Causality Relationship between Foreign Direct Investment, Trade and

Economic Growth in Indonesia

Muhammad Alhasymi Matondang

1

1

Student of Post Graduated Program, Universitas Negeri Medan, Medan -Indonesia

Keywords: Foreign Direct Investment, Economic Growth, Trade

Abstract: The aim of this paper is to analyse the relation between foreign investment, economic growth, and trade in

Indonesia. using secondary data in the form of time series data from 1981 to 2017. Data is obtained from the

World Bank website. For data analysis using vector autoregression (VAR) method. Stationary data at first

difference and cointegrated. Thus, the vector error correction (VECM) model is used to analyze the short

and long-term relationships of each variable. The results obtained are that there are no significant variables

in the short term and obtained significant long-term effects of FDI, export and import variables on GDP in

Indonesia. After a causality test, the conclusion is that the FDI variable has a one-way causality relationship

to the variables GDP, exports and imports. The import variable has a one-way causality relationship to GDP

and exports. Meanwhile, the import variable has a one-way causality relationship with exports.

1 INTRODUCTION

Indonesia is located in the Southeast Asia region. It

is an archipelago with abundant natural resources

and beautiful landscapes. Based on these

explanations, Indonesia has a very large possibility

for investment activities, especially foreign

investment (FDI) because there are many available

raw materials from various sectors such as

agriculture, plantations, mining. also the potential of

nature that can be used as a tourist area. If this

potential can be utilized optimally, it will improve

the economy in Indonesia.

Apart from foreign investment, trade can also

boost a country's economic growth. One of the

objectives of international trade is to increase GDP

(Gross Domestic Product) or the total value of

production of goods and services in a country for

one year. The impact of international trade can be

felt in terms of social, political and economic

interests to help drive the progress of

industrialization, transportation, globalization and

the presence of multinational companies.

Based on the description above, this study was

made to analyze the relationship between foreign

investment, trade and GDP growth in Indonesia.

This paper is divided into five parts. The first part is

the introduction. The second part is aimed at the

theoretical framework. The third part contains the

research methods used. The fourth part contains the

results and research discussions. And the last part

includes the conclusions obtained.

2 THEORETICAL STUDY

2.1 Economic Growth

Prof. Simon Kuznets, defined economic growth as

"a long-term increase in the ability of a country to

provide more and more types of economic goods to

its population. This ability grows according to

technological progress, and institutional and

idiological adjustments that are needed ".

Economic growth is one of the most important

indicators in carrying out an analysis of economic

development that occurs in a country. Where this

economic growth shows the extent to which

economic activity will generate additional income

for the community in a certain period. Economic

growth is closely related to the amount of GDP. If

the amount of GDP in a region is high, it can be

concluded that economic growth is high. GDP is

Matondang, M.

Causality Relationship between Foreign Direct Investment, Trade and Economic Growth in Indonesia.

DOI: 10.5220/0009503004850491

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 485-491

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

485

used for various purposes, but the most important is

to measure economic performance.

In Indonesia, GDP growth from 2010 to 2017 is

in the range of 4-5 percent. The highest growth

recorded in 2010 was 6.2 percent, with GDP at a

constant price of US $ 755.09 billion. In 2015 the

GDP value of US $ 988.13 billion with economic

growth at that time amounted to 4.9 percent. in

general, total GDP growth in Indonesia has

increased every year.

2.2 Foreign Direct Investment

Foreign direct investment is carried out by foreign

parties or it can also be said as a full-fledged

company investment, where management of both

management and part of the workforce is determined

by foreign parties. Direct investment includes capital

transfers or the establishment of factories and

usually uses production techniques of the country of

origin of investors, managerial services, marketing

and advertising determined by the foreign investor.

Based on data obtained from the World Bank,

the value of foreign investment entering Indonesia

each year continues to fluctuate. In 2010, foreign

capital was recorded at US $ 15.29 billion, and in

2017 amounted to US $ 21.46 billion. Although it

had dropped in 2016 amounting to US $ 4.54 billion.

This indicates that the investment climate in

Indonesia is quite good, so that foreign investors do

not hesitate to invest their funds.

