Analysis of Factors Affecting the Indonesian Syariah Stock Index

(ISSI) on the Indonesian Stock Exchange (IDX)

Siska Angriani Hasibuan

1

, Arwansyah

1

and Sri Fajar Ayu

1

1

Department of Economics, Faculty of Economics, State University of Medan, North Sumatra, 20219, Indonesia

Keywords: Indonesian Syariah Stock Index (ISSI), Inflation, BI Rate, Exchange Rate, Error Correction Model (ECM)

Abstract: The Indonesian Syariah Stock Index (ISSI) is an indicator that can be used by investors to know the

movements of the sharia stock market. This research aims to analyze the effect of the Indonesian Syariah

Stock Index (ISSI) on the Indonesian Stock Exchange (IDX). The analysis uses equations by the method of

Error Correction Model (ECM). This study analyzed the relationship between the dependent and independent

variables in both the short term and long term. Estimation results show that in the long term and the short

term, the variable amount of the inflation was a positif and significant in the short term but not significant in

the long term affect the Indonesian Syariah Stock Index (ISSI). The variable amount of the BI rate and

exchange rate was a negative and significant in the short term but not significant in the long term affect the

Indonesian Syariah Stock Index (ISSI). These results show that inflation, BI rate and exchange rate was

significant in the short term affect the Indonesian Syariah Stock Index (ISSI) on the Indonesian Stock

Exchange (IDX).

1 INTRODUCTION

The capital market has a very important role in the

economic development of a country, because with

increasing capital gathered in an economy will be

able to raise national income and employment for

the economy will be able to raise national income

and employment for the economy. Thus, the capital

market is one of the means that are effective in

moving the Community Fund for the next

transmitted on productive activities. In Indonesia,

the capital markets use the term stock exchanges.

Where, the capital market is a meeting between

parties that have excess funds with parties which

needs the funds by way of trade in securities. Capital

markets could also be interpreted as a market to

trade in securities that generally have aged more

than one year as stocks and bonds. While the place

where happened and selling securities called

Exchange. Therefore, the stock exchange is the

meaning of physical capital markets.

Sharia capital market in Indonesia is getting

lively with the birth of Indonesian Syariah Stock

Index (ISSI) issued by the Bapepam-LK and the

Board of the National Assembly of the Islamic

Ulama Indonesia (DSN-MUI) on May 12, 2011.

ISSI is an Islamic stock index that comprises all

shares listed in the Indonesia stock exchange and is

joined on the list of effects.

According to Syahrir (1995:81) to be able to

answer whether the stock market will continue to

grow on an ongoing basis then the most important

factors determining depends on two things, namely

the condition of macro economy Indonesia and

political stability nationwide. So the development of

Islamic stock index was also influenced by several

macro-economic and monetary factors such as Bank

Indonesia Certificate interest rate, inflation,

exchange rates and other internal factors such as the

condition of the national economy, the conditions

politics, security, Government policy, and others.

The development of Indonesian Syariah Stock

Index (ISSI) in Indonesia stock exchange (idx) for

kurum time 2015 – 2017 fluctuating progression. In

the year 2015, Indonesian Syariah Stock Index

(ISSI) experienced a growing increase in i.e. from

January 2015 until March 2015. With

katipitalisasinya Rp 2,997,601.71 (Billion) to reach

Rp 3,068,467.89 (billion) or experienced an increase

of 1.69%. But the following month decreased by

7.47%. The decline of Indonesian Syariah Stock

Index (ISSI) going to the Moon and back in

554

Hasibuan, S., Arwansyah, . and Ayu, S.

Analysis of Factors Affecting the Indonesian Syariah Stock Index (ISSI) on the Indonesian Stock Exchange (IDX).

DOI: 10.5220/0009506205540560

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 554-560

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Spetember increased until the end of December

2015.

Of the curve below can be known that ISSI from

January 2015 until December 2017 experiencing

fluctuations in each period features. On average in

the period of observation, i.e. Rp. ISSI value

3,069,621.312. The value of the highest ISSI

occurred in December 2017 i.e. Rp 3,704,543.09,

while the lowest values of ISSI occurs in September

2015 i.e. Rp 2,449,104.28. High low ISSI can reflect

the development of Sharia capital market in

Indonesia.

