Tax Planning for Shipping Company Business Expansion

Sandy Zulfadli

Faculty of Economics and Business, University of Indonesia

Keywords: Tax planning, Business Expansion, Indonesian Shipping

Abstract: Several previous studies have shown that tax planning schemes have significant effects on the valuation of

firms in terms of investment decisions for global expansion. This research limits its scope in tax planning,

precisely in how to choose the most profitable legal form of business units from taxation aspect, by

simulating how much total tax expenses are incurred by the company, whether they conduct business in

Singapore with subsidiary, with permanent establishment or without subsidiary nor permanent

establishment. The country used as the basis (as the benchmark/example for expansion destination) for this

paper is Singapore, as Singapore is frequently used by Indonesian-based companies for expansion

destination, due to its close geographical location, corporate-friendly tax regulations, and high legal

certainty, connected to its economic and political stability. The research method used in this paper is the

qualitative analysis method, with a case study approach using company X, which is based in Indonesia and

conducts domestic and international shipping operations. The data used in this paper are primary data such

as company profiles, business development plans and financial reports from X company, as well as

corporate tax regulations in Indonesia and Singapore. This study finds that a company that conducts its

business without subsidiary nor permanent establishment in Singapore, is the most profitable legal form of

business unit according to taxation aspect.

1. INTRODUCTION

With its unique geographical location between two

continents (mainland Asia and Australia) and two

oceans (the Pacific and Indian oceans), Indonesia

faces both advantages and disadvantages in business.

The Indonesian government currently aspires to

make Indonesia as world maritime power. Along

with the government’s vision, the private sector

moved in the same direction. To encourage maritime

connectivity, the government started to provide

many incentives to increase private sector

participation in supporting government programs.

This momentum can be an opportunity for the

private sector to develop businesses, especially in

the maritime industry.

Researchers see the potential of the maritime

industry, with shipping especially still having

enormous potential to be developed. Based on data

on loading and unloading at Indonesian ports as

outlined in Table 1, it can be seen in 2015 that

domestic cargo reached 294,309 thousand tons and

overseas cargo reached 340,001 thousand tons.

Table 1: Domestic and overseas loading and

unloading at the Port of Indonesia from 1988-2015

(thousand tons).

Source : http://www.bps.go.id/

Several previous studies have shown that tax

planning has a significant effect on firm value. Heeti

Herawati and Diah Ekawati (2016), said that overall

tax planning affects the value of the company. This

is in line with research conducted by Mihir A. Desai

1114

Zulfadli, S.

Tax Planning for Shipping Company Business Expansion.

DOI: 10.5220/0009505611141121

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1114-1121

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

and Dhammika Dharmapala (2007) where their

research concluded that tax planning has a positive

effect on firm value if the company has a good

governance. However, the studies mentioned above

used quantitative approach, where it clearly

illustrates the magnitude of the influence of tax

planning on firm value, but does not explain how tax

planning can contribute optimally to company value

for shareholders.

The characteristics of the business sector and

business processes conducted by the company are

the determinants of how the tax planning scheme

should be used. On this study, through a case study

of X company, the writer will simulate how tax

planning be used for shipping company business

expansion.

Business expansion usually starts in the selection

of the legal form of business unit and choosing the

destination country of business expansion. In this

step, many aspects should be considered, including

the tax saving aspect.

The country used as the basis (as the

benchmark/example for expansion destination) for

this paper is Singapore, as Singapore is frequently

used by Indonesian-based companies for expansion

destination, due to its close geographical location,

corporate-friendly tax regulations, and high legal

certainty, connected to its economic and political

stability.

This research limits its scope in tax planning,

precisely in how to choose the most profitable legal

form of business units from taxation aspect. So that,

the research question is how to choose the most

profitable legal form of business units according to

taxtation aspect.

To answer the question, author simulate how

much total tax expenses are incurred by the

company and how much total profit after taxes,

whether they conduct business in Singapore through

subsidiary, through branch/permanent establishment,

or without subsidiary nor permanent establishment.

The results of analysis then compared to each

alternatives, to conclude which legal form is the

most profitable. Justification shall be applied to the

conclusion of this study, so that could be a guidance

for other similar companies.

