Corporate Financial Performance Assessment using Economic Value

Added Method

Nurliyani

1

, Lisa Aisah

1

and Tiya Mardiyati Dalimunthe

1

1

Departement of Accounting, Universitas Negeri Medan, Medan -Indonesia

Keywords: Financial Performance, Financial Statements, EVA.

Abstract: The purpose of this study is to find out the financial performance of PT Jaya Agra Wattie Tbk in 2015 up to

2017 based on the EVA method. This research uses descriptive analysis method. Data sources in the form of

financial statements of PT Jaya Agra Wattie Tbk for the period 2015-2017 were obtained from the

Indonesia Stock Exchange website. From data analysis based on EVA method shows poor performance

because for 2 years EVA company research shows a negative value (EVA<0), and 1 year the company

shows a positive value (EVA>0). In 2015 positive EVA value of Rp.7.460.451.257 shows that the company

is able to create added value for its shareholders. While the year 2016 to 2017 was less good, where

EVA<0,2016 amounted EVA -Rp.68,025,625.37. Then in 2017 the EVA value decreases to -Rp.

225,973,196,925. this indicates that the company has not been able to create added value for its

shareholders.

1 INTRODUCTION

Economic conditions in Indonesia that are constantly

changing and not fixed with the development of

technology make a company continue to compete to

maintain the existence of its company. This

condition requires a company to make

improvements in various fields. One of them is in

finance.

Every company established aims to gain profits

or profits and maximize the wealth of its

shareholders. Besides that, it also aims to maintain

the survival of the company properly so that the

company can develop in accordance with the

activities carried out in the future (Neysa, 2017).

Financial management has an important role in

managing the company's finances, so financial

management is required to carry out its functions

effectively. The management of the company in

carrying out its business requires a financial

performance measurement tool to evaluate its

company (Dewi, 2017). According to (Fahmi, 2013),

financial performance is an analysis conducted to

see the extent to which a company has implemented

it using the rules of financial implementation

properly and correctly. The measurement of the

company's financial performance arises as a result of

the management decision-making process. This is a

more complex job because it will involve the

effectiveness of the use of capital, efficiency and

profitability of the company.

Assessing financial performance by using

financial ratios only oriented to profit oriented , but

at this time the company is required not only to be

profit oriented but also to be value oriented . To

overcome these weaknesses, the Economic Value

Added method is used (Dewi, 2017).

According to (Sawir, 2001) EVA (Economic

Value Added) is an indicator of the addition of the

value of an investment. EVA (Economic Value

Added) shows a good measure to what extent the

company has added value to the owners of the

company. In other words, if management focuses on

EVA (Economic Value Added), then they will make

decisions that are consistent with the aim of

maximizing the prosperity of the owner of the

company. If EVA (Economic Value Added) value is

positive, then operating profit after tax exceeds the

capital cost needed to generate the profit, and

management actions add value to shareholders

(Iswandira, 2015).

Application of Economic Value Added (EVA) in

a company will focusing more on the creation of

corporate value, this is one of the hallmarks of

Economic Value Added. With this approach,

1090

Nurliyani, ., Aisah, L. and Dalimunthe, T.

Corporate Financial Performance Assessment using Economic Value Added Method.

DOI: 10.5220/0009504210901096

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1090-1096

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

shareholders can see how much value the company

has achieved.

PT Jaya Agra Wattie Tbk. or commonly

abbreviated as JAWA is one company that is

engaged in agribusiness. JAWA was listed on

Indonesia Stock Exchange in 2011 under the Main

Board. The company was founded in 1921 and based

in Jakarta, Indonesia. The company operates in the

cultivation, processing, agricultural logistics and

marketing activities of rubber, crude palm oil (CPO),

coffee and tea.

