Islamic Accounting Information based on Statement of Financial

Accounting Standards (SFAS) 109 in BAZNAS Riau Province

Suhendi

1

, Zulhelmy

2

, Kiki Farida Ferine

1

and Bhakti Alamsyah

1

1

Pancabudi University, Medan, Indonesia, Medan-Indonesia

2

Universitas Islam Riau, Pekanbaru-Indonesia

Keywords: Zakah Accounting, Islamic accounting, Baznas

Abstract: This study has a variable period lead (leadership), age institutions Baznas (experience), education manager /

manager (insight), accounting training Islam followed by manager / manager and understanding of

Statement of Financial Accounting Standards (SFAS) 109 on the preparation and use of accounting

information Islam Baznas institutions Riau Province. The results showed Accounting Information Islam

(IAI) in Baznas Riau Province positive influence on the measurement of each dimension variable,

accounting information is done by using a Likert scale of five points, is points 3 to level the set-up and use

of the medium (Moderate), and variable-time lead (leadership), Islamic accounting training followed

significant effect seen on positive correlation (+) of 0.181 against the preparation and use of accounting

information Islam. Significant correlation results, ie sig. <0.05 or Pearson correlation values >0.50. Value

Cronbach's alpha (α) a variable 0,60 the indicators used by the variable is reliable, which means

trustworthy or reliable. Good data are normally distributed, the test is done using a normal curve

probabilityplot, which means normally data. Baznas Riau Province, after the enactment of Law No. 23 of

2011 concerning the management of zakat aplication financial statements according to standards

recommended that SFAS 109 (Accounting for Zakat).

1 INTRODUCTION

Republic of Indonesia Law No. 23 of 2011

concerning Management of Zakat Chapter I General

Provisions Article 1 paragraph 1 are: Management

of zakat is the activity of planning, implementing

and coordinating the collection, distribution and

utilization of zakat. And in paragraph 7: National

Zakat Amil Agency, hereinafter referred to as

BAZNAS, is an institution that manages zakat

nationally. Zakat potential in Indonesia according to

the Ministry of Religion.The Republic of Indonesia

annually reaches Rp. 7.5 trillion. PIRAC (Public

Interest Research and Advocacy Center) estimate the

amount of ZIS funds raised in Indonesia amounts to

around Rp. 4 trillion.

Table 1 Changes in accounting science from the

exact science department being economics the

original society considered as something constant,

for example business transactions that will be

influenced by culture and traditions and habits in

society.

Table 1: Percentage of National Zakat Collection 2002-

2015.

Years

Total Zakah

(Biliun Rupiah )

Growth of Year

(%)

2002 68 -

2008 920 14,12

2009 1.200 4,64

2010 1.500 4,97

2011 1.729 3,80

2012 2.200 7,81

2013 3.700 24,87

2014 5.400 28,18

2015 6.100 11,61

Source: BAZNAS (Badan Amil Zakat Nasional)

2015

Suhendi, ., Zulhelmy, ., Ferine, K. and Alamsyah, B.

Islamic Accounting Information based on Statement of Financial Accounting Standards (SFAS) 109 in BAZNAS Riau Province.

DOI: 10.5220/0009506513671370

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1367-1370

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1367

2 ISLAMIC ACCOUNTING

CONSEPTION

If we want to get the Islamic accounting concept

then in accordance with the colonial model as stated

by Gambling and Karim then the Islamic accounting

concept should be born from:

Figure 1: Stucture Islamic Accounting

Islamic accounting it can be described as follows:

a. The source of law is the instrument of God

through the Quran and Sunnah. The source of

this law should be a safety fence and every

concept, postulates, principles, and techniques

of accounting.

b. The emphasis on "accountability", honesty,

truth, and justice.

c. Problems outside of it handed over entirely to

the resourcefulness of the human mind is

included for the sake of "decision usefulness"

Zakat Accounting

Zakat accounting concerns Islamic values from the

beginning, because zakat is an institution that began

at the same time as Islam, important concepts in

accounting are included and are suitable for thinking

about Islamic accounting because zakat is only

applied to Muslims. Accounting for zakat concerns

zakat management organizations, which currently

have statements of financial accounting standards

specifically addressing the management of zakat.