Figure 1: The development of Indonesian Syariah

Stock Index 2015-2017

Based on the classical view that the main

factors affecting inflation is the money supply and

credit. View of keynes then add some variables such

as interest rates, government spending and

investment (Ackley,1983:543).

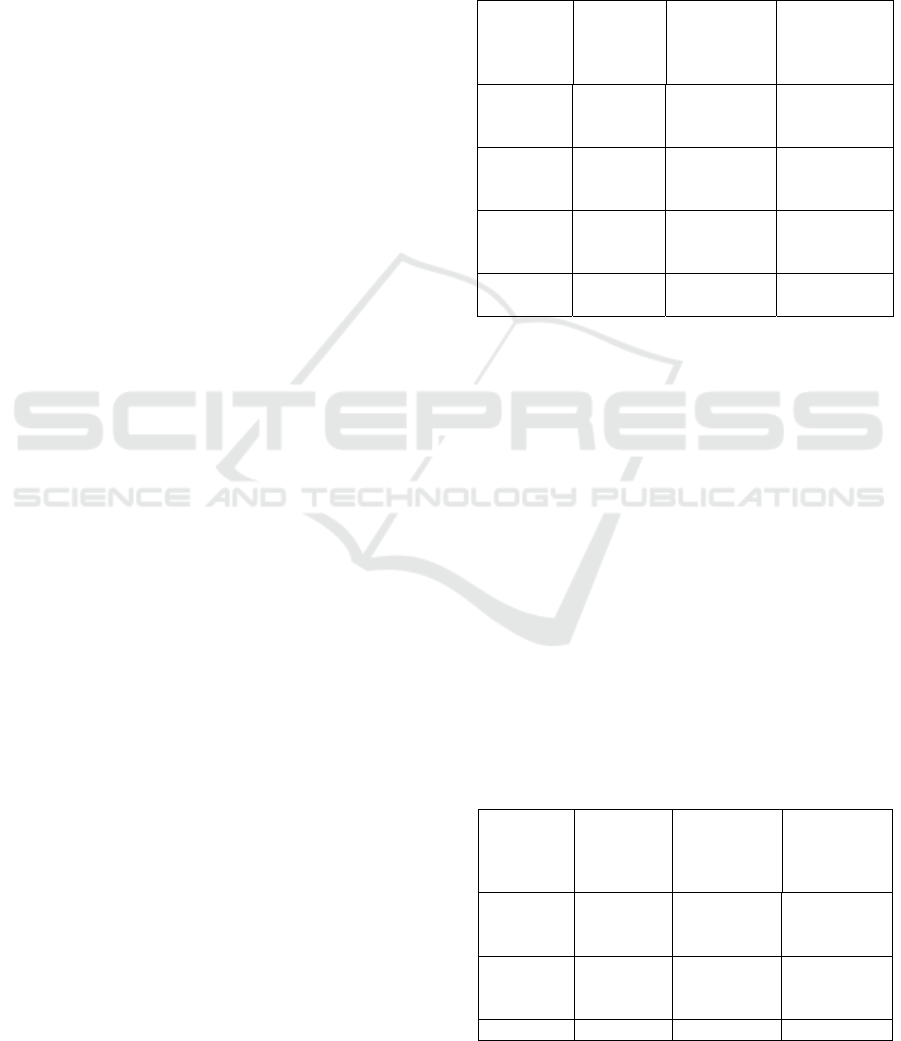

Table 1: The Development of Indonesian Syariah

Stock Index (ISSI), Inflation BI Rate, Exchange

Rate (Kurs) in Indonesia

Month of

Year

Capitalisasion

ISSI

(Milyar)