The PT Jaya Agra Wattie Tbk profit (loss)

report, based on the 2015 to 2017 financial

statements, can be seen in the following table 1:

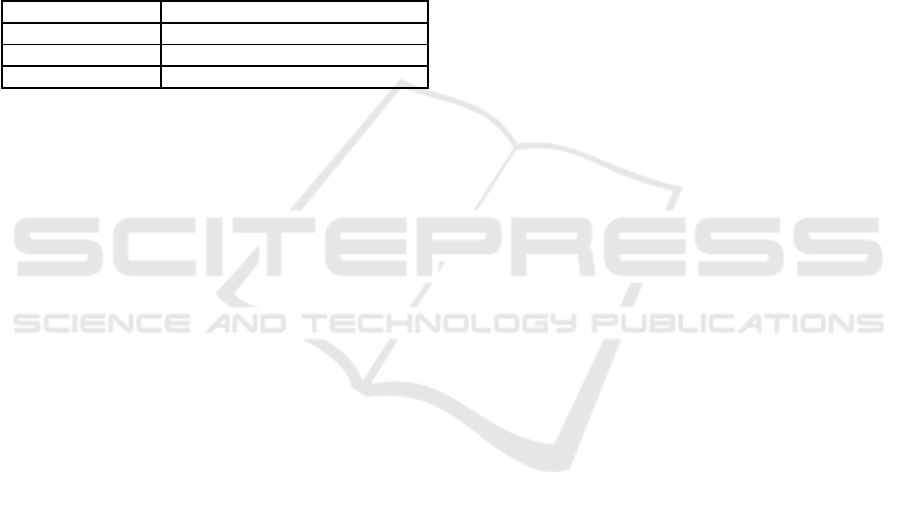

Table 1: The Profit (Loss) Report is presented in Rupiah.

Year Loss

2015 ( 11,715,503,160)

2016

(225.132,640,088)

2017

(199,929,077,450)

Source: Financial Statements of PT Jaya Agra Wattie Tbk.

From table 1, it can be seen that PT Jaya Agra

Wattie Tbk from 2015 to 2017 continues to suffer

losses. This continuous loss of the company will

make the company considered bad in earning profits

and bankruptcy can occur, thus financial

performance analysis is needed to evaluate the

company's performance in financial terms. The aim

to be achieved in this study is to find out the

financial performance of PT Jaya Agra Wattie Tbk

using the Economic method Value Added (EVA).

2 THEORICAL FRAMEWORK

Analyzing financial statements means digging up

more information contained in a financial report.

Definition of financial statement analysis according

to (Harahap, 2011) Outlines financial statement

posts into smaller units of information and see their

relationships that are significant or that have

meaning between one another between quantitative

data and non-quantitative data with the aim of

knowing deeper financial conditions that are very

important in the process of producing the right

decisions.

(Fahmi, 2013) financial performance is an

analysis carried out to see the extent to which a

company has implemented it using the rules of

financial implementation properly and correctly.

Financial Performance Assessment can be assessed

by calculating financial ratios. It can be concluded

that financial performance is an assessment

conducted to determine the extent to which the

condition of the company is by using comparisons

and applicable rules (Tanor, 2015).

The purpose of evaluating the performance of a

company according to (Sucipto, 2007) is as follows:

1. Manage organization operations effectively and

efficiently through maximum employee

motivation. In managing the company,

management determines the goals to be achieved

in the future and in the process is called

planning.

2. Helping decision making concerned with

employees such as promotions, transfers and

dismissals. Performance appraisal will produce

data that can be used as the basis for making

decisions related to employees who are judged

based on their performance.

3. Identify employee training and development

needs and to provide selection and evaluation

criteria for employee training programs. If

topmanagement does not recognize the

shortcomings and weaknesses it has, it is difficult

for management to evaluate and select employee

training programs that are in line with employee

needs.

4. Provide feedback for employees about how their

supervisors assess their performance. In

corporate organizations, management over

delegates part of its authority to management

under them.

5. Providing a basis for the distribution of awards.

The results of these measurements can also be

used as evaluation tools for management

performance so far whether they have worked

effectively or not.

Along with the development of theory and

knowledge, there are many new ideas in the field of

financial management to measure the financial

performance of a company. One of them is

Economic Value Added (EVA) that measures the

performance of companies by taking into account

the important role of funders (creditors and

shareholders).

