Analysis of the Interdependence of Monetary Instruments

a

g

ainst Real Mone

y

Demand in Indonesia

Putri Suryani Sebayang

1

, Fitrawaty

2

and Muhammad Fitri Rahmadana

2

1

Post Graduate School, State University of Medan, North Sumatra, 20219, Indonesia

2

Department Economics, Faculty of Economics, State University of Medan, North Sumatra, 20219, Indonesia

Keywords: Real Demand for Money (M1), GDP, Interest Rate of Bank Indonesia, Exchange Rate, Inflation, Vector

Error Correction Model (VECM)

Abstract: This research aims to determine how the relationship between variables gross domestic product, interest

rates, exchange rates, and inflation against the demand for real money (M1) in Indonesia. The data used in

the study of this empirical data for the time series of the year 1987-2017 derived from Bank Indonesia and

the Central Bureau of Statistics (BPS). The analysis method in this research is The Vector Error Correction

Model (VECM). The results showed there is a direct relationship between the exchange rates with demand

for real money (M1). And there is a direct relationship with the demand for real money (M1) with inflation.

The results of the study also showed the gross domestic product of influential negative and significantly

affect the demand for real money in the short-term. Variable exchange rates, interest rates and inflation

effect no effect against the demand for real money (M1) in the short-term. The demand for real money (M1)

in Indonesia in the long-term be influenced in a positive and significant by the variable gross domestic

product, exchange rates, interest rate. While the variable is a negative and significant effect of inflation

against the demand for real money (M1) in Indonesia in the long-term.

1 INTRODUCTION

The money created in the economy aims to launch

exchange-traded activities and trade, or in other

words, the money was defined as objects that are

approved by the community as a mediator to hold

someone or trade. Money Kartal is money issued by

the central bank both banknotes or coins that are

circulating in the community. (Prawoto, 2010:18).

The money supply is often linked to interest

rates, economic growth, and the development of

prices. The phenomenon is happening in Indonesia

showed at the time the money supply increases tend

to encourage price increases of goods in General,

resulting in inflation. Conversely, when the money

supply decreased, economic activity will slow down

that led to the decline in production levels that

followed price increases of goods.

Request money greatly affects the economy of

Indonesia it can be reinforced with the theory of the

demand for money. Many of the theories that discuss

the request for money. According to the classical

doctrine, money has no influence on the rill, no

sector of its effect on interest rates, employment

opportunities or national income (Nopirin, 2009). At

the beginning of this theory is not intended to

explain why communities save money. But more on

the role of on the money. Therefore some of the

theory with familiar classics such as Irving Fisher's

theory only describes the relationship the number of

coins, turnover, volume, and price of the goods. And

Marshall's theory that only describes the relationship

of the nominal value of money, prices, income, and

the proportion of the demand for money.

The theory of money demand continues to grow

and then comes the theory that further deepens the

theory Keynes is a theory developed by Baumol and

Tobin who explained that requests money for the

purpose of transactions affected interest rates

(Nopirin, 2007). Because when high-interest rates

then that will reduce an individual means of

payment in the form of cash and money to expand

the securities. Otherwise, once the interest rates low

so the individual will reproduce the cash money.

