Determinants of Intellectual Capital Disclosure by using Monetary

and Non-monetary Variables

Prima Aprilyani Rambe

1

, Citra Dewi

1

, Iskandar Muda

2

and Syafruddin Ginting

2

1

Student Postgraduate, Faculty Economic and Business,Universitas Sumatera Utara, Medan –Indonesia

2

Lecture Faculty Economic and Business, Universitas Sumatera Utara, Medan-Indonesia

Keywords: Intellectual Capital Disclosure, Profitability, Leverage, Firm size, Firm’s Age

Abstract: Purpose of this research is to analyse of determinants of intellectual capital disclosure by using monetary

and non monetary variables. Profitability, leverage, firms’s size and firm’s age are determinants of

intellectual capital disclosure. There were 12 companies which selected as a sample. An index of disclosure

of intellectual capital was constructed to analyse intellectual capital disclosure in the sustainability reports

for 2015 – 2017. This report was published on the website of Indonesia Stock Exchange. Object of this

research is only focus on banking firms. This reasearch was developed four hypothesis about association

between profitability, leverage, firm’s size, firm’s age and intellectual capital disclosure. This research

highlight the determinants of intellectual capital disclosure by using intellectual capital index from

Oliviera’s research. The results showed that there was association between profitability, firm’s age and

intellectual capital disclosure. But leverage and firm size showed that there was not association with

intellectual capital disclosure.

1 INTRODUCTION

Intellectual capital is one of the intangible assets in

the company. Information regarding intangible asset

is regulated in PSAK No. 19 (Revised 2009).

Disclosures about intangible assets are presented by

each company in the annual report. However, the

PSAK does not regulate what items must be

disclosed in the annual report regarding intangible

assets. Disclosure of intellectual capital is one of the

disclosures in the annual report. This disclosure is

voluntary. Although this disclosure is voluntary,

many companies make this disclosure in their annual

reports. Voluntary disclosure especially intellectual

capital is an added value for the company. Because

in this annual report, especially the disclosure of

intellectual capital provides information about the

performance of human resources owned by the

company. So, if a company has good financial

performance, this is because one of them is due to

good human resource management.

Knowledge-based industries are industries that

utilize the innovations they create to compete with

other industries by providing their own value for the

products or services produced by the industry.

Especially in the industrial era 4.0 technology is

very high needed in the company. Therefore, to

absorb the technology that is developing now, it

requires high intellectual capital. Banking

companies are one company that must use high

technology. Because banking companies must

improve the system and strategy with the aim that

the public can prove and feel that technology makes

it easy for transaction. Technology also helps

companies to maintain customer security and trust.

Skimming is one of the crimes in the world of

banking. This is also the reason for banks for

making improvements in innovation and technology.

To be able to innovate and adopt sophisticated

technology, high intellectual capital must be needed.

This study aims to determine the factors that

influence the disclosure of intellectual capital.

Disclosure of intellectual capital in this study uses

research conducted by (Oliveira, Rodrigues and

Craig, 2010). According to (Oliveira, Rodrigues and

Craig, 2010), there are 88items of intellectual capital

that should be disclosed. Meanwhile, according to

(Garanina and Dumay, 2017) based on Guthrie et.al

Rambe, P., Dewi, C., Muda, I. and Ginting, S.

Determinants of Intellectual Capital Disclosure by using Monetary and Non-monetary Variables.

DOI: 10.5220/0009504810971102

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1097-1102

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1097

stated that there are 79 items of intellectual capital

that should be disclosed. The difference between the

research conducted by (Oliveira, Rodrigues and

Craig, 2010) and (Garanina and Dumay, 2017) lies

in human capital, strategic capital and process

capital. There are several additional items in these

three elements. Most previous studies such as to

(Garanina and Dumay, 2017); (Sudibyo and Basuki,

2017); (Kamath, 2016); (Al-hamadeen & Swaidan,

2014) used items less than 88 items, started from 40

items to 79 items.