Inf

BI

Rate

Kurs

January

2015 2997601 6.96 7.75 12672

February

2015 3045813 6.29 7.5 12932

Maret 2015 3068468 6.38 7.5 13074

April 2015 2852498 6.79 7.5 12963

May 2015 2960219 7.15 7.5 13224

June 2015 2863814 7.26 7.5 13339

July 2015 2813505 7.26 7.5 13539

Agust 2015 2591624 7.18 7.5 14067

September

2015 2449104 6.83 7.5 14653

Oktober

2015 2576748 6.25 7.5 13684

November

2015 2556257 4.89 7.5 13847

Desember

2015 2600851 3.35 7.5 13788

January

2016 2598203 4.14 7.25 13788

February

2016 2689933 4.42 7 13375

Maret 2016 2796013 4.45 6.75 13329

April 2016 2824409 3.6 6.75 13180

May 2016 2804579 3.33 6.75 13648

June 2016 3029644 3.45 6.5 13210

July 2016 3172188 3.21 6.5 13112

Agust 2016 3263157 2.79 5.25 13270

September

2016 3256322 3.07 5 13042

October

2016 3127302 3.31 4.75 13048

November

2016 3291469 3.58 4.75 13555

December

2016 3175053 3.02 4.75 13473

January

2017 3168780 3.49 4.75 13369

February

2017 3214256 3.83 4.75 13336

Maret 2017 3323611 3.61 4.75 13322

April 2017 3402986 4.17 4.75 13329

May 2017 3378520 4.33 4.75 13323

June 2017 3491395 4.37 4.75 13348

July 2017 3477373 3.88 4.75 13325

Agus 2017 3506954 3.82 4.5 13342

September

2017 3478918 3.72 4.25 13472

October

2017 3526648 3.58 4.25 13563

November

2017 3427607 3.3 4.08 13526

December

2017 3704543 3.61 3.96 13555

Source: Central Bureau of Statistics (BPS), Bank

Indonesia

Inflation in January 2015 experience

increased until July 2015 up to 0.93%. Then the

following month until November 2015 decline. The

development of the fluctuating inflation happen until

2017.

According to Mankiw (2005:157) the interest

rate is the price of connecting the present and future

and constitutes an important variable between

‐10.00%

‐5.00%

0.00%

5.00%

10.00%

Jan‐2015

April‐2015

Juli‐2015

Okt‐2015

Jan‐2016

April‐2016

Juli‐2016

Okt‐2016

Jan‐2017

April‐2017

Juli‐2017

Okt‐2017

IndonesianSyariahStockIndex(ISSI)

2015‐2017

Analysis of Factors Affecting the Indonesian Syariah Stock Index (ISSI) on the Indonesian Stock Exchange (IDX)

555

macroeconomic variables. Or the market price of

transferring resources past and future or is the result

of savings and the cost of borrowing (Mankiw,

2005:494).

The development of the BI interest rate (BI Rate)

by the year 2015 on the 7.5 range experience. BI

interest rate (BI Rate) experienced a significant

decline until 2017 December.

The movement of the exchange rate of the rupiah

(exchange rate) from January to December 2015

2017 experienced trends that tend to rise with the

volatility is very high, this is a reflection of the

condition of the economy of the country. Over time,

from January 2016 rupiah exchange rate of Rp

13.788/dollar. But entered February until the middle

of March, the exchange rate of the rupiah gradually

experience the appreciation. However, until

December, school effects Trump, the rupiah

exchange rate experience depreiasi 1.8 percent. The

rupiah has been pushed back to positive sentiment

and strengthened through December 2016 rupiah

exchange rate of Rp 13.743/dollar. The exchange

rate of the rupiah tends to be stable through the year

2017.

In fact the company's share price is determined

by the company's prospects in the future. The share

price is a reflection of good corporate management

by management to create and utilize business

prospects, so take advantage and was able to fulfill

his responsibilities towards the owners, employees,

community, and Government. Therefore, the ability

to analyze the operating and financial performance

of the company as well as its market development

will greatly help the success of the investment in the

capital market. Based on the berlakang setting and

observing the State of the economy continues to

grow, the authors are interested in conducting a

study entitled "analysis of the factors that Affect

Indonesian Syariah Stock Index (ISSI) in Indonesia

stock exchange (BEI) ".

2 THEORETICAL FRAMEWORK

The stock is the securities described the inclusion of

capital into a company. While in principle the

Sharia, the inclusion of capital carried out on

companies – companies that do not violate the

principle – the principle of Shariah, such as the field

of gambling, usury, prohibited items such as

producing beer and others (Sutedi, 2011). According

to Kurniawan (2008), the stock of Sharia is shares

issued by a company that has the characteristics in

accordance with the Islamic Sharia.

Indonesian Syariah Stock Index (ISSI) is an

indicator that can be used by investors to know the

movement of the stock market. By looking at the

figures of the index, then it can be known whether

the current market movements increase or decrease

from the previous one. The index serves as an

indicator of market trends, that means the movement

of an index describing market conditions at any

given time.

