Determinant Human Development Index: Regional Government

Financial Performance Perspective in Central Java, Indonesia

Kiswanto

1

, Trisni Suryarini

1

and Rina Anggraeni

1

1

Faculty of Economics, Universitas Negeri Semarang, Semarang-Indonesia

Keywords: Financial Statement, Fiscal Stress, Human Development Index, Financial Performance

Abstract: This research aims to obtain the empirically evidence regarding the influence of the Compliances of

financial statement and fiscal stress on human development index with local government financial

performance as a intervening variable. The population in this research is Districts / cities in Central Java

Province 2013-2015. The method used is a saturated sample (census) that is the use of the entire population

with the number 35 districts / cities. The analytical techniques use analysis of Structural Equation Models

(SEM) with AMOS 21. The results of this study indicate that Completeness of financial statements affects

the government's financial performance is positively significant. Financial performance of the regions

affects the human development index positively significant. Fiscal stress does not have significant influence

to the financial performance of the region. The results of the study also proved that the Compliances of

financial statement has significant influence to human development index of the local financial

performance. The research result, it can be concluded that human development index influenced by the

Compliances of financial statement and financial performance.

1 INTRODUCTION

The human development index is an indicator to

measure the quality of human resources to achieve

welfare levels in development planning. Human

development planning carried out by an area

certainly needs support, especially from the

government. This support can be realized through

budget allocations in sectors that support human

development. HDI can be used as an instrument in

allocating development budgets in fields related to

public facilities such as education, health and the

economy.

Human development is expected to be a priority

in development planning, because the nature of

development is human development. Human

development is measured by the Human

Development Index (HDI). The indicator of HDI

improvement are formed by three basic dimensions,

namely long life and healthy life (a long healthy

life), knowledge, and a decent standard of living

(BPS, 2014).

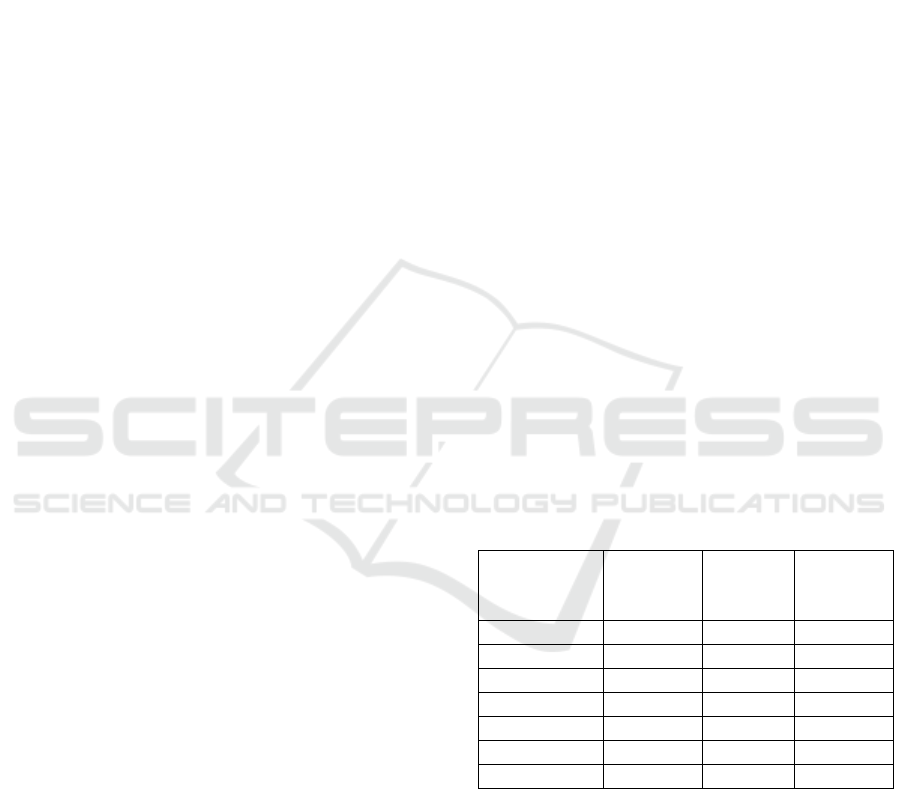

Table 1: Comparison of Indonesian HDI and Central

Java Province

human

development

index

Indonesia

Central

Java

Inter-

year

interval

2010 66,53 66,08

2011 67,09 66,64 0,56

2012 67,70 67,21 0,57

2013 68,31 68,02 0,81

2014 68,90 68,78 0,76

2015 69,55 69,49 0,71

Rata-rata 68,01 67,70 0,68

During the period 2010-2015 the Central Java

HDI Province has always increased, but in fact the

human development status of Central Java Province

is still stagnant and the intervals of change in HDI

since 2014 and 2015 have decreased. Table 1: The

average HDI of Central Java is still below the

national HDI average. Until now, the development

of Central Java Province is still in a "moderate"

status and is still the same since 2010 (BPS, 2016).

