Analysis of Financial Ratio for Measuring the Average of the

Banking Industry Ratio Listed in LQ45

Titing Suharti

1

, Diah Yudhawati

1

and Siti Nadira Azzahra

1

1

Economic and Business Faculty, Universitas Ibn Khaldun

Keywords: Competencies Liquidity, Solvability, Rentability, Industry Ratio

Abstract: This study aims to determine the average financial ratios of the banking industry at PT. Bank Negara

Indonesia (Persero) Tbk, PT. Bank Central Asia Tbk, PT. Bank Rakyat Indonesia (Persero) Tbk, PT. Bank

Mandiri (Persero) Tbk in 2013-2017 from the aspect of financial ratios Liquidity, Solvability and

Rentability. The sampling of this study was obtained by purposive sumpling method. Data analysis method

measures the ratio of industry Quick Ratio, Inventory Policy Ratio, Primary Ratio, Capital Ratio, Net Profit

Margin, and Return On Equity. Types of quantitative data and data sources use secondary data. The results

showed that the average liquidity ratio of the banking industry for the 2013-2017 period for the Quick Ratio

of 13.21% and Investing Policy Ratio was 7.88%. For the Solvency Ratio, the average banking industry

ratio for Primary Ratio was 14.13% and Capital Ratio 25.50%. For profitability ratios, the average banking

industry ratio for Net Profit Margin is 80.48% and Return on Equity is 18.22%.

1 INTRODUCTION

Every company must want their business to run

smoothly and even develop. One of the successes of

a company can be measured based on its financial

performance. The financial performance of the

company itself can be analyzed through financial

statements that are presented regularly every period.

Accounting information in financial statements is

very important for users of financial statements in

evaluating past, present and future events.

Financial ratio analysis is an activity to analyze

financial statements by comparing one other account

in the financial statements, these comparisons can be

between accounts in balance sheet financial

statements and profit losses (Sujarweni, 2017, p.

59). Financial ratio analysis describes a relationship

and a comparison between the number of one

account and the number of other accounts in the

financial statements.

By using the ratio analysis method can explain or

give an idea of the good or bad state or position of

financial performance of a company. The financial

ratio used to measure the ratio of the banking

industry in this study is the Liquidity Ratio,

Solvability Ratio, and Profitability Ratio.

The Liquidity Ratio consists of Quick Ratio and

Investing Policy Ratio. This ratio shows how

quickly the company fulfills its financial obligations,

generally short-term liabilities or obligations that are

less than one year. Solvability ratio is a measure

used to see the ability of a bank to fulfill all its

obligations. Some of these ratios include Primary

Ratio, and Capital Ratio (CAR). Profitability ratio,

used to measure how much the ability of a company

to obtain profits in relation to sales. This ratio

includes Net Profit Margin, and Return On Equity.

Based on this background the author is interested

in conducting research with the title "Financial Ratio

Analysis to Measure Average Banking Industry

Ratios Registered at Lq45 (Case Study at PT Bank

Negara Indonesia (Persero), PT Bank Central Asia

Tbk, PT Bank Rakyat Indonesia (Persero), PT Bank

Mandiri (Persero) Tbk in 2013-2017). "

2 THEORICAL FRAMEWORK

Financial Management is a process in the company's

financial activities related to efforts to obtain

company funds and minimize company costs and

also financial management efforts of a business

entity or organization to be able to achieve

predetermined financial goals.

810

Suharti, T., Yudhawati, D. and Azzahra, S.

Analysis of Financial Ratio for Measuring the Average of the Banking Industry Ratio Listed in LQ45.

DOI: 10.5220/0009507208100816

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 810-816

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

According to Kamaludin and Indriani (2012, p.

1) Financial management is an effort and activity in

order to increase the value of the company and as an

effort to get funds in the most profitable way and

allocate funds efficiently in the company as a means

to achieve the target for shareholder wealth.

Efficient financial management requires goals

and objectives that are used as standards in

evaluating financial decision efficiency. To be able

to take the right financial decisions, financial

managers need to determine the goals that must be

achieved.

The overall goal of financial management in a

company is to maximize profits, maintain cash flow,

prepare capital structures, maximize utilization of

corporate finance, optimize company wealth,

improve efficiency, ensure the survival of the

company, reduce operational risk, and reduce capital

costs.