3 ACCOUNTING TREATMENT

(PSAK 109)

PSAK must be applied by amil that has obtained

permission from the regulator, but amyls that do not

get permission can also apply PSAK. (Sri Nurhayati-

Wasilah, 2013: 315). This PSAK 109 refers to

several MUI fatwas, namely:

The MUI No.8 / 2011 Fatwa concerning Amil

Zakat, explains the criteria, the duty of amil zakat

and the imposition of operational costs on amil zakat

activities which can be taken from the amil portion,

or from fisabilillah part within reasonable limits,

proportional and in accordance with Islamic rules.

MUI No.14 / 2011 Fatwa concerning Distribution of

Zakat Assets in the form of Assets Managed. The

definition of asset assets while the benefits are for

mustahik zakat. If used by non-zakat mustahik, the

user must pay for the benefits he uses and is

recognized as a virtue fund by amil zakat.

Referring to the explanation of the relevance of

Circular Causation with constructs in research and

preparation of hypothesis formulation, the

conceptual framework that supports research is

presented as follows:

Model:

IAI={MMBAZNAS,PPM,PAS,UBPD,PPSAK }

From this function a linear model can be created :

IAI = α MMBAZNAS + β PPM + γ PAS+

φ UBPD + ω PPSAK + €

Where :

Y = Provision and use of information Islamic

accounting

X1 = The period of leading the institution

X2 = Age of the institution

X3 = Islamic accounting training that followed

by manager

X4 = Education of manager

X5 = Understanding of PSAK 109

Figure 2: Conceptual Framework

Islamic society

Islamic economics

Islamic accounting theory

Islamic accounting practices

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1368

4 RESEARCH RESULT

Reliability test results are used to determine whether

the indicators used are reliable. The reliability test

results are as follows:

