Efficiency of Indonesian Islamic People’s Financing Banks using

Data Envelopment Analysis

Naelati Tubastuvi

1

and Azmi Fitriati

1

1

Faculty of Economics and Business, Universitas Muhammadiyah Purwokerto, Indonesia

Keywords: Efficiency, Islamic People’s Financing Banks (BPRS), DEA (Data Envelopment Analysis)

Abstract: An efficient bank will be able to reduce costs and impose a relatively low margin on customers. In the long

term, achieving efficiency will significantly increase the market share of Islamic banking. This study aims

to measure the efficiency level of Islamic People's Financing Bank (BPRS) in Central Java Province,

Indonesia. The method used in this study is Data Envelopment Analysis (DEA) to measure and map the

Islamic People's Financing Bank (BPRS) efficiency level. The data used are all BPRS in Central Java

during the period of 2010-2016. Data on input and output variables are obtained from the balance sheet and

profit and loss statement for each BPRS. Two inputs and two outputs are used to measure the efficiency of

BPRS. The input variables are Third Party Funds (X1) and Personnel Costs (X2). Meanwhile, the output

variable are Total Financing (Y1) and Operating Income (Y2). The use of deposits and financing in input-

output because this study uses an intermediation approach. The results of this study indicate that in general,

the average efficiency level of BPRS in Central Java Province during the study period was 75.87%, BPRS

that achieved optimal efficiency levels were less than those that were not efficient. Pure technical

inefficiency BPRS exceeds the scale inefficiency, which means managerially incompetent are exist in the

utilization of input resources even though the BPRS has been operating on a reasonably optimal scale of

operation. Based on the analysis of total potential improvement, the results showed that in order to be more

efficient, BPRS that are not efficient should be able to optimize the financing level of 98.16% or almost

twice the current condition and reduce the operational expense by 0.91%. Similarly, third party funds (DPK)

that have not been optimized amounted to 0.91%.

1 INTRODUCTION

An efficient and profitable banking system becomes

an indispensable condition for economic growth

because of the important role of commercial banking

in the financial system and economic development

(Dietrich and Wanzenried, 2014). Failures in this

sector can lead to financial instability and disrupt the

national economy. Bank performance has attracted

attention in the literature of economics and finance

because of its very important role for the economy.

Bank performance can be measured by various

terminologies namely efficiency, productivity and

profitability (Bikker and Bos, 2008)

Based on profitability measurement, Indonesia

has better banking performance compared to

neighboring countries classified as ASEAN-5,

namely Singapore, Malaysia, Thailand and the

Philippines. Meanwhile, if the performance of

efficiency is measured using CIR (cost to income

ratio), the results are worrying. The results of

efficiency analysis using the Stochastic Frontier

Analysis approach conducted by (Alfin Apriyana,

Hermanto Siregar, 2015) show that Thai banks have

the highest efficiency value (77.7%) followed by

Singapore (73.6%), Malaysia (66.9%), Indonesia

(66.3%), and the Philippines (61.9%). Based on

these efficiency values, Indonesia is in a position

that is less efficient compared to ASEAN-5

countries. Figure 1 shows the final position of

various measures of banking performance in

ASEAN-5.

Source: bankscope data for December 2015 except for

Malaysia, Singapore Sep 2015

Figure 1: Comparison of ASEAN-5 Banking Performance.

75,4%

48,2%

64,2%

48,8%

43,7%

Indonesia Malaysia Philippina Thailand Singapura

CosttoIncomeRatio

5,2%

2,0%

3,3%

2,5%

1,6%

Indonesia Malaysia Philippina Thailand Singapura

NetInterestMargin

Tubastuvi, N. and Fitriati, A.

Efficiency of Indonesian Islamic People’s Financing Banks using Data Envelopment Analysis.

DOI: 10.5220/0009503613571366

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1357-1366

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1357

The development of the Islamic banking industry

in Indonesia shows a relatively good tendency,

although it seems slow. Data in December 2015,

based on sharia banking statistics, the number of

Islamic banks has reached up to 12 Islamic

Commercial Banks, 22 Sharia Business Units and

163 Islamic People's Financing Banks with a total

network of 2,301 offices throughout Indonesia

(OJK, 2017).

One of the smaller types of Islamic banks is

Islamic People's Financing Bank or BPRS. In the

past 2 years, Islamic People's Financing Bank also

faced significant challenges and obstacles. From

2015 to the end of April 2016 there were 8 rural

banks which were liquidated by Indonesia Financial

Services Authority where two of them (25%) were

Islamic People's Financing Bank. In 2015, there

were 3 liquidated rural banks / Islamic People's

Financing Bank where one of them (33%) was

Islamic People's Financing Bank namely BPRS

Hidayah Jakarta located in West Jakarta. Whereas in

2016 until the end of April 2016 there were 5 rural

banks / Islamic People's Financing Bank which were

liquidated by Indonesia Financial Services Authority

where 1 (one) of them (20%) were Islamic People's

Financing Bank namely PT. BPRS Al Hidayah

located in Pasuruan, East Java.

Based on the data above, it can be seen that in

the last 2 years the development of Islamic People's

Financing Bank was quite worrying because every

year there are Islamic People's Financing Banks that

were closed. Nowadays, there are several Islamic

People's Financing Bank that has worrying

conditions and under the supervision of the

Indonesia Financial Services Authority. This Islamic

People's Financing Bank is not likely to be

liquidated or revoked if the operating time is not

able to improve its performance. The revocation of

the business license (liquidation) of the Islamic

People's Financing Bank which is currently

happening is very worrying for sharia banking

circles. Initially, Sharia Banking including Islamic

People's Financing Bank was considered safe and

small, but it was the same as rural banks which had

the possibility of being closed or liquidated.