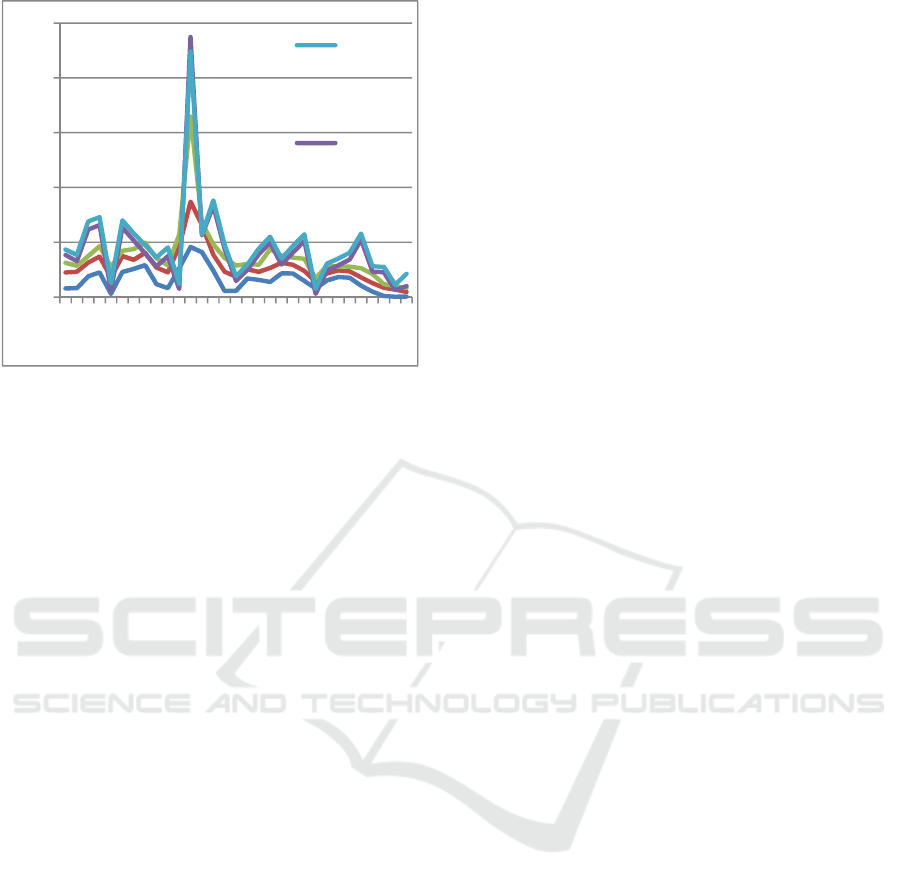

An overview of the linkages of the development

of monetary instruments with real money demand

(M1) can be seen in the picture below.

532

Sebayang, P., Fitrawaty, . and Rahmadana, M.

Analysis of the Interdependence of Monetary Instruments against Real Money Demand in Indonesia.

DOI: 10.5220/0009505005320537

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 532-537

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Figure 1: The trend of the real money demand (M1) and

monetary instruments variable in Indonesia year 1987-

2017

Based on Figure 1 shows that the demand for

real money year 2008 experienced a decline of 21.44

percent to 14.63 percent. When the world economy

is hit by the global economic crisis, the impact is felt

in Indonesia that led to the economic climate in the

country also come into effect, the peak occurred in

the year 2008. GDP growth the year 2008 noted the

development of a fairly good about 14.63 percent in

the middle of the occurrence of the external turmoil.

In late 2008, however, the exchange rate of rupiah

currency from rising of rupiahs per dollar into 9,419

10,950 rupiahs per dollar and at the same time the

banks start to tighten its credit policies. Then in mid-

2008 world oil prices rising back up to reach above

145 U.S. dollars per barrel and followed a financial

crisis in America in 2008. The economic impact on

the countries of Europe, Asia and Indonesia are also

included. Finally back pressing the rupiah exchange

rate in 2008 reached almost 10,950 rupiah per dollar.

Changes in interest rates and the sharp inflation

occurred in the year 2008, inflation has a high

influence on the demand for real money (M1).

Thus, the phenomenon of money demand

monetary interest to research. Identify economic

quantities that affect the demand for money through

various studies theory, empirical studies and the

phenomenon of data that has been done previously

showed the importance of the development of

research request for money in Indonesia. In General,

this research examines the relationship between the

independent variable and the dependent variable in

the short-term and long-term. The purpose of this

research is to analyze the association between

variables Bank Indonesia interest rate (BI Rate),

inflation (INF), the exchange rate (EXC), and the

GDP against the demand for real money (M1) in

Indonesia.

2 THEORETICAL FRAMEWORK

Money has a negative relationship with the level of

interest rates. Keynes stated that the community has

confidence the presence of a normal interest rate. If

the securities are held at the time the interest rate

goes up, it will be incurred losses. This can be

avoided by way of reducing the Securities and adds

cash money. The higher the interest rate, the higher

the cost of holding cash money anyway so desire

cash money holding it down. Conversely, when

interest rates go down means the cost of holding

money in cash is also getting low so cash money

demand rises (Nopirin, 2009).

Purchasing Power Parity theory predicts that the

decline in domestic purchasing power of the

currency indicated by the domestic price level would

relate to currency appreciation proportionately. In

short, there are two versions of the theory of

purchasing power parity, i.e. the interpretation of

absolute and relative. According to the interpretation

of the absolute purchasing power parity, a

comparison of the value of one currency with

another currency (exchange rate) is determined by

the price level in their respective countries. So the

exchange rate is based on a comparison of

purchasing power. While according to the

interpretation of relative purchasing power parity

exchange rate saying that power parity based on

price changes (Nopirin, 2009).