2.3 International Trade

International trade is an interaction between

countries in the form of buying and selling goods

and services on the basis of mutual agreement.

International cooperation in the field of trade is not

something that has just begun, but has been around

since the Middle Ages.

International trade is an "engine of growth".

Exports and imports are important factors in

stimulating a country's economic growth. Where,

exports and imports will enlarge the consumption

capacity of a country, increase output and provide

access to scarce resources and potential international

markets for various export products which without

these product products, poor countries will not be

able to develop activities and life of the national

economy (Todaro, 1993).

Based on data obtained from the World Bank.

The value of Indonesian exports and imports from

2010 to 2017 has fluctuated. In 2010 the value of

Indonesian exports amounted to US $ 166.64 billion

and imports amounted to US $ 145.42 billion,

resulting in a surplus of US $ 21.21 billion. In 2012

the value of Indonesian exports increased to US $

211 billion, followed by imports which also

increased by US $ 212.89 billion, resulting in a

deficit of US $ 1.88 billion. The trade deficit

continued until the next two years. In 2017 the value

of Indonesian exports was US $ 193.55 billion and

imports amounted to US $ 182.53 billion, a surplus

of US $ 11.03 billion.

2.4 Literatur Review

Based on the research of Zuzana Szkorupova (2014),

there was a long-term causal relationship between

the variables studied. This paper also discovers the

positive impact of foreign direct investment and the

positive impact of exports on gross domestic product

in Slovakia. Seng Shotan (2017), found strong

evidence about the causal impact of FDI on

Cambodia's economic growth (GDP). Afaf Abdull J,

Saaed and Majeed Ali Hussain (2015), show that

there is unidirectional causality between exports and

imports and between exports and economic growth

in Tunisia. Muhammad Shaikh and Hussain Shar

(2010), show that there is a causal relationship

between economic growth, exports and foreign

inventories (FDI). And concluded that investment

(FDI) in Pakistan has attracted economic growth and

exports. Rehmat Ullah, Khalid Javed and Falak Sher

(2012), showed that economic growth was also

positively influenced by investment. But the

Causality test does not support the causality of trade

openness to GDP. And José Luis, Carlos Rivera and

Priscilla Castro (2009), entitled Economic growth,

foreign direct investment and international trade:

evidence on causality in the Mexican economy,

shows the bidirectional causal relationship of FDI

and GDP in Mexico.

3 RESEARCH METHOD

This study uses the VAR and VECM methods to

analyze the relationships between variables. Data

used in the form of secondary data in the form of

time series from 1981 - 2017 in Indonesia. All data

is sourced from the World Bank website. Data is

processed using the program Eviews 10. The

variables examined are in the form of constant total

GDP in 2010, the foreign direct investment net

inflows variable, the variables of export and import

values.

Before deciding to use the right model for the

data in this study. There are several steps that must

be passed first, such as:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

486

3.1 Data Stationarity Test

Time series economic data are generally stochastic

(having a trend that is not stationary / data has unit

roots). If the data has a unit root, the value will tend

to fluctuate not around the average value, making it

difficult to estimate a model. (Rusydiana, 2009).

Unit Root Test is one of the concepts that lately is

increasingly popular to be used to test the stationary

time series data. This test was developed by Dickey

and Fuller, using the Augmented Dickey Fuller Test

(ADF). The stationarity test that will be used is the

ADF (Augmented Dickey Fuller) test using the 5

percent real level.

3.2 Optimum Lag Length Test

VAR estimation is very sensitive to the lag length

used. Determination of the number of lags (orders)

to be used in the VAR model can be determined

based on Akaike Information Criterion (AIC)

criteria, Schwarz Information Criterion (SC) or

Hannan Quinnon (HQ). Besides testing the optimal

lag length is very useful to eliminate the problem of

autocorrelation in the VAR system, so that the use of

optimal lags is expected to no longer appear the

problem of autocorrelation. (Nugroho, 2009).

