USD 0,0000

USD 1,0000

USD 2,0000

USD 3,0000

The Influence of Profitability, Asset Tangibility, Growth, and Non

Debt Tax Shield on Capital Structure in Manufacture Companies

Listed in Indonesian Stock Exchange

Christina V. Situmorang

1

and Arthur Simanjuntak

1

1

Universitas Methodist Indonesia, Medan -Indonesia

Keywords: Profitability, Asset Tangibility, Growth, Non Debt Tax Shield, Capital Structure

Abstract: The objective of the research was to examine the influence of Profitability, Asset Tangibility, Growth, and

Non Debt Tax Shield on Capital Structure in manufacture companies listed in BEI (Indonesia Stock Market)

in the period of 2012-2016. The research used causal research method. The population was 136 manufacture

companies listed in BEI in the period of 2012-2016, and 85 of them were used as the samples, taken by

using purposive sampling technique. The data were analyzed by using path analysis. The result of the

research showed that the variables of Profitability, Asset Tangibility, Growth, and Non Debt Tax Shield

simultaneously had influence on Capital Structure. Partially, Profitability and Growth positive significant

influence on Capital Structure. Asset Tangibility and Non Debt Tax Shield positive unsignificant influence

on Capital Structure.

1 INTRODUCTION

Investors in equity investments want profit, in the

form of dividend yield and capital gains, but

investing in equities also involves risks. Therefore,

to attract investors to invest their capital in equities

by offering a higher profit level compared to the

profit level of other investments that are less risky.

In this case, investors need a variety of information

that can be used as a signal to assess the prospect of

the company concerned, such as seeing the value of

the business, namely by analyzing financial

statements.

The main goal of companies that have become

public is to increase the prosperity of the owners or

shareholders by increasing the value of the company

(Salvatore 2005). Business value is the perception of

investors to see a company that is often associated

with the share price of the company. In reality, not

all companies want the stock price of the company

to be high, because the company is afraid that the

shares will not sell or attract investors to buy them

by conducting a share split.

The impact of the financial crisis in Europe and

America in 2008 spread throughout the world. The

crisis of a country that other countries treft, is the

contagion effect that can occur for all events in

different areas of economic and financial crisis. The

financial crisis, such as fluctuations in stock prices

that occur on a capital market, has an impact on

falling stock returns and ultimately affects abnormal

returns as a benchmark for performance.

Figure 1: Diagram of the stock price of production

companies in different countries in the Southeast

Asia region 2013-2015

The image above shows that the share price data

of production companies in the Southeast Asia

region for the period 2013-2015. The share price

grew between 2013 and 2014, with the exception of

the company Charoen Pokphand Foods Public

Company Limited (Thailand), which fell and in

2015 the share price fell compared to the share price

1282

Situmorang, C. and Simanjuntak, A.

The Influence of Profitability, Asset Tangibility, Growth, and Non Debt Tax Shield on Capital Structure in Manufacture Companies Listed in Indonesian Stock Exchange.

DOI: 10.5220/0009508312821288

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1282-1288

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in 2014 for the five companies in Southeast Asia.

The statement indicates that there were problems

with production companies in different countries in

the Southeast Asia region, as seen from the share

price of the company that declined.

The global crisis is expected to have a greater

impact in the real sector in the longer term,

especially trade related to the slowdown of the

global economy, especially in developed countries.

The global crisis has no major impact on direct trade

between Indonesia and Europe and with the United

States. But the path of indirect trade in Indonesia

with Europe and the United States will be influenced

by China. China, the largest importer of Indonesian

goods, is expected to reduce imports as a result of

the declining demand from Chinese countries for

Chinese goods.

The crisis of a country that affects other

countries is a contagion effect that can occur for all

events in different areas, both economic and

financial crises. The financial crisis, such as

fluctuations in stock prices that occur on a capital

market, has an impact on fluctuations in falling share

returns and ultimately affects the pattern of

abnormal returns as a measure of performance.

