Analysis of Factors Affecting Indonesia’ External Debt

Selvia Inca Devi

1

, Fitrawaty

2

and Eko Wahyu Nugrahadi

2

1,3

Post Graduate of Economics, Uniersitas Negeri Medan, Medan, Indonesia

2

Faculty of Economics, Universitas Negeri Medan, Medan, Indonesia

Keywords: External debt, GDP, Budget Deficit, Exchange Rate, Inflation, Interest Rates, ECM

Abstract: Indonesia's external debt increases in the year 1998-2017 has been a huge debt burden for the country of

Indonesia. This aims of this study is to analyze the influence of gross domestic product (GDP), the budget

deficit, exchange rate, inflation and interest rates on Indonesia’a external debt. Analysis of the data in this

study was using an error correction model (ECM). The results showed that in the short-term GDP, inflation,

and interest rates have a positive influence on Indonesia's external debt. While the budget deficit ofand the

exchange rate had a negative effect on Indonesia's external debt. In the long-term GDP, inflation have a

positive influence on Indonesia's external debt. While budget deficits, exchange rates and interest rates have

a negative effect on Indonesia's external debt. The coefficient of determination of 94.4 percent indicated that

the GDP, budget deficit, exchange rate, inflation and interest rates have a very big influence on Indonesia’

external debts.

1 INTRODUCTION

In general, the developing countries needs the debt

that sourced from overseas to cover the gap between

domestic savings and investment requirements. The

need for investment funds should be financed by

funds from domestic sources. But because of limited

funds from the domestic sources, so the external

debt to be an alternative of government to cover the

shortage of domestic savings.

The Increase of Indonesia's external debt

indicating that Indonesia has a dependency in terms

of funding sources from abroad. When the position

of dependence on foreign capital grew, the greater

risks will be faced by the global economy system. In

addition, there draining of State Budget Revenue

and Expenditure for the payment of principal and

interest debt installments that would directly impact

on reduced of budget portion to finance the other

important sectors.

The international dependency model

(dependency theory) views developing countries as

victims of the rigidity of institutions, politics, and

economics both domestically and internationally and

trapped in a set of dependencies and domination by

rich countries (Todaro, 2011). The theory postulates

that the best way chosen by the developing countries

are as slight as possible to depend on the developed

countries in terms of external debt. We recommend

to implementing development policy funding

sources of domestic.

In the three-gap model theory, external debt is

used by a country to finance the current account

deficit, budget deficit, the gap of savings and

investment, debt payments, reserves the monetary

authorities and capital requirements and also the

short-term capital flow movements such as capital

flight (Basri, 2002).

Figure 1: Development of Indonesia’ External debt.

155.080

172.871

202.413

225.375

252.364

266.109

293.328

310.730

320.025

325.250

0.000

50.000

100.000

150.000

200.000

250.000

300.000

350.000

Devi, S., Fitrawaty, . and Nugrahadi, E.

Analysis of Factors Affecting Indonesia’ External Debt.

DOI: 10.5220/0009505905450553

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 545-553

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

545

Table 1: External debt, GDP, Budget Deficit,

Exchange Rate, Inflation, Interest Rates in 2008-

2017

Source: Badan Pusat Statistik and Bank Indonesia

Indonesia's external debt total from the year 2008 in

the amount of USD 155.0806 billion continue to rise

until 2017 reached USD 325 250 billion. This is due

to the state budget condition, which continues to

widening deficits, inflation and rupiah continues to

depreciate. Another factors were low exports and the

reduced of tax revenues or domestic income, so the

government covers the deficit with external debt.

Without it, the budget will not be sufficient for

development financing that has been prepared in

State Budget Revenue and Expenditure.

There were several factors that cause increased

external debt, including national income, budget

deficits, exchange rates, inflation, and interest rates.

According to the table 1, GDP in Indonesia has

fluctuated and in several years, the increase of GDP

followed by the increase of external debt. This is

suitable with the research that has been conducted

by (Alin, 2015) that an increase in GDP will

increase the portion of external debt in the European

Union and Romania. But it is not suitable with the

monetarist theory which states that the GDP had a

negative effect on the external debt.

In 2008-2017 Indonesia tend to widening deficit

and this is also followed by an increase in external

debt. Meanwhile, according to the theory of three-

gap model of thatexternal debt required by a country

to finance the government budget deficit. The results

of research which had been conducted by

(Abdullahi, Bakar, & Hassan, 2015) found that the

budget deficit has a negative and significant effect in

the short and long- term on Nigeria’ external debts.