One of the most important element in the

administration of government and regional

1274

Kiswanto, ., Suryarini, T. and Anggraeni, R.

Determinant Human Development Index: Regional Government Financial Performance Perspective in Central Java, Indonesia.

DOI: 10.5220/0009508212741281

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1274-1281

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

development is how to manage regional finances

well, so that it is in accordance with the

development aspirations and demands of the

community. This condition indicates that the

revenue owned by the government of Central Java

Province has not been optimally used to increase

community welfare as measured by the HDI. HDI

used to assess the success of human development

performance in a region through the provision of

good public services. Good regional financial

management will have a good impact on the

availability of public services. With good public

services, it is expected to be able to improve aspects

of people's lives in this case illustrated by the

increasing HDI.

This study aims to examine several factors that

influence the human development index, among

others, the completeness of the preparation of

financial reports based on accrual basis, fiscal stress

(fiscal pressure), and regional financial performance.

Research to examine the direct effect of the

completeness of financial and fiscal stress reports is

still not widely done, so this study presents

mediating variables namely regional financial

performance which refers to the research conducted

by Amalia and Purbadharmaja (2012); Dewi and

Sutrisna (2014); Riphat, Setiawan and Damayanty,

(2016) point out that regional financial performance

influences the human development index with

various indicators used.

2 THEORICAL FRAMEWORK

AND HYPOTHESIS

DEVELOPMENT

The grand theory underlying this research is agency

theory. Agency theory is used as the main reference

in this study to explain the conflicts that occur in

local governments and communities represented by

DPRD related to regional financial policies (Sandri,

Putri and Dwirandra, 2016). There is a difference of

interests between the two parties that are bound by a

contract. In the contract the government besides

wanting to satisfy the principal also aims to

maximize its interests. The community that is trusted

by the DPRD is the principal and the government is

the agent. The agent is expected to take financial

policies that benefit the principal. Principals have

regulatory authority and provide resources to agents

in the form of taxes, levies, balancing funds,

management of regional wealth and other legitimate

income (Sandri, Putri and Dwirandra, 2016).

The adoption of fiscal decentralization requires

that each region has independence in regional

financial management both from regional revenues

and expenditures. The role of the central government

is very necessary in implementing the regional

finance ministry, the government's effort in

reforming state financial management in a

sustainable manner is to establish accrual-based

government accounting standards established in the

form of Government Regulation Number 71 of 2010

concerning Government Accounting Standards

(SAP) in lieu of Government Regulation (PP)

Number 24 of 2005 concerning Government

Accounting Standards (SAP).

Public sector accounting is very relevant to the

New Public Management concept because it can

help public sector managers to achieve

organizational goals related to internal and external

accountability. The application of Accrual

Accounting can be seen by looking at the

completeness of the district/city government

financial statements based on PP No. 71 of 2010.

Accrual-based SAP implementation is one of

government policies in an effort to improve the

quality of financial management (Surepno, 2015),

financial transparency, facilitate identification of

service costs and increasing the efficiency of

resource allocation (Widayat and Probohudono,

Agung, 2016)

The real contract between the agent and the

principal in the local government is the Regional

Budget. Executive (agent) draft the APBD in

accordance with the general budget policy and

budget priorities, which are then submitted to the

legislature (principals) to be studied and discussed

together before being determined to become a

regional regulation (PERDA). APBD can be used by

the principal (legislative) to oversee the

implementation of the budget by the executive

(agent). In this case the legislature which is a

representative of the community can supervise and

assess the financial performance of the local

government. Preparation of financial statement

based on SAP can provide more detailed information

for public sector decision making by agents directly

so that it becomes more effective and efficient in

providing services to the community (Citra,

Sudarma and Andayani, 2016).