3.3 Stability Test of the VAR Model

VAR stability needs to be tested before doing further

analysis, because if the VAR estimation results will

be combined with the unstable error correction

model, then Impulse Response Function and

Variance Decomposition become invalid (Setiawan,

2007 in Rusydiana, 2009).

3.4 Granger Causality Analysis

Causality tests are conducted to determine whether

an endogenous variable can be treated as an

exogenous variable. This starts from ignorance of

influence between variables. If there are two

variables y and z, then y causes z or z to cause y or

applies both or there is no relationship between the

two. The y variable causes the variable z to mean

how many z values in the current period can be

explained by the z value in the previous period and

the y value in the previous period.

3.5 Cointegration Test

As with the Engle-Granger statement, the existence

of non-stationary variables causes the possibility of a

long-term relationship between variables in the

system. Cointegration tests are carried out to

determine the existence of relationships between

variables, especially in the long term. If there is

cointegration on the variables used in the model, it

can be ascertained that there is a long-term

relationship between the variables. The method that

can be used in testing the existence of this

cointegration is the Johansen Cointegration method.

3.6 Empirical Model of VAR / VECM

After cointegration is known, the next test process is

carried out using the error correction method. If

there are differences in the degree of integration

between test variables, the test is carried out

simultaneously (jointly) between the long-term

equation with the error correction equation, after it is

known that in the variable there is cointegration. The

difference in degrees of integration for cointegrated

variables is called Lee and Granger (Hasanah, 2007

in Rusydiana, 2009) as multicointegration. But if

there is no cointegration phenomenon, then the test

is continued by using the first difference variable.

(Rusydiana, 2009).

VECM is the form of VAR that is estimated

because of the existence of data forms that are not

stationary but are cointegrated. VECM is often

referred to as the VAR design for non-stationary

series that has a cointegration relationship. The

VECM specification restricts the long-term

relationship of endogenous variables to converge

into their cointegrated relationship, but still allows

the existence of short-term dynamics.

4 RESULTS AND DISCUSSION

4.1 Stationary Test

The test method used to test the data stationarity is

the ADF (Augmenteed Dick Fuller) test using a real

level of five percent. If the t-ADF value is smaller

than the critical value of MacKinnon, it can be

concluded that the data used is stationary (does not

contain unit roots). Testing the roots of this unit is

carried out at the level up to the first difference.

The results of the ADF test can be seen in the

table below:

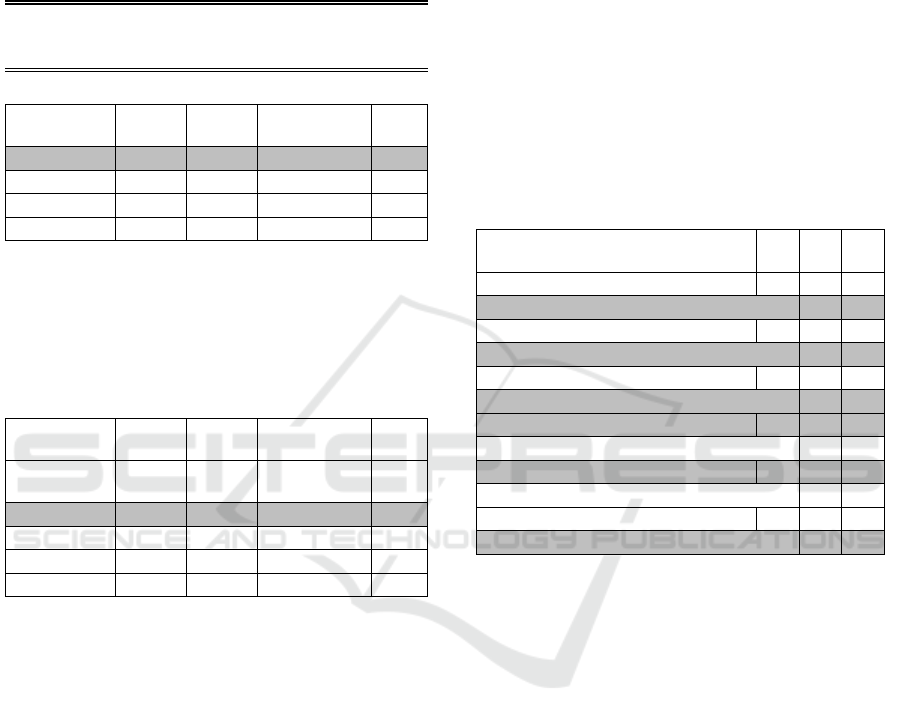

Table 1: ADF Unit root test

Null hypothesis : lnGDPC, lnFDI, lnEX, lnIM

Variabel

ADF Test statistic (p value)