Based on the long-term trend that Indonesia's

exchange rate tends to increase (depreciation). But if

seen in the short-term trend is the increase in the

exchange rate has not been followed by an increase

in external debt. According to the Keynesian theory

that when a country's currency has increased

(depreciation) it will reduce external debt. It is not

appropriate to the research conducted by

(Tambunan, 2008) that the exchange rates affect

positively on external debt.

Inflation in Indonesia tend to fluctuate every

year. In several years, the inflation and external debt

shows the trade-offs. This is not in appropriate with

the Keynesian theory that when inflation rises, the

government will adopt the policies to increase the

funds sourced from abroad as a result of an increase

in imports. Research conducted by (Zakaria, 2012)

found a relationship between inflation and external

debt is positive.

The decline in interest rates seen in the years

2008-2017 with long-term trends but tend to

fluctuate. There were a few years when interest rates

increase followed by an increase in external debt.

This is not in accordance with the opinion of Keynes

that relations with the interest rate of external debt

reverse. (Rosalina, 2018) also found that the interest

rate has a negative effect on external debts.

Based on the difference the results of previous

studies and existing theories, this study examines

how much the influence of the independent variable

on the dependent variable in the short and long-term.

This study aimed to analyze the effect of the Gross

Domestic Product (GDP), the budget deficit (BD),

the exchange rate (ER), inflation (INF), and interest

rates (IR) of the external debt (ED) in Indonesia in

the short and long-term.

2 THEORETICAL FRAMEWORK

2.1 External Debt

External debt is foreign aid given by governments of

developing countries or international agencies

specifically set up to provide loans to the obligation

to repay the loan and pay interest (Zulkarnain,

1996).

World Bank formulates that the debt conditions

to GDP safe ratio is 21 percent - 49 percent, while

the IMF set a safe limit of debt between 26 percent -

58 percent. Refers to the ratio of debt to GDP, the

debt to GDP ratio is said tobe safe if it is under 60

percent (as stipulated in article 12 paragraph 3 of

Law No. 17/2003). Based on data obtained from the

Central Bureau of Statistics that the ratio of external

debt to GDP of Indonesia in 2017 is still safe at

34.68 percent.

There are several theories that explain the

external debt of which three gap model of theory,

macroeconomic theory - the conventional approach,

the theory of dependency. Harrod Domar theory, the

Debt Laffer Curve Theory, the monetarist theory and

Keynesian theory.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

546

2.2 Gross Domestic Product

National income of a country can be measured by

the cumulative growth rate of Gross Domestic

Product (GDP). According to Central Bureau of

Statistics, GDP is the sum of the value added

generated by all business units within a country.

According to the Monetarists theory that the

increased of GDP will encourage increased exports,

this will lead to a surplus in the current account so

that the government will adopt policies to reduce the

external debt of Indonesia (Anisa, 2017) . So that the

relationship between GDP and external debt is

negative.

2.3 Budget Deficit

The budget deficit is the difference between state

income and expenditure in the same fiscal year.

According to the three gap model theory obtained

from the national income identity equation in terms

of expenditure and income states that in addition to

financing the current account deficit, a country's

external debt is also needed to finance the

government's budget deficit.

According (Harahap, 2007) that if a country's

budget deficit gets bigger, the government will

implement a policy to increase the amount of

external debt to finance investment needs. So that

the budget deficit had a positive influence on the

external debt.

2.4 Exchange Rate

The exchange rate is the exchange of two different

currencies, which is a comparison of the price or

value of the two currencies (Triyono, 2008).

Keynesian theory states that when a country's

currency has increased (depreciation) against other

currencies, so that the goods produced by that

country in abroad becomes cheaper and conversely

the foreign goods in that country is becoming more

expensive. It will lead to an increase in exports

resulting in a surplus in the current account.

Therefore external debt to be reduced. So that the

exchange rate had a negative effect on the external

debt.

2.5 Inflation

Inflation is the tendency of rising prices in general

and continuously (Boediono, 1985). In Keynesian

theory whereby when inflation increases, imports

will increase. This is because the domestic

consumers would buy a lot of goods from abroad as

a result of high domestic prices due to inflation.

Furthermore, when the value of imports is higher, it

will cause the current account deficit so that the

government will increase funds sourced from

overseas. So that the relationship between inflation

and external debt is positive.

2.6 Interest Rate

The interest rate is the cost to be paid by the

borrower on the loan capital or use of some of

money to the lender of capital (Mankiw, 2006).

Interest rates in relation to the external debt

according to Keynesian explain that when interest

rates increase, it will encourage a decline in

investment in the country so that it can affect the

decline in aggregate income. This will lead to a

decrease in import capabilities. If the import value is

lower than the export value, it will cause a surplus in

the current account so that it will reduce external

debt. It is accordance with the Keynesian theory

that interest rates have a negative influence on

external debt.