In the quantity theory of money theory of money

demand, Fisher and Keynes ware mainly for the

purpose of the transaction stated that demand for

money depends on income. The higher the income,

the greater the desire then would cash money. It can

be seen from the behavior of the community level

high revenues, will usually do more transactions

than the community that its revenues are lower. This

means that when revenues increase, then spending

more and more money so that also to deals increases

(Nopirin, 2009).

3 RESEARCH METHOD

The data will be used in this research in the form of

secondary data. Secondary data that will be used is

the data time series during the year 1987-2017

0

50

100

150

200

250

1987

1990

1993

1996

1999

2002

2005

2008

2011

2014

2017

GDP

Exchange

Rate

Analysis of the Interdependence of Monetary Instruments against Real Money Demand in Indonesia

533

which is the total amount of data Bank Indonesia

interest rate (BI Rate), inflation (INF), the exchange

rate (EXC), and the GDP against the demand for

real money (M1) in Indonesia. The data can be

taken from the Bank Indonesia (BI) and the Central

Bureau of Statistics (BPS) or via the official website

of each of the institutions (www.bi.go.id and

www.bps.go.id).

Methods of data analysis used in this study was a

statistical analysis method with equation model

VECM (vector error correction model) which

consists of the initial test variables by using the root

test a unit test that uses Augmented Dickey-Fuller. If

the present level of stationary data then continued

with the usual VAR equations (VAR unrestricted)

which comprise two equations to determine the

optimal VAR order and continued with the Granger

test method using Johansen. The last stage is doing

the estimation methods of VAR and accompanying

the VECM, namely test causality, function response

to shock (the Impulse Response Function/IRF), and

decomposition of variants (Forecast Error Variance

Decomposition/FEVD). This study uses statistics

programs help E-Views version 7.

4 ANALYSIS

4.1 Stationer Test

The first thing to do is to examine whether the data

is stationary or not. This Stasioneritas test needs to

be done because a regression analysis should not be

done when the data used is not stationary and

normally if it still has done the resulting equations

then are a spurious regression. The test methods

used in this Test method is stationeries Unit Root

Test or also known as the test of the Augmented

Dickey-Fuller (ADF).

4.1.1 Unit Root Test

The value of the test results with the Augmented

Dickey-Fuller (ADF), indicated by the value of the

statistical regression coefficients t on the observed

variable (X). If the value is greater than the value of

the ADF test critical values MacKinnon on the level

of the 1 percent, 5 percent, or 10 percent, then the

stationary means data.

Based on table 1 that Bank Indonesia interest rate

(BI Rate), and the demand for real money (M1) in

Indonesia is not significant at the α = 5 percent.

Because not stationary at the zero degrees, then it

needs to be done again using stationarity test the

degree of integration of the single.

Table 1: Unit Root Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Desc

M1

-1.178163

-2.971853

Non-

Stationary

GDP -3.918175 -2.963972

Stationary

EXC -3.292333 -2.963972

Stationary

BI Rate

-1.566971

-2.963972

Non-

Stationary

INF -5.751641 -2.963972

Stationary

4.1.2 Integration Test

A test of the degree of integration is a test done to

measure at the level of difference to how data all the

variables are stationary. The taking of decision is

when the count of an ADF variable is greater than

the critical value of MacKinnon, means the variable

is stationary, and vice versa.

Based on table 2 that variable Bank Indonesia

interest rate (BI Rate), inflation (INF), the exchange

rate (EXC), and the GDP against the demand for

real money (M1) in Indonesia has been stationary at

the same degree, that is one degree, shown from the

ADF value calculate more than the value of the

critical (Mackinnon critical values) at α = 5%. Thus,

the Granger test requires a stationary data at the

same degree can be used.

Table 2: Integration Test Results

Variables

Value

ADF

Critical

Value

McKinnon

(α = 5%)

Desc

M1 -4.327986 -2.971853 Stationary

GDP -6.849849

-2.967767 Stationary

EXC -6.776012

-2.967767 Stationary

BI Rate -5.525270

-2.967767 Stationary

INF -6.249907

-2.967767 Stationary

4.1.3 Cointegration Test

Granger test is a test of unit roots test and degree of

integration. Granger test meant to know the behavior

of the data in the long term between related variables

is there Granger or not as you see fit by economic

theory. To do this test used Granger Johansen test.

The taking of decision is when the value of the

Trace Statistic>Critical Value and the value of Max-

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

534

Eigen Statistics>Critical Value, meaning between

these variables in long-term relations equilibrium,

and vice versa.