(Franco Modigliani and Merton H. Miller 1958)

who published matters relating to the capital

structure and became one of the subjects that drew

the attention of academics on a global scale. For

more than half a century, various studies have been

conducted by academics to explain the relationship

of the capital structure with profitability, tangibility

of assets, growth and non-debt payments. In this

case, the company must be able to determine its

capital structure, namely how much is to be

borrowed from third parties by considering the

benefits and costs of using debts. There are several

developments in the theory of capital structure

(Franco Modigliani and Merton H. Miller 1958),

namely Trade-Off Theory, Pecking Order Theory

and Signaling Theory.

Some of the earlier researchers who supported

the theory of the pecking order were (Ilyas Muhajir

dan Triyono 2010), who concluded that profitability

had a positive effect on the capital structure. Groups

that do not support the pecking order theory are the

results of research (Huang & Song 2006) which

show that profitability has a negative effect on the

capital structure.

The results of empirical studies showing the

opposite results with regard to the effect of asset

tactility on the capital structure. The group of

researchers offering support is the research carried

out by (Jemmi Halim Liem 2013) that concludes that

asset tangibility (real assets) has a positive effect on

the capital structure (debt). The group of researchers

who did not support this advice was conducted by

(Booth et al. 2001), in which it was concluded that

asset tactility had a negative effect on the capital

structure.

Research carried out by (Margaretha &

Ramadhan 2010) which showed that growth has a

positive effect on the capital structure. The research

group that does not support this is the research of

(Rajan & Zingales 1995) that concludes that the

growth rate negatively affects the capital structure.

The group of researchers who support the

research of (Moh & Rimbey 1998), who came to the

conclusion that NDTS has a positive effect on the

capital structure. While the research conducted by

(Zou & Zezhong 2006) concluded that NDTS had no

influence on the capital structure.

This research focuses on manufacturing

companies listed on the Indonesian stock exchange,

because as we know, since the economic crisis in

2008, the center of global economic power from

Western countries, namely Europe and North

America, slowly shifted to Asia. In Asia, Indonesia

is one of the fastest growing economic zones.

Based on the above description, the authors are

interested in analyzing the "Effect of profitability,

tangibility, growth and non-debt tax shield on the

capital structure in manufacturing companies listed

on the Indonesian stock exchange for the period

2012-2016".

The formulation of the problem in this study is

whether profitability, tangibility of assets, growth

and non-debt tax shield partially and simultaneously

affect the capital structure of manufacturing

companies quoted on the Indonesian stock

exchange?

The aim of this research is to partially and

simultaneously identify and analyze the effect of

profitability, asset tactility, growth and non-debt tax

shield on the capital structure of production

companies that are listed on the Indonesia Stock

Exchange.

Although the contribution of research to researchers

and academics is expected to increase the

understanding and knowledge of researchers in the

field of economics, particularly in terms of

profitability, tangibility of assets, growth and non-

debt tax shield, the impact on the capital structure.

Production companies are expected to be used as

important information and input to improve business

performance in terms of improving the capital

structure.

This research is a development of research

carried out by (Yuliani et al. 2014) entitled

"Determining factors for the capital structure and its

impact on value in emerging markets (studies of the

real estate and real estate sector)". This difference

with previous research lies in the variable, where

earlier research uses independent variables, namely

The Influence of Profitability, Asset Tangibility, Growth, and Non Debt Tax Shield on Capital Structure in Manufacture Companies Listed in

Indonesian Stock Exchange

1283

the sales level, the asset structure, growth potential,

profitability, non-tax tax shield, company scale,

internal company circumstances, while this study

uses profitability, Tangibility Asset, Growth, and

Non-Debt Tax Shield. and the dependent variable of

the previous survey is the capital structure and

business value, while this study only uses variables

of the capital structure. In contrast to the previous

research period, this study period was 2012-2016,

while the previous research period was 2007-2011.

2 DEVELOPMENT OF

HYPOTHESES CAPITAL

STRUCTURE

According to (Wild et al. 2005) the capital structure

is the composition of financing between equity (own

financing) and debt in a company. Capital structure

is a permanent expense that reflects the balance

between long-term debt with equity. Capital

structure is reflected in long-term liabilities and the

element of own capital, where both elements are

permanent funds or long-term funds. In this study

the capital structure is approached by debt / equity

ratio (DER).