The size and importance of the financial

management function depends on the size of the

company. In small companies, financial functions

are generally carried out by the accounting

department. After the company developed, it

gradually became a department. The main function

of financial management is in terms of investment

decisions, funding decisions and dividend decisions

for a company or organization and even cooperatives

or even other agencies. These financial decisions are

implemented in daily activities to earn profits. Profit

obtained is expected to increase the value of the

company if the higher share prices, so that the

prosperity of shareholders by itself increases. The

financial management function includes three

financial management decisions. First, Investment

Decisions. Investment decisions are decisions on

assets that will be managed by the company. this

decision is most important because this investment

decision has a direct effect on the amount of

investment profits and the company's cash flow for

future times. Second, Funding Decision. Funding

decisions are financial management decisions in

carrying out consideration and analysis of the

combination of the most economical sources of

funds for the company to fund investment needs and

operational activities of the company. The funding

decision concerns the sources of funds that are on

the asset side. There are a number of things

regarding funding decisions, namely decisions

regarding the determination of the source of funds

needed to finance investments, and the

determination of the best balance of spending or

often called the optimum capital structure. Third,

Dividend Decision. Dividends are part of a

company's profits that must be paid to shareholders.

Dividend decisions are financial management

decisions in determining the amount of profit to be

shared with shareholders and funds to be deposited

in the company as retained earnings for the growth

of the company.

According to Wijaya (2017, p. 13) Financial

statements are business languages because in the

financial statements it contains information about

the company's financial condition to its users. Users

of financial statements are management, investors,

creditors, and other stakeholders related to the

company. Kamaludin and Indriani (2012, p. 34)

Financial Reports are the final results of a recording

process which is a summary of financial transactions

that occur during the relevant financial year.

Financial statements consisting of several sheets of

paper containing numbers. But behind these

numbers are stored various information ranging

from real assets, financial assets, corporate

liabilities, company profits, to future predictions of

what will be experienced by the company.

Financial statements are the end result of the

accounting process. Financial statements indicate the

position of resources owned by the company for one

period. In addition, financial statements show the

company's performance as indicated by the

company's ability to generate revenue with the

resources owned by the company. In the accounting

process identified various transactions or events

which are economic activities within the company

through measurement, recording, classification and

pengikhtisaran that produce information.

Information that is relevant and interconnected one

another can provide a proper description of the state

of the company and the results of the company's

operations that are combined and presented in the

form of financial statements.

In conducting financial statement analysis, it is

important for someone to analyze the types,

formulations and weaknesses in analyzing these

financial statements. Characteristics that must be

met by the information contained in financial

statements are set out in the basic framework of

preparing and presenting financial statements. In

general, there are five types of financial statements

that we know, namely: Balance Sheet, Income

statement, Capital change report, Cash flow report

and Notes / financial statements.

Every financial report made has a specific

purpose. In general, the financial statements of a

company, arranged at certain times and at certain

periods. The purpose of financial statements is

prepared to meet the interests of the company, so

Analysis of Financial Ratio for Measuring the Average of the Banking Industry Ratio Listed in LQ45

811

that financial statements can provide financial

information to parties inside and outside the

company that have an interest in the company. In

general, the purpose of financial statements is to

provide reliable financial information regarding

assets, liabilities and capital of a company, provide

financial information that helps users of financial

statements to estimate the company's ability to

generate profits, provide reliable information about

changes in net assets (assets reduced obligations) of

a company arising from business activities in order

to make a profit, Providing other important

information about changes in the assets and

liabilities of a company, such as information about

financing and investment activities, and put forward

other information relating to financial statements

that are relevant to the needs of report users , such as

information about the accounting policies adopted

by the company.

Financial statements are prepared or made with

the intention to provide an overview or report on

progress made by the management concerned. So

financial statements have a historical nature as well

as a whole and as a report. According to Kasmir

(2008, p. 12) financial statements have two

properties, namely first, is historical, meaning that

financial statements are made and arranged from

past or past data from the present. Second, it is

comprehensive, meaning that the financial

statements are prepared in accordance with the

standards set.