In disclosure of intellectual capital is influenced

by several factors. Many previous researchers such

as (Garanina and Dumay, 2017); (Sudibyo and

Basuki, 2017); (Kamath, 2016); (Eddine et al.,

2015); (Al-hamadeen & Swaidan, 2014) who have

conducted research on factors that influence

disclosure intellectual capital. As for the factors that

have been studied such as company age, company

size, auditor type, managerial ownership,

profitability, leverage and others. However, the

results of the study showed insistency in each study.

The factors examined in this study are profitability

and leverage that represent the monetary variable.

Firm size and age are factors that represent non-

monetary variables.

2 THEORICAL FRAMEWORK

This research is using three theories that can

explained about intellectual capital disclosure.It

comprises of stakeholder theory, signaling theory

and legitimating theory. Stakeholder theory is

consisting of shareholders,employees, customers,

competitors, lenders, government and society and

environmental activist groups, media and consumer

advocates (Kamath, 2016) as companies that grow in

size and characteristics, management is starting to

give strong hope to stakeholders (Kamath, 2016).

This explains why intellectual capital is expected to

be expressed more in large companies (Kamath,

2016). In the legitimacy theory emphasizes that

companies are in a continuous process to get the

approval of community norms about their functions

(Kamath, 2016). The signaling of the theory shows

that high-quality companies must show a signal to

the market that the company provides high profits so

that it will reduce the cost of capital (Kamath, 2016).

Many researchers conducted research on factors

that influence intellectual capital disclosures such as

(Seng, Kumarasinghe and Pandey, 2018);(Kamath,

2016);(Eddine et al., 2015); (Al-hamadeen &

Swaidan, 2014); (Ibikunle, Oba and Nwufo, 2013).

Several factors influence intellectual capital

disclosure such as profitability, leverage, company

size, company age, ownership structure and others.

However, in this study the factors used in

intellectual capital disclosure are profitability,

leverage, firm size and company age.

According to Meek et. Al (1995); Marston and

Shrives (1995) and El Gazzar and Fornaro (2003)

in(Ibikunle, Oba and Nwufo, 2013) show that

profitable companies are expected to reveal more

information about their performance. Hanifa and

Cooke (2002) in (Ibikunle, Oba and Nwufo, 2013)

found a positive and significant relationship between

company profitability and intellectual capital

disclosure. However, this is different from the

research conducted (Sudibyo and Basuki, 2017);

(Kateb, 2014);(Rahim, Atan and Kamaluddin,

2011); (Rahim, Atan and Kamaluddin,

2011);(Taliyang, Latif, & Mustafa, 2011) say that

profitability does not affect intellectual capital

disclosure. Based on the above, the hypothesis that

can be built is

H1: Profitability affects intellectual capital

disclosure.

Companies with a high degree of leverage tend

to make wider disclosures (Company, Jensen and

Meckling, 1974). Because stakeholders such as

creditors need more information when the creditor

will provide a loan to a company. This research was

supported by (Kateb, 2014). Research (Bagchi, Joshi

and Salleh, 2015) shows that firm size and leverage

have no effect on intellectual capital disclosure.

H2: Leverage affects intellectual capital

disclosure

Firm size and type of industry tend to be the

main determinants of intellectual capital disclosure.

Larger companies tend to be more progressive and

innovative because they have financial

resources(Kamath, 2016). Larger companies will

express more intellectuals because they think

managers of larger companies are more likely to

realize the possible benefits of more

disclosure(Ibikunle, Oba and Nwufo, 2013).

