An Empirical Analysis of Medan Indonesia MSMES Persistence

based on Capital Structure Behavior, Business Strategy, and Business

Operational: A Descriptive Study

Muhammad Andi Abdillah Triono

1

, Syahrizal Chalil Harahap

1

and Humisar Sihombing

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: Persistence, Capital Structure, Business Strategy, Business Operational

Abstract: The purpose of this study is to explore Medan City-Indonesia Micro, Small, and Medium Enterprises

(MSMEs) persistence based on their capital structure behavior, business strategy, and business operational.

Most literature in SMEs envisage lack of capital is the most severe constraint for SMEs survival and

growth. Furthermore, trade-off and packing theory are commonly used to explore SMEs behavior toward

how they seek new capitals. This study conducted from 1st of August 2018 until 15th of October 2018

which used primary data through in-depth interview which used questionnaire to capture the characteristics

of Medan Indonesia MSMEs capital structure behavior, business strategy, and business operational that

describe their persistence. The research population was targeted all MSMEs that operate in 33 districts of

Medan, Indonesia and cluster sampling (area sampling) is used as the study sampling method which come

out to 21 districts are selected as the sampling area that lead to 530 MSMEs as the research respondents and

covers a period of 2017 to 2018. Descriptive analysis is used with SPSS 18 as the study tool of analysis. The

result showed that 72.8 percent in 2018 Medan MSMEs did not apply for new capital such as debts and

equities. Moreover, data from finance retainment indicates that the proportion of retain in finance was at

62.6 percent which indicate most of Medan MSMEs used their own retain on earning for operating their

business. Furthermore, debts retained were at 61.1 percent which was higher than retain on equities at 56.4

percent. Therefore, this empirical evidence of persistence through analysis of descriptive statistics shows

that Medan MSMEs capital structure behavior were highly consistent with packing order theory. Moreover,

it showed that financial measures, focus on cost, focus on product quality, and focus on innovation are the

main characteristics of Medan MSMEs business strategy. Furthermore, it showed that Medan MSMEs

operational were mostly characterized by the used of small number of employees that account from using 1-

5 employees and operate less than 5 years.

1 INTRODUCTION

One crucial part of SMEs is persistence in doing

business because for those who has persistence

meant that they have optimism (Adomako, et al.,

2016). Studying aspects on SMEs persistence has

been attention-grabbing for most of researchers that

focusing in SMEs, namely: persistence of product

and process innovation on employment growth

according to the size of the firms (Triguero, et al.,

2013), persistence of SMEs investment in research

and development and growth (Ma´n˜ez, et al., 2015;

Deschryvere, 2013; Ahn, et al., 2017), persistence of

SMEs performance (Serrasqueiro & Nunes, 2008),

and persistence SMEs on performing Business

Excellence (BE) model (Sternad, et al., 2017).

However, there are unseen studies that focus on the

SMEs persistence based on their capital structure

behavior, business strategy, and business

operational, especially at the fourth biggest city in

Indonesia which is the capital city of North

Sumatera, Medan (WIKIPEDIA, 2018). This paper,

therefore, introduces a descriptive exploration of

Medan MSMEs in doing business which based on

capital structure behavior, business strategy, and

business operational that operate at Medan,

Indonesia.

736

Triono, M., Harahap, S. and Sihombing, H.

An Empirical Analysis of Medan Indonesia MSMES Persistence based on Capital Structure Behavior, Business Strategy, and Business Operational: A Descriptive Study.

DOI: 10.5220/0009503107360743

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 736-743

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

All business such as SMEs, firm long-term

investment is the blood in running or persistence the

business game which is called as firm capital

structure. Capital structure behavior on SMEs is

distinctly difference than those in large company,

this is because SMEs financing exhibits considerable

contrast when compared to large enterprises which

point out finance theory is not established with the

small business in mind Ang in (Daskalakis, et al.,

2017). Study which have been done by Matias &

Serrasqueiro (2017) that examined the behavior of

11.016 Portuguese SMEs and conclude that

Portuguese SMEs capital structure differs across

regions with the impact of firm size, age,

profitability, asset structure, and growth on firm

debt. Furthermore, Burgstaller & Wagner (2015) in

their study on 470 SMEs that classified as family

firm revealed that debt is relatively prefer rather than

other external capital injection to the company,

whether the family firm controlled by founders or

not. Hence, most studies conclude that the capital

structure behavior of SMEs are highly consistent

with packing order theory (Daskalakis, et al., 2017;

Matias & Serrasqueiro, 2017; Burgstaller & Wagner,

2015; Xiang & Worthington, 2015; Xiang, et al.,

2015).