The main motivation for reforming the banking

sector including the Islamic People's Financing Bank

is to encourage the banking sector in the regulatory

and legal framework, monitoring and conducting

supervision, financing risk management, liquidity

management, auditing and other important aspects.

If the banking sector reforms are going well, this

will be able to increase the efficiency of the banking

sector which has an effect on every aspect of the

bank's operations. An efficient bank will be able to

reduce costs and apply a relatively low margin to

customers. In the long run, the achievement of

efficiency will be able to increase market share

consistently in the Islamic banking industry.

Indonesian bankers must be able to manage their

institutions efficiently, both from technical

efficiency and scale efficiency (as a product of

economies of scale) in order to compete well.

Managerial ability to manage costs is very important

to continue to be elaborated so that alternative

strategies can be found. Alternative strategies can be

implemented by bankers because its possibility of

having a greater impact and management is directly

in the hands of bank managers.

Study of banking efficiency in Indonesia and

several countries showed that although there have

been many studies that measure banking efficiency

and identify their determinants, there is still a need

to add perspectives from two aspects

simultaneously, namely efficiency management

(technical efficiency) and economies of scale. This

is important in a managerial context because the first

is more short term (quick wins) while the second is

more medium term.

Data Envelopment Analysis (DEA) as one

method of efficiency measurement has been widely

used by researchers in various countries including

(Aghayi, 2017) which measures cost efficiency at

Iran's national bank, (Abul et al., no date) which

conducts efficiency testing on Malaysian banks,

(Imad Bou Hamad, Abdel Latef Anouze,

2016)which examined the efficiency of 151

commercial banks in Middle Eastern and North

African countries. Some researchers using the DEA

method include (Fallah Jelodar and Bagirov, 2016)

in Tanzania, (Yin et al., 2018) in China,

(Muhammad Masum et al., 2015) in Bangladesh,

(Ohe and Peypoch, 2016) in Japan and (Puri and

Yadav, 2015) in India.

2 LITERATURE REVIEW

The concept of efficiency comes from the concept of

microeconomics, namely producer theory. Producer

theory tries to maximize profits or minimize costs

from the manufacturer's perspective. In the producer

theory there is a production frontier curve that

describes the relationship between input and output

of the production process. Production frontier curve

represents the maximum level of output for each use

of input that represents the use of technology from a

company or industry (Ascarya and Yumanita, 2007).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1358

Figure 2: Production Frontier Curve.

Economic theory explains two types of

efficiency, namely economic efficiency and

technical efficiency. Economic efficiency has a

macroeconomic view, while technical efficiency has

a microeconomic view. Technical efficiency

measurements are only for techniques and

operational relationships in the process of using

inputs into output. The efficiency term in DEA

refers to the definition of technical efficiency,

namely the relationship between input and output in

a business unit.

Meanwhile, there are three types of efficiency in

the company perspective, namely: technical

efficiency, allocative efficiency and economic

efficiency. Technical Efficiency describes the

company's ability to achieve optimal output levels

using certain input levels. Technical Efficiency

measures the production process in producing a

certain number of outputs using minimum input. In

other words, production process becomes technically

efficient if the output of an item can no longer be

increased without reducing the output of other

goods.

Furthermore, Allocative Efficiency describes the

company's ability to optimize the use of inputs by

price structures and its technology. The terminology

of Pareto efficiency is often equated with allocative

efficiency for honoring the Italian economist

Vilfredo Pareto who developed the concept of

efficiency inexchange. Pareto Efficiency explains

that production inputs are used efficiently if these

inputs can no longer be used to increase a business

without causing at least the circumstances of another

business to get worse. In other words, if inputs are

allocated to produce output that cannot be used or

unwanted by consumers, these inputs are not used

efficiently.

Economic Efficiency describes a combination of

technical efficiency and allocative efficiency.

Implicitly, economic efficiency is the concept of

least cost production. For a certain level of output, a

production company is said to be economically

efficient if the company uses the cost per unit of the

most minimal output. In other words, for a certain

level of output, a production process is said to be

economically efficient if there is no other process

that can be used to produce the level of output at the

least cost per unit.

Recently, the frontier efficiency measurement

model has improved, both in theoretical and

practical concepts. In general, the efficiency level

measurement model is divided into two parts,

parametric and nonparametric. In a conventional

DEA model, all data is known correctly or given a

clear value. However, the observed values of input

and output data in real world problems are

sometimes inaccurate or unclear. In addition,

performance measurement in the conventional DEA

method is based on the assumption that inputs must

be minimized and output must be maximized, a

mathematical programming technique that is widely

used is the one that compares input and output of

DMU by evaluating its relative efficiency

(Damghani, 2016). Next, Ebrahimnejad (2014)

proposed a three-stage DEA model with two

independent parallel stages connected to the third

final stage. Calculate the efficiency of the model by

considering a series of intermediate steps and

constraints, resulting in the effectiveness of the

procedure for implementing the proposed model.

Previous Studies

Studies on the efficiency of Islamic banks is

supported by Hasan (2003) which describes the cost,

profit, revenue, and X-efficiency of Islamic banks

throughout the world. First, the study makes a

stochastic cost frontier approach to calculate the cost

efficiency of Islamic banks during 1996-2002.

Second, the study calculating profit efficiency by

paying attention to cost and revenue. Third, the

study determines revenue efficiency to determine

whether Islamic banks innovate banking products to

increase their income. Fourth, using the non-

parametric Data Envelopment Analysis (DEA)

method to calculate overall efficiency, namely

technical, pure technical, allocative, and scale

efficiency. The result is that, on average, the Islamic

bank industry is relatively inefficient compared to

conventional banks.

