Analysis of the Determination of the Composite Stock Price Index in

Indonesia Stock Exchange, 1996-2017

Siti Delvi Jarniati

1

, Fitrawaty

2

, and Eko Wahyu Nugrahadi

2

1

Post Graduate School, State University of Medan, North Sumatra, 20219, Indonesia

2

Department Economics, Faculty of Economics, State University of Medan, North Sumatra, 20219, Indonesia

Keywords: The Money Supply, Interest Rate of Bank Indonesia, Exchange Rate, Gross Domestic Product, Composite

Stock Price Index, Error Correction Model

Abstract: This research aims to analyze the relationship of long-term and short-term macroeconomic variables

between the money supply, the interest rate of Bank Indonesia, exchange rates and gross domestic product

against the composite stock price Index on the stock exchange Indonesia in 1996-2017. To answer these

problems the study Econometrics model analysis tools used error correction (Error Correction Model).

Research results showed in the short term the money supply, interest rates and gross domestic product of

Bank Indonesia effect negatively and significantly to the composite stock price index. While the exchange

rate in the short term has no effect against the composite stock price index. In the long run, the money

supply, interest rates and exchange rates of Bank Indonesia have no effect against the composite stock price

index. While the gross domestic product in the long run a positive and significant effect against the

composite stock price index. Together the same macroeconomic variables of the money supply, the interest

rate of Bank Indonesia, exchange rates and gross domestic product of influential significantly to the amount

of money in circulation, Bank Indonesia interest rates, exchange rates and gross domestic product on the

extent trust 75.69 percent.

1 INTRODUCTION

Boost the economy of a country can be done in

various ways, one of which is to move the stock

market. Capital markets are rated more effective in

improving a country's economy since the stock

market is a means of funding the activities of the

productive efforts or the company obtained from the

community who provide capital (investors). With the

capital markets, can help investors to invest their

funds with the aim of getting the asset. And the

company also assisted in getting financing or funds

as well as in conducting sales of an asset. The

existence of such event, the stock exchange formed

in ease of the transaction as well as capital market

activities so that mutually beneficial and corporate

investors. For investors through the capital markets,

they can choose the investment objects with various

levels of returns and the level of risk faced, while for

issuers (issuers) through the capital markets they can

collect long-term funds for support the continuity of

their business (Samsul, 2006).

The Composite Stock Price Index (IHSG) was

first introduced on April 1, 1983 as an indicator of

price movement of stocks listed on the Indonesia

stock exchange either common stock or preferred

stock. The Composite Stock Price Index (IHSG) is

an index that shows the movement of stock prices in

general, are listed on the stock exchange to become

a reference on the development of activities in the

capital market (Anoraga and Pakarti, 2001:101).

The price of shares in the stock exchange not

forever fixed, there are times when increased and

may also decrease depending on power demand and

supply, where the occurrence of such stock price

fluctuations make the stock attractive to some

investors (investors). On the other hand, the rise and

decline of stock prices could occur due to

fundamental factors, psychological as well as

external. Following the movement of the Composite

Stock Price Index (IHSG) in Indonesia year 1996-

2017.

The capital market in Indonesia is facing

challenges that are pretty heavy since the end of the

year 1997/1998, in conjunction with the shaken

Jarniati, S., Fitrawaty, . and Nugrahadi, E.

Analysis of the Determination of the Composite Stock Price Index in Indonesia Stock Exchange, 1996-2017.

DOI: 10.5220/0009506305610568

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 561-568

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

561

economy Indonesia joints by lacing the economic

crisis that almost the whole of the Asian region.

Composite stock price index (IHSG) has

experienced a very sharp downturn, where years of

1997-1998 composite stock price index (IHSG)

decreased by 29.85 percent and minus the year 1998

composite stock price index (IHSG) have

experienced a decline in of a minus 9.13 percent.

This is due to the economic crisis marked by the

depreciation of the exchange rate of the rupiah

against the dollar resulted in interest rates of

deposits and Bank Indonesia interest rates rose

sharply to 41.42 percent and inflation amounted to

77.65 percent.