Most strategic studies focus on large enterprises

such as competitive strategies and strategic groups

(Parnell, et al., 2015). Study on Australia SMEs

business strategy, Xiang & Worthington (2015)

reveals that SMEs that focus on innovations are

more likely to obtain debt. Moreover, longitudinal

study of internalization strategy on Canadian SMEs

Sui & Baum (2014) reported that no single strategy

is superior however internalization strategy

moderates to Canadian SMEs survival as the relative

important of resources. Moreover, in a time of crisis

KOSSYVA, et al., (2014) suggest that co-opetition

could be an applicable business strategy for SMEs.

There are many studies that focus on supply

chain management and information system which

are considered as two important application in

optimization of firm outcome performance.

Comparative study on Turkey and Bulgarian SMEs,

Tatoglu, et al., (2015) shows that supply chain

management and information system positively

influence SMEs operational which Turkey SMEs

had higher application on supply chain management

rather than Bulgarian. Furthermore, Yadav, et al.,

(2018) conducted simultaneous equation modelling

to analyze lean implementation toward operational

performance of 425 Indian SMEs which reveals that

operational performance of Indian SMEs are

positively related to lean implementation.

This paper used Xiang & Worthington, (2015)

key explanatory variables in explaining Medan

MSMEs capital structure behavior, business

strategy, and business operational.

2 THEORICAL FRAMEWORK

Theory and mechanism toward combining debt and

equity to financing business activities with a

systematically approach is called capital structure

theory (Ross, 2018). Moreover, Xiang &

Worthington, (2015) find evidence that Australian

SMEs financial behavior could be explained by

packing order theory and agency cost theory of

capital structure theory. Evidence from SMEs at

Portugal peripheral region through LSDVC dynamic

estimator Serrasqueiro & Caetano, (2015) conclude

that the most profitable and oldest SMEs resort less

to debt, which verify the forecast of Packing-Order

Theory, while SMEs with greater size and resort

more to debt verify the forecast of Packing Order

Theory and Trade-off Theory.

Modigliani and Miller introduce Trade-off theory

or static trade-off theory which states that a

company could lower its weighted average cost of

capital through capital structure with debt over

equity with assumption of debt payments are tax

deductible and debt financing is initially cheaper

than equity financing (Tarver, 2018). Moreover, a

company should favor to finance itself first

internally through retained earnings, however, if this

source of financing is unavailable then finance itself

through debt and if it not enough then as a last

resort, a company should finance itself through the

issuing of new equity (Tarver, 2018; Zoppa &

McMahon, 2002; Zeidan, et al., 2017).Therefore,

these two theories are emphasizing which sources of

capital that a company favor most.

Applying a specific action through generate a

plan to achieve a specific goal is called a strategy

(Charles, 2018). There are some specific strategies

in understanding product strengths, adjusting price,

or acquiring another business of SMEs such as,

namely, growth strategy, product differentiation

strategy, price-skimming strategy, acquisition

strategy (Suttle, 2018). Furthermore, Leonard (2018)

presents five types of business strategy in order to

satisfy customer needs, explicitly, cost leadership,

differentiation, focus low cost, focus differentiation,

and integrated low cost/differentiation. In

conclusion, a strategy is used by businesses is to

ensure sustainability of company growth and

generate money could be established.

Business operational is defined as everything that

occur within a company to maintain it operation and

earning money (Shopify Inc [CA], 2018).

An Empirical Analysis of Medan Indonesia MSMES Persistence based on Capital Structure Behavior, Business Strategy, and Business

Operational: A Descriptive Study

737

Furthermore, there are four business operation to

consider, namely, process, staffing, location, and

equipment or technology (Shopify Inc [CA], 2018).

Moreover, Lacoma (2018) concludes that there are

four keys elements of business operation, explicitly,

supply, efficiency, reliability and adaptability, and

quality control.

This study refers to the study of Xiang &

Worthington (2015) key explanatory variables,

which capital structure behavior regarded from

applied for additional finance (FINA), applied for

additional debt finance (DEBT), applied for

additional equity finance (EQUI), availability of

finance (AFINA), availability of Debt (ADEBT),

availability of equity (AEQUI). Moreover, in seeing

business strategy, viewed from focus on financial

measures (FOCUF), focus on cost measures

(FOCUC), focus on operational measures (FOCUO),

focus on quality measures (FOCUQ), focus on

innovation (FOCUI), focus on human resources

(FOCUH), and acquired written business strategy or

written business plan (PLAN). Furthermore,

business operational refers to no employee

(SIZE01), 1-5 employees used (SIZE02), 6-20

employees used (SIZE03), less than 5 years business

operate (AGE01), operate 6 – 20 years business

operate (AGE02), operate more than 20 years

(AGE03), doing an export of its goods or services

(EXP), doing an importing of goods or services

(IMP).

In this sense, the study seeks answers to the

following questions:

1. What percentage of Medan MSMEs applies

additional finance (FINA), debt (DEBT), and

equity (EQUI) in 2018?

2. What proportion of Medan MSMEs has the

availability of finance (AFINA), debt

(ADEBT), equity (AEQUI)?