2. LITERATUR REVIEW

In this section the researcher will review theories,

regulations and results of previous studies related to

tax planning. According to Arikunto, “In all

sciences, scientists always begin their research by

exploring what has been stated by other experts”

(Arikunto, 2016). Several previous studies have

shown that tax planning has a significant effect on

firm value. Heeti Herawati and Diah Ekawati (2016)

in their research journal: The Effect of Tax Planning

on Corporate Values, concluded that overall tax

planning affects the value of the company. The study

reinforces research conducted by Mihir A. Desai and

Dhammika Dharmapala (2007) where their research

concluded that tax planning has a positive effect on

firm value if the company has high governance.

2.1 Tax Planning

1. Tax management as well as general

management concepts requires the activities of

planning, organizing, implementing and

controlling. According to Pohan, “Tax

management is a comprehensive effort carried

out by tax managers in a company or

organization so all matters related to taxation

from the company or organization can be

managed properly, efficiently, and

economically, so can give maximum

contribution to the company. ”(Pohan, 2017).

2. Tax planning is considered as the starting point

of tax management. Tax Planning is a process

of organizing a taxpayer's business in such a

way that the tax debt for both the income tax

and other taxes are in a minimal amount, as long

as it does not violate the regulations. Larry

Cumbrey et al (1994) stated that tax planning is

“The systematic analysis of differing tax options

aimed at minimizing the tax liability in current

/and future tax periods” (Pohan, 2018).

3. Barry Spitz (1983) in Pohan (2017) explains the

steps that must be taken so that tax planning is

in line with expectations: a. Performing

available database analysis; b. Designing

possible tax plan; c. Evaluating tax plans; d.

Looking for weaknesses in the tax plan, and

correct those weaknesses; e. Updating the tax

plans.

2.2 Shipping Company

According to Indonesian Shipping Law No. 17 of

2018, “Shipping is an integrated system consisting

of transportation in waters, port, safety and security,

and protection of the maritime environment”.

According to Indonesian Government Regulation

No. 20 of 2010 “The National Sea

Transport/Shipping Company is an Indonesian legal

entity that carries out sea transportation activities

Tax Planning for Shipping Company Business Expansion

1115

within Indonesian waters and / or from and to

foreign ports”. The term shipping company in this

research refers to a corporate that wants to conduct

business in the shipping industry both domestically

and / or overseas.

Overall the products of shipping industry are as

follows: shipping services, agency services, charter

services, and freight forwarding. Charter services are

depends on the agreements. Charter agreements

specify the types of services provided, whether

bareboat or fully manned. Fully manned service fee,

defined whether its time charter or voyage/trip

charters.

2.3 Shipping Income Tax Regulation

Indonesian Income Tax Law of 1983 in Article 4

Paragraph (1) Letter stated, “…Taxpayers who are

subject to final tax or taxpayers who use Deemed

Profit norms as referred to in Article 15”.

Meanwhile in Article 15 mentioned that “The

Minister of Finance can make a regulation to set a

Special Calculation Norm to calculate the net

income of certain Taxpayers that cannot be

calculated based on Article 16”. Furthermore,

Indonesian Minister of Finance Decision Letter

Number KMK-416/KMK.04/1996 regulate that net

income of shipping income of a domestic shipping

company is about 4% of its gross shipping income

and effective tax rate is 1.2% of its gross shipping

income. As KMK-417/KMK.04/1996 regulate that

net income of shipping income of foreign shipping

company is about 6% of its gross shipping income

and effective tax rate is 2.64% of its gross shipping

income (Branch Profit Tax included). These

Indonesian shipping income taxes are final, so that

all costs connected to shipping income should not be

reduced from taxable income, as stipulated in

Indonesian Government Regulation No. 94 of 2010

Article 13. Regarding bookkeeping of final and non-

final income is regulated in Article 27, in this case

must be booked separately, join cost that cannot be

separated in order to calculate Taxable Income, the

charge is allocated proportionally.

Singapore Income Tax Act Sections 13A stated,

“There shall be exempt from tax the income of a

shipping enterprise derived or deemed to be derived

from the operation of Singapore ships or foreign

ships as hereinafter provided”. Inland Revenue

Authority of Singapore stated on its official website,

that “approved international shipping enterprises

operating ships plying in international waters enjoy

tax exemptions on certain types of international

shipping income under Section 13F of the Income

Tax Act (ITA)”. So that, shipping income of resident

shipping company and approved international

shipping company, were exempted under Section

13A and/or 13F of Singapore Income Tax Act.