In addition, previous study shows that the

efficiency of Islamic banks is increasing in Islamic

banks in Malaysia. (Sufian, 2006) measured and

analyzed the efficiency of Islamic banks both

foreign and domestic in Malaysia during 2001-2004.

DEA analysis method is used in this study with input

variables consisting of: total deposits, labor costs,

and assets. Financing variables and operating

Efficiency of Indonesian Islamic People’s Financing Banks using Data Envelopment Analysis

1359

income as output. The results showed that overall

the efficiency of Islamic banks in Malaysia has

increased. This study revealed that sharia foreign

banks were on average lower efficient than sharia

domestic banks during the year of observation.

The same study using DEA was carried out by

(Dan, Yumanita and Thamrin, 2006) during 2000-

2004. The results showed that technically relative

efficiency of Islamic banks with an intermediation

approach (100%) and production approach (85%) in

2004. Likewise, the relative efficiency on a scale

basis from the intermediation approach (87%) and

production approach (97%). In general, the in term

of production approach, Islamic banks has decreased

in technical efficiency, but has increased in scale

efficiency because at that time Islamic banks were

quite aggressive in expanding opening new offices.

Studies that are relatively relevant to this

research are those carried out by (Shawtari, Ariff

and Razak, 2015). Using the Data Envelopment

Windows Analysis (DEWA) approach, (Shawtari,

Ariff and Razak, 2015) tried to analyze the

efficiency of the banking industry in Yemen during

1996-2011. The results showed that the banking

industry in Yemen generally experienced a

downward trend and efficiency instability during the

study period. The results of the study also found that

the majority of Yemeni conventional banks were

relatively more stable although inefficient.

Meanwhile, Islamic banks and foreign banks are

more efficient from time to time. The state-owned

banks and private banks are relatively lagging

behind in terms of achieving efficiency. Other

studies related to the efficiency of Islamic banks in

Indonesia are mostly carried out by (Rusydiana and

Al Farisi, 2016), (Zeitun and Benjelloun, 2012), and

(Rusydiana and Nugroho, 2017).

(Fallah Jelodar and Bagirov, 2016) examined the

performance (efficiency) of banks in Tanzania in

several factors, namely management, personnel,

finance, and customer segmentation. The results

found 28 important factors that affect the

performance of banks selected and divided into 4

regions. Then, hierarchical analysis is used to

prioritize these factors and the weights obtained

from paired comparisons are ranked using the

DEAHP integration method. Another study was also

conducted by (Kaffash and Marra, 2017) with the

DEA method, resulting in a main approach, model

and type of efficiency in the banking group, money

market funds, and insurance groups by identifying

the main pathways, namely the main ideas

underlying each research field.

The DEA method is also used by (Tlig and ben

Hamed, 2017) which examines PATB (Tunisian

Bank professional association) using DEA with

three inputs, namely deposits, labor and fixed assets

and two outputs, namely loans and portfolio

investments. These data sources are fixed assets,

deposits, loans and portfolio investments measured

in TND (Tunisian Dinar) and labor measured by the

number of staff. The data used is inaccurate is the

level of innovation as input and customer

satisfaction as output. The empirical results showed

that large banks are the most efficient because they

spend a large part of the total budget on investment

in new technology. This is in line with (Wanke,

Barros and Emrouznejad, 2016) which states that

labor prices, capital prices, and market share were

found to be significant factors in measuring bank

efficiency.

3 RESEARCH METHOD

Research method used in this study is Data

Envelopment Analysis (DEA). DEA is a

nonparametric method that uses a linear program

model to calculate the ratio of the output and input

ratio for all units compared. The advantage of using

the DEA is that this approach does not require

explicit specifications of the form of function and

only requires a little structure to form its efficient

frontier. The disadvantage that might appear is the

self-identifier and near self-identifier.