3. What percentage of Medan MSMEs that focus

on financial measures (FOCUF), cost measures

(FOCUC), operational measures (FOCUO),

quality measures (FOCUQ), innovation

(FOCUI), human resources measure (FOCUH),

and acquired written business strategy or written

business plan (PLAN)?

4. What proportion of Medan MSMEs on their

operational measures which refers to no

employee (SIZE01), 1-5 employees used

(SIZE02), 6-20 employees used (SIZE03),

operate less than 5 years (AGE01), operate 6 –

20 years (AGE02), operate more than 20 years

(AGE03), doing an export of its goods or

services (EXP), doing an importing of goods or

services (IMP)?

3 RESEARCH METHOD

This study is descriptive exploration research that

used descriptive statistics analysis which conducted

through in-depth interviews via questionnaire which

based on the study of Xiang & Worthington (2015).

Targeted population is 751 Medan MSMEs that has

been recorded by the government of Medan City

through all in 33 districts in 2018. This research

used cluster sampling method which picked 21

districts randomly as the sampling area and about

530 Medan MSMEs has been gathered based on

government of Medan City dataset as sampling data

through in-depth interviews from 1st of August 2018

until 15th of October 2018. All four research

questions are analyzed through descriptive analysis

which SPSS 18 as the calculation tool.

Furthermore, this study used three latent

variables. Firstly, capital structure behavior with six

manifest variables that refers to additional finance

(FINA) with nominal type data, applied for

additional debt finance (DEBT) with nominal type

data, applied for additional equity finance (EQUI)

with nominal type data, availability of finance

(AFINA) with nominal type data, availability of

Debt (ADEBT) with nominal type data, and

availability of equity (AEQUI) with nominal type

data. The second latent variable is business strategy

with seven manifest variables that viewed from

focus on financial measures (FOCUF) with nominal

type data, focus on cost measures (FOCUC) with

nominal type data, focus on operational measures

(FOCUO) with nominal type data, focus on quality

measures (FOCUQ) with nominal type data, focus

on innovation (FOCUI) with nominal type data,

focus on human resources (FOCUH) with nominal

type data, and acquired written business strategy or

written business plan (PLAN) with nominal type

data. Finally, the third latent variable is business

operational which covers eight manifest variables

that refers to no employee (SIZE01) with nominal

type data, 1-5 employees used (SIZE02) with

nominal type data, 6-20 employees used (SIZE03)

with nominal type data, less than 5 years business

operate (AGE01) with nominal type data, operate 6

– 20 years business operate (AGE02) with nominal

type data, operate more than 20 years (AGE03) with

nominal type data, doing an export of its goods or

services (EXP) with nominal type data, doing an

importing of goods or services (IMP) with nominal

type data.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

738

4 ANALYSIS

Data were obtained via descriptive analysis which

organized in frequency and percentage. From 530

Medan MSMEs surveyed data, this study finds the

proportion of MSMEs at 21 districts in Medan

which is mention in Table 1 presents.