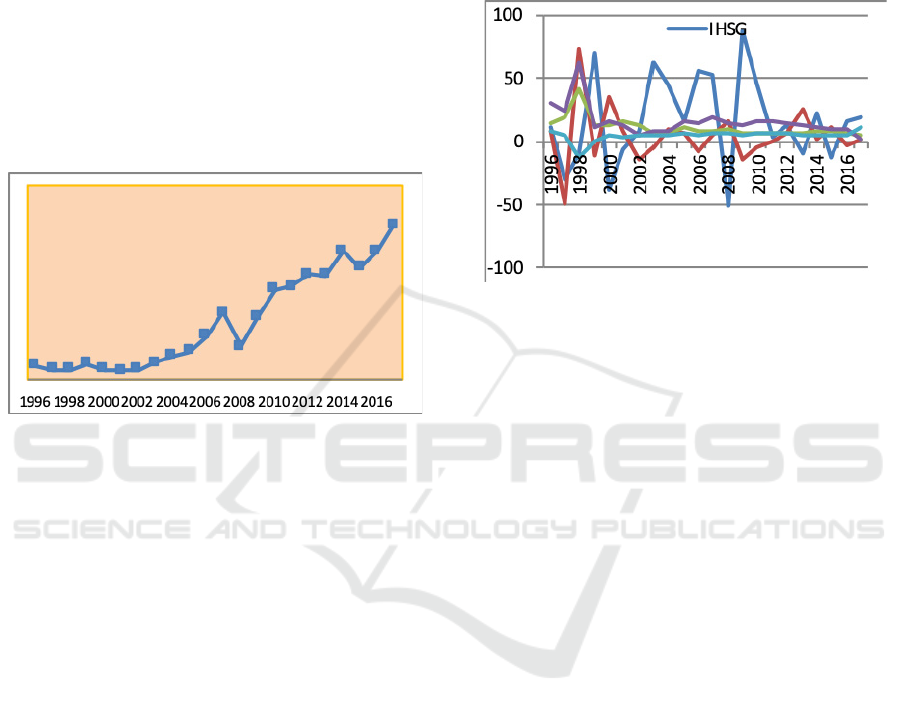

Figure 1: The trend of the Composite Stock Price

Index (IHSG) in Indonesia year 1996-2017.

The movement of the stock price index the

following year tend to experience increased despite

the decline in some periods. One of them is the year

2008 amounted to minus 50.64 percent. This

decrease occurs because of the global crisis that is

starting to feels its effects towards the end of the

year 2008 make a macro condition Indonesia get

heavy pressure. Although Indonesia's economy can

still grow by 6.10 percent and inflation from 11.06

percent in 2008. And the exchange rate of the rupiah

against the dollar in January 2008 of 9,291 rupiah

rising to 12,151 rupiah in September and then down

to 10,950 rupiah in December 2008 For the year

2017 growth composite stock price index (IHSG)

closed at the end of the year in the level of domestic

economic recovery predicted 6,355 continues amid

various challenges. Economy forecast to grow up 5.2

percent in 2017 than in 2016 by 5 percent with the

catalyst reference interest rates still low, Indonesia's

return to the export commodity prices and budget

infrastructure continues to grow.

Its own stock price index value can fluctuate

daily, this is because many factors affect the

movement. The movement of the stock price index

to be so important, because it can be used as one of

the benchmark investors prior to investing in the

capital markets and later it will affect the attitude of

the investors to buy, sell or hold some shares. As for

the influence of the composite stock price index

(IHSG) and macroeconomic variables, among

others, exchange rates, interest rates, money supply,

and GDP.