DER is a group of Levarage (debt) ratios. This

ratio reflects the composition or capital structure of

the total loan (debt) to the total capital that the

company holds to meet its long-term obligations.

Some theories about debt financing are:

Capital Structure Theory

Modigliani & Miller theory is a modern theory of

the capital structure that publishes its article "The

costs of capital, corporate finance and theory of

investment". MM proves that the value of a

company is not affected by the capital structure .

Exchange theory

The trade-off theory suggests that the optimal debt

ratio should take into account the benefits obtained

and the costs incurred by the company through the

use of corporate debts. This theory suggests that the

optimal capital structure will be achieved if the

benefits of the value added from the use of debts in

the form of tax savings are used to cover the rise in

the financial emergency costs associated with the

use of debt (Bradley et al. 1984)

Agency approach

According to this approach, the capital structure is

designed to reduce conflicts between different

interest groups. The conflict between shareholders

and managers is actually the concept of free cash

flow.

Signal Theory

If the manager is confident that the company's

outlook can use more debt, then this will work later

as a more reliable signal. This is because companies

that increase debt can be seen as companies that

have confidence in the future of the company. We

can therefore conclude from the above explanation

that debt is a positive sign or signal of the company.

Profitability

Profitability as a yardstick in determining alternative

financing, but the way to assess the profitability of a

company that depends on profit and shared assets is

net profit after tax (net result) derived from

operating activities in total assets. The profitability

ratio as measured by Return on Assets (ROA) is a

measure of the company's ability as a whole to make

a profit with the total available assets in the

company.

Tangibility Asset

Tangibility assets are one of the most important

factors in determining decisions about the capital

structure, because the amount of fixed assets can be

used as collateral for creditors (Joni & Lina 2010).

Because companies with a greater tangibility of

assets have a better position in providing loans. The

tactile capacity can be used as collateral for loans

provided by creditors. If the company does not

comply with its obligations towards creditors, the

tangibility of the assets is confiscated by the creditor

to pay off all obligations that the company can not

pay to the creditor.

Growth

The growth rate of the company may affect the

creditor's confidence in the company and the

willingness of investors to provide financing through

long-term debt (Firnanti 2011). Growing companies

will come under pressure to fund their investment

opportunities that exceed the retained earnings in the

company, so that it is in line with the pecking order

theory, so in this case the company will use debts

rather than equity or this case retained earnings.

Non-debt Tax Shield

Non-debt tax shield is a tax deduction for investment

write-offs and tax relief. (DeAngelo, H., and Masulis

1980) stated that the optimal capital structure model

with respect to the existence of both personal tax and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1284

corporate tax and non-debt tax shield (tax savings of

non-debt accounts). This non-debt tax shield

(NDTS) arises because the company makes

depreciation costs as an impact on the use of assets,

particularly fixed assets. The benefits that the

company obtains from the use of loan capital as

financing for the company's investment activities

will have an impact on the taxes and interest costs to

be paid. Also with companies that cause higher

depreciation costs, they will receive tax benefits as a

result of the depreciation costs paid.

Conceptual framework.

Figure 2: Concept Drawing

The research hypothesis is:

1. Profitability, tangibility of assets, growth and

non-debt tax shield partly affect the capital

structure of manufacturing companies listed on

the Indonesian stock exchange

2. Profitability, tangibility of assets, growth and

non-debt tax shield have a simultaneous effect

on the capital structure of manufacturing

companies quoted on the Indonesia Stock

Exchange

3 RESEARCH METHOD

This type of research is a conclusive (causal)

investigation. The population in this study consisted

of production companies listed on the Indonesia

Stock Exchange (IDX) from 2012 - 2016, a total of

140 companies. The sampling technique used was

targeted sampling and a sample of 85 companies

was obtained for the period 2012-2016 with a total

observation of 425 analysis units.