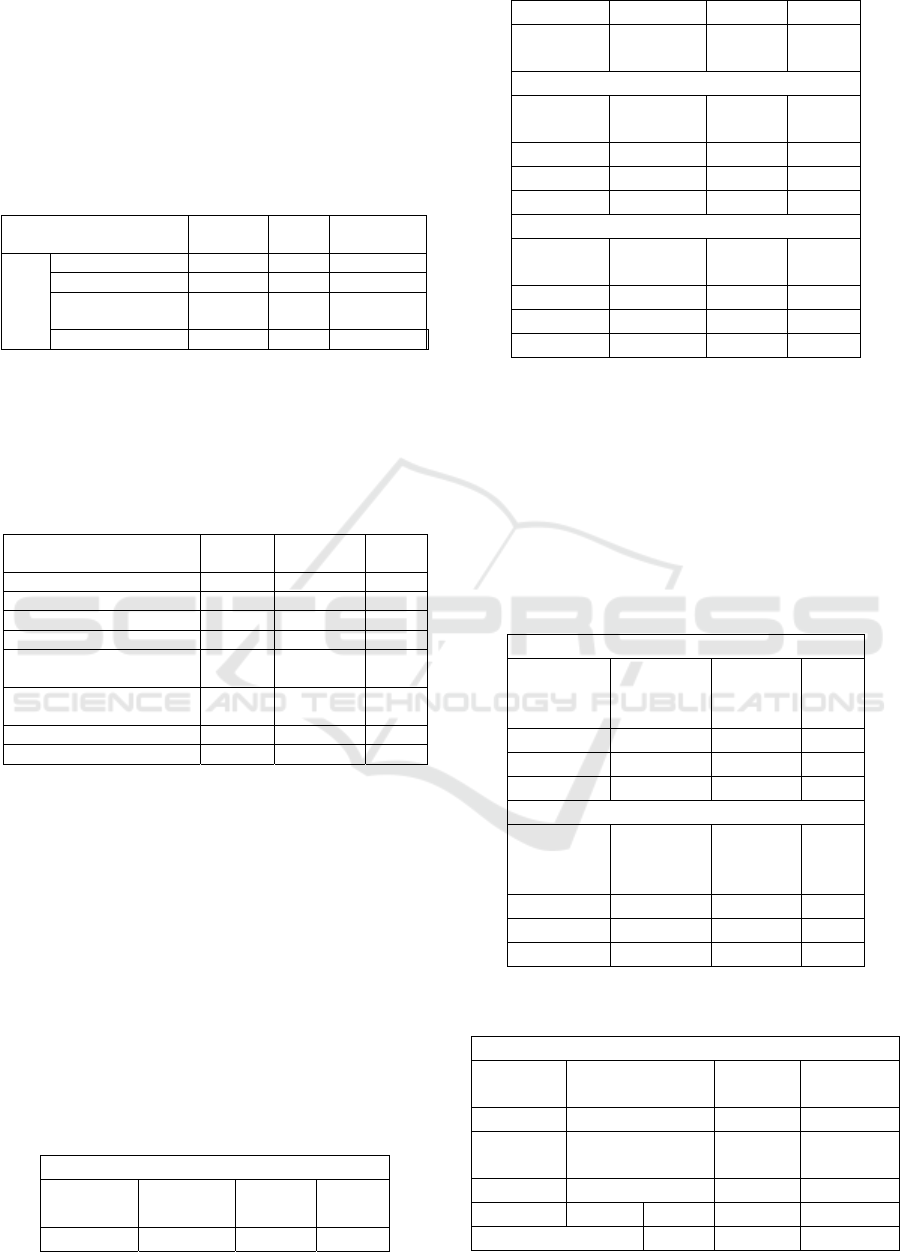

Table 1: Medan MSMEs

Frequency Percent

Valid

Percent

Valid Micro Enterprises 439 82.8 82.8

Small Enterprises 89 16.8 16.8

Medium

Enterprises

2 .4 .4

Total 530 100.0 100.0

Most MSMEs in Medan are Micro Enterprises with

the proportion of 82.8 percent from the total

sampling. Moreover, the percentage of small

enterprises was at 16.8 percent, and only 0.4 percent

were medium enterprises.

Table 2: Type of Medan MSMEs Businesses

Frequency Percent

Valid

Percent

Small Retailer 349 65.8 65.8

Property 28 5.3 5.3

Grocery 78 14.7 14.7

Agriculture 24 4.5 4.5

Recreation and Culture

Services

39 7.4 7.4

Communication

Services

6 1.1 1.1

Transportation Services 6 1.1 1.1

Total 530 100.0 100.0

Furthermore, Table 2 shows type of Medan

MSMEs Businesses with small retailer was the

highest portion of all business types at 65.8 percent

and around 14.7 percent was Grocery took the

second places after small retailer from overall

Medan MSMEs. Moreover, recreation and cultural

services was the third place after Grocery with the

percentage of 7.4 percent. Business in property was

the fourth biggest business type at Medan with a

proportion of 5.3 percent. Agriculture placed in fifth

place with a percentage of 4.5 percent. Finally,

communication and transportation services had the

same place with the proportion of 1.1 percent.

Table 3: Medan MSMEs Apply/Not Apply for

Finance in 2018

Apply for Debt and Equity (FINA)

Frequency Percent

Valid

Percent

Not Apply 386 72.8 72.8

Apply 144 27.2 27.2

Total 530 100.

0

100.0

Apply for Equity (EQUI)

Frequency Percent

Valid

Percent

Not Apply 394 74.3 74.3

Apply 136 25.7 25.7

Total 530 100.0 100.0

Apply for Debt (DEBT)

Frequency Percent

Valid

Percent

Not Apply 379 71.5 71.5

Apply 151 28.5 28.5

Total 530 100.0 100.0

Table 3 above showed that most of Medan MSMEs

did not apply for debt and equity with the proportion

of 72.8 percent and only 27.2 percent applied for

debt and equity. Furthermore, the table also showed

the percentage of 25.7 percent Medan MSMEs

applied for equity and 74.3 percent were not.

Moreover, only 28.5 percent Medan MSMEs applied

for debt and 71.5 percent were not.