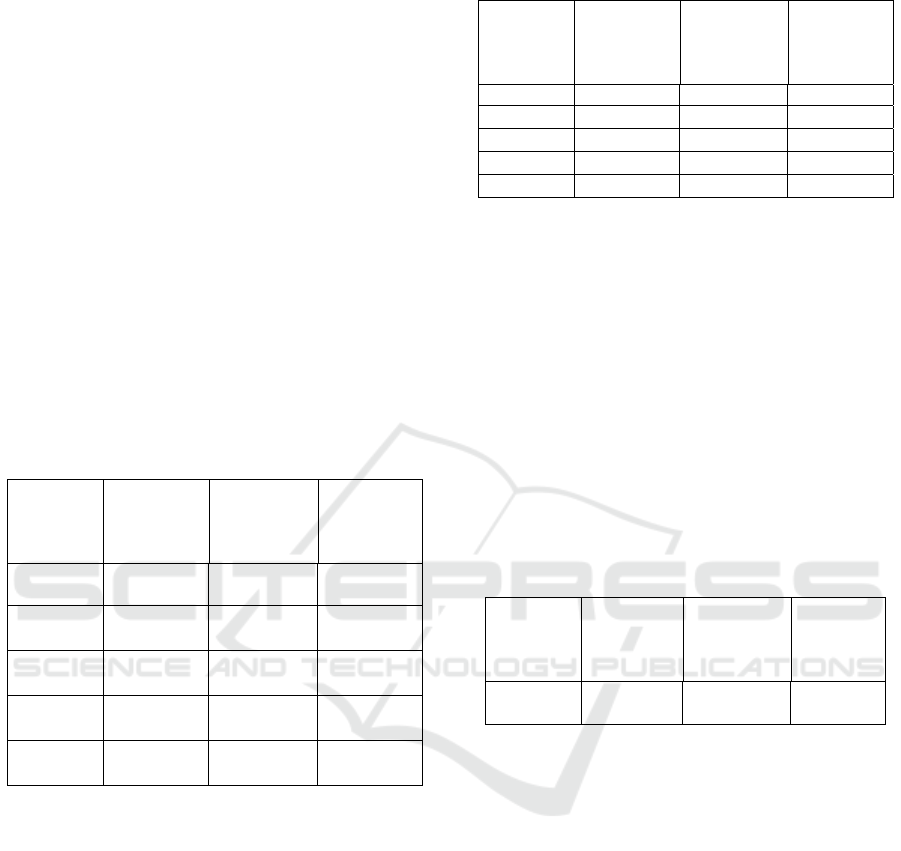

Figure 2: The movement of the Composite Stock

Price Index (IHSG) and macroeconomic variables.

Based on Figure 2 shows that the exchange rate

of rupiah increase of 4.24 percent to 16.25 percent in

2008. While the composite stock price index (IHSG)

experienced a decline in the year 2008 amounted to

minus 50.64 percent. With the increase in the price

of fuel oil, the year 2008 became a contributor to the

Bank Indonesia interest rates are quite high of 9.25

percent. Rising interest rates will make investors

will transfer their funds to the money market,

savings or deposits so that investments in capital

markets and can lower the price of the stock. While

the money supply year 2008 experienced a decline

of 19.32 percent to 14.94 percent. Changes in the

money supply will affect the interest rate. Interest

rate changes will affect your investments or even

consumption. GDP growth the year 2008 recorded

fairly good developments around 6.01 percent in the

middle of the occurrence of the external turmoil.

This data does not match the theory. The

phenomenon of the movement of the Composite

stock price Index (IHSG) in Indonesia attracted to

researchable. Empirical study and the phenomenon

of data that has been done previously showed the

importance of the research develop composite stock

price Index (IHSG) in Indonesia.

By developing researches past, the author

concludes that the role of macroeconomic factors

and affecting the composite stock price Index

(IHSG) in Indonesia is still important. In General,

this research examines the relationship between the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

562

independent variable and the dependent variable in

the short-term and long-term. The purpose of this

research is to analyze the effect of the exchange rate

(EXC), Bank Indonesia interest rate (BI Rate), the

money supply (MS), and the GDP against the

composite stock price Index (IHSG) in Indonesia.

2 THEORETICAL FRAMEWORK

According to the monetary Approach States that the

increase in the domestic money supply would cause

a domestic price increase in proportional and by

parity of purchasing power will encourage the

occurrence of depreciation of domestic currency.

The drop in the exchange rate of the domestic

currency eventually will reduce corporate earnings

which means also a decrease in the company's share

price (Shapiro 1996).

The rise and fall of interest rates could affect

stock prices. The impact of interest rates is generally

not directly. The decline in interest rates will cause

the interest rate for savings deposits in banking

becomes not interesting. The community will be

looking for another alternative with the higher yield

on the capital market. The decline in interest rates

will make lending interest expense decreased so that

it encourages expansion and the increase in net

profit. In the long run, the increase in net income can

make the stock price increases. While rising interest

rates against the stock give effect in the short-term.

The rise in interest rates would increase the burden

on companies (issuers) that can further lower the

price of the stock. Rising interest rates will make

investors will transfer their funds to the money

market, savings or deposits so that the investment in

the trading floor and then lowering the stock price.

