Interdependence Analysis of Factors Affecting Indonesia’s of

Payments

T. Citra Nisa Farza

1

, Fitrawaty

2

and Muhammad Yusuf

2

1

Post Graduate of Economics, Universitas Negeri Medan, Medan, Indonesia

2,3

Faculty of Economics, Universitas Negeri Medan, Medan, Indonesia

Keywords: Balance of Payments, Inflation, Exchange Rate, Interest Rate, Money Supply, Gross Domestic Product,

VECM

Abstract: This study aims to analyze the interdependencies between variables on a reciprocal basis using the VECM

method through a stationary test, determination of optimal lag, stability test models, and cointegration test.

The result showed that: (1) In the short-term, inflation negatively affects the balance of payments; interest

rate and GDP positively affect the balance of payments. In the long run, inflation is a positive effect on the

balance of payments; interest rate and GDP negatively affect on the balance of payments. Meanwhile, the

exchange rate negatively affect the balance of payments and money supply positively affect on the balance of

payments both in the short-term and long-term (2) the test of Impulse Response Function indicate a positive

response that given by the balance of payments toward the shock that occurred on inflation, exchange and

interest rates towards the end of the period, while the response of the balance of payments to the shock that

occurred in the money supply and GDP towards the end of the period is negative (3) the test of Decomposition

Varian shows that at the end of the period of contributions, the balance of payments has decreased while the

contribution of the exchange rate experienced enhancement.

1 INTRODUCTION

The adoption of an open economic system by many

countries, including developing countries, is highly

dependent on the high level of the economy. High

economic growth can be realized through the

application of expansionary policies. But in practice,

this policy cannot be separated from the problem of

imbalance between the high growth of demand and

the limited capacity for available supply. This

condition will cause shocks to the external balance

such as the occurrence of high import volumes

followed by low export volumes, high inflation as a

result of excess demand. This will directly reduce

competitiveness between countries which will

ultimately exacerbate external imbalances so that it

will further impact the deterioration of the current

account in the balance of payments (Maipita, 2015).

The balance of payments is an important

application to analyze the economy (Astuti,

Oktavilia, & Rahman, 2015) as one of the indicators

that influence the actions of market participants who

have an important role in the formation of a state

income (Effendy, 2014).

In the period of last ten years, the data shows the

development of Indonesia's balance of payments

fluctuating trend. In the second quarter of 2011, the

balance of payments reached the highest surplus of

USD 11,879 million, mainly driven by a surge in

capital and financial account surplus reached USD

12,849 million, a significant increase compared to

USD 6,646 million in the previous quarter.

Achievement of positive in the second quarter of

2011 was not followed by the next quarter which

recorded a BOP deficit of USD 3,960 million. The

significant reduction was due to the capital and

financial account which recorded a deficit of USD

4,107 million (Indonesia’s Balance of Payments

Report, 2011).

Along with the development of the economic

system, the theory of the balance of payments is also

experiencing growth, but some researchers have

argued that a more intensive school of thought which

outlines the theory of the balance of payments is the

Keynesian theory and the theory of Monetarist

(Masdjojo, 2010). Both groups have a different view

Farza, T., Fitrawaty, . and Yusuf, M.

Interdependence Analysis of Factors Affecting Indonesia’s of Payments.

DOI: 10.5220/0009507005770585

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 577-585

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

577

in the analysis of the balance of payments, mainly

located on the aspects of the factors that influence it,

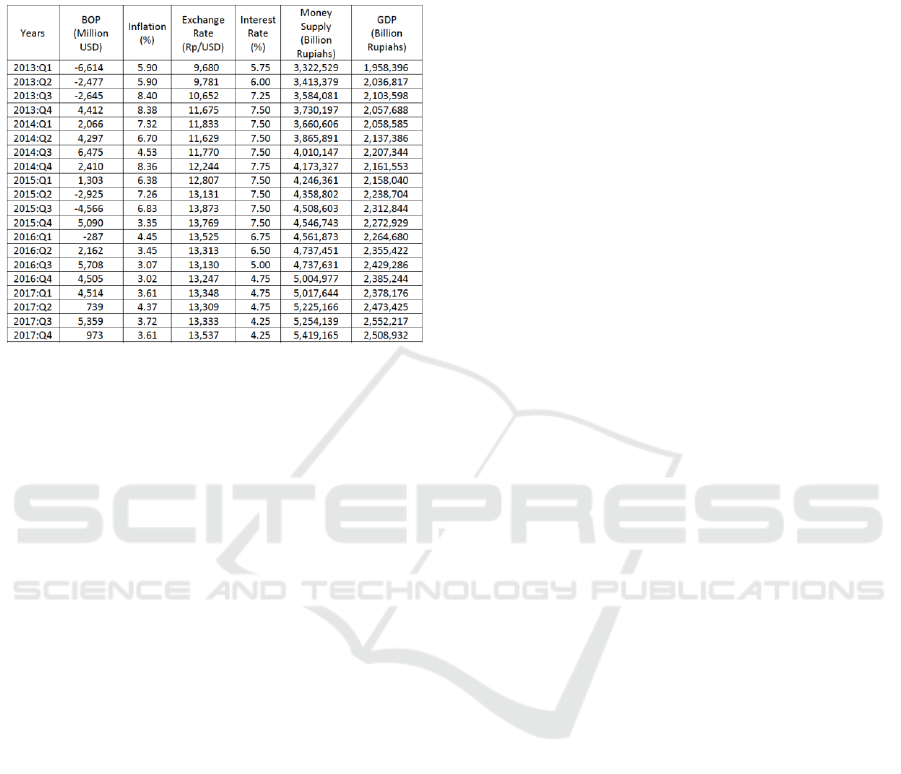

Table 1: BOP, Inflation, Interest Rate, Exchange

Rate, Money Supply and GDP in 2013:1-2017:4.