Based on research (Citra, Sudarma and

Andayani, 2016) explain accrual accounting has a

positive impact on financial performance, because

accrual accounting is believed to be the best practice

for managing finances in the public sector so as to

improve government performance.

H1: Completeness of Financial Reports has a

significant effect on regional financial

performance

Determinant Human Development Index: Regional Government Financial Performance Perspective in Central Java, Indonesia

1275

Regional autonomy on the one hand gives broad

authority to local governments, but on the other hand

gives greater responsibility for regional government

in an effort to improve the welfare of the community

(Huda, Herwanti and Pancawati, 2015). Some

regions are classified as lucky regions because they

have potential revenue sources. The decline in

economic activities in various regions can also cause

a decrease in PAD so that the regions will depend on

balancing funds that will cause symptoms of fiscal

stress (Setyawan et al., 2008).

Agency theory defines agency relations as a

contract where one or more (principals) hire other

people (agents) to do some services for their

interests by delegating some decision-making

authority to the agent. Conflicts of interest will arise

in delegating tasks given to agents (Huda, Herwanti

and Pancawati, 2015). The community that is trusted

by the DPRD is the principal and the government is

the agent. Agents are expected to take financial

policies that benefit the principal, so that there is no

information asymmetry in decision making that can

benefit both parties between the local government

and the community. Principals have regulator

authority and provide resources to agents in the form

of taxes, levies, balancing funds, management of

regional wealth and other legitimate income (Sandri,

Putri and Dwirandra, 2016).

The government is expected to explore the

potential that exists in its area, so that the regional

income can be used to finance regional expenditures,

especially those directly related to public services or

improving infrastructure that supports the

acceleration of regional economic growth. Setyawan

et al., (2008) explains that there is an indication that

high fiscal stress is increasingly encouraging regions

to increase their regional spending. Muryawan and

Sukarsa (2016) states that fiscal stress has a

significant effect on economic growth both directly

and through regional financial performance.

H2: fiscal stress has a significant effect on

regional financial performance

The regional government as the agent in carrying

out the mandate given by the community as the

principal, the local government must improve its

financial performance (Noviyanti and Kiswanto,

2016). Based on the differentiation of these

functions, the executive conducts planning,

implementation, and reporting on regional budgets,

which are manifestations of service to the public,

while the legislature plays an active role in

implementing legislation, budgeting, and

supervision (Anggraeni and Sutaryo, 2015). Budget

policies by local governments are used in order to

improve public services in order to improve people's

welfare which can be seen through human quality.

Government performance which is often used as a

reference in seeing the level of welfare of the

community is one of them financial performance.

Measuring instruments to assess the government's

financial performance are quite a lot, including the

financial ratio analysis of the Regional Budget

(APBD) (Harliyani and Haryadi, 2016).

Delavallade (2006) in Dewi and Sutrisna (2014)

states that the budget in the field of public

infrastructure is expected to be able to increase

people's access to welfare so that efficiency will

occur and in turn will improve human development.

Dewi and Sutrisna (2014); (Amalia and

Purbadharmaja, 2012); Anggraeni and Sutaryo

(2015) explain that regional financial independence

has an impact on increasing HDI.

H3: regional financial performance has a

significant effect on the human development

index

Determination of Government Regulation

Number 71 of 2010 the application of accrual-based

government accounting systems has a legal basis.

This means that the government has an obligation to

implement SAP accrual based not later than 2015.

This is in accordance with Law Number 17 of 2003

which mandates that the form and content of the

accountability report for the implementation of the

APBN/APBD be prepared and presented in

accordance with SAP. The preparation of the LKPD

in accordance with SAP is one form of government

accountability in financial management and by

publishing financial performance reports is one form

of transparency in regional government. Agency

theory is a relationship that is established based on

an agreement between two or more parties. Agency

relations in government are carried out based on

regional regulations and not solely to fulfil the

interests of principals. Through accountability and

transparency of performance carried out by local

governments, it will provide information for the

public in monitoring the government's performance

in financial management for public services.

One of the efforts to reform the management of

state finances in a sustainable manner is regional

financial management where one of the sources of

regional revenue comes from PAD. Good

management of government finances accompanied

by the application of good accrual accounting will

create a conducive atmosphere in the performance of

local governments to service the public and improve

the human development index.