Otherwise, once the lower interest rates will make

investors withdraw funds in the bank and will be

redirected to invest on the stock exchange (Mankiw,

2003).

According to Samsul (2006:210) which States

that the more money in circulation in the hands of

the community then it will be the higher the stock

price because the public will figure out how to

allocate their funds. The amount of money in

circulation will cause interest rates to drop, so

people did not choose the appropriate investment in

banking but in the form of shares. This can be

caused because in the short term, the public will

choose to invest in something that can be melted

easily and at risk are small, such as valuables easy

for refunded. Because in the short-term, the public

will prefer to meet their needs first, so to invest in a

stock that has a pretty big risk not so frowned upon

by the community. In the long-term when the money

circulating within the community is increasing, then

the appropriate people invested in stocks than in

savings or deposits any shares so demand will

increase.

Based on the principle of Acceleration there is a

link between national income with investment. To

achieve a greater level of investment, if national

income the greater amount. In contrast, the

investment will be increased if low national income,

does not evolve and will become low (Mankiw,

2003).

3 RESEARCH METHOD

The data will be used in this research in the form of

secondary data. Secondary data that will be used is

the data time series during the year 1996-2017

which is the total amount of data the exchange rate

(EXC), Bank Indonesia interest rate (BI Rate), the

money supply (MS), and the GDP against the

composite stock price Index (IHSG) in Indonesia.

The data can be taken from the Bank Indonesia (BI),

the Central Bureau of Statistics (BPS) and Indonesia

Stock Exchange (IDX) or via the official website of

each of the institutions (www.bi.go.id and

www.bps.go.id).

The estimation model used in this study is the

analysis of the dynamic model with the regression

that is by using the model of error correction (Error

Correction Model/ECM) Domowitz and Elbadawi.

In the context of Economics, the dynamic model

specification is very important because it deals with

the establishment of the model of an economic

system that is associated with the change of time of

both short-term and long-term. This study uses

statistics programs help E-Views version 7.

4 ANALYSIS

4.1 Stationer Test

The first thing to do is to examine whether the data

is stationary or not. This Stationeritas test needs to

be done because a regression analysis should not be

done when the data used is not stationary and

normally if it still done the resulting equations then

are a spurious regression. The test methods used in

this Test method is stasioneries Unit Root Test or

Analysis of the Determination of the Composite Stock Price Index in Indonesia Stock Exchange, 1996-2017

563

also known as the test of the Augmented Dickey-

Fuller (ADF).

4.1.1 Unit Root Test

The value of the test results with the Augmented

Dickey-Fuller (ADF), indicated by the value of the

statistical regression coefficients t on the observed

variable (X). If the value is greater than the value of

the ADF test critical values MacKinnon on the level

of the 1%, 5%, or 10%, then the stationary means

data.

Based on table 1 that the money supply (MS),

Bank Indonesia interest rate (BI Rate), the exchange

rate (EXC), the gross domestic product (GDP), and

the composite stock price Index (IHSG) is not

significant at the α = 5%. Because not stationary at

the zero degrees, then it needs to be done again

using stationarity test the degree of integration of the

single.

Table 1: Unit Root Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Desc

IHSG

-0.391630

-3.012363

Non-

Stationar

y

MS

-1.946926

-3.052169

Non-

Stationary

BI Rate

-2.548890

-3.029970

Non-

Stationary

EXC

-2.126737

-3.012363

Non-

Stationary

GDP

-0.359774

-3.040391

Non-

Stationary

4.1.2 Integration Test

A test of the degree of integration is a test done to

measure at the level of difference to how data all the

variables are stationary. The taking of decision is

when the count of an ADF variable is greater than

the critical value of MacKinnon, means the variable

is stationary, and vice versa.

Based on table 2 that variable the money supply

(MS), Bank Indonesia interest rate (BI Rate), the

exchange rate (EXC), the gross domestic product

(GDP), and the composite stock price Index (IHSG)

has been stationary at the same degree, that is one

degree, shown from the ADF value calculate more

than the value of the critical (Mackinnon critical

values) at α = 5%. Thus, the Granger test requires a

stationary data at the same degree can be used.