Source: Badan Pusat Statistik and Bank Indonesia

the mechanisms of influence and propositions on the

balance of payments.

A few researchers who have examined the

balance of payments in Indonesia, some of them such

as (Boediono, 1979) with simultaneous models;

(Hakim, 2000) and (Nusantara, 2000) with a single

dynamic equation; (Masdjojo, 2010) and (Effendy,

2014) with a model ECM and (Astuti et al., 2015)

with a model of Thirlwall and Hussain. Most of these

studies use monetary and Keynesian approach. These

approaches explained that inflation, exchange rates,

interest rates, money supply and Gross Domestic

Product (GDP) have relevance in determining the

balance of the current account and capital account

ultimately affect the BOP.

According to Keynesian theory, if the inflation

rate of a country relatively increases toward trading

partner countries, the current account balance will

decrease due to the increase of imports. If the value

of imports is higher than exports, it would cause a

deficit of the balance of payments by the trade

balance. Furthermore, the Keynesian elasticity

approach views that the trade balance will only

increase when the real exchange rate depreciates if

the conditions of the Marshall-Lerner fulfilled. When

the real exchange rate depreciates, it will cause the

price of goods produced by the country abroad to be

cheap and the price of foreign goods in the country is

becoming more expensive. This condition will

automatically increase exports and surplus of the

balance of payments (Salvatore, 1997). However, the

data shows that at Qtly. IV-2014 inflation rose to 8.36

percent, but in the same period, BOP recorded a

surplus of USD 2,410 million. Other than that, at

Qtly. II-2015 exchange rate depreciated from

Rp12,807/USD to Rp13,131/USD, but in the same

period, BOP recorded a deficit of USD 2,925 million.

This condition is not in accordance with Keynesian

theory.

Through the transmission of multiplier effects,

the Keynesian theory explains the relationship

between GDP and BOP, where if aggregate income

increases, imports will increase and a BOP deficit will

occur. Whereas Monetarists theory explains that GDP

will affect the balance in the domestic money market

through changes to the domestic demand for money

that would bring in a surplus of the BOP. On the other

hand, Keynesian through revenue mechanisms

explains that the relevance of interest rates and BOP,

where if interest rates rise, the decline in investment

and a decline in aggregate income. This condition will

reduce imports and cause the BOP surplus. his theory

supports the results of (Ehikioya & Mohammed,

2015) and (Chinedu, 2018) research which show

results are statistically very small, in other words, the

positive relationship between interest rates and

balance of payments in Nigeria.

While the Monetary theory explains if interest

rates rise then through the balance of the money

market, domestic money demand will increase so that

the value of the domestic currency appreciates. This

condition reduced exports and caused a balance of

payments deficit. Monetarists outlook is consistent

with the results of the study (Masdjojo, 2010) find

that interest rates negatively affect balance of

payments in both the short and long-term.

Furthermore, this theory explains the relationship of

money supply and the balance of payments based on

the view that the balance of payments is a monetary

phenomenon, where there is a relationship between

the balance of payments of a country and the supply

of money in it. The disproportion of the balance of

payments is a reflection of an disproportion in the

money market. Balance of payments surplus is a

reflection of the excess money supply, while the

balance of payments deficit is a reflection of the

excess demand for money (Nopirin, 2000).

Generally, this paper analyzes the

interdependence of factors affecting Indonesia's

balance of payments due to the conventional theory

of macroeconomics, economic variables often have

links with each other. Changes or shocks to one

economic variable will also affect changes in other

variables. The relationship is not even a one-way

relationship but is a reciprocal relationship (Halwani,

2002). The purpose of this paper to analyze the

relationship and to analyze the contribution of shock

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

578

inflation (INF), exchange rate (EXC), the interest rate

(IR), the money supply (MS) and Gross Domestic

Product (GDP) against Indonesia's balance of

payments (BOP).

2 THEORETICAL FRAMEWORK

Keynesian group thinking about balance of payments

is based on economic theory John Maynard Keynes

(1883-1946). Keynes argued that the balance of

payments does not automatically achieve a balance

but government intervention is required. Keynes

instead argued that the level of wages and prices has

a rigid nature and the state is always dealing with the

issue of unemployment. Keynes's thinking was later

developed by economists thereafter who focused on

the balance of payments theory (Duasa, 2004).

Elasticity approach emphasizes the effect of

devaluation on the trade balance, the devaluation will

improve the trade balance. It is called the Marshall

Lerner Condition. The essence of the approach is that

the improvement in the elasticity of the balance of

payments occurs as a result of the devaluation and

depends on the elasticity of foreign demand for

exports and domestic demand elasticities for imports.

It is assumed that the level of domestic and foreign

prices is the same. If the elasticity of domestic exports

is greater than one, exports will grow more than the

percentage of devaluation. Therefore, the domestic

balance of payments will increase. This will happen

because of the increase in the value of exports, which

will exceed the value of imports. However, the

elasticity approach recognizes that the effect of

exchange rate changes on the balance amount of the

domestic currency traded, depending on the elasticity

of supply and demand involved (Sakuntala, 2015).