According to (Young, and O’Byrne, 2001) "EVA

is an effective communication tool both for value

creation that can be reached by line managers which

ultimately drives the company's performance and to

connect with the capital market". EVA is able to

calculate the actual economic profit or True

Economic Profit of a company in a given year and is

very different compared to accounting profit.

According to (Hansen, and Mowen, 2009) "EVA

is the residual profit with the cost of capital equal to

the actual capital cost of the company (instead of a

Corporate Financial Performance Assessment using Economic Value Added Method

1091

minimum rate of return desired by the company for

other reasons)".

(Rudianto, 2006) in EVA, the assessment of

financial performance is measured by the following

provisions:

1. If EVA>0, then the company's financial

performance can be said to be good, so that there

is a process of changing its economic value.

2. If EVA=0, then the company's financial

performance is economically break-even.

3. If EVA<0, then the company's financial

performance is said to be less good because the

profits obtained do not meet the expectations of

funders, so there is no additional economic value

to the company.

The purpose of implementing EVA is expected

to get a more realistic calculation of the company's

economic value. This is caused by EVA calculated

based on the calculation of capital costs that use

market value based on the interests of creditors,

especially the shareholders and not based on

historical book values.

3 RESEARCH METHOD

This research uses a descriptive method. The object

of research is PT Jaya Agra Wattie Tbk. Which is

one of the companies engaged in agribusiness that is

listed on the Indonesia Stock Exchange. The source

through the website https://www.jawattie.com/ is in

the form of information that is in the form of

numbers and financial statements of PT Jaya Agra

Wattie Tbk for the period 2015-2017 obtained from

the Indonesia Stock Exchange.

The analysis tool used is Economic Value Added

(EVA). The steps in calculating EVA are as follows:

1. Calculate Economic Value Added (EVA). With

formula used (Sartono, 2010) :

EVA = NOPAT - ( WACC x Invested Capital)

2. Determine Net Operating Profit After Tax

(NOPAT). The formula used (Brigham and

Houston, 2010):

NOPAT = EBIT (1 - T )

Information:

NOPAT = Net Operating Profit After Tax

EBIT = Earnings Before Interest and Tax

T = Tax Level

3. Capital Costs (Capital Charges). The formula

used is as the following (Margaretha, 2011): Cost of

Capital = Invested Capital x WACC

a. WACC counted with formula (Margaretha,

2011):

WACC = W d K d + W e K e

W d = Total liabilities / Total liabilities + Equity

We = Total equity / Total liabilities + Equity

Information:

WACC = Weighted Average Cost of Capital

Wd = Amount of Debt to Structure Capital

We =Amount of Capital to Structure Capital

K d = cost of debt

K e = cost of equity

1) Cost Debt (Cost of Debt) To calculate the debt

costs of a company are as follows (Margaretha,

2011):

K d = k dbt (1 - T )

kdbt = interst expense/ long term debt

T = tax expense / net profit before tax x 100%

Information:

K d= After-tax debt costs

K dbt = interest expense before tax debt

T = Tax rate

2) Cost Equity (Cost of Equity) According to

(Prawiranegoro, 2008), cost of equity could

searching for with use ROE (Return On Equity).

ROE can searching for with use formula :

k e= ROE = net income after tax / total equity

b. Invested Capital (Invested Capital) With the

following formula (Young, and O’Byrne, 2008):

Invested capital = long-term debt + equity

4 ANALYSIS

In order to analyze and assess the financial

performance of PT Jaya Agra Wattie Tbk, economic

value added (EVA) is used. To calculate EVA, the

financial data needed is:

1. NOPAT ( Net Operating Profit After Tax )

2. WACC ( Weight Average Cost of Capital )

3. Total Capital that Invested (Invested Capital )

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1092

a. NOPAT Analysis ( Net Operating Profit After

Tax )

NOPAT calculation results of PT Jaya Agra Wattie

Tbk as shown in the table below this :

