A Comprehensive Analysis of Firm’s Value: A Study of Selected

Firms in Indonesia

Firman Syarif

1

and Mutia Ismail

1

1

Department of Accounting, Universitas Sumatera Utara, Medan –Indonesia

Keywords: Management Change, Investment Decision, Audit Committee, Good Corporate Governance, Capital

Structure and Firm’s Value

Abstract: The main objective of this study is to determine the influence of Management Change, Investment Decision,

Audit Committee, Good Corporate Governance and Capital Structure on Firm’s Value. A sample of 15 firms

listed on Indonesia Stock Exchange (ISE) for a period of 4 years from 2014-2017 was used. Data were sourced

from annual reports of selected firms. The Multiple Linier Regression (MLR) statistical technique was used

for data analysis and hypothesis testing. The study revealed that there is a significant influence of Management

Change, Investment Decision, Good Corporate Governance and Capital Structure on Firms’ Value. But there

isn’t a significant influence of Audit Committee on Firms’ Value. The study therefore recommends that

Investment Decision and Capital Structure are optimized by firms to aid maximization of firms’ value.

1 INTRODUCTION

All small firms, medium firms and large firms need

funds to activate. Among them, large firms really

need funds to do day to day operations and sometimes

try to expand domestically and abroad for their

activities. The main objective of the firms are to get

much profit, to maximize their stockholders welfare.

To make it succeed, they need funds to finance their

operations and activities. It is important to improve

the firms’ performance by changing the management,

investment decision, creating Good Corporate

Governance, form Audit Committee and also good

financing strategy such as arranging capital structure

(financing source) which are devided into two:

Reserve and retained earnings as the internal

financing and long term loans, issuance of bond

payables, common stock and preferred stock.

Firms must choose the best Directors to manage

the firm, investment decision should be done

carefully. The aim of decision investment is to get

high profit margin with certain risk. It is expected to

increase firms’ value. It is also meant to increase

stockholders’ welfare. Stockholders worth can be

measured by stock price. it can be counted from

amount of common stock outstanding times stock

price at that time. Market price is reflected from

various decision and policy done by management so

it could be said that firms’ value is derived from

management actions. According to the Cadbury

Report, 1992, the Combined Code, 2003, 2006, and

the FRC, 2016, a board of directors should

established Audit Committee, Audit remuneration,

Audit nomination , etc., to improve efficiency. This

research aims to narrow down and focus on Audit

Committee adoption as being one of the most

important function of board of directors.

A variety of research in financial management has

been widely performed and contributed useful

financial theory to science and management policies,

such as the capital structure theory (Modigliani and

Miller, 1958 and 1963) and agency theory (Jensen

and Meckling, 1976) etc. Therefore, the activities

within the company play an important role in the

survival of the company. The main goal of the firms’

policy are commonly aimed at the development of the

company by increasing fims’ value.

2 THEORICAL FRAMEWORK

At least eight theories and theoretical frameworks

have been developed relating 6 factors influencing

firms’ value (Kumar, 2007), these are:

Syarif, F. and Ismail, M.

A Comprehensive Analysis of Firm’s Value: A Study of Selected Firms in Indonesia.

DOI: 10.5220/0009508411671173

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1167-1173

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1167

1. Irrelevance Theory by Modigliani and

Miller (M&M) in 1958

2. Static Trade-off Theory (STT) by Myers and

Majluf in 1984

3. Asymmetric Information signaling

framework by Ross in 1977

4. Model based on agency cost by Jensen and

Meckling in 1976

5. Pecking Order Framework (POF) by Majluf

and Meyers in 1984

6. The legal environment framework of capital

structure by La Porta et. al in 1997

7. Target leverage framework or mean revision

theory by Fisher et al in 1989

8. Transaction cost framework by Williamson

in 1988

The principle of agency conflict and agency

theory

Agency theory is defined as “ one in which one or

more persons (the principal (s)) engange another

person (the agent) to perform some service on their

behalf which involve delegating some decision

making authority to the agent” (Jensen and Meckling,

1976).

The relationship between the principal and the

agent possesses two major interdependent problems.