Based on theory and previous research that has

been described above, then the hypothesis in this

study is the GDP, exchange rates and interest rates

in the short and long-term have a positive influence

on external debt, while the budget deficit, and

inflation in the short and long-term have the positive

influence on external debt.

3 RESEARCH METHOD

Data used in this research is secondary data time

series in 1998-2017. The data collection was done

by using the documentation technique. In this

research the collected data is external debt, GDP, the

budget deficit, exchange rate, inflation, and interest

rates published by the Badan Pusat Statistik and

Bank Indonesia.

Estimates Model used in this study is a model

equation Error Correction Model (ECM) to estimate

the relationship of short-term and long-term the

variables of GDP, the budget deficit, exchange rate,

inflation and interest rates on Indonesia’s external.

Before estimating the model, first perform data

analysis such as testing unit root tests Augmented

Dickey Fuller (ADF), test the degree of integration,

the determination of lag length optimal, using the

Akaike Information Criterion (AIC), Schwarz

Information Criterion (SIC), and likelihood Ratio

(LR), Engle Granger cointegration test. Further done

Analysis of Factors Affecting Indonesia’ External Debt

547

the testing of the econometric assumptions such as k

normality, multicollinearity and autocorrelation.

This study uses Eviews 9 software to analyse the

data.

4 RESULTS

4.1 Test of Stationarity

Stationary test was used to observe whether a

particular coefficient of autoregressive models was

estimated to have a value of one or not. A variable is

said to be stationary if the average value, variance

and covariance always constant at any point of time.

If the results of the test roots of a data unit obtained

some or all of the data is not stationary at the current

level, it is necessary to test the degree of integration

in the first difference and the second difference.

Based on table 2, the unit root test level test has

four variables that are not stationary so that the unit

root test first level carried out and there is one

variable is not stationary namely external debt.

Furthermore, conducted the test of unit root test

second difference, it was found that all research

variables had the same stationary level with the ADF

value greater than the critical value at α = 5%.

4.2 Test Long-Legth Optimal Lag

Long Lag Test (Determination of Optimal Lag) is

the amount of lag which is gives the significant

effect or response. From the test results obtained the

highest number of stars that are in the lag 1. Hence

lag (inaction) which is used to test the Engle-

Granger cointegration done by using a long lag = 1.

Table 2: Results of Unit Root Test Augmented

Dickey Fuller

Source: Eviews 9 (processed)

Table 3: Results-Length Determination of Optimal

Lag

Source: Eviews 9 (processed)

Table 4: Results of Engle-Granger Cointegration

Source: Eviews 9 (processed)

4.3 Cointegration Test

Cointegration test is a test that is performed to

determine whether there is a balance in the long term

on the model chosen and established. In this study

the cointegration test was done by using method of

Engle Granger (EG). ADF statistic value of -

2.218387 > -1.960171 and probability value of

0.0290 < 0.05. So that there was cointegration

between regression results variables between the

gross domestic product, budget deficits, exchange

rates, inflation and interest rates on external debts.

This indicates that the variable is said to be long-run

equilibrium condition, so that the regression results

are cointegrated regression.

4.4 Assumptions Econometrics Testing

A research theoretically produce the exact value of

estimators parameter when it meets the assumptions

detection of econometrics, they are normality test,

multicollinearity and autocorrelation.