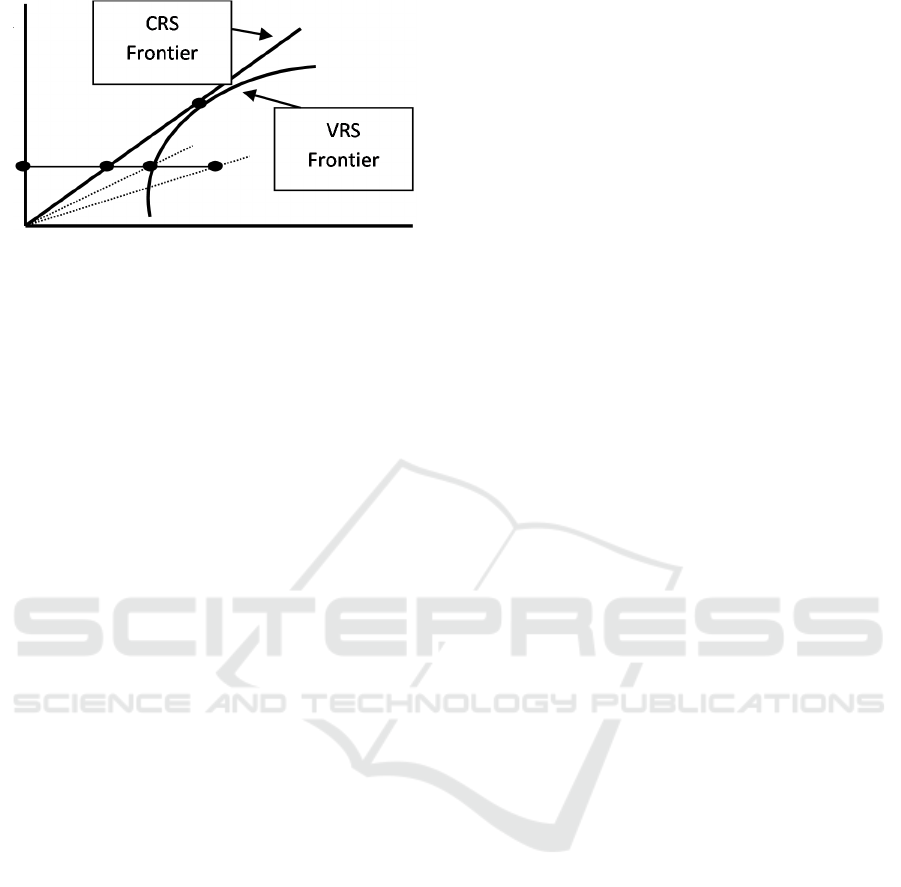

There are two model approaches in the DEA

method, namely CCR model (Charnes, Cooper and

Rhodes), and Banker, Charnes and Cooper (BCC).

The fundamental difference between the two models

is the assumption of Return to Scale (RTS). CCR

model requires the Constant Return to Scale (CRS)

assumption, that is, every change in the number of

inputs will be followed by changes in the number of

outputs with the same proportion. While BCC model

requires a Variable Return to Scale (RTS)

assumption, where changes in the number of inputs

in a certain proportion allow changes in the number

of outputs with different proportions, can be larger

proportions, equal or even smaller. The condition

where it can produce a larger output is called

Increasing Return to Scale (IRS). And if it produces

less than n times (smaller proportion), it is called the

Decreasing Return to Scale (DRS) condition. The

efficiency calculated using the VRS assumption is

called Pure Technical Efficiency. (Dan, Yumanita

and Thamrin, 2006).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1360

Source: Coelli et al (2005)

Figure 3 Efficiency of CRS and VRS.

The straight center line is CRS describing the

performance of companies working on an optimal

scale. While the curved line is the VRS line, which

explains the technical efficiency of the company

working on a different scale between one company

and another. Point E shows companies that are

technically efficient, but have not worked on an

optimal scale. For this reason, the company at points

D and E must increase its scale to reach point B,

which is efficient in overall.

Furthermore, the DEA method is widely used to

measure the level of technical efficiency, scale and

industrial economy of banks and financial

institutions (Coelli, 2015), and (Charnes, Cooper and

Rhodes, 1978)). This is in line with (Hadad et al.,

2003), (Ozdemir, 2013), (Tsolas and Giokas, 2012).

But now, the DEA is also starting to be widely used

in measuring the level of efficiency of non-bank

institutions, such as hospitals, universities, tax

offices, including non-profit institutions (Slamet

Rusydiana, 2013) such as zakat institutions

(Rusydiana and Al Farisi, 2016).

The data used in this study are all Islamic

People’s Financing Banks (BPRS) in the province of

Central Java during 2010-2016 with total of 22

banks. Data on input and output variables are

obtained from the balance sheet and profit and loss

of each bank. Two inputs and two outputs are used

to measure efficiency and Islamic People’s

Financing Banks. Input variables consist of Third

Party Funds (X1) and Personnel Expenses (X2).

Meanwhile output variable consist of Total

Financing (Y1) and Operating Income (X2).

Deposits and financing in input-output used because

this study uses an intermediation approach.

Tools analysis used in this study is Banxia

Frontier Analyst 3 to measure the level of efficiency

of all Islamic People’s Financing Banks DMUs in

Central Java during 2010-2016. Analysis for

efficiency measurement will be carried out 2 times.

The first calculation of efficiency with the CRS or

CCR approach introduced by (Charnes, Cooper and

Rhodes, 1978). Both efficiency calculations using

the VRS or BCC approach were first introduced by

Banker et.al (1984).

4 RESULT AND DISCUSSION

4.1 Efficiency

4.1.1 Islamic People’s Financing Banks

(BPRS) Efficiency Score in Central

Java

Table 1 shows the efficiency value of each Islamic

People’s Financing Banks in Central Java, it can be

seen that Islamic People’s Financing Banks that are

efficient (Constant 100%) in 2016 are BPRS Insan

Madani, BPRS Sukowati Sragen and BPRS Suriyah.

Whereas efficient BPRS in 2015 were BPRS Insan

Madani and Mitra Harmoni BPRS. Then in 2014,

Islamic People’s Financing Banks that are efficient

in Central Java i.e. BPRS Artha Mas Abadi, BPRS

Buana Mitra Perwira, BPRS Dharma Kuwera and

BPRS Insan Madani. Furthermore, in 2013 there

were several perfectly efficient Islamic People’s

Financing Banks namely: BPRS Artha Mas Abadi,

Bina Amanah Satria, Buana Mitra Perwira, Dharma

Kuwera and BPRS Insan Madani.

Next, Islamic People’s Financing Banks that

were efficient in 2012 i.e. BPRS Dharma Kuwera,

and BPRS Sukowati Sragen. In 2011, efficient

Islamic People’s Financing Banks were BPRS

Dharma Kuwera, and BPRS Sukowati Sragen. In

2010, several Islamic People’s Financing Banks in

Central Java were: BPRS Khasanah Umat, BPRS

Dharma Kuwera and BPRS Gunung Slamet.

It can be concluded that Islamic People’s

Financing Banks in Central Java which are relatively

stable at optimal efficiency levels are BPRS Insan

Madani, BPRS Dharma Kuwera and BPRS

Sukowati Sragen. BPRS Insan Madani can maintain

an efficient level from year to year gradually during

2013-2016 when compared to other Islamic People’s

Financing Banks in this observation. Meanwhile,

BPRS Dharma Kuwera was able to maintain an

efficient level from year to year gradually during

2010-2014. BPRS Sukowati Sragen was able to

reach efficient levels in 2011, 2012 and 2016.