According to Tandelilin (2010), inflation is the

trend of increased prices of products as a whole so

that's happening a decrease in the purchasing power

of money. Whereas Sukirno (2006) explains that

inflation is a process of rising prices are different in

anything the economy. Further Perspective (2000)

and Diantoro (2010) tells us that inflation is the

increase in the prices of goods and services in a

specific period of time. Inflation happens when

prices continue creeping up as a result of economic

growth or too the amount of money circulating in the

market. When a country is experiencing high

inflation and increase bersifatuncertainty (uncertain)

then the risk of investing in the asset-inflated

asetkeuangan and keredibilitas akanmelemah

domestic currency against global currencies.

The interest rate is the amount of interest payable

per unit of time is referred to as a percentage of the

amount loaned (Samuelson and Nordhaus, 2004).

The investment is also a function of the buga. The

higher the interest rate, the desire of the community

to make an investment also is getting smaller. The

reason, an entrepreneur will increase spending on its

investments in profits expected from the investment

is greater than the interest rate to be paid to the

investment fund is the cost for the use of funds (Cost

of Capital). Lower interest rates, then employers

would be more inclined to make investments,

because the cost of the use of funds is also the more

minor. According to Widoatmodjo (2007), the

interest rate of Bank Indonesia (BI-rate) is the

interest rate in response to changes in inflation and

exchange rate of the rupiah as a reference to the

banking interest rates.

Mankiw (2006) translation Chriswan Sungkono,

the exchange rate is the value used when someone

exchanged the currency of a country with the

currency of other countries. So the exchange rate is

the USD/INR value or the price of the rupiah which

is expressed in dollars, where the value is affected

by supply and demand. Exchange rates will affect

the sectors trade import export-related. Fluctuations

in the value of the uncontrolled rate can affect the

performance of companies listed on the stock

market. At a time when the value of the rupiah

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

556

terdespresiasi United States dollars, with the price of

imported goods become more expensive, especially

for a company that most raw material use of

imported products. The increase in the import of

such materials will automatically increase the cost of

production and in the end they would affect the rate

of decline in corporate profits, so this will have an

impact on the company's share price movement then

trigger against weakening of the movement of the

stock price index.

3 RESEARCH METHOD

Approach this research using a quantitative

approach, namely by means of measuring the

variables that are encircled by theory or a set theory

(conceptual framework). data collection is done

using secondary data sourced from the Central

Bureau of statistics (BPS), the financial services

authority (OJK), Bank Indonesia (BI) and of the

related reading material. The data used in this

research in the form of time series data (runtun time)

with a span of 3 years i.e. from January 2015 until

December 2017.

The estimation model used in this study is the

analysis of Error Correction Model (ECM) or

known by the error correction model is a model that

is used to look at the influence of long term and

short term from each of the independent variables

are bound against free (Satria, 2004). According to

Sargan, Engle and Granger, error correction model is

a technique for correcting an imbalance towards

short term long term balance, and may explain the

relationship between the variables bound to the free

variables on time now and time past. This analysis is

performed to correct imbalances in the short term

towards the long term. This study uses statistics

programs help E-Views of version 7.

4 ANALYSIS

4.1 Stationeritas Test

The first thing to do is to examine whether the data

is stationary or not. This Stasioneritas test needs to

be done because a regression analysis should not be

did when the data used is not stationary and

normally if it still done the resulting equations then

are a spurious regression.

4.1.1 Unit Root Test

The unit root test is the normal testing that was

introduced by David Dickey and Wayne Fuller. The

root test is done to find out whether the data used

stationary or not. Data of stationary time series data

that does not contain a root unit and vice versa.