Sidney Alexander in 1952 introduced a new

approach, namely the absorption approach,

developed to highlight the importance of the change

in income in the adjustment process. This approach

argues that currency devaluation will lead to price

inflation, which in turn would deprive the initial

effects of rising prices. The resulting process can only

be prevented if the inflation itself reduces aggregate

demand for goods through re-distribution effects of

approach or through a reduction in the real value of

existing money balances (Danjuma, 2013).

Monetarist group thinking on the balance of

payments was first developed by the research

department of the IMF headed by Mundell (1968) and

then followed by others such as Johnson (1975, 1976,

1977), Polak and others. The main basis of this

approach is the suggestion that there is stability in the

demand for money as well as the government does not

take action sterilization (reduce or eliminate the

influence of the balance of payments on the money

supply). With the assumption that the government

does not perform sterilization measures, then the

surplus or deficit in the balance of payments is

temporary In other words, the surplus or deficit will

arise, which causes the money supply to increase or

decrease until excess demand or money supply is lost

(the money market becomes balanced). Therefore, the

balance of payments that is not balanced a reflection

of the imbalance in the money market. In the long-

term, money market balance and the balance of

payments will occur automatically. But if the

government take action sterilization (cons with

monetary approach), then the surplus or deficit of the

balance of payments

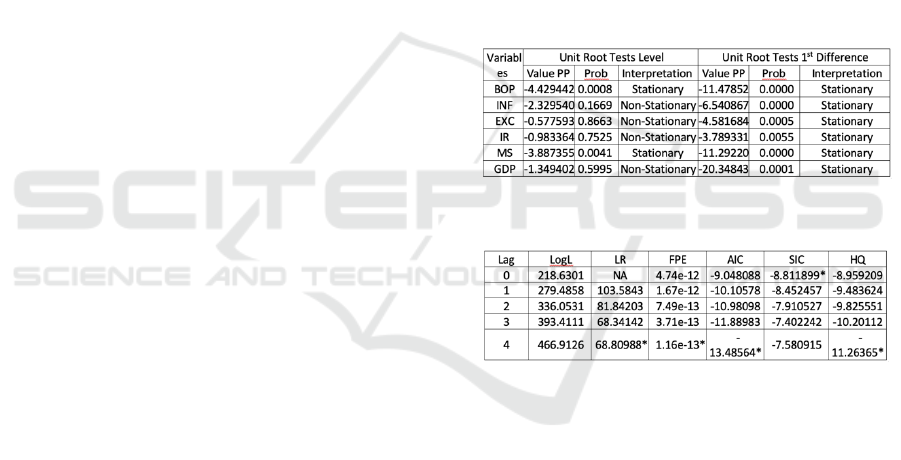

Table 2: Phillip-Perron Unit Root Test Results.

Source: Eviews 10 (Processed)

Table 3: Determination Optimal Lag Result.

Source: Eviews 10 (Processed)

will occur continuously (Nopirin, 2000). Based on the

theory and some results of empirical studies that have

been done by previous researchers, the research

hypothesis is:

Inflation, exchange rates, interest rates, money

supply, and GDP have interdependencies on

Indonesia's balance of payments.

Shock Inflation, exchange rates, interest rates,

money supply, and GDP contribute to

Indonesia’s balance of payments.

3 RESEARCH METHOD

This research using Vector Error Correction Model

(VECM) with the help of software EViews 10.

VECM is a VAR form that is estimated because of the

existence of non-stationary forms of data at the level

but cointegrated. VECM is often referred to as the

Interdependence Analysis of Factors Affecting Indonesia’s of Payments

579

VAR design for non-stationary series that has a

cointegration relationship.

The VECM specification restricts the long-term

relationship of endogenous variables to converge into

their cointegrated relationship, but still allows the

existence of short-term dynamics. The use of VECM

model analysis requires stationary test, determination

optimal lag, model stability test, and cointegration

test.

4 RESULTS

4.1 Stationary Test

This test is performed to determine which variables

were tested stationary or not. Stationary testing in this

study has used the Phillip-Perron (PP) test with a

critical value of 5 percent. In testing using EViews

software, the guideline used is if the absolute value of

PP t-statistic is greater than the critical value (by

looking at the prob value must be less than 0.05), then

the data is stationary.

Based on the test table PP unit root test on a level

(table 2) only variable BOP and MS are stationary.

Furthermore is the integration degree test to station

the data. Through the integration degree test at the 1

st

difference (table 2) was seen that all these data be

stationary for all variables have prob value < 0.05.

4.2 Determination of Optimal Lag

The uses of VECM models are very sensitive to the

lag length of the data used. Based on the calculations

on each of the criteria provided in the program

Eviews, optimal lag marked with a * (star). If the

long-lag test showed that most of the asterisk is at the

same lag, then the length of the lag is the lag.

Based on the determination of optimal lag test

(table 3) note that the criteria LR, FPE, AIC, and HQ

is the recommended candidate lag 4, seen from

asterisk most though criteria SIC recommend lag 0.