However, it is different from research conducted by

(Bagchi, Joshi and Salleh, 2015)which shows that

company size and leverage do not or have little

impact on the 114 companies studied (Kamath,

2016). Based on this, the hypothesis in this study

are:

H3: Firm size influences intellectual capital

disclosure

Company age is one of the factors considered in

influencing intellectual capital disclosure. Because if

a company can last long and is able to compete in a

business then this indicates that the company is able

to manage resources that are owned well. The ability

to manage resources owned is supported by

intellectual capital owned by the company.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1098

Therefore, the longer the company maintains its

existence, the more intellectual capital is disclosed

in the annual report. This research is supported by

research (Taliyang, S. M., Latif, R. A., dan Mustafa,

2011) which states that the age of the company

influences intellectual capital disclosure.

H4: The age of the company influences

intellectual capital disclosure.

3 RESEARCH METHOD

3.1 Sample

The sample in this study is the annual report of

banking companies listed on the Indonesia Stock

Exchange for the period of 2015 - 2017. There was

12 banking companies as a sample. Sampling

technique uses purposive sampling. It means this

sampling is using some criterias. There are :

1. Banking companies listed on the Indonesia

stock exchange for the period 2015-2017

2. Banking companies were reporting annual

reports for the period 2015-2017

3. Banking companies were earning profits during

the period 2015-2017

4. An annual report that provides all the

information needed for research data for the

period 2015-2017

3.2 Measurements of Variables

In this study consisted of dependent variables and

independent variables. The dependent variable in

this study is intellectual capital disclosure. The

measurement of intellectual capital disclosure is

using a disclosure index. There are 88 items used for

intellectual capital disclosure. The items disclosed

consist of strategy (21 items); Processes (11 items);

Innovation, research and development (8 items);

Technology (5 items); Customers (14 items); Human

Capital (29 items). Researchers used items revealed

from the study (Oliveira, Rodrigues and Craig,

2010). The formula used to calculate the index

revealed:

݀݅

ୀଵ

ICI=

m

Where di = 0 or 1

di = 0 if there is no disclosure item in annual report

d1 = 1 if there is disclosure item in annual report

M = total number of items should be disclosured in

annual report (88 items)

The independent variable used in this study consists

of four variables. There were two monetary

variables. That wasprofitability and leverage. Proxy

of profitability used Return on Asset (ROA).

Leverage used Debt to Equiry Ratio (DER/DR).

Meanwhile, non-monetary variables were firm size

and firm’s age.

The formula used for each independent variables

were:

1.ROA = Income before tax

Total assets

2.DER = Total Debts

Total Equity

3. Firm Size = Ln Total assets

4.Firm’s Age = Firm’s established until research

period

3.3 Model Specification

This study used multiple linear regression analysis to

see the relationship between intellectual capital

disclosure and profitability, leverage, firm size and

firm's age. The form of the relationship can be seen

below:

ICDI = a +b1ROA + b2DER + b3FS +b4FA + e

Where ICDI = Intellectual Capital Disclosure

Index

ROA = Return on Asset

DER = Debt to Equity Ratio

FS = Firm Size

FA = Firm’s Age

a to b4 are coefficient

e = error

4 ANALYSIS

Descriptive statistics provide a description or

description of a data that is seen from the average

value (mean), standard deviation, maximum and

minimum (Ghozali, 2016). The mean is used to

estimate the magnitude of the population average

estimated from the sample. The maximum-minimum

is used to see the minimum and maximum values of

the population. Based on descriptive statistical

analysis, the company description is as follows:

Determinants of Intellectual Capital Disclosure by using Monetary and Non-monetary Variables