Research model

The data analysis method used is multiple linear

regression by first performing descriptive statistical

tests and classical assumption tests. The equations in

the hypothesis:

Y = b1 X1 + b2 X2 + b3X3 + b4 X4 + є

at which:

Y : Capital structure

b1, b2, b3, b4 : variable coefficients independent

X1 : Profitability (ROA)

X2 : Asset Tangibility (FATA)

X3 : growth rate (TP)

X4 : Non - Debt Tax Shield (NDTS)

Ε : standard error

4 RESULT AND DISCUSSION

Table 1: Descriptive table of research Variable

statistics

N

Min Max Mean

Std.

Deviation

Profitabilitas 425 ,0066 ,4453 ,154888 ,1009156

Aset Tangibility 425 ,0029 1,0311 ,292145 ,2343584

Growth 425 ,0475 ,3013 ,175475 ,0564156

N

on Debt Tax

Shield

425 ,0120 ,9997 ,393648 ,2555603

Capital Structure 425 ,1002 ,9996 ,428096 ,2312980

Valid N (listwise) 425

Testing Classical Assumptions.

Testing the classical assumptions used in this study

includes normality tests, multicollinearity tests,

autocorrelation tests and heteroscedacity tests.

Normality Test

In this study, the restnormality test can be performed

by the non-parametric statistical test Kolmogorov-

Smirnov (K-S).

Table 2: Normality test table

One-Sample Kolmogorov-Smirnov Test

Unstandardi

zed Residual

N 425

Normal Parameters

a,b

Mean 0E-7

Std.

Deviation

,18724734

Most Extreme

Differences

Absolute ,040

Positive ,040

Negative -,037

Kolmogorov-Smirnov Z ,825

Asymp. Sig. (2-tailed) ,505

a. Test distribution is Normal.

b. Calculated from data.

Profitabilitas

(ROA)

Asset

T ibilit

Growth

Non-debt tax

shiel

d

capital

structure

(

DER

)

The Influence of Profitability, Asset Tangibility, Growth, and Non Debt Tax Shield on Capital Structure in Manufacture Companies Listed in

Indonesian Stock Exchange

1285

The Kolmogorov-Smirnov Z value of 0.825 is above

α = 0.05 (Asymp., Sig = 0.505> 0.05), so the

hypothesis H0 is accepted, which means that the

remaining data are normally distributed.

Multicollinearity Test

Multicollinearity tests are done using the variance

inflation factor (VIF). Data is said to have no

multicollinearity if the tolerance value is ≥ 0.10 and

VIF ≤ 10.

Table 3: Multicollinearity test table

Model

Collinearit

y

Statistics

Tolerance VIF

(Constant)

Profitabilitas

,804 1,244

Aset Tangibility

,996 1,004

Growth

,822 1,216

Non Debt Tax Shield

,972 1,029

a. Dependent variable: capital structure

All independent variables have VIF values ≤ 10, so

the data from this study did not experience

multicollinearity.

Autocorrelation Test.

This test is done by looking at the value of Durbin

Watson, as follows:

Table 4: Autocorrelation test table Durbin Watson

Model Summary

b

Model R R Square Adjusted

R Square

Std. Error of

the Estimate

Durbin-

Watson

1 ,587

a

,345 ,338 ,1881369 2,012

a. Predictors: (Constant), Non Debt Tax Shield, Aset

Tan

g

ibilit

y

, Growth, Profitabilitas

b

. De

p

endent Variable: Ca

p

ital Structu

r

The Durbin Watson (DW) value is 2.012. Based on

the Durbin Watson statistical table with α = 0.05, the

number of samples (n) = 85 and the number of

independent variables (k) = 4 are known to have the

value of dL = 1.82767 and the value of dU =

1.85576. So it can be concluded that: dU = 1.85576

<DW = 2.012 <4 - dU = 4 - 1.85576 = 2.14424 On

the basis of these predetermined criteria, indicates

that H0 (hypothesis 0 (zero)) is rejected means no

there are positive and negative autocorrelations.