H4: Completeness of Financial Report has a

significant effect on the human development

index through regional financial

performance

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1276

Regions are required to be able to optimize every

potential and fiscal capacity in order to reduce

dependence on the central government. When Fiscal

Stress is high, the government tends to explore the

potential of tax revenues to increase regional

revenues (Akoto and Shamsub, 2004). Therefore,

high rates of tax effort are identified with Fiscal

Stress conditions. The community that is trusted by

the DPRD is the principal and the government is the

agent. The agent is expected to take financial

policies that benefit the principal. Principals have

regulatory authority and provide resources to agents

in the form of taxes, levies, balancing funds,

management of regional wealth and other legitimate

income. The budget provided by the community for

regional development must be well managed

through transparency of financial reports regarding

funds managed by the regional government.

Muryawan and Sukarsa (2016) states that fiscal

stress has a significant effect on economic growth

both directly and through regional financial

performance. With good economic growth, there are

indications that fiscal pressure is high, regions tend

to increase regional revenues as a means of regional

financing for the development of a region. The

transparency of budgets originating from regional

revenues will drive the pace of the economy so that

it impacts on regional development.

H5: fiscal stress has a significant effect on the

human development index through regional

financial performance

3 RESEARCH METHOD

This type of research uses a quantitative approach.

The data form in this study is secondary data. The

population of this study is the district / city

government in Central Java Province in 2013-2015.

Sampling from the study used the saturated sample

method (census) is the use of the entire population

with the number of 35 districts / cities in Central

Java. this study uses four variables described in the

table below.

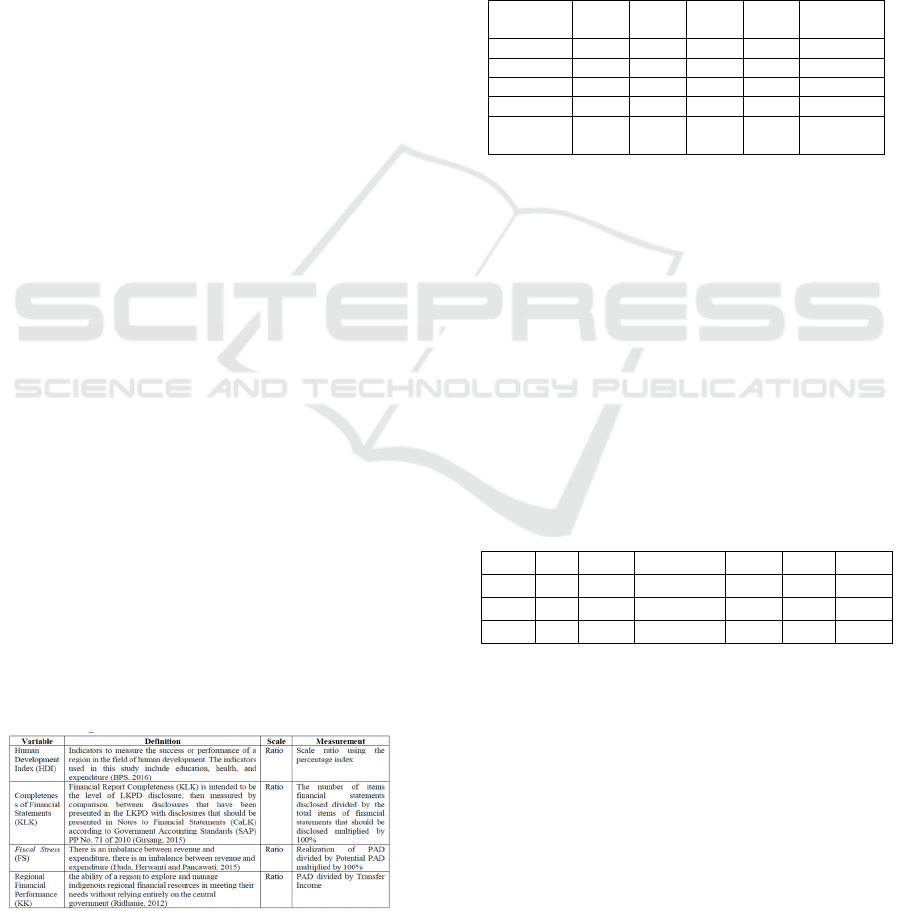

Table 2: Operational definitions of variables

The data analysis method used in this study is

descriptive statistical analysis using SPSS 21. To

test the direct effect used AMOS 21, while to test the

mediation effect or indirect effect used the sobel test.