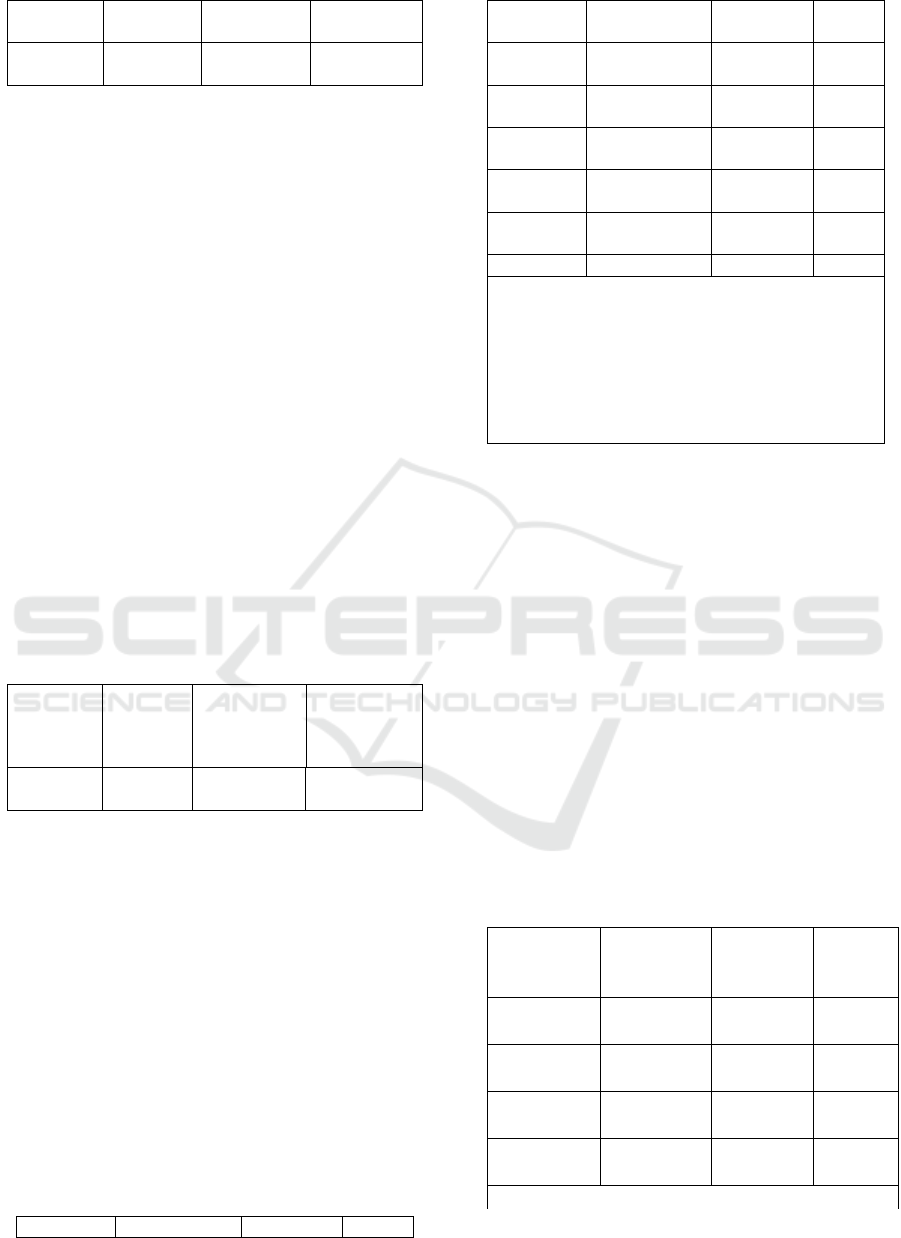

Table 2: Unit Root Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Description

ISSI

-

4.969355

-

2.948404

Stationary

INF

-

1.586033

-

2.948404

Not

Stationary

BI Rate

0.165

503

-

2.948404

Not

Stationary

Kurs

-

3.143863

-

2.948404

Stationary

Based on the chart above, showing that all

variables have not been stationary at level I or level

(O). This is because the value of the probability for a

variable inflation rates and BI Rate probability value

greater than α = 5% and the value of the ADF t-

statistics are smaller than the critical value

(Mackinon Critical Values) at α = 5%. Thus, testing

continued with the test of the degree of integration.

i. Integration Test

A test of the degree of integration is a test done to

measure at the level of diferensi to how data all the

variables are stationary. The method used is the

method Agumented Dickey Fuller (ADF) that is by

comparing a value to calculate the absolute value of

the ADF the ADF critical α = 5%. If the data is still

not stationary then this is done by the method of

testing with the next level of differentiation to

stationary data on the same level.