The first is the problem of information asymmetry

between the principal and the agent. The second is the

possibility of conflict or a divergence of interest

between the principal and the agent (Hill and Jones,

1992). In term of divergence of interest, the agent

does not necessarily make decisions in the best

interests of the principal. The agent (manager) may

prefer to persue their own personal objectives instead

of primary objective of wealth maximization for

shareholders (Huse, 2007; Eisenhardt, 1989; Berle

and Means 1932).

The formation of an audit committee by board of

commissionaires is design to overcome agency

problems and helps enhance the firms’ monitoring

and effectiveness. However, Khosa (2017) indicates

that the presence of an audit committee can mitigate

the agency costs between managers and shareholders.

Also, the establishment of an audit committee helps

to align the interest of management with those of

shareholders (Hillman and Dalziel, 2003). The

establishment of an audit committee as part of best

corporate governance practice helps to reduce agency

costs and information asymmetry by ensuring that a

firms’ activities are conducted in line with the

expectations of the principal and agent.

2.1 Prior Audit Committee Studies and

Hypotheses Development

The benefits gained by firms as a result of

establishing an audit committee, prior studies indicate

that the presence of an audit committee can have no

impact or a negative impact on a firm. Empirical

research by Khosa, (2017) indicates that audit

committee independence is negatively associated

with firm value. This research is consistent with the

findings of Yermack (1996). He showed that the

establishment of an audit committee board had a

negative correlation to a firm’s Tobin’s Q.

In contrast, Chan and Li’s (2008) research reveals

that the establishment of these committee (audit,

nominating and compensation) have a positive impact

on firm value since their knowledge and experience

can be shared during board meetings. Also, the

information given by a committee can enhance the

overall insight of a board of directors into their firm.

However, given the mixed empirical evidence, this

research predicts that audit committee can have either

a positive or negative association with firm value.

Henceforth, the main hypotheses to be tested are as

follows:

Ha1: there is a positive and statistically significant

relationship between the existence of an audit

committee and a firm’s value.

2.2 Prior Institutional Ownership Study and

Hypothesis Development

Analyzing the effect of dominant institutional

investors on firm value Mallorqui and Martin (2011)

found that the ownership of investment funds is

positively related to firm value but the ownership of

banking institutions is negatively related to firm

value.

The existing empirical evidence regarding the

relationship between institutional ownership of firm

value remains inconclusive. McConnell and Servaes

(1990) found a significant positive relationship

between institutional ownership and Tobin’s Q.

Consistent with these arguments, the following

hypotheses is proposed:

Ha2: There is a positive effect between institutional

ownership and firms’ value

2.3 Prior Capital Structure Study and

Hypothesis Development

Woolridge and Snow (1990), found a significant

positive abnormal return at the level of 0.71% of the

overall investment announcement. They are

categorized into several types of investment

announcement, joint ventures, R & D project,

diversify markets/products, and capital expenditure.

Significant positive market reaction and long term

investments, the investment is more than 3 years.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1168

Capital structure is one policy influencing firms’

value. According to Weston and Copeland (1997),

capital structure is a permanent financing consist of

long term liabilities, preferred stock and stockholders

equity. Capital structure shows the proportion on

using payables to finance the investments. Investors

try to balance between risk and return.

Research conducted Anuchitworawong (2000)

after crisis in Thailand, and Guo (2006), found that

capital structure has a negative and significant effect

on Return On Asset (ROA). Rayan, K (2008) found

financial leverage has a negative and significant

effect on firm value. Salehi, M (2009) who conducted

research in Iran, also found that financial leverage has

a negative impact on corporate performance, While

Bhatti, et al (2010), found that high levels of leverage

that will create a high systematic risk and high

volatility in stock prices. Henceforth, the main

hypotheses to be tested are as follows:

Ha3: There is a positive and statistically significant

relationship between capital structure and firms’

value.

2.4 Prior Investment Decision Study and

Hypotheses Development

The aim of investment decision is to get high profit

margin with certain high risk. The highest of profit

margin followed by the highest the management risk.

It is expected that increasing firms’ value means

increasing stockholders’ welfare. Capital expenditure

related to investment policy, where the policy is part

of the financial policies that have significance to

make the value of the company increases. This policy

is usually done when the company expanded the

business by adding production capacity,

modernization or building factories and capital

budgeting changes. Woolridge and Snow (1990) has

been treated as capital expenditure expansion of

production capacity, plant modernization and

changes in capital expenditure as capital expenditure.