The financial statements have limitations,

namely financial statements that are made

periodically are basically internal reports (reports

made between certain times that are temporary) and

not a final report. Therefore all amounts or things

reported in the financial statements do not indicate

the value of liquidation or realization in which this

report contains personal opinions made by the

Accountant or Management concerned. Second,

financial statements show numbers in rupiah that

appear to be definite and appropriate, but actually

the basis for their compilation with standard values

may differ or change. third, financial statements are

prepared based on the results of recording financial

transactions or rupiah values of various times or past

dates where the purchasing power of the money

decreases, compared to previous years so that the

increase in sales volume expressed in rupiah does

not necessarily indicate the units sold are getting

bigger, maybe the increase was due to the increase

in the selling price of the item which might also be

followed by an increase in the price level. Fourth,

financial statements cannot reflect various factors

that can affect the position or financial condition of

the company because these factors cannot be

measured in units of money.

Parties who need information usually come from

the company's internal parties themselves and from

external parties or outside the company. Internal

Company, Internal parties are parties that are

directly related to the company's operational

activities. Usually this report is used to make policy

decisions by a manager. The company's strategic

decisions or plans that will be carried out to

maximize the company's profits. Company External

Parties, Users of financial statements are not only

important for internal parties, but there are other

financial statement users including: Investors,

investors or investors have the right to know the

results of their investments and need information

that can help them make a profit, whether they

should buy, plant or sell the investment. Employees,

employees or groups that represent them also need

information about the stability and profitability of

the company. They also know information that

allows employees to provide remuneration (wages),

assess the ability of the company, find out

information about pension benefits and information

on employment opportunities. Creditors, creditors or

lenders are also interested in obtaining information

on whether the loans they have given and their

interest can be paid when they are due. Suppliers

and Business Creditors, Suppliers or partners also

need financial statement information that allows

them to be able to decide whether the outstanding

amount will be paid at maturity. Business creditors

need information if the company that is owed is the

main customer and their survival depends on the

company. The government, the Government requires

the company's financial statements regarding taxes

to regulate its activities, compile statistics for the

interests of the state, and most importantly, establish

tax policies.

There are four limitations to these financial

statements according to Jumingan (2017, pp. 10–11),

namely first, financial statements are basically

interim reports, not final reports, because real profit

and loss (final income) can only be determined if the

company sold or liquidated. For this reason financial

statements need to be prepared for a certain period

of time. One year is generally considered a standard

accounting period. Allocation of revenue and cost

over a certain period is influenced by personal

considerations. For example in choosing the final

inventory valuation method, determining the amount

of depreciation, depletion, amortization, and losses

due to uncollectible accounts receivable, the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

812

separation between capital expenditure and income

expenditure. So, it is clear that in fact the financial

data is not definite, cannot be measured absolutely

studied, this uncertainty is caused by contingent

assets, contingent liabilities, and deferred

maintenance. Second, the financial statements are

shown in the amount of rupiah that seems certain.

Actually, the amount of rupiah can be different if it

is used by another standard (because there is more

than one standard allowed). Especially when

compared with financial statements if the company

is liquidated, the amount of rupiah can be very

different. Property, plant and equipment are valued

at their historical prices, then deducted by the

accumulated depreciation. The net amount does not

reflect the value of the sale of fixed assets. In a state

of liquidation, intangible assets such as patents,

trademarks, organizational costs are only valued at

one rupiah. Third, the balance sheet and income

statement reflect financial transactions from time to

time. During that period the value of the rupiah may

have declined (the purchasing power of the rupiah

declined due to the increase in the price levels).

Fixed assets purchased in 1970 for example, the

purchase price has now tripled, consequently the

depreciation costs charged will be far smaller than

the depreciation rate based on the replacement cost

base. Also the increase in sales volume in rupiah

amounts is not necessarily as an increase in the

number of units sold. The increase in the rupiah

amount of sales volume may be caused by the

increase in unit selling prices. Therefore, to avoid

misleading analysis, comparative analysis must be

done carefully. Fourth, financial statements do not

provide a complete picture of the state of the

company. The financial statements do not reflect all

the factors that affect the financial condition and

results of operations because not all factors can be

measured in units of money. These factors, for

example, are the ability to find sellers and find

buyers, the reputation and prestige of the company

in the eyes of the public, external trust in the

company, efficiency, loyalty and integrity of the

leadership and employees, the quality of goods

produced, the condition of competitors generally,

and so on.