Table 2: Integration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Desc

IHSG -5.656342 -3.020686 Stationar

y

MS -3.258881

-3.020686 Stationary

BI Rate -4.554577

-3.020686 Stationary

EXC -3.054861 -3.029970

Stationary

GDP -3.599042 -3.020686

Stationary

4.1.3 Cointegration Test

In this research to test the residual method based

cointegration test. Residual-based test method using

statistical tests Augmented Dickey-Fuller (ADF) by

observing the regression residual cointegration

stationary or not. Then this residual value will be

tested using the test Augmented Dickey-Fuller

(ADF) to find out if the residual value of the

stationary or not. The results of this research show

that the estimated value of the ADF test > Critical

Value α = 5% (-3.891891 >-3.012363). So it could

be inferred that the empirical model used in this

study to qualify for the cointegration test.

Table 3: Cointegration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Desc

ECT

-3.891891

-3.012363

Stationar

y

4.2 Estimation Error Correction Model

(ECM)

Estimation model of inflation using the model of

Error Correction Model (ECM) Domowitz and

Elbadawi aims to seek short-term balance or correct

an imbalance towards short-term long-term balance.

To know that a used Error Correction Model (ECM)

is valid or not can be seen from the value of the

Error Correction Term (ECT) are significant or not.

Equation Error Correction Model (ECM) for a short-

term period are as follows:

The results of estimation Error Correction Model

(ECM) that short-term variable the money supply

(MS), Bank Indonesia interest rate (BI Rate), the

ECTGDP

BIRateMSDLnIHSG

938950.0409125.5EXC439834.0

064296.0642198.2714068.0

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

564

exchange rate (EXC), and the gross domestic

product (GDP) have a negative influence against the

composite stock price Index (IHSG) in Indonesia.

The magnitude of the balance and changes the

previous the composite stock price Index (IHSG)

against the period now is 0.98 percent. These

adjustments are obtained from coefficients the Error

Correction Term (ECT) of 0.988950 while the t-

statistics is 5.140962 with probability 0.0001 so

significant at 5% and means that the model can be

used.

Table 4: The Results of The Estimation of the Error

Correction Model (ECM) Short-Term

Independent

Variables

Coefficient t-Statistic Prob

D(LnMS) -2.642198 -3.116654

0.007

1

D(LnBI Rate) -0.064296 -3.045324

0.008

2

D(LnEXC) -0.439834 -1.973081

0.067

2

D(LnGDP) -5.409125 -2.878156

0.011

5

ECT 0.938950 5.140962

0.000

1

C 0.714068 3.788115

0.001

8

R-squared

Adjusted R-squared

F-statistic

Prob(F-statistic)

Durbin-Watson stat

0.756959

0.675946

9.343614

0.000335

1.834620

Equation Error Correction Model (ECM) for

long-term periods are as follows:

The results of estimation Error Correction Model

(ECM) that long-term variable changes Bank

Indonesia interest rate (BI Rate), the exchange rate

(EXC) of previous periods have a negative effect

against the composite stock price Index (IHSG).

While the Government spending variables the

money supply (MS), and economic growth (GDP)

previous periods have a positive effect against the

composite stock price Index (IHSG).

Table 5: The Results of The Estimation of the Error

Correction Model (ECM) Long-Term.

Independen

t Variables

Coefficient t-Statistic Prob

LnMS(-1)

0.270105 1.027487 0.3195

LnBI Rate(-

1

)

-0.088986 -1.928895 0.0717

LnEXC(-1)

-0.258058 -0.616914 0.5460

LnGDP(-1)

2.351471 3.502571 0.0029

C

-27.69448 -3.709158 0.0019

R-squared

Adjusted R-

squared

F-statistic

Prob(F-statistic)

Durbin-Watson

stat

0.938155

0.922694

60.67775

0.000000

1.575439

4.3 Statistical Tests

4.3.1 F-Test (Simultaneous Test)

F test or simultaneous test is performed to see the

effect of free variables simultaneously or together to

the dependent variable. The value of F-statistic Prob

0.000335 < 0.05. So it can be inferred that the

money supply (MS), BI interest rate (BI Rate), the

exchange rate (EXC) and gross domestic product

(GDP), a significant effect simultaneously against

the composite stock price index (IHSG) in Indonesia

4.3.2 T-Test (Partial Test)

The Money Supply (MS)

Based on the results of the study showed that the

change in the short-term money supply (MS) is a

negative and significant effect against the composite

stock price index (IHSG) in Indonesia with a

coefficient of -2.642198. This means if the money

supply rose by 1 billion rupiahs, then the composite

stock price index (IHSG) will be down by -2.642198

percent.