Based on the table 1, the average efficiency level

of Islamic People’s Financing Banks in Central Java

during the study period was 75.87%. It can be a

consideration for Islamic People’s Financing Banks

that have not been efficient to consider increasing

pure technical efficiency.

Efficiency of Indonesian Islamic People’s Financing Banks using Data Envelopment Analysis

1361

Table 1: Islamic People’s Financing Banks Efficiency Score in Central Java.

DMU Bank 2010 2011 2012 2013 2014 2015 2016

PT BPRS KHASANAH UMAT 1,000 0,911 0,857 0,812 0,653 0,695 0,668

PT BPRS Al Mabrur Babadan 0,789 0,789 0,785 0,879 0,668 0,587 0,593

PT BPRS ARTA LEKSANA 0,776 0,796 0,676 0,708 0,658 0,745 0,838

PT BPRS Artha Amanah Ummat 0,964 0,964 0,948 0,950 0,866 0,874 0,812

PT BPRS Artha Mas Abadi 0,777 0,777 0,797 1,000 1,000 0,838 0,770

PT BPRS Artha Surya Barokah 0,804 0,804 0,818 0,822 0,896 0,864 0,864

PT BPRS Asad Alif 0,674 0,665 0,648 0,648 0,639 0,516 0,509

PT BPRS BINA AMANAH

SATRIA

0,672 0,752 0,932 1,000 0,884 0,905 0,814

PT BPRS Buana Mitra Perwira 0,869 0,869 0,893 1,000 1,000 0,967 0,899

PT BPRS Bumi Artha Sampang 0,799 0,682 0,609 0,597 0,636 0,624 0,615

PT BPRS Central Syariah Utama 0,725 0,840 0,583 0,542 0,674 0,502 0,584

PT BPRS Dana Amanah 0,339 0,512 0,765 0,701 0,807 0,839 0,775

PT BPRS Dana Mulia 0,759 0,710 0,820 0,793 0,534 0,472 0,694

PT BPRS Dharma Kuwera 1,000 1,000 1,000 1,000 1,000 0,740 0,707

PT BPRS Gunung Slamet 1,000 0,801 0,953 0,917 0,868 0,925 0,885

PT BPRS IKHSANUL AMAL 0,684 0,573 0,545 0,490 0,413 0,583 0,492

PT BPRS Insan Madani 0,443 0,443 0,872 1,000 1,000 1,000 1,000

PT BPRS MERU SANKARA 0,313 0,499 0,607 0,643 0,549 0,591 0,654

PT BPRS Mitra Harmoni 0,358 0,358 0,491 0,624 0,505 1,000 0,839

PT BPRS PNM Binama 0,537 0,537 0,673 0,609 0,638 0,713 0,672

PT BPRS Sukowati Sragen 0,933 1,000 1,000 0,866 0,679 0,996 1,000

PT BPRS Suriyah 0,822 0,849 0,885 0,856 0,894 0,946 1,000

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1362

4.1.2 Islamic People’s Financing Banks

Efficiency Distribution Score in

Central Java

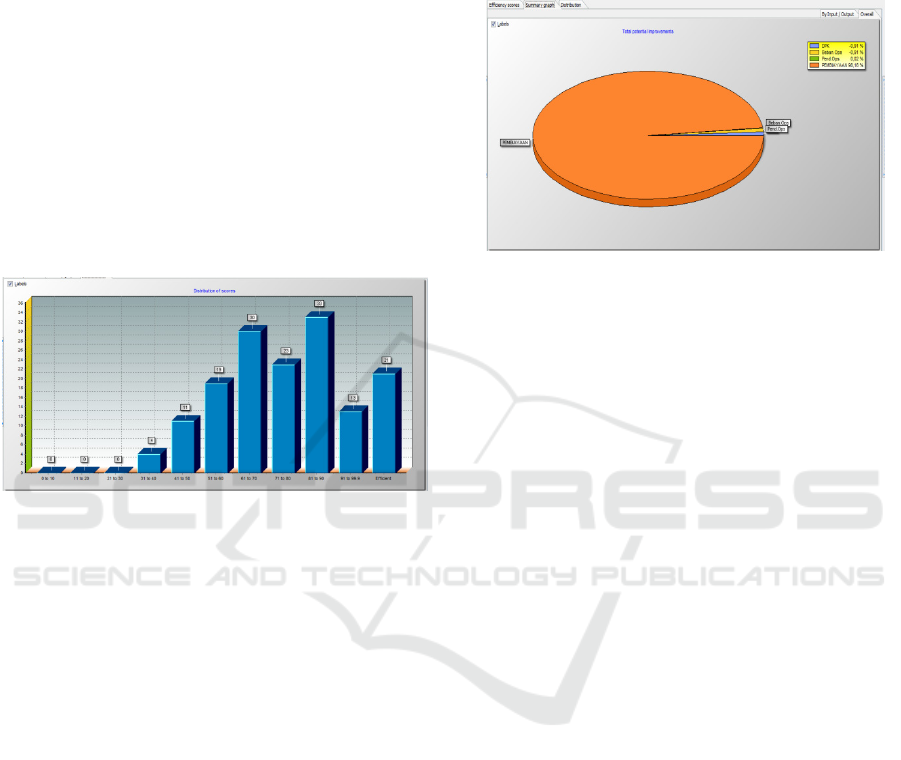

Based on table 1, figure 4 shows the number of

efficient and inefficient business units on a particular

group scale. Figure 4 shows the Islamic People’s

Financing Banks that are perfectly efficient (100%)

amounted to 21 DMUs (Decision Making Units).