According to Martono and Agus Harjito (2010,

p. 4) Defining financial statement analysis as

follows: Analysis of financial statements is an

analysis of the financial condition of a company that

involves the balance sheet and profit and loss. After

the financial statements are prepared based on

relevant data, and are carried out with the correct

accounting procedures and valuations, the actual

financial condition will be seen. The financial

condition in question is known how many assets

(wealth), liabilities (debt), and capital (equity) in the

balance sheet owned. Then it will be known the

income to be received and the amount of costs

incurred during a certain period. Thus, it can be

known how the business results (profit or loss)

obtained during a certain period of income statement

are presented. In order for financial statements to be

more meaningful so that they can be understood and

understood by various parties, it is necessary to

analyze the financial statements.

One important source of information for users of

financial statements in making an economic decision

is through financial statements. The financial report

presents a lot of information about the performance

of management and the health of the company.

However, it cannot be denied that financial

statements still have many shortcomings in

presenting information needed by some parties,

therefore analysis of financial statements is needed

to analyze and interpret the report so that it can

provide meaningful information to parties interested

in development. company performance results.

According to Kasmir (2013, p. 8) in general the

objectives and benefits of financial statement

analysis are first, Knowing the financial position of

the company in a given period, both assets,

liabilities, capital, and the results of the business

achieved for several periods. Second, to find out

what weaknesses are lacking in the company. Third,

to know the strengths possessed. Fourth, to find out

what improvement steps need to be done in the

future that relate to the company's current financial

position. Fifth, to evaluate management performance

in the future whether it needs refresher or not

because it is considered successful or failed. Sixth, it

can also be used as a comparison with similar

companies about the results they achieve.

Financial ratio analysis is an activity to analyze

financial statements by comparing one account with

another account in the financial statements, the

comparison can be between accounts in balance

sheet financial statements and profit and loss. This

financial ratio analysis aims to determine the

relationship between accounts in financial

statements, both in the balance sheet and in the

income statement.

Financial ratio analysis describes a relationship

and a comparison between the number of one

account and the number of other accounts in the

financial statements. By using analytical methods

such as this ratio will be able to explain or give an

idea of the good or bad state or financial position of

Analysis of Financial Ratio for Measuring the Average of the Banking Industry Ratio Listed in LQ45

813

a company. The purpose of conducting financial

statement analysis is to be able to assist companies

in identifying the company's financial strengths and

weaknesses, assessing the performance of the

company's financial statements in empowering all

existing resources to achieve the targets set by the

company.

According to Kasmir (2014, p. 315) there are

several financial ratios which are considered

important namely first, the Liquidity Ratio. It is a

ratio to measure a bank's ability to fulfill its short-

term obligations when billed. The types of liquidity

ratios are Quick Ratio, Investing Policy Ratio.

Second, Solvency Ratio. Is a measure of a bank's

ability to find sources of funds to finance its

activities. The ratio is Primary Ratio, and Capital

Ratio. Third, Rentability Ratio. Rentability Ratios

are often called business profitability. This ratio is

used to measure the level of business efficiency and

profitability achieved by the bank concerned.

Rentability Ratio consists of Net Profit Margin, and

Return on Equity (ROE).

The industry ratio is the financial ratio used to

make comparisons between items, which aims to

determine stability when a business is related to its

competitors. The ratio in financial statement analysis

is a number that shows the relationship between an

element and other elements in the financial

statements. The relationship between the elements of

the financial statements is expressed in a simple

mathematical form. This standard ratio can be

determined based on the alternative, first, based on

the records of the financial condition and results of

the company's previous year. Second, based on

financial report data that is budgeted or often called

a goal ratio. Third, based on industry ratios, where

the company in question is included as a member.

Fourth, based on the ratio of other companies that

are competitors, a company that is classified as

advanced and successful is selected.