As described on Inland Revenue Authority of

Singapore official website, this following types of

payment are not subject to Withholding Tax:

dividend payments; payments to Singapore Branches

of Non-Resident Companies; Payments made by

Banks, Finance Companies and certain Approved

Entities; Payments for the Charter of Ships; Other

payments.

Agreement between the Republic of Singapore

and the Republic of Indonesia for the Avoidance of

Double Taxation and the Prevention of Fiscal

Evasion with Respect to Taxes on Income, in Article

8 Paragraph 2 stated, “Income derived by an

enterprise of a Contracting State from the operation

of ships in international traffic maybe taxed in the

other Contracting State, but the tax imposed in that

other State shall be reduced by an amount equal to

50% thereof “.

3 METHODOLOGY

3.1 Research Method

The research method applied in this research is

descriptive qualitative research. There are several

kinds of qualitative research methods, but in this

case the researcher uses a case study approach.

The unit of analysis in this research is a single

analysis unit. The object of the research in question

is X company, which is a subsidiary of one of the

Republic of Indonesia State-Owned Enterprises,

formed to run commercial shipping business

domestically and internationally.

X company selected as an object, due to its

newly established, its well managed profit, and

recently plan to expand its business.

3.2 Data Analysis

The data used for this study consist of primary data

such as company profiles, business development

plans and financial reports from X company, as well

as corporate tax regulations in Indonesia and

Singapore. Data collection techniques are conducted

by interview method and documentation. The

instruments of data collection used were recording

devices, interview guidelines, checklists and tables.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1116

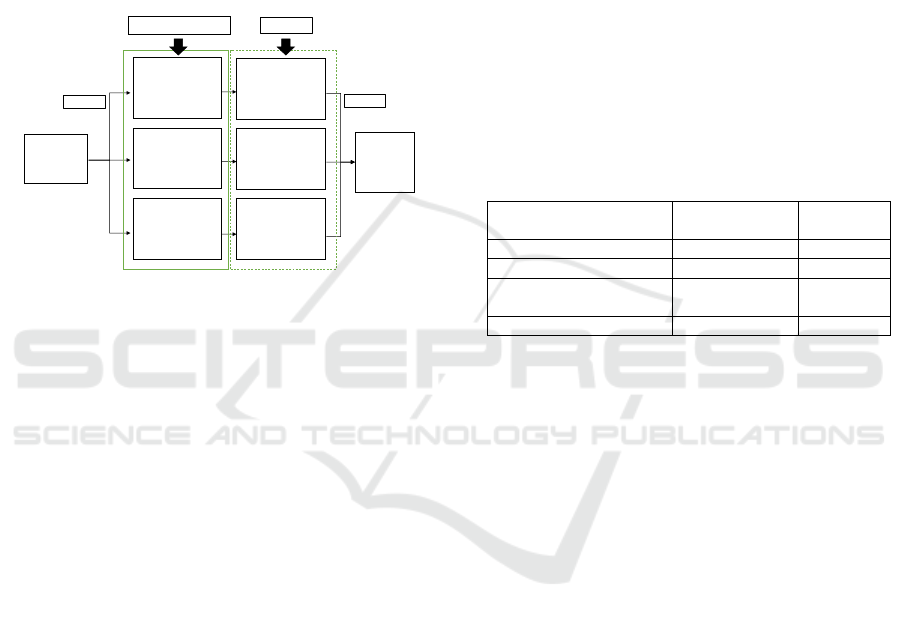

3.3 Research Model

This research model shows how to choose the

most profitable legal form of business units by

simulating how much total tax expenses are incurred

by the company and how much total profit after

taxes remain, whether they conduct business in

Singapore with subsidiary, with permanent

establishment or without subsidiary nor permanent

establishment. Research mind flow model described

in Figure 1.

Figure 1: Research mind flow model

4 ANALYSIS

The characteristics of the business sector and

business processes conducted by the company are

the determinants of how the tax planning scheme

constructed. In this section, through a case study of

X company, the author simulate what kind of

scheme should be used in tax planning for shipping

company business expansion.