Table 3: Integration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Description

ISSI

-

9.773489

-

2.948404

Stationary

INF

-

5.146643

-

2.951125

Not

Stationary

BI Rate - -

Analysis of Factors Affecting the Indonesian Syariah Stock Index (ISSI) on the Indonesian Stock Exchange (IDX)

557

4.921036 2.951125 Not

Stationary

Kurs

-

6.995325

-

2.951125

Stationary

Based on the above table of results test of the

degree of integration (first diferrence) above, to see

that all the variables i.e. Indonesian Syariah Stock

Index (ISSI), BI Rate, inflation, and exchange rates

(exchange rate) has been stationary since smaller

probability value at α = 5% and larger ADF t-

statistics compared to the critical value (Mackinon

Critical Values) at α = 5%.

ii. Cointegration Test

In this research for the residual method using

Granger test based test. Residual based test method

using statistical tests Agumented Dickey Fuller

(ADF) i.e. by observing the regression residual

Granger stationary or not. Then this residual value

will be tested using the test Agumented Dickey

Fuller (ADF) to find out if the residual value of the

stationary or not. The results of this research show

that the estimated value of the ADF test > Critical

Value α = 5% (-6.412763 >-2.948404). So it could

be inferred that the empirical model used in this

study to qualify for the cointegration test.

Table 4: Cointegration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Description

ECT -

6.412763

0.0000 Stasionary

b. Estimation Error Correction Model

(ECM)

Estimation model of ISSI using the model of Error

Correction Model (ECM). To know that a used Error

Correction Model (ECM) is valid or not can be seen

from the value of the Error Correction Term (ECT)

are significant or not. Equation Error Correction

Model (ECM) for short-term period are as follows:

D (lnISSI

t

) = 232,8617 - -0,693554 INF – -

0,329883 BI_Rate - -0,871180 KURS

t

+ 0,526368

ECT + εi

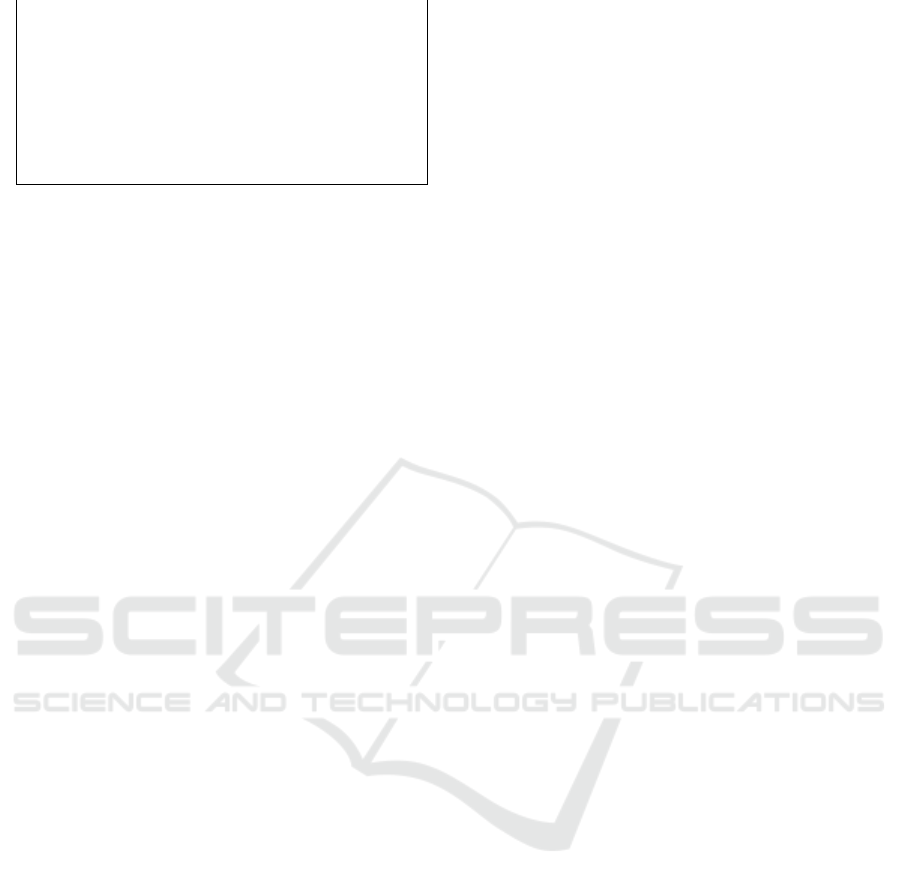

Table 5: The Results of The Estimation of the Error

Correction Model (ECM) Short-Term

Independ Coefficient t-Statistic Prob

ent

Variables

D(LN

INF)

-

0.693554

-

0.208781

0.