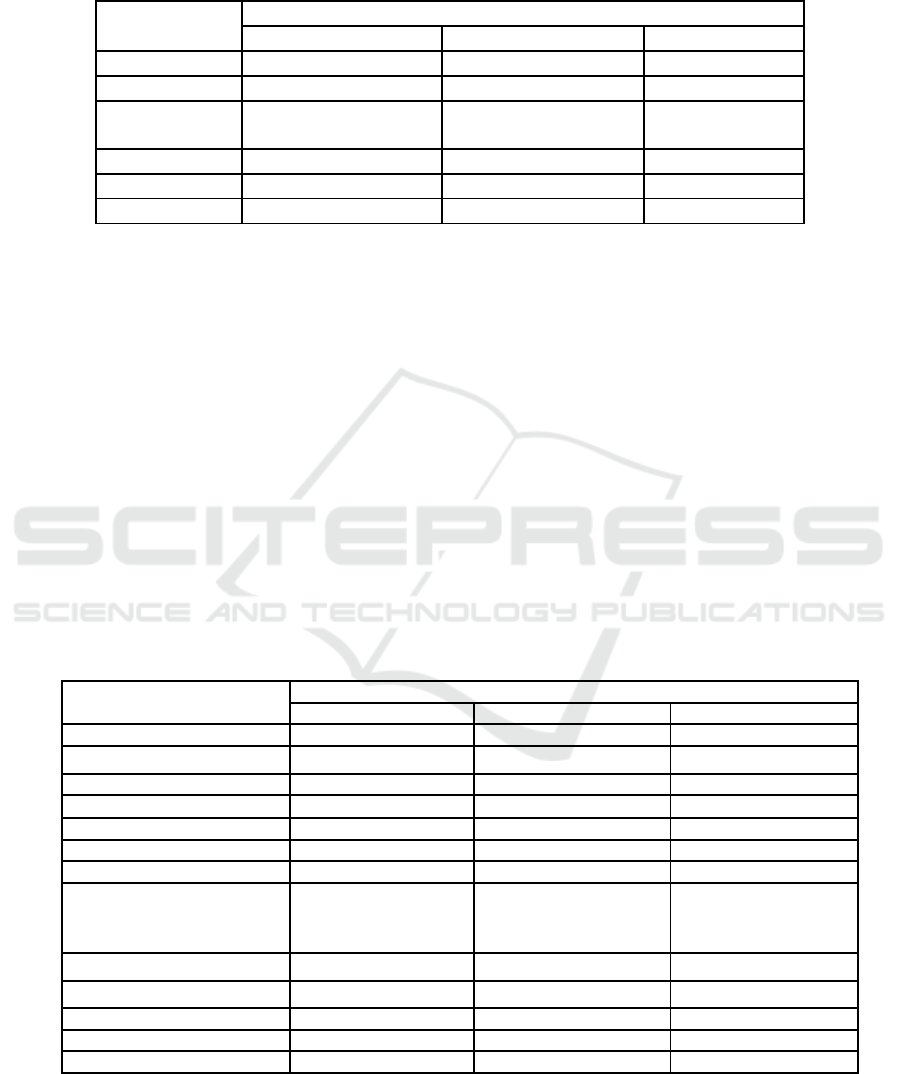

Table 2: Calculation of NOPAT 2015 – 2017 (expressed in Rupiah).

NOPAT

Year

component

2015 2016

2017

EBIT

76,593,643,005

4.103.437.116

1,422,183,930

Tax expense

(8,916,814,827)

(2,576,736,349) 34,321,928,850

Profit before

tax

-2,798,688,333

-

222,555,903,739

-

234,251,006,300

Tax

76.11%

1.14% -17.17%

1- Tax 0.24 0.99

1.17

NOPAT

18,297,270,901

4,056,471,578

1,666,330,986

Source: PT. Jaya Agra Wattie Tbk. Processed (2018).

Based on the NOPAT (Net Operating Profit

After Tax) calculation in the table above, it indicates

that the value of NOPAT of PT Jaya Agra Wattie

Tbk in 2015 amounted to Rp.18,297,270,901 in

2016 NOPAT decreased to Rp.4,056,471.578, this

decrease is due to a decrease in Earning Before

Interest Tax from Rp.76,593,643,005. in 2015

became Rp.4,103,437,116 in 2016. Then in 2017

NOPAT PT. Jaya Agra Wattie Tbk again

experienced a significant decline to

Rp.1,666,330,986, this is because PT. Jaya Agra

Wattie Tbk has decreased again or in other words

obtained EBIT (Earning Before Interest Tax) of

Rp.1,422,183,930.

