultural expenditure does not encourage

economic growth on the island of Sumatra in the

long term, this is due to agricultural programs

The Effect of Regional Government Expenditure on Economic Growth: Case Study of Sumatera Island - Dynamic Panel Approach

655

financed by regional government spending not yet

effective and not on target, especially assistance

with agricultural production tools (Alsintan), so that

local governments need to reevaluate programs that

are needed by farmers in the area.

General allocation funds in the short term affect

economic growth, but in the long run do not affect

economic growth. General allocation funds from the

central government, it is mandatory for local

governments to manage them properly, because it

will be beneficial to the development and progress

of the region. In the short term, the lack of funding

for regional development can be covered by the

transfer of general allocation funds from the central

government so as to encourage economic growth,

but for most regions in the long run the lack of

personnel expenditure due to increases in salaries

and employee welfare costs is funded by general

allocation funds has an impact on reducing regional

development programs, and ultimately inhibits

regional economic development.

BPK's opinion on short-term regional financial

reports has a negative relationship with economic

growth. Local governments in any way will do so

that financial statements are categorized as

unqualified, in the short term these financial

statements will burden development targets because

indicators that are not yet commonly done by the

behavior of local government employees. In the long

term, all activities that use the government budget

must be transparent and accountable and the targets

set can be achieved. So that the BPK's opinion in the

long run will encourage economic growth in the

Sumatra region.

This study has limitations, especially not all

provinces can be used as studies because of limited

data, and secondly there are still many

macroeconomic variables that can be used as a

determinant variable in economic growth in the

provinces in Sumatra.

REFERENCES

Agustine, A.D., (2014). Pengembangan Sektor Kelautan

dan Perikanan Untuk Meningkatkan Pendapatan Asli

Daerah (Studi di Dinas Kelautan dan Perikanan

Kabupaten Banyuwangi). Jurnal Administrasi

Publik, 2(2), pp.276-280.

Ahmad, I., (2011). Regional Fiscal Independence In East

Java Province Post Regional Autonomy. Economic

Journal of Emerging Markets, 3(2), pp.189-198.

Al-Shatti, A.S., (2014). The Impact of Public Expenditures

on Economic Growth in Jordan. International

Journal of economics and Finance, 6(10), p.157

Basri, F (1995). Perekonomian Indonesia Menjelang Abad

XXI, Penerbit Erlangga.

Bastian, I., (2006). Sistem Perencanaan dan Penganggaran

Pemerintahan Daerah di Indonesia, Salemba Empat,

Jakarta.

Dada, MA. (2013). Composition Effect of Government

Expenditure on Private Consumption and Output

Growth in Nigeria: a Single Equation Error

correction Modelling, Rumanian Journal of fiscal

polic. Vol. 4. issue 2(7). July-Des 2013.

Domowitz, I. and Elbadawi, I., (1987). An error-correction

approach to money demand: the case of Sudan.

Journal of Development Economics, 26(2), pp.257-

275.

Engle, R.F. and Granger, C.W., (1987). Co-integration and

error correction: representation, estimation, and

testing. Econometrica: journal of the Econometric

Society, pp.251-276.

Gisore, N., Kiprop, S., Kalio, A., Ochieng, J. and Kibet,

L., (2014). Effect of government expenditure on

economic growth in East Africa: A disaggregated

model. European Journal of Business and Social

Sciences, 3(8), pp.289-304.

Grabova, P., (2014). Corruption impact on Economic

Growth: An empirical analysis. Journal of Economic

Development, Management, IT, Finance, and

Marketing, 6(2), p.57.

Gujarati, D.N. (2003), Basic Econometrics. New York:

Mc.Graw-Hill.

Gyimah-Brempong, K., (2002). Corruption, economic

growth, and income inequality in Africa. Economics

of Governance, 3(3), pp.183-209

Huda, H.M., Purnamadewi, Y.L. and Firdaus, M.,( 2015).

Industrialisasi Perikanan Dalam Pengembangan

Wilayah di Jawa Timur. Tataloka, 17(2), pp.99-112.

Idrees, A.S. and Siddiqi, M.W., (2013). Does public

education expenditure cause economic growth?

Comparison of developed and developing countries.

Pakistan Journal of Commerce and Social Sciences,

7(1), p.174.

Manik, R.E. and Hidayat, P., (2010). Analisis kausalitas

antara pengeluaran pemerintah dan pertumbuhan

ekonomi Sumatera utara (Metode Cointegration Test

dan Granger causality Test). Jurnal Keuangan &

Bisnis Program Studi Magister Manajemen Sekolah

Tinggi Ilmu Ekonomi Harapan, 2(1), pp.46-56.

Mauro, P., (1995). Corruption and growth. The quarterly

journal of economics, 110(3), pp.681-712.

Mo, P.H., (2001). Corruption and economic growth.

Journal of comparative economics, 29(1), pp.66-79.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

656

Mursidah, M., Effendi, M. and Zaini, A., (2017). Analisis

Dampak Penggunaan Anggaran Sektor Pertanian

Terhadap Pertumbuhan Ekonomi Sektor Pertanian di

Provinsi Kalimantan Timur. Jurnal Pertanian

Terpadu, pp.58-69.

Muti’ah, (2017), The Effect of Regional Revenue,

Revenue Sharing Fund, General Allocation Fund

and Special Allocation Fund on Regional Economic

Growth (Empirical Study In the 33 provinces in

Indonesia Year 2011-2014), Research Journal of

Finance and Accounting, vol. 8, no. 8, pp.102-111.

Nawatmi, S., (2014). Korupsi Dan Pertumbuhan Ekonomi

Negara-Negara Asia Pasifik. Jurnal Bisnis dan

Ekonomi, 21(1). hh. 73-82.

Novianti, T, Rifin, A, Panjaitan, DV & Sri, R WN.,

(2014), The Infrastructure’s Influence on the Asean

Countries Economic Growth, Journal of Economics

and Development Studies, vol. 2, no. 4, pp. 243-254.

Oyinbo, O., Zakari, A. and Rekwot, G.Z., (2013).

Agricultural budgetary allocation and economic

growth in Nigeria: implications for agricultural

transformation in Nigeria. Journal of Sustainable

Development, 10(1), pp.16-27.

Shuaib, I.M., Igbinosun, F.E. and Ahmed, A.E., (2015).

Impact of Government agricultural expenditure on

the growth of the Nigerian economy. Asian Journal

of Agricultural Extension, Economics and

Sociology, 6(1), pp.23-33.

Tajuddin, I., Hasanuddin, B. and Rahmatia, P.U., (2014).

The Effects Of General Allocation Funds, Special

Allocation Funds And Revenue-Sharing Funds On

Investment, Economic Growth, Economic Structure,

And Employment. Journal of Research in Business

and Management vol. 2, Issue 10 pp. 54-61.

Todaro, MP., (1999). Economics Development in the

Third World, The Longman Inc, New York.

Todaro, MP., and Smith, SC., (2012), Economic

development, Boston, Mass, Addison-Wesley.

Widarjono, A., (2007). Ekonometrika Teori dan Aplikas,.

Yogyakarta, Ekonisia FE. UII.

The Effect of Regional Government Expenditure on Economic Growth: Case Study of Sumatera Island - Dynamic Panel Approach

657