Henceforth, the main hypotheses to be tested are as

follows:

Ha4: There is a positive and statistically effect of

investment decision on firms’value.

2.5 Prior Management Changes Study and

Hypotheses Development

Management changes in a firm can also change the

vision, mission and firms business strategies, and at

last it needs organization restructuring. This changing

is expected to increase value of the firm. Usually

organization restructuring will be followed by

management changes. Based on this description, the

hypotheses is as follows:

Ha5: There is a significant effect of management

changes on firms value

3 RESEARCH METHOD

The research paper uses secondary data from

www.idx.co.id (annual report from food and

beverage companies) and covers a 4-year period of

15 financial firms’ annual reports (From December

2014 to December 2017). The financial firms are

focus on Food and Beverage Companies listed in

Indonesia Stock Exchange.

The firms were selected to be part of the sample

by using the criteria that they have had 4 consecutive

years of annual reports, and that the independent

variables (Audit committee, institutional ownership,

management changes, investment decision and

capital structure), dependent variable (Tobin’s Q).

The 15 firms generate 60 firm-year operations,

which are sufficient to help answer the research

questions and make a meaningful contribution to the

firms’ value literature. Also, selecting data from

2014-2017 is appropriate to the research objectives

and the rationale behind this study.

Data gathered were analyzed using regression

analysis method. Regression analysis is a statistical

tool for estimating relationships among variable

especially when focus is on the relationship between

a dependent variable and one or more independent

variables. Regression is also used to understand if the

independent variable is related to the dependent

variable and to explore the form of this relationship

and also infer the causal relationship (effect) between

the variables (dependent and independent). However,

the multiple linier regression method was specifically

employed, using the Ordinary Least Squares (OLS)

method to estimate the parameters. The Ordinary

Least Squares (OLS) method was employed because

it is the best linier unbiased estimator.

3.1 The Regression Design

The data given will be tested using the following

regression model:

Tobin’s Qit = ɑ0 + ɑ1 Audit Committeeit + ɑ2

Institutional Ownership + ɑ3 Capital Structure +

ɑ4 Investment Decision + ɑ5 Management

Changes + εit

Where:

Tobin’s Qit for firm i at time t is the dependent

variable used as a proxy for firm valuation. That

is, Tobon’s Q will represent and serve as a firm-

based organisational valuation measure. The term

ɑ0 is constant; ɑ1, ɑ2, ɑ3, ɑ4, ɑ5 are the

independent variables. The last term εit is the

model error for firm i at time t.

(i) Dependent variable Tobin’s Q firm value

A Comprehensive Analysis of Firm’s Value: A Study of Selected Firms in Indonesia

1169

The dependent variable in this study is firm value,

which has also been used in several prior studies;

for example, (Agrawal and Knoeber, 1996;

Yermack, 1996; Gompers et al., 2003; Klapper

and Love, 2004; Beiner et al., 2006; Black et al.,

2006; Haniffa and Hudaib, 2006; Henry, 2008;

Guest, 2009; Ntim et al., 2015; Krause and Tse,

2016). Tobin’s Q represents the financial

valuation of corporate governance structures by

investors (outsiders), (Lindenberg and Rose,

1981). Tobin’s Q is measured as the ratio of total

assets minus the book value of equity plus the

market value of equity to total assets (Chung and

Pruitt 1994, Beiner et al., 2006).

(ii) The Independent variables in this study are

Audit Committee, Institutional Ownership,

Capital Structure, Investment Decision and

Management Changes.

3.2 Statistical Criteria

It is necessary to check the goodness of fit of the

model and the statistical significance of the eatimated

parameter; the statistical criterion used to check the

goodness of fit was the coefficient of determination

(R

2

) and the T-tsest, Durbin Watson and F-test were

the criteria used to check the statistical significance

of the estimated parameters; the criteria are further

explained below:

1. T-test: this test was used to test the

significance of the parameters estimated at (n-

k) degree of freedom, where n= number of

observations and k = parameters.