Based on the description above it can be seen

that from 2015 to 2017 the NOPAT company

experienced a decline. The company's operating

profit can be increased without additional capital,

meaning that management can use the company's

assets efficiently to make a profit optimal.

b. WACC (Weight Average Cost of Capital)

Analysis

After calculating NOPAT , the second step in

calculating EVA is calculating the company's

WACC. The weight in the average cost of capital is

measured by the target capital structure of the

company, which is the proportion of various

components of the company's capital for its

investment funds. The results of the WACC

calculation of PT Jaya Agra Wattie Tbk as shown in

the table below:

Table 3: WACC calculations 2015 - 2017 (expressed in Rupiah).

Component

Year

WACC

2015 2016

2017

Interest expense

79,392,331,338 226,659,340,855

235,673,190,230

Long-term Liabilities

1,626,712,445,984

1,594,844,261,850 1,197,888,515,756

Tax

76.11%

1.14% -17.17%

1- Tax 0.24 0.99

1.17

K d 1.17% 14.05%

23.05%

Total Amoun of debt

2,078,210,962,892

2,240,797,394,458 2,472,502,548,901

Total Equity

1,289,940,799,377

1,050,319,497,420 839,979,442,737

Total Amoun of debt +

Total

3,368,151,762,269

3,291,116,891,878 3,312,481,991,638

Equity

W

d

61.70%

68.09%

74.64%

W

e

38.30%

31.91%

25.36%

Net profit after tax (11,715,503,160)

(225.132,640,088) (199,929,077,450)

ROE -0.91%

-21.43%

-23.80%

WACC 0.37% 2.73%

11.17%

Source: PT. Jaya Agra Wattie Tbk. Processed (2018),

Based on WACC calculation in table 3,it appears

that the weighted average cost or WACC PT Jaya

Agra Wattie Tbk in 2015 that is equal to 0.37%.

WACC in 2016 an increase of 2.73% and 2017

Corporate Financial Performance Assessment using Economic Value Added Method

1093

WACC has increased significantly to 11.17%, this

was due to a decline in the cost of equity in this case

ROE the company becomes -23.80%.

Based on the description above, it can be seen

that from 2015 to 2017 the company has not

succeeded in reducing the weighted average capital

cost (WACC). This will make the company produce

a negative EVA so that it can not provide economic

added value for the company. A company can

increase its economic added value if it gets a greater

return than WACC.

c. Analysis of Total Capital Invested (Invested

Capital)

Furthermore, the third step in the calculation of EVA

is to calculate the company's invested capital .

The results of the calculation of PT Jaya Agra

Wattie Tbk 's Invested Capital as shown in the table

below:

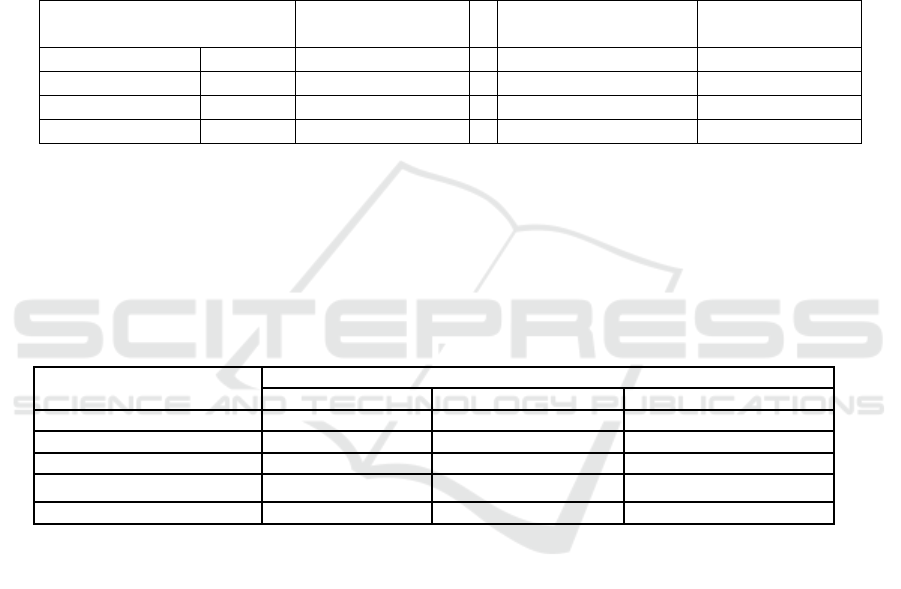

Table 4: Invested Capital calculations 2015 - 2017 (expressed in Rupiah)

Invested Capital

Component

Year

2015 2016 2017

Long-term debt

1,626,712,445,984

1,594,844,261,850

1,197,888,515,756

Equity

1,289,940,799,377

1,050,319,497,420

839,979,442,737

Invested Capital

2,916,653,245,361

2,645,163,759,270

2,037,867,958,493

Source: PT. Jaya Agra Wattie Tbk. Processed (2018).

Based on calculations, Table 4 explains that

Invested Capital (IC) PT. Jaya Arga Wattie Tbk in

2015 which is Rp.2,916,653,245,361. For 2016 the

IC has decreased to Rp.2,645,163,759,270. In 2017

IC PT. Jaya Arga Wattie Tbk which again decreased

to Rp.2,037,867,958,493.

From this explanation shows that the total capital

invested in the year 2015 until 2017 has decreased.

This is due to the decrease in the number of loans

and equity

Table 5: Calculation of EVA 2015 - 2017 (expressed in Rupiah).

Component EVA

Year

2015 2016 2017

NOPAT

18,297,270,901

4,056,471,578 1,666,330,986

WACC 0.37% 2.73%

11.17%

Invested Capital 2,916,653,245,361 2,645,163,759,270 2,037,867,958,493

Capital Costs (WACC x IC)

10,836,819,644 72,082,096,950 227,639,527,911

EVA 7,460,451.257 -68,025,625,372

-225,973,196,925

Source: PT. Jaya Agra Wattie Tbk. Processed (2018).

d. EVA Analysis (Economic Value Added)

After the calculation of NOPAT, WACC and

Incested Capital (IC). Furthermore, the value of the

company EVA can be calculated . Economic Value

Added (EVA) is the remaining profit after deducted

by all capital costs used to generate profits (Sartono,

2010).

The results of the calculation of EVA PT. Jaya

Arga Wattie Tbk as shown in table 5 below. Based

on the results of the EVA calculation in Table 5

shows that the value of EVA PT. Jaya Arga Wattie

Tbk in 2015 was Rp.7,460,451.257 positive EVA

values indicate that the management of PT. Jaya

Arga Wattie Tbk is able to create added value for its

shareholders. In 2016 the value of EVA negative ie -

Rp.68,025,625,372 due to an increase in the WACC

to 2.73%, so that the cost of capital is greater than

the operating profit after tax, the management of PT.

Jaya Arga Wattie Tbk has not been able to create

added value for its shareholders. In 201 7 EVA

value has a significant decrease and is still negative,

namely –Rp.225,973,196,925, which was caused by

a decrease in NOPAT to Rp.1,666,330,986, the

management of PT. Jaya Arga Watitie Tbk has not

been able to create added value for its shareholders.

From this explanation it can be concluded that in

the year 2015 the company produced the value of

EVA>0, meaning EVA is positive That is because

the company is able to generate a return on operating

profit after tax that exceeds the cost of capital. But in

2016 to 2017 the company produces an value

EVA<0, meaning EVA is negative because the

company is unable to produce a return on operating

profit after tax that exceeds the cost of capital.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1094

Negative EVA indicates that the company has not

been able to create value added wealth of the

company and its shareholders.