4.3 Model Stability Test

The stability of the model needs to be tested because

if the model stability estimation is not stable then the

analysis of Impulse Response Function (IRF) and

Variance Decomposition (VD) becomes invalid. The

test is stable or not the estimated VECM then

checking through the roots of the characteristic

polynomial. A VECM system is stable if all its roots

have modulus smaller than one (Basuki & Prawoto,

2016). Based on a stability model test results (table 4)

note that the modulus of the entire root unit < 1 then

the model specification is stable.

4.4 Cointegration Test

Cointegration test is performed to determine the

existence of the relationship between variables,

especially in the long-term. In testing using EViews,

the guide is taken if the value of the trace statistic and

the value of the Max-Eigen statistics > critical value

5 persent, then the data cointegrated. Table 5 shows

that the data cointegrated. Cointegration test results

indicate that among the BOP movement, INF, EXC,

IR, MS, and GDP have stability or equilibrium

relationship and similarity of movements in the long

term.

Table 4: Model Stability Test.

Roots of Characteristic Polynomial

Root

Modulus

-0.038409 - 0.925213i

0.926010

-0.038409 + 0.925213i

0.926010

-0.809792

0.809792

0.490669 - 0.344704i

0.599647

0.490669 + 0.344704i

0.599647

-0.569855

0.569855

-0.175068 - 0.519075i

0.547803

-0.175068 + 0.519075i

0.547803

0.255643 - 0.266422i

0.369234

0.255643 + 0.266422i

0.369234

0.275038

0.275038

-0.022807

0.022807

Source: Eviews 10 (Processed)

Table 5: Cointegration Test Results.

Rank Test (Trace)

Rank Test (Maximum

Eigenvalue)

Trace

Statistic

Critical

Value

5%

Max-Eigen

Statistic

Critical

Value

5%

165.750

9

95.75366

77.45187

40.07757

Source: Eviews 10 (Processed)

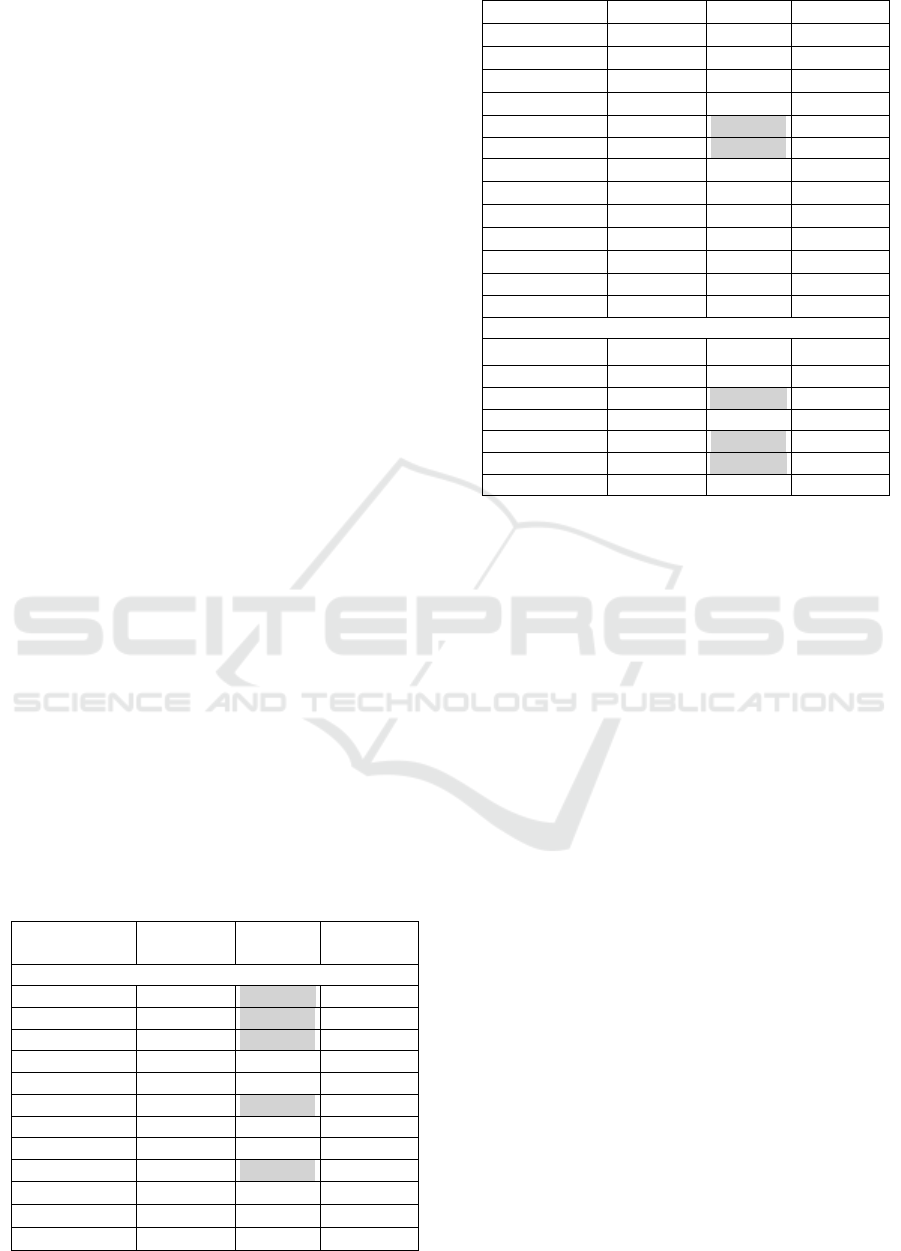

4.5 VECM Estimation with 4 Lags

This study has used 6 variables with a number of

observations of 52, then obtained a t-table value of

2.01290 so that it can be analyzed the influence of

variables in the short and long term. If the value of t-

statistic > t-table value, it can be concluded that there

is are significant effect and vice versa. Based on

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

580

estimates VECM with a lag of 4 (table 6) the

hypothesis testing of each independent variable on

Indonesia's balance of payments as follows:

4.5.1 BOP Interdependence Period Ago toward

BOP Now

The estimation results indicate that the BOP

(t-1)

and

BOP

(t-2)

positive and significant effect on the balance

of payments current. This means that the increase in

BOP

(t-1)

and BOP

(t-2)

will lead to the addition of BOP

current balance. Meanwhile, BOP

(t-3)

and BOP

(t-4)

also has a positive effect but not significant to the

BOP now. No significant effect shows that although

the government has implemented a policy increase in

exports and reduction in imports through import

substitution policies and export promotion, still there

is intervention by Bank of Indonesia on the monetary

policy. On the other hand, allegedly because of the

attitude of more rational economic actors, as the

impact of the economic crisis of the past lessons,

which in the short term they tend to "wait and see" to

the changes that take place, before taking economic

decisions.

4.5.2 Infation Interdependence toward BOP

Short-term estimation results indicate that the

variable INF

(t-1)

and INF

(t-4)

positive and significant

effect on alpha 5 percent against the BOP now. In the

event of an increase in inflation will cause an increase

in the balance of the BOP. These findings are

inconsistent with the theory that rising inflation will

cause a balance of payments deficit. This discrepancy

can be explained as follows: in spite of the increase in

inflation led to import prices cheaper than

domestically produced goods. But suspected

Table 6: VECM Estimation of Short-Term and Long-

Term BOP with 4 Lags.

Variables

Coefficient

t-statistic

Interpretatio

n

Short-Term

CointEq1

-1.146991

[-3.26677]

-

D(LNBOP(-1))

0.708524

[ 2.48194]

Significant

D(LNBOP(-2))

0.596875

[ 2.09609]

Significant

D(LNBOP(-3))

0.521618

[ 1.54748]

Insignificant

D(LNBOP(-4))

0.327448

[ 1.18011]

Insignificant

D(LNINF(-1))

13.57924

[ 2.03559]

Significant

D(LNINF(-2))

-9.466290

[-1.41444]

Insignificant

D(LNINF(-3))

-3.682499

[-0.65244]

Insignificant

D(LNINF(-4))

11.86841

[ 2.15374]

Significant

D(LNEXC(-1))

25.52099

[ 0.63087]

Insignificant

D(LNEXC(-2))

-80.35120

[-1.74466]

Insignificant

D(LNEXC(-3))

34.02898

[ 0.63263]

Insignificant

D(LNEXC(-4))

-83.77408

[-1.57192]

Insignificant

D(LNIR(-1))

25.56936

[ 0.91883]

Insignificant

D(LNIR(-2))

30.32042

[ 1.16475]

Insignificant

D(LNIR(-3))

19.32322

[ 0.94912]

Insignificant

D(LNIR(-4))

5.461924

[ 0.27860]

Insignificant

D(LNMS(-1))

208.6157

[ 2.31346]

Significant

D(LNJMS(-2))

332.8488

[ 3.29920]

Significant

D(LNJMS(-3))

181.3044

[ 1.70782]

Insignificant

D(LNMS(-4))

55.09422

[ 0.75236]

Insignificant

D(LNGDP(-1))

281.5600

[ 1.27347]

Insignificant

D(LNGDP(-2))

300.5649

[ 1.32447]

Insignificant

D(LNGDP(-3))

203.6904

[ 0.87560]

Insignificant

D(LNGDP(-4))

348.3178

[ 1.53747]

Insignificant

C

-38.73327

[-2.33921]

-

Long-Term

LNBOP(-1)

1.000000

-

-

LNINF(-1)

16.41184

[ 1.98655]

Insignificant

LNEXC(-1)

-63.60414

[-5.20134]

Significant

LNIR(-1)

-11.79401

[-0.90579]

Insignificant

LNMS(-1)

91.76460

[ 2.75204]

Significant

LNGDP(-1)

-185.5906

[-2.39868]

Significant

C

1895.796

-

-

Source: EViews 10 (Processed)

that more low import prices cannot be automatically

led to imports growing faster than exports, due to

consumer decision in increasing purchases of foreign

goods is not only influenced by price alone,

consumers also consider the rupiah exchange rate

against foreign currencies. The weakening of the

rupiah will cause consumers to prefer goods produced

in the country so that imports declined. On the other

hand, exports will increase because of the increased

competitiveness which will increase the number of

capital inflows in the country, so in the domestic

economy led to inflation balance of payments surplus.

Although these findings do not support the Keynesian

theory, the results of this study support the findings

of the study (Effendy, 2014) and (Danjuma, 2013)

were also obtained results that inflation variable

positive effect on the balance of payments.

Meanwhile, the variable INF

(t-2)

and INF

(t-3)

negative and insignificant effect on the BOP now.