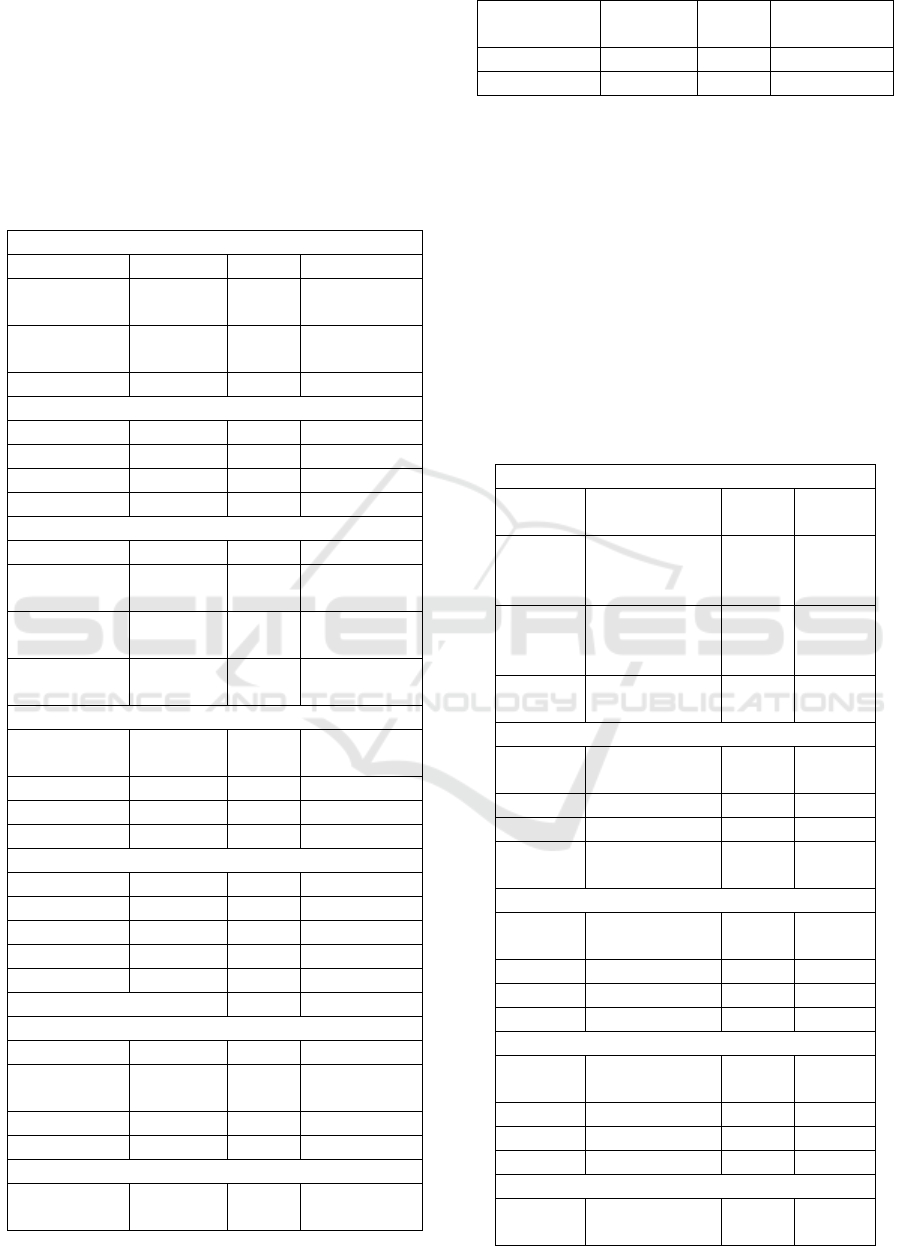

Table 4:Finance Retainment of Medan MSMEs

2018

Retainment of Finance (AFINA)

Frequency Percent

Valid

Perce

nt

N

ot Retain 198 37.4 37.4

Retain 332 62.6 62.6

Total 530 100.0 100.0

Retainment of Debt (ADEBT)

Frequency Percent

Valid

Percen

t

N

ot Retain 206 38.9 38.9

Retain 324 61.1 61.1

Total 530 100.0 100.0

Table 5: Medan MSMEs Retainment of Equity in

2018

Retainment of Equity (AEQUI)

Frequency Percent

Valid

Percent

N

ot Retain 230 43.4 43.5

Retai

n

299 56.4 56.5

Total 529 99.8 100.0

Missing System 1 .2

Total 530 100.0

An Empirical Analysis of Medan Indonesia MSMES Persistence based on Capital Structure Behavior, Business Strategy, and Business

Operational: A Descriptive Study

739

Table 4 and 5 shows the retainment of Medan

MSMEs in Debts and Equities. Table 4.4 concluded

that in 2018, 62.6 percent Medan MSMEs retain on

Finance. 61.1 percent showed that Medan MSMEs

had retainment in debt and 56.4 percent retainment

in equity based on table 5.

Table 6: Medan MSMEs Persistence based on

Business Strategy 2018

Focus on Financial Measures (FOCUF)

Frequency Percent Valid Percent

N

ot Focus 202 38.

1

38.1

Focus 328 61.