Level 1st difference

lnGDPC -2.29 (0.42) -4.37 (0.00)

***

lnFDI -3.89 (0.02)

***

-6.49 (0.00)

***

lnEX -2.91 (0.17) -5.28 (0.00)

***

lnIM -2.48 (0.33) -4.91 (0.00)

***

Causality Relationship between Foreign Direct Investment, Trade and Economic Growth in Indonesia

487

Note: (1) Test critical values at 1%, 5% and 10%

level are -3.53, -2.91 and -2.59,

Respectively

(2) ***, ** and * denote rejection of null

hypothesis at 1%, 5% and 10% level of

significance, respectively.

From the table above it can be seen that the data

is stationary at the 1st difference because the

probability value is smaller than α = 5 percent.

4.2 Optimal Lag Test

The next step to estimate the VAR model, must first

determine the optimal lag that will be used in the

VAR estimation. Determination of optimal lag is

important because in the VAR method, the optimal

lag of endogenous variables is the independent

variable used in the model. Testing the optimal lag

length is very useful to eliminate the problem of

autocorrelation in the VAR system which is used as

a VAR stability analysis. So that with the use of the

optimal lag it is expected that the autocorrelation

problem will not appear again. The optimal lag

length will be searched using the available

information criteria. The selected lag candidates are

length lag according to criteria such as Likehood

Ratio (LR), Final Prediction Error (FPE), Akaike

Information Crition (AIC), Schwarz Information

Crition (SC), and Hannan-Quin Crition (HQ).

Determination of optimal lag in this study was based

on sequential modified LR statistical test (LR)

criteria.

Table 2: Optimal Lag Test

VAR Lag Order Selection

Criteria

La

g

Lo

g

L LR FPE AIC SC HQ

0

-7.22 NA 2.27e-05 0.660 0.839 0.722

1

110.68 201.14* 5.72e-08* -5.334* -4.436* -5.028*

2

122.93 18.01 7.44e-08 -5.113 -3.497 -4.562

3

140.62 21.85 7.54e-08 -5.213 -2.878 -4.417

* indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at 5%

level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

Based on table 2 above, the selected lag is lag 1.

4.3 Stability Test of the VAR Model

Before entering into a further stage of analysis, the

estimated estimation of the VAR system system

must be tested for stability through VAR stability

condition check in the form of roots of characteristic

polynomial for all variables used multiplied by the

number of lags of each VAR. VAR stability needs to

be tested because if the estimated VAR stability is

unstable, the IRF and FEVD analysis becomes

invalid. Based on the results of these tests, a VAR

system is said to be stable if all roots or roots have

modulus smaller than one. In this study, based on the

VAR stability test shown in the Table it can be

concluded that the estimation of VAR stability to be

used for IRF and FEVD analysis has been stable

because of the modulus range <1.

Table 3: VAR Stability Test

Roots of Characteristic Pol

y

nomial

Endo

g

enous variables: D (lnGDPC) D (lnFDI)

D (lnEX) D (lnIM)

Exo

g

enous variables: C

La

g

specification: 1 2

Roo

t

Modulus

0.991023 0.991023

0.233548 - 0.600717i 0.644520

0.233548 + 0.600717i 0.644520

0.516572 - 0.293687i 0.594221

0.516572 + 0.293687i 0.594221

0.538923 0.538923

-0.118734 0.118734

-0.035249 0.035249

4.4 Cointegration Test

The purpose of the cointegration test in this study is

to determine whether a group of variables that are

not stationary at that level meets the requirements of

the integration process, namely where all variables

are stationary at the same degree, namely degrees 1

or I (1). Based on the results seen in the Table,

cointegration testing in this study uses the Johansen

Trace Statistic test cointegration test method.