Table 3: Cointegration Test Results

Hypothesis

Trace

Statistic

Critical

Value

(α = 5%)

Prob

None* 159.3965 68.81889 0.00000

At most 1* 94.54151

47.85613 0.0000

At most 2* 45.73188

29.79707 0.0004

At most 3*

19.68411

15.49471 0.0110

At most 4*

8.431014

3.841466 0.0037

Based on table 3 that there are equations that

model in Granger. Thus, an appropriate model to be

used in this research is the Vector Error Correction

models (VECM).

4.2 Estimation Vector Error

Correction Model (VECM)

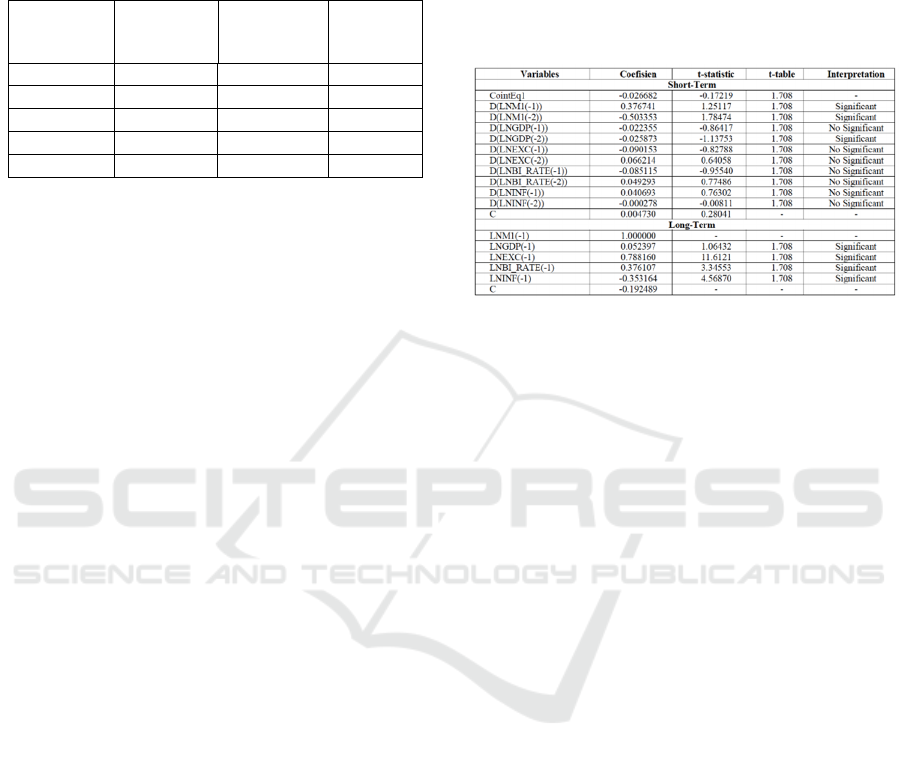

Based on table 4 provides statistical information for

each equation of variables DM1, DGDP, DEXC,

DBIRATE and DINF and the very bottom is the

information thoroughly. Numbers in brackets show

the first standard error numbers are locked up while

the bottom shows a value of the t-statistic.

VECM estimation results in the table above

show that in the long run, the first of the variable

gross domestic product had a positive relationship

towards the demand for real money amounting to

0.052397 and a significant increase in the

probability of 10 percent. These results show that

long-term changes in the gross domestic product will

be followed by the demand for real money with

direct direction. If an increase in the amount of 1

billion rupiahs in a gross domestic product will be

followed by an increase in the demand for real

money amounting to 0.052397 percent.

Second, the variable exchange rate against the

real money demand relationship 0.788160 of

positive and significant at probability 10 percent.

Thus, in the event of an increase of 1 percent on the

exchange rate of 1 the rupiah per dollar will be

followed by a decrease in the demand for real money

amounting to 0.788160 percent.

Third, the variable interest rate against the

demand for real money has a positive relation of

0.376107 and significant at probability 10 percent.

Thus, in the event of an increase of 1 percent on the

interest rate will be followed by a rise in the demand

for real money amounting to 0.376107 percent.