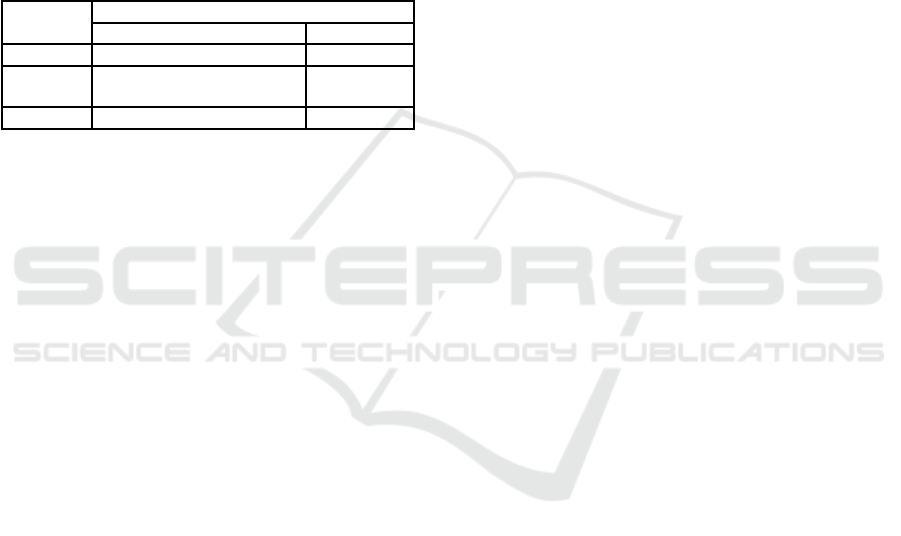

5 RESULTS

In this study, performance appraisal measured using

the EVA (Economic Value Added) method can be

restated in a summary of the results of EVA

calculations derived from table 2 and table 5

displayed again in table 6:

Table 6: Calculation of Company Performance 2015 –

2017 (expressed in Rupiah):

Information

Year

2015 2016 2017

NOPAT

18,297,270,9014,056,471,578 1,666,330,986

Capital

10,836,819,64472,082,096,950

227,639,527,911

Costs

EVA

7,460,451.257

-68,025,625,372 -25,973,196,925

Source: Table 2 and Table 5, processed (2018).

Based on Table 6, it can be seen that the

fluctuations in the NOPAT value achieved by PT.

Jaya Arga Wattie Tbk from 2015 continued to

decline until 2017. The decline in NOPAT

companies from 2015 to 201 6 reached by 78%.

NOPAT then again decreased in 2017 by 59%.

Capital costs at PT. Jaya Arga Wattie Tbk from

2015 to 2016 there was an increase of 85%. And

from 2016 to 2017 capital costs have increased again

by 68.3%. The cost of capital incurred by the

company is greater than the operating profit after tax

achieved by the company. This is what resulted in

the value of EVA at PT. Jaya Arga Wattie Tbk is

worth negative.

EVA achieved by PT. Jaya Arga Wattie Tbk in

2015 of Rp.7,460,451.257 . Then in 2016 until 2017

there was a drastic decrease of -232% from -Rp.

68,025,625,372 to –Rp.225,973,196,925. The EVA

value achieved by PT. Jaya Arga Wattie Tbk is

EVA<0, which means EVA is negative because the

after-tax operating profit (NOPAT) is smaller than

the capital cost (WACCx IC) resulting in a negative

EVA (Sawir, 2009).

Based on EVA calculations from the year 2015-

2017, company management has not been able to

create a positive EVA value, which means the

company has not been able to increase operating

profit after tax and the company has not been able to

reduce the cost of capital. Although the value of

EVA is still negative, but by entering EVA values

into the company's financial statements, investors

can see the true value of the company. To be able to

create added value the company can be done by

means of companies must be able to increase

operating profit without additional capital. Because

if NOPAT increases while the cost of fixed capital,

then the company EVA increase.

The results of the research on the development of

Teaching Materials for Problem Based Learning

Strategy include: 1) student worksheet; 2) learning

strategy material; and 3) problem-based evaluation

instruments.