Long-term information is obtained by first

determining the cointegration rank to find out what

the system of equations can explain from the whole

system. Cointegration testing criteria in this study

are based on trace statistics. If the trace statistic

value is greater than the critical value of 5 percent,

the alternative hypothesis that states the number of

cointegration is accepted so that it can be known

how many equations are cointegrated in the system.

This test aims to determine whether there is a

long-term effect on the variables that we will

examine. If there is proven cointegration, the VECM

stage can be continued. But if it is not proven, then

VECM cannot continue.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

488

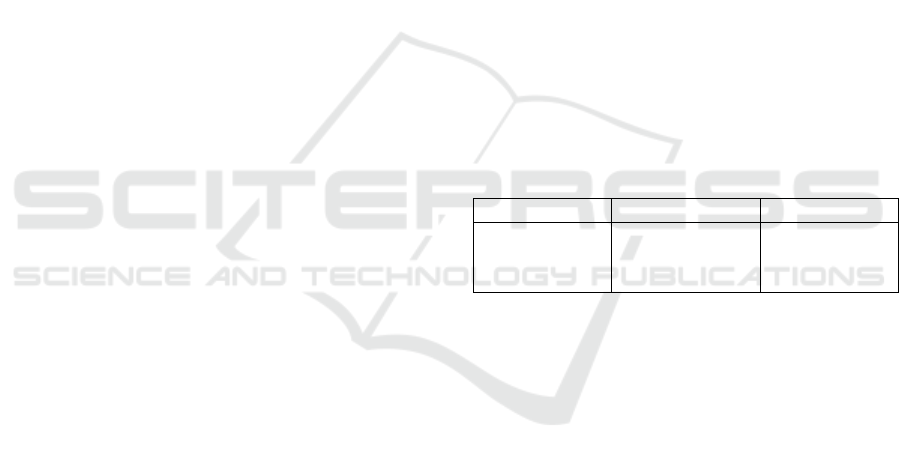

Table 4: Johansen Cointegration Test

Sam

p

le

(

ad

j

usted

)

: 1983 2017

Included observations: 35 after adjustments

Trend assum

p

tion: Linear deterministic trend

(

restricted

)

Series: LNGDPC LNFDI LNEX

LNIM

Lags interval (in first differences): 1 to 1

Unrestricted Cointe

g

ration Rank Test

(

Trace

)

H

yp

othesize

d

Ei

g

en- Trace 0.05

No. of CE(s) value Statistic Critical

Value

Prob.*

*

None * 0.6307 73.801 63.87610 0.0058

At most 1 0.5322 38.934 42.91525 0.1183

At most 2 0.2001 12.346 25.87211 0.7875

At most 3 0.1214 4.5319 12.51798 0.6644

Trace test indicates 1 cointegrating eqn(s) at the 0.05

level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Hau

g

-Michelis

(

1999

)

p

-values

Unrestricted Cointegration Rank Test (Maximum

Eigenvalue)

Hypothesize

d

Eigen-

Max-

Eigen 0.05

No. of CE(s) value Statistic Critical

Value

Prob.*

*

None * 0.6307 34.867 32.118 0.0225

At most 1 * 0.5322 26.587 25.823 0.0396

At most 2 0.2001 7.8146 19.387 0.8377

At most 3 0.1214 4.5319 12.518 0.6644

Max-eigenvalue test indicates 2 cointegrating eqn(s) at

the 0.05 level

* denotes re

j

ection of the h

yp

othesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Based on the table above, it can be seen that the

trace statistic value and maximum eigenvalue at r =

0 are greater than the critical value with a

significance level of 5 percent. This means that the

null hypothesis which states that no cointegration is

rejected and the alternative hypothesis which states

that there is cointegration is accepted. Based on the

analysis from the table above, it can be seen that

among the four variables in this study, there is

cointegration at the 5 percent significance level.