Business expansion usually starts in the selection

of the legal form of business unit and choosing the

destination country of business expansion. In this

step, many aspects should be considered, including

the tax saving aspect. In this section, the author

simulate how much total tax expenses are incurred

by the company in three forms of alternatives,

whether they conduct business in Singapore through

subsidiary, through branch/permanent establishment,

or without subsidiary nor permanent establishment

(direct business).

X company as the object of this research, in

accordance with its Articles of Assosiation the

Company shall conduct these following activities :

a. Carrying inter-port sea transportation.

b. Transporting passengers, animal and cargos.

c. Services related business activities.

Wimbo Hapsara as manager strategic planning

and business development of X company through

personal interview explain that in 2017, X company

conduct business only from domestic transaction and

gained nett profit about 15.71% of its revenue as

shown in Table 2. Due to the recent issues, X

company needed to expand its business

internationally to mantain the growth of its revenue

and for company sustainability. According to the

master plan of business development, X company

will expand to the countries that considered as

international maritime hub, such as : Singapore, Uni

Arab Emirates (Dubai), Hongkong, England

(London), United States of America (Houston). In

2018, X company projected to earn shipping income

from international transaction about 10% of total

revenue (Hapsara, 2018).

Table 2: Income statement profile of X company for the

year ended Dec, 31 2017.

Account Name

Amount

(million USD)

Percentage

Total Revenue

99,xxx

100%

Cost of Revenue

80,xxx

81%

Operating & Other

expense

3,xxx

3.36%

Nett Profit before Taxes

15,xxx

15.71%

Source : X company financial statements fo the year

ended dec,31 2018 (Processed by author).

Since the destination country of expansion is

Singapore, then tax planning should comply to both

of Indonesian tax regulations and Singapore tax

regulations. Agreement between both countries to

avoid double taxation, also had to be considered.

Before simulating how much tax savings from

each legal form of a business unit, it is necessary to

arrange several assumptions to simplify the financial

profile of each alternative to make it easier to

compare. The assumptions arranged by the author

are as follows:

- Direct business (conduct shipping business

without subsidiaries nor branch/permanent

establishment) are allowed by expansion

destination country.

- Projected total revenue in this case are about 120

million US Dollars. Which is 105 million US

Dollar shipping revenue from domestic

transaction, 10 million US Dollar shipping

revenue from expansion/international

transaction, and 5 million US Dollar other

revenue that object of regular rate of Indonesian

Tax Income.

Projected Income

Statement

Expansion : Subsidiary

Projected Income

Statement

Expansion : Branch

Projected Income

Statement

Expansion without

Subsidiary nor Branch

Income Statement

of X Company

(FYE Dec 31, 2017)

Tax Expense in

Indonesia + Tax

Expense of Subsidiary

Tax Expense in

Indonesia + Tax

Expense of Branch (PE)