9

61.9

Total 530 100.0 100.0

Focus on Cost (FOCUC)

Frequency Percent Valid Percent

N

ot Focus 212 40.0 40.0

Focus 318 60.0 60.0

Total 530 100.0 100.0

Focus on Operational Process (FOCUO)

Frequency Percent Valid Percent

Not

Focus

273 51.

5

51.5

Focus 257 48.

5

48.5

Total 530 10

0.0

100.0

Focus on Product Quality (FOCUQ)

Frequ

ency

Per

cent

Valid

Percent

Not Focus 188 35.5 35.5

Focus 342 64.5 64.5

Total 530 100.0 100.0

Focus on Innovation (FOCUI)

Frequency Percent Valid Percent

N

ot Focus 232 43.8 43.9

Focus 297 56.0 56.1

Total 529 99.8 100.0

Missing System 1 .2

Total 530 100.0

Focus on Human Resources (FOCUH)

Frequency Percent Valid Percent

Not

Focus

381 71.9 71.9

Focus 149 28.1 28.1

Total 530 100.0 100.0

Acquired Business Plan (PLAN)

Frequency Percent

Valid

Percent

Not

Acquired

308 58.1 58.1

Acquired 222 41.9 41.9

Total 530 100.0 100.0

The descriptive measures of Business Strategy at

Medan MSMEs show at Table 6. It shows that more

than fifty percent Medan MSMEs had business

strategy that is based on Innovation, Product quality

improvement, cost measures, and finance measures

with each proportion of these showed 56 percent, 64

percent, 60 percent, and 61.9 percent respectively.

However, acquired business plan, focus on human

resources, focus on operational process had been

identified less acquired in Medan MSMEs business

strategy which each measure showed 41.9 percent,

28.1 percent, 48.5 percent respectively.

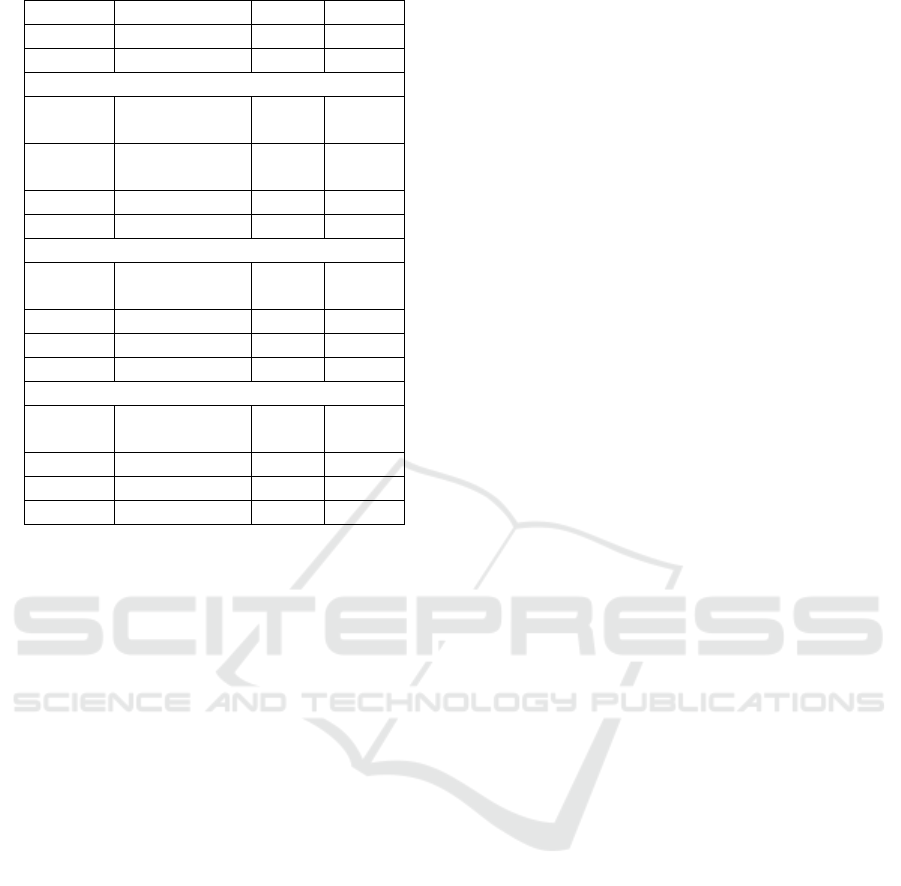

Table 7: Medan MSMEs Operational Characteristics

2018

No Utilize Employees (SIZE01)

Frequency Percent

Valid

Percent

Utilize

Employee

s

154 29.1 29.1

N

o

Utilize

Employee

376 70.9 70.9

Total 530 100.0 100.

0

1-5 Employees Used (SIZE02)

Frequency Percent

Valid

Percent

No 178 33.6 33.6

Yes 352 66.4 66.4

Total 530 100.0 100.