Thus, the results of the cointegration test indicate

that between the movements of GDPC, FDI, EX and

IM have a relationship of stability / balance and

similarity of movements in the long run. or, in each

short-term period, all variables tend to adjust to each

other, to achieve long-run equilibrium.

4.5 Granger Causality Test

he Granger Causality Test aims to see whether two

variables have a reciprocal relationship or not. In

other words, does one variable have a significant

causal relationship with other variables, because

each variable in the study has the opportunity to

become an endogenous or exogenous variable. The

bivariate causality test in this study used the VAR

Pairwise Granger Causality Test and used a real

level of five percent. The following table presents

the results of the Bivariate Granger Causality test

analysis.

Table 5: Results of Granger causality test

Pairwise Granger Causality Tests

Sam

p

le: 1981 2017

Lags: 1

Null Hypothesis: Obs

F-

Stat

Prob.

LNFDI does not Granger Cause LNGDPC

36 0.15 0.69

LNGDPC does not Granger Cause LNFDI 9.99 0.00

LNEX does not Granger Cause LNGDPC

36 0.08 0.78

LNGDPC does not Granger Cause LNEX

6.87 0.01

LNIM does not Granger Cause LNGDPC

36 0.16 0.69

LNGDPC does not Granger Cause LNIM

5.25 0.03

LNEX does not Granger Cause LNFDI

36 9.37 0.00

LNFDI does not Granger Cause LNEX

0.08 0.78

LNIM does not Granger Cause LNFDI

36 8.44 0.01

LNFDI does not Granger Cause LNIM

0.01 0.90

LNIM does not Granger Cause LNEX

36 2.36 0.13

LNEX does not Granger Cause LNIM

9.89 0.00

- H0 : LNFDI does not affect LNGDPC

H1 : LNFDI affect LNGDPC

The F-Statistic probability value is greater than α

= 5%, (0.69> 0.05), H1 is accepted (LNFDI

affects LNGDPC).

H0 : LNGDPC does not affect LNFDI

H1 : LNGDPC affect LNFDI

F-Statistic probability value is smaller than α =

5%, (0.00 <0.05), H0 is accepted (LNGDPC

does not affect LNFDI).

Thus, it was concluded that there was

unidirectional causality between the LNFDI and

LNGDPC variables.

- H0 : LNEX does not affect LNGDPC

H1 : LNEX affect LNGDPC

The F-Statistic probability value is greater than α

= 5%, (0.78> 0.05), H1 is accepted (LNEX

affects LNGDPC).

H0 : LNGDPC does not affect LNEX

H1 : LNGDPC affect LNEX

Causality Relationship between Foreign Direct Investment, Trade and Economic Growth in Indonesia

489

F-Statistic probability value is smaller than α =

5%, (0.01 <0.05), H0 is accepted (LNGDPC

does not affect LNEX).

Thus, it was concluded that there was

unidirectional causality between LNEX and

LNGDPC variables.

- H0 : LNIM does not affect LNGDPC

H1 : LNIM affect LNGDPC

The F-Statistic probability value is greater than α

= 5%, (0.69> 0.05), H1 is accepted (LNIM

affects LNGDPC).

H0 : LNGDPC does not affect LNIM

H1 : LNGDPC affect LNIM

F-Statistic probability value is smaller than α =

5%, (0.03 <0.05), H0 is accepted (LNGDPC

does not affect LNIM).

Thus, it was concluded that there was causality

in the direction of the variables LNIM and

LNGDPC

- H0 : LNEX does not affect LNFDI

H1 : LNEX affect LNFDI

F-Statistic probability value is smaller than α =

5%, (0.00 <0.05), H0 is accepted (LNEX does

not affect LNFDI).

H0 : LNFDI does not affect LNEX

H1 : LNFDI affect LNEX

F-Statistic probability value is greater than α =

5%, (0.78> 0.05), H1 is accepted (LNFDI affects

LNEX).

Thus, it was concluded that there was

unidirectional causality between LNFDI and

LNEX variables.

- H0 : LNIM does not affect LNFDI

H1 : LNIM affect LNFDI

F-Statistic probability value is smaller than α =

5%, (0.01 <0.05), H0 is accepted (LNIM does

not affect LNFDI).