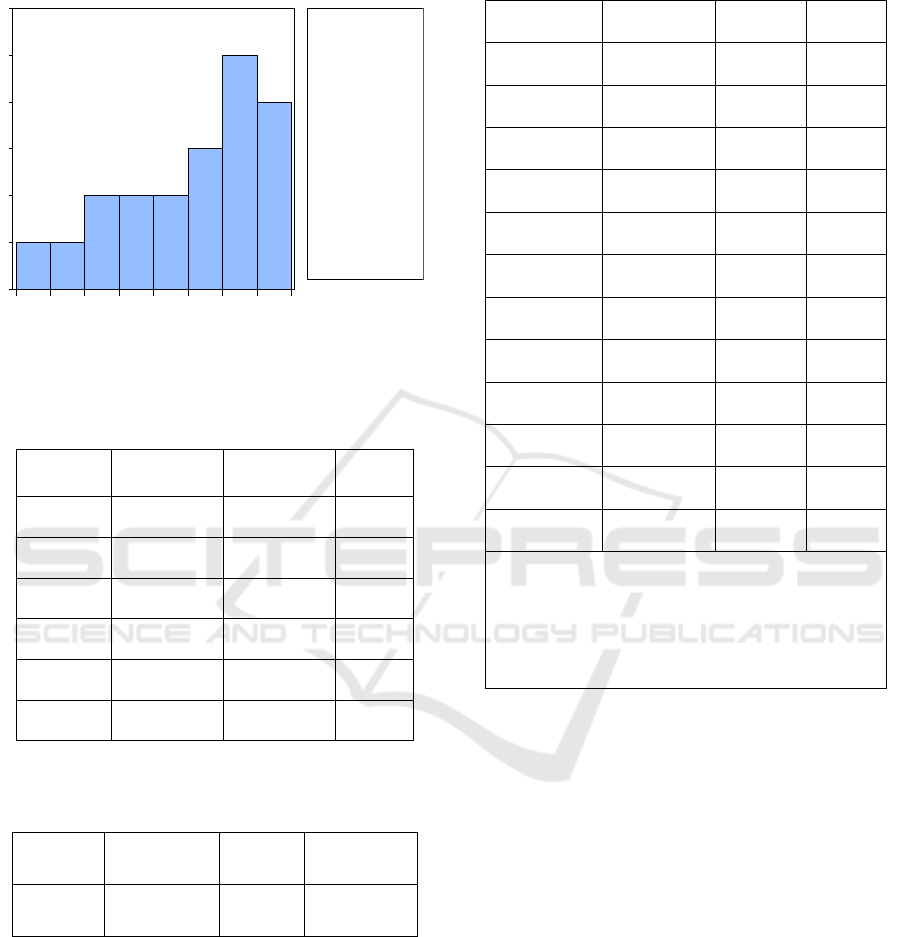

4.4.1 Normality Test

Data Normality Test is done to see whether the data

were normally distributed or not. In this study, the

test for normality using the Jarque-Bera test. Based

on estimates on Table 4, the data value JB statistical

probability of 0.423766 > α = 5% (0.05). Thus, it

can be concluded that the data used in the model

ECM is normal distribution.

4.4.2 Multicollinearity Test

Multikolonearitas test in this study was done by

looking at the value of tolerance and the value of

Variance Inflating Factor (VIF). Based on Table 5

the Value tolerance > 0.10 or VIF <10, it can be

concluded that the multikolinearitas is not happen.

4.4.3 Autocorrelation Test

The Autocorrelation testing by using LM methods

need to determine the lag. Based on Table 6 the

calculation results obtained value Obs * R-squared

of 8.273345 with probability 0.1060. From these

values illustrates that the probability value is greater

than α = 5%. It can be conclude that H

0

rejected and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

548

H

1

accepted it is indicates that there is no

autocorrelation in the model.

0

1

2

3

4

5

6

-0.25 -0.20 -0.15 -0.10 -0.05 0.00 0.05 0.10 0.15

Series: Residuals

Sample 1998 2017

Observations 20

Mean -6.25e-16

Median 0.016402

Maximum 0.145200

Minimum -0.230918

Std. Dev. 0.110942

Skewness -0.607330

Kurtosis 2.235031

Jarque-Bera 1.717148

Probability 0.423766

Source: Eviews 9 (processed)

Figure 2: Normality Test

Table 5: The Results of Multicollinearity Test

Variable

Coefficient

Variance

Uncentered

VIF

Centered

VIF

C 3.388294 4056.921 NA

LNGDP 0.002893 11.38971 3.352729

LNBD 0.000238 4.844887 1.716412

LNEF 0.040141 4080.061 1.524497

LNINF 0.007839 46.42314 4.097321

LNIR 0.014744 88.08453 1.447129

Source: Eviews 9 (processed)

Table 6: The Results of Autocorrelation Test

F

-statistic

Obs * R-

squared

Prob. F

Prob.

Chi-Square

2.586893 8.273345 0.1060 0.0407

Source: Eviews 9 (processed)

Table 7: Results of Estimation of ECM Engle

Granger

Variable Coefficient

T-

Statistic

Prob.

C 1.877821

3.426659 0.0110

D (LNGDP)

0.011038

0.170868 0.8692

D (LNBD) - 0.004576

-

1.234070 0.2570

D (LNER) - 0.373992

-

3.563008 0.0092

D (LNINF) 0.013044

0.713105 0.4989

D (LNIN) 0.012629

0.263113 0.8000

LNGDP (-1) 0.074769

1.609382 0.1516

LNBD (-1) - 0.020668

-

5.215808 0.0012

LNER (-1) - 0.187067

-

3.539204 0.0095

LNINF (-1) 0.066913

2.287816 0.0560

LNIR (-1) - 0.191336

-

5.200300 0.0013

ECT (-1) - 0.176742

-

2.669528 0.0320

R-squared 0.944058

Adjusted R-squared 0.856150

F-statistic 10.739130

Prob (F-statistic) 0.002247

Source: Eviews 9 (processed)

4.5 ECM Estimation Model

Analysis of the data used in this study is a model

equation Error Correction Model (ECM) to estimate

the relationship of short-term and long-term between

the variables of GDP, the budget deficit, exchange

rate, inflation and interest rates on Indonesia’a

external debt.