Figure 4 also provides information that most

business units are in an efficiency condition of 81%

-90%, i.e. 33 DMUs, followed by efficiency clusters

of 61-70%, i.e. 30 DMUs. While the least are

business units with an efficiency level of 31%-40%,

i.e. 4 DMUs. Furthermore, there are no Islamic

People’s Financing Banks that have efficiency levels

below 30%.

Figure 4: OPZ Efficiency Distribution Score.

4.1.3 Total Potential Improvement of

Islamic People’s Financing Banks in

Central Java

Total Potential Improvement is used to determine

Islamic People’s Financing Banks inefficiency

factors in this study. Figure 5 shows information of

total improvement potential which can provide a

general picture of Islamic People’s Financing Banks

inefficiencies in Central Java. Total potential

improvement chart shows that in an efficient

manner, an inefficient Islamic People’s Financing

Banks should reduce operating expenses by 0.91%.

Similarly, third party funds (DPK) that have not

been optimized amounted to 0.91%. But actually,

the main inefficiency is financing variable. In order

to achieve an optimal level of efficiency, the level of

financing needs to be increased by 98.16%.

Likewise, operating income needs to be increased.

Figure 5: Total Potential Improvement.

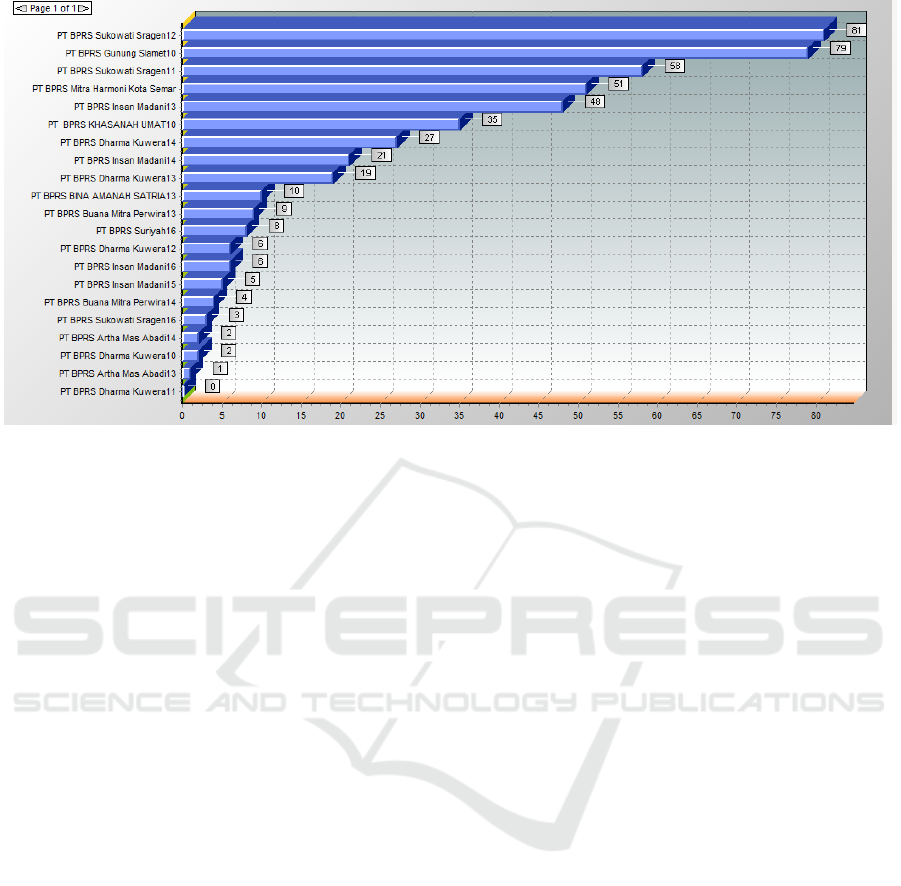

4.1.4 Benchmarked BPRS in Central Java

Figure 6 shows Islamic People’s Financing Banks

that could be used as a reference for other Islamic

People’s Financing Banks in Central Java that are

still in an inefficient condition. Based on the results

of the frontier analysis calculation shows that in

2016, Islamic People’s Financing Banks that was

most referred to was BPRS Suriyah, i.e. 8 DMUs.

While in 2015, Islamic People’s Financing Banks

that was mostly referred to was BPRS Mitra

Harmoni Kota Semarang, i.e. 51 DMUs. Whereas in

2014, Islamic People’s Financing Banks which was

most referred to was BPRS Dharma Kuwera, i.e. 27

DMUs. In 2013, BPRS Insan Madani became a

reference for 48 DMUs. Moreover, the highest

reference frequency actually occurred in 2012 by

BPRS Sukowati Sragen, which was referred to by

other inefficient Islamic People’s Financing Banks,

i.e. 81 DMUs. Similarly, this Islamic People’s

Financing Banks in 2011 amounted to 58 DMUs.

Finally, BPRS Gunung Slamet became a reference

for the BPRS in 2010, i.e. 79 DMUs

Efficiency of Indonesian Islamic People’s Financing Banks using Data Envelopment Analysis

1363

Figure 6: Reference Frequencie.