4 RESULT AND DISCUSSION

The data analysis method used in this study is

descriptive statistical analysis using SPSS 21. To

test the direct effect used AMOS 21, while to test the

mediation effect or indirect effect used the sobel test.

Table 3: Results of Descriptive Statistics Analysis

N Min Max Mean Std.

Deviation

KLK 105 0,57 1,00 0,72 0,21

FS 105 0,98 1,48 1,16 0,09

KK 105 7,30 58,38 18,41 9,17

HDI 105 61,81 80,96 69,36 4,59

Valid N

(listwise)

105

Based on the minimum value, maximum, and

mean in Table 3, it can be seen that the sample of

this study shows that the completeness of financial

statements, fiscal stress, financial performance and

human development index in the district/city of

Central Java Province are included in the good

category.

Hypothesis testing

The results of the Goodness of Fit test show that

the overall research model has good results. The test

results show that the research model in this study is

feasible to use and then it can be tested to

hypothesis.

Table 4: Table of Results of Estimated Regression

Weights

Estimate S.E. C.R. P

KK <-- KLK 9.92 4.36 2.27 .023

KK <-- FS 6.52 9.89 .65 .510

IPM <-- KK .32 .03 8.70 .001

The significance test of indirect influence in this

study was carried out with a model developed by

Sobel and known as the sobel test. Based on Table 5.

Estimated results of regression weight can be known

the effect of the completeness of financial statements

on financial performance and the effect of financial

performance on the human development index can

be known the values of a, b, Sa, and Sb. A value =

4.267, b = 0.329, Sa = 1.875, and Sb = 0.037. Then

the calculation is done to find out the value of Sab

and the value of t count. The mediation hypothesis

test is carried out using the program provided. The

Determinant Human Development Index: Regional Government Financial Performance Perspective in Central Java, Indonesia

1277

following are the results of estimating indirect

effects.

Table 5: Indirect Test Result Tables

Input Test Statistic Std Error p-value

a = 4,267 Sobel test =

2,205

0,637 0,027

b = 0,329 Aroian test =

2,192

0,641 0,028

Sa = 1,875 Goodman test

= 2,218

0,633 0,027

Sb = 0,037

Based on the results of the calculation of Table

5, the t-count value of 2.205 shows results that are

greater than 1.96 (2.205> 1.96), so that financial

performance has a significant effect on influencing

the relationship of financial report completeness to

the human development index.

Table 6: Recapitulation of Hypothesis Test Results

Statistic Result Decision

H

1

CR=2,276; Sig=0,023 Accepted

H

2

CR=0,659; Sig=0,510 Rejected

H

3

CR=8,700; Sig=0,001 Accepted

H

4

CR=0,149 Accepted

H

5

CR=0,043 Rejected

Effect of Financial Report Completeness on

Regional Financial Performance

The results of data processing are concluded that

H1 is accepted. The results of this study are in line

with the theoretical agency which states that the real

contract between the agent and the principal in the

local government is the Regional Budget. APBD can

be used by the principal (legislative) to oversee the

implementation of the budget by the executive

(agent). In this case the legislature which is the

representative of the public can supervise and assess

the financial performance of the local government.

Local governments are required to submit

performance reports, especially in the area of

regional finance, to assess whether the local

government has managed to carry out its duties

properly or not in managing regional finances.

Accrual Accounting is a reform in financial

management with the aim of increasing efficiency

and effectiveness in using sources and performance

accountability. The budget is prepared with a

performance approach, namely a budget that

prioritizes efforts to achieve work outcomes or

output from planning (Suryaningsum et al., 2015).

With the existence of Government Accounting

Standards (SAP) the government was used as a

guideline in the preparation of financial statements

of regional governments. LKPD is a source of

information for the community (principals) to find

out how the performance of local governments in

managing regional finance. The preparation of the

LKPD in accordance with SAP is one form of

government accountability in financial management

and by publishing financial performance reports is

one form of transparency in regional government.

The results of this study support the research of

(Citra, Sudarma and Andayani, 2016) which states

that accrual accounting has a positive impact on

financial performance, meaning that the good

implementation of accrual accounting also increases

the government's financial performance.

Effect of Fiscal Stress on Regional Financial

Performance

The second hypothesis is rejected, so show that

the existence of fiscal stress (fiscal stress) due to the

existence of regional autonomy that demands the

regions to increase their local revenue has not been

able to improve regional financial performance. This

is because the government's efforts to increase

regional revenues by exploring new revenues in the

form of existing regional potentials have not been

able to cover the regional budget which is increasing

every year, so that the dependence on external

assistance is still high (Amalia and Purbadharmaja,

2012). Measuring fiscal stress using the ratio of

PAD realization to the PAD target has not been able

to indicate the area in increasing regional sterility

from dependence on the central government.