1099

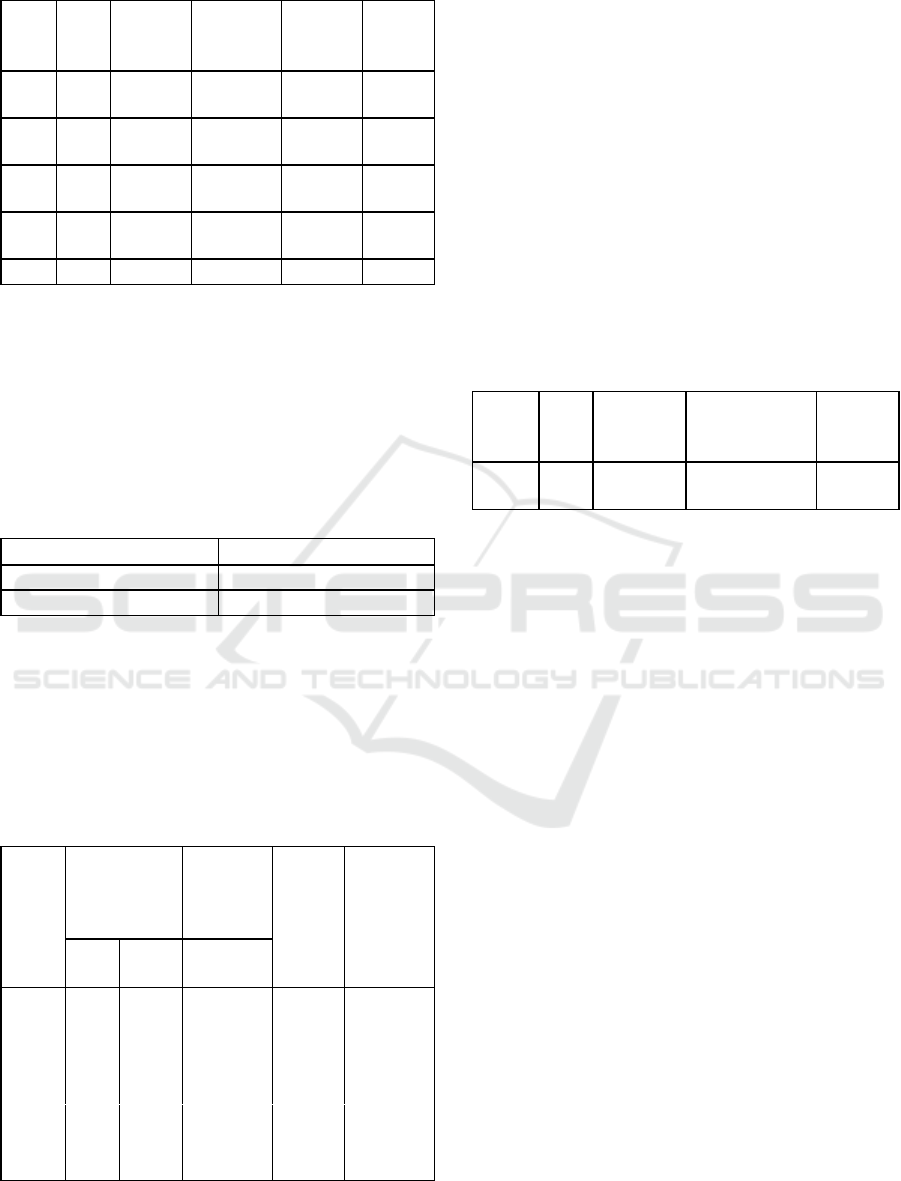

Table 1 : Descriptive Statistic

N

Min Max Mean Std

Deviatio

n

ICD 36 .1932 .8636 .476325 .254727

7

ROA 36 .0030 4.0000 1.334639 1.20708

86

DER 36 3.4353 14.7484 6.506355 2.62765

14

FS 36 27.3438 34.1953 31.80843

6

1.42953

75

FA 36 23 71 47.50 14.799

Before conducting multiple linear regression

analysis, this study used the classic assumption test

so that the processed sample data really represents

the overall population. The normality test is done to

test whether the regression model has a normal

distribution or not. The normality test in this study

used the Kolmogorov Smirnov Test. The table

below shows the normality test performed

Tabel 2: Normality test

N

36

Kolmogorov Smirnov .636

As

y

mp.Si

g

(2 tailed) .813

Based on the table above, we can see that this

study is normally distributed. This can be seen from

the significance values above 0.813 (> 0.05).