ECM approach used in this study is the approach

of Error Correction Model of Engle Granger.

According to this approach, the ECM model is valid

if the sign coefficient of ECT is negative and

statistically significant.

Based on the results in table 7, Engle Granger

Error Correction Model obtained coefficient value is

negative and significant (probability value < the

absolute value of critical value for α = 0.05), which

is the value of the coefficient of ECT (Error

Correction Term) of -0.176742 and the probability

Analysis of Factors Affecting Indonesia’ External Debt

549

of 0.0320 < 0.05. So the value of ECT coefficient is

negative and statistically significant. It is indicates

that specification model ECM Engle-Granger used

in this study is valid (proper / appropriate).

ECM model equations Engle Granger short-term

and long-term as follows:

d (lnuln) = 1.877821 + 0.011038 d (lngdp) -

0.004576 d (lnbd) - 0.373992 d (lner) +

0.013044 d (lninf) - 0.012629 d (lnir) +

lngdp 0.074769 (-1) - 0.0206681lnbd (-

1) - 0.187067 lner (-1) + 0.066913 lninf

(-1) - 0.191336 lnir (-1)- 0.176742 ECT.

4.6 Hypothesis Testing Results

4.6.1 The Results of t-test

Partial test results are shown in table 7. Through t-

test with a significant level of alpha 5 percent. In the

short term the value of t-statistic and probability of

each variable is the variable GDP by t-statistic =

0.170868 (prob = 0.8692) and no significant positive

effect on Indonesia’a external debt, the budget

deficit with a t-statistic = -1.234070 (prob = 0.2570)

have negative effect and no significant on

Indonesia’a external debt, the exchange rate with the

t-statistic = -3.563008 (prob = 0.0092) negatively

affect and significant on Indonesia’a external debt.

Inflation with t-statistic = 0.713105 (prob = 0.4989)

positively affect and no significant on Indonesia’a

external debt, and the interest rate with the t-statistic

0.263113 (prob = 0.8000) positively affect and no

significant on Indonesia’a external debt.

In the long term value of t-statistic and

probability of each variable is the variable GDP by t-

statistic = 1.609382 (prob = 0.1516) positively affect

and not significant on Indonesia’a external debt, the

budget deficit with a t-statistic = -5.215808 (prob =

0.0012) negatively affect and significant on

Indonesia’a external debt, the exchange rate with the

t-statistic =-3.539204 (prob. 0.0095) negatively

affect and significant on Indonesia’a external debt,

inflation with t-statistic =2.287816 (Prob = 0.0560)

negatively affect and significant on Indonesia’a

external debt, and the interest rate with the t-statistic

-5.200300 (prob =0.0013) negatively affect and

significant on Indonesia’a external debt.

4.6.2 F Test Results

Based on estimates in table 7, that in short-term and

long-term estimation results can be seen that the

value of the F-statistic of 10.73913 with a statistical

probability of 0.002247 smaller than α = 0.05

indicates that together (simultaneous test) all the

independent variables namely the gross domestic

product, the budget deficit, the value of exchange

rates, inflation and interest rates have an impact on

Indonesia’a external debt.

4.6.3 R

2

Test Results

The coefficient of determination (Rsquare) in the

short term and long term that is 0.944058, or 94.4

percent, so that variations of the gross domestic

product, budget deficits, exchange rates, inflation

and interest rates in the short term and long term is

94.4 percent affect to Indonesia’a external debt.

While the remaining 5.6 percent is explained by

variables outside the model (not examined).

4.7 Discussion

4.7.1 The Effect of GDP on External Debt

From the estimation is known that the gross

domestic product in the short term and the long term

have a positive effect and no significant at α = 0.05

with respective probabilities of 0.8692 and 0.1516.

This means that in the short term and the long-term

gross domestic product was not able to influence the

Indonesia’a external debt, which is indicated by the

insignificant variables GDP (lngdp) on Indonesia’a

external debt.

The effect which are not significant because in

short-term and long-term, the improvement of

Indonesia's gross domestic product has not been

significant enough to encourage a decrease in

external debt. National income in Indonesia is still

low, so it has not been able to reduce external debt.