The results of this test are not in line with the

agency theory that has been stated previously that

conflicts of interest will emerge and delegation of

tasks given to agents where agents are not in the

interest to maximize the interests of principals, but

have a tendency to selfish at the expense of public

interests (Huda, Herwanti and Pancawati, 2015). The

existence of a regional autonomy policy made by the

central government has not been able to encourage

regions to increase their regional revenues.

The results of this study indicate that the

existence of fiscal pressure due to regional

autonomy is not able to improve regional financial

performance. This can occur because of the inability

of the regions to explore regional potentials that can

increase PAD, so that dependence on external

assistance is still high (Amalia and Purbadharmaja,

2012). The results of this study are not in line with

the research conducted by (Muryawan and Sukarsa,

2016) which states that fiscal stress has a significant

effect on regional financial performance. So that the

presence of higher fiscal pressure has not been able

to motivate the regions to increase their local

revenue which will ultimately lead to the growth of

the economy of a region.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1278

Effect of Regional Financial Performance on the

Human Development Index

The results of data processing showed that H4

was accepted which explained that the financial

performance of local governments had a significant

effect on the human development index. The results

of this study support agency theory that measuring

financial performance in the public interest can

reduce conflicts arising between the community and

the government. Communities need information

about government performance, especially finance,

which can be used as consideration in paying taxes

as a source of regional income. The existence of

information regarding local government finance is

one of the additional information needed by the

community. The government as an agent must

convey information on all the performance that has

been done, so that the community as principal can

oversee the running of the government and can be

used as an evaluation material for the government's

performance.

The indicator for measuring regional financial

performance in this study is the regional financial

independence ratio assessed by PAD. The income

earned will be used to improve the quality of Human

Resources (HR). The independence ratio also

describes the level of community participation in

regional development. The higher the independence

ratio the higher the community participation in

paying regional taxes and retributions illustrates that

the level of community welfare is getting higher.

Therefore, with financial management of existing

regional revenues and expenditures allocated

appropriately for the welfare of the community.

The results of this study are also in line with the

research conducted by Dewi and Sutrisna (2014)

stating that high regional financial independence

illustrates that a region has been able to meet its

financial needs independently which can create

economic and social political stability and even

distribution of development outcomes , as well as

the research conducted by Amalia and

Purbadharmaja (2012); (Riphat, Setiawan and

Damayanty, 2016) which states that regional

financial independence has a significant effect on

HDI, which means that the greater regional financial

independence will increase regional development

that has an impact on development human.

Effect of Financial Report Completeness on

Human Development Index Through Regional

Financial Performance

The results of the calculation of the mediation

effect test (sobel test) state that H5 is accepted. The

results of the calculation of the mediation effect test

(sobel test) of financial performance variables as

mediating the relationship between the completeness

of financial statements and the human development

index show significant results. It can be interpreted

that financial performance can be used as a

mediating variable that strengthens the relationship

of financial report completeness to the human

development index.

This research is in line with agency theory where

the presence of agency relations in government is

carried out based on regional regulations and not

solely to fulfil principal interests. Many things need

to be considered in building a region, one of which

is the existence of regulations in managing state

finances in a sustainable manner with the

establishment of Government Accounting Standards

(SAP). SAP aims to create transparency and

accountability as part of financial management by

requiring regional governments to submit annual

financial reports. With the existence of Government

Accounting Standards (SAP), the government was

used as a guideline in the preparation of regional

government financial reports. Where LKPD is a

source of information for the community (principals)

to find out how the performance of local government

(agents) in managing regional finance.

The preparation of the LKPD in accordance with

SAP is one form of government accountability in

financial management and by publishing financial

performance reports is one form of transparency in

regional government. The form and content of local

government financial statements must be prepared

and presented in accordance with SAP, because the

suitability of the format for preparing and submitting

financial reports with SAP will reflect the quality,

benefits and capabilities of the financial statements

themselves. By following the standards set by the

regional government, the financial statements have

met the transparency criteria for the use of financial

statements. SAP can be used as a reference for local

governments in the preparation of local government

financial reports (LKPD) that contain all

government performance, especially financial

performance. Regional financial performance

measured using financial independence ratios is

strong enough to influence the relationship between

Financial Report Flexibility and the Human

Development Index. The role of performance

indicators is to provide information as a

consideration for decision making (Kurrohman,

2013). Amalia and Purbadharmaja (2012) stated that

financial independence cannot be separated from the

role of PAD in financing government spending.