To see how far the influence of one independent

variable individually in explaining the variance of

the dependent variable can be seen in the table

below

Tabel 3: Regresi

Model

Unstandardiz

ed

Coefficients

Standa

rdized

Coefficien

ts

t

Si

g

.B

St

d

. Erro

r

Beta

(Con

stant

)

2.212 1.027

2.153 .039

RO

A

-.126 .035 -.596 -3.644 .001

DER -.007 .015 -.072 -.456 .652

FS -.061 .036 -.341 -1.686 .102

FA .009 .004 .499 2.353 .025

Based on the table above, we can see that the

ROA and Firm's age variables affect intellectual

capital disclosure. DER and Firm Size variables do

not affect intellectual capital disclosure. From the

table above can also be taken multiple linear

regression analysis as follows;

ICDI = 2.212 - .126ROA - .007DER - .061FS +

.009FA + e

To measure how far the ability of the model to

explain the variance of the dependent variable, we

use the coefficient of determination. A value that

approaches one means that the independent variables

provide almost all the information needed to predict

the variance of the dependent variable.

Tabel 4: Determination Coefficient

Model R

R

Square

Adjusted R

Square

Std. Error

of the

Estimate

1 .571

a

.326 .239 .2222

634

The table above indicates the ability of multiple

regression equations to show the level of explanation

of the model towards the dependent variable. The

magnitude of the determination coefficient is 0.239

or 23.9%, which means that the ability of the

independent variable in this case is the return on

assets variable, the debt to equity ratio, firm size and

firm age simultaneously has an influence on the

intellectual capital disclosure variable of 23.9%.

While 76.1% is explained by other variables besides

the independent variables above.

5 RESULTS

Based on the results of the t test that has been done,

it can be seen that return on assets has a negative

effect on intellectual capital disclosure. This means

that the higher the value of return on assets, the

company will be less in doing intellectual capital

disclosure. It may be caused if the company's

performance has been good in this case is the profit

obtained by the company, the company does not

need to do a lot of disclosure in the annual report.

Where we know that disclosure of annual reports is

only voluntary. However, this is different from the

research conducted by (Rahim, Atan and

Kamaluddin, 2011) saying that profitability does not

affect intellectual capital disclosure (Kateb, 2014).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1100

For leverage variables does not give effect to

intellectual capital disclosure. This means that many

or few intellectual capital disclosures are not

determined by leverage. This is in line with the

research conducted by (Rahim, Atan and

Kamaluddin, 2011);(Eddine et al., 2015).

For company size variables as measured by total

assets, it shows that firm size does not affect

intellectual capital disclosure. Intellectual capital

disclosure is not in the annual report does not

depend on whether the company is large or small.

This research is in line with (Bagchi, Joshi and

Salleh, 2015) and contradicts the research conducted

by (Ibikunle, Oba and Nwufo, 2013)

While for the age variable the company has an

influence on intellectual capital disclosure.

Companies that have long been established will

make more disclosures in their annual reports. This

is in line with the research conducted by (Taliyang,

S. M., Latif, R. A., dan Mustafa, 2011).

6 CONCLUSIONS

Based on multiple linear regression tests that have

been done, it can be concluded that for financial

variables, namely profitability and non-financial

variables, namely the age of the company influence

the intellectual capital disclosure in banking

companies in Indonesia. While the leverage and size

of the company does not influence intellectual

capital disclosure in banking companies in

Indonesia. While the ability of the independent

variable in this case is the return on assets variable,

the debt to equity ratio, firm size and firm age

simultaneously has an influence on the intellectual

capital disclosure variable of 23.9%. While 76.1% is

explained by other variables besides the independent

variables above.

This study has limitations in the form of periods,

objects and variables used to determine the factors

that influence intellectual capital disclosure.

Therefore, further research is expected to extend the

research period to be used. In this study, only one

object of research is a banking company. Future

research is expected to be able to use several objects

or do comparative objects. Many factors have not

been tested in this study to determine the factors that

influence intellectual capital disclosure.