2. Coefficient of Determination (R

2

): this shows

the percentage of the total variation of the

dependent variable that can be explained by

the independent variable (s). R

2

shows the

extent to which the independent variable

influences the dependent variable. A high

value shows a high degree of influence and

vice versa

3. F-test: this is used to test the significance of R

2

and thus test the significance of the model as a

whole.

If F-calculated is greater than F-tabulated, reject

the H

0

and if F-calculated is less than F-

tabulated accept H

0

at 5% level of significance.

4. Durbin-Watson statistic: This is mostly

relevant when using time series data. This

criterion was used to test whether there is any

evidence of autocorrelation in the residuals of

the time series regression. The statistics ranges

from zero to four, a value of two or close to

two indicates no autocorrelation in the sample.

A value far less than two indicate positive

correlation while a value greater than two

indicate negative correlation.

5. Audit committee connoted by AC is estimated

by audit committee members in the firms.

Institutional ownership is estimated by

amount of institutional stocks or shares

devided by total stocks times 100%.

Management changes in this paper use dummy

variable where 1 if management changes

happened and 0 otherwise. Investment

decision connoted by ID is proxied by Price

Earnings Ratio (PER), estimated by stock

price devided earnings per share times 100%.

Capital structure or financial leverage

connoted by CS is estimated by total debt/total

equity, and its value is given in ratio. Firms’

value connoted by FV is estimated using

market value of the shares of sampled firms,

and its value is given.

6. The listed firms are Food and Beverage period

2014-2017, the firms have closing price data

and the stocks are actively traded. The firms

also have financial ratios as research variable

measurements.

4 ANALYSIS

The results of the OLS regression are analysed in the

table below.