Therefore, local governments need to increase local

revenue sources so that the implementation of

regional development and public services is

guaranteed. The budget in the field of public

infrastructure is expected to be able to increase

people's access to welfare so that efficiency will

Determinant Human Development Index: Regional Government Financial Performance Perspective in Central Java, Indonesia

1279

occur and in turn will increase human development.

The Human Development Index is an indicator of

development success and a mirror of government

financial management with high accountability. The

success of governance and regional development is

actually the result of good collaboration between the

community, the DPRD, the regional government and

vertical work (Suryaningsum et al., 2015).

Effect of Fiscal Stress on Human Development

Index Through Regional Financial Performance

The results of data processing state that H6 is

rejected.

Results The results of this study are not in line

with the agency theory that has previously been

revealed that conflicts of interest will emerge and

delegation of tasks given to agents where agents are

not in the interest to maximize the interests of

principals, but have a tendency to selfish at the

expense of public interests (Huda, Herwanti and

Pancawati, 2015). The existence of a regional

autonomy policy made by the central government

(agents) has not been able to encourage the regions

to increase their regional revenues. The inability of

regional financial performance which is measured

using the regional financial independence ratio as an

intervening variable can be influenced by several

things, one of which is that the presence of fiscal

pressure has not been able to motivate regions to

increase their local revenue sources which will

eventually lead to the growth of an economy. In line

with this, hopes of increasing own revenues will be

difficult to materialize if the budget allocation for

development is not increased. The lack of

availability of potential regional resources and

readiness of human resources for the regions is an

important factor in success in the era of autonomy.

The implementation of regional autonomy in the

regency / city government in Central Java Province

is required to be able to increase its regional revenue

so that the independence and implementation of

development can run in accordance with the planned

programs and activities. Financing regional

development comes from PAD, balancing funds, and

other legitimate income. Decreasing economic

activities in various regions can also cause a

decrease in PAD so that the area will depend on

balancing funds that will cause symptoms of fiscal

stress. But the existence of fiscal pressure has not

made the regions more independent in regulating

and allocating their budgets for regional

development.

5 CONCLUSIONS

The results of this study indicate that the

completeness of financial statements have an effect

on financial performance while fiscal stress has no

effect on your performance. Financial performance

can significantly influence the human development

index, while the completeness of financial

statements does not significantly influence. The

study also found that financial performance was able

to be a mediating variable.

Suggestion that can be given from this research

are local governments need to increase local

revenues or revenues by optimizing all regional

wealth with quality human resources and conducting

regional financial management in accordance with

the applicable SAP accrual basis. Suggestion for

further research, explore the possibility of other

variables that affect HDI that have not been

developed in this study.

REFERENCES

Akoto, J. . B. and Shamsub, H. (2004) ‘State And

Local Fiscal Structures And Fiscal Stress’,

Journal Of Public Budgeting, Accounting &

Financial Management, 16(1), pp. 40–61.

Amalia, F. R. and Purbadharmaja, I. B. P. (2012)

‘Alokasi Belanja Terhadap Indeks Pembangunan

Manusia’, pp. 257–264.

Anggraeni, T. and Sutaryo (2015) ‘Pengaruh Rasio

Keuangan Pemerintah Daerah Terhadap Indeks

Pembangunan Manusia Pemerintah Provinsi Di

Indonesia’, Jurnal Ekonomi Universitas Sebelas

Maret.

BPS (2014) ‘Indeks Pembangunan Manusia 2014

Metode Baru’.

BPS (2016) ‘Indeks Pembangunan Manusia (IPM)

Tahun 2015’, Badan Pusat Statistik, pp. 1–8.

Citra, Sudarma, M. and Andayani, W. (2016) ‘The

Impact of Fiscal Decentralization , Performance

Budgeting , and Accrual Accounting on

Performance of Provincial Government of

Gorontalo’, (12), pp. 1770–1782.

Dewi, P. A. K. and Sutrisna, I. K. (2014) ‘Pengaruh

kemandirian keuanganpdaerah dan

pertumbuhanaekonomi terhadapiindeks

pembangunannmanusia di provinsiibali’, E-

Jurnal EP Unud, 4(1), pp. 32–40.