0

6-20 employees used (SIZE03)

Frequency Percent

Valid

Percent

No 421 79.4 79.4

Yes 109 20.6 20.6

Total 530 100.0 100.0

Operate Less than 5 years (AGE01)

Frequency Percent

Valid

Percent

No 221 41.7 41.7

Yes 309 58.3 58.3

Total 530 100.0 1000

operate 6 – 20 years (AGE02)

Frequency Percent

Valid

Percent

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

740

No 421 79.4 79.4

Yes 109 20.6 20.6

Total 530 100.0 100.0

Operate more than 20 years (AGE03)

Frequency Percent

Valid

Percent

No 489 92.

3

92.3

Yes 41 7.7 7.7

Total 530 100.0 100.0

Doing an export (EXP)

Frequency Percent

Valid

Percent

No 508 95.8 95.8

Yes 22 4.2 4.2

Total 530 100.0 100.0

Doing Import (IMP)

Frequency Percent

Valid

Percent

No 463 87.4 87.4

Yes 67 12.6 12.6

Total 530 100.0 100.0

Table 7 represents Medan MSMEs operational

characteristics in 2018 from utilizing employees

until doing import of goods and services. Table 7

revealed that most Medan MSMEs Operational

characteristics were no utilizing of employees, using

employees in a number from 1 – 5 employees, and

operate less than 5 years which each proportion of

these showed 70.9 percent, 66.4 percent, and 58.3

percent.

5 RESULTS

Explanation of the research questions one and two

are describing the persistence in doing business of

Medan MSMEs based on capital structure behavior.

The result showed that 72.8 percent in 2018 Medan

MSMEs did not apply for new capital such as debts

and equities. Moreover, data from finance

retainment indicates that the proportion of retain in

finance was at 62.6 percent which indicate most of

Medan MSMEs used their own retain on earning for

operating their business. Furthermore, debts retained

were at 61.1 percent which was higher than retain on

equities at 56.4 percent. Therefore, this empirical

evidence of persistence through analysis of

descriptive statistics shows that Medan MSMEs

capital structure behavior were highly consistent

with packing order theory.

Medan MSMEs persistence on doing business

based on Business strategy was showed by

answering the third research question. The result

showed that financial measures, focus on cost, focus

on product quality, and focus on innovation are the

main characteristics of Medan MSMEs business

strategy.

The last answer of the research question is

describing the finding of Medan MSMEs persistence

in doing business based on Business Operational

Characteristics. It showed that Medan MSMEs

operational were mostly characterized by the used of

small number of employees that account from using

1-5 employees and operate less than 5 years..

6 CONCLUSIONS

This research reveals fascinating fact that the

characteristics of Medan MSMEs persistence in

doing business based on capital structure is highly

consistent with packing order theory rather than

static trade-off theory. Moreover, financial

measures, focus on cost, focus on product quality,

and focus on innovation are the main characteristic

persistence in doing business based on business

strategy. Furthermore, the used of small number of

employees that account from using 1-5 employees

and operate less than 5 years are the most

characteristics of persistence in doing business based

on business operational characteristics.

This study is descriptive in nature and restricted

to the micro, small, and medium (MSMEs) in

Medan, Indonesia only. Therefore, future

researchers are suggested to obtain more in-depth

interviews with longer period in observing MSMEs

through panel data which could leads more robust

result and could bring more clarity in MSMEs

literature and government policies.

REFERENCES

Adomako, S., Danso, A., Uddin, M. & Ofori-Damoah, J.

O.-D., (2016). Entrepreneurs’ Optimism, Cognitive

Style and Persistence. International Journal of

Entrepreneurial Behavior & Research, 22(1), pp. 84-

108.

Ahn, S., Yoon, J. & Kim, Y. J., (2017). Technology

Management, R&D Investment, and Small and

Medium-Sized Enterprise Growth. Singapore, IEEE

Computer Society.

Burgstaller, J. & Wagner, . E., (2015). How do family

An Empirical Analysis of Medan Indonesia MSMES Persistence based on Capital Structure Behavior, Business Strategy, and Business

Operational: A Descriptive Study

741

ownership and founder management affect capital

structure decisions and adjustment of SMEs?:

Evidence from a bank-based economy. The Journal

of Risk Finance, 16(1), pp. 73-101.

Charles, T., (2018). Describe the Three Levels of Strategy

for a Single-Business Company. [Online] Available

at: https://smallbusiness.chron.com/describe-three-

levels-strategy-singlebusiness-company-23508.html

[Accessed 4 December 2018].

Daskalakis, N., Balios, D. & Dalla, V., (2017). The

behaviour of SMEs’ capital structure determinants in

different macroeconomic states. Journal of

Corporate Finance, Volume 46, pp. 248-260.

Deschryvere, M., (2013). R&D, firm growth and the role

of innovation persistence: an analysis of Finnish

SMEs and large firms. Small Business Economics, 1

December.