Tax Expense in

Indonesia + Tax

Expense in overseas

Several Assumption

Projected

Compared

The Lowest

Profit After

Taxes = The

Most Profitable

Legal Form of

Business Unit

Deducted

Tax Planning for Shipping Company Business Expansion

1117

a. Shipping revenue from expansion/international 10,000,000$

b. Direct Cost 8,100,000$

c. Operating & Other Expenses incurred in Subsidiary (5%) 500,000$

d. Nett Profit Before Taxes from Expansion (a-b-c) 1,400,000$

e. Singapore Corporate Income Taxes -$

f. Nett Profit after Taxes from Expansion (d-e) 1,400,000$

g. Dividend declared 1,400,000$

h. Witholding tax of Dividends -$

i. Transferred to parent company 1,400,000$

a. Shipping revenue from domestic 105,000,000$

b. Other revenue (Object of regular rate) 5,000,000$

c. Total Revenue (a+b) 110,000,000$

d. Direct Cost 89,100,000$

e. Gross Profit (c-d) 20,900,000$

f. Operating & Other Expenses 4,032,000$

g. Overseas nett income (Dividends) 1,400,000$

h. Commercial Nett Profit Before Taxes (e-f+g) 18,268,000$

i. Positive fiscal adjustment 88,898,727$

j. Negative fiscal adjustment 105,000,000$

k. Fiscal Net Profit/Taxable Income (h+i-j) 2,166,727$

l. Indonesian Income Tax (Regular rate 25%) 541,682$

m. Overseas tax credit -$

n. Indonesian Shipping Income Tax ( Effective rate 1.2%) 1,260,000$

o. Total Tax expenses (l+m) 1,801,682$

p. Profit after taxes (h-o) 16,466,318$

Income Statement

For the year ended December 31, 20xx

X Company (Parent) in Indonesia

Income Statement

For the year ended December 31, 20xx

Subsidiary in Singapore

- Direct cost of all alternatives assumed to be

equal. In this case author used percentage of X

company financial profile that is 81% of total

projected revenue earned in each countries.

- Projected operating and other expenses incurred

in Indonesia assumed to be constant of all

alternatives, which is according to X company

financial profile, that is 3.36% of total projected

revenue.

- There are extra operating expenses to run

Branches or Subsidiaries, and both assumed to

be equivalent. In this case, author assumed the

percentage is about 5% of projected expansion

revenue.

- All nett profit of Subsidiaries declared as

dividend, and transferred to parent company after

deducted by dividend witholding tax.

- Fiscal adjustments only from shipping income

that considered to be final, deducted by direct

costs and operating & other expenses that cannot

deducted regarding to shipping income.

Due to assumptions above, projected operating

and other expenses in Indonesia are 3.36% of 120

million US Dollars or $ 4,032,000 of all alternatives.

Extra operating expenses whether expansion

conducted through Branch or Subsidiary are 5% of

10 million US Dollars or $ 500,000.

4.1 Expansion through Subsidiary

Expanding business through subsidiary means

forming a new entity in the destination country and

becomes resident company of destination country.

The consequences are revenues, direct costs and

operating expenses incurred in the destination

country reported as separate entity. Profit from

subsidiaries that has been earned transferred to the

parent company by dividend.

According to Singapore Tax Regulations,

Shipping income of resident companies are

exempted from Income Tax, as well as dividend

payments are not subject to Witholding Tax, so that

no taxes to be charged in Singapore. Since projected

shipping revenue from Singapore is US$10 million,

direct costs assumed is US$8.1million and operating

and other expenses assumed are US$500 grand, then

Nett profit after taxes in Singapore is US$1.4

million, and all transfered as dividend to parent

company.

Dividend from Singapore Subsidiary, is reported

in Parent Company financial statements as overseas

nett income that object of regular rate of Indonesian

Corporate Income Taxes, so total Indonesian

commercial nett profit before taxes is US$

18,268,000, spesific calculation is described in

Figure 2.

Figure 2: Income statement simulation over expansion

through subsidiary (Processed by the author).

After fiscal adjustment of US$16,101,273, the

Indonesian Taxable Income which is the object of

regular rate is US $ 2,166,727 and the Corporate

Income Tax payable is equal to US$ 541,682. There

is no overseas tax credited over, since no tax witheld

in Singapore. Shipping revenue from domestic

transactions are object of effective rate 1.2% under

Indonesian Minister of Finance Decision Letter

Number KMK-416/KMK.04/1996, that is

US$1,260,000.

According to descriptions above, total tax

expenses over total projected revenues are US$

1,801,682, and total profit after taxes is US$

16,466,318.