8362

D(LN

SBI)

-

0.329883

-

0.305303

0.

7625

D(LN

KURS)

-

0.871180

-

0.043955

0.

9653

ECT 0.526368

21.28

540

0.

0000

C 232.8617

5.890

509

0.

0000

R-squared

Adjusted R-

squared

F-statistic

Prob(F-statistic)

Durbin-Watson

stat

0.954614

0.942847

81.12831

0.000000

2.777986

The results of the estimation of ECM above

shows that short-term changes in interest rates,

Inflation variable BI (BI Rate), and exchange rates

(exchange rate) have a negative effect against

Indonesian Syariah Stock Index (ISSI), cateris

paribus. The magnitude of the balance and changes

in Islamic Indonesia stock index (ISSI) against

previous period now was 52.64%. These

adjustments are obtained from coefficients ECT of

0,526368. While t-his statistics are 21.28540 with

probabilities (0.0000 < 0.05), so significant at α =

5% and means that the model can be used.

Equation Error Correction Model (ECM) for

long-term periods are as follows:

lnISSI

t-1

= 232.8617 + 2.039721INF – -3.239223

BI_Rate – -98.53454 KURS

t

+ εi

Table 6: The Results of The Estimation of Error

Correction Model (ECM) Long-Term.

Independe

nt

Variables

Coefficien

t

t-

Statistic

Prob

LNINF(-1)

2.0397

21

2.734

483

0.0

109

LNSBI(-1)

-

3.239223

-

5.354096

0.0

000

LNKURS(

-1)

-

98.53454

-

5.854761

0.0

000

C

232.86

17

5.890

509

0.0

000

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

558

R-squared

Adjusted R-

squared

F-statistic

Prob(F-

statistic)

Durbin-Watson

stat

0.954614

0.942847

81.12831

0.000000

2.777986

The results of the estimation of ECM above

show that long-term changes in the variable interest

rates on BI (BI Rate) and exchange rates (exchange

rate) of previous periods have a negative influence

on the stock index of Sharia against Indonesia

(ISSI), cateris paribus. So it is with the previous

period Inflation variables that have a positive

influence against Indonesian Syariah Stock Index

(ISSI).

4.2 Test Determination (R

2

)

4.2.1 F-Test (Simultaneous Test)

Based on the results of the processing of data by the

method of Error Correction short and long term

Model obtained the value of R Squared of 0.954614

with which means the variable inflation rate, the BI

Rate, and exchange rates (exchange rate) affect

Indonesian Syariah Stock Index (ISSI) in IDX

amounting to 95.46%.

Based on the results of the processing of data by

the method of Error Correction Model of short and

long term value of the obtained F count of 81.12831

with the probability of 0.00000 greater than α = 5%

therefore H0 is accepted. Then the variable inflation

rate, the BI Rate, and exchange rates (exchange rate)

in the short run and the long run insignificant

together against Indonesian Syariah Stock Index

(ISSI) in IDX.

5 RESULTS

5.1 Inflation

Based on the results of the study showed that

changes the level of inflation in the short term

negative effect to changes in Indonesian Syariah

Stock Index (ISSI) in BEI with a coefficient of-

0.693554. In the short term that the statistics of

0.208781 smaller than the t-table (-0.208781 >

2.03693) and a smaller probability (0.8362 > 0.05)

then the Ho is rejected. This means that in the short

term inflation rate have an effect that is not

significant and marked negative against Indonesian

Syariah Stock Index (ISSI) in IDX.

While in the long-term government change

inflation rate long term positive effect to changes in

Indonesian Syariah Stock Index (ISSI) in the BEI by

a coefficient of 2.039721. In the long term that the t-

statistic of 2.734483 greater than t-table (2.734483 <

2.03693) and a smaller probability (0, 0109 > 0.05)

then Ho accepted. This means that in the long run

inflation rate significantly to the influential

Indonesian Syariah Stock Index (ISSI) in IDX.

5.2 BI Rate

Based on the results of the study showed changes in

the BI Rate in the short term to change Indonesian

Syariah Stock Index (ISSI)

in BEI with a coefficient

of-0.329883. In the short term that the t-statistics

registration-0.305303 smaller than the t-table (-

0.305303 < 2.03693) and greater probability (0.7625

> 0.05) then the Ho is rejected. This means that in

the short term the BI Rate influence is not significant

and marked negative against Indonesian Syariah

Stock Index (ISSI)

in IDX.