Girsang, H. A. V (2015) Analisa Faktor-Faktor

Yang Mempengaruhi Tingkat Pengungkapan

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1280

Laporan Keuangan Pemerintah Daerah (Studi

pada LKPD Kabupaten/Kota Provinsi Jawa

Tengah Periode 2010-2012). Universitas

Diponegoro. Available at:

http://eprints.undip.ac.id/46858/1/01_GIRSANG.

pdf.

Harliyani, E. M. and Haryadi (2016) ‘Pengaruh

Kinerja Keuangan Pemerintah Daerah Terhadap

Indeks Pembangunan Manusia di Provinsi

Jambi’, 3(3), pp. 129–140.

Huda, A. S., Herwanti, T. and Pancawati, S. (2015)

‘Pengaruh Kinerja Keuangan, Fiscal Stress, Dan

Kepadatan Penduduk Terhadap Alokasi Belanja

Modal Di Nusa Tenggara Barat’, Jurnal Assets,

5(2), pp. 1–12.

Kurrohman, T. (2013) ‘Evaluasi penganggaran

berbasis kinerja melalui kinerja keuangan yang

berbasis’, Jurnal Dinamika Akuntansi, 5(1), pp.

1–11.

Muryawan, S. M. and Sukarsa, M. (2016) ‘Pengaruh

Desentralisasi Fiskal, Fiscal Stress, dan Kinerja

Keuangan Daerah terhadap Pertumbuhan

Ekonomi di Kabupaten/Kota Provinsi Bali’, E-

Jurnal Ekonomi dan Bisnis, 5(2), pp. 229–252.

Available at:

http://ojs.unud.ac.id/index.php/EEB/article/view/

9379.

Noviyanti, N. A. and Kiswanto (2016) ‘Pengaruh

Karakteristik Pemerintah Daerah, Temuan Audit

Bpk Terhadap Kinerja Keuangan Pemerintah

Daerah’, Accounting Analysis Journal, 5(1), pp.

1–10.

Ridhanie, A. (2012) ‘Kinerja Pemerintah Daerah

Propinsi Kalimantan Selatan Terhadap Kualitas

Pembangunan Manusia’, Jurnal Ilmu Politik dan

Pemerintahan Lokal, I(2), pp. 73–92.

Riphat, S., Setiawan, H. and Damayanty, S. A.

(2016) ‘Causality Analysis Between Financial

Performance And Human Development Index :

A Case Study Of Provinces In Eastern

Indonesia’, Kajian Ekonomi dan Keuangan,

20(3), pp. 231–240.

Sandri, N. K., Putri, I. G. A. M. A. D. and

Dwirandra, A. A. N. B. (2016) ‘Kemampuan

Alokasi Belanja Modal Memoderasi Pengaruh

Kinerja Keuangan Daerah pada Indeks

Pembangunan Manusia’, Jurnal Buletin Studi

Ekonomi, 21(1), pp. 71–81. Available at:

https://ojs.unud.ac.id/index.php/bse/article/view/

22301.

Setyawan, B. et al. (2008) ‘Pengaruh Fiscal Stress

Terhadap Pertumbuhan Pendapatan Asli Daerah

Dan Belanja Modal’, Simposium Nasional Riset

Ekonomi & Bisnis Asosiasi Perguruan Tinggi

Katolik (Aptik), pp. 1–12.

Surepno (2015) ‘Kunci Sukses dan Peran Strategis

Implementasi Akuntansi Berbasis Akrual’,

Jurnal Dinamika Akuntansi, 7(2), pp. 119–128.

Suryaningsum, S. et al. (2015) ‘Pengelolaan

Keuangan Pemerintahan Dan Indeks

Pembangunan Manusia’, Buletin Ekonomi Jurnal

Manajemen, AKuntansi dan Ekonomi

Pembangunan, 13(1), pp. 1–14.

Widayat, W. and Probohudono, Agung, N. (2016)

‘Determinan Kesiapan Penerapan Sistem

Akuntansi Berbasis Akrual Pada Pemerintah

Daerah Di Indonesia’, Simposium Nasional

Akuntansi Xix, Lampung 2016, pp. 1–20.

Determinant Human Development Index: Regional Government Financial Performance Perspective in Central Java, Indonesia

1281