While the changes in the money supply (MS) no

effect on long-term change composite stock price

index (IHSG) in Indonesia with a coefficient of

0.270105.

Interest Rate BI (BI Rate)

Based on the results of the study showed that the

percentage of change in the interest rate BI (BI Rate)

in the short-term to change the percentage of the

composite stock price index (IHSG) in Indonesia

with a coefficient of -0.064296. If changes to the BI

interest rate rose by 1 percent, then the composite

stock price index changes (IHSG) in Indonesia

would drop -0.064296 percent.

GDPBIRate

MSnIHSG

351471.2EXC258058.0

088986.0270105.069448.27L

Analysis of the Determination of the Composite Stock Price Index in Indonesia Stock Exchange, 1996-2017

565

While in the long-term the interest rate BI (BI

Rate) has a negative and significant effect against

the composite stock price index (IHSG) in Indonesia

with a coefficient of -0.088986. This means if the

interest rate BI (BI Rate) rose by 1 percent, then the

composite stock price index will be down by

0.088986 percent.

The Exchange Rate (EXC)

Based on the results of the study showed that

changes in exchange rates in the short-term to

change the percentage of the composite stock price

index (IHSG) in Indonesia with the coefficient of

-0.439834. If changes in the money supply rose by

Rp 1/US dollar, then change the percentage of the

composite stock price index (IHSG) going up by

0.439834 percent.

While in the long-term Exchange rates had a

negative and no significant influence against the

composite stock price index (IHSG) in Indonesia. If

the exchange rate rose by Rp 1/US dollar, then

change the percentage of the composite stock price

index (IHSG) going down by 0.258058 percent.

The Gross Domestic Product (GDP)

Based on the results of the study showed that the

change of the gross domestic product (GDP) in the

short-term to change the percentage of the composite

stock price index (IHSG) in Indonesia with a

coefficient of -5.409125. If the change of gross

domestic product rose by 1 billion rupiahs, then

change the percentage of inflation will be down by

5.409125 percent.

While in the long-term the gross domestic

product (GDP) has a positive and significant

influence the composite stock price index (IHSG) in

Indonesia with a coefficient of 2.351471. If the

change of the gross domestic product (GDP) rose by

1 billion rupiahs, then the change in the composite

stock price index (IHSG) will rose by 2.351471

percent

4.3.3 Goodness of Fit Test

Test coefficient determination (R

2

) is used to see

how big the variation of free variables may explain

the variables bound. Adjusted R-squared value of

0.756959 can be explained that Government

spending variable precision (GS), the that the money

supply (MS), BI interest rate (BI Rate), the exchange

rate (EXC) and gross domestic product (GDP),

explains the variations change the composite stock

price Index (IHSG) amounted to 75.69 percent.

While the rest of 24.31 percent described other

factors outside the model.

5 RESULTS

5.1 Influence The Money Supply (MS) against

the Composite Stock Price Index (IHSG)

in Indonesia

Based on the results of the study showed that the

change in the short-term money supply (MS) is a

negative and significant effect against the composite

stock price index (IHSG) in Indonesia with a

coefficient of -2.642198. This means if the money

supply rose by 1 billion rupiahs, then the composite

stock price index (IHSG) will be down by -2.642198

percent. This is due to that the growing money

supply will trigger an uptrend, so with the condition

the price increases then the money held by the

community just simply used to make transactions.

Thus with the condition of the community does not

have an excess of money that can be used to save in

the form of savings or invested in the form of shares.

This is not in accordance with the research of the

goddess Kumalasai (2016) shows that the influence

of the money supply (MS) against the composite

stock price index (IHSG) positive effect.