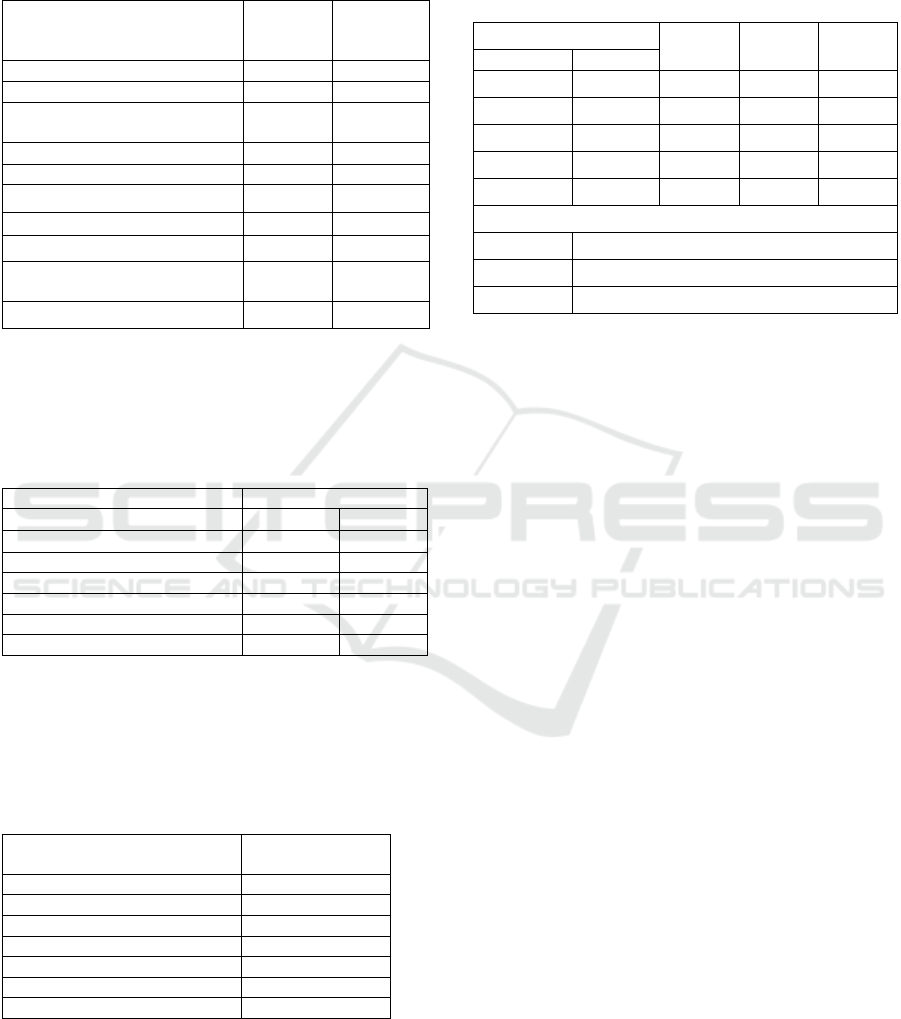

Table 1: Descriptive statistics

Variables Mean Std.Dev. Observation

AC 3.115 0.379 52

IO 70.263 19.221 52

MC 0.289 0.457 52

ID 21.454 10.055 52

CS 1.146 1.328 52

FV 3.113 3.248 52

Source: SPSS 22

Table above highlights descriptive statistics of

variables. Firm Value (FV) which is the dependent

variable has a mean of 3,1154 and a standard

deviation value of 3,24751. The mean value of Audit

committee stood at 3,1154 and a standard deviation

value of 0,37853. The mean value of Institutional

ownership stood at 70,2625 and a standard deviation

value of 19,2213. The mean value of Management

changes stood at 0,2885 and a standard deviation

value of 0,45747. The mean value of Investment

Decision stood at 21,4538 and a standard deviation

value of 10,05458. The mean value of Capital

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1170

structure stood at 1,1463 and a standard deviation

value of 1,32821. The last column represents the

number of samples in our observation.

Table 2: Normality Test

Unstandar-

dized

Residual

N

52

Normal Parameters Mean 0.000

Std.

Deviation

2.750

Absolute 0.178

Most Extreme Positive 0.178

Difference Negative -0.104

Kolmogorov-Smirnov Z

1.280

Asymp.Sig (2-tailed)

0.075

a. Test distribution is

Normal

b. Calculated from data

Source: SPSS 22

The asymp.sig (2-tailed) shows that p prob value

0,075> 0,05. It means that normality assumption has

been fulfilled.

Table 3: Multicollinierity Test

Model Collinearity Statistics

Tolerance VIF

(Constant)

Audit Committee 0.943 1.060

Institutional Ownership 0.882 1.134

Management Changes 0.991 1.009

Investment Decision 0.849 1.178

Capital Structure 0.922 1.084

Source: SPSS 22

All variables showed that Variance Inflation

Factor Value are below 10 and Tolerance value are

above 0,1. It means that there is no multicollinierity

among the variables.

Table 4: Autocorrelation Test

Run Test

Unstandardized

Residual

Test Value -0.3737

Cases < Test Value 26

Cases >= Test Value 26

Total Cases 52

Number of runs 28

Z 0.,280

Asymp.Sig (2-tailed) 0.779

Source: SPSS 22

Asymp.Sig (2-tailed) 0,779 > 0,05 shows that

there is no autocorrelation from the model.

Model Summary and Analysis of Result

The result obtained from the preliminary ordinary

least square estimation technique is presented below:

Table 5: Ordinary Least Square Regression Result

(Initial Output)

Variable

Coef.

T-Stat.

Prob.

Dep. Indep.

FV

AC

-0.167

-0.152 0.88

IO

0.058

2.577

0.013

MC 0.699 0.785 0.436

ID

0.158

3.609 0.001

CS

0.549

1.728

0.091

a. Dependent Variable: Firm Value

R

2

0.283

Adj R

2

0.205

F-stat

0.007

Source: SPSS 22

The coefficient of determination (R

2

) with a value

of 0,283 shows that about 0,283% of the total

systematic variations in the dependent variable (FV)

have been been explained by the explanatory

variables taken together. The adjusted R-Square

shows that after adjusting for the degree of freedom,

the model could still explain about 0,205% of the total

systematic variations in firm value (FV), while about

79,5% of the systematic variation in firm value (FV)

was left unaccounted for, which has been captured by

the stochastic disturbance term in the model. This

indicates a moderate fit of the regression line and also

the model has a high forecasting power. On the basis

of the overall statistical significance of the model as

indicated by the F-statistics, it was observed that

overall model was statistically significance since sig.

value 0,007 < 0,005. On the other side, on the basis of

the individual statistical significance, as shown by the

t-statistic, it was observed that audit committee has

Prob. Value 0,880; Institutional Ownership has

Prob.Value 0,013; Management changes has

Prob.Value 0,436; Investment Decision has Prob.