With a comparison of these standard ratios it will

be known whether the ratio of the company in

question lies above the average, average, or below

average. A good standard ratio is the one that gives

an average picture. Although the industrial ratio is

difficult to obtain or the preparation is very time

consuming (very slow). Thus for the purposes of

comparison can be used other forms of standard

ratios, for example a goal ratio or ratio of the

company itself that has been modified by

anticipating changes that are expected to occur

during an accounting period.

3 RESEARCH METHOD

The purpose of this study was to determine the

average financial ratios of the banking industry

registered in LQ45 for the period 2013-2017.

Basically the selection of ratios used to measure

industry ratios are Liquidity Ratios, Solvability

Ratios and Profitability Ratios. Liquidity ratios

include: Quick Ratio and Investing Policy Ratio.

Solvency ratios include: Primary Ratio and Capital

Ratio. Rentability Ratio includes: Net Profit Margin

and Return On Equity.

The companies studied were four banking

companies registered in LQ45, the sampling method

used was purposive sampling. The required data is

taken from the company's financial statements from

2013 to 2017.

The method used is descriptive research method,

this study uses a quantitative approach, namely data

that is processed and analyzed to obtain results and

conclusions. The pattern of research design in each

discipline has its own peculiarities, but the principles

generally have many similarities. Research design

provides an overview of the procedure for obtaining

information or data needed to answer all research

questions. Therefore, a good research design will

produce an effective and efficient research process.

The classification of research design is divided into

two, namely the design of exploratory and

conclusive research. The conclusive research design

is further divided into two types, namely descriptive

and causal.

4 ANALYSIS

This study aims to measure the average ratio of the

banking industry at PT. Bank Negara Indonesia

(Persero) Tbk, PT. Bank Central Asia Tbk, PT. Bank

Rakyat Indonesia (Persero) Tbk and PT. Bank

Mandiri (Persero) Tbk.

In the period of 2013 to 2017, BNI had a Quick

Ratio of 12.65%, 13.39%, 14.75%, 11.20%, and

13.01% respectively. During this period, the highest

Quick Ratio value was found in 2015 while the

lowest Quick Ratio value was in 2016

In the period of 2013 to 2017, BCA has a Quick

Ratio of 13.32%, 13.95%, 13.40%, 12.89% and

11.80% respectively. During that period, the highest

Quick Ratio value was in 2014 while the lowest

Quick Ratio value was in 2017.

In the period of 2013 to 2017, BRI had Quick

Ratio in a row of 13.75%, 13.54%, 14.83%, 11.80%

and 10.20%. During this period, the highest Quick

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

814

Ratio value was found in 2015 while the lowest

Quick Ratio value was in 2017.

In the period of 2013 to 2017, Bank Mandiri had

a Quick Ratio of 15.13%, 13.65%, 14.72%, 12.21%

and 11.58% respectively. During that period, the

highest Quick Ratio value was found in 2015 while

the lowest Quick Ratio value is in 2017.

In the period 2013 to 2017, BNI had Investing

Policy Ratios in a row of 4.06%, 4.21%, 2.78%,

5.61% and 7.21%. During this period, the value of

Investing Policy Ratio was highest in 2017 while the

lowest value of Investing Policy Ratio was in 2015.

In the period of 2013 to 2017, BCA had an

Investing Policy Ratio of 9.94%, 5.82%, 0.11%,

0.48% and 1.58% respectively. During this period,

the highest value of Investing Policy Ratio was in

2013 while the lowest value of Investing Policy

Ratio was in 2015.

In the period of 2013 to 2017, BRI had an

Investing Policy Ratio of 8.46%, 13.52%, 18.67%,

17.42% and 22.21%. During this period, the value of

Investing Policy Ratio was highest in 2017 while the

lowest value of Investing Policy Ratio was in 2013.

In the period 2013 to 2017, Mandiri had

Investing Policy Ratios in a row of 5.38%, 7.00%,

7.12%, 8.09% and 7.94%. During this period, the

highest value of Investing Policy Ratio was in 2016

while the lowest value of Investing Policy Ratio was

in 2013.

In the period 2013 to 2017 PT. Bank Negara

Indonesia (Persero) Tbk, Primary Ratio has 12.33%,

14.65%, 15.42%, 14.80% and 14.23% respectively.

During this period, the highest Primary Ratio was

found in 2015 while the lowest Primary Ratio was

found in 2013.