4.2 Expansion through Branches

Expanding business through branches means

conducting business in the destination country

without forming new entity, only placed a

permanent establishment and registered as tax

subject in destination country. In this form,

revenues, direct costs and operating expenses

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1118

a. Shipping revenue from domestic 105,000,000$

b. Shipping revenue from expansion/international 10,000,000$

c. Other revenue (Object of regular rate) 5,000,000$

d. Total Revenue (a+b+c) 120,000,000$

e. Direct Cost 97,200,000$

f. Gross Profit (d-e) 22,800,000$

g. Operating & Other Expenses 4,032,000$

h. Commercial Nett Profit Before Taxes (f-g) 18,768,000$

i. Positive fiscal adjustment (95.83% of e+g) 97,014,000$

j. Negative fiscal adjustment 115,000,000$

k. Fiscal Net Profit (h+i-j) 782,000$

l. Indonesian Income Tax (Regular rate 25%) 195,500$

m. Indonesian Shipping Income Tax ( Effective rate 1.2%) 1,380,000$

n. Total Tax expenses (l+m) 1,575,500$

o. Profit after taxes (h - n) 17,192,500$

X Company in Indonesia

Income Statement

For the year ended December 31, 20xx

a. Shipping revenue from Singapore 10,000,000$

b. Direct Cost 8,100,000$

c. Extra Operating & Other Expenses incurred in Branch (5%) 500,000$

d. Nett Profit Before Taxes from Expansion (a-b-c) 1,400,000$

e. Singapore Corporate Income Taxes -$

f. Nett Profit after Taxes from Expansion (d-e) 1,400,000$

g. Branch Profit 1,400,000$

h. Witholding tax of Branch Profit Tax -$

i. Transferred to X company 1,400,000$

a. Shipping revenue from domestic 105,000,000$

b. Shipping revenue from Branch 10,000,000$

c. Other revenue (Object of regular rate) 5,000,000$

d. Total Revenue (a+b+c) 120,000,000$

e. Direct Cost (Indonesia & Singapore) 97,200,000$

f. Gross Profit (d-e) 22,800,000$

g. Operating & Other Expenses 4,032,000$

h. Operating & Other Expenses incurred in Branch (5%) 500,000$

i. Commercial Nett Profit Before Taxes (f-g-h) 18,268,000$

j. Positive fiscal adjustment (95.83% of e+g+h) 97,493,167$

k. Negative fiscal adjustment 115,000,000$

l. Fiscal Net Profit (i+j-k) 761,167$

m. Indonesian Income Tax (Regular rate 25%) 190,292$

n. Indonesian Shipping Income Tax ( Effective rate 1.2%) 1,380,000$

o. Total Tax expenses (m+n) 1,570,292$

p. Profit after taxes (i - n) 16,697,708$

For the year ended December 31, 20xx

Branch in Singapore

Branch Profit Record

For the year ended December 31, 20xx

X Company in Indonesia

Income Statement

incurred in the destination country reported all in

central company financial statement. Any taxes that

incurred regarding revenue are deducted over the

commercial nett profit that earned in destination

country, and the rest is called as Branch Profits.

Branch Profit frequently transferred to central

company after deducted witholding tax (if any).

Since shipping income are exempted from

income tax under Section 13A and/or 13F of

Singapore Income Tax Act, then in this form of

business unit there is no taxes to be charged in

Singapore too. So that, the total Branch Profit to be

transfered to the central company is equal to

US$1,400,000.

Figure 3: Income statement simulation over expansion

through branch (Processed by the author).

All revenues, direct costs and operating & other

expenses recorded in central company income

statement. So that commercial nett profit before

taxes is US$ 18,286,000, spesific calculation in

Figure 3.

After fiscal adjustment of US$ 17,506,833, the

Indonesian Taxable Income which is the object of

regular rate is US $ 761,167 and the corporate

income tax payable is equal to US$ 190,292. There

is no overseas tax credited over, since no tax witheld

in Singapore. Shipping revenue from domestic and

international transactions are object of effective rate

1.2% under Indonesian Minister of Finance Decision

Letter Number KMK-416/KMK.04/1996, that is

US$1,380,000.

According to calculations above, total tax

expenses over total projected revenues are US$

1,570,292 and total profit after taxes is US$

16,697,708.

4.3 Expansion through Direct Business

Expanding business through direct business

means conducting business in the destination

country without forming new entity nor register a

permanent establishment. In this form, revenues,

direct costs and operating expenses incurred in the

destination country reported all in central company

financial statement. Any taxes that incurred

regarding revenue are become overseas tax credit in

Indonesia.

Actually this form similar to conduct business

expansion through Branches, however there is one

difference that is the absence of extra operating and

other expenses. Since Singapore tax income on a

quasi-territorial basis, as long as X company afford

to run this business remotely/virtually, International

transaction is better be runned from Indonesia.

Simulation of X company Income Statement

described in Figure 4. Commercial nett profit before

taxes is become US$ 18,786,000. After fiscal

adjustment of US$ 17,986,000, the Indonesian

Taxable Income which is the object of regular rate is

US $ 782,000 and the Corporate Income Tax

payable is equal to US$ 195,000. According to

calculations above, total tax expenses over total

projected revenues are US$ 1,575,500 and total

profit after taxes is US$ 17,192,500.