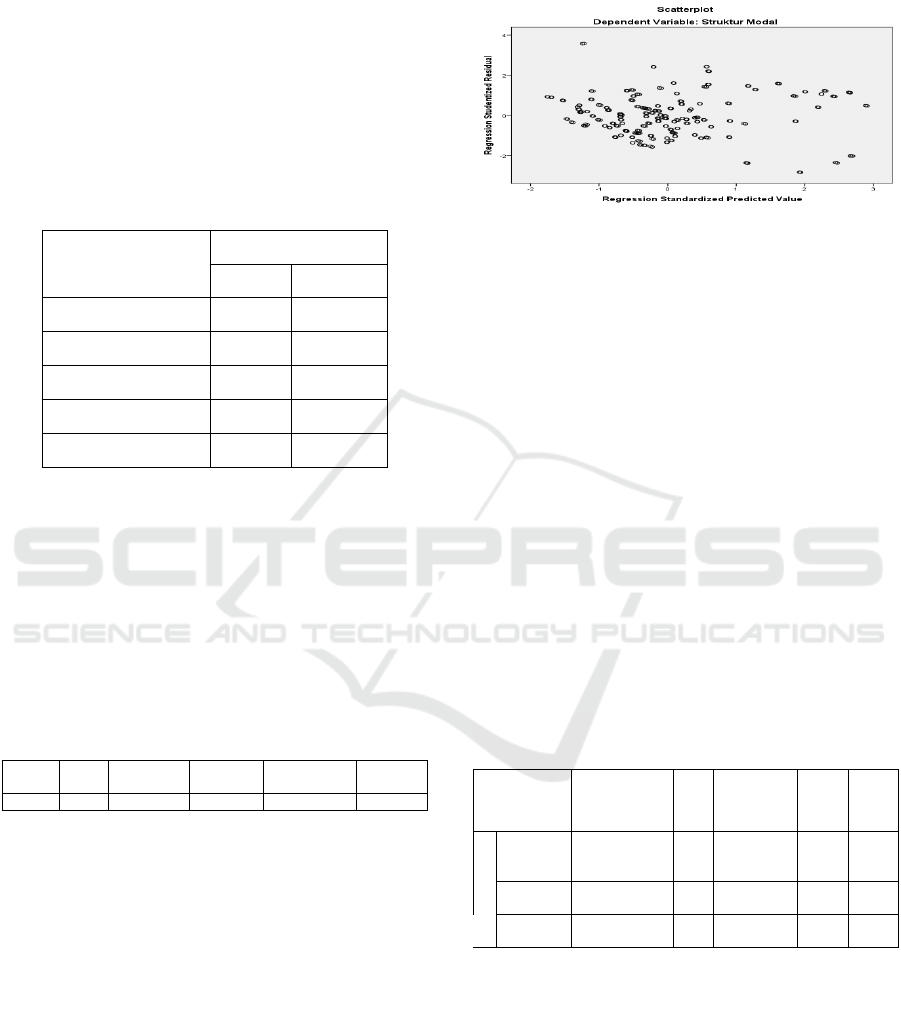

Heteroscedasticity Test

In this study, the heterosexasticity test was observed

using a scatterplot plot between the predicted value

of the related variable (ZPRED) and the residual

value (SRESID).

Figure 3: Heteroscedasticity test image - Scatter plot

graph

The Scatterplot Heteroscedasticity test above shows

that the points above and below the number 0 (zero)

spread on the y-axis and did not form a clear pattern,

so it can be concluded that heterocedasticity does

not occur.

Hypothesis test

Testing the hypothesis in this study uses the F-test, t-

test and determination coefficient (R2)

Test F

Significant value of 0.000 small levies of 0.05, so it

can be said that the variable profitability (ROA),

Tangibility Asset, Growth and Non Debt Tax Shield

have a simultaneous effect on the dependent

variable, namely Capital Structure (DER).

Table 5: F-test table

(ANOVA

b

)

Model Sum of S

q

uares Df Mean S

q

uare F Si

g

.