In the period 2013 to 2017, BCA had Primary

Ratio in a row of 12.89%, 14.11%, 15.08%, 16.66%

and 17.51%. During the period, the highest Primary

Ratio value was found in in 2017 while the lowest

Primary Ratio was found in 2013.

In the period 2013 to 2017, PT. Bank Rakyat

Indonesia (Persero) Tbk has a Primary Ratio of

12.67%, 12.19% 12.88%, 14.63% and 14.86%

respectively. During this period, the highest Primary

Ratio value was found in 2017 while the lowest

Primary Ratio value was in 2014.

In the period 2013 to 2017 PT. Bank Mandiri

(Persero), Tbk, has Primary Ratio of 12.11%,

12.26%, 13.13%, 14.77% and 15.12%, respectively.

During this period, the highest Primary Ratio value

was found in 2017 while the lowest Primary Ratio

value was in 2013.

In the period 2013 to 2017 PT. Bank Negara

Indonesia (Persero). Tbk, has a Capital Ratio of

21.77%, 24.49%, 27.74%, 26.94% and 26.16%

respectively. During this period, the highest value of

Capital Ratio was in 2015 while the lowest value of

Capital Ratio was in 2013.

In the period 2013 to 2017, PT. Bank Central

Asia. Tbk has Capital Ratio of 22.69%, 24.90%,

26.06%, 31.04% and 31.84% respectively. During

this period, the highest value of Capital Ratio was in

2017 while the lowest value of Capital Ratio was in

2013.

In the period 2013 to 2017, PT. Bank Mandiri

(Persero). Tbk, has a Capital Ratio of 21.77%,

24.49%, 27.74%, 26.94% and 26.16% respectively.

During this period, the highest value of Capital Ratio

was in 2015 while the lowest value of Capital Ratio

was in 2013.

In the period 2013 to 2017, BNI had a Net Profit

Margin of 80.74%, 81.14%, 80.10%, 80.19% and

79.96% respectively. During this period, the highest

Net Profit Margin was found in 2014 while the

lowest Net Profit Margin was found in 2017.

In the period of 2013 to 2017, BCA has Net

Profit Margin in a row of 83.47%, 80.53%, 79.60%,

79.85% and 79.98%. During this period, the highest

Net Profit Margin value was in 2013 while the

lowest Net Profit Margin value was in 2015.

In the period of 2013 to 2017, BRI had Net

Profit Margin in a row of 81.73%, 85.52%, 83.28%,

77.22% and 78.91%. During this period, the highest

Net Profit Margin value was in 2014 while the

lowest Net Profit Margin was found in 2016.

In the period of 2013 to 2017, Mandiri had Net

Profit Margin in a row of 79.95%, 79.51%, 80.31%,

78.71% and 78.92%. During this period, the highest

Net Profit Margin value was in 2015 while the

lowest Net Profit Margin was found in 2016.

In the period 2013 to 2017, BNI had a Net Profit

Margin of 19.00%, 17.75%, 11.65%, 12.78% and

13.65% respectively. During this period, the highest

ROE value was in 2013 while the lowest ROE was

in 2015.

In the period 2013 to 2017, BCA had ROE of

22.29%, 21.19%, 20.12%, 18.30%, and 17.75%

respectively. During this period, the highest ROE

value was in 203 while the lowest ROE was found in

2017.

In the period of 2013 to 2017, BRI had ROE of

26.92%, 24.82%, 22.46%, 17.86% and 17.36%

respectively. During this period, the highest ROE

was found in 2013 while the lowest ROE was found

in 2017.