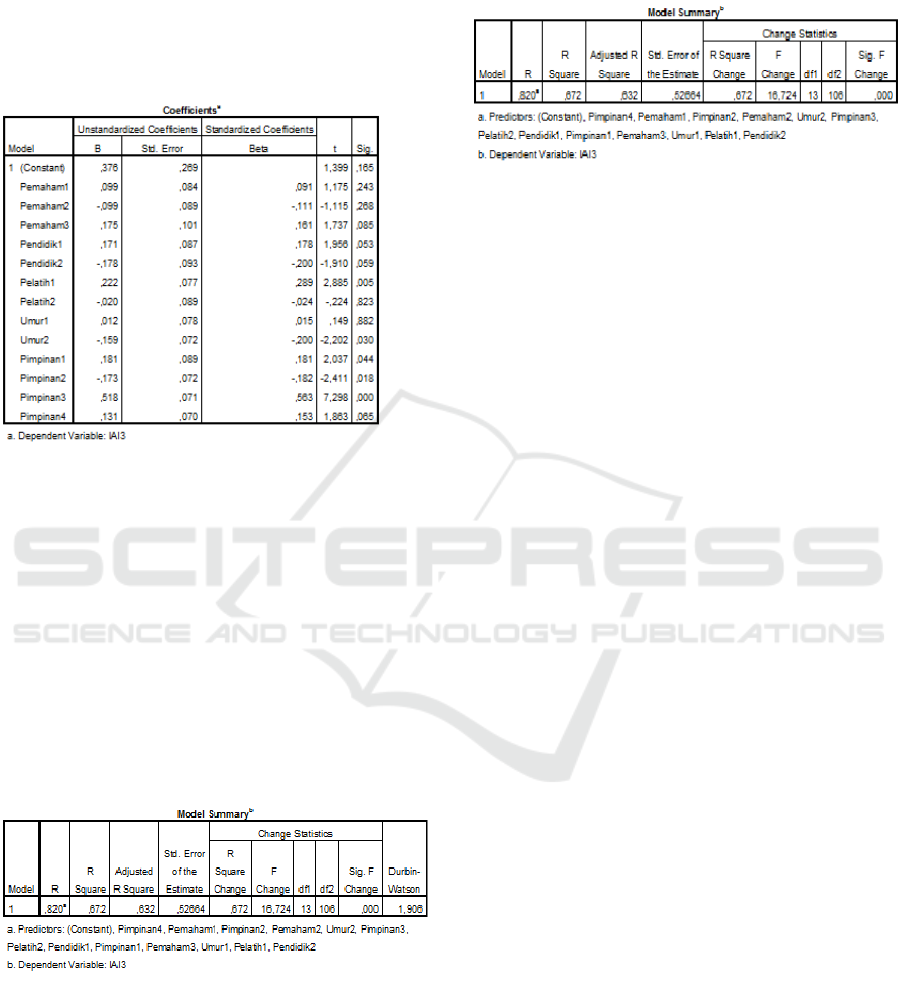

Tabel 2 : The results of multiple regression tests

Source: Research Results, 2018 (Data Processed)

In research using multiple regression analysis

techniques.

Y = a + b1 x1 + b2 x2 + b3 x3 + b4 x4 + b5 x5 + e

Y = 0,376 + 0,181 X

1

+ 0,120 X

2

+ 0,222 X

3

+ 0,171

X

4

+ 0,990 X

5

Tabel 3 : autocorrelation test results

D-W : 1,906

significant ( = 5%)

sample (n = 120)

variable independent 5 (lima) (k - 1= 5-1=4)

table D-W value from dL = 1,571 and dU = 1,780

dU< d < 4-dU

1,780 < 1,906 < 4 – 1,780

1,780 < 1,906 < 2,22

Tabel 4: the result of the coefficient of determination

Adjusted R Square is 0,67

5 CONCLUSIONS

Constanta is 0,376, independent variable have positif

(+). The shortage of deficiencies that occur in the

application of accounting PSAK 109 lies in the lack

of human resources in charge of carrying out the

preparation of financial statements. Leadership have

positive relationship namely 0,181, The preparation

and use of Islamic Accounting Information (IAI) has

been carried out by the Baznas agency in Riau

Province in accordance with the Statement of

Financial Accounting Standards (PSAK) 109.

Experience have positive relationship namely

0,120, with the management of zakat funds by

Baznas in this study can be described by simulating

the perspective, which is the form of God's law,

namely the sunatullah or the sentence in the Qur'an.

Islamic accounting training have positive

relationship namely 0,222, The preparation and use

of Islamic Accounting Information (IAI).

Knowledge have positif relationship namely 0,171,

The preparation and use of Islamic Accounting

Information (IAI). Understanding of PSAK 109 have

positive relationship namely 0,990, the processing of

data with SPSS and SIA (Accounting Information

Systems) through this software, where the shape of

the arrow direction alternating simultaneous.

REFERENCES

AAOIFI (2007), Accounting, Auditing and Governance

Standards for Islamic Financial Institutions 1428H-

2007, Accounting and Auditing Organisation for

Islamic Financial Institutions, Manama, pp. 433-4.

Akhyar Adnan, Muh. Dkk, (2009), Journal International

www. Emeraldinsigh.com /1753-8394.htm

Accounting treatment for corporate zakat: a critical

Islamic Accounting Information based on Statement of Financial Accounting Standards (SFAS) 109 in BAZNAS Riau Province

1369

review , Malaysia : International Journal of Islamic

and Middle Eastern Finance and Management Vol. 2

No. 1, pp. 32-45.

Alam Choudhury, Masudul. (2013), A probabilistic

evolutionary learning model with epistemological

meaning inIslamic economics and finance (Journal

of Financial Reporting and Accounting Vol. 11 No.

1, pp. 64-79).

Harahap, Sofyan Syafri. (1997). Akuntansi Islam. Jakarta:

Bumi Aksara.

Triyuwono,.Iwan, (2006), Perspektif, Metodologi dan

Teori Akuntansi Syariah, Jakarta : Raja Grafindo

Persada.

Zulhelmy. (2003), Isu-isu Kontemporer dan Keuangan

Islam, Bogor : Al Azhar

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1370