KOSSYVA, D., SARRI, K. & GEORGOPOULOS, N.,

(2014). CO-OPETITION: A BUSINESS

STRATEGY FOR SMES IN TIMES OF

ECONOMIC CRISIS. South-Eastern Europe Journal

of Economics, pp. 89-106.

Lacoma, T., (2018). The Key Elements of Business

Success From an Operating Perspective. [Online]

Available at: https://smallbusiness.chron.com/key-

elements-business-success-operating-perspective-

21234.html [Accessed 4 December 2018].

Leonard, K., (2018). Five Types of Business-Level

Strategies. [Online]

Available at: https://smallbusiness.chron.com/five-types-

business-level-strategies-781.html [Accessed 4

December 2018].

Ma´n˜ez, J. A., Rochina-Barrachina, M. E., Sanchis-

Llopis, A. & Sanchis-Llopis, J. A., (2015). The

determinants of R&D persistence in SMEs. Small

Business Economics, p. 505–528.

Matias, F. & Serrasqueiro, Z., (2017). Are there reliable

determinant factors of capital structure decisions?

Empirical study of SMEs in different regions of

Portugal. Research in International Business and

Finance, Volume 40, pp. 19-33.

Parnell, J. A., Long, Z. & Lester, D., (2015). Competitive

strategy, capabilities and uncertainty in small and

medium sized enterprises (SMEs) in China and the

United States. Management Decision, 53(2), pp.

402-431.

Ross, S., (2018). What is capital structure theory?.

[Online] Available at:

https://www.investopedia.com/ask/answers/031915/

what-capital-structure-theory.asp [Accessed 3 12

2018].

Serrasqueiro, Z. & Caetano, A., (2015). Trade-Off Theory

versus Pecking Order Theory: capital structure

decisions in a peripheral region of Portugal. Journal

of Business Economics and Management, 16(2), pp.

445-466.

Serrasqueiro, Z. S. & Nunes, P. M., (2008). Performance

and size: empirical evidence from Portuguese SMEs.

Small Business Economics, p. 195–217.

Shopify Inc [CA], (2018). Business Operations. [Online]

Available at:

https://www.shopify.com/encyclopedia/business-

operations [Accessed 4 December 2018].

Sternad, D., Krenn, M. & Schmid, S., (2017). Business

excellence for SMEs: motives, obstacles, and size-

related adaptations. Total Quality Management &

Business Excellence.

Sui, S. & Baum, M., (2014). Internationalization strategy,

firm resources and the survival of SMEs in the

export market. Journal of International Business

Studies, 45(7), p. 821–841.

Suttle, R., (2018). Different Types of Business Strategies.

[Online] Available at:

https://smallbusiness.chron.com/different-types-

business-strategies-4634.html [Accessed 4

December 2018].

Tarver, E., (2018). Which financial principles help

companies choose capital structure?. [Online]

Available at:

https://www.investopedia.com/ask/answers/052215/

does-tradeoff-model-or-pecking-order-play-greater-

role-capital-budgeting.asp [Accessed 4 December

2018].

Tatoglu, E. et al., (2015). How do supply chain

management and information systems practices

influence operational performance? Evidence from

emerging country SMEs. International Journal of

Logistics: Research and Applications.

Triguero, A., Co´rcoles, D. & Cuerva, M. C., (2013).

Persistence of innovation and firm’s growth:

evidence from a panel of SME and large Spanish

manufacturing firms. Small Business Economics, 1

December.

WIKIPEDIA, (2018). Medan. [Online] Available at:

https://en.wikipedia.org/wiki/Medan [Accessed 4

December 2018].

Xiang, D. & Worthington, A., (2015). Finance-seeking

behaviour and outcomes for small- and medium-

sized enterprises. International Journal of

Managerial Finance, Volume 11, pp. 513-530.

Xiang, D., Worthington, A. C. & Higgs, H., (2015).

Discouraged finance seekers: An analysis of

Australian small and medium-sized enterprises.

International Small Business Journal, p. 689–707.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

742

Yadav, V. et al., (2018). The impact of lean practices on

the operational performance of SMEs in India.

Industrial Management & Data Systems.

Zeidan, R. M., Galil, K. & Shapir, O. M., (2017). Do

Ultimate Owners Follow the Pecking Order

Theory?. [Online]

Available at:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=

2747749 [Accessed 4 December 2018].

Zoppa, A. & McMahon, R. G., (2002). PECKING

ORDER THEORY AND THE FINANCIAL

STRUCTURE OF MANUFACTURING SMEs

FROM AUSTRALIA’S BUSINESS

LONGITUDINAL SURVEY. [Online] Available at:

www.flinders.edu.au/sabs/business-

files/research/papers/2002/02-01.pdf [Accessed 4

December 2018].

An Empirical Analysis of Medan Indonesia MSMES Persistence based on Capital Structure Behavior, Business Strategy, and Business

Operational: A Descriptive Study

743