Value 0,001 and Capital Structure has Prob. Value

0,091.

Hypothesis Testing

In order to test the hypotheses of the study, the t-

statistic obtained from the regression result were

used, the paper adopted 5% level of significance

under the one-tailed test. Our decision rule is to

accept the alternative hypothesis if Prob. Value is less

than 0,005, otherwise we reject alternative and accept

the null.

A Comprehensive Analysis of Firm’s Value: A Study of Selected Firms in Indonesia

1171

Hypothesis 1:

H

a1

: there is a positive and statistically significant

relationship between the existence of an audit

committee and a firm’s value

From the empirical analysis it was observed that

Prob.Value from audit committee 0,633 and

coefficient regression - 0,167, which states that audit

committee influences negatively and not significant

on firms value.

Hypoyhesis 2:

H

a2

: : There is a positive effect between institutional

ownership and firms’ value

From the empirical analysis, it was observed that

Prob. Value from Institutional ownership 0,05 and

coefficient regression 0,058, means that Institutional

ownership influence positively but not significantly

on firms value.

Hypothesis 3:

H

a3

: There is a positive and statistically significant

relationship between capital structure and firms’

value.

From the empirical analysis, it was observed that

Prob. Value from capital structure 0,091 and

coefficient regression 0,318, means that capital

structure influence positively but not significantly on

firms value.

Hypothesis 4:

H

a4

: There is a positive and statistically effect of

investment decision on firms’value

From the empirical analysis, it was observed that

Prob. Value from investment decision 0,001 and

coefficient regression 0,158, means that investment

decision influence positively and significantly on

firms value.

Hypothesis 5

H

a5

: There is a significant effect of management

changes on firms value

From the empirical analysis, it was observed that

Prob. Value from management changes 0,436 and

coefficient regression 0,999, means that management

changes influence positively but not significantly on

firms value.

5 CONCLUSIONS

The research examined the relationship among audit

committee, institutional ownership, management

changes, investment decision and capital structure on

firms value. From all independent variables, only

variable investment decision influence positively and

significantly on firms value.

Firm investment decisions are shown to be

directly related to financial factors, and they also

related to firms value. Investment decisions of firms

with high creditworthiness are extremely sensitive to

the availability of internal funds; less creditworthy

firms are much less sensitive to internal fund

availability`

REFERENCES

Cadbury Committee Report (1992), The Report of the

Committee on the Financial Aspects of Corporate

Governance, Gee Publishing, London.

Chan, K. C., and J. Li, (2008), ),“Audit committee and firm

value: evidence on outside top executives as expert-

independent directors’’ Corporate Governance: An

International Review 16, 16–31.

Combined Code (2003), Combined Code on Corporate

Governance, Financial Reporting Council, London.

Combined Code (2006), Combined Code on Corporate

Governance, Financial Reporting Council, London.

Eisenhardt, M.K (1989), Agency Theory: An Assessment

and Review, The Academy of Management Review,

Volume14, No. 1, page 57-74.

Fama E. F. and Jensen, M. C. (1983), ‘Separation of

Ownership and Control’, Journal of Law and

Economics, Volume 26, No. 2, page 301-325.

Fama, E. F. (1980), Agency problems and the theory of the

firm’, Journal of Political Economy, 88, 288–307.

Gujarati, D. N. (2003), Basic Econometrics, 4th Edition,

McGraw-Hill Companies, New York, USA.

Hair, J. F. J., Anderson, R. E. Tatham, R. L and Black, W.

C. (1998), Multivariate Data Analysis. New York:

Macmillan.

Hair, J. F. J., Anderson, R. E. Tatham, R. L and Black, W.

C. (2006), Multivariate Data Analysis with Readings.

New York: Macmillan.

Hausman, J. A. (1978), ‘Specification tests in

econometrics’ Econometrica, 46 (6): 1251– 1271. ISSN

0012-9682. .