5 CONCLUSION AND

SUGESTIONS

5.1 Conclusion

Based on the results of analysis and discussion, the

conclusions in this study are:

1. Based on the selected input and output variables,

the level of efficiency of the Islamic People's

Financing Bank (BPRS) in Central Java during

2010-2016 was fluctuated. Efficiency

fluctuations in Islamic People's Financing Bank

industry in Central Java may occur due to

internal influences and external impacts such as

unstable macroeconomic conditions. This result

is in line with (Zeitun and Benjelloun, 2012) who

examined the level of banking efficiency in

developing economies. (Zeitun and Benjelloun,

2012) concluded that the financial crisis had a

significant impact on the level of bank

efficiency. The other studies conducted by

(Kamarudin, Sufian and Nassir, 2016) concluded

that the impact of the financial crisis on the level

of banking efficiency actually occurred after the

crisis because there is a time lag until the impact

begins to be felt in the financial and banking

industries, including Islamic People's Financing

Bank.

2. In general, the average efficiency level of Islamic

People's Financing Bank in Central Java during

the study period was 75.87%. This can be a

consideration for Islamic People's Financing

Bank that are not efficient to be able to increase

pure technical efficiency in the future. The

number of Islamic People's Financing Bank that

achieved optimal efficiency levels were less than

those that were not efficient. This results is

relevant to research by (Dan, Yumanita and

Thamrin, 2006) which explained that during the

2003-2005, only 24 banks of all 110 commercial

banks in Indonesia that were efficient in 2003

and only 9 banks were fully efficient in 2004.

The other bank has not yet reached the maximum

efficiency level in both the decreasing and

increasing return to scale positions.

3. Scale efficiency and pure technical efficiency

showed that pure technical inefficiency exceeds

scale inefficiency in Islamic People's Financing

Bank in Central Java. In general, the findings

showed that the Islamic People's Financing Bank

in Central Java is managerially incompetent in

using input resources effectively even though

they have operated on a reasonably optimal scale

of operation. In other words, according to

(Setiawan and Bagaskara, 2016) and (Setiawan

and Sherwin, no date), the conditions that occur

in banking are bad management originating from

internal bank sources.

4. Total potential improvement analysis showed

that in an industrial manner, Islamic People's

Financing Bank that are not efficient should be

able to optimize the financing variable in order to

be more efficient. Based on the calculation

results, in order to be efficient. Inefficient

Islamic People's Financing Bank should reduce

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1364

the operational burden by 0.91%. Similarly, third

party funds (DPK) that have not been optimized

amounted to 0.91%. But actually, the main

inefficiency is the financing variable. In order to

achieve an optimal level of efficiency, the level

of financing needs to be increased by 98.16%.

Likewise, operating income needs to be

increased. In other words, it needs to increase

efficiency and productivity, especially output.

5.2 Suggestions

There are several recommendations related to the

measurement of the efficiency level of Islamic

People's Financing Bank in Central Java:

1. Based on returns to scale (RTS) analysis, it is

very interesting to observe a decrease in the

number of banks operating under the IRS

conditions, and the increase in the number of

banks operating in DRS conditions is a concern

to reduce the scale of operations, by reducing

unnecessary costs can increase the level of

efficiency. Islamic People's Financing Bank in

Central Java is inefficient in monitoring

operating costs during 2010-2016. Thus,

management performance improvement is

needed through better planning and control to

achieve optimal management performance. In

addition, it is also necessary for Islamic People's

Financing Bank to enlarge the assets (size),

strengthen capital and also increase the loan

portfolio, in order to achieve optimal efficiency

levels (Anwar et al., 2016).

2. There are several factors that become obstacles

to the development of the Islamic banking

industry in Indonesia, namely: 1) Insufficient

capital of Sharia Banks; 2) Weak understanding

of Islamic banks practitioners; 3) Lack of

government support and 4) Public trust &

interest in Islamic banks tend to be low

(Rusydiana, 2016). Therefore, the related parties

need to improveme in terms of capital, quality of

Islamic bank human resources, and moreover the

government support.

REFERENCES

Abul, M. et al. (no date) Modeling Bank Efficiency with

Bad Output and Network Data Envelopment Analysis

Approach.

Aghayi, N. (2017) ‘Cost efficiency measurement with

fuzzy data in DEA’, Journal of Intelligent and Fuzzy

Systems. doi: 10.3233/JIFS-152079.

Alfin Apriyana, Hermanto Siregar, H. H. (2015)

‘Apriyana 2015_faktor yang mempengaruhi efisiensi

perbankan di ASEAN’, Manajemen Teknologi, 14.

Anwar, D. et al. (2016) PENGARUH MANAJEMEN

LIKUIDITAS TERHADAP KINERJA BANK

PEMBIAYAAN RAKYAT SYARIAH (BPRS) DI

INDONESIA. Available at:

http://paper.ssrn.com/sol3/papers.cfm?abstract_id=222

3329.

Bikker, J. and Bos, J. W. B. (2008) Bank performance: A

theoretical and empirical framework for the analysis of

profitability, competition and efficiency, Bank

Performance: A Theoretical and Empirical Framework

for the Analysis of Profitability, Competition and

Efficiency. doi: 10.4324/9780203030899.

Charnes, A., Cooper, W. and Rhodes, E. (1978)

Measuring the efficiency of decision making units,

Company European Journal of Operational Research.

Coelli, T. J. (2015) ‘6 DATA ENVELOPMENT

ANALYSIS’, in An Introduction to effiesiency and

Productivity Analysis, p. 161.

Dan, A., Yumanita, D. and Thamrin, J. M. H. (2006)

Analisis Efisiensi Perbankan Syariah di Indonesia

dengan Data Envelopment Analysis, Indonesia

Diterbitkan dalam TAZKIA Islamic Finance and

Business Review.

Dietrich, A. and Wanzenried, G. (2014) ‘The determinants

of commercial banking profitability in low-, middle-,

and high-income countries’, Quarterly Review of

Economics and Finance. doi:

10.1016/j.qref.2014.03.001.