Fourth, variable Inflation against real money

demand relationship -0.353164 negative and

significant at the 10 percent probability. Thus, in the

event of an increase of 1 percent in Inflation will be

followed by a decrease in the demand for money is

real of 0.353164 percent

Table 4: Estimation VECM Test Results

On the model of equation VECM, where each

variable influence each other (exogenous) and may

also be affected (endogenous). The first equation,

DM1 which is a query variable real money as an

endogenous variable is affected by the variable

demand for real money yourself (DM1), gross

domestic product (DGDP), exchange rates (DEXC),

the interest rate of Bank Indonesia (DBI RATE) and

inflation (DINF) next could be explained on the

model equations are given below. The resulting

equation in the VECM estimation is as follows:

D(LNM1) = 0.004730 - 0.022355 D(LNGDP(-1)

-

0.025873 D(LNGDP(-2))

– 0.090153

D(LNEXC(-1))

+

0.066214

D(LNEXC(-2)

–

0.085115

D(LNBI RATE(-1)) + 0.049293

D(LNBI RATE(2))

+ 0.040693

D(LNINF(-1)) - 0.000278

D(LNINF(-2))

- 0.026682 ECT

As for the VECM equation for the long-term are

as follows:

LNM1 = - 0.192489 + 0.052397 LNPDB(-1) +

0.788160 LNEXC(1

)

+

0.376107 LNBI RATE(-1)) -

0.353164 LNINF(-1)

The first equation with endogenous variables

requests real money (M1), where a variabel gross

domestic product, inflation, exchange rate and a

variable interest rate do not give significant effects

against the movement of real money demand. The

demand for real money (M1) was also significantly

influenced by the movement itself on two and one

years earlier. Real money demand relationship

Analysis of the Interdependence of Monetary Instruments against Real Money Demand in Indonesia

535

pattern (M1) and himself is negative except for the

previous two years related positively. The

relationship of real money demand and gross

domestic product are insignificant and have a

positive relationship for the two to a year earlier.

The relationship between real money demand and

inflation was not significant and has a negative

relationship for two to a year earlier. Real money

demand a relationship and exchange rate were not

significant and negative except for two months

before that deal was positive. Real money demand

relationship and significant interest rate on one-

month before and have a positive relationship one

year earlier and have a negative relationship to the

previous two years.

The results of this equation indicates that any

increase in the product gross domestic at this time, it

will be an increase in the demand for real money in

the next one to two years. The increase in Inflation

at the moment will have an impact on the decline in

the demand for real money one and twenty years

after. The increase in the exchange rate when. This

will result in increased demand for real money one

year later, but then leads to a decrease in the two

years thereafter. An increase in the current interest

rate will lower the demand for real money in one

year afterward. but later led to a decrease in the two

years thereafter. Within the same way, we can

interpret the equations with the dependent variables

etc.

4.3 Estimation Impulse Response

Function (IRF)

To know a variable response to changes or shock

that occurs from the variable itself with other

variables in this study used the analysis of impulse

response. Following the results of the analysis of

impulse response:

Figure 2: The Impulse Response Function

The variable demand for real money (M1) at the

change of one (1) standard deviation experience a

decrease. The response continues to be negative with

declining small fluctuations after the next 10 years.

The GDP variable on changes one (1) standard

deviation of GDP alone showed the value of positive

response at one year next and experience negative

response on one the following year. Next at one

month later inflation experience positive and

negative responses one month there after in turns

until the end of the period.

4.4 EstimationVariance Decomposition

After he had done the testing against the impulse

response, then the next to perform testing of the

decomposition of the variant that aims to find out

donations variant of variables against the demand for

real money (M1).

In the first period, the analysis of variance

showed that the decomposition forecast error

variance from the demand for real money on the first

period determined by himself in the amount of 100

per cent, while the variable contribution of gross

domestic product, exchange rate, Bank Indonesia

interest rates and inflation are not able to explain the

variability of the demand for real money (M1) of 0

percent.

5 CONCLUSIONS

The condition is the amount of money circulating in

the economy of Indonesia is dominated with the

influence of interest rates and inflation. It refers to

the theory the interest rate transmission explained

that the role of the monetary sector is still pretty. It

is important in controlling the number of money in

circulation. The Government through the Central

banks still hold strong control to control the

economy in Indonesia. Economic growth was also

considerable effect on rates interest rate, inflation

and the amount of money in circulation. But based

on the results of impulse response, these variables

quickly back to a point of stability caused economic

growth only give short-term influence.

REFERENCES

Nopirin, Ph.D. (2009). Ekonomi Moneter Buku II. BPFE.

Yogyakarta.

Prawoto, N. (2010). Money demand: A Study on the

Indonesian influental factors. Economic Journal of

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

536

Emerging Markets, December 2010 2(3), p. 223-

236

Dharmadasa, C dan Nakanishi, M. (2013). Demand for

money in Sri Langka: ARDL Approach to Co-

integration. 3rd International conference on

humanities, Geography and Economics (ICHGE),

January 4-5, 2013 Bali, p. 143-147.

Analysis of the Interdependence of Monetary Instruments against Real Money Demand in Indonesia

537