Student worksheets are developed to help

students understand the teaching material for

learning strategies. Student worksheets are designed

to adopt problem-based learning steps which

include: 1) problem orientation; 2) learning

organization; 3) individual or group investigations;

4) development and presentation of problem solving

results; 5) analysis and evaluation of the problem

solving process.

Teaching materials designed include: 1) learning

theory in learning; 2) basic concepts of learning

strategies; 3) 21st century learning strategies; 4)

learning approach; 5) learning methods and

techniques; 6) learning models; 7) teaching factory;

8) strengthening character education.

Evaluation instruments designed include: 1)

problem-based problem instruments; and 2)

assessment guidelines.

6 CONCLUSIONS

Based on the results of research and discussion

conducted by researchers at PT. Jaya Arga Wattie

Tbk, it can be concluded that company performance

based on analysis of Economic Value Added (EVA)

from 2016 to 2017 is not good , where EVA<0, that

is, for 2 consecutive years EVA companies show

negative values. In 2016 the EVA value was -Rp.

68,025,625.37. Then in 2017 the EVA value

decreases to –Rp.225,973,196,925 .

Value EVA<0, which means EVA is negative

because the company is unable to produce a return

on operating profit after tax that exceeds the cost of

capital. This means that the company's management

has not been able to create added value for the

company and has not been able to create added value

for shareholders.

Corporate Financial Performance Assessment using Economic Value Added Method

1095

REFERENCES

Brigham, Eugene and Houston, Joel F. (2010) Financial

Management. jakarta: Erlangga.

Dewi, M. (2017) ‘Penilaian Kinerja Keuangan Perusahaan

dengan Menggunakan Metode EVA (Economic Value

Added) (Studi Kasus pada PT. Krakatau Steel Tbk

Periode 2012-2016)’, Jurnal Manajemen dan

Keuangan, 6(1), pp. 648–659.

Fahmi, I. (2013) Analysis of Financial Statements.

bandung: alfabeta.

Hansen, Dor R and Mowen, M. (2009) Managerial

Accounting. jakarta: Salemba Empat.

Harahap, S. S. (2011) Critical Analysis of the First Edition

of Financial Statementso. jakarta: PT. Raja Grafindo

Persada.

Iswandira, A. Nurhayati, I. dan Suharti, T. (2015)

‘Analisis Economic Value Added (Eva) Dan Market

Value Added (Mva Sebagai Alat Untuk Mengukur

Kinerja Keuangan Perusahaan Pt.Indofood Sukses

Makmur Tbk.’, jurnal ilmiah inovator.

Margaretha, F. (2011) Financial Management for Non-

Financial Managers. jakarta: Erlangga.

Neysa, Irena A. Murni, S dan Tumiwa, J. (2017) ‘Analisis

Kinerja Keuangan Dengan Menggunakan Metode

Economic Value Added (Eva) Pada Perusahaan Plastik

Dan Kemasan Yang Terdaftar di Bursa Efek Indonesia

Periode Tahun 2011-2015’, jurnal EMBA, 5(2), pp.

433–442.

Prawiranegoro, and Purwati. (2008) Management

Accounting. 2nd edn. jakarta: Mitra Wacana Media.

Rudianto (2006) Management Accounting. jakarta:

Gransindo.

Sartono, A. (2010) Financial Management Theory and

Application. Yogyakarta: BPFE.

Sawir, A. (2001) Financial Performance Analysis and

Corporate Financial Planning. jakarta: PT Gramedia

Main Library. Sucipto (2007) Financial Performance

Assessment. jakarta: Salemba Empat.

Tanor, Melissa O. Sabijono, H dan walandouw, Stanley

Kho. (2015) ‘Analisis Laporan Keuangan Dalam

Mengukur Kinerja Keuangan Pada Pt. Bank Artha

Graha Internasional, Tbk’, jurnal EMBA, 3, pp. 639–

649.

Young, S. David and O’Byrne, S. F. (2001) Value Based

Management. jakarta: Salemba Empat.

Young, S. David and O’Byrne, S. F. (2008) EVA and

Value Based Management. jakarta: Salemba Empat.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1096