Fallah Jelodar, M. and Bagirov, A. M. (2016)

‘Prioritization of the Factors Affecting Bank

Efficiency Using Combined Data Envelopment

Analysis and Analytical Hierarchy Process Methods’.

doi: 10.1155/2016/5259817.

Hadad, M. D. et al. (2003) ANALISIS EFISIENSI

INDUSTRI PERBANKAN INDONESIA :

PENGGUNAAN METODE NONPARAMETRIK

DATA ENVELOPMENT ANALYSIS (DEA) ?

Imad Bou Hamad, Abdel Latef Anouze, D. L. (2016) ‘An

Integrated approach of data envelopment analysis and

boosted generalized linier mixed models for efficiency

assessment’, An Oper Res. doi: 10.1007/s10479-016-

2348-4.

Kaffash, S. and Marra, M. (2017) ‘Data envelopment

analysis in financial services: a citations network

analysis of banks, insurance companies and money

market funds’, Annals of Operations Research. doi:

10.1016/j.tca.2017.09.021.

Kamarudin, F., Sufian, F. and Nassir, A. M. (2016) ‘Crisis

financiera global, propiedad y eficiencia de las

ganancias en los bancos comerciales estatales y

privados en Bangladesh’, Contaduria y

Administracion. Universidad Nacional Autónoma de

México, Facultad de Contaduría y Administración,

61(4), pp. 705–745. doi: 10.1016/j.cya.2016.07.006.

Muhammad Masum, A. K. et al. (2015) ‘Domestic banks

in Bangladesh could ensure efficiency by improving

Efficiency of Indonesian Islamic People’s Financing Banks using Data Envelopment Analysis

1365

human resource management practices’, PLoS ONE.

doi: 10.1371/journal.pone.0121017.

Ohe, Y. and Peypoch, N. (2016) ‘Efficiency analysis of

Japanese Ryokans: A window DEA approach’,

Tourism Economics. doi:

10.1177/1354816616670505.

OJK (2017) ‘Laporan Perkembangan Keuangan Syariah

Indonesia’, OJK.

Ozdemir, A. (2013) ‘Integrating analytic network process

and data envelopment analysis for efficiency

measurement of Turkish commercial banks’

NUMBER OF REFERENCES 0 NUMBER OF

FIGURES 0 NUMBER OF TABLES 0 Integrating

analytic network process and data envelopment

analysis fo.

Puri, J. and Yadav, S. P. (2015) ‘Intuitionistic fuzzy data

envelopment analysis: An application to the banking

sector in India’, Expert Systems with Applications.

doi: 10.1016/j.eswa.2015.02.014.

Rusydiana, A. S. and Al Farisi, S. (2016) ‘The Efficiency

of Zakah Institutions Using Data Envelopment

Analysis’, Al-Iqtishad: Journal of Islamic Economics.

doi: 10.15408/aiq.v8i2.2876.

Rusydiana, A. S. and Nugroho, T. (2017) ‘Measuring

Efficiency of Life Insurance Instution in Indonesia:

Data Envelopment Analysis Approach’, Global

Review of Islamic Economics and Business, 5(1), pp.

12-024.

Setiawan, C. and Bagaskara, B. P. (2016) Issue: 1 1816

Journal of Emerging Issues in Economics, Finance and

Banking (JEIEFB) An Online International Research

Journal, Finance and Banking (JEIEFB) An Online

International Research Journal. Available at:

www.globalbizresearch.org.

Setiawan, C. and Sherwin, S. M. (no date) Banks

Efficiency and the Determinants of Non-Performing

Financing of Full-Fledged Islamic Banks in Indonesia.

Shawtari, F. A., Ariff, M. and Razak, S. H. A. (2015)

‘Efficiency assessment of banking sector in Yemen

using data envelopment window analysis: A

comparative analysis of Islamic and conventional

banks’, Benchmarking. doi: 10.1108/BIJ-10-2014-

0097.

Slamet Rusydiana, A. (2013) INDEKS MALMQUIST

UNTUK PENGUKURAN EFISIENSI DAN

PRODUKTIVITAS BANK SYARIAH DI

INDONESIA MALMQUIST INDEX TO MEASURE

THE EFFICIENCY AND PRODUCTIVITY OF

INDONESIA ISLAMIC BANKS.

Sufian, F. (2006) THE EFFICIENCY OF ISLAMIC

BANKING INDUSTRY: A NON-PARAMETRIC

ANALYSIS WITH NON-DISCRETIONARY INPUT

VARIABLE, Islamic Economic Studies.

Tlig, H. and ben Hamed, A. (2017) ‘Assessing the

Efficiency of commercial Tunisian Banks using Fuzzy

Data Envelopment Analysis’, Data Envelopment

Analysis and Decision Science. doi:

10.5899/2017/dea-00146.

Tsolas, I. E. and Giokas, D. I. (2012) ‘Bank branch

efficiency evaluation by means of least absolute

deviations and DEA’, Managerial Finance. doi:

10.1108/03074351211239397.

Wanke, P., Barros, C. P. and Emrouznejad, A. (2016)

‘Assessing productive efficiency of banks using

integrated Fuzzy-DEA and bootstrapping: A case of

Mozambican banks’, European Journal of Operational

Research. doi: 10.1016/j.ejor.2015.10.018.

Yin, Z. et al. (2018) ‘Evaluation and evolution of bank

efficiency considering heterogeneity technology: An

empirical study from China’. doi:

10.1371/journal.pone.0204559.

Zeitun, R. and Benjelloun, H. (2012) The Efficiency of

Banks and Financial Crisis in a Developing Economy:

The Case of Jordan..

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1366