While the changes in the money supply (MS) no

effect on long-term change composite stock price

index (IHSG) in Indonesia with a coefficient of

0.270105. This is due to the greater quantity of

money held by the society, indicating the high level

of people's income, which in turn will encourage

people to invest and increase the composite stock

price index (IHSG). But the amount of money

circulating in the previous period has not had an

influence on the composite stock price index

(IHSG). And according to a research of Ash-Shidig

& Setiawan (2015) stating that the money supply

had no effect against the Jakarta Islamic Index stock

index

5.2 Influence the Interest Rate BI against the

Composite Stock Price Index (IHSG) in

Indonesia

Based on the results of the study showed that the

percentage of change in the interest rate BI (BI Rate)

in the short-term to change the percentage of the

composite stock price index (IHSG) in Indonesia

with a coefficient of -0.064296. If changes to the BI

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

566

interest rate rose by 1 percent, then the composite

stock price index changes (IHSG) in Indonesia

would drop -0.064296 percent. It is due to a rise in

interest rates BI (BI Rate) then it will directly

increase the burden of interest. Companies that have

high leverage will have a very heavy impact against

a rise in interest rates. The rise in interest rates will

be able to reduce the profitability of the company

from rising costs (cost) of the company so that it can

be said that the rising interest rate effect negatively

to a stock price index. This is not in accordance with

the theories of Keynes. According to Samsul

(2006:204), the increase in the interest rate of the

loan could increase credit interest charges and lower

net profits of the company. The profit decline will

result in earnings per share also decreased so that the

resulting decline in stock prices in the market. On

the other hand, the rise in deposit interest rates will

encourage investors to sell stocks and then switch

into deposits. This led to the increase in Bank

Indonesia interest rate will result in a decline in the

stock price, vice versa

While in the long-term the interest rate BI (BI

Rate) has a negative and significant effect against

the composite stock price index (IHSG) in Indonesia

with a coefficient of -0.088986. This means if the

interest rate BI (BI Rate) rose by 1 percent, then the

composite stock price index will be down by

0.088986 percent. In the long term interest rates

have no effect against the stock price because

investors in Indonesia is a type of investor who does

profit taking action in hopes of obtaining capital

gains. Can also be caused the stock market less

rapidly adjust interest rate information into stock

prices. And according to research Kewal (2012),

Kumar and Puja (2012), Mok (2004). Interest rates

do not affect the stock price because investors in

Indonesia is a type of investor who conducts

transactions in shares so investors tend to do profit

taking action in hopes of obtaining capital gains

5.3 Influence Exchange Rate (EXC) against

the Composite Stock Price Index (IHSG)

in Indonesia

Based on the results of the study showed that

changes in exchange rates in the short-term to

change the percentage of the composite stock price

index (IHSG) in Indonesia with the coefficient of -

0.439834. If changes in the money supply rose by

Rp 1/US dollar, then change the percentage of the

composite stock price index (IHSG) going up by

0.439834 percent. In the short-term the exchange

rate has no effect against the composite stock price

index (IHSG). This is not in accordance with the

theory of the balance of payments approach where if

import bigger then a balance of payments deficit

which will mean a demand for foreign currencies

will increase thus lowering domestic currency and

vice versa. The weakening domestic currency will

weaken the purchasing power of these result in a

decline in corporate earnings, which in turn will

lower profits. This will lower the profit decline in

the value of the company and eventually lower the

price of the company shares (Shapiro 1996).

While in the long-term Exchange rates had a

negative and no significant influence against the

composite stock price index (IHSG) in Indonesia. If

the exchange rate rose by Rp 1/US dollar, then

change the percentage of the composite stock price

index (IHSG) going down by 0.258058 percent. This

is because shareholders in the stock exchange in

Indonesia did not consider the change of rate in the

analysis of investment shares. And in line with the

research done Luh Gede Sri Artini, et al using

Ordinary Least Square (OLS) shows that the

exchange rate effect is negative and insignificant

against the composite stock price index in Indonesia.

5.4 Influence Gross Domestic Product (GDP)

against the Composite Stock Price Index

(IHSG) in Indonesia

Based on the results of the study showed that the

change of the gross domestic product (GDP) in the

short term to change the percentage of the composite

stock price index (IHSG) in Indonesia with a

coefficient of -5.409125. If the change of gross

domestic product rose by 1 billion rupiahs, then

change the percentage of inflation will be down by

5.409125 percent. This does not fit the theory of

Keynes, the higher a person's income then the

motive money already complex requests to the

speculative motive. Rising gross domestic product

(GDP) is a good signal (positive) for investment and

vice versa. Increase the gross domestic product

(GDP) had the purchasing power of the consumer so

that they can increase the demand for the company's

products. An increase in demand for the company's

products will increase the profit of the company and

ultimately may increase the company's share price

(Tandelilin, 2010:212).