H0 : LNFDI does not affect LNIM

H1 : LNFDI affect LNIM

The F-Statistic probability value is greater than α

= 5%, (0.90> 0.05), H1 is accepted (LNFDI

affects LNIM).

Thus, it was concluded that there was

unidirectional causality between LNFDI and

LNIM variables.

- H0 : LNIM does not affect LNEX

H1 : LNIM affect LNEX

F-Statistic probability value is greater than α =

5%, (0.13> 0.05), H1 is accepted (LNIM affects

LNEX).

H0 : LNEX does not affect LNIM

H1 : LNEX affect LNIM

F-Statistic probability value is smaller than α =

5%, (0.00 <0.05), H0 is accepted (LNEX does

not affect LNIM).

Thus, it can be concluded that there is a

unidirectional causality between the LNIM and

LNEX variables

4.6 VECM Model

The VECM estimation results will get a short-term

and long-term relationship between Total GDP,

Foreign Investment, Export and Import. In this

estimation, Total GDP is the dependent variable,

while the independent variable is Foreign

Investment, Export and Import.

Based on the estimation results of the VECM

model there are no significant influencing variables

in the short term because the t-statistic values

obtained by almost all variables are smaller than the

t-table value at α = 0.05.

However, for the long term there is a significant

influence between the variables of foreign

investment (lnFDI), exports (lnEX) and imports

(lnIM) on GDP (lnGDPC) in Indonesia.

Table 6: Long term influence

Variables Coefficient T-Stat

lnFDI (-1) 0.533134 4.71614

lnEX (-1) 3.659332 4.85363

lnIM (-1) 3.964144 4.65306

Source : Output eviews

Based on the table above. It can be concluded

that there is a positive and significant long-term

effect of foreign investment of 0.53 percent, exports

of 3.65 percent and imports of 3.9 percent of total

GDP in Indonesia at the level of confidence α =

0.05.

5 CONCLUSIONS

The purpose of this study is to examine the

relationship between GDP, foreign investment and

trade (exports and imports) in Indonesia. This paper

presents some facts about patterns of FDI inflows,

international trade and GDP growth in Indonesia.

from the data obtained (1981-2017) it shows that

international trade (export-import) and GDP growth

increase over time. Although foreign investment into

Indonesia tends to fluctuate, the trend is positive. All

variables studied have a long-term relationship in I

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

490

(1). In the VECM model there are short-term effects

that are not significant for the FDI, import and

export variables on GDP. However, there is a long-

term relationship between the three dependent

variables on GDP in Indonesia. Based on the results

of the test granger causality, the results of the FDI

variable have a one-way causality relationship to the

variables GDP, exports and imports.

The import variable has a one-way causality

relationship to GDP and exports. While the import

variable has a one-way causality relationship with

exports. Thus it can be concluded that in this paper

the GDP variable is an endogenous variable whose

value is influenced by other variables (FDI, import

and export). The variable foreign investment (FDI)

is an exogenous variable that can affect other

variables (GDP, exports and imports). Meanwhile,

the export and import variables can be exogenous

and endogenous variables. Therefore, foreign

investment (FDI) in Indonesia must be continuously

improved because it can affect GDP and Indonesia's

trade.

REFERENCES

Abdull, Afaf J. Saaed and Majeed Ali Hussain (2015)

‘Impact of Exports and Imports on Economic

Growth: Evidence from Tunisia’, Journal of

Emerging Trends in Economics and Management

Sciences (JETEMS), 6(1), pp. 13-21. Available at:

https://hdl.handle.net/10520/EJC179819

Szkorupova, Zuzana (2014) ‘A causal relationship

between foreign direct investment, economic growth

and export for Slovakia’, Procedia Economics and

Finance, pp. 123-128. doi:

10.1016/S2212-

5671(14)00458-4.

Todaro, Michael P. (1998) Pembangunan Ekonomi Di

Dunia Ketiga, Edisi Keenam. Jakarta: Erlangga.

Causality Relationship between Foreign Direct Investment, Trade and Economic Growth in Indonesia

491