1 Regression 7,817 4 1,954 55,214 ,000

b

Residual 14,866 420 ,035

Total 22,683 424

a. Dependent Variable: Capital Structure

b. Predictors: (Constant), Non Debt Tax Shield, Asset

Tangibility, Growth, Profitabilitas

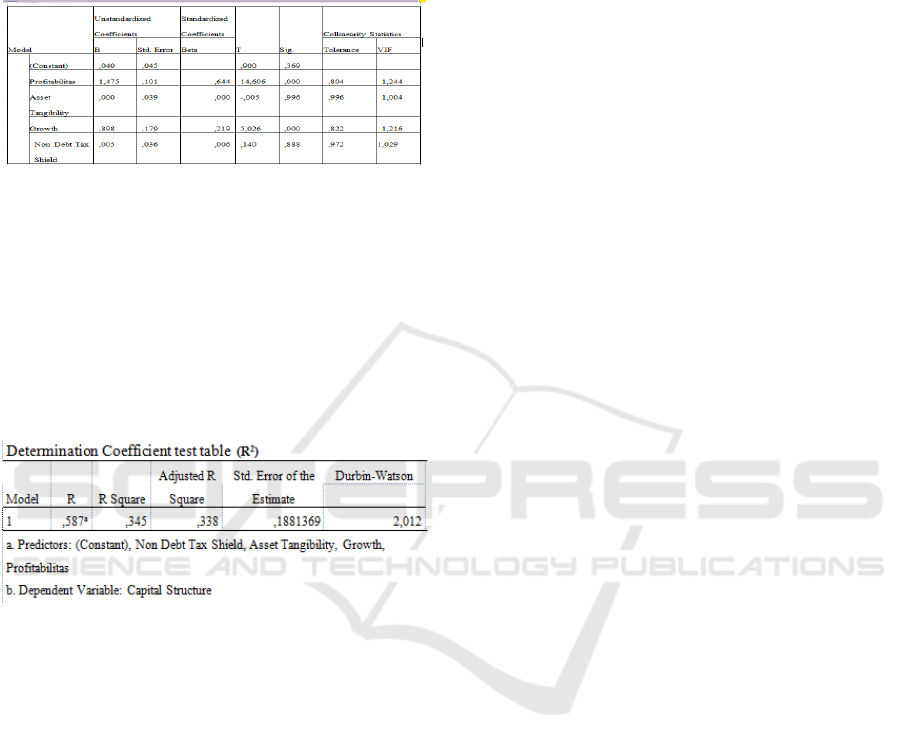

T-test

The t statistical test basically shows how far

someone is independent in explaining dependent

variation.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1286

ROA and growth have a positive and significant

effect on the capital structure, while Tangibility

Assets and Non Debt Tax Shields do not have a

significant effect on the capital structure.

Table 6: T-test Table

Determination Coefficient test (R2)

The coefficient value (R) is 0.587, which shows a

strong relationship, with a (0.3% or 33.8%) fixed

coefficient of determination (Adjusted R Square).

This means that Profitability (ROA), Tangibility

Asset, Growth and Non Debt Tax Shield Capital

Structure (DER) can explain 33.8%, while the

remaining 66.2% is explained by other variables

outside this estimation model.

Table 7: Determination Coefficient Table

5 CONCLUSIONS

From the results of the research carried out,

conclusions can be drawn as follows:

1. In part, profitability (ROA) has a positive and

significant effect on the capital structure (DER).

Tangibility Asset has a positive and not

significant effect on the capital structure (DER).

Growth has a positive and significant effect on

the debt structure (DER). Non-debt tax Shield

has a positive and not significant effect on the

capital structure (DER).

2. At the same time, profitability (ROA),

Tangibility Asset, growth and non-debt tax

shield influence the capital structure (DER).

Constraint

This study has several limitations, namely :

1. Limitations on the criteria of the research

sample used are only companies with profit that

meet the criteria, but processing companies that

suffer losses do not meet the criteria. So that in

this case the profitability can not be fully

reflected in production companies that are listed

on the Indonesia Stock Exchange (IDX)

2. This study only uses independent variables

Profitability, Assibility, Growth and Non-Debt

Tax Shield, as future researchers add the

number of independent variables to be analyzed

in addition to the above variables. Investment

decisions, for example proxied by Price Earning

Ratio (PER), Growth Potential, Interest Rate

(SBBI) and others.

Suggestion

Based on the conclusions and limitations of this

study, the researcher gave some suggestions to the

following researcher, among others, as follows:

1. Can conduct research with the criteria of

companies that have profit / loss for 10 (ten)

years in a row.