The estimation results indicate that the INF long-term

positive effect on the BOP but not significantly. No

significant influence of the INF because of rising

inflation in Indonesia is relatively low. This low

rising inflation as a lubricant in the Indonesian

economy which could further increase the national

income. When national income increases, the BOP

will rise. The results support the research conducted

(Chinedu, 2018); (Effendy, 2014) and (Danjuma,

2013) which states the rate of inflation in the Nigerian

economy has positive statistics on the balance of

payments.

Interdependence Analysis of Factors Affecting Indonesia’s of Payments

581

4.5.3 Interdependence of Exchange Rate toward

BOP

Short-term estimation results indicate that the

variable EXC

(t-1)

and EXC

(t-3)

and insignificant

positive effect on the BOP now amounted to

25.52099 and 34.02898. This means that if there is an

increase exchange rate of 1 percent in the previous

period, it will improve the balance of the BOP now at

25.52099 percent and if there is an increase exchange

rate of 1 percent in the three previous periods, it will

improve the balance of the BOP now at 34.02898

percent.

Meanwhile, EXC

(t-2)

and EXC

(t-4)

and negative

and insignificant effect on the BOP now. Long-term

estimation results show that exchange rate has a

negative and significant influence on alpha 5 percent

against BOP, this means that changes in the domestic

exchange rate negatively affect changes in BOP

balance. These findings are consistent with the view

of Keynesian and Monetarist. The results support the

research conducted (Udochi, 2017); (Ali Shahzad,

Nafees, & Farid Govt, 2017); (Azra Batool, Memood,

& Khan Jadoon, 2015) and (Chiawa, Asare, &

Dauran, 2013) who found the result that exchange

rate depreciation has an impact on improving the

balance of payments.

4.5.4 Interdependence of Interest Rate toward

BOP

The estimation results indicate that the variable short-

term IR

(t-1),

IR

(t-2)

, IR

(t-3)

and IR

(t-4)

has a positive

effect but not significant at alpha 5 percent toward the

BOP now. This result is consistent with the

Keynesian theory which suggested a positive

relationship between interest rates and changes in the

balance of the balance of payments. if for some

reason a country's domestic interest rate increases,

then through the money market this condition will

attract foreign investors to save their funds in the

country's banking system. There is an increased

inflow of foreign exchange effect on the surplus

balance of capital and financial account (CFA) and if

the Current Account (CA) has not changed, then the

surplus CFA can cause BOP surplus.

Meanwhile, the long-term estimation results

indicate that IR variable has a negative impact and

insignificant at alpha 5 percent against the BOP is

equal -11.79401. The results support the research of

(Masdjojo, 2010) and (Effendy, 2014) who found the

result that the long-term interest rates had a negative

effect and no significant effect on the balance of

payments.

4.5.5 Interdependence of Money Supply toward

BOP

Short-term estimation results indicate that the

variable MS

(t-1)

and MS

(t-2)

have a positive and

significant effect on alpha 5 percent toward the BOP

now at 208.6157 and 332.8488. In the short-term

increase in the money supply will lead to

improvements in the balance of payment. These

results are consistent with Monetarist theory, the

mechanism can be explained through prices and

incomes approach: that increases in the money supply

should be linked to what occurred to the price level.

Meanwhile, the variable MS

(t-3)

and MS

(t-4)

have a

positive effect but not significant toward the BOP

now. The insignificance can be explained that with

the increase in the money supply can encourage an

increase in aggregate demand. However, this

condition is not followed by an increase in aggregate

supply, then it will encourage inflation. Inflation

further negative impact on exports. The decline in

exports was not accompanied by a rise in imports is

alleged to be the cause of insignificant influence

money supply three periods ago and money supply

four periods ago against the BOP now. On long-term,

money supply is also a positive and significant effect

on alpha 5 percent against the BOP. These findings

support the theory Monetarists, a positive relationship

between money supply and BOP can also be seen

from the data the development of money supply and

BOP during the study period showed a trend equally

increased (unidirectional). The findings of this study

support the results (Udochi, 2017); (Azra Batool et

al., 2015) and (Ehikioya & Mohammed, 2015) who

obtained the result that the amount of money in

circulation has a direct and significant effect on the

balance of payments in Nigeria.

4.5.6 GDP Interdependence toward BOP

The results of short-term estimates indicate that

GDP

(t-1)

, GDP

(t-2)

, GDP

(t-3)

and GDP

(t-4)

have a

positive effect but not significant at alpha 5 percent

toward the BOP now. The findings of this study are

in line with Monetarist thinking which states that

economic growth will affect the balance of payments

balance through the mechanism of balance of money

markets. That mechanism according to Monetarists

theory can be explained by changes in the demand for

money. The results of this study support the research

of (Masdjojo, 2010) and (Azra Batool et al., 2015)

who found the results that GDP has a positive effect

on BOP in the short term. Whereas in the long run,

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

582

the GDP variable has a negative and significant effect

on BOP.

ECT is negative (convergen) of -1.146991 and

significant at the alpha 5 percent. ECT value of

1.146991 means that when there is an imbalance in

the previous period by 1 percent, the BOP will adjust

to the decreased -1.146991 percent. The difference

between the balance of the BOP with a value that is

equal to 1.146991 balance will be adjusted in 1

quarter.

4.6 Impulse Response Function (IRF) Test

Analysis of IRF to see the response of each variable

to the shock of other variables, not just in the short

term but can be analyzed for some future horizon as a

long-term information. IRF analysis also serves to see

how long these effects occur (Basuki, & Prawoto,

2016). In this study, IRF test results are shown in a

tabular form which drawn along the 60 periods

(quarter). The next will be seen in three periods,

namely a period of short-term (1-4 quarters), medium

term (5-20 quarters) and long-term (21-60 quarters).