Figure 4: Income statement simulation over expansion

through Direct Business (Processed by the author).

Tax Planning for Shipping Company Business Expansion

1119

5 CONCLUSION

According to previous analysis, author compared

profit after taxes of all alternatives. The resume

results of all alternatives shown by Table 3.

Table 3 : Resume of income statement simulations.

Alternatives of legal

form

Tax Expenses

(US$)

Profit After

Taxes

(US$)

Subsidiary

1,801,682

16,466,318

Branch/Permanent

Establishment

1,570,292

16,697,708

Direct Business

1,575,500

17,192,500

Source : Processed by author.

Author finds that conduct business expansion

through direct business (without subsidiary nor

branch/permanent establishment), becomes the most

profitable legal form of business unit, connected to

the result of simulations that earned the largest profit

after taxes over all alternatives. The difference

between profit after taxes of expansion through

Direct Business and Branch/Permanent

Establishment is equal to US$ 494,792, which is

US$5,208 lower than the absences of extra operating

& other expenses assumed to this case. Amount of

US$5,208 defined as the tax gap over the absences

of extra operating & other expenses. It seems that

the gap not too significant, but shows that there are

differences caused by the absences, and the amount

will increase by the amount of extra operating &

other expenses assumed for other alternatives.

If the assumptions about direct business cannot

be applied due to local government policies, then the

most profitable legal form is to carry out business

expansion through branches / permanent

establishment. The difference between profit after

tax X company which carries out business

expansion through subsidiary and through branches /

permanent establishment is US $ 231,390. This

difference describes the tax saving caused by

effective shipping rates of 1.2% of gross reveue

earned by branch / permanent establishment, taxed

lower than a regular income tax rate (25% of

dividend earned from Subsidiary). As long as

Branch Profit are greater than 4.8%, there will

always be tax savings occured over tax planning.

Based on the simulation steps carried out in the

previous section, the author recommends that

company’s manager take these steps to provide

relevant information for stakeholder, regarding tax

planning aspect for shipping company business

expansion especially in choosing the legal form of

business unit.

The results of the research on the development of

Teaching Materials for Problem Based Learning

Strategy include: 1) student worksheet; 2) learning

strategy material; and 3) problem-based evaluation

instruments.

Student worksheets are developed to help

students understand the teaching material for

learning strategies. Student worksheets are designed

to adopt problem-based learning steps which

include: 1) problem orientation; 2) learning

organization; 3) individual or group investigations;

4) development and presentation of problem solving

results; 5) analysis and evaluation of the problem

solving process.

Teaching materials designed include: 1) learning

theory in learning; 2) basic concepts of learning

strategies; 3) 21st century learning strategies; 4)

learning approach; 5) learning methods and

techniques; 6) learning models; 7) teaching factory;

8) strengthening character education.

Evaluation instruments designed include: 1)

problem-based problem instruments; and 2)

assessment guidelines.

REFERENCES

Arikunto, S.,(2016). Manajemen Penelitian, Rineka Cipta.

Jakarta, Revised edition.

Desai, M.A., Dharmapala, D., (2007). Corporate Tax

Avoidance and Firm Value, SSRN.(2007):14-

15.<http://www.nber.org/papers/w11241>

Herawati, H., Ekawati, D., (2016), Pengaruh Perencanaan

Pajak Terhadap Nilai Perusahaan, Jurnal Riset

Akuntansi & Keuangan.

Inland Revenue Authority of Singapore, (2018). Payments

that are Not Subject to Witholding Tax,

<http://www.iras.gov.sg>

Pohan, Chairil Anwar. (2018). Pedoman Lengkap Pajak

Internasional: Konsep, Strategi, Penerapan.

Gramedia Pustaka Utama, Jakarta.

Pohan, Chairil Anwar. (2017). Manajemen Perpajakan :

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1120

Strategi Perencanaan Pajak & Bisnis, Gramedia

Pustaka Utama, Jakarta, Revised edition.

Tax Planning for Shipping Company Business Expansion

1121