While in the long-term the gross domestic

product (GDP) has a positive and significant

influence the composite stock price index (IHSG) in

Indonesia with a coefficient of 2.351471. If the

change of the gross domestic product (GDP) rose by

1 billion rupiahs, then the change in the composite

Analysis of the Determination of the Composite Stock Price Index in Indonesia Stock Exchange, 1996-2017

567

stock price index (IHSG) will rose by 2.351471.

This is in accordance with the principles of the

theory of Acceleration, there are a very tight linkage

between national income with investment.

Investment opportunity for achieving a greater level

of national income in increasingly large numbers. In

contrast, the investment will be increased if low low

national income, does not evolve and foretold will

be incremented (Tandelilin, 2010:212).

6 CONCLUSIONS

Only The variable amount of the money supply

(MS), BI interest rate (BI Rate) and gross domestic

product (GDP) in the short-term a negative and

significant effect against the composite stock price

index (IHSG) in Indonesia. While the variable

exchange rates (EXC) in the short-term and the

long-term have no effect against the composite stock

price index (IHSG) in Indonesia. And gross

domestic product (GDP) is a positive and significant

effect against the composite stock price index

(IHSG). While in the long-term the money supply

(MS) and the BI interest rate (BI Rate) have no

effect against the composite stock price index

(IHSG).

Adjusted R-squared value of 0.756959 can be

explained that Government spending variable

precision (GS), the that the money supply (MS), BI

interest rate (BI Rate), the exchange rate (EXC) and

gross domestic product (GDP), explains the

variations change the composite stock price Index

(IHSG) amounted to 75.69 percent. While the rest of

24.31 percent described other factors outside the

model.

Because of and gross domestic product (GDP) is

the main determining factor affecting the composite

stock price index (IHSG) in Indonesia in both short-

term and long-term so that the Government together

with the private sector and the people able to work

synergistically to increase the gross domestic

product in order to be able to push the performance

of capital markets. As for steps that can be taken

include enhancement of human resources with a

wide range of conveniences in education and the

improvement of infrastructure and means of

supporting the economy. As well as the granting of

licenses and the ease of bureaucracy for the

construction industry and the economy.

REFERENCES

Anoraga, Pandji dan Pakarti, Piji. (2001). Pengantar

Pasar Modal. Edisi Revisi, Cetakan III.Rineka

Cipta. Jakarta.

Ash-Shidig, Setiawan, et al. (2015). Analisis

Pengaruh Suku Bunga SBI, Uang Beredar,

Inflasi Dan Nilai Tukar Terhadap Indeks Harga

Saham Jakarta Islamic Index (JII). Jurnal

Ekonomi & Perbankan Syariah Vol.3 No.2

Oktober 2015, Hal 25-46.

Kewal. (2012). Pengaruh Inflasi, SBI, Kurs, dan

Pertumbuhan PDB Terhadap IHSG. Jurnal

Economia, Vol. 8, No.1 April 2012.

Kumar, N. P., and Padhi Puja. (2012). The Impact of

Macroeconomic Fundamentals on Stock Prices

Revisited: An Evidence from Indian Data. Junal

MPRA Paper. No. 38980.

Luh Gede Sri Artini, et. (2017). Analisis

Fundamental Makro Dan Integrasi Pasar Saham

Dunia Dengan Bursa Efek Indonesia. Jurnal

Manajemen Strategi Bisnis & Kewirausahaan

Vol. II No.2 Agustus 2017.

Mok, H. (2004). Causality of Interest Rate,

Exchange Rate and Stok Prices at Stock Market

Open and Close in Hongkong. Asia Pacific

Journal of Management. Vol. 10:2.

Mankiw, N. Gregory. (2003).“Teori Makro

Ekonomi”. Edisi Kelima. Jakarta: Erlangga.

Samsul, Mohamad. (2006). Pasar Modal dan

Manajemen Portofolio. Edisi Pertama. Erlangga.

Jakarta.

Shapiro, A. (1996). Multinational Financial

Management. 5th Edition, Prentice-Hall

International. International Conference on

Trends in Multidisciplinary Business and

Economics Research, Timber 2014, Vol. 1, 55-

61, ISBN 978-969-9948-36-7.

Tandelilin, Eduardus. (2010). Portofolio dan

Investasi : Teori dan Aplikasi. Edisi Pertama.

Kaniskus. Yogyakarta

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

568