The IRF Indonesia’s balance of payments results

(table 7) for the short term that each standard

deviation of BOP shocks will be responded to by the

BOP itself up to 0.151890. While each standard

deviation of inflation shocks will be responded to by

inflation to decline by -0.767687. This means that if

an increase in inflation of 1 percent will result in a

decrease in the BOP balance of -0.767687 percent,

the higher the inflation, the lower the BOP. Every

single standard deviation occurs exchange rate

Table 7: Impulse Response Function BOP Test

Results.

Source: Eviews 10 (Processed)

Table 8: Variance Decomposition BOP Test Resuts.

Source: Eviews 10 (Processed)

shocks, BOP will respond until it rises by

1,945682. Every single standard deviation of interest

rate shock will be responded to by BOP up to

0.972387 which means that if an interest rate increase

of 1 percent will result in an increase in BOP of

0.972387 percent, the higher the inflation, the lower

the BOP. Every single standard deviation occurs

exchange rate shocks, BOP will respond until it rises

by 1,945682. Every single standard deviation of

interest rate shock will be responded to by BOP up to

0.972387 which means that if an interest rate increase

of 1 percent will result in an increase in BOP of

0.972387 percent. Every single standard deviation

occurs money supply shock, then BOP will respond

until an increase of 0.16824. Every single standard

deviation occurs when GDP shocks will be responded

to by BOP up to 0.945733, the higher the GDP, the

higher the BOP.

In general, in the short term period (4

th

quarter)

BOP responds positively to BOP variable shocks

themselves, exchange rates, interest rates, money

supply, and GDP. While the response given by BOP

to inflation variable shocks is negative. In the medium

term period (21

st

quarter) BOP responds positively to

the shock of the BOP variable itself, inflation,

exchange rates, and interest rates. While the response

given by BOP to variable shocks of money supply and

GDP is negative. In the long term period (60

th

quarter)

BOP responds positively to inflation variable shocks,

exchange rates, and interest rates. While the

responses given by BOP to the BOP variable shock

itself, the money supply and GDP are negative.

4.7 Variance Decomposition (VD) Test

VD analysis aims to explain the contribution of each

research variable to the shocks caused to the main

endogenous variables observed. This analysis is used

to predict how much the variance contribution of each

variable has an effect on other variables at present and

future periods. The BOP VD results (table 8) show

that in the first quarter of the BOP variance

decomposition was determined by the BOP variable

itself of 100 percent and continued to decline until the

60

th

quarter. At the end of the short-term quarter, the

contribution of other variables in preparing the BOP

was 6.13 percent of inflation, 16.31 percent of the

exchange rate, 7.04 percent of interest rates, 7.69

percent of the money supply and 7.45 percent of

GDP. But in the 4

th

quarter, the BOP variable itself

still contributed the most to BOP.

As the period increases to the end of the medium

term period (20

th

quarter) the exchange rate variable

starts to contribute more to the preparation of BOP

Interdependence Analysis of Factors Affecting Indonesia’s of Payments

583

than the BOP variable itself is 45.27 percent.

Meanwhile, the smallest contribution is given by the

GDP variable of 3.96 percent. Contributions given to

this exchange rate variable continued to increase until

the end of the long-term period (60

th

quarter) by 63.16

percent. While the BOP variable itself only

contributed 8.04 percent, the rest were given variables

of inflation, interest rates, the money supply, and

GDP respectively at 8.50 percent, 6.50 percent, 10.77

percent, and 3.04 percent.

The contribution of each variable in this study has

increased and decreased on a quarterly basis. Variable

BOP itself and GDP decreased from short term to

long term. Variable exchange rates and money supply

increased contribution from short term to long term.

Meanwhile, the variable inflation and GDP from

short-term to medium term to increase contributions,

contribute to the further decline in the medium term

to long term. In the long term that contributes most to

the BOP is a variable exchange rate. This shows that

the exchange rate is one of the most important

indicators to determine the surplus or deficit of the

BOP balance in the future. The need for supervision

and government intervention in maintaining

exchange rate stability so that there is no shock to the

equilibrium of external balance.

5 CONCLUSIONS

The VECM estimation results show ECT values of -

1.146991. This shows that in the case of Indonesia it

takes approximately 1 quarter to achieve BOP

balance. This illustrates the ability of the Government

and Bank Indonesia to be relatively good in

anticipating various changes that occur in the

macroeconomy, especially those concerning BOP

balance.

The IRF test results indicate that the response

given to the shock BOP variables that occur in the

variable BOP itself, inflation, exchange rates, interest

rates, money supply, and GDP tends to fluctuate at

the beginning of the period and consistent towards the

end of the period. BOP response to shocks that occur

in the BOP itself disappeared towards the end of the

period for forming the balance back. BOP response to

shocks that occur in the variable inflation, exchange

rates and interest rates towards the end of the period

was positive and permanent. While the BOP response

to shocks that occur in the variable of the money

supply and GDP towards the end of the period was

negative and permanent.

The VD test results show that BOP variables,

inflation, exchange rates, interest rates, money

supply, and GDP each contribute to the BOP variable

where the BOP contribution itself decreases while the

exchange rate contribution increases until the end of

the period. This shows that the exchange rate has a

strong effect on the formation of the BOP balance in

the long run. This finding is in accordance with the

theory put forward by Monetarists.