The policy of increasing external debt by the

government is channeling these funds to the

construction of infrastructure facilities and

stabilizing the economy in Indonesia which is

classified as a developing country. Indonesia still

has a dependency to other countries and because of

the large external debt, Indonesia not only pays the

principal debt repayments but also pay interest on

the debt is so large.

The results are consistent with research

conducted by (Wibowo, 2012) that the GDP had a

positive effect and no significant effect on

Indonesia’a external debt.

4.7.2 The Effect of Budget Deficit on External

Debt

Based on the estimates found that the budget deficit

variable in the short-term has a negative effect and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

550

no significant at α = 0.05 with a probability of

0.2570. It means that the budget deficit in the short-

term have a negative influence but does not have a

significant impact on Indonesia’a external debt.

The budget deficit variable shows a negative but

not significant relationship. It is indicate that the

budget deficit of a country means there is a

reduction in the budget to finance the and the

Indonesian economy so that additional funds is

needed. External debt is one that is used as an

alternative source of financing development funding

by the government. But in the short-term, when the

budget is deficit, the government needs funds

relatively quickly so that the required funds are not

necessarily derived from external debt, but can also

be sourced from domestic funding as by issuing

State Debt Securities (obligation).

The government also each year continues to

increase state revenue through increased tax

revenues and make savings on the expenditure side

as subsidy spending and reducing program spending

unproductive and inefficient that do not support the

growth of the real sector. Thus, in the short-term

budget deficits increased no significantly affect the

external debt. The results are consistent with

research conducted by (Saputro & Soelistyo, 2017),

where the budget deficit does no significantly

influence Indonesia’a external debt.

Furthermore, based on the results of the

estimation is known that variable budget deficit in

the long term have a negative and significant impact

at α = 0.05 with a probability of 0.0012. This means

that in the long-term budget deficits have a negative

influence and significant influence on Indonesia's

external debt. The decline in the budget deficit is not

accompanied by a reduction in Indonesia’a external

debt. Just when the budget deficit has decreased but

the external debt has increased. This is because in

the long-term internal funding sources Indonesia still

not sufficient to meet the investment needs in

Indonesia so that Indonesia still has a dependence on

external debt.

Research conducted by (Abdullahi et al., 2015)

found that the budget deficit had a negative effect in

the long term on external debts in Nigeria.

4.7.3 The Effect of Exchange Rates on External

Debt

Based on estimates found that the variable exchange

rate in the short term and the long term have a

negative and significant impact at α = 0.05 with their

respective probabilities of 0.0092 and 0.0095. This

means that in the short term and the long term affect

the exchange rate of Indonesia’a external debt as

indicated by significant exchange rate variable

(lnkurs) on Indonesia’a external debt.

According to Keynesian theory, when a country's

currency has increased (depreciation) against other

currencies, the goods produced by the country

abroad becomes cheaper and goods abroad in the

country is becoming more expensive (assuming

domestic prices constant in both countries). This will

lead to an increase in exports resulting in a surplus

in the current account. Therefore external debt to be

reduced. If the exchange rate to depreciate the

government would take a policy to reduce external

debt in the long term or the next year because it has

more funds for developing, investing able to finance

other government spending.

Likewise, when a country's currency has

decreased (appreciation) against other currencies,

the goods produced by the country abroad become

more expensive and goods abroad becomes cheaper

(assuming domestic prices constant in both

countries). This will lead to a reduction in exports

and increased imports. Increased imports will lead to

a reduction in the current account deficit so.

Therefore external debt will increase.

Thus the exchange rate had a negative effect on

Indonesia's external debt. According (Manuhutu,

2010), due to the depreciation of the domestic

exchange rate against foreign currencies will

increase the burden of foreign loans so that more and

more depressed domestic exchange rate, the number

of foreign loans is high. Results of the study

according to the study carried out by (Setiawan,

Indira & Paundralingga, 2007) that the exchange

rate had a negative effect and signifikan on external

debts in the long term

Other studies support that (Cain, Thaxter,

Thomas, Thomas, & Walker, 2013), in which the

long-term role in the exchange rate is inversely

related to the external debt. Changes in a country's

exchange rate affects the size of the external debt.

4.7.4 The Effect of Inflation on External Debt

Based on the estimates found that the variable

inflation in the short term has a positive effect and

no significant at α = 0.05 with a probability of

0.4989. This means that in the short term the

variable inflation have a positive influence but does

not have a significant impact on Indonesia’a external

debt. The results of this study are consistent with the

research conducted by (Ningrum, 2018), which

found that inflation has a positive and not significant

influence on Indonesia’a external debt.

Analysis of Factors Affecting Indonesia’ External Debt

551

The insignificant effect of inflation on external

debt due to rising/falling inflation cannot

significantly affect Indonesia's external debt.