In the period 2013 to 2017, Mandiri had ROE of

21.21%, 19.70%, 17.70%, 9.55% and 12.61%

respectively. During this period, the highest ROE

Analysis of Financial Ratio for Measuring the Average of the Banking Industry Ratio Listed in LQ45

815

was found in 2013 while the lowest ROE was found

in 2016

5 RESULTS

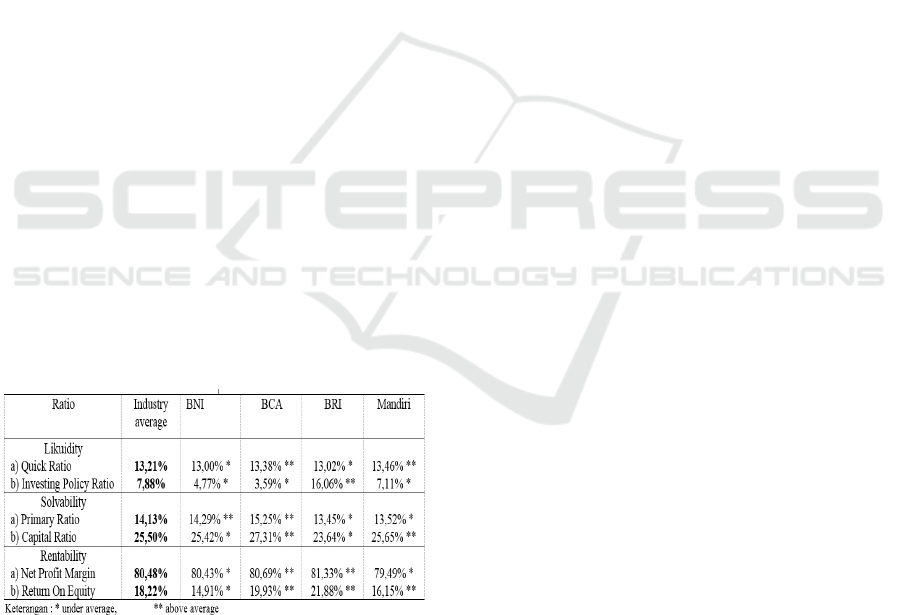

Liquidity ratio analysis shows that in 2013-2017, the

average bank financial ratio in the Quick Ratio was

13.21%. Banks that have an average above the

industry average of Mandiri of 13.46% and BCA of

14.38%. Investing Policy Ratio of 7.88%. Banks that

have an average above the industry average of BRI

is 16.06%.

Solvability analysis in 2013-2017, shows the

average financial ratio of banks at Primary Ratio of

14.13%. Banks that have an average above the

industry average of BCA of 15.25% and BNI of

14.29%. the average bank financial ratio at the

Capital Ratio is 25.50%. Banks that have an average

above the industry average of BCA of 27.31% and

Mandiri of 25.65%.

Analysis of profitability in 2013-2017 shows that

the average bank financial ratio on Net Profit

Margin is 80.48%. Banks that have an average

above the industry average, namely BCA at 80.69%

and BRI 81.33%. In this ratio, all banks in a

profitable condition means they can generate profits.

The average bank financial ratio on Return on

Equity is 18.22%. Banks that have an average above

the industry average of BRI are 21.88% and BCA

are 19.93%.

Table 1: Recapitulation of Financial Ratios Periode

2013-2017

6 CONCLUSIONS

From the results of the analysis and discussion, it

can be concluded that the Liquidity Ratio: the

industry average for Quick Ratio is 13.21% and the

industry average of Investing Policy Ratio is 7.88%

during the period 2013-2017. Solvability Ratio: the

industry average for Primary Ratio is 14.13% and

the industry average Capital Ratio is 25.50% during

the period 2013-2017. Profitability Ratio: the

industry average for Net Profit Margin is 80.48%

and the industry average Return on Equity is 18.22%

during the period 2013-2017.

REFERENCES

Jumingan. (2017). Analisis Laporan Keuangan. Jakarta:

Bumi Aksara.

Kamaludin, & Indriani, R. (2012). Manajemen Keuangan.

Bandung: CV Mandar Maju.

Kasmir. (2008). Analisa Laporan Keuangan. Jakarta: Raja

Grafindo Persada.

Kasmir. (2013). Analisa Laporan Keuangan. Jakarta: Raja

Grafindo Persada.

Kasmir. (2014). Analisa Laporan Keuangan. Jakarta: Raja

Grafindo Persada.

Martono, & Agus D. (2010). Manajemen Keuangan.

Yogyakarta: Ekonisia.

Sujarweni. (2017). Analisis Laporan Keuangan.

Yogyakarta: Pustaka Baru press.

Wijaya, D. (2017). Manajemen Keuangan. Jakarta:

Grasindo.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

816