2. Can add independent variables such as

investment decision (PER), growth potential,

interest rate (SBBI) and other

REFERENCES

Booth, L., Aivazian, V. & Demirguc-kunt, A., (2001).

Capital Structures in Developing Countries. The

Journal of Finance, 56(1), pp.87–130.

Bradley, M., Jarrell, G.A. & And Kim, E.H., (1984). On

the Existence of an Optimal Capital Structure: Theory

and Evidence: Discussion. The Journal of Finance,

39(3), pp.857–877. Available at: http://www.jstor.org/

stable/2327951?origin=crossref.

DeAngelo, H., and Masulis, R., (1980). Optimal Capital

Structure under Corporate and Personal Taxation*.

Journal of Fmanclal Economics, 8, pp.3–29.

Firnanti, F., (2011). Faktor faktor yang mempengaruhi

struktur modal perusahaan manufaktur di Bursa Efek

Indonesia. Jurnal Bisnis dan Akuntansi, 13(2),

pp.119–128.

Franco Modigliani and Merton H. Miller, (1958). The

American Economic Review. American Economic

Association, 48, pp.261–297. Available at:

http://pubs.aeaweb.org/doi/10.1257/aer.99.1.i.

Huang, G. & Song, F.M., (2006). (P)The determinants of

capital structure: Evidence from China. China

Economic Review, 17(1), pp.14–36.

Ilyas Muhajir dan Triyono, (2010). FAKTOR-FAKTOR

YANG MEMPENGARUHI STRUKTUR MODAL

PERUSAHAAN MANUFAKTUR PADA BURSA

EFEK INDONESIA PERIODE 2005-2009.

Universitas Muhammadiyah Semarang, 7.

Jemmi Halim Liem, W.R.M. dan B.S.S., (2013).

FAKTOR-FAKTOR YANG MEMPENGARUHI

The Influence of Profitability, Asset Tangibility, Growth, and Non Debt Tax Shield on Capital Structure in Manufacture Companies Listed in

Indonesian Stock Exchange

1287

STRUKTUR MODAL PADA INDUSTRI

CONSUMER GOODS YANG TERDAFTAR DI BEI

PERIODE 2007-2011. Jurnal Ilmiah Mahasiswa

Universitas Surabaya, 2(1), pp.1–11.

Joni & Lina, (2010). Faktor-Faktor Yang Mempengaruhi

Struktur Modal. Jurnal Bisnis Dan Akuntansi, 12(2),

pp.82–97.

Margaretha, F. & Ramadhan, R., (2010). Faktor-Faktor

Yang Mempengaruhi Struktur Modal Pada Industri

Manufaktur Di Bursa Efek Indonesia. , 12(2), pp.119–

130.

Moh, M.A. & Rimbey, J.N., (1998). The Impact of

Ownership Structure On Corporate Debt Policy : a

Time-Series Cross-Sectional Analysis. The Financial

Review, 33, pp.85–98.

Rajan, R.G. & Zingales, L., (1995). WHAT DO WE

KNOW ABOUT CAPITAL STRUCTURE ? SOME

EVIDENCE FROM INTERNATIONAL DATA.

Journal of Finance 50, 50(5), pp.1421–1460.

Salvatore, D., (2005). Managerial Economic: Ekonomi

Manajerial dalam Perekonomian Global Kelima. I. S.

Budi, ed., Salemba Empat.

Wild, J.J., Subramanyam, K.R.. & Halsey, R., (2005).

Financial Statement Analysis:, Available at:

http://www.tandfonline.com/doi/abs/10.1300/J109v01

n04_05.

Yuliani, Umrie, R.H. & Diah, Y.M., (2014). Determinan

Struktur Modal dan Pengaruhnya Terhadap Nilai

Perusahaan pada Pasar yang Sedang Berkembang

(Studi pada Sektor Real Estate and Property). Jurnal

Manajemen Usahawan Indonesia, 39(1), pp.27–52.

Zou, H. & Zezhong, J., (2006). The financing behaviour of

listed Chinese firms. The British Accounting Review,

38, pp.239–258.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1288