Because if there is inflation, the government does

not directly take the policy of raising external debt,

and conversely when there is deflation, the

government does not directly reduce external debt.

But when inflation occurs, the government carries

out other policies such as conducting monetary

policy by means of Bank Indonesia to reduce the

money supply by raising interest rates.

Furthermore, based on the estimation results it is

known that variable inflation in the long term has a

effect positive and significant at α = 0.05 with a

probability of 0.0560. This means that in the long

term the variable inflation can influence Indonesia’a

external debt as indicated by the significant variable

inflation (lninf) on Indonesia’a external debt.

The positive relationship of inflation to external

debt in accordance with domestic theory and

imported inflation states that when a country

experiences inflation it will cause the price of

domestic goods to be relatively more expensive than

the price of imported goods. Domestic products are

difficult to compete with imported products. This

will cause the export value to be smaller than

imports, resulting in a deficit in the current account

which will further increase external debt. So that

inflation has a positive influence on external debt.

The same theory is also explained in Keynesian

theory where when inflation increases, imports will

increase. This is because domestic consumers will

buy a lot of goods from abroad as a result of high

domestic prices due to inflation. Furthermore, when

the import value is higher, it will cause the current

account deficit to add funds sourced from abroad.

The results of this study are consistent with the

research conducted by (Zakaria, 2012), and (Kwon,

Mcfarlane, & Robinson, 2009), where the

relationship between inflation and external debt is

positive.

4.7.5 The Effect of Interest Rates on External

Debt

Based on estimates found that the variable interest

rate in the short term has a positive effect and no

significantat α = 0.05 with a probability of 0.8000.

This means that interest rate have a positive

influence but does not have a significant impact on

the Indonesia’a external debt.

No significant influence of interest rates on

external debts because interest rates can not affect

Indonesia's external debt significantly. The

Government will continue to raise external debt

despite its benchmark interest rate in Indonesia has

increased/decreased. Due to the short-term external

debt used by the government for spending on

structural and sectoral fields such as health,

education and infrastructure. The results are

consistent with research conducted by (Wibowo,

2012) that the GDP had a positive effect and no

significant effect on Indonesia’a external debt.

Furthermore, based on the estimation results

found that the variable interest rate in the long run

have a negative effect dansignifikan at α = 0.05 with

a probability of 0.0013. This means that in the long-

term interest rates affect Indonesia's external debt as

indicated by significant variable interest rate (lnsb)

on Indonesia’a external debt.

This result is consistent with that proposed by

Sukirno (2002), that the investment will be made by

investors in accordance and in line with theories that

there is such a classical theory and keynes that the

theory is that if the interest rate is greater than the

rate of return on capital, the planned investment is

not profitable, so the investment will not be made by

the investor.

Keynesian theory explains that when interest

rates rise, then to a decrease in investment in the

country so as to affect the decline in aggregate

opinion. This will lead to a decrease in import

capabilities. If the import value is lower than the

value of exports will lead to a surplus in the current

account that will reduce external debt. Therefore,

according to the Keynesian theory that interest rates

have a negative influence on external debt.

The results are consistent with research

conducted by Rosalina (2018), where variable

interest rates have a negative effect on the external

debt.

5 CONCLUSION

In the short-term there is 1 (one) a significant

variable that is the exchange rate, while in the long -

term there are four (4) significant variables that

budget deficits, exchange rates, inflation and interest

rates. Other independent variables in the short term

variables such as GDP, inflation and interest rates

have a positive impact and no significant effect on

Indonesia's external debt and budget deficit variables

have a negative impact and no significant effect on

Indonesia’a external debt. While in the long term

variable GDP had a positive effect and no significant

effect on Indonesia’a external debt.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

552

The coefficient of determination (R

2

) on the

results of model estimation Engle Granger Error

Correction Model can be explained that the variation

of the external debt variable (Y) in the short term

and long term able to be explained by variables that

is equal to 0.944058, or by 94.4 percent, thus in the

short term and long term variations that amounted to

94.4 percent of gross domestic product, budget

deficits, exchange rates, inflation and interest rates.

While the remaining 5.6 percent is explained by

variables outside the model (not examined).

There are some suggestions that can be used as a

recommendation, including for Bank Indonesia and

the Government to adopt policies to maintain

inflation stability, interest rates and the rupiah

exchange rate so as to encourage an increase in

national income and reduce external debt. Further

restricting the import of goods from other countries

and maximize the results from the source country of

Indonesia. This will increase exports so that there is

a surplus in the current account. Then reduce

dependence on external debt by means of further

enhancing the country's national income from taxes

and natural resources and human resources of

Indonesia. And to further research needs to examine

this further research using different approaches.