Hill, C.W.L. and Jones, T.M. (1992), ‘Stakeholder-agency

theory’, Journal of Management Studies, Volume 29,

No. 2: 131–54.

Hillman, A.J., and Dalziel, T., (2003), Boards of directors

and firm performance: integrating agency and resource

dependence perspectives; Academy of Management

Review. 28, 383– 396

Huse, M. (2007), Board, Governance and Value Creation:

The Human Side of Corporate governance, published.

Jensen, M.C., & Meckling, W.H. (1976). Theory of the

firm: Managerial behavior, agency costs and

ownership structure. Journal of Financial Economics,

3, 305-360.

Jensen, M.C.(1986), Agency Cost of Free Cashflow,

Corporate Finance and Take Overs. American

Economic Review, vol 26. Kajola, S.O.,2008,

“Corporate Governance and Firm Performance:The

case of Nigerian listed

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1172

Khosa, A. (2017), “Independent directors and firm value of

group-affiliated firms", International Journal of

Accounting & Information Management, Vol. 25 Issue:

2, pp.217- 236.

Mintah, A.P. (2016), Remuneration committee governance

and firm performance in UK financial firms;

Investment Management and Financial Innovation

Journal, Volume 13, Issue 1, 2016.

Mintah, A. P. (2015), The Nomination Committee and Firm

Performance; An Empirical Investigation of UK

Financial Institutions during the pre/post financial

crisis, Corporate Board; Role, Duties & Compositions,

Volume 11, Issue 3, 2015.

McConnell, J.J., & Servaes, H. (1990). Additional evidence

on equity ownership and corporate value. Journal of

Financial Economics, 27, 595-612.

Minguez-Vera, A., & Martin-Ugedo, J.F. (2007). Does

ownership structure affect value? A panel data analysis

for the Spanish market. International Review of

Financial Analysis, 16, 81-98

Modigliani, vol. 3 Cambridge, Massachusetts. MIT Press.

Modigliani, F. and M. Miller (1958), “The cost of

capital structure, corporatipn finance and the theory of

Investment”, The American Economic Review, 448(3)

Myers, S.C. and N.S. Majluf (1984), “Corporate Financing

and Investment Decision when Firms have Information

that Investors do not have”. Journal of Financial

Economics, 13.

Ntim G. C.; Opong, K.K.; and Danbolt, J., (2015), Board

size, corporate regulations and firm valuation in an

emerging market: a simultaneous equation approach,

International Review of Applied Economics, 2015;

Volume 29, No. 2, page 194-220.

Ntim, G. C. (2013), Corporate ownership and market

valuation in South Africa: uncovering the effects of

shareholdings by different groups of corporate insiders

and outsiders, International Journal of Business

Governance and Ethics, 2013 Volume 8, No.3, page

242 – 264.

Ntim, G. C. Lindop, S. and Thomas, D.A. (2013),

Corporate governance and risk reporting in South

Africa: A study of corporate risk disclosures in the pre-

and post-2007/2008 global financial crisis periods.

Rajan, R.G., & Zingales, L. (1995), “What do you know

about Capital Structure? Some Evidence from

International Data. The Journal of Finance.

Ross, A.S. Westerfield, W.R., Jordan, B (2004),

“Essentials of Corporate Finance”, McGraw Hill Inc.

Boston.

Shleifer, A., & Vishny, R.W. (1986). Large shareholders

and corporate control. The Journal of Political

Economy, 94, 461-488. Smith, M.P. (1996).

Turnbull, N. (1999), Internal Control: Guidance for

Directors on the Combined Code, Institute of Chartered

Accountants in England and Wales, London, (ICAEW).

Turnbull, N. (2005), Internal Control: Guidance for

Directors on the Combined Code, Institute of Chartered

Accountants in England and Wales, London, (ICAEW).

Wiwattanakantang, Y. (2001). Controlling shareholders

and corporate value: Evidence from Thailand. Pacific-

Basin Finance Journal, 9, 323-362.

Yermack, D. (1996), ‘Higher Market Valuation of

Companies with a Small Board of Directors’, Journal

of Financial Economics, Volume 40, page 185-211.

A Comprehensive Analysis of Firm’s Value: A Study of Selected Firms in Indonesia

1173