The government is expected to continue to

improve the high economic growth mainly through

increasing the number of exports and foreign

investment. The high export and inflow of funds will

contribute to the improvement of Indonesia's balance

of payments balance. In addition, Bank Indonesia is

expected to maintain the stability of the rupiah

exchange rate against the USD. The exchange rate

should find its equilibrium level to form the balance

of payments.

For further researchers who want to conduct an

analysis of the balance of payments should develop a

research model and add variables such as domestic

credit. Because according to Keynesian and Monetary

theory domestic credit has a relationship with the

balance of payments.

REFERENCES

Ali Shahzad, A., Nafees, B., & Farid Govt, N. (2017).

Marshall-Lerner Condition for South Asia: A

Panel Study Analysis, Pakistan Journal of

Commerce and Social Sciences, 11(2), 559-

575.

Astuti, I. P., Oktavilia, S., & Rahman, A. R. (2015).

Peranan Neraca Pembayaran Internasional

dalam Perekonomian Indonesia. Jejak, 8(2),

178–188.

https://doi.org/10.15294/jejak.v8i2.6169.

Azra Batool, S., Memood, T., & Khan Jadoon, A.

(2015). What Determines Balance of

Payments: A Case of Pakistan. Journal of

Management and Business, 2(1), 47-70.

Badan Pusat Statistik. https://www.bps.go.id.

Bank Indonesia. Beberapa Edisi. Laporan Neraca

Pembayaran Indonesia (NPI).

http://www.bi.go.id.

Basuki, A. T., & Prawoto, N. (2016). Analisis Regresi

Dalam Penelitian Ekonomi & Bisnis :

Dilengkapi Aplikasi SPSS & EVIEWS. Depok:

PT Rajagrafindo Persada.

Boediono. (1979). Econometric Model of the

Indonesian Economy for Short-run Policy

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

584

Analysis. Disertasi. University of

Pennsylvania.

Chiawa, M. A., Asare, B. K., & Dauran, N. S. (2013).

A Cointegrated Vector Autoregressive Model

of Determinants of Balance of Payment

Fluctuations in Nigeria. American Journal of

Scientific and Industrial Research, 4(6), 512-

531.

https://doi.org/10.5251/ajsir.2013.4.6.512.531

.

Chinedu, O. (2018). Institutional Quality and Balance

of Payments Equilibrium in Nigeria. Journal

of Economics, Management and Trade.

https://doi.org/10.9734/JEMT/2018/40905.

Danjuma, F. (2013). An Empirical Analysis of the

Balance of Payments as a Monetary

Phenomenon: Nigeria’s Experience. Finance

and Banking (JEIEFB). An Online

International Monthly Journal. Retrieved

from

www.globalbizresearch.comwww.globalbizre

search.com.

Duasa, J. (2004). The Malaysian Balance Of

Payments: Keynesian Approach Versus

Monetary Approach. Global Economic Revie,

Perspective on East Asian Economies and

Industries, 37(1).

Effendy, A. K. (2014). Analisis Neraca Pembayaran

Indonesia Dengan Pendekatan. Jurnal Ilmiah

Universitas Brawijaya.

Ehikioya, I. L., & Mohammed, I. (2015). Monetary

Policy and Balance of Payments Stability in

Nigeria. International Journal of Academic

Research in Public Policy and Governance.

https://doi.org/10.6007/ijarppg/v2-i1/1625.

Hakim, L. (2000). Faktor-Faktor Yang

Mempengaruhi Cadangan Devisa Indonesia

1989.1-1997.4. Media Ekonomi, 6(1), 667-

682.

Halwani, R. H. (2002). Ekonomi Internasional dan

globalisasi ekonomi. Jakarta: Ghalia

Indonesia.

Maipita, I. (2015). Keterkaitan Instrumen Kebijakan

Moneter dengan Neraca Pembayaran di

Indonesia. QE Journal, 2(1), 15-27.

Masdjojo, G. N. (2010). Kajian Pendekatan

Keynesian Dan Monetaris Terhadap Dinamika

Cadangan Devisa Melalui Penelusuran Neraca

Pembayaran Internasional: Studi Empiris Di

Indonesia Periode 1983- 2008. Disertasi.

Semarang: Universitas Diponegoro.

Nopirin. (2000). Ekonomi Moneter. Buku II,

Yogyakarta : BPFE-Yogyakarta.

Nusantara, A. 2000. Perkembangan Pendekatan

Moneter tentang NPI: Equilibrium,

Disequilibrium dan Global Approach. Edisi 2,

Gema Stikubank.

Sakuntala, D. (2015). Analisis Faktor-Faktor Yang

Mempengaruhi Neraca Pembayaran Indonesia

Melalui Pendekatan Moneter. Tesis. Medan:

Universitas Negeri Medan.

Salvatore, D. (1997). Ekonomi Internasional. Edisi 5,

Jilid 2, Jakarta: Penerbit Erlangga.

Udochi, D. (2017). Analysis of Balance of Payments

Trend in Nigeria: A Test of Marshall-Lerner

Hypothesis. Saudi Journal of Business and

Management Studies, 2(5), 468-474.

https://doi.org/10.21276/sjbms.

Interdependence Analysis of Factors Affecting Indonesia’s of Payments

585