REFERENCES

Abdullahi, M. M., Bakar, N. A. B. A., & Hassan, S. B.

(2015). Determining the Macroeconomic Factors of

External Debt Accumulation in Nigeria: An ARDL

Bound Test Approach. Procedia - Social and

Behavioral Sciences, 211(November), 745–752.

https://doi.org/10.1016/j.sbspro.2015.11.098

Alin, H. G. (2015). Public Debt In The EU Countries.,

Annals of Constantin Brancusi University of Targu-

Jiu. Economy Series, 275–280. ISSN 2344–

3685/ISSNL1844-7007.

Anisa, A. C. (2017). Faktor-faktor yang Mempengaruhi

Neraca Pembayaran Indonesia. JOM Fekon, 4(1). 313-

324.

Badan Pusat Statistik. https://www.bps.go.id

Bank Indonesia. http://www.bi.go.id

Basri, F. (2002). Perekonomian Indonesia; Tantangan dan

Harapan bagi Kebangkitan Ekonomi Indonesia.

Jakarta: Erlangga.

Boediono. (1985). Ekonomi Moneter Edisi 3. Yogyakarta:

PPFE.

Cain, D., Thaxter, A., Thomas, D. A., Thomas, K., &

Walker, A.-A. (2013). The Original Sin and Exchange

Rate Dynamics: Panel Cointegration Evidence.

American Charter of Economics and Finance, 2(2), 1–

23. https://doi.org/10.2139/ssrn.2312425

Harahap, D. M. (2008). Mempengaruhi Utang Luar Negeri

Indonesia. Usu E_Repository, 8.

Kwon, G., Mcfarlane, L., & Robinson, W. (2006). Public

Debt, Money Supply, and Inflation: A Cross-Country

Study and Its Application to Jamaica. International

Monetary Fund (IMF) Working Papers. 56(3). 1-37.

Mankiw, Gregory N. (2006). Principles of Economics,

Pengantar Ekonomi Mikro. Edisi ketiga. Jakarta:

Salemba Empat

Manuhutu, Y. (2010). Nilai Tukar Berpengaruh Terhadap

Pinjaman Luar Negeri Indonesia, 1997-2007. Eko-

Regional, 5(2), 81–86.

https://doi.org/10.1007/BF02657288

Ningrum, R. M. (2018). Analisis Error Correction Model

Terhadap Utang Luar Negeri Indonesia Tahun 1992-

2016. Univesitas Muhammadiyah Surakarta.

Rosalina. (2018). Analisis Interdependensi Produk

Domestik Bruto, Inflasi, Suku Bunga dan Nilai Tukar

terhadap Utang Luar Negeri Indonesia. Tesis.

Universitas Negeri Medan

Saputro, Y. D., & Soelistyo, A. (2017). Analisis Faktor-

faktor Yang Mempengaruhi Utang Luar Negeri

Indonesia. Jurnal Ekonomi Pembangunan, Vol X Jilid

X, 45–59. https://doi.org/10.1155/2014/757618.

Setiawan, I., Indira, D & Paundralingga, A, Y. (2007).

Pembayaran Pinjaman Luar Negeri Korporasi dan

Pergerakan Rupiah, Bulletin Ekonomi Moneter dan

Perbankan, Bank Indonesia. 9(3). 31-71. doi:

https://doi.org/10.21098/bemp.v9i3.208.

Sukirno, S. (2002). Pengantar Teori Makro Ekonomi.

Jakarta: Rajawali Press.

Tambunan, T. (2008). Pembangunan Ekonomi dan Utang

Luar Negeri. Rajawali Pers: Jakarta.

Todaro, P. M. (2011). Ekonomi Pembangunan di Dunia

Ketiga. Jakarta: Bina Aksara.

Triyono. (2008). Analisis Perubahan Kurs Rupiah

Terhadap Dollar Amerika. Jurnal Ekonomi

Pembangunan, 9(2), 156–167.

Wibowo, C. (2012). Analisis faktor-faktor yang

mempengaruhi beban hutang luar negeri Pemerintah

Indonesia, Universitas Sebelas Maret.

Zakaria, M. (2012). Interlinkages Between Openness and

Foreign Debt in Pakistan, Dogus Universitesi Dergisi

13(1), 161–170.

Zulkarnain, D. (1996). Masalah Utang Luar Negeri Bagi

Negara-Negara Berkembang dan Bagaimana

Indonesia Mengatasinya. Jakarta: Fakultas Ekonomi

Universitas Indonesia.

Analysis of Factors Affecting Indonesia’ External Debt

553