REFERENCES

Al-hamadeen & Swaidan, M. (2014) ‘Content and

Determinants of Intellectual Capital Disclosure :

Evidence from Annual Reports of the Jordanian

Industrial Public Listed Companies’, International

Journal of Business and Social Science, 5(8), pp.

165–175.

Bagchi, D., Joshi, P. L. and Salleh, N. M. Z. N. (2015)

‘The extent of disclosure on implicit capital and

firm’s characteristics: Malaysian experience’,

International Journal of Learning and Intellectual

Capital, 12(2), p. 170. doi:

10.1504/IJLIC.2015.068986.

Company, P., Jensen, C. and Meckling, H. (1974)

‘THEORY OF THE FIRM : MANAGERIAL

BEHAVIOR , AGENCY COSTS AND

OWNERSHIP STRUCTURE I . Introduction and

summary In this paper WC draw on recent progress

in the theory of ( 1 ) property rights , firm . In

addition to tying together elements of the theory of

e’, 3(1976), pp. 305–360. doi: 10.1016/0304-

405X(76)90026-X.

Eddine, C. O. H. et al. (2015) ‘The determinants of

intellectual capital disclosure: A meta-analysis

review’, Journal of Asia Business Studies, 9(3), pp.

232–250. doi: 10.1108/JABS-03-2015-0028.

Garanina, T. and Dumay, J. (2017) ‘Forward-Looking

Intellectual Capital Disclosure in IPOs:Implications

for Intellectual Capital and Integrated Reporting’,

Journal of Intellectual Capital, 18(1), pp. 128–148.

Ghozali, I. (2016) ‘Aplikasi Analisis Multivariate Dengan

Program IBM dan SPSS 21’, in Aplikasi Analisis

Multivariate dengan Pogram iIBM SPSS 21. doi:

10.1016/j.tsf.2010.09.040.

Ibikunle, J., Oba, V. C. and Nwufo, C. (2013)

‘Determinants of Intellectual Capital Disclosures in

Nigeria’, Acta Universitatis Danubius. Economica,

9(6), pp. 195–206.

Kamath, B. (2016) ‘Article information ’:, Journal of

Financial Reporting and Accounting, 15(3), pp. 367–

391. doi: http://dx.doi.org/10.1108/MRR-09-2015-

0216.

Kateb, I. (2014) ‘The determinants of intellectual capital

disclosure : Evidence from French stock exchange’,

4(2), pp. 628–646.

Oliveira, L., Rodrigues, L. L. and Craig, R. (2010)

‘Intellectual capital reporting in sustainability

reports’, Journal of Intellectual Capital, 11(4), pp.

575–594. doi: 10.1108/14691931011085696.

Rahim, A., Atan, R. and Kamaluddin, A. (2011)

‘Intellectual Capital Reporting in Malaysian

Determinants of Intellectual Capital Disclosure by using Monetary and Non-monetary Variables

1101

Technology Industry’, Asian Journal of Accounting

and Governance, 2(1), pp. 51–59. doi:

10.17576/ajag-2011-2-6541.

Seng, D., Kumarasinghe, S. and Pandey, R. (2018)

‘Intellectual capital disclosure in private sector listed

companies in India’, Knowledge and Process

Management, 25(1), pp. 41–53. doi:

10.1002/kpm.1560.

Sudibyo, A. A. and Basuki, B. (2017) ‘Intellectual capital

disclosure determinants and its effects on the market

capitalization: evidence from Indonesian listed

companies’, SHS Web of Conferences, 34, p. 07001.

doi: 10.1051/shsconf/20173407001.

Taliyang, S. M., Latif, R. A., dan Mustafa, N. H. (2011)

‘The determinants of intellectual capital disclosure

among malaysian listed companies’, International

Journal of Management and Marketing Research,

4(3), pp. 25–33.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1102