While in the long-term BI Rate negative

effect to changes in Indonesian Syariah Stock Index

(ISSI) in BEI with a coefficient of-3.239223. In the

long run bahwat-statistics registration 5.354096

more besardari t-table (5.354096 > 2.03693) and

greater probability (0.0000 > 0.05) then Ho

accepted. Then the variable BI Rate in the long run

have significant influence towards Islamic Indonesia

stock index (ISSI) in IDX.

5.3 The Exchange Rate

Based on the results of the study showed that

changes in exchange rates (exchange rate) in the

short term have no effect against Islamic Indonesia

stock index changes (ISSI) in BEI with a coefficient

of-0.871180. In the short term that the t-statistic of

21.28540 greater than t-table (21.28540 > 2.03693)

and greater probability (0.9653 > 0.05) then the Ho

is rejected. This means that in the short term

exchange rates (exchange rate) does not have

significant influence towards Indonesian Syariah

Stock Index (ISSI)

in IDX.

While in the long term changes in exchange

rates (exchange rate) against the potential negative

effect long-term change in Indonesian Syariah Stock

Index (ISSI) in BEI with a coefficient of-98.53454.

In the long term that the t-statistic of 5.890509

greater than t-table (5.890509 > 2.03693) and greater

probability (0.0000 > 0.05) then Ho accepted. Then

Analysis of Factors Affecting the Indonesian Syariah Stock Index (ISSI) on the Indonesian Stock Exchange (IDX)

559

the variable exchange rates (exchange rate) over the

long term have significant influence towards

Indonesian Syariah Stock Index (ISSI) in IDX.

6 CONCLUSIONS

Based on the results of research and discussion, then

the conclusions of this research is the existence of a

negative influence in the short term between variable

inflation rate, the BI Rate and exchange rates against

Indonesian Syariah Stock Index (ISSI) and yet not

significant. While for the long term, the inflation

rate has a positive influence against Islamic

Indonesia stock index (ISSI) and significant. But, the

BI Rate and the exchange rate has a negative

influence against Indonesian Syariah Stock Index

(ISSI) and significant on the Indonesia stock

exchange (BEI) in Indonesia.

REFERENCES

Mankiw, N. Gregory. (2006). Macroeconomics. United

State: Worth Publisher, t.t. Diterjemahkan oleh Fitria

Liza dan Imam Nurmawan, Makroekonmi. Jakarta:

Erlangga.

________________. (2003). Teori Makroekonomi.

Jakarta: Erlangga.

Manurung, Jonni & Adler Haymans Manurung, Ekonomi

Keuangan dan Kebijakan Moneter. Jakarta: Erlangga.

Nasir, Muhammad, Fakriah, Ayuwandirah. “Analisis

Variabel Makroekonomi Terhadap Indeks Saham

Syariah Indonesia”. Hal. 62.

Paramita, Alina. “Analisis Pengaruh Indikator

Makroekonomi, Indeks Harga Saham Gabungan,

Bursa Saham Syariah Internasional Terhadap Indeks

Saham Syariah Indonesia”. Hal, 100-101.

Purnawan, Irfan. “Analisis Pengaruh Makroekonomi

Domestik Dan Makroekonomi Global Terhadap

Indeks Saham Syariah Indonesia (ISSI) Periode 2011-

2014”. Hal. 27.Suciningtias, Siti Aisiyah dan Rizki

Khoiroh “Analisis Dampak Variabel Makro Ekonomi

Terhadap Indeks Saham Syariah Indonesia (ISSI)”.

Hal. 410.

Samuelson, P.A, Nordhaus,W.D, (2004). Ilmu

Makroekonomi, Edisi Tujuh Belas, Jakarta: PT. Media

Golbal Edukasi.

Dwi Ari Ambarwati, Sri. (2010). Manajemen Keuangan

Lanjut. Yogyakarta: Graha Ilmu.

Tandeliin, Eduardus. 2001. Analisis Investasi dan

Manajemen Portofolio. Yogyakarta: BPFE.

Wahyuningrum, Meylani. “Analisis Faktor-Faktor Yang

Mempengaruhi Indeks Saham Syariah Indonesia

(ISSI)”. Hal. 12-13.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

560